COCA-COLA CONSOLIDATED, INC. ANNUAL BONUS PLAN (AMENDED AND RESTATED EFFECTIVE JULY 30, 2024) Exhibit 10.2

COCA-COLA CONSOLIDATED, INC. ANNUAL BONUS PLAN (AMENDED AND RESTATED EFFECTIVE JULY 30, 2024) Table of Contents Page ARTICLE I PURPOSE ....................................................................................................................1 ARTICLE II DEFINITIONS ...........................................................................................................1 2.1 Affiliate ....................................................................................................................1 2.2 Board ........................................................................................................................1 2.3 Change in Control ....................................................................................................1 2.4 Code .........................................................................................................................3 2.5 Committee ................................................................................................................3 2.6 Company ..................................................................................................................3 2.7 Participant ................................................................................................................3 2.8 Participating Company.............................................................................................3 2.9 Performance Measures .............................................................................................3 2.10 Plan ..........................................................................................................................4 2.11 Plan Administrator ...................................................................................................4 2.12 Retirement ................................................................................................................4 2.13 Total Disability .........................................................................................................4 ARTICLE III ADMINISTRATION .................................................................................................5 3.1 Committee ................................................................................................................5 3.2 Authority of Committee ...........................................................................................5 3.3 Delegation of Authority ...........................................................................................5 3.4 Indemnification ........................................................................................................5 ARTICLE IV ELIGIBILITY ...........................................................................................................6 ARTICLE V PARTICIPATION .......................................................................................................6 ARTICLE VI QUALIFICATION FOR AND AMOUNT OF AWARDS ........................................6 6.1 Performance Measures .............................................................................................6 6.2 Gross Cash Award ....................................................................................................6 6.3 Base Salary...............................................................................................................7 6.4 Approved Bonus % Factor .......................................................................................7 6.5 Indexed Performance Factor ....................................................................................7 6.6 Overall Goal Achievement Factor ...........................................................................7 6.7 Approval of Awards .................................................................................................7 6.8 Qualification for Award ...........................................................................................7 6.9 Total Disability, Retirement or Death during Fiscal Year ........................................8 6.10 Change in Control ....................................................................................................8 ARTICLE VII PAYMENT DATE ....................................................................................................8 7.1 Payment Date ...........................................................................................................8

ii 7.2 Deferral of Awards ...................................................................................................8 ARTICLE VIII AMENDMENT OR TERMINATION....................................................................8 8.1 Amendment or Termination .....................................................................................8 8.2 Notice .......................................................................................................................9 ARTICLE IX CODE SECTION 409A ............................................................................................9 9.1 Interpretation ............................................................................................................9 9.2 Remedial Amendments ............................................................................................9 9.3 No Offsets ................................................................................................................9 9.4 Change in Control ....................................................................................................9 ARTICLE X DESIGNATION OF BENEFICIARIES ...................................................................10 10.1 Beneficiary Designation.........................................................................................10 10.2 No Beneficiary Named or in Existence .................................................................10 ARTICLE XI WITHDRAWAL OF PARTICIPATING COMPANY .............................................10 11.1 Withdrawal of Participating Company ..................................................................10 11.2 Effect of Withdrawal .............................................................................................. 11 ARTICLE XII MISCELLANEOUS .............................................................................................. 11 12.1 No Right to Continued Employment ..................................................................... 11 12.2 No Right to Designation as Participant .................................................................. 11 12.3 Payment on Behalf of Payee .................................................................................. 11 12.4 Nonalienation ......................................................................................................... 11 12.5 Recovery of Awards ...............................................................................................12 12.6 No Trust or Fund Created ......................................................................................12 12.7 Binding Effect ........................................................................................................12 12.8 Coordination with Other Company Benefit Plans .................................................12 12.9 Entire Plan ..............................................................................................................13 12.10 Construction ...........................................................................................................13 12.11 Applicable Law ......................................................................................................13

1 Coca-Cola Consolidated, Inc. Annual Bonus Plan (Amended and Restated Effective July 30, 2024) ARTICLE I PURPOSE Coca-Cola Consolidated, Inc. maintains the Coca-Cola Consolidated, Inc. Annual Bonus Plan to promote the best interests of the Company and its stockholders by providing key management employees with additional incentives to assist the Company in meeting and exceeding its annual business goals. ARTICLE II DEFINITIONS Whenever used herein and capitalized, the following terms shall have the respective meanings indicated unless the context plainly requires otherwise: 2.1 Affiliate Any corporation or other entity with respect to which the Company owns, directly or indirectly, 100% of the corporation’s or other entity’s outstanding capital stock or other equity interests, and any other corporation or entity with respect to which the Company owns directly or indirectly 50% or more of such corporation’s or entity’s outstanding capital stock or other equity interests and which the Committee designates as an Affiliate. 2.2 Board The Board of Directors of the Company. 2.3 Change in Control Any of the following: (a) The acquisition or possession by any person, other than Harrison Family Interests (as defined in Subsection (e)(i) of this Section), of beneficial ownership of shares of the Company’s capital stock having the power to cast more than 50% of the votes in the election of the Board or to otherwise designate a majority of the members of the Board; or (b) At any time when Harrison Family Interests do not have beneficial ownership of shares of the Company’s capital stock having the power to cast more than 50% of the votes in the election of the Board or to otherwise designate a majority of the members of the Board, the acquisition or possession by any person, other than Harrison Family Interests, of beneficial ownership of shares of the Company’s capital stock having the power to cast both (A) 30% or more of the votes in the election of the Board and (B) a greater percentage of the votes in the election of the Board than the shares beneficially owned by Harrison Family Interests are then entitled to cast; or

2 (c) The sale or other disposition of all or substantially all of the business and assets of the Company and its subsidiaries (on a consolidated basis) outside the ordinary course of business in a single transaction or series of related transactions, other than any such sale or disposition to a person controlled, directly or indirectly, by the Company or to a person controlled, directly or indirectly, by Harrison Family Interests that succeeds to the rights and obligations of the Company with respect to the Plan; or (d) Any merger or consolidation of the Company with another entity in which the Company is not the surviving entity and in which either (i) the surviving entity does not succeed to the rights and obligations of the Company with respect to the Plan or (ii) after giving effect to the merger, a “Change in Control” under Subsection (a) or (b) of this Section would have occurred as defined therein were the surviving entity deemed to be the Company for purposes of Subsections (a) and (b) of this Section (with appropriate adjustments in the references therein to “capital stock” and “the Board” to properly reflect the voting securities and governing body of the surviving entity if it is not a corporation). (e) For purposes of this Section: (i) “Harrison Family Interests” means and includes, collectively, the lineal descendants of J. Frank Harrison, Jr. (whether by blood or adoption), any decedent’s estate of any of the foregoing, any trust primarily for the benefit of any one or more of the foregoing, any person controlled, directly or indirectly, by any one or more of the foregoing, and any person in which any one or more of the foregoing have a majority of the equity interests; (ii) “person” includes an entity as well as an individual, and also includes, for purposes of determining beneficial ownership, any group of persons acting in concert to acquire or possess such beneficial ownership; (iii) “beneficial ownership” has the meaning ascribed to such term in Rule 13d-3 of the Securities Exchange Act of 1934; (iv) “control” of a person means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such person; and (v) “subsidiary” of the Company means any person as to which the Company, or another subsidiary of the Company, owns more than 50% of the equity interest or has the power to elect or otherwise designate a majority of the members of its board of directors or similar governing body. Notwithstanding any other provision of this Section, the revocable appointment of a proxy to vote shares of the Company’s capital stock at a particular meeting of stockholders shall not of itself be deemed to confer upon the holder of such proxy the beneficial ownership of such shares. If any person other than Harrison Family Interests would (but for this sentence) share beneficial ownership of any shares of the Company’s capital stock with any Harrison Family Interests, then such person

3 shall be deemed the beneficial owner of such shares for purposes of this definition only if and to the extent such person has the power to vote or direct the voting of such shares otherwise than as directed by Harrison Family Interests and otherwise than for the benefit of Harrison Family Interests. 2.4 Code The Internal Revenue Code of 1986, as amended. References thereto shall include the valid and binding governmental regulations, court decisions and other regulatory and judicial authority issued or rendered thereunder. 2.5 Committee The Compensation Committee of the Board. 2.6 Company Coca-Cola Consolidated, Inc. a Delaware corporation, or any entity which succeeds to its rights and obligations with respect to the Plan. 2.7 Participant An employee of the Company or a Participating Company who has been granted an award under the Plan in accordance with Article V. 2.8 Participating Company Subject to the provisions of Article XII, the Company and any Affiliate which adopts the Plan with the approval of the Committee for the benefit of its designated employees. Each Participating Company shall be deemed to appoint the Committee as its exclusive agent to exercise on its behalf all of the power and authority conferred by the Plan upon the Company. The authority of the Committee to act as such agent shall continue until the Participating Company withdraws from the Plan or the Plan is terminated by the Company. 2.9 Performance Measures The measurable performance objective or objectives established pursuant to the Plan and used in calculating the Overall Goal Achievement Factor in Section 6.6. Performance Measures may be described in terms of Company-wide objectives or objectives that are related to the performance of the individual Participant or of the Participating Company, division, department, region or function within the Participating Company in which the Participant is employed. The Performance Measures may be established relative to the performance of other companies. If the Committee determines that a change in the business, operations, corporate structure or capital structure of the Company or a Participating Company, or the manner in which it conducts its business, or other events or circumstances render the Performance Measures

4 unsuitable, the Committee may, in its sole discretion, modify such Performance Measures or the related minimum acceptable level of achievement, in whole or in part, as the Committee deems appropriate and equitable. No payments shall be made with respect to awards made under the Plan subject to Performance Measures unless, and then only to the extent that, the Committee certifies the Performance Measures have been achieved. 2.10 Plan The Coca-Cola Consolidated, Inc. Annual Bonus Plan, as contained herein and as it may be amended from time to time hereafter. 2.11 Plan Administrator The Vice Chairman, Chief Financial Officer or such other person or persons as may be designated from time to time by the Chief Executive Officer of the Company. 2.12 Retirement A Participant’s termination of employment with the Company and its Affiliates other than on account of death and: (i) After attaining age 60; (ii) After attaining age 55 and completing 20 “years of service;” or (iii) As the result of Total Disability. For purposes of determining a Participant’s “years of service” under Subsection (ii) of this Section, a Participant is credited with a year of service for any calendar year in which the Participant completes at least 1,000 hours of service, including periods of Total Disability and authorized leaves of absence and excluding periods of employment with Affiliates of the Company prior to becoming an Affiliate unless inclusion of such employment is approved by the Committee. “Hours of service” are credited in accordance with the provisions of the Company’s Savings Plan, as amended from time to time, as if that plan were in existence when the service was performed. 2.13 Total Disability A physical or mental condition under which the Participant qualifies as totally disabled under the group long-term disability plan of the Participating Company; provided, however, that if the Participant is not covered by such plan or if there is no such plan, the Participant shall be under a Total Disability if the Participant is determined to be disabled under the Social Security Act. Notwithstanding any other provisions of the Plan, a Participant shall not be considered under a Total Disability if such disability is due to (i) war, declared or undeclared, or any act of war, (ii) intentionally self-inflicted injuries, (iii) active participation in a riot, or (iv) the Participant’s intoxication or the Participant’s illegal use of drugs.

5 ARTICLE III ADMINISTRATION 3.1 Committee The Plan will be administered by the Committee. 3.2 Authority of Committee In administering the Plan, the Committee is authorized to (i) establish guidelines for administration of the Plan, (ii) make determinations under and interpret the terms of the Plan, (iii) make awards pursuant to the Plan and prescribe the terms and conditions of such awards consistent with the provisions of the Plan and of any agreement or other document evidencing an award made under the Plan, and (iv) to take such other actions as may be necessary or desirable in order to carry out the terms, intent and purposes of the Plan. Subject to the foregoing, all determinations and interpretations of the Committee will be binding upon the Participating Companies and each Participant. 3.3 Delegation of Authority The Committee, in its discretion, may delegate to a special committee consisting of one or more officers of the Company, all or part of the Committee’s authority and duties with respect to awards to individuals who at the time of the award are not, and are not anticipated to become, persons subject to the reporting and other provisions of Section 16 of the Securities Exchange Act of 1934. The Committee may revoke or amend the terms of a delegation at any time but such action shall not invalidate any prior actions of the Committee’s delegate or delegates that were consistent with the terms of the Plan. 3.4 Indemnification No member of the Board, the Committee or any employee of the Company (each such person, an “Indemnified Person”) shall be liable for any action taken or omitted to be taken or any determination made in good faith with respect to the Plan or any award hereunder. Each Indemnified Person shall be indemnified and held harmless by the Company against and from (i) any loss, cost, liability or expense (including attorneys’ fees) that may be imposed upon or incurred by such Indemnified Person in connection with or resulting from any action, suit or proceeding to which such Indemnified Person may be a party or in which such Indemnified Person may be involved by reason of any action taken or omitted to be taken under the Plan or any evidence of Award and (ii) any and all amounts paid by such Indemnified Person, with the Company’s approval, in settlement thereof, or paid by such Indemnified Person in satisfaction of any judgment in any such action, suit or proceeding against such Indemnified Person, provided that the Company shall have the right, at its own expense, to assume and defend any such action, suit or proceeding, and, once the Company gives notice of its intent to assume the defense, the Company shall have sole control over such defense with counsel of the Company’s choice. The foregoing right of indemnification shall not be available to an Indemnified Person to the extent that a court of competent jurisdiction in a final judgment or other final adjudication, in either case not subject to further appeal, determines that the

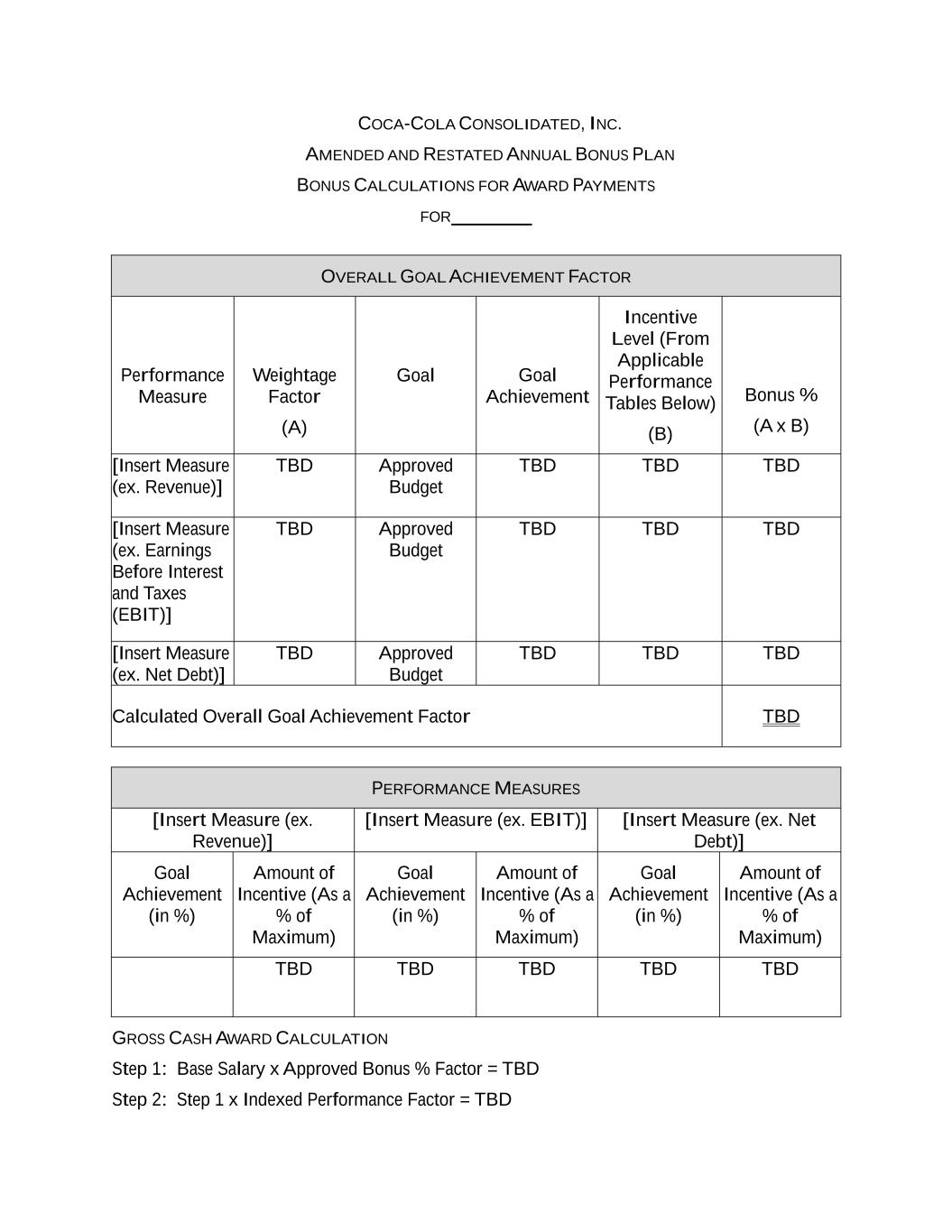

6 acts or omissions of such Indemnified Person giving rise to the indemnification claim resulted from such Indemnified Person’s bad faith, fraud or willful criminal act or omission or that such right of indemnification is otherwise prohibited by law or by the Company’s Certificate of Incorporation or By-laws. The foregoing right of indemnification shall not be exclusive of any other rights of indemnification to which Indemnified Persons may be entitled under the Company’s Certificate of Incorporation or By-laws, as a matter of law, or otherwise, or any other power that the Company may have to indemnify such Indemnified Persons or hold them harmless. ARTICLE IV ELIGIBILITY The Committee is authorized to grant cash awards to any officer, including officers who are directors, and to other employees of a Participating Company and in key positions. ARTICLE V PARTICIPATION Management will recommend annually key positions which it recommends be granted awards under the Plan. Management will inform individuals in selected key positions of their participation in the Plan. ARTICLE VI QUALIFICATION FOR AND AMOUNT OF AWARDS 6.1 Performance Measures Participants will qualify for awards under the Plan based on the achievement of one or more Performance Measures established for the fiscal year. 6.2 Gross Cash Award The total cash award to the Participant will be computed as follows: Gross Cash Award = Base Salary times Approved Bonus % Factor times Indexed Performance Factor times Overall Goal Achievement Factor Notwithstanding the above formula, the maximum cash award that may be made to any individual Participant based upon performance for any fiscal year shall be $3,000,000. Annex A illustrates a sample calculation of the Gross Cash Award.

7 6.3 Base Salary The Base Salary is the Participant’s base salary level for the fiscal year. 6.4 Approved Bonus % Factor The Approved Bonus % Factor is a number set by the Committee to reflect each Participant’s relative responsibility and the contribution to Company performance attributed to each Participant’s position with a Participating Company. 6.5 Indexed Performance Factor The Indexed Performance Factor is determined by the Committee prior to making payments of awards for each fiscal year, based on each individual’s performance during such fiscal year. 6.6 Overall Goal Achievement Factor The Overall Goal Achievement Factor used in calculating the Gross Cash Award for each Participant each year will be determined by multiplying the weightage factor determined by the Committee for such year (which may be from 0% to 100% for each Performance Measure selected by the Committee) by the goal achievement percentage determined by the Committee for the level of performance achieved with respect to specified levels of, or growth or reduction in, such Performance Measure. Annex A illustrates the methodology for calculation of the Overall Goal Achievement Factor. 6.7 Approval of Awards The Committee (or its permitted delegate pursuant to Section 3.3) will review and approve all awards. The Committee has the full and final authority in its discretion to adjust the Gross Cash Award determined in accordance with the formula described above in arriving at the amount of the award to be paid to any Participant. 6.8 Qualification for Award Except as otherwise provided in Section 6.9, the Participant must be an active employee of the Company or an Affiliate on the last day of the applicable fiscal year to qualify for an award. If a Participant’s employment with the Company and all Affiliates is terminated, voluntarily or involuntarily, during a fiscal year for any reason other than those described in Section 6.9, the Participant shall forfeit any right to an award or any portion thereof; provided, however, that in unusual circumstances, the Committee, in its sole discretion, may waive the forfeiture in whole or in part. Any employee who assumes a key position during a fiscal year may be eligible for a pro-rated award at the option of the Committee.

8 6.9 Total Disability, Retirement or Death during Fiscal Year In the event of the Total Disability, Retirement, or death of any Participant during any fiscal year, and in the event of the subsequent attainment of the Performance Measure applicable to such Participant, such Participant or such Participant’s designated beneficiary or estate, as applicable, shall be entitled to receive no later than the March 31 next following the close of the fiscal year to which such award relates, a pro rata portion of the Participant’s award based on the portion of the fiscal year completed through the date of the Participant’s Total Disability, Retirement or death. 6.10 Change in Control Notwithstanding any provision of the Plan to the contrary, if a Change in Control occurs prior to the end of a fiscal year, within 15 days following the occurrence of the Change in Control, each Participant shall be entitled to receive a pro rata portion of the Participant’s award for the fiscal year, based on the portion of the fiscal year completed through the date of the Change in Control. For purposes of any award payment made pursuant to this Section, an Overall Goal Achievement Factor of 100% shall be deemed to have been earned as of the effective date of the Change in Control for each Performance Measure. ARTICLE VII PAYMENT DATE 7.1 Payment Date Except as provided in Section 7.2, awards shall be paid no later than the March 31 next following the close of the fiscal year to which such awards relate. In any event, the Committee shall provide written certification that the annual performance goals have been attained prior to any payments being made for any fiscal year. 7.2 Deferral of Awards A Participant may, in accordance with procedures established under the Company’s Supplemental Savings Incentive Plan (“SSIP”) and in accordance with the requirements of Section 409A of the Code, defer payment of an award under the SSIP. Thereafter, payment of any award so deferred will be subject to all provisions of the SSIP. ARTICLE VIII AMENDMENT OR TERMINATION 8.1 Amendment or Termination The Committee reserves the right at any time to amend or terminate the Plan, in whole or in part, for any reason and without the consent of any Participating Company, Participant or Beneficiary. Each Participating Company by its participation in the Plan shall be deemed to have delegated this authority to the Committee. Notwithstanding the foregoing, any amendment which must be approved by the stockholders of the Company in order to comply with applicable law or the rules of the exchange on which shares of

9 Common Stock are traded shall not be effective unless and until such approval has been obtained. Presentation of this Plan or any amendment thereof for stockholder approval shall not be construed to limit the Company’s authority to offer similar or dissimilar benefits under other plans or otherwise with or without stockholder approval. Without limiting the generality of the foregoing, the Committee may amend this Plan to eliminate provisions that are no longer necessary as a result in changes in tax or securities laws or regulations. 8.2 Notice Notice of any amendment or termination of the Plan shall be given by the Committee to all Participating Companies. ARTICLE IX CODE SECTION 409A 9.1 Interpretation The Plan and the payments and benefits under the Plan are intended to either be exempt from the application of, or comply with, Internal Revenue Code Section 409A and the regulations and guidance promulgated thereunder (collectively “Section 409A”). Accordingly, the Plan shall be construed, administered and governed in a manner that effects such intent, and the Company shall not take any action that would be inconsistent with such intent. Not in limitation of the foregoing, the payments and benefit provided under the Plan may not be deferred, accelerated, extended, paid out, modified or replaced in a manner that would result in the imposition of an additional tax or interest under Section 409A on a Participant. 9.2 Remedial Amendments The Company reserves the right to reform any provision of the Plan that the Company determines could cause a Participant to incur any additional tax or interest under Section 409A to the minimum extent reasonably appropriate to conform with Section 409A. To the extent that any provision hereof is modified in order to comply with Section 409A, such modification shall be made in good faith and shall, to the maximum extent reasonably possible, maintain the original intent and economic benefit to the Participants and the Company of the applicable provision without violating the provisions of Section 409A. 9.3 No Offsets Notwithstanding any other provision of the Plan to the contrary, in no event shall any payment under the Plan that constitutes “nonqualified deferred compensation” for purposes of Section 409A be subject to offset by any other amount unless otherwise permitted by Section 409A. 9.4 Change in Control

10 Notwithstanding any other provision of the Plan to the contrary, in no event shall Section 3.1(f) shall not be effective unless the Change in Control also constitutes a “change in control event” as defined in Section 409A. ARTICLE X DESIGNATION OF BENEFICIARIES 10.1 Beneficiary Designation Every Participant shall file with the Plan Administrator a written designation of one or more persons as the beneficiary who shall be entitled to receive any amount payable under the Plan after the Participant’s death. A Participant may from time to time revoke or change such beneficiary by filing a new designation as described in the preceding sentence. The last such designation received by the Plan Administrator shall be controlling; provided, however, that no designation, or change or revocation thereof, shall be effective unless received by the Plan Administrator prior to the Participant’s death, and in no event shall it be effective as of any date prior to such receipt. All decisions by the Plan Administrator concerning the effectiveness of any beneficiary designation and the identity of any beneficiary shall be final. If a beneficiary dies after the death of the Participant and prior to receiving the payment(s) that would have been made to such beneficiary had such beneficiary’s death not occurred, and if no contingent beneficiary has been designated, then for the purposes of the Plan the payment(s) that would have been received by such beneficiary shall be made to the beneficiary’s estate. 10.2 No Beneficiary Named or in Existence If no beneficiary designation is in effect at the time of a Participant’s death (including a situation where no designated beneficiary is alive or in existence at the time of the Participant’s death), any amounts payable under the Plan after the Participant’s death shall be made to the Participant’s surviving spouse, if any, or if the Participant has no surviving spouse, to the Participant’s estate. If there is any doubt as to the right of any person to receive such payments, the Plan Administrator may direct the Company to withhold payment, without liability for any interest thereon, until the rights thereto are determined, or the Plan Administrator may direct the Company to pay any such amount into any court of appropriate jurisdiction; and such payment shall be a complete discharge of the liability of the Company. ARTICLE XI WITHDRAWAL OF PARTICIPATING COMPANY 11.1 Withdrawal of Participating Company A Participating Company (other than the Company) may withdraw from participation in the Plan by giving the Committee prior written notice approved by resolution of its board of directors or similar governing body specifying a withdrawal date, which shall be the last day of a month at least 30 days subsequent to the date which notice is received by the Committee. A Participating Company shall withdraw from the participation in the Plan if

11 and when it ceases to be an Affiliate. The Committee may require a Participating Company to withdraw from the Plan as of any withdrawal date the Committee specifies. 11.2 Effect of Withdrawal A Participating Company’s withdrawal from the Plan shall not in any way modify, reduce or otherwise affect the Participating Company’s obligations under awards made before the withdrawal, as such obligations are defined under the provisions of the Plan existing immediately before this withdrawal. Withdrawal from the Plan by any Participating Company shall not in any way affect any other Participating Company’s participation in the Plan. ARTICLE XII MISCELLANEOUS 12.1 No Right to Continued Employment Nothing contained in the Plan shall give any employee the right to be retained in the employment of the Company or any Affiliate or affect the right of the Company or any Affiliate to dismiss any employee with or without cause. The adoption and maintenance of the Plan shall not constitute a contract between the Company and any employee or consideration for, or an inducement to or condition of, the employment of any employee. Unless a written contract of employment has been executed by a duly authorized representative of the Company, such employee is an “employee at will.” 12.2 No Right to Designation as Participant Designation as a Participant in the Plan for a fiscal year shall not entitle or be deemed to entitle the Participant to be designated as a Participant for any subsequent fiscal year. 12.3 Payment on Behalf of Payee If the Committee finds that any person to whom any amount is payable under the Plan is unable to care for such person’s affairs because of illness or accident, or is a minor, or has died, then any payment due such person or such person’s estate (unless a prior claim therefor has been made by a duly appointed legal representative) may, if the Committee so elects, be paid to such person’s spouse, a child, a relative, an institution maintaining or having custody of such person, or any other person deemed by the Committee to be a proper recipient on behalf of such person otherwise entitled to payment. Any such payment shall be a complete discharge of the liability of the Plan and the Company therefor. 12.4 Nonalienation No interest, expectancy, benefit, payment, claim or right of any Participant or beneficiary under the Plan shall be (i) subject in any manner to any claims of any creditor of the Participant or beneficiary, (ii) subject to the debts, contracts, liabilities or torts of the Participant or beneficiary or (iii) subject to alienation by anticipation, sale, transfer,

12 assignment, bankruptcy, pledge, attachment, charge or encumbrance of any kind. If any person attempts to take any action contrary to this Section, such action shall be null and void and of no effect and the Committee and the Company shall disregard such action and shall not in any manner be bound thereby and shall suffer no liability on account of its disregard thereof. If the Participant or beneficiary hereunder becomes bankrupt or attempts to anticipate, alienate, sell, assign, pledge, encumber, or charge any right hereunder, then such right or benefit shall, in the discretion of the Committee, cease and terminate, and in such event the Committee may hold or apply the same or any part thereof for the benefit of the Participant or beneficiary or the spouse, children, or other dependents of the Participant or beneficiary, or any of them, in such manner and in such amounts and proportions as the Committee may deem proper. 12.5 Recovery of Awards All incentive-based compensation received by any current or former Participant in the Plan shall be subject to recovery pursuant to the Coca-Cola Consolidated, Inc. Incentive- Based Compensation Recovery Policy, as amended, superseded or replaced from time to time (the “Policy”), the terms and provisions of which are incorporated by reference into this Plan, and each award under the Plan shall be deemed to include, as a condition to the award, an agreement by the Participant to abide by the terms of the Policy. Any award hereunder shall also be subject rights of recovery that may be available to the Company under applicable law, rule or regulation or pursuant to the terms of any other policy of the Company or any provision in any employment agreement. 12.6 No Trust or Fund Created The obligation of the Company to make payments hereunder constitutes a liability of the Company to a Participant or beneficiary, as the case may be. Such payments shall be made from the general funds of the Company and the Company shall not be required to establish or maintain any special or separate fund, or purchase or acquire life insurance on a Participant’s life, or otherwise to segregate assets to assure that such payment shall be made. Neither a Participant nor a beneficiary shall have any interest in any particular asset of the Company by reason of its obligations hereunder. Nothing contained in the Plan shall create or be construed as creating a trust of any kind or any other fiduciary relationship between the Company and a Participant or any other person. The rights and claims of a Participant or a beneficiary to a benefit provided hereunder shall have no greater or higher status than the rights and claims of any other general, unsecured creditor of any Participating Company. 12.7 Binding Effect Obligations incurred by any Participating Company pursuant to the Plan shall be binding upon and inure to the benefit of such Participating Company, its successors and assigns, and the Participant and the Participant’s Beneficiary. 12.8 Coordination with Other Company Benefit Plans

13 Any income Participants derive from payments pursuant to awards will not be considered eligible earnings for purposes of pension plans, savings plans, profit sharing plans or any other benefits plans sponsored or maintained by the Company or an Affiliate unless expressly included by the provisions of any such plan. 12.9 Entire Plan This document, any written amendments hereto and any Annex or Exhibit attached hereto contain all the terms and provisions of the Plan and shall constitute the entire Plan, any other alleged terms or provisions being of no effect. 12.10 Construction Unless otherwise indicated, all references to articles, sections, and subsections shall be to the Plan as set forth in this document. The titles of articles and the captions preceding sections and subsections have been inserted solely as a matter of convenience of reference only and are to be ignored in any construction of the provisions of the Plan. Whenever used herein, unless the context clearly indicates otherwise, the singular shall include the plural and the plural the singular. 12.11 Applicable Law The Plan shall be governed and construed in accordance with the laws of the State of Delaware, except to the extent such laws are preempted by the laws of the United States of America.

IN WITNESS WHEREOF, the Company has caused this Plan to be executed as of the 30th day of July, 2024. COCA-COLA CONSOLIDATED, INC. By: /s/ E. Beauregarde Fisher III _ E. Beauregarde Fisher III Executive Vice President, General Counsel and Secretary

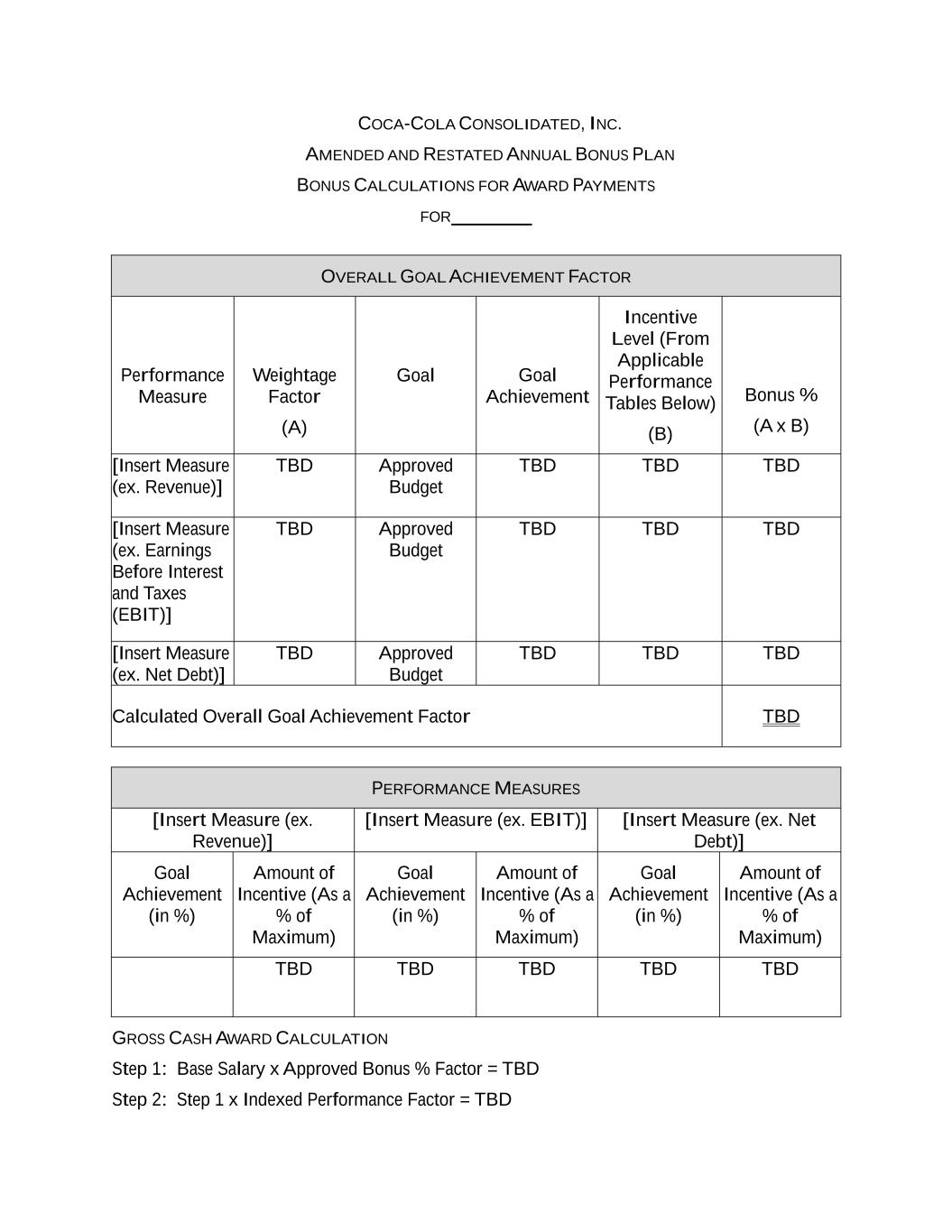

COCA-COLA CONSOLIDATED, INC. AMENDED AND RESTATED ANNUAL BONUS PLAN BONUS CALCULATIONS FOR AWARD PAYMENTS FOR OVERALL GOAL ACHIEVEMENT FACTOR Performance Measure Weightage Factor (A) Goal Goal Achievement Incentive Level (From Applicable Performance Tables Below) (B) Bonus % (A x B) [Insert Measure (ex. Revenue)] TBD Approved Budget TBD TBD TBD [Insert Measure (ex. Earnings Before Interest and Taxes (EBIT)] TBD Approved Budget TBD TBD TBD [Insert Measure (ex. Net Debt)] TBD Approved Budget TBD TBD TBD Calculated Overall Goal Achievement Factor TBD PERFORMANCE MEASURES [Insert Measure (ex. Revenue)] [Insert Measure (ex. EBIT)] [Insert Measure (ex. Net Debt)] Goal Achievement (in %) Amount of Incentive (As a % of Maximum) Goal Achievement (in %) Amount of Incentive (As a % of Maximum) Goal Achievement (in %) Amount of Incentive (As a % of Maximum) TBD TBD TBD TBD TBD GROSS CASH AWARD CALCULATION Step 1: Base Salary x Approved Bonus % Factor = TBD Step 2: Step 1 x Indexed Performance Factor = TBD

2 Step 3: Determine “Overall Goal Achievement Factor” in above table Step 4: Calculate “Gross Cash Award”: Step 2 x Step 3 = Gross Cash Award