EXHIBIT 99.4

Focusing on Health Sciences & Photonics

October 6, 2005

Factors Affecting Future Performance

This press release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements relating to estimates and projections of future earnings per share and revenue growth and other financial results, developments relating to our customers and end-markets, and plans concerning business development opportunities. Words such as “believes,” “anticipates,” “plans,” “expects,” “projects,” “forecasts,” “will” and similar expressions, and references to guidance, are intended to identify forward-looking statements. Such statements are based on management’s current assumptions and expectations and no assurances can be given that our assumptions or expectations will prove to be correct.

A number of important risk factors could cause actual results to differ materially from the results described, implied or projected in any forward-looking statement. These factors include, without limitation: (1) economic and geopolitical forces that may limit any continued or expected economic or end market strengthening or recoveries; (2) risks related to our failure to introduce new products in a timely manner; (3) the impact of our debt on our cash flow and investment opportunities; (4) our ability to comply with financial covenants contained in our credit agreements and our debt instruments; (5) a delay in resolution of the Company’s tax audits and an adverse determination by the Internal Revenue Service with respect to the Company’s tax audits, (6) cyclical downturns continuing to affect several of the industries into which we sell our products; (7) our ability to adjust our operations to address unexpected changes; (8) our ability to execute acquisitions and license technologies and successfully integrate acquired businesses and licensed technologies into our existing business; (9) the loss of any of our licenses that may require us to stop selling products or lose competitive advantage; (10) competition; (11) regulatory compliance; (12) regulatory changes; (13) our failure to obtain and enforce intellectual property protection; (14) our defense of third party claims of patent infringement and our ability to realize the full value of our intangible assets; and (15) other factors which we describe under the caption “Forward-Looking Information and Factors Affecting Future Performance” in our most recent annual report on Form 10-K and quarterly report on Form 10-Q and in our other filings with the Securities and Exchange Commission.

We disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this press release.

Page 2

Today’s discussion …

Signed Contract to Sell Aerospace Business to Eaton Corporation

Intention to Sell Semicon and Fluid Testing Businesses

Potential Use of Proceeds

Financial Implication

PKI Post-Fluid Sciences Sale

… accelerating shift to Health Sciences & Photonics

Page 3

Sale of Aerospace business …

Buyer Eaton Corporation

Proceeds ~ $330 million

Expected Closing 4th Quarter 2005

2005E EBITDA ~ $34 million

After-tax Proceeds ~ $240 million

Book Gain > $1.00 per share

Note: All figures presented are estimates

… realizing good value

Page 4

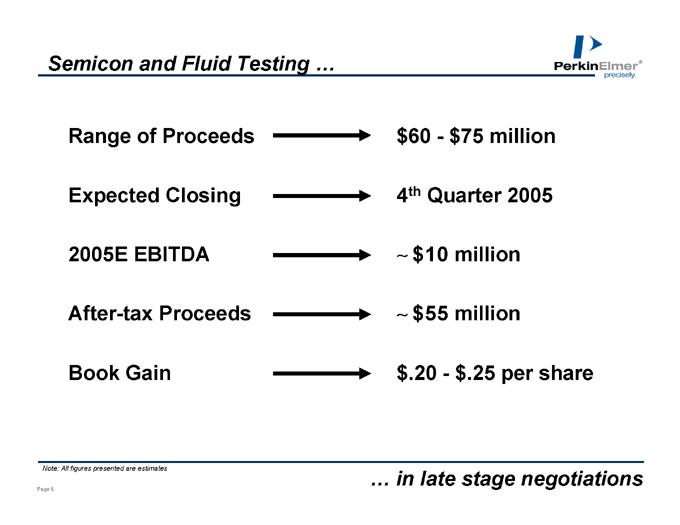

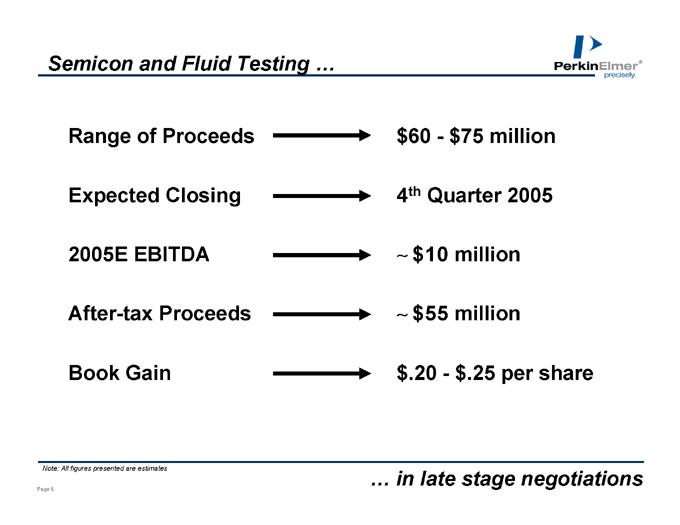

Semicon and Fluid Testing …

Range of Proceeds $60 - $75 million

Expected Closing 4th Quarter 2005

2005E EBITDA ~ $10 million

After-tax Proceeds ~ $55 million

Book Gain $.20 - $.25 per share

Note: All figures presented are estimates

… in late stage negotiations

Page 5

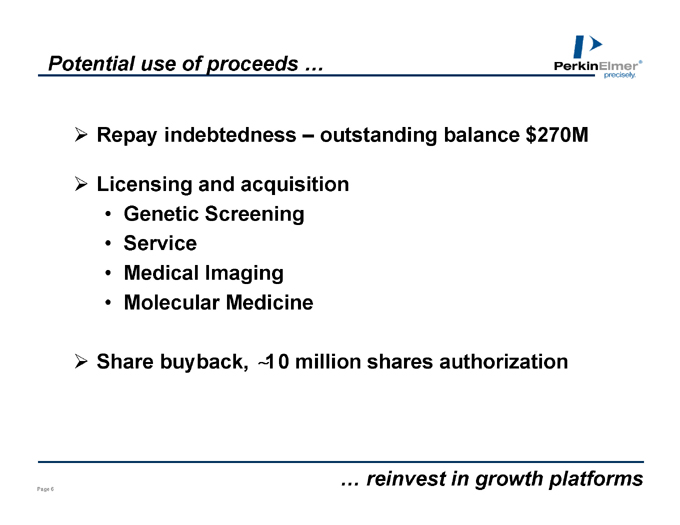

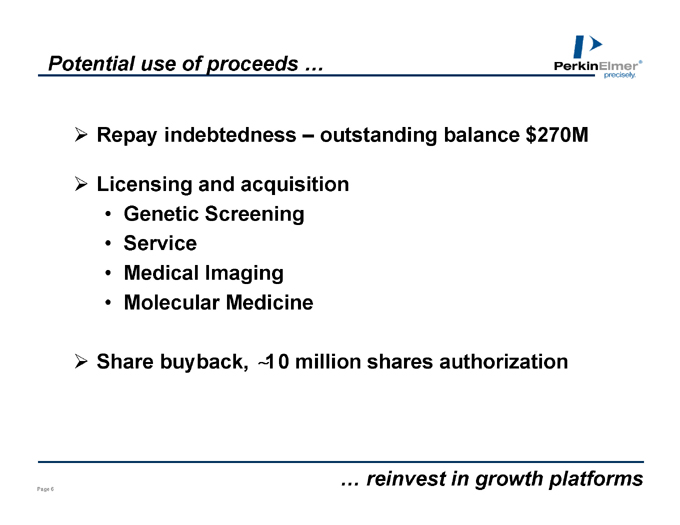

Potential use of proceeds …

Repay indebtedness – outstanding balance $270M

Licensing and acquisition

Genetic Screening

Service

Medical Imaging

Molecular Medicine

Share buyback, ~10 million shares authorization

… reinvest in growth platforms

Page 6

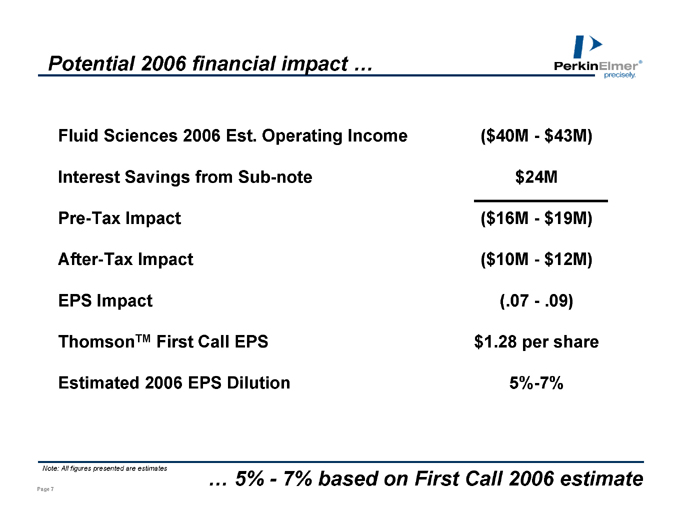

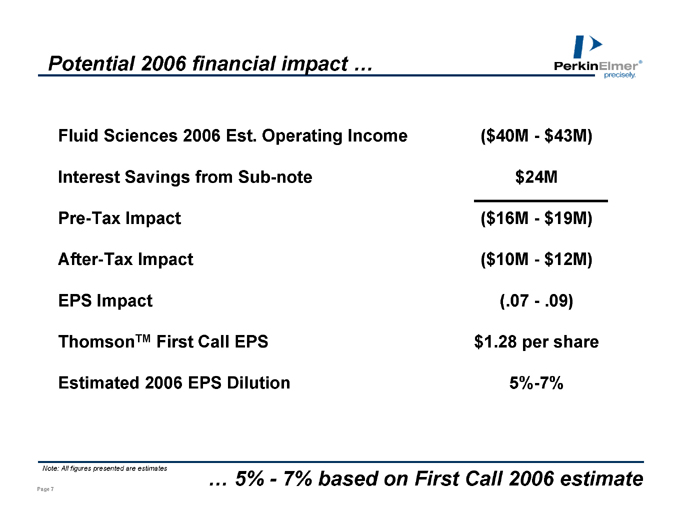

Potential 2006 financial impact …

Fluid Sciences 2006 Est. Operating Income ($40M - $43M)

Interest Savings from Sub-note $24M

Pre-Tax Impact ($16M - $19M)

After-Tax Impact ($10M - $12M)

EPS Impact (.07 - .09)

ThomsonTM First Call EPS $1.28 per share

Estimated 2006 EPS Dilution 5%-7%

Note: All figures presented are estimates

… 5% - 7% based on First Call 2006 estimate

Page 7

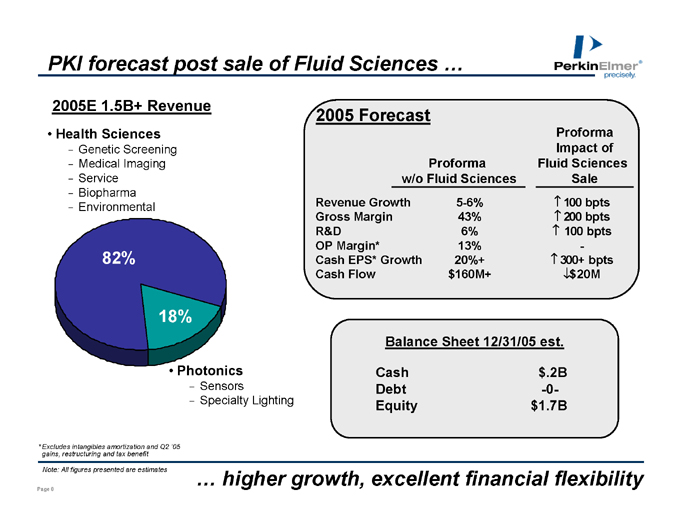

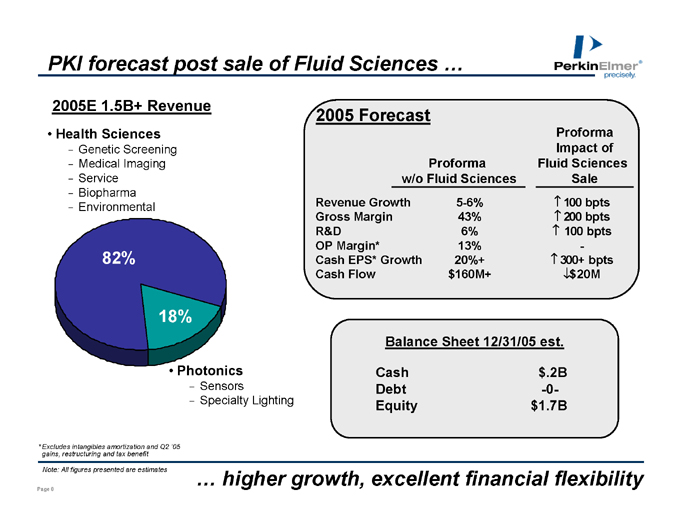

PKI forecast post sale of Fluid Sciences …

2005E 1.5B+ Revenue

Health Sciences

Genetic Screening

Medical Imaging

Service

Biopharma

Environmental

82% 18%

Photonics

Sensors

Specialty Lighting

* Excludes intangibles amortization and Q2 ’05 gains, restructuring and tax benefit

2005 Forecast

Proforma w/o Fluid Sciences

Proforma Impact of Fluid Sciences Sale

Revenue Growth 5-6% 100 bpts

Gross Margin 43% 200 bpts

R&D 6% 100 bpts

OP Margin* 13% -

Cash EPS* Growth 20%+ 300+ bpts

Cash Flow $160M+ $20M

Balance Sheet 12/31/05 est.

Cash $.2B

Debt -0-

Equity $1.7B

Note: All figures presented are estimates

… higher growth, excellent financial flexibility

Page 8

Use of Non-GAAP Financial Measures

Use of Non-GAAP Financial Measures

This presentation contains non-GAAP financial measures of earnings per share operating profit and operating margin in each case exclude amortization of acquisition-related intangible assets and restructuring changes. This presentation also includes a non-GAAP financial measure of earnings per share excluding intangibles amortization, restructuring charges and a tax benefit. We exclude the amortization of acquisition related intangibles, restructuring charges, and where applicable, the tax benefit in calculating these non-GAAP measures because such items are outside of our normal operations. This presentation also contains non-GAAP financial measures of free cash flow and EBITDA. We define free cash flow as our net cash provided by operating activities minus our capital expenditures. We define EBITDA as earnings before interest expense, income taxes, depreciation and amortization expense. We believe that the inclusion of these non-GAAP financial measures in this presentation also helps investors to gain a meaningful understanding of our core operating results and future prospects, consistent with how management measures and forecasts the Company’s performance, especially when comparing such results to previous periods or forecasts.

Page 9