August 21, 2009

U.S. Securities and Exchange Commission

Division of Investment Management

100 F Street, NE

Washington, D.C. 20549-0504

Attention: James O’Connor, Esq.

VIA EDGAR AND OVERNIGHT MAIL

| | | | |

| Re: | | Registrant: | | Natixis Cash Management Trust |

| | File No.: | | 811-02819 |

| | Filing Type: | | Form N-1A |

Dear Mr. O’Connor:

This letter responds to comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) received by telephone on August 13, 2009, regarding the Natixis Cash Management Trust (the “Trust”) registration statement on Form N-1A for the Natixis Cash Management Trust – Money Market Series (the “Fund”), which was filed with the Commission on July 2, 2009 (the “Registration Statement”). For your convenience, we have included asExhibit A a revised summary prospectus marked to indicate revisions.

For your convenience, we have summarized Staff comments below, followed by the Trust’s response. Any term that is used, but not defined, in this letter retains the same meaning as used by the Trust in the Registration Statement. References to page numbers are to the prospectus included in the Registration Statement.

| | 1. | Comment. Please delete the first three lines of text at the bottom of the “Table of Contents.” |

Response. In response to the comment, the text has been deleted.

| | 2. | Comment. In the Annual Fund Operating Expenses table, please delete “…and/or expense reimbursement” from the last line in the table. |

Response. The Trust believes that the language quoted above complies with the caption suggested in Instruction 3(e) to Item 3 of Form N-1A which suggests that a fund “use appropriate descriptive captions, such as “Fee Waiver [and/or Expense Reimbursement]” and “Total Annual Fund Operating Expenses After Fee Waiver [and/or Expense Reimbursement],” respectively.”

| | 3. | Comment. In the paragraph under “Example” on page 1 of the prospectus, please delete the following text “…which is based upon the expenses shown in the Annual Fund Operating Expenses table,” and “…and all dividends and distributions are reinvested.” |

Response. In response to the comment the text has been deleted and will be moved to the statutory prospectus.

1

| | 4. | Comment. Please delete footnote 2 from page 1 of the prospectus. |

Response. The Trust respectfully submits that such disclosure is required pursuant to Instruction 2(b) to Item 3 of Form N-1A, which requires disclosure of “any fee charged for any redemption of the Fund’s shares,” and has therefore retained the footnote.

| | 5. | Comment. Please delete footnote 3 on page 2 of the prospectus. |

Response. In response to the comment, footnote 3 has been deleted.

| | 6. | Comment. Please delete the following language from footnote 4 on page 2 of the prospectus: “Without this undertaking, expenses would have been higher.” |

Response. In response to the comment, the text has been deleted.

| | 7. | Comment. Please delete the following language from footnote 4 on page 2 of the prospectus: “The expense reimbursement excludes the premium for the Fund’s participation in the U.S. Treasury Department’s Temporary Guarantee Program for money market funds.” |

Response. The Trust believes that it is appropriate to convey to individuals contemplating the purchase of shares that the premiums for the Fund’s participation in the U.S. Treasury Department’s Temporary Guarantee Program for money market funds is excluded from the Fund’s fee waiver agreement, and therefore will be borne by investors. However, in furtherance of the SEC’s stated objective of providing “key information in plain English in a clear and concise format” through the summary prospectus, we have deleted the referenced language and modified the first sentence of footnote 4 to reflect the fact that premiums for participation in the U.S. Treasury Department Guarantee Program are excluded from the Fund’s fee waiver agreement, therefore shortening the disclosure.

| | 8. | Comment. Please delete the first asterisk footnote on page 2 of the prospectus. |

Response. In response to the comment, the footnote has been deleted and will be moved to the statutory prospectus.

| | 9. | Comment. Please explain why the Fund included “Financial Services industry risk” as a principal investment risk on page 3 of the prospectus. Is the Fund reserving the right to invest more than 25% of its net assets in the financial services industry? |

Response. The Trust included “Financial Services industry risk” as a principal investment risk because the Fund may invest a significant portion of its assets in the obligations of banks and other financial services companies; however, the Fund does not intend to concentrate in the financial services industry.

2

| | 10. | Comment. In the first paragraph under “Risk/Return Bar Chart and Table” on page 3 of the prospectus, please delete the following language: “The Fund’s performance might have been different had the current subadvisory arrangements and investment strategies been in place for all periods shown.” |

Response. In response to the comment, the text has been deleted and moved to the statutory prospectus.

| | 11. | Comment. Directly under the bar chart on page 3 of the prospectus, please delete the following language: “The Fund’s total return for Class A shares year to date as of June 30, 2009 was [ ]%.” |

Response. The Trust respectfully submits that because the Fund’s fiscal year end is June 30, the total return information is required by Item 4(b)(2)(ii) of Form N-1A.

| | 12. | Comment. Directly above the Average Annual Total Returns table on page 3 of the prospectus, please delete the following language “The table below shows the average annual total returns for each class of the Fund for the one year, five year and ten year periods.” |

Response. In response to the comment, the text has been deleted.

| | 13. | Comment. Please delete the single and double asterisk footnotes that appear under the table on page 4 of the prospectus. |

Response. In response to the comment, the double asterisk footnote has been deleted. However, with regard to the single asterisk footnote, the Trust believes that it is appropriate to disclose that lower minimums may apply under certain circumstances, so that investors are informed of their ability to invest in smaller amounts. Therefore, the text of the single asterisk footnote has been replaced by the following “Lower investment minimums may apply under certain circumstances. See the section ‘Shareholder Services’ in the SAI.”

| | 14. | Comment. In the first paragraph of text under the table on page 4 of the prospectus, please delete the following language:“Additional information for purchasing or redeeming Fund shares can be found in the section “Fund Services” of the Prospectus and in the sections “Buying Shares” and “Redemptions” of the SAI.” |

Response. In response to the comment, the text has been deleted.

3

| | 15. | Comment. In the “Tax Information” section on page 4 of the prospectus, please delete the following language: “The Fund will provide you with an annual statement showing the amount and tax character of the distributions you received each year.” |

Response. In response to the comment, the text has been deleted.

| | 16. | Comment. Please explain why the Fund did not include the statement required by Item 8 (Financial Intermediary Compensation) of Form N-1A. |

Response. Per Item 8 of Form N-1A, the Trust omitted the statement regarding payments to broker-dealers or other financial intermediaries because neither the Fund nor any of its related companies pay financial intermediaries for the sale of Fund shares or related services.

| | 17. | Comment. Please explain whether the investment strategies and investment risks listed on page 5 of the prospectus are principal investment strategies and risks. If so, please insert the word “Principal” before each heading on page 5 of the prospectus. |

Response. The investment strategies listed on page 5 of the prospectus are principal investment strategies and the heading has been revised accordingly. The investment risks on page 5 of the prospectus provide additional information about the risks to which the Fund may be subject and the heading has been revised accordingly.

| | 18. | Comment. Please explain why credit risk, interest rate risk and foreign investment risk, which are disclosed as principal investment risks on page 2 of the prospectus, are repeated on pages 5 and 6 of the prospectus. |

Response. While the principal elements of credit risk, interest rate risk and foreign investment risk are disclosed under “Principal Investment Risks” on page 2 of the prospectus, more comprehensive information about these risks are included on pages 5 and 6 of the prospectus. We note that this added information is not included in the “Summary Prospectus.”

| | 19. | Comment. Please clarify on page 16 of the SAI that the binding undertaking to reduce the Fund’s advisory fee runs is effective during the period September 1, 2009 through August 31, 2010. |

Response. In response to the comment, the Trust will revise the disclosure on page 16 of the SAI as follows: “The undertaking will be binding on Natixis Advisors for a period of one year from September 1, 2009 through August 31, 2010, and is reevaluated on an annual basis.”

4

In connection with the above-referenced filing, we acknowledge that:

| | • | | The Fund is responsible for the adequacy and accuracy of the disclosure in the above-referenced filing; |

| | • | | Staff comments or changes to disclosure in response to Staff comments in the filing reviewed by the Staff do not foreclose the Commission from taking any action with respect to the above-referenced filing; and |

| | • | | The Fund may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

In addition, we understand that the Division of Enforcement of the Commission has access to all information provided to the Staff in its review of the above-referenced filing or in response to the Division of Investment Management’s comments on the filing.

If you have any questions or require any clarification concerning the foregoing, please call me at 617-449-2818.

|

| Very truly yours, |

|

| /s/ John M. DelPrete |

John M. DelPrete Assistant Secretary Natixis Cash Management Trust |

Michael G. Doherty, Esq.

John M. Loder, Esq.

5

Exhibit A

Table of Contents

If you have any questions about any of the terms used in this Prospectus, please refer to the “Glossary of Terms.”

To learnmore about the possible risks of investing in the Fund, please refer to the section “Investment Risks.” This section details the risks of practices in which the Fundmay engage. Please read this section carefully before you invest.

Fund shares are not bank deposits and are not guaranteed, endorsed or insured by the Federal Deposit Insurance Corporation or any other government agency, and are subject to investment risks, including possible loss of the principal invested.

|

| Natixis Cash Management Trust Prospectus – September 1, 2009 |

Exhibit A

FUND SUMMARY

Natixis Cash Management Trust — Money Market Series

Investment Goal

Natixis Cash Management Trust — Money Market Series (the “Fund”) seeks maximum current income consistent with preservation of capital and liquidity.

Fund Fees & Expenses

The following table describe the fees and expenses that you may pay if you buy and hold shares of the Fund.

| | | | | | | | | |

Shareholder Fees (fees paid directly from your investment) | | Class A | | | Class B | | | Class C | |

Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | | None | | | None | | | None | |

Maximum deferred sales charge (load) (as a percentage of original purchase price or redemption proceeds, as applicable) | | None | 1 | | None | 1 | | None | 1 |

Redemption fees | | None | 2 | | None | 2 | | None | 2 |

| | | |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | Class A | | | Class B | | | Class C | |

Management fees | | 0.35 | % | | 0.35 | % | | 0.35 | % |

Distribution and/or service (12b-1) fees | | None | | | None | | | None | |

Other expenses3 | | | % | | | % | | | % |

Total annual fund operating expenses | | | % | | | % | | | % |

Fee reduction and/or expense reimbursement34 | | | % | | | % | | | % |

Total annual fund operating expenses after fee reduction and/or expense reimbursement | | | % | | | % | | | % |

Example

This example**, which is based upon the expenses shown in the “Annual Fund Operating Expenses” table, is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the sameand all dividends and distributions are reinvested. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | |

| | | Class A | | | Class B* | | | Class C* | |

1 year | | | % | | | % | | | % |

3 years | | | % | | | % | | | % |

5 years | | | % | | | % | | | % |

10 years | | | % | | | % | | | % |

|

| Natixis Cash Management Trust 1 Prospectus – September 1, 2009 |

Exhibit A

FUND SUMMARY

| 1 | Shares of each class are sold without any sales charge. However, shares may be subject to a Contingent Deferred Sales Charge (“CDSC”) if the shares were purchased by exchange from another Natixis Fund. See the section “Exchanging Shares.” |

| 2 | Generally, a transaction fee will be charged for expedited payment of redemption proceeds of $5.50 for wire transfers, $50 for international wire transfers or $20.50 for overnight delivery. These fees are subject to change. |

3 | Other expenses include expenses indirectly borne by the Fund through investments in certain pooled investment vehicles (“Acquired Fund Fees and Expenses”) of less than 0.01% of the Fund’s average daily net assets. The expense information shown in the table above may differ from the expense information disclosed in the Fund’s financial highlights table because the financial highlights table reflects the operating expenses of the Fund and does not include Acquired Fund Fees and Expenses. |

34 | The Fund’s investment adviser has given a binding contractual undertaking to the Fund to limit the amount of the Fund’s total annual fund operating expenses, exclusive of Acquired Fund Fees and Expenses, brokerage expenses, interest expense, taxes, the premium for the Fund’s participation in the U.S. Treasury Department’s Temporary Guarantee Program for money market fundsand organizational and extraordinary expenses, such as litigation and indemnification expenses, to 0.65% of the Fund’s average daily net assets for each of Class A, B and C shares. This undertaking is in effect through August 31, 2010, and may be terminated before then only with the consent of the Fund’s Board of Trustees.however, the Board of Trustees does not intend to terminate this undertaking. Without this undertaking, expenses would have been higher. The Fund’s investment adviser will be permitted to recover, on a class by class basis, management fees reduced and/or expenses it has borne through this undertaking to the extent that a class’ expenses in later periods fall below the annual rates set forth in this undertaking. A class will not be obligated to pay any such reduced fees and expenses more than one year after the end of the fiscal year in which the fee/expense was reduced.The expense reimbursement excludes the premium for the Fund’s participation in the U.S. Treasury Department’s Temporary Guarantee Program for money market funds. |

* | Assumes CDSC does not apply to the redemption. See the section “Exchanging Shares.” |

** | The example is based on the Net Expenses for the first year illustrated in the example and on the total annual fund operating expenses for the remaining years. |

Investments, Risks And Performance

Principal Investment Strategies

The Fund will invest up to 100% of its assets in high-quality, short-term, U.S. dollar-denominated money market investments issued by U.S. and foreign issuers. Examples of these investments include certificates of deposit, bankers’ acceptances or bank notes, securities issued or guaranteed by the U.S. government, commercial paper, repurchase agreements, other corporate debt obligations and cash. The Fund seeks to maintain a stable $1.00 share price.

The Fund’s subadviser will manage the Fund’s portfolio in compliance with regulatory requirements for money market funds. These requirements include holding investments which are generally rated in the two highest rating categories as rated by a major credit agency and investments which have a maturity of 397 days or less and a dollar-weighted average portfolio maturity of 90 days or less. The Fund is also diversified, which limits its exposure to any given issuer.

|

| Natixis Cash Management Trust 2 Prospectus – September 1, 2009 |

Exhibit A

FUND SUMMARY

Principal Investment Risks

Money Market Fund risk: An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. The share price of money market funds can fall below the $1.00 share price. You should not rely on or expect the Fund’s investment adviser, subadviser or their affiliates to enter into support agreements or take other actions to maintain the Fund’s $1.00 share price. The credit quality of the Fund’s holdings can change rapidly in certain markets, and the default of a single holding could have an adverse impact on the Fund’s share price. The Fund’s share price can also be negatively affected during periods of high redemption pressures and/or illiquid markets. The actions of a few large investors in one class of shares of the Fund may have a significant adverse effect on the share prices of all classes of shares of the Fund. Further regulation could impact the way that the Fund is managed, possibly negatively impacting its return.

Credit risk: An issuer may be unable or unwilling to make payments of principal and interest when due. Credit risk also includes the risk of default. These events could cause the Fund’s share price or yield to fall.

Interest Rate risk: Changes in interest rates may cause the value of the Fund’s investments to decrease. Generally, the value of money market securities rises when prevailing interest rates fall and falls when interest rates rise. A period of low interest rates may cause the Fund to have a low or negative yield, potentially reducing the value of your investment.

Foreign Investment risk: The Fund’s investment in foreign securities, including American Depositary Receipts, are subject to foreign currency fluctuations, higher volatility than U.S. securities and limited liquidity. Political, economic and information risks are also associated with foreign securities. Investments in emerging markets may be subject to these risks to a greater extent than those in more developed markets.

Financial Services industry risk: Because it may invest a significant portion of its assets in the obligations of banks and other financial services companies, the Fund is subject to a number of risks generally associated with investments in the financial services industry, such as credit risk, interest rate risk and regulatory developments related to the financial services industry. Changes in government regulation and interest rates can have a substantial negative impact on the financial services industry.

Risk/Return Bar Chart and Table

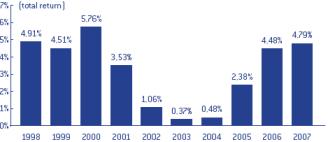

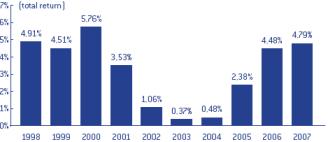

The bar chart and table shown below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year and by showing the Fund’s average annual returns for the one-year, five-year and ten-year periods. The Fund’s past performance does not necessarily indicate how the Fund will perform in the future. The Fund’s current subadviser assumed its role in June 2001. The performance results shown below, for periods prior to that date, reflect results achieved by the previous subadviser.The Fund’s performance might have been different had the current subadvisory arrangements and investment strategies been in place for all periods shown.Updated performance information and current yield information is available online at www.funds.natixis.com and/or by calling the Natixis Funds Personal Access Line® 24 hours a day at 800-225-5478, press 1.

|

| Natixis Cash Management Trust 3 Prospectus – September 1, 2009 |

Exhibit A

FUND SUMMARY

The bar chart shows the Fund’s total returns for Class A shares for each of the last ten calendar years.† The returns for Class B and C shares differ from Class A returns shown in the bar chart to the extent their respective expenses differ.

| | |

| | Highest Quarterly Return: [____ Quarter ____], up [____%] Lowest Quarterly Return: [____ Quarter ____], up [____%] |

| † | The Fund’s total return for Class A shares year-to-date as of June 30, 2009 was [ ]%. |

Thetable below shows the average annual total returns for each class of the Fund for the one-year, five-year and ten-year periods.

| | | | | | | | | |

Average Annual Total Returns (for the periods ended December 31, 2008) | | 1 Year | | | 5 Years | | | 10 Years | |

Class A | | | % | | | % | | | % |

Class B | | | % | | | % | | | % |

Class C | | | % | | | % | | | % |

Management

Investment Adviser

Natixis Asset Management Advisors, L.P. (“Natixis Advisors”)

Subadviser

Reich & Tang Asset Management, LLC

Purchase and Sale of Fund Shares

The following chart shows the investment minimums for various types of accounts:

| | | | | | | |

Type of Account | | Minimum Initial

Purchase | | Minimum

Subsequent

Purchase | |

Any account other than those listed below | | $ | 2,500 | | $ | 100 | |

For shareholders participating in Natixis Funds’ Investment Builder Program | | $ | 1,000 | | $ | 50 | * |

For Traditional IRA, Roth IRA, Rollover IRA, SEP-IRA and Keogh plans using the Natixis Funds’ prototype document (direct accounts, not held through intermediary) | | $ | 1,000 | | $ | 100 | |

Coverdell Education Savings Accounts | | $ | 500 | | $ | 100 | |

For SIMPLE IRA** plans under NatixisFunds’ prototype document

| | $ | 0 | | $ | 0 | |

| | Lower investment minimums may apply under certain circumstances.See the section“Shareholder Services”in the SAI.* Shareholders with accounts participating in NatixisFunds’ Investment Builder Program prior to May 1, 2005may continue to make subsequent purchases of $25 into those accounts. |

|

| Natixis Cash Management Trust 4 Prospectus – September 1, 2009 |

Exhibit A

FUND SUMMARY

** | Effective January 1, 1997, the Savings Inventive Match Plan for Employees of Small Employers (SIMPLE) IRA became available replacing SARSEP Plans. SARSEP plansestablished prior to January 1, 1997 are subject to the same minimums as SIMPLE IRAs. Effective October 1, 2006, Natixis Funds no longer offers SIMPLE IRAs. SIMPLE IRA plans established prior to October 1, 2006may remain active and continue to add new employees. |

The Fund’s shares are redeemable on any business day through your investment dealer, by mail, by exchange, by wire, through the Automated Clearing House system, by telephone or by the Systematic Withdrawal Plan. Class B shares of the Fund are not currently offered for sale.Additional information for purchasing or redeeming Fund shares can be found in the section “Fund Services” of the Prospectus and in the sections “Buying Shares” and “Redemptions” of the SAI.

Tax Information

Distributions of investment income are generally taxable to you as ordinary income. Distributions of capital gains may be taxable as either long-term capital gain or ordinary income depending on how long the Fund owned the investments that generated the gains.The Fund will provide you with an annual statement showing the amount and tax character of the distributions you received each year.Fund distributions are taxable whether you receive them in cash or in additional shares. Distributions by the Fund to retirement plans that qualify for tax-exempt treatment under federal income tax law generally will not be taxable.

|

| Natixis Cash Management Trust 5 Prospectus – September 1, 2009 |

Exhibit A

INVESTMENT GOAL, STRATEGIESAND RISKS

Natixis Cash Management Trust — Money Market Series

The investment objective and principal investment strategies of the Fund are summarized under the sections “Investment Goal” and “Investments, Risks and Performance.”

The Fund will invest in securities which the Fund’s subadviser, Reich & Tang, acting under guidelines established by the Fund’s Board of Trustees, has determined are of high quality and present minimal credit risk.

PrincipalInvestment Strategies

The Fund will invest up to 100% of its assets in high-quality, short-term, U.S. dollar-denominated money market investments issued by U.S. and foreign issuers. To preserve investors’ capital, the Fund seeks to maintain a stable $1.00 share price. Some of the Fund’s investments may include:

| • | | Certificates of deposit |

| • | | Bankers’ acceptances or bank notes |

| • | | Securities issued or guaranteed by the U.S. government |

| • | | Other corporate debt obligations |

Reich & Tang will manage the Fund’s portfolio in compliance with industry-standard requirements for money market funds. These requirements include:

| • | | Credit quality — The Fund’s investments are generally rated in the two highest rating categories as rated by a major credit agency. |

| • | | Maturity — Each of the Fund’s investments has a maturity of 397 days or less and the dollar-weighted average portfolio maturity is 90 days or less. |

| • | | Diversification — The Fund is diversified, which limits its exposure to any given issuer. |

Reich & Tang may adjust the Fund’s holdings or its average maturity based on actual or anticipated changes in interest rates or credit quality. The Fund is appropriate for investors who seek a conservative investment for their portfolio or who are comfortable with the risks described below and may need cash immediately.

More Information AboutInvestment Risks

The Fund has principal investment strategies that come with inherent risks. The principal risks of investing in the Fund are described in the Fund Summary under “Principal Investment Risks.” The followingprovides more information about the risksis a list of risks to which the Fund may be subject because of its investments in various types of securities or engagement in various practices.

Credit Risk and Interest Rate Risk

The Fund is subject to credit risk and interest rate risk. Credit risk relates to the ability of an issuer of a security, or the counterparty to a contract, to make payments of principal and interest when due and includes the risk of default. A default could cause the Fund’s share price or yield to fall. Interest rate risk relates to changes in a security’s value as a result of changes in interest rates. Generally, the value of money market securities rises when prevailing interest rates fall and falls when interest rates rise.

|

| Natixis Cash Management Trust 6 Prospectus – September 1, 2009 |

Exhibit A

INVESTMENT GOAL, STRATEGIESAND RISKS

Foreign Risk

The risk associated with investments in issuers located in foreign countries. A fund’s investments in foreign securities may experience more rapid and extreme changes in value than investments in securities of U.S. companies. In the event of a nationalization, expropriation or other confiscation, a fund that invests in foreign securities could lose its entire investment. The Fund’s investment in foreign securities may be subject to foreign withholding or other taxes. In that case, the Fund’s yield on those securities would be decreased.

Information Risk

The risk that key information about a security is inaccurate or unavailable.

Interest Rate Risk

The risk of market losses attributable to changes in interest rates. In general, the prices of fixed-income securities rise when interest rates fall, and prices fall when interest rates rise.

Liquidity Risk

The risk that certain securities or instruments may be difficult or impossible to sell at the time and at the price that the seller would like. This may result in a loss or may otherwise be costly to a fund. These types of risks may also apply to restricted securities, Section 4(2) commercial paper, structured notes and Rule 144A securities.

Management Risk

The risk that a strategy used by the Fund’s portfolio management may fail to produce the intended result.

Market Risk

The risk that the market value of a security may move up and down, sometimes rapidly and unpredictably, based upon a change in an issuer’s financial condition as well as overall market and economic conditions.

Opportunity Risk

The risk of missing out on an investment opportunity because the assets necessary to take advantage of it are invested in less profitable investments.

Political Risk

The risk of losses directly attributable to government or political actions.

Valuation Risk

The risk that the Fund has valued certain securities at a higher price than the price at which they can be sold.

Portfolio Holdings

A description of the Fund’s policies and procedures with respect to the disclosure of the Fund’s portfolio securities is available in the section “Portfolio Holdings Information” in the Fund’s SAI.

|

| Natixis Cash Management Trust 7 Prospectus – September 1, 2009 |