Exhibit 99.2

Investment Community Conference Call

August 15, 2007

Safe Harbor Statement

This presentation contains forward-looking statements that are based on management’s current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from those described. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including estimates of revenues, operating margins, capital expenditures, cash, other financial metrics, expected legal, arbitration, political, regulatory or clinical results and other such estimates and results. Forward-looking statements involve significant risks and uncertainties, including those discussed below and more fully described in the Securities and Exchange Commission (SEC) reports filed by Amgen, including Amgen’s most recent annual report on Form 10-K and most recent periodic reports on Form 10-Q and Form 8-K. Please refer to Amgen’s most recent Forms 10-K, 10-Q and 8-K for additional information on the uncertainties and risk factors related to our business. Unless otherwise noted, Amgen is providing this information as of August 15, 2007 and expressly disclaims any duty to update information contained in this presentation.

No forward-looking statement can be guaranteed and actual results may differ materially from those we project. The Company’s results may be affected by our ability to successfully market both new and existing products domestically and internationally, sales growth of recently launched products, difficulties or delays in manufacturing our products and regulatory developments (domestic or foreign) involving current and future products and manufacturing facilities. We depend on third parties for a significant portion of our Enbrel® (etanercept) supply and limits on supply may constrain ENBREL sales. In addition, sales of our products are affected by reimbursement policies imposed by third-party payers, including governments, private insurance plans and managed care providers and may be affected by domestic and international trends toward managed care and health care cost containment as well as U.S. legislation affecting pharmaceutical pricing and reimbursement. Government regulations and reimbursement policies may affect the development, usage and pricing of our products. Furthermore, our research, testing, pricing, marketing and other operations are subject to extensive regulation by domestic and foreign government regulatory authorities. We or others could identify side effects or manufacturing problems with our products after they are on the market. In addition, we compete with other companies with respect to some of our marketed products as well as for the discovery and development of new products. Discovery or identification of new product candidates cannot be guaranteed and movement from concept to product is uncertain; consequently, there can be no guarantee that any particular product candidate will be successful and become a commercial product. In addition, while we routinely obtain patents for our products and technology, the protection offered by our patents and patent applications may be challenged, invalidated or circumvented by our competitors. Further, some raw materials, medical devices and component parts for our products are supplied by sole third-party suppliers. Our business may be impacted by government investigations, litigation and product liability claims.

This presentation includes GAAP and non-GAAP financial measures. In accordance with the requirements of SEC Regulation G, reconciliations between these two measures, if these slides are in hardcopy, accompany the hardcopy presentation or, if these slides are delivered electronically, are available on the Company’s website at www.amgen.com within the Investors section.

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

2

George Morrow

Executive Vice President, Global Commercial Operations

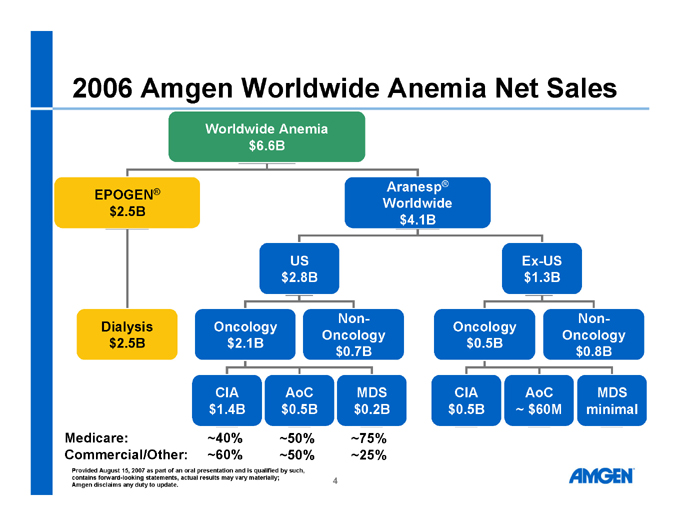

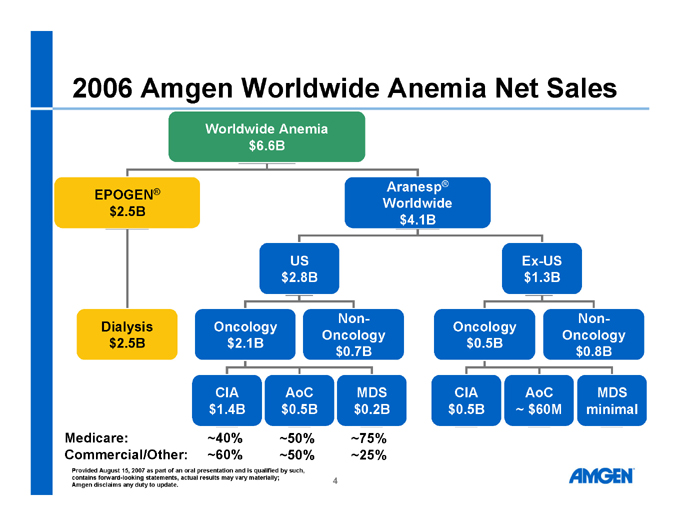

2006 Amgen Worldwide Anemia Net Sales

Worldwide Anemia $6.6B

EPOGEN® $2.5B Aranesp® Worldwide $4.1B Dialysis $2.5B

US $2.8B Ex-US $1.3B Oncology $2.1B Non-Oncology $0.7B CIA $1.4B AoC $0.5B MDS $0.2B Oncology $0.5B Non-Oncology $0.8B CIA $0.5B AoC ~ $60M MDS minimal

Medicare: ~40% ~50% ~75% Commercial/Other: ~60% ~50% ~25%

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

4

NCD Patient Care Concerns

Policy Provisions Comment

Non-coverage of Hb ³ 10.0 g/dL after 4 weeks Response criteria One-time dose escalation of 25%

Approximately 50% increased risk of transfusion

No allowance for patient co-morbidity, which impacts transfusion risk

Misclassifies non-responders

Must stop ESA when treatment is preventing hemoglobin decline

Untested and inconsistent with established treatment guidelines

Increases non-response and thus transfusions

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

5

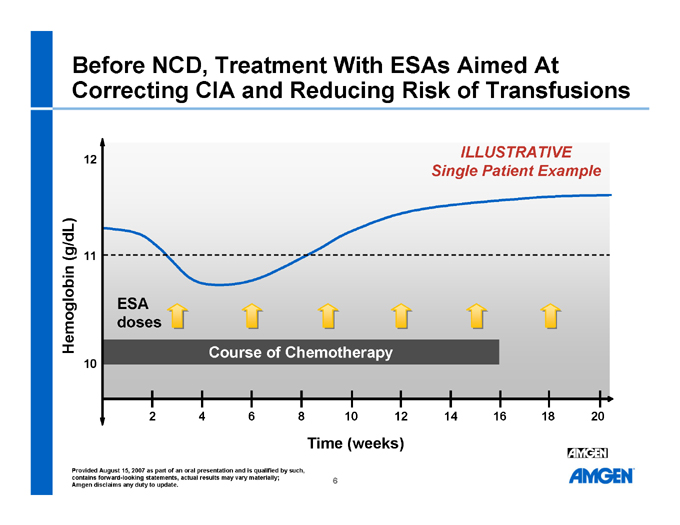

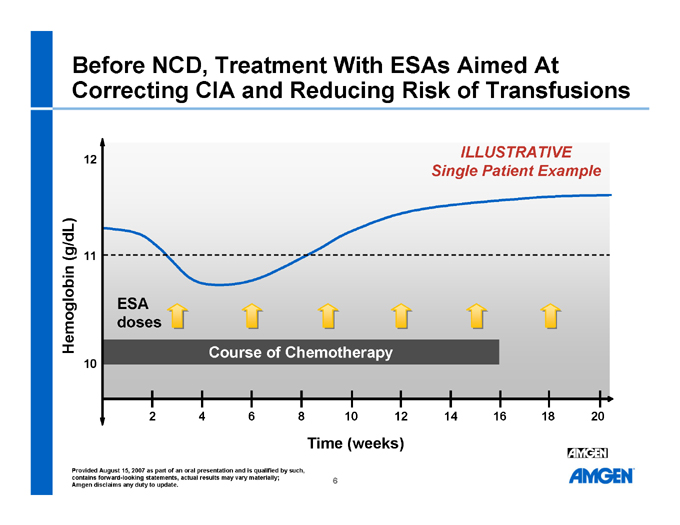

Before NCD, Treatment With ESAs Aimed At Correcting CIA and Reducing Risk of Transfusions

ILLUSTRATIVE Single Patient Example Hemoglobin (g/dL) ESA doses Course of Chemotherapy

Time (weeks) 12 11 10 2 4 6 8 10 12 14 16 18 20

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

6

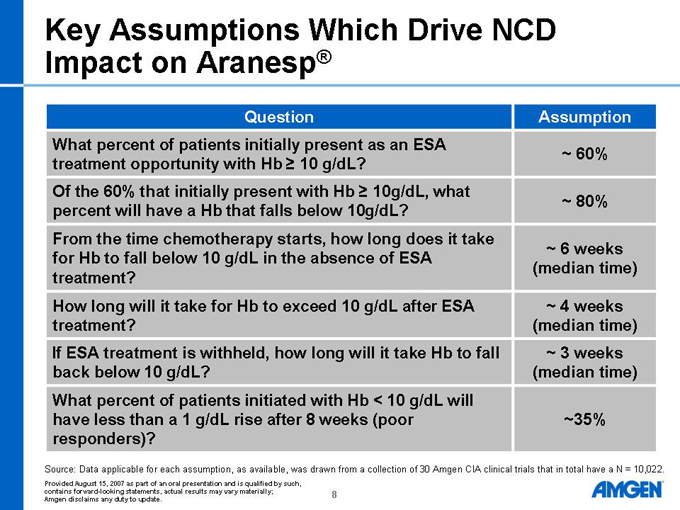

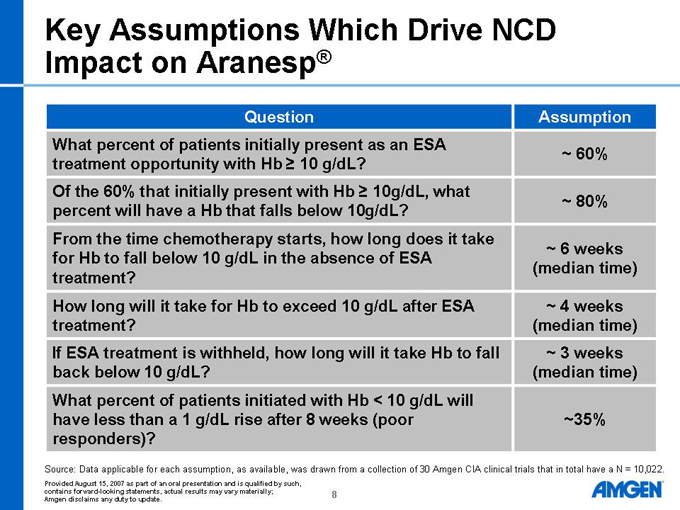

Key Assumptions Which Drive NCD Impact on Aranesp®

Question

What percent of patients initially present as an ESA treatment opportunity with Hb ³ 10 g/dL?

Of the 60% that initially present with Hb ³ 10g/dL, what percent will have a Hb that falls below 10g/dL?

From the time chemotherapy starts, how long does it take for Hb to fall below 10 g/dL in the absence of ESA treatment?

How long will it take for Hb to exceed 10 g/dL after ESA treatment?

If ESA treatment is withheld, how long will it take Hb to fall back below 10 g/dL?

What percent of patients initiated with Hb < 10 g/dL will have less than a 1 g/dL rise after 8 weeks (poor responders)?

Assumption

~ 60%

~ 80%

~ 6 weeks (median time)

~ 4 weeks (median time)

~ 3 weeks (median time)

~35%

Source: Data applicable for each assumption, as available, was drawn from a collection of 30 Amgen CIA clinical trials that in total have a N = 10,022.

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

8

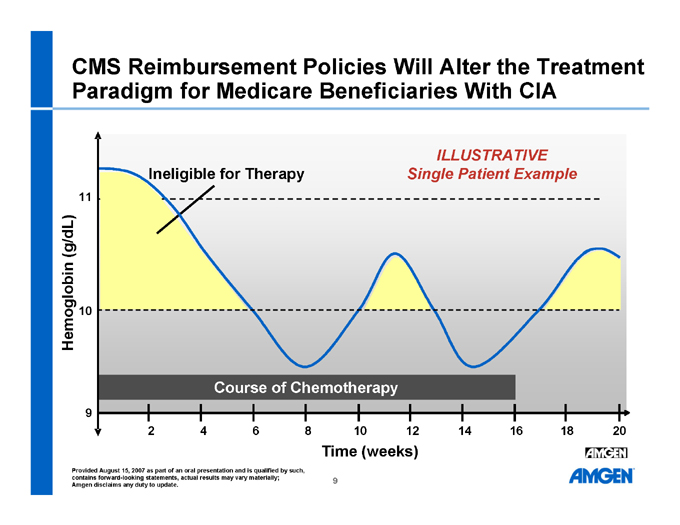

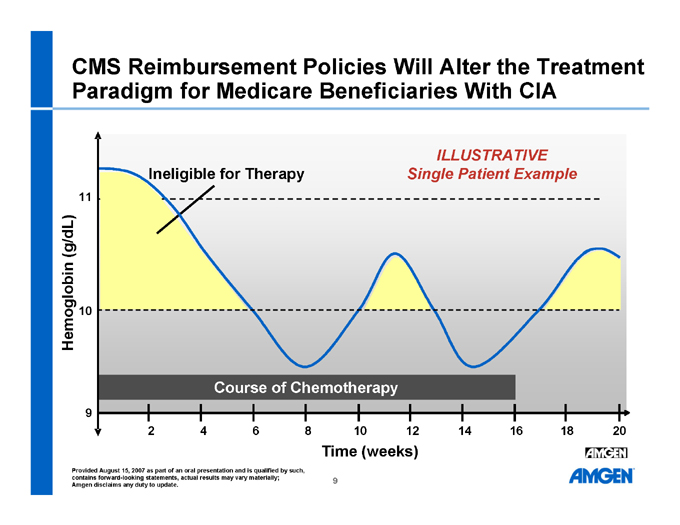

CMS Reimbursement Policies Will Alter the Treatment Paradigm for Medicare Beneficiaries With CIA

ILLUSTRATIVE Single Patient Example

Ineligible for Therapy

Course of Chemotherapy

Hemoglobin (g/dL)

Time (weeks) 11 10 9 2 4 6 8 10 12 14 16 18 20

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

9

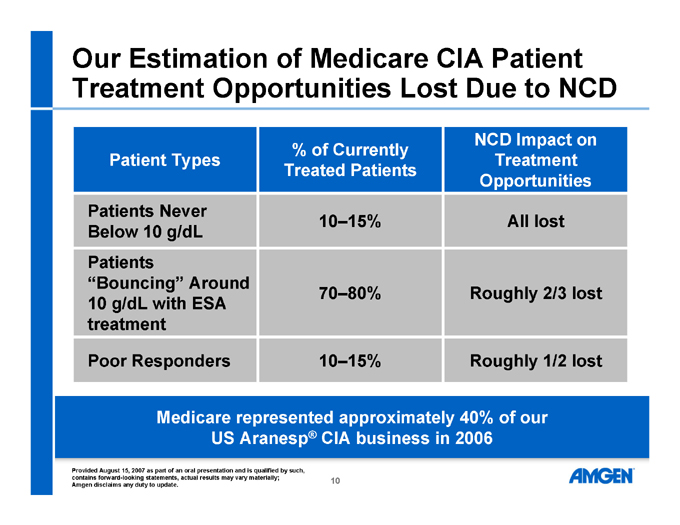

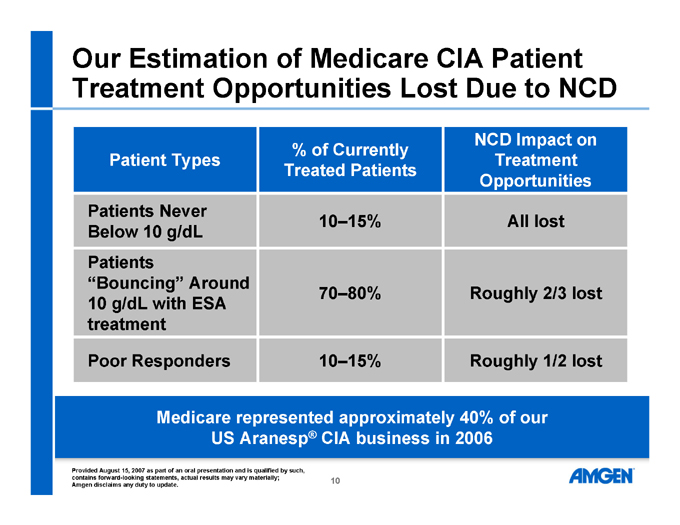

Our Estimation of Medicare CIA Patient Treatment Opportunities Lost Due to NCD

Patient Types % of Currently Treated Patients NCD Impact on Treatment Opportunities

Patients Never Below 10 g/dL 10–15% All lost

Patients “Bouncing” Around 10 g/dL with ESA treatment 70–80% Roughly 2/3 lost

Poor Responders 10–15% Roughly 1/2 lost

Medicare represented approximately 40% of our US Aranesp® CIA business in 2006

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

10

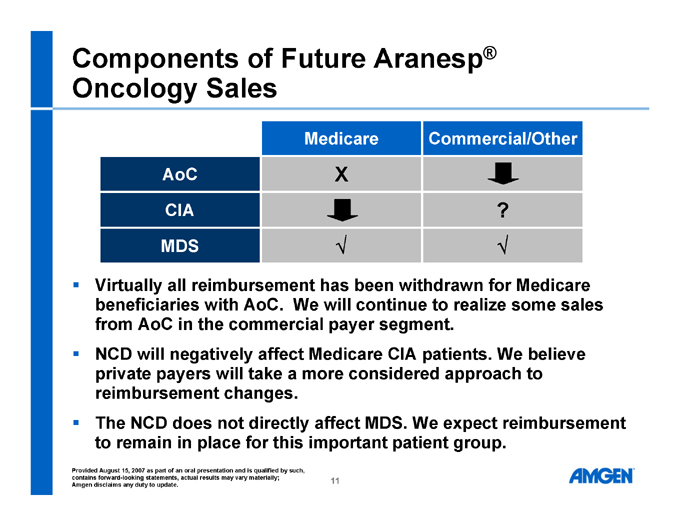

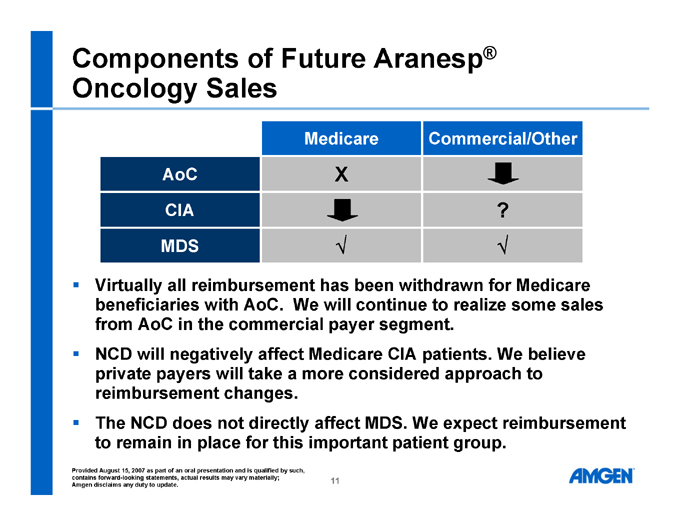

Components of Future Aranesp® Oncology Sales

Medicare Commercial/Other

AoC Xê CIAê ? MDS Ö Ö

Virtually all reimbursement has been withdrawn for Medicare beneficiaries with AoC. We will continue to realize some sales from AoC in the commercial payer segment.

NCD will negatively affect Medicare CIA patients. We believe private payers will take a more considered approach to reimbursement changes.

The NCD does not directly affect MDS. We expect reimbursement to remain in place for this important patient group.

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

11

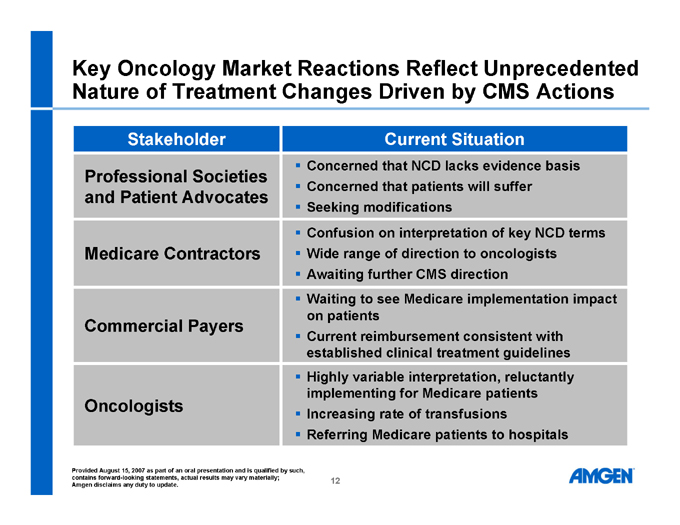

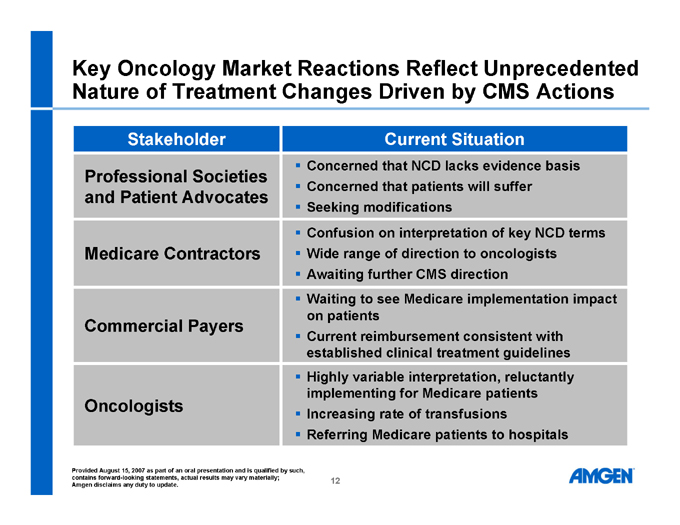

Key Oncology Market Reactions Reflect Unprecedented Nature of Treatment Changes Driven by CMS Actions

Stakeholder Current Situation

Professional Societies and Patient Advocates Medicare Contractors Commercial Payers Oncologists

Concerned that NCD lacks evidence basis

Concerned that patients will suffer

Seeking modifications

Confusion on interpretation of key NCD terms

Wide range of direction to oncologists

Awaiting further CMS direction

Waiting to see Medicare implementation impact on patients

Current reimbursement consistent with established clinical treatment guidelines

Highly variable interpretation, reluctantly implementing for Medicare patients

Increasing rate of transfusions

Referring Medicare patients to hospitals

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

12

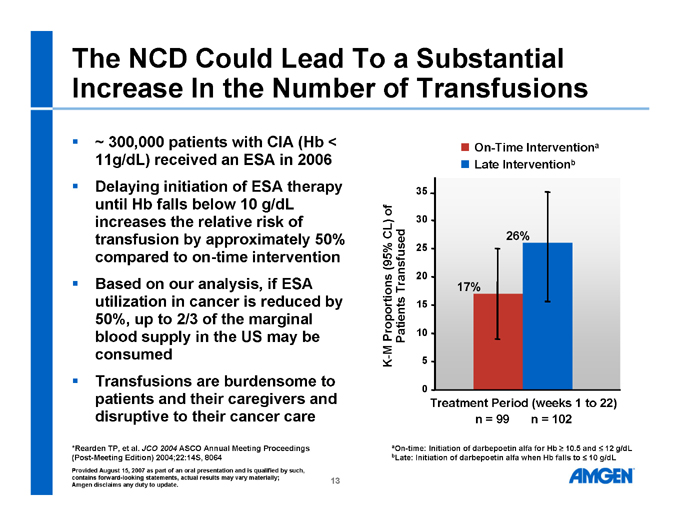

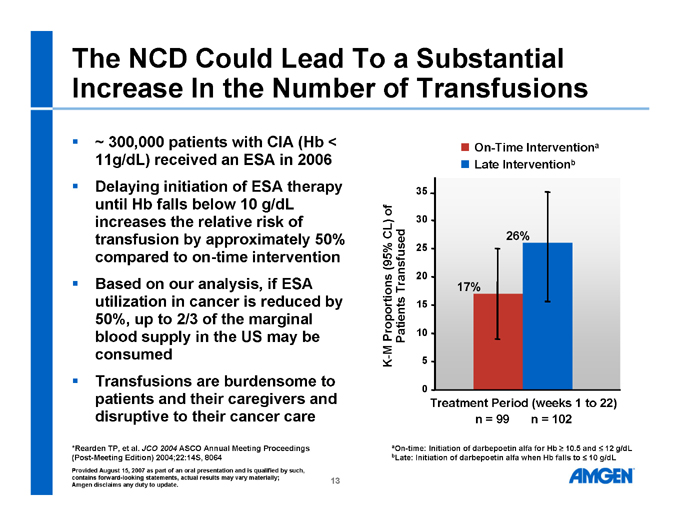

The NCD Could Lead To a Substantial Increase In the Number of Transfusions

~ 300,000 patients with CIA (Hb < 11g/dL) received an ESA in 2006

Delaying initiation of ESA therapy until Hb falls below 10 g/dL increases the relative risk of transfusion by approximately 50% compared to on-time intervention

Based on our analysis, if ESA utilization in cancer is reduced by 50%, up to 2/3 of the marginal blood supply in the US may be consumed

Transfusions are burdensome to patients and their caregivers and disruptive to their cancer care

K-M Proportions (95% CL) of Patients Transfused On-Time Interventiona Late Interventionb

35 30 25 20 15 10 5 0 17% 26% Treatment Period (weeks 1 to 22) n = 99 n = 102

aOn-time: Initiation of darbepoetin alfa for Hb ³ 10.5 and £ 12 g/dL

bLate: Initiation of darbepoetin alfa when Hb falls to £ 10 g/dL

*Rearden TP, et al. JCO 2004 ASCO Annual Meeting Proceedings (Post-Meeting Edition) 2004;22:14S, 8064

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

13

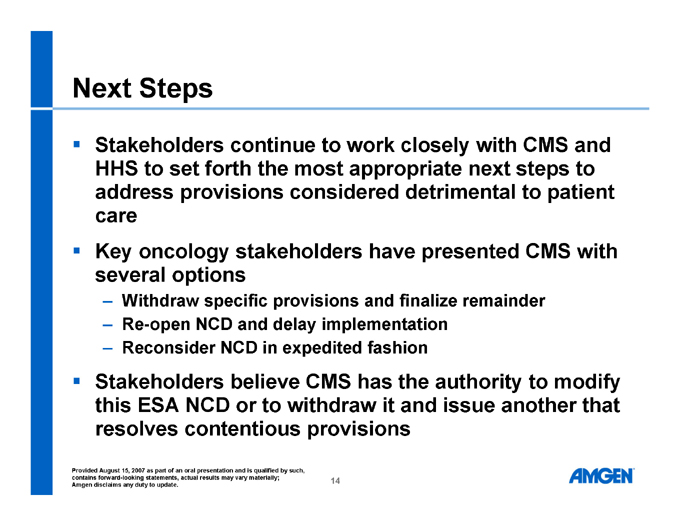

Next Steps

Stakeholders continue to work closely with CMS and HHS to set forth the most appropriate next steps to address provisions considered detrimental to patient care

Key oncology stakeholders have presented CMS with several options

– Withdraw specific provisions and finalize remainder

– Re-open NCD and delay implementation

– Reconsider NCD in expedited fashion

Stakeholders believe CMS has the authority to modify this ESA NCD or to withdraw it and issue another that resolves contentious provisions

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

14

Bob Bradway

Executive Vice President and CFO

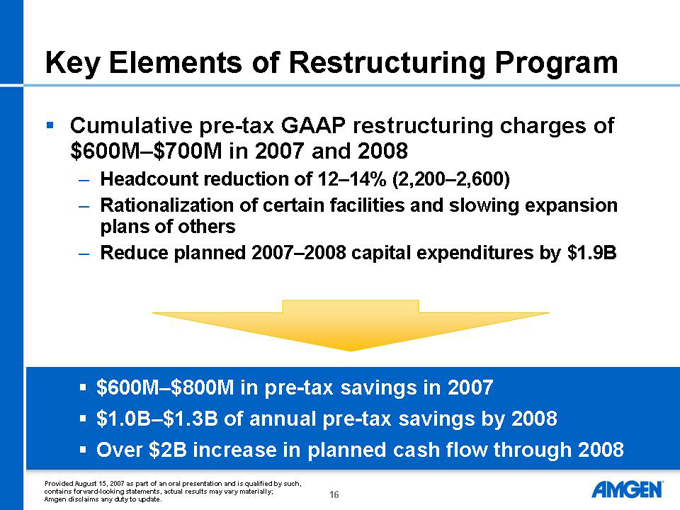

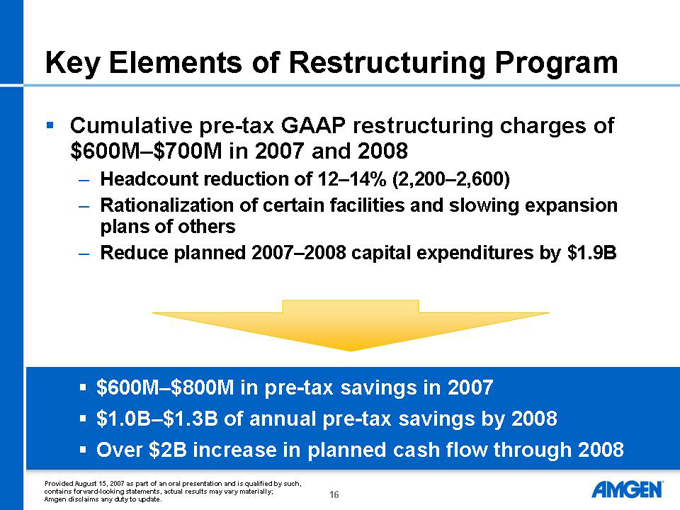

Key Elements of Restructuring Program

Cumulative pre-tax GAAP restructuring charges of $600M–$700M in 2007 and 2008

Headcount reduction of 12–14% (2,200–2,600)

Rationalization of certain facilities and slowing expansion plans of others

Reduce planned 2007–2008 capital expenditures by $1.9B

$600M–$800M in pre-tax savings in 2007

$1.0B–$1.3B of annual pre-tax savings by 2008

Over $2B increase in planned cash flow through 2008

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

16

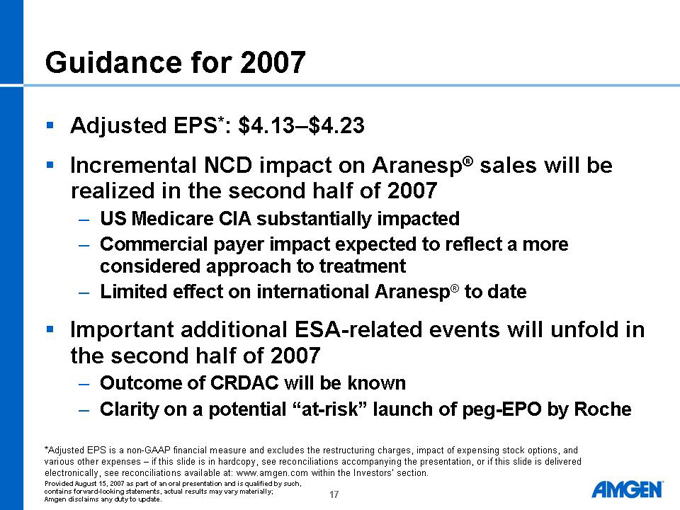

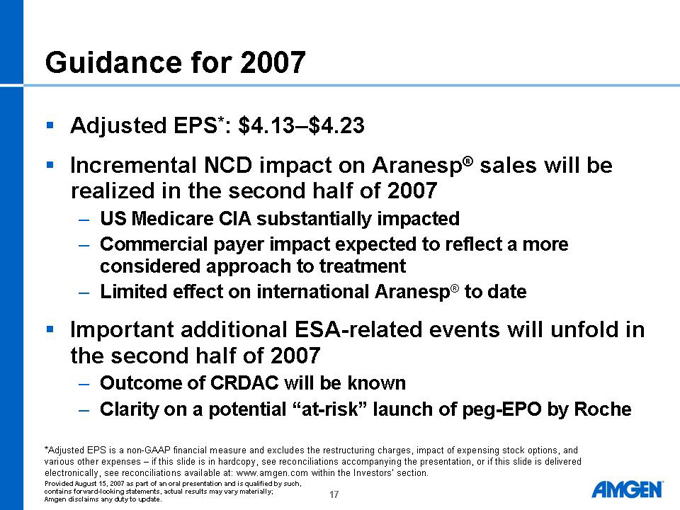

Guidance for 2007

Adjusted EPS*: $4.13–$4.23

Incremental NCD impact on Aranesp® sales will be realized in the second half of 2007

US Medicare CIA substantially impacted

Commercial payer impact expected to reflect a more considered approach to treatment Limited effect on international Aranesp® to date

Important additional ESA-related events will unfold in the second half of 2007

Outcome of CRDAC will be known

Clarity on a potential “at-risk” launch of peg-EPO by Roche

*Adjusted EPS is a non-GAAP financial measure and excludes the restructuring charges, impact of expensing stock options, and various other expenses – if this slide is in hardcopy, see reconciliations accompanying the presentation, or if this slide is delivered electronically, see reconciliations available at: www.amgen.com within the Investors’ section.

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

17

Comments on P&L Trends Post-NCD

Longer-term revenue considerations

Full year impact of NCD and other key events on Aranesp® in 2008

Incremental sales growth for Neulasta®/NEUPOGEN®, Enbrel® and Sensipar®

Operating expenses

Higher cost of sales due to product mix

Higher Wyeth profit share

Lower SG&A (excluding Wyeth profit share)

Lower R&D as a % sales

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

20

Investment Community Conference Call

August 15, 2007

Reconciliations

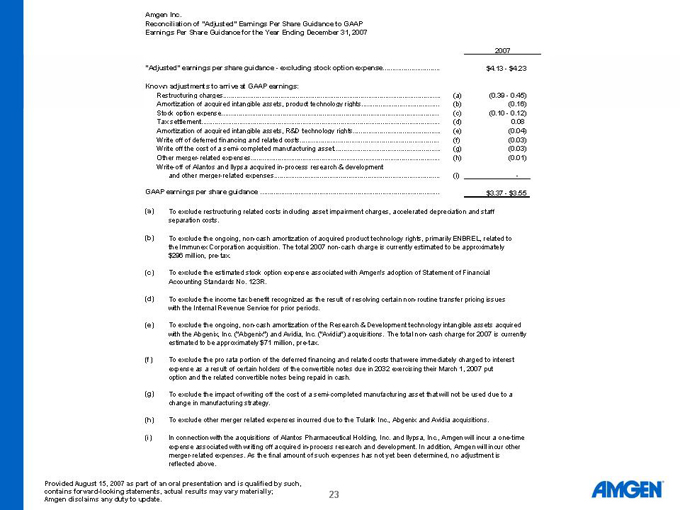

Amgen Inc.

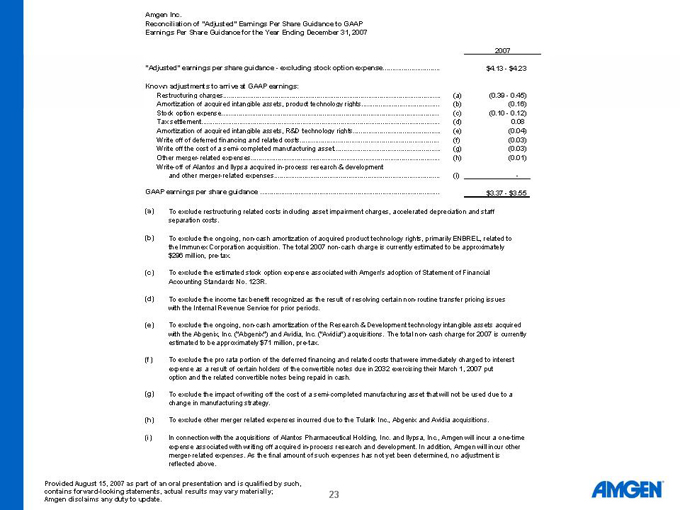

Reconciliation of “Adjusted” Earnings Per Share Guidance to GAAP

Earnings Per Share Guidance for the Year Ending December 31, 2007

“Adjusted” earnings per share guidance - excluding stock option expense

Known adjustments to arrive at GAAP earnings:

Restructuring charges

Amortization of acquired intangible assets, product technology rights

Stock option expense

Tax settlement

Amortization of acquired intangible assets, R&D technology rights

Write off of deferred financing and related costs

Write off the cost of a semi-completed manufacturing asset

Other merger-related expenses

Write-off of Alantos and Ilypsa acquired in-process research & development and other merger-related expenses

GAAP earnings per share guidance

2007

$4.13 - $4.23

(a) (0.39 - 0.45)

(b) (0.16)

(c) (0.10 - 0.12)

(d) 0.08

(e) (0.04)

(f) (0.03)

(g) (0.03)

(h) (0.01)

(i) -

$3.37 - $3.55

(a) To exclude restructuring related costs including asset impairment charges, accelerated depreciation and staff separation costs.

(b) To exclude the ongoing, non-cash amortization of acquired product technology rights, primarily ENBREL, related to the Immunex Corporation acquisition. The total 2007 non-cash charge is currently estimated to be approximately $296 million, pre-tax.

(c) To exclude the estimated stock option expense associated with Amgen’s adoption of Statement of Financial Accounting Standards No. 123R.

(d) To exclude the income tax benefit recognized as the result of resolving certain non-routine transfer pricing issues with the Internal Revenue Service for prior periods.

(e) To exclude the ongoing, non-cash amortization of the Research & Development technology intangible assets acquired with the Abgenix, Inc. (“Abgenix”) and Avidia, Inc. (“Avidia”) acquisitions. The total non-cash charge for 2007 is currently estimated to be approximately $71 million, pre-tax.

(f) To exclude the pro rata portion of the deferred financing and related costs that were immediately charged to interest expense as a result of certain holders of the convertible notes due in 2032 exercising their March 1, 2007 put option and the related convertible notes being repaid in cash.

(g) To exclude the impact of writing off the cost of a semi-completed manufacturing asset that will not be used due to a change in manufacturing strategy.

(h) To exclude other merger related expenses incurred due to the Tularik Inc., Abgenix and Avidia acquisitions.

(i) In connection with the acquisitions of Alantos Pharmaceutical Holding, Inc. and Ilypsa, Inc., Amgen will incur a one-time expense associated with writing off acquired in-process research and development. In addition, Amgen will incur other merger-related expenses. As the final amount of such expenses has not yet been determined, no adjustment is reflected above.

Provided August 15, 2007 as part of an oral presentation and is qualified by such, contains forward-looking statements, actual results may vary materially; Amgen disclaims any duty to update.

23

Investment Community Conference Call

August 15, 2007