As filed with the Securities and Exchange Commission on July 21, 2014

Registration No. 333-186686

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Samson Investment Company,as the Issuer

Samson Resources Corporation,as the Parent Guarantor

(Exact name of registrant as specified in its charter)

SEE TABLE OF ADDITIONAL REGISTRANTS

| | | | |

| Nevada | | 1311 | | 73-1281091 |

| Delaware | | 1311 | | 45-3991227 |

(State or other jurisdiction

of incorporation) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer Identification

Number) |

Samson Plaza

Two West Second Street

Tulsa, OK 74103-3103

(918) 591-1791

(Address, including zip code, and telephone number, including area code, of registrants’ principal executive offices)

Andrew C. Kidd, Esq.

Samson Resources Corporation

Senior Vice President and General Counsel

Two West Second Street

Tulsa, OK 74103-3103

(918) 591-1791

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Edward P. Tolley III, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017-3954

Telephone: (212) 455-2000

Facsimile: (212) 455-2502

Approximate date of commencement of proposed exchange offer:As soon as practicable after this Registration Statement is declared effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, please check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Company Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of Each Class of

Securities to be Registered | | Amount

to be

Registered | | Proposed

Maximum

Offering Price

Per Note | | Proposed

Maximum

Aggregate

Offering Price(1) | | Amount of

Registration Fee |

9.750% Senior Notes due 2020 | | $2,250,000,000 | | 100% | | $2,250,000,000 | | $306,900(4) |

Guarantees of 9.750% Senior Notes due 2020(2) | | N/A | | N/A | | N/A | | N/A(3) |

|

|

| (1) | Estimated solely for the purpose of calculating the registration fee under Rule 457(f) of the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | See inside facing page for table of additional registrants. |

| (3) | Pursuant to Rule 457(n) under the Securities Act, no separate filing fee is required for the guarantees. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Additional Registrants

| | | | | | |

Exact Name of Registrant as Specified in its Charter (or Other Organizational Document) | | State or Other

Jurisdiction of

Incorporation

or Organization | | I.R.S. Employer

Identification

Number | | Address, Including Zip Code, and Telephone Number, Including Area Code, of Principal Executive Offices |

Geodyne Resources, Inc. | | Delaware | | 73-1052703 | | Samson Plaza Two West Second St. Tulsa, OK 74103-3103 (918) 591-1791 |

Samson Contour Energy Co. | | Delaware | | 76-0447267 | | Samson Plaza Two West Second St. Tulsa, OK 74103-3103 (918) 591-1791 |

Samson Contour Energy E&P, LLC | | Delaware | | 76-0082502 | | Samson Plaza Two West Second St. Tulsa, OK 74103-3103 (918) 591-1791 |

Samson Holdings, Inc. | | Delaware | | 73-1498587 | | Samson Plaza Two West Second St. Tulsa, OK 74103-3103 (918) 591-1791 |

Samson Lone Star, LLC | | Delaware | | 45-3939455 | | Samson Plaza Two West Second St. Tulsa, OK 74103-3103 (918) 591-1791 |

Samson Resources Company | | Oklahoma | | 73-0928007 | | Samson Plaza Two West Second St. Tulsa, OK 74103-3103 (918) 591-1791 |

Samson-International, Ltd. | | Oklahoma | | 73-1404039 | | Samson Plaza Two West Second St. Tulsa, OK 74103-3103 (918) 591-1791 |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 21, 2014

PRELIMINARY PROSPECTUS

SAMSON INVESTMENT COMPANY,

as the Issuer

SAMSON RESOURCES CORPORATION,

as the Parent Guarantor

Offer to Exchange (the “Exchange Offer”)

$2,250,000,000 aggregate principal amount of 9.750% Senior Notes due 2020 (the “exchange notes”) which have been registered under the Securities Act of 1933, as amended (the “Securities Act”), for any and all outstanding unregistered 9.750% Senior Notes due 2020 (the “outstanding notes”).

We are conducting the exchange offer in order to provide you with an opportunity to exchange your unregistered outstanding notes for freely tradable notes that have been registered under the Securities Act.

The Exchange Offer

| | • | | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradable. |

| | • | | You may withdraw tenders of outstanding notes at any time prior to the expiration date of the exchange offer. |

| | • | | The exchange offer expires at 12:00 a.m., New York City time, on , 2014, unless extended. We do not currently intend to extend the expiration date. |

| | • | | The exchange of outstanding notes for exchange notes in the exchange offer will not constitute taxable events to holders for United States federal income tax purposes. |

| | • | | The terms of the exchange notes to be issued in the exchange offer are substantially identical to the outstanding notes, except that the exchange notes will be freely tradable. |

Results of the Exchange Offer

| | • | | The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the exchange notes on a national market. |

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture governing the notes. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding notes under the Securities Act.

See “Risk Factors” beginning on page 10 of this prospectus for a discussion of certain risks that you should consider before participating in the exchange offer.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the exchange notes or the related guarantees to be distributed in the exchange offer or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. The prospectus may be used only for the purposes for which it has been published, and no person has been authorized to give any information not contained herein. If you receive any other information, you should not rely on it. We are not making an offer of these securities in any state where the offer is not permitted.

Table of Contents

i

Basis of Presentation

On November 22, 2011, Samson Resources Corporation, a company primarily controlled by affiliates of Kohlberg Kravis Roberts & Co. L. P. (“KKR”) and ITOCHU Corporation (“ITOCHU”), entered into a stock purchase agreement (the “SPA”) with Samson Investment Company and its selling stockholders (the “Acquisition”). As a result of the Acquisition, KKR and certain other co-investors, including investment funds affiliated with Crestview Partners II GP, L.P. and Natural Gas Partners IX, L.P., through Samson Aggregator L.P. (“Samson Aggregator”), hold approximately 73.4% of the outstanding shares of common stock of Samson Resources Corporation as of June 1, 2014. In addition, ITOCHU, through JD Rockies Resources Limited (“JD Rockies”), holds approximately 24.6% of the outstanding shares of common stock of Samson Resources Corporation as of June 1, 2014. In this prospectus, Samson Aggregator and JD Rockies are sometimes collectively referred to as the “Principal Stockholders.” For more information about our equity investors, see “Security Ownership of Certain Beneficial Owners” and “Certain Relationships and Related Party Transactions.”

The Acquisition closed on December 21, 2011 and we financed the Acquisition, repaid all of our then outstanding long-term indebtedness and paid related fees and expenses with: (i) approximately $1,345.0 million of borrowings under a reserve-based borrowing base revolving credit facility (the “RBL Revolver”); (ii) $2,250.0 million of borrowings under a syndicated senior unsecured bridge facility (the “Bridge Facility”); (iii) $4,145.0 million of equity capital from the Principal Stockholders; and (iv) $180.0 million aggregate liquidation preference of cumulative redeemable preferred stock, par value $0.10 per share (the “Cumulative Preferred Stock”), issued by Samson Resources Corporation to the selling stockholders (collectively, the “Original Financing”).

In addition, prior to the consummation of the Acquisition, Samson Investment Company completed a reorganization as a result of which certain assets and liabilities associated with its Gulf Coast and Offshore regions (the “Gulf Coast and Offshore assets”) were retained by the selling stockholders. The Gulf Coast and Offshore assets were not included in the Acquisition.

On February 8, 2012, Samson Investment Company issued the outstanding notes and used the proceeds therefrom, together with cash on hand, to repay outstanding borrowings under our Bridge Facility in full and pay fees and expenses incurred in connection therewith.

The issuance of the outstanding notes, the Acquisition, the Original Financing, the reorganization with respect to the Gulf Coast and Offshore assets, the repayment of the outstanding borrowings under our Bridge Facility in full and the payment of fees and expenses in connection therewith are collectively referred to as the “Transactions.”

Unless the context requires otherwise, in this prospectus, references to (i) “Samson,” the “Company,” “we,” “us” and “our” refer to Samson Resources Corporation and its consolidated subsidiaries after the consummation of the Transactions, (ii) “Samson Investment Company” refer to Samson Investment Company, the issuer of the notes, (iii) “Predecessor” refer to Samson Investment Company and its consolidated subsidiaries prior to the consummation of the Acquisition, (iv) the “Second Lien Term Loan” refer to the Company’s $1,000.0 million second lien term loan credit facility and (v) the “notes” refer to the outstanding notes and the exchange notes collectively.

The Company reports on a December 31 fiscal year end, while the Predecessor reported on a June 30 fiscal year end. Accordingly, the financial statements contained elsewhere in this prospectus include the unaudited financial statements of the Company for the three months ended March 31, 2014 and 2013, the audited financial statements of the Company for the fiscal years ended December 31, 2013 and 2012 and for the period from inception (November 14, 2011) through December 31, 2011, and the audited financial statements of the Predecessor for the period from July 1, 2011 through December 21, 2011 and for the fiscal year ended June 30, 2011.

ii

Prospectus Summary

This summary highlights key aspects of the information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in the exchange notes. You should read this summary together with the entire prospectus, including the information presented under the heading “Risk Factors” and the information in the historical financial statements and related notes appearing elsewhere in this prospectus. For a more complete description of our business, see the “Business” section in this prospectus. In addition, certain statements include forward-looking information that involves risks and uncertainties. See “Cautionary Statement Regarding Forward-Looking Statements.” Unless the context requires otherwise, in this prospectus, references to “natural gas” or “gas” include natural gas liquids, which we sometimes refer to as “NGLs.” Certain other operational and industry terms used in this prospectus are defined in “Annex A: Glossary of Oil and Natural Gas Terms.”

Our Company

We are an independent oil and natural gas company engaged in the exploration, development and production of oil and natural gas from properties located onshore in the United States. We are focused on creating stakeholder value through methodically exploring and developing our resource base primarily through horizontal drilling and advanced fracture stimulation. As of March 31, 2014, we operated ten rigs focused on the horizontal development of our oil and natural gas properties across approximately two million net acres. We are located in some of the most prolific and long-lived basins in the United States, such as the Williston, Powder River, Greater Green River, San Juan, Anadarko, Arkoma and East Texas basins. As of December 31, 2013, we had approximately 1.9 Tcfe of proved reserves (approximately 17% oil and 16% NGLs). For the three months ended March 31, 2014 and the year ended December 31, 2013, we produced on average approximately 529 MMcfe per day (approximately 15% oil and 15% NGLs) and approximately 578 MMcfe per day (approximately 15% oil and 13% NGLs), respectively.

Our principal executive offices are located at Samson Plaza, Two West Second Street, Tulsa, Oklahoma 74103-3103, and our telephone number at that address is (918) 591-1791. Our Internet address iswww.samson.com. Information on, or accessible through, our website does not constitute part of this prospectus.

1

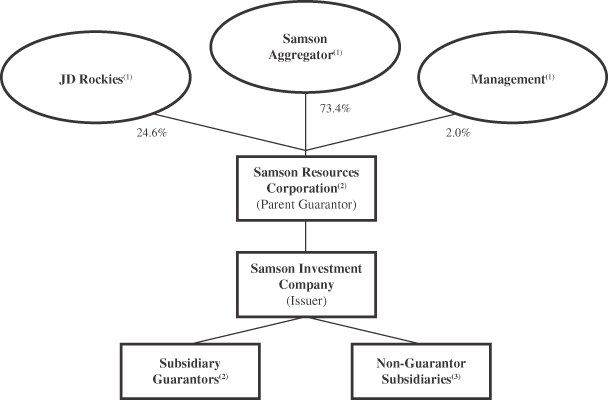

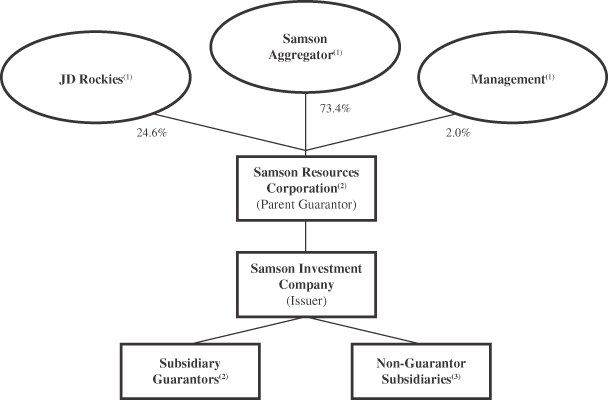

Corporate Structure

The following chart summarizes our organizational structure. This chart is provided for illustrative purposes only and does not represent all legal entities affiliated with us.

| (1) | Samson Aggregator is a limited partnership indirectly owned by investment funds associated with KKR and certain other co-investors, including investment funds affiliated with Crestview Partners II GP, L.P. and Natural Gas Partners IX, L.P. JD Rockies is a wholly-owned subsidiary of ITOCHU. For more information about our Principal Stockholders, see “Security Ownership of Certain Beneficial Owners.” The ownership percentages presented above are based on the outstanding shares of common stock of Samson Resources Corporation as of June 1, 2014. |

| (2) | The notes are guaranteed by Samson Resources Corporation and each of Samson Investment Company’s subsidiaries that guarantees obligations under the RBL Revolver and the Second Lien Term Loan. Samson Investment Company is 100% owned directly by Samson Resources Corporation, and each subsidiary guarantor is 100% owned directly or indirectly by Samson Investment Company. For additional information, see “Description of Notes—Guarantees,” Note 23 to our audited consolidated financial statements included elsewhere in this prospectus and Note 16 to our unaudited condensed consolidated financial statements included elsewhere in this prospectus. |

| (3) | For certain information about our non-guarantor subsidiaries, see Note 23 to our audited consolidated financial statements included elsewhere in this prospectus and Note 16 to our unaudited condensed consolidated financial statements included elsewhere in this prospectus. |

2

The Exchange Offer

On February 8, 2012, Samson Investment Company issued in a private offering $2,250,000,000 aggregate principal amount of outstanding notes.

General | In connection with the private placement of the outstanding notes, we entered into a registration rights agreement pursuant to which we agreed, under certain circumstances, to use our commercially reasonable efforts to file a registration statement relating to an offer to exchange the outstanding notes for exchange notes and to consummate the exchange offer within 450 days after the date of original issuance of the outstanding notes. You are entitled to exchange in the exchange offer your outstanding notes for exchange notes which are identical in all material respects to the outstanding notes except: |

| | • | | the exchange notes have been registered under the Securities Act; |

| | • | | the exchange notes are not entitled to any registration rights which are applicable to the outstanding notes under the registration rights agreement; and |

| | • | | the additional interest provisions of the registration rights agreement are not applicable. |

| | Pursuant to the terms of the registration rights agreement and the indenture governing the notes, because the exchange offer was not consummated within 450 days after the original issuance of the outstanding notes and a shelf registration statement covering the resale of the outstanding notes was not declared effective by such date, we began incurring additional interest on the outstanding notes in May 2013. Upon the completion of the exchange offer, such additional interest will no longer accrue on the notes, including with respect to outstanding notes that are not tendered for exchange in the exchange offer. For additional information, see “—Effect on Holders of Outstanding Notes” and “The Exchange Offer—Purpose and Effect of the Exchange Offer.” |

The Exchange Offer | We are offering to exchange $2,250,000,000 aggregate principal amount of exchange notes which have been registered under the Securities Act for any and all of its outstanding notes. |

| | You may only exchange outstanding notes in minimum denominations of $2,000 and integral multiples of $1,000 in excess of $2,000. |

Resale | Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to the exchange offer in exchange for the outstanding notes may be offered for resale, resold and otherwise transferred by you (unless you are our “affiliate” within the meaning |

3

| | of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

| | • | | you are acquiring the exchange notes in the ordinary course of your business; and |

| | • | | you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

| | If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any resale of the exchange notes. See “Plan of Distribution.” |

| | Any holder of outstanding notes who: |

| | • | | does not acquire exchange notes in the ordinary course of its business; or |

| | • | | tenders its outstanding notes in the exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes |

| | cannot rely on the position of the staff of the SEC enunciated in theMorgan Stanley & Co. Incorporated no action letter (available June 5, 1991) and theExxon Capital Holdings Corporation no action letter (available May 13, 1988), as interpreted in theShearman & Sterling no action letter (available July 2, 1993), or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes. |

Expiration Date | The exchange offer will expire at 12:00 a.m., New York City time, on , 2014, unless extended by us. We currently do not intend to extend the expiration date. |

Withdrawal | You may withdraw the tender of your outstanding notes at any time prior to the expiration of the exchange offer. We will return to you any of your outstanding notes that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the exchange offer. |

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions, which we may waive. See “The Exchange Offer—Conditions to the Exchange Offer.” |

Procedures for Tendering Outstanding Notes | If you wish to participate in the exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a facsimile of |

4

| | such letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must then mail or otherwise deliver the letter of transmittal, or a facsimile of such letter of transmittal, together with your outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. |

| | If you hold outstanding notes through The Depository Trust Company (“DTC”) and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures of DTC by which you will agree to be bound by the letter of transmittal. By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: |

| | • | | you are not our “affiliate” within the meaning of Rule 405 under the Securities Act; |

| | • | | you do not have an arrangement or understanding with any person or entity to participate in the distribution of the exchange notes; |

| | • | | you are acquiring the exchange notes in the ordinary course of your business; and |

| | • | | if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities, you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes. |

Special Procedures for Beneficial Owners | If you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those outstanding notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender those outstanding notes on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. |

Guaranteed Delivery Procedures | If you wish to tender your outstanding notes and your outstanding notes are not immediately available, or you cannot deliver your outstanding notes, the letter of transmittal or any other required documents, or you cannot comply with the procedures under DTC’s Automated Tender Offer Program for transfer of book-entry interests prior to the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under “The Exchange Offer—Guaranteed Delivery Procedures.” |

5

Effect on Holders of Outstanding Notes | As a result of the making of, and upon the exchange of the exchange notes for all validly tendered outstanding notes pursuant to the terms of the exchange offer, we will have fulfilled a covenant under the registration rights agreement. Accordingly, subject to certain limited exceptions, additional interest will no longer accrue, and there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreement. If you do not tender your outstanding notes in the exchange offer, you will continue to be entitled to all the rights and limitations applicable to the outstanding notes as set forth in the indenture, except we will not have any further obligation to you to provide for the exchange and registration of untendered outstanding notes under the registration rights agreement. To the extent that outstanding notes are tendered and accepted in the exchange offer, the trading market for outstanding notes that are not so tendered and accepted could be adversely affected. |

Consequences of Failure to Exchange | All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the outstanding notes under the Securities Act. |

Certain United States Federal Income Tax Consequences | The exchange of outstanding notes for exchange notes in the exchange offer will not constitute taxable events to holders for United States federal income tax purposes. See “Certain United States Federal Income Tax Consequences.” |

Use of Proceeds | We will not receive any cash proceeds from the issuance of the exchange notes in the exchange offer. See “Use of Proceeds.” |

Exchange Agent | Wells Fargo Bank, National Association is the exchange agent for the exchange offer. The address and telephone number of the exchange agent are set forth in the section captioned “The Exchange Offer—Exchange Agent.” |

6

The Exchange Notes

The summary below describes the principal terms of the exchange notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of Notes” section of this prospectus contains more detailed descriptions of the terms and conditions of the outstanding notes and exchange notes. The exchange notes will have terms identical in all material respects to the outstanding notes, except that the exchange notes will not contain terms with respect to transfer restrictions, registration rights and additional interest for failure to observe certain obligations in the registration rights agreement.

Issuer | Samson Investment Company. |

Securities Offered | $2,250,000,000 aggregate principal amount of exchange notes. |

Maturity Date | The exchange notes will mature on February 15, 2020. |

Interest Rate | Interest on the exchange notes will be payable in cash and will accrue at a rate of 9.750% per annum. |

Interest Payment Dates | We will pay interest on the exchange notes on February 15 and August 15. Interest began to accrue from the issue date of the outstanding notes. |

Ranking | The exchange notes will be unsecured senior obligations and will: |

| | • | | rank senior in right of payment to any future subordinated indebtedness; |

| | • | | rank equally in right of payment with all of Samson Investment Company’s and the guarantors’ existing and future senior indebtedness; |

| | • | | be effectively subordinated to Samson Investment Company’s and the guarantors’ existing and future secured obligations, including indebtedness under the RBL Revolver and the Second Lien Term Loan, to the extent of the value of the assets securing such indebtedness; and |

| | • | | be structurally subordinated to all existing and future indebtedness and other liabilities of our non-guarantor subsidiaries (other than indebtedness and liabilities owed to one of the non-guarantor subsidiaries). |

Guarantees | The exchange notes will be fully and unconditionally guaranteed on a senior unsecured basis by each of Samson Resources Corporation and Samson Investment Company’s existing and future direct or indirect subsidiaries that guarantees obligations under the RBL Revolver and the Second Lien Term Loan or that in the future, guarantees its indebtedness or indebtedness of another guarantor, subject to certain exceptions. Any subsidiary guarantee of the notes will be released in the event such guarantee is released under the RBL Revolver and the Second Lien Term Loan. See “Description of Notes—Guarantees.” |

| | For certain information about our non-guarantor subsidiaries, see Note 23 to our audited consolidated financial statements included |

7

| | elsewhere in this prospectus and Note 16 to our unaudited condensed consolidated financial statements included elsewhere in this prospectus. |

Optional Redemption | We may redeem the exchange notes, in whole or in part, at any time prior to February 15, 2016, at a price equal to 100% of the principal amount of the exchange notes redeemed plus accrued and unpaid interest, if any, to the redemption date and a “make-whole premium,” as described under “Description of Notes—Optional Redemption.” Thereafter, we may redeem the notes, in whole or in part, at the redemption prices listed under “Description of Notes—Optional Redemption.” |

| | At any time (which may be more than once) prior to February 15, 2015, we may redeem up to 35% in total of the aggregate principal amount of the exchange notes at a redemption price of 109.750% of the aggregate principal amount thereof, plus accrued and unpaid interest, if any, to the redemption date, with the net proceeds of certain equity offerings. |

Change of Control Offer and Certain Asset Sales | Upon the occurrence of a change of control, you will have the right, as holders of the notes, to require us to repurchase some or all of your notes at 101% of their face amount, plus accrued and unpaid interest, if any, to the repurchase date. See “Description of Notes—Repurchase at the Option of Holders—Change of Control.” |

| | If we sell assets under certain circumstances, we will be required to make an offer to purchase the notes at 100% of the principal amount thereof, plus accrued and unpaid interest to the purchase date. See “Description of Notes—Repurchase at the Option of Holders—Asset Sales.” |

Certain Covenants | The indenture governing the notes contains covenants limiting Samson Investment Company’s ability and the ability of its restricted subsidiaries to, among other things: |

| | • | | incur additional debt, guarantee debt or issue certain preferred shares; |

| | • | | pay dividends on or make other distributions in respect of capital stock or make other restricted payments; |

| | • | | make certain investments; |

| | • | | sell, transfer or otherwise dispose of certain assets; |

| | • | | create liens on certain assets to secure debt; |

| | • | | consolidate, merge, sell or otherwise dispose of all or substantially all of its assets; |

| | • | | enter into certain transactions with affiliates; and |

| | • | | designate subsidiaries as unrestricted subsidiaries. |

8

| | These covenants are subject to a number of important qualifications and limitations. See “Description of Notes—Certain Covenants.” During any period in which the exchange notes have investment grade ratings from both Moody’s Investors Service, Inc. (“Moody’s”) and Standard & Poor’s Ratings Services (“S&P”) and no default has occurred and is continuing under the indenture governing the notes, we will not be subject to certain of these covenants. |

No Prior Market | The exchange notes will be freely transferable but will be new securities for which there will not initially be a market. Accordingly, we cannot assure you whether a market for the exchange notes will develop or as to the liquidity of any such market that may develop. |

Governing Law | The exchange notes and the related guarantees will be, and the indenture governing the notes is, governed under the laws of the state of New York. |

Risk Factors

You should consider carefully all of the information set forth in this prospectus prior to exchanging your outstanding notes. In particular, we urge you to consider carefully the factors set forth under the heading “Risk Factors.”

9

Risk Factors

You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before deciding to tender your outstanding notes in the exchange offer. Any of the following risks may materially and adversely affect our business, results of operations and financial condition. The risks and uncertainties described below are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also materially and adversely affect our business, results of operations and financial condition. In such a case, you may lose all or part of your original investment. The risks discussed below also include forward-looking statements, and our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements” in this prospectus.

Risks Relating to the Exchange Offer

Your ability to transfer the exchange notes may be limited by the absence of an active trading market, and there is no assurance that any active trading market will develop for the exchange notes.

We do not intend to apply for a listing of the exchange notes on a securities exchange or on any automated dealer quotation system. There is currently no established market for the exchange notes, and we cannot assure you as to the liquidity of markets that may develop for the exchange notes, your ability to sell the exchange notes or the price at which you would be able to sell the exchange notes. If such markets were to exist, the exchange notes could trade at prices that may be lower than their principal amount or purchase price depending on many factors, including prevailing interest rates, the market for similar notes, our financial and operating performance and other factors. An active market for the exchange notes may not develop or, if developed, may not continue. Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the notes. The market, if any, for the exchange notes may experience similar disruptions and any such disruptions may adversely affect the prices at which you may sell your exchange notes.

Certain persons who participate in the exchange offer must deliver a prospectus in connection with resales of the exchange notes.

Based on interpretations of the staff of the SEC contained in theMorgan Stanley & Co. Incorporated no action letter (available June 5, 1991) and theExxon Capital Holdings Corporationno action letter (available May 13, 1988), as interpreted in theShearman & Sterling no action letter (available July 2, 1993), we believe that you may offer for resale, resell or otherwise transfer the exchange notes without compliance with the registration and prospectus delivery requirements of the Securities Act. However, in some instances described in this prospectus under “Plan of Distribution,” certain holders of exchange notes will remain obligated to comply with the registration and prospectus delivery requirements of the Securities Act to transfer the exchange notes. If such a holder transfers any exchange notes without delivering a prospectus meeting the requirements of the Securities Act or without an applicable exemption from registration under the Securities Act, such a holder may incur liability under the Securities Act. We do not and will not assume, or indemnify such a holder against this liability.

Risks Relating to the Oil and Natural Gas Industry and Our Business

Oil and natural gas prices are volatile. A decline in oil or natural gas prices could materially adversely affect our business, results of operations, financial condition, access to capital and ability to grow.

Our future business, results of operations, financial condition and rate of growth depend primarily upon the prices we receive for our oil and natural gas production. In addition, we may record impairments of our oil and natural gas properties as a result of prevailing prices for oil and natural gas. Oil and natural gas prices historically have been volatile, and are likely to continue to be volatile in the future, especially given current economic and

10

geopolitical conditions. This price volatility also affects the amount of cash flow we have available for capital expenditures and our ability to borrow money or raise additional capital. The prices for oil and natural gas are subject to a variety of factors beyond our control, such as:

| | • | | the domestic and global supply and demand of oil and natural gas; |

| | • | | uncertainty in capital and commodities markets; |

| | • | | the price and quantity of foreign imports; |

| | • | | domestic and global political and economic conditions (including in oil and natural gas producing countries or regions, such as the Middle East, Russia, North Sea, Africa and South America); |

| | • | | the level of consumer product demand; |

| | • | | weather conditions, force majeure events such as earthquakes and nuclear meltdowns; |

| | • | | technological advances affecting energy consumption and the development of oil and natural gas reserves; |

| | • | | domestic and foreign governmental regulations and taxes, including administrative and/or agency actions and policies; |

| | • | | commodity processing, gathering and transportation cost and availability, and the availability of refining capacity; |

| | • | | the price and availability of alternative fuels and energy; |

| | • | | the strengthening and weakening of the U.S dollar relative to other currencies; |

| | • | | variations between product prices at sales points and applicable index prices; |

| | • | | hedge fund trading; and |

| | • | | other speculative activities. |

Declines in oil or natural gas prices would not only reduce our revenue, but could reduce the amount of oil and/or natural gas that we can produce economically and, as a result, could have a material adverse effect on our business, results of operations, financial condition and reserves. If we experience significant price declines, we may, among other things, be unable to maintain or increase our borrowing capacity, repay current or future indebtedness (including payments of interest and principal on the notes) or obtain additional capital, all of which could materially adversely affect the value of the notes.

Drilling for and producing oil and natural gas are high risk activities with many uncertainties that could materially adversely affect our business, results of operations and financial condition.

Our drilling activities are subject to many risks, including the risk that we will not discover commercially productive reservoirs. Drilling for oil and natural gas can be unprofitable, not only from dry holes, but from productive wells that do not produce sufficient revenue to return a profit. Our decisions to purchase, explore, develop or otherwise exploit prospects or properties will depend in part on the evaluation of data obtained through geophysical and geological analyses, as well as production data and engineering studies, the results of which are often inconclusive or subject to varying interpretations. In addition, the results of our exploratory drilling in new or emerging areas are more uncertain than drilling results in areas that are developed and have established production. Our cost of drilling, completing, equipping and operating wells is often uncertain before drilling commences. Declines in commodity prices and overruns in budgeted expenditures are common risks that can make a particular project uneconomic or less economic than forecasted. Further, many factors may curtail, delay or cancel drilling, including the following:

| | • | | delays or restrictions imposed by or resulting from compliance with regulatory and contractual requirements; |

11

| | • | | delays in receiving governmental permits, orders or approvals; |

| | • | | differing pressure than anticipated or irregularities in geological formations; |

| | • | | equipment failures or accidents; |

| | • | | adverse weather conditions; |

| | • | | surface access restrictions; |

| | • | | loss of title or other title related issues; |

| | • | | shortages or delays in the availability of, increases in the cost of, or increased competition for, drilling rigs and crews, fracture stimulation crews and equipment, pipe, chemicals and supplies; and |

| | • | | restrictions in access to or disposal of water resources used in drilling and completion operations. |

Historically, there have been shortages of drilling and workover rigs, pipe and other oilfield equipment as demand for rigs and equipment has increased along with the number of wells being drilled. These factors may, among other things, cause significant increases in costs for equipment, services and/or personnel. Such shortages or increases in costs could significantly decrease our profit margin, cash flow and operating results, or restrict our ability to drill the wells and conduct the operations which we currently have planned and budgeted or which we may plan in the future.

The occurrence of certain of these events, particularly equipment failures or accidents, could impact third parties, including persons living in proximity to our operations, our employees and employees of our contractors, leading to possible injuries, death or significant property damage. As a result, we face the possibility of liabilities from these events that could materially adversely affect our business, results of operations and financial condition.

Moreover, the costs associated with exploring for, locating and successfully producing, oil and natural gas can accumulate very rapidly. If we do not successfully manage the expenses associated with drilling oil and/or natural gas wells, such costs could make the drilling of certain future wells we may ordinarily drill uneconomic. In addition, uncertainties associated with enhanced recovery methods may result in our inability to realize an acceptable return on our investments in such projects. The additional production and reserves, if any, attributable to the use of enhanced recovery methods are inherently difficult to predict. If our enhanced recovery methods do not allow for the extraction of oil or natural gas in a manner or to the extent that we anticipate, we may not realize an acceptable return on our investments in such projects. Further, 2-D and 3-D seismic data that we obtain is subject to interpretation and may not accurately identify the presence of oil or natural gas underlying our acreage position, which could also materially adversely affect the results of our drilling operations.

Estimates of proved reserves and future net cash flows are not precise. The actual quantities of our proved reserves and our future net cash flows may prove to be lower than estimated.

Numerous uncertainties exist in estimating quantities of proved reserves and future net cash flows therefrom. Our estimates of proved reserves and related future net cash flows are based on various assumptions, which may ultimately prove to be inaccurate, including, but not limited to, future commodity prices, the quantities of oil and natural gas that are ultimately recovered, future operating and development costs, future taxes (such as severance, ad valorem, excise and other similar taxes) and the effect of governmental regulations.

Because all reserve estimates are to some degree subjective, the actual results of certain items may differ materially from those assumed in estimating reserves. Furthermore, different reserve engineers may make different estimates of reserves and cash flows based on the same data. Our actual production, revenue and expenditures with respect to reserves will likely be different from estimates and the differences may be material.

12

The estimated discounted future net cash flows from our proved reserves included in this prospectus are based on prices calculated using the unweighted average of the historical first-day-of-the-month oil and natural gas prices for the prior 12 months, while actual future prices and costs may be materially different. Actual future net cash flows also will be affected by other factors, including:

| | • | | the amount and timing of actual production; |

| | • | | levels of future capital spending; |

| | • | | increases or decreases in the supply of, or demand for, oil and natural gas; and |

| | • | | changes in governmental regulations or taxation. |

Accordingly, our estimates of future net cash flows may be materially different from the future net cash flows that are ultimately received. In addition, the ten percent discount factor mandated by the rules and regulations of the SEC to be used in calculating discounted future net cash flows may not be the most appropriate discount factor based on interest rates in effect from time to time and risks associated with us or the oil and natural gas industry in general. Therefore, the estimates of our discounted future net cash flows should not be construed as accurate estimates of the current market value of our proved reserves. Should our actual proved reserves and related net cash flows differ from our estimates, it may materially adversely affect our business, results of operations and financial condition.

The development of our estimated proved undeveloped reserves may take longer and may require higher levels of capital expenditures than we currently anticipate and are dependent upon economically viable commodity prices to justify development. Therefore, our estimated proved undeveloped reserves may not ultimately be developed or produced.

Approximately 34% of our total estimated proved reserves were classified as proved undeveloped as of December 31, 2013. Development of these proved undeveloped reserves may take longer and require higher levels of capital expenditures than we currently anticipate. Delays in the development of these reserves, increases in costs to drill and develop such reserves or decreases in commodity prices will reduce the PV-10 value of our estimated proved undeveloped reserves and future net cash flows estimated for such reserves and may result in some projects becoming uneconomic. In addition, pursuant to existing SEC rules and guidance, subject to limited exceptions, proved undeveloped reserves may only be booked if they relate to wells scheduled to be drilled within five years of the date of booking. Accordingly, delays in the development of such reserves, increases in capital expenditures required to develop such reserves and changes in commodity prices could cause us to have to reclassify our proved undeveloped reserves as unproved reserves, which may materially adversely affect our business, results of operations and financial condition.

Our business requires substantial capital expenditures, and any inability to obtain needed capital or financing on satisfactory terms or at all, or any negative developments in the capital markets, could have a material adverse effect on our business.

The oil and natural gas industry is capital intensive. We intend to finance our future capital expenditures through cash flows from operations, borrowings under our RBL Revolver, the issuance of debt or equity securities and the sale of assets.

Our cash flow from operations and access to capital are subject to a number of variables, including:

| | • | | the level of oil and natural gas we are able to produce from existing wells; |

| | • | | the prices at which we are able to sell oil and natural gas; |

| | • | | our ability to acquire, locate and produce new reserves; |

| | • | | global credit and securities markets; and |

13

| | • | | the ability and willingness of lenders and investors to provide capital and the cost of that capital. |

In the event our cash flows or other sources of liquidity decrease, we may need to seek additional debt or equity financing to sustain our operations at current levels. If we are unable to secure sufficient capital to meet our capital requirements, we may be required to curtail our operations and capital spending.

In addition, lingering disruptions in the U.S. and international credit and financial markets could materially adversely affect financial institutions, inhibit lending and limit access to capital and credit for many companies. Future turmoil in the credit markets could have a material adverse effect on our business, particularly if our ability to borrow money from lenders or access the capital markets to finance our operations were to be impaired.

Moreover, if any of the banks in our RBL Revolver were to fail, due to market turmoil or otherwise, it is possible that the borrowing capacity under our RBL Revolver would be reduced. In the event that the availability under our RBL Revolver was reduced significantly, we could be required to obtain capital from alternate sources in order to finance our capital needs and/or delay certain capital expenditures to ensure that we maintain appropriate levels of liquidity. If it became necessary to access additional capital, any such alternatives could have terms less favorable than those terms under the RBL Revolver and the Second Lien Term Loan.

Should any of the above risks occur, it could materially adversely affect our business, results of operations and financial condition.

Our future drilling activities are scheduled over an extended time period, making them susceptible to uncertainties that could materially alter the occurrence or timing of such drilling.

We have identified certain potential drilling locations as an estimation of our future drilling activities on our existing acreage, representing a significant part of our business strategy. Our ability to drill and develop these potential drilling locations depends on a number of uncertainties, including: (i) our ability to timely drill wells on lands subject to complex development terms and circumstances; (ii) the availability and cost of capital, equipment, services and personnel; (iii) seasonal conditions; (iv) regulatory and third-party permits, orders and approvals; (v) oil and natural gas prices; (vi) drilling and completion costs; and (vii) and well results. Because of these uncertainties, we do not know if such potential drilling locations will ever be drilled or if we will be able to produce oil and/or natural gas from these or any other potential drilling locations. Moreover, unless production is established or other operations are conducted on a timely basis with respect to the undeveloped acres on which some of our potential drilling locations are located, the leases for such acreage may expire. If we are not able to renew or otherwise maintain leases before they expire, any proved undeveloped reserves associated with such leases will be removed from our proved reserves. Therefore, our actual drilling activities may materially differ from those presently estimated, which could materially adversely affect our business, results of operations and financial condition.

Unless we replace our oil and natural gas reserves, our reserves and production will decline, which would materially adversely affect our business, results of operations and financial condition.

Producing oil and natural gas reservoirs are generally characterized by declining production rates that vary depending upon reservoir characteristics and other factors. Unless we conduct successful development, exploitation and exploration activities or acquire properties containing proved reserves, our proved reserves will decline as those reserves are produced. The rate of decline will change if production from our existing wells declines in a different manner than we have estimated and can also change under other circumstances, many of which are outside of our control. As a result, our future oil and natural gas reserves and production and, therefore, our cash flow and results of operations are highly dependent upon our success in efficiently developing and exploiting our current properties and economically finding or acquiring additional recoverable reserves. We may not be able to develop, find or acquire additional reserves to replace our current and future production at acceptable costs. If we are unable to replace our current and future production, the value of our reserves could decrease, and our business, results of operations and financial condition would be materially adversely affected.

14

The results of our planned exploratory drilling in existing or emerging plays are subject to drilling and completion technique risks and drilling results may not meet our expectations for costs, reserves or production.

Many of our operations involve the use of recently-developed drilling and completion techniques. Risks that we face while drilling include, but are not limited to, landing our well bore in the desired drilling zone, staying in the desired drilling zone while drilling horizontally through the formation, running casing to the desired length of the well bore and being able to run tools and other equipment consistently through the well bore. Risks that we face while completing our wells include, but are not limited to, being able to effectively and efficiently fracture stimulate the planned number of stages, being able to run tools the entire length of the well bore during completion operations and successfully cleaning out the well bore after completion of the final fracture stimulation stages. If our drilling results are less than anticipated or we are unable to execute our drilling program, it could materially adversely affect our business, results of operations and financial condition.

Full cost accounting rules may require us to record certain non-cash asset write-downs in the future, which could materially adversely affect our results of operations.

We utilize the full cost method of accounting for oil and natural gas activities. Under full cost accounting, we are required to perform a ceiling test each quarter. The ceiling test is an impairment test and generally establishes a maximum, or “ceiling,” of the book value of oil and natural gas properties. To the extent that the book value of our oil and natural gas properties exceed the ceiling, a non-cash impairment charge is recorded. The impairment charge may not be reversed in future periods even if the calculated ceiling increases. The mechanics of the ceiling test are described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies, Practices and Estimates.”

At March 31, 2014 and December 31, 2013, we had approximately $3.9 billion of costs that were excluded from amortization. These costs relate to the amounts associated with unproved properties and wells in progress. Costs associated with unproved properties are assessed at least annually to ascertain whether impairment has occurred. In addition, impairment assessments are made for interim reporting periods if facts and circumstances exist that suggest impairment has occurred. The facts and circumstances included in our impairment assessment are described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies, Practices and Estimates.” During any period in which impairment is indicated, some or all of the accumulated costs incurred to date for the impaired property become part of our amortization base and are then subject to depletion and the full cost ceiling limitation. Accordingly, a significant change in the factors considered for impairment, many of which are beyond our control, may shift a significant amount of cost from unproved properties into our amortization base and negatively impact the results of our full cost ceiling test. During the three months ended March 31, 2014 and 2013 and during the years ended December 31, 2013 and 2012, we recorded approximately $62.8 million, $3.8 million, $1.6 billion and $1.3 billion, respectively, of impairments associated with our unproved property.

During the three months ended March 31, 2013 and the years ended December 31, 2013 and 2012, we recorded full cost ceiling test impairments of approximately $69.3 million, $1.8 billion and $2.3 billion, respectively, as a result of our quarterly ceiling tests. We could incur additional write-downs in the future, particularly as a result of a decline of oil and natural gas prices, impairments of costs associated with unproved properties or changes in reserve estimates. The amount of future write-downs could be substantial and could have a material adverse effect on our results of operations for the periods in which any such charges are taken.

15

We may incur substantial losses and be subject to substantial claims as a result of our oil and natural gas operations. Additionally we may not be insured for, or our insurance may be inadequate to protect us, against these risks.

Our oil and natural gas operations are subject to all of the risks associated with exploring, drilling for and producing oil and natural gas, including the possibility of:

| | • | | environmental hazards, such as uncontrollable flows of oil, natural gas, brine, well fluids, toxic gas or other pollution into the environment, including groundwater contamination; |

| | • | | abnormally pressured formations; |

| | • | | mechanical failures and difficulties, such as stuck oilfield drilling and service tools and casing collapse; |

| | • | | fires, explosions and ruptures of pipelines; |

| | • | | fires and explosions at well locations or involving associated equipment; |

| | • | | personal injuries and death; |

| | • | | terrorist attacks targeting oil and natural gas related facilities and infrastructure. |

It is impossible for us to predict the magnitude of any such event and whether our contingency plans would be sufficient to allow us to successfully respond to such an event in a way that would prevent a material interruption in our business operations.

Any of these risks could materially adversely affect our ability to conduct operations or result in substantial damages and losses to us as a result of:

| | • | | injury or loss of life; |

| | • | | damage to and destruction of property, natural resources and equipment; |

| | • | | pollution and other environmental damage; |

| | • | | regulatory investigations and penalties; |

| | • | | suspension of our operations; and |

| | • | | repair and remediation costs. |

We do not insure fully against all risks associated with our business either because such insurance is not available or because we believe that the cost of available insurance is excessive relative to the risks presented. In addition, our insurance policies have materiality deductibles, self-insurance levels and limits on our maximum recovery, and the amount of our insurance coverage for a particular risk may be insufficient to compensate us for any losses that we may actually incur. A loss not covered or not fully covered by insurance could materially adversely affect our business, results of operations and financial condition.

The success of our operations depends, in part, on other parties, particularly with respect to properties we do not operate, which could reduce our production and revenue or could result in increased liabilities for environmental or safety related incidents.

A significant portion of our properties are operated by other parties. With respect to such properties, we have limited ability to influence or control day-to-day operations, including those relating to compliance with environmental, safety and other regulations, or the amount of capital expenditures that we are required to fund with respect to such properties. As a result, the success and timing of drilling and development activities on such properties depend upon factors outside of our control, including the operator’s compliance with the applicable

16

operating or similar agreement, the timing and amount of capital expenditures, the operator’s expertise and financial resources, the inclusion of other participants in drilling wells and the use of technology. Furthermore, we may not be able to remove the operator of our non-operated properties in the event of poor performance. In addition, even with respect to our operated properties, we may depend upon third-party working interest owners to fund their respective share of capital expenditures to successfully execute a project. Such limitations and dependence on other parties could cause us to incur unexpected future costs and materially adversely affect our business, results of operations and financial condition.

Cyber attacks targeting systems and infrastructure used by the oil and natural gas industry may adversely impact our operations.

Our business has become increasingly dependent on digital technologies to conduct certain exploration, development and production activities, including to estimate quantities of oil and natural gas reserves, process and record financial and operating data and analyze seismic and drilling information. Unauthorized access to our proprietary information or information technology systems could lead to data corruption, communication interruption or other operational disruptions in our exploration or production operations. In addition, a cyber attack directed at oil and natural gas distribution systems could damage critical distribution and storage assets or the environment, delay or prevent delivery of production to markets and make it difficult or impossible to accurately account for production and settle transactions. Further, as cyber attacks continue to evolve, we may be required to expend significant additional resources to continue to modify or enhance our protective measures or to investigate and remediate any vulnerabilities to cyber attacks. It is possible that any of these occurrences, or a combination of them, could materially adversely affect our business, results of operations and financial condition.

We rely on independent experts and technical or operational service providers over whom we may have limited control.

We use a variety of independent contractors to provide us with certain technical assistance and services. For example, we rely upon the owners and operators of rigs and drilling equipment, and upon providers of field services (including completions), to drill and complete wells within our prospects. Our limited control over the activities and business practices of these service providers, any inability on our part to maintain satisfactory commercial relationships with them or their failure to provide quality services could materially adversely affect our business, results of operations and financial condition.

There is significant competition in the oil and natural gas industry, which may materially adversely affect our ability to successfully implement our business strategies.

The oil and natural gas industry is intensely competitive, and we compete with other companies that possess and employ financial, technical and personnel resources that are substantially greater than ours. Our ability to acquire additional properties and to find and develop reserves in the future will depend on our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. Our competitors may be able to pay more for oil and natural gas leases and mineral estates, productive oil and natural gas properties and exploratory prospects or define, evaluate, bid for and purchase a greater number of oil and natural gas leases, properties and prospects than our financial or personnel resources permit. Such competition can also drive up the costs to acquire oil and natural gas leases, properties and prospects in areas where we are already conducting business and operations. In addition, other companies may have a greater ability to continue exploration activities during periods of low commodity prices and/or high service costs. Moreover, our larger competitors may be able to absorb the burden of present and future federal, state, local and other laws and regulations more easily than we can, which could materially adversely affect our competitive position.

17

New technologies may cause our current exploration and drilling methods to become obsolete.

The oil and natural gas industry is subject to rapid and significant advancements in technology, including the introduction of new products and services using new technologies. As competitors use or develop new technologies, we may be placed at a competitive disadvantage, and competitive pressures may force us to implement new technologies at a substantial cost. One or more of the technologies that we currently use or that we may implement in the future may become obsolete. We may not be able to implement technologies on a timely basis or at a cost that is acceptable to us. If we are unable to maintain technological advancements consistent with industry standards, our business, results of operations and financial condition may be materially adversely affected.

Reductions in our workforce and recent turnover in management positions could materially adversely affect our business.

In December 2012, we initiated a restructuring plan (the “Restructuring Plan”) to reduce operating costs and improve profitability. Under the Restructuring Plan, we closed our Midland, Texas office and implemented a reduction in force of approximately 120 employees across multiple functions throughout the Company. The Restructuring Plan, and other cost reduction measures we may take in the future, may not result in the expected cost savings and may distract management from our core business, harm our reputation or yield unanticipated consequences, such as attrition beyond the planned reduction in workforce, difficulties in attracting and hiring new employees, increased difficulties in the execution of our day-to-day operations, reduced employee productivity and a deterioration of employee morale. In addition, we may have to rely more on consultants and service providers and incur additional costs to further retain remaining key employees and to hire new employees as an unanticipated consequence of the Restructuring Plan.

In addition, during 2012 and 2013, a number of our former executive officers resigned from the Company, including Mr. David Adams, our former Chief Executive Officer and President, and, during that same period, several members of our current management team joined the Company, including Mr. Randy Limbacher, our Chief Executive Officer and President. The recent turnover in our management may cause disruption to our operations.

We depend on the performance of our officers and other key employees. Our ability to hire and retain our officers and other key employees is important to our continued success and growth. The loss of any member of our management or other key employee could negatively impact our ability to execute our business strategies, which could materially adversely affect our business, results of operations and financial condition.

Our business requires the recruitment and retention of a skilled workforce and the loss of employees or skilled labor shortages could result in the inability to implement our business plans and could materially adversely affect our profitability.

Our business requires the retention and recruitment of a skilled workforce, including field personnel to drill wells and conduct field operations, geologists, geophysicists, engineers and other professionals. We compete with other companies in the energy industry for this skilled workforce, some of which may be able to offer better compensation packages to attract and retain qualified personnel than we are able to offer. If we are unable to retain our current employees and/or recruit new employees of comparable knowledge and experience, our business, results of operations and financial condition could be negatively impacted. In addition, we could experience increased costs to attract and retain these professionals, and our recent workforce reductions under the Restructuring Plan could also harm our ability to attract such professionals in the future.

We may be affected by skilled labor shortages, which we have from time-to-time experienced, especially in North American regions where there are large unconventional shale resource plays. These shortages could negatively impact the productivity and profitability of certain projects. Our inability to pursue new projects, or maintain productivity and profitability on existing projects due to the limited supply of skilled workers and/or increased labor costs could materially adversely affect our profitability and results of operations.

18

We may be unable to make attractive acquisitions or successfully integrate acquired assets or businesses, and any inability to do so may disrupt our business and hinder our ability to grow. In addition, any acquisitions we do complete will be subject to substantial risks.

In the future we may make acquisitions of assets or businesses that complement or expand our current business. If we are unable to make these acquisitions for any reason, including because we are: (i) unable to identify attractive acquisition candidates, to analyze acquisition opportunities successfully from an operational and financial point of view or to negotiate acceptable purchase contracts with them; (ii) unable to obtain financing for these acquisitions on economically acceptable terms; or (iii) outbid by competitors, then our future growth could be limited.

Furthermore, even if we do make acquisitions they may not result in an increase in our cash flow from operations or otherwise result in the benefits anticipated. Any acquisition involves potential risks that could significantly impair our ability to manage our business and materially adversely affect our business, results of operations and financial condition, including, among other things:

| | • | | mistaken assumptions about volumes, potential drilling locations, revenues and costs, including synergies and the overall costs of equity or debt; |

| | • | | difficulties in integrating the operations, technologies, products and personnel of the acquired companies; |

| | • | | difficulties in complying with regulations, such as environmental regulations, and managing risks related to an acquired business or assets; |

| | • | | timely completion of necessary financing and required amendments, if any, to existing agreements; |

| | • | | an inability to implement uniform standards, controls, procedures and policies; |

| | • | | undiscovered, unknown and unforeseen problems, defects, liabilities or other issues related to any acquisition for which contractual protections prove inadequate, including environmental liabilities and title defects; |

| | • | | assumption of liabilities that were not disclosed to us or that exceed our estimates; |

| | • | | diversion of management’s and employees’ attention from normal daily operations of the business; |

| | • | | difficulties in entering regions in which we have no or limited direct prior experience and where competitors in such regions have stronger operating positions; and |

| | • | | potential loss of key employees. |

Moreover, our reviews of acquired properties are inherently incomplete since it is generally not feasible to review in depth every individual property involved in each acquisition. Even a detailed review of records and properties may not necessarily reveal existing or potential problems, nor will it necessarily permit a buyer to become sufficiently familiar with the properties to assess fully their deficiencies and potential. Inspections may not always be performed on every well, and environmental problems, such as groundwater contamination, are not necessarily observable even when an inspection is undertaken. The inability to make future acquisitions or adequately evaluate the impact of such acquisitions could materially adversely affect our business, results of operations and financial condition.

Our business operations could be disrupted if our information technology systems fail to perform adequately.

The efficient operation of our business depends on our information technology systems. We rely on our information technology systems to effectively manage our business data, communications and other business processes. For example, we have recently implemented a new enterprise resource planning (“ERP”) software system to assist in the management of data across our company. The failure of our information technology systems, including the ERP software system, to perform as we anticipate could disrupt our business and result in

19

transaction errors, processing inefficiencies and the loss of sales and customers, causing our business, results of operations and financial condition to suffer. In addition, our information technology systems may be vulnerable to damage or interruption from circumstances beyond our control, including fire, natural disasters, power outages, systems failures, security breaches and viruses. Any such damage or interruption could materially adversely affect our business, results of operations and financial condition.

Market conditions or operational impediments may hinder our access to oil and natural gas markets or delay our production.

Market or operational conditions or the unavailability of satisfactory oil and natural gas transportation and infrastructure arrangements may hinder our access to oil and natural gas markets or delay our production. The availability of a ready market for our oil and natural gas production depends on a number of factors, including the demand for and supply of oil and natural gas and the proximity of our reserves to pipelines and terminal facilities. Our ability to market our production depends in substantial part on the availability and capacity of gathering systems, transportation, fractionation systems, pipelines and processing facilities owned and operated by third parties. Our failure to obtain such services on acceptable terms could materially adversely affect our business. We may be required to curtail production from or shut in wells for a lack of a market or because of inadequacy or unavailability of pipelines, gathering system capacity, transportation or processing, treating and fractionation facilities or refinery demand. If that were to occur, we would be unable to realize revenue from those wells until other arrangements were made to deliver the products at a reasonable cost to market, which could materially adversely affect our business, results of operations and financial condition.

Our use of derivative financial instruments could result in financial losses or could reduce our income.