Acquisition of Limestone Bancorp, Inc. October 25, 2022

Safe Harbor Statement Statements in this presentation which are not historical are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may include discussions of the strategic plans and objectives or anticipated future performance and events of Peoples Bancorp Inc. (“Peoples”). The information contained in this presentation should be read in conjunction with Peoples’ Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the Securities and Exchange Commission (“SEC”) and available on the SEC’s website (www.sec.gov) or at Peoples’ website (www.peoplesbancorp.com). Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in Peoples’ 2021 Annual Report on Form 10-K filed with the SEC under the section, “Risk Factors” in Part I, Item 1A. As such, actual results could differ materially from those contemplated by forward-looking statements made in this presentation. Management believes that the expectations in these forward-looking statements are based upon reasonable assumptions within the bounds of management's knowledge of Peoples’ business and operations. Peoples disclaims any responsibility to update these forward-looking statements to reflect events or circumstances after the date of this presentation. 2

Safe Harbor Statement This call does not constitute an offer to sell or the solicitation of an offer to buy securities of Peoples Bancorp Inc. (“Peoples”). Peoples will file a registration statement on Form S-4 and other documents regarding the proposed merger with Limestone Bancorp, Inc. (“Limestone”) with the Securities and Exchange Commission (“SEC”). The registration statement will include a joint proxy statement/prospectus which will be sent to the shareholders of both Peoples and Limestone in advance of their respective special meetings of shareholders to be held to consider the proposed merger. Investors and security holders are urged to read the proxy statement/prospectus and any other relevant documents to be filed with the SEC in connection with the proposed transaction because they contain important information about Peoples, Limestone and the proposed merger. Investors and security holders may obtain a free copy of these documents (when available) through the website maintained by the SEC at www.sec.gov. These documents may also be obtained, free of charge, on Peoples’ website at www.peoplesbancorp.com under the tab “Investor Relations” or by contacting Peoples’ Investor Relations Department at: Peoples Bancorp Inc., 138 Putnam Street, PO Box 738, Marietta, Ohio 45750, Attn: Investor Relations. Peoples, Limestone, and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the proposed merger. Information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Additional information about the directors and executive officers of Peoples is set forth in the proxy statement for Peoples' 2022 annual meeting of shareholders, as filed with the SEC on Schedule 14A on March 7, 2022. 3

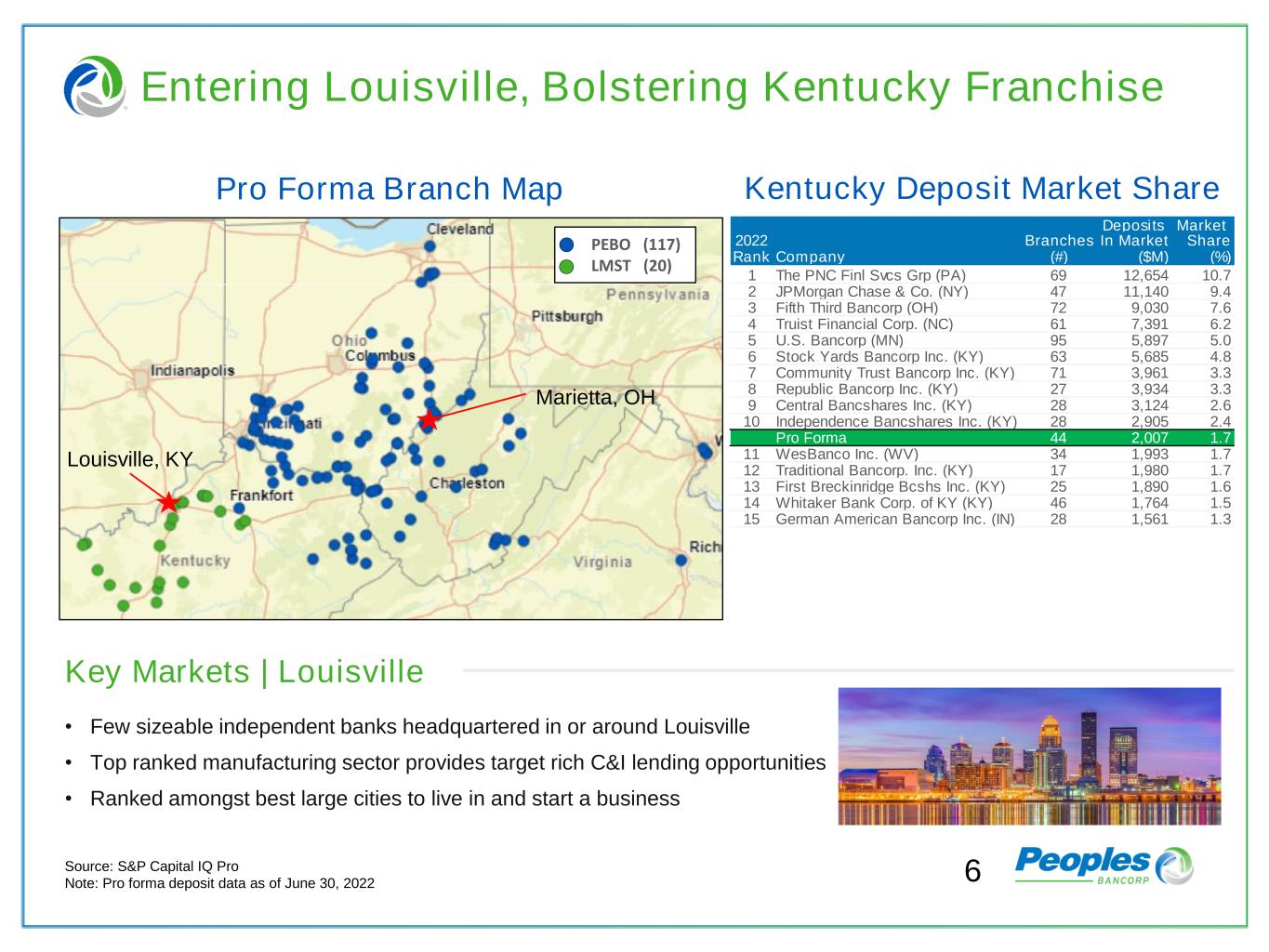

4 Strategic Rationale Strong Strategic Fit • #6 in pro forma Kentucky deposit market share among community banks(1) • Strategic entrance into selected Kentucky markets, including the Louisville, Lexington, Frankfort, Owensboro and Elizabethtown, KY MSAs • Strong and complementary corporate and credit culture • CRE and C&I lending focus further diversifies loan portfolio • Accelerates goal of becoming the Best Community Bank in America Enhanced Performance • Benefits of additional scale and operating leverage while staying under $10B in assets • Enhanced earnings profile – ~1.50% estimated pro forma 2024 ROAA • 30% cost savings to drive meaningful improvement in efficiency • Potential revenue synergies across multiple business lines (not modeled) Note: Pro forma balance sheet data as of September 30, 2022, excluding merger adjustments (1) Includes community banks with less than $50 billion in total assets (2) Inclusive of interest rate marks Sound Risk Profile Financially Compelling Pro Forma Results • Grows balance sheet with high-quality loans and core deposits • Excellent credit discipline and asset quality • Non-complex business lines in stable markets • Leverages Peoples’ experience in acquisitions and integration • Diversifies balance sheet, geography and overall risk profile Total Assets Total Loans ‘24E EPS Accretion IRRTBV Earnback(2) ’24 ROATCE $8.5B $5.7B 11+% 20%+2.8 years ~22% Total Deposits $7.1B ’24 ROAA ~1.50%

5Source: S&P Capital IQ Pro Note: Financial data as of September 30, 2022 Company Overview Loan and Deposit Detail 1-4 Family 12.2% NOO CRE & Multi-family 35.0% C&D 11.3% Home Equity 2.6% Owner Occ. CRE 10.5% C&I 25.5% Consumer & Other 3.0% Non-interest Bearing 23.6% IB, MMDA & Savings 53.9% Retail CDs 8.1% Jumbo CDs 14.3% L o a n C o m p o s it io n D e p o s it C o m p o s it io n $1,128 MM $1,219 MM Total Loans Total Deposits Company Overview Company Name Limestone Bancorp, Inc. Headquarters Louisville, KY Ticker LMST MRQ Balance Sheet ($000) Total Assets 1,493,695 Total Loans 1,127,945 Total Deposits 1,218,580 Tangible Common Equity 120,322 Loans / Deposits (%) 93 TCE / TA (%) 8.1 MRQ Profitability ($000) Net Income 5,813 ROAA (%) 1.59 ROAE (%) 17.83 Net Interest Margin (%) 3.73 Efficiency Ratio (%) 57.4 MRQ Asset Quality (%) NPAs / Assets (%) 0.08 LLR / Gross Loans (%) 1.16 MRQ Yield on Loans 4.77% MRQ Cost of Deposits 0.41%

Pro Forma Branch Map Source: S&P Capital IQ Pro Note: Pro forma deposit data as of June 30, 2022 Entering Louisville, Bolstering Kentucky Franchise 6 PEBO (117) LMST (20) Kentucky Deposit Market Share Key Markets | Louisville • Few sizeable independent banks headquartered in or around Louisville • Top ranked manufacturing sector provides target rich C&I lending opportunities • Ranked amongst best large cities to live in and start a business Marietta, OH Louisville, KY Deposits Market 2022 Branches In Market Share Rank Company (#) ($M) (%) 1 The PNC Finl Svcs Grp (PA) 69 12,654 10.7 2 JPMorgan Chase & Co. (NY) 47 11,140 9.4 3 Fifth Third Bancorp (OH) 72 9,030 7.6 4 Truist Financial Corp. (NC) 61 7,391 6.2 5 U.S. Bancorp (MN) 95 5,897 5.0 6 Stock Yards Bancorp Inc. (KY) 63 5,685 4.8 7 Community Trust Bancorp Inc. (KY) 71 3,961 3.3 8 Republic Bancorp Inc. (KY) 27 3,934 3.3 9 Central Bancshares Inc. (KY) 28 3,124 2.6 10 Independence Bancshares Inc. (KY) 28 2,905 2.4 Pro Forma 44 2,007 1.7 11 WesBanco Inc. (WV) 34 1,993 1.7 12 Traditional Bancorp. Inc. (KY) 17 1,980 1.7 13 First Breckinridge Bcshs Inc. (KY) 25 1,890 1.6 14 Whitaker Bank Corp. of KY (KY) 46 1,764 1.5 15 German American Bancorp Inc. (IN) 28 1,561 1.3

Transaction Terms and Key Assumptions 7 Consideration(1) • Approximately $208.2 million deal value, $27.25 per LMST share • 100% stock consideration • 0.90x fixed exchange ratio Pricing Multiples(1) • Price / Tangible Book Per Share: 173% • Price / LTM EPS: 12.3x • Core Deposit Premium: 8.4% Key Transaction Assumptions • 30% cost savings (75% phased in 2023 and 100% in 2024 and thereafter) • $17.7 million in pre-tax merger expenses • Credit mark of 1.65% of LMST total loans - 25% PCD, 75% non-PCD • Interest rate marks: - $39.8 million loan mark, accreted back over 3.5 years - $9.4 million write down of LMST HTM securities, accreted back over 11.8 years - $18.9 million write down of AOCI, accreted back over 5.3 years - Combined $3.6 write down of time deposits, trust preferred, sub-debt and FHLB marks Core Deposit Intangible • 3.60% of LMST’s core deposits, amortized SYD over 10 years Financial Impact • 2024 EPS accretion (fully phased): 11+% • Initial TBVPS dilution of 9.6%, with an earnback of 2.8 years (crossover, inclusive of rate marks) Pro Forma Ownership • 80% PEBO shareholders, 20% LMST shareholders • One board seat to be offered to Limestone’s existing Chairman Timing & Approvals • Shareholder approval • Customary regulatory approvals and closing conditions • Targeted closing in the second quarter of 2023 (1) Based on Peoples’ closing price of $30.28 per share as of October 21, 2022

(1) No rate mark scenario assumes no loan interest rate mark, HTM securities mark, AOCI mark, time deposit mark, FHLB mark, subordinated debt mark, TruPS mark or amortization as a result of CDI Expected Financial Impact (with and without interest rate marks) 8 Financial Impact TBV Acc. / (Dil.) (0.2%) TBV Earnback 0.3 Years EPS Accretion: 2024 5.2% Pro Forma Capital Ratios At Close TCE 7.0% Leverage 9.0% CET1 11.2% Tier 1 11.7% Total Capital 13.1% Financial Impact TBV Acc. / (Dil.) (9.6%) TBV Earnback 2.8 Years EPS Accretion: 2024 11.7% Pro Forma Capital Ratios At Close TCE 6.4% Leverage 8.4% CET1 10.4% Tier 1 10.9% Total Capital 12.3% Including AOCI and Rate Marks Excluding AOCI and Rate Marks(1)

Comprehensive Due Diligence 9 • PEBO is an experienced acquirer with 9 bank transactions completed since 2012 • Track record of successful integration and realization of cost savings • Comprehensive process including business, operational, credit, financial, legal, HR and regulatory review • Detailed credit review completed by internal team with assistance from external partners • Due diligence team reviewed approximately 75% of the target’s commercial loan portfolio • Nearly 100% review of loan exposures over $1 million, 90% over $500,000 and 100% of criticized relationships over $100,000 • Detailed review of cost structure, interest rate risk, and growth strategy • Thorough review of regulatory, compliance, legal & operational risks • Third party valuation firm analyzed interest rate marks including CDI and loan rate marks • Outside tax accountants reviewed and assessed Limestone’s existing Deferred Tax Assets and NOLs Comprehensive Diligence Process Disciplined Acquirer

Transaction Highlights • Strong corporate franchise which provides a solid entry into the Louisville market • CRE and C&I focused franchise further diversifies pro forma loan portfolio • Similar business model which provides for a seamless integration; strong credit discipline and excellent asset quality • Expands presence in KY markets, moving Peoples to 11th in KY deposit market share • Provides diversification and expansion of franchise while staying under $10 billion in total assets • Financially attractive with strong, double-digit earnings accretion (fully phased-in) and manageable tangible book earnback • Experienced acquirer with significant integration experience 10

Appendix

Combined Pro Forma Loan Composition 12Source: Company provided documents Note: Financial data as of September 30, 2022; Excludes purchase accounting adjustments Peoples Bancorp Inc. Limestone Bancorp, Inc. Pro Forma Pro Forma Yield on Loans Calk Pro Forma CRE Concentration Dollars in millions Dollars in millions Dollars in millions Loan Type Balance % Loan Type Balance % Loan Type Balance % 1-4 Family $733.4 15.9% 1-4 Family $137.4 12.2% 1-4 Family $870.7 15.2% NOO CRE & Multi-family 882.0 19.1% NOO CRE & Multi-family 394.7 35.0% NOO CRE & Multi-family 1,276.7 22.2% C&D 215.6 4.7% C&D 127.3 11.3% C&D 342.9 6.0% Home Equity 174.5 3.8% Home Equity 29.4 2.6% Home Equity 203.9 3.6% Owner Occ. CRE 541.5 11.7% Owner Occ. CRE 118.0 10.5% Owner Occ. CRE 659.5 11.5% C&I 877.5 19.0% C&I 287.4 25.5% C&I 1,164.8 20.3% Consumer & Other 1,186.7 25.7% Consumer & Other 33.9 3.0% Consumer & Other 1,220.6 21.3% Gross Loans (HFI) $4,611.2 100.0% Gross Loans (HFI) $1,127.9 100.0% Gross Loans (HFI) $5,739.2 100.0% MRQ Yield on Loans: 5.26% MRQ Yield on Loans: 4.77% MRQ Yield on Loans: 5.16% 1-4 Family 15.9% NOO CRE & Multi-family 19.1% C&D 4.7% Home Equity 3.8% Owner Occ. CRE 11.7% C&I 19.0% Consumer & Other 25.7% 1-4 Family 12.2% NOO CRE & Multi-family 35.0% C&D 11.3% Home Equity 2.6% Owner Occ. CRE 10.5% C&I 25.5% Consumer & Other 3.0% 1-4 Family 15.2% NOO CRE & Multi-family 22.2% C&D 6.0% Home Equity 3.6% Owner Occ. CRE 11.5% C&I 20.3% Consumer & Other 21.3%

Pro Forma Deposit Composition 13 Combined Source: Company provided documents Note: Financial data as of September 30, 2022; Excludes purchase accounting adjustments Peoples Bancorp Inc. Limestone Bancorp, Inc. Pro Forma Pro Forma Cost of Deposits Calc Pro Forma Cost of Funds Calc Dollars in millions Dollars in millions Dollars in millions Deposit Type Balance % Deposit Type Balance % Deposit Type Balance % Non-IB Demand $1,636.0 27.9% Non-IB Demand $287.9 23.6% Non-IB Demand $1,923.9 27.2% Money Market 624.7 10.7% Money Market 215.5 17.7% Money Market 840.2 11.9% Savings 1,077.4 18.4% Savings 154.5 12.7% Savings 1,231.9 17.4% Other IB Demand 1,896.7 32.3% Other IB Demand 286.9 23.5% Other IB Demand 2,183.6 30.8% Time Deposits 630.8 10.8% Time Deposits 273.8 22.5% Time Deposits 904.6 12.8% Total Deposits $5,865.6 100.0% Total Deposits $1,218.6 100.0% Total Deposits $7,084.2 100.0% MRQ Cost of Deposits: 0.16% MRQ Cost of Deposits: 0.41% MRQ Cost of Deposits: 0.20% Loans / Deposits: 79% Loans / Deposits: 93% Loans / Deposits: 81% Non-IB Demand 27.9% Money Market 10.7% Savings 18.4% Other IB Demand 32.3% Time Deposits 10.8% Non-IB Demand 23.6% Money Market 17.7% Savings 12.7% Other IB Demand 23.5% Time Deposits 22.5% Non-IB Demand 27.2% Money Market 11.9% Savings 17.4% Other IB Demand 30.8% Time Deposits 12.8%

Limestone Financial Highlights Source: S&P Capital IQ Pro Note: YTD data as of September 30, 2022 14 ($000s) 2018Y 2019Y 2020Y 2021Y YTD Balance Sheet Total Assets 1,069,692 1,245,779 1,312,302 1,415,692 1,493,695 Total Loans HFI 765,244 926,271 962,081 1,001,840 1,127,945 Total Deposits 894,231 1,026,975 1,119,607 1,208,668 1,218,580 Loans / Deposits (%) 86 90 86 83 93 Yield on Interest Earning Assets (%) 4.55 4.76 4.20 3.92 4.05 Cost of Interest-bearing Liab (%) 1.23 1.66 1.05 0.59 0.66 Capital Position Total Equity 92,097 105,750 116,024 130,959 128,371 Tang. Common Equity 92,097 96,998 107,528 122,718 120,322 TCE Ratio (%) 8.61 7.84 8.25 8.72 8.10 Profitability Net Income 8,794 10,518 9,005 14,909 13,428 ROAA (%) 0.86 0.95 0.70 1.09 1.26 ROAE (%) 10.36 10.50 8.19 12.03 13.87 NII / AA (%) 0.53 0.53 0.53 0.57 0.61 NIE / AA (%) 2.75 2.62 2.50 2.34 2.33 Efficiency Ratio (%) 72.3 70.6 67.6 61.0 58.7 Net Interest Margin (%) 3.52 3.39 3.35 3.46 3.56 Asset Quality and LLR NPAs / Assets (%) 0.60 0.42 0.30 0.24 0.08 LLR / Gross Loans (%) 1.16 0.90 1.29 1.15 1.16 NCOs / Avg. Loans (%) (0.16) 0.06 0.03 0.22 (0.20)

Limestone Metro Market Overview Source: S&P Capital IQ Pro Note: Four largest cities in KY, data as of June 30, 2022 15 Louisville Lexington Owensboro Bowling Green Corporate Headquarters: Brown-Forman, Churchill Downs, Humana, Kindred Healthcare, Papa John’s International, Texas Roadhouse, and Yum! Brands Corporate Headquarters: Fasig Tipton, Jif (peanut butter), Keeneland, Lexmark, and Tempur Sealy Corporate Headquarters: Owensboro Health Corporate Headquarters: Camping World, Fruit of the Loom, Houchens Industries, and the Medical Center at Bowling Green Other large employers: UPS, Ford Motor Company, GE Appliances, and Norton Healthcare Other large employers: Xerox, Toyota, IBM, Lockheed Martin, and Valvoline Other large employers: Kimberly-Clark, US Bank Mortgage Processing, and Toyotetsu Other large employers: General Motors Corvette plant, Rafferty’s Restaurants Universities: University of Louisville and Bellarmine University Universities: University of Kentucky and Transylvania University Universities: Kentucky Wesleyan University and Brescia University Universities: Western Kentucky University Deposits in MSA: $43.3 billion Limestone market share: 1.0% MSA Population: 1.284 mil Deposits in MSA: $16.2 billion Limestone market share: 0.7% MSA Population: 530k Deposits in MSA: $3.4 billion Limestone market share: 2.3% MSA Population: 121k Deposits in MSA: $4.6 billion Limestone market share: 2.7% MSA Population: 185k