W O R K IN G T O G E T H E R . B U IL D IN G S U C C ES S. 20 24 INVESTOR PRESENTATION I 3rd QUARTER

WORKING TOGETHER BUILDING SUCCESS 2 TABLE OF CONTENTS PAGE 4 PROFILE, CULTURE, STRATEGY & INVESTMENT RATIONALE PAGE 12 BUILT ON A SOLID FOUNDATION PAGE 26 Q3 2024 FINANCIAL INSIGHTS PAGE 35 Q3 2024 APPENDIX

3 Statements in this presentation which are not historical are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may include discussions of the strategic plans and objectives or anticipated future performance and events of Peoples Bancorp Inc. (“Peoples”). The information contained in this presentation should be read in conjunction with Peoples’ Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Form 10-K”), and the Quarterly Report on Form 10-Q for the third quarter ended September 30, 2024, each of which is available on the Securities and Exchange Commission's (“SEC”) website (sec.gov) or at Peoples’ website (peoplesbancorp.com). Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in the 2023 Form 10-K under the section, “Risk Factors” in Part I, Item 1A. As such, actual results could differ materially from those contemplated by forward-looking statements made in this presentation. Management believes that the expectations in these forward-looking statements are based upon reasonable assumptions within the bounds of management’s knowledge of Peoples’ business and operations. Peoples disclaims any responsibility to update these forward-looking statements to reflect events or circumstances after the date of this presentation. SAFE HARBOR STATEMENT

PROFILE, CULTURE, STRATEGY & INVESTMENT RATIONALE 4

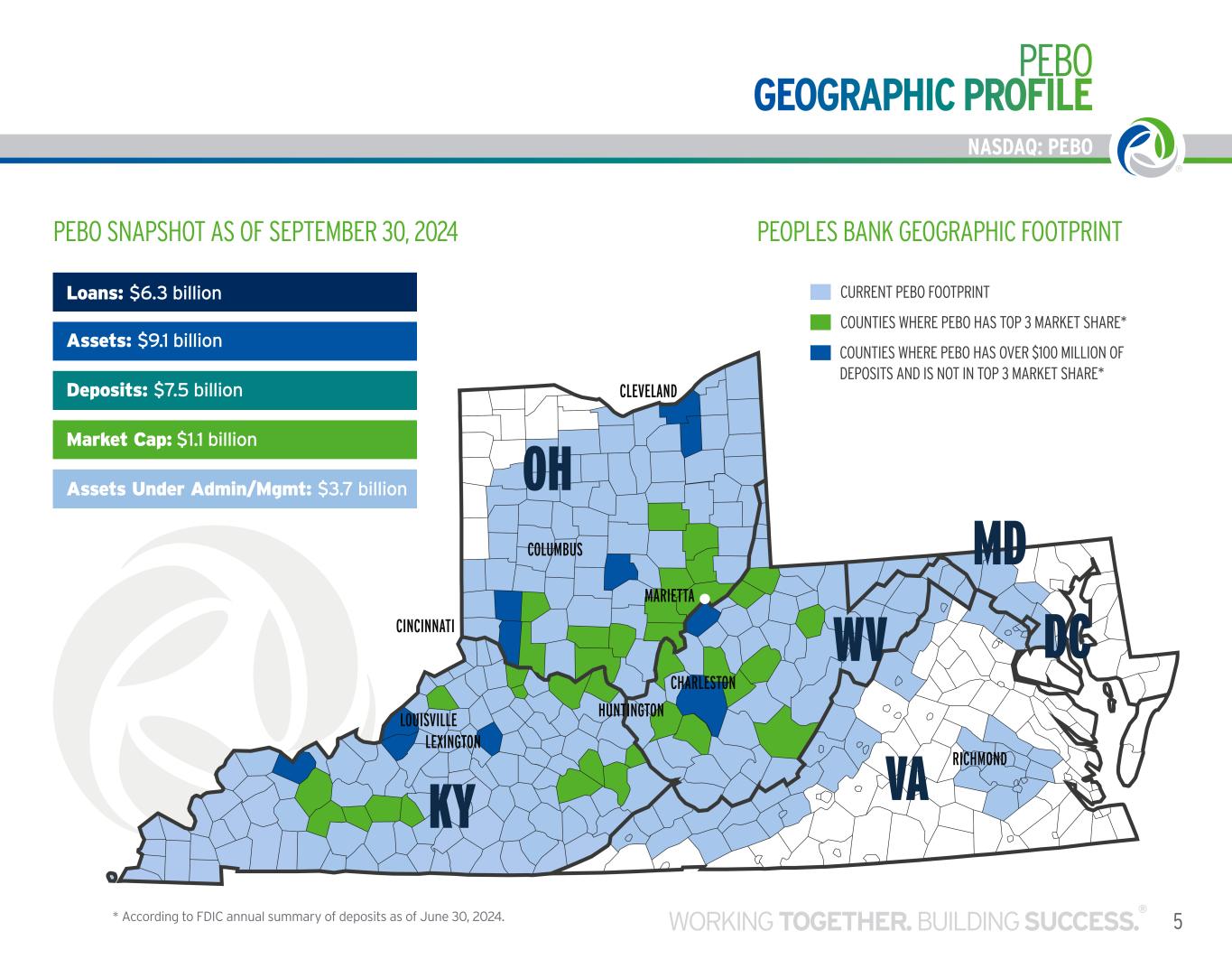

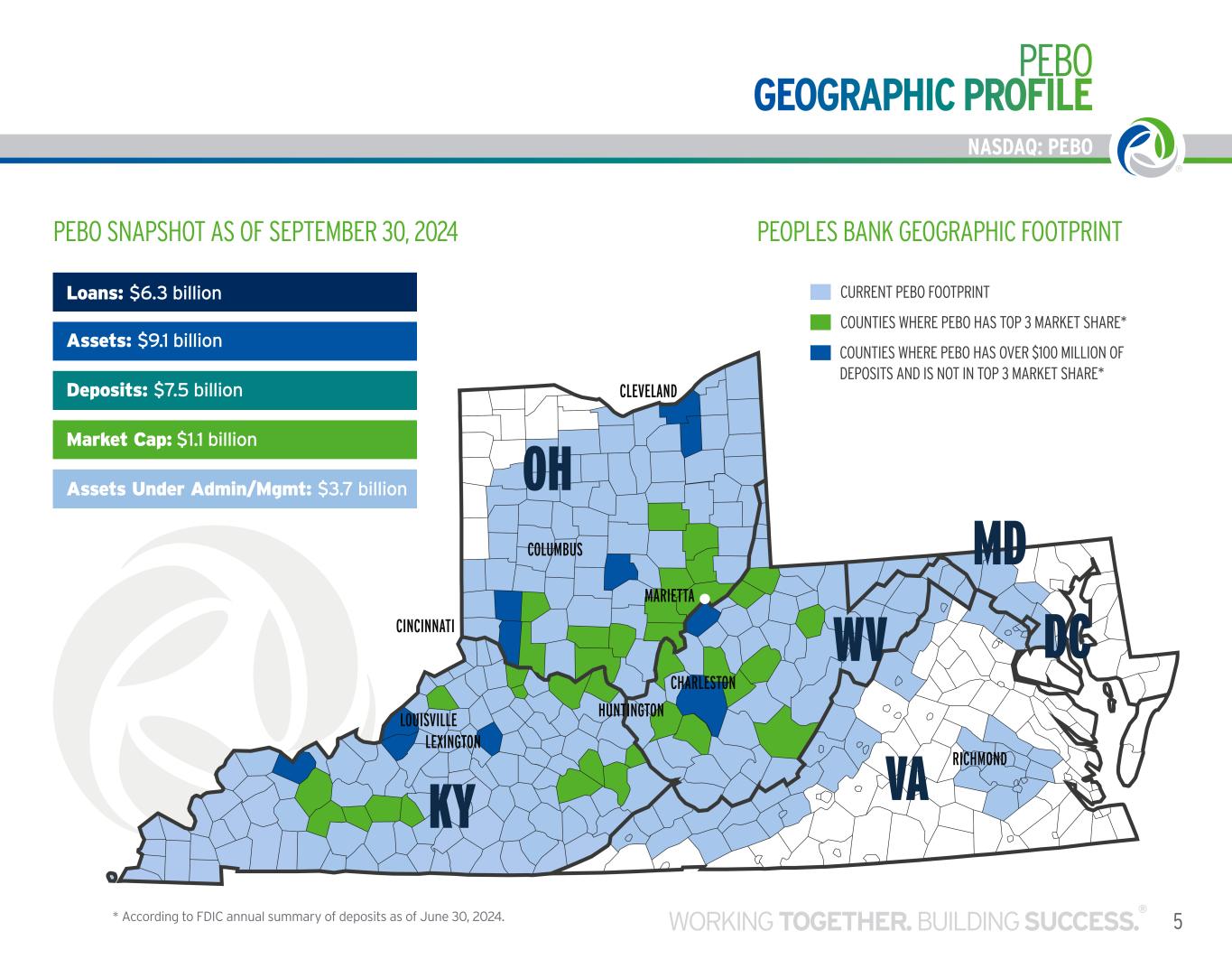

NASDAQ: PEBO PEBO GEOGRAPHIC PROFILE 5WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO PEOPLES BANK GEOGRAPHIC FOOTPRINT COUNTIES WHERE PEBO HAS OVER $100 MILLION OF DEPOSITS AND IS NOT IN TOP 3 MARKET SHARE* COUNTIES WHERE PEBO HAS TOP 3 MARKET SHARE* CURRENT PEBO FOOTPRINT * According to FDIC annual summary of deposits as of June 30, 2024. Loans: $6.3 billion Assets: $9.1 billion Deposits: $7.5 billion Market Cap: $1.1 billion Assets Under Admin/Mgmt: $3.7 billion PEBO SNAPSHOT AS OF SEPTEMBER 30, 2024 WV VAKY OH MD DC COLUMBUS CLEVELAND CINCINNATI LEXINGTON LOUISVILLE RICHMOND CHARLESTON MARIETTA HUNTINGTON

6 CORPORATE CULTURE NASDAQ: PEBO OUR VISION Our vision is to be the BEST COMMUNITY BANK IN AMERICA for our employees, clients, shareholders, and local communities. ENVIRONMENTAL, SOCIAL AND GOVERNANCE (“ESG”) MATTERS In 2024 and beyond, we are committed to continuing to conduct our business in a manner that aligns with our values, our ESG areas of focus, and our investment rationale. Our ESG areas of focus are organized around our associates, our communities, our clients and our shareholders. More about our ESG practices can be found on our website at peoplesbancorp.com/esg Our actions are guided by our core values represented by the Promise Circle, which embodies how we do business and our never ending pursuit of creating value for our associates, our communities, our clients, and our shareholders. Being true to these core values in the decisions we make and in our business practices is essential to driving sustainable long-term growth. OUR CORE VALUES

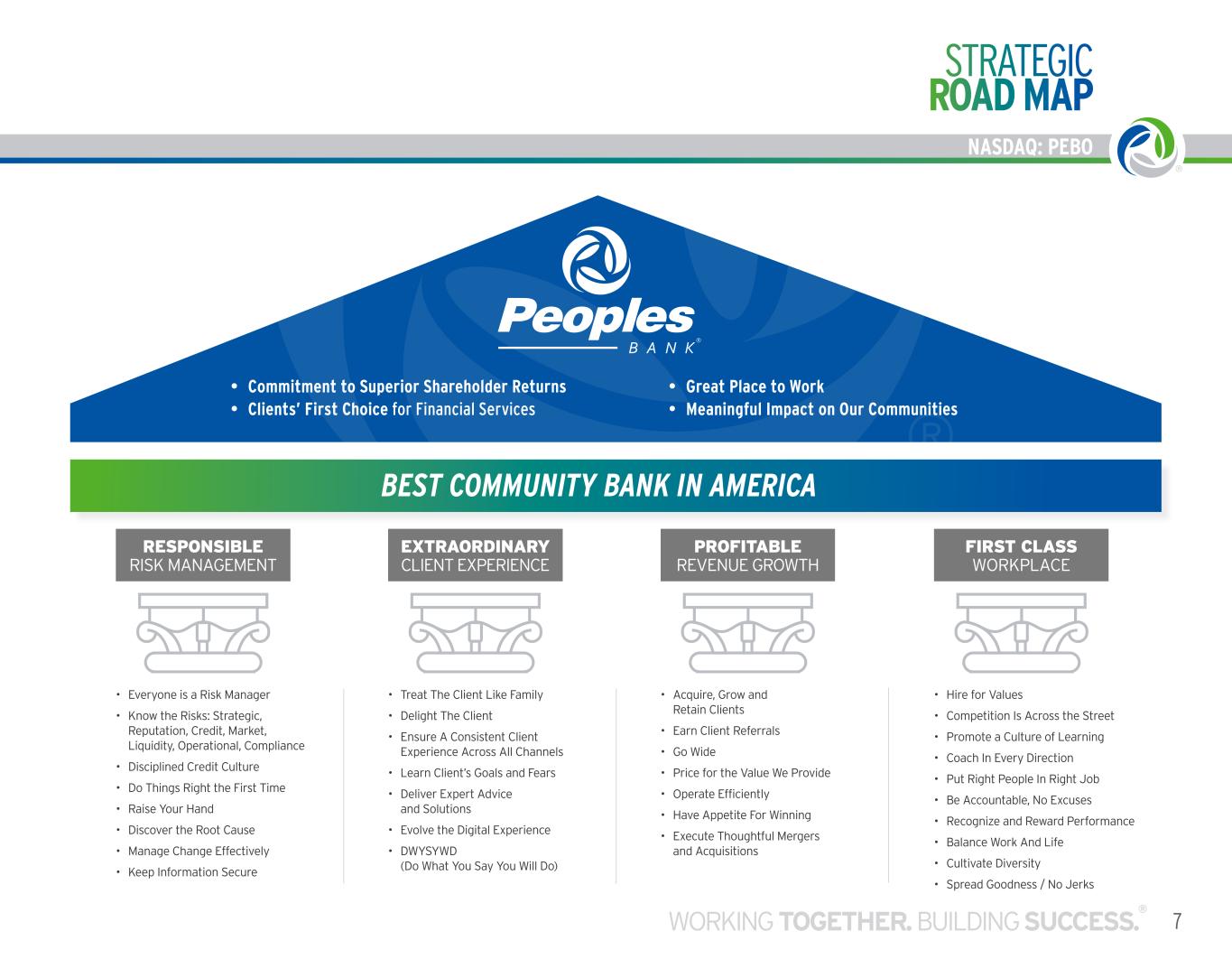

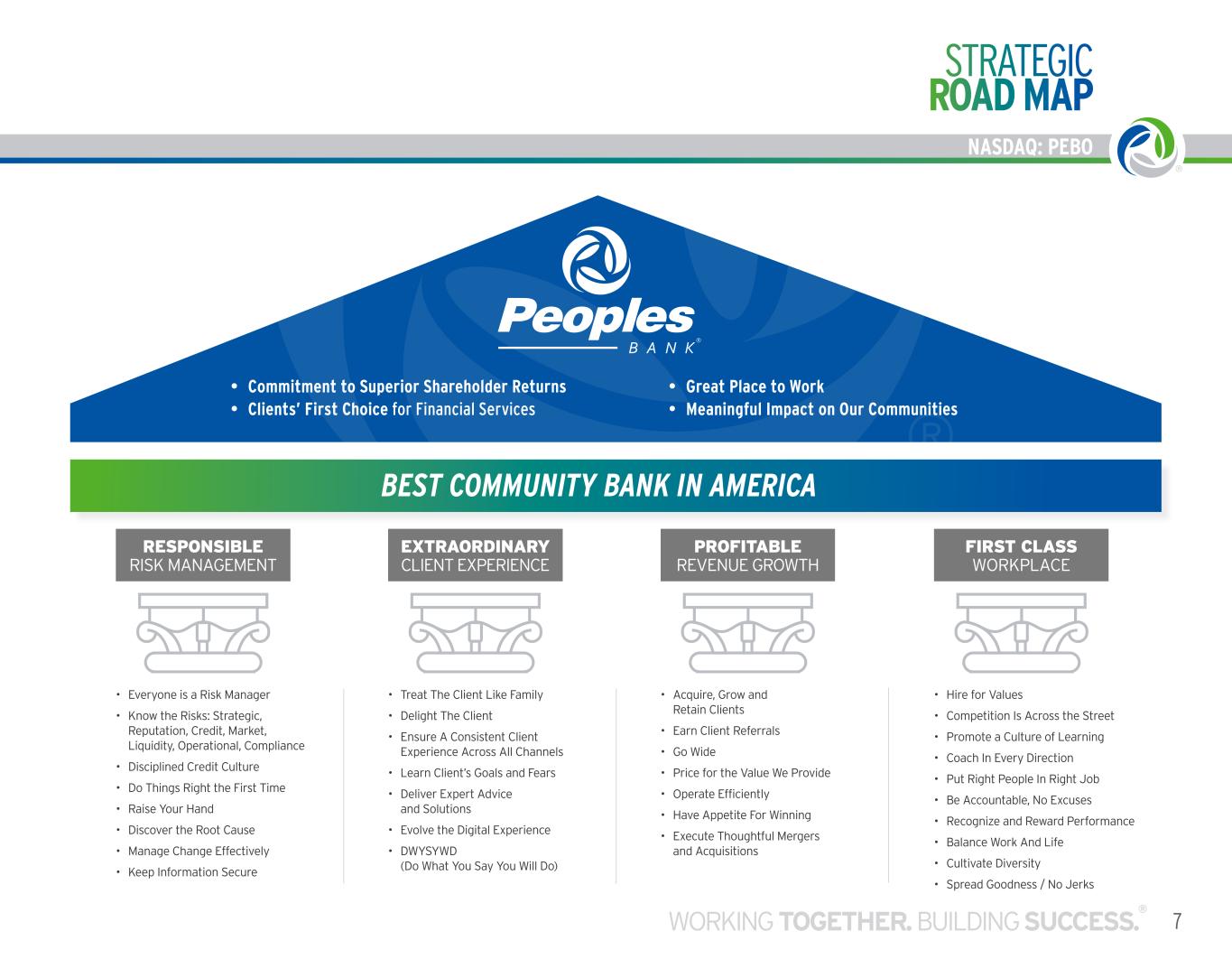

NASDAQ: PEBO STRATEGIC ROAD MAP 7WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO • Everyone is a Risk Manager • Know the Risks: Strategic, Reputation, Credit, Market, Liquidity, Operational, Compliance • Disciplined Credit Culture • Do Things Right the First Time • Raise Your Hand • Discover the Root Cause • Manage Change Effectively • Keep Information Secure • Treat The Client Like Family • Delight The Client • Ensure A Consistent Client Experience Across All Channels • Learn Client’s Goals and Fears • Deliver Expert Advice and Solutions • Evolve the Digital Experience • DWYSYWD (Do What You Say You Will Do) • Acquire, Grow and Retain Clients • Earn Client Referrals • Go Wide • Price for the Value We Provide • Operate Efficiently • Have Appetite For Winning • Execute Thoughtful Mergers and Acquisitions • Hire for Values • Competition Is Across the Street • Promote a Culture of Learning • Coach In Every Direction • Put Right People In Right Job • Be Accountable, No Excuses • Recognize and Reward Performance • Balance Work And Life • Cultivate Diversity • Spread Goodness / No Jerks RESPONSIBLE RISK MANAGEMENT EXTRAORDINARY CLIENT EXPERIENCE PROFITABLE REVENUE GROWTH FIRST CLASS WORKPLACE • Commitment to Superior Shareholder Returns • Clients’ First Choice for Financial Services • Great Place to Work • Meaningful Impact on Our Communities BEST COMMUNITY BANK IN AMERICA

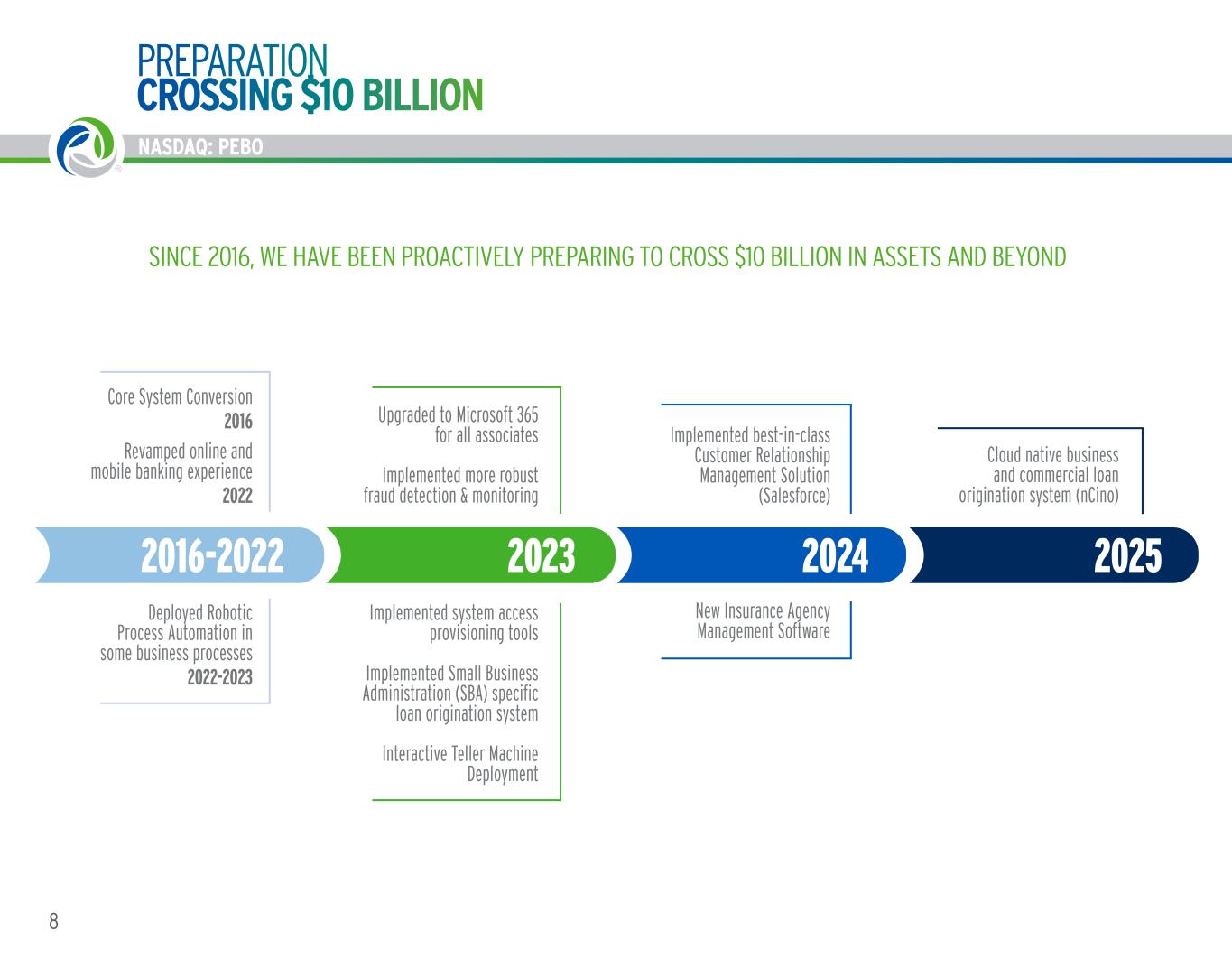

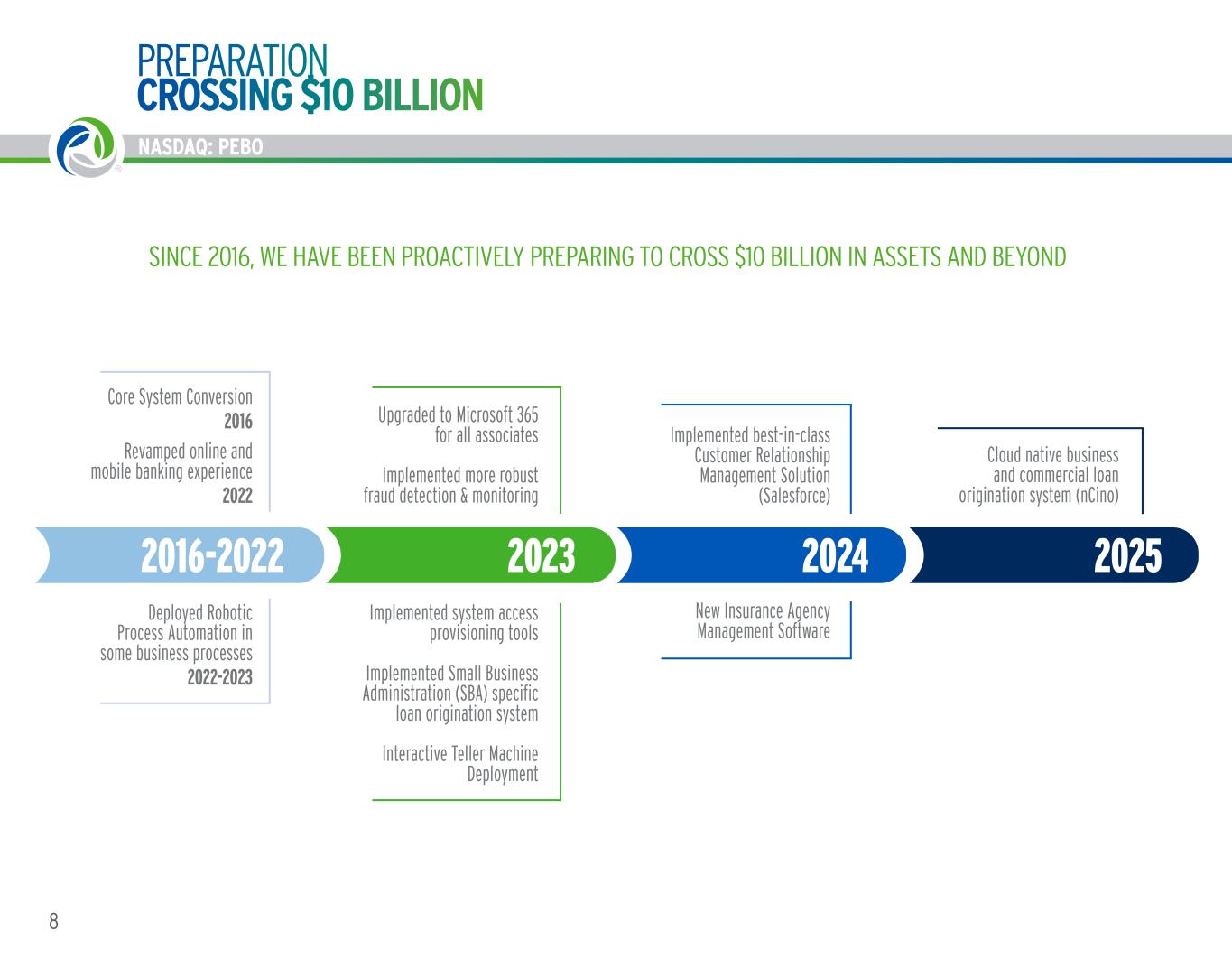

SINCE 2016, WE HAVE BEEN PROACTIVELY PREPARING TO CROSS $10 BILLION IN ASSETS AND BEYOND PREPARATION CROSSING $10 BILLION 20252016-2022 2023 2024 Core System Conversion 2016 Revamped online and mobile banking experience 2022 Implemented best-in-class Customer Relationship Management Solution (Salesforce) Upgraded to Microsoft 365 for all associates Implemented more robust fraud detection & monitoring Cloud native business and commercial loan origination system (nCino) Deployed Robotic Process Automation in some business processes 2022-2023 Implemented system access provisioning tools Implemented Small Business Administration (SBA) specific loan origination system Interactive Teller Machine Deployment New Insurance Agency Management Software 8 NASDAQ: PEBO

NASDAQ: PEBO 9WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO LEADING EDGE PRODUCTS, TECHNOLOGY AND CAPABILITIES CREDIT CARD SOLUTIONS Purchasing card, ghost card, virtual card, credit cards for consumers and small business COMMERCIAL CAPABILITIES Remote deposit capture, sweep accounts and more FRAUD PREVENTION TOOLS Positive pay, reverse positive pay, debit card on/off switch, 24/7 fraud monitoring and more SPECIALTY FINANCE Online applications and servicing for leasing and premium finance BANKING MOBILE APP Mobile check deposit, Zelle, Apple Pay, ACH approval and more Google Play Store Rating: 4.6 Stars INVESTMENT and INSURANCE APPS Google Play Store Rating as of October 10, 2024

NASDAQ: PEBO 10 INVESTMENT RATIONALE UNIQUE COMMUNITY BANKING MODEL • Strongest deposit market share positions in rural markets where we can affect pricing. Top 3 market share in 35 counties across three states. • Presence near larger cities puts us in a position to capture lending opportunities in urban markets (e.g. Cincinnati, Cleveland, Columbus, Lexington, Louisville, Richmond, Washington D.C.) • Greater revenue diversity than average $1 -$10 billion bank, with a fee income ratio of 22%* • Strong community reputation and active involvement • Nationwide insurance premium financing and equipment leasing businesses STRONG, DIVERSE SOURCES OF FEE INCOME • 17th largest bank-owned insurance agency, with expertise in commercial, personal, life and health • Wealth management – $3.7 billion in assets under administration and management, including brokerage, trust and retirement planning as of September 30, 2024 • Top 100 U.S. equipment leasing company (North Star Leasing and Vantage Financial, LLC combined) CAPACITY TO GROW OUR FRANCHISE • Strong capital, earnings growth and operating performance to support M&A strategy • Proven acquisition and integration capabilities and scalable infrastructure COMMITTED TO DISCIPLINED EXECUTION AND GENERATING POSITIVE OPERATING LEVERAGE • Integrated enterprise risk management process • Focused on business line performance and contribution, operating efficiency and credit quality • Disciplined credit practice as indicated by portfolio construction and data ATTRACTIVE DIVIDEND OPPORTUNITY • Targeting 40% to 50% payout ratio under normal operating environment • Dividend paid increased from $0.15 per share for Q1 2016 to $0.40 declared in Q3 2024 • Based on the closing stock price of Peoples’ common shares of $31.70 on October 18, 2024, the quarterly dividend produces an annualized yield of 5.05% *Non-interest income, excluding gains and loses, as a percent of total revenue as of 9/30/24

NASDAQ: PEBO 11WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO EXTERNAL RECOGNITION MENTAL WELLBEING THREE YEARS IN A ROW

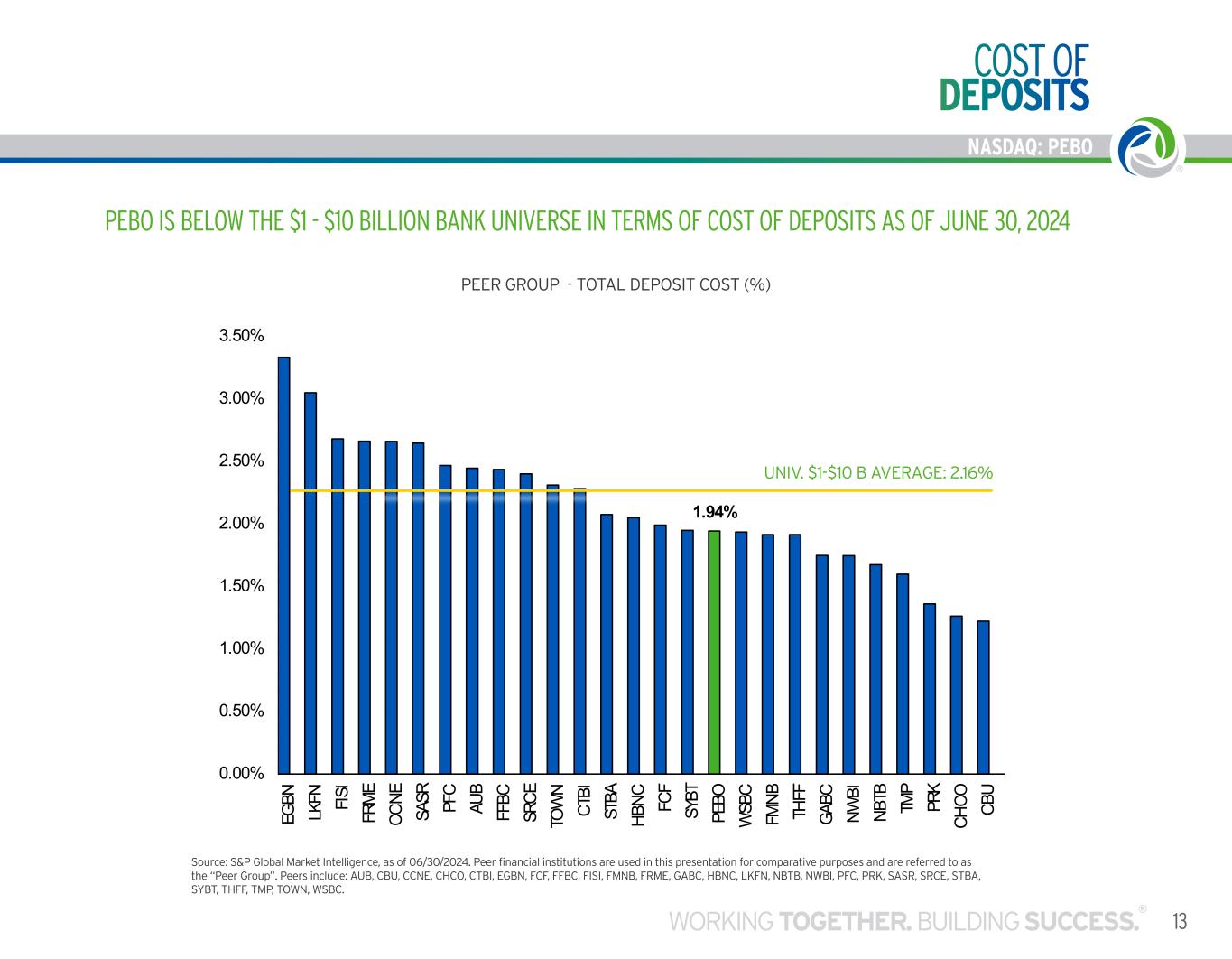

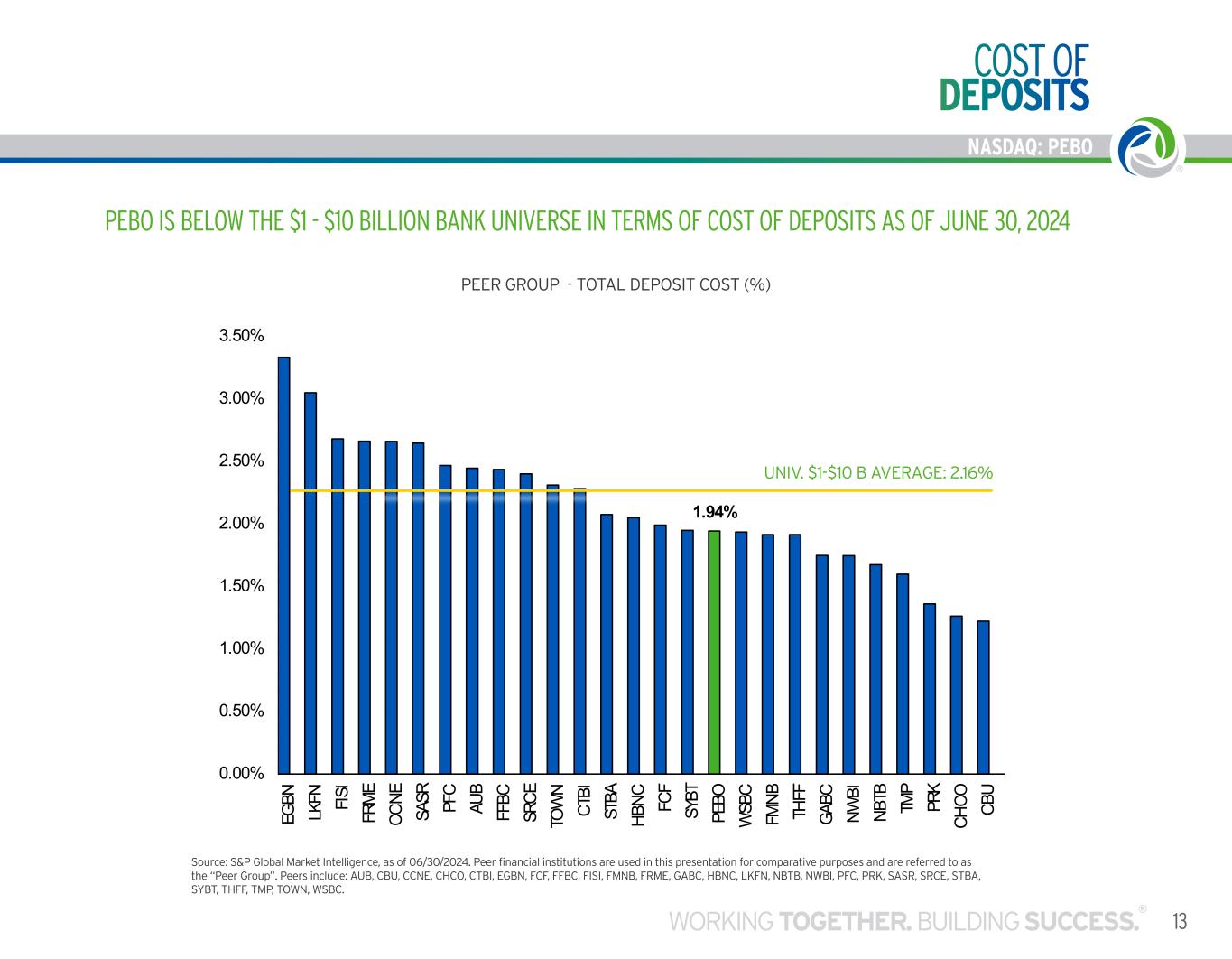

BUILT ON A SOLID FOUNDATION CAPITAL, CREDIT AND LIQUIDITY 12 PEBO IS BELOW THE $1 - $10 BILLION BANK UNIVERSE IN TERMS OF COST OF DEPOSITS AS OF JUNE 30, 2024

NASDAQ: PEBO 13WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO 1.94% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% EG BN LK FN FI SI FR M E CC NE SA SR PF C AU B FF BC SR CE TO W N CT BI ST BA HB NC FC F SY BT PE BO W SB C FM NB TH FF GA BC NW BI NB TB TM P PR K CH CO CB U PEER GROUP - TOTAL DEPOSIT COST (%) PEBO IS BELOW THE $1 - $10 BILLION BANK UNIVERSE IN TERMS OF COST OF DEPOSITS AS OF JUNE 30, 2024 Source: S&P Global Market Intelligence, as of 06/30/2024. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Peer Group”. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC. COST OF DEPOSITS UNIV. $1-$10 B AVERAGE: 2.16% PEER GROUP - TOTAL DEPOSIT COST (%)

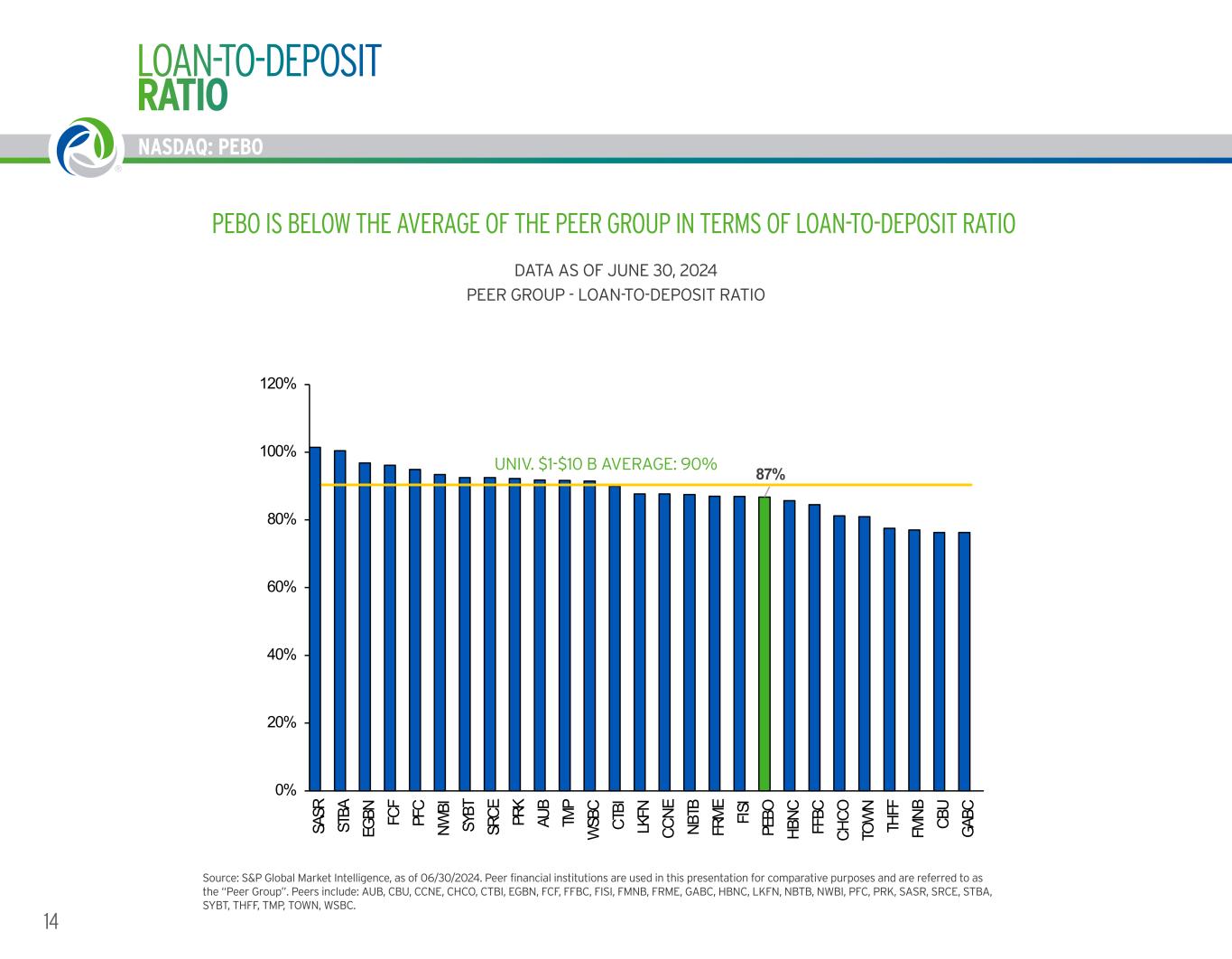

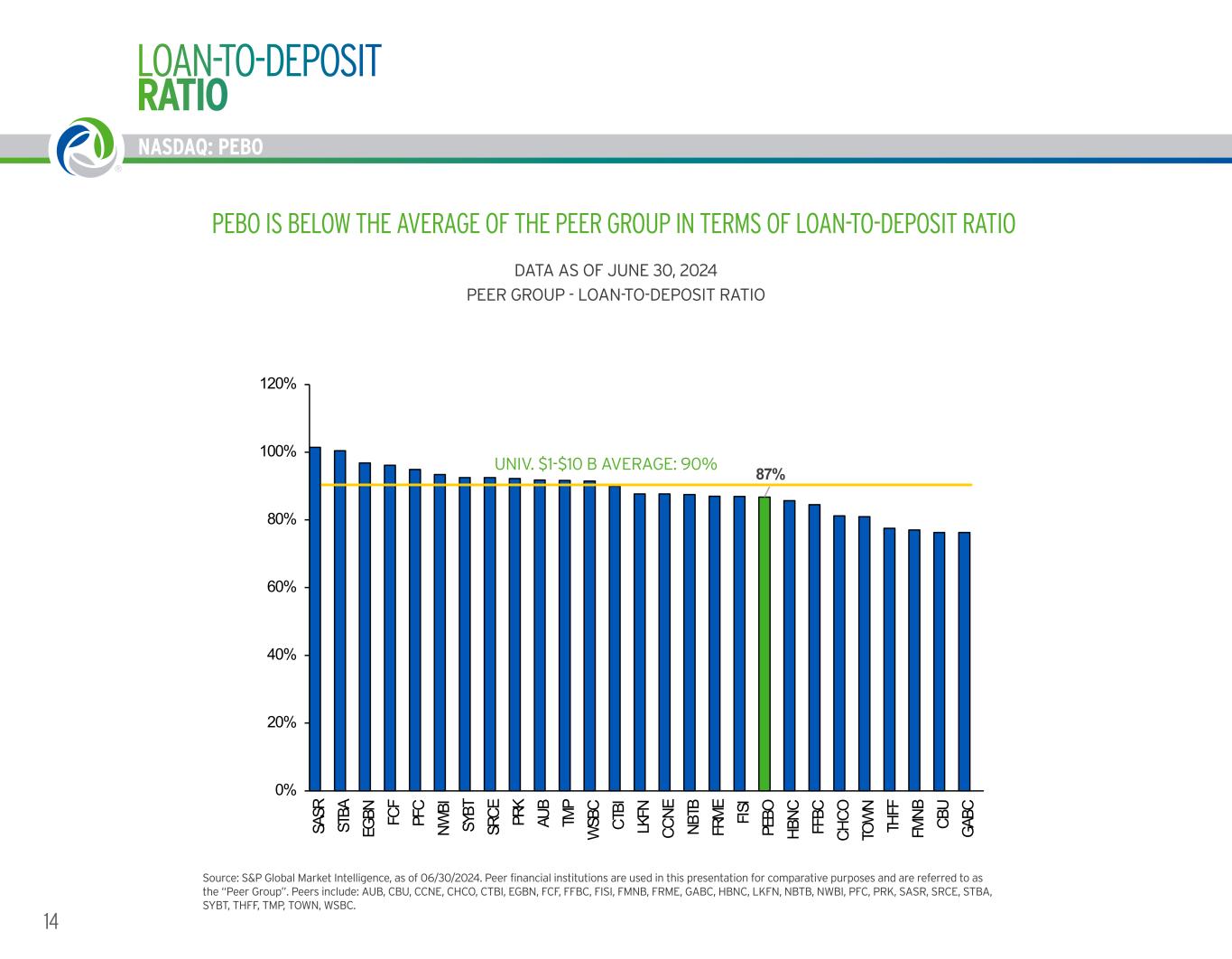

14 NASDAQ: PEBO NEAR BEST IN CLASS NET INTEREST MARGIN LARGELY DUE TO STRONG DEPOSIT FRANCHISE PEER GROUP - NET INTEREST MARGIN DATA AS OF JUNE 30, 2024 PEBO IS BELOW THE AVERAGE OF THE PEER GROUP IN TERMS OF LOAN-TO-DEPOSIT RATIO 87%UNIV. $1-$10 B Average: 90% 0% 20% 40% 60% 80% 100% 120% SA SR ST BA EG BN FC F PF C NW BI SY BT SR CE PR K AU B TM P W SB C CT BI LK FN CC NE NB TB FR M E FI SI PE BO HB NC FF BC CH CO TO W N TH FF FM NB CB U GA BC PEER GROUP - LOANS / DEPOSITS Source: S&P Global Market Intelligence, as of 06/30/2024. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Peer Group”. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC. LOAN-TO-DEPOSIT RATIO PEER GROUP - LOAN-TO-DEPOSIT RATIO DATA AS OF JUNE 30, 2024 UNIV. $1-$10 B AVERAGE: 90%

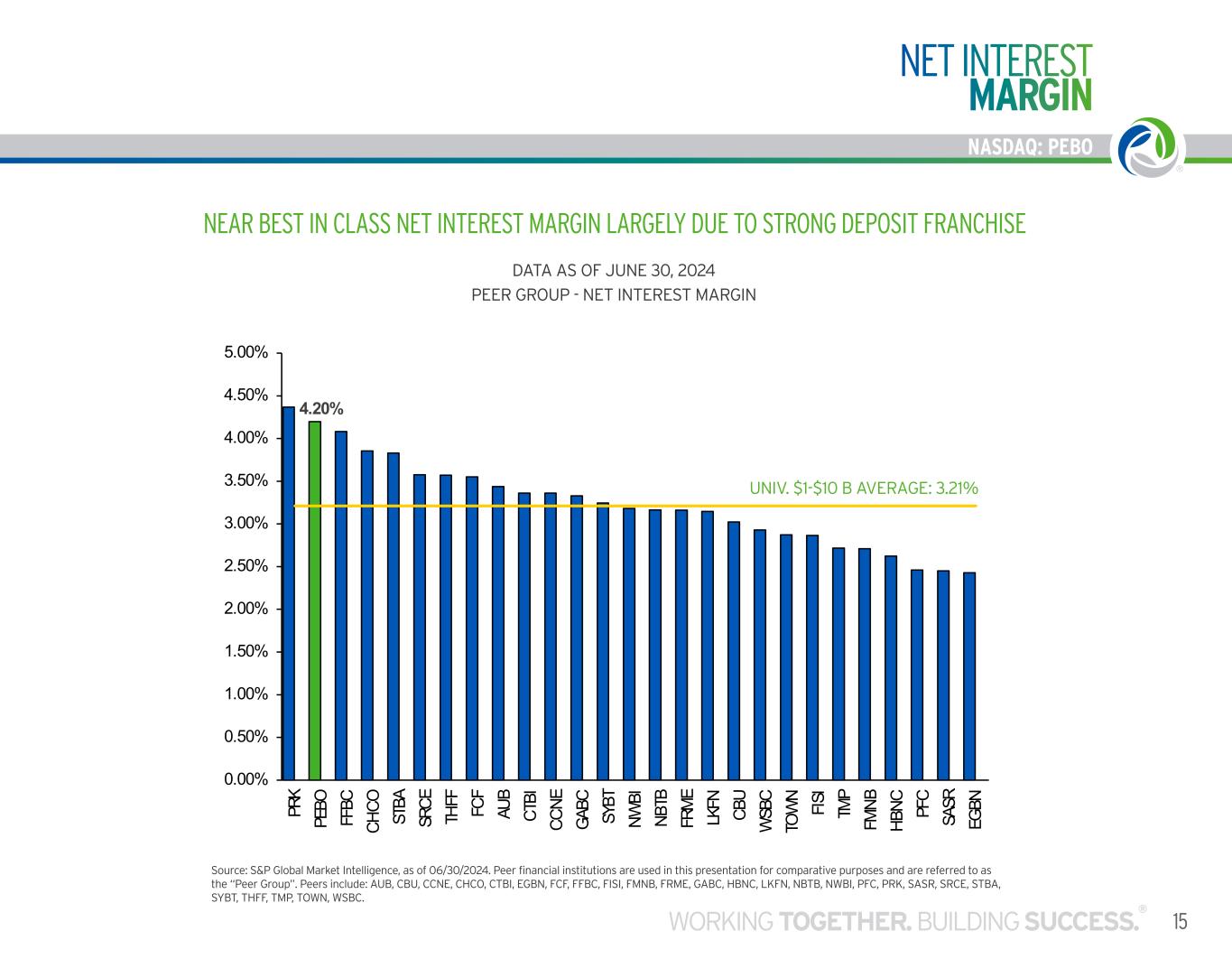

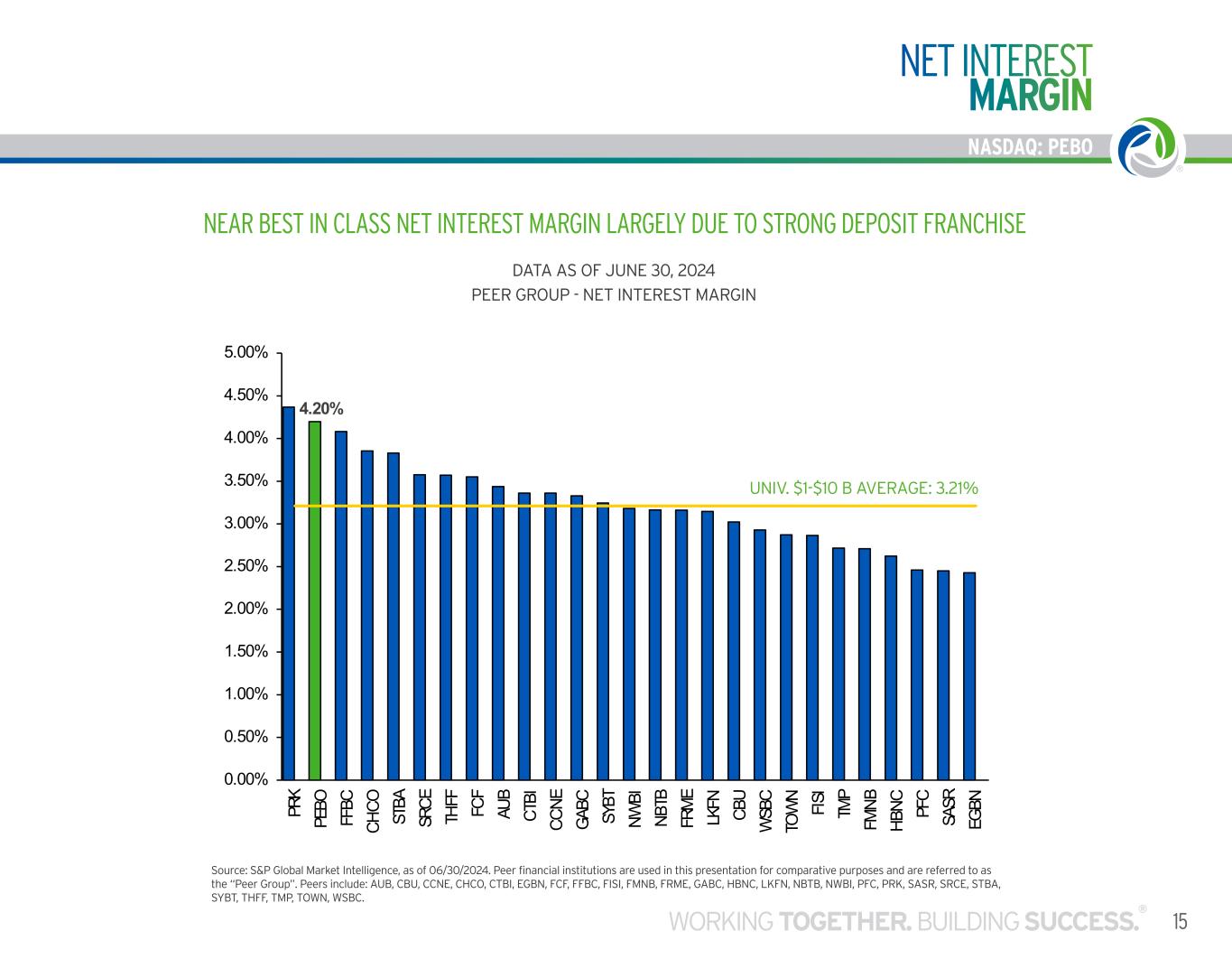

NASDAQ: PEBO 15WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO NET INTEREST MARGIN 4.20% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% PR K PE BO FF BC CH CO ST BA SR CE TH FF FC F AU B CT BI CC NE GA BC SY BT NW BI NB TB FR M E LK FN CB U W SB C TO W N FI SI TM P FM NB HB NC PF C SA SR EG BN PEER GROUP-NET INTEREST MARGIN UNIV. $1-$10 B Average: 3.21% NEAR BEST IN CLASS NET INTEREST MARGIN LARGELY DUE TO STRONG DEPOSIT FRANCHISE PEER GROUP - NET INTEREST MARGIN Source: S&P Global Market Intelligence, as of 06/30/2024. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Peer Group”. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC. DATA AS OF JUNE 30, 2024 UNIV. $1-$1 VERAGE: 3. % PEER GROUP - LOAN-TO-DEPOSIT RATIO

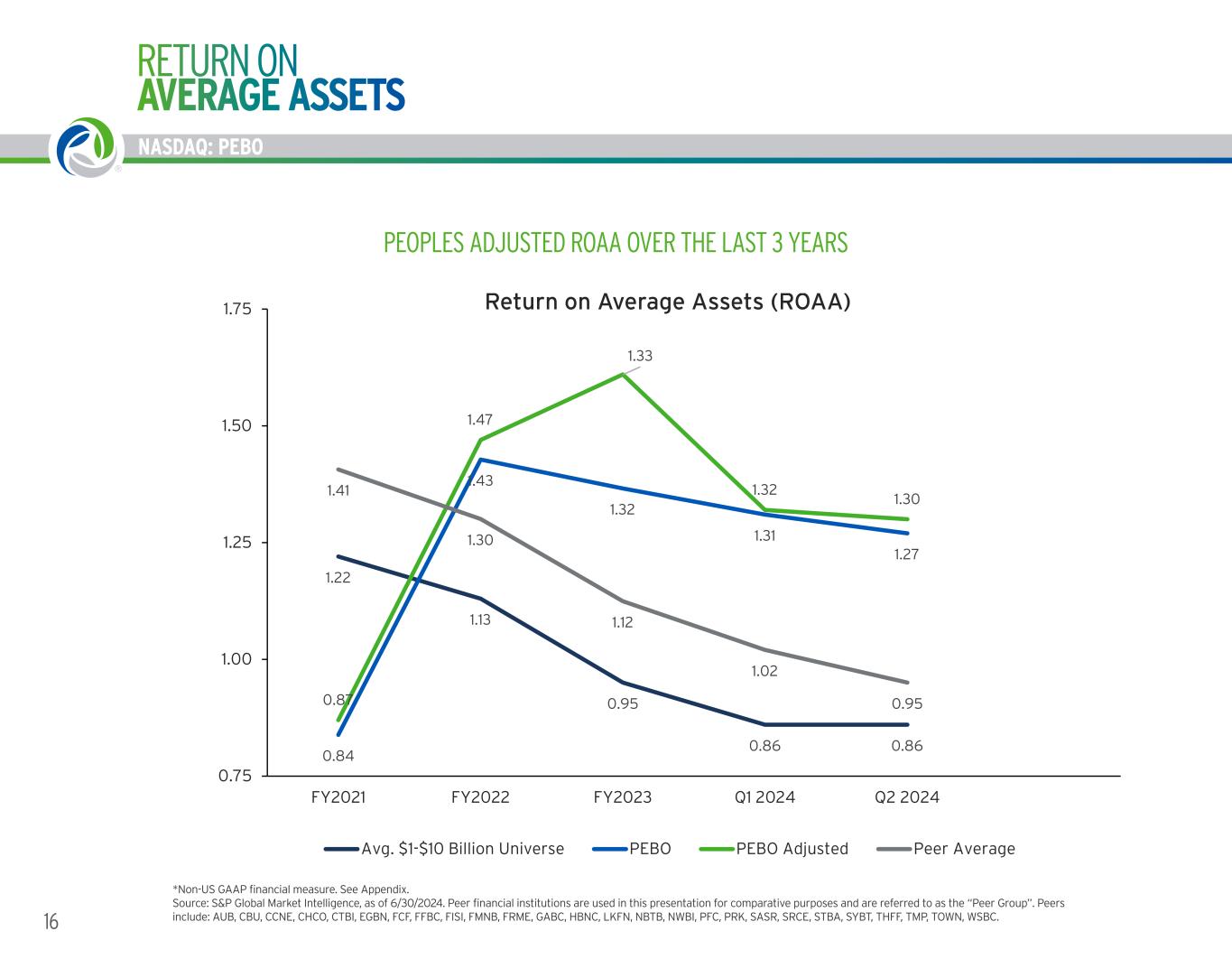

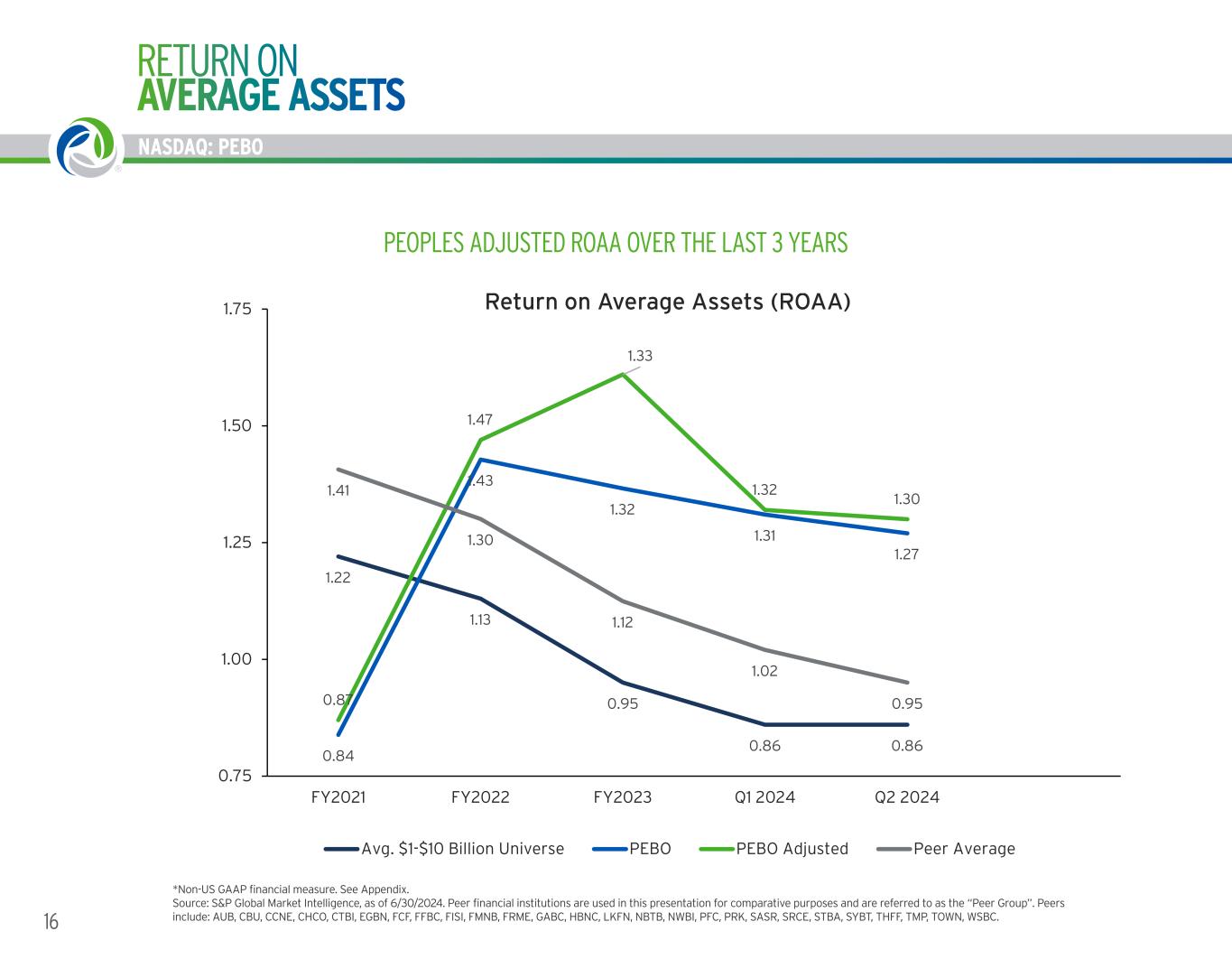

16 NASDAQ: PEBO 1.22 1.13 0.95 0.86 0.86 0.84 1.43 1.32 1.31 1.27 0.87 1.47 1.33 1.32 1.30 1.41 1.30 1.12 1.02 0.95 0.75 1.00 1.25 1.50 1.75 FY2021 FY2022 FY2023 Q1 2024 Q2 2024 Return on Average Assets (ROAA) Avg. $1-$10 Billion Universe PEBO PEBO Adjusted Peer Average RETURN ON AVERAGE ASSETS PEOPLES ADJUSTED ROAA OVER THE LAST 3 YEARS *Non-US GAAP financial measure. See Appendix. Source: S&P Global Market Intelligence, as of 6/30/2024. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Peer Group”. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC.

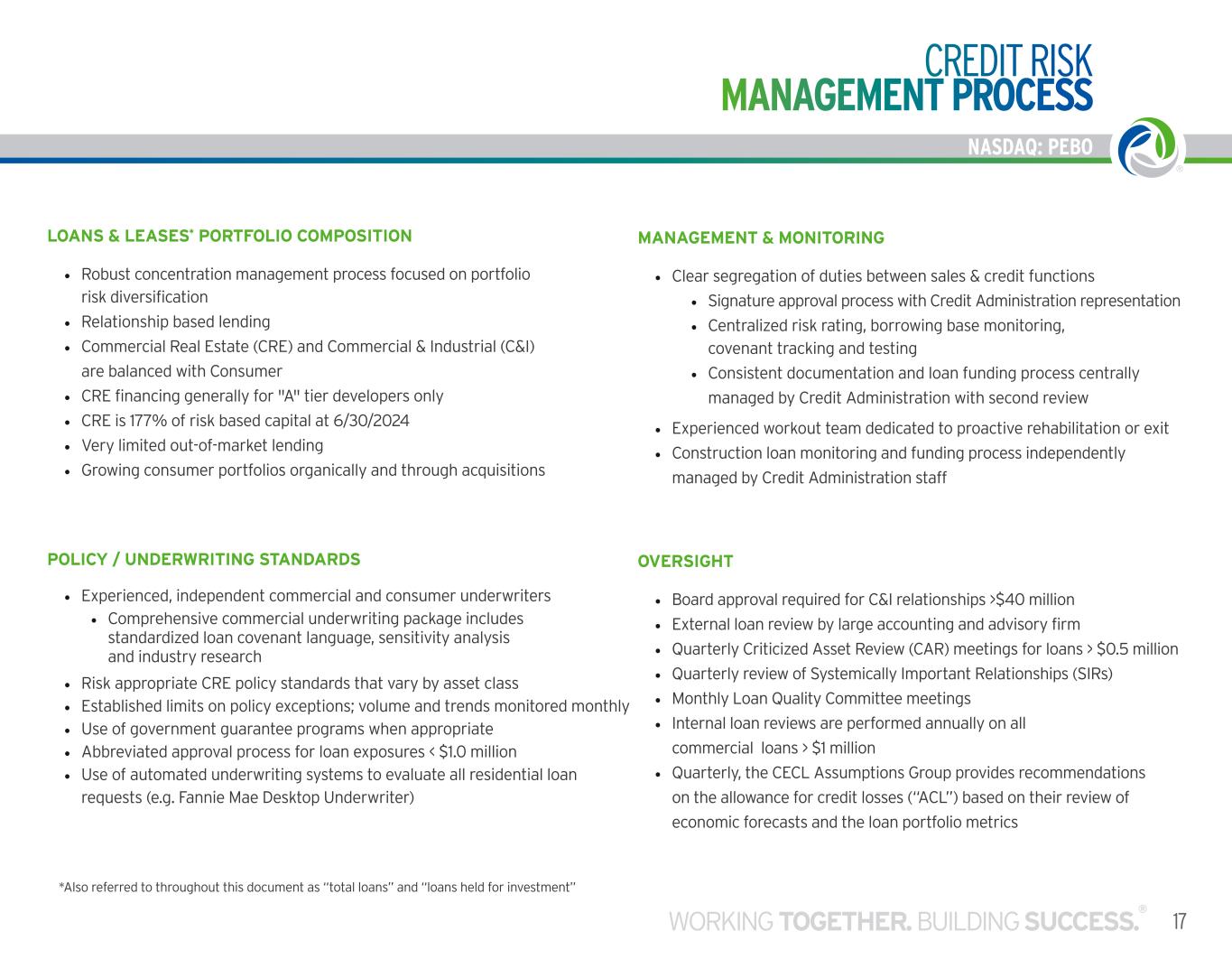

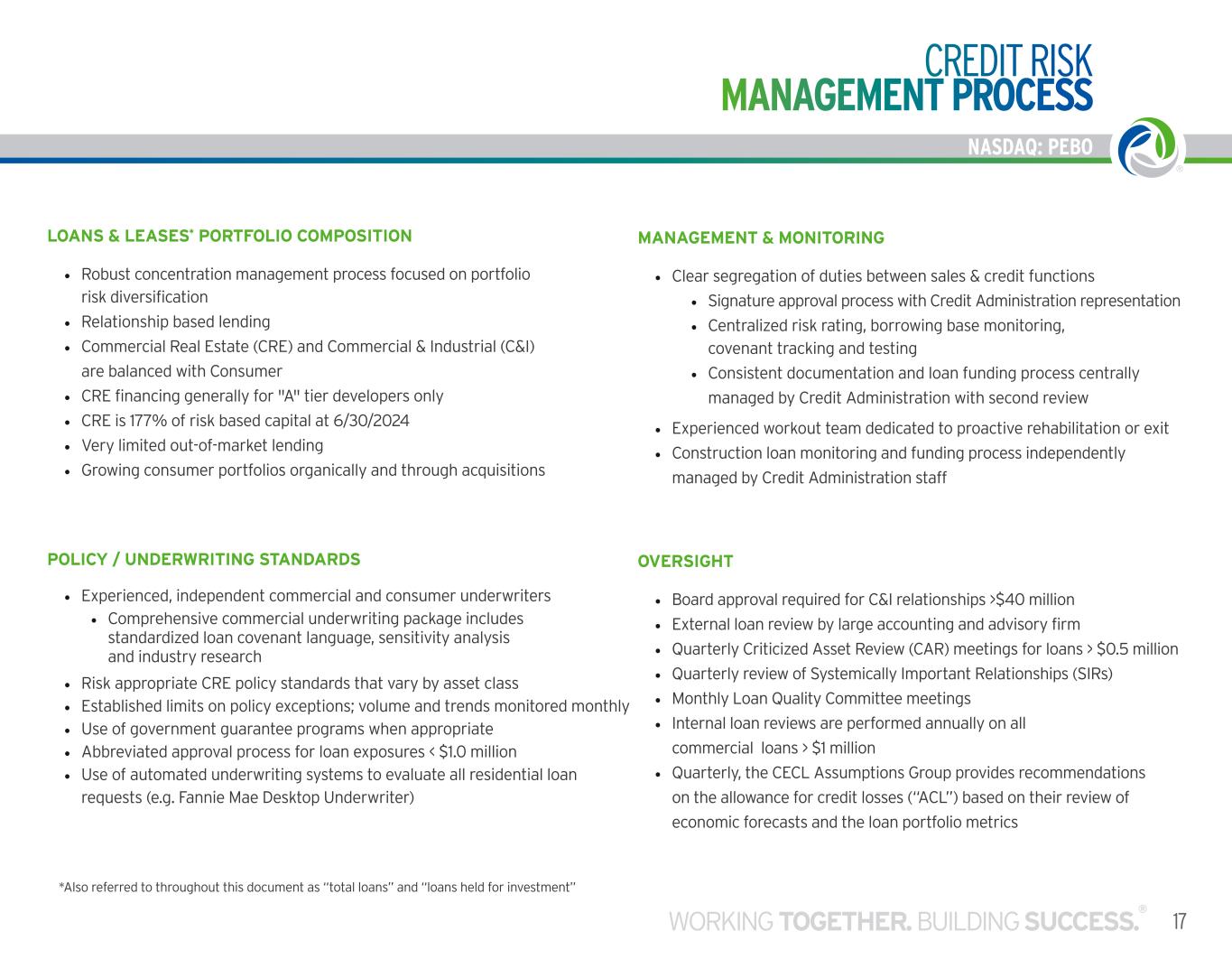

NASDAQ: PEBO 17WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO LOANS & LEASES* PORTFOLIO COMPOSITION • Robust concentration management process focused on portfolio risk diversification • Relationship based lending • Commercial Real Estate (CRE) and Commercial & Industrial (C&I) are balanced with Consumer • CRE financing generally for "A" tier developers only • CRE is 177% of risk based capital at 6/30/2024 • Very limited out-of-market lending • Growing consumer portfolios organically and through acquisitions POLICY / UNDERWRITING STANDARDS • Experienced, independent commercial and consumer underwriters • Comprehensive commercial underwriting package includes standardized loan covenant language, sensitivity analysis and industry research • Risk appropriate CRE policy standards that vary by asset class • Established limits on policy exceptions; volume and trends monitored monthly • Use of government guarantee programs when appropriate • Abbreviated approval process for loan exposures < $1.0 million • Use of automated underwriting systems to evaluate all residential loan requests (e.g. Fannie Mae Desktop Underwriter) MANAGEMENT & MONITORING • Clear segregation of duties between sales & credit functions • Signature approval process with Credit Administration representation • Centralized risk rating, borrowing base monitoring, covenant tracking and testing • Consistent documentation and loan funding process centrally managed by Credit Administration with second review • Experienced workout team dedicated to proactive rehabilitation or exit • Construction loan monitoring and funding process independently managed by Credit Administration staff OVERSIGHT • Board approval required for C&I relationships >$40 million • External loan review by large accounting and advisory firm • Quarterly Criticized Asset Review (CAR) meetings for loans > $0.5 million • Quarterly review of Systemically Important Relationships (SIRs) • Monthly Loan Quality Committee meetings • Internal loan reviews are performed annually on all commercial loans > $1 million • Quarterly, the CECL Assumptions Group provides recommendations on the allowance for credit losses (“ACL”) based on their review of economic forecasts and the loan portfolio metrics *Also referred to throughout this document as “total loans” and “loans held for investment” CREDIT RISK MANAGEMENT PROCESS

18 NASDAQ: PEBO 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% $0 $20 $40 $60 $80 $100 FY-20 FY-21 FY-22 FY-23 Q1-24 Q2-24 Q3-24 NONPERFORMING ASSETS (NPAs) AND NPA PERCENT OF TOTAL ASSETS CRE Residential C&I HELOC Consumer NPA as a percent of Total Assets CRITICIZED AND CLASSIFIED LOANS NPAS AS A PERCENT OF TOTAL ASSETS HAVE REMAINED UNDER 0.80% N PA ’S IN $ M IL LI O N S NONPERFORMING ASSETS (NPAs) AND NPA PERCENT OF TOTAL ASSETS ASSET QUALITY

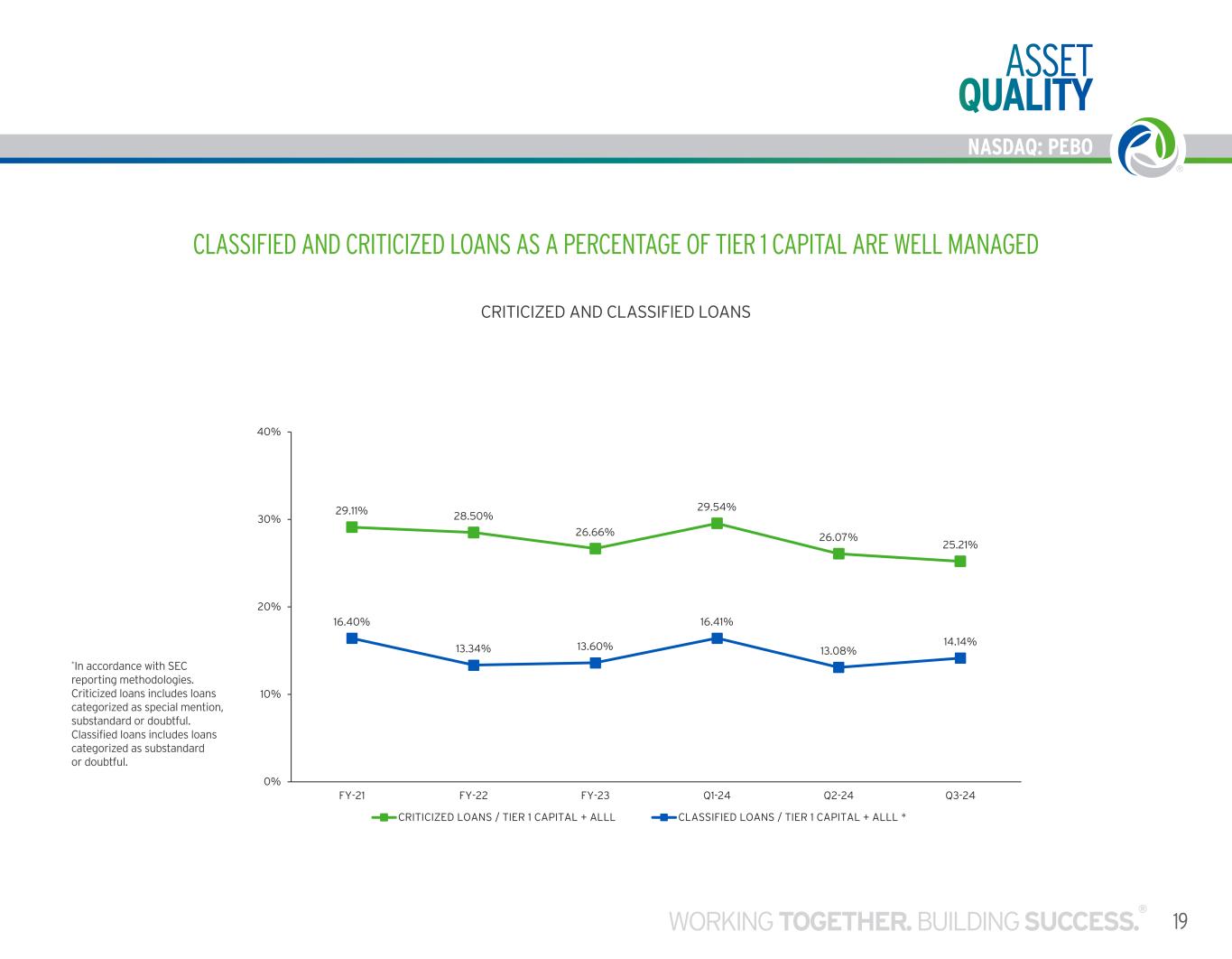

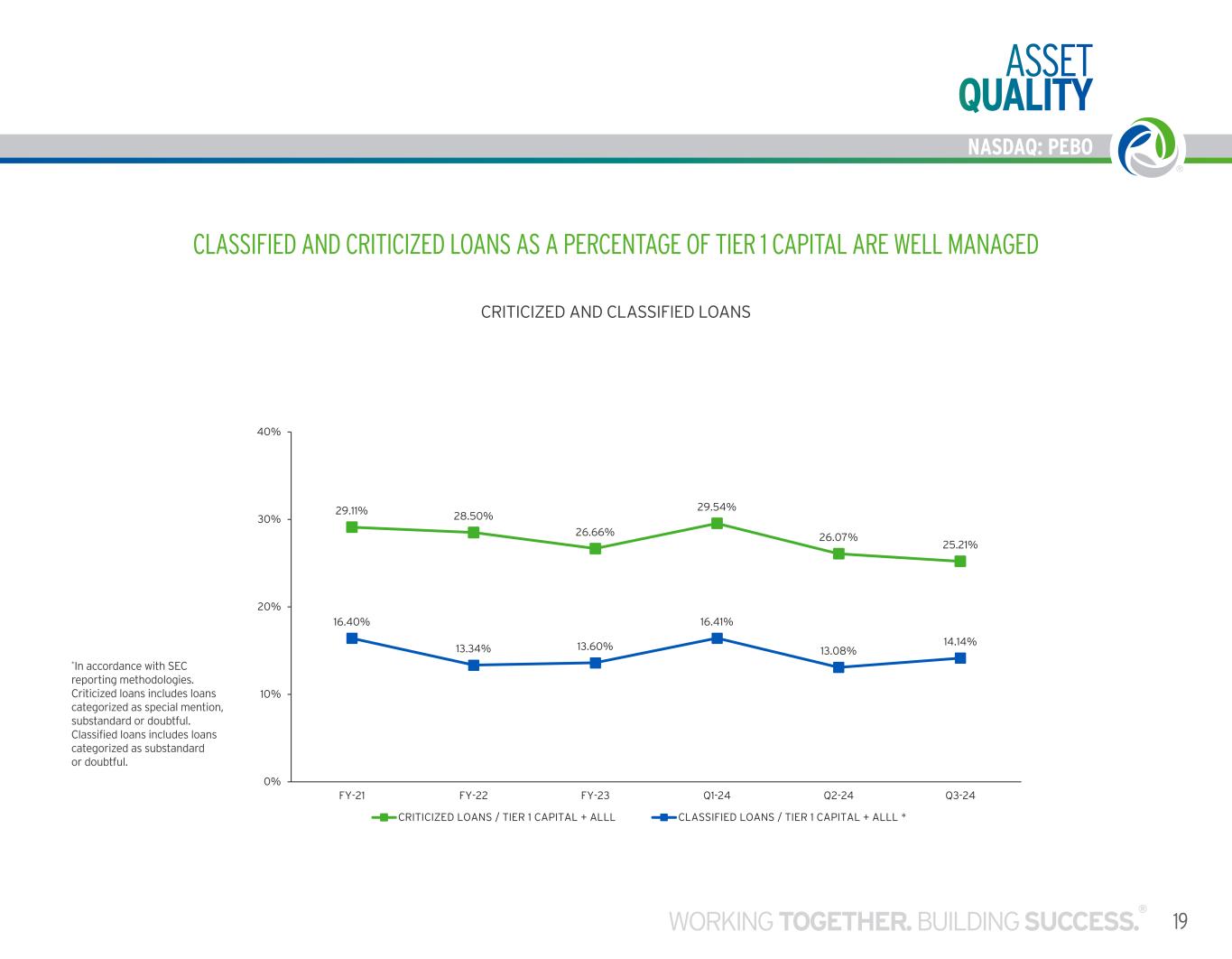

NASDAQ: PEBO 19WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO CLASSIFIED AND CRITICIZED LOANS AS A PERCENTAGE OF TIER 1 CAPITAL ARE WELL MANAGED *In accordance with SEC reporting methodologies. Criticized loans includes loans categorized as special mention, substandard or doubtful. Classified loans includes loans categorized as substandard or doubtful. CRITICIZED AND CLASSIFIED LOANS ASSET QUALITY 29.11% 28.50% 26.66% 29.54% 26.07% 25.21% 16.40% 13.34% 13.60% 16.41% 13.08% 14.14% 0% 10% 20% 30% 40% FY-21 FY-22 FY-23 Q1-24 Q2-24 Q3-24 CRITICIZED AND CLASSIFIED LOANS CRITICIZED LOANS / TIER 1 CAPITAL + ALLL CLASSIFIED LOANS / TIER 1 CAPITAL + ALLL *

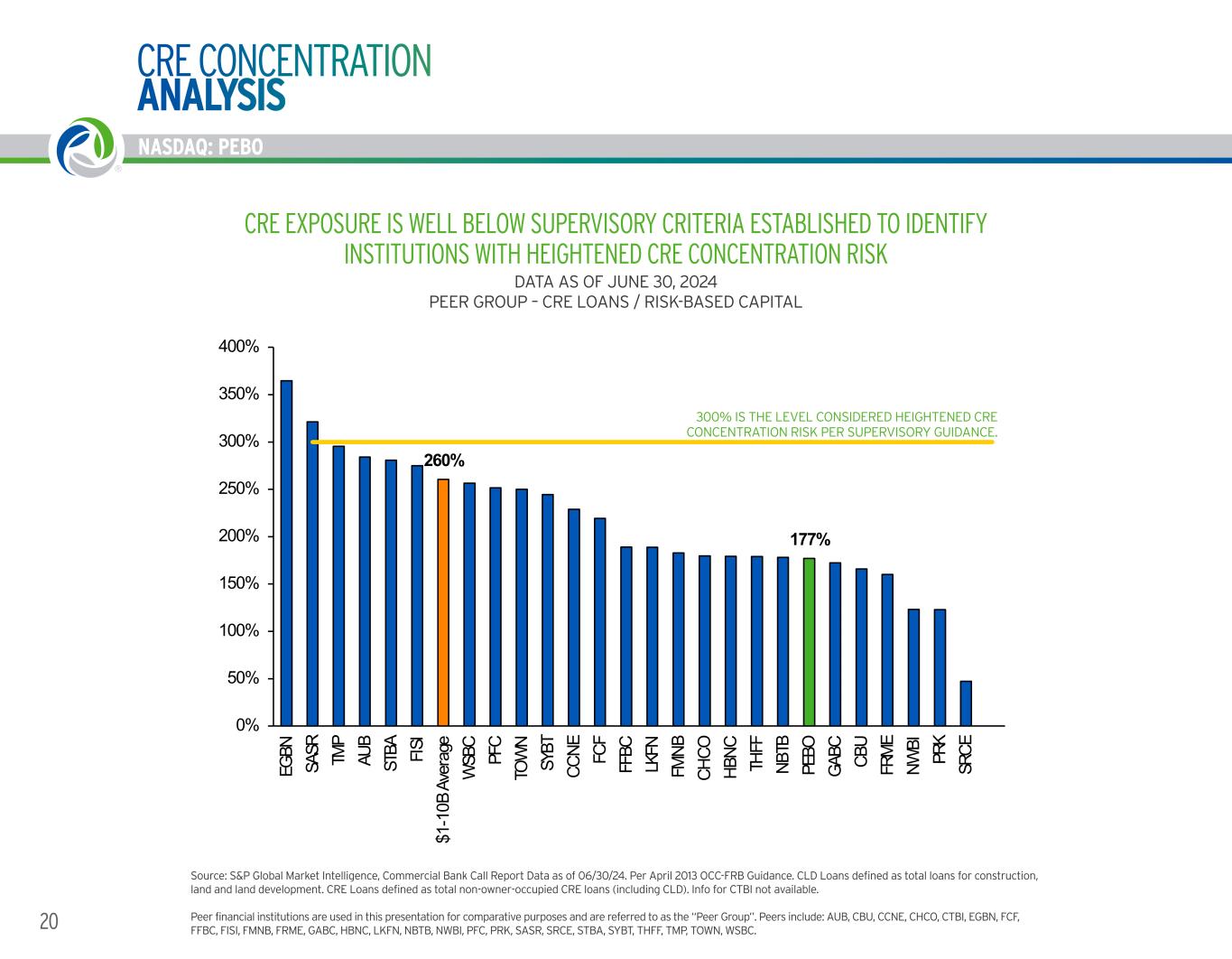

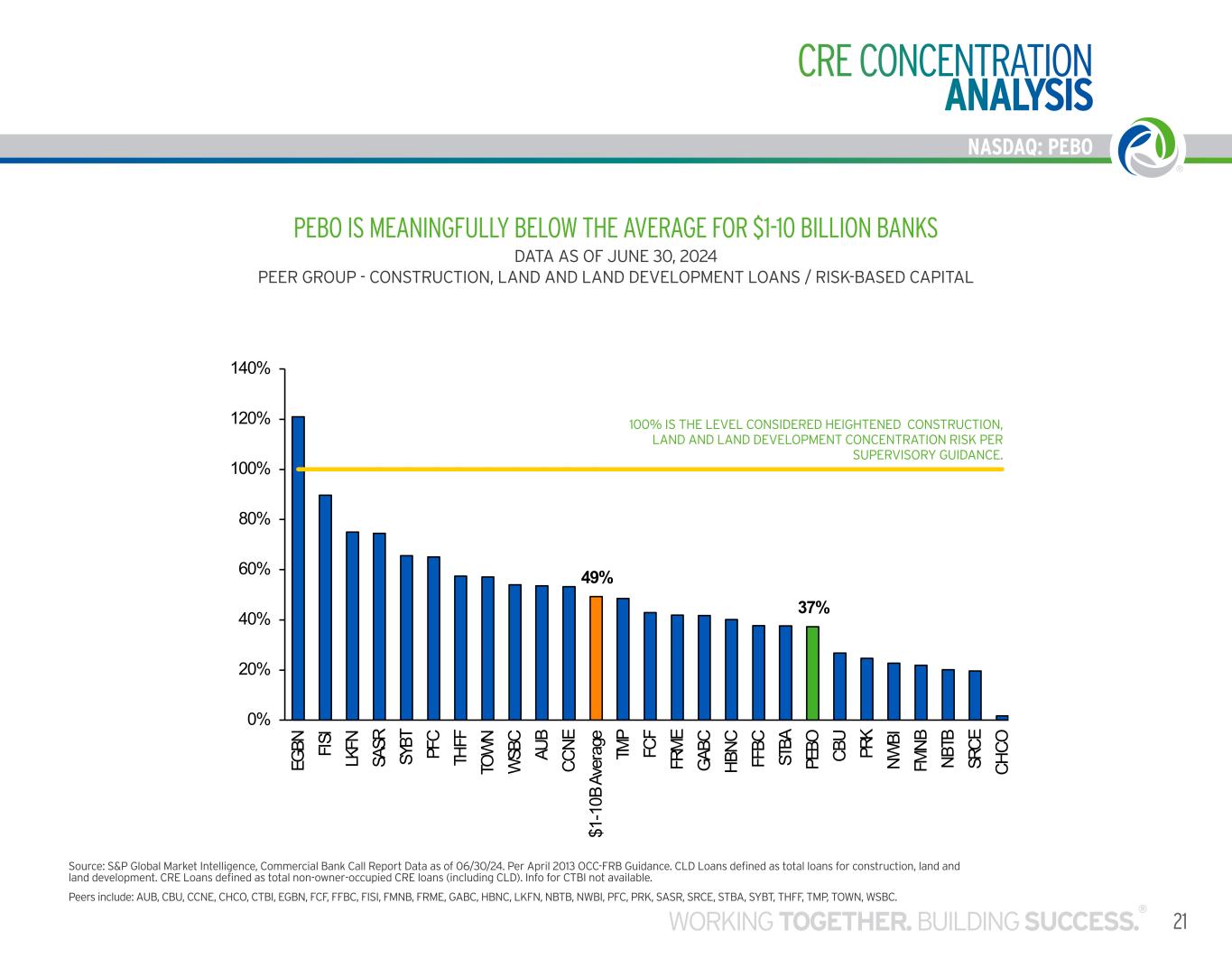

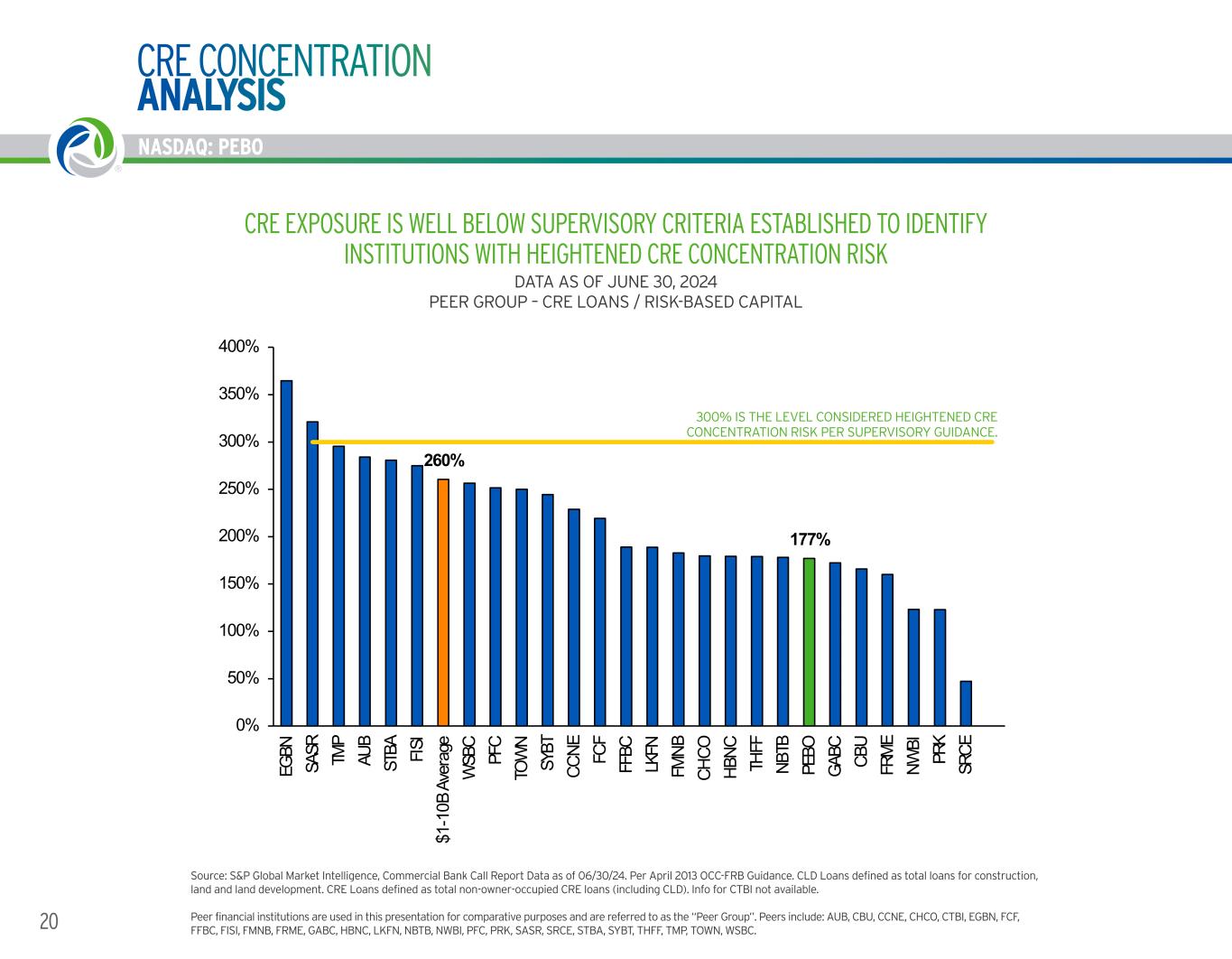

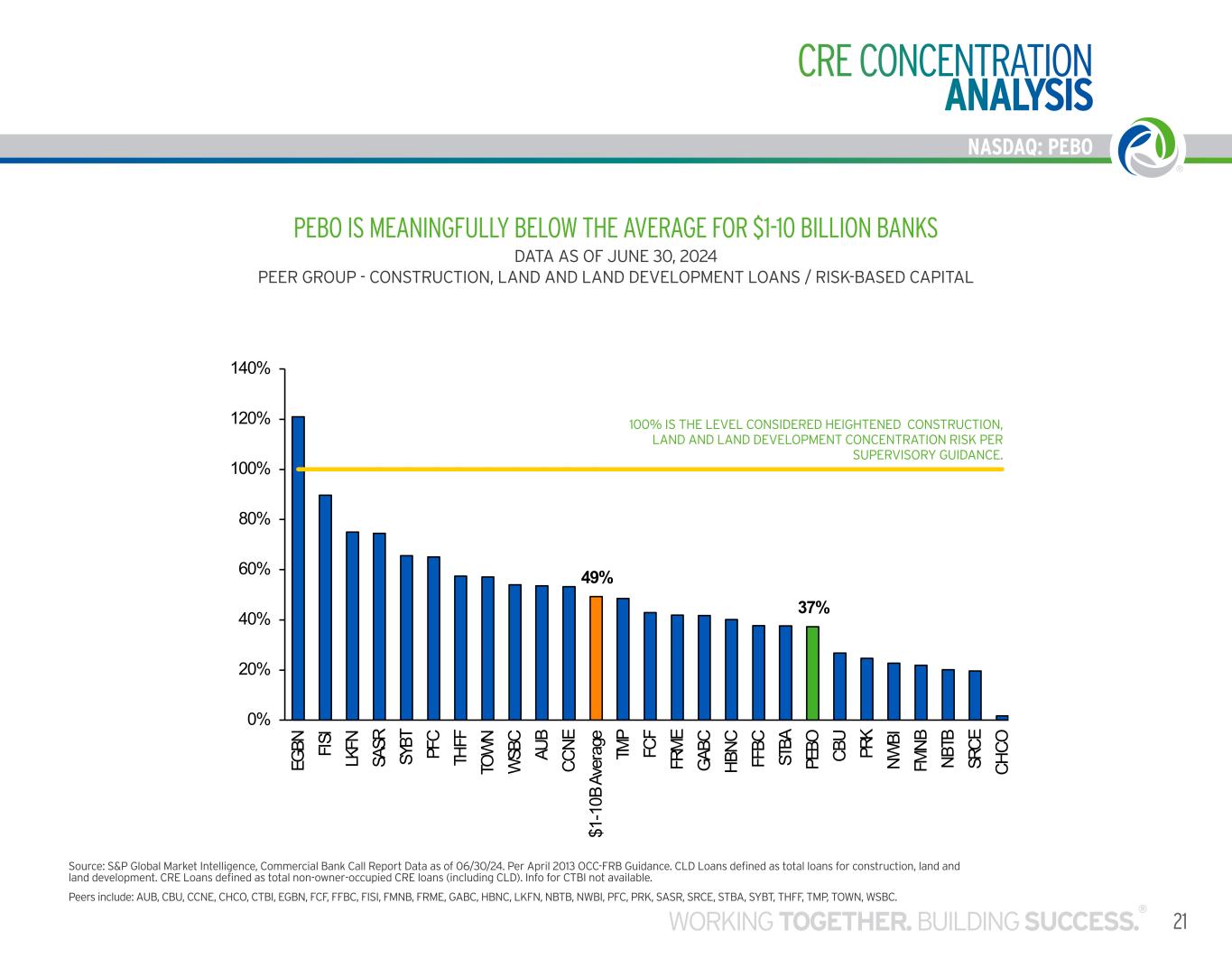

20 NASDAQ: PEBO DATA AS OF JUNE 30, 2024 PEER GROUP - CONSTRUCTION, LAND AND LAND DEVELOPMENT LOANS / RISK-BASED CAPITAL PEBO IS MEANINGFULLY BELOW THE AVERAGE FOR $1-10 BILLION BANKSCRE EXPOSURE IS WELL BELOW SUPERVISORY CRITERIA ESTABLISHED TO IDENTIFY INSTITUTIONS WITH HEIGHTENED CRE CONCENTRATION RISK Source: S&P Global Market Intelligence, Commercial Bank Call Report Data as of 06/30/24. Per April 2013 OCC-FRB Guidance. CLD Loans defined as total loans for construction, land and land development. CRE Loans defined as total non-owner-occupied CRE loans (including CLD). Info for CTBI not available. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Peer Group”. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC. 260% 177% 0% 50% 100% 150% 200% 250% 300% 350% 400% EG BN SA SR TM P AU B ST BA FI SI $1 -1 0B A ve ra ge W SB C PF C TO W N SY BT CC NE FC F FF BC LK FN FM NB CH CO HB NC TH FF NB TB PE BO GA BC CB U FR M E NW BI PR K SR CE PEER GROUP-CRE LOANS / RISK-BASED CAPITAL 300% IS THE LEVEL CONSIDERED HEIGHTENED CRE CONCENTRATION RISK PER SUPERVISORY GUIDANCE. CRE CONCENTRATION ANALYSIS PEER GROUP – CRE LOANS / RISK-BASED CAPITAL DATA AS OF JUNE 30, 2024

NASDAQ: PEBO 21WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO Source: S&P Global Market Intelligence, Commercial Bank Call Report Data as of 06/30/24. Per April 2013 OCC-FRB Guidance. CLD Loans defined as total loans for construction, land and land development. CRE Loans defined as total non-owner-occupied CRE loans (including CLD). Info for CTBI not available. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC. DATA AS OF JUNE 30, 2024 PEER GROUP - CONSTRUCTION, LAND AND LAND DEVELOPMENT LOANS / RISK-BASED CAPITAL PEBO IS MEANINGFULLY BELOW THE AVERAGE FOR $1-10 BILLION BANKS CRE CONCENTRATION ANALYSIS 49% 37% 0% 20% 40% 60% 80% 100% 120% 140% EG BN FI SI LK FN SA SR SY BT PF C TH FF TO W N W SB C AU B CC NE $1 -1 0B A ve ra ge TM P FC F FR M E GA BC HB NC FF BC ST BA PE BO CB U PR K NW BI FM NB NB TB SR CE CH CO PEER GROUP - CONSTRUCTION, LAND AND DEVELOPMENT LOANS / RISK- BASED CAPITAL 100% IS THE LEVEL CONSIDERED HEIGHTENED CONSTRUCTION, LAND AND LAND DEVELOPMENT CONCENTRATION RISK PER SUPERVISORY GUIDANCE.

22 NASDAQ: PEBO Data as of September 30, 2024. LOAN COMPOSITION REFLECTS DIVERSIFIED RISK PROFILE LOAN COMPOSITION TOTAL LOAN PORTFOLIO = $6.3 BILLION COMMERCIAL CONSUMER SPECIALTY FINANCE 1 2 3 CONSUMER LOAN PORTFOLIO = $1.8 BILLION RESIDENTIAL REAL ESTATE CONSUMER, INDIRECT HOME EQUITY LINE OF CREDIT CONSUMER, DIRECT 1 2 3 4 COMMERCIAL LOAN PORTFOLIO = $3.8 BILLION COMMERCIAL REAL ESTATE COMMERCIAL & INDUSTRIAL CONSTRUCTION 1 2 3 SPECIALTY FINANCE PORTFOLIO = $0.7 BILLION LEASES PREMIUM FINANCE 1 2 60%29% 11% TOTAL LOAN PORTFOLIO COMMERICAL CONSUMER SPECIALITY FINANCE 58% 33% 9% COMMERICAL LOAN PORTFOLIO COMMERICAL REAL ESTATE COMMERCIAL & INDUSTRIAL CONSTRUCTION 43% 38% 13% 6% CONSUMER LOAN PORTFOLIO R SIDENTIAL REAL ESTATE COSUMER, INDIRECT HOME EQUITY LINE OF CREDIT CONSUMER, DIRECT 60% 40% SPECIALITY FINANCE PORTFOLIO LEASES PREIMUM FINANCE

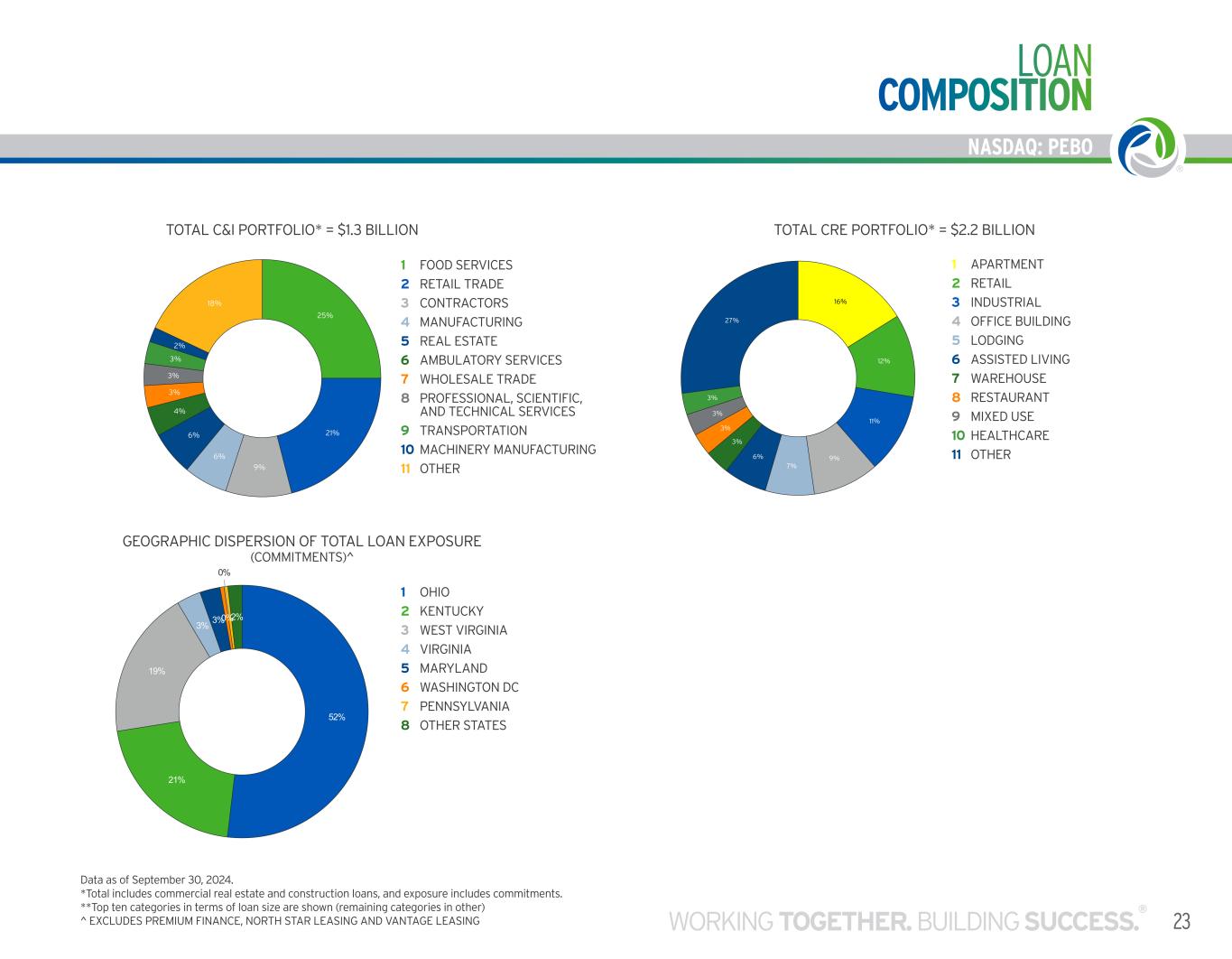

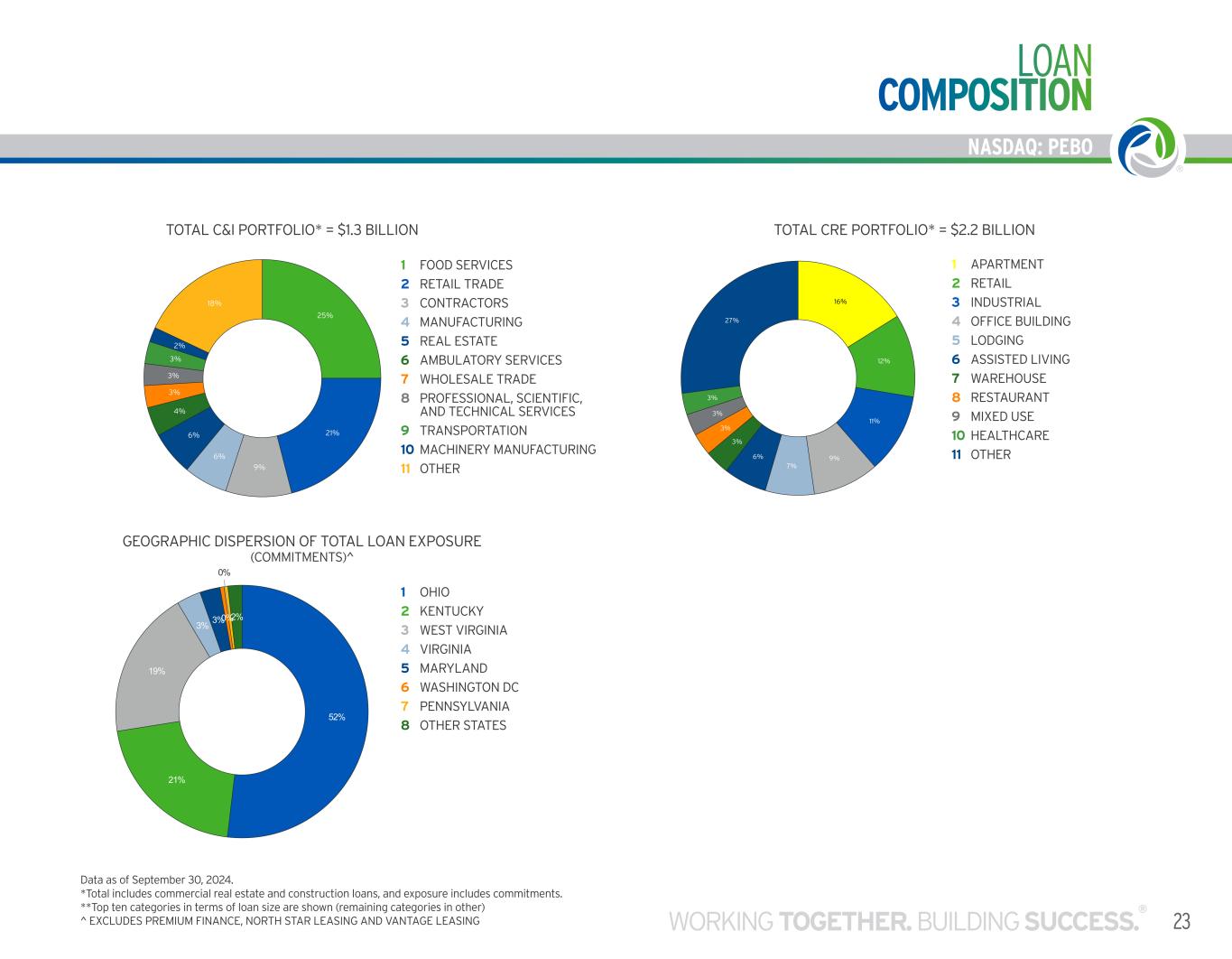

NASDAQ: PEBO 23WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO LOAN COMPOSITION REFLECTS DIVERSIFIED RISK PROFILE LOAN COMPOSITION Data as of September 30, 2024. *Total includes commercial real estate and construction loans, and exposure includes commitments. **Top ten categories in terms of loan size are shown (remaining categories in other) ^ EXCLUDES PREMIUM FINANCE, NORTH STAR LEASING AND VANTAGE LEASING 25% 21% 9% 6% 6% 4% 3% 3% 3% 2% 18% TOTAL CRE LOAN PORTFOLIO= $2.2 BILLION FOOD SERVICES RETAIL TRADE CONTRACTORS MANUFACTURING (FOOD, BEVERAGE, TEXTILE, LEATHER, WOOD, PAPER, CHEMICAL) REAL ESTATE AMBULATORY HEALTH CARE SERVICES WHOLESALE TRADE PROFESSIONAL, SCIENTIFIC, AND TECHNICAL SERVICES TRANSPORTATION MACHINERY MANUFACTURING OTHER TOTAL C&I PORTFOLIO* = $1.3 BILLION TOTAL CRE PORTFOLIO* = $2.2 BILLION 52% 21% 19% 3% 3%0% 0% 2% GEOGRAPHIC DISPERSION OF TOTAL LOAN EXPOSURE (COMMITMENTS)^ OHIO KENTUCKY WEST VIRGINIA VIRGINIA MARYLAND WASHINGTON DC PENNSLYVANIA OTHER STATES GEOGRAPHIC DISPERSION OF TOTAL LOAN EXPOSURE (COMMITMENTS)^ 16% 12% 11% 9% 7% 6% 3% 3% 3% 3% 27% TOTAL CRE LOAN PORTFOLIO* = $2.2 BI LI N APARTMENT RETAIL INDUSTRIAL OFFICE BUILDING LODGING ASSISTED LIVING WAREHOUSE RESTAURANT MIXED USE HEALTHCARE OTHER APARTMENT RETAIL INDUSTRIAL OFFICE BUILDING LODGING ASSISTED LIVING WAREHOUSE RESTAURANT MIXED USE HEALTHCARE OTHER 1 2 3 4 5 6 7 8 9 10 11 OHIO KENTUCKY WEST VIRGINIA VIRGINIA MARYLAND WASHINGTON DC PENNSYLVANIA OTHER STATES 1 2 3 4 5 6 7 8 FOOD SERVICES RETAIL TRADE CONTRACTORS MANUFACTURING REAL ESTATE AMBULATORY SERVICES WHOLESALE TRADE PROFESSIONAL, SCIENTIFIC, AND TECHNICAL SERVICES TRANSPORTATION MACHI ERY MANUFACTURING OTHER 1 2 3 4 5 6 7 8 9 10 11

24 NASDAQ: PEBO PRUDENT USE OF CAPITAL STRENGTH IN THE CURRENT ENVIRONMENT (AS OF SEPTEMBER 30, 2024) ORGANIC GROWTH • In 2024, expect between 4% and 6% loan growth compared to 2023 DIVIDENDS • 8 consecutive years of increasing dividends • Dividend paid increased from $0.15 per share for Q3 2016 to $0.40 per share declared in Q3 2024 • Based on the closing stock price of Peoples’ common shares of $31.70 on October 18, 2024, the quarterly dividend produces an annualized yield of 5.05% ACQUISITION ACTIVITIES • Acquisitions completed since 2011: • 10 banks • 8 insurance • 2 investment • 2 equipment leasing • 1 premium finance SHARE REPURCHASES • Repurchased shares in 2020, 2022 ($7.4 million), 2023 ($3 million) and 2024 ($3 million)

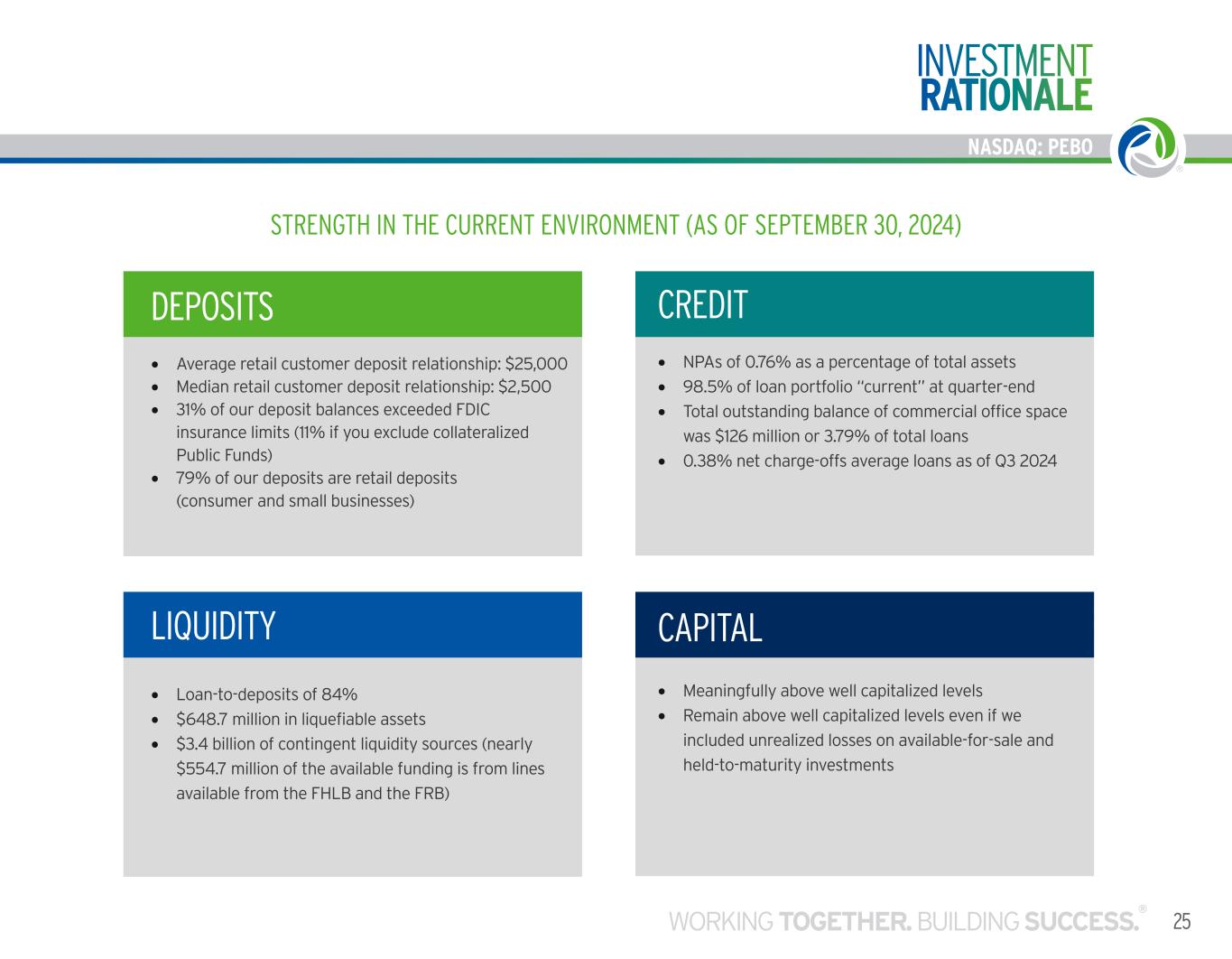

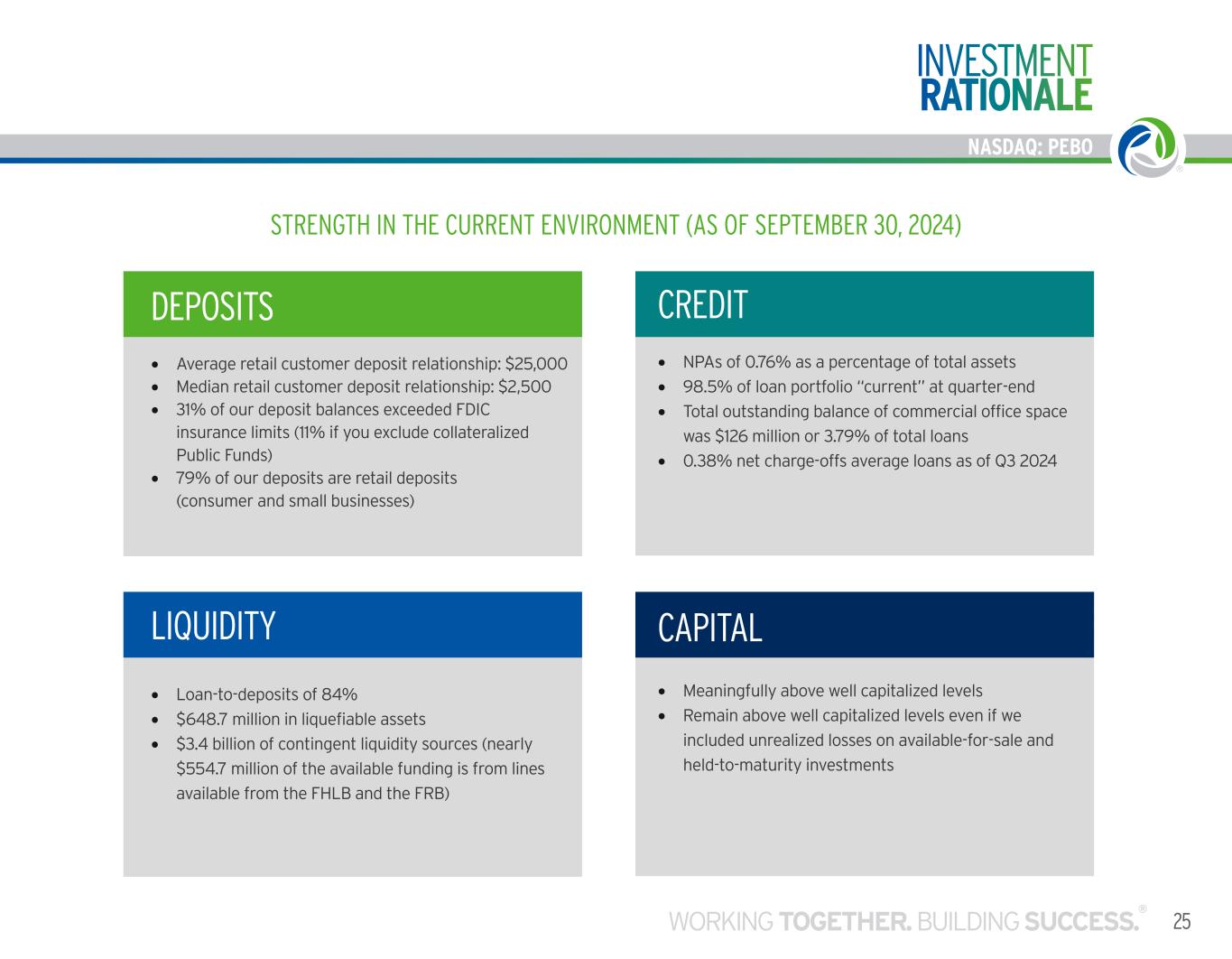

NASDAQ: PEBO 25WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO INVESTMENT RATIONALE CREDIT • NPAs of 0.76% as a percentage of total assets • 98.5% of loan portfolio “current” at quarter-end • Total outstanding balance of commercial office space was $126 million or 3.79% of total loans • 0.38% net charge-offs average loans as of Q3 2024 CAPITAL • Meaningfully above well capitalized levels • Remain above well capitalized levels even if we included unrealized losses on available-for-sale and held-to-maturity investments DEPOSITS • Average retail customer deposit relationship: $25,000 • Median retail customer deposit relationship: $2,500 • 31% of our deposit balances exceeded FDIC insurance limits (11% if you exclude collateralized Public Funds) • 79% of our deposits are retail deposits (consumer and small businesses) LIQUIDITY • Loan-to-deposits of 84% • $648.7 million in liquefiable assets • $3.4 billion of contingent liquidity sources (nearly $554.7 million of the available funding is from lines available from the FHLB and the FRB) STRENGTH IN THE CURRENT ENVIRONMENT (AS OF SEPTEMBER 30, 2024)

Q3 2024 FINANCIAL INSIGHTS 26

NASDAQ: PEBO 27WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO Q3 2024 HIGHLIGHTS & KEY IMPACTS LOAN TO DEPOSIT RATIO 84% NET INCOME $32 MILLION OR $0.89 PER DILUTED COMMON SHARE NET CHARGE-OFFS 0.38% OF AVERAGE TOTAL LOANS EFFICIENCY RATIO 55% RETURN ON AVERAGE ASSETS 1.38% NET INTEREST MARGIN 4.27%

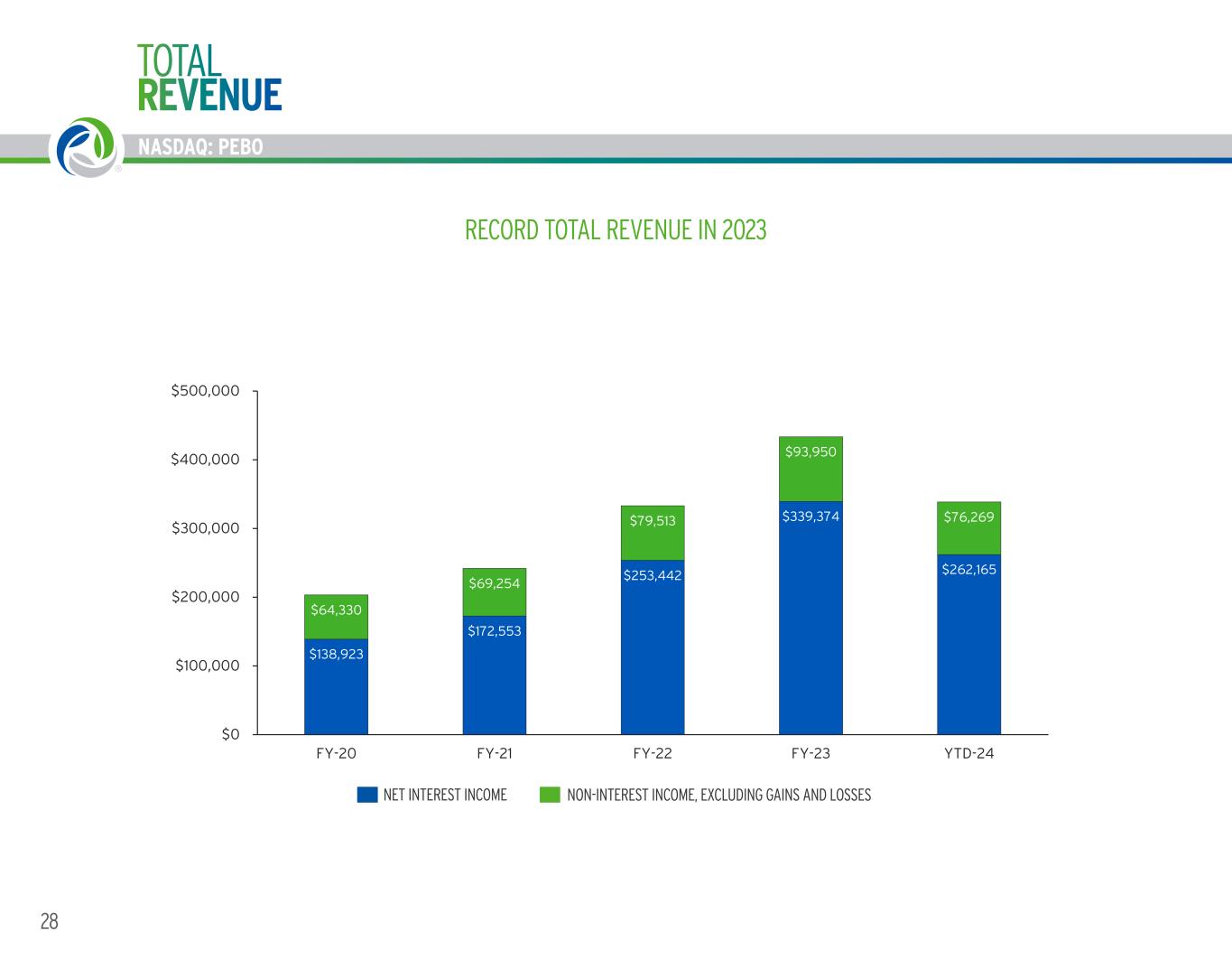

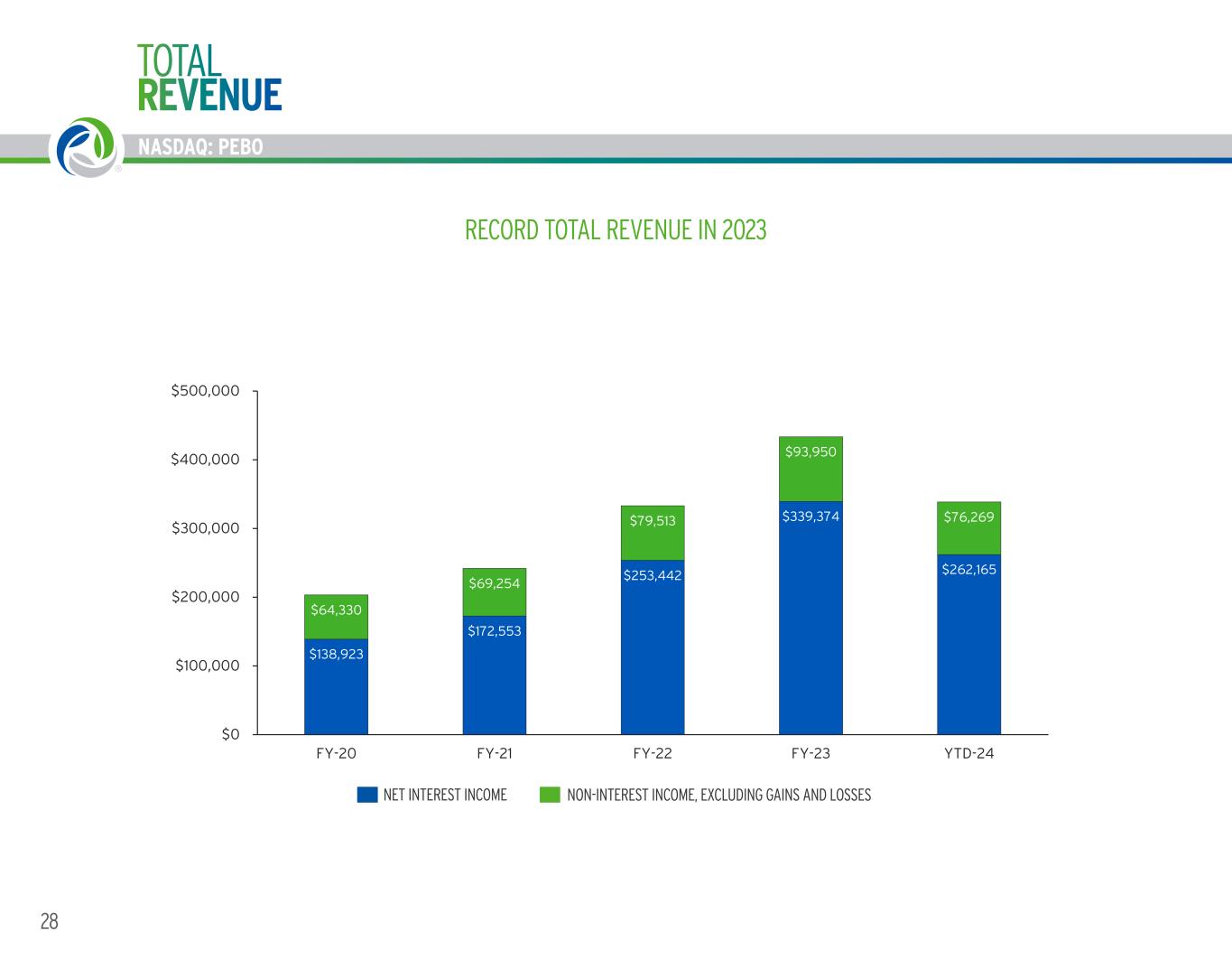

28 TOTAL REVENUE NASDAQ: PEBO RECORD TOTAL REVENUE IN 2023 REVENUE SOURCES OF OUR FEE BASED BUSINESSES NON-INTEREST INCOME YTD 2024 $138,923 $172,553 $253,442 $339,374 $262,165 $64,330 $69,254 $79,513 $93,950 $76,269 $0 $100,000 $200,000 $300,000 $400,000 $500,000 FY-20 FY-21 FY-22 FY-23 YTD-24 RECORD TOTAL REVENUE IN 2023 NET INTEREST INCOME NON-INTEREST INCOME, EXCLUDING GAINS AND LOSSES NON-INTEREST INCOME, EXCLUDING GAINS AND LOSSESNET INTEREST INCOME

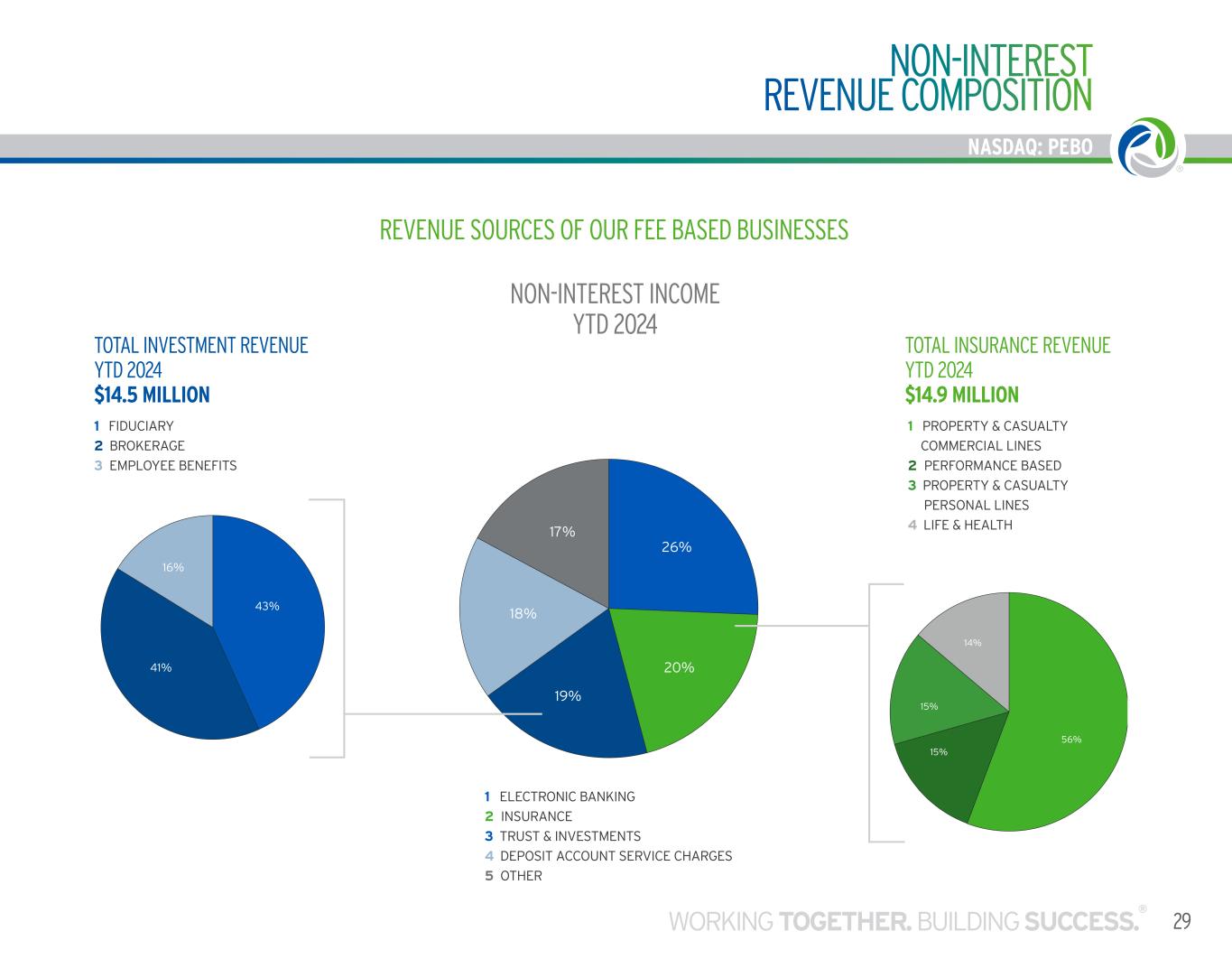

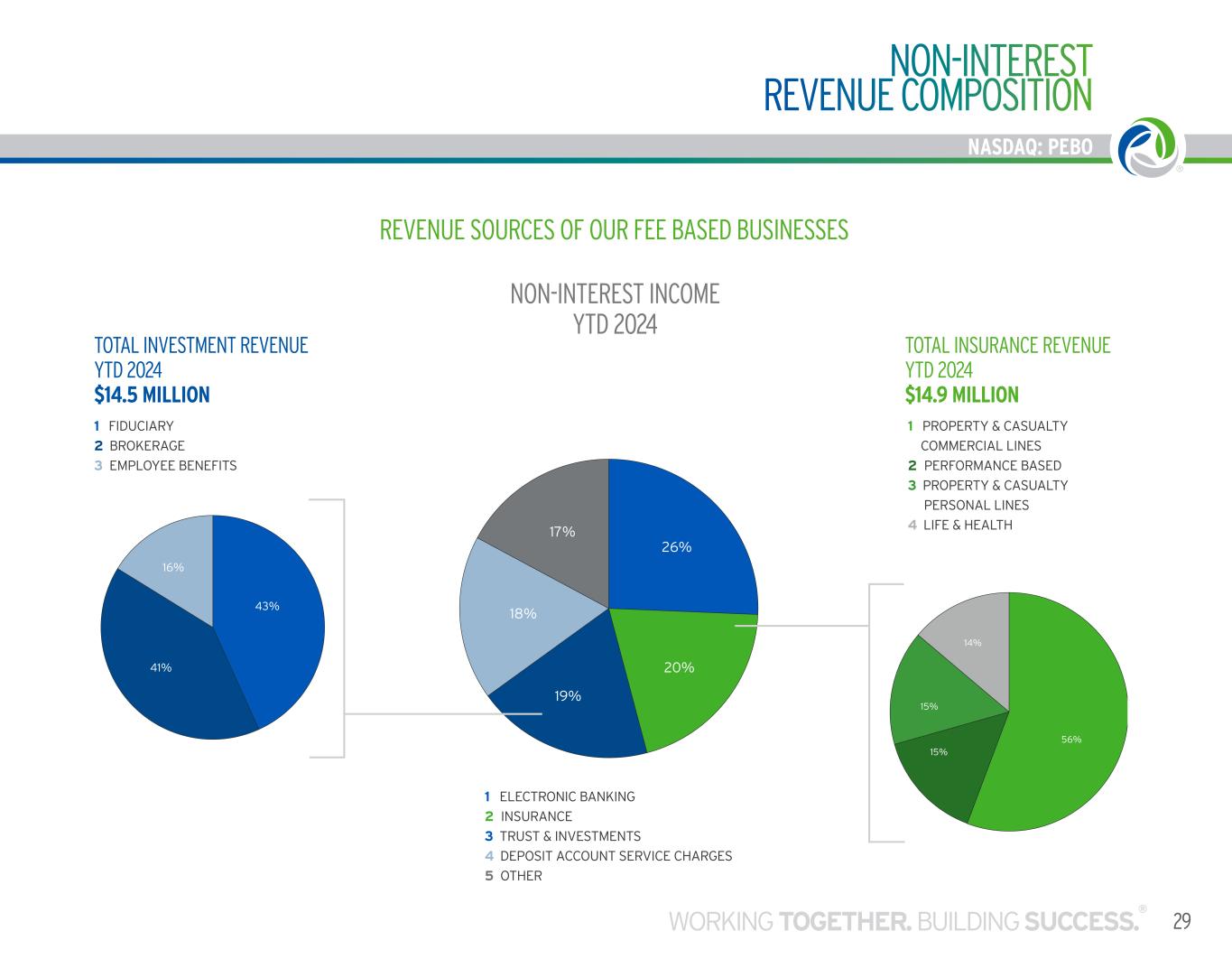

NASDAQ: PEBO NON-INTEREST REVENUE COMPOSITION 29WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO 56% 15% 15% 14% TOTAL INSURANCE REVENUE YTD 2024 $10.6 MILLION PROPERTY & CASUALTY COMMERICAL LINES PERFORMANCE BASED PROPERTY & CASUALTY PERSONAL LINES LIFE & HEALTH 3 43% 41% 16% TOTAL INVESTMENT REVENUE YTD 2024 $9.6 MILLION FIDUCIARY BROKERAGE EMPLOYEE BENEFITS 4 REVENUE SOURCES OF OUR FEE BASED BUSINESSES 26% 20% 19% 18% 17% NON-INTEREST INCOME YTD 2024 ELECTRONIC BANKING INSURANCE TRUST & INVESTMENTS DEPOSIT ACCOUNT SERVICE CHARGES OTHER TOTAL INVESTMENT REVENUE YTD 2024 $14.5 MILLION 1 FIDUCIARY 2 BROKERAGE 3 EMPLOYEE BENEFITS 1 PROPERTY & CASUALTY COMMERCIAL LINES 2 PERFORMANCE BASED 3 PROPERTY & CASUALTY PERSONAL LINES 4 LIFE & HEALTH TOTAL INSURANCE REVENUE YTD 2024 $14.9 MILLION 1 ELECTRONIC BANKING 2 INSURANCE 3 TRUST & INVESTMENTS 4 DEPOSIT ACCOUNT SERVICE CHARGES 5 OTHER NON-INTEREST INCOME YTD 2024

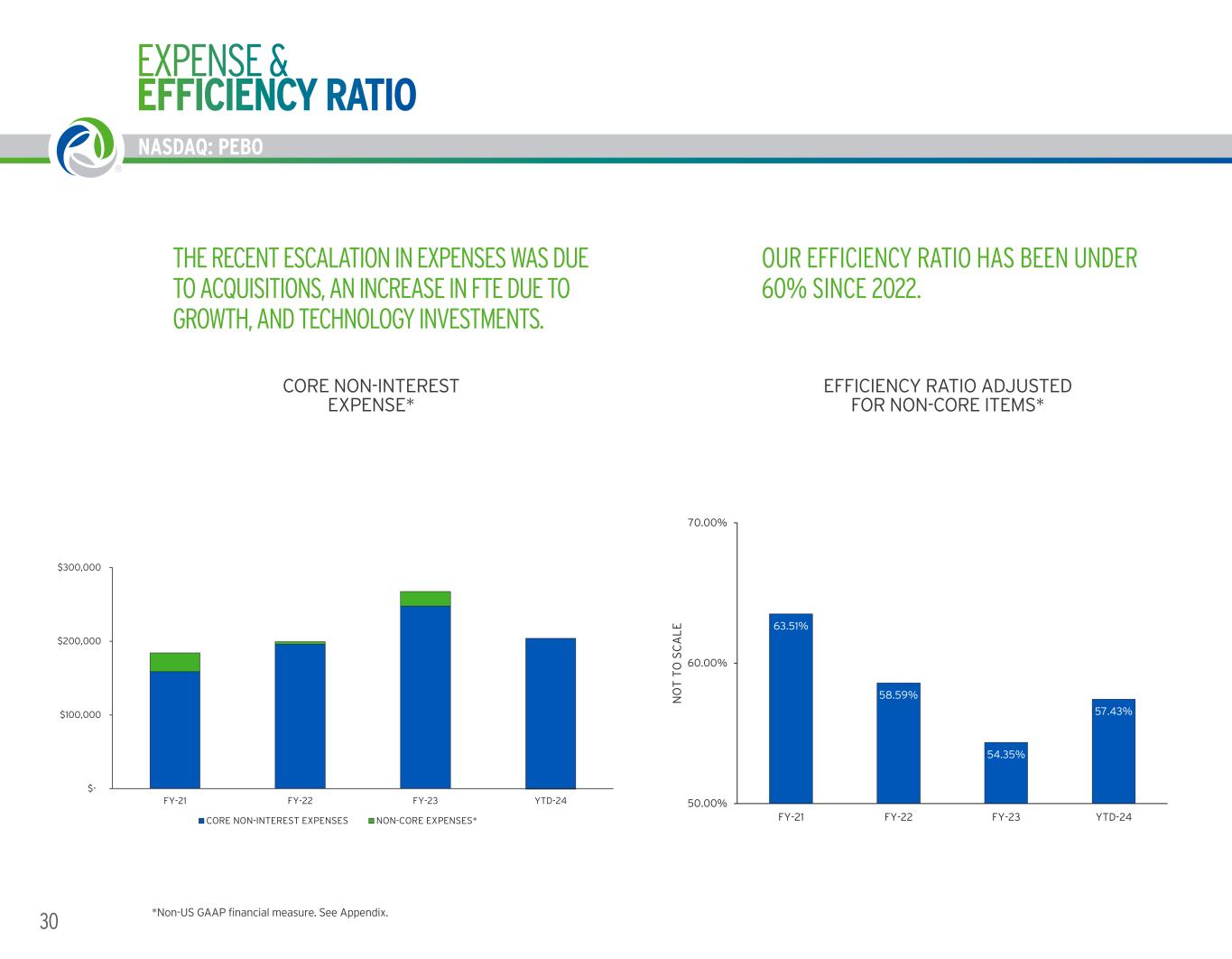

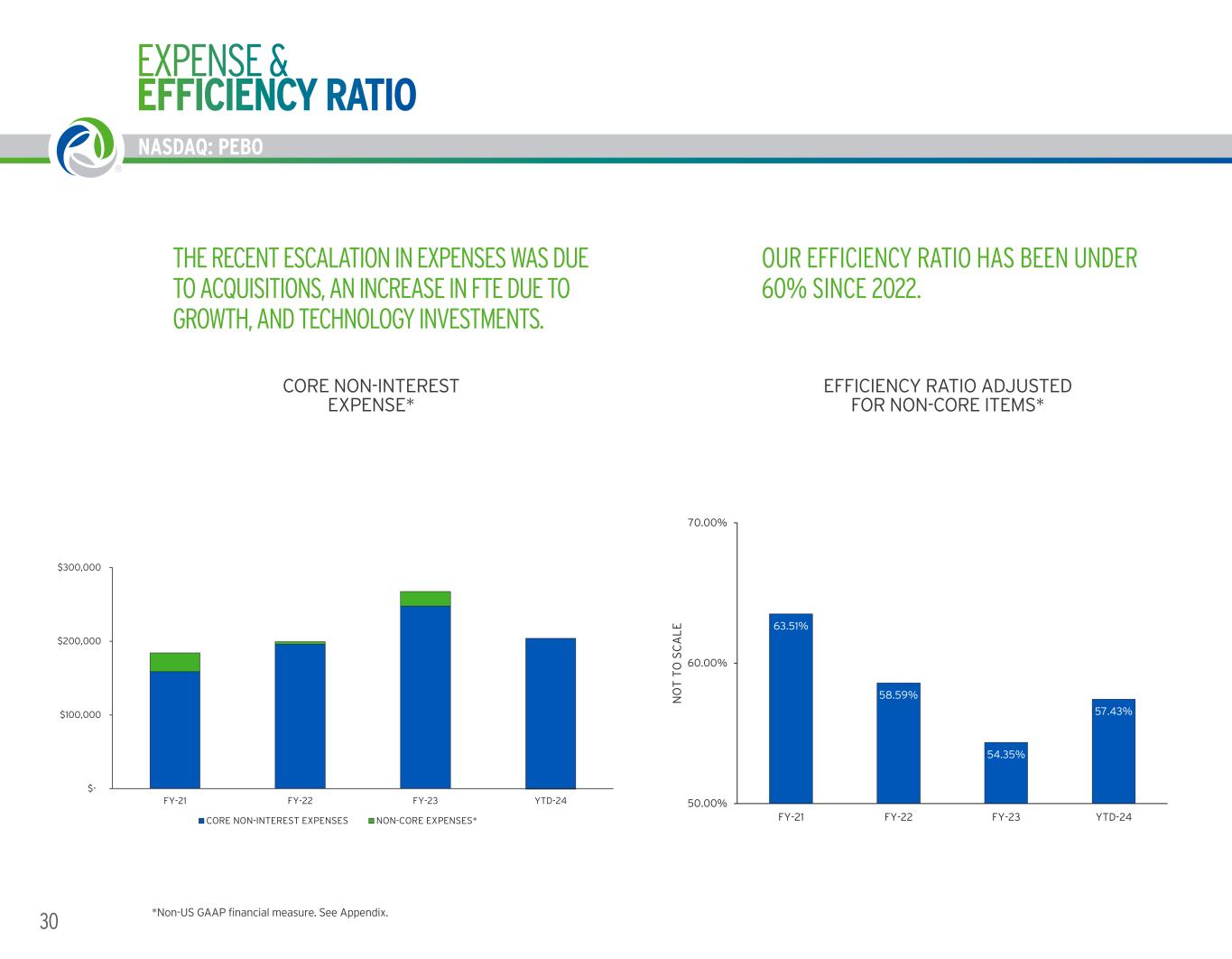

30 EXPENSE & EFFICIENCY RATIO THE RECENT ESCALATION IN EXPENSES WAS DUE TO ACQUISITIONS, AN INCREASE IN FTE DUE TO GROWTH, AND TECHNOLOGY INVESTMENTS. *Non-US GAAP financial measure. See Appendix. OUR EFFICIENCY RATIO HAS BEEN UNDER 60% SINCE 2022. NASDAQ: PEBO CORE NON-INTEREST EXPENSE* $- $100,000 $200,000 $300,000 FY-21 FY-22 FY-23 YTD-24 CORE NON-INTEREST EXPENSE* CORE NON-INTEREST EXPENSES NON-CORE EXPENSES* 63.51% 58.59% 54.35% 57.43% 50.00% 60.00% 70.00% FY-21 FY-22 FY-23 YTD-24 N O T T O S C A L E EFFICENCY RATIO ADJUSTED FOR NON-CORE ITEMS CORE NON-INTEREST EXPENSE* EFFICIENCY RATIO ADJUSTED FOR NON-CORE ITEMS*

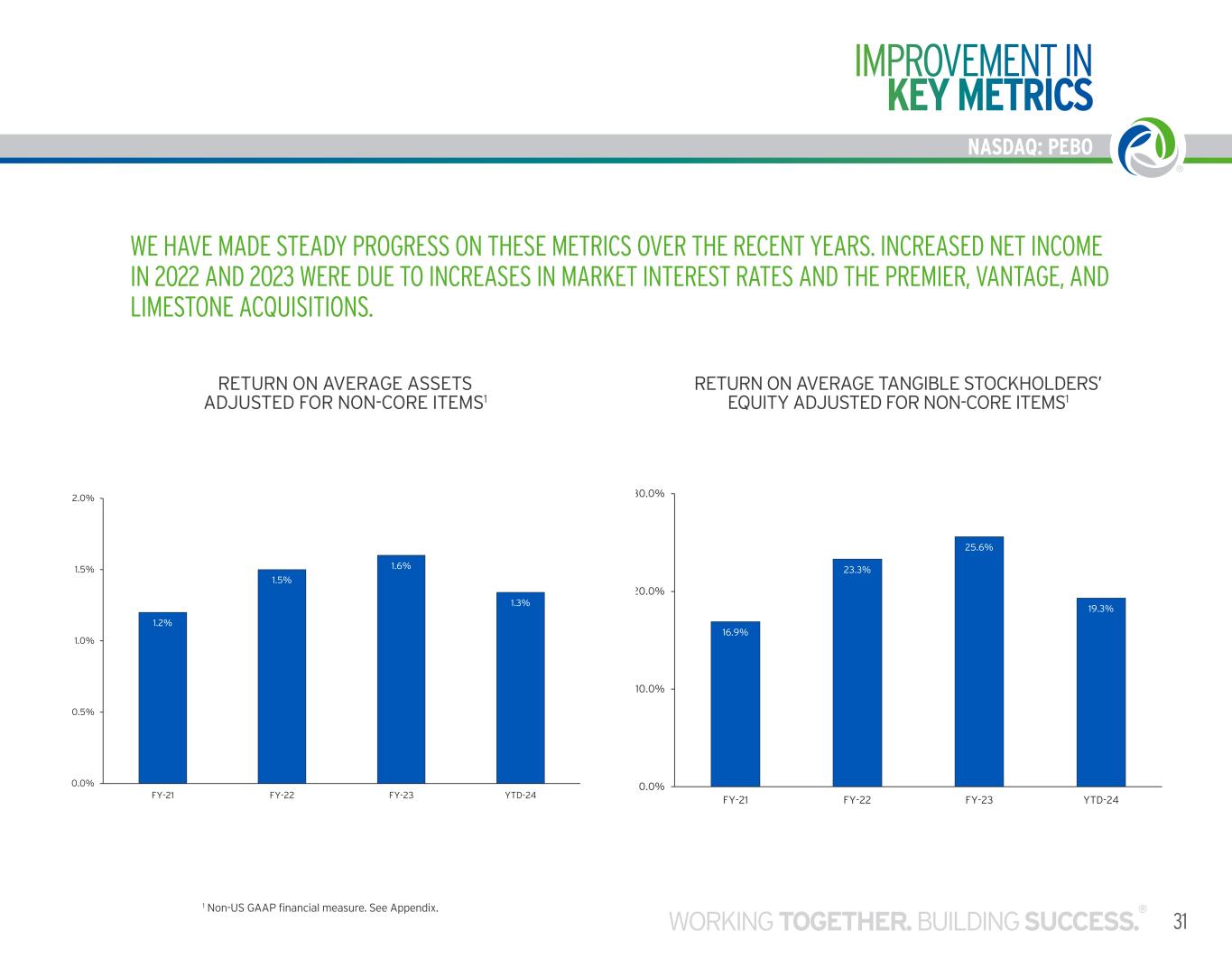

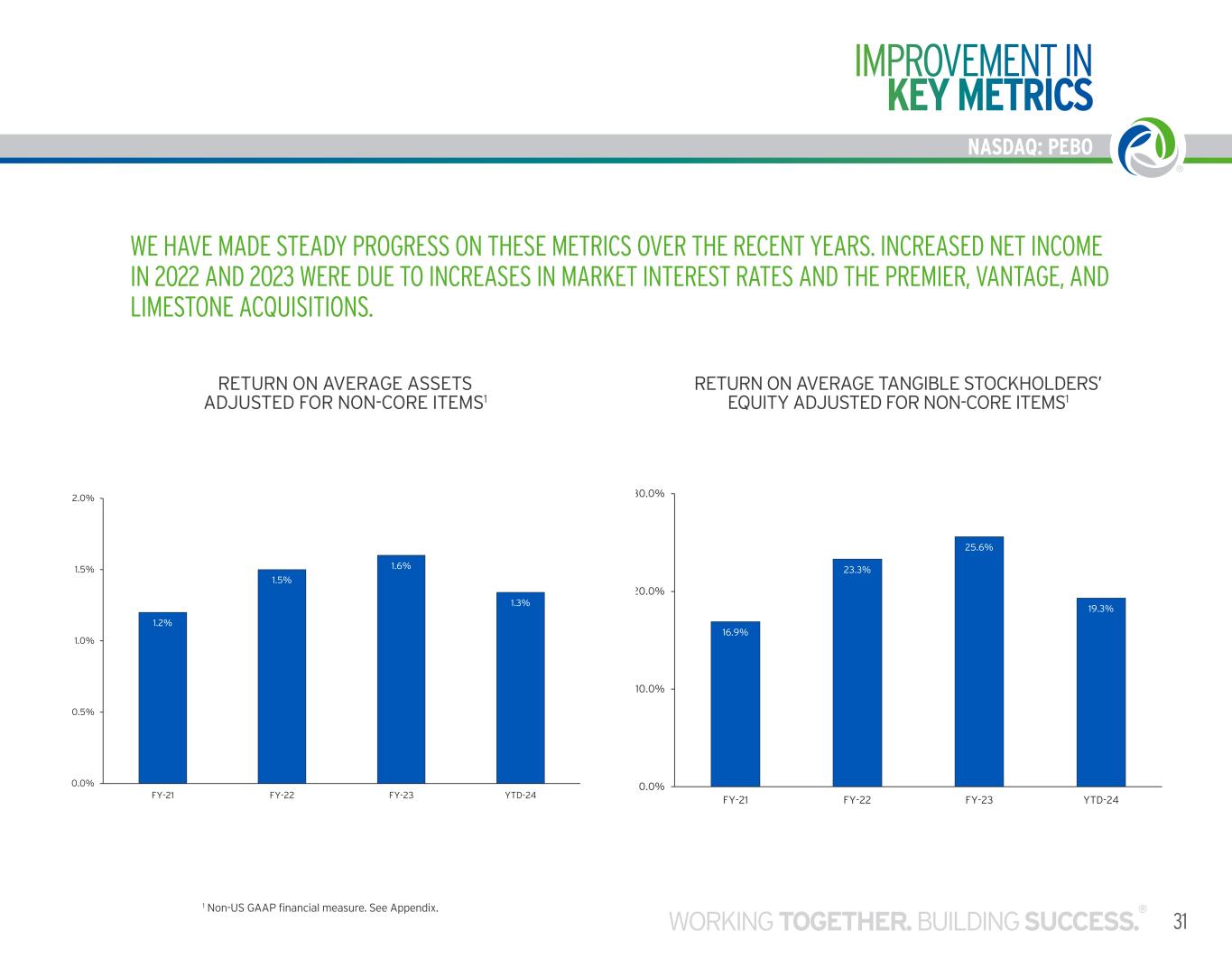

NASDAQ: PEBO IMPROVEMENT IN KEY METRICS 31WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO WE HAVE MADE STEADY PROGRESS ON THESE METRICS OVER THE RECENT YEARS. INCREASED NET INCOME IN 2022 AND 2023 WERE DUE TO INCREASES IN MARKET INTEREST RATES AND THE PREMIER, VANTAGE, AND LIMESTONE ACQUISITIONS. 1 Non-US GAAP financial measure. See Appendix. 16.9% 23.3% 25.6% 20.04% 19.21%1.2% 1.5% 1.6% 1.3% 0.0% 0.5% 1.0% 1.5% 2.0% FY-21 FY-22 FY-23 YTD-24 RETURN ON AVERAGE ASSETS ADJUSTED FOR NON-CORE ITEMS 16.9% 23.3% 25.6% 19.3% 0.0% 10.0% 20.0% 30.0% FY-21 FY-22 FY-23 YTD-24 RETURN ON AVERAGE TANGIBLE STOCKHOLDERS EQUITY ADJUSTED FOR NON-CORE ITEMS RETURN ON AVERAGE ASSETS ADJUSTED FOR NON-CORE ITEMS1 RETURN ON AVERAGE TANGIBLE STOCKHOLDERS’ EQUITY ADJUSTED FOR NON-CORE ITEMS1

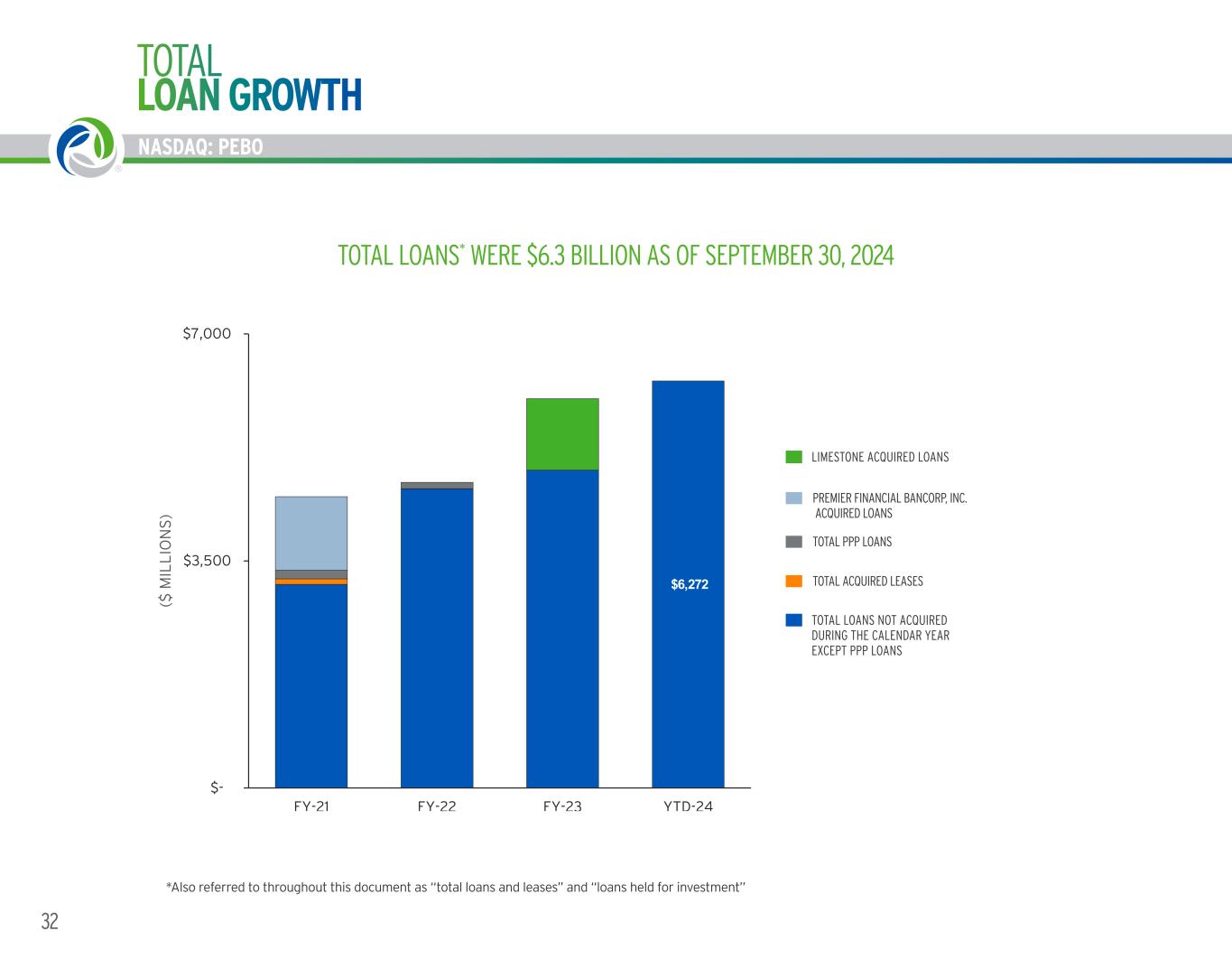

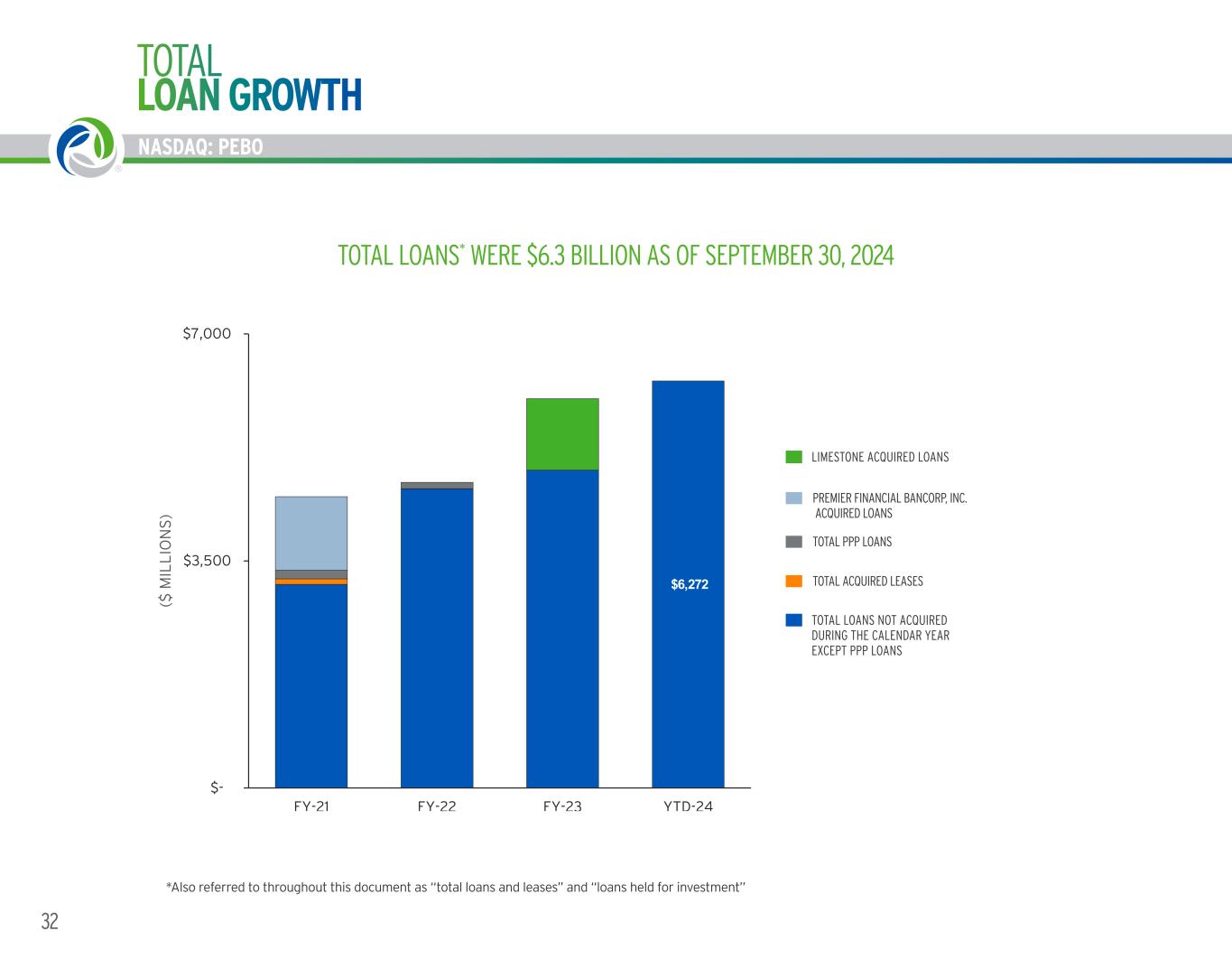

32 TOTAL LOAN GROWTH TOTAL LOANS* WERE $6.3 BILLION AS OF SEPTEMBER 30, 2024 *Also referred to throughout this document as “total loans and leases” and “loans held for investment” NASDAQ: PEBO $6,272 $- $3,500 $7,000 FY-21 FY-22 FY-23 YTD-24 ($ M IL L IO N S ) TOTAL LOANS* AS OF SEPTEMBER 30, 2024 LIMESTONE ACQUIRED LOANS PREMIER FINANCIAL BANCORP, INC, ACQUIRED LOANS TOTAL LOANS NOT ACQUIRED DURING THE CALENDAR YEAR EXCEPT PPP LOANS TOTAL ACQUIRED LEASES TOTAL LOANS NOT ACQUIRED TOTAL LOANS NOT ACQUIRED DURING THE CALENDAR YEAR EXCEPT PPP LOANS LIMESTONE ACQUIRED LOANS TOTAL ACQUIRED LEASES TOTAL PPP LOANS PREMIER FINANCIAL BANCORP, INC. ACQUIRED LOANS

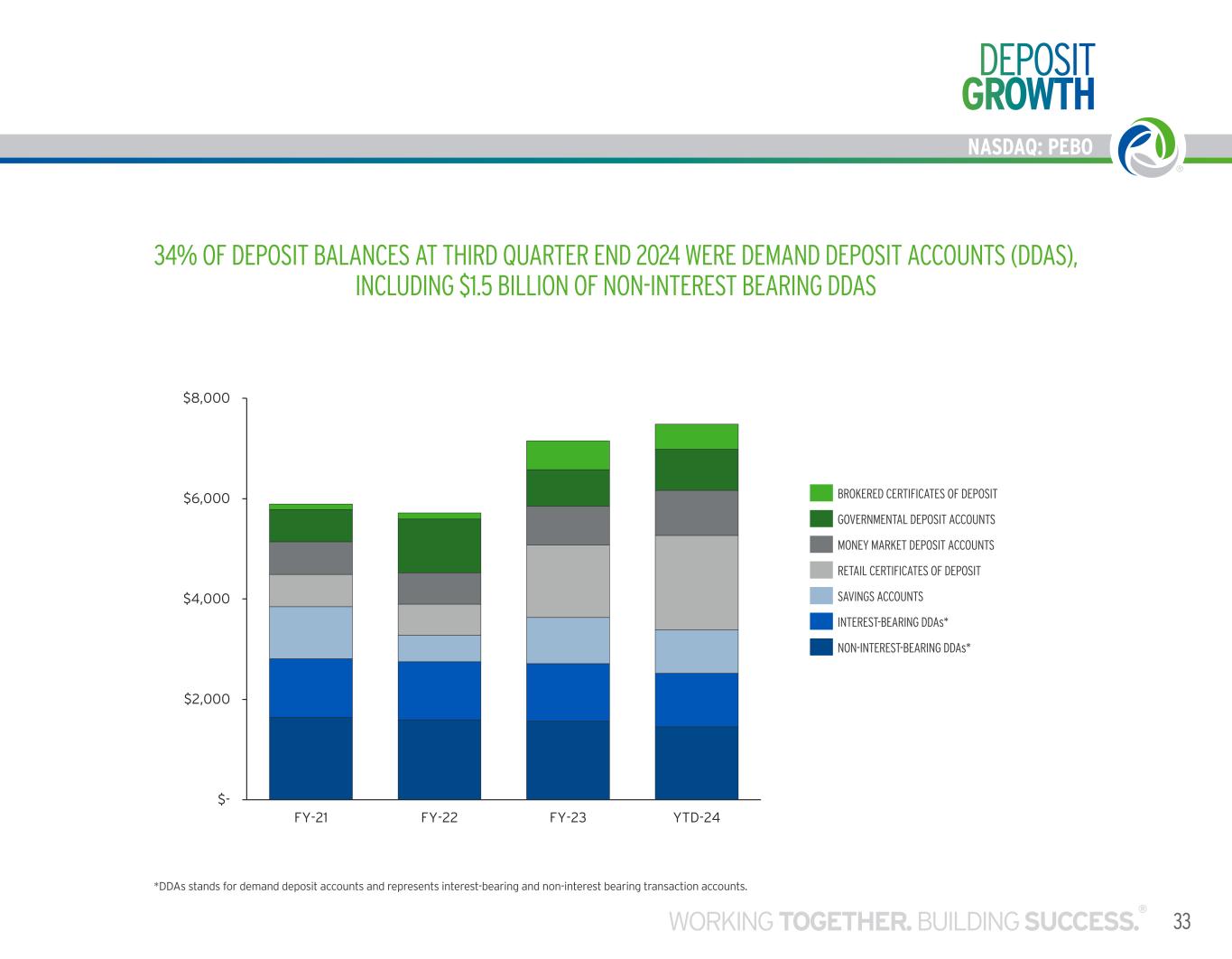

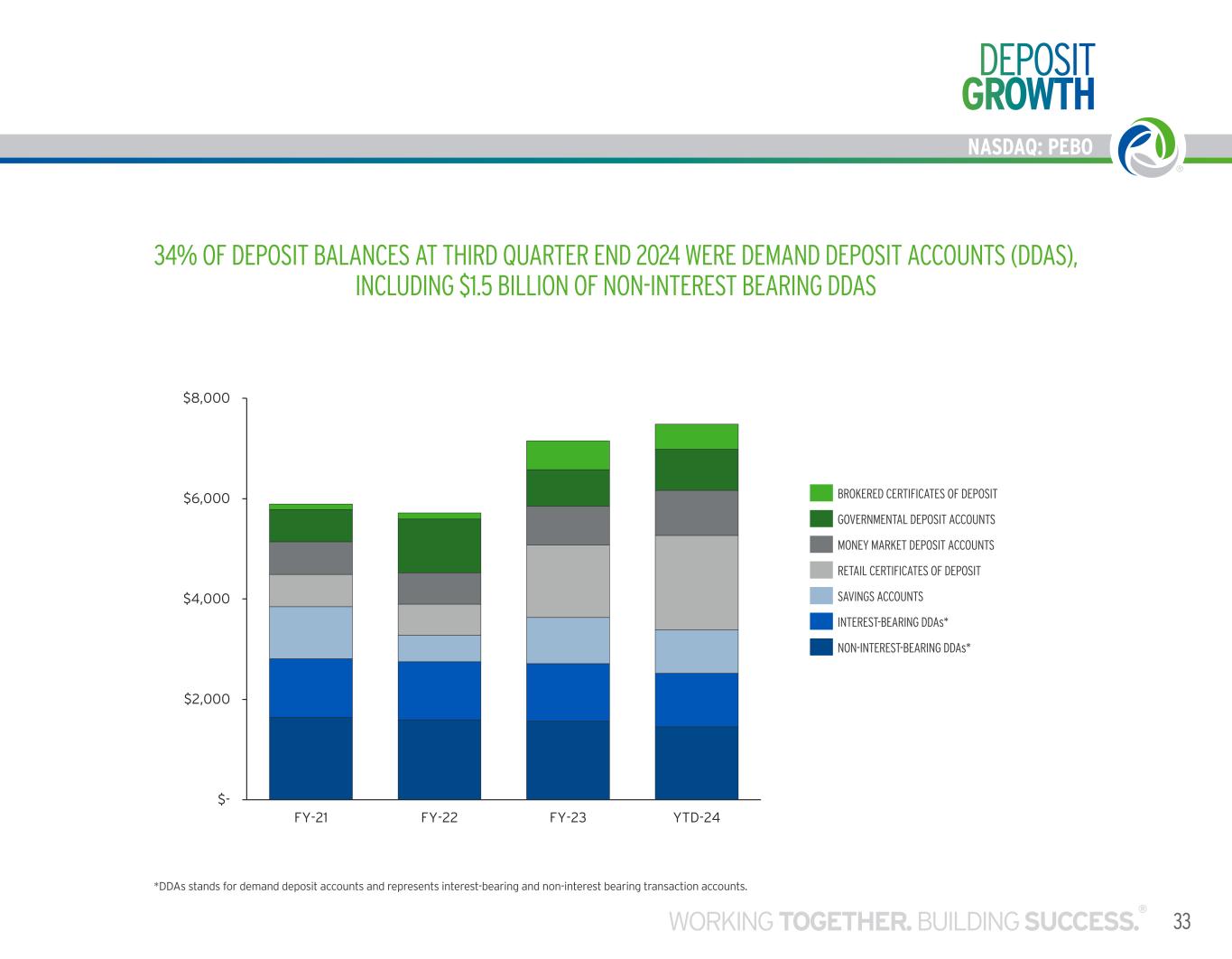

34% OF DEPOSIT BALANCES AT THIRD QUARTER END 2024 WERE DEMAND DEPOSIT ACCOUNTS (DDAS), INCLUDING $1.5 BILLION OF NON-INTEREST BEARING DDAS *DDAs stands for demand deposit accounts and represents interest-bearing and non-interest bearing transaction accounts. DEPOSIT GROWTH NASDAQ: PEBO 33WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO $- $2,000 $4,000 $6,000 $8,000 FY-21 FY-22 FY-23 YTD-24 DEPOSIT BALANCES AS OF SEPTEMBER 30, 2024 BROKERED CERTIFICATES OF DEPOSIT GOVERNMENTAL DEPOSIT ACCOUNTS MONEY MARKET DEPOSIT ACCOUNTS RETAIL CERTIFICATES OF DEPOSIT SAVINGS ACCOUNTS INTEREST-BEARING DDs* NON-INTEREST-BEARING DDs* BROKERED CERTIFICATES OF DEPOSIT GOVERNMENTAL DEPOSIT ACCOUNTS MONEY MARKET DEPOSIT ACCOUNTS RETAIL CERTIFICATES OF DEPOSIT SAVINGS ACCOUNTS INTEREST-BEARING DDAs* NON-INTEREST-BEARING DDAs*

34 2024 2025 LOAN GROWTH EXPECT BETWEEN 4% AND 6%, COMPARED TO 2024 EXPECT BETWEEN 4% AND 6%, COMPARED TO 2024 FEE-BASED INCOME NORMALIZE IN THE FOURTH QUARTER, EXCLUDING EARLY TERMINATION GAINS ON LEASES RECORDED DURING THE THIRD QUARTER ANTICIPATE GROWTH BETWEEN MID TO HIGH SINGLE DIGITS COMPARED TO 2024 CREDIT COSTS ANTICIPATE OUR FULL YEAR NET CHARGE-OFF RATE WILL BE AROUND 30-35 BASIS POINTS SIMILAR PROVISION TO 2024 QUARTERLY RUN RATE CORE NON-INTEREST EXPENSE EXPECTED TO BE BETWEEN $67 AND $69 MILLION FOR THE FOURTH QUARTER OF 2024 RETURN TO POSITIVE OPERATING LEVERAGE. QUARTERLY NON-INTEREST EXPENSE TO BE BETWEEN $69 AND $71 MILLION FOR SECOND, THIRD AND FOURTH QUARTERS NET INTEREST MARGIN EXPECT TO BE BETWEEN 4.00% AND 4.10% ASSUMING 50 BASIS POINT REDUCTION BY THE FEDERAL RESERVE DURING THE FOURTH QUARTER ANTICIPATE A STABILIZATION BETWEEN 4.00% AND 4.20% ASSUMING 50 BASIS POINT REDUCTION IN RATES FROM FEDERAL RESERVE IN FIRST NINE MONTHS OF 2025 2024-2025 FINANCIAL EXPECTATIONS NASDAQ: PEBO

NASDAQ: PEBO 35WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO EXPECT BETWEEN 4% AND 6%, COMPARED TO 2024 ANTICIPATE GROWTH BETWEEN MID TO HIGH SINGLE DIGITS COMPARED TO 2024 ANTICIPATE A STABILIZATION BETWEEN 4.00% AND 4.20% ASSUMING 50 BASIS POINT REDUCTION IN RATES FROM FEDERAL RESERVE IN FIRST NINE MONTHS OF 2025 Q3 2024 APPENDIX

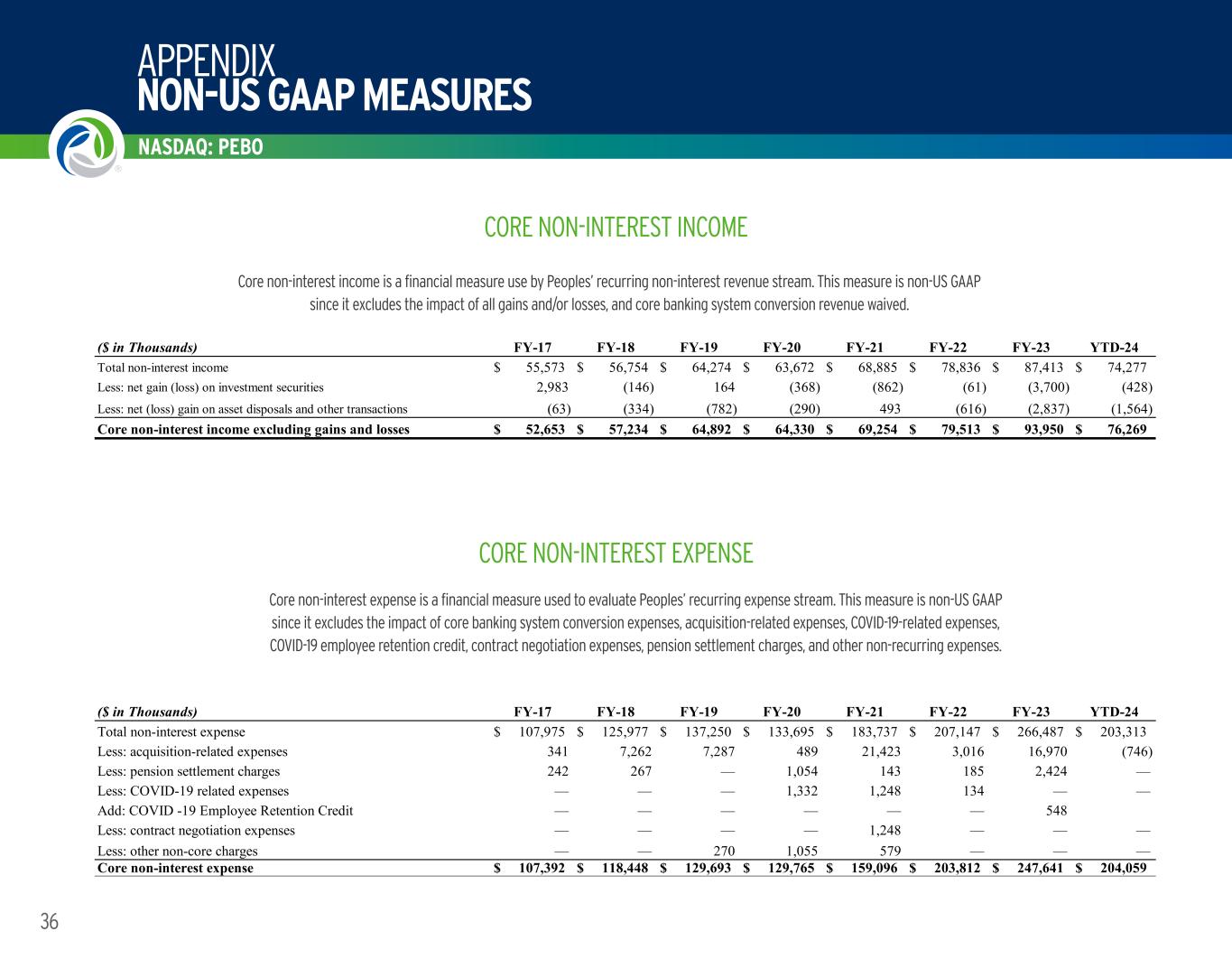

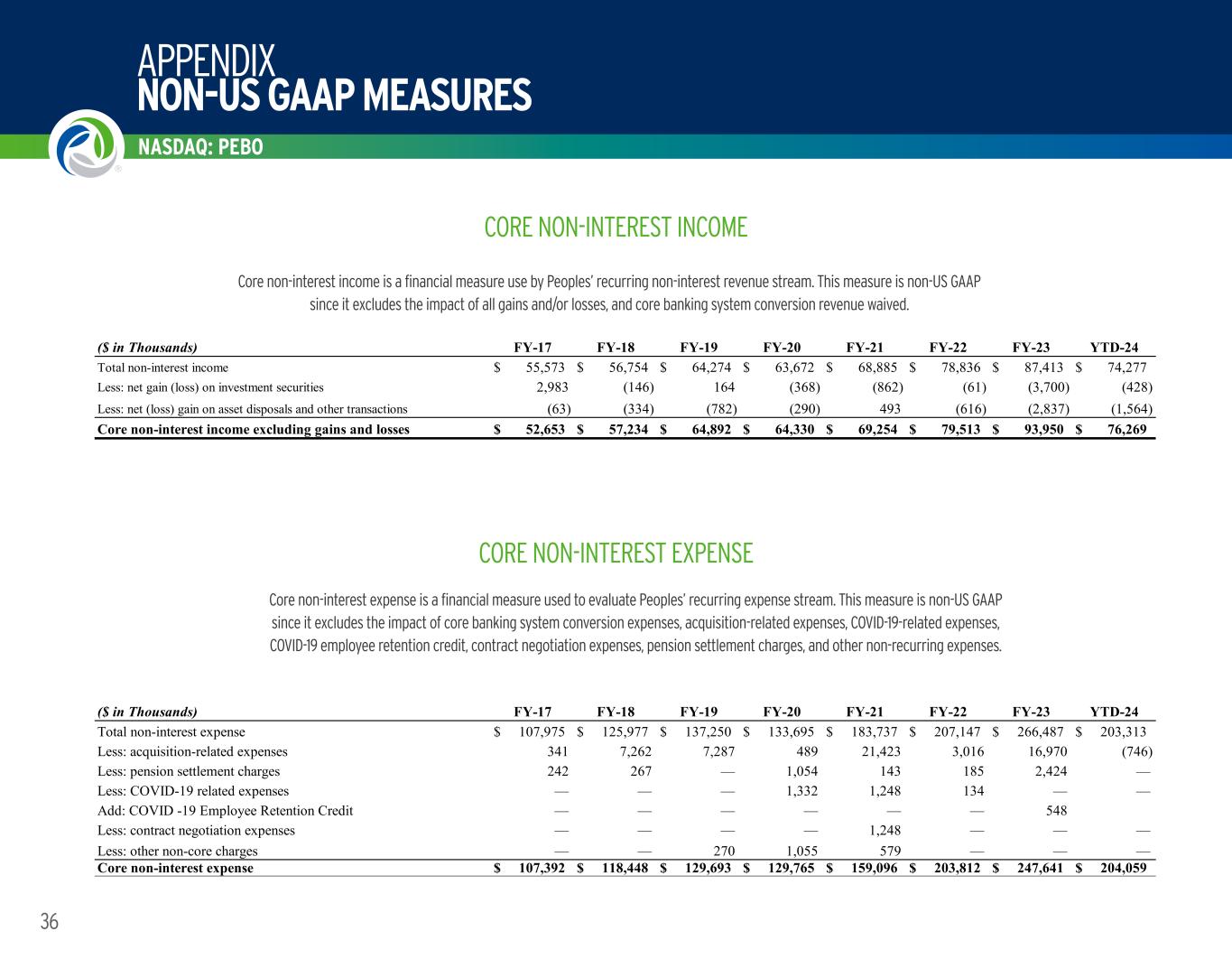

NASDAQ: PEBO APPENDIX NON-US GAAP MEASURES 36 CORE NON-INTEREST INCOME CORE NON-INTEREST EXPENSE ($ in Thousands) FY-17 FY-18 FY-19 FY-20 FY-21 FY-22 FY-23 YTD-24 Total non-interest income $ 55,573 $ 56,754 $ 64,274 $ 63,672 $ 68,885 $ 78,836 $ 87,413 $ 74,277 Less: net gain (loss) on investment securities 2,983 (146) 164 (368) (862) (61) (3,700) (428) Less: net (loss) gain on asset disposals and other transactions (63) (334) (782) (290) 493 (616) (2,837) (1,564) Core non-interest income excluding gains and losses $ 52,653 $ 57,234 $ 64,892 $ 64,330 $ 69,254 $ 79,513 $ 93,950 $ 76,269 ($ in Thousands) FY-17 FY-18 FY-19 FY-20 FY-21 FY-22 FY-23 YTD-24 Total non-interest expense $ 107,975 $ 125,977 $ 137,250 $ 133,695 $ 183,737 $ 207,147 $ 266,487 $ 203,313 Less: acquisition-related expenses 341 7,262 7,287 489 21,423 3,016 16,970 (746) Less: pension settlement charges 242 267 — 1,054 143 185 2,424 — Less: COVID-19 related expenses — — — 1,332 1,248 134 — — Add: COVID -19 Employee Retention Credit — — — — — — 548 Less: contract negotiation expenses — — — — 1,248 — — — Less: other non-core charges — — 270 1,055 579 — — — Core non-interest expense $ 107,392 $ 118,448 $ 129,693 $ 129,765 $ 159,096 $ 203,812 $ 247,641 $ 204,059 ($ in Thousands) FY-17 FY-18 FY-19 FY-20 FY-21 FY-22 FY-23 YTD-24 Total non-interest income $ 55,573 $ 56,754 $ 64,274 $ 63,672 $ 68,885 $ 78,836 $ 87,413 $ 74,277 Less: net gain (loss) on investment securities 2,983 (146) 164 (368) (862) (61) (3,700) (428) Less: net (loss) gain on asset disposals and other transactions (63) (334) (782) (290) 493 (616) (2,837) (1,564) Core non-interest income excluding gains and losses $ 52,653 $ 57,234 $ 64,892 $ 64,330 $ 69,254 $ 79,513 $ 93,950 $ 76,269 ($ in Thousands) FY-17 FY-18 FY-19 FY-20 FY-21 FY-22 FY-23 YTD-24 Total non-interest expense $ 107,975 $ 125,977 $ 137,250 $ 133,695 $ 183,737 $ 207,147 $ 266,487 $ 203,313 Less: acquisition-related expenses 341 7,262 7,287 489 21,423 3,016 16,970 (746) Less: pension settlement charges 242 267 — 1,054 143 185 2,424 — Less: COVID-19 related expenses — — — 1,332 1,248 134 — — Add: COVID -19 Employee Retention Credit — — — — — — 548 Less: contract negotiation expenses — — — — 1,248 — — — Less: other non-core charges — — 270 1,055 579 — — — Core non-interest expense $ 107,392 $ 118,448 $ 129,693 $ 129,765 $ 159,096 $ 203,812 $ 247,641 $ 204,059 Core non-interest income is a financial measure use by Peoples’ recurring non-interest revenue stream. This measure is non-US GAAP since it excludes the impact of all gains and/or losses, and core banking system conversion revenue waived. Core non-interest expense is a financial measure used to evaluate Peoples’ recurring expense stream. This measure is non-US GAAP since it excludes the impact of core banking system conversion expenses, acquisition-related expenses, COVID-19-related expenses, COVID-19 employee retention credit, contract negotiation expenses, pension settlement charges, and other non-recurring expenses.

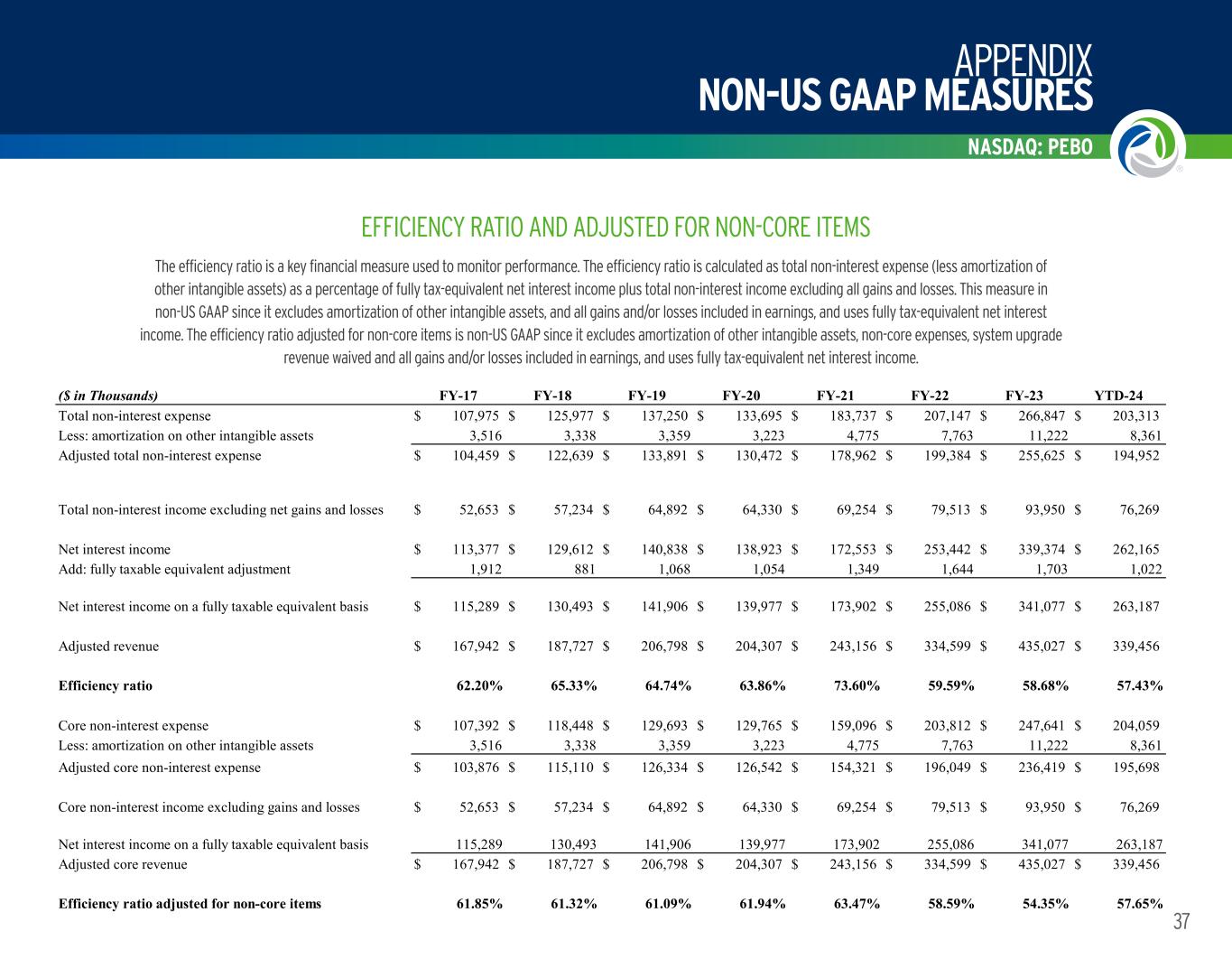

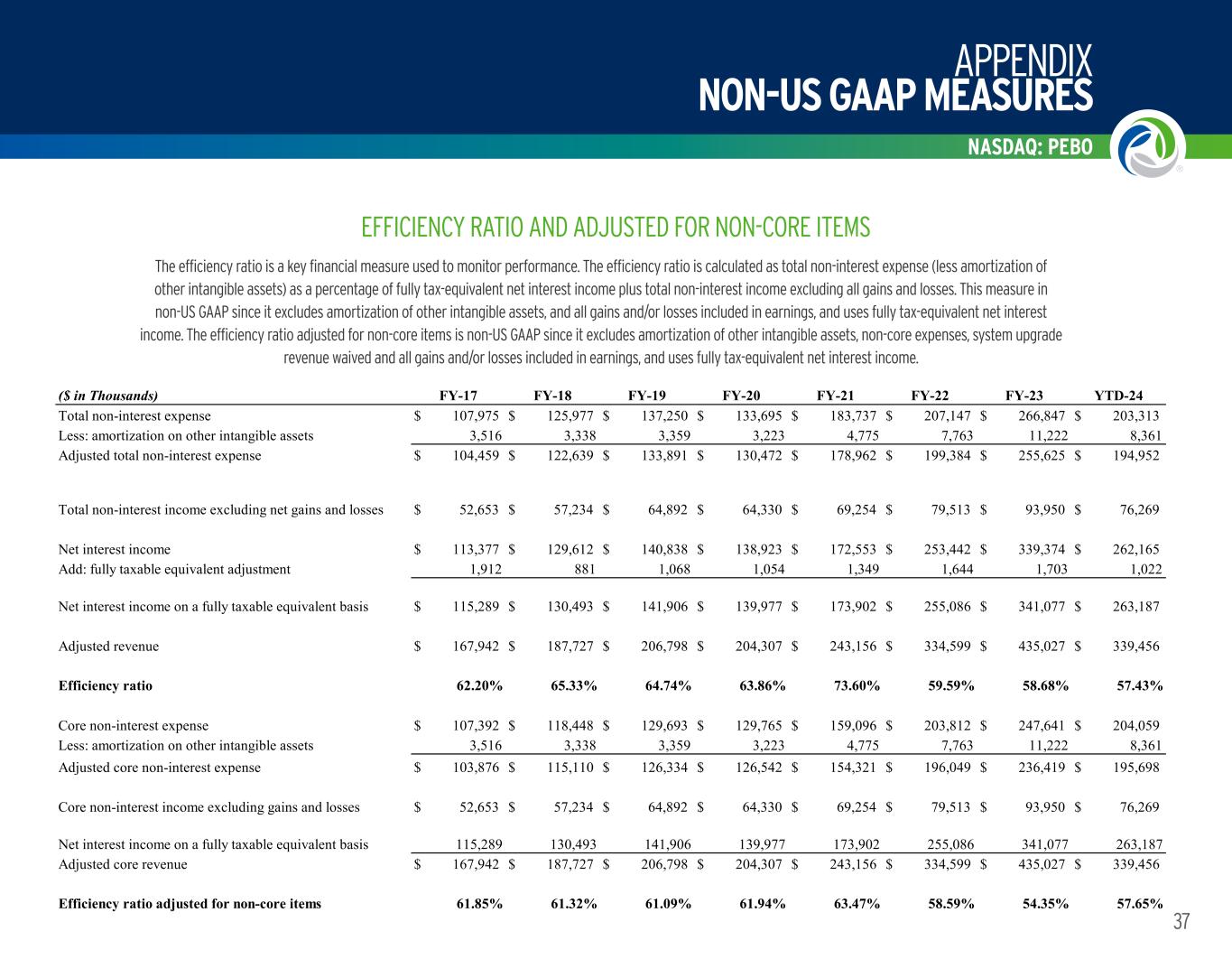

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO 37 EFFICIENCY RATIO AND ADJUSTED FOR NON-CORE ITEMS ($ in Thousands) FY-17 FY-18 FY-19 FY-20 FY-21 FY-22 FY-23 YTD-24 Total non-interest expense $ 107,975 $ 125,977 $ 137,250 $ 133,695 $ 183,737 $ 207,147 $ 266,847 $ 203,313 Less: amortization on other intangible assets 3,516 3,338 3,359 3,223 4,775 7,763 11,222 8,361 Adjusted total non-interest expense $ 104,459 $ 122,639 $ 133,891 $ 130,472 $ 178,962 $ 199,384 $ 255,625 $ 194,952 Total non-interest income excluding net gains and losses $ 52,653 $ 57,234 $ 64,892 $ 64,330 $ 69,254 $ 79,513 $ 93,950 $ 76,269 Net interest income $ 113,377 $ 129,612 $ 140,838 $ 138,923 $ 172,553 $ 253,442 $ 339,374 $ 262,165 Add: fully taxable equivalent adjustment 1,912 881 1,068 1,054 1,349 1,644 1,703 1,022 Net interest income on a fully taxable equivalent basis $ 115,289 $ 130,493 $ 141,906 $ 139,977 $ 173,902 $ 255,086 $ 341,077 $ 263,187 Adjusted revenue $ 167,942 $ 187,727 $ 206,798 $ 204,307 $ 243,156 $ 334,599 $ 435,027 $ 339,456 Efficiency ratio 62.20% 65.33% 64.74% 63.86% 73.60% 59.59% 58.68% 57.43% Core non-interest expense $ 107,392 $ 118,448 $ 129,693 $ 129,765 $ 159,096 $ 203,812 $ 247,641 $ 204,059 Less: amortization on other intangible assets 3,516 3,338 3,359 3,223 4,775 7,763 11,222 8,361 Adjusted core non-interest expense $ 103,876 $ 115,110 $ 126,334 $ 126,542 $ 154,321 $ 196,049 $ 236,419 $ 195,698 Core non-interest income excluding gains and losses $ 52,653 $ 57,234 $ 64,892 $ 64,330 $ 69,254 $ 79,513 $ 93,950 $ 76,269 Net interest income on a fully taxable equivalent basis 115,289 130,493 141,906 139,977 173,902 255,086 341,077 263,187 Adjusted core revenue $ 167,942 $ 187,727 $ 206,798 $ 204,307 $ 243,156 $ 334,599 $ 435,027 $ 339,456 Efficiency ratio adjusted for non-core items 61.85% 61.32% 61.09% 61.94% 63.47% 58.59% 54.35% 57.65% The efficiency ratio is a key financial measure used to monitor performance. The efficiency ratio is calculated as total non-interest expense (less amortization of other intangible assets) as a percentage of fully tax-equivalent net interest income plus total non-interest income excluding all gains and losses. This measure in non-US GAAP since it excludes amortization of other intangible assets, and all gains and/or losses included in earnings, and uses fully tax-equivalent net interest income. The efficiency ratio adjusted for non-core items is non-US GAAP since it excludes amortization of other intangible assets, non-core expenses, system upgrade revenue waived and all gains and/or losses included in earnings, and uses fully tax-equivalent net interest income. CORE NON-INTEREST EXPENSE Core non-interest income is a financial measure use by Peoples’ recurring non-interest revenue stream. This measure is non-US GAAP since it excludes the impact of all gains and/or losses, and core banking system conversion revenue waived.

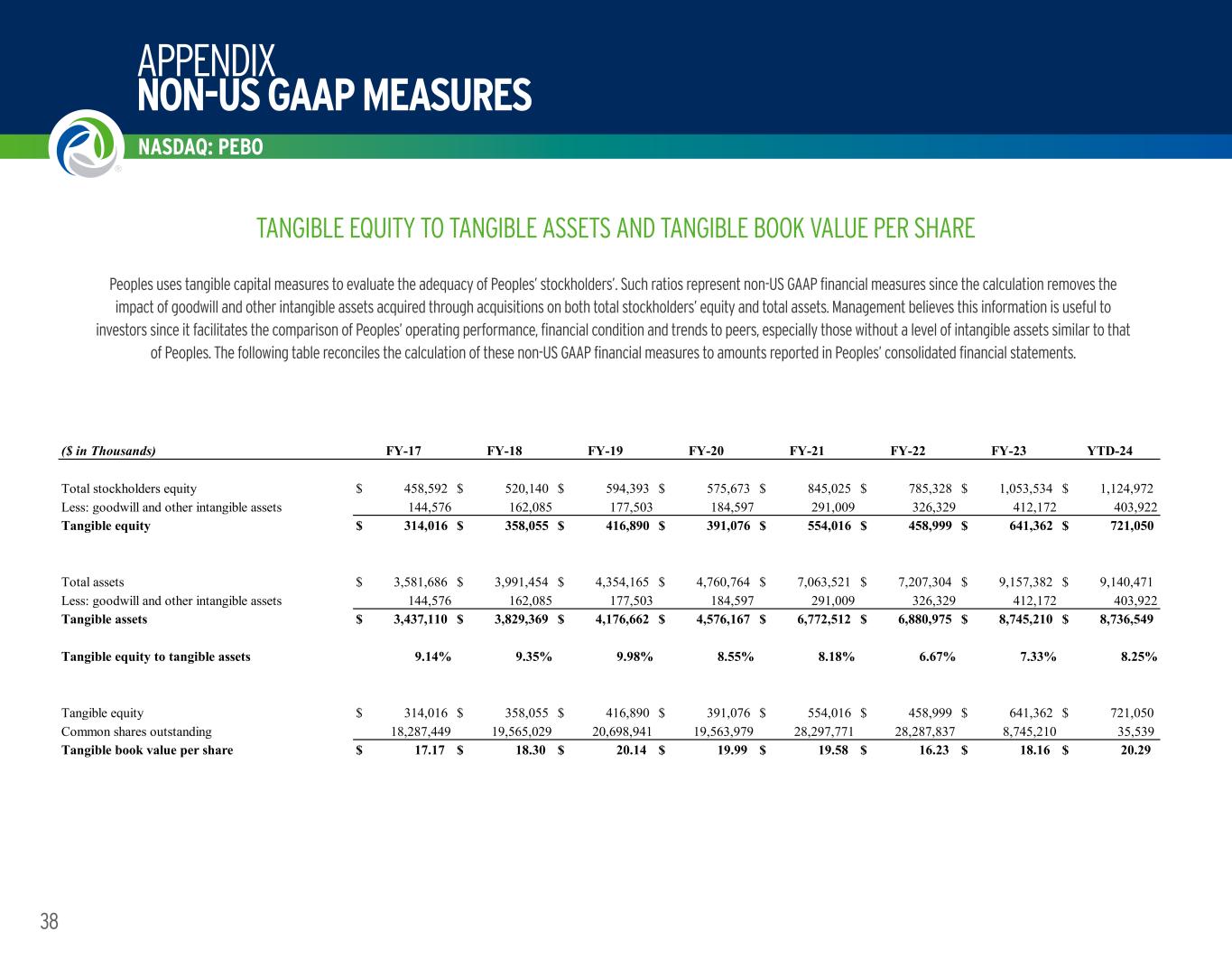

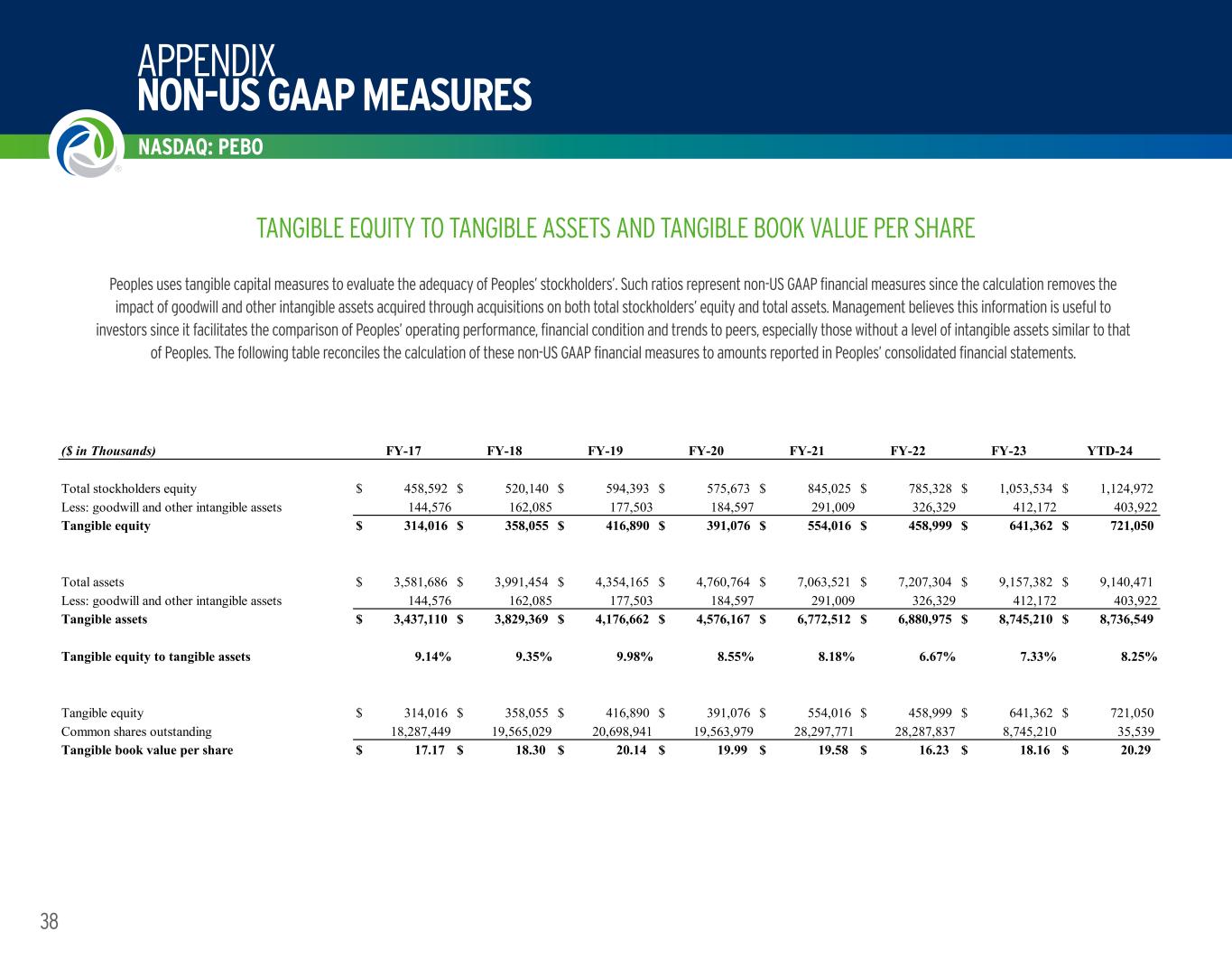

NASDAQ: PEBO APPENDIX NON-US GAAP MEASURES 38 TANGIBLE EQUITY TO TANGIBLE ASSETS AND TANGIBLE BOOK VALUE PER SHARE ($ in Thousands) FY-17 FY-18 FY-19 FY-20 FY-21 FY-22 FY-23 YTD-24 Total stockholders equity $ 458,592 $ 520,140 $ 594,393 $ 575,673 $ 845,025 $ 785,328 $ 1,053,534 $ 1,124,972 Less: goodwill and other intangible assets 144,576 162,085 177,503 184,597 291,009 326,329 412,172 403,922 Tangible equity $ 314,016 $ 358,055 $ 416,890 $ 391,076 $ 554,016 $ 458,999 $ 641,362 $ 721,050 Total assets $ 3,581,686 $ 3,991,454 $ 4,354,165 $ 4,760,764 $ 7,063,521 $ 7,207,304 $ 9,157,382 $ 9,140,471 Less: goodwill and other intangible assets 144,576 162,085 177,503 184,597 291,009 326,329 412,172 403,922 Tangible assets $ 3,437,110 $ 3,829,369 $ 4,176,662 $ 4,576,167 $ 6,772,512 $ 6,880,975 $ 8,745,210 $ 8,736,549 Tangible equity to tangible assets 9.14% 9.35% 9.98% 8.55% 8.18% 6.67% 7.33% 8.25% Tangible equity $ 314,016 $ 358,055 $ 416,890 $ 391,076 $ 554,016 $ 458,999 $ 641,362 $ 721,050 Common shares outstanding 18,287,449 19,565,029 20,698,941 19,563,979 28,297,771 28,287,837 8,745,210 35,539 Tangible book value per share $ 17.17 $ 18.30 $ 20.14 $ 19.99 $ 19.58 $ 16.23 $ 18.16 $ 20.29 Peoples uses tangible capital measures to evaluate the adequacy of Peoples’ stockholders’. Such ratios represent non-US GAAP financial measures since the calculation removes the impact of goodwill and other intangible assets acquired through acquisitions on both total stockholders’ equity and total assets. Management believes this information is useful to investors since it facilitates the comparison of Peoples’ operating performance, financial condition and trends to peers, especially those without a level of intangible assets similar to that of Peoples. The following table reconciles the calculation of these non-US GAAP financial measures to amounts reported in Peoples’ consolidated financial statements.

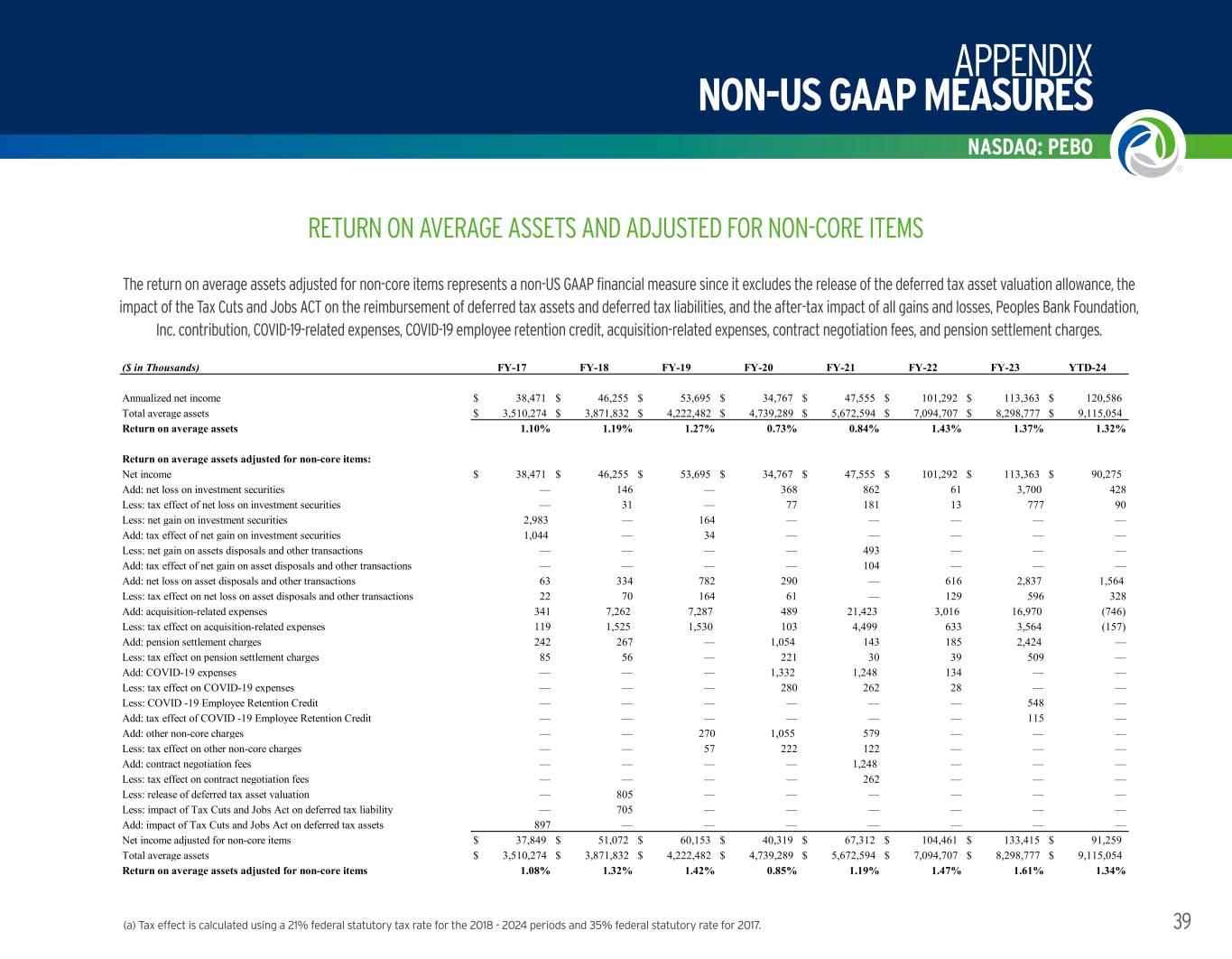

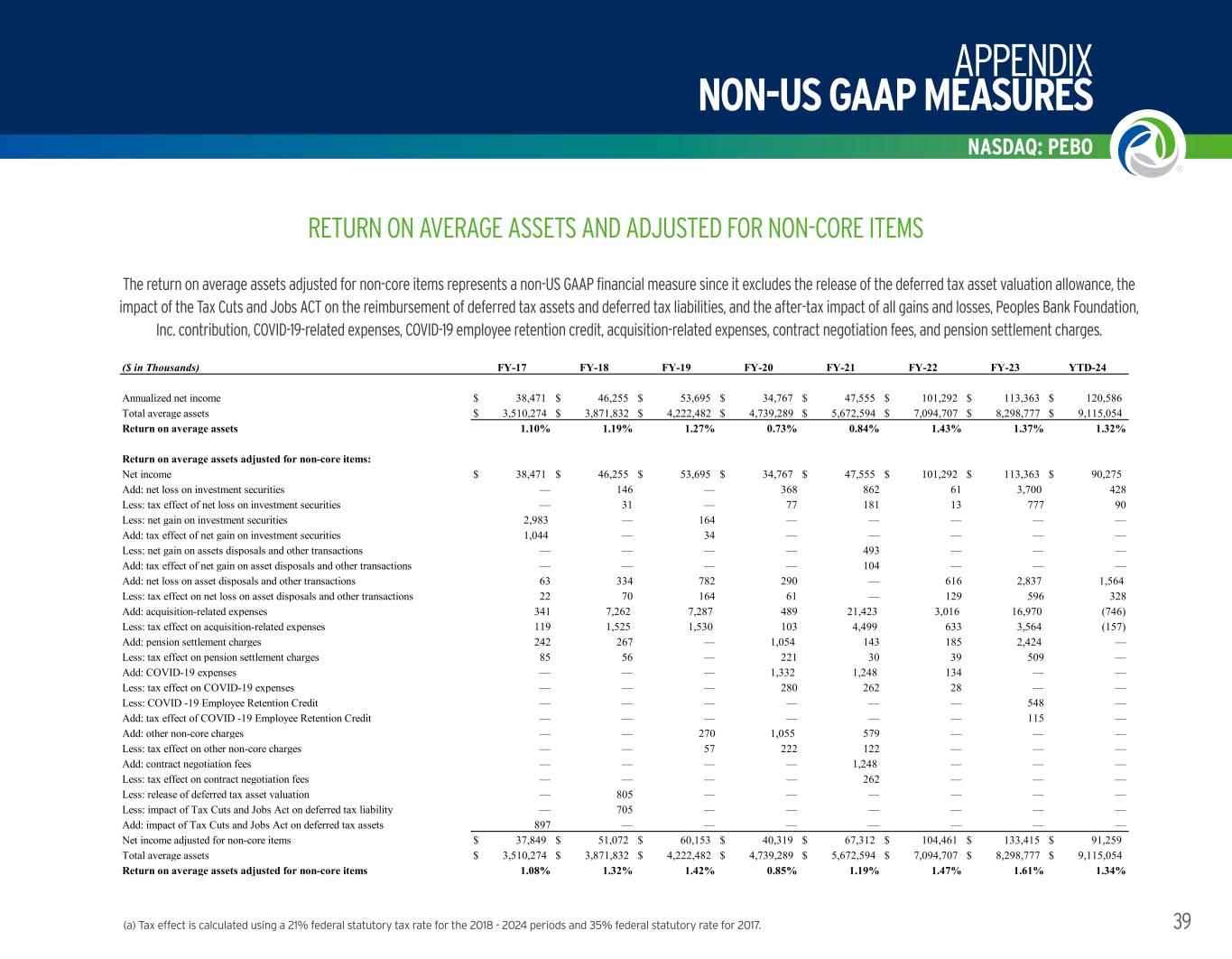

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO 39 Peoples uses tangible capital measures to evaluate the adequacy of Peoples’ stockholders’. Such ratios represent non-US GAAP financial measures since the calculation removes the impact of goodwill and other intangible assets acquired through acquisitions on both total stockholders’ equity and total assets. Management believes this information is useful to investors since it facilitates the comparison of Peoples’ operating performance, financial condition and trends to peers, especially those without a level of intangible assets similar to that of Peoples. The following table reconciles the calculation of these non-US GAAP financial measures to amounts reported in Peoples’ consolidated financial statements. (a) Tax effect is calculated using a 21% federal statutory tax rate for the 2018 - 2024 periods and 35% federal statutory rate for 2017. RETURN ON AVERAGE ASSETS AND ADJUSTED FOR NON-CORE ITEMS The return on average assets adjusted for non-core items represents a non-US GAAP financial measure since it excludes the release of the deferred tax asset valuation allowance, the impact of the Tax Cuts and Jobs ACT on the reimbursement of deferred tax assets and deferred tax liabilities, and the after-tax impact of all gains and losses, Peoples Bank Foundation, Inc. contribution, COVID-19-related expenses, COVID-19 employee retention credit, acquisition-related expenses, contract negotiation fees, and pension settlement charges. ($ in Thousands) FY-17 FY-18 FY-19 FY-20 FY-21 FY-22 FY-23 YTD-24 Annualized net income $ 38,471 $ 46,255 $ 53,695 $ 34,767 $ 47,555 $ 101,292 $ 113,363 $ 120,586 Total average assets $ 3,510,274 $ 3,871,832 $ 4,222,482 $ 4,739,289 $ 5,672,594 $ 7,094,707 $ 8,298,777 $ 9,115,054 Return on average assets 1.10% 1.19% 1.27% 0.73% 0.84% 1.43% 1.37% 1.32% Return on average assets adjusted for non-core items: Net income $ 38,471 $ 46,255 $ 53,695 $ 34,767 $ 47,555 $ 101,292 $ 113,363 $ 90,275 Add: net loss on investment securities — 146 — 368 862 61 3,700 428 Less: tax effect of net loss on investment securities — 31 — 77 181 13 777 90 Less: net gain on investment securities 2,983 — 164 — — — — — Add: tax effect of net gain on investment securities 1,044 — 34 — — — — — Less: net gain on assets disposals and other transactions — — — — 493 — — — Add: tax effect of net gain on asset disposals and other transactions — — — — 104 — — — Add: net loss on asset disposals and other transactions 63 334 782 290 — 616 2,837 1,564 Less: tax effect on net loss on asset disposals and other transactions 22 70 164 61 — 129 596 328 Add: acquisition-related expenses 341 7,262 7,287 489 21,423 3,016 16,970 (746) Less: tax effect on acquisition-related expenses 119 1,525 1,530 103 4,499 633 3,564 (157) Add: pension settlement charges 242 267 — 1,054 143 185 2,424 — Less: tax effect on pension settlement charges 85 56 — 221 30 39 509 — Add: COVID-19 expenses — — — 1,332 1,248 134 — — Less: tax effect on COVID-19 expenses — — — 280 262 28 — — Less: COVID -19 Employee Retention Credit — — — — — — 548 — Add: tax effect of COVID -19 Employee Retention Credit — — — — — — 115 — Add: other non-core charges — — 270 1,055 579 — — — Less: tax effect on other non-core charges — — 57 222 122 — — — Add: contract negotiation fees — — — — 1,248 — — — Less: tax effect on contract negotiation fees — — — — 262 — — — Less: release of deferred tax asset valuation — 805 — — — — — — Less: impact of Tax Cuts and Jobs Act on deferred tax liability — 705 — — — — — — Add: impact of Tax Cuts and Jobs Act on deferred tax assets 897 — — — — — — — Net income adjusted for non-core items $ 37,849 $ 51,072 $ 60,153 $ 40,319 $ 67,312 $ 104,461 $ 133,415 $ 91,259 Total average assets $ 3,510,274 $ 3,871,832 $ 4,222,482 $ 4,739,289 $ 5,672,594 $ 7,094,707 $ 8,298,777 $ 9,115,054 Return on average assets adjusted for non-core items 1.08% 1.32% 1.42% 0.85% 1.19% 1.47% 1.61% 1.34%

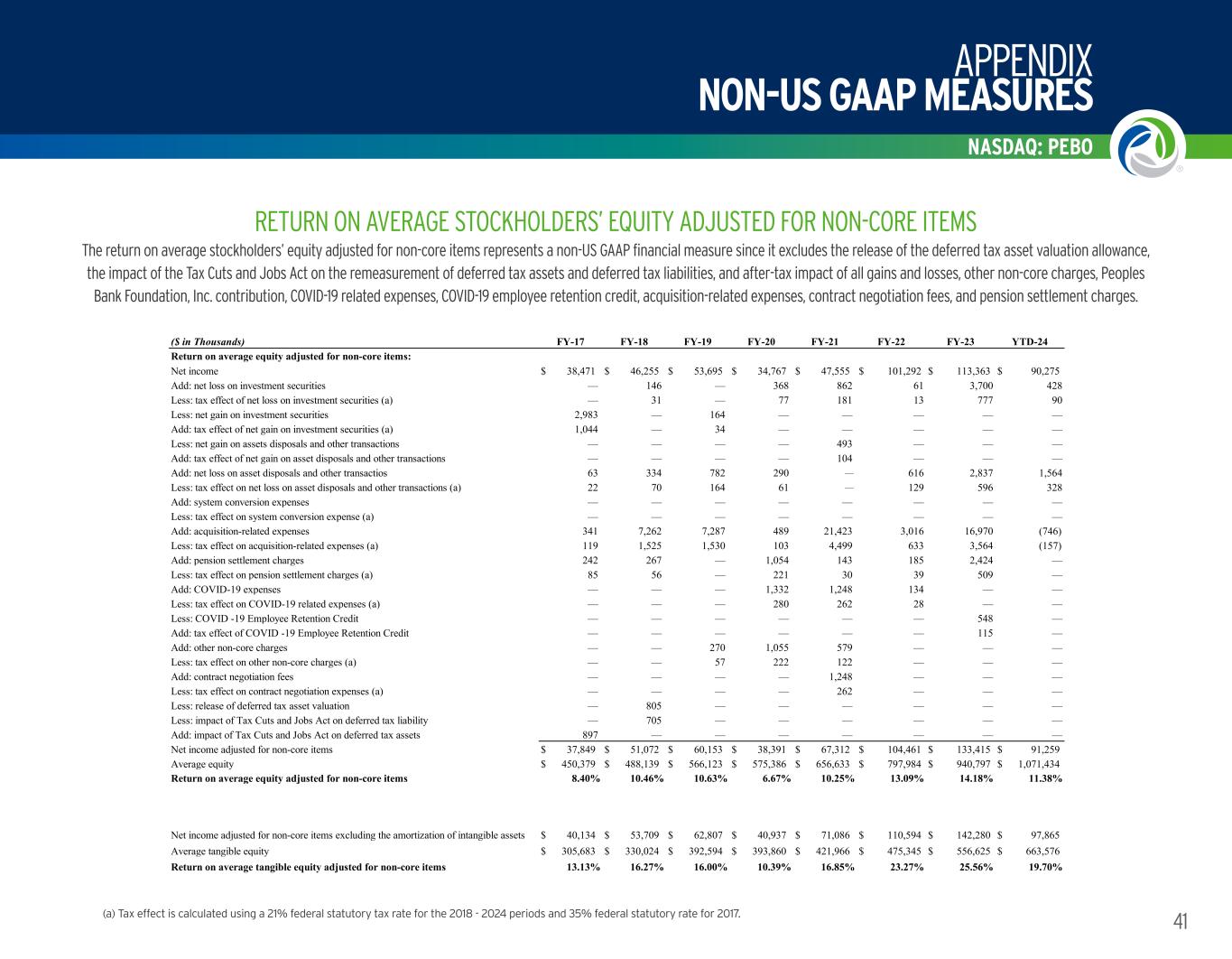

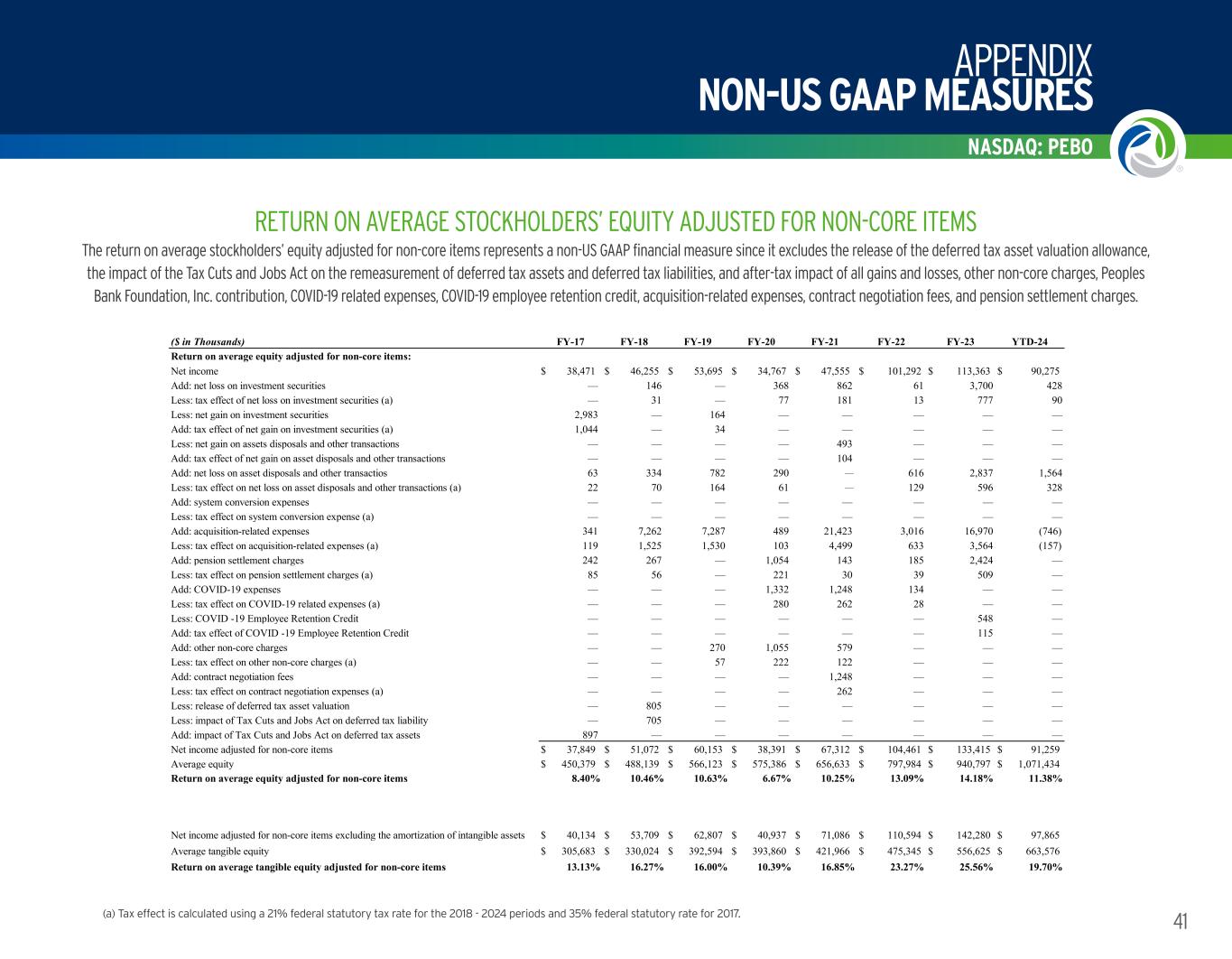

NASDAQ: PEBO APPENDIX NON-US GAAP MEASURES 40 (a) Tax effect is calculated using a 21% federal statutory tax rate for the 2018 - 2024 periods and 35% federal statutory rate for 2017. RETURN ON AVERAGE TANGIBLE STOCKHOLDERS’ EQUITY The return on average tangible stockholders’ equity ratio is a key financial measure used to monitor performance. It is calculated as net income (less after-tax impact of amortization of other intangible assets) divided by average tangible stockholders’ equity. This measure is non-US GAAP since that excludes the after-tax impact of amortization of other intangible assets from earnings and the impact of goodwill and other intangible assets acquired through acquisitions on total stockholders’ equity. ($ in Thousands) FY-17 FY-18 FY-19 FY-20 FY-21 FY-22 FY-23 YTD-24 Annualized net income $ 38,471 $ 46,255 $ 53,695 $ 34,767 $ 47,555 $ 101,292 $ 113,363 $ 120,586 Add: amortization of other intangible assets 3,516 3,338 3,359 3,223 4,775 7,763 11,222 8,361 Less: tax effect of amortization of other intangible assets (a) 1,231 701 705 677 1,003 1,630 2,357 1,756 Net income excluding the amortization of intangible assets $ 40,756 $ 48,892 $ 56,349 $ 34,770 $ 51,327 $ 107,425 $ 122,228 $ 127,191 Total average equity $ 450,379 $ 488,139 $ 566,123 $ 575,386 $ 656,633 $ 797,984 $ 940,797 $ 1,071,434 Less: average goodwill and other intangible assets 144,696 158,115 173,529 181,526 234,667 322,639 384,172 407,858 Average tangible equity $ 305,683 $ 330,024 $ 392,594 $ 393,860 $ 421,966 $ 475,345 $ 556,625 $ 663,576 Annualized net income $ 38,471 $ 46,255 $ 53,695 $ 34,767 $ 47,555 $ 101,292 $ 113,363 $ 120,586 Total average equity $ 450,379 $ 488,139 $ 566,123 $ 575,386 $ 656,633 $ 797,984 $ 940,797 $ 1,071,434 Return on average equity 8.54% 9.48% 9.48% 6.04% 7.24% 12.69% 12.05% 11.25% Annualized net income excluding the amortization of intangible assets $ 40,756 $ 48,892 $ 56,349 $ 37,313 $ 51,327 $ 107,425 $ 122,228 $ 129,409 Average tangible equity $ 305,683 $ 330,024 $ 392,594 $ 393,860 $ 421,966 $ 475,345 $ 556,625 $ 663,576 Return on average tangible equity 13.33% 14.81% 14.35% 9.47% 12.16% 22.60% 21.96% 19.50% ($ in Thousands) FY-17 FY-18 FY-19 FY-20 FY-21 FY-22 FY-23 YTD-24 Return on average equity adjusted for non-core items: Net income $ 38,471 $ 46,255 $ 53,695 $ 34,767 $ 47,555 $ 101,292 $ 113,363 $ 90,275 Add: net loss on investment securities — 146 — 368 862 61 3,700 428 Less: tax effect of net loss on investment securities (a) — 31 — 77 181 13 777 90 Less: net gain on investment securities 2,983 — 164 — — — — — Add: tax effect of net gain on investment securities (a) 1,044 — 34 — — — — — Less: net gain on assets disposals and other transactions — — — — 493 — — — Add: tax effect of net gain on asset disposals and other transactions — — — — 104 — — — Add: net loss on asset disposals and other transactios 63 334 782 290 — 616 2,837 1,564 Less: tax effect on net loss on asset disposals and other transactions (a) 22 70 164 61 — 129 596 328 Add: system conversion expenses — — — — — — — — Less: tax effect on system conversion expense (a) — — — — — — — — Add: acquisition-related expenses 341 7,262 7,287 489 21,423 3,016 16,970 (746) Less: tax effect on acquisition-related expenses (a) 119 1,525 1,530 103 4,499 633 3,564 (157) Add: pension settlement charges 242 267 — 1,054 143 185 2,424 — Less: tax effect on pension settlement charges (a) 85 56 — 221 30 39 509 — Add: COVID-19 expenses — — — 1,332 1,248 134 — — Less: tax effect on COVID-19 related expenses (a) — — — 280 262 28 — — Less: COVID -19 Employee Retention Credit — — — — — — 548 — Add: tax effect of COVID -19 Employee Retention Credit — — — — — — 115 — Add: other non-core charges — — 270 1,055 579 — — — Less: tax effect on other non-core charges (a) — — 57 222 122 — — — Add: contract negotiation fees — — — — 1,248 — — — Less: tax effect on contract negotiation expenses (a) — — — — 262 — — — Less: release of deferred tax asset valuation — 805 — — — — — — Less: impact of Tax Cuts and Jobs Act on deferred tax liability — 705 — — — — — — Add: impact of Tax Cuts and Jobs Act on deferred tax assets 897 — — — — — — — Net income adjusted for non-core items $ 37,849 $ 51,072 $ 60,153 $ 38,391 $ 67,312 $ 104,461 $ 133,415 $ 91,259 Average equity $ 450,379 $ 488,139 $ 566,123 $ 575,386 $ 656,633 $ 797,984 $ 940,797 $ 1,071,434 Return on average equity adjusted for non-core items 8.40% 10.46% 10.63% 6.67% 10.25% 13.09% 14.18% 11.38% Net income adjusted for non-core items excluding the amortization of intangible assets $ 40,134 $ 53,709 $ 62,807 $ 40,937 $ 71,086 $ 110,594 $ 142,280 $ 97,865 Average tangible equity $ 305,683 $ 330,024 $ 392,594 $ 393,860 $ 421,966 $ 475,345 $ 556,625 $ 663,576 Return on average tangible equity adjusted for non-core items 13.13% 16.27% 16.00% 10.39% 16.85% 23.27% 25.56% 19.70%

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO 41 RETURN ON AVERAGE STOCKHOLDERS’ EQUITY ADJUSTED FOR NON-CORE ITEMS (a) Tax effect is calculated using a 21% federal statutory tax rate for the 2018 - 2024 periods and 35% federal statutory rate for 2017. The return on average stockholders’ equity adjusted for non-core items represents a non-US GAAP financial measure since it excludes the release of the deferred tax asset valuation allowance, the impact of the Tax Cuts and Jobs Act on the remeasurement of deferred tax assets and deferred tax liabilities, and after-tax impact of all gains and losses, other non-core charges, Peoples Bank Foundation, Inc. contribution, COVID-19 related expenses, COVID-19 employee retention credit, acquisition-related expenses, contract negotiation fees, and pension settlement charges. ($ in Thousands) FY-17 FY-18 FY-19 FY-20 FY-21 FY-22 FY-23 YTD-24 Annualized net income $ 38,471 $ 46,255 $ 53,695 $ 34,767 $ 47,555 $ 101,292 $ 113,363 $ 120,586 Add: amortization of other intangible assets 3,516 3,338 3,359 3,223 4,775 7,763 11,222 8,361 Less: tax effect of amortization of other intangible assets (a) 1,231 701 705 677 1,003 1,630 2,357 1,756 Net income excluding the amortization of intangible assets $ 40,756 $ 48,892 $ 56,349 $ 34,770 $ 51,327 $ 107,425 $ 122,228 $ 127,191 Total average equity $ 450,379 $ 488,139 $ 566,123 $ 575,386 $ 656,633 $ 797,984 $ 940,797 $ 1,071,434 Less: average goodwill and other intangible assets 144,696 158,115 173,529 181,526 234,667 322,639 384,172 407,858 Average tangible equity $ 305,683 $ 330,024 $ 392,594 $ 393,860 $ 421,966 $ 475,345 $ 556,625 $ 663,576 Annualized net income $ 38,471 $ 46,255 $ 53,695 $ 34,767 $ 47,555 $ 101,292 $ 113,363 $ 120,586 Total average equity $ 450,379 $ 488,139 $ 566,123 $ 575,386 $ 656,633 $ 797,984 $ 940,797 $ 1,071,434 Return on average equity 8.54% 9.48% 9.48% 6.04% 7.24% 12.69% 12.05% 11.25% Annualized net income excluding the amortization of intangible assets $ 40,756 $ 48,892 $ 56,349 $ 37,313 $ 51,327 $ 107,425 $ 122,228 $ 129,409 Average tangible equity $ 305,683 $ 330,024 $ 392,594 $ 393,860 $ 421,966 $ 475,345 $ 556,625 $ 663,576 Return on average tangible equity 13.33% 14.81% 14.35% 9.47% 12.16% 22.60% 21.96% 19.50% ($ in Thousands) FY-17 FY-18 FY-19 FY-20 FY-21 FY-22 FY-23 YTD-24 Return on average equity adjusted for non-core items: Net income $ 38,471 $ 46,255 $ 53,695 $ 34,767 $ 47,555 $ 101,292 $ 113,363 $ 90,275 Add: net loss on investment securities — 146 — 368 862 61 3,700 428 Less: tax effect of net loss on investment securities (a) — 31 — 77 181 13 777 90 Less: net gain on investment securities 2,983 — 164 — — — — — Add: tax effect of net gain on investment securities (a) 1,044 — 34 — — — — — Less: net gain on assets disposals and other transactions — — — — 493 — — — Add: tax effect of net gain on asset disposals and other transactions — — — — 104 — — — Add: net loss on asset disposals and other transactios 63 334 782 290 — 616 2,837 1,564 Less: tax effect on net loss on asset disposals and other transactions (a) 22 70 164 61 — 129 596 328 Add: system conversion expenses — — — — — — — — Less: tax effect on system conversion expense (a) — — — — — — — — Add: acquisition-related expenses 341 7,262 7,287 489 21,423 3,016 16,970 (746) Less: tax effect on acquisition-related expenses (a) 119 1,525 1,530 103 4,499 633 3,564 (157) Add: pension settlement charges 242 267 — 1,054 143 185 2,424 — Less: tax effect on pension settlement charges (a) 85 56 — 221 30 39 509 — Add: COVID-19 expenses — — — 1,332 1,248 134 — — Less: tax effect on COVID-19 related expenses (a) — — — 280 262 28 — — Less: COVID -19 Employee Retention Credit — — — — — — 548 — Add: tax effect of COVID -19 Employee Retention Credit — — — — — — 115 — Add: other non-core charges — — 270 1,055 579 — — — Less: tax effect on other non-core charges (a) — — 57 222 122 — — — Add: contract negotiation fees — — — — 1,248 — — — Less: tax effect on contract negotiation expenses (a) — — — — 262 — — — Less: release of deferred tax asset valuation — 805 — — — — — — Less: impact of Tax Cuts and Jobs Act on deferred tax liability — 705 — — — — — — Add: impact of Tax Cuts and Jobs Act on deferred tax assets 897 — — — — — — — Net income adjusted for non-core items $ 37,849 $ 51,072 $ 60,153 $ 38,391 $ 67,312 $ 104,461 $ 133,415 $ 91,259 Average equity $ 450,379 $ 488,139 $ 566,123 $ 575,386 $ 656,633 $ 797,984 $ 940,797 $ 1,071,434 Return on average equity adjusted for non-core items 8.40% 10.46% 10.63% 6.67% 10.25% 13.09% 14.18% 11.38% Net income adjusted for non-core items excluding the amortization of intangible assets $ 40,134 $ 53,709 $ 62,807 $ 40,937 $ 71,086 $ 110,594 $ 142,280 $ 97,865 Average tangible equity $ 305,683 $ 330,024 $ 392,594 $ 393,860 $ 421,966 $ 475,345 $ 556,625 $ 663,576 Return on average tangible equity adjusted for non-core items 13.13% 16.27% 16.00% 10.39% 16.85% 23.27% 25.56% 19.70%

NASDAQ: PEBO APPENDIX NON-US GAAP MEASURES 42 THIS PAGE LEFT INTENTIONALLY BLANK

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO 43 THIS PAGE LEFT INTENTIONALLY BLANK

peoplesbancorp.com Peoples Bancorp® is a federally registered service mark of Peoples Bancorp Inc. The three arched ribbons logo is a federally registered service mark of Peoples Bank. Peoples Bank (w/logo)® is a federally registered service mark of Peoples Bank. Working Together. Building Success.® is a federally registered service mark of Peoples Bank. TYLER WILCOX President and Chief Executive Officer 740.373.7737 Tyler.Wilcox@pebo.com KATIE BAILEY Executive Vice President Chief Financial Officer and Treasurer 740.376.7138 Kathryn.Bailey@pebo.com