Exhibit 99.4

PJT Partners

PJT

Project Cipher

COUNTERPROPOSAL

June 14, 2016

Confidential

Confidential

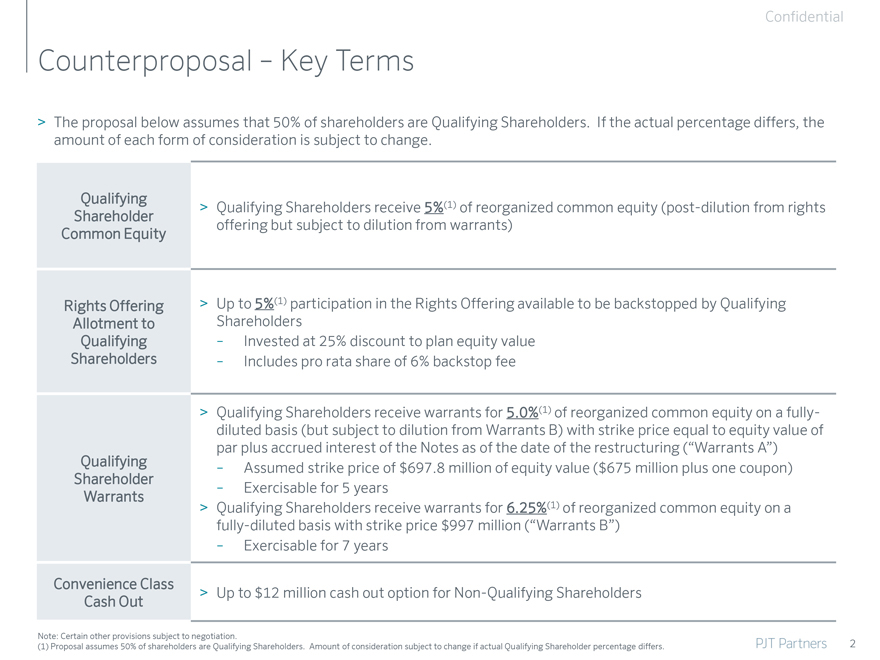

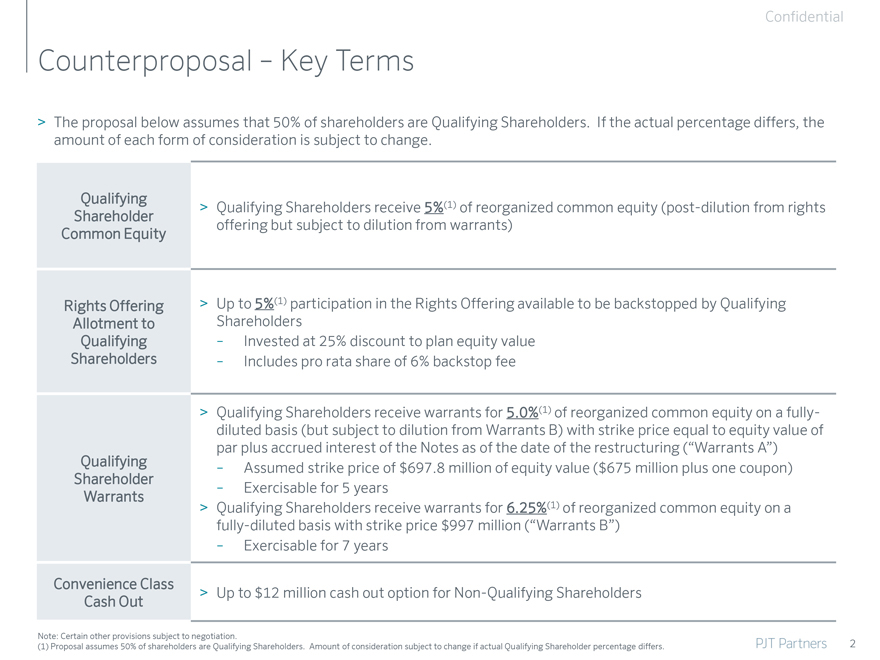

Counterproposal – Key Terms

> The proposal below assumes that 50% of shareholders are Qualifying Shareholders. If the actual percentage differs, the amount of each form of consideration is subject to change.

Qualifying

Shareholder > Qualifying Shareholders receive 5%(1) of reorganized common equity (post-dilution from rights

Common Equity offering but subject to dilution from warrants)

Rights Offering > Up to 5%(1) participation in the Rights Offering available to be backstopped by Qualifying

Allotment to Shareholders

Qualifying – Invested at 25% discount to plan equity value

Shareholders – Includes pro rata share of 6% backstop fee

> Qualifying Shareholders receive warrants for 5.0%(1) of reorganized common equity on a fully-

diluted basis (but subject to dilution from Warrants B) with strike price equal to equity value of

par plus accrued interest of the Notes as of the date of the restructuring (“Warrants A”)

Qualifying – Assumed strike price of $697.8 million of equity value ($675 million plus one coupon)

Shareholder

Warrants – Exercisable for 5 years

> Qualifying Shareholders receive warrants for 6.25%(1) of reorganized common equity on a

fully-diluted basis with strike price $997 million (“Warrants B”)

– Exercisable for 7 years

Convenience Class > Up to $12 million cash out option for Non-Qualifying Shareholders

Cash Out

Note: Certain other provisions subject to negotiation.

(1) Proposal assumes 50% of shareholders are Qualifying Shareholders. Amount of consideration subject to change if actual Qualifying Shareholder percentage differs. PJT Partners 2

Confidential

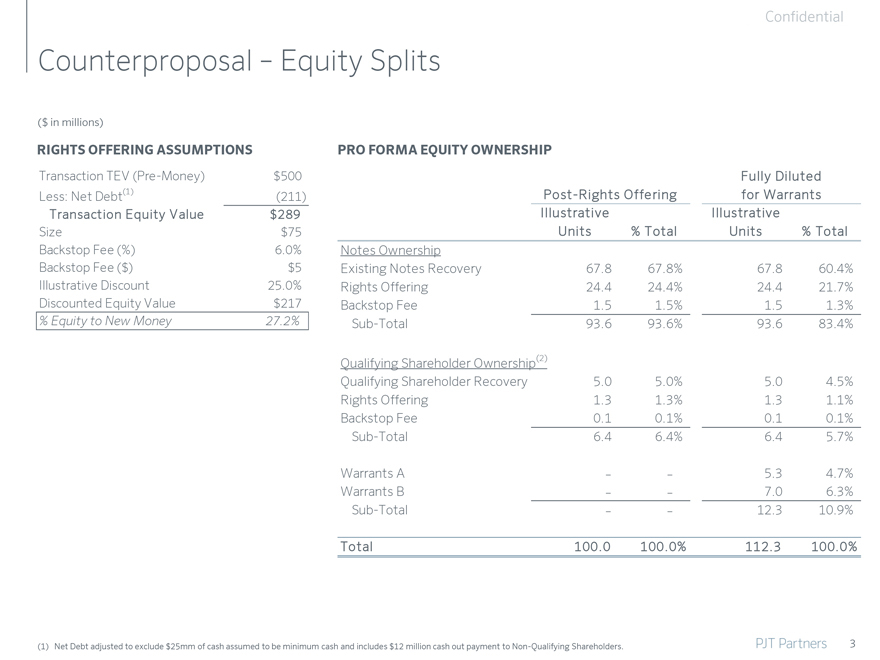

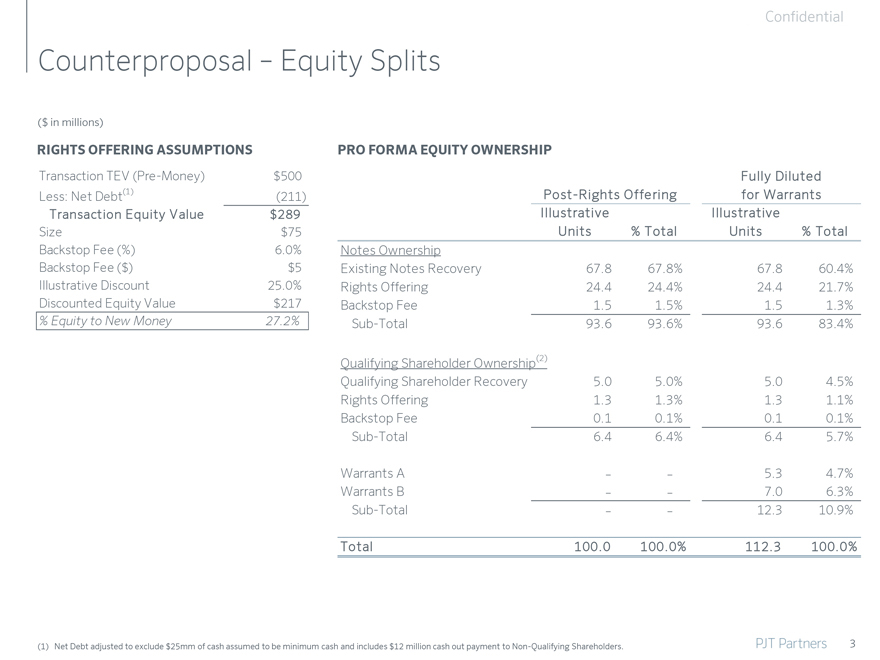

Counterproposal – Equity Splits

($ in millions)

RIGHTS OFFERING ASSUMPTIONS

Transaction TEV (Pre-Money) $500

Less: Net Debt(1) (211)

Transaction Equity Value $289

Size $75

Backstop Fee (%) 6.0%

Backstop Fee ($) $5

Illustrative Discount 25.0%

Discounted Equity Value $217

% Equity to New Money 27.2%

PRO FORMA EQUITY OWNERSHIP

Fully Diluted

Post -Rights Offering for Warrants

Illustrative Illustrative

Units % Total Units % Total

Notes Ownership

Existing Notes Recovery 67.8 67.8% 67.8 60.4%

Rights Offering 24.4 24.4% 24.4 21.7%

Backstop Fee 1.5 1.5% 1.5 1.3%

Sub-Total 93.6 93.6% 93.6 83.4%

Qualifying Shareholder Ownership(2)

Qualifying Shareholder Recovery 5.0 5.0% 5.0 4.5%

Rights Offering 1.3 1.3% 1.3 1.1%

Backstop Fee 0.1 0.1% 0.1 0.1%

Sub-Total 6.4 6.4% 6.4 5.7%

Warrants A – – 5.3 4.7%

Warrants B – – 7.0 6.3%

Sub-Total – – 12.3 10.9%

Total 100.0 100.0% 112.3 100.0%

(1) Net Debt adjusted to exclude $25mm of cash assumed to be minimum cash and includes $12 million cash out payment to Non-Qualifying Shareholders. PJT Partners 3