IRIS International, Inc. ® 2007 Investor’s Conference 2007 Investor’s Conference Five-Year Long Range Plan 2007 - Five-Year Long Range Plan 2007 - 2011 2011 Metropolitan Club, New York, NY Metropolitan Club, New York, NY César M. García, President & CEO Thomas Adams PhD, Corporate VP, CTO Thomas Warekois, Corporate VP, President Iris Diagnostics 04.10.07 Exhibit 99.2 |

® 2 Safe Harbor Provision Safe Harbor Provision This presentation contains forward-looking statements made in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, the Company’s views on future financial performance, market growth, capital requirements, new product introductions and acquisitions, and are generally identified by phrases such as “thinks,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” ,“plans,” and similar words. Forward-looking statements are not guarantees of future performance and are inherently subject to uncertainties and other factors which could cause actual results to differ materially from the forward-looking statement. These statements are based upon, among other things, assumptions made by, and information currently available to, management, including management’s own knowledge and assessment of the Company’s industry, R&D initiatives, competition and capital requirements. Other factors and uncertainties that could affect the Company’s forward-looking statements include, among other things, the following: identification of feasible new product initiatives, management of R&D efforts and the resulting successful development of new products and product platforms; acceptance by customers of the Company’s products; integration of acquired businesses; substantial expansion of international sales; reliance on key suppliers; the potential need for changes in long-term strategy in response to future developments; future advances in diagnostic testing methods and procedures; potential changes in government regulations and healthcare policies, both of which could adversely affect the economics of the diagnostic testing procedures automated by the Company’s products; rapid technological change in the microelectronics and software industries; and competitive factors, including pricing pressures and the introduction by others of new products with similar or better functionality than our products. These and other risks are more fully described in the Company’s filings with the Securities and Exchange Commission, including the Company’s most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q, which should be read in conjunction herewith for a further discussion of important factors that could cause actual results to differ materially from those in the forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. |

® 3 Agenda Agenda • Strategic Overview C. Garcia • Technology Plans T. Adams • Commercialization Plans T. Warekois • Summary C. Garcia • Q&A |

® Strategic Overview |

® 5 Iris Product Evolution Iris Product Evolution 2002-2006 2002-2006 Urine Chemistry Urine Microscopy Yr. 2002 Body Fluids Urine Chemistry Urine Microscopy Yr. 2006 Body Fluids IRIS re-defined the urinalysis test paradigm! |

® 6 Fundamentals of Our Next Stage of Fundamentals of Our Next Stage of High Growth High Growth • Continue to re-define other diagnostics (IVD) practices in related market disciplines – Increasing clinical utility – Consolidating functionalities /automation theme – Follow the “Chain of Treatment” – Address high value applications • Capitalize on “call-point” synergies • Leverage key technological advantages • Critical Mass: Capitalize on economies of scale – Manufacturing, distribution, service, etc. • Deployment of know-how beyond urinalysis segment • Reduce risks |

® 7 Prevalent “Call-Point” Prevalent “Call-Point” Synergies Synergies • US Urinalysis Hematology • EX- US Urinalysis Microbiology Hematology |

® 8 3 GM Platform Themes 3 GM Platform Themes Third Generation Morphology Platform • Improved imaging – Morphological signatures translate into increased clinical utility • High sensitivity & specificity • Expanded test Menu • Automation & test consolidation Urine Microscopy Hematology Body Fluids |

® 9 IRIS: Planned IRIS: Planned Portfolio by 2011 Portfolio by 2011 PRODUCT PORTFOLIO Urinalysis Hematology Ultra Sensitive Detection Sample Processing Centrifuges DNA Hybridizers PSA CEC HIV Breast Cancer Routine CBC Cell Morphology Body Fluids Diff Urine Chemistry Urine Microscopy Culture Screening |

® 10 Broad Enabling Technology & Know-how Broad Enabling Technology & Know-how CORE TECHNOLOGY Urinalysis Bacteria 3 GM NADIA Dry Chemistry X Wet Chemistry X X X Imaging X X X Bubble Technology X X Immuno-PCR X Automated Particle Recognition X X X PRODUCT PLATFORMS |

® 11 IRIS Target Market Opportunity IRIS Target Market Opportunity Grows to $3.9 Billion Grows to $3.9 Billion ($ in millions) $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2005 Future Hematology HIV Oncology Urine Culture Urine Chemistry Urine Microscopy |

IRIS International, Inc. ® IRIS Technology & Product Portfolio IRIS Technology & Product Portfolio Thomas Adams, PhD Corporate VP & CTO |

® 13 2007 - 2007 - 2011 2011 Product & Technology Portfolio Product & Technology Portfolio ENABLING TECHNOLOGY PORTFOLIO Chemistry Platform NADIA Centrifugation Applications / FISH Bubble Technology 3rd Gen. Flow Microscopy PRODUCT PORTFOLIO Urinalysis Hematology Ultra-Sensitive Detection Applications Sample Processing |

® 14 Product & Technology Portfolio Product & Technology Portfolio ENABLING TECHNOLOGY PORTFOLIO Chemistry Platform NADIA Centrifugation Applications / FISH Bubble Technology 3rd Gen. Flow Microscopy PRODUCT PORTFOLIO Urinalysis Hematology Ultra-Sensitive Detection Applications Sample Processing |

® 15 Iris Chemistry Program Iris Chemistry Program • Iris is producing products, adding distribution channels, and developing programs to displace competitors in all market segments: – iChem fully automated urine chemistry analyzer – iChem100 semi-automated urine chemistry analyzer with iConnect – iChem CLIA waived hand-held urine chemistry analyzer – vChem – visual UA strip Urinalysis iChem AUTO (unveiling soon) |

® 16 Urinalysis Iris Chemistry Program Milestones Iris Chemistry Program Milestones • iChem AUTO – FDA 510(k) Submission Q2-07 – International Launch Q3-07 – 1 st Commercial Shipment Q4-07 • iChem CLIA-Waived – FDA 510(k) Submission Q1-08 – Global Launch Q2-08 – 1 st Commercial Shipment Q2-08 iChem AUTO (unveiling soon) |

® 17 Morphology Morphology • The science of cell form and structure • IRIS has developed a franchise in urine microscopy capitalizing on the iQ200’s imaging capabilities • A natural expansion into hematology Urinalysis Hematology |

® 18 Hematology 3 GM Platform Technology 3 GM Platform Technology 3 rd Gen. Flow Microscope Improved Urine Microscopy Body Fluids Hematology Urinalysis |

® 19 Iris History in Hematology Iris History in Hematology The White Iris Leukocyte Differential Analyzer • White blood cells • Normal five subtypes plus immature cells • A nine part differential! - The most comprehensive white cell differential analyzer with FDA clearance (1996) • Built ten prototypes 1994 • Product abandoned due to lack of funding and very high manufacturing costs • Market survey-- high interest in combined system: CBC plus expanded differential with imaging Hematology |

® 20 Hematology Statistics Hematology Statistics • These results suggest that most CBCs are accompanied by a differential performed by the primary analyzer • A significant percentage require manual review after the automated CBC/ Diff test Hematology Number of CBC and Automated Differential Blood Cell Count in the US in 2001 (millions) CBCs CBCs with "auto differentials" Hospitals 245 208 Reference Laboratories 132 121 |

® 21 Clinical Need Clinical Need Hematology |

® 22 Manual Blood Smear Review Manual Blood Smear Review Hematology |

® 23 Reasons for Manual Blood Scan Reasons for Manual Blood Scan Hematology |

® 24 Hematology Reimbursements Hematology Reimbursements • Automated CBC with WBC differential $10.86 • Automated WBC and differential $ 9.04 • Blood Smear with WBC and differential $ 4.81 Hematology The 3GM Platform enables expansion into higher value testing. |

® 25 Cell Morphology Cell Morphology Number of Manual Differential Blood Cell Counts US Only • In 2001, in hospitals there were 51.2 million manual differentials performed • In reference laboratories, there were 10.7 million differentials performed Hematology The 3GM Platform enables expansion into a market three times bigger than urinalysis |

® 26 Changing the Hematology Test Paradigm Changing the Hematology Test Paradigm CBC Analyzer Slide Maker Stainer Yr. 2007 Manual Morphology Analysis CBC with Expanded WBC Diff “Virtual” Slide Yr. 2010 Automated Morphology Analysis IRIS image-based Third Generation Morphology (3GM)Platform! Hematology |

® 27 Morphology Morphology Normal blood film Hematology |

® 28 Morphology Morphology Normal and Abnormal Lymphocyte Hematology |

® 29 Today: Capitalize on the 3GM Platform Today: Capitalize on the 3GM Platform • Advances in electronics & optics: – High speed color cameras with high resolution are affordable – Computers, data transfer rates, memory all significantly improved and cheaper • iQ200 platform is a proven reliable platform • Iris established as leader in morphology, using proprietary automated particle recognition • Expanded Iris R &D team has experience to design and develop this new product • Economies of scale & manufacturing competencies • A combined hematology, urinalysis, body fluids platform Urine Microscopy Hematology Body Fluids |

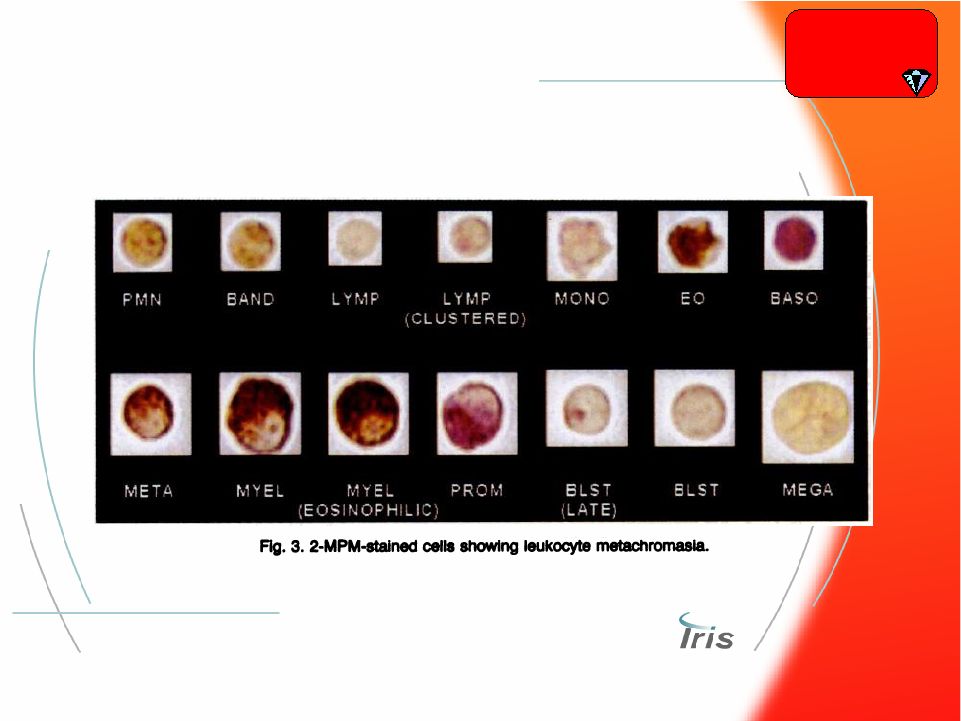

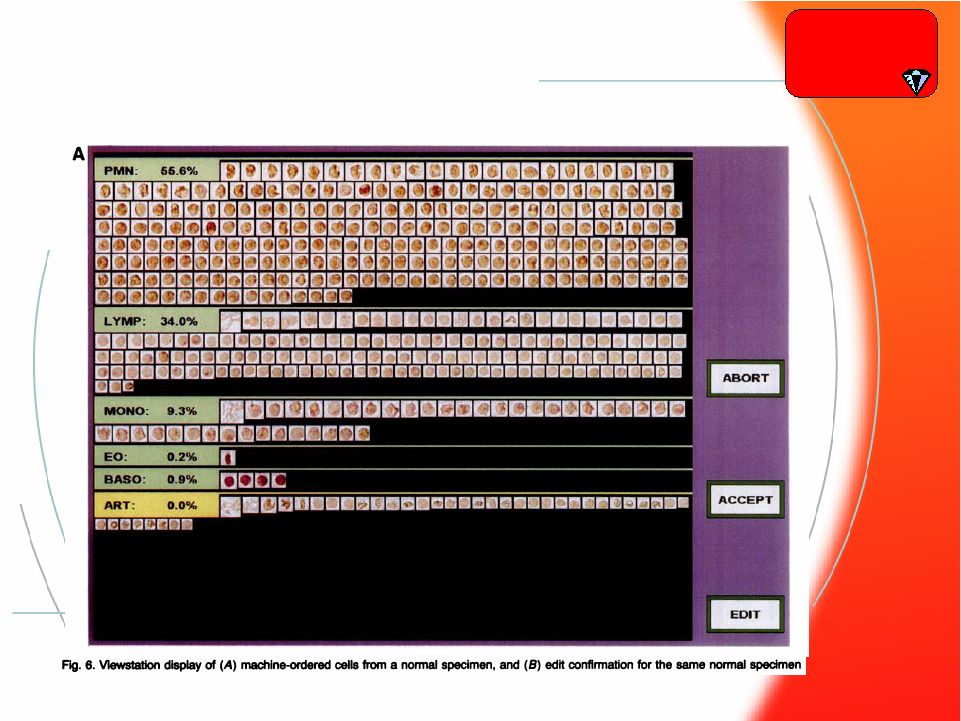

® 30 What did The White IRIS show? Hematology |

® 31 Quantifying Morphological Signatures Quantifying Morphological Signatures Colors to numbers – How? Hematology |

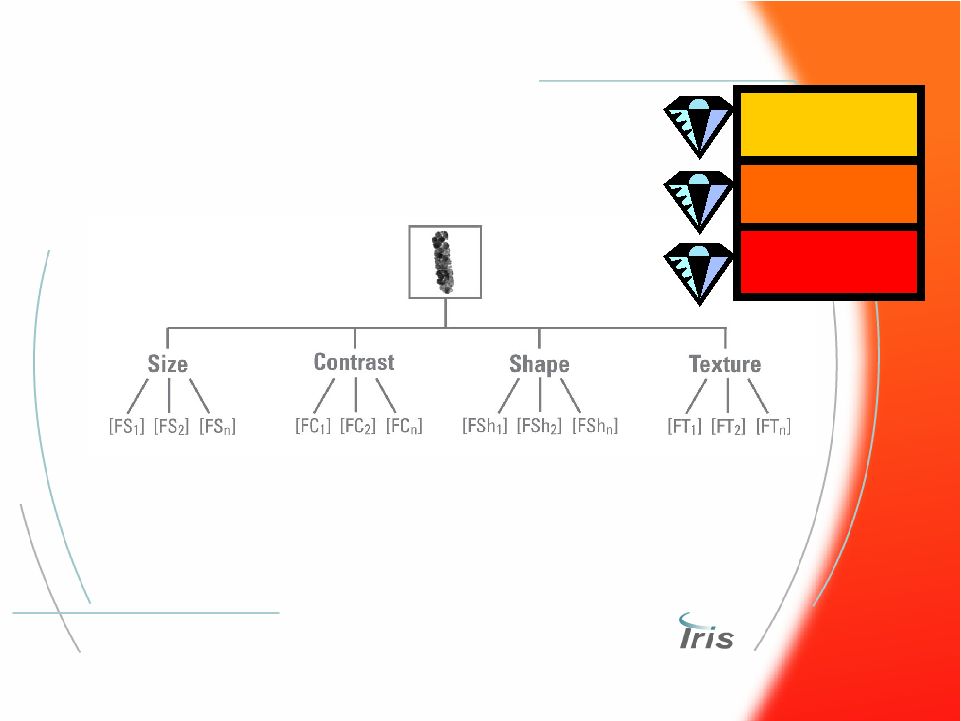

® 32 Automated Image Analysis Processing Automated Image Analysis Processing Feature Extraction • Each isolated particle is analyzed for specific features • Each feature is analyzed using a series of algorithms • Features of each particle are converted to numerical values Urine Microscopy Hematology Body Fluids |

® 33 IRIS White Cell Auto-recognition IRIS White Cell Auto-recognition Hematology |

® 34 Molecular Diagnostics Molecular Diagnostics Two New Platform Technologies • Platform technologies work together to enable monitoring of disease to extremely low concentrations – Nucleic Acid Detection Immuno Assay (NADIA) – Isolation and concentration of molecules of interest using albumin-coated micro bubbles • Higher sensitivity enables early detection of relapse • Superior patient monitoring of disease will enable better therapeutic outcomes Bubble Isolation Technology NADIA Ultra Sensitive Detection |

® 35 • A method for early detection of relapse of cancer and HIV • Test kits utilize real-time PCR instruments – Large installed base of ~3,000 worldwide • Femtogram/ml capability • Applicable to multiple high value applications in large market segments PCR instrumentation ImmunoAssay Nucleic Acid Testing NADIA NADIA Nucleic Acid Detection ImmunoAssay Ultra Sensitive Detection |

RNA Proteins Modified Proteins DNA Biological Function Transcription Translation Post-Translation Modification 30,000 Genes > 500,000 Proteins Proteins Are Critical to Understanding Proteins Are Critical to Understanding Disease Disease Genome Transcriptome Proteome x 5 to 50 functional links per protein Ultra Sensitive Detection |

® 37 Detection of Proteins in Blood Detection of Proteins in Blood • There are >250,000 proteins in blood • 95% are below current detection limits • Sensitivity as low as 1,000 molecules • NADIA enables detection of >95% proteins • NADIA can detect fg/ml concentrations, which is much more sensitive than conventional assays Ultra Sensitive Detection |

® 38 Product Pipeline Product Pipeline • PSA - monitoring after prostatectomy • Bacteria and yeast - isolation and concentration in urine • Circulating epithelial cells - isolation and concentration in blood • HIV viral load - monitoring at current undetectable levels • HER-2/Neu - monitoring after lumpectomy /mastectomy Ultra Sensitive Detection |

® 39 NADIA PSA NADIA PSA 10(7) 10(0) 0 0 Molecules/ml Readout Time PSA Concentration in Relapse EIA NADIA Ultra Sensitive Detection |

® 40 NADIA PSA - NADIA PSA - Capabilities Capabilities Ultra Sensitive Detection • FDA 510(k) submitted 2/7/2007 • Next step is reverse outcome study |

® 41 Circulating Epithelial Cells Circulating Epithelial Cells • Breast, prostate, colon, lung, and pancreatic cancers are epithelial cell cancers (carcinomas) • Cells from these cancers circulate in blood in all stages of disease • Cells can be isolated and identified • Markers can be measured to guide therapy Ultra Sensitive Detection |

® 42 HIV: Viral Load HIV: Viral Load • Viral load tests measure amount of HIV RNA • Along with CD4 cell count, most valuable measure for predicting HIV disease progression • Current HIV RNA sensitivity to 50 copies/ml • Two RNA molecules per virion (the complete virus particle, structurally intact and infectious) • 75% of patients on HAART therapy have levels below detection limits of current technology • NADIA p24 expected to have 25X better sensitivity • Ability to see upward and downward trend at current undetectable levels 2,000 p24 molecules per virion Ultra Sensitive Detection |

® 43 Breast Cancer: Breast Cancer: Her-2/neu Marker • HER-2/neu is as prognostic marker to determine how aggressive a breast cancer tumor is • Approximately one-third of breast cancers have too many copies • Today, IHC tests are performed on cancer tissue • IRIS technology provides for a blood-based alternative • Isolate and phenotype Her-2/neu concentration per cell • Provide physicians with valuable information – Patients who are relapsing and may be responsive to antibody therapy, Herceptin® Ultra Sensitive Detection |

® 44 Bubble Isolation Technology Bubble Isolation Technology • Bubbles made from human albumin are 2-5 microns in size • Bubbles are coated with antibodies to recognize specific cell types • Bubbles bind to target cells and rise to the surface simultaneously purifying and concentrating cells • Bubbles can be made to disappear |

Bacteria Concentration - Bacteria Concentration - Proof of Concept Proof of Concept Capture of E. coli on Albumin (HSA) Bubbles BUBBLES 0.1 ml (~5E 6) + BACTERIA E. coli 1 ml (~5E³ cells) Sterile undernate Flotate Gentle agitation X minutes |

® 46 A Negative Predictor for Bacteriuria A Negative Predictor for Bacteriuria Fluorescent Bacteria E.coli Staph. aureus |

® 47 IMD R & D Milestones Test Indication Expected FDA Submission PSA Monitoring PSA levels after prostatectomy Filed 510(k) on 2/7/07 Isolation Technology - Bacteria and Yeast Urinary tract infections Collaborative program with Iris Diagnostics Isolation Technology - Circulating Epithelial Cells Detection of epithelial cells File de novo 510k in 2007 HIV Viral Load Monitoring HIV Viral Load during HAART therapy File PMA in 2008 Her-2/neu Monitoring breast cancer after mastectomy/lumpectomy File PMA in 2009 Ultra Sensitive Detection |

® 48 Product Launch Plan Product Launch Plan Product 2007 2008 2009 2010 2011 iChem AUTO X iChem CLIA X Express 4 Centrifuge X NADIA PSA X NADIA CEC X Bacteriuria NP X 3 GM Urinalysis X 3 GM Hematology X NADIA HIV X NADIA Breast X 1st Commercial Shipment |

IRIS International, Inc. ® Executing Commercial Excellence Executing Commercial Excellence PRODUCT PORTFOLIO Urinalysis Hematology Ultra-Sensitive Detection Applications Thomas Warekois Corporate VP & President IRIS Diagnostics 04.10.07 |

® 50 Executing Commercial Excellence Executing Commercial Excellence • Urinalysis market leadership and growth – Increasing installed base and recurring revenue stream – Expanding body fluids applications – New urine chemistry system introductions – Automated urine chemistry/microscopy workcells – Future application targeted to improving bacterial screening efficiency Urinalysis |

® 51 Executing Commercial Excellence Executing Commercial Excellence • Introduction of a new hematology paradigm – Automated morphology capabilities – Expanded cell analysis – Platform consolidation Hematology |

® 52 Executing Commercial Excellence Executing Commercial Excellence • Commercialization of NADIA based tests – Initial focus on ultra-sensitive PSA in post- surgical application – Pipeline prioritization balanced between impact to patient care and market opportunity – Expected use of collaborations to drive revenues Ultra Sensitive Detection |

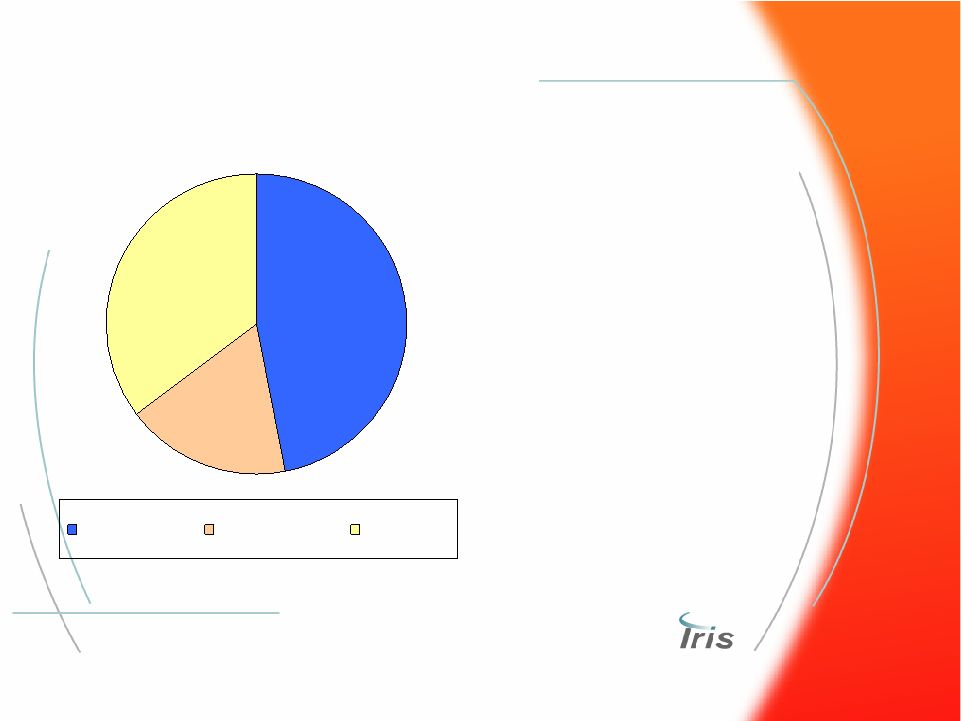

® 53 2006 Global Urinalysis Market 2006 Global Urinalysis Market Urine Chemistry Urine Microscopy Urine Culture • Overall market growing at 3% with microscopy at ~15% • Microscopy analysis still highly manual (60%) • Demand for automation in lab-based sector linking urine chemistry and microscopy • Physician office based urine chemistry can benefit from instrumentation • Urine culture workflow improvements could improve chain of treatment $900 Million Market $300 MM $400 MM $200 MM |

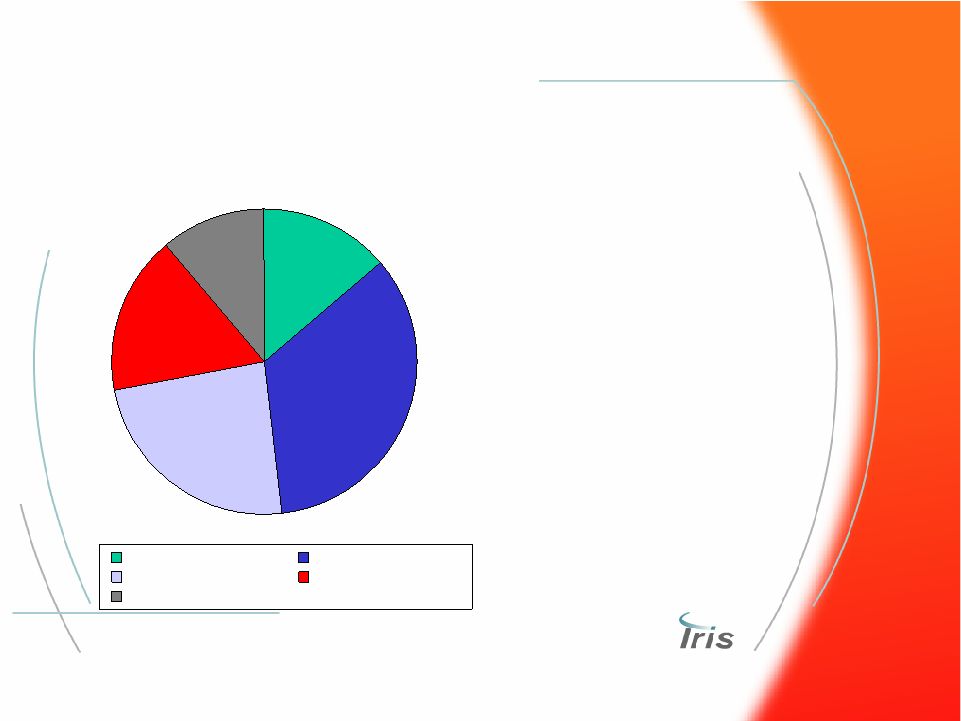

® 54 Global Hematology Market ($1.8 Bln) Global Hematology Market ($1.8 Bln) Siemens Beckman Coulter Sysmex Abbott Others • Market growing at 4% • Key drivers is automation linking separate cell analysis, slide making and slide imaging • Software algorithms increasing sophistication of analysis • Population of >30,000 systems • Annual global purchases of ~5,000 CBC/Diff systems 2006 Market Shares 17% 11% 14% 34% 24% |

® 55 Reaching Lab-Based Customers Reaching Lab-Based Customers • Purchases driven by similar business models, demands and decision criteria • Customer base fits well with direct sales and key country distributor model – Reference lab networks/GPO/IDN – Synergies with sales, service and support – Value of hematology partner to accelerate market access under evaluation • Consideration of additional direct country sales models based on achievement of critical mass populations Unique value propositions with IRIS expertise in morphology analysis and “bubble technology” Urinalysis Hematology |

® 56 Molecular Diagnostics Molecular Diagnostics • $2.0 billion market worldwide • Most testing currently for infectious diseases • Fast growing IVD segment with 20% growth over the next five years – Increasing number of new oncology tests with emphasis on early detection – Growth in existing infectious disease testing associated with new therapies • Critical diagnostic discipline for improving patient care Ultra Sensitive Detection |

® 57 IRIS NADIA Opportunity IRIS NADIA Opportunity Improved Patient Diagnostics • Market approach must recognize critical success factors – Clear definition of medical need and clinical response – Aligned regulatory strategy – Support of key opinion leaders and appropriate scientific publications – Critical mass “noise” levels to communicating benefits to the laboratory, practicing clinicians and patients (advocacy groups) – Support for test introduction into the laboratory Ultra Sensitive Detection |

® 58 Iris NADIA Opportunities Iris NADIA Opportunities The Commercial Roadmap Develop Proof of Principle and initial scientific publications Initial commercialization through specialty lab partnerships or alliances Mid-term commercialization through alliances with specific diagnostics companies or pharmaceutical companies Implement regional regulatory, reimbursement and promotional strategies with partner(s) Commercialize specific test as enhancement to existing panels and testing protocols Execute on out-licensing opportunities Ultra Sensitive Detection |

® 59 IRIS Target Market Opportunity IRIS Target Market Opportunity Grows to $3.9 Billion Grows to $3.9 Billion ($ in millions) $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2005 Future Hematology HIV Oncology Urine Culture Urine Chemistry Urine Microscopy |

® 60 IRIS Five-Year Plan Summary IRIS Five-Year Plan Summary • Broad pipeline – Innovative products – Disrupting conventional laboratory practices – Maximizing application of core competencies / reducing risks • The expanded capabilities and synergies between Molecular Diagnostics Group and other IRIS R&D groups are yielding significant benefits to IRIS • Capitalizing on track record and know-how • R&D funding is within IRIS financial capabilities • New products opportunities addressing expanded relevant market approaching $4.0 billion • Licensing and joint venture opportunities • GOAL: Grow IRIS to 3X current size in 5 years (~$250MM) |

® 61 |

® 62 |