Analyst’s Day Presentation Anaheim, CA July 28, 2010 Analyst’s Day Presentation Anaheim, CA July 28, 2010 César M. García - Moderator Chairman, President & Chief Executive Officer (NASDAQ GM: IRIS) César M. García - Moderator Chairman, President & Chief Executive Officer (NASDAQ GM: IRIS) Exhibit 99.1 |

Safe Harbor Provision This presentation contains forward-looking statements made in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, the Company’s views on future financial performance, market growth, capital requirements, new product introductions and acquisitions, and are generally identified by phrases such as “thinks,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” ,“plans,” and similar words. Forward-looking statements are not guarantees of future performance and are inherently subject to uncertainties and other factors which could cause actual results to differ materially from the forward-looking statement. These statements are based upon, among other things, assumptions made by, and information currently available to, management, including management’s own knowledge and assessment of the Company’s industry, R&D initiatives, competition and capital requirements. Other factors and uncertainties that could affect the Company’s forward-looking statements include, among other things, the following: identification of feasible new product initiatives, management of R&D efforts and the resulting successful development of new products and product platforms; acceptance by customers of the Company’s products; integration of acquired businesses; substantial expansion of international sales; reliance on key suppliers; the potential need for changes in long-term strategy in response to future developments; future advances in diagnostic testing methods and procedures; potential changes in government regulations and healthcare policies, both of which could adversely affect the economics of the diagnostic testing procedures automated by the Company’s products; rapid technological change in the microelectronics and software industries; and competitive factors, including pricing pressures and the introduction by others of new products with similar or better functionality than our products. These and other risks are more fully described in the Company’s filings with the Securities and Exchange Commission, including the Company’s most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q, which should be read in conjunction herewith for a further discussion of important factors that could cause actual results to differ materially from those in the forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. 2 |

Analyst’s Day Agenda • CEO Overview & Introductions – Brief recap of earnings announcements – iChem VELOCITY Status – Strategic Rationale of Allied Path Acquisition • IRIIS CLIA Lab Initiative including NADiA Commercialization Strategy) • NADiA ProsVue Status • Status of International Commercial Strategy • Q & A 3 |

CEO Overview |

Q2-10 Results / Major Accomplishments • Achieved highest revenue quarter in IRIS history – $26.7MM – ~20% revenue growth vs. prior year’s quarter • Submitted two important 510(k) applications – NADiA ProsVue - April 28, 2010 – iChem VELOCITY and iRICELL – June 30, 2010 • Margin improvement to 54% from 51% in prior year’s quarter • Substantially completed the AlliedPath Acquisition • Special items totaling $1.5 million ($0.06 per share) offset the commercial success experienced in the quarter 5 |

iChem VELOCITY • 510(k) submitted June 30, 2010 • Approximately 37 units sold Q2-10, totaling approximately 280 units since September 2008 • Positive instruments reliability after latest round of retrofits • All major reliability issues have been addressed – Continuous improvement programs will be handled through the sustaining engineering process • We have secured Arkray AX-4280 systems to cover US demand through Q4-10 6 |

Two New iQ200 Systems Introduced at AACC • The new iRICELL® system portfolio features 7.0 software including new Edit Free Release Technology. The iRICELL®pro also includes the benefits of embedded iWARE™ Software • Edit Free Release™Technology increases the number of automatically released patient results based on lab-set criteria improving TAT • Urine Culture Candidate identification highlights suspected negative urine cultures based on chemistry and microscopy results. • The new iWARE software elevates lab productivity with an embedded expert system for real-time clinical validation and concordance reporting. • iWARE provides an enhanced LIS communication protocol providing direct communication between urinalysis and microbiology laboratories to better manage demands of urine culture testing. • These new Iris workcells improve laboratory productivity, standardize identification and management of urine culture samples and deliver higher quality while lowering overall laboratory costs. 7 |

CLIA Laboratory Acquisition • Acquired AlliedPath, a high-complexity CLIA certified laboratory • Early-stage laboratory offering differentiated molecular diagnostics testing services focused on cancer – Offers complex high margin personalized medicine testing services – Rapid turn-around times – Provides personalized test reports with educational component • Markets high-value tests to community-based pathology labs – Pathology labs do not have the expertise, instrumentation or necessary capital to offer these esoteric tests – Partnerships allow pathology labs to market high-value tests to expand their test menu and increase local market share • Seasoned management team with significant laboratory expertise – Randy White, PhD, President of Laboratory – Philip Ginsberg, MD, Chief Medical Officer • Consideration of $4.7 million in cash with $1.3 million in earn-outs for milestones met over the next three years • The acquisition is dilutive to earnings in 2010 – $0.09-$0.11 per diluted share 8 |

Acquisition Rationale for NADiA Strategic Fit with High-value Oncology Testing Focus Direct Commercial Channel for NADiA • Ability to control all aspects of commercial operations for NADiA’s planned platform of products starting with ProsVue launch • Execution of push-pull (pathologists - urologists) commercial strategy for ProsVue • Freedom to pursue a value-based pricing strategy and interact with third party payors • Provides ability to offer LDTs • Ability to accelerate development efforts of molecular pipeline CLIA certified laboratory • Offers high-value tests complementing ProsVue – Attractive market with significant growth potential – High value tests with accessions averaging $700 • Strong management team • Immediate infrastructure (billing, sample acquisition, results management, etc.) • Access to insurance network 9 |

Experienced Management Team Randy White, PhD Division Pres. 40 yrs National Health Laboratories, American Medical Labs, Nanogen, Xenomics Philip Ginsburg, MD CMO 25 yrs Quest, GenProbe Robin Vedova VP Admin. 30 yrs B-D, GenProbe Mary Holland VP Sales 25 yrs DPC, Third Wave, Nanogen Geoff Metcalf VP Marketing 20 yrs Iris Diagnostics, Siemens, B-D Over 140 years of Laboratory & Diagnostics Experience 10 |

What is Molecular Pathology? • A field of science dedicated to the identification of specific genetic alterations which may indicate disease prognosis and / or the likelihood of efficacy of a certain drug therapy • Enables personalized treatment of disease • Supports evidence-based treatment – in full alignment with the general direction of the US healthcare reform • An opportunity to align the Iris Molecular Diagnostics programs with the molecular pathology lab menu to maximize clinical utility and create differentiated solutions 11 |

IRIS CLIA Lab Business V. Randy White, PhD. Corporate VP & President Iris Laboratory Division |

Personalized Medicine Market • US market for esoteric laboratory tests and services – Estimated at $11 billion in 2009 growing to $21 billion in 2015 • Expected annual growth rate of 11% • Includes molecular diagnostics of $3 billion in 2009 expected to grow to $7 billion in 2015 (15% growth rate) • Growing number of targeted diagnostics and therapeutics tailored to an individual’s genetic make-up • HER2/neu – Herceptin • ER/PR – Tamoxifin • KRAS/EGFR - Erbitux Emerging as a new healthcare paradigm Source: PricewaterhouseCoopers, The new science of personalized medicine. October 2009. 13 |

Personalized Medicine Market • Payers willing to support reimbursement based on outcomes data: • A $1,000 test AVOIDS $30,000 round of chemotherapy • A post-prostectomy patient NOT referred for $50,000 radiation therapy - ProsVue • Tests cleared by FDA or compliant with CLIA as a laboratory developed test (LDT) 14 |

Personalized Medicine • Q: I discovered a lump in my breast. What does that mean? • A: To make sure it’s not cancer, we should perform a biopsy. Discover Test: Biopsy / Histology Laboratory: Pathology group 15 Simplified example meant for illustrative purposes only. |

Personalized Medicine • Q: What did the biopsy show? • A: Invasive ductal breast carcinoma. Diagnose Test: Immunohistochemistry (IHC) Laboratory: IRIS (name TBD) 16 Simplified example meant for illustrative purposes only. Discover |

Personalized Medicine • Q: What is the best therapy for me? • A: To determine that, we need to do additional imaging and run further tests on the tumor tissue. Test: Molecular path. ER/PR, Her2 (IHC and FISH), Ki-67 Laboratory: IRIS (name TBD) 17 Simplified example meant for illustrative purposes only. Discover Diagnose Characterize |

Personalized Medicine • Q: What did the test results show? • A: Your cancer over expressed the Her2 gene, so you’re a candidate for Herceptin. After you complete therapy, we’ll follow you up every 3 months. Test: Circulating Tumor Cells (CTCs) Laboratory: IRIS (name TBD) 18 Simplified example meant for illustrative purposes only. Discover Diagnose Characterize Therapy |

Personalized Medicine • Q: So how am I doing? • A: Looks like we caught it in time. We will continue to monitor your progress. Let’s follow up again in another 3 months. Test: Follow-up CTC Laboratory: IRIS (name TBD) 19 Simplified example meant for illustrative purposes only. Discover Diagnose Characterize Monitor Therapy |

Patient Benefits • Improved Quality of life – Reduces adverse drug reactions • Improved outcomes – Therapy “Tailored” to the individual • Cost effective – Avoids unwarranted expense 20 |

Laboratory Growth Strategy • Build sales force to focus on pathology groups, hospitals and regional laboratories • Expand test menu – Additional molecular panels, i.e. breast cancer – Additional disciplines; i.e. flow cytometry and FISH • Provide superior service – Offer differentiated high-value tests – Rapid turn-around-times – Digital pathology system – Support educational component to keep clients up to date on emerging tests and technologies 21 |

ProsVue Commercialization Strategy • Target high-volume urologists and leverage key opinion leaders (KOLs) through focused sales force – Drive utilization of ProsVue at clinical sites and KOL academic institutions – Target Urologists using the DaVinci robotic system – Approximately 1,000 urologists perform 80% of radical prostactectomies in US • Coordinate reimbursement strategy with sales force activities – Utilize reimbursement specialists to influence key insurance companies involved with the sales targets • Implement health economic studies / publication strategy • Leverage AlliedPath synergies – Engage pathologists in advocating the use of ProsVue with local urologists 22 |

Flow Cytometry NADiA Molecular Pathology Personalized Medicine Personalized Medicine Personalized Medicine Existing Commodity Evolving Market Completely New Standard of Care Gaining Acceptance Completely New FDA Cleared ASR / Lab Developed Tests Under FDA Review Reimbursement Approved CPT Code Stacking Value-based Pricing Average Price = $300/acc Average Price = $880/acc Average Price = $700/ProsVue Test Sale Cycle = Short Sale Cycle = Medium Sale Cycle = Long / Education Customers Customers Customers Hematologist Pathologist Urologist Hema-oncologist Oncologist Radiation Oncologist Immunologist Pathologist Hematological Cancers Tissue-Based Cancers Serum-Based Cancer Markers Testing Services 23 |

Test Menu Diagnosis Disease Characterization Treatment Response Prediction Therapeutic Monitoring Lung Colorectal Breast Prostate Hematological Cancers Current molecular panels Flow cytometry tests in 2010 NADiA ProsVue Future NADiA tests Molecular panel in 2010 FISH tests in 2010 24 |

Acquisition Highlights • Increased control of NADiA commercialization – Directly manage sales, marketing and value-based pricing strategies – Accelerates development efforts of NADiA • Ability for push-pull marketing strategy to engage pathologists in advocating the use of ProsVue with local urologists • Provides state-of-the-art high complexity CLIA-certified laboratory with differentiated molecular diagnostic services • Seasoned management team • Attractive market dynamics in field of personalized medicine with significant growth rates ($ in millions) 2004 2009 CAGR Neogenomics 0.6 $ 29.5 $ 118% Clarient 2.2 $ 92.0 $ 111% Genoptix 0.7 $ 184.0 $ 205% Revenues 25 |

Commercial Organization Overview Iris Laboratory ( name TBD) Admin Operations Sales Marketing NADiA ProsVue Molecular Path & Flow •Urologists •Pathologists •Pathologists •Oncologists •Hematologists 26 |

NADIA Update As of July 28, 2010 NADIA Update As of July 28, 2010 Thomas H. Adams, PhD. Corporate VP & CTO |

Molecular Diagnostics: NADiA Technology Platform Molecular Diagnostics: NADiA Technology Platform Nucleic Acid Detection Immunoassay • Ultra-sensitive protein detection • High sensitivity aids in monitoring cancer relapse and infectious diseases • Superior patient monitoring will enable better therapeutic outcomes • Applicable to multiple high value applications in large market segments • Test kits utilized on real-time PCR instruments Molecular Diagnostics Pipeline NADiA ® ProsVue™ Monitor prostate cancer post-prostatectomy NADiA Her-2/Neu Identify and quantify levels of Her-2/neu post-surgery NADiA HIV Viral Load Monitor anti-retroviral therapy 28 Prostate Cancer HIV Breast Cancer |

NADiA ProsVue Overview • We are very pleased with the results of our NADiA ProsVue retrospective clinical study. • NADiA ProsVue is the “proof of concept” application for our NADiA platform, with many other high value assays to follow • Prostate Cancer Statistics (US Only) – Approximately 190,000 new cases every year – 85,000 prostatectomies per year – Approximately 27,000 deaths – The second most common cancer among men after skin cancer • NADiA Value Proposition – Reduce unnecessary treatment – Reduce cost to the healthcare system – We believe NADiA ProsVue can enable a standardized protocol to identify which patient gets radiation treatment or not at the early stages of cancer • Focus on moderate to high risk patient – Reimbursement value that should be supportable by superior healthcare economics – Peace of mind to the patient 29 |

NADiA ProsVue consists of two elements – An exquisitely sensitive and precise tPSA assay – A patent-protected algorithm for analyzing multiple data points for the purpose of stratifying patients into recurrence risk categories Post Radical Prostatectomy (RP) Treatment Paradigm – Watchful Waiting • MD monitors the patient’s progression of PSA levels over time. Once the level surpasses a BCR threshold employed by the MD (the most common is 200 pg/ml) salvage radiation therapy is typically recommended – Adjuvant Radiation Therapy (ART) • If the MD believes that the patient is at high risk of recurrence, he/she may recommend adjuvant radiation therapy following the RP ART is typically started after the patient regains continence (~3-4 months) – Salvage Radiation Therapy (SRT) • Any radiation therapy after either 2 yrs post RP, or after BCR is defined as salvage – Androgen Deprivation Therapy (ADT) • If the MD believes that the cancer has spread beyond the prostate bed, he/she may recommend the use of ADT drugs to slow the growth of the cancer throughout the body – Chemotherapy • Chemotherapy is typically used only after a distant metastasis has been identified Treatment Options Post RP Therapy Environment 30 |

• Overtreatment of prostate cancer patients is prevalent as current tools do not provide clear results on who will benefit from therapy • ProsVue is expected to be a significant aid to improve patient treatment – Ability to identify patients with low risk of recurrence who would not benefit from follow-up therapy • Avoidance of costs and side-effects of unnecessary treatment • Patient quality of life • Lower diagnostic spending (in vivo and in vitro) • ProsVue market opportunity – 85,000 radical prostatectomies annually • Primary: Approx. 49,000 will be categorized moderate and high risk • Secondary: Pool of approx. 250,000 men who had an RP in past five years and are moderate and high risk 8% 42% 50% High Moderate Low Post RP Risk Stratification (1) (Immediately after surgery) BCR Relapse Rate (5.3 yrs) (1) BCR Relapse No BCR Relapse High 63% 37% Moderate 23% 77% Low 5% 95% Follow-up treatment likely unnecessary NADiA ® ProsVue ™ Value Proposition (1) Pound Study, The Journal of the American Medical Association, May 5,1999. 31 |

NADiA NADiA ® ® ProsVue™ ProsVue™ Clinical Study Clinical Study A 300 patient retrospective study with a prognostic claim 32 611 Patients <100pg* 72 Recurrent Patients 300 Random Patient Pool IRIS 510(k) Submission 04/28/10 228 Stable*** Patients IMD Test and Data Analysis RT PCR Already 510(k) Cleared 392 Qualified Patients 25,000 Patient Pool ** Qualified = met all pre-established clinical criteria * 1 measurement post surgery *** Stable after at least 8 year follow up 62 Institutions Contacted DUKE Memorial Sloan Kettering Eastern Virginia Univ Washington st |

NADiA ProsVue 510(k) • Application Status – 510(k) submitted April 28, 2010 – IRIS received on June 25, 2010 an “Additional Information” (AI) letter from the FDA summarizing their initial review of our 510(k) submission. – The AI letter is being reviewed by the IMD group, our consultants and Corporate Regulatory Affairs. We plan sorting all comments among three major categories: • Misunderstandings / omissions by the reviewer • Items already reviewed / agreed to in the two pre-IDE’s • New items for discussion – Next step: Face to face meeting with FDA 33 |

Publications Based on Pre-Filing Data N/A N/A Oct. 18-20, 2010 Abstract/poster submitted to ASCO-NCI- EORTC 2010 meeting on Molecular Cancer Markers Freedland Duke 15/15 pilot data / Diamandis Data Duke 15:15 study establishing the prognostic value of ProsVue slope over Cut Point or Doubling times. Q4 2010 Clinical Chemistry N/A N/A Diamandis EP5-A, EP6-A, EP17-A data from 510(k); consider including data from split vs contained plate run study Assay performance: Clearly demonstrates ProsVue has required precision & accuracy Q1 2011 Clinical Chemistry N/A N/A Vessela, Diamandis 100 patients ProsVue vs Cobas & IMMULITE Q1 2011 Clinical Chemistry N/A Poster presented at 2008 AACC Oakridge meeting Diamandis ProsVue vs Diamandis assay data from 40:40 study - includes lead time vs IMx assay/ Competitive Data: ProsVue measures low and constant levels of tPSA other commercial assay do NOT have low range sensitivity required Date Name Dates Name Journal Meeting Author(s) Source data Primary Points 34 |

Publications Plan - Post Filing Q2 2010 Moul plus other PIs ProsVue 510(k) clinical data - subset with high-risk pathologic features Low & high risk patients according to pathology & ProsVue slope Q2 2010 Freedland ProsVue 510(k) clinical data - recurrent patient subpopulation ProsVue slope & its relationship with time to BCR & time to clinical recurrence Q1 2011 J Urology Feb. 17-19 2011 or March 2011 2011 ASCO-AUA-SUO GU Cancers Symposium and/or 2011 EAU (European Association of Urology) meeting Moul plus other PIs ProsVue 510(k) clinical data plus 92 unselected stable patients ProsVue slope data from clinical trial to predict stable disease Q2 2011 J Urology Oct. 18-20, 2010 Data could be presented at the ASCO- NCI-EORTC 2010 meeting if accepted for poster presentation Lilja All 392 patients from NADiA ProsVue 510(k) clinical study Clinical Verification ProsVue Slope as prognostic marker Date Name Dates Name Journal Meeting Author(s) Source data Primary Points 35 |

Clinical Study/ Dr. Moul • Abstract • Author: Moul, MD • Meeting: Feb 2011 ASCO GU • Publication: J Urology • When: First Quarter of 2011 • Topic: Clinical Interpretation of NADiA ProsVue results 36 |

NADiA ® HIV Assay Status • In-house testing of retained clinical samples received from the Institute of Human Virology is in process • Expect completing the internal development and design verification in 2010 • Clinical studies targeted for 2011 37 |

HIV: NADIA p24 Marker • 75% of patients on HAART retroviral therapy have levels below 50 copies/ml (undetectable with current technology) • NADIA p24 expected to have 25X better sensitivity • Ability to see upward and downward trend at current undetectable levels • • 2 RNA molecules per virion 2 RNA molecules per virion • 2000 molecules p24 per virion 2000 molecules p24 per virion Demonstrated Sensitivity (as of July 2010) – Analytical sensitivity NADiA HIV is approximately 1 fg/ml – World’s most sensitive p24 assay 38 |

Viral Load vs. NADiA • Samples tested = 210 • Samples negative by Viral Load assay = 118 • Viral load negative samples positive by NADiA = 86 (73%) • Samples positive for Viral Load = 92 • Samples positive for Viral Load /negative by NADiA = 2 (2.2% missed) Notes: – Positive by NADiA >5 fg/ml – Roche Viral Load Assay 39 |

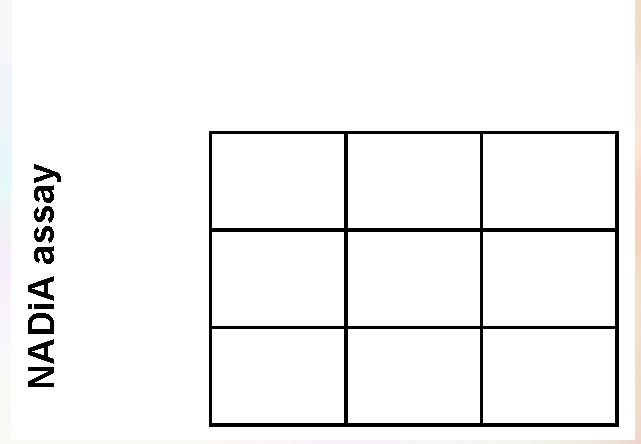

Viral load vs. NADiA HIV Sensitivity 97.8% Specificity 27.1% PPV 51.1% NPV 94.1% Accuracy 53.3% Pos Neg Total Pos 90 86 176 Neg 2 32 34 Total 92 118 210 Viral load assay 40 |

International Direct Sales Initiative Thomas Warekois Corporate VP, President Iris Diagnostics Division |

Changing market conditions are presenting both opportunity and rationale for Iris Diagnostics to selectively invest in new, direct sales organizations Iris Diagnostics International Strategy Strategic Drivers • Increased complexity in selling urinalysis solutions • Purchase decision process, deal complexity and call points • Mitigation of competitive claims and message • Managing distributor focus and investments • Planning for future country opportunities and expanding Iris product pipeline Implementation Status • Stabilized ~ 60 customers acquired from IL-Germany and IL-UK on January 1, 2010. • Established core organizations in UK and Germany plus an EU regional center for service calls, sales operations and finance for France, UK and Germany • YTD total 2011 revenue / spending to budget expectation (local currency) • Focus on sales funnel build in UK • Complete transition of service from IL to Iris by end 2010. 42 |

Investments levels are scaled to expected sales levels although there is a short-term challenge of critical mass. Iris Diagnostics International Strategy EU CENTER 7 Headcount • Director • Service Mgmt • Sales Ops • Finance • Clinical Support Spending • 0.6 Mio € FRANCE, UK ,GERMANY 16 Headcount ( June 2010) • Director for each country • Sales/Clinical Support • Service /Clinical Support • 2010 Business Forecasts • Revenues 5 Mio € • 40+ new iQ unit placements with starting population of ~160 iQ (Jan 2010) • Spending 2 Mio € € @ 1.3 43 |

|

Thank You Thank You |