UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

or

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No. 1-11181

IRIS INTERNATIONAL, INC.

(Exact name of Registrant as Specified In Its Charter)

| | |

| Delaware | | 94-2579751 |

(State or other jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

9158 Eton Avenue, Chatsworth, California 91311

(Address of principal executive offices) (Zip Code)

(818) 709-1244

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer a non-accelerated filer or a smaller reporting company. See definitions of “larger accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer ¨ | | Accelerated filer þ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| | | | (Do not check if smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes ¨ No þ

The aggregate market value of the shares of common stock held by non-affiliates of the Registrant on June 30, 2011 was approximately $179 million based upon the closing price of $9.99 per share of its common stock as reported on the NASDAQ Global Market on such date.

The registrant had 17,888,511 shares of common stock outstanding on June 30, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for the 2012 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission, or SEC, pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered on this Form 10-K are incorporated by reference into Part III, Items 10-14 of this Form 10-K.

IRIS INTERNATIONAL, INC.

ANNUAL REPORT ON FORM 10-K

Fiscal Year Ended December 31, 2011

i

PART I

Forward-Looking Statements

This report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions, including any projections of earnings, revenues or other financial items, any statement of the plans and objectives of management for future operations, any statements concerning proposed new products or strategic arrangements, any statements regarding future economic conditions or performance, and any statement of assumptions underlying any of the foregoing. In some cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,” “expects,” “plans,” “anticipates,” “estimates,” “potential,” “intends”, or “continue” or the negative thereof or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements contained herein are reasonable, there can be no assurance that such expectations or any of the forward-looking statements will prove to be correct, and actual results could differ materially from those projected or assumed in the forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to inherent risks and uncertainties, including but not limited to the Risk Factors set forth under Item 1A, and for the reasons described elsewhere in this report. All forward-looking statements and reasons why results may differ included in this report are made as of the date hereof, and we assume no obligation to update these forward-looking statements or reasons why actual results might differ.

Company Overview

We are a leading manufacturer of automatedin vitro diagnostic systems (IVD), sample processing products and high-value personalized diagnostics tests for use in hospitals and laboratories worldwide. Our IVD products analyze the chemistry and morphology of cells and sediments in a variety of body fluids. Our IVD products leverage our strengths in flow imaging technology, particle recognition and automation to bring efficiency to the hospital and commercial laboratories. The initial applications for our technology have been in the urinalysis market and we are the leading worldwide provider of automated urine microscopy and chemistry systems, with approximately 3,600 systems sold in over 50 countries. We are expanding our core imaging and morphology expertise into related markets, including applications in hematology and body fluids. In addition, our personalized medicine group operates a high complexity CLIA-certified laboratory for the further development and commercialization of our NADiA ultra-sensitive nucleic acid detection immunoassay platform, with applications in oncology and infectious disease.

Historically, we have predominantly focused on developing, manufacturing and commercializingin vitro diagnostics instruments and consumables for urinalysis, including our flagship iQ® analyzers, a family of fully-automated, image-based bench-top analyzers for urine microscopy. Urine microscopy is the visualization and identification of cells and other sediments in urine. The iQ analyzer uses a proprietary flow microscope and image-analysis software that captures the morphology of cells and sediment in urine and serous fluids, and assists in their identification and classification. Our systems are designed to provide users with faster, more complete and more consistent results, while substantially reducing hands-on time spent by laboratory technicians and turnaround time, as compared to traditional manual methods.

The iQ analyzer can be seamlessly integrated with an automated urine chemistry analyzer to simultaneously perform urine microscopy and chemistry testing in a fully automated manner. Our proprietary iChem®VELOCITY® automated urine chemistry analyzer and a fully integrated urine microscopy and urine chemistry work-cell, called the iRICELL received FDA 510(k) clearance in March 2011 and immediately thereafter, we commenced selling these new products in the United States. Historically, in the U.S. we sold our family of iQ analyzers integrated with an automated chemistry analyzer that was sourced from a Japanese manufacturer.

We intend to solidify our leadership position in the urinalysis market, as well as enter into several adjacent markets with our product pipeline under development. To maintain our market position in urinalysis, we continue to implement improvements to our existing product lines, including enhancing our data analysis and productivity

1

tools for our iRICELL systems, such as Edit Free Release Technology to improve turnaround time and iWare to enhance the interface to laboratory information systems, or LIS. These enhancements also allow more effective management of resources and costs in the screening of diseases such as urinary tract infection. In addition, late in 2011 we launched the iRICELL1500 in the United States, the first fully automated urine testing solution to address the specific needs of lower volume laboratories performing fewer than 70 urine tests per day.

We are also developing our 3GEMS™ (Third Generation Morphology System) platform, which will serve as the basis for our next generation products in urinalysis and an emerging pipeline of hematology products. These 3GEMS hematology products, currently in development, use image-based technology to automate the identification and characterization of blood cells. We believe an automated hematology analyzer using our proprietary imaging technology and software recognition capabilities will provide significant improvements in the identification of abnormal blood cells, including an automated, image-based expanded white blood cell differential analysis and other abnormal cell morphology. Like our urine microscopy products, these new hematology products by virtue of IRIS’s inherent capabilities to capture and analyze images are expected to significantly reduce the need for manual slide preparation and reviews under a microscope, increasing the efficiency and efficacy of what is currently a subjective and highly labor-intensive process.

Our Sample Processing group markets and develops centrifuges, DNA processing workstations and sample processing consumables. Our StatSpin® brand bench-top centrifuges are used for specimen preparation in coagulation, cytology, chemistry and urinalysis. Our worldwide markets include medical institutions, commercial laboratories, clinics, doctors’ offices, veterinary laboratories and research facilities. As a product line extension to our manual ThermoBrite DNA processing station, in December 2011 we announced the introduction of our new ThermoBrite® Elite Automated Laboratory Assistant, which we plan to launch in the first quarter of 2012. This new product platform provides automation for FISH (fluorescencein-situ hybridization) testing. Our Sample Processing products are sold worldwide primarily through distributors and incorporated into our OEM partners’ products.

We believe a significant driver in the future growth of diagnostics will be in personalized medicine, meaning the ability to analyze the molecular make-up of an individual patient’s cancer and assess disease progression in order to more precisely prescribe appropriate treatment. Our proprietary molecular diagnostics platform called NADiA has the ability to measure proteins below the detection thresholds of current immunoassay and molecular diagnostic methods. We believe our proprietary diagnostic products will address the need for increased sensitivity in the monitoring of disease enabling personalized treatment of cancers.

In September 2011, the FDA cleared our first NADiA assay: NADiA ProsVue™, an ultra-sensitive, blood-based test designed to be a prognostic indicator of post-prostatectomy patients at reduced risk of prostate cancer recurrence. NADiA ProsVue uses a threshold based on the slope of three successive test measurements of residual amounts of total prostate specific antigen, or tPSA, which are typically under the limit of detection of ELISA-based ultra-sensitive tPSA assays. In October 2011, we received Conformité Européenne (CE) Mark. The ProsVue commercialization strategy consists of an initial targeted direct sales approach focused on key opinion leaders and high volume urologists through our CLIA laboratory, followed by potential collaborations with major laboratories and diagnostic partners.

In September 2011, we also completed a restructuring of our Personalized Medicine division, which included downsizing and consolidating our CLIA certified laboratory operations into Iris Molecular Diagnostics. As part of this restructuring, we discontinued non-proprietary testing, but retained all licenses and high-complexity CLIA laboratory capabilities, as well as limited personnel to perform NADiA and other proprietary tests.

Market Overview and Opportunity

The global market for IVD was estimated at approximately $44 billion in 2010 and is expected to grow in the mid-single digits annually. IVD manufacturers provide products and services to the clinical laboratory industry, which is confronted with significant challenges in the current market. Healthcare professionals are demanding improved turnaround time for diagnostic tests, greater sensitivity and lower costs. To improve accuracy, productivity and efficiency, many laboratories are turning to automated methods to perform these tests.

2

Moreover, automated testing solutions better position laboratories to cope with the declining number of certified medical technologists available to perform tests.

Currently, we participate primarily in the urinalysis segment of the IVD market which we estimate is approximately $650 million. With the development of our hematology product, we will be able to enter a significantly larger market estimated at approximately $2.0 billion. In addition, with our expansion into molecular diagnostics, we have the opportunity to participate in the personalized medicine market. PricewaterhouseCoopers estimates the molecular diagnostics market in 2009 was $3 billion with a 15% growth rate. We believe we are well positioned to experience growth in this segment, which will include sales of our proprietary molecular tests utilizing our NADiA assays and licensing of our proprietary test platforms and technology.

Urinalysis

Urinalysis is performed as part of most routine medical examinations and is necessary for the diagnosis and monitoring of conditions such as urinary tract infection, and kidney and bladder disease. Traditionally, urinalysis comprises urine chemistry and urine microscopy tests, while urine cultures are considered part of microbiology. We believe that the advancement of automated technologies will blur this distinction, with urine cultures being performed increasingly in the same laboratories as urine chemistry and urine microscopy tests and eventually becoming part of the urinalysis market.

Urine Chemistry and Microscopy Market Overview

Urine chemistry consists of a panel of tests that identifies various chemical analytes in urine, while urine microscopy analyzes the microscopic solid particles and cells suspended in urine. Urine chemistry comprises the majority of the urinalysis market and is broadly used, with limited differentiation between products. Traditional urine microscopy is used less routinely because as a manual process it is time consuming and requires a trained medical technician to characterize sediments and cells based on their morphology. In order to reduce costs, many laboratories perform manual urine microscopy only in response to results from an initial urine chemistry test despite evidence that urine microscopy can provide a more reliable clinical diagnosis. The commercial success of our iQ analyzer is attributable to its capability to image and accurately identify particles and cells suspended in urine in a time-efficient manner eliminating manual microscopic examination.

Of the $650 million urinalysis segment, urine chemistry represented approximately $490 million and automated urine microscopy represented approximately $160 million, but growing at a much faster rate than the other urinalysis sub-segments. We estimate there are approximately 17,000 sites performing greater than 40 microscopy tests per day on a global basis including approximately 6,000 in China. These higher volume sites represent a significant opportunity for us, because they would benefit from the automation and consolidation of their urine chemistry and microscopy procedures. We believe the full automation and integration of results brought by the iQ product platform has accelerated the adoption of automated urine microscopy as a routine test. We believe approximately 50% of these targeted global sites continue to perform manual microscopy procedures. The penetration of automated urine microscopy analyzers varies significantly from country to country.

Limitations in Urine Chemistry and Microscopy

Current manual testing of urine and body fluids requires the clinical laboratory to split samples, perform automated and manual procedures and consolidate the separate results into one report. Moreover, the manual procedure for microscopy requires a qualified medical technician to accurately categorize particles and cells observed under the microscope. Therefore, these tests represent both time and cost intensive procedures for the clinical laboratory. Further, the inherent variability in sample preparation limits the quantitative and qualitative accuracy of the diagnostic result. The manual nature of urine microscopy procedures coupled with the lack of qualified personnel represent a significant market opportunity. However, the challenge remains to compete for capital for urinalysis automation versus other disciplines of the laboratory.

Laboratories typically perform microscopy and chemistry tests separately and generally perform microscopy only in the case of an abnormal chemistry result because urine microscopy is a very tedious process. If both tests are performed, the separate results must then be manually consolidated into one report or file. Without the

3

automatic integration of both the microscopy and chemistry results, valuable clinical information may be overlooked. By reducing the amount of manual labor spent conducting these tests and by automatically integrating the chemistry and microscopy results, we believe we can improve the consistency, reliability and value of the combined results and improve specimen turnaround time.

Hematology

Hematology Market Overview

The enumeration of the various cellular components of blood is an essential part of routine medical examinations. A complete blood count, or CBC, is the most common type of blood test performed and measures the number of specific types of blood cells, including red blood cells (RBC), white blood cells (WBC), platelets, and other blood components, such as hemoglobin. In most instances, a white cell differential count, which measures the percentage of five types of white blood cells, is added to the CBC test. Variations from concentration, size, or maturity of the blood cells can be used to indicate an infection or illness. CBC tests and differential WBC counts are performed primarily in hospitals and clinical reference laboratories.

According to Global Industry Analysts, Inc., the hematology market was approximately $2.0 billion in 2011 and growing approximately 2% to 3% per year driven primarily by system replacement sales and a small increase in test volume. Over the past 15 years, innovation within this market has been limited to automation of slide making and staining and algorithmic improvements to aid in the interpretation of results.

Limitations in Hematology

Traditional CBC test instruments use indirect means to measure the type and number of blood cells rather than direct observation of the blood cells. Despite the high number of these automated CBC analyzers in use, a significant percentage of the samples require a manual cell differential count of the blood specimen under a microscope. Frequently, a manual count is required due to the inability of automated CBC and differential analyzers to discriminate the complex morphology, especially the shape, of abnormal cells, such as immature white blood cells, or the presence of diseased cells, as in the case of sickle-cell anemia. The presence of immature white blood cells is often associated with conditions such as leukemia, infection, inflammation or tissue injury. However, a manual differential count of a blood specimen must be performed by a medical technologist trained in cytology or a pathologist under a microscope — a time consuming and subjective process, resulting in longer specimen turnaround times and higher cost.

According to a 2006 study conducted by the College of American Pathologists, of the 263 US laboratories surveyed, an average of 29% of automated CBCs required a manual review, scan or differential and this percentage dramatically increased depending on the pathology of the patient population. IRIS also confirmed this manual review rate, independently through a survey. Since the hematology market is dominated by a few large companies that typically compete on their ability to marginally reduce manual review rates, we believe there is significant opportunity to offer an automated image-based instrument that has the ability to identify immature white blood cells and other anomalies in a systematic fashion and to reduce significantly the number of manual reviews performed.

Sample Processing

Sample Processing Market Overview

Nearly every patient specimen presented to a clinical laboratory for testing requires some sort of sample processing before analysis. These samples include cytologic (blood, urine and other body fluids), histologic (tissue biopsies), and other materials which may need to be separated into its different constituents. In the United States, there are over 180,000 testing sites where sample processing occurs, including hospital laboratories, independent laboratories, doctor’s offices, health maintenance organizations and community clinics.

Although testing is performed on many different types of samples, most tests are performed on blood specimens that require separation in a centrifuge. The centrifuge market comprises five segments including non-refrigerated bench-top, refrigerated bench-top, floor, high-speed and ultra-centrifuges. According to Strategic Directions International, the worldwide market for sample processing centrifuges in 2010 was estimated

4

at $660 million, of which the market for non-refrigerated bench-top centrifuges, the market segment we serve, is estimated at approximately $100 million. To improve laboratory productivity and sample turnaround time, the trend has been towards smaller and faster bench-top models and away from large capacity floor models which have longer processing time per batch. This represents a significant opportunity for our Express line of bench-top centrifuges.

FISH (fluorescence in situ hybridization) is a cytogenetic technique that uses nucleic acid probes, which are segments of labeled DNA that are designed to hybridize or bind to the target DNA of a positive specimen. The probes are labeled with fluorescent or chromogenic molecules to enable the identification of genetic abnormalities, providing valuable information about cancer and other genetic diseases. With the increasing rate of adoption of FISH testing as standard protocol for cancer diagnostics development and application, laboratories performing as few as 10 tests per day are requiring a higher level of automation and standardization. Management estimates there are over 4,000 laboratories in the clinical and research market performing FISH testing and provides a large market opportunity for the recently introduced ThermoBrite Elite automated FISH processing system.

Limitations with Current Sample Processing Methods

The time it takes to process a sample is critical for clinical laboratories as the volume of samples to be tested increases. Each day, laboratory technicians are expected to handle thousands of samples with minimal error in a defined amount of time with limited laboratory space. In most laboratories, sample processing occurs in a central location where blood specimens are sorted and centrifuged in batches. The entire process can take up to an hour and requires dedicated resources to manage the sample flow. Once processed, the samples are often split and then sent to the various stations within the laboratory for analysis. The centralized processing of samples is thus quite inefficient as samples wait to enter the floor model centrifuge in large batches followed by long centrifugation times. In fact, many sample processing procedures create significant delays in specimen turnaround time.

In regards to FISH, the majority testing is performed manually and requires a significant amount of a skilled laboratory technician’s time and expertise. FISH procedures require numerous steps, including the successive immersion of slides in various reagents for specific time periods. These protocols are time sensitive and can take up to four to six hours of hands-on processing time. As such, a technician cannot devote attention to other laboratory tasks specifically during the pre-hybridization phase as they may risk ruining a precious patient sample. The increasing demand for these types of tests and the declining number of CLIA-certified technologists to perform them creates a significant market opportunity for the automation of FISH testing.

Personalized Medicine

Personalized medicine may be defined as giving the right treatment to the right patient at the right time. The implementation of personalized medicine has been made possible by state of the art molecular diagnostic testing. By examining the molecular make up of an individual patient’s cancer, therapy can be tailored for that specific patient, rather than blindly treating all patients with “one size fits all” drug cocktails. This leads to better management of the individual patient’s cancer, with fewer potentially ineffective drugs, reduced incidence of side effects, and overall cost savings for the healthcare industry.

Molecular Diagnostics Market Overview

Molecular diagnostic tests examine nucleic acids, including DNA and RNA, and protein biomarkers, to identify a disease, determine prognosis, monitor its progression and response to treatment, or predict individual predisposition to a disease or genetic disorder. These biomarkers can also provide information in drug discovery, preclinical drug development and patient monitoring during clinical trials. Currently, the clinical market for molecular diagnostics is primarily nucleic acid testing performed by real-time polymerase chain reaction, or PCR, instruments that amplify and detect nucleic acid targets for diseases or infections.

The analysis of DNA expression, presence of cell surface receptors, or the production of specific proteins in cells, provides the ability to characterize diseases, such as cancer and infectious diseases. As a result, the detection and identification of DNA and proteins can provide physicians with a means to tailor therapy, monitor disease progression and detect relapse.

5

Currently, the ability to detect specific proteins in cells is limited by sensitivity. We believe that development of an ultra-sensitive detection method for proteins with the capability to measure concentrations hundreds of times below the detection limits of currently available immunoassays, may provide a reliable method to detect disease at an earlier stage, which may result in improved patient care.

According to PricewaterhouseCoopers, the worldwide molecular diagnostics market in 2009 was approximately $3 billion and growing at 15% annually. We believe growth in the market is being driven primarily by an increase in the number of personalized diagnostic tests available to treat cancers and infectious diseases.

Limitations with Current Methods

Proteins are critical to understanding diseases and current testing methods lack the degree of sensitivity necessary to detect minute amounts of protein and the precision to monitor serial determinations for disease progression. Traditional methods to detect proteins, including enzyme-linked immunosorbent assay (ELISA) and chemiluminescence immunoassay (CIA), are unable to quantify protein biomarkers in extremely low concentrations. These methods become effective only after a disease has progressed to a more advanced stage and the concentration of the protein biomarker has increased to reach the lower limit of detection of those conventional methods. We believe there is a significant market opportunity for an ultra-sensitive detection technology that measures concentration as low as one femtogram per milliliter (10-15 gram/milliliter) compared to today’s technologies that are limited to measuring concentrations of greater than 50,000 femtograms per milliliter.

Our Products

Our commercialized products and product pipeline comprise three main categories: morphology, sample processing and personalized medicine. Our morphology category includes all urinalysis and hematology products consisting of our commercialized urine chemistry and microscopy products, as well as our development-stage products such as our 3GEMS urinalysis and hematology analyzers. Our sample processing category develops and markets small centrifuges and other processing equipment and accessories for rapid specimen processing. Our personalized medicine category consists of our 510(k) cleared ProsVue prostate cancer test and other development-stage products that utilize our NADiA technology for ultra-sensitive detection of proteins for monitoring cancer and infectious disease applications. The following table is a summary of our major commercialized and in-development products.

6

| | | | |

Major Products | | Status | | Description |

Morphology and Related Products | | |

iQ analyzers (Sprint, Elite, Select) | | Marketed | | Fully-automated urine microscopy and body fluids analyzer |

iQ Body Fluids Module | | Marketed | | |

Optional iWare Software | | Marketed | | |

iChemVELOCITY | | Launched 1Q11 in US and other markets requiring 510(k) clearance | | Fully-automated urine chemistry analyzer |

| | Launched internationally: 3Q2008 | | |

iRICELL (Pro and Plus versions of 3000, 2000 and 1500) | | Launched 1Q11 in US and other markets requiring 510(k) clearance | | Integrated iQ and iChemVELOCITY workcell |

| | Launched internationally: 3Q2008 | | |

3GEMS Urinalysis and Body Fluids | | In development | | Next generation urine microscopy and body fluids analyzer |

3GEMS Hematology | | In development | | Complete blood count, white blood cell count with expanded differentials and red blood cell and platelet morphology |

| |

Sample Processing | | |

Express centrifuge line | | Marketed | | Centrifuges for clinical diagnostic market |

ThermoBrite Elite | | Launching 1Q12 | | Benchtop platform for automating slide based procedures for FISH testing. A version with expanded functionality and capacity is in development. |

ThermoBrite | | Marketed | | DNA workstation for FISH procedures |

Cytofuge 2 | | Marketed | | Centrifuge used for thin layer cell preparation |

Cytofuge 12 | | Marketed | | 12 placement centrifuge used for thin layer cell preparation |

IDEXX Drive | | Marketed | | For internal use in IDEXX chemistry analyzers |

IDEXX whole blood separator | | Manufacturing rights licensed to IDEXX | | Consumable used in IDEXX chemistry analyzers |

OvaTube | | Marketed | | Ova and parasite testing for veterinarian market |

| |

Personalized Medicine | | |

NADiA ProsVue | | Launched 1Q12 | | Prognosticate stable prostate cancer patients after radical prostatectomy |

| | |

NADiA ProsVue - Expanded Applications | | In Development | | To enable a larger patient base to be monitored for a longer period post-prostatectomy |

NADiA CECs | | In feasibility | | Detect circulating epithelial cells to monitor cancer progression |

NADiA HIV | | Feasibility complete Pursuing licensing partners | | Monitoring HIV viral load during anti-retroviral therapy |

Morphology and Related Products

Cell morphology is the science of cell form and structure. Our morphology segment utilizes our proprietary imaging technology to identify cells and particles in a fully automated manner. In the urinalysis market, we offer urine microscopy analyzers and urine chemistry instruments on a standalone and integrated basis. As part of our 3GEMS Third Generation Morphology program, we are developing a next-generation urine microscopy analyzer and an image-based hematology analyzer.

7

Automated Urine Microscopy Analyzers

Our flagship product is the family of iQ urine microscopy analyzers. Our iQ technology platform utilizes proprietary image flow cytometry and software to achieve significant reductions in cost and processing time as compared to manual urine microscopy. Our technology enables high speed digital processing to classify and display images of microscopic particles in an easy-to-view graphical user interface. We believe our iQ product line has numerous benefits over competing products, including increased accuracy, digital imaging of particles and fully automated analysis of urine and body fluids and lower manual review rates of abnormal samples.

The iQ microscopy product line comprises the iQ SELECT, a fully-automated instrument capable of analyzing 40 samples an hour and enabling partial automation at laboratory sites with lower test volumes; the iQ ELITE, a fully-automated instrument capable of analyzing 70 samples an hour that is appropriate for mid-sized hospital laboratories; and the iQ SPRINT, a fully-automated instrument capable of analyzing 101 samples an hour that is appropriate for large volume hospital and commercial laboratories. By utilizing our urinalysis system, we believe the average laboratory, which we define as those laboratories that typically perform 60 microscopy tests per day, can re-assign one medical technician currently performing these tests to another function, with a payback period of approximately two years. We also offer the iQ Body Fluids Module as an addition to the iQ urinalysis test menu, which enables the rapid diagnosis for the presence of nucleated cells, red blood cells, bacteria and crystals in body fluid samples. In 2010, we attained 510(k) clearance for the synovial fluid application and added it to this optional software module.

In 2010, we also introduced the iRICELL® Plus and the iRICELL® Pro integrated urinalysis workstations which we believe delivers significant workflow enhancements and productivity to the laboratory. In addition, we launched iWARE™, an optional, expert software product that further enhances laboratory productivity by enabling real-time patient validation based on lab-defined verification rules for urine chemistry and microscopy results. The iWARE product includes an enhanced LIS communication protocol allowing for direct electronic communication between urinalysis and microbiology laboratories for more effective management of resources and costs in the screening for negative urine cultures.

Our iRICELL integrated urinalysis workstations are offered in various instrument configurations; the 3000 series integrating the high throughput iQ SPRINT with our iChemVELOCITY and a 2000 series connecting our mid-range iQ ELITE with our iChemVELOCITY. In 2011, we launched the iRICELL1500 in the United States, the first fully automated urine testing solution to address the specific needs of laboratories performing fewer than 70 urine tests per day. The iRICELL 1500 Workcell integrates the iCHEM VELOCITY automated chemistry analyzer with the iQ SELECT automated microscopy analyzer. This new product offering provides a fully automated system for managing the workload of urine microscopy and urine chemistry testing, delivering customer benefits of enhanced laboratory productivity and quality, while lowering laboratory operating costs.

Urine Chemistry Analyzers

We market our proprietary fully-automated urine chemistry analyzer, the iChemVELOCITY, which can be seamlessly connected to the iQ automated urine microscopy analyzers and provide laboratories with walk-away solutions for chemistry and microscopy urinalysis with results combined and displayed in a single report. The iChemVELOCITY is designed for medium to high volume laboratories that typically process more than 70 urine chemistry samples per day. We offer the iChemVELOCITY as a stand-alone analyzer or as part of our integrated urinalysis workcell solution, the iRICELL.

Internationally, we began selling the iChemVELOCITY in September 2008 following CE Mark certification. In March 2011, upon receipt of 510(k) clearance on our iChemVELOCITY and iRICELL products, we commenced selling them in the United States and other countries that required 510(k) clearance. Historically in the U.S., we sold a fully-automated urine chemistry analyzer manufactured by a Japanese IVD company.

Consumables and Service

We generate significant revenue from the sale of consumables and service contracts for our urine microscopy and urine chemistry analyzers. For the year ended December 31, 2011, revenue derived from consumables and service contracts accounted for 59% of our total consolidated revenues and 67% of our

8

IDD urinalysis segment’s revenue. Consumables include urine and body fluids reagents, calibrators and controls for our microscopy systems and test strips, calibrators, controls, and other solutions for the urine chemistry analyzers we manufacture and distribute. After the initial year of sale, which is covered by product warranty, we offer annual service contracts for our domestic and other direct customers in select international markets. To our distributors, we offer spare parts who in turn service the end-use customer.

3GEMS Platform

Our 3GEMS platform combines our core imaging technology with improved software and sample processing to enhance the identification of various cell types and particles found in urine, blood and other body fluids. We believe the increased sensitivity and specificity, reliability, ease of use and improved imaging of our 3GEMS platform will increase the clinical utility of our diagnostic tests and allow physicians and other caregivers to make more informed treatment decisions. The 3GEMS platform will be the basis for our next generation of image-based analyzers for the morphological examination of urine, body fluids and blood. The following describes our 3GEMS products under development:

| | Ÿ | | Next Generation Urine Microscopy Analyzers. Our next generation urine microscopy analyzer will include advances in electronics and optics and many proprietary elements designed to further automate and expand the menu of microscopic sediments under analysis. We anticipate these advances will improve the clinical utility and productivity of the instrument as a greater number of cell types will be able to be identified with greater precision. |

| | Ÿ | | Next Generation Body Fluids Module. We currently offer products that utilize our proprietary technology for morphology analysis of other body fluids, including cerebrospinal, synovial and serous fluids. We are developing a next generation body fluids module that we believe will possess improved diagnostic capabilities relative to our current product offering. |

| | Ÿ | | Hematology Analyzers. We are developing a portfolio of hematology analyzers to automate the identification and characterization of cells in blood. Our initial hematology analyzer will conduct a complete blood count, or CBC, the most common type of blood test, as well as automatically provide an expanded white cell differential analysis. This augmented differential analysis will identify the presence and quantity of immature white blood cells, whose presence is often associated with conditions such as leukemia, infection, inflammation or tissue injury. Importantly, the automation of the white cell differential will significantly reduce the need for a medical technologist trained in cytology or pathologist to manually identify and count cells under a microscope — a time consuming and subjective process. Finally, since our analyzer captures digital images of individual cells, the creation of slides to enable the review of a blood smear under a microscope and to retain physical evidence of a particular sample would be significantly reduced. Our virtual slides will be stored digitally and transmitted electronically between laboratories or healthcare providers. |

In March 2011, we entered into a Joint Development Agreement with Fujirebio Inc., one of the largestin vitro diagnostics companies in Japan, for the co-development of the 3GEMS Hematology Analyzer product line. Terms of the agreement call for Fujirebio to contribute $6 million based on the achievement of certain milestones toward the costs of the development of the 3GEMS Hematology development program in exchange for the distribution rights of the product in Japan.

Sample Processing

Our sample processing group markets and develops centrifuges, semi-automated DNA processing workstations and sample processing consumables. Our StatSpin brand bench-top centrifuges are used for specimen preparation in coagulation, cytology, chemistry and urinalysis. Our worldwide markets include medical institutions, commercial laboratories, clinics, doctors’ offices, veterinary laboratories and research facilities.

With our sample processing products, we believe we offer laboratories the ability to reduce turnaround times and increase their efficiency by processing samples as they arrive rather than in a batch mode. Our bench-top centrifuges offer a significant advantage with two to three minute cycles compared to conventional centrifuges taking up to 15-30 minutes, depending on batch size. Further, our bench-top models are small enough to sit alongside an analyzer eliminating the need for a separate central sample processing area.

9

Our Express 4 centrifuge employs a unique high speed horizontal rotor for separating samples and replaces larger and slower batch centrifuges by reducing sample preparation time and streamlining laboratory workflow. This product platform enables us to serve the high-volume chemistry market.

In November of 2010, we acquired the assets of a multi-purpose, bench-top instrument platform for automating highly repetitive, manual laboratory protocols for FISH testing and other slide-based cytogenetic applications. This new product called the ThermoBrite Elite automates all of the pre- and post-hybridization steps, as well as on-board denaturation and hybridization, which provides the end-user with higher confidence in a standardized and reproducible result. In addition, the ThermoBrite Elite has the ability to customize protocols for sample types and assays providing superior versatility and the potential to penetrate the research market. The ThermoBrite Elite is a natural brand extension to our successful semi-automated ThermoBrite DNA Hybridization System and is consistent with our expansion in personalized medicine with an emphasis on cancer diagnostics. ThermoBrite Elite was introduced in December 2011 and will be launched in the first quarter of 2012, and is expected to position us as a major competitor in the high growth cytogenetic instrumentation market.

Another product offering from our sample processing group is the StatSpin Ovatube, a centrifugal separation system for use in veterinary hospitals, clinics and reference laboratories to process fecal samples for the detection of gastrointestinal ova and parasites. Gastrointestinal parasites are not only primary disease agents in companion animals, some are also transmissible to people. Management estimates there are some 20 million ova and parasite tests performed on companion animals each year in the U.S. alone, with some 10 million of these tests being performed in 25,000 veterinary clinics. Of all the diagnostic techniques used to detect gastrointestinal parasites, none is more accurate and reliable than centrifugal fecal flotation, as recommended by the Companion Animal Parasite Council (CAPC). The StatSpin OvaTube complies with this recommendation.

Personalized Medicine

NADiA (Nucleic Acid Detection Immunoassay) Platform

Our Personalized Medicine category is leveraging our proprietary NADiA technology and Microbubble Isolation Technology platforms to develop ultra-sensitive and precise diagnostic tests. NADiA technology has the ability to measure proteins in extremely low concentrations below the detection thresholds of current immunoassay and molecular diagnostic methods. NADiA combines immunoassay and PCR methodologies, or Immuno-PCR, with the potential to detect proteins with femtogram/milliliter sensitivity (10-15 gram/milliliter). The Immuno-PCR approach is similar to that of an enzyme immunoassay, which makes use of antibody binding reactions and washing steps, but in the NADiA method, the enzyme label is replaced with a double-strand of DNA which is used to detect and quantify the target protein using PCR amplification. We believe diagnostic tests that utilize our NADiA technology will aid in the early detection of disease relapse and potentially provide better therapeutic outcomes for patients.

NADiA ProsVue

In 2011, we received 510(k) clearance and CE Mark for our NADiA ProsVue prognostic prostate cancer test for post-prostatectomy patients. NADiA ProsVue is anin vitro diagnostic assay for determining the rate of change or slope of residual concentrations of serum total prostate specific antigen (tPSA) over a period of time measured in picogram/milliliter per month. The slope provided by NADiA ProsVue is indicated for use as a prognostic marker in conjunction with clinical evaluation as an aid in identifying those patients at reduced risk for recurrence of prostate cancer for the eight year period following prostatectomy.

A retrospective clinical study of 304 patients evaluated the slope of three successive ProsVue tests over a period of at least ten months after a prostatectomy to identify prostate cancer patients with no evidence of disease or clinical progression. Recurrence of disease was determined by positive imaging, biopsy results or prostate cancer related death. The study resulted in a negative predictive value (NPV), or the proportion of patients correctly identified as stable, of 92.7% and a positive predictive value (PPV), or proportion of patients correctly identified as recurring, of 78.0%. Consequently, a ProsVue slope of equal to or less than 2.0 pg/mL per month in the first year following radical post-prostatectomy was highly associated with no evidence of disease over the long-term follow up.

NADiA ProsVue is expected to reduce unnecessary treatment of certain post-prostatectomy men thus reducing the morbidity and costs associated with adjuvant treatment, such as radiation therapy. This is significant

10

as approximately 80% of men that have a radical prostatectomy are cured of the disease, but about 30%-50% of men who receive adjuvant treatment based upon the pathological features of their disease may not benefit from such treatment as they are otherwise stable. This unnecessary treatment costs between $35,000 and $50,000 per patient and is typically associated with serious morbidity such as impotence and urinary incontinence. NADiA ProsVue is a beneficial tool available to help clinicians make confident and informed decisions about the patients they refer for follow-up therapy post radical prostatectomy. Further, ProsVue has the ability to provide “peace of mind” to patients who may be concerned about the recurrence of their disease.

The initial ProsVue commercialization strategy consists of a combination of targeted direct sales, followed by potential collaborations with major laboratories and diagnostic partners to help increase the market penetration of the test. Our CLIA laboratory has completed the verification of ProsVue in its new facility and has the ability and capacity to receive accessions and process samples. We have hired a small and focused commercial organization to initiate the direct launch of ProsVue. The commercial team, including sales, marketing, customer support, inbound logistics, and reimbursement, will execute a comprehensive marketing campaign in select geographical areas within the US initially, and in the future transition to serve as the “specialty organization” supporting a partner sales infrastructure of national scope.

Expanded Applications for ProsVue

We are developing several new tests with expanded applications for ProsVue to build a focus on men’s health. These complementary tests for prostate cancer will leverage our launch of ProsVue to urologists. We anticipate broadening the claims for ProsVue to enable a larger patient base to be monitored for a longer period post-prostatectomy. In addition, we plan to conduct further clinical studies to utilize ProsVue for patient monitoring during follow-up treatments. Due to ProsVue’s ability to detect low levels of tPSA, we believe the test could be beneficial in aiding clinicians in these expanded applications.

HIV Viral Load Test

We also developed an ultra-sensitive viral load test to monitor HIV patients that are taking highly active anti-retroviral therapy. Viral load testing is one of the most valuable measures for predicting HIV disease progression and gauging how well anti-retroviral treatment is working. Effective anti-retroviral treatment can often reduce RNA viral load to levels that are undetectable by current diagnostic tests. Unlike current tests measuring HIV RNA, our NADiA technology measures a specific HIV viral protein, p24, which is present in greater numbers relative to HIV RNA. Specifically, per unit of sample, there are 3,000 p24 molecules while only two copies of HIV RNA. We have developed an experimental blood-based HIV viral load p24 assay utilizing NADiA technology that achieved a sensitivity of one femtogram/mL, which is below the limit of detection of the most sensitive FDA cleared HIV RNA-based assay. As a result of our decision to focus on cancer diagnostics, we are currently pursuing a development and commercial partner for our NADiA HIV assay.

Microbubble Isolation Technology

In addition to our NADiA technology, we have a novel cell isolation technology that makes it possible to isolate rare cells in the presence of billions of non-target cells using antibody-coated albumin microbubbles to bind to target cells. We believe our albumin microbubbles have significant competitive advantages. In addition, the albumin microbubbles can easily collapse and disappear without the cumbersome step of separating magnetic beads from targeted cells, as is necessary with current commercial isolation technologies. This technology can be used to target antigens, bacteria, viruses, and cells while simultaneously concentrating and removing other contaminating materials from the sample.

Utilizing our microbubble isolation technology and NADiA, we are developing a test method to identify, quantify and characterize circulating epithelial cells present in blood to aid in monitoring cancer progression. The initial application will focus on prostate cancer, with breast and colon cancer to follow.

Arista Molecular CLIA Laboratory

In September 2011, we completed a restructuring of our Personalized Medicine division, which included downsizing and consolidating Arista Molecular’s CLIA laboratory operations into Iris Molecular Diagnostics. As

11

part of this restructuring, we discontinued non-proprietary testing services, but maintained Arista’s licenses and high-complexity CLIA laboratory capabilities, as well as limited personnel to perform NADiA and other proprietary tests. The restructuring provided significant cost reductions and enhanced profitability in our business. See Note 4 — “Restructuring and Impairment of Assets,” in the accompanying notes to financial statements for more information about the restructuring of our Personalized Medicine segment.

Our Strategy

Our goal is to maintain our leadership position in automatedin vitro diagnostics for urinalysis and sample processing while becoming a global leader in hematology and molecular diagnostics by offering products and solutions that increase laboratory productivity and efficiency and diagnostic tests that improve patient care. To achieve this goal, we intend to:

Increase the market adoption of the automated urinalysis platform in the in vitro diagnostics market. We strive to develop automated diagnostic instrumentation and solutions that enable increased laboratory productivity and efficiency. As we continue to market the clinical value of urinalysis, specifically in microscopy, we expect to increase market awareness and demand for our automated urinalysis products. In addition, we continue to pursue large multi-unit, multi-site contracts with large volume laboratories and to invest in emerging markets to increase our installed base of instruments.

Broaden our product offerings in the urinalysis IVD market. We intend to broaden our offerings in the urinalysis IVD market by developing and commercializing new products and solutions that improve laboratory efficiency and provide healthcare providers with more timely and more valuable information. The iChemVELOCITY, an automated urine chemistry analyzer, and iRICELL workstation represent key new product offerings that we launched domestically in 2011. The iChemVELOCITY, when linked with our iQ microscopy analyzer, allows us to offer an integrated system, called the iRICELL. We also recently introduced the iRICELL 1500 to provide an automated solution for lower volume laboratories and expand our addressable market opportunity. In addition, we are leveraging our 3GEMS imaging technology to develop next-generation urinalysis instruments to provide our customers with innovative products.

Use our imaging technology expertise to enter the automated hematology in vitro diagnostics market. We intend to leverage our imaging technology, which forms the basis of our market-leading urinalysis products, into other IVD markets where customers will value automation and increased efficiency. We are developing a hematology product portfolio that utilizes our next-generation 3GEMS imaging technology to reduce the need to prepare manual slides and perform subjective assessments of those slides under a microscope. We believe our product, by using a digitally-imaged virtual slide, will significantly decrease labor spent in laboratories by reducing the manual examination of abnormal blood samples while improving standardization.

Enter higher value segments of the market focused on personalized medicine. We believe that NADiA, our proprietary molecular diagnostic technology, has the potential to improve patient care management by allowing for earlier monitoring of disease and detection of relapse and to improve patient outcomes due to its ultra-sensitive detection of proteins. Our portfolio of emerging molecular diagnostic tests for cancer is designed to provide physicians and patients with more valuable information that may impact the treatment decision in managing the course of disease. As a result, we believe our NADiA platform is well-positioned for growth with the advent of personalized medicine utilizing genomic and molecular data to better determine targeted therapies for patients.

We launched ProsVue, a prognostic test for prostate cancer, in the first quarter of 2012, which is our first commercialized product utilizing our NADiA technology platform. Our product pipeline in personalized medicine includes expanded applications for ProsVue, as well as applications for circulating epithelial cells to monitor solid tumor cancers with an initial application for prostate cancer followed by breast and colon cancer. To accelerate the commercialization and market penetration of these tests, as well as others outside these applications, we plan to pursue licensing opportunities with commercial partners.

Pursue selective acquisitions. We will continue to pursue selective acquisitions to augment our organic growth. Our acquisition strategy is to target companies and product lines that complement our business and

12

provide additional earnings and infrastructure necessary for the commercialization of our pipeline. For example, our Sample Processing division acquired an automated bench-top instrument for FISH testing, the ThermoBrite Elite, which will be launched in the first quarter of 2012.

Competition

Competition in the IVD industry is intense. Many of our competitors are substantially larger than we are and have greater financial, research, manufacturing, marketing, sales and other resources than we do. As a result, our competitors may develop technologies or products that could render our products or products under development obsolete or noncompetitive.

Urinalysis

The principal competitive factors in the urinalysis market are cost-per-test, ease of use and quality of results. In the automated urine microscopy segment, Sysmex Corporation markets its automated non-imaging urine sediment analyzers globally and remains our principal competitor in the urine microscopy segment. Elektronika 77, a Hungarian company, offers a slide-based automated microscopy analyzer that can be run as stand-alone or in combination with a urine chemistry system. In the urine chemistry segment, Siemens Healthcare Diagnostics, ARKRAY and Roche Diagnostics are our principal competitors selling urine analyzers and test strips used in determining the concentration of various chemical substances found in urine. In addition, there have been several Chinese microscopy and chemistry instruments introduced in the international marketplace at discounted prices, albeit with reduced quality and functionality. We believe our systems provide the highest level of integration of urine chemistry and microscopy and the broadest menu available to provide digital images of urine and other body fluids particles with superior quality, which provides significant competitive advantages.

We are experiencing increased domestic and international pricing pressures in the urinalysis market due to the ongoing consolidation of both hospitals and medical device suppliers, increasing competition and decreasing reimbursement. Competitors are attempting to offer one-stop shopping for a variety of laboratory instruments, supplies and service with price discounts based on the hospital’s aggregate volume of business. We have been successful in countering this type of strategy by our large competitors by negotiating contracts with group purchasing organizations, or GPOs, in the United States allowing GPO members to purchase our products at competitive pricing.

Hematology

Hematology is a mature segment of thein vitro diagnostics market in which there are a number of large competitors who already have an established market presence and significantly greater resources than we have. The major competitors in the hematology market include Abbott Laboratories, Beckman Coulter, Inc., Siemens Healthcare Diagnostics, Sysmex Corporation and Horiba ABX. Our hematology analyzer currently under development represents a significant advancement in this market by combining an automated instrument with image-based expanded white cell differentials with complete blood counts. We believe this differentiates us from existing products, and should allow us to make a strong entry into the hematology testing market.

Sample Processing

The primary competitive factors in the centrifuge market include speed, ease of use, size and cost. The major competitors in the bench-top centrifuge market include the Drucker Company, LW Scientific and Hettich. With the industry trend moving away from bulky floor models to smaller, faster, more efficient bench-top models, we are facing competition from a number of U.S. and foreign competitors. We believe our products are differentiated due to innovative design, single push button operation, small footprint, quiet cycle and rapid separation time.

In the pre-analytical FISH market, the majority of patient samples are still processed manually by dipping slides in successive Coplin jars. We believe protocol complexity and time/temperature sensitivity have limited the competitive landscape of cost-effective FISH automation alternatives to date. The market leader is Abbott Molecular’s VP2000 followed distantly by SciGene’s Little Dipper and the Abbott Xmatrix. While the VP2000 automates a number of sample pre-treatment steps, the ThermoBrite Elite provides expanded features with automation of all the pre- and post-hybridization steps, as well as on-board denaturation and hybridization at an affordable price for both large and small laboratories.

13

Personalized Medicine

In the ultra-sensitive protein detection market, we may experience competition from companies that utilize enzyme-linked immunosorbent assay, or ELISA, chemiluminescence and fluorescence technologies, including Abbott Diagnostics, Beckman Coulter, Inc., Ortho-Clinical Diagnostics, Inc., Roche Diagnostics and Siemens Healthcare Diagnostics. Our technology detects proteins at lower concentrations, which we believe will enable earlier detection of relapse of disease. Many of these companies market instruments and reagents for measuring serum markers in concentrations greater than 50,000 femtograms per milliliter, while we believe our technology detects concentrations as low as one femtogram per milliliter.

We believe that our first 510(k) cleared ProsVue test for prostate cancer primarily competes on the basis of clinical validation of its prognostic capabilities, as well as having attained regulatory clearance. There are a number of companies that offer “ultra-sensitive” PSA tests, but these tests are not sufficiently accurate nor precise at the low level of detection required. Myriad Genetics will soon be offering Prolaris as a prognostic test for patients both pre- and post-radical prostatectomy. Based upon published studies, Myriad claims incremental value in evaluating low-risk patients, but according to the clinical study data, it does not provide actionable information for medium and high risk patients. Prolaris has no 510(k) clearance and its performance has not been validated against clinical recurrence events such as confirmation of cancer recurrence in bone scans, biopsy or death from prostate cancer. We believe that due to ProsVue’s ability to detect concentrations of tPSA at extremely low levels, the test can provide valuable information for the clinician when evaluating further treatment post-surgery.

Intellectual Property

We have a long history of innovation. Our diversified core technology spans a number of scientific endeavors, which include IVD, immuno-assay, rare cell separation technology, specimen processing and handling, pattern recognition and image analysis. Our commercial success depends on our ability to protect and maintain our proprietary technology by filing various patent applications domestically and in many foreign countries. We own various active patents and have pending patent applications for our technologies domestically and internationally.

These patents cover developments in imaging analysis and processing software, blood processing, digital refractometers, fluidics, centrifuges, immuno-PCR processes, rare cell separation, automated slide handling and disposable urinalysis products sold by us. In addition, we have various patents related to products of our sample processing business segment. These patents have various useful lives ranging from five to 15 years with expirations ranging from one to 15 years. Our core IVD patents in the United States will start to expire in 2017.

For our molecular platform technologies, we have a license for three patents from the University of California that cover the use of nucleic acid labeled antibodies in immunoassays. In addition, we filed a patent on the improved use of DNA labeled antibodies and obtained patents covering NADiA and our microbubble isolation technology methods. In October of 2010, Iris Molecular Diagnostic was granted a patent by the European Patent Office, which covers important aspects of the NADiA technology. This patent will be effective until November of 2024 and will be in force in numerous countries throughout Europe. In addition, Iris Molecular Diagnostics has also applied for numerous other patents throughout the world to obtain additional patent protection for our NADiA platform. In 2012, the European Patent Office also granted Iris Molecular Diagnostics a patent covering its microbubble for affinity isolation technology.

We have trade secrets, unpatented technology and proprietary knowledge about the sale, promotion, operation, development and manufacturing of our products. We have confidentiality agreements with our employees and consultants to protect these rights.

We claim copyright in our source code and have a patent on the ways in which our software displays images, and have filed copyright registrations with the United States Copyright Office. We also own various federally registered trademarks, including “IRIS”, “iChem”, “iQ”, “iRICELL”, “VELOCITY” “NADiA”, “3GEMS”, “ThermoBrite”, and “StatSpin.” We own other registered and unregistered trademarks, and have certain trademark rights in foreign jurisdictions. We intend to aggressively protect our patents, copyrights and trademarks.

14

Third-Party Payor Reimbursements

Successful sales of our products in the United States and other countries will depend on the availability of reimbursement from third-party payors such as private insurance plans, managed care organizations, and government funded healthcare programs, including Medicare and Medicaid. In the United States, the American Medical Association assigns to diagnostic tests specific Current Procedural Terminology, or CPT, codes, which are necessary for reimbursement of those tests. Once the CPT code is established, the Center for Medicare and Medicaid Services, or CMS, establishes reimbursement payment levels and coverage rules under Medicaid and Medicare, and private payors establish their own rates and coverage rules for such testing procedures. Our urinalysis tests are covered by established CPT codes and are therefore approved for reimbursement by Medicare and Medicaid as well as most third-party payors.

However, we have developed tests that do not relate to previously established CPT codes and we will need to obtain new CPT codes in order to obtain reimbursement. Reimbursement by a third-party payor depends on a number of factors, including the level of demand by health care providers and the payor’s determination that the use of the product represents a clinical advance or a reduction in the overall cost of treatment. In addition, in the United States, third-party payors and state governments routinely review reimbursement coverage for diagnostic tests considering budgetary constraints vis-à-vis demonstrated clinical efficacy. Outside of the United States, health care reimbursement systems vary from country to country, and to the extent we sell our products outside the United States, we may not be able to obtain adequate reimbursement coverage, if any, for our products.

Government Regulations

Our products are subject to stringent government regulation in the United States and other countries. These laws and regulations govern product testing, manufacturing, labeling, storage, record keeping, distribution, sale, marketing, advertising and promotion. The regulatory process can be lengthy, expensive and uncertain, and securing clearances or approvals often requires the submission of extensive testing and other supporting information. If we do not comply with regulatory requirements, we may be subject to fines, recall or seizure of products, total or partial suspension of production, withdrawal of existing product approvals or clearances, refusal to approve or clear new applications or notices and criminal prosecution. Further, any change in existing federal, state or foreign laws or regulations, or in their interpretation or enforcement, or the enactment of any additional laws or regulations, could affect us both materially and adversely.

In the United States, the FDA regulates medical devices under the Food, Drug, and Cosmetics Act. Before a new medical device can be commercially introduced in the United States, the manufacturer usually must obtain FDA clearance by filing a pre-market notification, or PMA, under Section 510(k) of the Food, Drug, and Cosmetics Act, or obtain FDA approval by filing a PMA application. The PMA application process is significantly more complex, expensive, time-consuming and uncertain than the 510(k) notification process. To date, we have cleared all of our regulated products with the FDA through the 510(k) notification process. We cannot guarantee that we will be able to use the 510(k) notification process for future products. Furthermore, FDA clearance of a 510(k) notification or approval of a PMA application is subject to continual review, and the subsequent discovery of previously unknown facts may result in restrictions on a product’s marketing or withdrawal of the product from the market.

We are also required to register as a medical device manufacturer with the FDA and comply with FDA regulations concerning good manufacturing practices for medical devices, or GMP Standards. In 1997, the FDA expanded the scope of the GMP Standards with new regulations requiring medical device manufacturers to maintain control procedures for the design process, component purchases and instrument servicing (Quality System Regulation or QSR). The FDA biannually inspects our manufacturing facilities for compliance with GMP Standards. We believe that we are in substantial compliance with the QSR.

Labeling, advertising and promotional activities for medical devices are subject to scrutiny by the FDA and, in certain instances, by the U.S. Federal Trade Commission. The FDA also enforces statutory and policy prohibitions against promoting or marketing medical devices for unapproved uses.

Clinical laboratory diagnostic tests that are developed and validated by a laboratory for use in testing that the laboratory performs itself are called laboratory developed tests and have traditionally been regulated by the

15

Centers for Medicare & Medicaid Services under the purview of CLIA as a laboratory service. We may develop lab developed tests in the future. The FDA maintains that it has authority to regulate the development and use of lab developed tests as diagnostic medical devices, but historically has elected not to exercise its enforcement authority with regard to most lab developed tests. The FDA indicated in June 2010 that it is considering exercising greater oversight of laboratory developed tests using a risk-based approach.

Many states have also enacted statutory provisions regulating medical devices. The State of California’s requirements in this area, in particular, are extensive, and require registration with the state and compliance with regulations identical to the GMP Standards established by the FDA. While the impact of such laws and regulations has not been significant to date, it is possible that future developments in this area could affect us both materially and adversely.

In addition to domestic regulation of medical devices, many of our products are subject to regulations in foreign jurisdictions. The requirements for the sale of medical devices in foreign markets vary widely from country to country, ranging from simple product registrations to detailed submissions similar to those required by the FDA. Our business strategy includes expanding the geographic distribution of these and other products, and we cannot guarantee that we will be able to secure the necessary clearances and approvals in the relevant foreign jurisdictions. Furthermore, the regulations in certain foreign jurisdictions continue to develop and we cannot be sure that new laws or regulations will not have a material adverse effect on our existing business or future plans. Among other things, CE Mark certifications are required for the sale of many products in certain international markets such as the European Community. We have secured CE Mark certification for our existing product lines.

We have obtained European Norm ISO 13485:2003 certification for our manufacturing facilities and are subject to surveillance by European notified bodies. In addition, our Chatsworth manufacturing facility is certified to ISO 13485:2003 with the Canadian Medical Devices Conformity Assessment System, or CMDCAS, which is the regulatory protocol used by Health Canada to certify manufacturers.

Our products are also subject to regulation by the U.S. Department of Commerce export controls, primarily as they relate to the associated computers and peripherals. We have not experienced any material difficulties in obtaining necessary export licenses to date.

Federal and State Clinical Laboratory Certification and Licensing

Our Arista laboratory, similar to almost all clinical laboratories operating in the United States, is required to maintain federal certification pursuant to the Clinical Laboratory Improvement Act, as amended, commonly known, together with its implementing regulations, as CLIA. The CLIA regulations have established three levels of regulatory control based on test complexity: “waived,” “moderate complexity” and “high complexity.” Arista has staffed and organized its Carlsbad, California clinical laboratory facility to meet the standards for a “high complexity” test laboratory, the most rigorous level of quality. CLIA imposes requirements relating to test processes, personnel qualifications, facilities and equipment, record keeping, quality assurance and participation in proficiency testing, which involve comparing the results of testing of specimens that have been specifically prepared for our laboratory to the known values of those specimens. Compliance with CLIA standards is verified by periodic on-site inspections. CLIA accreditation is maintained through regular inspections by the College of American Pathologists, and therefore, subject to its requirements and evaluation. The CLIA requirements also apply as a condition for participation by clinical laboratories in the Medicare and Medicaid programs.

CLIA does not preempt state laws that are more stringent than federal law. Therefore, additional requirements apply to our laboratory under California’s clinical laboratory licensure laws. The State of California Department of Health and Human Services — Laboratory Field Services enforces the state’s requirements to apply for and maintain licensure, CLIA certification, and proficiency testing. Our facilities have been inspected by these authorities and have been issued licenses to manufacture medical devices and provide laboratory diagnostic services in California. These licenses must be renewed every year. The State of California could prohibit our provision of laboratory services if we failed to maintain these licenses. Sanctions for failure to meet these certification, accreditation and licensure requirements may include suspension, limitation or revocation of certification, accreditation or licensure, civil penalties, criminal penalties, injunctive actions, and the imposition of plans of correction to remedy deficiencies. If a laboratory’s CLIA certificate or California license is revoked or suspended, the laboratory must then cease performing testing, until licensure is reinstated.

16

Antifraud Laws/Overpayments

Federal Medicare/Medicaid laws apply a wide array of fraud and abuse provisions to laboratories that participate in these programs. These laws include the federal False Claims Act, which prohibits, among other things: the submission of false claims or false information to government programs; deceptive or fraudulent conduct; and the provision and billing for excessive or unnecessary services. Federal law also prohibits fraud on private sector health insurers. Penalties for violating these laws may include exclusion from participation in the Medicare/Medicaid programs, asset forfeitures, civil penalties and criminal penalties. If an entity is determined to have violated the federal False Claims Act, it may be required to pay up to three times the actual damages sustained by the government, plus civil penalties ranging from $6,000 to $11,000 for each separate false claim. While there are many potential bases for liability under the federal False Claims Act, such liability primarily arises when an entity knowingly submits, or causes another to submit, a false claim for reimbursement to the federal government. Submitting a claim or failing to repay an overpayment with reckless disregard or deliberate ignorance of its validity could result in substantial civil liability. Exclusion from the Medicare and Medicaid programs is mandatory for certain offenses, and regulators also have the authority to impose permissive exclusions from Medicare and Medicaid programs in response to a wide range of less serious misconduct. In addition, the CMS may suspend Medicare payments to any provider it believes has engaged in fraudulent billing practices. Because the financial consequences to a laboratory of exclusion from participation in federal health care payment programs would typically be devastating, avoiding such exclusion has been a motivating factor in the settlement of many fraud investigations.

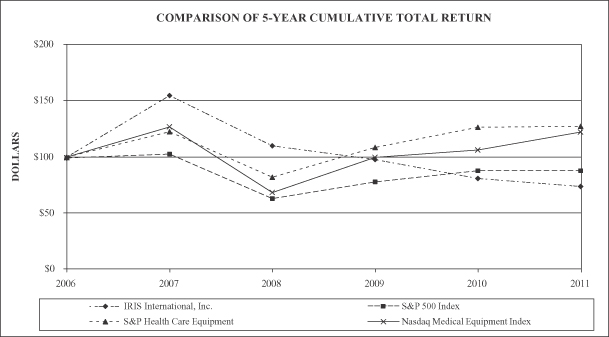

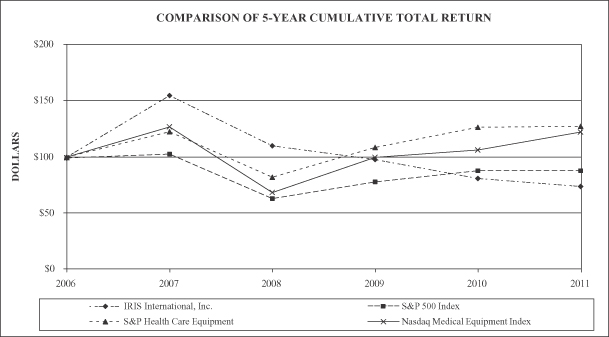

California law extends similar penalties beyond Medicare to punish laboratories engaged in conduct which defrauds the Medi-Cal program, private insurers or patients. California law also denies Medi-Cal enrollment to any provider that has entered into a settlement in lieu of conviction for fraud or abuse in any government program and further provides that a provider under investigation by certain governmental agencies for fraud or abuse will be subject to a temporary suspension from Medi-Cal pending investigation.