Continental Airlines, Inc.

2009-1 EETC Investor Presentation

Issuer Free Writing Prospectus

Filed pursuant to Rule 433(d)

Registration No. 333-158781

The issuer has filed a registration statement (including a prospectus) with the

SEC for the offering to which this communication relates. Before you invest, you

should read the prospectus in that registration statement and other documents

the issuer has filed with the SEC for more complete information about the issuer

and this offering. You may get these documents for free by visiting EDGAR on the

SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any

dealer participating in the offering will arrange to send you the prospectus if you

request it by calling 1-212-761-5344 (institutional investors)

Continental Airlines 2009-1 EETC

• Continental Airlines (“Continental”) is offering $389,687,000 of Pass Through

Certificates, Series 2009-1

• One class of Pass Through Certificates: Class A

• The proceeds from the offering will be used by Continental to:

– Finance the purchase of 5 new Boeing 737-900ER aircraft to be selected by

Continental from a pool of 7 Boeing 737-900ER aircraft scheduled for delivery in

3Q 2009

– Refinance the following 12 aircraft originally delivered new to Continental in

1998-1999:

• 4 Boeing 737-700s

• 3 Boeing 737-800s

• 2 Boeing 757-200s

• 3 Boeing 777-200ERs

• Joint Structuring Agents: Morgan Stanley and Goldman Sachs

• Joint Bookrunners: Morgan Stanley, Goldman Sachs and Calyon

2009-1 EETC Structural Summary

Principal Amount

Expected Ratings

Initial and Highest LTV(1)(2)

Interest Rate

Initial Average Life

Regular Distribution Dates

Final Expected Distribution Date

Final Maturity Date

Section 1110 Protection

Liquidity Facility

Depositary

$389,687,000

Baa2 / A-

54.0%

Fixed, semi-annual, 30/360 day count

5.9 years

January 8 and July 8, commencing January 8, 2010

July 8, 2016

January 8, 2018

Yes

3 semi-annual interest payments

Funds raised will be held in escrow with the

Depositary and withdrawn from time to time to

purchase Equipment Notes as the aircraft are

financed

Notes:

1. Calculated as of January 8, 2010, the first Regular Distribution Date, assuming the financings of all 17 aircraft are completed prior to such date

2. Highest LTV on underlying Equipment Notes is 55.0%

Key Structural Elements

• Single Class A tranche being offered. Continental has the right to issue a

single additional subordinated tranche in the future

• Single waterfall with clear priority of Class A principal and interest payments

over the subordinated tranche if subsequently issued

• Core aircraft types to Continental’s fleet operations

• Cross-collateralization and cross-default of all aircraft

Collateral Summary

Notes:

1. The currently owned aircraft are subject to existing security interests. Such security interests are scheduled to be discharged prior to October 2009, and each currently

owned aircraft will be available for financing under this Offering once such existing security interest with respect to such aircraft has been discharged

2. The lesser of the mean and median values as appraised by AISI, BK Associates and Morten Beyer & Agnew (Maintenance Adjusted Base Value in the case of the Currently

Owned Aircraft and standard Base Value in the case of the New Aircraft)

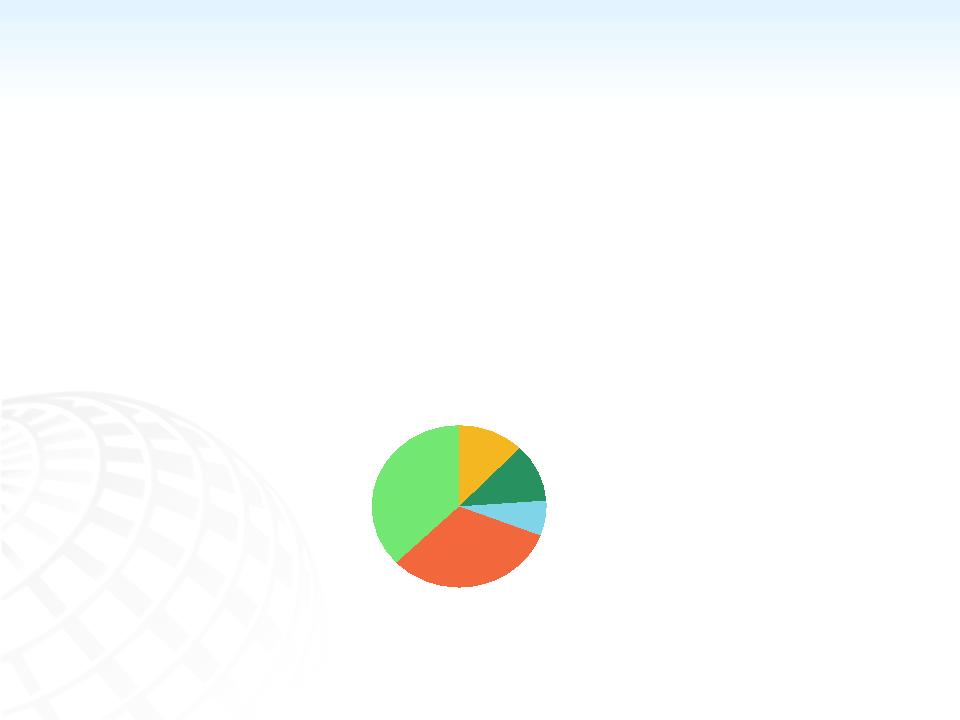

Diverse Collateral Pool

• The collateral pool benefits from diversification of aircraft types

• 68% Narrowbody / 32% Widebody Mix(1)

CAL 2009-1 Collateral Mix

Distribution of Appraised Value(1)

737-800

11.6%

777-200ER

31.9%

737-700

12.3%

737-900ER

37.3%

757-200

6.9%

Note:

1. The percentages were calculated assuming the first 5 Boeing 737-900ER aircraft of the 7 from which Continental may choose from are financed hereunder

Aircraft Appraisals

• Continental has obtained Base Value Desktop Appraisals from three

appraisers (AISI, BK Associates and Morten Beyer & Agnew)

• Maintenance Adjusted Base Value for the currently owned aircraft

• Base Value for the new aircraft

• Maintenance Adjusted Base Value includes adjustments from the mid-time,

mid-life baseline to account for the actual maintenance status of the aircraft

• Appraisers looked at specific maintenance records of each of the currently

owned aircraft

• Provides a more precise valuation of a given aircraft than Base Value

• Aggregate aircraft appraised value of $720,626,667(1)

• Appraisals available in the Preliminary Prospectus Supplement

• Appraisals indicate collateral cushion of 45.9% - 52.2% over the life of the

bond(2)

Notes:

1. Aggregate aircraft appraised value of the 12 currently owned aircraft and the first 5 Boeing 737-900ER aircraft. Appraised value is the lesser of the average and median values

of each aircraft as appraised by three appraisers. An appraisal is only an estimate of value and should not be relied upon as a measure of realizable value

2. The percentages were calculated assuming the first 5 Boeing 737-900ER aircraft of the 7 from which Continental may choose from are financed hereunder

Collateral Overview

Boeing 737-NG Family

• World’s all-time best selling family of narrowbody commercial aircraft

• B737-800 is the best selling model within the 737 family

#1 in terms of order book (3,137) and #2 in terms of operators (104)

• B737-700 is the second best selling model within the 737-NG family

#2 in terms of order book (1,979)

• Introduced in 2007, B737-900ER is the newest member of the 737 family

Offers the lowest seat-mile costs of any narrowbody aircraft in production

Source: The Boeing Company, Morten Beyer & Agnew Future Aircraft Values - January 2009, BK Associates

Collateral Overview

Boeing 757-200

• The only aircraft type currently operated by all six U.S. legacy carriers

• Offers the lowest seat-mile costs in its capacity and range class

• Currently has no direct replacement and values have stabilized in recent

years as U.S. airlines have retained the type and retro-fitted it with winglets to

improve range performance to expand both domestic and international

operations

Increasingly being used on long-haul routes connecting smaller cities which

would be uneconomical to serve using widebody aircraft

• Long term value retention is supported by the development of freighter

conversion programs and by the potential acquisition by air carriers based in

developing nations

Source: SH&E, Morten Beyer & Agnew

Collateral Overview

Boeing 777-200ER

• The most popular widebody aircraft in service and a staple of the trans-

Atlantic and trans-Pacific fleets of many operators

• Second best selling widebody family in Boeing history and fourth best selling

aircraft in Boeing history(1)

• Strong potential for freighter conversion, which can extend the life of the

aircraft and support residual values

• Availability is limited with most surplus aircraft now absorbed. In the medium

term, the 777-200ER is well-positioned with a broad operator and distribution

base

Source: The Boeing Company, SH&E, BK Associates

Note:

1. Excludes MD-80

The following is a transcript of the oral comments of Thomas F. Cahill, Jr., which comments were accompanied by the foregoing slide presentation. The captions below correspond to the title of the slide that was presented during the comments below the caption. Such comments and slide presentation were posted on www.netroadshow.com on June 16, 2009.

1. Investor Presentation

Good morning everyone. My name is Tom Cahill. I am managing director of Morgan Stanley. On behalf of Continental, Morgan Stanley, Goldman Sachs and Calyon Securities I’d like to welcome you to this net roadshow presentation for the Continental Airlines 2009-1 EETC investor presentation.

2. Disclaimer

Before we begin, I do need to read off a SEC disclaimer. The issuer has filed a registration statement including a prospectus with the SEC for the offering to which this communication relates. Before you invest you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively the issuer, any underwriter or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling Morgan Stanley at 212-761-5334.

3. 2009-1 EETC

Okay to begin I’d like to talk a little about this transaction, the Continental Airlines 2009-1 EETC. Continental is offering $389.6 million of pass through certificates. This will be a single class, the class A only, and the proceeds of this security will be used by Continental to finance five new Boeing 737-900 ER aircraft to be selected out of a pool of seven that will be scheduled for delivery during the third quarter of this year, as well as to refinance 12 aircraft broken down by four Boeing 737-700s, three Boeing 737-800s, two Boeing 757-200s and three Boeing 777-200 ERs all in Continental’s existing fleet. The joint structuring agents for this transaction are Morgan Stanley and Goldman Sachs, and the bookrunners for this transaction are Morgan Stanley, Goldman Sachs and Calyon.

4. 2009-1 EETC Structural

All right kicking this off for the EETC structural summary. The principal amount is $389.6 million. The expected ratings are Baa2 and A- from Moody’s and S&P, respectively. We’ll have a maximum LTV of 54%. The interest rate will be fixed rate and semi-annual convention. It has an initial average life of 5.9 years and will have regular distribution dates of January 8 and July 8 commencing this coming January 8, 2010. The expected final distribution date is July 8, 2016, corresponding to a seven year final, and will have a legal final maturity date of

January 8, 2018. All of the aircraft will be benefiting from Section 1110 protection, and there will be a liquidity facility for 18 months or three semi-annual interest payments. Initially, the proceeds of this transaction will be placed with a depositary, which will be held in escrow until the aircraft are unencumbered or delivered by the manufacturer.

5. Key Structural Elements

I’d like to draw your attention to a couple of key structural elements. This transaction is going to consist of a single offering a Class A tranche alone. Continental does have the right to issue an additional subordinated tranche in the future. As in some of the recent EETCs this will have a single waterfall and there will be a clear priority in this transaction for the Class A principal and interest payments that will be senior to any subsequent subordinated tranche issuance. All of these aircraft are core to Continental and its fleet operations, and this transaction will have both cross-collateralization and cross-default on all of the aircraft from day one, which is particularly important and represents an enhancement over previous transactions that have been issued.

6. Collateral Summary

I draw your attention next to the collateral summary. As you can see on this page we’ve laid out for each of the aircraft not only the type, the registration number, what the delivery month was and for those aircraft that are already in Continental Airlines’ fleet, which EETC transaction they currently reside and the respective appraised values. In particular of the 12 aircraft that are in Continental’s fleet, two were financed in other transactions and are currently available and the remaining ten are part of the 98-1, the 99-1 or the 99-2 EETC transactions. In each of those transactions these particular aircraft were deliberately financed with shorter than normal tenors so that the company could take advantage of a favorable yield curve at that time and this transaction is now the normal refinancing of these aircraft to bring that to equalization to what the previous financings were. In fact I would note that for all of these aircraft in this transaction the maturity date of this transaction is inside of the maturity date for those three other transactions.

7. Diverse Collateral Pool

For the next page we talk about the collateral pool. As you can see by this pie chart this pool represents a diverse collateral pool that represents 68% narrowbody and 32% widebody mix. And the actual percentages for their different respective aircraft types ranges from a 6.9% for the 757-200s to 37.3% for the 737-900ERs.

8. Aircraft Appraisals

As in all EETC transactions Continental has obtained three desk top appraisals from AISI, BK Associates and Morten Beyer & Agnew. These are maintenance adjusted base values for the currently owned aircraft and base values for the new aircraft. Maintenance adjusted base values include an adjustment from the mid-time, mid-life baseline to account for the actual maintenance status of the aircraft. What that means specifically is that the appraisers looked at the specific maintenance records of each of the currently owned aircraft and then made adjustments in order

to provide a more precise valuation of the given aircraft than just the standard base value appraisal. The aggregate aircraft appraised value is $720.6 million and the specific appraisals are available in the prospectus supplement. These appraisals indicate there is a collateral cushion of approximately 46 to 52% over the life of this transaction.

9. Boeing 737-NG Family

Now I’d like to make a couple comments on the aircraft specifically. The Boeing 737 Next Gen family is basically the worlds all time best selling aircraft and narrowbody commercial aircraft. The 737-800 specifically is the best selling model within this family, represents the number one in terms of order books with 3,137 units and number two in terms of operators with 104 operators. 737-700 is the second best selling model within the family and is number two in the terms of the order book with 1,979 units. Introduced in 2007, the 737-900 ER is the newest member of the 737 family and it offers the lowest seat mile costs of any narrowbody aircraft in production.

10. Boeing 757-200

Turning to the 757-200, this is the only aircraft type currently operated by all six U.S. legacy carriers and it offers the lowest seat mile costs in its capacity class. While there is currently no direct replacement and values have stabilized in recent years as U.S. airlines have retained the type and retro-fitted with winglets to improve range performance to expand both domestic and international operations, it’s increasingly being used on long haul routes connecting smaller cities which would be uneconomical to serve using widebody aircraft. Longer term the value is retained in this aircraft is supported by the development of freighter conversion programs and by the potential acquisition by air carriers based in developing nations.

11. Boeing 777-200ER

With regard to the Boeing 777-200ER this is the most popular widebody aircraft in service and a staple of the trans-Atlantic and trans-Pacific fleets of many operators. It is the second best widebody family in Boeing’s history and the fourth best selling aircraft in Boeing’s history. There is a strong potential for freighter conversion, which can extend the life of the aircraft and support residual values. The availability is limited with most surplus aircraft now absorbed. In the medium term the 777-200ER is well positioned with a broad operator and a distribution base.

12. Conclusion

And with that on behalf of Continental, Morgan Stanley, Goldman Sachs and Calyon Securities, I’d like to bring this presentation to a close. Again I would ask you to the extent that you have any supplemental questions or need any other information please contact your respective salesperson and they’ll be more than happy to help you. Thank you.