3Q 2017 Earnings Call October 19, 2017 Exhibit 99.1

Safe Harbor Statement Certain statements included in this presentation are forward-looking and thus reflect our current expectations and beliefs with respect to certain current and future events and anticipated financial and operating performance. Such forward-looking statements are and will be subject to many risks and uncertainties relating to our operations and business environment that may cause actual results to differ materially from any future results expressed or implied in such forward-looking statements. Words such as “expects,” “will,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “goals” and similar expressions are intended to identify forward-looking statements. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed or assured. All forward-looking statements in this presentation are based upon information available to us on the date of this presentation. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as required by applicable law. Our actual results could differ materially from these forward-looking statements due to numerous factors including, without limitation, the following: our ability to comply with the terms of our various financing arrangements; the costs and availability of financing; our ability to maintain adequate liquidity; our ability to execute our operational plans and revenue-generating initiatives, including optimizing our revenue; our ability to control our costs, including realizing benefits from our resource optimization efforts, cost reduction initiatives and fleet replacement programs; costs associated with any modification or termination of our aircraft orders; our ability to utilize our net operating losses; our ability to attract and retain customers; potential reputational or other impact from adverse events in our operations; demand for transportation in the markets in which we operate; an outbreak of a disease that affects travel demand or travel behavior; demand for travel and the impact that global economic and political conditions have on customer travel patterns; excessive taxation and the inability to offset future taxable income; general economic conditions (including interest rates, foreign currency exchange rates, investment or credit market conditions, crude oil prices, costs of aircraft fuel and energy refining capacity in relevant markets); economic and political instability and other risks of doing business globally; our ability to cost-effectively hedge against increases in the price of aircraft fuel if we decide to do so; any potential realized or unrealized gains or losses related to fuel or currency hedging programs; the effects of any hostilities, act of war or terrorist attack; the ability of other air carriers with whom we have alliances or partnerships to provide the services contemplated by the respective arrangements with such carriers; the effects of any technology failures or cybersecurity breaches; disruptions to our regional network; the costs and availability of aviation and other insurance; industry consolidation or changes in airline alliances; the success of our investments in airlines in other parts of the world; competitive pressures on pricing and on demand; our capacity decisions and the capacity decisions of our competitors; U.S. or foreign governmental legislation, regulation and other actions (including Open Skies agreements and environmental regulations); the impact of regulatory, investigative and legal proceedings and legal compliance risks; the impact of any management changes; labor costs; our ability to maintain satisfactory labor relations and the results of any collective bargaining agreement process with our union groups; any disruptions to operations due to any potential actions by our labor groups; weather conditions; and other risks and uncertainties set forth under Part I, Item 1A., “Risk Factors,” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, as well as other risks and uncertainties set forth from time to time in the reports we file with the U.S. Securities and Exchange Commission.

Oscar Munoz Opening Remarks Chief Executive Officer

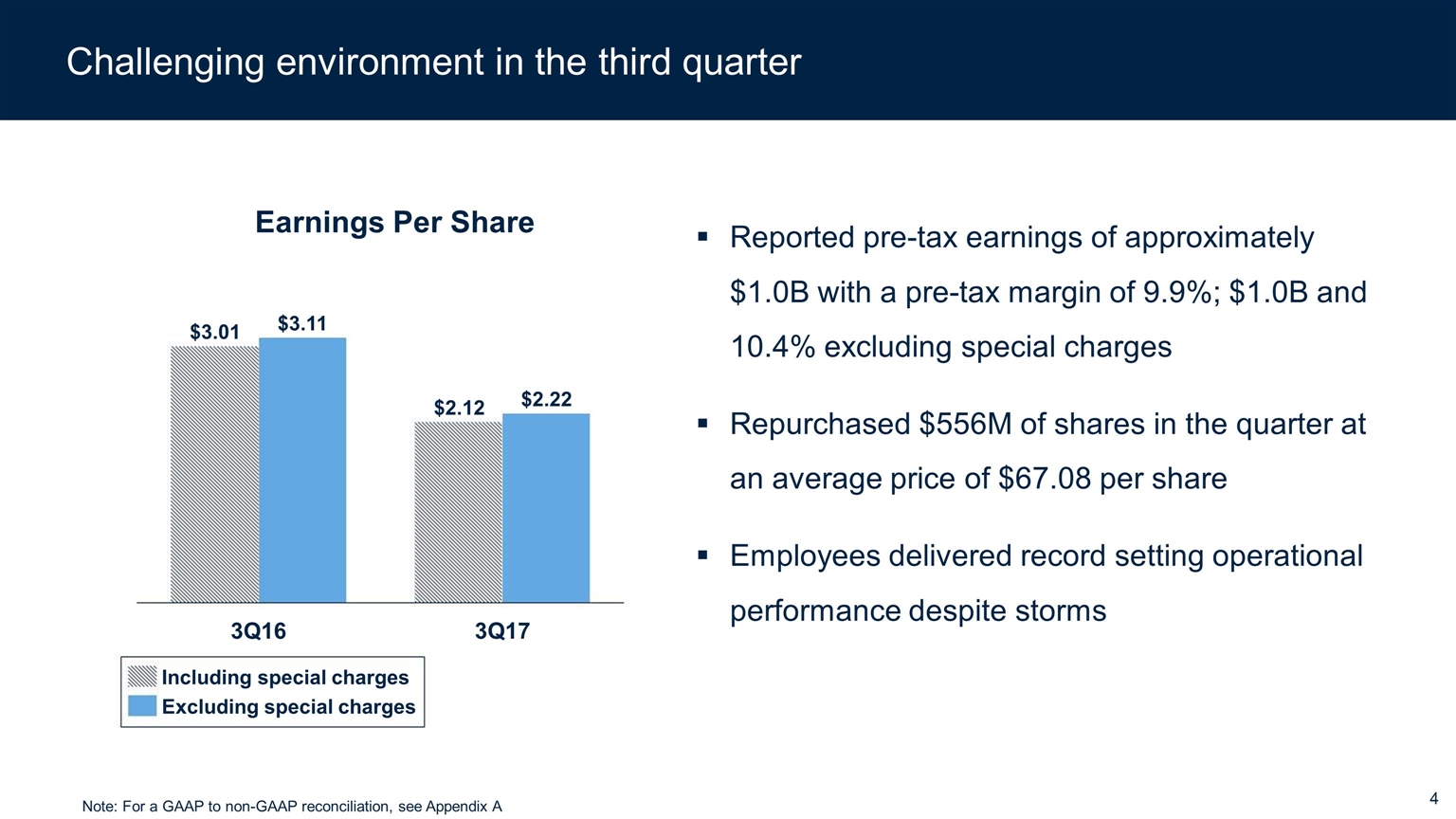

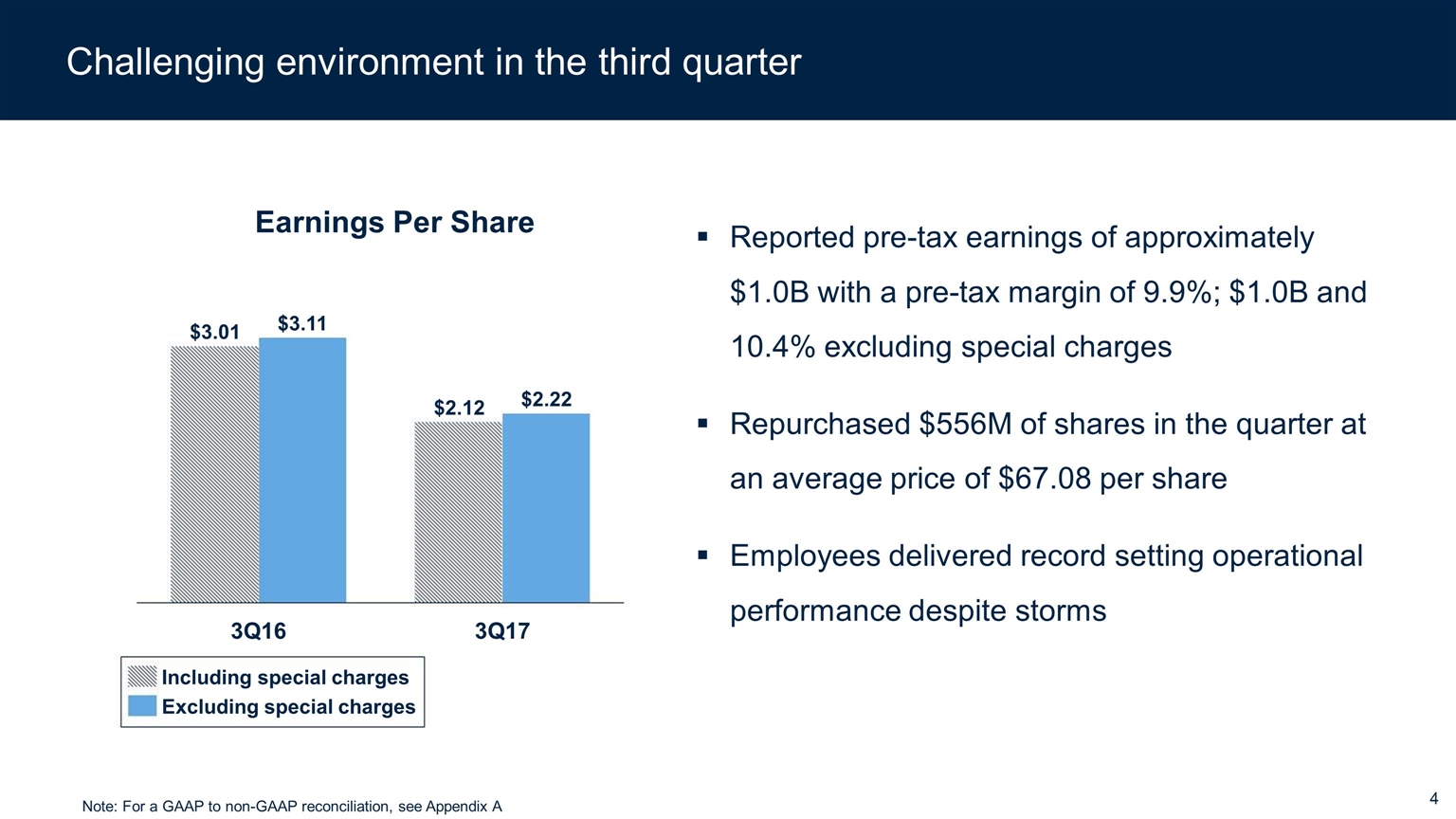

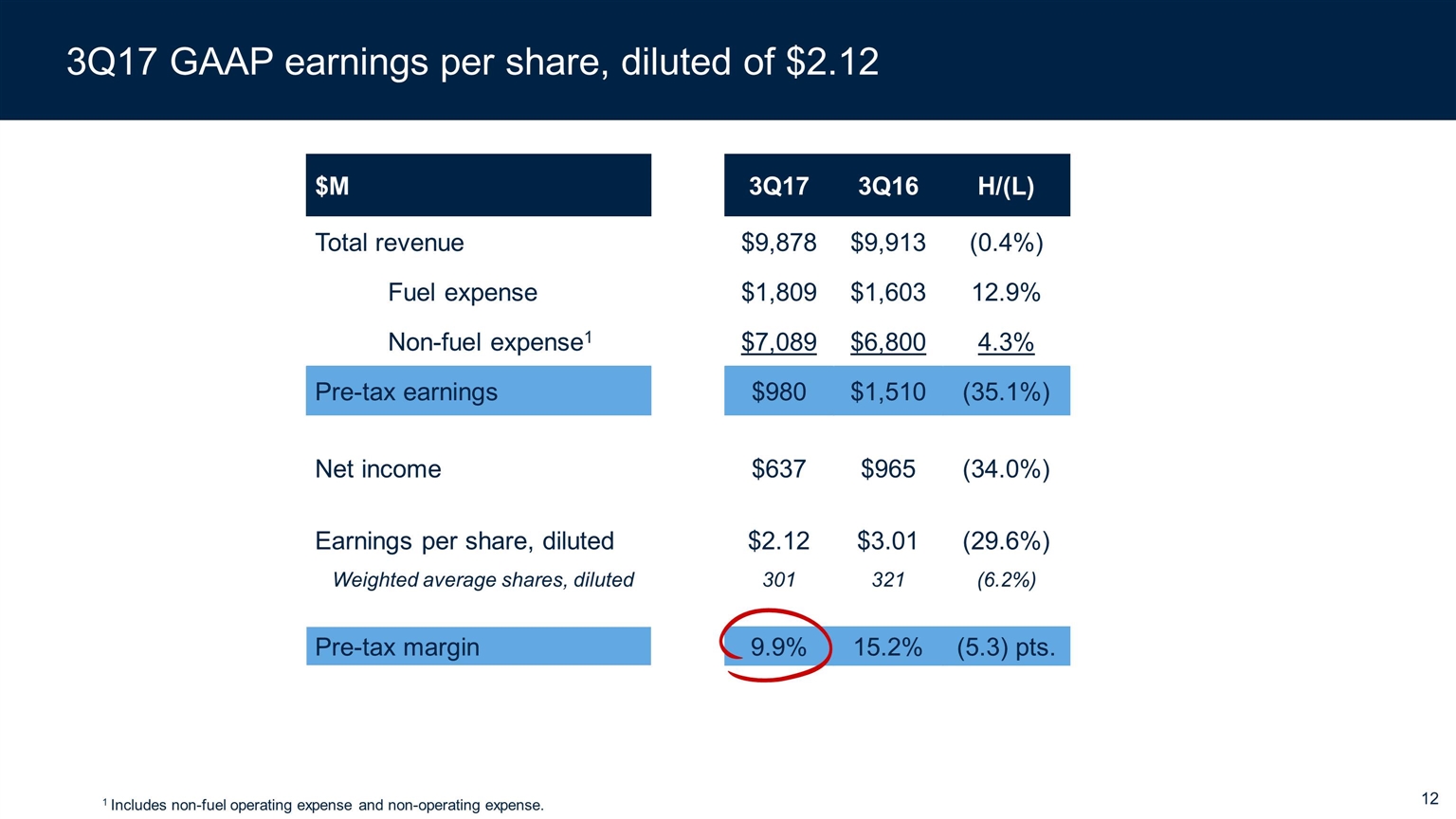

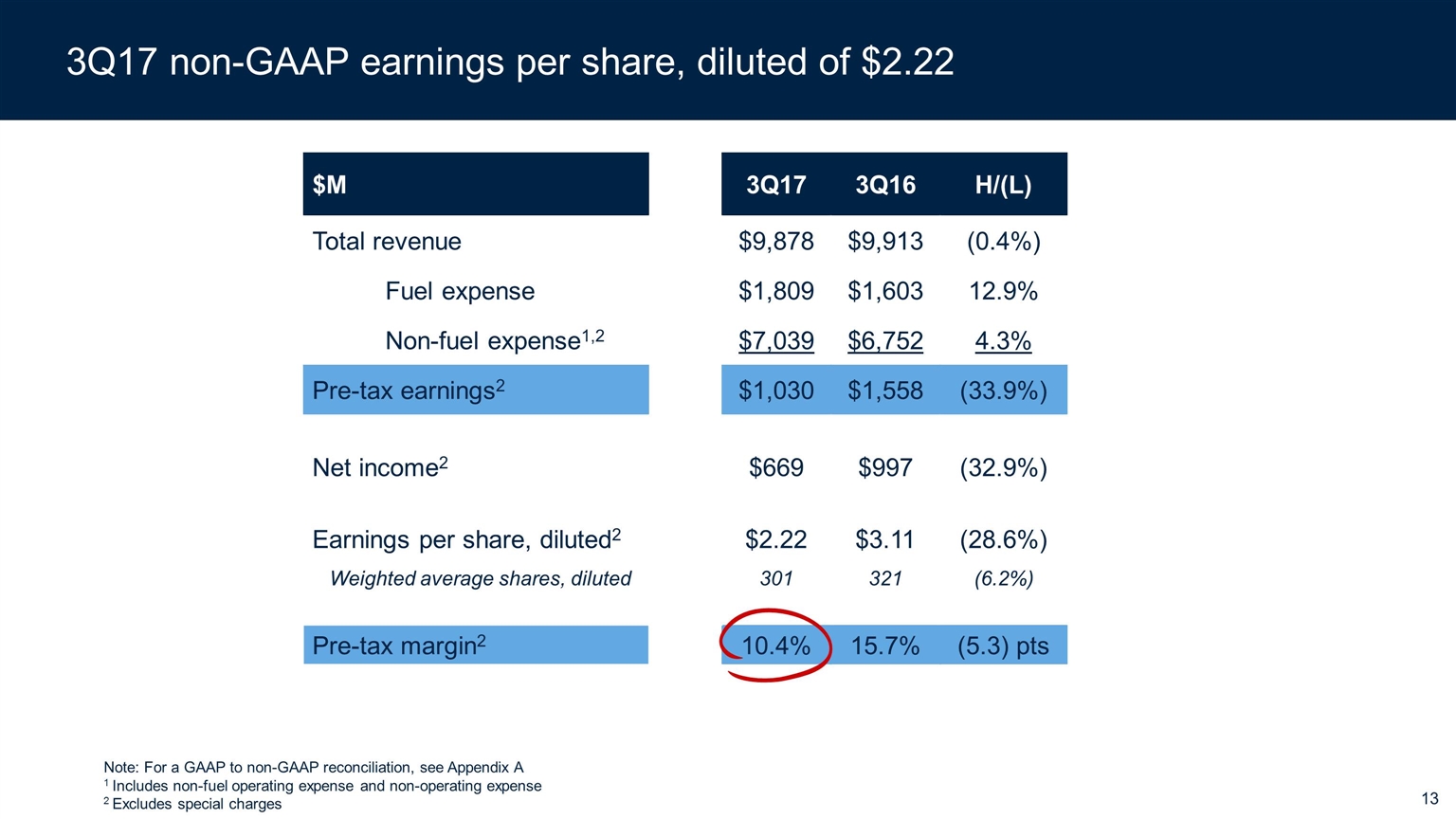

Challenging environment in the third quarter Reported pre-tax earnings of approximately $1.0B with a pre-tax margin of 9.9%; $1.0B and 10.4% excluding special charges Repurchased $556M of shares in the quarter at an average price of $67.08 per share Employees delivered record setting operational performance despite storms $ $ $ $ Earnings Per Share Note: For a GAAP to non-GAAP reconciliation, see Appendix A

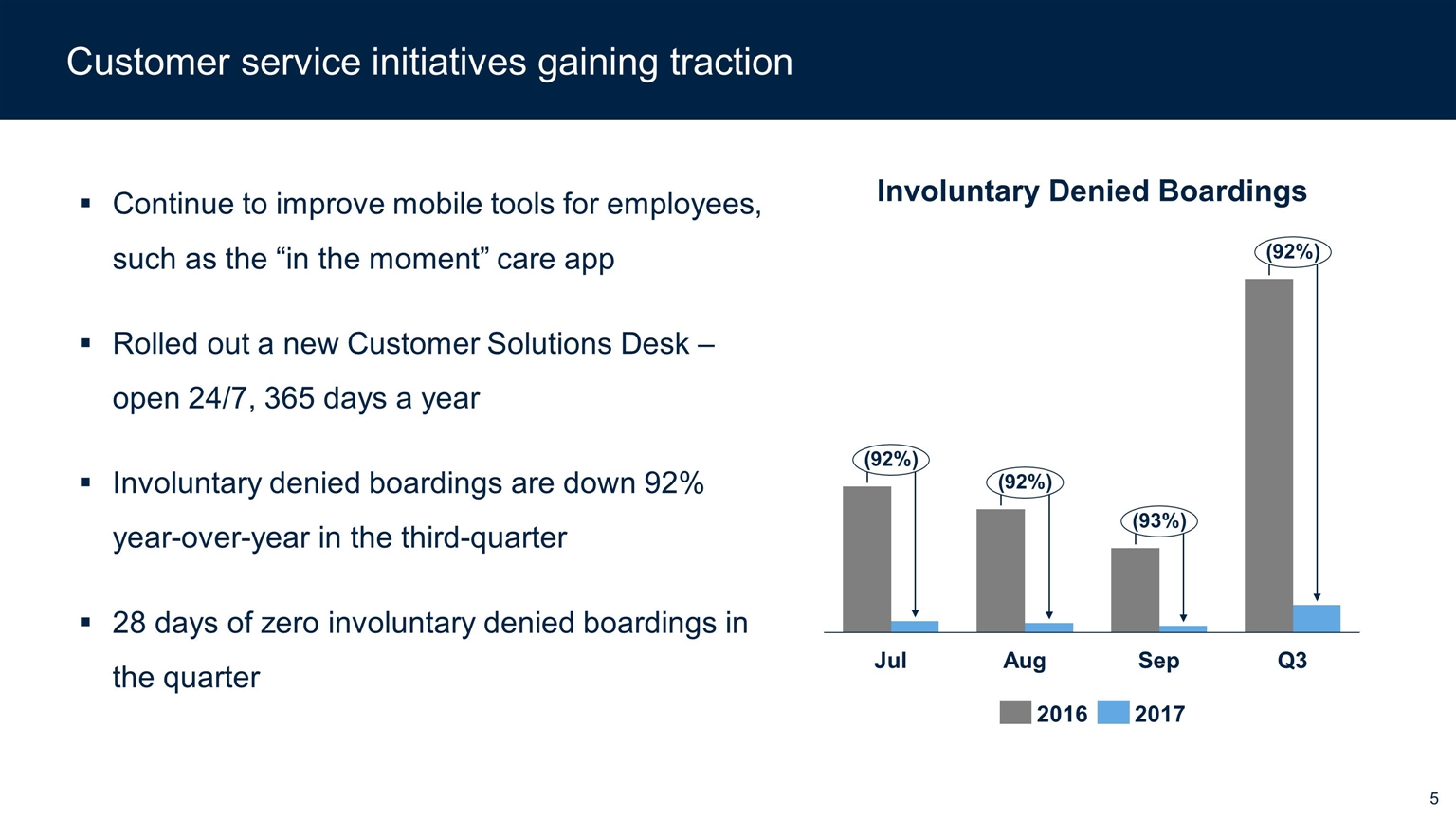

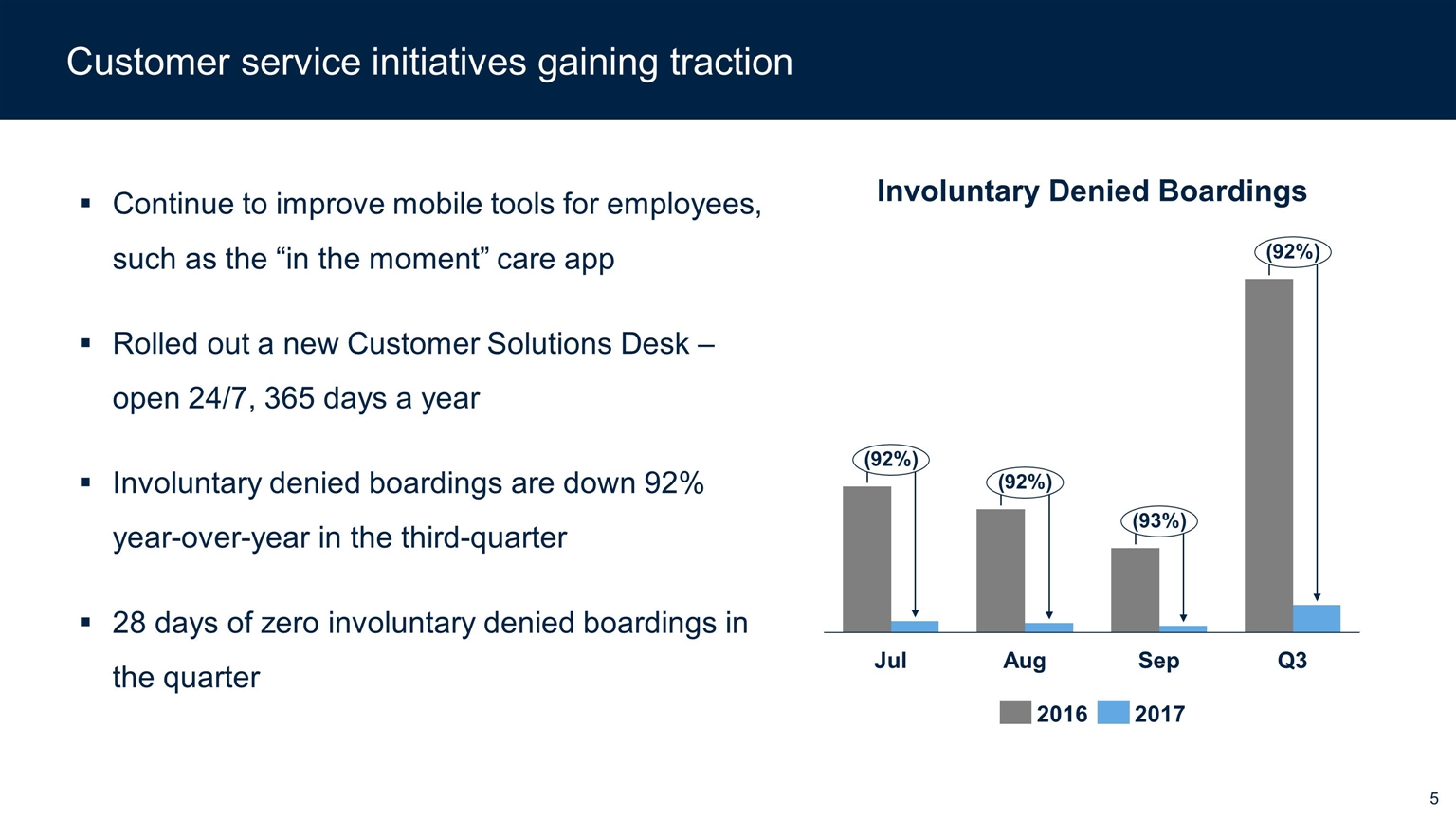

Customer service initiatives gaining traction Continue to improve mobile tools for employees, such as the “in the moment” care app Rolled out a new Customer Solutions Desk – open 24/7, 365 days a year Involuntary denied boardings are down 92% year-over-year in the third-quarter 28 days of zero involuntary denied boardings in the quarter Involuntary Denied Boardings

Scott Kirby President Revenue and Operations Update

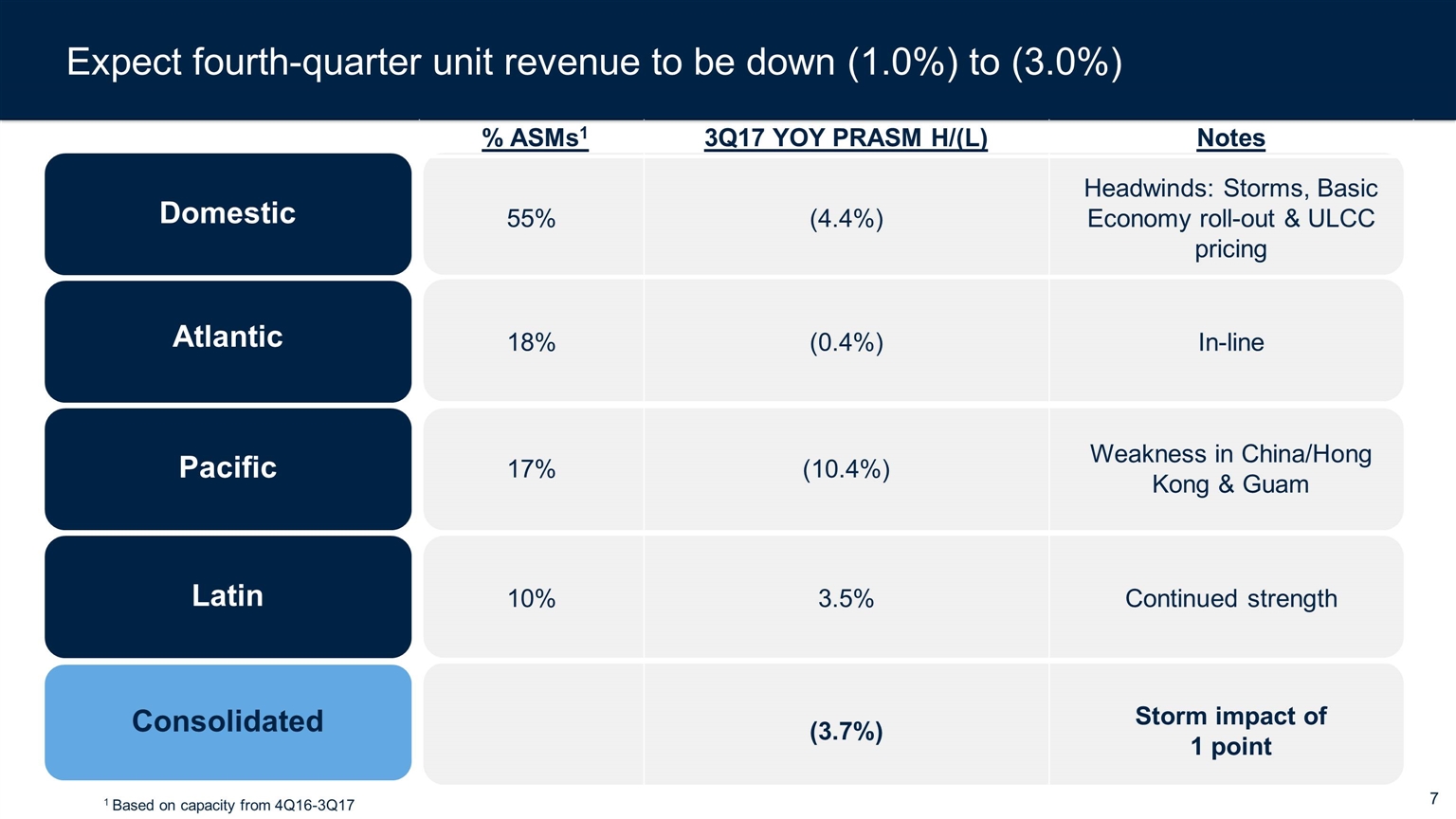

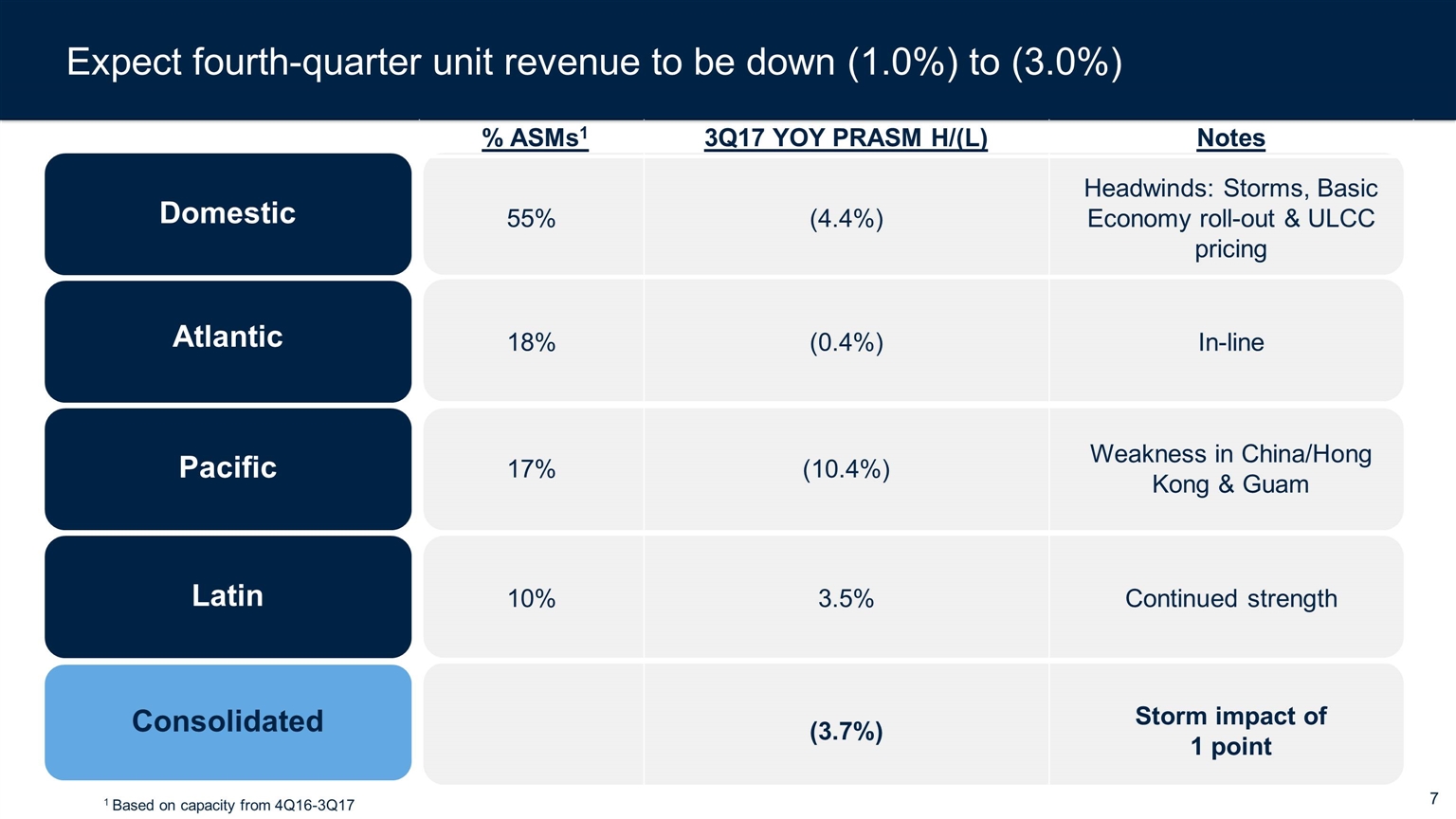

Expect fourth-quarter unit revenue to be down (1.0%) to (3.0%) Domestic Consolidated Latin Pacific Atlantic 1 Based on capacity from 4Q16-3Q17 % ASMs1 3Q17 YOY PRASM H/(L) Notes 55% (4.4%) Headwinds: Storms, Basic Economy roll-out & ULCC pricing 18% (0.4%) In-line 17% (10.4%) Weakness in China/Hong Kong & Guam 10% 3.5% Continued strength (3.7%) Storm impact of 1 point

We have been focused on: Running a great operation Improving the culture for employees and focusing on the customer Rebuilding our network profitably Executing on 2016 Investor Day initiatives 2017 has been an eventful year at United Improving profitability at United remains our top financial objective

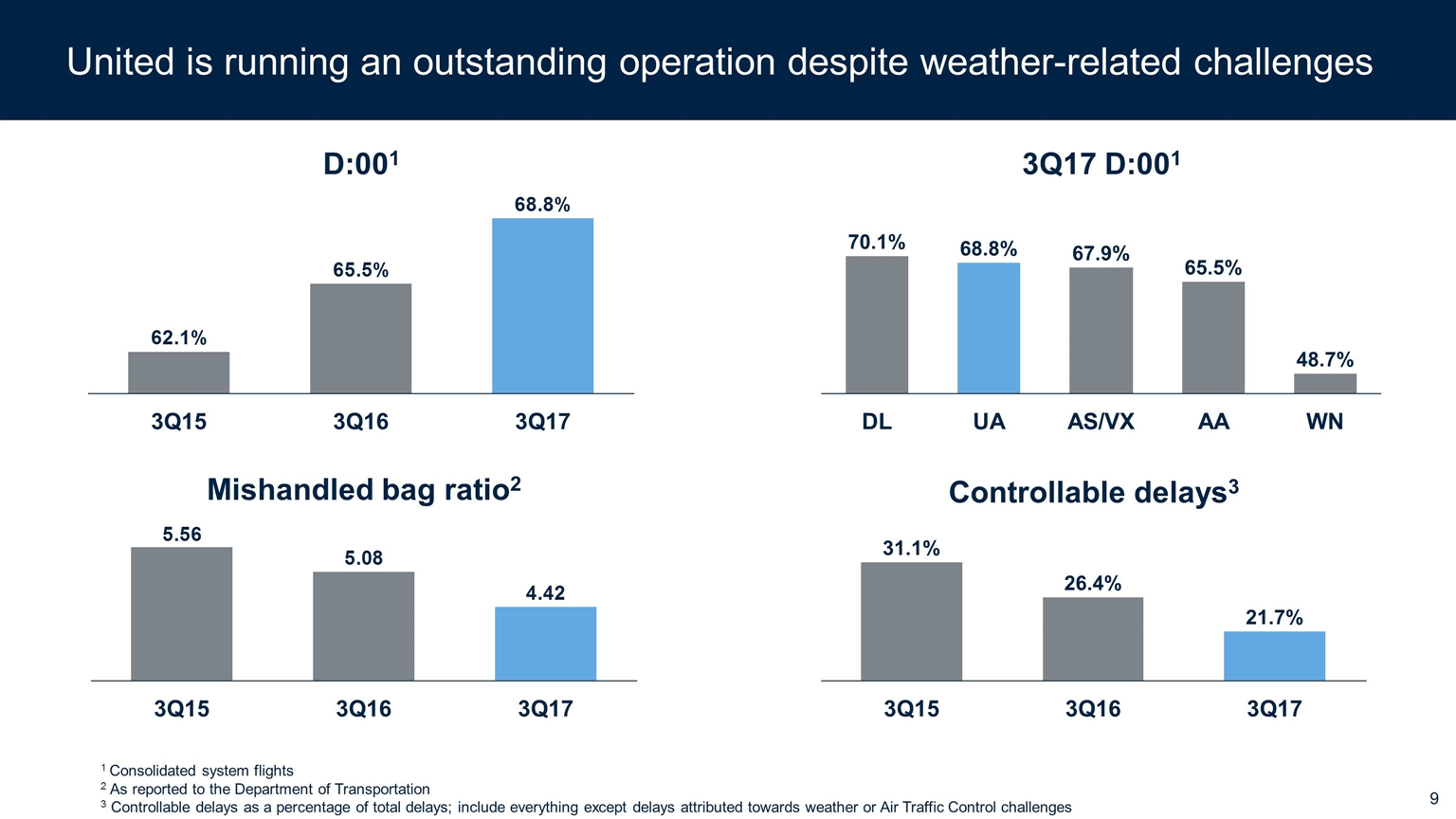

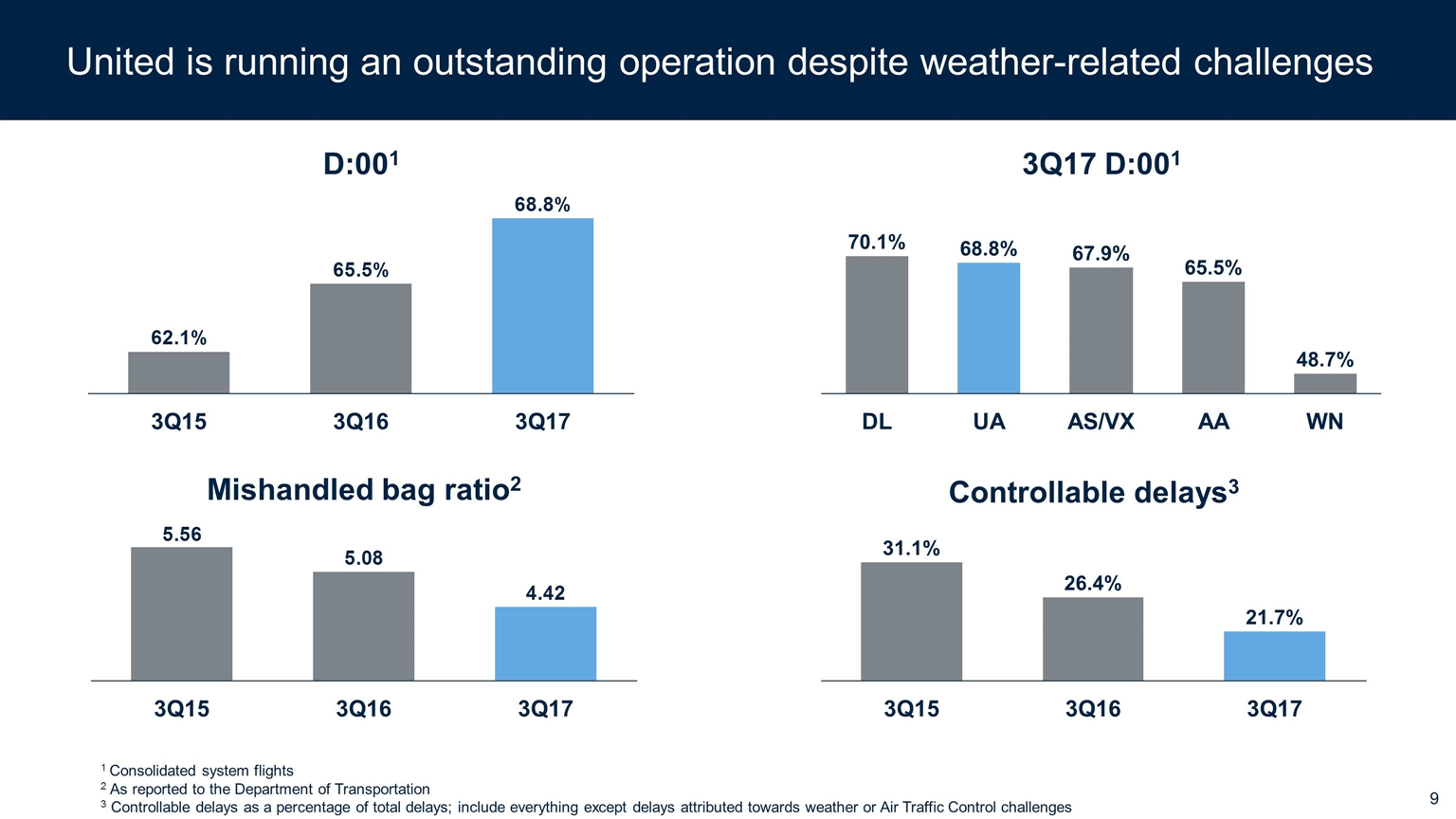

United is running an outstanding operation despite weather-related challenges Mishandled bag ratio2 D:001 1 Consolidated system flights 2 As reported to the Department of Transportation 3 Controllable delays as a percentage of total delays; include everything except delays attributed towards weather or Air Traffic Control challenges Controllable delays3 3Q17 D:001

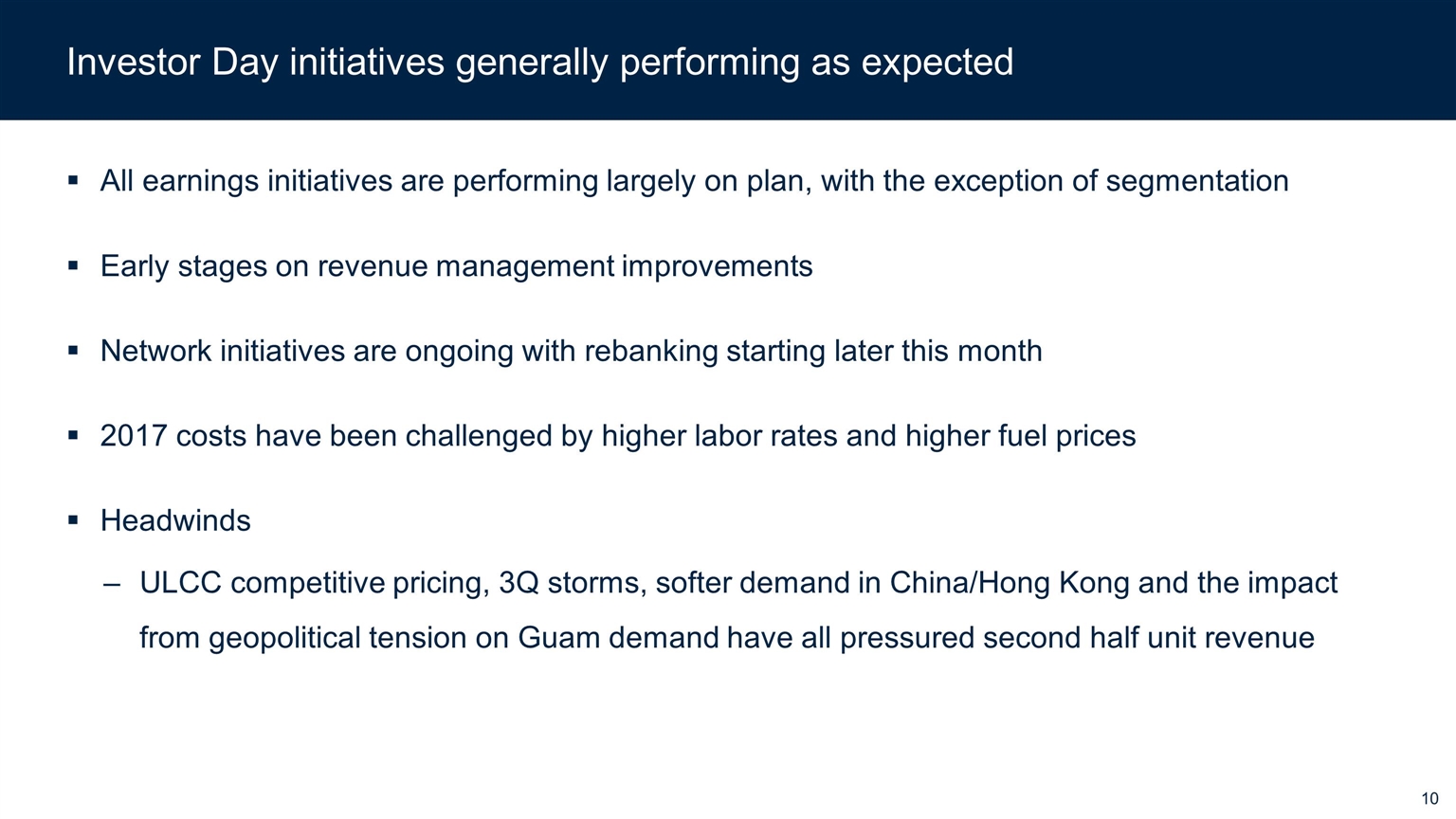

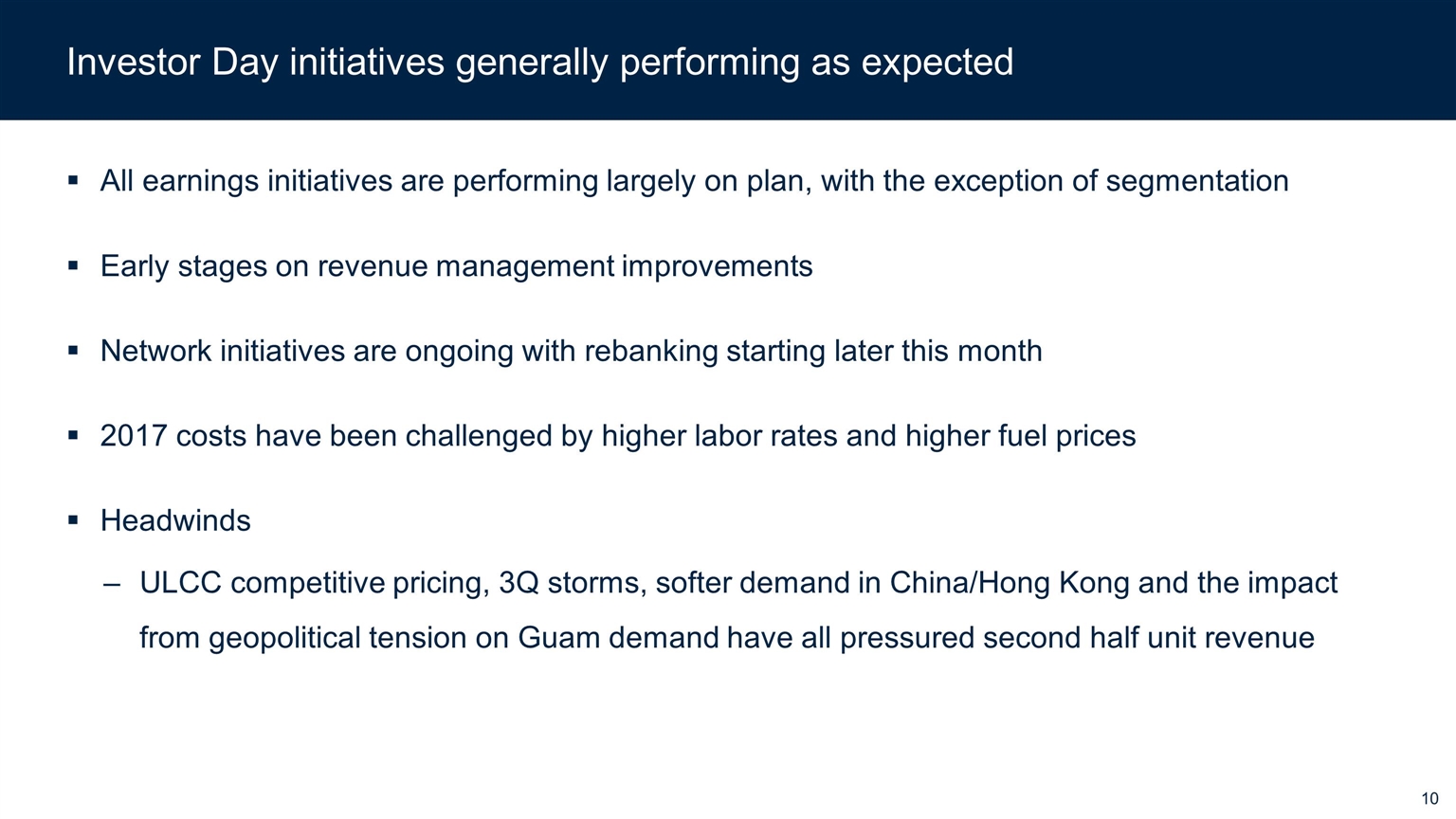

All earnings initiatives are performing largely on plan, with the exception of segmentation Early stages on revenue management improvements Network initiatives are ongoing with rebanking starting later this month 2017 costs have been challenged by higher labor rates and higher fuel prices Headwinds ULCC competitive pricing, 3Q storms, softer demand in China/Hong Kong and the impact from geopolitical tension on Guam demand have all pressured second half unit revenue Investor Day initiatives generally performing as expected

Andrew Levy Financial Update Executive Vice President and Chief Financial Officer

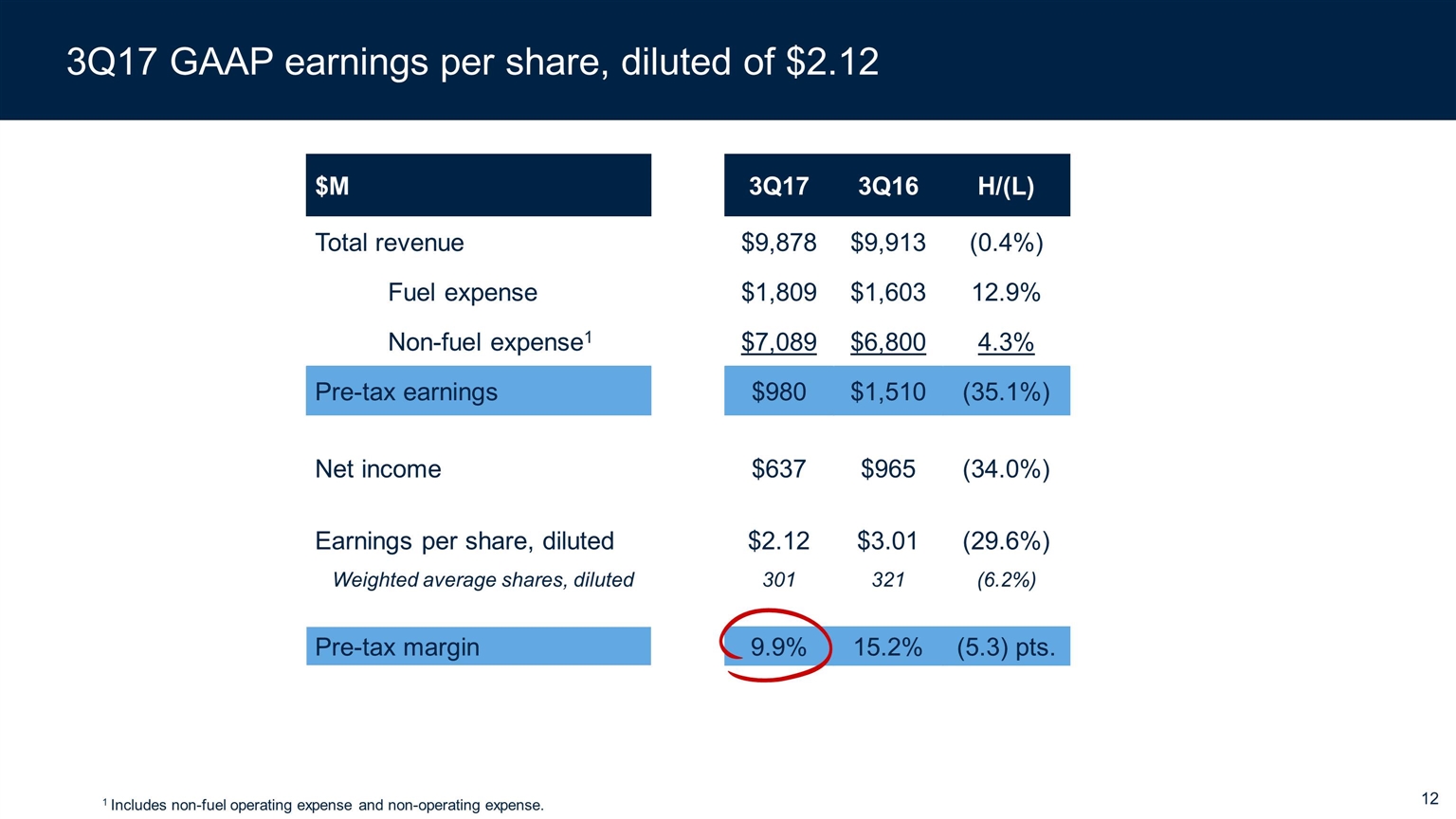

3Q17 GAAP earnings per share, diluted of $2.12 $M 3Q17 3Q16 H/(L) Total revenue $9,878 $9,913 (0.4%) Fuel expense $1,809 $1,603 12.9% Non-fuel expense1 $7,089 $6,800 4.3% Pre-tax earnings $980 $1,510 (35.1%) Net income $637 $965 (34.0%) Earnings per share, diluted $2.12 $3.01 (29.6%) Weighted average shares, diluted 301 321 (6.2%) Pre-tax margin 9.9% 15.2% (5.3) pts. 1 Includes non-fuel operating expense and non-operating expense.

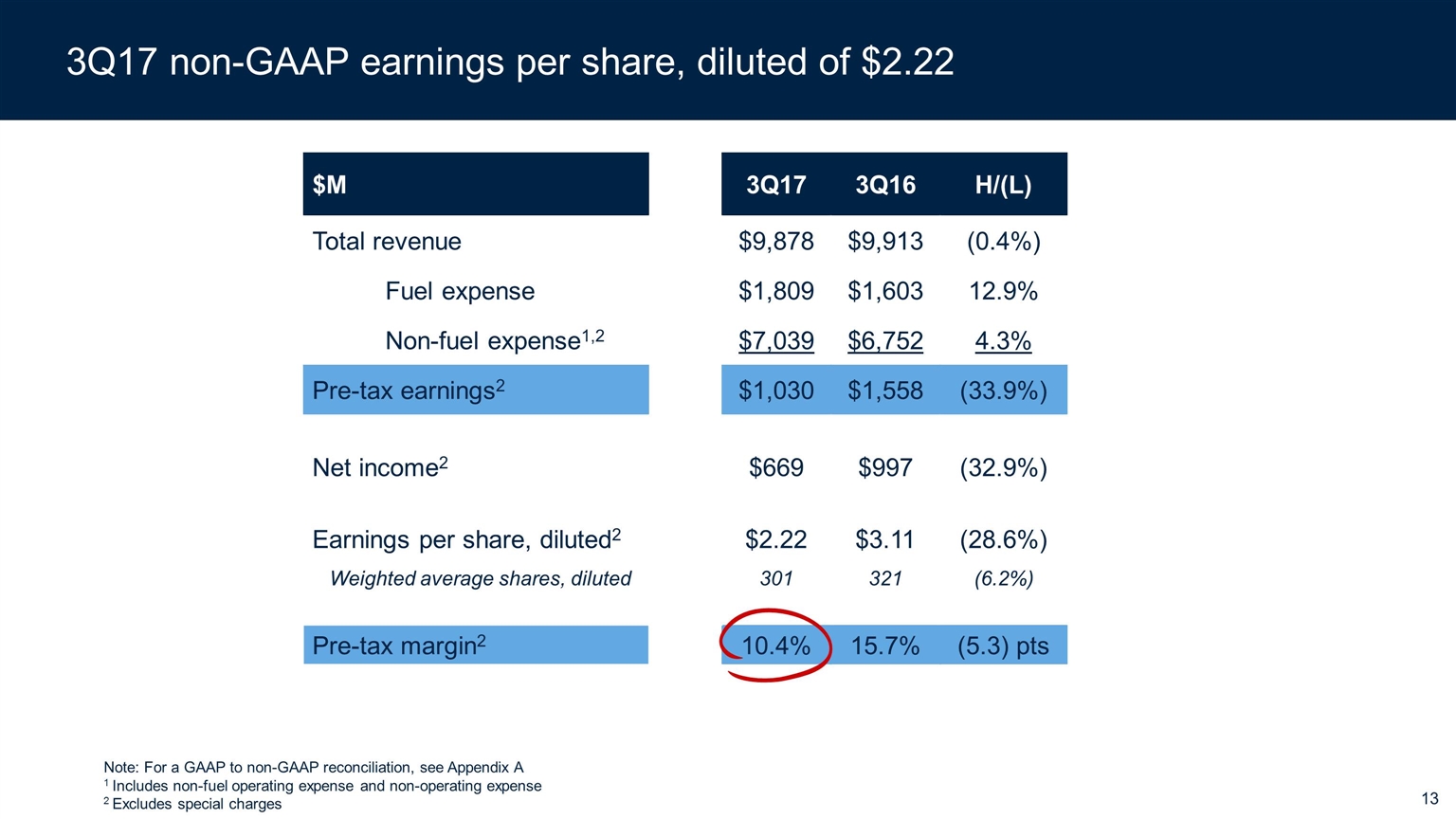

3Q17 non-GAAP earnings per share, diluted of $2.22 $M 3Q17 3Q16 H/(L) Total revenue $9,878 $9,913 (0.4%) Fuel expense $1,809 $1,603 12.9% Non-fuel expense1,2 $7,039 $6,752 4.3% Pre-tax earnings2 $1,030 $1,558 (33.9%) Net income2 $669 $997 (32.9%) Earnings per share, diluted2 $2.22 $3.11 (28.6%) Weighted average shares, diluted 301 321 (6.2%) Pre-tax margin2 10.4% 15.7% (5.3) pts Note: For a GAAP to non-GAAP reconciliation, see Appendix A 1 Includes non-fuel operating expense and non-operating expense 2 Excludes special charges

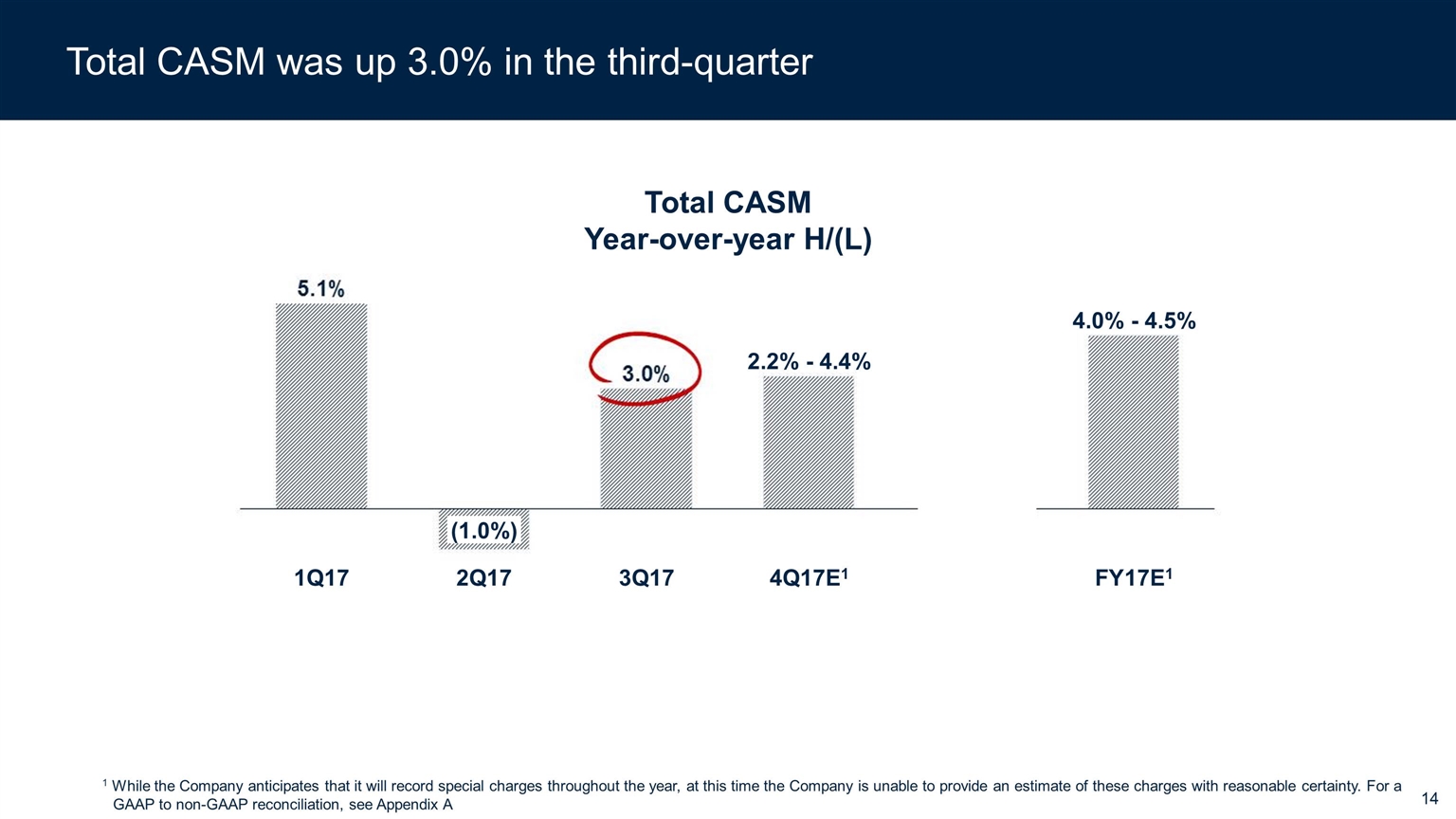

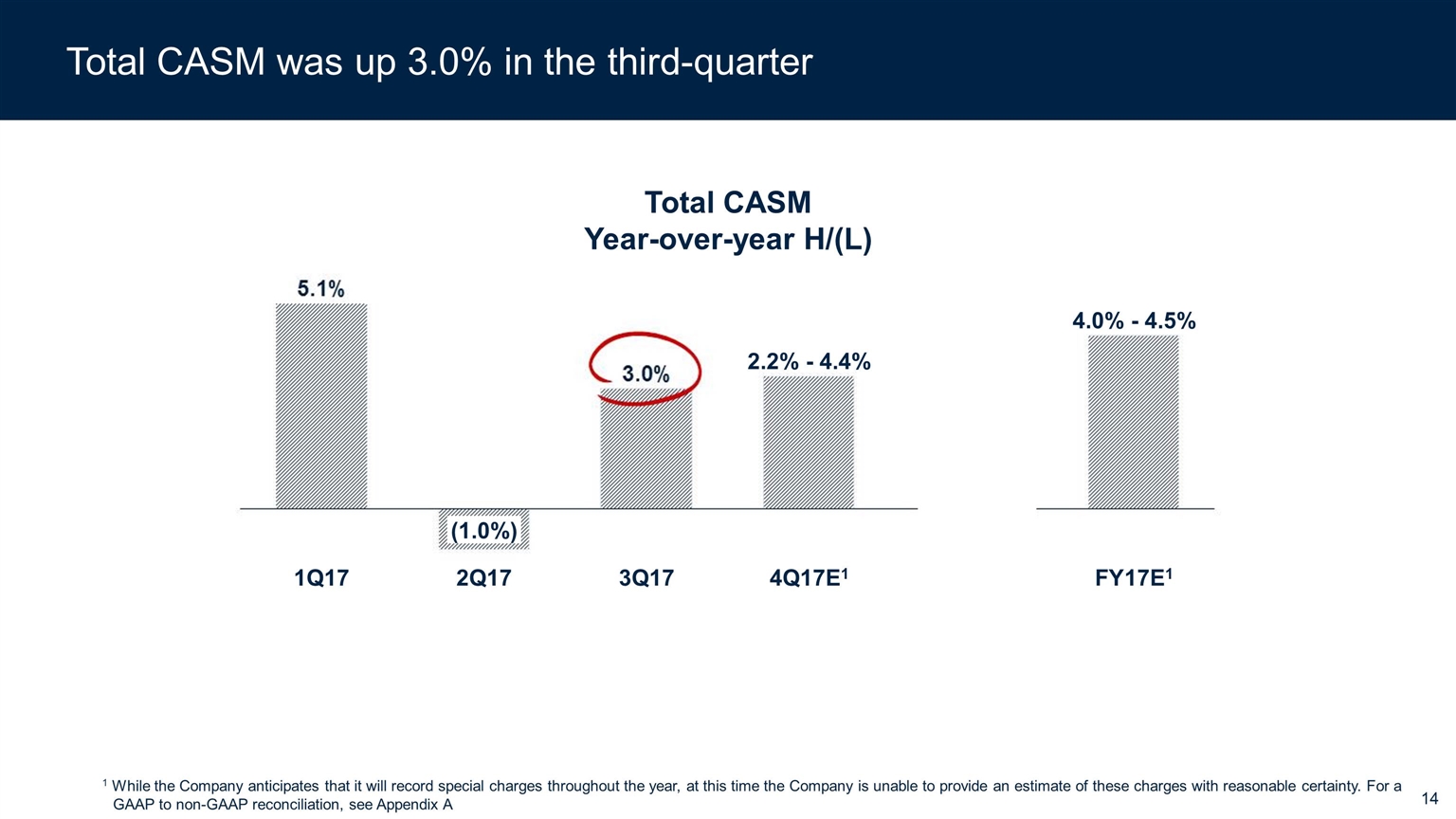

Total CASM was up 3.0% in the third-quarter 1 2.2% - 4.4% 1 4.0% - 4.5% Total CASM Year-over-year H/(L) 1 While the Company anticipates that it will record special charges throughout the year, at this time the Company is unable to provide an estimate of these charges with reasonable certainty. For a GAAP to non-GAAP reconciliation, see Appendix A

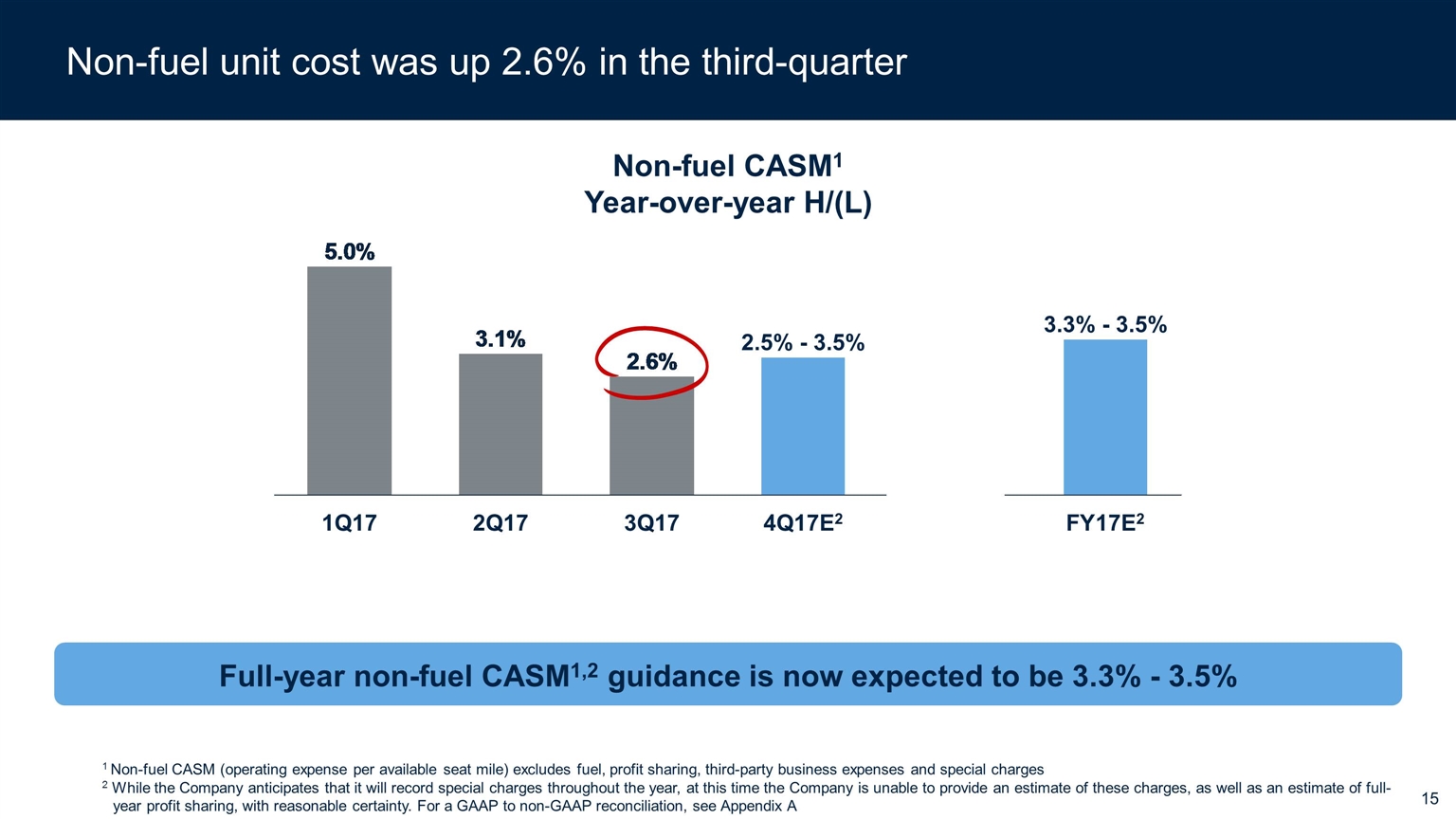

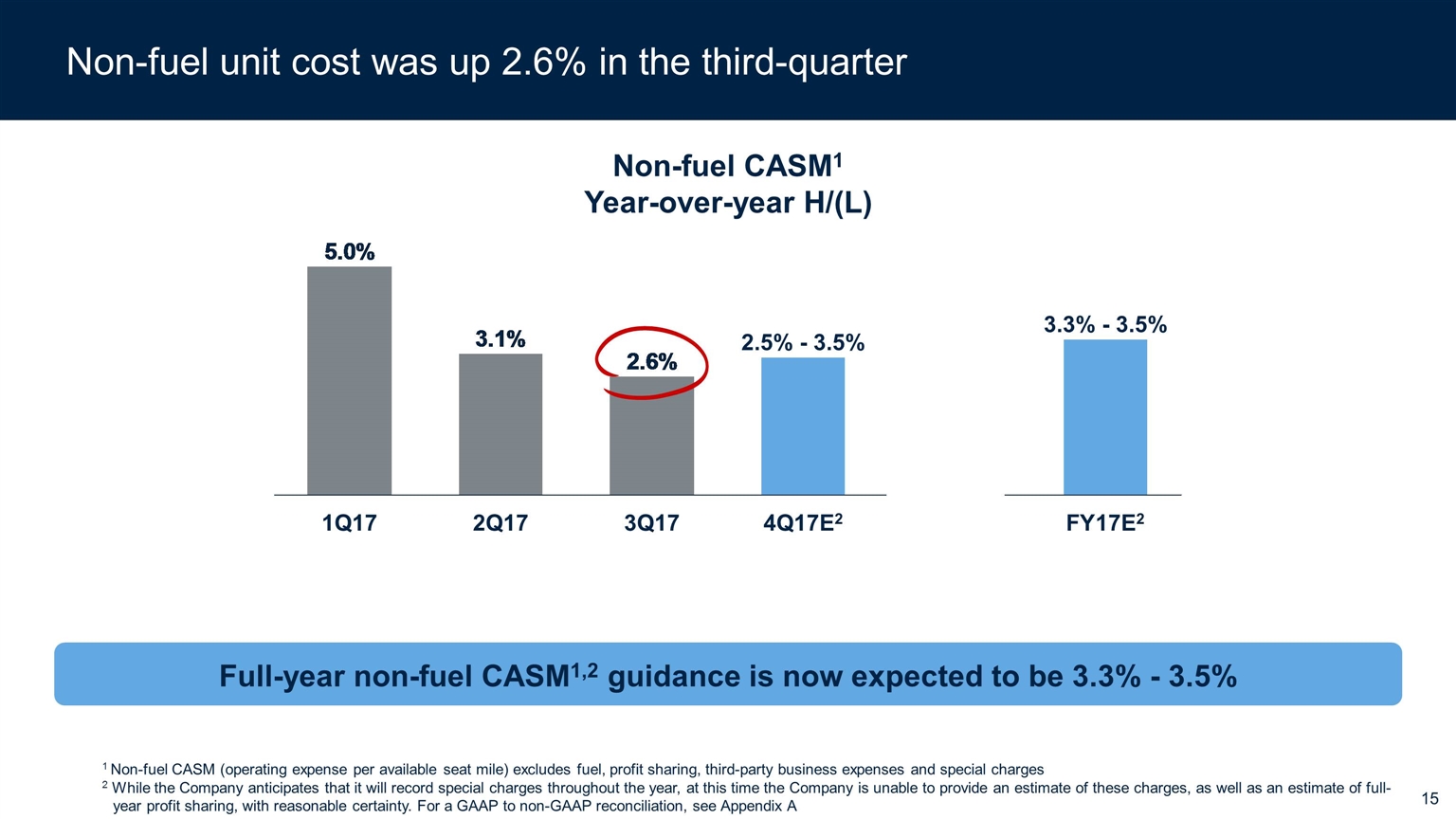

Non-fuel unit cost was up 2.6% in the third-quarter 2 3.3% - 3.5% 2 2.5% - 3.5% Non-fuel CASM1 Year-over-year H/(L) 1 Non-fuel CASM (operating expense per available seat mile) excludes fuel, profit sharing, third-party business expenses and special charges 2 While the Company anticipates that it will record special charges throughout the year, at this time the Company is unable to provide an estimate of these charges, as well as an estimate of full-year profit sharing, with reasonable certainty. For a GAAP to non-GAAP reconciliation, see Appendix A Full-year non-fuel CASM1,2 guidance is now expected to be 3.3% - 3.5%

Ended the third quarter with $6.3B in unrestricted liquidity, including $2B untapped revolver Comfortably in excess of our target liquidity range of $5B - $6B Raised $400M of unsecured debt at an interest rate of 4.25% during the quarter Contributed $160M to our pension in the quarter, completing our $400M target for the year Balance sheet and liquidity update Maintaining a strong balance sheet remains a priority

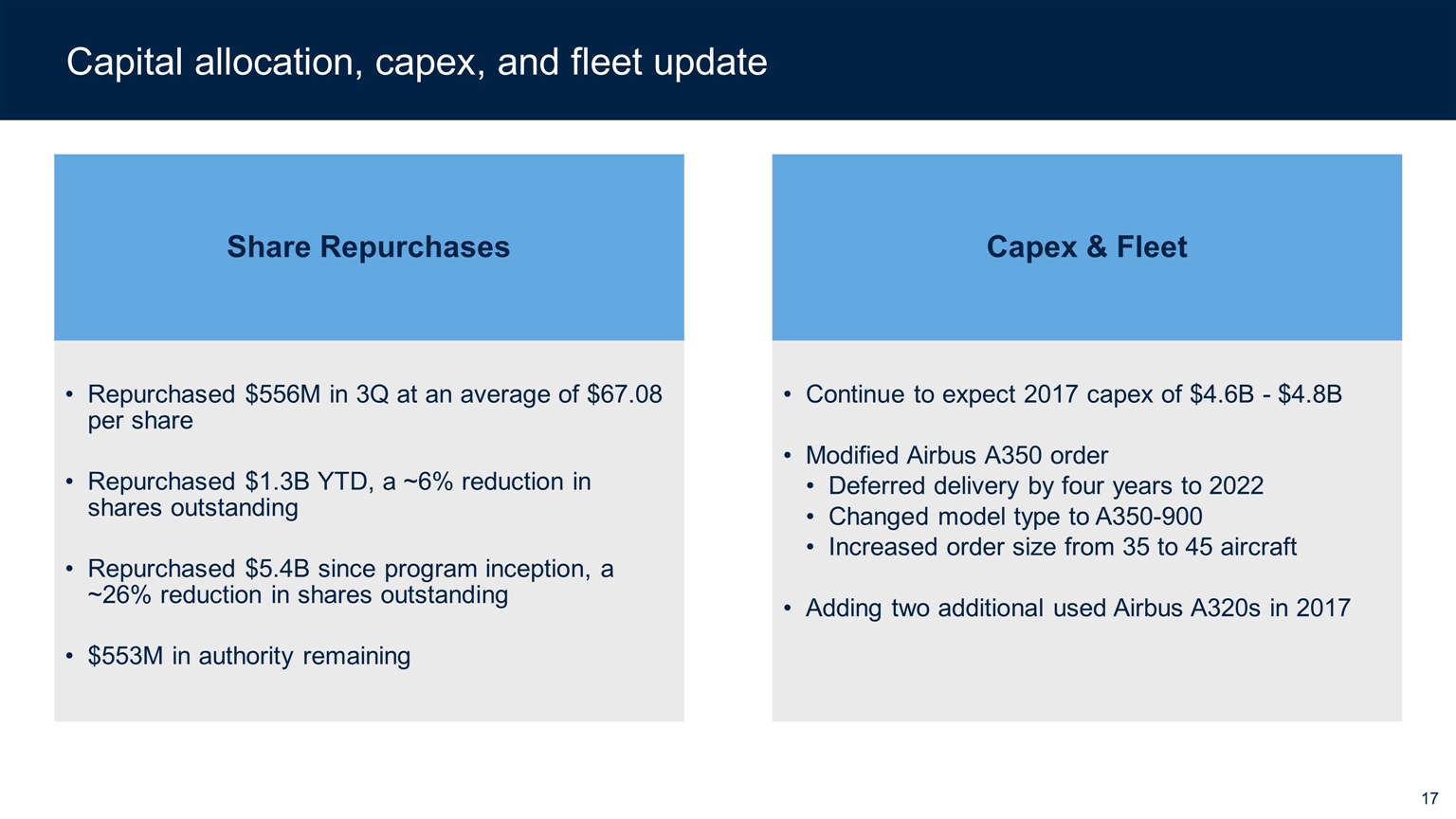

Capital allocation, capex, and fleet update Share Repurchases Capex & Fleet Repurchased $556M in 3Q at an average of $67.08 per share Modified Airbus A350 order Deferred delivery by four years to 2022 Changed model type to A350-900 Increased order size from 35 to 45 aircraft Repurchased $1.3B YTD, a ~6% reduction in shares outstanding Repurchased $5.4B since program inception, a ~26% reduction in shares outstanding $553M in authority remaining Adding two additional used Airbus A320s in 2017 Continue to expect 2017 capex of $4.6B - $4.8B

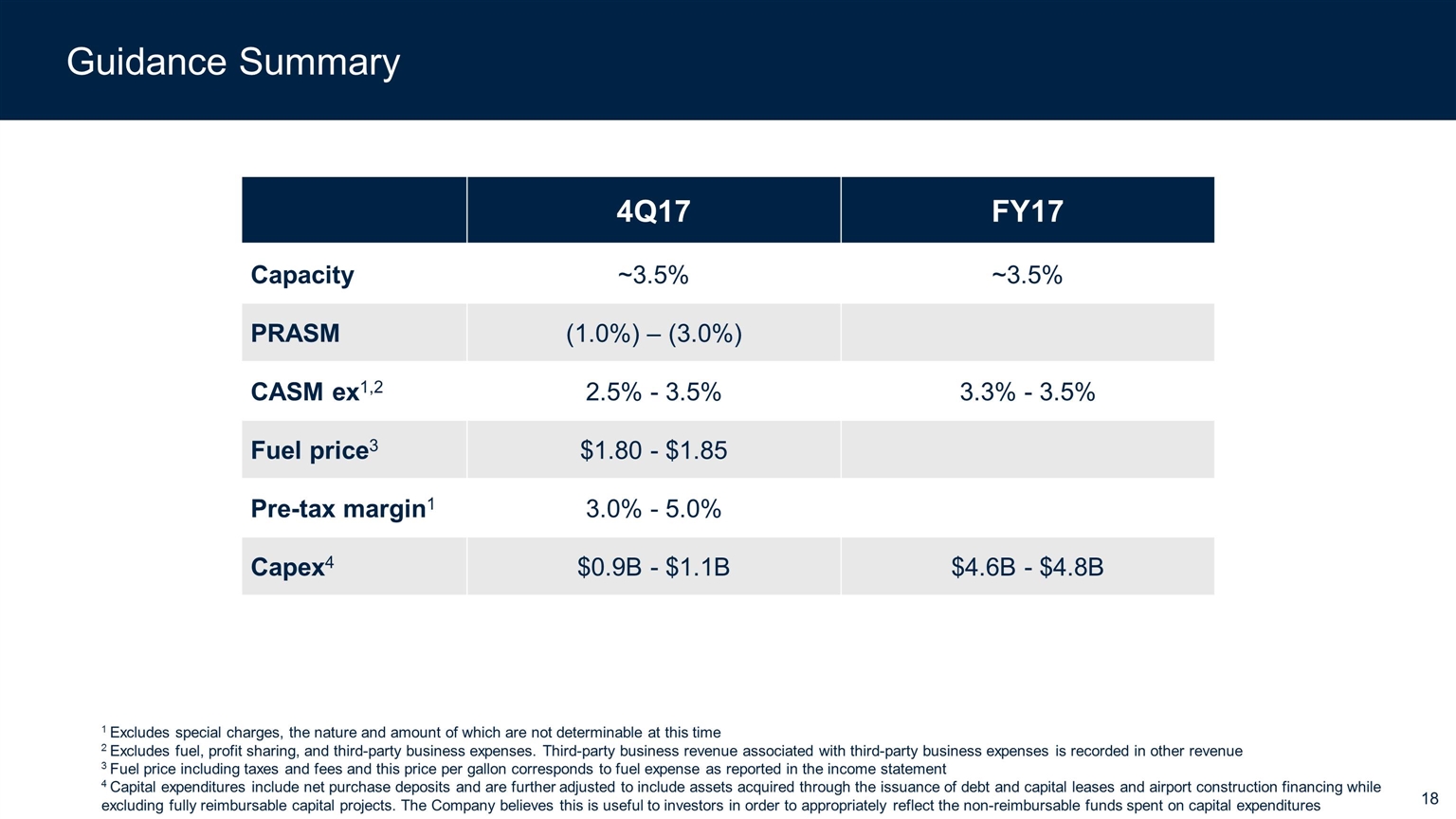

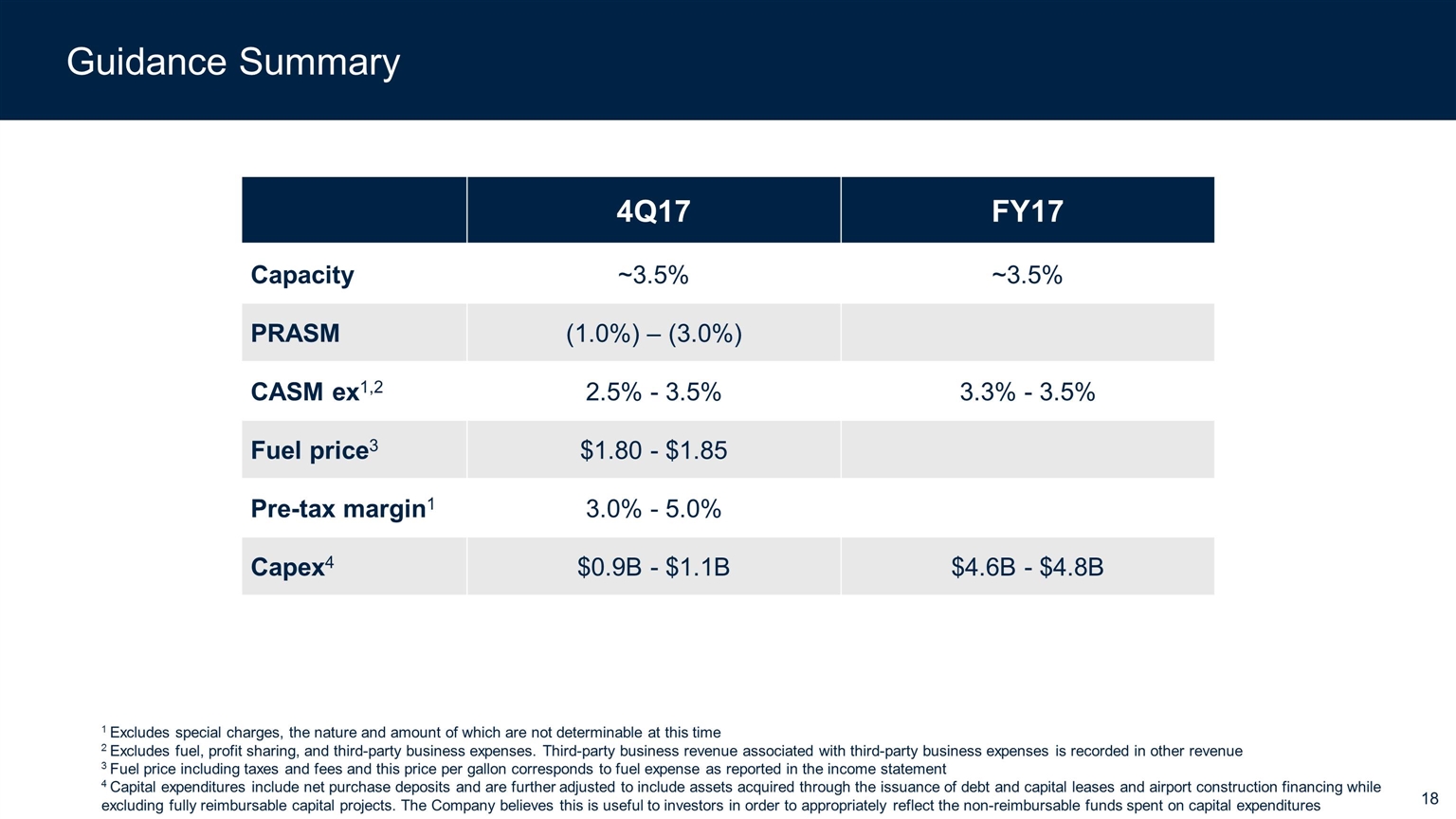

Guidance Summary 4Q17 FY17 Capacity ~3.5% ~3.5% PRASM (1.0%) – (3.0%) CASM ex1,2 2.5% - 3.5% 3.3% - 3.5% Fuel price3 $1.80 - $1.85 Pre-tax margin1 3.0% - 5.0% Capex4 $0.9B - $1.1B $4.6B - $4.8B 1 Excludes special charges, the nature and amount of which are not determinable at this time 2 Excludes fuel, profit sharing, and third-party business expenses. Third-party business revenue associated with third-party business expenses is recorded in other revenue 3 Fuel price including taxes and fees and this price per gallon corresponds to fuel expense as reported in the income statement 4 Capital expenditures include net purchase deposits and are further adjusted to include assets acquired through the issuance of debt and capital leases and airport construction financing while excluding fully reimbursable capital projects. The Company believes this is useful to investors in order to appropriately reflect the non-reimbursable funds spent on capital expenditures

Oscar Munoz Closing Remarks Chief Executive Officer

Question & Answer Session

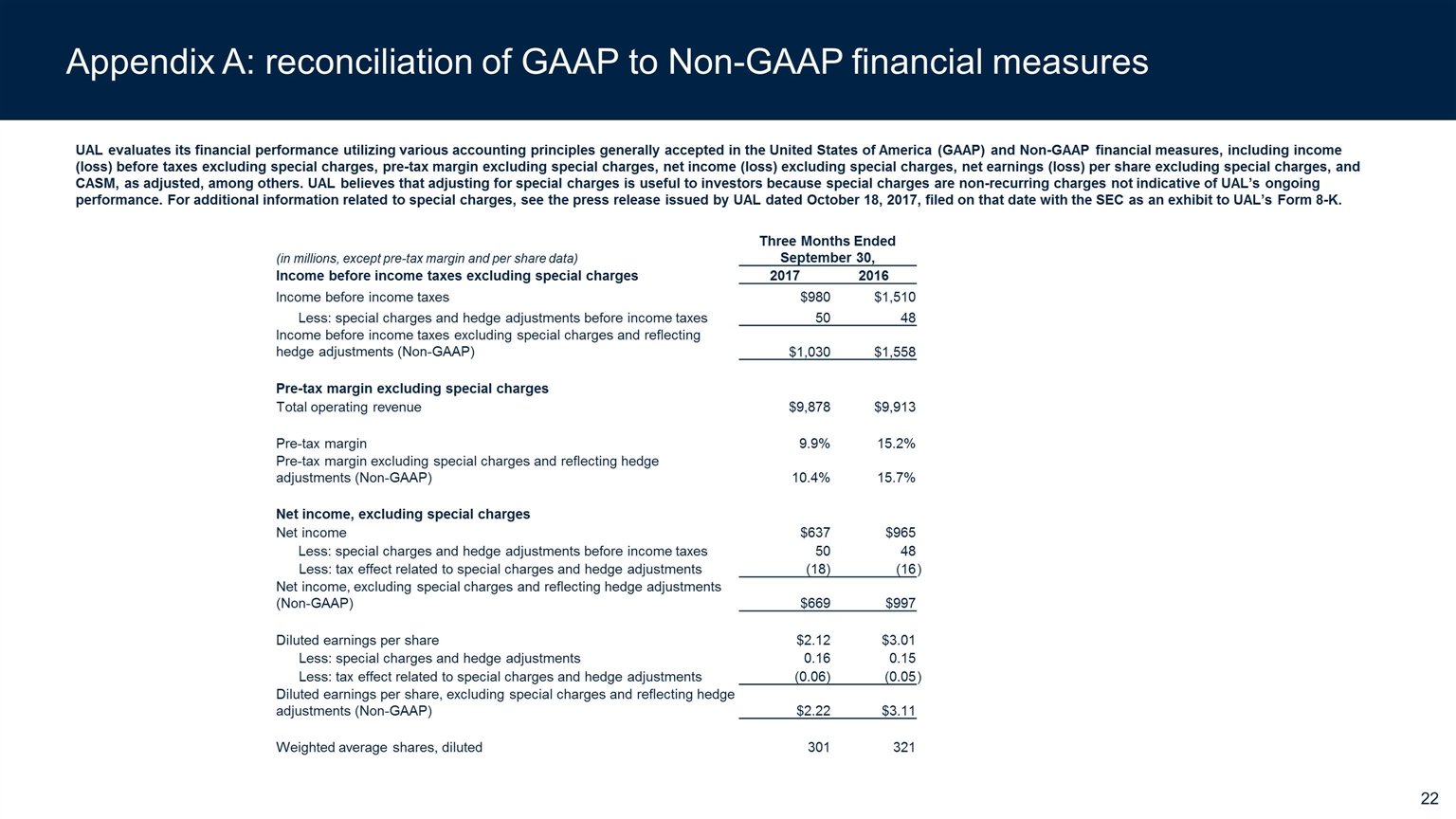

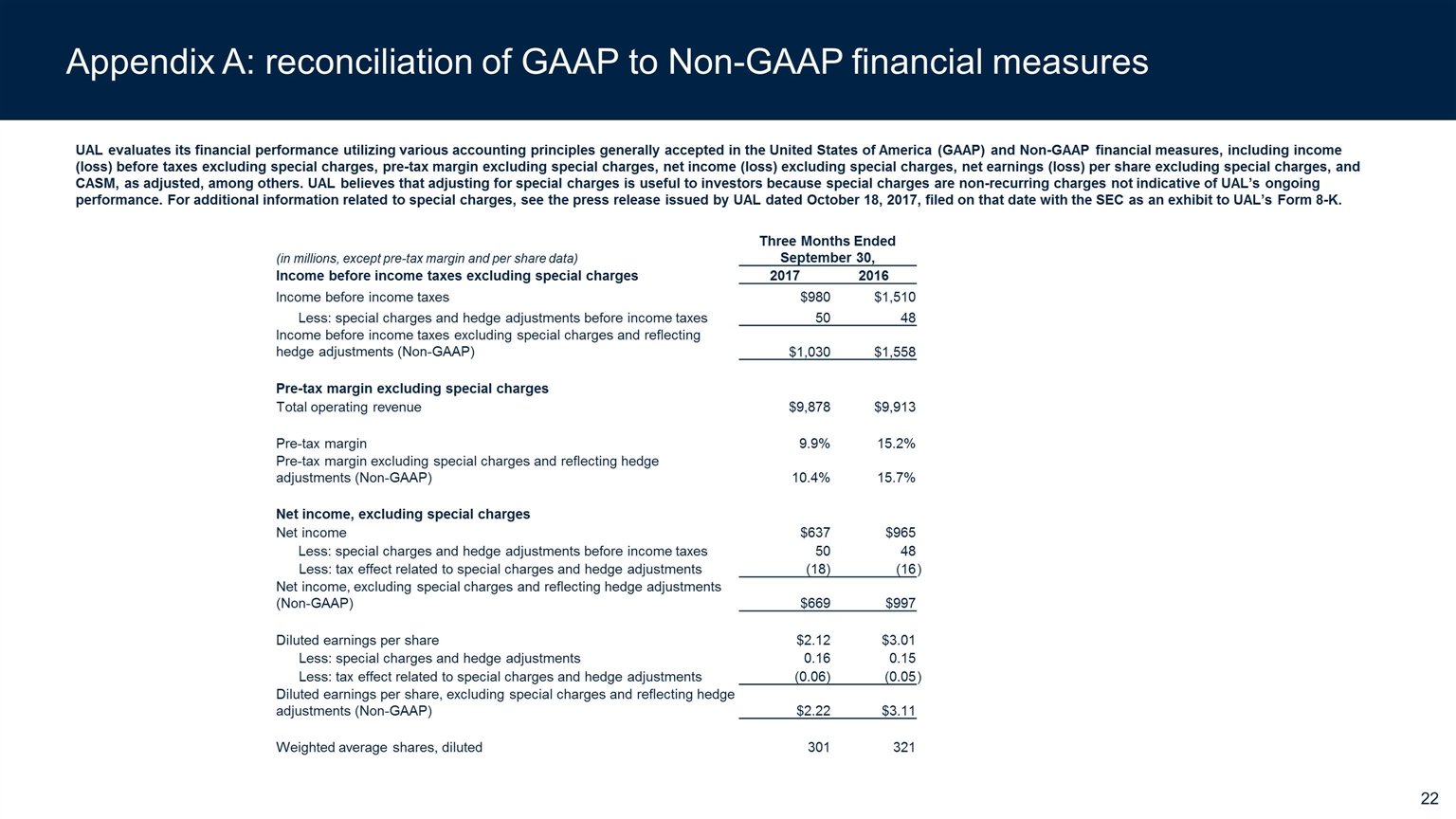

Appendix A: reconciliation of GAAP to Non-GAAP financial measures UAL evaluates its financial performance utilizing various accounting principles generally accepted in the United States of America (GAAP) and Non-GAAP financial measures, including income (loss) before taxes excluding special charges, pre-tax margin excluding special charges, net income (loss) excluding special charges, net earnings (loss) per share excluding special charges, and CASM, as adjusted, among others. UAL believes that adjusting for special charges is useful to investors because special charges are non-recurring charges not indicative of UAL’s ongoing performance. For additional information related to special charges, see the press release issued by UAL dated October 18, 2017, filed on that date with the SEC as an exhibit to UAL’s Form 8-K. (in millions, except pre-tax margin and per share data) Three Months Ended September 30, Income before income taxes excluding special charges 2017 2016 Income before income taxes $980 $1,510 Less: special charges and hedge adjustments before income taxes 50 48 Income before income taxes excluding special charges and reflecting hedge adjustments (Non-GAAP) $1,030 $1,558 Pre-tax margin excluding special charges Total operating revenue $9,878 $9,913 Pre-tax margin 9.9% 15.2% Pre-tax margin excluding special charges and reflecting hedge adjustments (Non-GAAP) 10.4% 15.7% Net income, excluding special charges Net income $637 $965 Less: special charges and hedge adjustments before income taxes 50 48 Less: tax effect related to special charges and hedge adjustments (18) (16 ) Net income, excluding special charges and reflecting hedge adjustments (Non-GAAP) $669 $997 Diluted earnings per share $2.12 $3.01 Less: special charges and hedge adjustments 0.16 0.15 Less: tax effect related to special charges and hedge adjustments (0.06) (0.05 ) Diluted earnings per share, excluding special charges and reflecting hedge adjustments (Non-GAAP) $2.22 $3.11 Weighted average shares, diluted 301 321

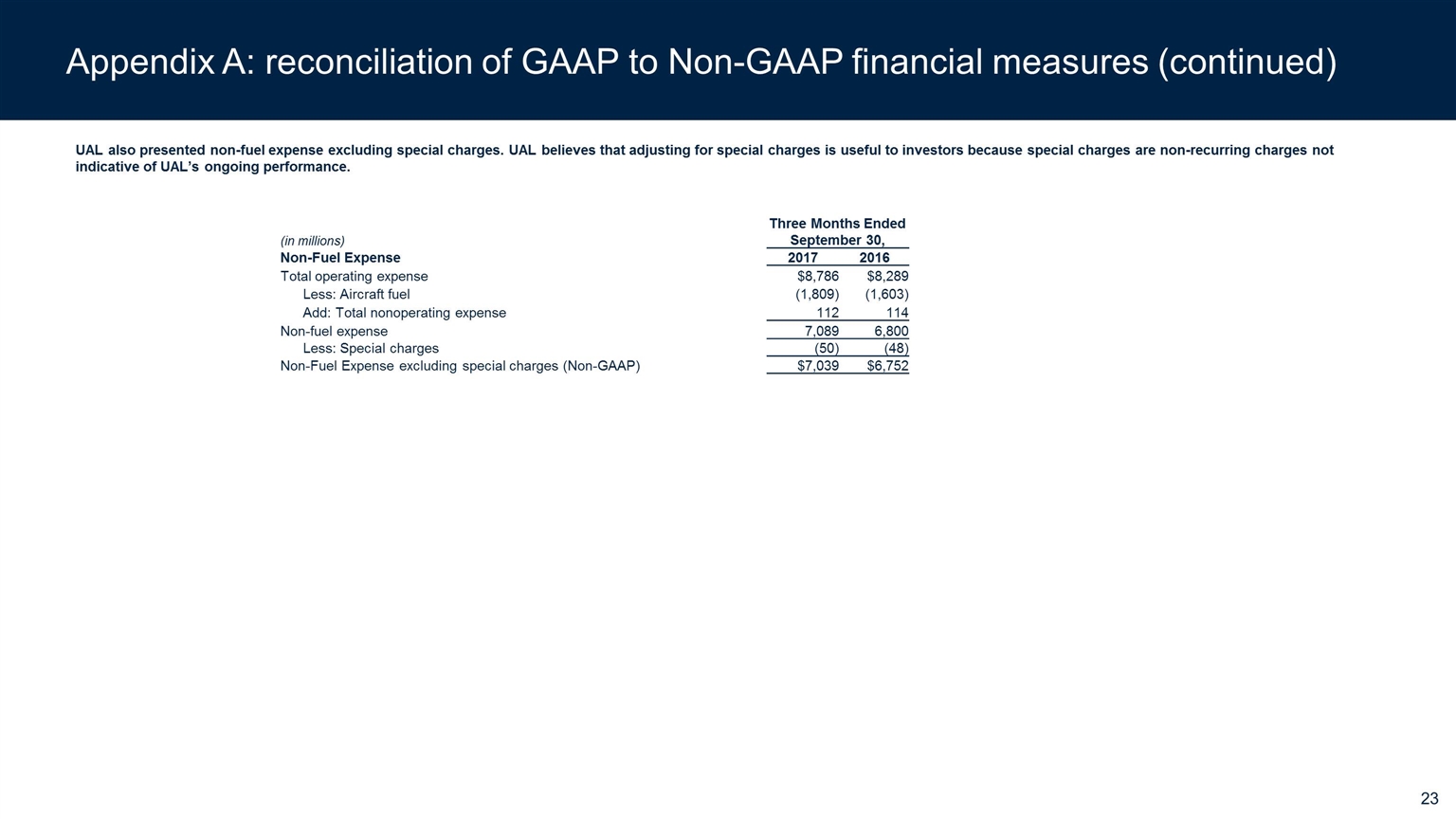

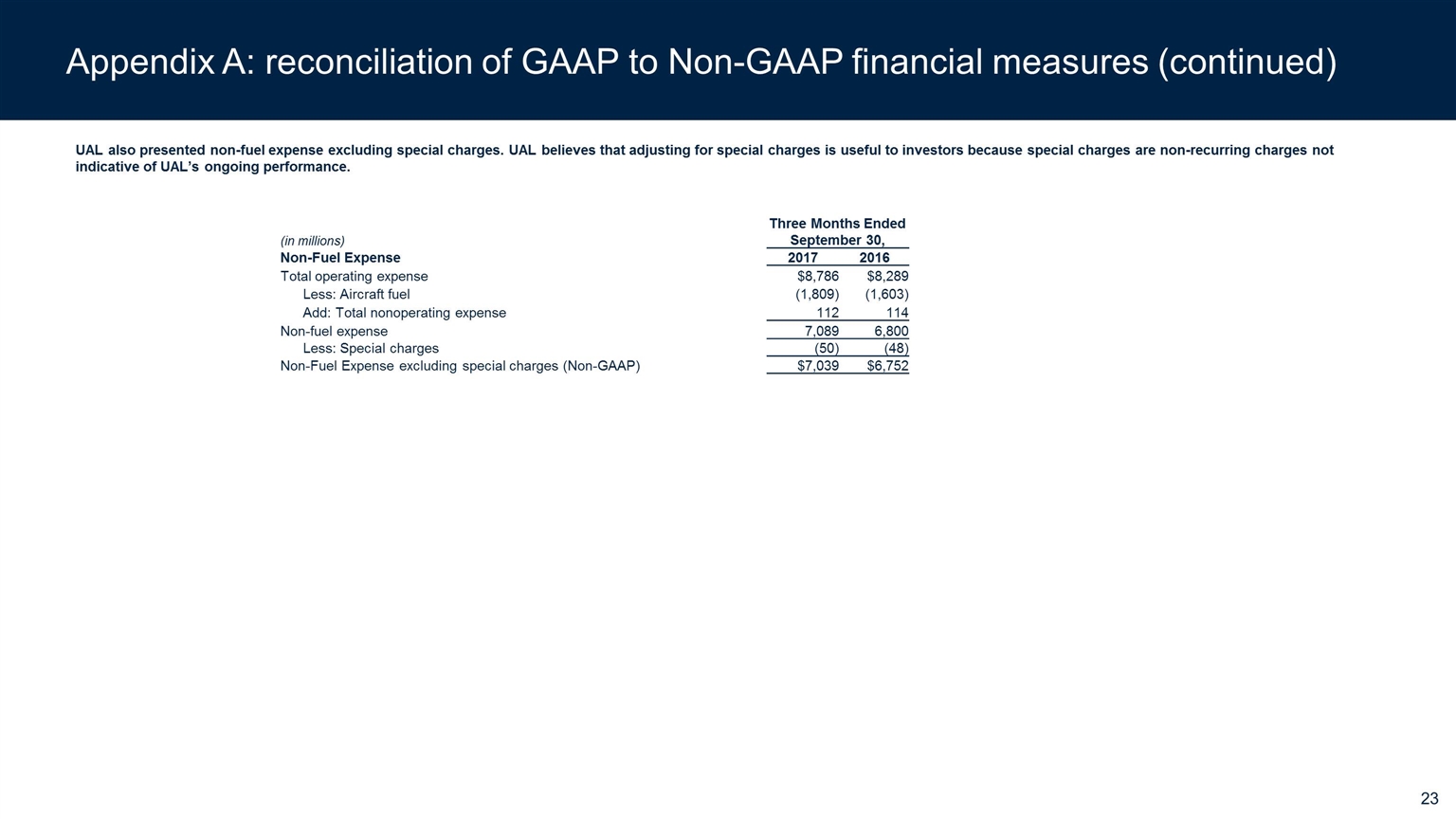

Appendix A: reconciliation of GAAP to Non-GAAP financial measures (continued) UAL also presented non-fuel expense excluding special charges. UAL believes that adjusting for special charges is useful to investors because special charges are non-recurring charges not indicative of UAL’s ongoing performance. (in millions) Three Months Ended September 30, Non-Fuel Expense 2017 2016 Total operating expense $8,786 $8,289 Less: Aircraft fuel (1,809) (1,603) Add: Total nonoperating expense 112 114 Non-fuel expense 7,089 6,800 Less: Special charges (50) (48) Non-Fuel Expense excluding special charges (Non-GAAP) $7,039 $6,752

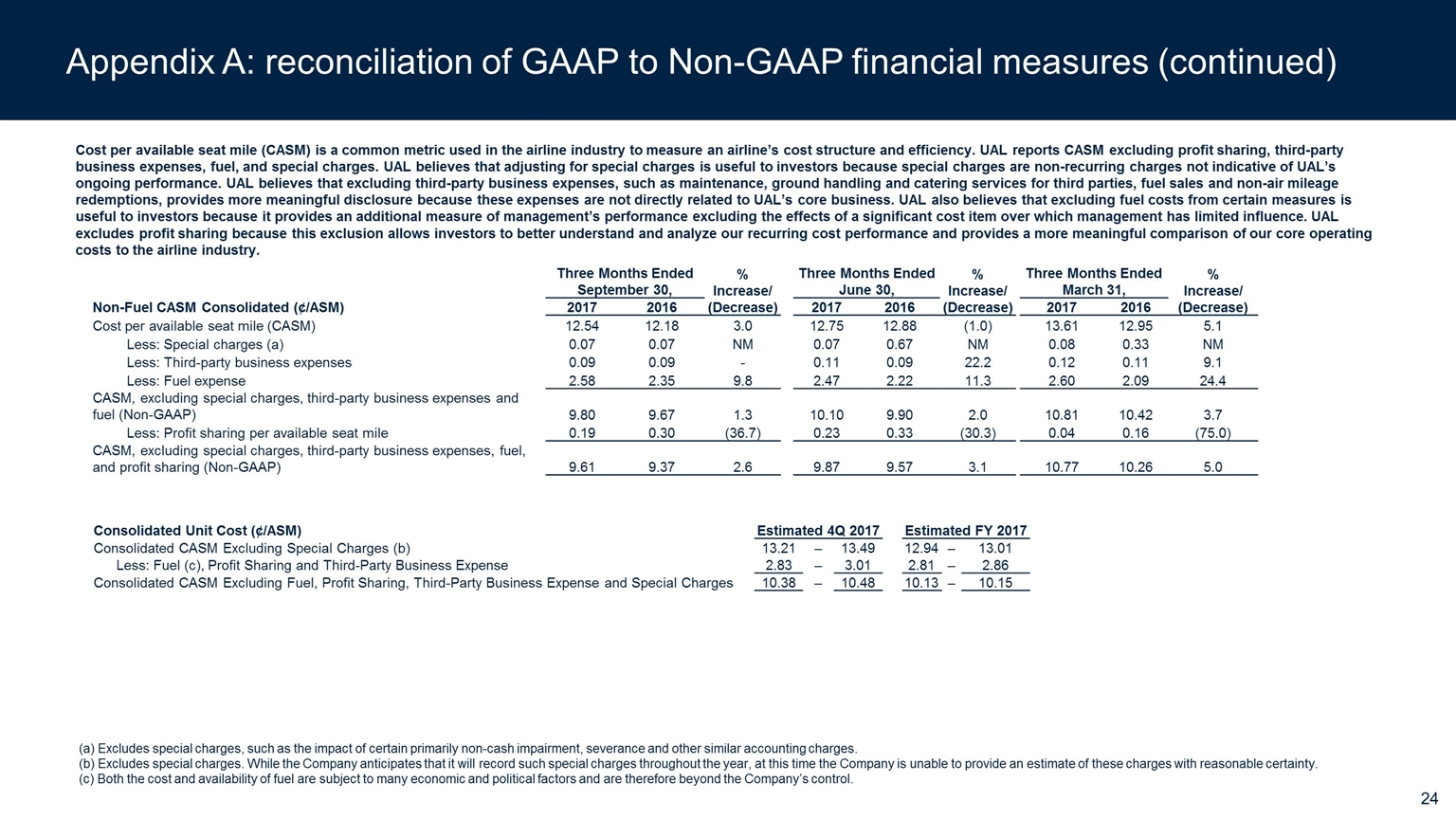

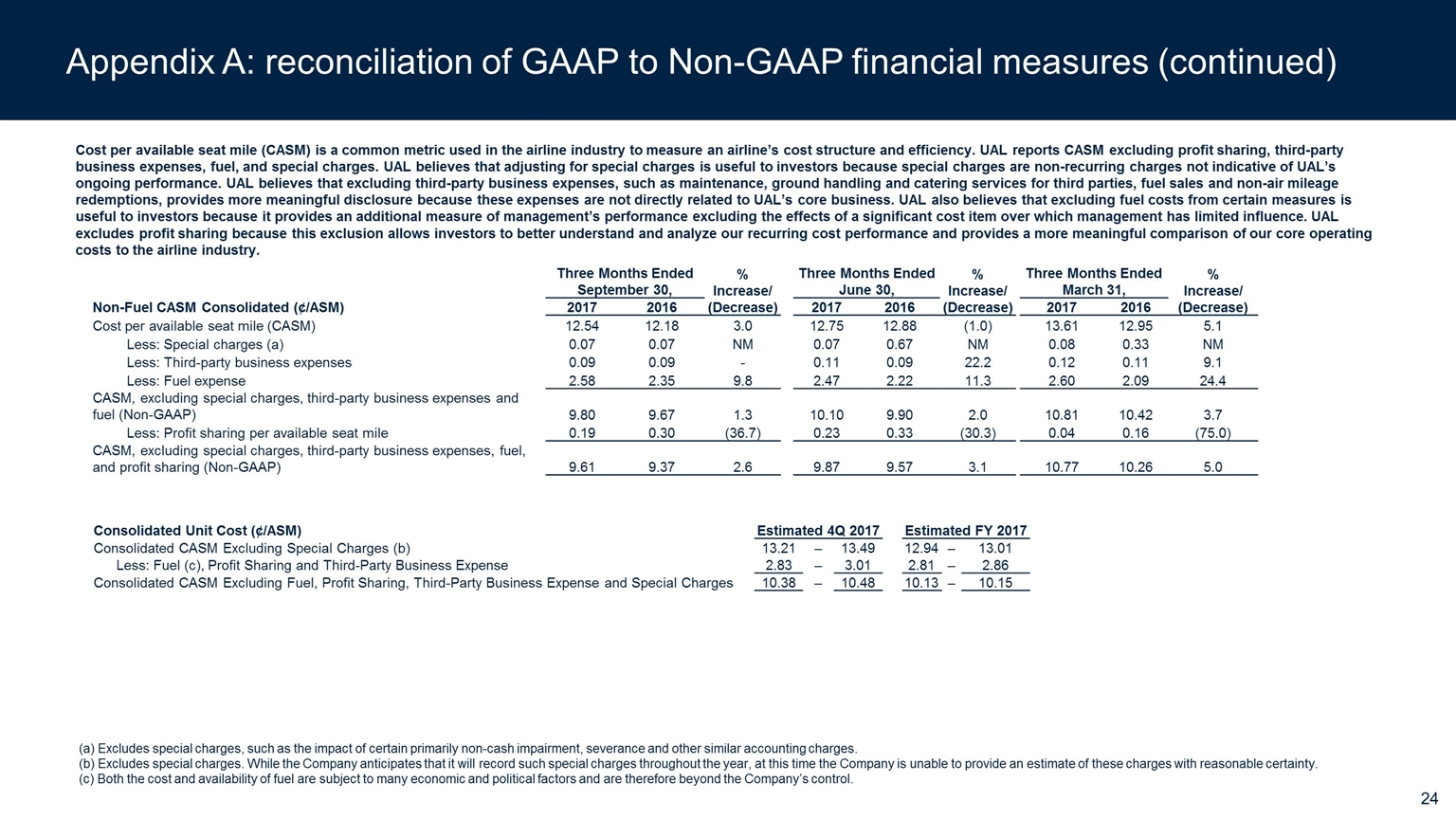

Appendix A: reconciliation of GAAP to Non-GAAP financial measures (continued) Cost per available seat mile (CASM) is a common metric used in the airline industry to measure an airline’s cost structure and efficiency. UAL reports CASM excluding profit sharing, third-party business expenses, fuel, and special charges. UAL believes that adjusting for special charges is useful to investors because special charges are non-recurring charges not indicative of UAL’s ongoing performance. UAL believes that excluding third-party business expenses, such as maintenance, ground handling and catering services for third parties, fuel sales and non-air mileage redemptions, provides more meaningful disclosure because these expenses are not directly related to UAL’s core business. UAL also believes that excluding fuel costs from certain measures is useful to investors because it provides an additional measure of management’s performance excluding the effects of a significant cost item over which management has limited influence. UAL excludes profit sharing because this exclusion allows investors to better understand and analyze our recurring cost performance and provides a more meaningful comparison of our core operating costs to the airline industry. Three Months Ended September 30, % Increase/ (Decrease) Three Months Ended June 30, % Increase/ (Decrease) Three Months Ended March 31, % Increase/ (Decrease) Non-Fuel CASM Consolidated (¢/ASM) 2017 2016 2017 2016 2017 2016 Cost per available seat mile (CASM) 12.54 12.18 3.0 12.75 12.88 (1.0) 13.61 12.95 5.1 Less: Special charges (a) 0.07 0.07 NM 0.07 0.67 NM 0.08 0.33 NM Less: Third-party business expenses 0.09 0.09 - 0.11 0.09 22.2 0.12 0.11 9.1 Less: Fuel expense 2.58 2.35 9.8 2.47 2.22 11.3 2.60 2.09 24.4 CASM, excluding special charges, third-party business expenses and fuel (Non-GAAP) 9.80 9.67 1.3 10.10 9.90 2.0 10.81 10.42 3.7 Less: Profit sharing per available seat mile 0.19 0.30 (36.7) 0.23 0.33 (30.3) 0.04 0.16 (75.0) CASM, excluding special charges, third-party business expenses, fuel, and profit sharing (Non-GAAP) 9.61 9.37 2.6 9.87 9.57 3.1 10.77 10.26 5.0 (a) Excludes special charges, such as the impact of certain primarily non-cash impairment, severance and other similar accounting charges. (b) Excludes special charges. While the Company anticipates that it will record such special charges throughout the year, at this time the Company is unable to provide an estimate of these charges with reasonable certainty. (c) Both the cost and availability of fuel are subject to many economic and political factors and are therefore beyond the Company’s control. Consolidated Unit Cost (¢/ASM) Estimated 4Q 2017 Estimated FY 2017 Consolidated CASM Excluding Special Charges (b) 13.21 – 13.49 12.94 – 13.01 Less: Fuel (c), Profit Sharing and Third-Party Business Expense 2.83 – 3.01 2.81 – 2.86 Consolidated CASM Excluding Fuel, Profit Sharing, Third-Party Business Expense and Special Charges 10.38 – 10.48 10.13 – 10.15