Filed pursuant to Rule 424(b)(3)

Registration No. 333-221865-01

This preliminary prospectus supplement relates to an effective registration statement under the Securities Act of 1933, as amended, but it is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 9, 2018

PROSPECTUS SUPPLEMENT TO PROSPECTUS, DATED DECEMBER 1, 2017

$225,729,000

2018-1 PASS THROUGH TRUSTS

CLASS B PASS THROUGH CERTIFICATES, SERIES 2018-1

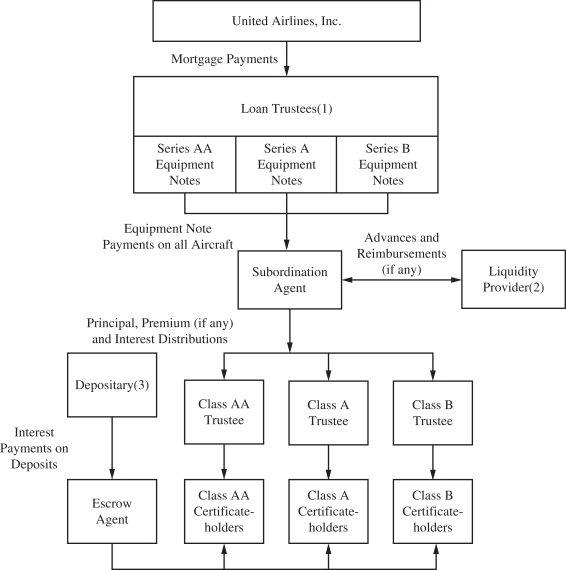

United Airlines Class B Pass Through Certificates, Series 2018-1, are being offered under this prospectus supplement. The Class AA Pass Through Certificates and the Class A Pass Through Certificates of the same series were previously offered under a separate prospectus supplement of United Airlines, Inc. dated January 31, 2018 and were issued on February 14, 2018. The Class AA and Class A certificates are not being offered under this prospectus supplement. The Class B certificates will rank junior in right of distributions to the Class AA and Class A certificates. The Class B certificates represent interests in the Class B trust to be established in connection with this offering.

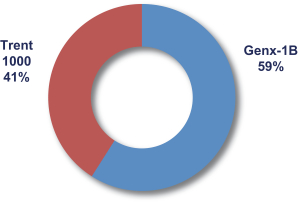

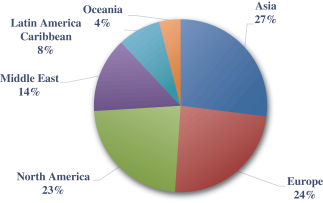

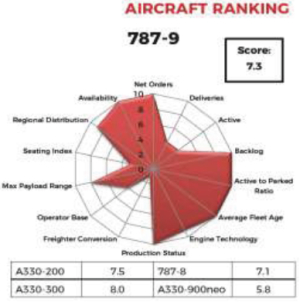

The purpose of the offerings of the Class AA certificates, Class A certificates and Class B certificates is to finance 16 new Boeing aircraft scheduled for delivery to United Airlines, Inc. from August 2017 to May 2018. Prior to the date hereof, 13 of such aircraft were delivered and financed with the proceeds of the Class AA and Class A certificates. A portion of the proceeds from the issuance of the Class B certificates will be used by the Class B trust on the date of such issuance to acquire Series B equipment notes issued with respect to such of those 16 aircraft as were previously financed with the proceeds of the Class AA and Class A certificates. The balance of the proceeds from the issuance of the Class B certificates will initially be held in escrow and will be used to acquire Series B equipment notes to finance, together with Series AA equipment notes and Series A equipment notes, the acquisition by United Airlines, Inc. of the remainder of such 16 aircraft. The equipment notes have been or will be issued by United Airlines, Inc. and secured by the financed aircraft.

Interest on the escrowed funds will be payable semiannually on March 1 and September 1, commencing September 1, 2018. Interest on the Series B equipment notes will be payable semiannually on each March 1 and September 1 after issuance (but not before September 1, 2018). Principal payments on the Series B equipment notes are scheduled on March 1 and September 1 of each year, beginning on March 1, 2019 for certain equipment notes and September 1, 2019 for the remaining equipment notes. Payments on the Series B equipment notes held in the Class B trust will be passed through to the holders of Class B certificates.

National Australia Bank Limited, acting through its New York Branch, will provide the liquidity facility for the Class B certificates in an amount sufficient to make three semiannual interest payments.

The Class B certificates will not be listed on any national securities exchange.

Investing in the Class B certificates involves risks. See “Risk Factors” beginning on page S-18.

| | | | | | | | |

Pass Through Certificates | | Face Amount | | Interest

Rate | | Final Expected

Distribution Date | | Price to

Public(1) |

Class B | | $225,729,000 | | % | | March 1, 2026 | | 100% |

(1) Plus accrued interest, if any, from the date of issuance.

The underwriters will purchase all of the Class B certificates if any are purchased. The aggregate proceeds from the sale of the Class B certificates will be $225,729,000. United Airlines, Inc. will pay the underwriters a commission of $ . Delivery of the Class B certificates in book-entry form only will be made on or about , 2018.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Lead Bookrunners

| | | | |

| Credit Suisse | | Citigroup | | Goldman Sachs & Co. LLC |

| Joint Structuring Agent | | Joint Structuring Agent | | |

Bookrunners |

| Deutsche Bank Securities | | | | Morgan Stanley |

| | | | | | |

| Barclays | | BofA Merrill Lynch | | BNP PARIBAS | | Credit Agricole Securities |

| | | | |

| J.P. Morgan | | Standard Chartered Bank | | Wells Fargo Securities |

The date of this prospectus supplement is , 2018.