El Paso Electric Company First Quarter 2012 Earnings Conference Call May 2, 2012 Exhibit 99.02

El Paso Electric R May 2, 2012 2 Safe Harbor Statement Statements in this presentation, other than statements of historical information, are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 (the “act”). Such statements are intended to be made as of the date of this presentation, and the company does not undertake to update any such forward-looking statement. Forward-looking statements involve known and unknown risks and other factors that may cause actual results to differ materially from those expressed in this presentation. In connection with the safe- harbor provisions of the act, the company has set forth below a number of important risks and factors that could cause actual results to differ materially from forward-looking information. Factors that could cause or contribute to such differences include, but are not limited to: The financial impact of the proposed settlement of our rate case filed February 1, 2012 which is expected to be approved by the PUCT in May or June 2012 Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased costs to customers or to recover previously incurred fuel costs in rates Recovery of capital investments and operating costs through rates in Texas and New Mexico Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability Unanticipated increased costs associated with scheduled and unscheduled outages The size of our construction program and our ability to complete construction on budget and on time Costs at Palo Verde (PV) Deregulation and competition in the electric utility industry Possible increased costs of compliance with environmental or other laws, regulations and policies Possible income tax and interest payments as a result of audit adjustments proposed by the IRS Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets Other factors detailed by EE in its public filings with the Securities and Exchange Commission. Please refer to EE’s 2011 Form 10K and other 1934 Act Filings

El Paso Electric R May 2, 2012 3 Highlights for the 1st Quarter 2012 On April 17, 2012, a tentative settlement agreed to by all the parties in the 2012 Texas rate case was approved by the City Council of El Paso – Rates within the city limits of El Paso were final with the approval by the City Council – Rates outside of the city limits of El Paso will be final once the settlement is approved by the PUCT which is expected to occur in May or June On March 29, 2012, EE exercised the accordion feature associated with the current revolving credit facility credit agreement – Increased the amount available to borrow on the credit facility from $200 million to $300 million

El Paso Electric R May 2, 2012 4 Dividend Update EE declared a $0.22 per share dividend payable on March 30, 2012 for shareholders of record on March 15, 2012 – Board of Directors will review the level of the dividend annually in conjunction with the annual shareholders meeting, which is scheduled for May 31, 2012 – Anticipate moving toward a target 45% dividend payout ratio

El Paso Electric R May 2, 2012 5 CEO Search Process Thomas (“Tom”) V. Shockley, III is currently serving as interim CEO Board of Directors has begun search process to identify, evaluate and select a permanent CEO Internal and external candidates are being evaluated for position Timeframe has not been set, but Board has indicated that a CEO will only be named after a thorough process has been completed

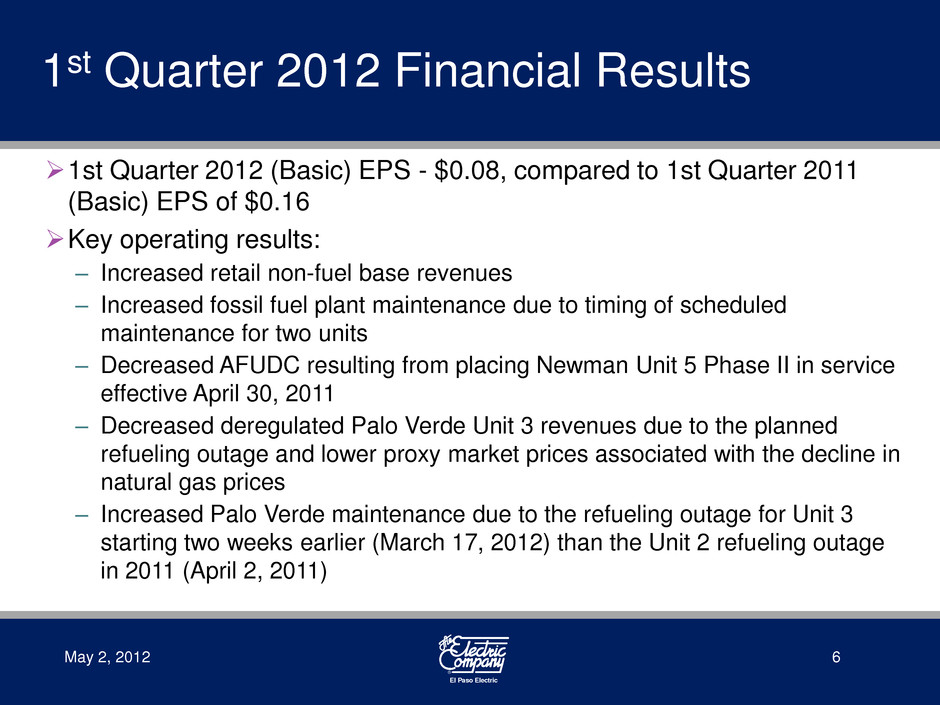

El Paso Electric R May 2, 2012 6 1st Quarter 2012 Financial Results 1st Quarter 2012 (Basic) EPS - $0.08, compared to 1st Quarter 2011 (Basic) EPS of $0.16 Key operating results: – Increased retail non-fuel base revenues – Increased fossil fuel plant maintenance due to timing of scheduled maintenance for two units – Decreased AFUDC resulting from placing Newman Unit 5 Phase II in service effective April 30, 2011 – Decreased deregulated Palo Verde Unit 3 revenues due to the planned refueling outage and lower proxy market prices associated with the decline in natural gas prices – Increased Palo Verde maintenance due to the refueling outage for Unit 3 starting two weeks earlier (March 17, 2012) than the Unit 2 refueling outage in 2011 (April 2, 2011)

El Paso Electric R May 2, 2012 7 Changes in Revenues and Sales YTD Non-fuel Base Revenue Percent Change MWH Percent Change Residential $ 46,025 2.3% 555,569 2.6% C&I Small 33,801 1.8% 491,237 2.7% C&I Large 9,371 6.5% 246,358 7.5% Other Public 16,940 (0.5%) 343,511 2.6% Total Retail Sales $ 106,137 2.0% 1,636,675 3.3% Heating Degree Days 1,159 (8.4%) Average Retail Customers 382,081 1.5% YTD March 2012 Compared to YTD March 2011

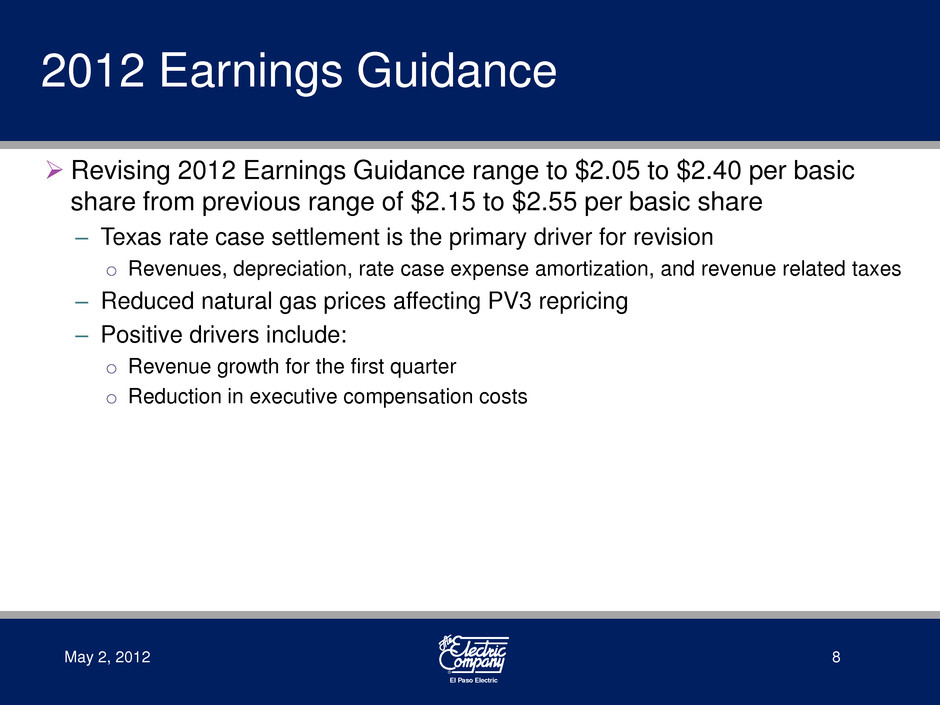

El Paso Electric R May 2, 2012 8 2012 Earnings Guidance Revising 2012 Earnings Guidance range to $2.05 to $2.40 per basic share from previous range of $2.15 to $2.55 per basic share – Texas rate case settlement is the primary driver for revision o Revenues, depreciation, rate case expense amortization, and revenue related taxes – Reduced natural gas prices affecting PV3 repricing – Positive drivers include: o Revenue growth for the first quarter o Reduction in executive compensation costs

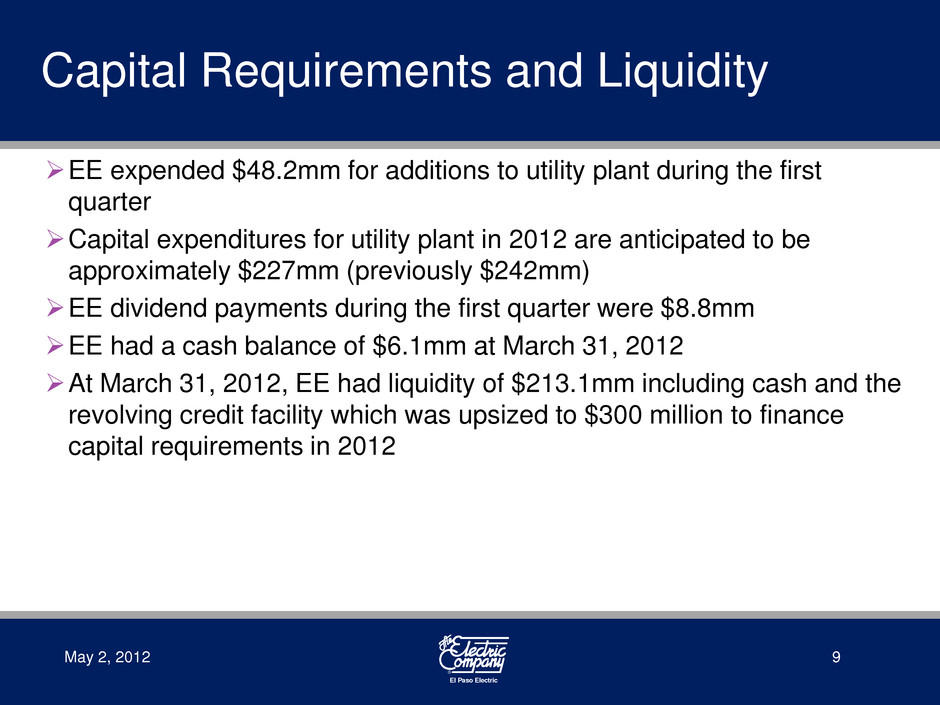

El Paso Electric R May 2, 2012 9 Capital Requirements and Liquidity EE expended $48.2mm for additions to utility plant during the first quarter Capital expenditures for utility plant in 2012 are anticipated to be approximately $227mm (previously $242mm) EE dividend payments during the first quarter were $8.8mm EE had a cash balance of $6.1mm at March 31, 2012 At March 31, 2012, EE had liquidity of $213.1mm including cash and the revolving credit facility which was upsized to $300 million to finance capital requirements in 2012

El Paso Electric R May 2, 2012 10 Cash Capital Expenditures (1) Does not include acquisition costs for nuclear fuel. (2) Includes $691 million for new generating capacity including $38 million to complete Rio Grande Unit 9, $186 million to construct two 87 MW gas-fired LMS-100 units that are scheduled to come on line in 2014 and 2015, $174 million for two 87 MW gas-fired LMS- 100 units scheduled to come on line in 2016, and $284 million of initial expenditures for two additional 292 MW combined cycle generating units that are anticipated to come on line in 2018 and 2019 and $9 million for anticipated renewable projects to be built in El Paso. Construction work in progress of $189mm at March 31, 2012 Primary additions to rate base through 2016 include: – New Generating Plant additions - $691mm – T&D construction necessary to meet customer growth - $401mm – Capex at Palo Verde - $154mm $0 $50 $100 $150 $200 $250 $300 $350 $400 2011 2012 Est 2013 Est 2014 Est 2015 Est 2016 Est EE Actual and Estimated Costs Production Transmission Distribution General $227 $240 $267 $337 $178 $311 ($ in millions) (1) (2)

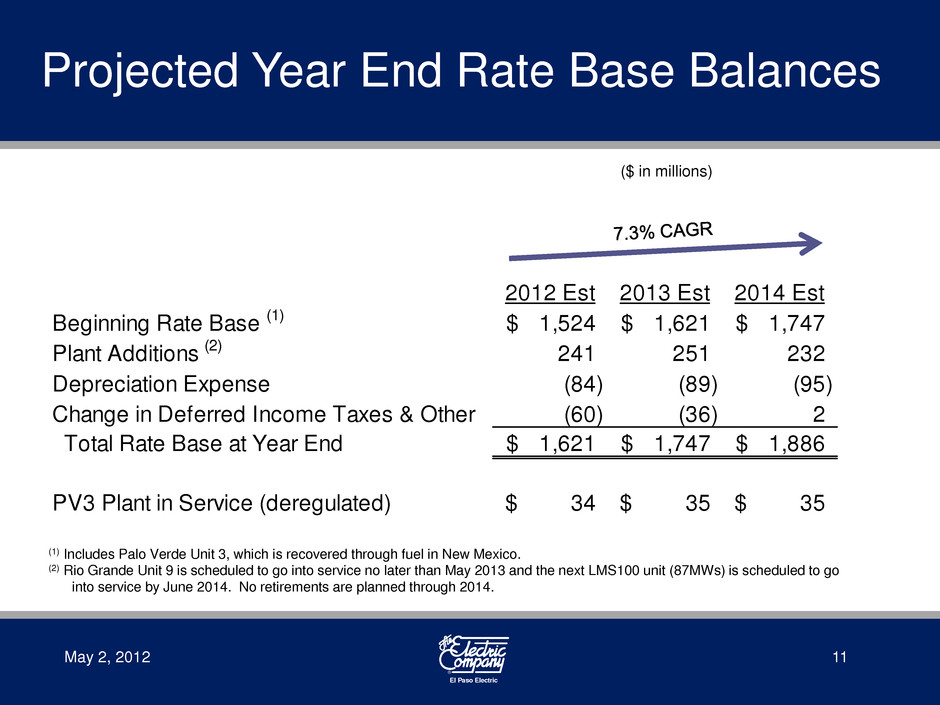

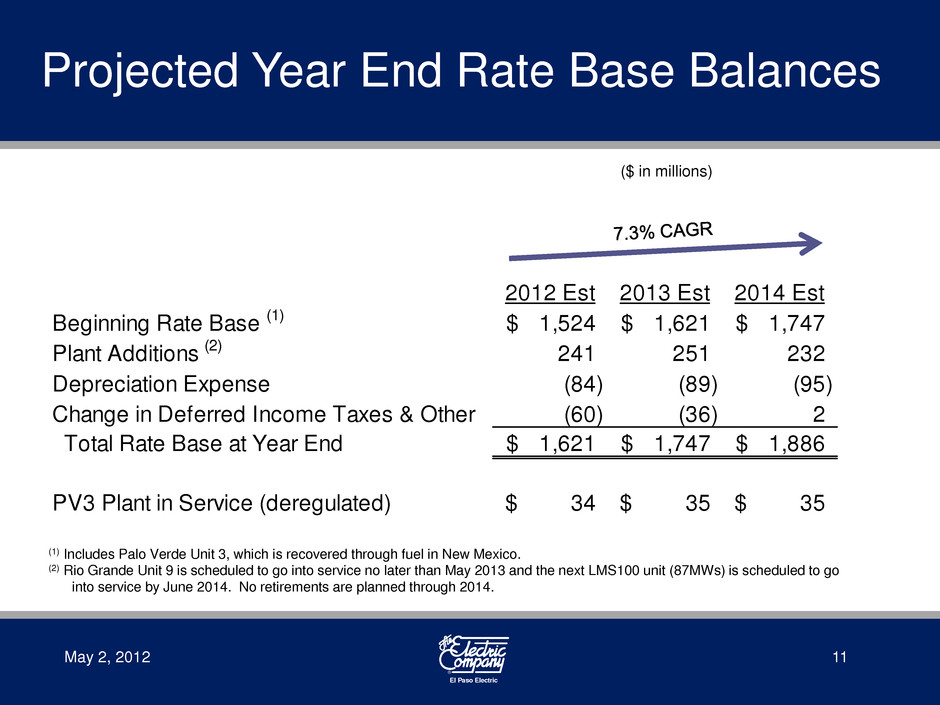

El Paso Electric R May 2, 2012 11 Projected Year End Rate Base Balances ($ in millions) (1) Includes Palo Verde Unit 3, which is recovered through fuel in New Mexico. (2) Rio Grande Unit 9 is scheduled to go into service no later than May 2013 and the next LMS100 unit (87MWs) is scheduled to go into service by June 2014. No retirements are planned through 2014. 2012 Est 2013 Est 2014 Est Beginning Rate Base (1) 1,524$ 1,621$ 1,747$ Plant Additions (2) 241 251 232 Depreciation Expense (84) (89) (95) Change in Deferred Income Taxes & Other (60) (36) 2 Total Rate Base at Year End 1,621$ 1,747$ 1,886$ PV3 Plant in Service (deregulated) 34$ 35$ 35$

El Paso Electric R May 2, 2012 12 Q & A