Safe Harbor Statement 2 This presentation includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased costs to customers or to recover previously incurred fuel costs in rates Recovery of capital investments and operating costs through rates in Texas and New Mexico Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability Changes in customers’ demand for electricity as a result of energy efficiency initiatives and emerging competing services and technologies Unanticipated increased costs associated with scheduled and unscheduled outages of generating plant The size of our construction program and our ability to complete construction on budget Potential delays in our construction schedule due to legal challenges or other reasons Costs at Palo Verde Deregulation and competition in the electric utility industry Possible increased costs of compliance with environmental or other laws, regulations and policies Possible income tax and interest payments as a result of audit adjustments proposed by the IRS or state taxing authorities Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets Possible physical or cyber attacks, intrusions or other catastrophic events Other factors detailed by EE in its public filings with the Securities and Exchange Commission. EE’s filings are available from the Securities and Exchange Commission or may be obtained through EE’s website, http://www.epelectric.com May 6, 2015

Recent Highlights 3 Began commercial operation of Montana Power Station (MPS) Units 1 & 2 Began construction of MPS Units 3 & 4 Continue to be ranked favorably in Texas for reliability Palo Verde Nuclear Generation Station was the nation’s largest power producer for the 23rd consecutive year May 6, 2015 Surpassed the 400,000 retail customer milestone Filed a request in Texas to decrease the fixed fuel factor by 24% Palo Verde Nuclear Generation Station

Historical Test Year End (Mar 2015) Timing of NM & TX Rate Cases 4 May 6, 2015 Historical Test Year End (Dec 2014) File Rate Case (May 2015) Rate Increase Effective (Early Q2 2016) 2016 2014 2015 2016 File Rate Case (Jul or Aug 2015) Rate Increase Effective (Early Q2 2016) 2015 2014 PROPOSED NEW MEXICO RATE CASE TIMELINE PROPOSED TEXAS RATE CASE TIMELINE * Webcast will be scheduled to review NM Rate Case ** MPS Units 1 & 2 placed into service on March 19 & March 20, 2015, respectively

Recent Regulatory Filings (Since 4/15/2015) 5 May 6, 2015 Regulatory Filing Description Jurisdiction Docket No. Fixed Fuel Factor TX 44633 Fort Bliss Solar CCN TX 44637 Fort Bliss Solar CCN NM 15-00099-UT Four Corners Sale NM 15-00109-UT Holloman Solar CCN * NM El Paso MPS Community Solar * TX Las Cruces Community Solar * NM * Expect to file by the end of the quarter

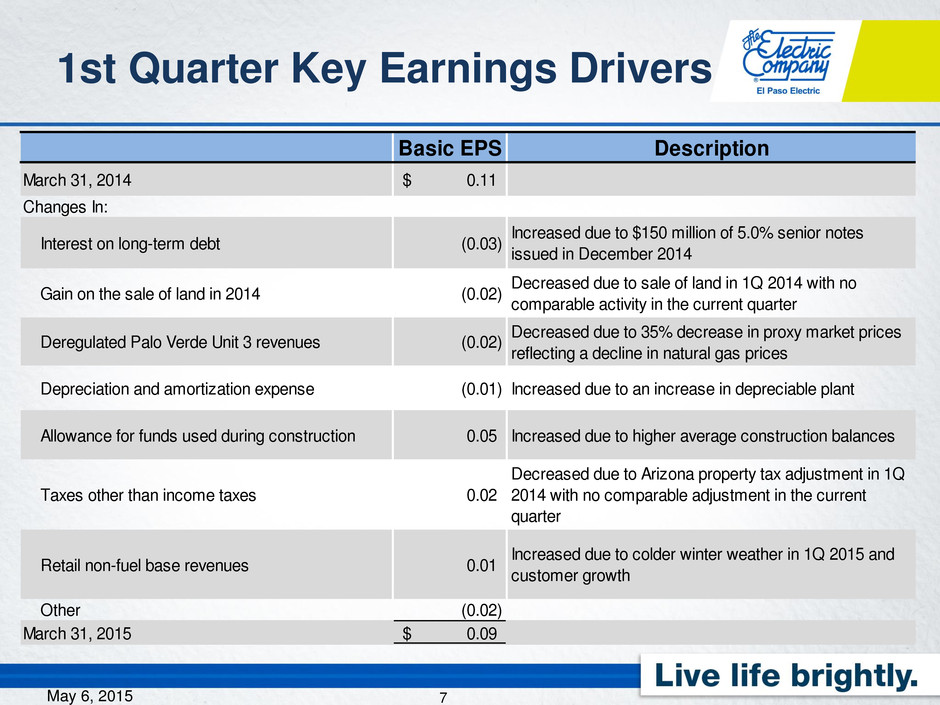

1st Quarter Financial Results 6 1st Quarter 2015 net income of $3.5 million or $0.09 per share, compared to 1st Quarter 2014 net income of $4.6 million or $0.11 per share May 6, 2015

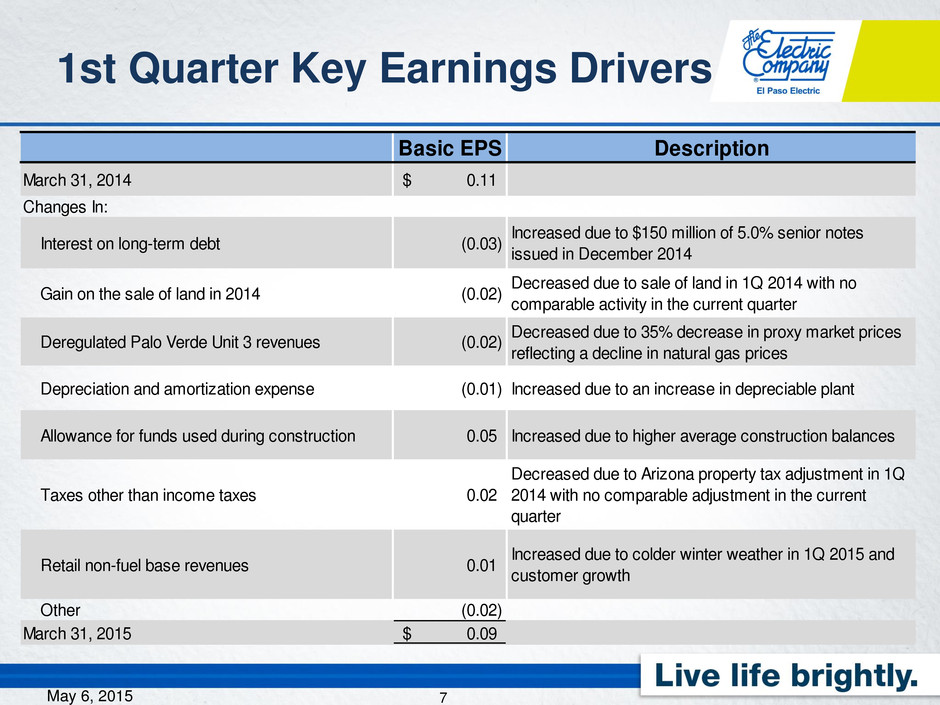

Vision Mission 1st Quarter Key Earnings Drivers 7 Basic EPS Description March 31, 2014 0.11$ Changes In: Interest on long-term debt (0.03) Increased due to $150 million of 5.0% senior notes issued in December 2014 Gain on the sale of land in 2014 (0.02) Decreased due to sale of land in 1Q 2014 with no comparable activity in the current quarter Deregulated Palo Verde Unit 3 revenues (0.02) Decreased due to 35% decrease in proxy market prices reflecting a decline in natural gas prices Depreciation and amortization expense (0.01) Increased due to an increase in depreciable plant Allowance for funds used during construction 0.05 Increased due to higher average construction balances Taxes other than income taxes 0.02 Decreased due to Arizona property tax adjustment in 1Q 2014 with no comparable adjustment in the current quarter Retail non-fuel base revenues 0.01 Increased due to colder winter weather in 1Q 2015 and customer growth Other (0.02) March 31, 2015 0.09$ May 6, 2015

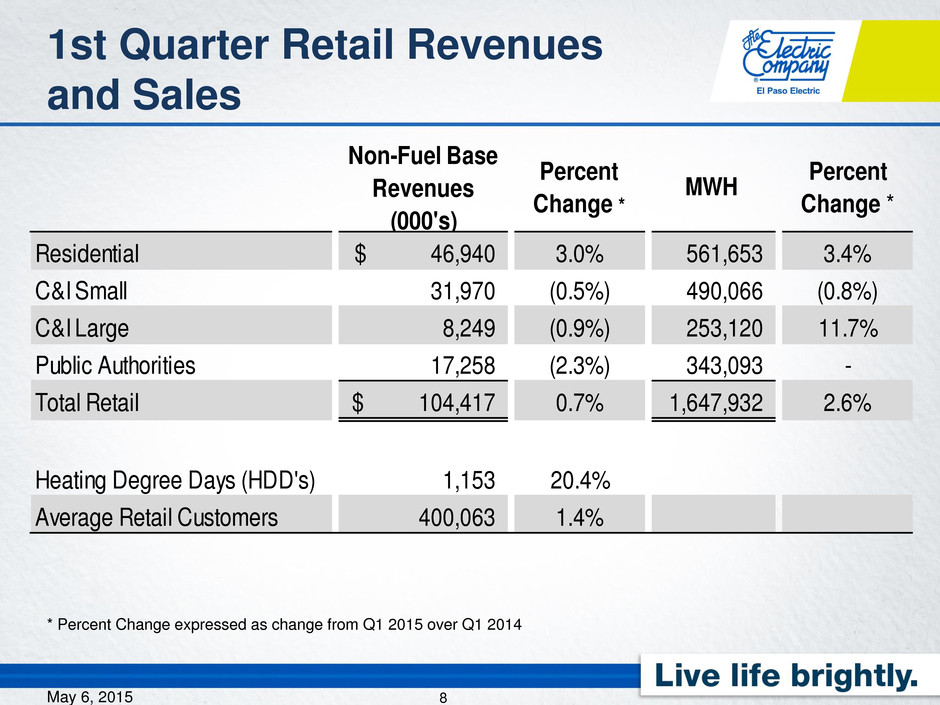

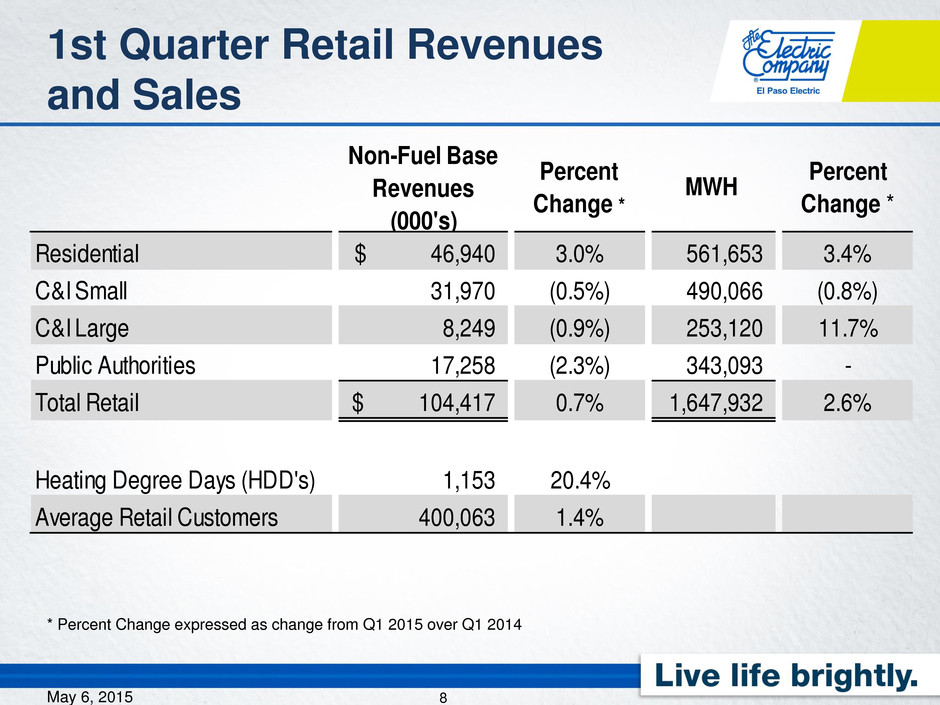

Vision Mission 1st Quarter Retail Revenues and Sales 8 Non-Fuel Base Revenues (000's) Percent Change * MWH Percent Change * Residential 46,940$ 3.0% 561,653 3.4% C&I Small 31,970 (0.5%) 490,066 (0.8%) C&I Large 8,249 (0.9%) 253,120 11.7% Public Authorities 17,258 (2.3%) 343,093 - Total Retail 104,417$ 0.7% 1,647,932 2.6% Heating Degree Days (HDD's) 1,153 20.4% Average Retail Customers 400,063 1.4% May 6, 2015 * Percent Change expressed as change from Q1 2015 over Q1 2014

Capital Requirements & Liquidity 9 Expended $73.9mm for additions to utility plant for the three months ended March 31, 2015 Board declared quarterly cash dividend of $0.28 per share on January 29, 2015 payable on March 31, 2015 EE made $11.3mm in dividend payments for the three months ended March 31, 2015 At March 31, 2015, EE had liquidity of $249.3mm including a cash balance of $8mm and unused capacity under the revolving credit facility Capital expenditures for utility plant in 2015 are anticipated to be approximately $259.5mm Recorded DOE settlement of $6.6mm May issue long-term debt in late 2015 or early 2016 May 6, 2015

2015 Earnings Guidance 10 We are affirming our earnings guidance range for 2015 of $1.75 to $2.15 per share May 6, 2015

Q & A 11 May 6, 2015