- AAPL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SD Filing

Apple (AAPL) SDConflict minerals disclosure

Filed: 6 Feb 20, 4:31pm

Exhibit 1.01

CONFLICT MINERALS REPORT

Summary of Apple’s Commitment to Responsible Sourcing

Apple is deeply committed to upholding human rights across its global supply chain. Apple works to safeguard the well-being of people touched by its supply chain, from the mine site level to the facilities where products are assembled. Apple’s suppliers employ millions of people at their respective facilities, which range in size from a few employees to hundreds of thousands.

Apple is also committed to protecting the environment where minerals are sourced. In 2017, Apple announced its goal of, one day, using only recycled and renewable minerals and materials in its products. Across Apple’s product line, an increased amount of recycled materials is being utilized. As Apple makes progress toward this ambitious goal, it continues to strengthen its existing programs to source tin, tantalum, tungsten, and gold (“3TG”) and other minerals responsibly. Apple is committed to meeting and exceeding legal requirements and internationally accepted due diligence standards, with the ultimate goal of improving conditions on the ground in the Democratic Republic of the Congo (“DRC”) and adjoining countries.

Apple’s comprehensive approach to responsible minerals sourcing includes requirements and programs at many levels of the supply chain. The Apple Supplier Code of Conduct (“Supplier Code”) and the Supplier Responsibility Standard on the Responsible Sourcing of Materials (“Responsible Sourcing Standard”) require suppliers to engage with smelters and refiners to assess and identify a broad range of risks beyond conflict, including social, environmental, and human rights risks. Suppliers are also required to review reported incidents and public allegations linked to their smelters and refiners and to engage with 3TG traceability and third party audit programs to address and mitigate risk.

Beyond supplier requirements, Apple works with partners to better understand the human rights impact of due diligence programs on the lives of people working and living in mining communities. Apple also supports whistleblower initiatives to empower independent, local voices to raise issues and report incidents at the mine-site level.

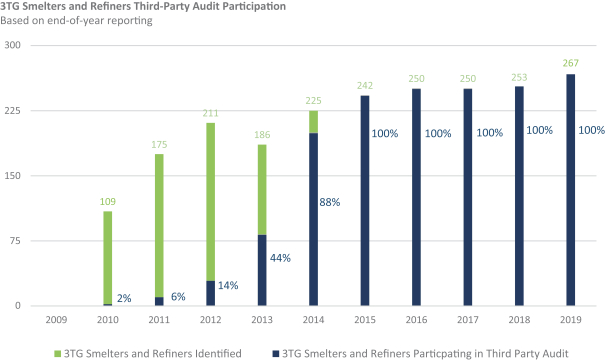

As of December 31, 2019—for the fifth straight year—100 percent of the 267 identified smelters and refiners in Apple’s supply chain for all applicable Apple products manufactured during calendar year 2019 participated in an independent third-party conflict minerals audit (“Third Party Audit”) program for 3TG. These audits encompassed the identified smelters and refiners that provide materials for Apple’s iPhone®, iPad®, Mac®, iPod touch®, Apple TV®, Apple Watch®, AirPods®, HomePod™, and Beats® products; Apple Card™; and all Apple accessories.

In 2019, Apple directed its suppliers to remove from its supply chain 18 smelters and refiners that were not willing to participate in, or complete, a Third Party Audit or that did not otherwise meet Apple’s requirements for the responsible sourcing of minerals. Of the 267 smelters and refiners of 3TG determined to be in Apple’s supply chain as of December 31, 2019, Apple found no reasonable basis for concluding that any such smelter or refiner sourced 3TG that directly or indirectly financed or benefited armed groups from the DRC or an adjoining country.

While the African Great Lakes region faces ongoing challenges to achieve lasting change, Apple remains committed to continue responsibly sourcing 3TG from the region. Apple believes that all stakeholders—governments, civil society, and industry—should enhance their efforts to implement comprehensive due diligence programs, measure impact, and work together with local communities to improve conditions in the region.

Apple Inc. | 2019 Conflict Minerals Report | 1

Introduction

Apple is committed to treating the people in its supply chain with dignity and respect and protecting the planet we all share. Conducting human rights due diligence is the foundation of Apple’s responsible sourcing of minerals program.

Apple conducts robust due diligence on the source and chain of custody of 3TG in its global supply chain but does not directly purchase or procure raw minerals from mine sites.

In addition to the responsible sourcing of minerals, Apple works to reduce the amount of minerals mined from the Earth. In 2017, Apple announced its goal of, one day, using only recycled and renewable minerals and materials in its products. In 2019, Apple continued to make progress toward this goal by increasing the amount of recycled material used in its products. 3TG are among the 14 materials prioritized in Apple’s initial efforts to transition to recycled and renewable materials, based on an evaluation of the environmental, social, and supply impacts of 45 mined elements and raw materials. The results of this evaluation and the related methodology behind these Material Impact Profiles are available on Apple’s website for others to access and use athttps://www.apple.com/environment/pdf/Apple_Material_Impact_Profiles_April2019.pdf. The information contained on this website is not a part of, or incorporated by reference into, this filing.

Apple’s responsible minerals sourcing efforts are aligned with the Organisation for EconomicCo-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (2016) and related Supplements (the “OECD Due Diligence Guidance”).

OECD Step 1: Strong Company Management Systems

Aligned with Step 1 of the OECD Due Diligence Guidance, Apple has robust internal management systems overseeing its responsible sourcing of minerals efforts. Apple’s Board of Directors oversees its CEO and other senior management in the competent and ethical operation of Apple on aday-to-day basis. Apple’s Audit Committee, consisting entirely of independent directors, assists Apple’s Board of Directors in monitoring significant business risks, including operational and reputational exposures. Apple also has a code of ethics, “Business Conduct: The way we do business worldwide,” that applies to all employees, the Board of Directors, independent contractors, consultants, and others who do business with Apple. This code of ethics, which mandates that Apple conduct business ethically, honestly, and in full compliance with applicable laws and regulations, applies to every business decision in every area of the company worldwide.

Apple’s Supplier Responsibility (“SR”) team partners with its suppliers to drive its high standards for the protection of labor and human rights, health and safety, and the environment. The SR team within Apple’s Worldwide Operations group coordinates activities related to Apple’s Supplier Code and Responsible Sourcing Standard and works across a number of Apple business teams and functions, including, but not limited to, product design, manufacturing operations, environmental initiatives, procurement, legal, finance, and Apple retail. The SR team also regularly consults with Apple’s senior management to review progress and set ongoing strategy for its responsible sourcing and human rights programs.

Apple’s Supplier Code and Responsible Sourcing Standard

Apple’s Supplier Code and Responsible Sourcing Standard apply to all levels of Apple’s supply chain and are based on industry and internationally accepted principles, such as the United Nations Guiding Principles on Business and Human Rights (“UN Guiding Principles”), the International Labour Organisation’s International Labour Standards, and the OECD Due Diligence Guidance. The Responsible Sourcing Standard outlines Apple’s extensive requirements on the responsible sourcing of minerals and other materials, including expectations for suppliers concerning 3TG due diligence and related sourcing matters. The Supplier Code is available in 15 languages and the Responsible Sourcing Standard is available in five languages.

Apple Inc. | 2019 Conflict Minerals Report | 2

Each year, Apple evaluates and strengthens its Supplier Code and Responsible Sourcing Standard. In 2019, Apple strengthened its Responsible Sourcing Standard by more clearly describing how its requirements apply to all levels of the supply chain, including traders,sub-suppliers, mines, and collection points for recycled minerals used in its products.

As part of its commitment to industry-wide progress, Apple benchmarks the scope and requirements of dozens of third-party sustainability standards, including upstream protocols for mineral processors and mining companies, and publishes this information in its Responsible Sourcing Standard. In 2019, Apple again analyzed third-party sustainability standards and mapped those against risk criteria such as labor and human rights, health and safety, and the environment. This benchmarking helps to illustrate which standards satisfy Apple’s requirements.

Supplier Engagement

Apple requires its suppliers to adhere to the Supplier Code and Responsible Sourcing Standard, including any subsequent amendments or updates. Suppliers are required to apply Apple’s requirements to their suppliers through all levels of the supply chain. In this way and through direct outreach by Apple to smelters and refiners, Apple implements its requirement that smelters and refiners in its supply chain comply with Apple’s strict standards, including that smelters and refiners participate in Third Party Audit programs.

To ensure that Apple’s suppliers understand Apple’s 3TG sourcing policy, Apple communicates its requirements to its direct suppliers annually and regularly engages with suppliers using tailored communication and guidance throughout the year. In addition, Apple’s SupplierCare portal provides suppliers with access to online training materials in English and Mandarin Chinese that focus on Apple’s due diligence expectations and requirements for 3TG reporting. If Apple discovers that standards are not being met, Apple works side by side with suppliers to help them improve. In 2019, certain suppliers also participated in a live online training webinar that provided additional guidance on Apple’s requirements and best practices for the responsible sourcing of minerals.

Throughout the year, suppliers can reach out to Apple with questions about 3TG sourcing through the SupplierCare portal or through a dedicated Apple email. Apple also maintains a separate dedicated 3TG email address that allows suppliers to report concerns or grievances related to 3TG mining, processing, and trading. The concerns or grievances submitted to Apple are reviewed with relevant Apple business teams, andfollow-up activities are conducted as appropriate.

In 2019, Apple took steps to further strengthen the implementation of the Supplier Code and Responsible Sourcing Standard by expanding the integration of its responsible sourcing requirements into its Apple-managed supplier assessments, which are distinct from third party smelter and refiner audits. These assessments evaluate suppliers’ performance against all areas of Apple’s Supplier Code. In addition, Apple continued to engage an independent audit firm to conduct specialized responsible sourcing audits of certain suppliers in order to have a deeper review of their internal management systems and implementation of Apple’s requirements related to 3TG and other minerals. At the end of an Apple-managed assessment or specialized audit, the supplier is given a list of areas to strengthen against Apple’s Supplier Code and Responsible Sourcing Standard, and the supplier is required to correct any identified nonconformances in a timely manner. Apple provides support to help suppliers complete a corrective action plan to meet and exceed its requirements. If a supplier is unwilling or unable to meet Apple’s requirements, Apple will indefinitely end its business relationship with that supplier.

Apple’s efforts to responsibly source 3TG and cobalt were recognized as number one in its industry group by the Responsible Sourcing Network, a project of thenon-profit organization As You Sow, in their 2019 publication “Mining the Disclosures 2019: An Investor Guide to Conflict Minerals and Cobalt Reporting in Year Six.”

Apple Inc. | 2019 Conflict Minerals Report | 3

Going Beyond: Working Together with Stakeholders for Progress

Apple believes that continuous improvement and refinement of industry standards are critical to driving industry-wide progress on the responsible sourcing of minerals. Apple is committed to systemic engagement and working in collaboration with stakeholders beyond its own supply chain. As part of this commitment, Apple engaged with a broad range of civil society, industry, academic, and government experts in 2019 to gather feedback on its own program. Apple also convened an expert group to discuss opportunities to work collectively on the measurement of human rights impacts and other innovative approaches to the responsible sourcing of minerals in the supply chain.

In 2018, Apple worked with the International Organization for Migration (“IOM”)—the leading global expert on migration—to develop and publish the Remediation Guidelines for Victims of Exploitation in Extended Mineral Supply Chains, a set of guidelines for industry actors on how to address confirmed allegations in the upstream supply chain in accordance with the UN Guiding Principles. In 2019, IOM continued to share these guidelines with government and industry stakeholders, and the guidelines were featured in several publications, including a United Nations Report of the Special Rapporteur on trafficking in persons, especially women and children.

In 2019, Apple also supported the development of certain responsible sourcing-related industry-wide standards, including the Code of Risk mitigation for Artisanal and Small-scale Mining (“ASSM”) engaging in Formal Trade (“CRAFT Code”) developed by the Alliance for Responsible Mining and RESOLVE, a sustainability nonprofit organization; and the Blockchain Guidelines of the Responsible Business Alliance’s Responsible Minerals Initiative (“RMI”). Apple continued to participate in RMI’s Blockchain working group, helping to standardize data interoperability across minerals blockchain solutions and ensure data privacy. Apple believes that minerals blockchain solutions should be used as a tool to support—but not to replace—supply chain due diligence, and that the interests of people working at mine sites and in surrounding communities should be taken into consideration.

Apple also continued to support the development of standards for large-scale mining by conducting outreach to industry standard-setting bodies to encourage the alignment of industry standards and the adoption of tools such as the Risk Readiness Assessment tool (“RRA”). The RRA was designed by Apple to help assess risks in supply chains beyond those associated with conflict, such as social, environmental, and human rights risks. In addition, Apple continued to integrate the principles of the Extractive Industries Transparency Initiative (“EITI”) as part of its risk mapping and due diligence requirements.

In 2019, Apple chaired the board of the Responsible Business Alliance (“RBA”), served on the Steering Committee of the RMI, continued to participate in the European Partnership for Responsible Minerals, and participated in the Responsible Artisanal Gold Solutions Forum. Apple also served on the Governance Committee of the Public Private Alliance for Responsible Minerals Trade (“PPA”), a multi-sector initiative supporting the ethical production, trade, and sourcing of minerals from the Great Lakes region of Central Africa.

In 2019, Apple participated in a PPA delegation to the DRC and Rwanda to visit mine sites and engage with mining community advocates, labor and human rights experts, and government leaders on the importance of credible due diligence and traceability systems as a means of ensuring that the minerals trade does not finance armed conflict or contribute to human rights abuses, including child labor or sexual and gender-based violence against women.

Apple Inc. | 2019 Conflict Minerals Report | 4

OECD Step 2: Identification and Assessment of Risk in the Supply Chain

Consistent with Step 2 of the OECD Due Diligence Guidance, Apple reviews public allegations from civil society and other independent voices related to risks outlined in Annex II of the OECD Due Diligence Guidance that are potentially linked to its supply chain. Apple also works with Third Party Audit programs—in particular, RMI and the London Bullion Market Association (“LBMA”)—to address identified risks at the smelter, refiner, and mine-site levels. In 2019, Apple reviewed publicly available information on certain risks, including investigative reports by international organizations, including the UN Group of Experts on the DRC, andnon-governmental organizations (“NGOs”). Apple also worked with Third Party Audit programs to seek verification of allegations to the extent possible; to advance appropriate corrective action, where necessary; and to improve due diligence processes.

Apple works at multiple levels in its supply chain to identify and assess risk. Apple requires its suppliers that utilize 3TG to submit an industry-wide standard Conflict Minerals Reporting Template (“CMRT”). Apple collects and processes data provided by suppliers through their completion of the CMRT to map Apple’s supply chain to the smelter and refiner level and to the mine-site level, to the extent available. Suppliers are also required to inform Apple immediately, in accordance with its Responsible Sourcing Standard, if they identify certain high risks such as conflict risks, risks included in Annex II of the OECD Due Diligence Guidance, or human rights risks associated with 3TG.

To help assess risks in its supply chain beyond those associated with conflict, such as social, environmental, and human rights risks, Apple developed the RRA in 2016. In 2018, Apple completed the transition of the RRA to RMI to make the tool broadly available to the industry. The RRA, which is available in English, Mandarin Chinese, Indonesian, Japanese, and Korean, has been increasingly utilized by companies at all levels of the supply chain in the electronics sector and in other sectors, such as the automotive and aerospace industries. In 2019, RMI announced that completion of the RRA will be an annual requirement for smelters and refiners in its Responsible Minerals Assurance Process (“RMAP”) assessment program, starting in 2020. According to the Enough Project, an international human rights organization, Apple’s risk assessment efforts, including sharing the RRA, contributed to the overall strengthening of conflict minerals supply chain due diligence.

As of December 31, 2019, 287 downstream companies and upstream smelters and refiners utilized the RRA, compared to 265 users in 2018. Apple continues to use the RRA on a targeted basis to assess risks in its global supply chain, with a particular focus on new smelters and refiners that enter its supply chain and on additional minerals beyond 3TG.

Going Beyond: Strengthening Industry-Wide Systems

Industry-Wide Minerals Grievance Platform

Apple believes that addressing allegations potentially affecting only Apple’s supply chain will not lead to lasting progress on the ground. Accordingly, Apple has taken steps to mobilize a broad group of stakeholders to address public allegations. In 2019, Apple continued to work with RMI to fund, design, and launch the Minerals Grievance Platform (mineralsgrievanceplatform.org), an industry-wide platform for screening and addressing grievances linked to smelters and refiners. The information contained on this website is not a part of, or incorporated by reference into, this filing.

Through the platform, industry organizations, NGOs, and Third Party Audit programs collectively screen and conduct due diligence on filed grievances. C4ADS, anon-profit independent third-party organization, investigates those grievances and shares the findings with platform participants. This collaboration increases transparency, consistency, and accountability in how public allegations concerning smelters and refiners are identified, addressed, and resolved.

Apple Inc. | 2019 Conflict Minerals Report | 5

Mine-Level Incident Reporting and Review

Apple believes that transparency and public reporting of mine-level incident data promote a better understanding of the success and the challenges of industry-wide due diligence efforts. Apple also believes that industry-wide due diligence efforts are strengthened when companies review and respond to reported incidents and associated risks identified on the ground.

Since 2016, Apple’s Conflict Minerals Reports have included a summary of the incident data provided by the International Tin Association’s International Tin Supply Chain Initiative (“ITSCI”)—an upstream traceability and due diligence program monitoring tin, tantalum, and tungsten mines across the African Great Lakes region—and a snapshot of the corrective actions taken to address relevant incidents. Apple believes this analysis has provided further transparency to ITSCI’s operations and a deeper understanding of the outcomes of remediation and mitigation measures. As a result of advocacy by Apple, ITSCI published a summary of incident outcomes on its website at https://www.itsci.org/2020/02/03/itsci-programme-incident-and-outcome-review-november-2018-to-october-2019/. ITSCI also continues to publish descriptions of individual incidents for stakeholders to access. The information contained on the ITSCI website is not a part of, or incorporated by reference into, this filing.

In 2019, Apple continued working with ITSCI to develop its incident review process and monitor incidents generated through the ITSCI reporting system from a variety of sources, including ITSCI field agents, ITSCI’s whistleblowing mechanism, and NGOs.

Apple reviews incidents to understand, to the extent possible, if they involve individuals identified as members or potential members of organizations within the meaning of “armed groups,” as defined in Item 1.01(d)(2) of Form SD (“armed groups”), and whether they are linked to smelters and refiners reported in Apple’s supply chain.

Incident Review: Closing Out 2018 ITSCI High-Risk Incidents

As reported in Apple’s Conflict Minerals Report for 2018, eight of the more than 1,300 incidents reported by ITSCI continued to be reviewed by Apple. In particular, in those eight incidents, the police in the DRC, the DRC national army, and the Mai Mai group, an armed group in the DRC, were alleged to be involved. Three of these eight incidents were reported closed at the end of 2018 as reported in Apple’s Conflict Minerals Report for 2018. In 2019, ITSCI informed Apple that the remaining five incidents had been closed in accordance with ITSCI criteria, after ITSCI’sfollow-up.

Incident Review: 2019 ITSCI High-Risk Incidents

In 2019, Apple reviewed over 1,400 ITSCI incidents and identified nine potential incidents involving the police in the DRC, the DRC national army, and/ornon-state armed groups in connection with a variety of alleged illicit activities. Based on information received to date, these alleged illicit activities ranged from fraud, bribery, and illegal payments and taxation, including at mining sites and checkpoints or road barriers, to corruption and other criminal activity, potentially for personal gain. Of the nine identified incidents, three have been closed and six remain open with investigations or corrective actions still in progress. Apple intends to continue to monitor these incidents with ITSCI.

Apple has not, to date, been able to determine whether the reported incidents were connected to specific 3TG included in Apple’s products. The challenges of tracking specific mineral quantities through the supply chain continue to impede the traceability of any specific mineral shipment through the entire product manufacturing process.

Apple Inc. | 2019 Conflict Minerals Report | 6

OECD Step 3: Strategy to Respond to Identified Risks

In alignment with Step 3 of the OECD Due Diligence Guidance, Apple implements its due diligence program and conducts supply chain analysis in a number of ways, including through information gained from independent research, third party audit analysis, and by direct engagement with smelters and refiners to respond to risks identified in Apple’s supply chain.

In addition, Apple closely monitors completion of Third Party Audits and corrective action plans by the smelters and refiners in its supply chain. In the instances where smelters and refiners delay implementation of corrective action plans developed by Third Party Audits, Apple leverages its downstream position, conducting applicable smelter or refiner outreach to reiterate the requirement for the smelter or refiner to complete and close the associated corrective action plan in order to remain in Apple’s supply chain.

Apple uses a small amount of gold in its products but continues to address the challenges in the gold supply chain through its due diligence program, which is aligned with the OECD Due Diligence Guidance Supplement on Gold and other sources. As part of its risk assessment and due diligence efforts, Apple designed and implemented systems that focus specifically on the gold supply chain. Apple reviewed gold refiners in its supply chain to identify potential risks and other sourcing challenges, and then worked with suppliers to address such identified risks and challenges and/or to remove refiners as necessary. Apple also prioritizes gold in its efforts to transition to recycled and renewable materials in its products.

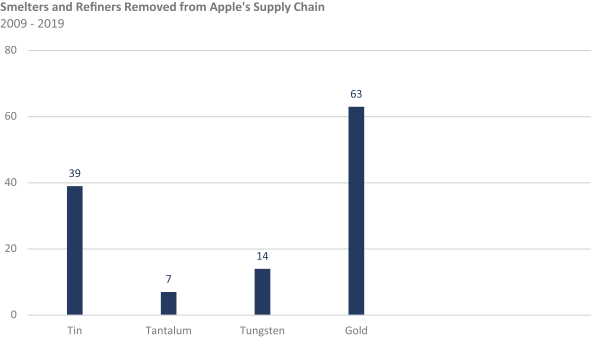

If smelters or refiners are unable or unwilling to meet Apple’s high standards, Apple will take necessary actions to terminate the applicable business relationships with such smelters or refiners. In 2019, Apple directed its suppliers to remove from its supply chain 18 smelters and refiners that were not willing to participate in, or complete, a Third Party Audit or did not otherwise meet Apple’s requirements on the responsible sourcing of minerals. Since 2009, Apple has removed 123 3TG smelters or refiners from its supply chain, including over 60 gold refiners.

Apple Inc. | 2019 Conflict Minerals Report | 7

Going Beyond: Addressing Gold Risk with Innovative Sourcing

In addition to conducting robust due diligence, Apple believes that innovative and data-driven solutions to sourcing will help reduce risk and improve traceability. In 2019, Apple continued to fund the Salmon Gold project with Tiffany & Co., led by RESOLVE, a sustainabilitynon-profit. The Salmon Gold project works with small-scale miners and indigenous peoples in remote regions of the Yukon, Alaska, and British Columbia to support a mining practice that helps restore rivers and streams so that salmon and other fish can thrive. Since RESOLVE first introduced the Salmon Gold partnership in 2017, the organization has connected local placer miners, environmentalists, and government agencies to course-correct the damage done by historic mining. The gold mined from this project is then traced from its origin to a refiner in Apple’s supply chain using blockchain technology.

In 2019, Apple also supported the Massachusetts Institute of Technology’sD-Lab Innovation Centers in Colombia, which support training of local gold miners and community leaders to develop sustainable solutions to ASSM challenges. Apple believes that the lessons learned from these programs will help support further innovation across the supply chains of additional minerals.

OECD Step 4: Independent Third Party Audit of Supply Chain Due Diligence

Apple believes Third Party Audits remain the foundation of robust due diligence systems. In particular, Apple believes that Third Party Audits play a significant role in providing assurance that smelters and refiners have appropriate due diligence systems in place and help ensure that operations and sourcing practices do not support conflict in the DRC or an adjoining country. Since 2015, Apple has continued to reach a 100 percent rate of participation by identified smelters and refiners in its supply chain in Third Party Audit programs.

Apple Inc. | 2019 Conflict Minerals Report | 8

Going Beyond: Considering Impact

While audits are the foundation of a robust due diligence program, they are not designed to assess the extent to which conditions are improving for those living and working in mining communities. To this end, Apple continued building upon its efforts to measure the impact of due diligence programs on the lives of people working and living in mining communities, with a focus on livelihood, labor, and human rights impacts.

In 2019, Apple continued to fund the activities of project partners working on measuring human rights impact: the International Peace Information Service (“IPIS”), an independent research institute; Ulula, a software and analytics company; the University of California in Los Angeles Project on Resources and Governance Institute (“UCLA”);Sub-Saharan Field Research and Consulting Services (“SFR”); and the Harvard University Humanitarian Initiative’s (“HHI”) Women in War Program.

Based in part on expert feedback, in 2019 IPIS and Ulula worked with UCLA and SFR to refine their project methodology. UCLA identified 103 mine sites with and without due diligence programs and developed an algorithm to control for variables such as the mine’s local geography, past conflict, and road access; SFR designed a household data collection randomization strategy to ensure a representative sample; IPIS conducted approximately 2,000in-person interviews at randomly sampled households in the 103 selected mining communities; and Ulula designed a mobile-based tool to follow up onin-person surveys to track changes in responses over time.

In a separate study, HHI, working with a local Congolese organization, employed a qualitative research methodology using interviews and focus groups at mining sites in North and South Kivu provinces. Preliminary findings from this study indicate that due diligence programs helped deter armed group engagement at artisanal mine sites, and mining communities report their departure has made the mines more secure and the mining process more transparent and predictable. However, women report often feeling excluded from due diligence activities, highlighting opportunities for these systems to be more inclusive.

In 2019, Apple’s research partners shared their initial study methodology and findings with the OECD at the 2019 OECD Responsible Minerals Forum in support of the OECD’s work to develop a comprehensive monitoring and evaluation framework to measure the outcomes of implementation of the OECD Due Diligence Guidance.

Apple believes that all stakeholders—governments, civil society, and industry—should work together to enhance efforts to measure and consider the human rights impact of minerals due diligence programs.

OECD Step 5: Report on Supply Chain Due Diligence

In alignment with Step 5 of the OECD Due Diligence Guidance, Apple reports annually on its due diligence requirements through its annual Conflict Minerals Reports filed with the U.S. Securities and Exchange Commission. Apple also publishes a list of all identified 3TG and cobalt smelters and refiners, 100 percent of which participated in third party audits in 2019. Apple also annually publishes its Supplier List which represents over 98 percent of direct spend for materials, manufacturing, and assembly of Apple products worldwide.

In addition, Apple publishes an annual Supplier Responsibility Progress Report that details Apple’s work and progress in protecting people and the environment, which includes the minerals supply chain. Apple’s annual Environmental Progress Report contains information on Apple’s efforts to use recycled and renewable materials, including 3TG. Apple also provides Product Environmental Reports, which provide environmental information relevant to the entire lifecycle of that product. Apple publishes an annual Statement on Efforts to Combat Human Slavery and Trafficking in Its Supply Chain, with additional information on its commitment to uphold human rights and to combat and prevent modern slavery.

Apple Inc. | 2019 Conflict Minerals Report | 9

Going Beyond: Empowering Voices in Mining Communities

Apple believes that empowering independent voices at the mine-site level is critical to identifying and assessing risks in the supply chain. In 2019, Apple continued to provide funding to the Fund for Global Human Rights, an international human rights organization, to support human rights defenders and local activists in the DRC working on a range of issues including economic and social rights of mining communities; inclusive economic growth; judicial advocacy; the rule of law; and health, safety, and fair compensation for mining communities.

In 2019, Apple also funded the completion of a project started in 2018 to expand a mobile platform developed by Integrity Action, an international NGO focused on reducing corruption and strengthening accountability by amplifying citizen voices through mobile platforms in multiple countries, including in the DRC.

For the fourth consecutive year, Apple provided funding to ITSCI’s whistleblowing mechanism in the DRC, which enables people in mining communities in seven provinces of the DRC to place anonymous voice calls; send SMS messages in local languages; and otherwise raise concerns related to mineral extraction, trade, handling, and exporting to ITSCI’son-the-ground NGO partners, including Save Act Mine. Allegations of misconduct are surfaced as incidents for furtherfollow-up. In 2019, ITSCI and its partner organizations worked to increase awareness and utilization of the whistleblowing mechanism by launching a radio campaign in mining communities, distributing promotional material, and consulting with local civil society actors and other stakeholders.

In 2019, Apple continued to provide funding to Pact Institute, Inc. (“Pact”), an international development NGO, to deliver rights awareness training to miners, youth, and community officials in ASSM communities in the DRC. These training sessions were designed to raise awareness on a range of human rights issues and were based in part on curriculum developed by the United Nations Children’s Emergency Fund (UNICEF). Apple also funded Pact to launch the third year of a vocational education program for youth living in mining communities in the Katanga province of the DRC. The program advances vocational skills such as hairdressing, auto mechanics, and welding. To accelerate the scaling of this program, Apple partnered with the RBA in 2019 to open the program to their member companies.

Conclusion: Risk Mitigation and Future Due Diligence Measures

Apple will continue to responsibly source 3TG throughout its supply chain and to press for continuous improvements in industry-wide due diligence approaches and human rights-focused practices to make a positive impact on the lives of people living in the DRC and adjoining countries. Going forward, Apple intends to continue to drive change by:

| • | Increasing the amount of recycled minerals used in its products to reduce the amount of minerals mined from the Earth. |

| • | Collaborating with industry groups and NGOs to continue improving 3TG due diligence and traceability systems, and encouraging its suppliers to adopt best practices for the responsible sourcing of minerals. |

| • | Supporting independent local stakeholders to identify relevant risks and raise grievances related to conditions in and around mining areas for 3TG. |

| • | Continuing to collaborate with relevant stakeholders to improve how incidents and allegations are tracked and addressed on a transparent, industry-wide basis. |

| • | Expanding on efforts to supplement due diligence activities with innovative approaches to sourcing and traceability, such as utilizing blockchain technology for mineral chain of custody. |

| • | Working with the OECD and other stakeholders to measure the human rights impact of due diligence programs. |

Apple Inc. | 2019 Conflict Minerals Report | 10

Determination

Based on the information provided by Apple’s suppliers and its own due diligence efforts through December 31, 2019 as described in this report, Apple believes the facilities that may have been used to process 3TG in Apple’s products include the smelters and refiners listed in Annex I. Through its smelter and refiner identification and validation process, Apple has identified a total of 323 smelters and refiners as potential sources of 3TG that, initially, were believed to have been in its supply chain at some point during 2019. Of these 323 smelters and refiners:

| • | 267 smelters and refiners were determined to be in Apple’s 3TG supply chain as of December 31, 2019. |

| • | 2 smelters and refiners were subsequently found to be inoperative in 2019. |

| • | 54 smelters and refiners were removed and no longer reported in Apple’s supply chain as of December 31, 2019. Of these smelters and refiners: |

| • | 36 were, initially, erroneously, or unintentionally reported in 2019 by suppliers due to reasons such as changes in a supplier’s supply chain or product line, or changes in a supplier’s declaration of scope in the supplier’s CMRT. Apple took steps to verify that its suppliers did not allow the 36 smelters and refiners tore-enter or remain in Apple’s supply chain. |

| • | 18 were removed that had previously participated in, but subsequently stopped participating in, a Third Party Audit program; were not willing to participate in, or complete, a Third Party Audit within given timelines; exceeded Third Party Audit corrective action plan timelines; and/or were removed at Apple’s request due to not meeting the Supplier Code, Responsible Sourcing Standard, and/or 3TG mineral requirements. |

Apple’s reasonable country of origin inquiry is based on Third Party Audit information and other sources such as the United States of America Geological Survey (USGS) and, to the extent that country of origin information has not been made available through audit programs, through the collection of additional information by Apple. To the extent reasonably possible, Apple has documented the country of origin of identified smelters and refiners based on information received through RMI RMAP, LBMA, a survey of smelters and refiners, and/or third-party reviews of publicly available information. However, some country of origin information has not been audited by a third party because, among other reasons, applicable smelters and refiners have gone out of operation before completing a Third Party Audit. Therefore, Apple does not have sufficient information to conclusively determine the countries of origin of the 3TG in all of its products; however, based on the information provided by Apple’s suppliers, smelters, and refiners as well as from Third Party Audit programs, Apple believes that the 3TG contained in its products originate from the countries listed in Annex II, as well as from recycled and scrap sources.

Of all 267 of the smelters and refiners of 3TG determined to be in Apple’s supply chain as of December 31, 2019, Apple found no reasonable basis for concluding that any such smelter or refiner sourced 3TG that directly or indirectly financed or benefited armed groups from the DRC or an adjoining country. Of these 267 smelters and refiners, 24 are known to be directly sourcing from the DRC or an adjoining country, of which 100 percent participated in, or continued to participate in, a Third Party Audit in 2019 involving a review of the traceability of the smelter’s or refiner’s 3TG as well as a validation of its due diligence systems and country of origin information. The foregoing does not include smelters and refiners indirectly sourcing from the DRC or adjoining countries by acquiring 3TG from these 24 smelters and refiners.

About This Report

This report has been prepared pursuant to Rule13p-1 under the Securities Exchange Act of 1934, as amended, for the reporting period from January 1 to December 31, 2019.

Apple Inc. | 2019 Conflict Minerals Report | 11

Apple believes it constitutes a “downstream” company in that Apple or its suppliers purchase cassiterite, columbite-tantalite (coltan), wolframite, gold, or their derivatives, which presently are limited to tin, tantalum, tungsten, and gold (collectively “3TG”)-related materials after processing by smelters or refiners. In addition, Apple does not directly purchase or procure raw minerals from mine sites. This report relates to the process undertaken in accordance with OECD Due Diligence Guidance for Apple products that were manufactured, or contracted to be manufactured, during 2019 and that contain 3TG.

These products are Apple’s iPhone®, iPad®, Mac®, iPod touch®, Apple TV®, Apple Watch®, AirPods®, HomePod™, and Beats® products; Apple Card™; and all Apple accessories. Third-party products that Apple retails but that it does not manufacture or contract to manufacture are outside the scope of this report. The smelters and refiners identified in this report include those producing inputs for service or spare parts contracted for manufacturing in 2019 for use in connection with the subsequent service of previously sold products, including products serviced in subsequent years using those parts. This report does not include smelters of tin, tantalum, or tungsten or refiners of gold where such 3TG are included inend-of-life service parts for products that Apple no longer manufactures or contracts to manufacture.

This report’s use of the terms “smelters” and “refiners” refers to the facilities processing primary 3TG to retail purity. Apple suppliers have in some cases reported smelters and refiners that Apple believes are not operational or may have been misidentified as smelters and refiners. As a result, Apple continues to conduct independent research on smelters and refiners and to work with suppliers throughout its supply chain to revalidate, improve, and refine their reported information, taking into account supply chain fluctuations and other changes in status or scope and relationships over time. “Identified” smelters and refiners are those that (i) have been reported in a supplier’s CMRT; (ii) Apple believes are currently operational, were operational at some point during the applicable year, or, while inoperative, capable ofre-engagement with minimal delay or effort, and (iii) otherwise meet the definition of a smelter or refiner, provided that Apple may determine to treat a third party as an identified smelter or refiner notwithstanding a reclassification of such third party or a change in its status. As part of its reasonable country of origin inquiry, Apple has determined that certain suppliers are utilizing at least some 3TG from secondary materials (i.e., scrap or recycled materials). In such cases, the suppliers continue to provide a CMRT and remain subject to Third Party Audit requirements with respect to their identified smelters and refiners. In addition, certain identified smelters and refiners are believed to process at least some 3TG from recycled or scrap sources, although such identified smelters and refiners continue to participate in Third Party Audits. Facilities that process only secondary materials (i.e., scrap or recycled materials) are excluded from the scope of this report.

Participating smelters and refiners are those that have agreed to participate in, or have been found compliant with independent third-party conflict minerals audit programs confirming their 3TG sourcing practices. Such programs may also include audits of traceability requirements, conformity with the OECD Due Diligence Guidance, management systems, and/or risk assessments. Independent third-party 3TG audit programs include the RMAP and the LBMA’s Responsible Gold Program. Throughout this report, the audits by these programs are included in references to “Third Party Audit” programs.

Apple Inc. | 2019 Conflict Minerals Report | 12

ANNEX I : Smelter and Refiner Lists

List 1: Smelters and refiners of 3TG reported in Apple’s supply chain as of December 31, 2019.

| Conflict Mineral | Name of Smelter or Refiner | Country Location of Smelter or Refiner | ||

Tin | Alpha | United States of America | ||

Tin | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | China | ||

Tin | Chifeng Dajingzi Tin Industry Co., Ltd. | China | ||

Tin | China Tin Group Co., Ltd. | China | ||

Tin | CV Ayi Jaya | Indonesia | ||

Tin | CV Dua Sekawan | Indonesia | ||

Tin | CV Gita Pesona | Indonesia | ||

Tin | CV United Smelting | Indonesia | ||

Tin | CV Venus Inti Perkasa | Indonesia | ||

Tin | Dowa | Japan | ||

Tin | EM Vinto*** | Bolivia | ||

Tin | Fenix Metals* | Poland | ||

Tin | Gejiu Fengming Metallurgy Chemical Plant | China | ||

Tin | Gejiu Kai Meng Industry and Trade, LLC | China | ||

Tin | GejiuNon-Ferrous Metal Processing Co., Ltd. | China | ||

Tin | Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. | China | ||

Tin | Gejiu Zili Mining and Metallurgy Co., Ltd. | China | ||

Tin | Guangdong HanheNon-Ferrous Metal Co., Ltd.* | China | ||

Tin | Guanyang Guida Nonferrous Metal Smelting Plant | China | ||

Tin | HuiChang Hill Tin Industry Co., Ltd. | China | ||

Tin | Huichang Jinshunda Tin Co., Ltd. | China | ||

Tin | Jiangxi New Nanshan Technology Ltd. | China | ||

Tin | Ma’anshan Weitai Tin Co., Ltd. | China | ||

Tin | Magnu’s Minerais Metais e Ligas Ltda. | Brazil | ||

Tin | Malaysia Smelting Corp. (MSC) | Malaysia | ||

Tin | Melt Metais e Ligas S.A. | Brazil | ||

Tin | Metallic Resources, Inc.* | United States of America | ||

Tin | Metallo Belgium N.V. | Belgium | ||

Tin | Metallo Spain S.L.U. | Spain | ||

Tin | Mineração Taboca S.A. | Brazil | ||

Tin | Minsur | Peru | ||

Tin | Mitsubishi Materials Corp.* | Japan | ||

Apple Inc. | 2019 Conflict Minerals Report | 13

| Conflict Mineral | Name of Smelter or Refiner | Country Location of Smelter or Refiner | ||

Tin | O.M. Manufacturing (Thailand) Co., Ltd. | Thailand | ||

Tin | O.M. Manufacturing Philippines, Inc.* | Philippines | ||

Tin | Operaciones Metalurgicas S.A. | Bolivia | ||

Tin | PT Aries Kencana Sejahtera | Indonesia | ||

Tin | PT Artha Cipta Langgeng | Indonesia | ||

Tin | PT ATD Makmur Mandiri Jaya | Indonesia | ||

Tin | PT Babel Inti Perkasa | Indonesia | ||

Tin | PT Babel Surya Alam Lestari | Indonesia | ||

Tin | PT Bangka Prima Tin | Indonesia | ||

Tin | PT Bangka Serumpun | Indonesia | ||

Tin | PT Bangka Tin Industry | Indonesia | ||

Tin | PT Belitung Industri Sejahtera | Indonesia | ||

Tin | PT Bukit Timah | Indonesia | ||

Tin | PT DS Jaya Abadi | Indonesia | ||

Tin | PT Inti Stania Prima | Indonesia | ||

Tin | PT Karimun Mining | Indonesia | ||

Tin | PT Kijang Jaya Mandiri | Indonesia | ||

Tin | PT Lautan Harmonis Sejahtera | Indonesia | ||

Tin | PT Menara Cipta Mulia | Indonesia | ||

Tin | PT Mitra Stania Prima | Indonesia | ||

Tin | PT Panca Mega Persada | Indonesia | ||

Tin | PT Premium Tin Indonesia | Indonesia | ||

Tin | PT Prima Timah Utama | Indonesia | ||

Tin | PT Rajawali Rimba Perkasa | Indonesia | ||

Tin | PT Rajehan Ariq | Indonesia | ||

Tin | PT Refined Bangka Tin | Indonesia | ||

Tin | PT Sariwiguna Binasentosa | Indonesia | ||

Tin | PT Stanindo Inti Perkasa | Indonesia | ||

Tin | PT Sukses Inti Makmur | Indonesia | ||

Tin | PT Sumber Jaya Indah | Indonesia | ||

Tin | PT Timah Tbk Kundur | Indonesia | ||

Tin | PT Timah Tbk Mentok | Indonesia | ||

Tin | PT Tinindo Inter Nusa | Indonesia | ||

Tin | PT Tirus Putra Mandiri | Indonesia | ||

Apple Inc. | 2019 Conflict Minerals Report | 14

| Conflict Mineral | Name of Smelter or Refiner | Country Location of Smelter or Refiner | ||

Tin | PT Tommy Utama | Indonesia | ||

Tin | Resind Indústria e Comércio Ltda. | Brazil | ||

Tin | Rui Da Hung | Taiwan | ||

Tin | Soft Metais Ltda. | Brazil | ||

Tin | Thai Nguyen Mining and Metallurgy Co., Ltd. | Vietnam | ||

Tin | Thaisarco | Thailand | ||

Tin | Tin Technology & Refining* | United States of America | ||

Tin | White Solder Metalurgia e Mineração Ltda. | Brazil | ||

Tin | Yunnan ChengfengNon-ferrous Metals Co., Ltd. | China | ||

Tin | Yunnan Tin Co., Ltd. | China | ||

Tin | Yunnan YunfanNon-ferrous Metals Co., Ltd. | China | ||

Tantalum | Asaka Riken Co., Ltd. | Japan | ||

Tantalum | Changsha South Tantalum Niobium Co., Ltd.* | China | ||

Tantalum | D Block Metals, LLC* | United States of America | ||

Tantalum | Exotech Inc.* | United States of America | ||

Tantalum | F&X Electro-Materials Ltd. | China | ||

Tantalum | FIR Metals & Resource Ltd. | China | ||

Tantalum | Global Advanced Metals Aizu | Japan | ||

Tantalum | Global Advanced Metals Boyertown | United States of America | ||

Tantalum | Guangdong Rising RareMetals-EO Materials Ltd. | China | ||

Tantalum | Guangdong Zhiyuan New Material Co., Ltd. | China | ||

Tantalum | H.C. Starck Co., Ltd. | Thailand | ||

Tantalum | H.C. Starck Hermsdorf GmbH | Germany | ||

Tantalum | H.C. Starck Inc. | United States of America | ||

Tantalum | H.C. Starck Ltd. | Japan | ||

Tantalum | H.C. Starck Smelting GmbH & Co. KG | Germany | ||

Tantalum | H.C. Starck Tantalum and Niobium GmbH | Germany | ||

Tantalum | Hengyang King Xing Lifeng New Materials Co., Ltd. | China | ||

Tantalum | Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | China | ||

Tantalum | Jiangxi Tuohong New Raw Material | China | ||

Tantalum | Jiujiang Janny New Material Co., Ltd.** | China | ||

Tantalum | JiuJiang JinXin Nonferrous Metals Co., Ltd. | China | ||

Tantalum | Jiujiang Tanbre Co., Ltd. | China | ||

Tantalum | Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | China | ||

Apple Inc. | 2019 Conflict Minerals Report | 15

| Conflict Mineral | Name of Smelter or Refiner | Country Location of Smelter or Refiner | ||

Tantalum | Kemet Blue Metals | Mexico | ||

Tantalum | Kemet Blue Powder | United States of America | ||

Tantalum | LSM Brasil S.A. | Brazil | ||

Tantalum | Metallurgical Products India Pvt., Ltd. | India | ||

Tantalum | Mineração Taboca S.A. | Brazil | ||

Tantalum | Mitsui Mining and Smelting Co., Ltd. | Japan | ||

Tantalum | Ningxia Orient Tantalum Industry Co., Ltd. | China | ||

Tantalum | PRG Dooel | Macedonia | ||

Tantalum | QuantumClean* | United States of America | ||

Tantalum | Resind Indústria e Comércio Ltda. | Brazil | ||

Tantalum | Solikamsk Magnesium Works OAO | Russia | ||

Tantalum | Taki Chemical Co., Ltd. | Japan | ||

Tantalum | Telex Metals* | United States of America | ||

Tantalum | Ulba Metallurgical Plant JSC | Kazakhstan | ||

Tantalum | XinXing Haorong Electronic Material Co., Ltd. | China | ||

Tantalum | Yanling Jincheng Tantalum & Niobium Co., Ltd. | China | ||

Tungsten | A.L.M.T. Corp.* | Japan | ||

Tungsten | ACL Metais Eireli | Brazil | ||

Tungsten | Asia Tungsten Products Vietnam Ltd. | Vietnam | ||

Tungsten | Chenzhou Diamond Tungsten Products Co., Ltd. | China | ||

Tungsten | Chongyi Zhangyuan Tungsten Co., Ltd. | China | ||

Tungsten | FuJian JinXin Tungsten Co., Ltd. | China | ||

Tungsten | Ganzhou Haichuang Tungsten Co., Ltd. | China | ||

Tungsten | Ganzhou Huaxing Tungsten Products Co., Ltd. | China | ||

Tungsten | Ganzhou Jiangwu Ferrotungsten Co., Ltd. | China | ||

Tungsten | Ganzhou Seadragon W & Mo Co., Ltd. | China | ||

Tungsten | Global Tungsten & Powders Corp. | United States of America | ||

Tungsten | Guangdong Xianglu Tungsten Co., Ltd. | China | ||

Tungsten | H.C. Starck Smelting GmbH & Co. KG | Germany | ||

Tungsten | H.C. Starck Tungsten GmbH | Germany | ||

Tungsten | Hunan Chenzhou Mining Co., Ltd. | China | ||

Tungsten | Hunan Chuangda Vanadium Tungsten Co., Ltd. Wuji | China | ||

Tungsten | Hunan Chunchang Nonferrous Metals Co., Ltd. | China | ||

Tungsten | Hunan Litian Tungsten Industry Co., Ltd.* | China | ||

Apple Inc. | 2019 Conflict Minerals Report | 16

| Conflict Mineral | Name of Smelter or Refiner | Country Location of Smelter or Refiner | ||

Tungsten | Hydrometallurg, JSC | Russia | ||

Tungsten | Japan New Metals Co., Ltd. | Japan | ||

Tungsten | Jiangwu H.C. Starck Tungsten Products Co., Ltd. | China | ||

Tungsten | Jiangxi Gan Bei Tungsten Co., Ltd. | China | ||

Tungsten | Jiangxi TongguNon-ferrous Metallurgical & Chemical Co., Ltd. | China | ||

Tungsten | Jiangxi Xinsheng Tungsten Industry Co., Ltd. | China | ||

Tungsten | Jiangxi Yaosheng Tungsten Co., Ltd. | China | ||

Tungsten | Kennametal Fallon | United States of America | ||

Tungsten | Kennametal Huntsville | United States of America | ||

Tungsten | KGETS Co., Ltd. | Republic of Korea | ||

Tungsten | Lianyou Metals Co., Ltd.* | Taiwan | ||

Tungsten | Malipo Haiyu Tungsten Co., Ltd. | China | ||

Tungsten | Masan Tungsten Chemical, LLC (MTC) | Vietnam | ||

Tungsten | Moliren Ltd. | Russia | ||

Tungsten | Niagara Refining, LLC | United States of America | ||

Tungsten | Philippine Chuangxin Industrial Co., Inc.* | Philippines | ||

Tungsten | Tejing (Vietnam) Tungsten Co., Ltd. | Vietnam | ||

Tungsten | Unecha Refractory Metals Plant | Russia | ||

Tungsten | Wolfram Bergbau und Hütten AG | Austria | ||

Tungsten | Woltech Korea Co., Ltd. | Republic of Korea | ||

Tungsten | Xiamen Tungsten (H.C.) Co., Ltd. | China | ||

Tungsten | Xiamen Tungsten Co., Ltd. | China | ||

Tungsten | Xinfeng Huarui Tungsten & Molybdenum New Material Co., Ltd. | China | ||

Tungsten | Xinhai Rendan Shaoguan Tungsten Co., Ltd. | China | ||

Gold | 8853 S.p.A.*,*** | Italy | ||

Gold | Advanced Chemical Co.* | United States of America | ||

Gold | Aida Chemical Industries Co., Ltd.* | Japan | ||

Gold | AllgemeineGold-und Silberscheideanstalt A.G.* | Germany | ||

Gold | Almalyk Mining and Metallurgical Complex (AMMC) | Uzbekistan | ||

Gold | AngloGold Ashanti Córrego do Sítio Mineraçäo | Brazil | ||

Gold | Argor-Heraeus S.A. | Switzerland | ||

Gold | Asahi Pretec Corp.* | Japan | ||

Gold | Asahi Refining Canada Ltd. | Canada | ||

Apple Inc. | 2019 Conflict Minerals Report | 17

| Conflict Mineral | Name of Smelter or Refiner | Country Location of Smelter or Refiner | ||

Gold | Asahi Refining USA Inc. | United States of America | ||

Gold | Asaka Riken Co., Ltd.* | Japan | ||

Gold | AU Traders and Refiners*** | South Africa | ||

Gold | Aurubis AG | Germany | ||

Gold | Bangalore Refinery | India | ||

Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines)*** | Philippines | ||

Gold | Boliden AB | Sweden | ||

Gold | C. Hafner GmbH + Co. KG* | Germany | ||

Gold | CCR Refinery - Glencore Canada Corp. | Canada | ||

Gold | Cendres + Métaux S.A.*,*** | Switzerland | ||

Gold | Chimet S.p.A.* | Italy | ||

Gold | Chugai Mining* | Japan | ||

Gold | Daejin Indus Co., Ltd.*,** | Republic of Korea | ||

Gold | DayeNon-Ferrous Metals Mining Ltd. | China | ||

Gold | DODUCO Contacts and Refining GmbH* | Germany | ||

Gold | Dowa | Japan | ||

Gold | DS PRETECH Co., Ltd.* | Republic of Korea | ||

Gold | DSC (Do Sung Corp.)* | Republic of Korea | ||

Gold | Eco-System Recycling Co., Ltd. East Plant* | Japan | ||

Gold | Eco-System Recycling Co., Ltd. North Plant* | Japan | ||

Gold | Eco-System Recycling Co., Ltd. West Plant* | Japan | ||

Gold | Emirates Gold DMCC | United Arab Emirates | ||

Gold | Geib Refining Corp.* | United States of America | ||

Gold | Gold Refinery of Zijin Mining Group Co., Ltd. | China | ||

Gold | Great Wall Precious Metals Co., Ltd. of CBPM | China | ||

Gold | Heimerle + Meule GmbH | Germany | ||

Gold | Heraeus Metals Hong Kong Ltd. | Hong Kong | ||

Gold | Heraeus Precious Metals GmbH & Co. KG | Germany | ||

Gold | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | China | ||

Gold | Ishifuku Metal Industry Co., Ltd.* | Japan | ||

Gold | Istanbul Gold Refinery | Turkey | ||

Gold | Italpreziosi | Italy | ||

Gold | Japan Mint* | Japan | ||

Apple Inc. | 2019 Conflict Minerals Report | 18

| Conflict Mineral | Name of Smelter or Refiner | Country Location of Smelter or Refiner | ||

Gold | Jiangxi Copper Co., Ltd. | China | ||

Gold | JSC UralElectromed | Russia | ||

Gold | JX Nippon Mining & Metals Co., Ltd. | Japan | ||

Gold | Kazzinc | Kazakhstan | ||

Gold | Kennecott Utah Copper, LLC | United States of America | ||

Gold | KGHM Polska Miedź Spółka Akcyjna | Poland | ||

Gold | Kojima Chemicals Co., Ltd.* | Japan | ||

Gold | Korea Zinc Co., Ltd. | Republic of Korea | ||

Gold | Kyrgyzaltyn JSC | Kyrgyzstan | ||

Gold | L’Orfebre S.A. | Andorra | ||

Gold | LS-NIKKO Copper Inc. | Republic of Korea | ||

Gold | LT Metal Ltd.* | Republic of Korea | ||

Gold | Marsam Metals | Brazil | ||

Gold | Materion | United States of America | ||

Gold | Matsuda Sangyo Co., Ltd.* | Japan | ||

Gold | Metalor Technologies (Hong Kong) Ltd. | Hong Kong | ||

Gold | Metalor Technologies (Singapore) Pte., Ltd. | Singapore | ||

Gold | Metalor Technologies (Suzhou) Ltd. | China | ||

Gold | Metalor Technologies S.A. | Switzerland | ||

Gold | Metalor USA Refining Corp. | United States of America | ||

Gold | MetalúrgicaMet-Mex Peñoles S.A. de C.V. | Mexico | ||

Gold | Mitsubishi Materials Corp. | Japan | ||

Gold | Mitsui Mining and Smelting Co., Ltd. | Japan | ||

Gold | MMTC-PAMP India Pvt., Ltd. | India | ||

Gold | Moscow Special Alloys Processing Plant | Russia | ||

Gold | Nadir Metal Rafineri San. Ve Tic. A.Ş. | Turkey | ||

Gold | Navoi Mining and Metallurgical Combinat*** | Uzbekistan | ||

Gold | Nihon Material Co., Ltd.* | Japan | ||

Gold | Ögussa Österreichische Gold- und Silber-Scheideanstalt GmbH*,*** | Austria | ||

Gold | Ohura Precious Metal Industry Co., Ltd. | Japan | ||

Gold | OJSC “The Gulidov KrasnoyarskNon-Ferrous Metals Plant” (OJSC Krastsvetmet) | Russia | ||

Gold | OJSC Novosibirsk Refinery | Russia | ||

Gold | PAMP S.A. | Switzerland | ||

Apple Inc. | 2019 Conflict Minerals Report | 19

| Conflict Mineral | Name of Smelter or Refiner | Country Location of Smelter or Refiner | ||

Gold | Planta Recuperadora de Metales SpA | Chile | ||

Gold | Prioksky Plant ofNon-Ferrous Metals | Russia | ||

Gold | PT Aneka Tambang (Persero) Tbk | Indonesia | ||

Gold | PX Précinox S.A. | Switzerland | ||

Gold | Rand Refinery (Pty) Ltd. | South Africa | ||

Gold | Remondis PMR B.V.* | Netherlands | ||

Gold | Royal Canadian Mint | Canada | ||

Gold | SAAMP*** | France | ||

Gold | Safimet S.p.A*,*** | Italy | ||

Gold | Samduck Precious Metals* | Republic of Korea | ||

Gold | SAXONIA Edelmetalle GmbH* | Germany | ||

Gold | SEMPSA Joyería Platería S.A.* | Spain | ||

Gold | Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | China | ||

Gold | Sichuan Tianze Precious Metals Co., Ltd. | China | ||

Gold | Singway Technology Co., Ltd.* | Taiwan | ||

Gold | SOE Shyolkovsky Factory of Secondary Precious Metals | Russia | ||

Gold | Solar Applied Materials Technology Corp.* | Taiwan | ||

Gold | Sumitomo Metal Mining Co., Ltd. | Japan | ||

Gold | SungEel HiMetal Co., Ltd.* | Republic of Korea | ||

Gold | T.C.A. S.p.A.* | Italy | ||

Gold | Tanaka Kikinzoku Kogyo K.K.* | Japan | ||

Gold | The Refinery of Shandong Gold Mining Co., Ltd. | China | ||

Gold | Tokuriki Honten Co., Ltd. | Japan | ||

Gold | Torecom* | Republic of Korea | ||

Gold | Umicore Brasil Ltda. | Brazil | ||

Gold | Umicore Precious Metals Thailand*,*** | Thailand | ||

Gold | Umicore S.A. Business Unit Precious Metals Refining | Belgium | ||

Gold | United Precious Metal Refining, Inc.* | United States of America | ||

Gold | Valcambi S.A. | Switzerland | ||

Gold | Western Australian Mint trading as The Perth Mint | Australia | ||

Gold | Wieland Edelmetalle GmbH* | Germany | ||

Gold | Yamakin Co., Ltd.* | Japan | ||

Gold | Yokohama Metal Co., Ltd.* | Japan | ||

Gold | Zhongyuan Gold Smelter of Zhongjin Gold Corp. | China | ||

Apple Inc. | 2019 Conflict Minerals Report | 20

List 2: Smelters and refiners of 3TG in Apple’s supply chain during 2019, but subsequently determined to be inoperative or removed prior to December 31, 2019.

| Conflict Mineral | Name of Smelter or Refiner | Country Location of Smelter or Refiner | ||

Tin | An Vinh Joint Stock Mineral Processing Co. | Vietnam | ||

Tin | CNMC (Guangxi) PGMA Co., Ltd. | China | ||

Tin | Dongguan CiEXPO Environmental Engineering Co., Ltd.** | China | ||

Tin | Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy Joint Stock Co. | Vietnam | ||

Tin | Estanho de Rondônia S.A. | Brazil | ||

Tin | Modeltech Sdn Bhd | Malaysia | ||

Tin | Nghe TinhNon-Ferrous Metals Joint Stock Co. | Vietnam | ||

Tin | Pongpipat Co., Ltd. | Myanmar | ||

Tin | Precious Minerals and Smelting Ltd. | India | ||

Tin | Super Ligas | Brazil | ||

Tin | Tuyen QuangNon-Ferrous Metals Joint Stock Co. | Vietnam | ||

Tantalum | CP Metals Inc. | United States of America | ||

Tantalum | NPM Silmet A.S. | Estonia | ||

Tungsten | CNMC (Guangxi) PGMA Co., Ltd. | China | ||

Tungsten | Jiangxi Minmetals Gao’anNon-ferrous Metals Co., Ltd. | China | ||

Tungsten | Jiangxi Xianglu Tungsten Co., Ltd. | China | ||

Tungsten | South-East Nonferrous Metal Co., Ltd. of Hengyang City | China | ||

Gold | Abington Reldan Metals, LLC | United States of America | ||

Gold | Al Etihad Gold Refinery DMCC | United Arab Emirates | ||

Gold | Atasay Kuyumculuk Sanayi Ve Ticaret A.S. | Turkey | ||

Gold | Caridad | Mexico | ||

Gold | CGR Metalloys Pvt Ltd. | India | ||

Gold | Degussa Sonne / Mond Goldhandel GmbH | Germany | ||

Gold | Dijllah Gold Refinery FZC | United Arab Emirates | ||

Gold | Fujairah Gold FZC | United Arab Emirates | ||

Gold | GCC Gujrat Gold Centre Pvt., Ltd. | India | ||

Gold | Guangdong Jinding Gold Ltd. | China | ||

Gold | Guoda Safina High-Tech Environmental Refinery Co., Ltd. | China | ||

Gold | Hangzhou Fuchunjiang Smelting Co., Ltd. | China | ||

Gold | Hunan Chenzhou Mining Co., Ltd. | China | ||

Apple Inc. | 2019 Conflict Minerals Report | 21

| Conflict Mineral | Name of Smelter or Refiner | Country Location of Smelter or Refiner | ||

Gold | Hunan Guiyang yinxing Nonferrous Smelting Co., Ltd. | China | ||

Gold | HwaSeong CJ Co., LTD. | Republic of Korea | ||

Gold | International Precious Metal Refiners | United Arab Emirates | ||

Gold | JSC EkaterinburgNon-Ferrous Metal Processing Plant | Russia | ||

Gold | Kazakhmys Smelting, LLC | Kazakhstan | ||

Gold | Kyshtym Copper-Electrolytic Plant ZAO | Russia | ||

Gold | L’azurde Company For Jewelry | Saudi Arabia | ||

Gold | Lingbao Gold Co., Ltd. | China | ||

Gold | Lingbao Jinyuan Tonghui Refinery Co., Ltd. | China | ||

Gold | Luoyang Zijin Yinhui Gold Refinery Co., Ltd. | China | ||

Gold | Morris and Watson | New Zealand | ||

Gold | Pease & Curren | United States of America | ||

Gold | Penglai Penggang Gold Industry Co., Ltd. | China | ||

Gold | QG Refining, LLC | United States of America | ||

Gold | Refinery of Seemine Gold Co., Ltd. | China | ||

Gold | Sabin Metal Corp. | United States of America | ||

Gold | SAFINA A.S. | Czech Republic | ||

Gold | Sai Refinery | India | ||

Gold | Samwon Metals Corp. | Republic of Korea | ||

Gold | Shandong Humon Smelting Co., Ltd. | China | ||

Gold | Shandong Tiancheng Biological Gold Industrial Co., Ltd. | China | ||

Gold | Sovereign Metals | India | ||

Gold | State Research Institute Center for Physical Sciences and Technology | Lithuania | ||

Gold | Tongling Nonferrous Metals Group Co., Ltd. | China | ||

Gold | TOOTau-Ken-Altyn | Kazakhstan | ||

Gold | Yunnan Copper Industry Co., Ltd. | China | ||

| * | The smelter/refiner is believed to process at least some 3TG from recycled or scrap sources. |

| ** | The smelter/refiner has changed its compliance or operational status since December 31, 2019. |

| *** | The smelter/refiner continues to be in the process of removal as of the filing of this report and/or is no longer approved to be in Apple’s supply chain. |

Apple Inc. | 2019 Conflict Minerals Report | 22

ANNEX II: Countries of Origin of 3TG

Argentina Australia Azerbaijan Bolivia Botswana Brazil Burkina Faso Burundi* Canada Chile China Colombia Côte D’Ivoire Cyprus Democratic Republic of the Congo* Dominican Republic Ecuador Egypt Ethiopia Fiji Finland France French Guiana Georgia Ghana Guatemala Guinea Guyana Honduras | India Indonesia Iran** Japan Kazakhstan Kenya Laos Liberia Madagascar Malaysia Mali Mauritania Mexico Mongolia Morocco Mozambique Myanmar Namibia Netherlands New Zealand Nicaragua Nigeria Papua New Guinea Peru Philippines Portugal Russia Rwanda* Saudi Arabia Senegal | Serbia Sierra Leone Slovakia Solomon Islands Somaliland (Autonomous region of Somalia) South Africa Spain Suriname Sweden Taiwan Tajikistan Tanzania* Thailand Turkey Uganda* United Kingdom United States of America Uruguay Uzbekistan Venezuela Vietnam Zimbabwe |

| * | The DRC or an adjoining country. |

| ** | Minerals from this country were substantially transformed before being incorporated into finished products. Such a substantial transformation of the minerals happened outside of the United States of America in a third country by a person other than a United States of America person. |

Apple Inc. | 2019 Conflict Minerals Report | 23