UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | |

| ý | | Filed by the Registrant |

| ¨ | | Filed by a Party other than the Registrant |

Check the appropriate box:

| | | | | | | | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

GLOBE LIFE INC.

(Name of Registrant as specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

March 18, 2024

To the Shareholders of

GLOBE LIFE INC. (the Company):

Globe Life Inc.'s 2024 Annual Meeting of Shareholders (Annual Meeting) will be held in a virtual meeting format, via live audio webcast at 10:00am, Central Daylight Time, on Thursday, April 25, 2024. The Annual Meeting will be conducted using Robert’s Rules of Order and Globe Life Inc.'s Shareholders' Rights Policy. This policy is posted on the Company’s website at https://investors.globelifeinsurance.com under the Corporate Governance heading, or you may obtain a printed copy by writing to the Corporate Secretary at 3700 South Stonebridge Drive, McKinney, Texas 75070.

The accompanying Notice and Proxy Statement discuss proposals which will be submitted to a shareholder vote. If you have any questions or comments about the matters discussed in the Proxy Statement or about the operations of the Company, we will be pleased to hear from you.

It is important that your shares be voted at the Annual Meeting. Please mark, date, sign, and return your proxy or vote over the telephone or via the Internet. If you attend the Annual Meeting, you may change your vote during the meeting if you desire to do so.

We hope that you will take this opportunity to join us at the virtual Annual Meeting.

| | |

| Sincerely, |

|

J. Matthew Darden Co-Chairman and Chief Executive Officer |

|

|

Frank M. Svoboda Co-Chairman and Chief Executive Officer |

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

| | | | | | | | | | | | | | | | | |

| DATE: | | Thursday, April 25, 2024 | Voting Matters | Page |

| TIME: | | 10:00am Central Daylight Time | ☑ | Election of Directors | 5 |

| PLACE: | | Online via live audio webcast

Register to attend the meeting at register.proxypush.com/GL | ☑ | Ratification of Appointment of Independent Registered Public Accounting Firm | 11 |

| | | ☑ | Advisory Vote to Approve Executive Compensation | 11 |

Shareholders will also be asked to consider and act upon other business that properly comes before the meeting.

Virtual Annual Meeting

The 2024 Annual Meeting will be held in a virtual meeting format, online via live audio webcast. We believe that a virtual meeting will help to facilitate attendance and participation by shareholders from any geographic location with internet connectivity.

You may register for and attend the virtual meeting online using a smartphone, tablet or computer. You will need the latest version of Chrome, Safari, Edge or Firefox. Please ensure that your browser is compatible. As a shareholder, in order to register you will need to visit register.proxypush.com/GL and enter the control number included on your proxy card or voting instruction form. After registering, you will receive a confirmation email and another email approximately one hour prior to the start of the meeting (10:00am Central Daylight Time), at the email address provided during registration, with a unique link to access the virtual meeting. Registration support is available via an email address displayed on the registration page. Meeting access support may be obtained via a toll-free number listed on the email pre-registered shareholders will receive one hour prior to the start of the meeting. Shareholders will be able to participate in the virtual meeting, securely vote, submit questions or comments to management in accordance with the Company's Shareholders' Rights Policy, and access a copy of the shareholder list (by clicking on an active link), just as one could at an in-person meeting. Guests will also be able to access the meeting and listen to the live webcast. Directions on how to attend the virtual Annual Meeting can be found on our website at https://investors.globelifeinsurance.com under the Calls & Meetings heading.

The meeting may be adjourned from time to time (including an adjournment taken to address a technical failure to convene or continue a meeting using remote communication) without further notice other than by an announcement at the meeting or at any adjournment. Any business described in this notice may be transacted at any adjourned meeting.

Record Date

The close of business on Friday, March 1, 2024 is the record date for determining shareholders who are entitled to notice of and to vote at the Annual Meeting.

How to Vote

Your vote is important. We urge you to vote and submit your proxy in advance of the meeting. You are requested to mark, date, sign and return the enclosed form of proxy in the accompanying envelope, whether or not you expect to attend the virtual Annual Meeting. You may also choose to vote your shares by internet or telephone. You may revoke your proxy at any time before it is voted at the meeting. If you are a beneficial shareholder and wish to vote during the meeting, you must first have obtained a legal proxy from your bank, broker or other nominee which must be submitted, via email, either in advance of the meeting to EQSS-ProxyTabulation@equiniti.com or along with the voting ballot during the meeting.

| | |

| By Order of the Board of Directors |

|

|

Christopher T. Moore Corporate Senior Vice President, Associate Counsel and Corporate Secretary

|

McKinney, Texas

March 18, 2024

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on April 25, 2024: The Company’s Proxy Statement and 2023 Annual Report are available at: https://investors.globelifeinsurance.com/annual-reports.

TABLE OF CONTENTS

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| OTHER BUSINESS | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Board Oversight of Cybersecurity Risk | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Board Diversity | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Elements of Compensation | | |

| | |

| Annual Cash Bonuses | | |

| | |

| Stock Ownership/Retention Guidelines | | |

| Prohibition on Hedging and Pledging of Company Stock | | |

| | |

| Savings Plans | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Restricted Stock Units and Termination of Employment | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Note: The Company cautions you that this Proxy Statement may contain forward-looking statements within the meaning of the federal securities law. These prospective statements reflect management's current expectations, but are not guarantees of future performance. Accordingly, please refer to the Company's cautionary statement regarding forward-looking statements and the business environment in which the Company operates, contained in the Company's Form 10-K for the period ended December 31, 2023, found on file with the Securities and Exchange Commission. The Company specifically disclaims any obligation to update or revise any forward-looking statement because of new information, future developments, or otherwise.

PROXY STATEMENT SUMMARY

AND COMPANY HIGHLIGHTS

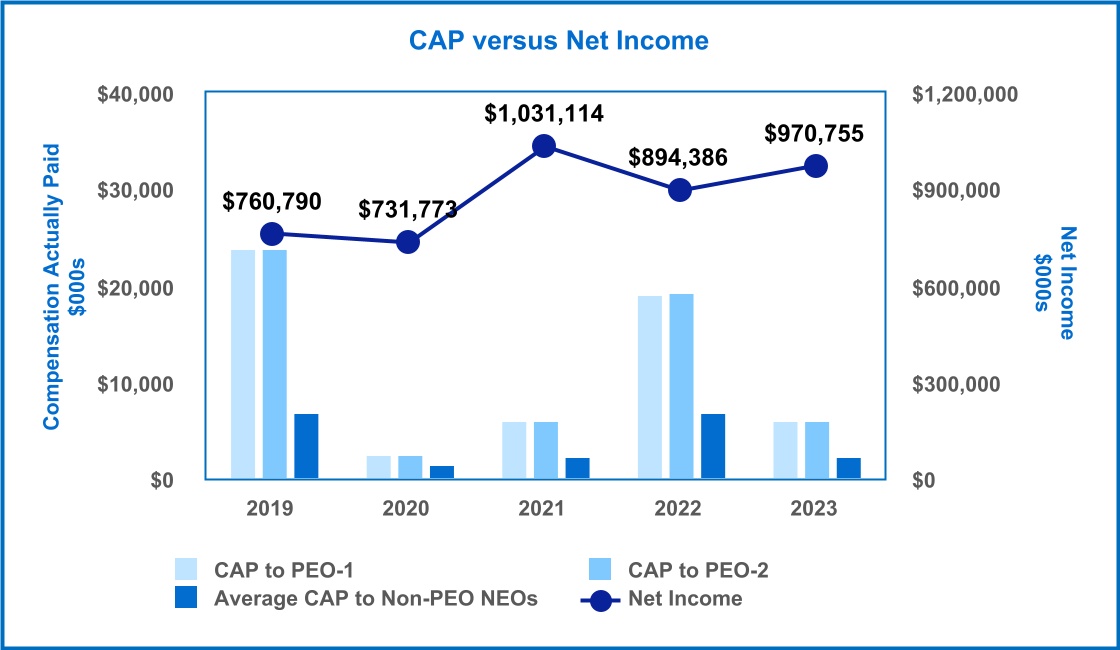

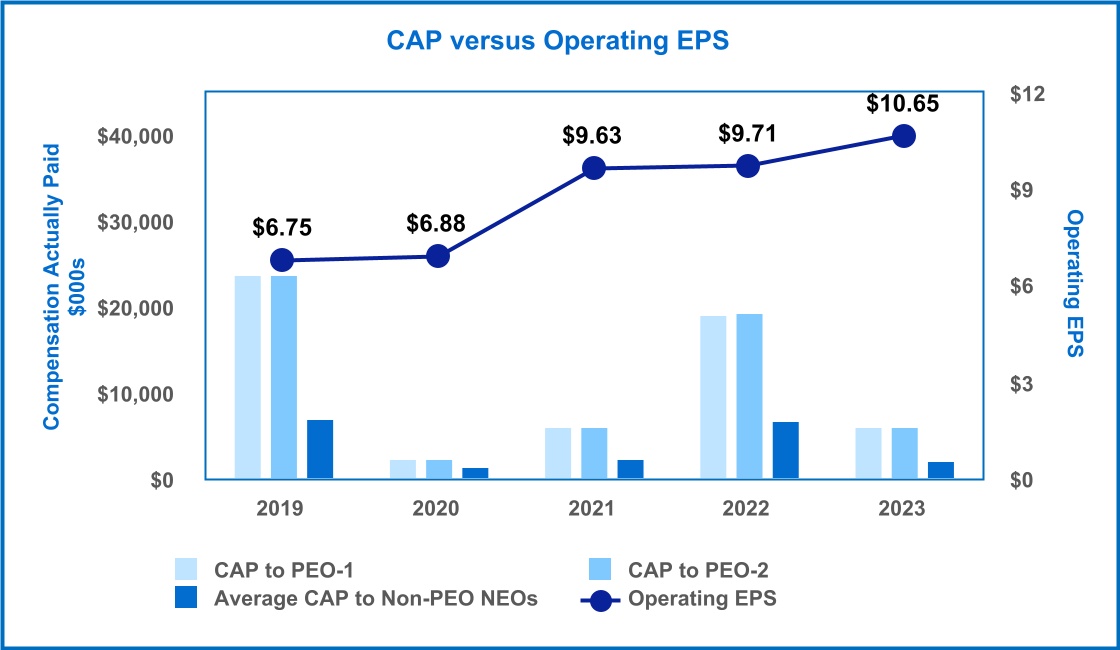

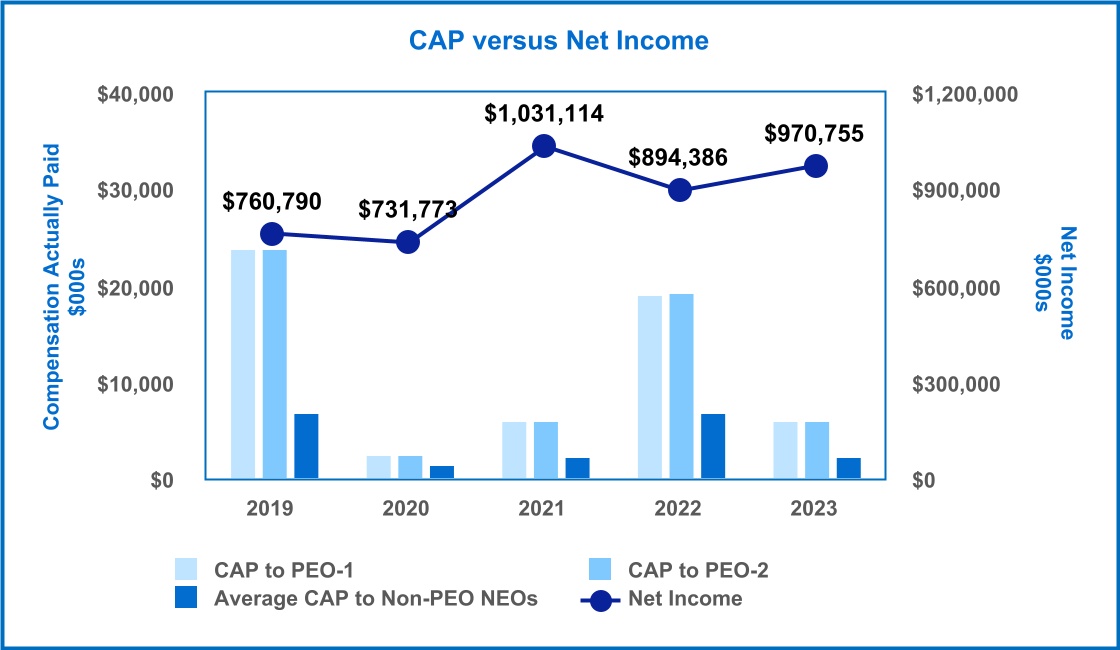

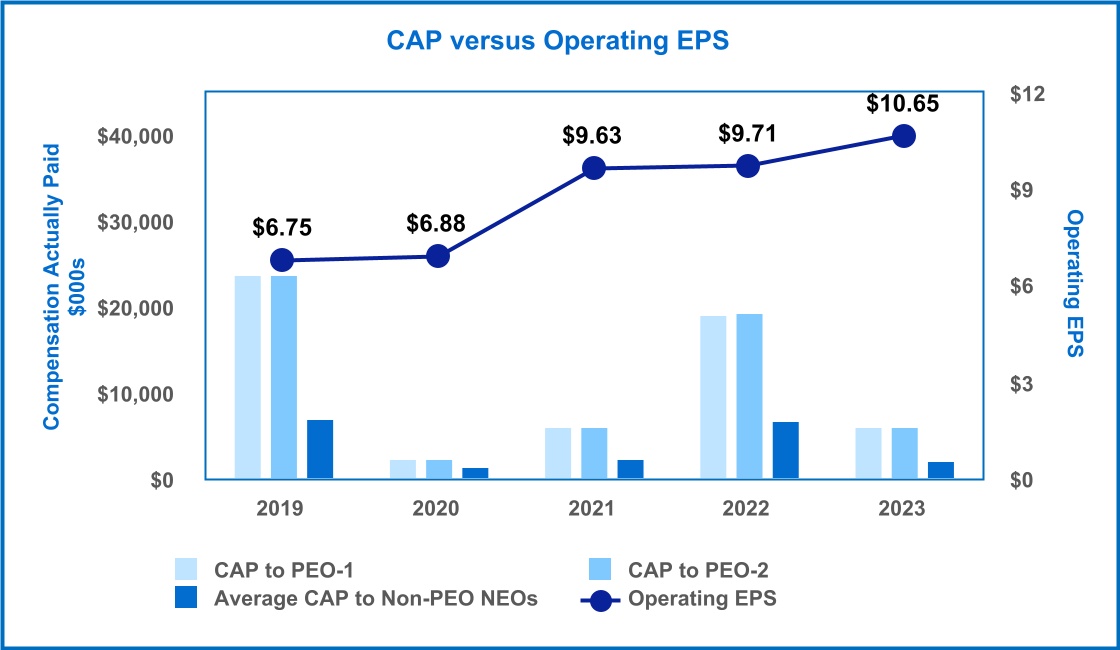

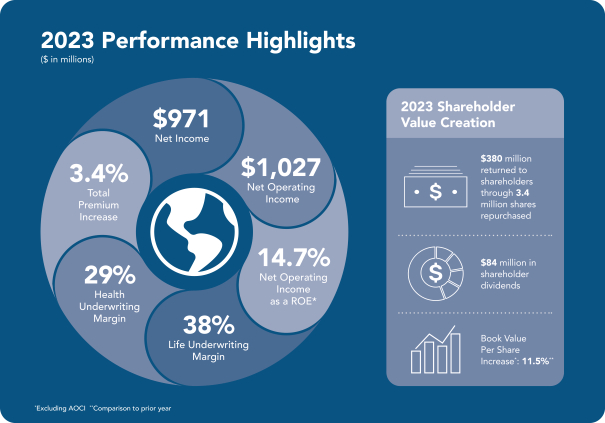

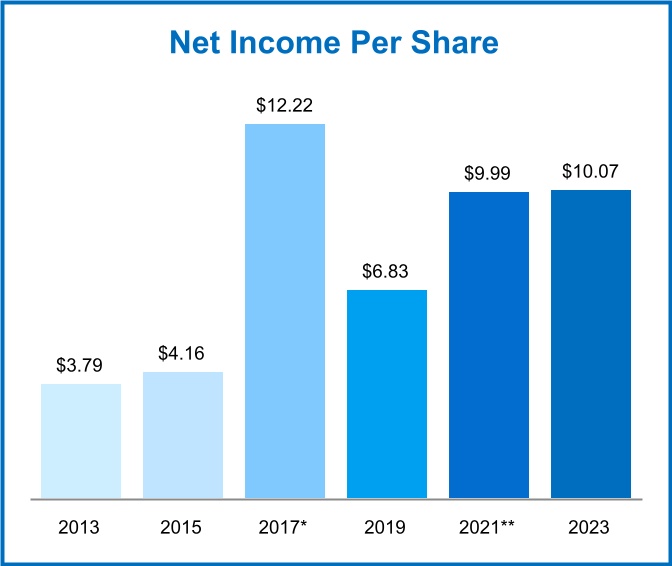

Performance Highlights

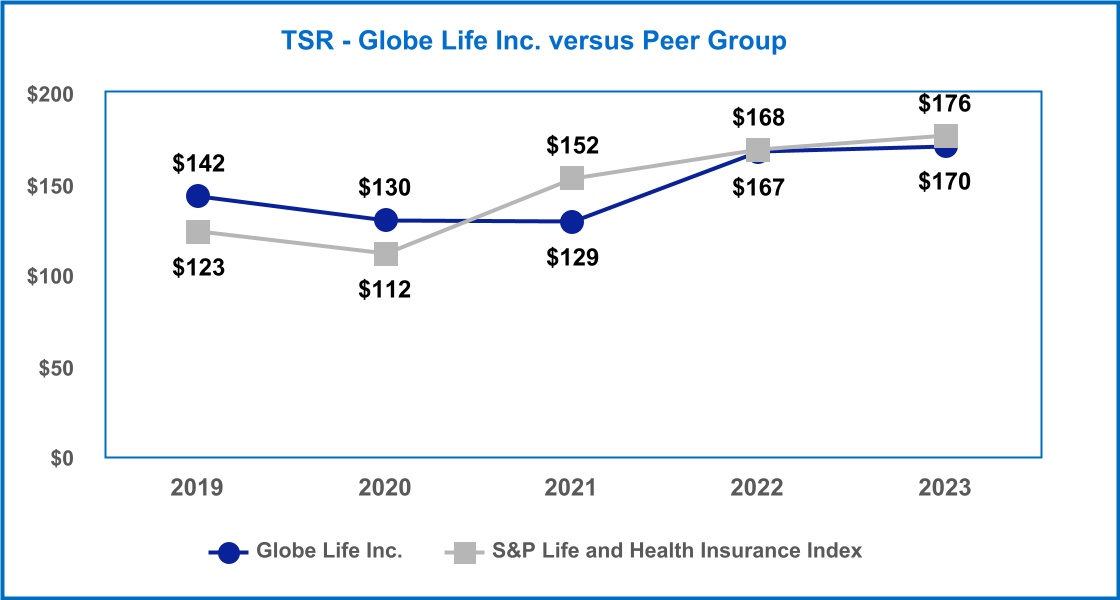

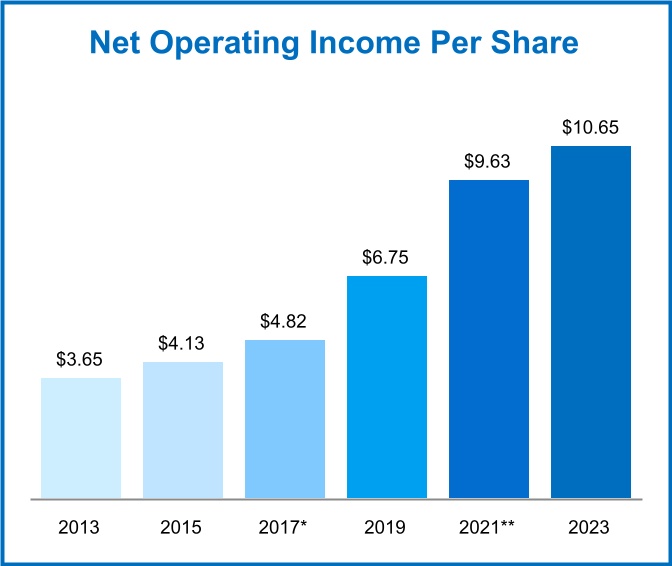

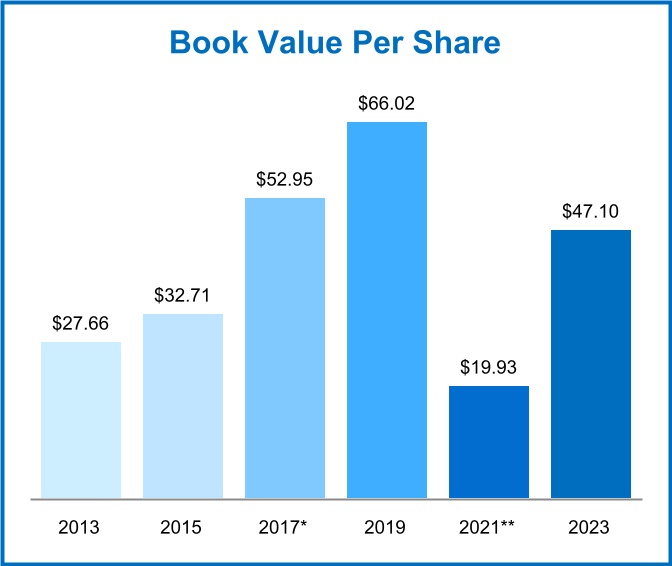

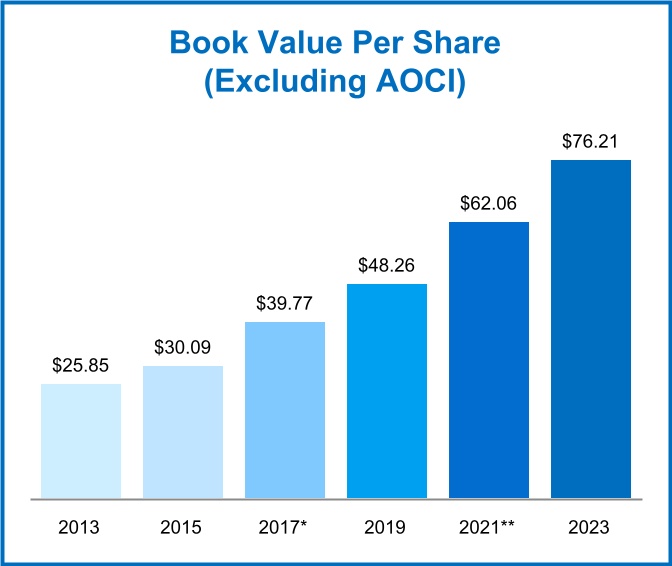

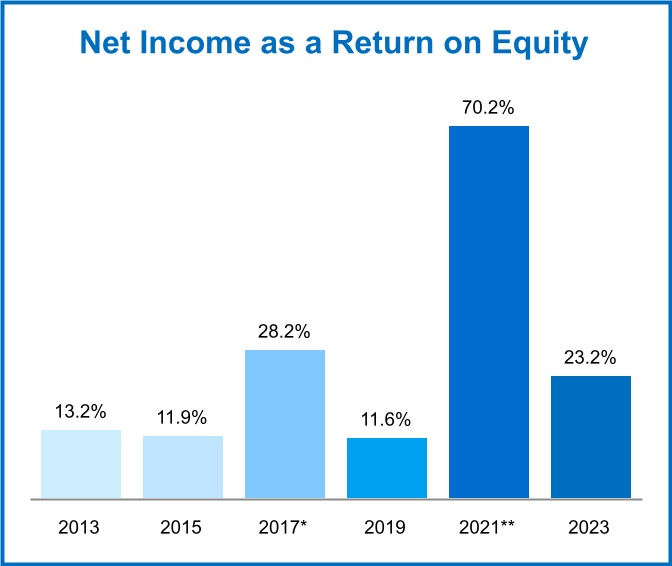

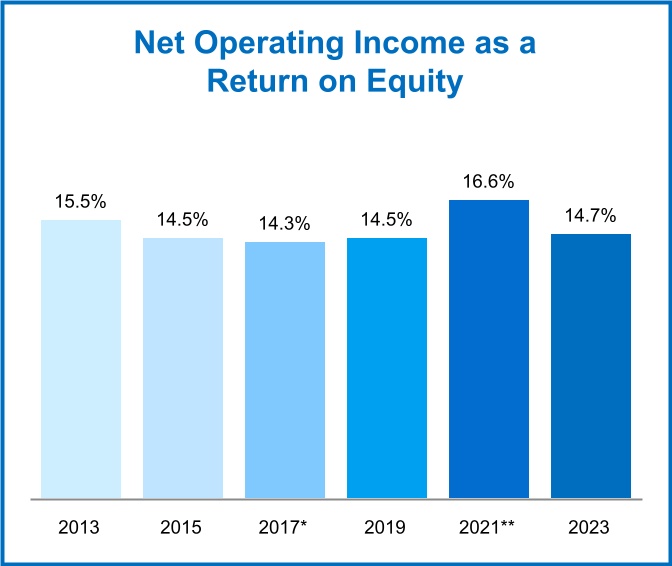

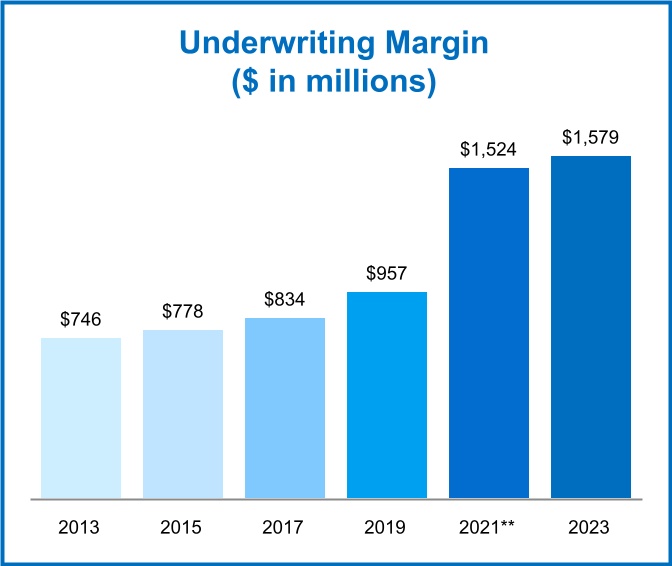

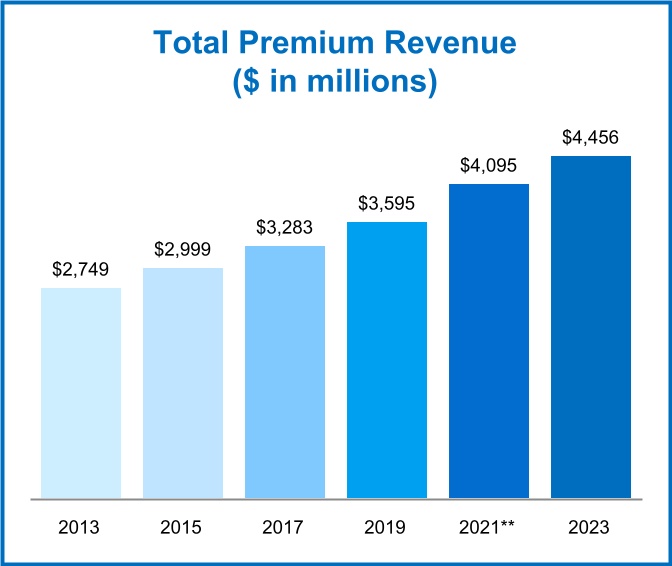

Globe Life Inc. (the "Company") had a strong year in 2023. We continued to grow both total underwriting margins and total premium during the year. Total sales grew by 6%, primarily due to strong agent count growth. We are optimistic about the future and believe the Company is well positioned to continue to create consistent growth. The charts below highlight the key financial metrics we use to evaluate our business. Refer to APPENDIX A—Non-GAAP Reconciliations for definitions of non-GAAP measures, and Results of Operations in our 2023 Annual Report on Form 10-K for a reconciliation of such non-GAAP measures. *In 2017, tax legislation revised the corporate income tax rate from 35% to 21% effective Jan. 1, 2018, among other modifications.

**The results included in this proxy statement reflect the adoption of ASU 2018-12, Financial Services - Insurance (Topic 944): Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI). The Company implemented the standard on January 1, 2023 on a modified retrospective basis as of the transition date of January 1, 2021. For additional information, please refer to our 2023 Annual Report on Form 10-K.

1 GL 2024 Proxy Statement

*In 2017, tax legislation revised the corporate income tax rate from 35% to 21% effective Jan. 1, 2018, among other modifications.

**The results included in this proxy statement reflect the adoption of ASU 2018-12, Financial Services - Insurance (Topic 944): Targeted Improvements to the Accounting for Long-Duration Contracts (LDTI). The Company implemented the standard on January 1, 2023 on a modified retrospective basis as of the transition date of January 1, 2021. For additional information, please refer to our 2023 Annual Report on Form 10-K.

2 GL 2024 Proxy Statement

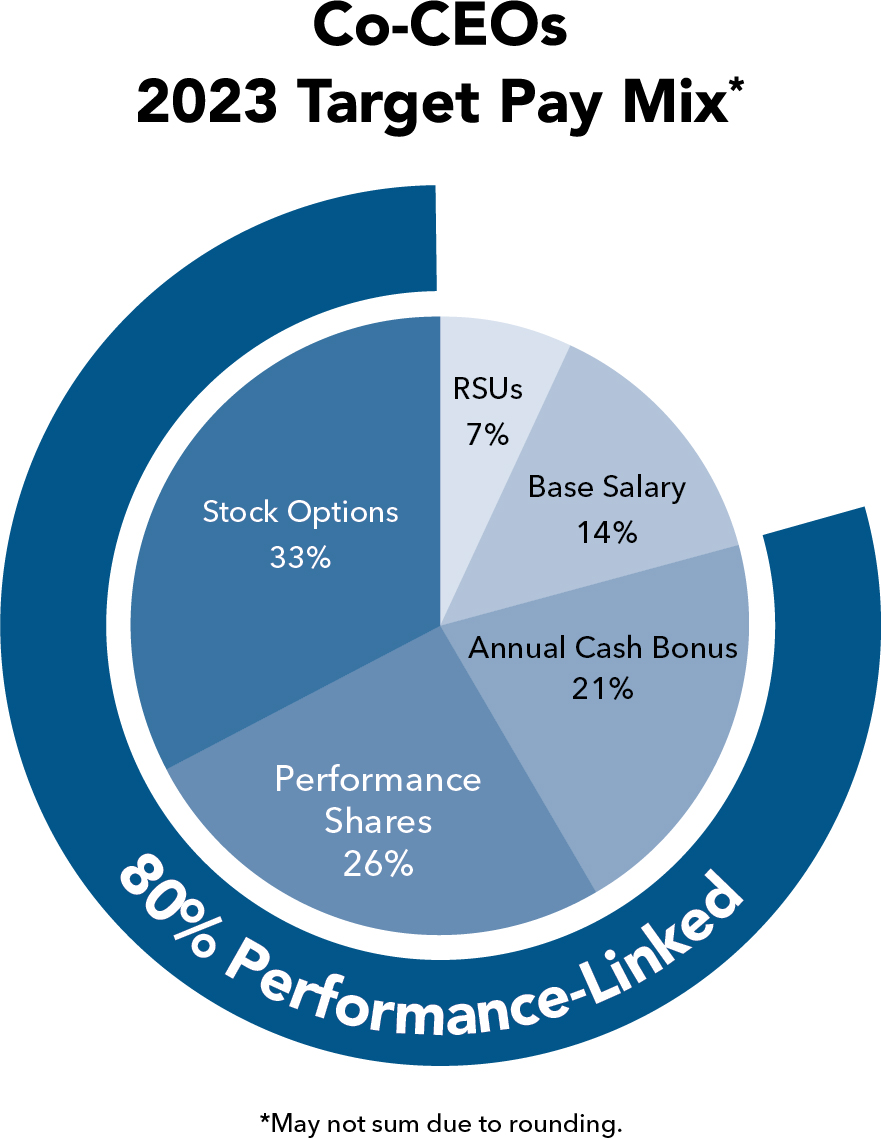

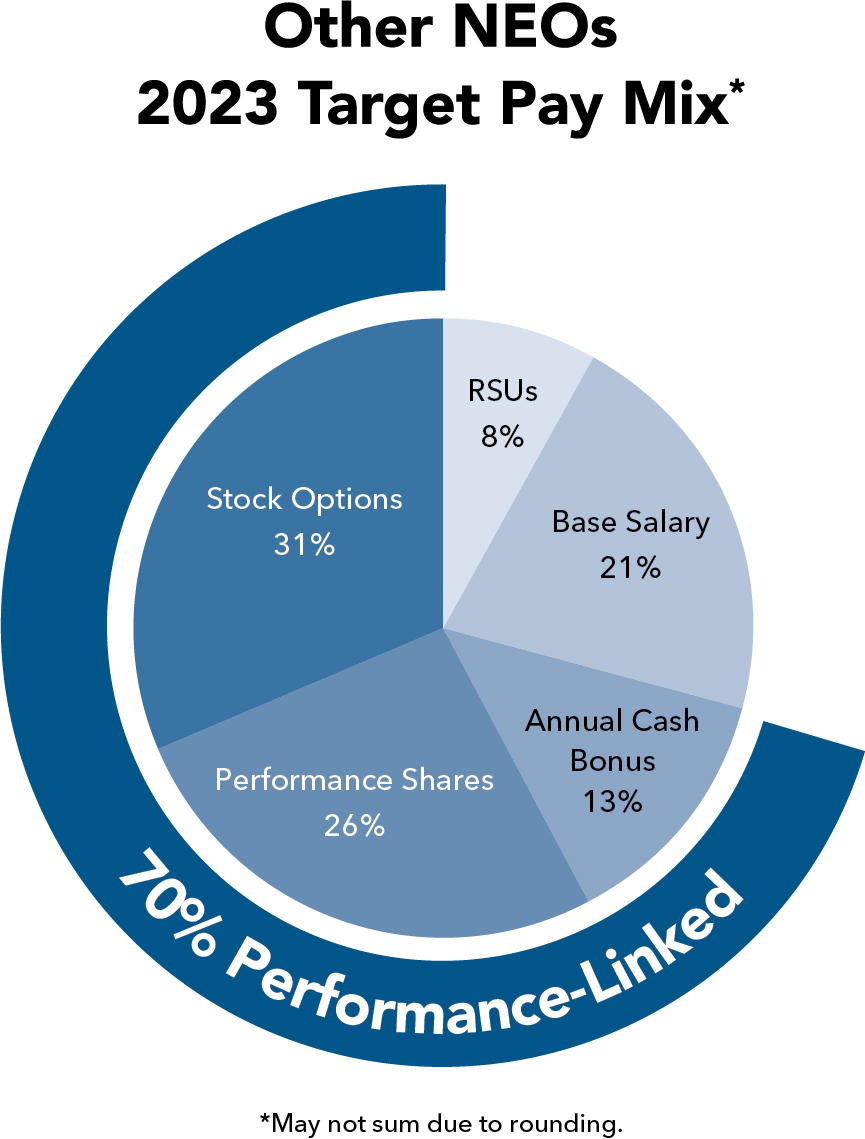

Executive Compensation Highlights

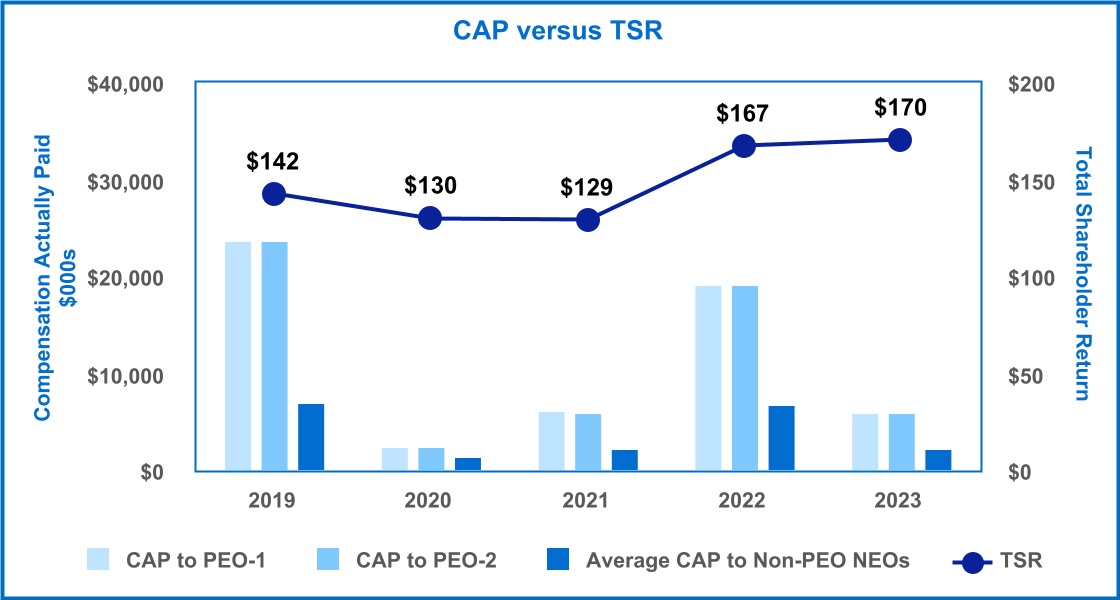

Our executive compensation programs are designed to motivate the achievement of our business goals in a manner that is consistent with the long-term risks inherent in our business. They reward the sustained annual performance that produces shareholder wealth over the long term. Specific highlights include:

| | | | | | | | |

| Pay for Performance | • | Consistent with our business horizon, executive compensation is long-term in its focus, with a strong emphasis on share accumulation to best align management interests with those of our shareholders |

| • | Aggregate equity awards are made as a percentage of market capitalization to provide maximum alignment with shareholders |

| • | Realizable pay continues to be well-aligned with the Company's total shareholder return (TSR) |

| | |

| Equity Plan Features | • | No single trigger change of control vesting |

| • | No discounted stock options or stock appreciation rights (SARs) |

| • | Prohibition on stock option and SAR repricing |

| • | No tax gross-ups |

| • | No liberal share recycling on stock options and SARs |

| • | Awards subject to both minimum vesting requirements and the Company’s Clawback Policy |

| | |

| Compensation Governance | • | The Board’s independent Compensation Committee oversees the compensation program |

| • | The Compensation Committee retains an independent compensation consultant that reports only to that committee |

| • | Maximum payout caps for annual incentive compensation; limited to 150% of each named executive officer’s (NEOs) target opportunity |

| • | No dividend equivalents on performance share units |

| • | Robust stock ownership guidelines for directors and executives |

| • | Clawback policy applicable to current and former executive officers in the event we are required to prepare an accounting restatement of our financial statements due to our material non-compliance with any financial reporting requirement under securities laws |

| • | NEOs (including the Co-CEOs) do not have employment contracts or severance agreements |

| | |

| Shareholder Support | • | In 2023, we received strong support for our executive compensation programs, with 84% of votes cast approving our advisory say-on-pay resolution |

| • | Over the last five years, our say-on-pay voting results have averaged a 91% approval rate |

The compensation recommendations and decisions for 2023 of our management, the Compensation Committee (with the aid of its independent compensation consultant, Board Advisory, Inc.) and the independent members of the Board are summarized in the Executive Summary of the Compensation Discussion and Analysis section of this Proxy Statement. Governance Highlights

Corporate governance remained a focus of our Board and Company management in 2023. Our corporate governance practices are overseen by the Board of Directors, its standing committees, and our Co-Chief Executive Officers. Cornerstones of our corporate governance framework include:

| | | | | | | | |

| Independent Board Oversight | • | Strong independent Lead Director |

| • | 100% independent Board committees |

| • | Regular executive sessions of the independent members of the Board |

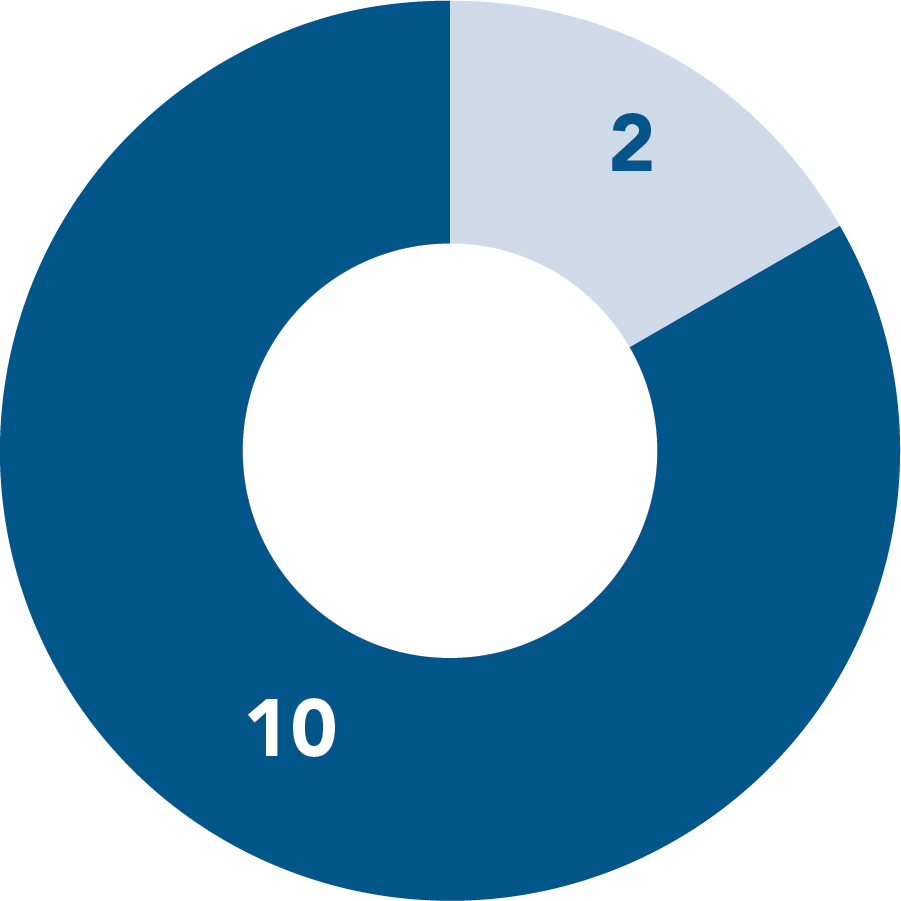

| • | 10 of 12 Board members are independent |

| | | | | | | | |

| Good Corporate Governance Practices | • | Appropriate mix of diversity and tenure on Board |

| • | Director Retirement Age and Tenure Policy |

| • | Annual Board and Board committee evaluations, including periodic individual Director evaluations |

| • | Director and executive officer stock ownership requirements |

| • | Policies that prohibit hedging and pledging and provide for clawbacks |

3 GL 2024 Proxy Statement

| | | | | | | | |

| Shareholders' Rights | • | Shareholders' Rights Policy |

| • | Proxy access |

| • | No supermajority voting provisions |

| • | Annual election of Directors |

| • | Majority voting standard for uncontested Director elections |

| | | | | | | | |

| People and Culture | • | Succession planning and leadership development for executive officers and senior management positions |

| • | Succession planning and education for the Board and Board leadership |

| • | Oversight of programs, policies and initiatives designed to foster an engaged, stable, and diverse workforce |

| • | Work environment based on accountability, standards of integrity and ethical business conduct |

| • | Oversight of corporate culture that aligns with the Company's long-term goals and objectives |

| | | | | | | | |

| Focus on Sustainability | • | Oversight of sustainability by the Board and its standing committees, which assist the Board by monitoring Environmental, Social & Governance (ESG) related issues |

| • | Senior management-led ESG Committee responsible for setting the Company's sustainability agenda, pursuant to a charter adopted by the Board of Directors |

| • | Business practices designed to further good corporate citizenship and reflect sound fiscal management |

| • | ESG Report published annually |

Board Composition Highlights*

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gender Diversity (50%) | | | Tenure | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | <5 years | llllll | |

| | | | | | | | | | | | | | | | | |

| Racial/Ethnic Diversity (25%) | | | | 5-9 years | llll | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | 10+ years | ll | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | 6 | | Directors joined the Board since 2021 | |

| | | |

| | | |

| | | |

| | | | | | |

| | 5 | | Directors departed the Board since 2021 | |

| | | |

| | | |

| Independence (83%) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

*As of March 18, 2024

4 GL 2024 Proxy Statement

Voting Matters

At Globe Life Inc.'s 2024 Annual Meeting of Shareholders, you are being asked to:

| | | | | | | | |

| Elect Directors | | Eleven of our current directors are standing for re-election (Linda L. Addison, Marilyn A. Alexander, Cheryl D. Alston, Mark A. Blinn, James P. Brannen, Alice S. Cho, J. Matthew Darden, Steven P. Johnson, David A. Rodriguez, Frank M. Svoboda and Mary E. Thigpen), each to a one-year term based upon a majority voting standard.

|

| | |

| Approve Auditors | | Deloitte & Touche LLP, who have served as Globe Life Inc.'s registered independent public accountants since 1999, are proposed to be ratified to continue in that role for 2024. |

| | |

Advise

on

Executive

Compensation | | You are being asked to approve, on a non-binding advisory basis, the executive compensation of our named executive officers as disclosed in the various compensation tables and accompanying narrative compensation disclosures found in the Compensation Discussion and Analysis section of this Proxy Statement. |

PROPOSAL NUMBER 1

Election of Directors

The Board of Directors proposes the election of Linda L. Addison, Marilyn A. Alexander, Cheryl D. Alston, Mark A. Blinn, James P. Brannen, Alice S. Cho, J. Matthew Darden, Steven P. Johnson, David A. Rodriguez, Frank M. Svoboda, and Mary E. Thigpen as directors, each to hold office for a one-year term, expiring at the close of the Annual Meeting of Shareholders to be held in 2025, and until his or her successor is elected and qualified. All directors tendered an irrevocable contingent resignation letter pursuant to the Company’s Director Resignation Policy. Jane Buchan will retire from the Board, with over 18 years of Board Service, at the Annual Meeting of Shareholders on April 25, 2024.

The Company’s By-laws provide that there will be not less than seven nor more than 15 directors with the exact number to be fixed by the Board. Effective as of the Annual Meeting of Shareholders on April 27, 2023, the number of directors was set at 12 persons. On February 28, 2024, the Board determined to reduce the number of directors from 12 to 11 persons upon the retirement of Jane Buchan from the Board, as discussed above.

If any of the nominees becomes unavailable for election, the directors’ proxies will vote for the election of any other person recommended by the Board unless the Board reduces the number of directors.

| | | | | | | | |

| Proposal | | The Board recommends that shareholders vote “FOR” the proposal. |

| 1 | |

5 GL 2024 Proxy Statement

Director Nominee Profiles

| | | | | | | | |

| Linda L. Addison | |

| Lead Director |

| Independent Director | Member, Governance and Nominating Committee |

| |

Principal occupation: Past Managing Partner, Norton Rose Fulbright US LLP, since January 2017. Ms. Addison is also a director of Lexitas and serves on the non-profit boards of Catalyst and the M.D. Anderson Center Board of Visitors. She is a Senior Trustee of the University of Texas Law School Foundation. She formerly served as an independent director of KPMG LLP, the U.S. audit, tax and advisory firm (2018 - 2023). Ms. Addison received a B.A. from the University of Texas at Austin and a J.D. from the University of Texas School of Law. She earned the Certification in Climate Leadership from Diligent Institute, the CERT Certificate in Cybersecurity Oversight from Carnegie Mellon University's Software Engineering Institute, and is an NACD Board Leadership Fellow. As a global business leader and chief executive with more than three decades of practical experience, including as former Managing Partner and Chair of the Management Committee of Norton Rose Fulbright US LLP, Ms. Addison brings a broad array of management skills and operational experience to the Board, including expertise in corporate governance, climate leadership oversight, cybersecurity oversight, strategic planning, enterprise risk management, regulatory/compliance, compensation, mergers and acquisitions, and human capital management.

|

| Director since Feb. 2018 |

| Age 72 |

|

| Marilyn A. Alexander | |

|

| Independent Director | Member, Compensation Committee |

| |

Principal occupation: Self-employed management consultant since November 2003, and Principal in Alexander & Friedman, Laguna Beach, California, a management consultancy practice focusing on business planning, brand strategy and development, communications, process and organizational issues, since January 2006. Ms. Alexander is also a director of McCarthy Holdings, Inc. Additionally, she is a member of the Board of Trustees, Chapman University, Orange, California. She has an A.B. in Philosophy from Georgetown University and an M.B.A. from the Wharton Graduate School of the University of Pennsylvania and holds a CPA license in the Commonwealth of Virginia. Ms. Alexander contributes to the Board from her extensive expertise in finance, marketing and strategic planning based upon more than 35 years of experience at top corporations including Disneyland Resort, where she was Senior Vice President and Chief Financial Officer, Walt Disney World Resort, Marriott Corporation and Towers Perrin, as well as her own consultancy practice. |

| Director since Feb. 2013 |

| Age 72 |

|

| Cheryl D. Alston | |

|

| Independent Director | Member, Compensation Committee |

| |

Principal occupation: Executive Director and Chief Investment Officer of the Employees' Retirement Fund of the City of Dallas, Texas (ERF), a $4 billion pension plan for the City's civilian employees, since October 2004. Ms. Alston also serves on the Board of CHRISTUS Health and Blue Cross Blue Shield of Kansas City and is a Director on the Janus Henderson Mutual Fund Board. She formerly served as a director of the Federal Home Loan Bank of Dallas (2017-2021). She holds a B.S. in Economics from the Wharton School of Business at the University of Pennsylvania and an M.B.A. from the Leonard N. Stern School of Business at New York University. With a career spanning more than 20 years in the financial services industry, including positions at ERF, Cigna Corporation and Chase Global Securities, Ms. Alston brings to the Board significant experience in the areas of strategic planning, investment management, asset allocation, corporate governance, finance and budget administration.

|

| Director since Feb. 2018 |

| Age 57 |

|

| Mark A. Blinn | |

|

| Independent Director | Member, Compensation Committee |

| |

Principal occupation: Retired executive. He serves on the Boards of Texas Instruments Incorporated, Emerson Electric Co., and Leggett & Platt, Incorporated. He is an Executive Board Member of the Southern Methodist University (SMU) Cox Executive Board. Mr. Blinn holds a B.S., M.B.A. and J.D. from Southern Methodist University, as well as a charter financial analyst (CFA) designation. As President and Chief Executive Officer, and formerly Chief Financial Officer, of Flowserve Corporation and through his senior leadership roles at FedEx Kinko’s Office and Print Services, Inc. and Centex Corporation, Mr. Blinn developed a well-rounded set of business skills and knowledge that significantly benefits the Board, including extensive expertise in business operations, organizational design, accounting/finance and experience running a large complex international organization. He also possesses a thorough understanding of legal and governance matters through his time spent as a practicing attorney. |

| Director since Nov. 2021 |

| Age 62 |

|

6 GL 2024 Proxy Statement

| | | | | | | | |

| | |

| James P. Brannen | |

|

| Independent Director | Chair, Governance and Nominating Committee |

| |

Principal Occupation: Retired executive (Formerly Chief Executive Officer of FBL Financial Group Inc., West Des Moines, Iowa, then a public financial services company, August 2012-December 2019). He also serves on the Boards of First Interstate BancSystem and Amerisure Mutual Insurance Company. He formerly served as a director for Great Western Bancorp, Inc. (2015-2022), FBL Financial Group Inc. (2012-2019), the Greater Des Moines Partnership (2012-2019), and the Property Casualty Insurers Association of America (2012-2019). Mr. Brannen holds a B.B.A. in Accounting from the University of Iowa and is a member of the American Institute of Certified Public Accountants and the Iowa Society of Certified Public Accountants. With nearly 30 years of relevant experience in the insurance and financial services industry, and having held a variety of C-suite positions during his distinguished career, Mr. Brannen brings to the Board extensive expertise in finance and executive management. |

| Director since Nov. 2021 |

| Age 61 |

|

| Alice S. Cho | |

|

| Independent Director | Member, Audit Committee |

|

Principal Occupation: Senior Advisor for The Boston Consulting Group, a global management consulting firm providing strategic advice to C-suite leaders and boards, since 2021 (Formerly Advisor of Varo Money, Inc., a digital bank startup, 2017-2020). Ms. Cho is also an independent director of First Interstate BancSystem and serves on the dean's advisory council at the University of Chicago Harris School of Public Policy. She earned a B.A. from Whitman College and earned an A.M. from the University of Chicago, where she was a Sloan fellow. Through her advisory and management positions at Promontory Financial Group, BITS (Bank Policy Institute), the Federal Reserve Board, and the U.S. Executive Office of the President, Ms. Cho brings to the Board extensive experience in financial services, public policy, and corporate boards, including advising boards and top executives on risk management, regulatory compliance, corporate governance, and digital technology issues. |

| Director since Feb. 2023 |

| Age 57 |

|

| J. Matthew Darden | |

|

| Co-Chairman and Chief Executive Officer |

| |

Principal occupation: Co-Chairman of the Company since April 2023 and Co-Chief Executive Officer since Jan. 2023 (Formerly Senior Executive Vice President and Chief Strategy Officer of Company April 2022 - Dec. 2022; Executive Vice President and Chief Strategy Officer of Company Jan. 2017-April 2022; President of subsidiary American Income Life Insurance Company July 2018-Dec. 2022). Mr. Darden received a B.B.A. and an M.B.A from Baylor University and is a member of the American Institute of Certified Public Accountants and the Texas Society of Certified Public Accountants. He provides the Board with a host of relevant and broad-based skills gained from more than 29 years of direct insurance industry experience, including expertise in marketing, finance, accounting, consulting, technology, business combinations and capital market transactions. Through his managerial roles at the Company, most recently serving as its Chief Strategy Officer, and his 16+ years of public accounting experience at Deloitte & Touche LLP and Ernst and Young LLP, Mr. Darden brings a wealth of highly-valued managerial, financial, operational and strategic experience to the Board. |

| Director since Apr. 2023 |

| Age 53 |

|

| Steven P. Johnson | |

|

| Independent Director | Member, Audit Committee |

| |

Principal occupation: Financial Consultant and Advisor for Boulder Creek Development, LLC, a developer of office/warehouse buildings, primarily for smaller businesses, and its affiliated companies since June 2013. He earned a B.B.A. from the University of Wisconsin-Eau Claire. Mr. Johnson brings to the Board considerable expertise in accounting, auditing, regulatory, corporate governance, Sarbanes-Oxley compliance and enterprise risk management, as well as insurance industry experience as an external auditor, stemming from his 41-year career with Deloitte & Touche LLP, where he held a variety of senior firm leadership and client service positions, including Worldwide Lead Client Service Partner for several prominent firm clients and six years as Deputy Managing Partner - Operations. |

| Director since Nov. 2016 |

| Age 73 |

|

7 GL 2024 Proxy Statement

| | | | | | | | |

| | |

| David A. Rodriguez | |

|

| Independent Director | Member, Governance and Nominating Committee |

|

Principal Occupation: Retired executive (Formerly Global Chief Human Resources Officer of Marriott International, Bethesda, MD, August 2006 - December 2021). He also serves on the Board of American Woodmark Corporation and the Board of Trustees of the SIOP Foundation. Mr. Rodriguez earned a B.A. in Psychology and an M.A. and Ph.D. in Industrial/Organizational Psychology from New York University. He brings to the Board extensive experience in human resource management, including organizational culture and inclusion, through a 36-year career at companies including Marriott International, Citicorp/Citibank and Avon Products, and his service on the Board of American Woodmark Corporation and the Board of Trustees of the SIOP Foundation. |

| Director since Feb. 2023 |

| Age 65 |

|

| Frank M. Svoboda | |

|

| Co-Chairman and Chief Executive Officer |

|

Principal occupation: Co-Chairman of the Company since April 2023 and Co-Chief Executive Officer since Jan. 2023 (Formerly Senior Executive Vice President and Chief Financial Officer of Company April 2022-Dec. 2022; Executive Vice President and Chief Financial Officer of Company June 2012 - April 2022; President of subsidiary Globe Life And Accident Insurance Company July 2018-Dec. 2022). He received a B.A. degree in Accounting and Finance from Nebraska Wesleyan University and is a member of the American Institute of Certified Public Accountants and the Texas Society of Certified Public Accountants. Mr. Svoboda has more than 36 years of direct insurance industry experience, including in the areas of tax, accounting, consulting, compensation and benefits, business combination and capital market transactions. As the Company's Chief Financial Officer for more than a decade, with overall responsibility for various accounting, financial and investment functions at the Company and its subsidiaries, and through his service as the Company's Vice President of Tax for nine years prior thereto, as well as the 19 years he spent in public accounting at KPMG LLP, he provides the Board with significant financial and operational expertise. |

| Director since Apr. 2023 |

| Age 62 |

|

| Mary E. Thigpen | |

|

| Independent Director | Chair, Audit Committee |

| |

Principal occupation: Self-employed Consultant providing advisory services in digital transformation strategies, technology and cybersecurity assessments, and systemic risk mitigation competencies since February 2019 and September 2015-October 2017. (Formerly CEO of OpsDataStore, LLC, Johns Creek, Georgia, a big data analytics, AI, and visualization software company, October 2017-January 2019). Ms. Thigpen also serves as a director of Achievelt Online, LLC and Hope Bancorp, Inc. and its affiliate Bank of Hope. She formerly served as a director of Opus Bank (2019-2020). She received a B.S. in Mathematical and Computer Sciences from Clemson University. Ms. Thigpen provides the Board with expertise in technology, cybersecurity, strategic planning, corporate governance, enterprise and systemic risk management, international business, digital sales and marketing developed as a result of her time as CEO of OpsDataStore and as CEO of North Plains, LLC and through senior leadership positions at Cox Communications, BearingPoint, Arthur Andersen LLP and Hewlett-Packard Company, as well as through her consultancy practice. |

| Director since Feb. 2018 |

| Age 64 |

|

8 GL 2024 Proxy Statement

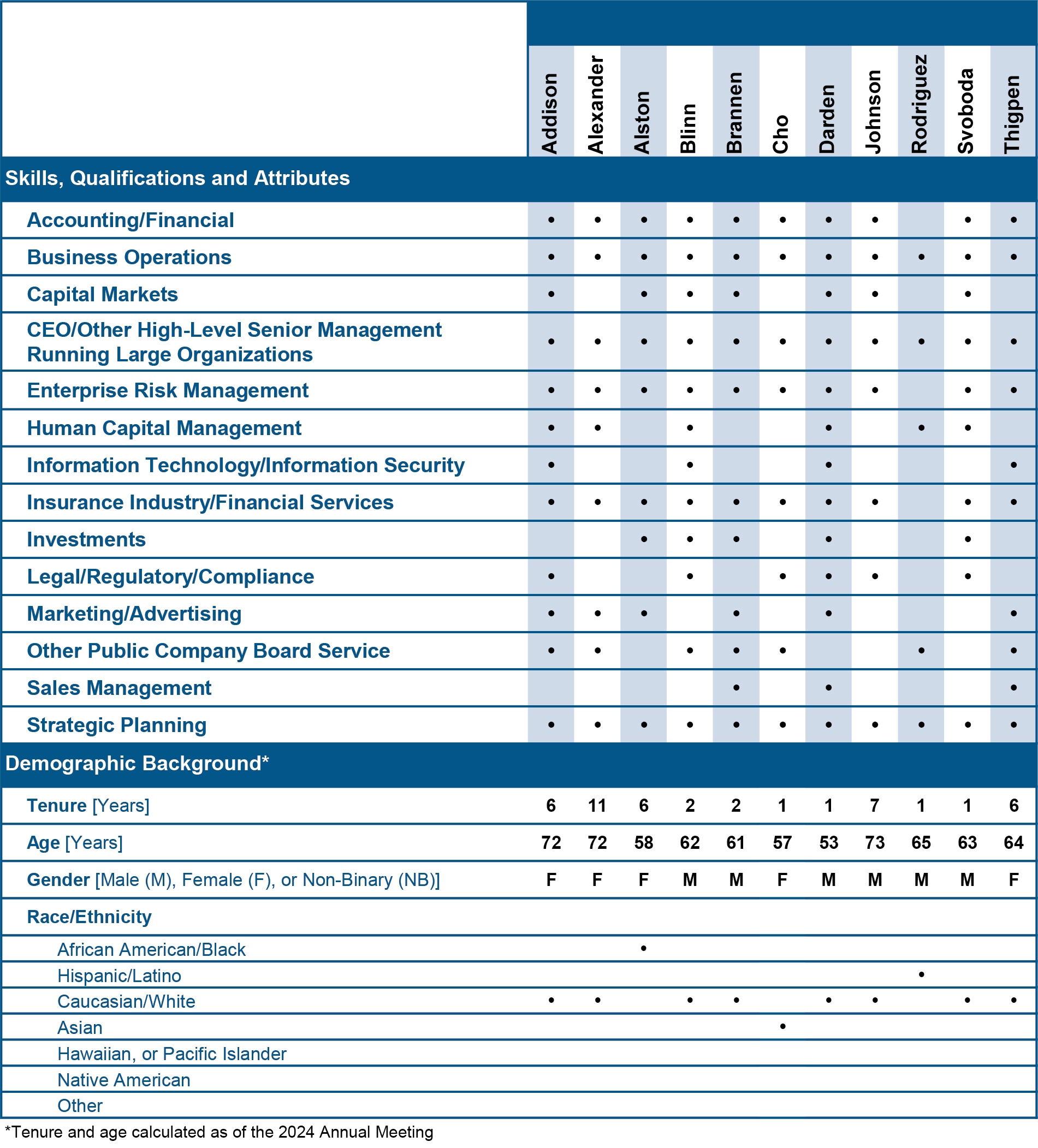

Director Nominee Skills and Qualifications

The Board has emphasized the importance of identifying and proposing for shareholder approval Director Nominees who possess a well-rounded range of skills, qualifications, professional experiences and perspectives. It is the Board’s belief that a Board comprised of individuals with diverse skills and viewpoints will enhance its ability to effectively oversee the Company’s business operations and guide management’s efforts to achieve long-term strategic objectives. The chart below outlines those skills and qualifications the Board believes are most relevant to our business.

| | | | | | | | |

| Skills and Qualifications | | Relevance to Globe Life Inc. |

| Accounting/Financial | | An understanding of accounting and financial concepts is fundamental to the oversight of our financial affairs, as well as for reviewing our operational and financial results. |

| Business Operations | | Helpful for understanding the myriad issues affecting our extensive business operations, which include sales, marketing, customer service, claims, underwriting, financial reporting, accounting and other support-oriented functions. |

| Capital Markets | | Beneficial for appraising and offering guidance on our capital structure and financial strategies, including with respect to dividends, stock repurchases and prospective mergers/acquisitions. |

| CEO/Other High-Level Senior Management Running Large Organizations | | Experience managing and leading large complex businesses is important for gaining a practical understanding of how organizations such as ours function and the decisions and actions required to drive sustainable financial and operational results. |

| Enterprise Risk Management | | Important for exercising risk oversight and for informing management's views as to current and emerging risks which, if not properly managed/mitigated, could have a material adverse impact on our business and ultimately shareholder value. |

| Human Capital Management | | Helps the Board guide the Company's efforts to recruit, retain and develop talented professionals, and to seamlessly integrate them into our corporate culture, in order to drive performance. |

| Information Technology/Information Security | | Can better inform the Board regarding technical risks and issues associated with information systems, upon which we are highly dependent, and associated technology in order to ensure our business continues to operate in an efficient and resilient manner. |

Insurance Industry/

Financial Services | | Experience in the insurance industry or financial services sector contributes to the Board's understanding of the distinct financial, legal and regulatory issues we regularly encounter as an insurance holding company with multiple insurance subsidiaries. |

| Investments | | We manage a substantial portfolio of invested assets. A general understanding of investment management concepts is essential for overseeing our investment management activities. |

| Legal/Regulatory/Compliance | | We operate in a heavily regulated environment in which compliance with applicable laws and regulations is necessary to enable our businesses to function. An understanding of our legal risks/obligations is crucial for the Board to be able to exercise its oversight role. |

| Marketing/Advertising | | Marketing/advertising experience, including social media and digital marketing, can provide expertise directly relevant to us as a consumer-driven business and can help to ensure that our marketing and branding efforts are properly aligned with our long-term strategic objectives. |

Other Public Company

Board Service | | Service on public company boards and committees provides valuable perspectives on good corporate governance practices and knowledge about key issues affecting public companies such as ours. |

| Sales Management | | Enhances the Board’s ability to evaluate our sales programs and initiatives aimed at developing and maintaining our various sales distribution systems in order to grow sales and profits. |

| Strategic Planning | | Valuable for offering guidance and oversight related to management's development of our long-term corporate strategy and for assessing the best approaches for implementing our strategic priorities. |

9 GL 2024 Proxy Statement

While not an exhaustive list, the skills matrix below reflects some of the qualifications and attributes possessed by the Director Nominees that the Board believes are relevant to our business. Also listed are certain voluntarily self-identified demographic characteristics of the Director Nominees.

10 GL 2024 Proxy Statement

PROPOSAL NUMBER 2

Approval of Auditors

A proposal to ratify the appointment of the firm of Deloitte & Touche LLP (Deloitte) as the independent registered public accounting firm of the Company for the year ending December 31, 2024 will be presented to the shareholders at the Annual Meeting. Deloitte served as the Company’s independent registered public accounting firm, auditing the financial statements of the Company and its subsidiaries for the fiscal year ended December 31, 2023, and has served in this capacity since 1999. After review and evaluation, the Audit Committee of the Board has appointed Deloitte to serve as the Company’s independent registered public accounting firm for 2024, and has recommended that the shareholders ratify the appointment of Deloitte for 2024.

A representative of Deloitte is expected to be present at the meeting and will be available to respond to appropriate questions and, although the firm has indicated that no statement will be made, Deloitte will have the opportunity to make a statement should the firm desire to do so.

If the shareholders do not ratify the appointment of Deloitte, the selection of an independent registered public accounting firm will be reconsidered by the Audit Committee of the Board of Directors.

| | | | | | | | |

| Proposal | | The Board recommends that shareholders vote “FOR” the proposal. |

| 2 | |

PROPOSAL NUMBER 3

Advisory Vote on Executive Compensation

In accordance with Section 14A of the Securities Exchange Act of 1934, we are asking for shareholder approval of the compensation of our named executive officers. This vote is not intended to address any specific item of compensation, but rather this vote relates to the overall compensation of our named executive officers and the compensation policies and practices described in this Proxy Statement.

The compensation of our executive officers is based on a philosophy that emphasizes and rewards the attainment of performance measures that the Compensation Committee believes promote the creation of long-term shareholder value and therefore align management’s interests with the interests of shareholders. Our compensation program is designed to enable the Company to attract, motivate, reward and retain key executives while, at the same time, creating a close relationship between performance and compensation. The Compensation Committee believes that the design of the compensation program and the compensation of named executive officers under the program fulfill this objective. Shareholders are urged to read the Compensation Discussion and Analysis section of this Proxy Statement for a detailed discussion of how our compensation policies and practices implement our compensation philosophy. This vote is advisory and therefore not binding on the Company, the Board, or the Compensation Committee. The Board and the Compensation Committee value the opinions of Company shareholders and will take such vote into account when making future executive compensation decisions.

Accordingly, the Company is asking shareholders to approve the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s shareholders hereby approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2024 Annual Meeting of Shareholders pursuant to the executive compensation disclosure rules of the Securities and Exchange Commission, which disclosure includes the Compensation Discussion and Analysis, the compensation tables and related compensation disclosures.”

| | | | | | | | |

| Proposal | | The Board recommends that shareholders vote “FOR” advisory approval of our executive compensation. |

| 3 | |

11 GL 2024 Proxy Statement

OTHER BUSINESS

The directors are not aware of any other matters which may properly be and are likely to be brought before the Annual Meeting. If any other proper matters are brought before the Annual Meeting, the persons named in the proxy, J. Matthew Darden and Frank M. Svoboda, will vote in accordance with their judgment on these matters.

INFORMATION REGARDING DIRECTORS, NOMINEES, AND EXECUTIVE OFFICERS

Executive Officers

The following table shows certain information concerning each person deemed to be an executive officer of the Company, except those persons also serving as directors. Each executive officer is appointed by the Board of the Company or its subsidiaries annually and serves at the pleasure of that board. There are no arrangements or understandings between any executive officer and any other person pursuant to which the officer was selected.

| | | | | | | | |

| Name | Current

Age | Principal Occupation and Business Experience for the Past Five Years* |

| Jennifer A. Haworth | 50 | EVP and Chief Marketing Officer of Company since Jan. 2020; Division SVP, Marketing of Globe since Sept. 2019. (Corporate SVP, Marketing of Company Nov. 2019 - Dec. 2019; VP, Marketing of Company Jan. 2018 - Nov. 2019; SVP, Marketing of Globe Dec. 2011 - Sept. 2019) |

| Robert E. Hensley | 56 | EVP and Chief Investment Officer of Company since July 2021; Divisional SVP, Investments of American Income, Family Heritage, Globe, Liberty and United American since Feb. 2021. (Vice President for Provident Investment Management LLC, Chattanooga, TN, Nov. 1999 - Nov. 2020) |

| Thomas P. Kalmbach | 59 | EVP and Chief Financial Officer of Company since Jan. 2023; President of Globe since Jan. 2023; President of Family Heritage since Apr. 2022. (EVP and Chief Actuary of Company Jan. 2019 - Dec. 2022; SVP and Chief Actuary of American Income, Globe, Liberty and United American Aug. 2018 - Dec. 2022) |

| Michael C. Majors | 61 | EVP, Policy Acquisition and Chief Strategy Officer of Company since Jan. 2023; President of United American since Mar. 2015. (EVP - Administration and Investor Relations of Company July 2018 - Dec. 2022) |

| R. Brian Mitchell | 60 | EVP and General Counsel of Company since June 2012; Chief Risk Officer of Company since May 2017; President of American Income since Jan. 2023; President of Liberty since July 2018. |

| Dolores L. Skarjune | 58 | EVP and Chief Administrative Officer of Company since Jan. 2023; Divisional SVP, Administration of Family Heritage since June 2023; Divisional SVP, Sales and Administration of American Income, Globe, Liberty, and United American since Sept. 2019. (Corporate SVP, Sales Administration of Company Jan. 2021 - Dec. 2022; SVP of Sales Administration of American Income, Globe, Liberty and United American Aug. 2012 - Sept. 2019) |

| Christopher K. Tyler | 50 | EVP and Chief Information Officer of Company since June 2022. (Chief Information Officer of Magellan Health Feb. 2020 - May 2022; Chief Information Officer of Lifecare Health Partners May 2018 - Dec. 2019) |

| Rebecca E. Zorn | 52 | EVP and Chief Talent Officer of Company since Jan. 2021; Divisional SVP and Chief Talent Officer of American Income, Family Heritage, Globe, Liberty and United American since Sept. 2019. (Corporate SVP and Chief Talent Officer of Company Nov. 2019 - Dec. 2020; VP and Chief Talent Officer of Company Jan. 2019 - Nov. 2019; Assistant Secretary and Director of Human Resources of Company Jan. 2018 - Dec. 2018; SVP and Chief Talent Officer of American Income, Family Heritage, Globe, Liberty and United American June 2019 - Sept. 2019) |

*American Income, Family Heritage, Globe, Liberty, and United American, as used in this Proxy Statement, refer to American Income Life Insurance Company, Family Heritage Life Insurance Company of America, Globe Life And Accident Insurance Company, Liberty National Life Insurance Company and United American Insurance Company, subsidiaries of the Company.

12 GL 2024 Proxy Statement

Stock Ownership

The following table shows certain information about stock ownership as of January 31, 2024 for the directors, nominees and named executive officers of the Company, including shares with respect to which they have the right to acquire beneficial ownership on or prior to April 1, 2024.

| | | | | | | | |

| | Company Common Stock or Options Beneficially Owned as of January 31, 20241 |

| Name | Directly2 | Indirectly3 |

| Linda L. Addison | 17,689 | 0 |

| Marilyn A. Alexander | 20,337 | 0 |

| Cheryl D. Alston | 21,755 | 0 |

| Mark A. Blinn | 4,518 | 0 |

| James P. Brannen | 5,020 | 0 |

| Jane Buchan | 98,384 | 0 |

| Alice S. Cho | 2,835 | 0 |

| J. Matthew Darden | 211,862 | 1,476 |

| Steven P. Johnson | 1,959 | 13,447 |

| David A. Rodriguez | 2,687 | 0 |

| Frank M. Svoboda | 295,870 | 141,793 |

| Mary E. Thigpen | 12,543 | 0 |

| Thomas P. Kalmbach | 97,571 | 847 |

| Michael C. Majors | 127,515 | 0 |

| R. Brian Mitchell | 134,320 | 48,690 |

| Robert E. Hensley | 18,850 | 0 |

All Directors, Nominees and Executive Officers as a group (20 persons):4 | 1,279,329 | 210,265 |

1 No individual director, nominee, or executive officer beneficially owns 1% or more of the common stock of the Company.

2 Includes: for Alston, 14,017 shares; for Buchan, 18,100 shares; for Darden, 185,660 shares; for Svoboda, 292,500 shares; for Kalmbach, 87,500 shares; for Majors, 92,500 shares; for Mitchell, 133,000 shares; for Hensley, 16,500 shares; and for all directors, nominees and executive officers as a group, 1,021,327 shares, that are subject to presently exercisable Company stock options.

3 Indirect beneficial ownership includes shares (a) owned by the director, named executive officer or spouse as trustee of a trust or executor of an estate, (b) held in a trust in which the director, named executive officer or a family member living in his home has a beneficial interest, (c) owned by the spouse or a family member living in the director’s, named executive officer’s or nominee’s home or (d) owned by the director or named executive officer in a personal corporation or limited partnership. Indirect beneficial ownership also includes: for Darden, approximately 1,476 shares; for Kalmbach, approximately 847 shares; for Mitchell, approximately 11,311 shares; and for Svoboda, approximately 1,895 shares, calculated based upon conversion of stock unit balances held in their respective accounts in the Company Savings and Investment Plan to shares. Indirect ownership for Mr. Svoboda includes 139,898 shares held in his family living trust. Indirect ownership for Mr. Mitchell includes 36,151 shares held in his family living trust and 1,228 shares held in a trust for the benefit of his son.

4 All directors, nominees and executive officers as a group, beneficially own 1.51% of the common stock of the Company.

CORPORATE GOVERNANCE

Director Independence Determinations

The New York Stock Exchange (NYSE) rules require that the Company have a majority of independent directors. The rules provide that no director will qualify as “independent” unless the Board of Directors affirmatively determines that the director has no material relationship with the Company and its subsidiaries (collectively, the "Company"), either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company. The Board adopted the categorical standards prescribed by the NYSE as well as 12 additional categorical standards to assist it in making determinations of independence.

These independence standards are available on the Company’s website at https://investors.globelifeinsurance.com under the Board of Directors heading at Director Independence Criteria. You may also obtain a printed copy of the independence standards at no charge by writing to the Corporate Secretary at 3700 South Stonebridge Drive, McKinney, Texas 75070.

Based on these categorical standards and after evaluation of the directors’ responses to an annual questionnaire, the Governance and Nominating Committee makes recommendations to the Board of Directors regarding director independence. After review of the Committee's recommendations regarding director independence, the Board

13 GL 2024 Proxy Statement

determined on February 28, 2024 that the following directors meet the categorical standards prescribed by the New York Stock Exchange and set by the Board, and are “independent”:

| | | | | | | | | | | | | | | | | |

| • | Linda L. Addison | • | Mark A. Blinn | • | Steven P. Johnson |

| • | Marilyn A. Alexander | • | James P. Brannen | • | David A. Rodriguez |

| • | Cheryl D. Alston | • | Alice S. Cho | • | Mary E. Thigpen |

The Board determined that J. Matthew Darden and Frank M. Svoboda (as Company employees) were not "independent.”

Leadership Structure

Management

Since June 1, 2012, the Company has successfully operated with two principal executive officers, most recently with J. Matthew Darden and Frank M. Svoboda serving as Co-Chief Executive Officers (“Co-CEOs”) of the Company since January 1, 2023.

While this leadership structure may be non-traditional and less common among the Company’s peers, the Board has determined that having Co-CEOs remains the most appropriate strategic leadership choice for the Company, as currently constituted. In appointing Messrs. Darden and Svoboda as Co-CEOs, the Board observed that such leadership structure has proven highly effective for the Company for over a decade; allowing compatible, experienced executives with complementary skill sets to partner together to manage the complex and varied corporate functions attendant to our business. The Company does not have a President or Chief Operating Officer, opting instead for the Co-CEOs to perform the functions typically associated with such roles.

While both Co-CEOs are ultimately responsible for all aspects of the Company’s day-to-day business operations and jointly oversee the management of the Company, they have separated their duties in a manner designed to leverage the prior experience and expertise of each, while collaborating to set forth their strategic vision for the Company, consistent with guidance from the Board.

The Board believes this leadership structure allows for a valuable mix of backgrounds, expertise and perspectives at the Company’s most senior-level executive position, enabling more informed decision-making and enhanced business judgment by those principally charged with leading the organization into the future. The Board has determined that maintaining a Co-CEO structure, premised upon a shared commitment by both individuals to successfully execute the Company’s strategy, serves to best position the Company for continued growth and shareholder value creation.

Board of Directors

The Board does not have a fixed policy regarding the separation of the Board Chair and Chief Executive Officer (CEO) positions. It is the Board's position that such determination should be part of the regular succession planning process and should be made based on the best interests of the Company at a given time. The Company currently operates with the roles of the Board Chair and CEO combined, believing that it provides the appropriate level of corporate governance for shareholders, policyholders, regulators and our other constituent groups.

Although the Board is not currently chaired by an independent director, the Company's Corporate Governance Guidelines provide for the position of a lead independent director (Lead Director) and define the qualifications and duties of that Lead Director. The Board has conducted frequent executive sessions of only the independent directors for a number of years, with all of such executive sessions presided over by the Lead Director. As set forth in the Corporate Governance Guidelines, the Lead Director is elected annually by and from the independent directors then serving on the Board; provided, however, that a director must have served a minimum of one year in order to qualify for election as the Lead Director and that a person may not serve as the Lead Director for more than three one-year terms in succession without express agreement of the Board.

14 GL 2024 Proxy Statement

The Lead Director has duties which include, but are not limited to, the following:

| | | | | | | | |

| Lead Director Duties |

| • | Acting as the principal liaison between the independent directors and the Board Chair(s) and facilitating the flow of quality and timely information between the independent directors and Company management | |

| • | Identifying important issues for Board consideration and coordinating preparation for Board meetings and executive sessions of the Board, including approval of meeting agendas and schedules to assure adequate time for discussion | |

| • | Ensuring that directors are encouraged to share their viewpoints and raise questions at Board meetings, facilitating discussion around core issues and helping to achieve consensus | |

| • | Leading executive sessions of the Board that encourage open and candid conversations and provide useful feedback for the Board Chair(s) | |

| • | Leading Board meetings if the Board Chair(s) is/are not present | |

| • | Assisting the Committee Chairs and individual Board members in fulfilling their roles and responsibilities, upon request | |

| • | Working with the Governance and Nominating Committee to ensure that a strong executive development and succession planning process operates continuously in the Company and that independent Board members are fully informed of the process and properly fulfill their roles | |

| • | Leading the Board through the Co-CEO/Chair succession planning process, including overall timing and candidate identification, selection and leadership transition | |

| • | Working with the Governance and Nominating Committee to ensure that: (1) a robust Board and individual director evaluation process occurs regularly; (2) underperforming directors, if any, are identified and offered assistance for improvement; and (3) the Board has the appropriate set of skills and experiences to fulfill its responsibilities | |

| • | Approving retention of Board consultants, except consultants explicitly retained pursuant to Committee responsibilities | |

| • | Calling special purpose meetings of the independent directors | |

| • | Being available for consultation and communication with shareholders upon request of the Board Chair(s) | |

| • | Assisting in a crisis situation by coordinating communication with the Board and providing other assistance as requested by management | |

| • | Performing other duties consistent with the Lead Director role as requested by the Board or management | |

Should the Lead Director be unable to meet any of the responsibilities of the position, the independent members of the Board may select one or more of the other independent members to fulfill those responsibilities as they determine to be necessary until the Lead Director is able to do so or until another Lead Director is elected.

Linda L. Addison was elected as Lead Director to serve for a term beginning in April 2023 and expiring April 25, 2024. The independent members of the Board have determined that, upon the completion of such term, Ms. Addison will continue to serve as Lead Director until the close of the 2025 Annual Meeting of Shareholders.

Board Oversight of Strategy

A key responsibility of the Board is the oversight of management’s development and execution of the Company’s strategy. The Board’s oversight of strategy is a continuous process in which elements of the strategy are discussed at each regularly-scheduled Board meeting. Annually, the Board and management engage in a discussion regarding the Company’s long-term strategy, operational priorities and annual operating plan.

The Company’s strategic plan establishes priorities, aligns resources and ensures the organization is working toward common goals. The strategic plan includes an assessment of the competitive environment and details the operational priorities necessary to increase shareholder value while successfully managing risk.

The Board reviews the Company’s primary objectives for attaining short and long-term success, including financial and operational goals. The Board assesses management’s progress in achieving objectives through discussion of strategic business activities and performance measures. The Company’s risk management program (including ERM and ESG topics) is also evaluated by the Board. The varied skills and experiences of the Board members are essential to the Board’s ability to meet its strategic planning oversight responsibility, including monitoring and providing guidance related to management’s execution of the Company’s business strategy.

Board Oversight of Risk

The Company’s Board is committed to a corporate culture that aligns day-to-day decision making with risk awareness and helps assure that the Company’s long-term strategic initiatives are consistent with its risk appetite. As a part of its general oversight responsibilities, the Board has determined that overall responsibility for overseeing enterprise risk management at the Company rests with the full Board of Directors as opposed to any specific Board-level committee. The Board recognizes the importance of identifying, assessing and monitoring risks that may have a material adverse effect on the Company, including operational, financial, compliance/legal and strategic risks. In

15 GL 2024 Proxy Statement

fulfilling its risk oversight function, the Board has delegated certain oversight responsibilities to its three standing committees – Audit Committee, Compensation Committee, and Governance and Nominating Committee – who assist the Board by monitoring and evaluating risks that fall within their respective purviews and overseeing management’s implementation of associated mitigation activities. Although the Board has delegated certain oversight responsibilities to its standing committees, these committees regularly report to the Board on specified risk areas, and the Board maintains primary responsibility for risk oversight. The organization's most significant risks are assessed and reported to the full Board on an annual basis, as well as to the applicable standing committee(s) as necessary. The Audit Committee receives a quarterly risk report from the Chief Risk Officer, which includes results from recently conducted risk assessments. The "Emerging Risk Assessment" and scenario-based risk assessments for the Company's top risks are conducted annually and the results are reported to the Audit Committee and, subsequently, to the full Board.

Risk Oversight Responsibilities

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| Board of Directors |

•Strategic Planning & Resource Allocation Risk •Credit Risk •Capital Risk •Financial Market Risk •Market Dynamics Risk

| | | | •IT & Systems Risk •Reputation & Communications Risk •Distribution Risk

| | | | •Business Resiliency Risk •Third-Party Risk •Key Relationship Management Risk |

|

| | | | | | | | | | |

| | | | | | | | | | |

Audit

Committee | Compensation

Committee | Governance and

Nominating Committee |

•Financial Reporting Risk •Tax Risk •Legal Risk •Compliance Risk •Insurance Product Risk •Asset-Liability Matching Risk •Information Security Risk •Fraud Risk •Data Governance Risk | •Talent Risk (including Compensation and Benefits Risk and Incentive Risk) | •Health & Safety Risk •Governance Risk •Talent Risk

|

| | |

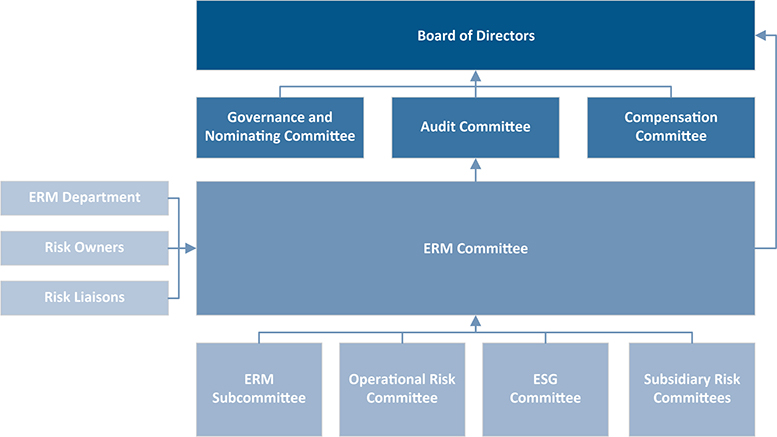

The Board oversees risk, in part, by regularly monitoring, receiving, and reviewing written and oral reports from and interacting with a senior management level Enterprise Risk Management (ERM) Committee chaired by the Company’s Chief Risk Officer. The Chair of the Audit Committee serves as the Board’s official liaison to the ERM Committee and attends its quarterly meetings as a non-voting member. Other Board members may attend such meetings and submit matters and issues to be considered and reported on by the ERM Committee.

Each of the Company’s insurance subsidiaries has a Subsidiary Risk Committee that provides information on key risks to the ERM Committee. These committees are responsible for implementing the Company’s ERM framework, maintaining a culture of risk management, and establishing risk-related policies and procedures at each subsidiary.

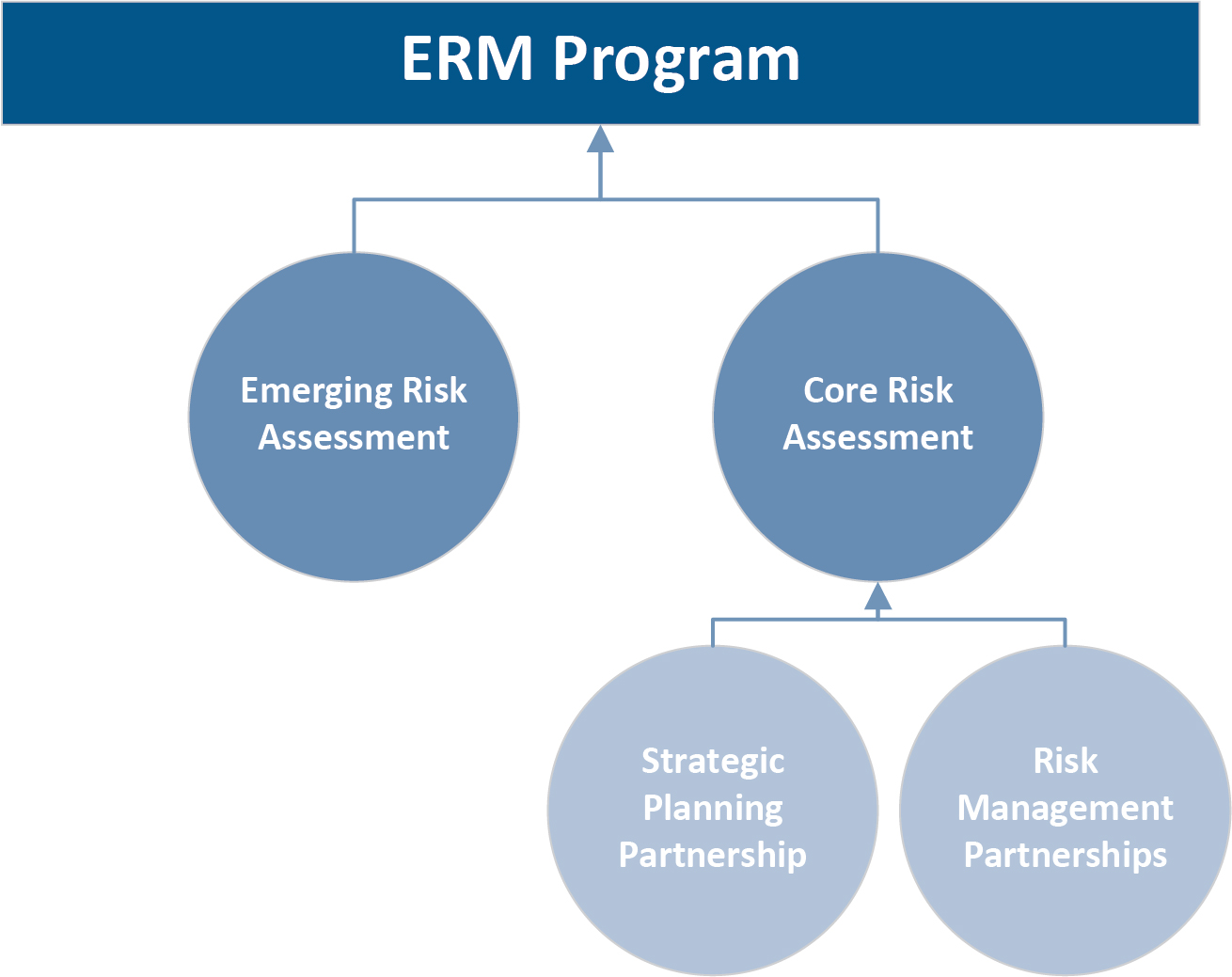

The Company's ERM Department aids the ERM Committee’s efforts to identify, assess and prioritize the Company’s most significant risks, while working directly with "risk owners" on mitigation, monitoring and reporting of such risks. This Department also supports the Company’s operational business units in evaluating and managing risk in their respective areas through facilitation of a variety of annual risk assessments. The "Emerging Risk Assessment" process begins with the ERM Department compiling emerging risk data from industry resources, then conducting workshops with leaders at various levels of management to discuss and identify the Company's top emerging risks. The results and proposed action plans are discussed with the ERM Committee and then shared with the Audit Committee. The ERM Department also coordinates the "Core Risk Assessment" process, which begins by hosting workshops with leaders at various levels of management to identify the most significant (or “core”) risks to the organization. Each of the core risks is scoped into a scenario-based risk assessment process with risk owners to determine risk scenarios and associated risk ratings, existing and planned mitigation, and key risk metrics. The risk assessments include collaboration with other internal departments principally focused on risk management as well as the department with primary responsibility for strategic planning. The core risks are also assessed in relation to the Company’s strategic priorities and objectives. The risk assessment results are reported to the Board at least annually to obtain their insight and guidance.

16 GL 2024 Proxy Statement

Risk Assessment Process

The Company has created a "risk liaison" network, consisting of key employees and leaders throughout the organization who have been designated as "risk liaisons." These individuals (numbering nearly 40 in 2023) are asked to participate in risk assessments and to report to senior management on current and emerging risks about which they become aware through the performance of their day-to-day job responsibilities, resulting in a bottom-up or mid-level-up enterprise-wide risk reporting environment.

The Company also has a Chief Compliance Officer who oversees the Regulatory Compliance Department, which is charged with tracking, reviewing and interpreting state, federal and international laws and regulations relevant to the Company's business operations. Through active management of periodic regulatory examinations of the Company's insurance subsidiaries, this department is well-positioned to identify regulatory risks that may need to be brought to the attention of the ERM Committee.

The Company has an Operational Risk Committee (formerly the "Security Risk Committee"), a sub-committee of the ERM Committee, that is chaired by the Chief Security Officer. This committee supports the ERM Committee's efforts, and in turn, the Board's efforts, to establish and authorize strategies for managing compliance and operational risks, in accordance with applicable legal and regulatory requirements and in alignment with the Company's business and strategic needs. Part of the committee's responsibilities include reviewing and evaluating risks associated with the confidentiality, integrity and availability of critical business systems and sensitive customer and Company data.

The Board believes the Company’s risk reporting structure, as discussed herein and illustrated in the following graphic, serves to ensure that the Board, its standing committees, and management maintain the communication and understanding necessary to cultivate a corporate culture in which risk awareness is pervasive and integral to management’s efforts to achieve the Company’s short-term operational and long-term strategic objectives.

17 GL 2024 Proxy Statement

Risk Reporting Structure

More information on the risks facing the Company may be found in Item 1A. Risk Factors of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as updated by subsequent SEC filings made by the Company.

Board Oversight of Cybersecurity Risk

The Board considers information security to be an enterprise-wide risk management issue and oversees material information security risks through the Audit Committee. The Company’s General Counsel and Chief Risk Officer, who chairs the ERM Committee, oversees the Company-wide ERM Program and execution of the Company's risk strategy, including cybersecurity risk. The Chief Information Security Officer (CISO), who reports to the General Counsel, spearheads the Company's efforts with respect to information security strategy, governance, risk and incident management. The Operational Risk Committee also provides executive-level direction with respect to implementation of the Company’s Information Security program.

The Audit Committee of the Board of Directors is briefed by the CISO on a quarterly basis. These quarterly briefings focus on relevant cybersecurity issues, including compliance with applicable regulations and current or planned changes to such regulations, an overview of current cyber threats, risk management activities, and discussion of cyber incident investigations that warrant the attention of the Board. The CISO also provides an annual update to the full Board on changes in cybersecurity, top threats facing the Company, key risks and mitigation efforts, and any material cybersecurity incidents. On a quarterly basis, the Chair of the Audit Committee updates the full Board on any information security topics brought before the Audit Committee.

Board Oversight of Sustainability and ESG

As part of their general responsibility for overseeing the Company’s corporate strategy and approach to enterprise risk management, the Board and its standing committees monitor and guide management’s implementation of ESG initiatives. The Board has emphasized the importance of considering ESG factors when management develops and implements the Company’s strategic objectives, underscoring the need to ensure the sustainability of the Company and its business operations and to create long-term value for its shareholders and other stakeholders. To ensure adequate Board-level attention is devoted to relevant ESG-related issues, the Board’s standing committees have assumed oversight of specific ESG topics that fall within their respective areas of responsibility, as described below.

To enable the Company to appropriately respond to ESG-related risks and opportunities, the Board and its committees regularly engage with senior management on ESG-related issues. Recent discussions have centered on topics such as: data privacy; cybersecurity; executive compensation; corporate culture; employee engagement; employee health and wellness; diversity, equity, and inclusion (DEI); talent acquisition and development; succession

18 GL 2024 Proxy Statement

planning; risks associated with the Company's information assets; investment portfolio risks; regulatory developments; and other considerations, as further discussed under Sustainable Business Practices. The Company's independent Lead Director has earned the Climate Leadership Certificate from Diligent Corporation, which is an asset in facilitating discussions at the Board level to address climate-related issues.

Since 2018, the Company has had an ESG Committee, a sub-committee of the ERM Committee, comprised of a cross-functional group of key leaders and internal subject matter experts, including but not limited to the Company’s Executive Vice President, General Counsel and Chief Risk Officer; Executive Vice President, Policy Acquisition and Chief Strategy Officer; Executive Vice President and Chief Investment Officer; Executive Vice President and Chief Talent Officer; Corporate Senior Vice President, Associate Counsel and Corporate Secretary; Divisional Senior Vice President, Risk and Chief Security Officer; Divisional Vice President, Enterprise Risk; Director of Facilities; and the Director of ESG. The ESG Committee typically meets quarterly and reports its activities regularly to the ERM Committee. The Company's Chief Risk Officer and Chair of the ERM Committee, in turn, provides quarterly updates to the Board with respect to risk-related topics and initiatives, including those that are ESG-related. This role facilitates a targeted ESG discussion with the Board at least annually.

The Company has a formal ESG function (the "ESG team") within the Enterprise Risk Management department, in support of the Company's ongoing commitment to embed ESG considerations into its business decision-making and risk management processes. The ESG team is responsible for helping to facilitate the Company’s ESG strategy and initiatives consistent with guidance provided by the ESG Committee and the Board. The ESG team also supports efforts to enhance the Company's ESG disclosures.

The Company’s ESG reporting structure to the Board is illustrated below. This structure is designed to allow for Board oversight of ESG-related issues that are material to the Company and facilitates the open communication and informed guidance necessary for diligent consideration and risk mitigation of ESG issues.

ESG Reporting Structure

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board of Directors | |

| | | | | | | | | |

Audit

Committee | | | Compensation

Committee | | | Governance and

Nominating Committee |

•Enterprise Risk Management •Data Privacy & Cybersecurity •Financial Accountability & Transparency •Climate Change Impact on Financial Risks | | | •Compensation & Benefits •Executive Compensation •Pay Equity •Diversity, Equity & Inclusion

| | | •Board/Committee Composition •Employee Health, Safety & Wellness •Corporate Culture, Employee Engagement •Employee Learning & Development •Leadership Development & Succession •Diversity, Equity & Inclusion •Human Rights •Ethical Business Practices |

| | | | | | | | | |

| | | | ERM Committee | | | | |

| | | | | | | |

| | | | | | | | | |

| | | | ESG Committee | | | | |

Governance Guidelines and Codes of Ethics

The Company has adopted Corporate Governance Guidelines, a Code of Ethics for the Co-CEOs and Senior Financial Officers, and a Code of Business Conduct and Ethics for its directors, officers, employees and contractors, all of which comply with the requirements of securities law, applicable regulations and New York Stock Exchange rules. These documents are available on the Company’s website at https://investors.globelifeinsurance.com under the Corporate Governance heading. Printed copies of these documents may be obtained at no charge by writing to the Corporate Secretary at 3700 South Stonebridge Drive, McKinney, Texas 75070.

19 GL 2024 Proxy Statement

Insider Trading Policy

The Company has adopted an Insider Trading Policy that governs the purchase, sale and other disposition of the Company’s securities by its directors, officers and employees. The Insider Trading Policy is reasonably designed to promote compliance with insider trading laws, rules and regulations and the NYSE Listing Standards.

Shareholder Engagement

We recognize that open and steady communication with our shareholders can allow us to better understand and remain responsive to the issues they prioritize and to gain valuable feedback on our corporate governance, performance and strategic initiatives.

We regularly engage with our shareholders. Our investor relations team routinely communicates with shareholders and investment analysts throughout the year through calls, meetings, investor conferences and other means. Such discussions regularly include senior executives, such as the Company’s Co-CEOs and the Chief Financial Officer, and conversations primarily focus on financial and operating performance, capital management and corporate strategy.

In addition to the foregoing discussions, in 2023 we reached out to the Company’s 25 largest shareholders, representing approximately 55% of our total outstanding shares, in order to solicit their feedback, if any, related to operational and governance issues pertinent to the Company. Of the nine shareholders who responded, six declined the engagement offer and we engaged in meaningful discussions with three shareholders.

Information about our outreach efforts and the feedback received from our investors was subsequently shared with the Company’s Board of Directors for its consideration.

Communications with the Board of Directors

Security holders of the Company and other interested parties may communicate with the full Board of Directors, the Lead Director, the independent directors, or a specific director or directors by writing to them in care of the Corporate Secretary at 3700 South Stonebridge Drive, McKinney, Texas 75070.

Executive Sessions of the Board

The Company’s independent directors meet in regularly-scheduled executive sessions without any participation by Company officers or employee directors. These executive sessions are currently held either before or after the Board’s regularly-scheduled physical meetings. Additional executive sessions can be scheduled at the request of the independent directors. The Lead Director presided over each of the executive sessions during 2023. If that director had not been present, another independent director would have been chosen by the independent directors to preside.

Board and Annual Shareholder Meeting Attendance

During 2023, the Board held four physical meetings, one videoconference meeting, and acted two times by unanimous written consent. In 2023, all of the directors attended at least 75% of the meetings of the Board and the committees on which they served.

The Company has a long-standing policy that the members of its Board be present at the Annual Meeting of Shareholders, unless they have an emergency, illness or an unavoidable conflict. At the April 27, 2023 Annual Meeting of Shareholders, all but one of the directors were present.

20 GL 2024 Proxy Statement

Committees of the Board of Directors

The Board has the following standing committees more fully described below: Audit, Compensation, and Governance and Nominating. The Board may also, from time to time, establish additional special committees.

The Board's Audit, Compensation, and Governance and Nominating Committees are currently comprised of the following members, each of whom is independent under the applicable rules and regulations of the SEC, the NYSE, and Section 16 of the Securities Exchange Act of 1934:

| | | | | | | | | | | |

| Director | Board Committees |

| Audit Committee | Compensation Committee | Governance and Nominating Committee |

| Linda L. Addison (L) | | | |

| Cheryl D. Alston | | | |

| Marilyn A. Alexander | | | |

| Mark A. Blinn | | | |

| James P. Brannen | | | |

Jane Buchan1 | | | |

| Alice S. Cho | | | |

| Steven P. Johnson | | | |

| David A. Rodriguez | | | |

| Mary E. Thigpen | | | |

Number of Meetings Held in 20232 | 11 | 5 | 4 |

| | |

(L) - Lead Director;  - Chair; - Chair;  - Member - Member 1 Scheduled to retire from the Board at the Annual Meeting on April 25, 2024. 2 The Audit Committee held 4 physical meetings and 7 teleconference meetings in 2023; the Compensation Committee held 5 physical meetings in 2023; and the Governance and Nominating Committee held 4 physical meetings in 2023. |