SCHEDULE 14A INFORMATION | ||||

| ||||

PROXY STATEMENT PURSUANT TO SECTION 14(a) | ||||

OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| ||||

| Filed by the Registrant | [X] | ||

| Filed by a Party other than the Registrant | [ ] | ||

| ||||

Check the appropriate box: | ||||

| ||||

[ ] | Preliminary Proxy Statement | |||

[ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

[X] | Definitive Proxy Statement | |||

[ ] | Definitive Additional Materials | |||

[ ] | Soliciting Material under Rule 14a-12 | |||

| ||||

| Fidelity Select Portfolios | |||

| (Name of Registrant as Specified In Its Charter) | |||

| ||||

Payment of Filing Fee (Check the appropriate box): | ||||

| ||||

[X] | No fee required. | |||

[ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total Fee Paid: | ||

[ ] | Fee paid previously with preliminary materials. | |||

[ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on November 16, 2010.

The Letter to Shareholders, Notice of Meeting, and Proxy Statement are available at www.accessmyproxy.com/fidelity.

HOME FINANCE PORTFOLIO

A FUND OF

FIDELITY® SELECT PORTFOLIOS®

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of Home Finance Portfolio:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the Meeting) of Home Finance Portfolio (the fund), a series of Fidelity Select Portfolios (the trust), will be held at an office of the trust, 245 Summer Street, Boston, Massachusetts 02210 (at the corner of Summer Street and Dorchester Avenue, across from Boston's South Station) on November 16, 2010, at 8:45 a.m. Eastern Time (ET). The purpose of the Meeting is to consider and act upon the following proposals, and to transact such other business as may properly come before the Meeting or any adjournments thereof.

1. To modify the fund's fundamental "invests primarily" policy (the investment policy concerning the fund's primary investments).

2. To modify the fund's fundamental concentration policy.

3. To change the fund from a diversified fund to a non-diversified fund.

The Board of Trustees has fixed the close of business on September 20, 2010 as the record date for the determination of the shareholders of the fund entitled to notice of, and to vote at, such Meeting and any adjournments thereof.

By order of the Board of Trustees,

SCOTT C. GOEBEL Secretary

September 20, 2010

Your vote is important - please vote your shares promptly.

Shareholders are invited to attend the Meeting in person. Any shareholder who does not expect to attend the Meeting is urged to vote using the touch-tone telephone or internet voting instructions found below or indicate voting instructions on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense,we ask your cooperation in responding promptly, no matter how large or small your holdings may be. If you wish to wait until the Meeting to vote your shares, you will need to request a paper ballot at the Meeting in order to do so.

INSTRUCTIONS FOR EXECUTING PROXY CARD

The following general rules for executing proxy cards may be of assistance to you and help avoid the time and expense involved in validating your vote if you fail to execute your proxy card properly.

1.Individual Accounts: Your name should be signed exactly as it appears in the registration on the proxy card.

2.Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration.

3.All other accounts should show the capacity of the individual signing. This can be shown either in the form of the account registration itself or by the individual executing the proxy card. For example:

|

| REGISTRATION | VALID SIGNATURE |

A. | 1) | ABC Corp. | John Smith, Treasurer |

| 2) | ABC Corp. | John Smith, Treasurer |

|

| c/o John Smith, Treasurer |

|

B. | 1) | ABC Corp. Profit Sharing Plan | Ann B. Collins, Trustee |

| 2) | ABC Trust | Ann B. Collins, Trustee |

| 3) | Ann B. Collins, Trustee | Ann B. Collins, Trustee |

C. | 1) | Anthony B. Craft, Cust. | Anthony B. Craft |

|

| f/b/o Anthony B. Craft, Jr. |

|

|

| UGMA |

|

INSTRUCTIONS FOR VOTING BY TOUCH-TONE TELEPHONE

OR THROUGH THE INTERNET

1. Read the proxy statement, and have your proxy card or notice handy.

2. Call the toll-free number or visit the web site indicated on your proxy card or notice.

3. Enter the number found either in the box on the front of your proxy card or on the proposal page of your notice.

4. Follow the recorded or on-line instructions to cast your vote.

SPECIAL MEETING OF SHAREHOLDERS OF

FIDELITY SELECT PORTFOLIOS: HOME FINANCE PORTFOLIO

TO BE HELD ON NOVEMBER 16, 2010

This Proxy Statement is furnished in connection with a solicitation of proxies made by, and on behalf of, the Board of Trustees of Fidelity Select Portfolios (the trust) to be used at the Special Meeting of Shareholders of Home Finance Portfolio(the fund) and at any adjournments thereof (the Meeting), to be held on November 16, 2010, at 8:45 a.m. ET at 245 Summer Street, Boston, Massachusetts 02210, an office of the trust and Fidelity Management & Research Company (FMR), the fund's investment adviser.

The purpose of the Meeting is set forth in the accompanying Notice. The solicitation is being made primarily by the mailing of this Proxy Statement and the accompanying proxy on or about September 20, 2010. Supplementary solicitations may be made by mail, telephone, telegraph, facsimile, electronic means or by personal interview by representatives of thetrust.In addition, D.F. King & Co., Inc. may be paid on a per-call basis to solicit shareholders by telephone on behalf of the fund at an anticipated cost of approximately $28,000. The fund may also arrange to have votes recorded by telephone. D.F. King & Co., Inc. may be paid on a per-call basis for vote-by-phone solicitations on behalf of the fund at an anticipated cost of approximately $1,000.

<R>If the fund records votes by telephone or through the internet, it will use procedures designed to authenticate shareholders' identities, to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their instructions have been properly recorded. Proxies voted by telephone or through the internet may be revoked at any time before they are voted.</R>

The expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations will be paid by the fund, provided the expenses do not exceed the fund's existing voluntary expense cap of 1.15%.

Expenses exceeding the fund's voluntary expense cap will be paid by FMR.

The fund will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares.

The principal business address of FMR, the fund's investment adviser and administrator, and FMR Co., Inc. (FMRC), sub-adviser to the fund, is 82 Devonshire Street, Boston, Massachusetts 02109. The principal business address of Fidelity Distributors Corporation (FDC), the fund's principal underwriter and distribution agent, is 82 Devonshire Street, Boston, Massachusetts 02109. Fidelity Management & Research (U.K.) Inc. (FMR U.K.), located at 10 Paternoster Square, 4th Floor, London, EC4M 7LS, United Kingdom; Fidelity Management & Research (Hong Kong) Limited (FMR H.K.), located at Floor 19, 41 Connaught Road Central, Hong Kong; Fidelity Management & Research (Japan) Inc. (FMR Japan), located at Kamiyacho Prime Place at 1-17, Toranomon-4-Chome, Minato-Ku, Tokyo, Japan; Fidelity Research & Analysis Company (FRAC), located at 82 Devonshire Street, Boston, Massachusetts 02109; FIL Investments Japan Limited (FIJ), located at Shiroyama Trust Tower, 4-3-1, Toranomon, Minato-ku, Tokyo 105-6019, Japan; FIL Investment Advisors (FIIA), located at Pembroke Hall, 42 Crow Lane, Pembroke HM19, Bermuda; and FIL Investment Advisors (U.K.) Ltd. (FIIA(U.K.)L), located at Oakhill House, 130 Tonbridge Road, Hildenborough, TN119DZ, United Kingdom are also sub-advisers to the fund.

If the enclosed proxy is executed and returned, or an internet or telephonic vote is delivered, that vote may nevertheless be revoked at any time prior to its use by written notification received by the trust, by the execution of a later-dated proxy, by the trust's receipt of a subsequent valid internet or telephonic vote, or by attending the Meeting and voting in person.

All proxies solicited by the Board of Trustees that are properly executed and received by the Secretary prior to the Meeting, and are not revoked, will be voted at the Meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on a properly executed proxy, it will be voted FOR the matters specified on the proxy. All shares that are voted and votes to ABSTAIN will be counted towards establishing a quorum, as will broker non-votes. (Broker non-votes are shares for which (i) the beneficial owner has not voted and (ii) the broker holding the shares does not have discretionary authority to vote on the particular matter.)

With respect to fund shares held in Fidelity individual retirement accounts (including Traditional, Rollover, SEP, SARSEP, Roth and SIMPLE IRAs), the IRA Custodian will vote those shares for which it has received instructions from shareholders only in accordance with such instructions. If Fidelity IRA shareholders do not vote their shares, the IRA Custodian will vote their shares for them, in the same proportion as other Fidelity IRA shareholders have voted.

One-third of the fund's outstanding voting securities entitled to vote constitutes a quorum for the transaction of business at the Meeting. If a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient votes to approve one or more of the proposed items are not received, or if other matters arise requiring shareholder attention, the persons named as proxy agents may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting or represented by proxy. When voting on a proposed adjournment, the persons named as proxy agents will vote FOR the proposed adjournment all shares that they are entitled to vote with respect to each item, unless directed to vote AGAINST an item, in which case such shares will be voted AGAINST the proposed adjournment with respect to that item. A shareholder vote may be taken on one or more of the items in this Proxy Statement prior to such adjournment if sufficient votes have been received and it is otherwise appropriate. Please visit www.fidelity.com/proxies to determine the status of this scheduled Meeting.

<R>On July 31, 2010 there were 10,934,292 shares of the fund issued and outstanding.</R>

<R>As of July 31, 2010, the nominees and officers of the trust owned, in the aggregate, less than 1% of the fund's outstanding shares.</R>

<R>To the knowledge of the trust, no shareholder owned of record or beneficially more than 5% of the outstanding shares of the fund on that date.</R>

FMR has advised the trust that certain shares are registered to FMR or an FMR affiliate. To the extent that FMR or an FMR affiliate has discretion to vote, these shares will be voted at the Meeting FOR each proposal. Otherwise, these shares will be voted in accordance with the plan or agreement governing the shares. Although the terms of the plans and agreements vary, generally the shares must be voted either (i) in accordance with instructions received from shareholders or (ii) in accordance with instructions received from shareholders and, for shareholders who do not vote, in the same proportion as certain other shareholders have voted.

Shareholders of record at the close of business on September 20, 2010 will be entitled to vote at the Meeting. Each such shareholder will be entitled to one vote for each dollar of net asset value held on that date, with fractional dollar amounts entitled to a proportional fractional vote.

For a free copy of the fund's annual report for the fiscal year ended February 28, 2010 call 1-800-544-8544, visit Fidelity's web site at www.fidelity.com, or write to FDC at 82 Devonshire Street, Boston, Massachusetts 02109.

VOTE REQUIRED: Approval of Proposals 1, 2, and 3requires the affirmative vote of a "majority of the outstanding voting securities" of thefund. Under the Investment Company Act of 1940 (1940 Act), the vote of a "majority of the outstanding voting securities" means the affirmative vote of the lesser of (a) 67% or more of the voting securities present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy or (b) more than 50% of the outstanding voting securities. With respect to each Proposal, votes to ABSTAIN and broker non-votes will have the same effect as votes cast AGAINST the Proposal.

If Proposals 1 and 2 are approved, the fund will compare its performance to the S&P® Consumer Finance Index and will be renamed Consumer Finance Portfolio.

The Board of Trustees, including the Independent Trustees, recommends modifying Home Finance Portfolio so that its investment policies include all types of consumer finance, such as auto loans, student loans, or credit cards, in addition to mortgages or related services. Broadening the fund's investment focus will result in a fund with more diverse holdings and provide greater exposure to faster growing industries like consumer finance, while reducing exposure to slower growing industries like mortgage finance. In addition, in order to preserve flexibility, the fund will change from a diversified fund to a non-diversified fund. This change would allow the fund to invest more of its assets in fewer issuers.

The fund's investment universe has shrunk substantially in recent years, and FMR believes the fund's narrow investment focus is unlikely to remain viable over the long term given the contraction in the home finance market.

Broadening the fund's focus to include companies involved in all types of consumer finance will expand the universe of potential investment opportunities. A broader investment theme may also enhance the fund's appeal, which could attract new investors, increase the fund's asset size, and potentially lower fund expenses over time. If shareholders do not approve the fundamental policy changes FMR will consider recommending other options to the fund's Board of Trustees, including liquidation or merger.

Currently, the fund invests primarily in companies providing mortgages and other consumer loans and related services associated with home finance. These companies include, for example, financial institutions providing mortgages and mortgage-related services.

If shareholders approve the Proposals that follow, the fund will broaden its focus to invest primarily in companies providing products or services associated with consumer finance. These companies may include, for example, financial institutions providing auto loans, credit cards, mortgages, student loans, or services related to these activities.

<R>The consumer finance industry can be significantly affected by governmental regulation, changing economic conditions, demand for consumer loans, interest rate changes and refinancing activity. Profitability can be largely dependent on the availability and cost of capital funds and the rate of consumer debt defaults, and can fluctuate significantly when interest rates change. Credit losses resulting from financial difficulties of borrowers can negatively affect the consumer finance industry. Companies in the consumer finance industry are subject to extensive governmental regulation, which can change frequently and may adversely affect the scope of their activities, the prices they can charge and the amount of capital they must maintain, or may affect them in other ways that are unforeseeable.</R>

In addition, if Proposals 1 and 2 are approved by shareholders, the fund will be renamed Consumer Finance Portfolio and the fund's benchmark will change from the MSCI® U.S. IM Thrifts & Mortgage Finance 25/50 Index to the S&P Consumer Finance Index. This new name will better reflect the fund's new investment focus and the new benchmark will provide shareholders with a more meaningful benchmark they can use to evaluate performance. The S&P Consumer Finance Index includes 50 of the largest companies trading on the U.S. stock exchanges whose primary business is related to consumer finance.

Top ten holdings and index holdings categories for the fund's current and proposed benchmark index are shown on the next page. A fund's benchmark index is illustrative of its potential investment universe, and the top ten holdings and index holdings categories comparison provides some indication of how the fund's investment universe may change. The fund may or may not hold any of the securities named on the next page.

Comparison of Index Constituents as of June 30, 2010 | |

MSCI U.S. IM Thrifts & Mortgage Finance | S&P Consumer Finance |

Astoria Financial Corp. | American Express Co. |

First Niagara Finl Group Inc. | Annaly Mortgage Management |

Hudson City Bancorp Inc. | Comerica Inc (MI) |

MGIC Investment Corp. | Discover Financial Services |

New York Community | Hudson City Bancorp Inc. |

Newalliance Bancshares Inc. | M&T Bank Corp |

Northwest Bancshares Inc. | MasterCard Inc. (Cl A) |

Peoples United Financial Inc. | New York Community |

TFS Financial Corp. | PNC Financial Services Group Inc. |

Washington Federal Inc. | Visa Inc. |

Bold text indicates constituents in both benchmarks, though not necessarily in the top 10 of both.

Comparison of Index Constituents by Category | |||

MSCI U.S. IM Thrifts & | S&P Consumer Finance | ||

Thrifts & Mortgage Finance | 100% | Regional Banks | 24% |

|

| Thrifts & Mortgage Finance | 21.6% |

|

| Consumer Finance | 19.9% |

|

| Mortgage REITS | 10.1% |

|

| Data Processing & Outsourced Svcs | 9.5% |

|

| Diversified Banks | 8.1% |

|

| Other Diversified | 6.2% |

|

| Specialized Finance | 0.7% |

|

| Asset Management & Custody Banks | 0% |

|

| Investment Banking & Brokerage | 0% |

|

| Multi-Line Insurance | 0% |

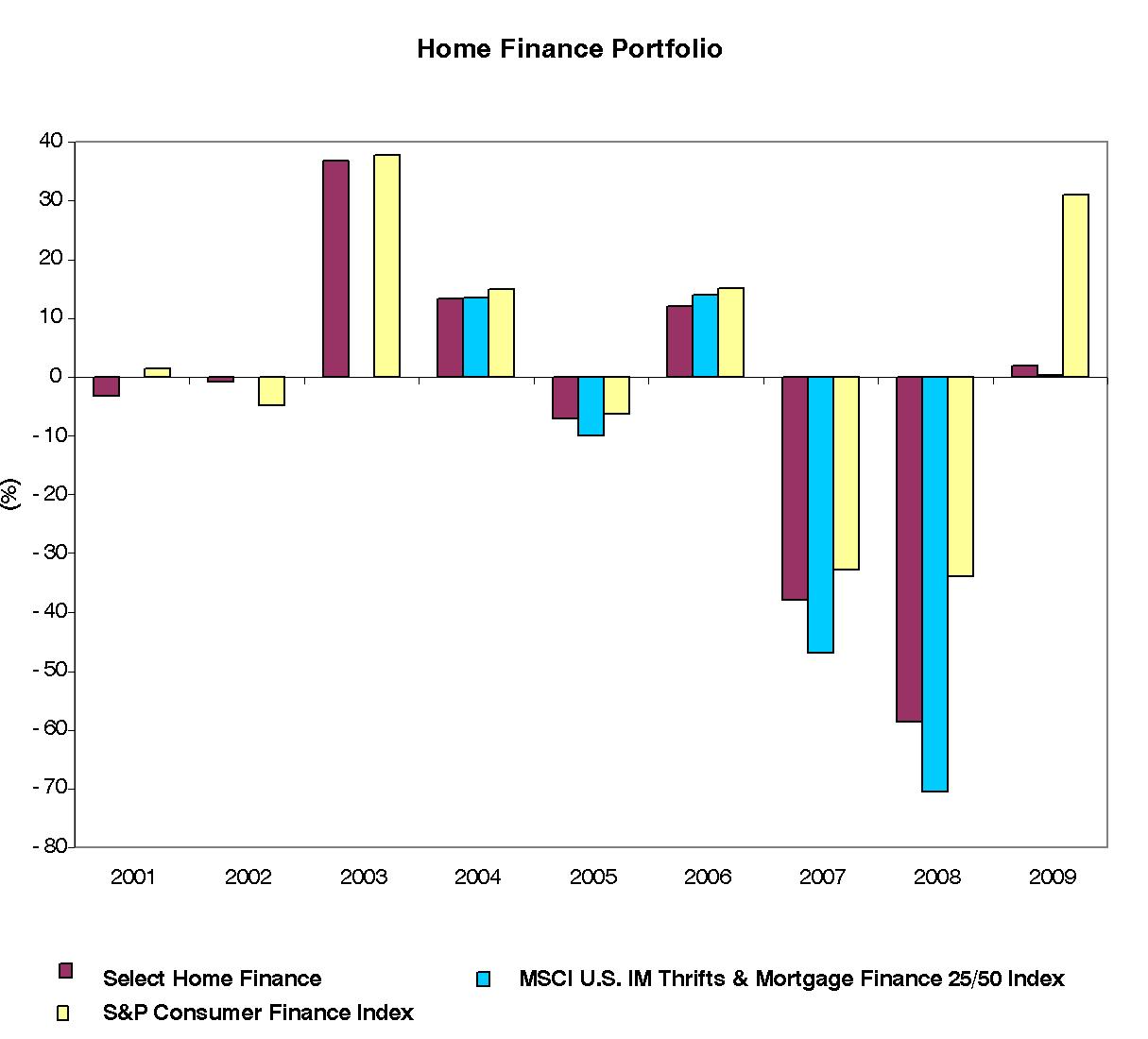

The following graph and chart below compare the fund's performance to its current and proposed benchmarks. The current and proposed indices provide a representation of the fund's current and proposed investment universe and this chart allows you to compare the performance and volatilityof these representations over time.

Performance information is shown for the Home Finance Portfolio, the MSCI U.S. IM Thrifts & Mortgage Finance 25/50 Index, and the S&P Consumer Finance Index. The MSCI U.S. IM Thrifts & Mortgage Finance 25/50 Index is a modified market capitalization-weighted index of stocks designed to measure the performance of Thrifts & Mortgage Finance companies in the MSCI U.S. Investable Market 2500 Index. Index returns shown for periods prior to January 1, 2010 are returns of the MSCI U.S. Investable Market Thrifts & Mortgage Finance Index. The MSCI U.S. Investable Market Thrifts & Mortgage Finance Index is a market capitalization-weighted index of stocks designed to measure the performance of Thrifts & Mortgage Finance companies in the MSCI U.S. Investable Market 2500 Index. The inception date of the MSCI U.S. Investable Market Thrifts & Mortgage Finance Index is April 30, 2003. The S&P Consumer Finance Index includes 50 of the largest companies trading on the U.S. stock exchanges whose primary business is related to consumer finance.

During the periods shown in the chart: | Highest Return | Lowest Return |

Home Finance Portfolio | 30.96% | -25.20% |

MSCI U.S. IM Thrifts & Mortgage Finance 25/50 Index | 15.81% | -40.59% |

S&P Consumer Finance Index | 34.99% | -28.17% |

The fund will compare its performance to the S&P Consumer Finance Index and be renamed Consumer Finance Portfolio, and its new policies will take effect on the first day of the month following shareholder approval.

If Proposals 1 and 2 are approved, the fund also will change its name test policy. The fund's current name test policy is to normally invest at least 80% of assets in securities of companies principally engaged in providing mortgages and other consumer loans and related services associated with home finance. The fund's new name test policy will be to normally invest at least 80% of assets in securities of companies principally engaged in providing products and services associated with consumer finance.

The changes to the fund's benchmark, name, and name test policy will not take effect unless Proposals 1 and 2 are approved. If Proposals 1 and 2 are approved, these changes will take place regardless of whether Proposal 3 is approved.

1. To modify the fund's fundamental "invests primarily" policy (the investment policy concerning the fund's primary investments).

The fund's current fundamental investment policy concerning its primary investments states that the fund "invests primarily in companies providing mortgages and other consumer loans and related services associated with home finance."

The Trustees recommend that shareholders of the fund vote to modify this fundamental investment policy to state that the fund "invests primarily in companies providing [mortgages and other consumer loans and related services associated with home finance]products and services associated with consumer finance." (proposed additional language isunderlined, deleted language is [bracketed]).

The primary purpose of the proposal is to facilitate positioning the fund to broaden its investment policies, as explained above. If the proposal is approved, the modified fundamental investment policy cannot be changed again without the approval of shareholders.

CONCLUSION. The Trustees recommend voting FOR the Proposal. Proposals 1 and 2 are contingent proposals, so if shareholders of the fund approve only one of those proposals, the fundamental policy change approved will not take effect because the other proposal was not also approved. Neither Proposal 1 nor 2 are contingent upon proposal 3, so if shareholders of the fund approve Proposals 1 and 2 but not Proposal 3, the fundamental policy changes approved will still take effect.

2. To modify the fund's fundamental concentration policy.

The fund's current fundamental investment policy concerning the concentration of its investments within a single industry states: "The fund may not purchase the securities of any issuer if, as a result, less than 25% of the fund's total assets would be invested in the securities of issuers principally engaged in the thrifts and mortgage finance industries."

The Trustees recommend that shareholders of the fund vote to modify this fundamental investment policy to state: "The fund may not purchase the securities of any issuer if, as a result, less than 25% of the fund's total assets would be invested in the securities of issuers principally engaged in the [thrifts and mortgage finance industries]consumer finance industry." (proposed additional language isunderlined, deleted language is [bracketed]).

The primary purpose of the proposal is to facilitate positioning the fund to broaden its investment policies, as explained above. If the proposal is approved, the modified fundamental concentration policy cannot be changed again without the approval of shareholders.

CONCLUSION. The Trustees recommend voting FOR the Proposal. Proposals 1 and 2 are contingent proposals, so if shareholders of the fund approve only one of those proposals, the fundamental policy change approved will not take effect because the other proposal was not also approved. Neither Proposal 1 nor 2 are contingent upon proposal 3, so if shareholders of the fund approve Proposals 1 and 2 but not Proposal 3, the fundamental policy changes approved will still take effect.

3. To change the fund from a diversified fund to a non-diversified fund.

The Board of Trustees, including all of the Independent Trustees, has approved, and recommends that the shareholders of the fund approve, the elimination of the fund's fundamental policy concerning diversification so that the fund would be allowed to operate as a "non-diversified" fund. This change would mean that the fund would be able to focus its investments more heavily in securities of fewer issuers, assuming shareholders approve this proposal.

Generally, diversification reduces risk and non-diversification increases risk. For an extended period of time, the fund has operated as a diversified fund. You are being asked to change the fund from diversified, to non-diversified, or to make it potentially a riskier fund.

The point of this proposal is to empower the fund's investment manager - FMR - to decide to allocate risk in relation to expected return with the freedom to invest larger portions of the fund's portfolio in a single issuer - potentially up to 25% in one issuer, and potentially as much as 25% in a second issuer.

This flexibility will allow the fund to take over 5% positions that in the aggregate exceed 25% of fund assets. FMR believes that this increased investment flexibility may provide opportunities to enhance the fund's performance; however, if FMR invests a significant percentage of the fund's assets in a single issuer, the fund's performance would be closely tied to the market value of that issuer, and could be more volatile (riskier) than the performance of diversified funds. Investing a larger percentage of the fund's assets in a single issuer's securities increases the fund's exposure to credit and other risks associated with that issuer's financial condition and business operations. FMR will use this increased flexibility to acquire larger positions in the securities of a single issuer only if and when it believes doing so justifies the risks involved.

The fund currently is "diversified," as defined in the 1940 Act. As a 1940 Act diversified fund, the fund must invest at least 75% of its assets so that no more than 5% of its total assets is invested in the securities of any issuer. As to the remaining 25% of total assets, there is no limitation on the amount of assets the fund may invest in a single issuer. The principal difference between a diversified fund and a non-diversified fund is that a non-diversified fund may invest over 5% of assets in a greater number of issuers.

The fund's current fundamental diversification limitation is as follows:

"The fund may not with respect to 75% of the fund's total assets, purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, or securities of other investment companies) if, as a result, (a) more than 5% of the fund's total assets would be invested in the securities of that issuer, or (b) the fund would hold more than 10% of the outstanding voting securities of that issuer."

Because the above investment policy is fundamental, it cannot be changed or eliminated without shareholder approval. The Trustees, including all of the Independent Trustees, recommend that shareholders vote to eliminate the above limitation.

If shareholders approve this proposal, FMR may operate the fund as non-diversified or it may not. FMR will reserve the freedom of action to operate the fund as non-diversified only if and when it would be in shareholders' best interests to do so, provided that if FMR does not operate the fund as non-diversified within three years of shareholder approval, 1940 Act rules will require FMR to again seek shareholder approval to reserve the freedom of action to operate the fund as non-diversified.

If shareholders approve this proposal, the Trustees, including all of the Independent Trustees, intend to adopt the following non-fundamental limitation concerning diversification:

"In order to qualify as a "regulated investment company" under Subchapter M of the Internal Revenue Code of 1986, as amended, the fund currently intends to comply with certain diversification limits imposed by Subchapter M."

Under Subchapter M (the tax code), the fund is now (and will remain) restricted to holding 25% of its assets in any one issuer and to holding no more than two 25% positions. The tax code requirements are generally applied at the end of each quarter of the fund's taxable year.

The proposal would - as a legal matter - also allow the fund to hold a greater number of over 10% positions in the voting securities of an issuer. FMR does not currently expect that approval of this proposal will materially affect the way in which the fund is managed with regard to the number of over 10% positions.

Conclusion.The Trustees recommend voting FOR the Proposal. If this Proposal is not approved by the shareholders of the fund, the fund will continue to operate as a diversified fund. Proposal 3 is not contingent upon Proposals 1 and 2, so if shareholders of the fund approve Proposal 3 it will take effect regardless of whether shareholders of the fund approve Proposals 1 and 2.

OTHER BUSINESS

The Board knows of no other business to be brought before the Meeting. However, if any other matters properly come before the Meeting, it is the intention that proxies that do not contain specific instructions to the contrary will be voted on such matters in accordance with the judgment of the persons therein designated.

SUBMISSION OF CERTAIN SHAREHOLDER PROPOSALS

The trust does not hold annual shareholder meetings. Shareholders wishing to submit proposals for inclusion in a proxy statement for a subsequent shareholder meeting should send their written proposals to the Secretary of the Fund, attention "Fund Shareholder Meetings," 82 Devonshire Street, Mailzone V10A, Boston, Massachusetts 02109. Proposals must be received a reasonable time before the fund begins to print and send its proxy materials to be considered for inclusion in the proxy materials for the meeting. Timely submission of a proposal does not, however, necessarily mean the proposal will be included. With respect to proposals submitted on an untimely basis and presented at a shareholder meeting, persons named as proxy agents will vote in their discretion.

NOTICE TO BANKS, BROKER-DEALERS AND

VOTING TRUSTEES AND THEIR NOMINEES

Please advise the trust, in care of Fidelity Investments Institutional Operations Company, Inc., 100 Salem St., Smithfield, RI, 02197, whether other persons are beneficial owners of shares for which proxies are being solicited and, if so, the number of copies of the Proxy Statement and Annual Reports you wish to receive in order to supply copies to the beneficial owners of the respective shares.

Fidelity and Select Portfolios are registered trademarks of FMR LLC.

The third party marks appearing above are the marks of their respective owners.

1.917559.100 | \\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\ | SELHF-pxs-0910 |

Form of Proxy Card: Home Finance Portfolio

|

|

|

|

| |

| Fidelity Investments®(logo) |

|

Vote this proxy card TODAY! Your prompt response will save the expense of additional mailings. |

| |

|

|

|

| ||

| PO Box 673023 Dallas, TX 75267-3023 |

|

| ||

|

|

|

|

| |

|

|

|

| |

|

|

| LOG-ON: | Vote on the internet atwww.2voteproxy.com/proxyand follow the on-screen instructions. |

|

|

| CALL: | To vote by phone call toll-free1-800-597-7836 and follow the recorded instructions. |

|

|

|

|

|

| [Control Number prints here] |

| MAIL: | Return the signed proxy card in the enclosed envelope. |

|

|

|

|

|

[TRUST NAME: FUND NAME Prints Here]

PROXY SOLICITED BY THE TRUSTEES

The undersigned, revoking previous proxies, hereby appoint(s) Edward C. Johnson 3d, Margaret A. Carey, and Alan J. Lacy, or any one or more of them, attorneys, with full power of substitution, to vote all shares of the fund as indicated above which the undersigned is entitled to vote at the Special Meeting of Shareholders of the fund to be held at an office of the trust at 245 Summer Street, Boston, MA 02210, on November 16, 2010, at 8:45 a.m. Eastern Time and at any adjournments thereof. All powers may be exercised by a majority of said proxy holders or substitutes voting or acting or, if only one votes and acts, then by that one. This Proxy shall be voted on the proposals described in the Proxy Statement as specified on the reverse side. Receipt of the Notice of the Meeting and the accompanying Proxy Statement is hereby acknowledged.

........................................................................... | ........................................................................... |

| |

........................................................................... | .................................................. | PLEASE SIGN, DATE, AND RETURN PROMPTLY IN ENCLOSED ENVELOPE IF YOU ARE NOT VOTING BY PHONE OR INTERNETDated_______________ | |

|

........................................................................... | ........................................................................... |

Signature(s) (Title(s), if applicable) (Sign in the Box) NOTE: Please sign exactly as your name appears on this Proxy. When signing in a fiduciary capacity, such as executor, administrator, trustee, attorney, guardian, etc., please so indicate. Corporate or partnership proxies should be signed by an authorized person indicating the person's title. | |

| ........................................................................... |

| |

<R>........................................................................... | ........................................................................... | SELHF-PXC-0910-1.03</R>

| |

Please refer to the Proxy Statement discussion of each of these matters.

IF THE PROXY IS SIGNED, SUBMITTED, AND NO SPECIFICATION IS MADE, THE PROXY SHALL BE VOTEDFOR THE PROPOSALS.

As to any other matter, said attorneys shall vote in accordance with their best judgment.

THE BOARD OF TRUSTEES RECOMMENDS A VOTEFOR EACH OF THE FOLLOWING:

Please fill in box(es) as shown using black or blue ink or number 2 pencil. [X] PLEASE DO NOT USE FINE POINT PENS. | ||||||

|

| FOR | AGAINST | ABSTAIN | ||

1. | To modify the fund's fundamental "invests primarily" policy (the investment policy concerning the fund's primary investments). | (_) | (_) | (_) | ||

2. | To modify fund's fundamental concentration policy. | (_) | (_) | (_) | ||

3. | To change the fund from a diversified fund to a non-diversified fund. | (_) | (_) | (_) | ||

| PLEASE SIGN ON REVERSE SIDE |

|

| |

<R> |

|

| SELHF-PXC-0910-1.01</R> | |

Proxy Materials

PLEASE CAST YOUR VOTE NOW!

Home Finance Portfolio

Dear Shareholder:

A special meeting of shareholders of Home Finance Portfolio will be held on November 16, 2010. The purpose of the meeting is to provide you with the opportunity to vote on three important proposals that affect the fund and your investment in it. As a shareholder, you have the opportunity to voice your opinion on the matters that affect your fund. This package contains information about the proposals and the materials to use when casting your vote.

Please read the enclosed materials and cast your vote on the proxy card(s).Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be.

The proposals have been carefully reviewed by the Board of Trustees. The Trustees, most of whom are not affiliated with Fidelity, are responsible for protecting your interests as a shareholder. The Trustees believe these proposals are in the interests of shareholders. They recommend that you votefor each proposal.

The following Q&A is provided to assist you in understanding the proposals. Each of the proposals is described in greater detail in the enclosed proxy statement.

Voting is quick and easy. Everything you need is enclosed. To cast your vote, simply complete the proxy card(s) enclosed in this package. Be sure to sign the card(s) before mailing it in the postage-paid envelope. You may also vote your shares by touch-tone telephone or through the Internet. Simply call the toll-free number or visit the web site indicated on your proxy card(s), enter the control number found on the card(s), and follow the recorded or online instructions.

If you have any questions before you vote, please call Fidelity at 1-800-544-8544. We'll be glad to help you get your vote in quickly. Thank you for your participation in this important initiative.

Sincerely,

(The chairman's signature appears here.)

Edward C. Johnson 3d

Chairman and Chief Executive Officer

Important information to help you understand and vote on the proposals

Please read the full text of the proxy statement. Below is a brief overview of the proposals to be voted upon. Your vote is important. We appreciate you placing your trust in Fidelity and look forward to helping you achieve your financial goals.

What proposalsam I being asked to vote on?

You are being asked to modify certain fundamental policies in an effort to broaden the focus of Home Finance Portfolio to include companies providing products and services associated with consumer finance, such as auto loans, credit cards, student loans or services related to these activities, in addition to those that provide mortgages or related services. Specifically, you are being asked to vote on the following proposals:

1. To modify the fund's fundamental "invests primarily" policy (the investment policy concerning the fund's primary investments).

2. To modify the fund's fundamental concentration policy.

3. To change the fund from a diversified fund to a non-diversified fund.

What will happen to the Fund if the proposals are approved?

If the proposals are approved by shareholders, the fund will invest at least 80% of its assets in securities of companies principally engaged in providing products and services associated with consumer finance, and will have the flexibility to invest a significant portion of its assets in a small number of individual issuers. The fund also will be renamed Consumer Finance Portfolio and will adopt a new supplemental performance benchmark, the S&P® Consumer Finance Index. We believe this new name will reflect the fund's new investment focus and the new benchmark will provide shareholders with a more meaningful benchmark they can use to evaluate performance.

Will these changes affect the way the fund is managed?

Yes, if approved by shareholders, the fund will adopt revised investment policies that broaden its focus from companies that provide mortgages or related services, to also include those that engage in consumer lending activities such as auto loans, student loans or credit cards or services related to these activities.

If shareholders approve the third proposal, the fund will change from a diversified fund to a non-diversified fund, giving the fund greater investment flexibility and the ability to focus its investments more heavily in securities of fewer issuers. Most other Fidelity Select Portfolios are also non-diversified.

The fund's investment objective - to seek capital appreciation - will not change.

Why are you proposing these changes?

The fund's investment universe has shrunk substantially in recent years. As evidence of this change, the market capitalization of the MSCI® U.S. IM Thrifts & Mortgage Finance 25/50 Index dropped from $223 billion in January 2007 to $41 billion as of May 2010, limiting the investment opportunities within the fund's current universe. Fidelity believes that, given the contraction in the home finance market, the fund and its shareholders will benefit from a broadened focus and larger array of investment opportunities.

When will these changes be effective?

If approved by shareholders, we expect that these changes will take effect on December 1, 2010, or on the first day of the month following shareholder approval of the proposals in the proxy statement.

Do all of the proposals need to be approved in order for the fund to change?

No. Proposals 1 and 2 are contingent proposals, so if shareholders of the fund approve only one of those proposals, the fundamental policy change approved will not take effect because the other contingent proposal was not also approved. However, neither proposal 1 nor 2 is contingent upon proposal 3, so if shareholders of the fund approve proposals 1 and 2 but not proposal 3, the fundamental policy changes approved will still take effect. If shareholders approve proposal 3, it will take effect regardless of whether shareholders approve proposals 1 and 2.

Has the fund's Board of Trustees approved the proposals?

Yes. The Board of Trustees has unanimously approved the proposals and recommends that you vote to approvethem.

I also received an "Important Notice Regarding Change in Investment Policy." What is this?

This separate notice pertains to a change in the fund's "name test" policy. The name test policy requires the fund to invest at least 80% of its assets in investments suggested by its name. We are legally required to give shareholders at least 60 days' advance notice of a change in a fund's name test policy. If proposals 1 and 2 are approved by shareholders, the proposed change in the fund's name test policy will take effect on the first day of the month following shareholder approval of the proposals contained in the proxy statement.

What if there are not enough votes to reach quorum by the scheduled shareholder meeting date or if the proposals are not approved?

To facilitate receiving a sufficient number of votes, we will need to take further action. D.F. King & Co., Inc., a proxy solicitation firm, or Fidelity, may contact you by mail or telephone. Therefore, we encourage shareholders to vote as soon as they review the enclosed proxy materials to avoid additional mailings or telephone calls.

If there are not sufficient votes to approve the proposals by the time of the shareholder meeting (November 16, 2010), the meeting may be adjourned to permit further solicitation of proxy votes.

Please be advised that if shareholders do not approve the proposals, FMR and the Board of Trustees will evaluate other possible options for the fund, potentially including liquidation or merger.

Who is D.F. King & Co., Inc.?

D.F. King is a third party proxy vendor that Fidelity hires to call shareholders and record proxy votes. In order to hold a shareholder meeting, quorum must be reached. If quorum is not attained, the meeting may adjourn to a future date. Fidelity attempts to reach shareholders via multiple mailings to remind them to cast their vote. As the meeting approaches, phone calls may be made to clients who have not yet voted their shares so that the shareholder meeting does not have to be postponed.

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to make a call to you to solicit your vote.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each dollar of net asset valueyou own of the fund on the record date (with fractional dollar amounts entitled to a proportional fractional vote). The record date is September 20, 2010.

How do I vote my shares?

You can vote your shares by completing and signing the enclosed proxy card(s) and mailing it in the enclosed postage-paid envelope. You may also vote by touch-tone telephone by calling the toll-free number printed on your proxy card(s) and following the recorded instructions. In addition, you may vote through the internet by visiting the web site indicated on your proxy card and following the on-line instructions. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call Fidelity at1-800-544-8544.

How do I sign the proxy card?

Individual Accounts: Shareholders should sign exactly as their names appear on the account registration shown on the card.

Joint Accounts: Either owner may sign, but the name of the person signing should conform exactly to a name shown in the registration.

All Other Accounts: The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, "Ann B. Collins, Trustee."

(fidelity_logo_graphic)

82 Devonshire Street, Boston, MA 02109

SELHF-pxl-0910 1.917560.100

Form of D.F. King email to be sent to a shareholder that has consented to receive proxy solicitations electronically

You have elected to receive Proxy Materials via the Internet. This e-mail notification contains information relating to Proxy Materials that are available for the Fidelity fund(s) that are maintained in your account and that are identified below. Please read these instructions carefully before proceeding.

NOTICE OF AVAILABILITY OF IMPORTANT PROXY MATERIALS:

Proxy Materials are available for the following shareholders' meeting.

[Insert Trust Name]

Special Meeting of Shareholders

Meeting date: [Month]/[Date]/[Year]

[If the original meeting has been adjourned to a new date the e-mail will include:Adjourned meeting date: [Month]/[Date]/[Year]

For shareholders as of: [Month]/[Date]/[Year]

You can access these Proxy Materials at the following Web address[es]:

LETTER TO SHAREHOLDERS, NOTICE OF MEETING, and PROXY STATEMENT: http://www.XXXXXXXXXX

[If proxy materials include a 35d-1 Notice (Name Test Policy Buckslip) the email will also include:BUCKSLIP: http://www.XXXXXXXXXX]

[If proxy materials are for a merger proxy the email will also include:PROSPECTUS: http://www.XXXXXXXXXX]

If your e-mail software supports it, you can simply click on the above link[s]. If not, you can type (or copy and paste) the Web address[es] into the address line of your Web browser.

HOW TO VOTE:

Because electronic Proxy Materials do not include a proxy card that you can mail in, you will need to cast your vote through the Internet or by touchtone telephone. Either way, you will need the CONTROL number(s) below.

TRUST NAME: FUND NAME -

[TRUST NAME: FUND NAME PRINTS HERE]

CONTROL NUMBER: XXXXX (use this number to cast your vote)

[TRUST NAME: FUND NAME -

[TRUST NAME: FUND NAME PRINTS HERE]]

[CONTROL NUMBER: XXXXX] (use this number to cast your vote)

To vote through the Internet, visithttp://www.2voteproxy.com/eproxy and follow the on-line instructions.

To vote by touchtone telephone, call 1-800-597-7836 and follow the recorded instructions.

ADDITIONAL INFORMATION:

To access the electronic Proxy Materials, you may need Adobe Acrobat Reader software. This software is available for download at no cost athttp://www.adobe.com. Downloading time may be slow.

If you are invested in a Fidelity fund and have technical questions about viewing, saving, or printing your Proxy Materials, please call 1-800-544-6666 and press "0" to speak to a Fidelity Representative. Operating hours are Monday through Friday 8:00 am to 12:00 am ET, and Saturday 8:00 am to 6:30 pm ET.

If you are invested in a Fidelity Advisor Fund and have technical questions about viewing, saving, or printing your Proxy Materials, please call 1-877-208-0098. Operating hours are Monday through Friday 8:30 am to 7:00 pm ET.

To request a paper copy of Proxy Materials relating to a Fidelity fund, please contact Fidelity at the toll-free telephone number listed in the electronic Proxy Materials.

To update your enrollment information or cancel your enrollment, please go to:http://www.investordelivery.com/proxy, enter your enrollment number and PIN, and follow the on-line instructions for updating or canceling your enrollment.

National Financial Services LLC

Fidelity Investments Institutional Operations Company, Inc.

Buckslip to be sent to a shareholder that has consented to receive proxy solicitations electronically but in attempting to deliver an email failure occurred:

We were unable to notify you electronically of the availability of important Proxy Materials for a Fidelity fund maintained in your account. We attempted to send the notice to your e-mail address, as reflected on our records. That e-mail address appears to be invalid.

To correct your e-mail address, please visithttp://www.investordelivery.com/proxy and follow the on-line instructions. To do this, you will need your Enrollment Number and PIN.

If you do not remember your Enrollment Number or PIN, please visithttp://www.2voteproxy.com/proxy and follow the on-line instructions for enrolling for electronic delivery of Proxy Materials. To do this, you will need your Control Number from the enclosed proxy card.

Because we were unable to send the notice to you electronically, we are sending this notice and the related Proxy Materials (enclosed) to you in paper form. You will continue to receive Proxy Materials in paper form until you provide us with a valid e-mail address by one of the methods described above. You will start receiving electronic Proxy Materials again once you have provided us with a valid e-mail address.

Please read the enclosed Proxy Materials and vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be.

FORM OF

SCRIPT FOR REGISTERED SHAREHOLDER TOUCH-TONE TELEPHONE VOTING

FIDELITY INVESTMENTS

Speech 1 |

Welcome. - (Spoken only when call initially answered) Please enter the control number located in the box on the upper portion of your proxy card. |

Speech 2 |

To vote as the[Fund Name]Board of Trustees recommends on [the/all] proposal[s], press 1 now. To vote on [the/each] proposal separately, press 0 now. |

If user presses 1 go to Closing A, ELSEIF caller presses 0 go to Speech 3

Closing A |

You voted as the Board of Trustees recommended for [the/every] proposal affecting your fund. If correct, press 1. If incorrect, press 0. |

If the user presses 1 go to Speech 8, ELSEIF caller presses 0 go to Speech 2

Speech 3 |

Proposal 1: To vote FOR, press 1; AGAINST, press 9, ABSTAIN, press 0 |

Go to Closing B

Speech 4 |

Proposal 2: To vote FOR, press 1; AGAINST, press 9, ABSTAIN, press 0 |

Go to Closing B

Speech 5 |

Proposal 3: To vote FOR all nominees, press 1. To WITHHOLD for all nominees, press 9. To WITHHOLD for an individual nominee, press 0.

|

If caller presses 0 go to Speech 5a, ELSEIF go to Closing B

Speech 5a |

Enter the two-digit number that appears next to the nominee you DO NOT wish to vote for. |

Speech 5b |

Press 1 to withhold for another nominee or Press 0 if you have completed voting for Trustees. |

If caller presses 1 go to Speech 5a, ELSEIF the caller presses 0 go to Closing B

Speech 6 |

Proposal 4: To vote FOR, press 1; AGAINST, press 9, ABSTAIN, press 0 |

Go to Closing B

Speech 7 |

Proposal 5: To vote FOR, press 1; AGAINST, press 9, ABSTAIN, press 0 |

Go to Closing B

FORM OF

SCRIPT FOR REGISTERED SHAREHOLDER TOUCH-TONE TELEPHONE VOTING

FIDELITY INVESTMENTS

Closing B |

Your vote(s) [has/have] been cast as follows: (Vote for each proposal is given).

If this is correct, Press 1. If incorrect, Press 0. |

If caller presses 1 go to Speech 8, ELSEIF the caller presses 0 go to Speech 2

Speech 8 |

If you have received more than one proxy card, you must vote each card separately. If you would like to vote another proxy, press 1 now. To end this call, press 0 now. |

If caller presses 1 go to Speech 1, ELSEIF the caller presses 0 go to Speech 9

Speech 9 |

Thank you for voting. |

FORM OF

SCREEN SCRIPT FOR REGISTERED SHAREHOLDER INTERNET VOTING

FIDELITY INVESTMENTS

[Upon login to www.2voteproxy.com/proxy shareholder sees Screen 1]

SCREEN 1

Text 1 - (centered)

Internet Proxy Voting Service

Input A

Please Enter Control Number from Your ProxyCard:

Input B

Check here [ ] to vote all proposals as the Board recommends,

then click the VOTE button below.

-OR-

Input C

To vote each proposal separately, click the VOTE button only.

[VOTE]

Input D

To enroll for electronic delivery, without voting your proxy, please enter your control number above and click[ENROLL]

Input E

Note: Electronic Proxy Materials may not be available for all of your securities and accounts.

Graphic I - Example Proxy Card (left justified)

Text 2 - (right justified)

2voteproxy.com is a service of:

The Colbent Corporation

Full service proxy specialists

This site is best viewed using

Internet Explorer Versions 6.0 or higher

using a display resolution of 800 X 600 or higher.

Graphic II - (right justified)

[Upon input of control number and selection of input B or input C shareholder is directed to 2voteproxy Voting Ballot (Screen 2) ]

SCREEN 2

Text 1 - (centered)

Internet Proxy Voting Service

Proxy Voting Form

Fidelity Investments

[Trust Name: Fund Name]

Text 2 - (centered)

THE BOARD OF TRUSTEES RECOMMENDS A VOTEFOR EACH OF THE FOLLOWING:

Input A - (left justified)

Proposal 1. | [Title of proposal to be inserted] | [FOR][AGAINST][ABSTAIN] |

Input B - (left justified)

Proposal 2. | [Title of proposal to be inserted] | [FOR][AGAINST][ABSTAIN] |

Input C - (left justified)

Proposal 3. | [Title of proposal to be inserted] | [FOR all nominees][WITHHOLD AUTHORITY to vote for all nominees] [FOR ALL NOMINEES (Except as indicated)] |

Input D - (left justified)

Proposal 4. | [Title of proposal to be inserted] | [FOR][AGAINST][ABSTAIN] |

Input E - (left justified)

Proposal 5. | [Title of proposal to be inserted] | [FOR][AGAINST][ABSTAIN] |

Text 3 - (centered)

Please refer to the proxy statement for discussion of [each of these/this] matter[s].

If no specification is made on a proposal, the proposal will be voted "For".

Input F - (centered)

You will have an opportunity to confirm that your selections were properly recorded after you submit your vote. If you would like to receive an email confirmation, enter your email address here:

Text 4- (centered)

Please review your selections carefully before voting.

If you vote more than once on the same Proxy, only your last (most recent) vote will be considered valid.

Input G - (centered)

Click here to sign and [Submit] your proxy vote and to appoint [insert proxy agent names], or any one or more of them, attorneys, with full power of substitution, to vote all Fund shares that you are entitled to vote.

[Upon submission of vote shareholder is directed to 2voteproxy Confirmation Screen (Screen 3)]

SCREEN 3

Text 1 - (centered)

Internet Proxy Voting Service

Proxy Voting Form

Fidelity Investments

[Trust Name: Fund Name]

Thank you! Your vote has been submitted.

Text 2 - (centered)

THE BOARD OF TRUSTEES RECOMMENDS A VOTEFOR EACH OF THE FOLLOWING

Text 3 - (left justified)

Proposal 1. | [Title of proposal to be inserted] | [FOR][AGAINST][ABSTAIN] |

Proposal 2. | [Title of proposal to be inserted] | [FOR][AGAINST][ABSTAIN] |

Proposal 3. | [Title of proposal to be inserted] | [FOR all nominees][WITHHOLD AUTHORITY to vote for all nominees] [FOR all nominees (Except as indicated)] |

Proposal 4. | [Title of proposal to be inserted] | [FOR][AGAINST][ABSTAIN] |

Proposal 5. | [Title of proposal to be inserted] | [FOR][AGAINST][ABSTAIN] |

Text 4 - (centered)

Please refer to the proxy statement for discussion of [each of these/this] matter[s].

Text 5 - (centered)

[If no email confirmation was requested]: No email confirmation has been sent.

[If email confirmation was requested ]: An email with confirmation of this vote will be sent to: [email address]

Text 6 - (centered)

Note: Electronic Proxy Materials may not be available for all of your securities and accounts.

Hyperlink 1 - (centered)

[Register for Electronic Delivery]

[Directs shareholder to electronic delivery sign-up screen(s)]

Hyperlink 2 - (left justified)

[Change Vote]

[Directs shareholder to Screen 2 to change vote]

Hyperlink 3 - (centered)

[Printer Friendly Confirmation]

[If shareholder selects printer friendly confirmation, a confirmation in the following form appears that the shareholder can print]

Form Of

2voteproxy Printer Friendly Confirmation

Text - (left justified)

Internet Proxy Voting Service

Thank you! Your vote has been submitted.

- ---------------------------------------------------------------------------------

Your vote for Control Number [control number] has been submitted to

Fidelity Investments for [trust name: fund name] as follows:

Proposal 1. [proposal title].......... [FOR] [AGAINST][ABSTAIN]

Proposal 2. [proposal title].......... [FOR] [AGAINST][ABSTAIN]

Proposal 3. [proposal title].......... [FOR all nominees] [WITHHOLD AUTHORITY to vote for all nominees][FOR allnominees (Except as indicated)]

Proposal 4. [proposal title].......... [FOR] [AGAINST][ABSTAIN]

Proposal 5. [proposal title].......... [FOR] [AGAINST][ABSTAIN]

Click here to Return [When shareholder clicks he/she is returned to Screen 3]

Hyperlink 4 -(right justified)

[Vote Another Proxy]

[If shareholder selects vote another proxy he/she will return to Screen 1]

Hyperlink 5 -(centered)

[Exit Internet Proxy Voting Service]

[If shareholder selects exit internet proxy voting service he/she will return to Screen 1]

[If shareholder requests email confirmation, a confirmation in the following form will be sent to the designated email address]

Form Of

2voteproxy Email Confirmation

Text - (left justified)

Your vote for Control Number [control number] has been submitted to Fidelity Investments for

[trust name: fund name] as follows:

- ---------------------------------------------------------------------------------

Proposal 1. [proposal title].......... [FOR] [AGAINST][ABSTAIN]

Proposal 2. [proposal title].......... [FOR] [AGAINST][ABSTAIN]

Proposal 3. [proposal title].......... [FOR all nominees] [WITHHOLD AUTHORITY to vote for all nominees][FOR all nominees (Except as indicated)]

Proposal 4. [proposal title].......... [FOR] [AGAINST][ABSTAIN]

Proposal 5. [proposal title].......... [FOR] [AGAINST][ABSTAIN]

- ---------------------------------------------------------------------------------

Thank you for voting.

FORM OF

PROXY MATERIAL ACCESS SITE

FIDELITY INVESTMENTS

[Upon login to www.accessmyproxy.com/fidelity shareholder sees Screen 1]

SCREEN 1

Text 1 - D.F. King logo (left justified)

D.F. KING

Graphic 1 - brown building (left justified)

Hyperlink 1 - >> vote my shares(left justified)

[Upon selecting hyperlink shareholder is directed to the registered shareholder internet proxy voting site to vote shares electronically]

Graphic 2 - American Flag displayed on gray building (right justified)

Text 2 - (centered)

Welcome to the Materials Access Site for Fidelity® Investments

Table 1 - (centered)

[Table appears here that contains active links to PDF copies of proxy and related materials for this campaign and previous proxy campaigns mailed and tabulated by D.F. King & Co., Inc.]

Text 5 - (centered) ©2010 D.F. King & Co., Inc.

Important Notice Regarding Change in Investment Policy

The following changes will take effect on the first day of the month following shareholder approval of the proposals contained in the proxy statement dated September 20, 2010. To determine whether the proposal was approved by shareholders, visitwww.fidelity.com after November 16, 2010.

Current name test policy | New name | New name test policy | Nature of Change | |

Home Finance Portfolio | normally invests at least 80% of its assets in securities of companies principally engaged in providing mortgages and other consumer loans and related services associated with home finance | Consumer Finance Portfolio | normally invests at least 80% of its assets in securities of companies principally engaged in providing products and services associated with consumer finance | Broaden the fund's investment focus to result in a fund with more diverse holdings and provide greater exposure to faster growing industries like consumer finance, while reducing exposure to slower growing industries like mortgage finance |

SELHF-buck-0910 | \\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\\ | 1.917561.100 |