UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | February 28 |

Date of reporting period: | February 28, 2005 |

Item 1. Reports to Stockholders

Fidelity®

Select Portfolios®

Consumer Sector

Consumer Industries

Food and Agriculture

Leisure

Multimedia

Retailing

Annual Report

February 28, 2005

(2_fidelity_logos) (Registered_Trademark)

Contents

Shareholder Expense Example | ||

Fund Updates* | ||

Consumer Sector | ||

Consumer Industries | ||

Food and Agriculture | ||

Leisure | ||

Multimedia | ||

Retailing | ||

Notes to Financial Statements | ||

Report of Independent Registered Public Accounting Firm | ||

Trustees and Officers | ||

Distributions | ||

Proxy Voting Results |

* Fund updates for each Select Portfolio include: Performance, Management's Discussion of Fund Performance, Investment Summary, Investments, and Financial Statements.

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) website at www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR Corp. or an affiliated company.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent quarterly holdings report, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com/holdings.

NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on redemptions or certain exchanges of shares purchased prior to October 12, 1990, redemption fees and exchange fees, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2004 to February 28, 2005).

Actual Expenses

The first line of the table below for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Hypothetical Example for Comparison Purposes

The second line of the table below for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Beginning | Ending | Expenses Paid | |

Consumer Industries Portfolio | |||

Actual | $ 1,000.00 | $ 1,141.80 | $ 6.21 |

HypotheticalA | $ 1,000.00 | $ 1,018.99 | $ 5.86 |

Food and Agriculture Portfolio | |||

Actual | $ 1,000.00 | $ 1,152.20 | $ 5.60 |

HypotheticalA | $ 1,000.00 | $ 1,019.59 | $ 5.26 |

Leisure Portfolio | |||

Actual | $ 1,000.00 | $ 1,138.00 | $ 5.25 |

HypotheticalA | $ 1,000.00 | $ 1,019.89 | $ 4.96 |

Multimedia Portfolio | |||

Actual | $ 1,000.00 | $ 1,127.20 | $ 5.54 |

HypotheticalA | $ 1,000.00 | $ 1,019.59 | $ 5.26 |

Retailing Portfolio | |||

Actual | $ 1,000.00 | $ 1,126.50 | $ 5.48 |

HypotheticalA | $ 1,000.00 | $ 1,019.64 | $ 5.21 |

A 5% return per year before expenses

* Expenses are equal to each Fund's annualized expense ratio (shown in the table below); multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Annualized | |

Consumer Industries Portfolio | 1.17% |

Food and Agriculture Portfolio | 1.05% |

Leisure Portfolio | .99% |

Multimedia Portfolio | 1.05% |

Retailing Portfolio | 1.04% |

Annual Report

Performance

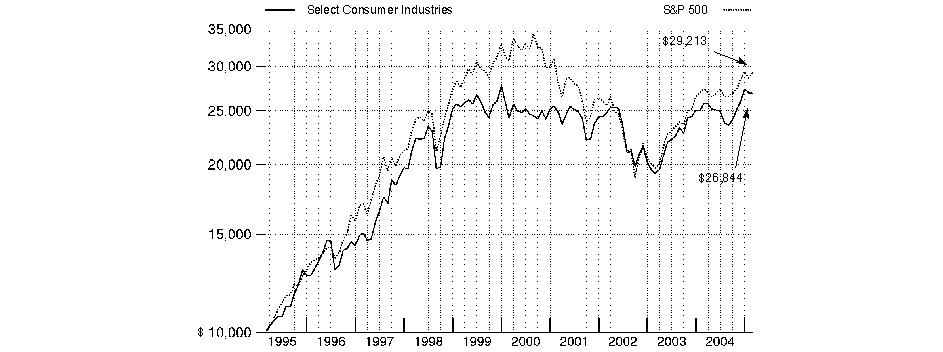

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity a fund's total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

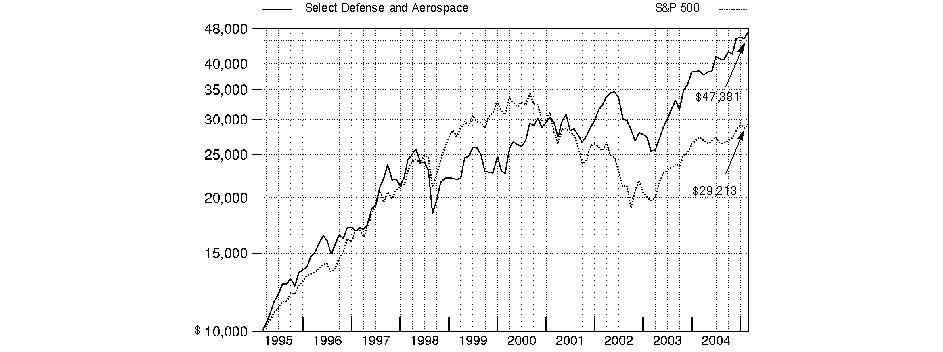

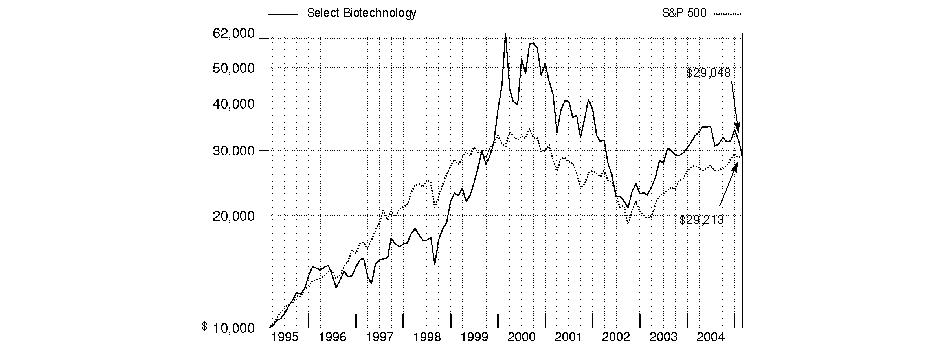

Average Annual Total Returns

Periods ended February 28, 2005 | Past 1 | Past 5 | Past 10 |

Select Consumer Industries | 4.18% | 2.06% | 10.38% |

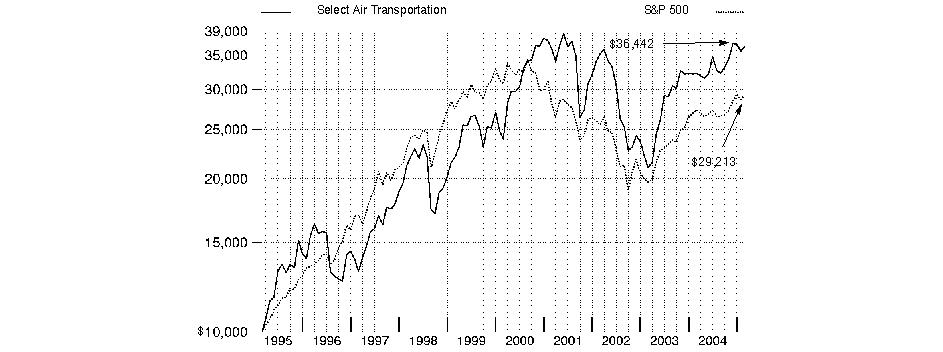

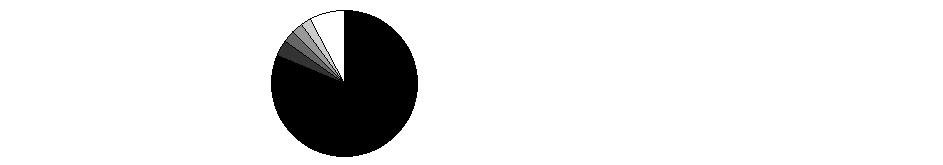

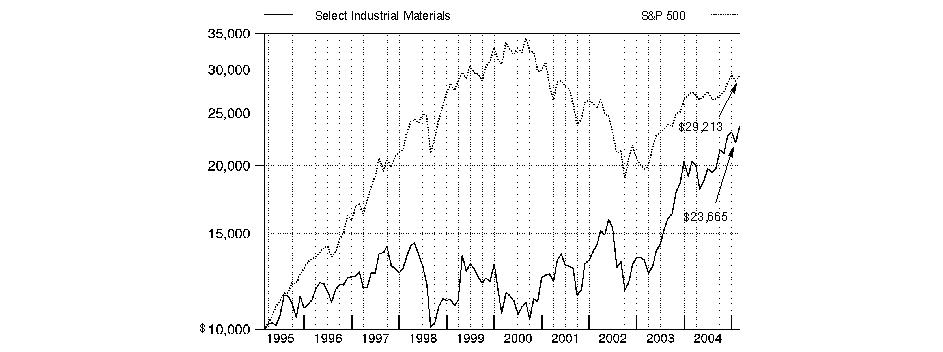

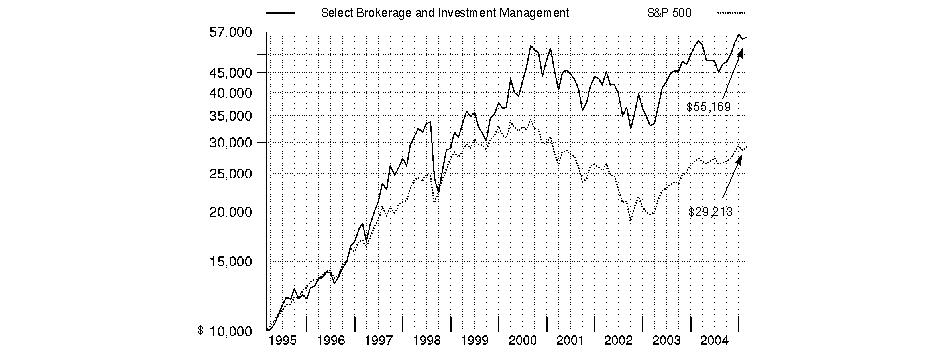

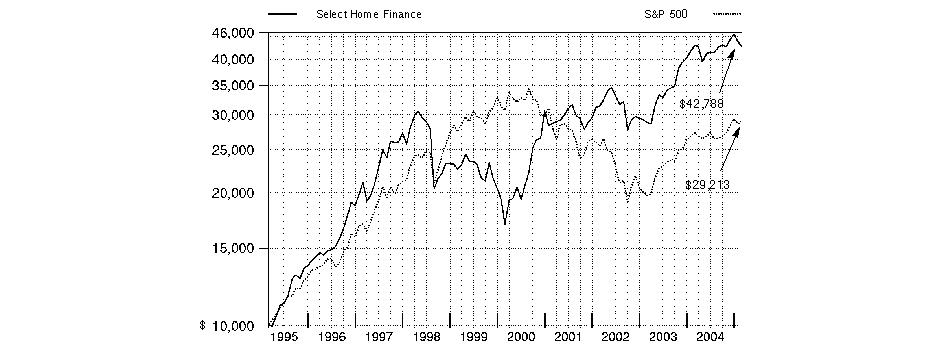

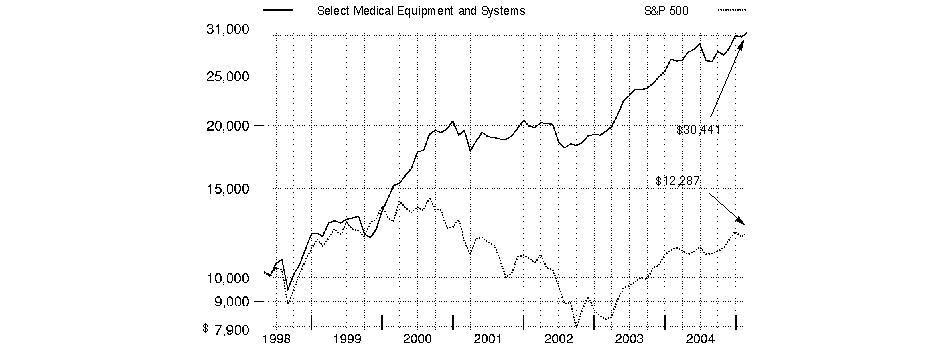

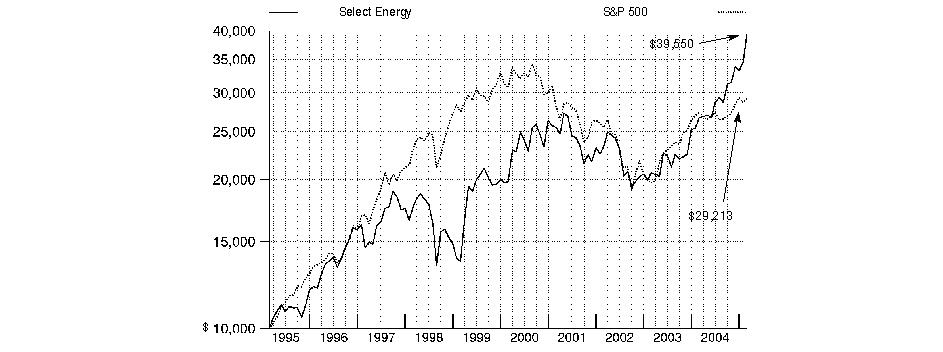

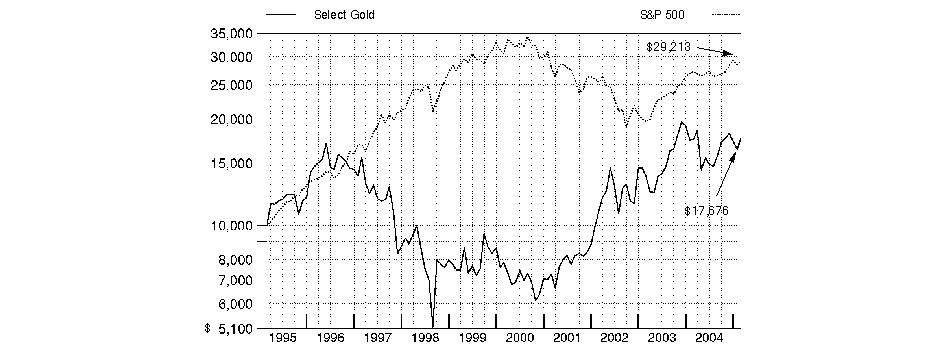

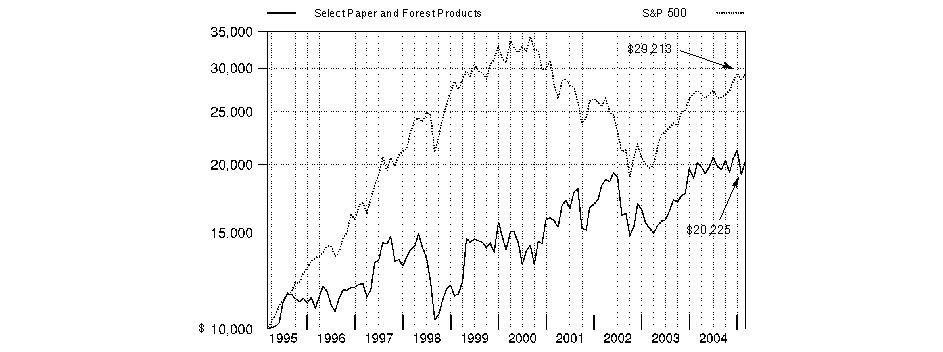

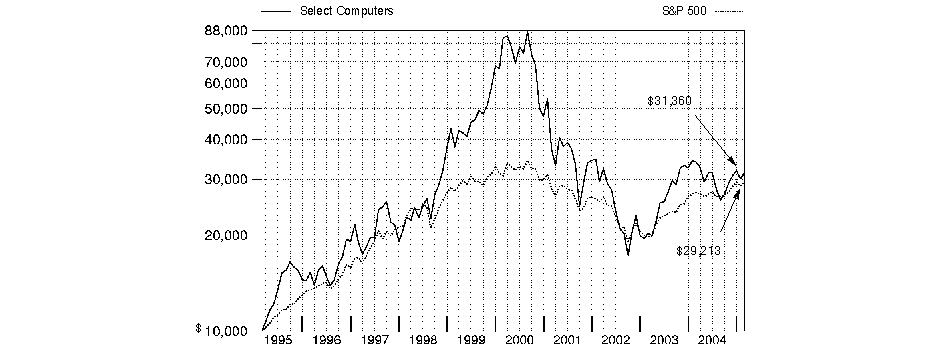

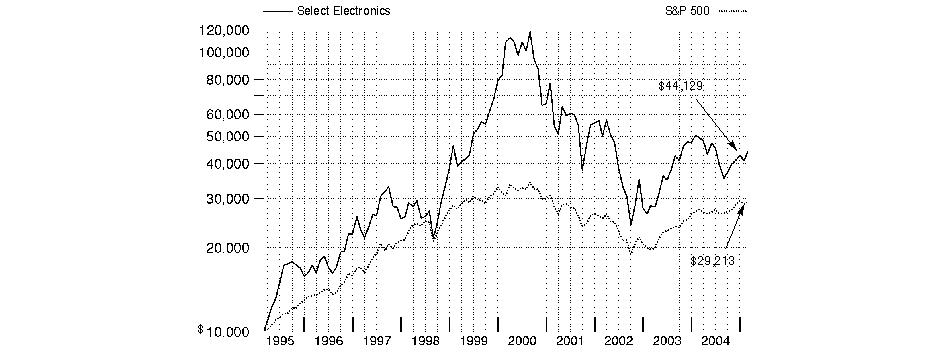

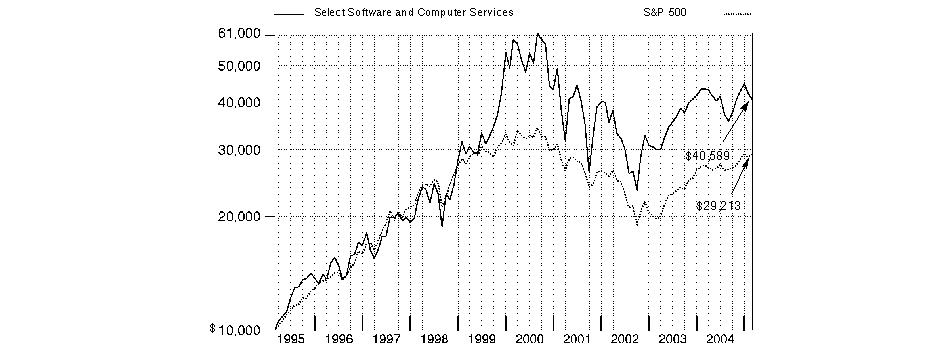

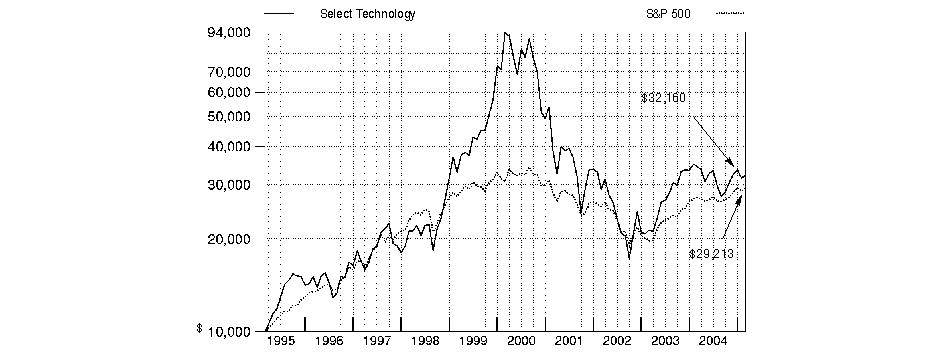

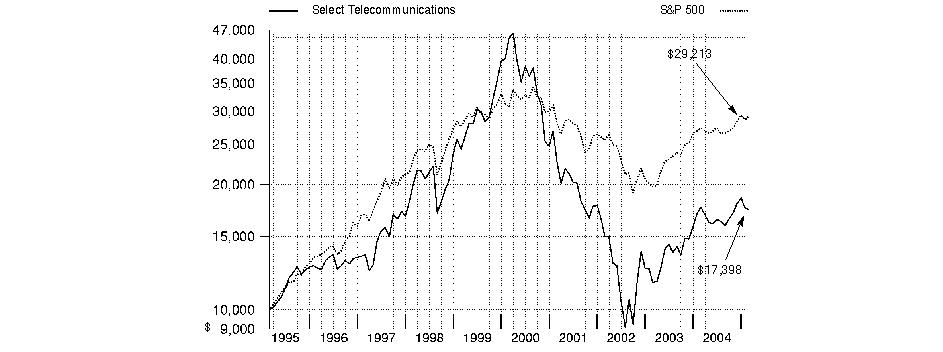

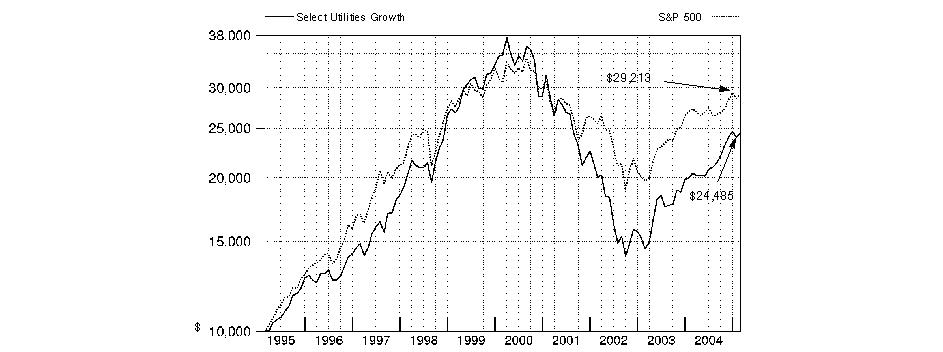

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity® Select Consumer Industries Portfolio on February 28, 1995. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

Consumer Industries Portfolio

Management's Discussion of Fund Performance

Comments from John Roth, Portfolio Manager of Fidelity® Select Consumer Industries Portfolio

Stocks got off to a shaky start in the first month of the new year, but most major equity benchmarks managed to cling to their gains for the 12 months ending February 28, 2005. Small-cap stocks continued a six-year-plus run of outperforming large-caps, as the small-cap Russell 2000® Index gained 9.53% during the period, compared to 6.98% for the larger-cap Standard & Poor's 500SM Index. Mid-caps were among the market's biggest gainers, highlighted by the 14.98% rise in the Russell Midcap® Index. Turning to investment styles, value significantly outdistanced growth. The Russell 3000® Value Index advanced 13.71%, versus 1.47% for the Russell 3000 Growth Index. Energy was the best-performing sector, spurred by record-high oil prices. Technology fared worst, despite a strong rally in the fourth quarter of 2004. However, a good portion of that gain was wiped out in January and February, leaving the tech-heavy NASDAQ Composite® Index with a modest 1.64% increase for the one-year period. Large-cap blue-chip stocks fared somewhat better, but the 3.96% return of the Dow Jones Industrial AverageSM was well under its historical average of roughly 11%.

For the 12-month period ending February 28, 2005, the fund returned 4.18%, trailing the Goldman Sachs® Consumer Industries Index's 5.97% gain and the S&P 500®. The fund's performance lagged its sector benchmark due mainly to its overweighted position in poor-performing media stocks. In particular, broadcasting stocks were held back as the recovery in advertising spending did not meet the market's expectations. On the positive side, the fund's overweighted positions in selected Internet portals and specialty retailers were strong contributors to performance. Individual detractors included doughnut franchiser Krispy Kreme, which struggled as its growth rate decelerated and the profitability of its stores declined. Amazon.com's stock performance also lagged, as the company focused on investing in new product categories to grow its business longer term, disappointing investors who expected faster near-term earnings growth. Looking at contributors, American Eagle Outfitters was a great example of a retailer that executed its business strategy well. Internet search provider Google also was a major contributor. After a successful initial public offering, the stock rose as the company reported earnings that handily beat investors' expectations.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Consumer Industries Portfolio

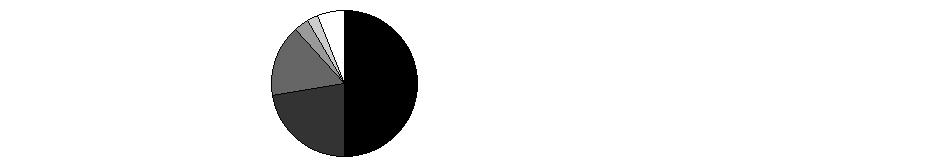

Investment Summary

Top Ten Stocks as of February 28, 2005 | |

% of fund's | |

News Corp. Class A | 3.6 |

Procter & Gamble Co. | 3.3 |

Target Corp. | 3.0 |

McDonald's Corp. | 3.0 |

Omnicom Group, Inc. | 2.7 |

Google, Inc. Class A (sub. vtg.) | 2.6 |

Wal-Mart Stores, Inc. | 2.5 |

Walt Disney Co. | 2.4 |

eBay, Inc. | 2.1 |

Yahoo!, Inc. | 2.1 |

27.3 | |

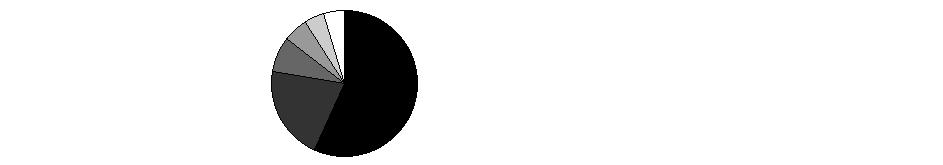

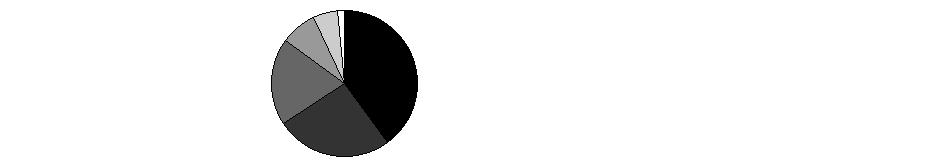

Top Industries as of February 28, 2005 | |||

% of fund's net assets | |||

| Media | 16.5% | |

| Hotels, Restaurants & Leisure | 15.9% | |

| Specialty Retail | 10.2% | |

| Multiline Retail | 5.6% | |

| Food & Staples Retailing | 5.6% | |

| All Others * | 46.2% | |

* Includes short-term investments and net other assets. |

Annual Report

Consumer Industries Portfolio

Investments February 28, 2005

Showing Percentage of Net Assets

Common Stocks - 95.8% | |||

Shares | Value (Note 1) | ||

AUTOMOBILES - 1.5% | |||

Harley-Davidson, Inc. | 6,300 | $ 389,844 | |

Thor Industries, Inc. | 5,600 | 199,360 | |

TOTAL AUTOMOBILES | 589,204 | ||

BEVERAGES - 3.1% | |||

PepsiCo, Inc. | 7,800 | 420,108 | |

The Coca-Cola Co. | 18,700 | 800,360 | |

TOTAL BEVERAGES | 1,220,468 | ||

CHEMICALS - 0.5% | |||

Monsanto Co. | 3,500 | 205,730 | |

COMMERCIAL SERVICES & SUPPLIES - 3.6% | |||

Apollo Group, Inc. Class A (a) | 7,700 | 567,028 | |

Bright Horizons Family Solutions, Inc. (a) | 3,596 | 247,692 | |

Cendant Corp. | 14,700 | 325,164 | |

PHH Corp. (a) | 785 | 16,485 | |

R.R. Donnelley & Sons Co. | 2,800 | 92,988 | |

Strayer Education, Inc. | 1,600 | 169,232 | |

TOTAL COMMERCIAL SERVICES & SUPPLIES | 1,418,589 | ||

ELECTRICAL EQUIPMENT - 0.4% | |||

Evergreen Solar, Inc. (a) | 25,400 | 150,368 | |

FOOD & STAPLES RETAILING - 5.6% | |||

Costco Wholesale Corp. | 9,700 | 451,923 | |

CVS Corp. | 6,700 | 333,861 | |

Safeway, Inc. (a) | 15,200 | 279,680 | |

Sysco Corp. | 100 | 3,442 | |

Wal-Mart Stores, Inc. | 19,300 | 996,073 | |

Walgreen Co. | 2,400 | 102,792 | |

Whole Foods Market, Inc. | 600 | 61,692 | |

TOTAL FOOD & STAPLES RETAILING | 2,229,463 | ||

FOOD PRODUCTS - 4.6% | |||

Bunge Ltd. | 7,700 | 421,267 | |

Dean Foods Co. (a) | 9,440 | 326,152 | |

Fresh Del Monte Produce, Inc. | 6,500 | 193,960 | |

Groupe Danone sponsored ADR | 4,800 | 95,520 | |

Nestle SA ADR | 1,600 | 110,160 | |

Smithfield Foods, Inc. (a) | 15,100 | 514,155 | |

SunOpta, Inc. (a) | 5,200 | 33,178 | |

The J.M. Smucker Co. | 3,100 | 152,396 | |

TOTAL FOOD PRODUCTS | 1,846,788 | ||

HOTELS, RESTAURANTS & LEISURE - 15.9% | |||

Aristocrat Leisure Ltd. (d) | 10,200 | 87,043 | |

Boyd Gaming Corp. | 100 | 4,901 | |

Brinker International, Inc. (a) | 7,070 | 267,670 | |

Buffalo Wild Wings, Inc. (a) | 5,954 | 224,466 | |

Shares | Value (Note 1) | ||

Caesars Entertainment, Inc. (a) | 6,900 | $ 138,414 | |

Carnival Corp. unit | 9,800 | 532,924 | |

CBRL Group, Inc. | 2,900 | 124,149 | |

Ctrip.com International Ltd. ADR (a) | 4,000 | 154,200 | |

Hilton Hotels Corp. | 10,300 | 216,918 | |

International Game Technology | 6,100 | 185,806 | |

International Speedway Corp. Class A | 1,100 | 58,630 | |

Kerzner International Ltd. (a) | 2,000 | 127,880 | |

Krispy Kreme Doughnuts, Inc. (a)(d) | 31,100 | 170,428 | |

Las Vegas Sands Corp. | 100 | 4,790 | |

McDonald's Corp. | 36,000 | 1,190,880 | |

MGM MIRAGE (a) | 4,000 | 296,680 | |

Outback Steakhouse, Inc. | 9,200 | 413,172 | |

Royal Caribbean Cruises Ltd. | 8,100 | 382,725 | |

Starbucks Corp. (a) | 3,600 | 186,516 | |

Starwood Hotels & Resorts Worldwide, Inc. unit | 10,700 | 612,468 | |

Station Casinos, Inc. | 1,400 | 85,316 | |

Wendy's International, Inc. | 9,520 | 360,332 | |

WMS Industries, Inc. (a) | 2,000 | 59,980 | |

Wyndham International, Inc. Class A (a) | 191,500 | 160,860 | |

Yum! Brands, Inc. | 5,300 | 258,534 | |

TOTAL HOTELS, RESTAURANTS & LEISURE | 6,305,682 | ||

HOUSEHOLD DURABLES - 0.4% | |||

Harman International Industries, Inc. | 1,400 | 157,038 | |

HOUSEHOLD PRODUCTS - 5.2% | |||

Colgate-Palmolive Co. | 11,700 | 619,164 | |

Kimberly-Clark Corp. | 2,000 | 131,960 | |

Procter & Gamble Co. | 25,120 | 1,333,621 | |

TOTAL HOUSEHOLD PRODUCTS | 2,084,745 | ||

INDUSTRIAL CONGLOMERATES - 1.3% | |||

3M Co. | 3,700 | 310,578 | |

General Electric Co. | 5,400 | 190,080 | |

TOTAL INDUSTRIAL CONGLOMERATES | 500,658 | ||

INTERNET & CATALOG RETAIL - 2.8% | |||

Amazon.com, Inc. (a) | 7,200 | 253,296 | |

eBay, Inc. (a) | 19,800 | 848,232 | |

TOTAL INTERNET & CATALOG RETAIL | 1,101,528 | ||

INTERNET SOFTWARE & SERVICES - 5.1% | |||

Google, Inc. Class A (sub. vtg.) | 5,500 | 1,033,945 | |

iVillage, Inc. (a) | 100 | 575 | |

Sina Corp. (a) | 4,600 | 131,238 | |

Sohu.com, Inc. (a)(d) | 2,900 | 51,939 | |

Yahoo!, Inc. (a) | 25,596 | 825,983 | |

TOTAL INTERNET SOFTWARE & SERVICES | 2,043,680 | ||

Common Stocks - continued | |||

Shares | Value (Note 1) | ||

LEISURE EQUIPMENT & PRODUCTS - 4.7% | |||

Brunswick Corp. | 13,700 | $ 638,968 | |

MarineMax, Inc. (a) | 8,200 | 280,932 | |

Polaris Industries, Inc. | 7,700 | 537,383 | |

RC2 Corp. (a) | 1,900 | 58,767 | |

SCP Pool Corp. | 10,100 | 343,804 | |

TOTAL LEISURE EQUIPMENT & PRODUCTS | 1,859,854 | ||

MEDIA - 16.5% | |||

Clear Channel Communications, Inc. | 27 | 899 | |

E.W. Scripps Co. Class A | 6,700 | 309,272 | |

Fox Entertainment Group, Inc. Class A (a) | 12,400 | 412,920 | |

Gannett Co., Inc. | 3,600 | 283,500 | |

Harte-Hanks, Inc. | 2,900 | 77,720 | |

JC Decaux SA (a) | 22,500 | 578,885 | |

Lamar Advertising Co. Class A (a) | 10,310 | 405,080 | |

McGraw-Hill Companies, Inc. | 2,400 | 220,440 | |

News Corp. Class A | 85,100 | 1,416,064 | |

Omnicom Group, Inc. | 11,600 | 1,056,412 | |

Reuters Group PLC sponsored ADR | 2,900 | 137,141 | |

SBS Broadcasting SA (a) | 2,500 | 106,500 | |

Spanish Broadcasting System, Inc. | 11,040 | 110,952 | |

Univision Communications, Inc. | 4,500 | 118,755 | |

Walt Disney Co. | 34,200 | 955,548 | |

Washington Post Co. Class B | 430 | 386,140 | |

TOTAL MEDIA | 6,576,228 | ||

MULTILINE RETAIL - 5.6% | |||

Big Lots, Inc. (a) | 6,400 | 74,688 | |

Family Dollar Stores, Inc. | 6,300 | 207,396 | |

Federated Department Stores, Inc. | 3,800 | 214,510 | |

JCPenney Co., Inc. | 5,200 | 231,348 | |

Neiman Marcus Group, Inc. Class A | 1,300 | 93,860 | |

Nordstrom, Inc. | 3,400 | 182,784 | |

Saks, Inc. | 2,100 | 31,899 | |

Target Corp. | 23,700 | 1,204,434 | |

TOTAL MULTILINE RETAIL | 2,240,919 | ||

PAPER & FOREST PRODUCTS - 0.0% | |||

Neenah Paper, Inc. | 60 | 2,110 | |

PERSONAL PRODUCTS - 3.7% | |||

Alberto-Culver Co. | 8,200 | 428,614 | |

Avon Products, Inc. | 15,900 | 680,043 | |

Gillette Co. | 7,600 | 381,900 | |

TOTAL PERSONAL PRODUCTS | 1,490,557 | ||

Shares | Value (Note 1) | ||

REAL ESTATE - 0.6% | |||

MeriStar Hospitality Corp. (a) | 18,800 | $ 137,992 | |

ZipRealty, Inc. | 6,000 | 92,820 | |

TOTAL REAL ESTATE | 230,812 | ||

SOFTWARE - 0.6% | |||

Electronic Arts, Inc. (a) | 3,900 | 251,511 | |

SPECIALTY RETAIL - 10.2% | |||

Aeropostale, Inc. (a) | 2,900 | 92,510 | |

American Eagle Outfitters, Inc. | 13,700 | 741,581 | |

Best Buy Co., Inc. | 2,900 | 156,658 | |

Chico's FAS, Inc. (a) | 8,600 | 253,270 | |

Foot Locker, Inc. | 11,200 | 305,760 | |

Gap, Inc. | 3,600 | 76,788 | |

Home Depot, Inc. | 9,860 | 394,597 | |

Hot Topic, Inc. (a) | 2,750 | 58,740 | |

Limited Brands, Inc. | 1,027 | 24,422 | |

Lowe's Companies, Inc. | 10,300 | 605,434 | |

Office Depot, Inc. (a) | 11,200 | 215,600 | |

PETsMART, Inc. | 3,300 | 100,650 | |

Staples, Inc. | 10,400 | 327,808 | |

Steiner Leisure Ltd. (a) | 10,500 | 345,975 | |

Toys 'R' Us, Inc. (a) | 7,000 | 160,090 | |

Weight Watchers International, Inc. (a) | 1,900 | 81,700 | |

West Marine, Inc. (a)(d) | 4,300 | 103,974 | |

TOTAL SPECIALTY RETAIL | 4,045,557 | ||

TEXTILES, APPAREL & LUXURY GOODS - 3.9% | |||

Coach, Inc. (a) | 3,700 | 205,461 | |

Kenneth Cole Productions, Inc. Class A (sub. vtg.) | 2,000 | 58,020 | |

Liz Claiborne, Inc. | 7,400 | 313,020 | |

NIKE, Inc. Class B | 6,700 | 582,565 | |

Phoenix Footwear Group, Inc. (a) | 7,000 | 47,600 | |

Polo Ralph Lauren Corp. Class A | 5,200 | 204,880 | |

Quiksilver, Inc. (a) | 3,900 | 123,201 | |

TOTAL TEXTILES, APPAREL & LUXURY GOODS | 1,534,747 | ||

TOTAL COMMON STOCKS (Cost $32,783,079) | 38,086,236 | ||

Money Market Funds - 3.4% | |||

Shares | Value (Note 1) | ||

Fidelity Cash Central Fund, 2.51% (b) | 1,048,495 | $ 1,048,495 | |

Fidelity Securities Lending Cash Central Fund, 2.52% (b)(c) | 293,575 | 293,575 | |

TOTAL MONEY MARKET FUNDS (Cost $1,342,070) | 1,342,070 | ||

TOTAL INVESTMENT PORTFOLIO - 99.2% (Cost $34,125,149) | 39,428,306 | ||

NET OTHER ASSETS - 0.8% | 319,547 | ||

NET ASSETS - 100% | $ 39,747,853 | ||

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent quarter end is available upon request. |

(c) Includes investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

Income Tax Information |

At February 28, 2005, the fund had a capital loss carryforward of approximately $115,103 all of which will expire on February 28, 2013. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Consumer Industries Portfolio

Financial Statements

Statement of Assets and Liabilities

February 28, 2005 | ||

Assets | ||

Investment in securities, at value (including securities loaned of $284,934) (cost $34,125,149) - See accompanying schedule | $ 39,428,306 | |

Receivable for investments sold | 864,986 | |

Receivable for fund shares sold | 200,427 | |

Dividends receivable | 22,736 | |

Interest receivable | 1,490 | |

Prepaid expenses | 140 | |

Receivable from investment adviser for expense reductions | 3,152 | |

Other receivables | 5,802 | |

Total assets | 40,527,039 | |

Liabilities | ||

Payable for investments purchased | $ 93,042 | |

Payable for fund shares redeemed | 331,074 | |

Accrued management fee | 19,990 | |

Other affiliated payables | 15,143 | |

Other payables and accrued expenses | 26,362 | |

Collateral on securities loaned, at value | 293,575 | |

Total liabilities | 779,186 | |

Net Assets | $ 39,747,853 | |

Net Assets consist of: | ||

Paid in capital | $ 34,639,266 | |

Accumulated net investment loss | (21) | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | (194,549) | |

Net unrealized appreciation (depreciation) on investments | 5,303,157 | |

Net Assets, for 1,640,276 shares outstanding | $ 39,747,853 | |

Net Asset Value, offering price and redemption price per share ($39,747,853 ÷ 1,640,276 shares) | $ 24.23 | |

Statement of Operations

Year ended February 28, 2005 | ||

Investment Income | ||

Dividends | $ 299,346 | |

Interest | 14,700 | |

Security lending | 8,236 | |

Total income | 322,282 | |

Expenses | ||

Management fee | $ 210,448 | |

Transfer agent fees | 140,801 | |

Accounting and security lending fees | 28,563 | |

Non-interested trustees' compensation | 193 | |

Custodian fees and expenses | 12,002 | |

Registration fees | 18,410 | |

Audit | 34,628 | |

Legal | 257 | |

Miscellaneous | 4,656 | |

Total expenses before reductions | 449,958 | |

Expense reductions | (13,376) | 436,582 |

Net investment income (loss) | (114,300) | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities | 28,195 | |

Foreign currency transactions | 705 | |

Total net realized gain (loss) | 28,900 | |

Change in net unrealized appreciation (depreciation) on investment securities | 1,505,127 | |

Net gain (loss) | 1,534,027 | |

Net increase (decrease) in net assets resulting from operations | $ 1,419,727 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

Year ended | Year ended | |

Increase (Decrease) in Net Assets | ||

Operations | ||

Net investment income (loss) | $ (114,300) | $ (119,555) |

Net realized gain (loss) | 28,900 | 4,330,397 |

Change in net unrealized appreciation (depreciation) | 1,505,127 | 4,329,229 |

Net increase (decrease) in net assets resulting from operations | 1,419,727 | 8,540,071 |

Distributions to shareholders from net realized gain | (1,510,535) | (589,523) |

Share transactions | 23,571,117 | 20,824,895 |

Reinvestment of distributions | 1,475,744 | 577,945 |

Cost of shares redeemed | (20,792,957) | (14,480,206) |

Net increase (decrease) in net assets resulting from share transactions | 4,253,904 | 6,922,634 |

Redemption fees | 11,308 | 7,160 |

Total increase (decrease) in net assets | 4,174,404 | 14,880,342 |

Net Assets | ||

Beginning of period | 35,573,449 | 20,693,107 |

End of period (including accumulated net investment loss of $21 and $0, respectively) | $ 39,747,853 | $ 35,573,449 |

Other Information Shares | ||

Sold | 1,007,148 | 964,806 |

Issued in reinvestment of distributions | 62,267 | 25,128 |

Redeemed | (898,454) | (645,822) |

Net increase (decrease) | 170,961 | 344,112 |

Financial Highlights

Years ended February 28, | 2005 | 2004 E | 2003 | 2002 | 2001 |

Selected Per-Share Data | |||||

Net asset value, beginning of period | $ 24.21 | $ 18.39 | $ 23.58 | $ 25.31 | $ 28.46 |

Income from Investment Operations | |||||

Net investment income (loss) C | (.07) | (.09) | (.18) | (.07) | (.11) |

Net realized and unrealized gain (loss) | 1.05 | 6.28 | (5.02) | (.25) | .68 |

Total from investment operations | .98 | 6.19 | (5.20) | (.32) | .57 |

Distributions from net realized gain | (.97) | (.38) | - | (1.42) | (3.80) |

Redemption fees added to paid in capital C | .01 | .01 | .01 | .01 | .08 |

Net asset value, end of period | $ 24.23 | $ 24.21 | $ 18.39 | $ 23.58 | $ 25.31 |

Total Return A, B | 4.18% | 33.82% | (22.01)% | (.87)% | 2.74% |

Ratios to Average Net Assets D | |||||

Expenses before expense reductions | 1.23% | 1.59% | 1.86% | 1.71% | 1.80% |

Expenses net of voluntary waivers, if any | 1.22% | 1.59% | 1.86% | 1.71% | 1.80% |

Expenses net of all reductions | 1.19% | 1.54% | 1.83% | 1.69% | 1.78% |

Net investment income (loss) | (.31)% | (.39)% | (.84)% | (.30)% | (.37)% |

Supplemental Data | |||||

Net assets, end of period (000 omitted) | $ 39,748 | $ 35,573 | $ 20,693 | $ 23,471 | $ 20,483 |

Portfolio turnover rate | 112% | 138% | 116% | 110% | 92% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the former sales charges.

C Calculated based on average shares outstanding during the period.

D Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund.

E For the year ended February 29.

See accompanying notes which are an integral part of the financial statements.

Anuual Report

Food and Agriculture Portfolio

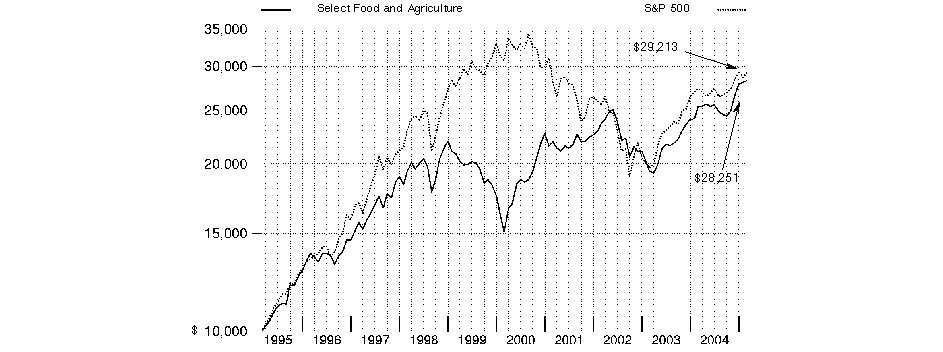

Performance

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity a fund's total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

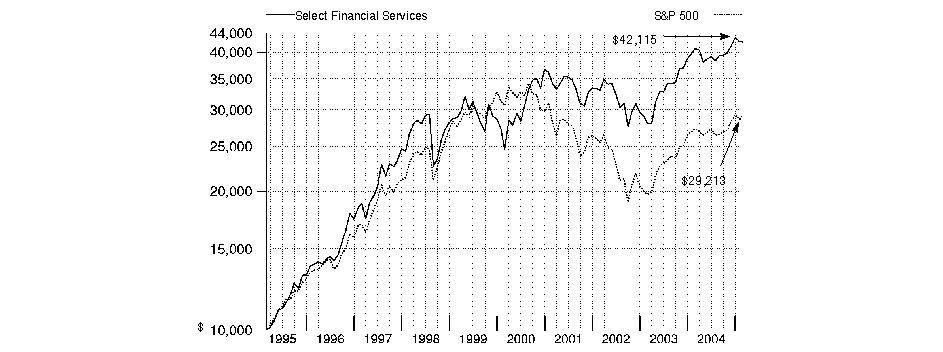

Average Annual Total Returns

Periods ended February 28, 2005 | Past 1 | Past 5 | Past 10 |

Select Food and Agriculture | 11.24% | 13.40% | 10.94% |

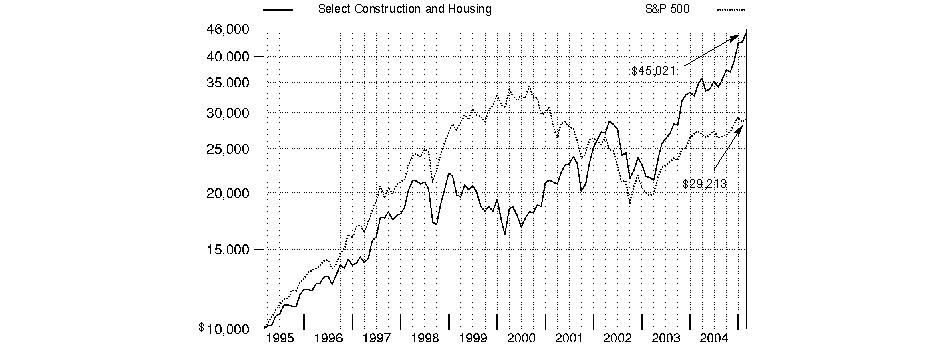

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Select Food and Agriculture Portfolio on February 28, 1995. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Food and Agriculture Portfolio

Management's Discussion of Fund Performance

Comments from Robert Lee, Portfolio Manager of Fidelity® Select Food and Agriculture Portfolio

Stocks got off to a shaky start in the first month of the new year, but most major equity benchmarks managed to cling to their gains for the 12 months ending February 28, 2005. Small-cap stocks continued a six-year-plus run of outperforming large-caps, as the small-cap Russell 2000® Index gained 9.53% during the period, compared to 6.98% for the larger-cap Standard & Poor's 500SM Index. Mid-caps were among the market's biggest gainers, highlighted by the 14.98% rise in the Russell Midcap® Index. Turning to investment styles, value significantly outdistanced growth. The Russell 3000® Value Index advanced 13.71%, versus 1.47% for the Russell 3000 Growth Index. Energy was the best-performing sector, spurred by record-high oil prices. Technology fared worst, despite a strong rally in the fourth quarter of 2004. However, a good portion of that gain was wiped out in January and February, leaving the tech-heavy NASDAQ Composite® Index with a modest 1.64% increase for the one-year period. Large-cap blue-chip stocks fared somewhat better, but the 3.96% return of the Dow Jones Industrial AverageSM was well under its historical average of roughly 11%.

For the 12 months ending February 28, 2005, the fund returned 11.24%, outpacing both the Goldman Sachs® Consumer Industries Index, which gained 5.97%, and the S&P 500®. Roughly half of the fund's outperformance of the Goldman Sachs index can be credited to the strong showing of food and agricultural stocks relative to other groups contained in the index. This factor more than offset the unfavorable impact of the fund's natural inclusion of food retail stocks, such as Safeway, and food distributor stocks, notably Sysco, both of which underperformed the Goldman Sachs index. The other half of the fund's outperformance was driven by successful industry and stock selection within food and agriculture area. The fund benefited from being overweighted in the restaurant and agriculture commodity groups, which performed well. These gains - together with successful stock selection within most food and agriculture segments - more than offset some missed opportunities in the agricultural chemical and wine distributor groups. Among restaurant holdings, Red Robin Gourmet Burgers and Buffalo Wild Wings were among the biggest contributors to the fund's absolute and relative performance, buoyed by continued strong earnings growth. Other restaurant winners included Sonic and McDonald's, both of which performed well despite rising food commodity costs and higher gasoline prices, which curbed consumers' ability to spend. In contrast, Outback Steakhouse was hurt by these challenges, and its stock detracted from performance. My timing regarding P.F. Chang's China Bistro was another detractor from performance, as I overweighted the stock when it was declining, then sold before it posted very strong returns late in the period. Elsewhere, rising commodity prices helped boost holdings in agriculture commodity companies such as Archer-Daniels-Midland and Bunge Limited.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Food and Agriculture Portfolio

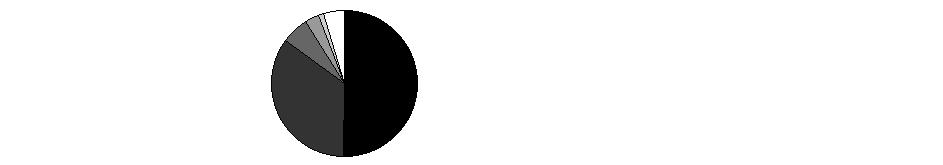

Investment Summary

Top Ten Stocks as of February 28, 2005 | |

% of fund's | |

Altria Group, Inc. | 7.3 |

McDonald's Corp. | 6.8 |

Unilever NV (NY Shares) | 6.8 |

PepsiCo, Inc. | 5.8 |

Nestle SA ADR | 5.4 |

Archer-Daniels-Midland Co. | 4.7 |

Kellogg Co. | 4.1 |

The Coca-Cola Co. | 3.9 |

General Mills, Inc. | 3.2 |

Buffalo Wild Wings, Inc. | 2.5 |

50.5 | |

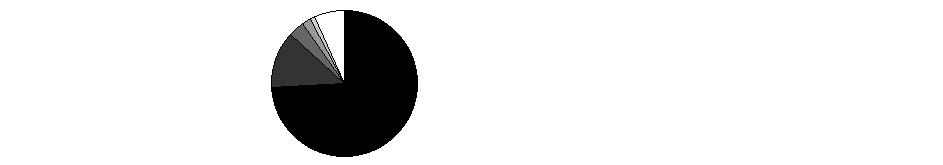

Top Industries as of February 28, 2005 | |||

% of fund's net assets | |||

| Food Products | 37.0% | |

| Hotels, Restaurants & Leisure | 20.8% | |

| Beverages | 12.9% | |

| Tobacco | 12.4% | |

| Household Products | 4.7% | |

| All Others * | 12.2% | |

* Includes short-term investments and net other assets. |

Annual Report

Food and Agriculture Portfolio

Investments February 28, 2005

Showing Percentage of Net Assets

Common Stocks - 97.0% | |||

Shares | Value (Note 1) | ||

BEVERAGES - 12.9% | |||

Anheuser-Busch Companies, Inc. | 55,800 | $ 2,647,710 | |

Coca-Cola Femsa SA de CV sponsored ADR | 12,600 | 323,820 | |

Coca-Cola Hellenic Bottling Co. SA ADR | 100 | 2,685 | |

Constellation Brands, Inc. Class A | 14,600 | 781,538 | |

Diageo PLC sponsored ADR | 100 | 5,727 | |

Efes Breweries International NV unit (e) | 7,000 | 224,000 | |

Fomento Economico Mexicano SA de CV sponsored ADR | 6,200 | 374,604 | |

PepsiAmericas, Inc. | 100 | 2,275 | |

PepsiCo, Inc. | 151,400 | 8,154,404 | |

The Coca-Cola Co. | 127,300 | 5,448,440 | |

TOTAL BEVERAGES | 17,965,203 | ||

BIOTECHNOLOGY - 0.3% | |||

Global Bio-Chem Technology Group Co. Ltd. | 204,000 | 142,558 | |

Senomyx, Inc. | 30,700 | 340,463 | |

TOTAL BIOTECHNOLOGY | 483,021 | ||

CHEMICALS - 2.7% | |||

Monsanto Co. | 54,000 | 3,174,120 | |

Syngenta AG sponsored ADR | 24,700 | 557,232 | |

TOTAL CHEMICALS | 3,731,352 | ||

FOOD & STAPLES RETAILING - 3.9% | |||

Albertsons, Inc. | 79,900 | 1,788,961 | |

Central European Distribution Corp. (a) | 6,300 | 242,676 | |

Kroger Co. (a) | 7,700 | 138,523 | |

Performance Food Group Co. (a) | 4,800 | 130,272 | |

Safeway, Inc. (a) | 88,000 | 1,619,200 | |

Sysco Corp. | 45,700 | 1,572,994 | |

United Natural Foods, Inc. (a) | 100 | 3,117 | |

Whole Foods Market, Inc. | 100 | 10,282 | |

TOTAL FOOD & STAPLES RETAILING | 5,506,025 | ||

FOOD PRODUCTS - 37.0% | |||

Archer-Daniels-Midland Co. | 274,000 | 6,603,400 | |

Azucarera Ebro Agricolas SA | 8,600 | 148,040 | |

Bunge Ltd. | 32,200 | 1,761,662 | |

Cadbury Schweppes PLC sponsored ADR | 9,200 | 364,964 | |

Campbell Soup Co. | 17,200 | 476,440 | |

ConAgra Foods, Inc. | 62,100 | 1,696,572 | |

Corn Products International, Inc. | 67,100 | 1,876,787 | |

Dean Foods Co. (a) | 50 | 1,728 | |

Fresh Del Monte Produce, Inc. | 2,400 | 71,616 | |

General Mills, Inc. | 84,400 | 4,420,028 | |

Groupe Danone sponsored ADR | 32,400 | 644,760 | |

H.J. Heinz Co. | 100 | 3,764 | |

Hershey Foods Corp. | 29,500 | 1,858,500 | |

Shares | Value (Note 1) | ||

Hormel Foods Corp. | 100 | $ 3,115 | |

Kellogg Co. | 129,700 | 5,706,800 | |

Kraft Foods, Inc. Class A | 99,100 | 3,314,895 | |

McCormick & Co., Inc. (non-vtg.) | 32,900 | 1,249,871 | |

Nestle SA ADR | 108,600 | 7,477,110 | |

People's Food Holdings Ltd. | 153,700 | 127,933 | |

Petra Foods Ltd. | 211,000 | 143,104 | |

Ralcorp Holdings, Inc. | 4,500 | 209,475 | |

Richmond Foods PLC | 10,200 | 128,517 | |

Sanderson Farms, Inc. | 100 | 4,487 | |

Sara Lee Corp. | 100 | 2,240 | |

Smithfield Foods, Inc. (a) | 61,100 | 2,080,455 | |

Tyson Foods, Inc. Class A | 100 | 1,702 | |

Unilever NV (NY Shares) | 142,500 | 9,531,825 | |

Wm. Wrigley Jr. Co. | 24,000 | 1,597,440 | |

TOTAL FOOD PRODUCTS | 51,507,230 | ||

HOTELS, RESTAURANTS & LEISURE - 20.8% | |||

Applebee's International, Inc. | 75 | 2,138 | |

Brinker International, Inc. (a) | 52,500 | 1,987,650 | |

Buffalo Wild Wings, Inc. (a) | 92,914 | 3,502,858 | |

California Pizza Kitchen, Inc. (a) | 20,900 | 499,928 | |

Darden Restaurants, Inc. | 100 | 2,680 | |

Domino's Pizza, Inc. | 48,300 | 824,481 | |

Famous Dave's of America, Inc. (a) | 39,300 | 438,588 | |

Jack in the Box, Inc. (a) | 3,458 | 124,142 | |

McCormick & Schmick Seafood Restaurants | 13,200 | 210,540 | |

McDonald's Corp. | 288,200 | 9,533,656 | |

O'Charleys, Inc. (a) | 18,100 | 382,272 | |

Outback Steakhouse, Inc. | 37,600 | 1,688,616 | |

P.F. Chang's China Bistro, Inc. (a) | 68 | 3,727 | |

Panera Bread Co. Class A (a) | 3,000 | 160,380 | |

Rare Hospitality International, Inc. (a) | 100 | 2,926 | |

Red Robin Gourmet Burgers, Inc. (a) | 71,700 | 3,250,161 | |

Sonic Corp. (a) | 25,450 | 857,411 | |

Starbucks Corp. (a)(d) | 44,600 | 2,310,726 | |

The Cheesecake Factory, Inc. (a) | 51 | 1,736 | |

Wendy's International, Inc. | 68,900 | 2,607,865 | |

Yum! Brands, Inc. | 10,800 | 526,824 | |

TOTAL HOTELS, RESTAURANTS & LEISURE | 28,919,305 | ||

HOUSEHOLD PRODUCTS - 4.7% | |||

Clorox Co. | 100 | 6,004 | |

Colgate-Palmolive Co. | 60,500 | 3,201,660 | |

Procter & Gamble Co. | 58,500 | 3,105,765 | |

Reckitt Benckiser PLC | 8,700 | 274,252 | |

TOTAL HOUSEHOLD PRODUCTS | 6,587,681 | ||

MACHINERY - 0.5% | |||

AGCO Corp. (a) | 15,900 | 309,573 | |

Common Stocks - continued | |||

Shares | Value (Note 1) | ||

MACHINERY - CONTINUED | |||

CNH Global NV | 100 | $ 1,814 | |

Deere & Co. | 4,600 | 327,106 | |

TOTAL MACHINERY | 638,493 | ||

PERSONAL PRODUCTS - 1.8% | |||

Alberto-Culver Co. | 6,300 | 329,301 | |

Gillette Co. | 43,400 | 2,180,850 | |

TOTAL PERSONAL PRODUCTS | 2,510,151 | ||

SPECIALTY RETAIL - 0.0% | |||

Weight Watchers International, Inc. (a) | 100 | 4,300 | |

TOBACCO - 12.4% | |||

Altria Group, Inc. | 154,900 | 10,169,184 | |

British American Tobacco PLC sponsored ADR | 18,800 | 691,464 | |

Imperial Tobacco Group PLC | 100 | 2,668 | |

Loews Corp. - Carolina Group | 32,500 | 1,064,050 | |

Reynolds American, Inc. | 40,300 | 3,302,585 | |

Universal Corp. | 2,600 | 130,520 | |

UST, Inc. | 35,100 | 1,918,215 | |

TOTAL TOBACCO | 17,278,686 | ||

TOTAL COMMON STOCKS (Cost $111,722,747) | 135,131,447 | ||

Money Market Funds - 4.2% | |||

Fidelity Cash Central Fund, 2.51% (b) | 3,508,246 | 3,508,246 | |

Fidelity Securities Lending Cash Central Fund, 2.52% (b)(c) | 2,330,350 | 2,330,350 | |

TOTAL MONEY MARKET FUNDS (Cost $5,838,596) | 5,838,596 | ||

TOTAL INVESTMENT PORTFOLIO - 101.2% (Cost $117,561,343) | 140,970,043 | ||

NET OTHER ASSETS - (1.2)% | (1,641,734) | ||

NET ASSETS - 100% | $ 139,328,309 | ||

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent quarter end is available upon request. |

(c) Includes investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $224,000 or 0.2% of net assets. |

Other Information |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: |

United States of America | 83.4% |

Netherlands | 7.0% |

Switzerland | 5.8% |

Bermuda | 1.3% |

United Kingdom | 1.1% |

Others (individually less than 1%) | 1.4% |

100.0% |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Food and Agriculture Portfolio

Financial Statements

Statement of Assets and Liabilities

February 28, 2005 | ||

Assets | ||

Investment in securities, at value (including securities loaned of $2,310,726) (cost $117,561,343) - See accompanying schedule | $ 140,970,043 | |

Receivable for investments sold | 245,035 | |

Receivable for fund shares sold | 2,467,886 | |

Dividends receivable | 129,646 | |

Interest receivable | 8,605 | |

Prepaid expenses | 482 | |

Other affiliated receivables | 291 | |

Other receivables | 7,880 | |

Total assets | 143,829,868 | |

Liabilities | ||

Payable for investments purchased | $ 813,167 | |

Payable for fund shares redeemed | 1,219,009 | |

Accrued management fee | 65,276 | |

Other affiliated payables | 44,684 | |

Other payables and accrued expenses | 29,073 | |

Collateral on securities loaned, at value | 2,330,350 | |

Total liabilities | 4,501,559 | |

Net Assets | $ 139,328,309 | |

Net Assets consist of: | ||

Paid in capital | $ 115,580,648 | |

Undistributed net investment income | 28,038 | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 310,875 | |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 23,408,748 | |

Net Assets, for 2,709,811 shares outstanding | $ 139,328,309 | |

Net Asset Value, offering price and redemption price per share ($139,328,309 ÷ 2,709,811 shares) | $ 51.42 | |

Statement of Operations

Year ended February 28, 2005 | ||

Investment Income | ||

Dividends | $ 1,859,004 | |

Interest | 53,359 | |

Security lending | 31,699 | |

Total income | 1,944,062 | |

Expenses | ||

Management fee | $ 676,891 | |

Transfer agent fees | 419,605 | |

Accounting and security lending fees | 60,863 | |

Non-interested trustees' compensation | 726 | |

Custodian fees and expenses | 19,188 | |

Registration fees | 31,866 | |

Audit | 34,982 | |

Legal | 274 | |

Miscellaneous | 7,498 | |

Total expenses before reductions | 1,251,893 | |

Expense reductions | (20,471) | 1,231,422 |

Net investment income (loss) | 712,640 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities | 8,330,787 | |

Foreign currency transactions | (427) | |

Total net realized gain (loss) | 8,330,360 | |

Change in net unrealized appreciation (depreciation) on: Investment securities | 2,593,630 | |

Assets and liabilities in foreign currencies | (344) | |

Total change in net unrealized appreciation (depreciation) | 2,593,286 | |

Net gain (loss) | 10,923,646 | |

Net increase (decrease) in net assets resulting from operations | $ 11,636,286 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Food and Agriculture Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

Year ended | Year ended | |

Increase (Decrease) in Net Assets | ||

Operations | ||

Net investment income (loss) | $ 712,640 | $ 504,056 |

Net realized gain (loss) | 8,330,360 | 1,532,340 |

Change in net unrealized appreciation (depreciation) | 2,593,286 | 22,627,041 |

Net increase (decrease) in net assets resulting from operations | 11,636,286 | 24,663,437 |

Distributions to shareholders from net investment income | (683,408) | (521,536) |

Share transactions | 105,702,482 | 24,022,618 |

Reinvestment of distributions | 642,326 | 489,419 |

Cost of shares redeemed | (82,447,637) | (32,354,647) |

Net increase (decrease) in net assets resulting from share transactions | 23,897,171 | (7,842,610) |

Redemption fees | 41,906 | 13,977 |

Total increase (decrease) in net assets | 34,891,955 | 16,313,268 |

Net Assets | ||

Beginning of period | 104,436,354 | 88,123,086 |

End of period (including undistributed net investment income of $28,038 and $0, respectively) | $ 139,328,309 | $ 104,436,354 |

Other Information Shares | ||

Sold | 2,217,961 | 567,727 |

Issued in reinvestment of distributions | 13,111 | 11,371 |

Redeemed | (1,767,243) | (800,611) |

Net increase (decrease) | 463,829 | (221,513) |

Financial Highlights

Years ended February 28, | 2005 | 2004 E | 2003 | 2002 | 2001 |

Selected Per-Share Data | |||||

Net asset value, beginning of period | $ 46.50 | $ 35.71 | $ 44.68 | $ 46.01 | $ 31.88 |

Income from Investment Operations | |||||

Net investment income (loss) C | .29 | .22 | .25 | .34 | .44 |

Net realized and unrealized gain (loss) | 4.90 | 10.80 | (8.06) | 2.79 | 13.96 |

Total from investment operations | 5.19 | 11.02 | (7.81) | 3.13 | 14.40 |

Distributions from net investment income | (.29) | (.24) | (.32) | (.21) | (.36) |

Distributions from net realized gain | - | - | (.88) | (4.28) | - |

Total distributions | (.29) | (.24) | (1.20) | (4.49) | (.36) |

Redemption fees added to paid in capital C | .02 | .01 | .04 | .03 | .09 |

Net asset value, end of period | $ 51.42 | $ 46.50 | $ 35.71 | $ 44.68 | $ 46.01 |

Total ReturnA,B | 11.24% | 30.94% | (17.85)% | 7.76% | 45.47% |

Ratios to Average Net AssetsD | |||||

Expenses before expense reductions | 1.06% | 1.27% | 1.25% | 1.24% | 1.28% |

Expenses net of voluntary waivers, if any | 1.06% | 1.27% | 1.25% | 1.24% | 1.28% |

Expenses net of all reductions | 1.05% | 1.25% | 1.17% | 1.14% | 1.24% |

Net investment income (loss) | .61% | .55% | .59% | .79% | 1.07% |

Supplemental Data | |||||

Net assets, end of period (000 omitted) | $ 139,328 | $ 104,436 | $ 88,123 | $ 119,980 | $ 119,769 |

Portfolio turnover rate | 86% | 62% | 225% | 315% | 151% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the former sales charges.

C Calculated based on average shares outstanding during the period.

D Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund.

E For the year ended February 29.

See accompanying notes which are an integral part of the financial statements.

Annual Report

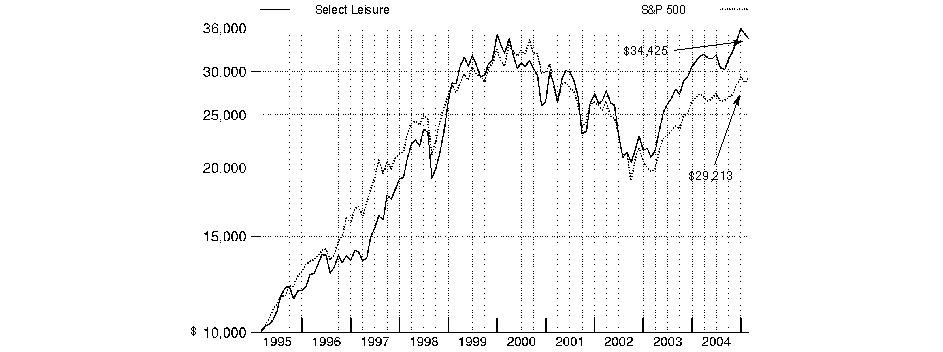

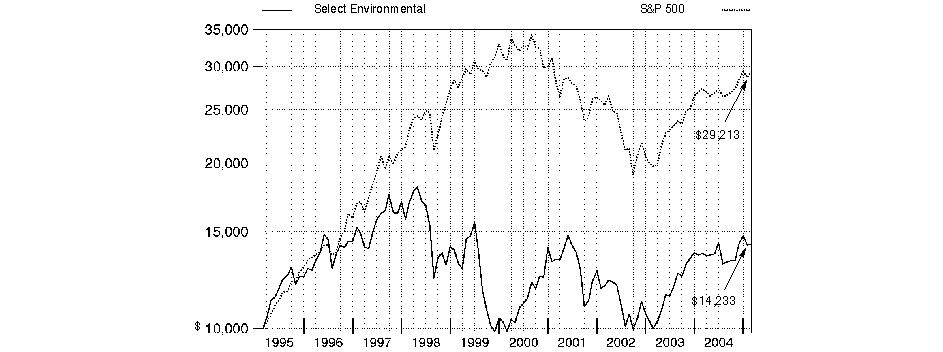

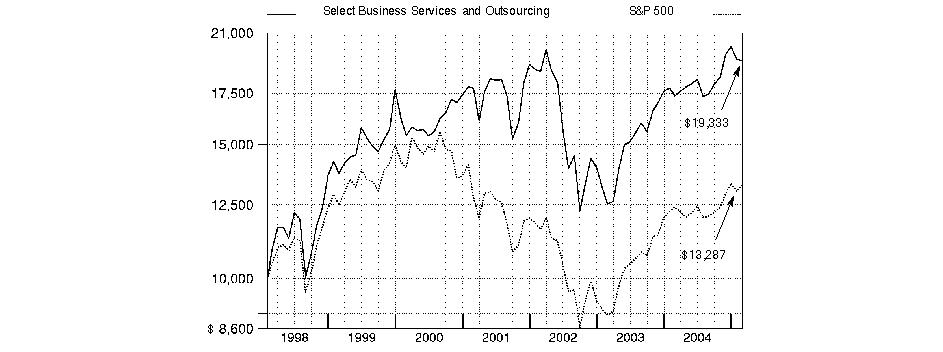

Performance

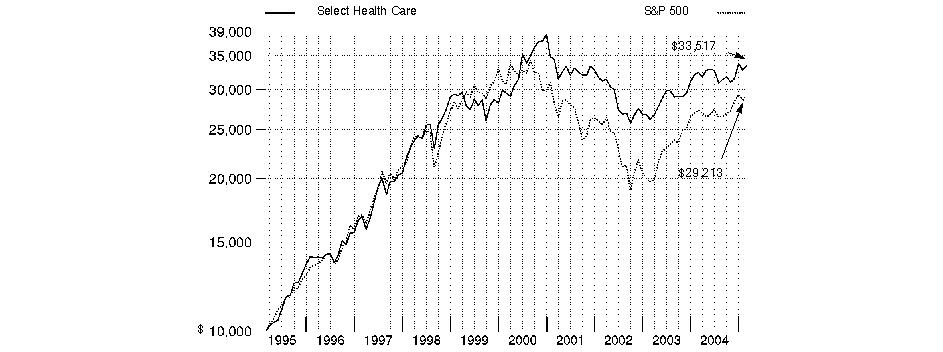

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity a fund's total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2005 | Past 1 | Past 5 | Past 10 |

Select Leisure | 7.43% | 1.20% | 13.16% |

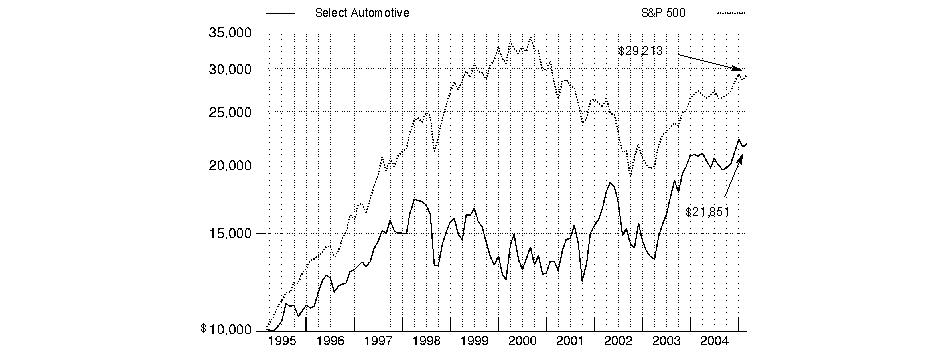

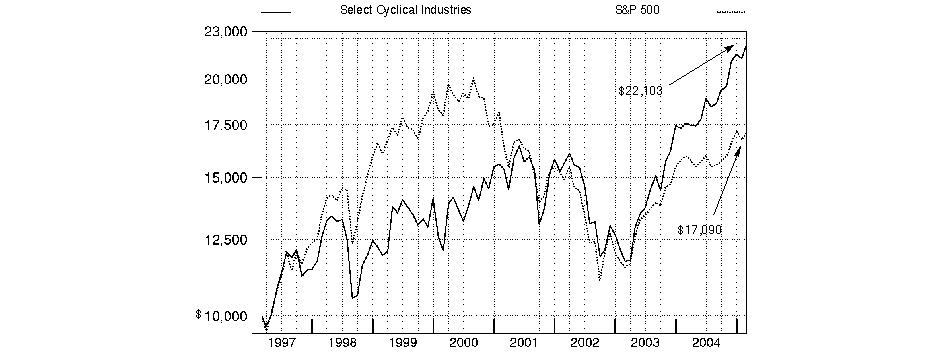

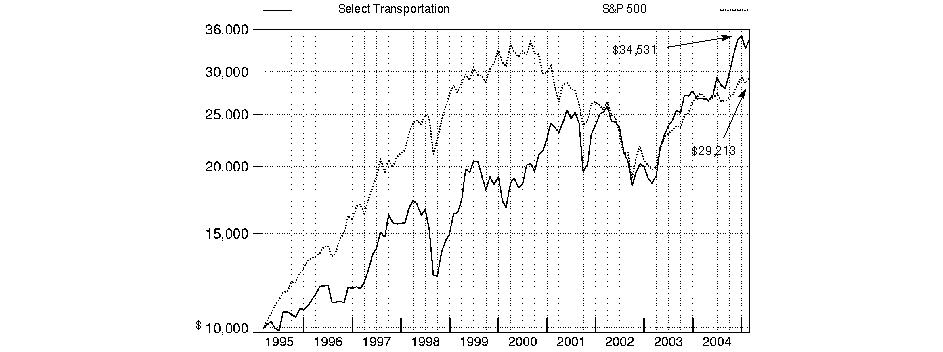

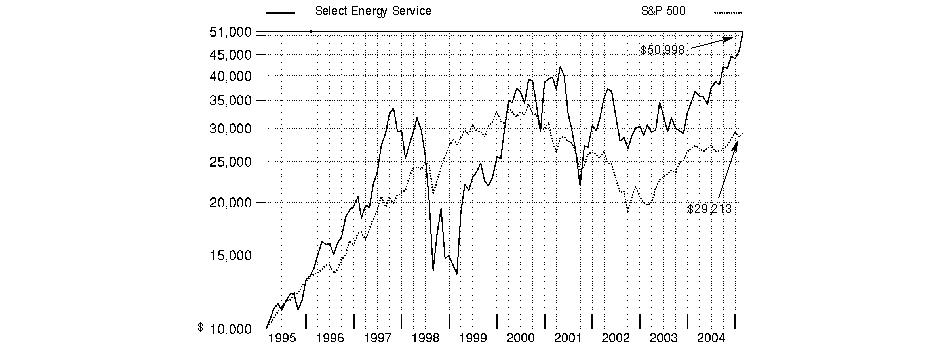

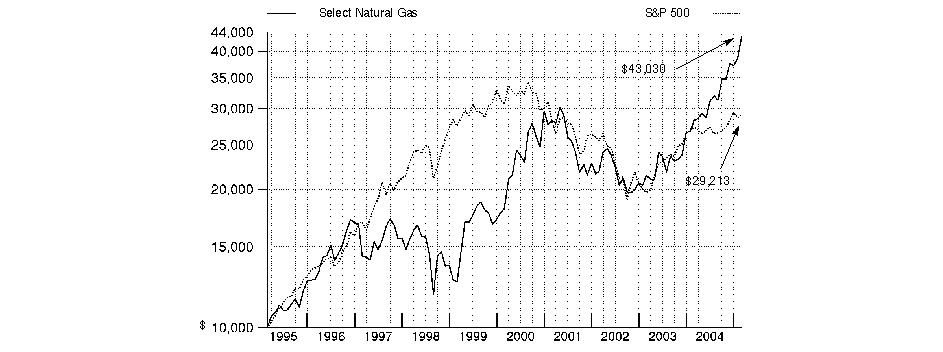

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Select Leisure Portfolio on February 28, 1995. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Leisure Portfolio

Management's Discussion of Fund Performance

Comments from Aaron Cooper, Portfolio Manager of Fidelity® Select Leisure Portfolio

Stocks got off to a shaky start in the first month of the new year, but most major equity benchmarks managed to cling to their gains for the 12 months ending February 28, 2005. Small-cap stocks continued a six-year-plus run of outperforming large-caps, as the small-cap Russell 2000® Index gained 9.53% during the period, compared to 6.98% for the larger-cap Standard & Poor's 500SM Index. Mid-caps were among the market's biggest gainers, highlighted by the 14.98% rise in the Russell Midcap® Index. Turning to investment styles, value significantly outdistanced growth. The Russell 3000® Value Index advanced 13.71%, versus 1.47% for the Russell 3000 Growth Index. Energy was the best-performing sector, spurred by record-high oil prices. Technology fared worst, despite a strong rally in the fourth quarter of 2004. However, a good portion of that gain was wiped out in January and February, leaving the tech-heavy NASDAQ Composite® Index with a modest 1.64% increase for the one-year period. Large-cap blue-chip stocks fared somewhat better, but the 3.96% return of the Dow Jones Industrial AverageSM was well under its historical average of roughly 11%.

For the 12-month period ending February 28, 2005, Fidelity Select Leisure Portfolio returned 7.43%, outperforming both the Goldman Sachs® Consumer Industries Index, which returned 5.97%, and the S&P 500®. Solid stock picking and a relatively large position in the Internet portals and content space, a group not included in the sector index, drove most of the relative outperformance. Among the companies that did well in that space were Yahoo! and Google, each of which attracted increasing traffic to the Internet in a very effective manner. Good stock selection and an overweighting in casinos and gaming also made a big contribution to performance, as did the fund's overweighted position in the hotels, resorts and cruise lines group. Among the strongest performers here were casino operator Kerzner International, Starwood Hotels & Resorts and Carnival Cruise Lines. The biggest absolute detractor was Krispy Kreme Doughnuts, a stock that is no longer held, which fell on a series of unexpected company-specific issues, including a Securities and Exchange Commission investigation. Broadcasting and cable television stocks also hurt performance, with media names such as Clear Channel Communications and EchoStar Communications turning in disappointing results.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Leisure Portfolio

Investment Summary

Top Ten Stocks as of February 28, 2005 | |

% of fund's | |

Yahoo!, Inc. | 6.7 |

Lamar Advertising Co. Class A | 6.3 |

Omnicom Group, Inc. | 5.8 |

Carnival Corp. unit | 5.1 |

Walt Disney Co. | 4.9 |

Harman International Industries, Inc. | 4.8 |

McDonald's Corp. | 4.4 |

News Corp. Class A | 3.6 |

Liberty Media Corp. Class A | 2.7 |

Getty Images, Inc. | 2.6 |

46.9 | |

Top Industries as of February 28, 2005 | |||

% of fund's net assets | |||

| Media | 46.9% | |

| Hotels, Restaurants & Leisure | 26.6% | |

| Internet Software & Services | 9.3% | |

| Household Durables | 4.8% | |

| Software | 2.9% | |

| All Others * | 9.5% | |

* Includes short-term investments and net other assets. |

Annual Report

Leisure Portfolio

Investments February 28, 2005

Showing Percentage of Net Assets

Common Stocks - 99.5% | |||

Shares | Value (Note 1) | ||

AUTOMOBILES - 1.5% | |||

Harley-Davidson, Inc. | 51,500 | $ 3,186,820 | |

COMMERCIAL SERVICES & SUPPLIES - 0.9% | |||

Cendant Corp. | 85,500 | 1,891,260 | |

COMMUNICATIONS EQUIPMENT - 0.3% | |||

Arris Group, Inc. (a) | 80,700 | 512,445 | |

DIVERSIFIED TELECOMMUNICATION SERVICES - 0.0% | |||

BellSouth Corp. | 100 | 2,580 | |

SBC Communications, Inc. | 100 | 2,405 | |

Verizon Communications, Inc. | 100 | 3,597 | |

TOTAL DIVERSIFIED TELECOMMUNICATION SERVICES | 8,582 | ||

HOTELS, RESTAURANTS & LEISURE - 26.6% | |||

Boyd Gaming Corp. | 17,000 | 833,170 | |

Brinker International, Inc. (a) | 20,300 | 768,558 | |

Buffalo Wild Wings, Inc. (a) | 27,500 | 1,036,750 | |

Carnival Corp. unit | 193,600 | 10,527,968 | |

Hilton Hotels Corp. | 50,600 | 1,065,636 | |

International Game Technology | 49,500 | 1,507,770 | |

Kerzner International Ltd. (a) | 53,500 | 3,420,790 | |

McDonald's Corp. | 277,500 | 9,179,700 | |

MGM MIRAGE (a) | 19,400 | 1,438,898 | |

Outback Steakhouse, Inc. | 68,300 | 3,067,353 | |

Penn National Gaming, Inc. (a) | 42,000 | 2,535,120 | |

Red Robin Gourmet Burgers, Inc. (a) | 20,900 | 947,397 | |

Royal Caribbean Cruises Ltd. | 93,800 | 4,432,050 | |

Starbucks Corp. (a)(d) | 66,300 | 3,435,003 | |

Starwood Hotels & Resorts Worldwide, Inc. unit | 41,700 | 2,386,908 | |

Station Casinos, Inc. | 15,500 | 944,570 | |

Wendy's International, Inc. | 95,400 | 3,610,890 | |

WMS Industries, Inc. (a) | 10,500 | 314,895 | |

Wynn Resorts Ltd. (a) | 25,400 | 1,817,878 | |

Yum! Brands, Inc. | 34,600 | 1,687,788 | |

TOTAL HOTELS, RESTAURANTS & LEISURE | 54,959,092 | ||

HOUSEHOLD DURABLES - 4.8% | |||

Harman International Industries, Inc. | 88,400 | 9,915,828 | |

INTERNET & CATALOG RETAIL - 0.6% | |||

eBay, Inc. (a) | 27,000 | 1,156,680 | |

INTERNET SOFTWARE & SERVICES - 9.3% | |||

CNET Networks, Inc. (a) | 65,700 | 594,585 | |

Google, Inc. Class A (sub. vtg.) | 25,500 | 4,793,745 | |

Yahoo!, Inc. (a) | 430,204 | 13,882,684 | |

TOTAL INTERNET SOFTWARE & SERVICES | 19,271,014 | ||

Shares | Value (Note 1) | ||

LEISURE EQUIPMENT & PRODUCTS - 2.8% | |||

Brunswick Corp. | 88,100 | $ 4,108,984 | |

Eastman Kodak Co. | 35,100 | 1,193,049 | |

Polaris Industries, Inc. | 5,500 | 383,845 | |

TOTAL LEISURE EQUIPMENT & PRODUCTS | 5,685,878 | ||

MACHINERY - 0.8% | |||

Cummins, Inc. | 22,700 | 1,666,407 | |

MEDIA - 46.9% | |||

Arbitron, Inc. (a) | 8,400 | 340,620 | |

Clear Channel Communications, Inc. | 133,341 | 4,437,588 | |

Comcast Corp. Class A (a) | 14,600 | 475,230 | |

Cumulus Media, Inc. Class A (a) | 31,000 | 438,650 | |

E.W. Scripps Co. Class A | 37,200 | 1,717,152 | |

EchoStar Communications Corp. Class A | 102,100 | 3,037,475 | |

Entercom Communications Corp. | 49,000 | 1,686,580 | |

Fox Entertainment Group, Inc. Class A (a) | 92,500 | 3,080,250 | |

Getty Images, Inc. (a) | 76,100 | 5,428,974 | |

Grupo Televisa SA de CV sponsored ADR | 36,000 | 2,320,200 | |

JC Decaux SA (a) | 109,100 | 2,806,950 | |

Lamar Advertising Co. Class A (a)(d) | 331,300 | 13,016,777 | |

Liberty Media Corp. Class A (a) | 538,868 | 5,464,122 | |

Liberty Media International, Inc. | 31,801 | 1,374,757 | |

McGraw-Hill Companies, Inc. | 16,200 | 1,487,970 | |

News Corp. Class A | 450,696 | 7,499,581 | |

Omnicom Group, Inc. | 130,700 | 11,902,849 | |

Salem Communications Corp. Class A (a) | 38,800 | 896,668 | |

Spanish Broadcasting System, Inc. | 70,600 | 709,530 | |

The DIRECTV Group, Inc. (a) | 173,401 | 2,602,749 | |

Time Warner, Inc. (a) | 172,400 | 2,970,452 | |

UnitedGlobalCom, Inc. Class A (a) | 231,500 | 2,152,950 | |

Univision Communications, Inc. | 169,800 | 4,481,022 | |

Viacom, Inc. Class B (non-vtg.) | 64,196 | 2,240,440 | |

Walt Disney Co. | 359,700 | 10,050,018 | |

Westwood One, Inc. (a) | 27,400 | 598,416 | |

XM Satellite Radio Holdings, Inc. | 108,135 | 3,564,130 | |

TOTAL MEDIA | 96,782,100 | ||

SOFTWARE - 2.9% | |||

Electronic Arts, Inc. (a) | 76,300 | 4,920,587 | |

NAVTEQ Corp. | 24,300 | 1,061,910 | |

TOTAL SOFTWARE | 5,982,497 | ||

WIRELESS TELECOMMUNICATION SERVICES - 2.1% | |||

American Tower Corp. Class A (a) | 234,700 | 4,302,051 | |

TOTAL COMMON STOCKS (Cost $175,001,686) | 205,320,654 | ||

Money Market Funds - 2.1% | |||

Shares | Value (Note 1) | ||

Fidelity Securities Lending Cash Central Fund, 2.52% (b)(c) | 4,294,108 | $ 4,294,108 | |

TOTAL INVESTMENT PORTFOLIO - 101.6% (Cost $179,295,794) | 209,614,762 | ||

NET OTHER ASSETS - (1.6)% | (3,208,860) | ||

NET ASSETS - 100% | $ 206,405,902 | ||

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent quarter end is available upon request. |

(c) Includes investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

Other Information |

Distribution of investments by country of issue, as a percentage of total net assets, is as follows: |

United States of America | 88.6% |

Panama | 5.1% |

Liberia | 2.1% |

Bahamas (Nassau) | 1.7% |

France | 1.4% |

Mexico | 1.1% |

100.0% |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Leisure Portfolio

Financial Statements

Statement of Assets and Liabilities

February 28, 2005 | ||

Assets | ||

Investment in securities, at value (including securities loaned of $4,630,701) (cost $179,295,794) - See accompanying schedule | $ 209,614,762 | |

Receivable for investments sold | 4,154,494 | |

Receivable for fund shares sold | 347,817 | |

Dividends receivable | 98,331 | |

Interest receivable | 2,575 | |

Prepaid expenses | 773 | |

Other affiliated receivables | 105 | |

Other receivables | 40,868 | |

Total assets | 214,259,725 | |

Liabilities | ||

Payable to custodian bank | $ 30,973 | |

Payable for investments purchased | 1,515,917 | |

Payable for fund shares redeemed | 1,812,379 | |

Accrued management fee | 103,249 | |

Other affiliated payables | 70,935 | |

Other payables and accrued expenses | 26,262 | |

Collateral on securities loaned, at value | 4,294,108 | |

Total liabilities | 7,853,823 | |

Net Assets | $ 206,405,902 | |

Net Assets consist of: | ||

Paid in capital | $ 171,819,142 | |

Accumulated net investment loss | (739) | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 4,268,494 | |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | 30,319,005 | |

Net Assets, for 2,749,621 shares outstanding | $ 206,405,902 | |

Net Asset Value, offering price and redemption price per share ($206,405,902 ÷ 2,749,621 shares) | $ 75.07 | |

Statement of Operations

Year ended February 28, 2005 | ||

Investment Income | ||

Dividends | $ 1,290,457 | |

Interest | 48,645 | |

Security lending | 31,083 | |

Total income | 1,370,185 | |

Expenses | ||

Management fee | $ 1,160,202 | |

Transfer agent fees | 677,692 | |

Accounting and security lending fees | 102,439 | |

Non-interested trustees' compensation | 1,186 | |

Custodian fees and expenses | 12,802 | |

Registration fees | 29,987 | |

Audit | 35,376 | |

Legal | 549 | |

Interest | 379 | |

Miscellaneous | 12,237 | |

Total expenses before reductions | 2,032,849 | |

Expense reductions | (97,639) | 1,935,210 |

Net investment income (loss) | (565,025) | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities | 9,227,830 | |

Foreign currency transactions | 1,646 | |

Total net realized gain (loss) | 9,229,476 | |

Change in net unrealized appreciation (depreciation) on: Investment securities | 3,427,965 | |

Assets and liabilities in foreign currencies | 37 | |

Total change in net unrealized appreciation (depreciation) | 3,428,002 | |

Net gain (loss) | 12,657,478 | |

Net increase (decrease) in net assets resulting from operations | $ 12,092,453 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

Year ended | Year ended | |

Increase (Decrease) in Net Assets | ||

Operations | ||

Net investment income (loss) | $ (565,025) | $ (614,516) |

Net realized gain (loss) | 9,229,476 | 41,417,523 |

Change in net unrealized appreciation (depreciation) | 3,428,002 | 24,508,475 |

Net increase (decrease) in net assets resulting from operations | 12,092,453 | 65,311,482 |

Distributions to shareholders from net realized gain | (12,897,221) | - |

Share transactions | 89,140,152 | 79,019,245 |

Reinvestment of distributions | 12,212,709 | - |

Cost of shares redeemed | (98,538,099) | (52,161,777) |

Net increase (decrease) in net assets resulting from share transactions | 2,814,762 | 26,857,468 |

Redemption fees | 42,388 | 37,107 |

Total increase (decrease) in net assets | 2,052,382 | 92,206,057 |

Net Assets | ||

Beginning of period | 204,353,520 | 112,147,463 |

End of period (including accumulated net investment loss of $739 and $0, respectively) | $ 206,405,902 | $ 204,353,520 |

Other Information Shares | ||

Sold | 1,203,993 | 1,278,672 |

Issued in reinvestment of distributions | 165,996 | - |

Redeemed | (1,366,919) | (839,593) |

Net increase (decrease) | 3,070 | 439,079 |

Financial Highlights

Years ended February 28, | 2005 | 2004 E | 2003 | 2002 | 2001 |

Selected Per-Share Data | |||||

Net asset value, beginning of period | $ 74.40 | $ 48.60 | $ 61.57 | $ 66.22 | $ 84.73 |

Income from Investment Operations | |||||

Net investment income (loss) C | (.20) | (.24) | (.33) | (.29) | (.11) |

Net realized and unrealized gain (loss) | 5.55 | 26.03 | (12.66) | (4.37) | (8.52) |

Total from investment operations | 5.35 | 25.79 | (12.99) | (4.66) | (8.63) |

Distributions from net realized gain | (4.70) | - | - | - | (9.92) |

Redemption fees added to paid in capital C | .02 | .01 | .02 | .01 | .04 |

Net asset value, end of period | $ 75.07 | $ 74.40 | $ 48.60 | $ 61.57 | $ 66.22 |

Total Return A, B | 7.43% | 53.09% | (21.07)% | (7.02)% | (12.04)% |

Ratios to Average Net Assets D | |||||

Expenses before expense reductions | 1.01% | 1.15% | 1.27% | 1.12% | 1.12% |

Expenses net of voluntary waivers, if any | 1.01% | 1.15% | 1.27% | 1.12% | 1.12% |

Expenses net of all reductions | .96% | 1.09% | 1.19% | 1.09% | 1.12% |

Net investment income (loss) | (.28)% | (.38)% | (.62)% | (.46)% | (.15)% |

Supplemental Data | |||||

Net assets, end of period (000 omitted) | $ 206,406 | $ 204,354 | $ 112,147 | $ 211,055 | $ 269,848 |

Portfolio turnover rate | 117% | 156% | 124% | 60% | 71% |

A Total returns would have been lower had certain expenses not been reduced during the periods shown.

B Total returns do not include the effect of the former sales charges.

C Calculated based on average shares outstanding during the period.

D Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or other expense offset arrangements and do not represent the amount paid by the fund during periods when reimbursements or reductions occur. Expenses net of any voluntary waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the fund.

E For the year ended February 29.

See accompanying notes which are an integral part of the financial statements.

Annual Report

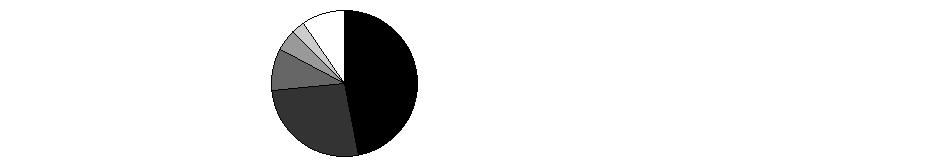

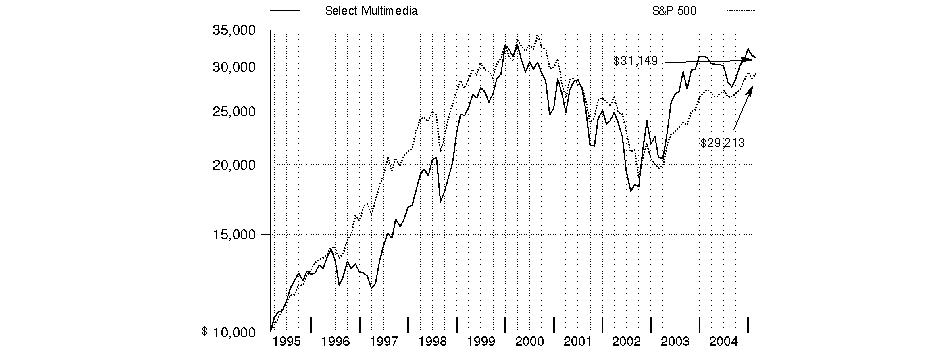

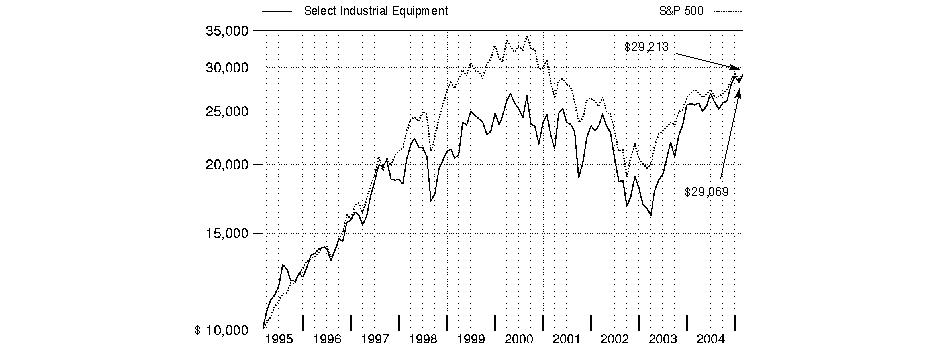

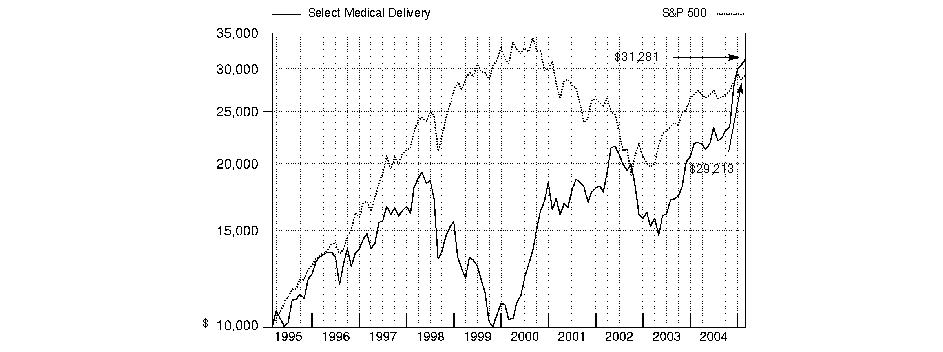

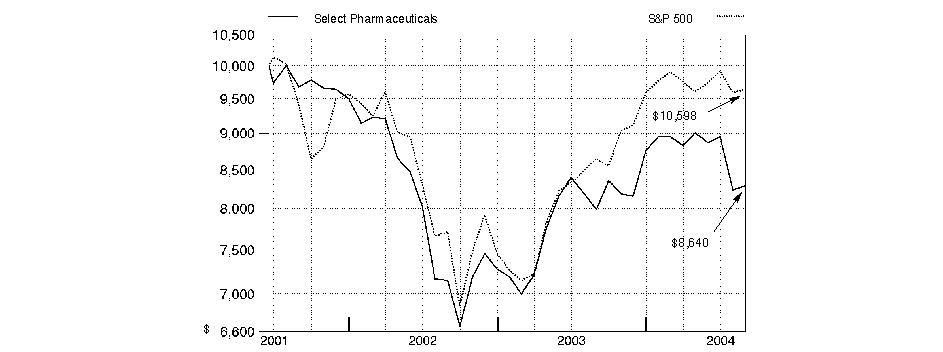

Performance

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's dividend income and capital gains (the profits earned upon the sale of securities that have grown in value) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity a fund's total returns will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2005 | Past 1 | Past 5 | Past 10 |

Select Multimedia | 0.01% | -0.10% | 12.03% |

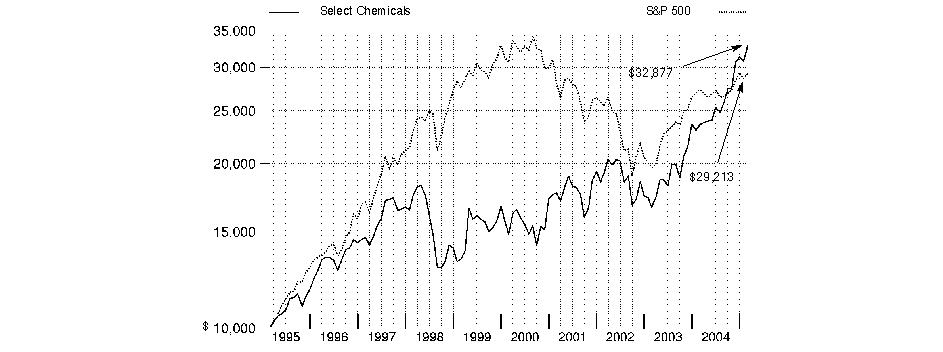

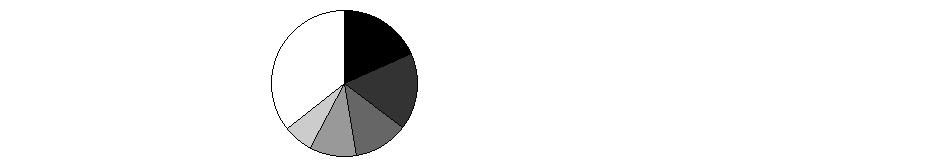

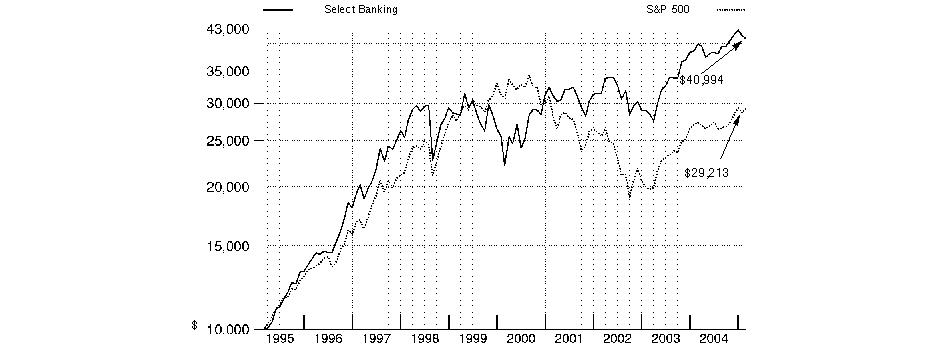

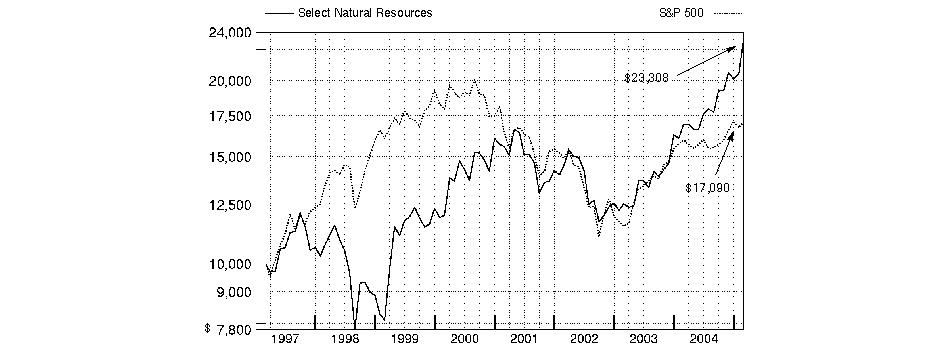

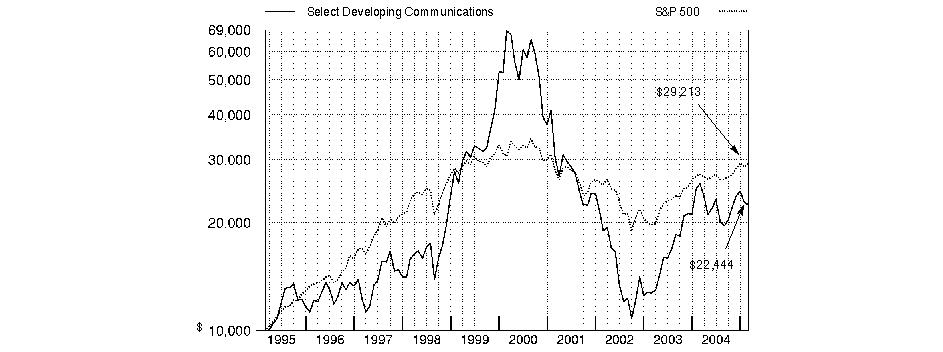

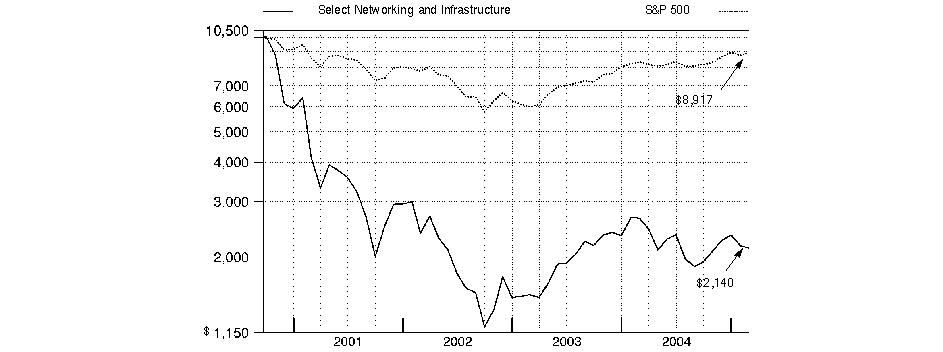

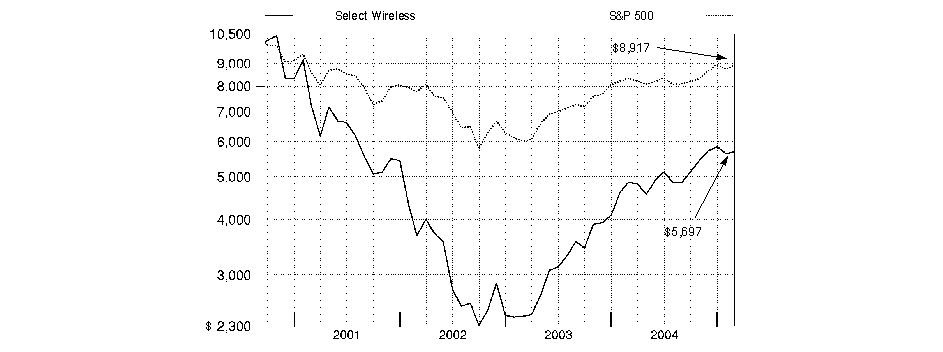

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Fidelity Select Multimedia Portfolio on February 28, 1995. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Multimedia Portfolio

Management's Discussion of Fund Performance

Comments from John Roth, Portfolio Manager of Fidelity® Select Multimedia Portfolio

Stocks got off to a shaky start in the first month of the new year, but most major equity benchmarks managed to cling to their gains for the 12 months ending February 28, 2005. Small-cap stocks continued a six-year-plus run of outperforming large-caps, as the small-cap Russell 2000® Index gained 9.53% during the period, compared to 6.98% for the larger-cap Standard & Poor's 500SM Index. Mid-caps were among the market's biggest gainers, highlighted by the 14.98% rise in the Russell Midcap® Index. Turning to investment styles, value significantly outdistanced growth. The Russell 3000® Value Index advanced 13.71%, versus 1.47% for the Russell 3000 Growth Index. Energy was the best-performing sector, spurred by record-high oil prices. Technology fared worst, despite a strong rally in the fourth quarter of 2004. However, a good portion of that gain was wiped out in January and February, leaving the tech-heavy NASDAQ Composite® Index with a modest 1.64% increase for the one-year period. Large-cap blue-chip stocks fared somewhat better, but the 3.96% return of the Dow Jones Industrial AverageSM was well under its historical average of roughly 11%.

For the 12-month period ending February 28, 2005, the fund returned 0.01%, trailing both the Goldman Sachs® Consumer Industries Index's 5.97% gain and the S&P 500®. The fund's performance lagged the Goldman Sachs index due mainly to unfavorable industry selection. The largest detractor from performance relative to the sector benchmark was the fund's overweighted position in poor-performing media stocks. Radio broadcaster Clear Channel Communications was the largest relative detractor during the period, as its business fundamentals remained weak despite a recovery in the advertising environment. IAC/InterActiveCorp also hurt, with its travel business suffering from increased competition from the big hotel chains and other online providers. On the positive side, overweightings in selected Internet portals were strong contributors to performance. Internet portal Yahoo!, the fund's top contributor to relative performance and its third-largest holding at the period end, benefited from the shift of ad dollars from traditional media to the Internet. Another major holding, Internet search engine Google, also was a major contributor. After a successful initial public offering, the company's stock continued to rise after it reported earnings that handily beat investor expectations.

The views expressed in this statement reflect those of the portfolio manager only through the end of the period of the report as stated on the cover and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Multimedia Portfolio

Investment Summary

Top Ten Stocks as of February 28, 2005 | |

% of fund's | |

Walt Disney Co. | 9.3 |

Omnicom Group, Inc. | 8.2 |

Yahoo!, Inc. | 6.6 |

Google, Inc. Class A (sub. vtg.) | 5.8 |

News Corp. Class A | 5.2 |

Washington Post Co. Class B | 5.1 |

McGraw-Hill Companies, Inc. | 4.6 |

Gannett Co., Inc. | 4.3 |

XM Satellite Radio Holdings, Inc. Class A | 3.3 |

E.W. Scripps Co. Class A | 3.2 |

55.6 | |

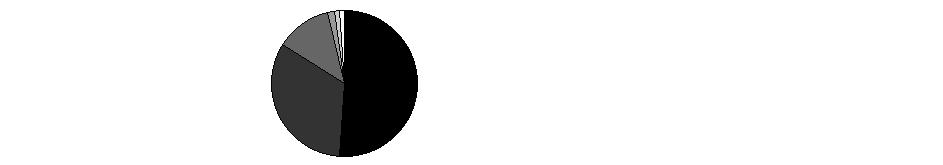

Top Industries as of February 28, 2005 | |||

% of fund's net assets | |||

| Media | 76.4% | |

| Internet Software & Services | 14.0% | |

| Commercial Services & Supplies | 2.9% | |

| Software | 2.7% | |

| Internet & Catalog Retail | 2.0% | |

| All Others * | 2.0% | |

* Includes short-term investments and net other assets. |

Annual Report

Multimedia Portfolio

Investments February 28, 2005

Showing Percentage of Net Assets

Common Stocks - 100.0% | |||

Shares | Value (Note 1) | ||

COMMERCIAL SERVICES & SUPPLIES - 2.9% | |||

51job, Inc. ADR (d) | 9,600 | $ 194,688 | |

Apollo Group, Inc. Class A (a) | 11,600 | 854,224 | |

Monster Worldwide, Inc. (a) | 33,300 | 960,705 | |

R.R. Donnelley & Sons Co. | 47,600 | 1,580,796 | |

TOTAL COMMERCIAL SERVICES & SUPPLIES | 3,590,413 | ||

ELECTRONIC EQUIPMENT & INSTRUMENTS - 0.0% | |||

Dolby Laboratories, Inc. Class A | 700 | 16,156 | |

HOTELS, RESTAURANTS & LEISURE - 0.4% | |||

Ctrip.com International Ltd. ADR (a) | 12,300 | 474,165 | |

INTERNET & CATALOG RETAIL - 2.0% | |||

eBay, Inc. (a) | 42,400 | 1,816,416 | |

IAC/InterActiveCorp (a) | 29,500 | 663,750 | |

Shopping.Com Ltd. | 3,400 | 55,692 | |

TOTAL INTERNET & CATALOG RETAIL | 2,535,858 | ||

INTERNET SOFTWARE & SERVICES - 14.0% | |||

aQuantive, Inc. (a) | 88,400 | 934,388 | |

Google, Inc. Class A (sub. vtg.) | 38,800 | 7,294,012 | |

iVillage, Inc. (a) | 45,300 | 260,475 | |

Netease.com, Inc. sponsored ADR (a) | 3,700 | 156,473 | |

Sina Corp. (a)(d) | 12,100 | 345,213 | |

ValueClick, Inc. (a) | 21,800 | 275,770 | |

Yahoo!, Inc. (a) | 257,800 | 8,319,206 | |

TOTAL INTERNET SOFTWARE & SERVICES | 17,585,537 | ||

MEDIA - 76.4% | |||

ADVO, Inc. | 8,800 | 322,696 | |

British Sky Broadcasting Group PLC (BSkyB) sponsored ADR | 16,700 | 728,287 | |

Cablevision Systems Corp. - NY Group Class A (a) | 80,255 | 2,492,720 | |

Central European Media Enterprises Ltd. Class A (a) | 20,700 | 942,471 | |

Cheil Communications, Inc. | 30 | 4,973 | |

Clear Channel Communications, Inc. | 26 | 865 | |

E.W. Scripps Co. Class A | 88,000 | 4,062,080 | |

EchoStar Communications Corp. Class A | 61,400 | 1,826,650 | |

Fox Entertainment Group, Inc. Class A (a) | 120,200 | 4,002,660 | |

Gannett Co., Inc. | 68,000 | 5,355,000 | |

Getty Images, Inc. (a) | 26,200 | 1,869,108 | |

Grupo Televisa SA de CV sponsored ADR | 11,700 | 754,065 | |

Shares | Value (Note 1) | ||

Harte-Hanks, Inc. | 11,300 | $ 302,840 | |

ITV PLC | 152,101 | 339,139 | |

JC Decaux SA (a) | 116,800 | 3,005,058 | |

Lamar Advertising Co. Class A (a) | 100,400 | 3,944,716 | |

Liberty Media Corp. Class A (a) | 4 | 41 | |

Liberty Media International, Inc. | 13,670 | 590,954 | |

Lions Gate Entertainment Corp. (a) | 54,200 | 569,925 | |

McGraw-Hill Companies, Inc. | 63,200 | 5,804,920 | |

Mediaset Spa | 142,600 | 2,009,274 | |

News Corp.: | |||

Class A | 394,322 | 6,561,518 | |

Class B (d) | 191,000 | 3,287,110 | |

Omnicom Group, Inc. | 112,900 | 10,281,803 | |

Playboy Enterprises, Inc. Class B (non-vtg.) (a) | 112,660 | 1,565,974 | |

Point.360 (a) | 1,000 | 3,400 | |

R.H. Donnelley Corp. (a) | 7,100 | 433,100 | |

Radio One, Inc. Class D (non-vtg.) (a) | 85,000 | 1,161,950 | |

Reuters Group PLC sponsored ADR | 18,400 | 870,136 | |

SBS Broadcasting SA (a) | 16,700 | 711,420 | |

The DIRECTV Group, Inc. (a) | 34 | 510 | |

Time Warner, Inc. (a) | 81,025 | 1,396,061 | |

Tribune Co. | 47,400 | 1,930,602 | |

UnitedGlobalCom, Inc. Class A (a) | 135,900 | 1,263,870 | |

Univision Communications, Inc. | 94,700 | 2,499,133 | |

Viacom, Inc. Class B (non-vtg.) | 71,496 | 2,495,210 | |

Walt Disney Co. | 420,300 | 11,743,181 | |

Washington Post Co. Class B | 7,100 | 6,375,800 | |

World Wrestling Entertainment, Inc. | 28,800 | 364,608 | |

XM Satellite Radio Holdings, Inc. | 125,300 | 4,129,888 | |

TOTAL MEDIA | 96,003,716 | ||

SOFTWARE - 2.7% | |||

Electronic Arts, Inc. (a) | 35,500 | 2,289,395 | |

Macrovision Corp. (a) | 200 | 4,850 | |

NDS Group PLC sponsored ADR (a) | 8,700 | 312,504 | |

Shanda Interactive Entertainment Ltd. ADR (d) | 26,800 | 810,164 | |

TOTAL SOFTWARE | 3,416,913 | ||

WIRELESS TELECOMMUNICATION SERVICES - 1.6% | |||

SpectraSite, Inc. (a) | 32,300 | 1,996,140 | |

TOTAL COMMON STOCKS (Cost $105,586,908) | 125,618,898 | ||

Money Market Funds - 7.1% | |||

Shares | Value (Note 1) | ||

Fidelity Cash Central Fund, 2.51% (b) | 1,575,724 | $ 1,575,724 | |

Fidelity Securities Lending Cash Central Fund, 2.52% (b)(c) | 7,276,575 | 7,276,575 | |

TOTAL MONEY MARKET FUNDS (Cost $8,852,299) | 8,852,299 | ||

TOTAL INVESTMENT PORTFOLIO - 107.1% (Cost $114,439,207) | 134,471,197 | ||

NET OTHER ASSETS - (7.1)% | (8,856,060) | ||

NET ASSETS - 100% | $ 125,615,137 | ||

Legend |

(a) Non-income producing |

(b) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete listing of the fund's holdings as of its most recent quarter end is available upon request. |

(c) Includes investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Multimedia Portfolio

Financial Statements

Statement of Assets and Liabilities

February 28, 2005 | ||

Assets | ||

Investment in securities, at value (including securities loaned of $7,637,313) (cost $114,439,207) - See accompanying schedule | $ 134,471,197 | |

Receivable for investments sold | 930,425 | |

Receivable for fund shares sold | 50,406 | |

Dividends receivable | 56,208 | |

Interest receivable | 1,065 | |

Prepaid expenses | 460 | |

Other affiliated receivables | 87 | |

Other receivables | 29,066 | |

Total assets | 135,538,914 | |

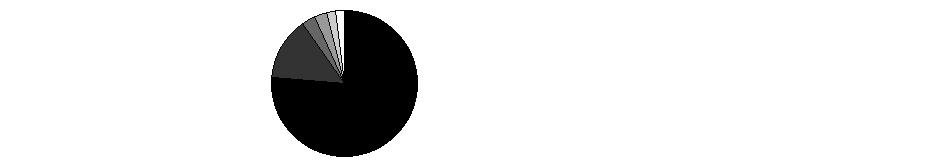

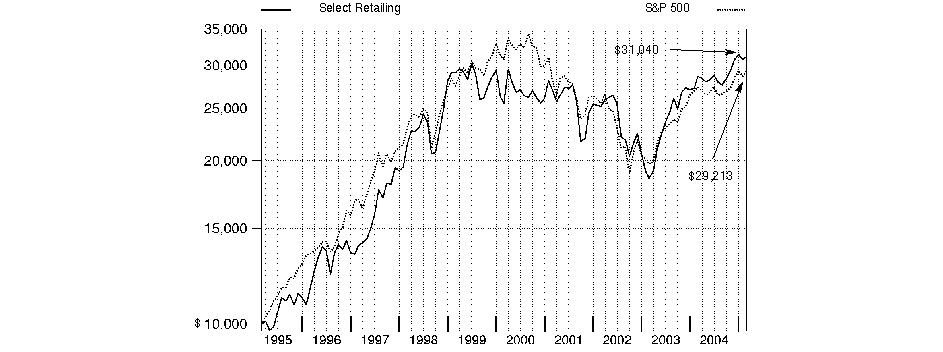

Liabilities | ||