UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | July 31 |

Date of reporting period: | January 31, 2023 |

Item 1.

Reports to Stockholders

Contents

Top Holdings (% of Fund's net assets) | ||

| Mitsubishi Estate Co. Ltd. | 4.9 | |

| Vonovia SE | 4.7 | |

| CK Asset Holdings Ltd. | 4.6 | |

| Sino Land Ltd. | 3.4 | |

| Londonmetric Properity PLC | 3.2 | |

| Advance Residence Investment Corp. | 3.1 | |

| Great Eagle Holdings Ltd. | 3.0 | |

| Mitsui Fudosan Logistics Park, Inc. | 2.7 | |

| Segro PLC | 2.6 | |

| National Storage REIT unit | 2.6 | |

| 34.8 | ||

| Top Five REIT Sectors (% of Fund's net assets) | ||

| REITs - Diversified | 14.5 | |

| REITs - Apartments | 8.3 | |

| REITs - Warehouse/Industrial | 6.9 | |

| REITs - Management/Investment | 6.5 | |

| REITs - Health Care | 4.3 | |

Asset Allocation (% of Fund's net assets) |

|

Foreign investments - 93.8% |

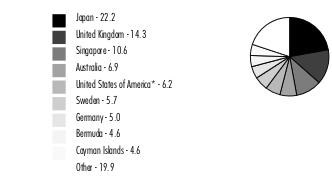

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are based on country or territory of incorporation and are adjusted for the effect of derivatives, if applicable. |

| Common Stocks - 95.9% | |||

| Shares | Value ($) | ||

| Australia - 6.9% | |||

| Abacus Property Group unit | 4,977,140 | 9,862,590 | |

| Arena (REIT) unit | 2,312,908 | 6,135,613 | |

| Charter Hall Group unit | 521,985 | 5,139,770 | |

| Ingenia Communities Group unit | 1,409,476 | 4,641,797 | |

| National Storage REIT unit | 10,259,997 | 16,885,273 | |

| NEXTDC Ltd. (a) | 249,013 | 1,759,797 | |

TOTAL AUSTRALIA | 44,424,840 | ||

| Belgium - 4.0% | |||

| Home Invest Belgium SA (b) | 78,791 | 1,692,081 | |

| Inclusio SA | 271,921 | 4,212,570 | |

| Montea SICAFI SCA | 60,537 | 4,843,822 | |

| Warehouses de Pauw | 473,635 | 14,963,351 | |

TOTAL BELGIUM | 25,711,824 | ||

| Bermuda - 4.6% | |||

| Great Eagle Holdings Ltd. | 8,050,541 | 19,333,726 | |

| Tai Cheung Holdings Ltd. | 13,230,000 | 7,206,677 | |

| Wing Tai Properties Ltd. | 7,204,000 | 3,329,341 | |

TOTAL BERMUDA | 29,869,744 | ||

| Cayman Islands - 4.6% | |||

| CK Asset Holdings Ltd. | 4,646,000 | 29,704,250 | |

| France - 1.0% | |||

| ARGAN SA | 74,132 | 6,294,282 | |

| Germany - 5.0% | |||

| Instone Real Estate Group BV (c) | 179,200 | 1,821,542 | |

| Vonovia SE | 1,086,541 | 30,692,501 | |

TOTAL GERMANY | 32,514,043 | ||

| Hong Kong - 3.9% | |||

| Magnificent Hotel Investment Ltd. (a) | 201,209,000 | 3,045,108 | |

| Sino Land Ltd. | 17,241,275 | 22,404,661 | |

TOTAL HONG KONG | 25,449,769 | ||

| Ireland - 1.5% | |||

| Irish Residential Properties REIT PLC | 8,023,700 | 9,961,627 | |

| Italy - 0.5% | |||

| Infrastrutture Wireless Italiane SpA (c) | 305,800 | 3,339,465 | |

| Japan - 22.2% | |||

| Advance Residence Investment Corp. (b) | 8,112 | 19,815,676 | |

| Daiwa Securities Living Invest | 17,295 | 14,470,850 | |

| Goldcrest Co. Ltd. | 751,500 | 9,427,774 | |

| Health Care & Medical Investment Corp. | 11,587 | 14,435,588 | |

| Ichigo, Inc. | 693,200 | 1,588,799 | |

| JTOWER, Inc. (a)(b) | 139,400 | 6,676,905 | |

| Katitas Co. Ltd. | 208,400 | 5,110,060 | |

| Kenedix Residential Investment Corp. (b) | 5,400 | 8,048,512 | |

| Kyoritsu Maintenance Co. Ltd. (b) | 111,300 | 5,083,512 | |

| Mirarth Holdings, Inc. | 1,724,900 | 5,106,680 | |

| Mitsubishi Estate Co. Ltd. | 2,475,300 | 31,815,332 | |

| Mitsui Fudosan Logistics Park, Inc. | 5,000 | 17,450,320 | |

| Nomura Real Estate Holdings, Inc. | 217,800 | 4,800,410 | |

TOTAL JAPAN | 143,830,418 | ||

| New Zealand - 2.7% | |||

| Arvida Group Ltd. | 8,145,096 | 6,118,282 | |

| Auckland International Airport Ltd. (a) | 910,397 | 5,010,408 | |

| Stride Property Group unit | 6,917,236 | 6,221,224 | |

TOTAL NEW ZEALAND | 17,349,914 | ||

| Singapore - 10.6% | |||

| CDL Hospitality Trusts unit | 352,884 | 364,135 | |

| City Developments Ltd. | 1,592,700 | 10,108,592 | |

| Keppel DC (REIT) | 8,207,700 | 12,793,057 | |

| Parkway Life REIT | 4,487,600 | 13,889,463 | |

| Singapore Land Group Ltd. | 9,109,000 | 15,632,073 | |

| Wing Tai Holdings Ltd. | 13,631,881 | 16,018,187 | |

TOTAL SINGAPORE | 68,805,507 | ||

| Spain - 3.4% | |||

| Aena SME SA (a)(c) | 23,300 | 3,500,800 | |

| Arima Real Estate SOCIMI SA (a) | 1,196,569 | 9,431,162 | |

| Cellnex Telecom SA (c) | 228,710 | 8,962,689 | |

TOTAL SPAIN | 21,894,651 | ||

| Sweden - 5.7% | |||

| Catena AB | 140,600 | 5,853,852 | |

| Fastighets AB Balder (a) | 776,700 | 3,977,230 | |

| Fastighets AB Trianon Class B | 362,700 | 813,314 | |

| Fastighetsbolaget Emilshus AB | 681,200 | 1,922,259 | |

| Heba Fastighets AB (B Shares) | 1,576,800 | 5,759,807 | |

| Hemnet Group AB | 539,400 | 7,510,006 | |

| Nibe Industrier AB (B Shares) | 438,500 | 4,710,973 | |

| Wihlborgs Fastigheter AB | 779,960 | 6,399,228 | |

TOTAL SWEDEN | 36,946,669 | ||

| Switzerland - 2.9% | |||

| Flughafen Zuerich AG (a) | 18,300 | 3,324,184 | |

| PSP Swiss Property AG | 122,674 | 15,262,227 | |

TOTAL SWITZERLAND | 18,586,411 | ||

| United Kingdom - 14.3% | |||

| Berkeley Group Holdings PLC | 20,300 | 1,037,363 | |

| Big Yellow Group PLC | 551,600 | 8,221,684 | |

| Grainger Trust PLC | 4,030,181 | 12,898,508 | |

| Great Portland Estates PLC | 421,048 | 2,956,212 | |

| Harworth Group PLC | 2,130,300 | 3,046,555 | |

| Londonmetric Properity PLC | 8,817,784 | 20,470,102 | |

| Rightmove PLC | 674,000 | 4,897,212 | |

| Safestore Holdings PLC | 501,519 | 6,220,075 | |

| Segro PLC | 1,667,008 | 17,062,028 | |

| Shaftesbury PLC | 695,568 | 3,375,242 | |

| Unite Group PLC | 785,480 | 9,654,739 | |

| Urban Logistics REIT PLC | 1,708,265 | 3,022,160 | |

TOTAL UNITED KINGDOM | 92,861,880 | ||

| United States of America - 2.1% | |||

| Airbnb, Inc. Class A (a) | 93,500 | 10,388,785 | |

| CoStar Group, Inc. (a) | 39,600 | 3,084,840 | |

TOTAL UNITED STATES OF AMERICA | 13,473,625 | ||

| TOTAL COMMON STOCKS (Cost $660,711,988) | 621,018,919 | ||

| Money Market Funds - 5.1% | |||

| Shares | Value ($) | ||

| Fidelity Cash Central Fund 4.38% (d) | 25,042,672 | 25,047,681 | |

| Fidelity Securities Lending Cash Central Fund 4.38% (d)(e) | 8,024,040 | 8,024,843 | |

| TOTAL MONEY MARKET FUNDS (Cost $33,072,524) | 33,072,524 | ||

| TOTAL INVESTMENT IN SECURITIES - 101.0% (Cost $693,784,512) | 654,091,443 |

NET OTHER ASSETS (LIABILITIES) - (1.0)% | (6,610,026) |

| NET ASSETS - 100.0% | 647,481,417 |

| (a) | Non-income producing |

| (b) | Security or a portion of the security is on loan at period end. |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $17,624,496 or 2.7% of net assets. |

| (d) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (e) | Investment made with cash collateral received from securities on loan. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.38% | 25,343,355 | 126,716,039 | 127,011,714 | 246,329 | 111 | (110) | 25,047,681 | 0.1% |

| Fidelity Securities Lending Cash Central Fund 4.38% | 5,012,018 | 28,967,592 | 25,954,767 | 75,078 | - | - | 8,024,843 | 0.0% |

| Total | 30,355,373 | 155,683,631 | 152,966,481 | 321,407 | 111 | (110) | 33,072,524 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Communication Services | 31,386,277 | 10,849,471 | 20,536,806 | - |

Consumer Discretionary | 19,554,768 | 11,426,148 | 8,128,620 | - |

Health Care | 6,118,282 | - | 6,118,282 | - |

Industrials | 19,631,205 | 11,119,997 | 8,511,208 | - |

Information Technology | 1,759,797 | - | 1,759,797 | - |

Real Estate | 542,568,590 | 180,135,659 | 362,432,931 | - |

| Money Market Funds | 33,072,524 | 33,072,524 | - | - |

| Total Investments in Securities: | 654,091,443 | 246,603,799 | 407,487,644 | - |

| Statement of Assets and Liabilities | ||||

January 31, 2023 (Unaudited) | ||||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $7,410,972) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $660,711,988) | $ | 621,018,919 | ||

Fidelity Central Funds (cost $33,072,524) | 33,072,524 | |||

| Total Investment in Securities (cost $693,784,512) | $ | 654,091,443 | ||

| Foreign currency held at value (cost $7,144) | 7,137 | |||

| Receivable for investments sold | 13,007 | |||

| Receivable for fund shares sold | 1,057,672 | |||

| Dividends receivable | 2,121,632 | |||

| Reclaims receivable | 1,192,759 | |||

| Distributions receivable from Fidelity Central Funds | 54,632 | |||

| Prepaid expenses | 2,174 | |||

| Other receivables | 7 | |||

Total assets | 658,540,463 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 1,312,800 | ||

| Payable for fund shares redeemed | 1,200,187 | |||

| Accrued management fee | 360,868 | |||

| Distribution and service plan fees payable | 5,161 | |||

| Other affiliated payables | 95,796 | |||

| Other payables and accrued expenses | 59,391 | |||

| Collateral on securities loaned | 8,024,843 | |||

| Total Liabilities | 11,059,046 | |||

| Net Assets | $ | 647,481,417 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 803,598,103 | ||

| Total accumulated earnings (loss) | (156,116,686) | |||

| Net Assets | $ | 647,481,417 | ||

| Net Asset Value and Maximum Offering Price | ||||

| Class A : | ||||

Net Asset Value and redemption price per share ($13,692,860 ÷ 1,303,864 shares) (a) | $ | 10.50 | ||

| Maximum offering price per share (100/94.25 of $10.50) | $ | 11.14 | ||

| Class M : | ||||

Net Asset Value and redemption price per share ($2,184,858 ÷ 209,996 shares) (a) | $ | 10.40 | ||

| Maximum offering price per share (100/96.50 of $10.40) | $ | 10.78 | ||

| Class C : | ||||

Net Asset Value and offering price per share ($1,679,884 ÷ 165,336 shares) (a) | $ | 10.16 | ||

| International Real Estate : | ||||

Net Asset Value , offering price and redemption price per share ($271,740,340 ÷ 25,489,116 shares) | $ | 10.66 | ||

| Class I : | ||||

Net Asset Value , offering price and redemption price per share ($72,729,237 ÷ 6,863,673 shares) | $ | 10.60 | ||

| Class Z : | ||||

Net Asset Value , offering price and redemption price per share ($285,454,238 ÷ 26,994,851 shares) | $ | 10.57 | ||

(a)Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge. | ||||

| Statement of Operations | ||||

Six months ended January 31, 2023 (Unaudited) | ||||

| Investment Income | ||||

| Dividends | $ | 8,733,396 | ||

| Foreign Tax Reclaims | 472,322 | |||

| Income from Fidelity Central Funds (including $75,078 from security lending) | 321,407 | |||

| Income before foreign taxes withheld | $ | 9,527,125 | ||

| Less foreign taxes withheld | (665,471) | |||

| Total Income | 8,861,654 | |||

| Expenses | ||||

| Management fee | $ | 2,304,687 | ||

| Transfer agent fees | 436,271 | |||

| Distribution and service plan fees | 31,818 | |||

| Accounting fees | 160,159 | |||

| Custodian fees and expenses | 37,658 | |||

| Independent trustees' fees and expenses | 1,243 | |||

| Registration fees | 65,519 | |||

| Audit | 34,090 | |||

| Legal | 575 | |||

| Interest | 2,676 | |||

| Miscellaneous | 2,913 | |||

| Total expenses before reductions | 3,077,609 | |||

| Expense reductions | (62,428) | |||

| Total expenses after reductions | 3,015,181 | |||

| Net Investment income (loss) | 5,846,473 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (80,189,835) | |||

| Fidelity Central Funds | 111 | |||

| Foreign currency transactions | (118,228) | |||

| Total net realized gain (loss) | (80,307,952) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (1,258,505) | |||

| Fidelity Central Funds | (110) | |||

| Assets and liabilities in foreign currencies | (7,311) | |||

| Total change in net unrealized appreciation (depreciation) | (1,265,926) | |||

| Net gain (loss) | (81,573,878) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (75,727,405) | ||

| Statement of Changes in Net Assets | ||||

Six months ended January 31, 2023 (Unaudited) | Year ended July 31, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 5,846,473 | $ | 16,306,038 |

| Net realized gain (loss) | (80,307,952) | 18,855,234 | ||

| Change in net unrealized appreciation (depreciation) | (1,265,926) | (203,391,678) | ||

| Net increase (decrease) in net assets resulting from operations | (75,727,405) | (168,230,406) | ||

| Distributions to shareholders | (31,353,019) | (54,162,695) | ||

| Share transactions - net increase (decrease) | (90,572,746) | 68,244,424 | ||

| Total increase (decrease) in net assets | (197,653,170) | (154,148,677) | ||

| Net Assets | ||||

| Beginning of period | 845,134,587 | 999,283,264 | ||

| End of period | $ | 647,481,417 | $ | 845,134,587 |

| Fidelity Advisor® International Real Estate Fund Class A |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 11.88 | $ | 14.84 | $ | 11.74 | $ | 12.14 | $ | 11.63 | $ | 11.03 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .07 | .18 | .22 | .17 | .16 | .23 | ||||||

| Net realized and unrealized gain (loss) | (1.02) | (2.39) | 3.08 | .05 | .55 | .69 | ||||||

| Total from investment operations | (.95) | (2.21) | 3.30 | .22 | .71 | .92 | ||||||

| Distributions from net investment income | (.03) | (.52) | (.20) | (.24) | (.17) | (.21) | ||||||

| Distributions from net realized gain | (.40) | (.23) | - | (.38) | (.03) | (.11) | ||||||

| Total distributions | (.43) | (.75) | (.20) | (.62) | (.20) | (.32) | ||||||

Redemption fees added to paid in capital A | - | - | - | - | - | - C | ||||||

| Net asset value, end of period | $ | 10.50 | $ | 11.88 | $ | 14.84 | $ | 11.74 | $ | 12.14 | $ | 11.63 |

Total Return D,E,F | (8.03)% | (15.76)% | 28.46% | 1.71% | 6.21% | 8.49% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | 1.25% I | 1.23% | 1.23% | 1.27% | 1.32% | 1.36% | ||||||

| Expenses net of fee waivers, if any | 1.20% I | 1.22% | 1.23% | 1.27% | 1.32% | 1.36% | ||||||

| Expenses net of all reductions | 1.20% I | 1.22% | 1.23% | 1.26% | 1.31% | 1.35% | ||||||

| Net investment income (loss) | 1.40% I | 1.33% | 1.66% | 1.40% | 1.35% | 2.03% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 13,693 | $ | 16,274 | $ | 17,071 | $ | 11,710 | $ | 12,564 | $ | 11,319 |

Portfolio turnover rate J | 26% I | 47% | 37% | 69% | 52% | 56% |

| Fidelity Advisor® International Real Estate Fund Class M |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 11.76 | $ | 14.71 | $ | 11.64 | $ | 12.02 | $ | 11.53 | $ | 10.93 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .06 | .14 | .18 | .13 | .12 | .20 | ||||||

| Net realized and unrealized gain (loss) | (1.02) | (2.37) | 3.05 | .05 | .54 | .68 | ||||||

| Total from investment operations | (.96) | (2.23) | 3.23 | .18 | .66 | .88 | ||||||

| Distributions from net investment income | - | (.49) | (.16) | (.18) | (.14) | (.17) | ||||||

| Distributions from net realized gain | (.40) | (.23) | - | (.38) | (.03) | (.11) | ||||||

| Total distributions | (.40) | (.72) | (.16) | (.56) | (.17) | (.28) | ||||||

Redemption fees added to paid in capital A | - | - | - | - | - | - C | ||||||

| Net asset value, end of period | $ | 10.40 | $ | 11.76 | $ | 14.71 | $ | 11.64 | $ | 12.02 | $ | 11.53 |

Total Return D,E,F | (8.15)% | (16.01)% | 28.08% | 1.41% | 5.86% | 8.19% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | 1.52% I | 1.53% | 1.55% | 1.59% | 1.62% | 1.65% | ||||||

| Expenses net of fee waivers, if any | 1.45% I | 1.51% | 1.55% | 1.58% | 1.62% | 1.65% | ||||||

| Expenses net of all reductions | 1.44% I | 1.51% | 1.54% | 1.58% | 1.61% | 1.65% | ||||||

| Net investment income (loss) | 1.15% I | 1.04% | 1.34% | 1.08% | 1.06% | 1.74% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 2,185 | $ | 2,804 | $ | 3,488 | $ | 2,976 | $ | 3,703 | $ | 4,360 |

Portfolio turnover rate J | 26% I | 47% | 37% | 69% | 52% | 56% |

| Fidelity Advisor® International Real Estate Fund Class C |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 11.52 | $ | 14.43 | $ | 11.43 | $ | 11.80 | $ | 11.33 | $ | 10.73 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .03 | .07 | .11 | .07 | .07 | .15 | ||||||

| Net realized and unrealized gain (loss) | (.99) | (2.32) | 3.00 | .04 | .55 | .67 | ||||||

| Total from investment operations | (.96) | (2.25) | 3.11 | .11 | .62 | .82 | ||||||

| Distributions from net investment income | - | (.43) | (.11) | (.10) | (.12) | (.10) | ||||||

| Distributions from net realized gain | (.40) | (.23) | - | (.38) | (.03) | (.11) | ||||||

| Total distributions | (.40) | (.66) | (.11) | (.48) | (.15) | (.22) C | ||||||

Redemption fees added to paid in capital A | - | - | - | - | - | - D | ||||||

| Net asset value, end of period | $ | 10.16 | $ | 11.52 | $ | 14.43 | $ | 11.43 | $ | 11.80 | $ | 11.33 |

Total Return E,F,G | (8.33)% | (16.40)% | 27.44% | .85% | 5.56% | 7.70% | ||||||

Ratios to Average Net Assets B,H,I | ||||||||||||

| Expenses before reductions | 2.02% J | 2.02% | 2.05% | 2.04% | 2.02% | 2.05% | ||||||

| Expenses net of fee waivers, if any | 1.95% J | 2.01% | 2.05% | 2.03% | 2.02% | 2.04% | ||||||

| Expenses net of all reductions | 1.95% J | 2.01% | 2.04% | 2.03% | 2.01% | 2.04% | ||||||

| Net investment income (loss) | .65% J | .55% | .85% | .63% | .66% | 1.35% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 1,680 | $ | 2,087 | $ | 3,036 | $ | 3,836 | $ | 3,869 | $ | 4,894 |

Portfolio turnover rate K | 26% J | 47% | 37% | 69% | 52% | 56% |

| Fidelity® International Real Estate Fund |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 12.06 | $ | 15.04 | $ | 11.90 | $ | 12.31 | $ | 11.78 | $ | 11.17 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .08 | .22 | .26 | .20 | .19 | .27 | ||||||

| Net realized and unrealized gain (loss) | (1.03) | (2.42) | 3.12 | .05 | .56 | .70 | ||||||

| Total from investment operations | (.95) | (2.20) | 3.38 | .25 | .75 | .97 | ||||||

| Distributions from net investment income | (.04) | (.54) | (.24) | (.28) | (.19) | (.24) | ||||||

| Distributions from net realized gain | (.40) | (.24) | - | (.38) | (.03) | (.11) | ||||||

| Total distributions | (.45) C | (.78) | (.24) | (.66) | (.22) | (.36) C | ||||||

Redemption fees added to paid in capital A | - | - | - | - | - | - D | ||||||

| Net asset value, end of period | $ | 10.66 | $ | 12.06 | $ | 15.04 | $ | 11.90 | $ | 12.31 | $ | 11.78 |

Total Return E,F | (7.91)% | (15.50)% | 28.83% | 1.98% | 6.49% | 8.84% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | .98% I | .95% | .97% | 1.00% | 1.02% | 1.05% | ||||||

| Expenses net of fee waivers, if any | .95% I | .94% | .97% | 1.00% | 1.02% | 1.05% | ||||||

| Expenses net of all reductions | .95% I | .94% | .96% | .99% | 1.01% | 1.04% | ||||||

| Net investment income (loss) | 1.65% I | 1.61% | 1.92% | 1.67% | 1.65% | 2.34% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 271,740 | $ | 316,203 | $ | 360,653 | $ | 224,266 | $ | 251,947 | $ | 244,195 |

Portfolio turnover rate J | 26% I | 47% | 37% | 69% | 52% | 56% |

| Fidelity Advisor® International Real Estate Fund Class I |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 11.98 | $ | 14.94 | $ | 11.83 | $ | 12.23 | $ | 11.70 | $ | 11.13 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .09 | .22 | .27 | .21 | .20 | .28 | ||||||

| Net realized and unrealized gain (loss) | (1.03) | (2.40) | 3.09 | .06 | .55 | .68 | ||||||

| Total from investment operations | (.94) | (2.18) | 3.36 | .27 | .75 | .96 | ||||||

| Distributions from net investment income | (.04) | (.54) | (.25) | (.28) | (.19) | (.28) | ||||||

| Distributions from net realized gain | (.40) | (.24) | - | (.38) | (.03) | (.11) | ||||||

| Total distributions | (.44) | (.78) | (.25) | (.67) C | (.22) | (.39) | ||||||

Redemption fees added to paid in capital A | - | - | - | - | - | - D | ||||||

| Net asset value, end of period | $ | 10.60 | $ | 11.98 | $ | 14.94 | $ | 11.83 | $ | 12.23 | $ | 11.70 |

Total Return E,F | (7.84)% | (15.46)% | 28.83% | 2.09% | 6.61% | 8.88% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | .91% I | .92% | .90% | .93% | .94% | .96% | ||||||

| Expenses net of fee waivers, if any | .91% I | .91% | .90% | .93% | .94% | .96% | ||||||

| Expenses net of all reductions | .91% I | .91% | .90% | .92% | .93% | .95% | ||||||

| Net investment income (loss) | 1.69% I | 1.64% | 1.99% | 1.73% | 1.74% | 2.44% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (000 omitted) | $ | 72,729 | $ | 95,002 | $ | 290,807 | $ | 145,964 | $ | 137,778 | $ | 350,392 |

Portfolio turnover rate J | 26% I | 47% | 37% | 69% | 52% | 56% |

| Fidelity Advisor® International Real Estate Fund Class Z |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 A | ||||||

Selected Per-Share Data | ||||||||||

| Net asset value, beginning of period | $ | 11.97 | $ | 14.93 | $ | 11.82 | $ | 12.25 | $ | 11.16 |

| Income from Investment Operations | ||||||||||

Net investment income (loss) B,C | .09 | .23 | .28 | .22 | .30 | |||||

| Net realized and unrealized gain (loss) | (1.03) | (2.39) | 3.09 | .05 | .79 | |||||

| Total from investment operations | (.94) | (2.16) | 3.37 | .27 | 1.09 | |||||

| Distributions from net investment income | (.06) | (.55) | (.26) | (.32) | - | |||||

| Distributions from net realized gain | (.40) | (.25) | - | (.38) | - | |||||

| Total distributions | (.46) | (.80) | (.26) | (.70) | - | |||||

| Net asset value, end of period | $ | 10.57 | $ | 11.97 | $ | 14.93 | $ | 11.82 | $ | 12.25 |

Total Return D,E | (7.87)% | (15.35)% | 28.99% | 2.12% | 9.77% | |||||

Ratios to Average Net Assets C,F,G | ||||||||||

| Expenses before reductions | .81% H | .79% | .81% | .83% | .84% H | |||||

| Expenses net of fee waivers, if any | .80% H | .79% | .81% | .83% | .84% H | |||||

| Expenses net of all reductions | .80% H | .79% | .81% | .82% | .83% H | |||||

| Net investment income (loss) | 1.80% H | 1.76% | 2.08% | 1.83% | 3.02% H | |||||

| Supplemental Data | ||||||||||

| Net assets, end of period (000 omitted) | $ | 285,454 | $ | 412,765 | $ | 324,228 | $ | 110,808 | $ | 158,056 |

Portfolio turnover rate I | 26% H | 47% | 37% | 69% | 52% H |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Gross unrealized appreciation | $49,002,215 |

| Gross unrealized depreciation | (100,934,198) |

| Net unrealized appreciation (depreciation) | $(51,931,983) |

| Tax cost | $706,023,426 |

| Purchases ($) | Sales ($) | |

| Fidelity International Real Estate Fund | 85,538,963 | 206,144,692 |

| Distribution Fee | Service Fee | Total Fees | Retained by FDC | |

| Class A | - % | .25% | $17,468 | $804 |

| Class M | .25% | .25% | 5,842 | - |

| Class C | .75% | .25% | 8,508 | 1,462 |

| $31,818 | $2,266 |

| Retained by FDC | |

| Class A | $3,558 |

| Class M | 88 |

Class C A | 11 |

| $3,657 |

| Amount | % of Class-Level Average Net Assets A | |

| Class A | $16,573 | .24 |

| Class M | 3,028 | .26 |

| Class C | 2,177 | .26 |

| International Real Estate | 290,927 | .21 |

| Class I | 57,172 | .15 |

| Class Z | 66,394 | .04 |

| $436,271 |

| % of Average Net Assets | |

| Fidelity International Real Estate Fund | .05 |

| Amount | |

| Fidelity International Real Estate Fund | $134 |

| Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense | |

Fidelity International Real Estate Fund | Borrower | $2,618,556 | 4.09% | $2,676 |

| Purchases ($) | Sales ($) | Realized Gain (Loss) ($) | |

| Fidelity International Real Estate Fund | 368,621 | 2,422,957 | 603,750 |

| Amount | |

| Fidelity International Real Estate Fund | $1,040 |

| Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End | |

| Fidelity International Real Estate Fund | $8,081 | $- | $- |

| Expense Limitations | Reimbursement | |

| Class A | 1.20% A | $3,504 |

| Class M | 1.45% A | 816 |

| Class C | 1.95% A | 560 |

| International Real Estate | .95% A | 38,809 |

| Class I | .95% A | - |

| Class Z | .80% A | 5,918 |

| $49,607 |

| Expense reduction | |

| Class A | $75 |

| Class M | 88 |

| Class C | 14 |

| $177 |

Six months ended January 31, 2023 | Year ended July 31, 2022 | |

| Fidelity International Real Estate Fund | ||

| Distributions to shareholders | ||

| Class A | $589,083 | $865,319 |

| Class M | 95,765 | 171,713 |

| Class C | 71,168 | 135,188 |

| International Real Estate | 11,787,000 | 18,841,300 |

| Class I | 3,502,573 | 9,606,899 |

| Class Z | 15,307,430 | 24,542,276 |

Total | $31,353,019 | $54,162,695 |

| Shares | Shares | Dollars | Dollars | |

Six months ended January 31, 2023 | Year ended July 31, 2022 | Six months ended January 31, 2023 | Year ended July 31, 2022 | |

| Fidelity International Real Estate Fund | ||||

| Class A | ||||

| Shares sold | 125,483 | 397,495 | $1,286,884 | $5,356,663 |

| Reinvestment of distributions | 54,508 | 57,737 | 575,600 | 828,355 |

| Shares redeemed | (246,432) | (235,551) | (2,475,766) | (3,133,992) |

| Net increase (decrease) | (66,441) | 219,681 | $(613,282) | $3,051,026 |

| Class M | ||||

| Shares sold | 6,705 | 25,506 | $68,442 | $335,839 |

| Reinvestment of distributions | 9,147 | 12,008 | 95,765 | 171,073 |

| Shares redeemed | (44,376) | (36,172) | (433,166) | (453,163) |

| Net increase (decrease) | (28,524) | 1,342 | $(268,959) | $53,749 |

| Class C | ||||

| Shares sold | 15,385 | 49,064 | $149,968 | $639,665 |

| Reinvestment of distributions | 6,950 | 9,648 | 71,168 | 135,188 |

| Shares redeemed | (38,117) | (87,967) | (370,418) | (1,156,517) |

| Net increase (decrease) | (15,782) | (29,255) | $(149,282) | $(381,664) |

| International Real Estate | ||||

| Shares sold | 2,939,664 | 7,944,369 | $30,924,168 | $109,613,164 |

| Reinvestment of distributions | 1,034,325 | 1,218,768 | 11,077,624 | 17,718,284 |

| Shares redeemed | (4,714,208) | (6,914,301) | (48,302,062) | (92,451,752) |

| Net increase (decrease) | (740,219) | 2,248,836 | $(6,300,270) | $34,879,696 |

| Class I | ||||

| Shares sold | 1,500,853 | 5,918,552 | $15,040,412 | $82,528,405 |

| Reinvestment of distributions | 318,645 | 647,187 | 3,390,384 | 9,343,048 |

| Shares redeemed | (2,888,235) | (18,092,769) | (28,478,454) | (245,224,431) |

| Net increase (decrease) | (1,068,737) | (11,527,030) | $(10,047,658) | $(153,352,978) |

| Class Z | ||||

| Shares sold | 5,665,334 | 16,160,904 | $56,831,326 | $224,896,432 |

| Reinvestment of distributions | 1,117,458 | 1,165,843 | 11,856,230 | 16,803,235 |

| Shares redeemed | (14,283,744) | (4,543,486) | (141,880,851) | (57,705,072) |

| Net increase (decrease) | (7,500,952) | 12,783,261 | $(73,193,295) | $183,994,595 |

| Strategic Advisers Fidelity International Fund | |

| Fidelity International Real Estate Fund | 13% |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2022 to January 31, 2023). |

Annualized Expense Ratio- A | Beginning Account Value August 1, 2022 | Ending Account Value January 31, 2023 | Expenses Paid During Period- C August 1, 2022 to January 31, 2023 | |||||||

| Fidelity® International Real Estate Fund | ||||||||||

| Class A | 1.20% | |||||||||

| Actual | $ 1,000 | $ 919.70 | $ 5.81 | |||||||

Hypothetical- B | $ 1,000 | $ 1,019.16 | $ 6.11 | |||||||

| Class M | 1.45% | |||||||||

| Actual | $ 1,000 | $ 918.50 | $ 7.01 | |||||||

Hypothetical- B | $ 1,000 | $ 1,017.90 | $ 7.38 | |||||||

| Class C | 1.95% | |||||||||

| Actual | $ 1,000 | $ 916.70 | $ 9.42 | |||||||

Hypothetical- B | $ 1,000 | $ 1,015.38 | $ 9.91 | |||||||

| Fidelity® International Real Estate Fund | .95% | |||||||||

| Actual | $ 1,000 | $ 920.90 | $ 4.60 | |||||||

Hypothetical- B | $ 1,000 | $ 1,020.42 | $ 4.84 | |||||||

| Class I | .91% | |||||||||

| Actual | $ 1,000 | $ 921.60 | $ 4.41 | |||||||

Hypothetical- B | $ 1,000 | $ 1,020.62 | $ 4.63 | |||||||

| Class Z | .80% | |||||||||

| Actual | $ 1,000 | $ 921.30 | $ 3.87 | |||||||

Hypothetical- B | $ 1,000 | $ 1,021.17 | $ 4.08 | |||||||

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

|

Contents

Top Holdings (% of Fund's net assets) | ||

| Prologis (REIT), Inc. | 10.6 | |

| Crown Castle International Corp. | 9.3 | |

| SBA Communications Corp. Class A | 7.0 | |

| Equinix, Inc. | 6.3 | |

| Welltower, Inc. | 4.7 | |

| Ventas, Inc. | 4.7 | |

| Digital Realty Trust, Inc. | 4.6 | |

| UDR, Inc. | 3.5 | |

| CubeSmart | 3.5 | |

| Mid-America Apartment Communities, Inc. | 3.5 | |

| 57.7 | ||

| Top Five REIT Sectors (% of Fund's net assets) | ||

| REITs - Diversified | 32.6 | |

| REITs - Apartments | 10.7 | |

| REITs - Warehouse/Industrial | 10.6 | |

| REITs - Health Care | 9.4 | |

| REITs - Storage | 8.6 | |

Asset Allocation (% of Fund's net assets) |

|

| Common Stocks - 99.1% | |||

| Shares | Value ($) (000s) | ||

| Equity Real Estate Investment Trusts (REITs) - 95.7% | |||

| REITs - Apartments - 10.7% | |||

| American Homes 4 Rent Class A | 1,734,900 | 59,490 | |

| Invitation Homes, Inc. | 1,867,400 | 60,691 | |

| Mid-America Apartment Communities, Inc. | 668,400 | 111,436 | |

| UDR, Inc. | 2,662,841 | 113,410 | |

| 345,027 | |||

| REITs - Diversified - 32.6% | |||

| Apartment Income (REIT) Corp. | 1,133,068 | 43,351 | |

| Crown Castle International Corp. | 2,023,000 | 299,627 | |

| Digital Realty Trust, Inc. | 1,290,000 | 147,860 | |

| Elme Communities (SBI) | 1,209,700 | 23,226 | |

| Equinix, Inc. | 273,700 | 202,026 | |

| Gaming & Leisure Properties | 1,049,410 | 56,206 | |

| Lamar Advertising Co. Class A | 461,500 | 49,168 | |

| SBA Communications Corp. Class A | 760,083 | 226,147 | |

| 1,047,611 | |||

| REITs - Health Care - 9.4% | |||

| Ventas, Inc. | 2,902,054 | 150,355 | |

| Welltower, Inc. | 2,008,640 | 150,728 | |

| 301,083 | |||

| REITs - Hotels - 5.5% | |||

| DiamondRock Hospitality Co. | 3,966,900 | 38,201 | |

| Host Hotels & Resorts, Inc. | 4,048,000 | 76,305 | |

| RLJ Lodging Trust | 2,621,019 | 32,946 | |

| Ryman Hospitality Properties, Inc. | 307,900 | 28,601 | |

| 176,053 | |||

| REITs - Management/Investment - 4.3% | |||

| American Assets Trust, Inc. | 772,400 | 21,983 | |

| LXP Industrial Trust (REIT) | 2,537,800 | 29,312 | |

| National Retail Properties, Inc. | 1,808,500 | 85,632 | |

| 136,927 | |||

| REITs - Manufactured Homes - 5.5% | |||

| Equity Lifestyle Properties, Inc. | 1,259,674 | 90,419 | |

| Sun Communities, Inc. | 550,863 | 86,408 | |

| 176,827 | |||

| REITs - Shopping Centers - 6.0% | |||

| Kimco Realty Corp. | 3,107,890 | 69,803 | |

| Phillips Edison & Co., Inc. (a) | 1,275,800 | 42,765 | |

| Regency Centers Corp. | 901,800 | 60,087 | |

| Urban Edge Properties | 1,276,700 | 20,108 | |

| 192,763 | |||

| REITs - Single Tenant - 2.5% | |||

| Four Corners Property Trust, Inc. | 747,200 | 21,489 | |

| Spirit Realty Capital, Inc. | 1,346,200 | 59,071 | |

| 80,560 | |||

| REITs - Storage - 8.6% | |||

| CubeSmart | 2,469,400 | 113,074 | |

| Extra Space Storage, Inc. | 644,940 | 101,791 | |

| Iron Mountain, Inc. | 1,105,300 | 60,327 | |

| 275,192 | |||

| REITs - Warehouse/Industrial - 10.6% | |||

| Prologis (REIT), Inc. | 2,642,015 | 341,561 | |

TOTAL EQUITY REAL ESTATE INVESTMENT TRUSTS (REITS) | 3,073,604 | ||

| Real Estate Management & Development - 3.4% | |||

| Real Estate Services - 3.4% | |||

| CBRE Group, Inc. (b) | 1,270,200 | 108,615 | |

| TOTAL COMMON STOCKS (Cost $2,165,285) | 3,182,219 | ||

| Money Market Funds - 1.3% | |||

| Shares | Value ($) (000s) | ||

| Fidelity Cash Central Fund 4.38% (c) | 28,321,899 | 28,328 | |

| Fidelity Securities Lending Cash Central Fund 4.38% (c)(d) | 14,018,348 | 14,020 | |

| TOTAL MONEY MARKET FUNDS (Cost $42,348) | 42,348 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.4% (Cost $2,207,633) | 3,224,567 |

NET OTHER ASSETS (LIABILITIES) - (0.4)% | (13,942) |

| NET ASSETS - 100.0% | 3,210,625 |

| (a) | Security or a portion of the security is on loan at period end. |

| (b) | Non-income producing |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request. |

| (d) | Investment made with cash collateral received from securities on loan. |

| Affiliate (Amounts in thousands) | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 4.38% | 44,732 | 833,050 | 849,454 | 684 | - | - | 28,328 | 0.1% |

| Fidelity Securities Lending Cash Central Fund 4.38% | 66,732 | 131,481 | 184,193 | 19 | - | - | 14,020 | 0.0% |

| Total | 111,464 | 964,531 | 1,033,647 | 703 | - | - | 42,348 | |

| Valuation Inputs at Reporting Date: | ||||

Description (Amounts in thousands) | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Common Stocks | 3,182,219 | 3,182,219 | - | - |

| Money Market Funds | 42,348 | 42,348 | - | - |

| Total Investments in Securities: | 3,224,567 | 3,224,567 | - | - |

| Statement of Assets and Liabilities | ||||

| Amounts in thousands (except per-share amount) | January 31, 2023 (Unaudited) | |||

| Assets | ||||

| Investment in securities, at value (including securities loaned of $14,028) - See accompanying schedule: | ||||

Unaffiliated issuers (cost $2,165,285) | $ | 3,182,219 | ||

Fidelity Central Funds (cost $42,348) | 42,348 | |||

| Total Investment in Securities (cost $2,207,633) | $ | 3,224,567 | ||

| Receivable for investments sold | 1,305 | |||

| Receivable for fund shares sold | 1,553 | |||

| Dividends receivable | 1,114 | |||

| Distributions receivable from Fidelity Central Funds | 78 | |||

| Prepaid expenses | 14 | |||

| Other receivables | 397 | |||

Total assets | 3,229,028 | |||

| Liabilities | ||||

| Payable for fund shares redeemed | $ | 2,116 | ||

| Accrued management fee | 1,348 | |||

| Other affiliated payables | 493 | |||

| Other payables and accrued expenses | 426 | |||

| Collateral on securities loaned | 14,020 | |||

| Total Liabilities | 18,403 | |||

| Net Assets | $ | 3,210,625 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 2,181,286 | ||

| Total accumulated earnings (loss) | 1,029,339 | |||

| Net Assets | $ | 3,210,625 | ||

Net Asset Value , offering price and redemption price per share ($3,210,625 ÷ 77,631 shares) | $ | 41.36 | ||

| Statement of Operations | ||||

| Amounts in thousands | Six months ended January 31, 2023 (Unaudited) | |||

| Investment Income | ||||

| Dividends | $ | 49,431 | ||

| Income from Fidelity Central Funds (including $19 from security lending) | 703 | |||

| Total Income | 50,134 | |||

| Expenses | ||||

| Management fee | $ | 9,112 | ||

| Transfer agent fees | 2,928 | |||

| Accounting fees | 414 | |||

| Custodian fees and expenses | 14 | |||

| Independent trustees' fees and expenses | 7 | |||

| Registration fees | 48 | |||

| Audit | 27 | |||

| Legal | 3 | |||

| Interest | 3 | |||

| Miscellaneous | 17 | |||

| Total expenses before reductions | 12,573 | |||

| Expense reductions | (65) | |||

| Total expenses after reductions | 12,508 | |||

| Net Investment income (loss) | 37,626 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 137,871 | |||

| Total net realized gain (loss) | 137,871 | |||

| Change in net unrealized appreciation (depreciation) on investment securities | (515,601) | |||

| Net gain (loss) | (377,730) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (340,104) | ||

| Statement of Changes in Net Assets | ||||

| Amount in thousands | Six months ended January 31, 2023 (Unaudited) | Year ended July 31, 2022 | ||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 37,626 | $ | 83,284 |

| Net realized gain (loss) | 137,871 | 257,355 | ||

| Change in net unrealized appreciation (depreciation) | (515,601) | (482,664) | ||

| Net increase (decrease) in net assets resulting from operations | (340,104) | (142,025) | ||

| Distributions to shareholders | (332,579) | (230,857) | ||

| Share transactions | ||||

| Proceeds from sales of shares | 155,988 | 1,336,283 | ||

| Reinvestment of distributions | 303,560 | 213,175 | ||

| Cost of shares redeemed | (1,695,996) | (1,789,187) | ||

Net increase (decrease) in net assets resulting from share transactions | (1,236,448) | (239,729) | ||

| Total increase (decrease) in net assets | (1,909,131) | (612,611) | ||

| Net Assets | ||||

| Beginning of period | 5,119,756 | 5,732,367 | ||

| End of period | $ | 3,210,625 | $ | 5,119,756 |

| Other Information | ||||

| Shares | ||||

| Sold | 3,707 | 27,133 | ||

| Issued in reinvestment of distributions | 7,394 | 4,120 | ||

| Redeemed | (41,291) | (37,055) | ||

| Net increase (decrease) | (30,190) | (5,802) | ||

| Fidelity® Real Estate Investment Portfolio |

Six months ended (Unaudited) January 31, 2023 | Years ended July 31, 2022 | 2021 | 2020 | 2019 | 2018 | |||||||

Selected Per-Share Data | ||||||||||||

| Net asset value, beginning of period | $ | 47.48 | $ | 50.45 | $ | 40.16 | $ | 45.62 | $ | 42.48 | $ | 42.92 |

| Income from Investment Operations | ||||||||||||

Net investment income (loss) A,B | .44 | .72 | .73 | .93 | 1.06 | .81 | ||||||

| Net realized and unrealized gain (loss) | (2.77) | (1.69) | 11.34 | (3.48) | 3.98 | .49 | ||||||

| Total from investment operations | (2.33) | (.97) | 12.07 | (2.55) | 5.04 | 1.30 | ||||||

| Distributions from net investment income | (.64) | (.42) | (.75) C | (.87) | (1.04) | (.82) | ||||||

| Distributions from net realized gain | (3.15) | (1.58) | (1.02) C | (2.04) | (.87) | (.92) | ||||||

| Total distributions | (3.79) | (2.00) | (1.78) D | (2.91) | (1.90) D | (1.74) | ||||||

| Net asset value, end of period | $ | 41.36 | $ | 47.48 | $ | 50.45 | $ | 40.16 | $ | 45.62 | $ | 42.48 |

Total Return E,F | (4.58)% | (2.22)% | 31.46% | (6.15)% | 12.29% | 3.13% | ||||||

Ratios to Average Net Assets B,G,H | ||||||||||||

| Expenses before reductions | .72% I | .71% | .73% | .74% | .74% | .76% | ||||||

| Expenses net of fee waivers, if any | .72% I | .71% | .73% | .74% | .74% | .75% | ||||||

| Expenses net of all reductions | .72% I | .71% | .72% | .73% | .74% | .75% | ||||||

| Net investment income (loss) | 2.16% I | 1.47% | 1.74% | 2.19% | 2.46% | 1.99% | ||||||

| Supplemental Data | ||||||||||||

| Net assets, end of period (in millions) | $ | 3,211 | $ | 5,120 | $ | 5,732 | $ | 4,213 | $ | 4,304 | $ | 3,939 |

Portfolio turnover rate J | 7% I | 18% | 35% | 38% | 23% | 20% K |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Fidelity Real Estate Investment Portfolio | $396 |

| Gross unrealized appreciation | $1,067,958 |

| Gross unrealized depreciation | (59,492) |

| Net unrealized appreciation (depreciation) | $1,008,466 |

| Tax cost | $2,216,101 |

| Purchases ($) | Sales ($) | |

| Fidelity Real Estate Investment Portfolio | 125,688 | 1,552,142 |

| % of Average Net Assets | |

| Fidelity Real Estate Investment Portfolio | .02 |

| Amount | |

| Fidelity Real Estate Investment Portfolio | $17 |

| Borrower or Lender | Average Loan Balance | Weighted Average Interest Rate | Interest Expense | |

| Fidelity Real Estate Investment Portfolio | Borrower | $11,846 | 3.32% | $3 |

| Purchases ($) | Sales ($) | Realized Gain (Loss) ($) | |

| Fidelity Real Estate Investment Portfolio | 581 | 83,043 | 2,647 |

| Amount | |

| Fidelity Real Estate Investment Portfolio | $6 |

| Total Security Lending Fees Paid to NFS | Security Lending Income From Securities Loaned to NFS | Value of Securities Loaned to NFS at Period End | |

| Fidelity Real Estate Investment Portfolio | $2 | $- | $- |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (August 1, 2022 to January 31, 2023). |

Annualized Expense Ratio- A | Beginning Account Value August 1, 2022 | Ending Account Value January 31, 2023 | Expenses Paid During Period- C August 1, 2022 to January 31, 2023 | |||||||

| Fidelity® Real Estate Investment Portfolio | .72% | |||||||||

| Actual | $ 1,000 | $ 954.20 | $ 3.55 | |||||||

Hypothetical- B | $ 1,000 | $ 1,021.58 | $ 3.67 | |||||||

- Highly liquid investments - cash or convertible to cash within three business days or less

- Moderately liquid investments - convertible to cash in three to seven calendar days

- Less liquid investments - can be sold or disposed of, but not settled, within seven calendar days

- Illiquid investments - cannot be sold or disposed of within seven calendar days

|

Item 2.

Code of Ethics

Not applicable.

Item 3.

Audit Committee Financial Expert

Not applicable.

Item 4.

Principal Accountant Fees and Services

Not applicable.

Item 5.

Audit Committee of Listed Registrants

Not applicable.

Item 6.

Investments

(a)

Not applicable.

(b)

Not applicable

Item 7.

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8.

Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9.

Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10.

Submission of Matters to a Vote of Security Holders

There were no material changes to the procedures by which shareholders may recommend nominees to the Fidelity Select Portfolios’s Board of Trustees.

Item 11.

Controls and Procedures

(a)(i) The President and Treasurer and the Chief Financial Officer have concluded that the Fidelity Select Portfolios’s (the “Trust”) disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the Trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the Trust’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust’s internal control over financial reporting.

Item 12.

Disclosure of Securities Lending Activities for Closed-End Management

Investment Companies

Not applicable.

Item 13.

Exhibits

(a) | (1) | Not applicable. |

(a) | (2) | |

(a) | (3) | Not applicable. |

(b) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Fidelity Select Portfolios

By: | /s/Stacie M. Smith |

Stacie M. Smith | |

President and Treasurer | |

Date: | March 23, 2023 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/Stacie M. Smith |

Stacie M. Smith | |

President and Treasurer | |

Date: | March 23, 2023 |

By: | /s/John J. Burke III |

John J. Burke III | |

Chief Financial Officer | |

Date: | March 23, 2023 |