0000320351fmr:C000020445Memberfmr:TH3Member2024-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Nicole Macarchuk, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

| |

Date of fiscal year end: | February 29 |

|

|

Date of reporting period: | August 31, 2024 |

Item 1.

Reports to Stockholders

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Fidelity® Natural Resources Fund Fidelity® Natural Resources Fund : FNARX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Natural Resources Fund for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Natural Resources Fund | $ 37 | 0.70% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $648,226,804 | |

| Number of Holdings | 38 | |

| Portfolio Turnover | 56% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Oil, Gas & Consumable Fuels | 70.1 | |

| Metals & Mining | 18.0 | |

| Containers & Packaging | 6.3 | |

| Energy Equipment & Services | 4.9 | |

| |

| Common Stocks | 99.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 58.8 |

| Canada | 29.5 |

| Portugal | 4.8 |

| Zambia | 2.5 |

| United Kingdom | 1.8 |

| Brazil | 1.6 |

| Ghana | 1.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Exxon Mobil Corp | 22.5 | |

| Imperial Oil Ltd | 8.9 | |

| Shell PLC ADR | 8.3 | |

| MEG Energy Corp | 5.6 | |

| Valero Energy Corp | 4.9 | |

| Galp Energia SGPS SA | 4.8 | |

| Phillips 66 | 3.4 | |

| Athabasca Oil Corp | 3.1 | |

| Agnico Eagle Mines Ltd (United States) | 2.8 | |

| Freeport-McMoRan Inc | 2.7 | |

| | 67.0 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914555.100 514-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Utilities Portfolio Utilities Portfolio : FSUTX |

| | | |

This semi-annual shareholder report contains information about Utilities Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Utilities Portfolio | $ 38 | 0.67% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,538,756,649 | |

| Number of Holdings | 31 | |

| Portfolio Turnover | 55% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Electric Utilities | 62.2 | |

| Multi-Utilities | 25.2 | |

| Independent Power and Renewable Electricity Producers | 9.5 | |

| Gas Utilities | 2.1 | |

| |

| Common Stocks | 99.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.0 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

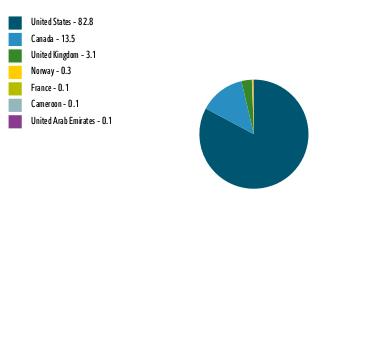

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| NextEra Energy Inc | 13.0 | |

| Sempra | 7.1 | |

| PG&E Corp | 6.3 | |

| Edison International | 6.0 | |

| American Electric Power Co Inc | 5.4 | |

| Public Service Enterprise Group Inc | 5.3 | |

| Entergy Corp | 4.8 | |

| Constellation Energy Corp | 4.8 | |

| Eversource Energy | 4.5 | |

| FirstEnergy Corp | 4.2 | |

| | 61.4 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914501.100 65-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Consumer Staples Portfolio Fidelity Advisor® Consumer Staples Fund Class Z : FIJCX |

| | | |

This semi-annual shareholder report contains information about Consumer Staples Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 31 | 0.58% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,405,206,341 | |

| Number of Holdings | 39 | |

| Portfolio Turnover | 39% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Beverages | 39.6 | |

| Household Products | 18.8 | |

| Food Products | 14.3 | |

| Consumer Staples Distribution & Retail | 10.8 | |

| Personal Care Products | 9.7 | |

| Tobacco | 6.4 | |

| Oil, Gas & Consumable Fuels | 0.1 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 95.1 |

| United Kingdom | 4.8 |

| Canada | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Coca-Cola Co/The | 14.2 | |

| Procter & Gamble Co/The | 14.2 | |

| Keurig Dr Pepper Inc | 9.8 | |

| Kenvue Inc | 6.3 | |

| Walmart Inc | 5.5 | |

| Philip Morris International Inc | 4.2 | |

| Monster Beverage Corp | 3.9 | |

| Energizer Holdings Inc | 3.8 | |

| PepsiCo Inc | 3.6 | |

| Estee Lauder Cos Inc/The Class A | 3.4 | |

| | 68.9 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914494.100 3234-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Consumer Staples Portfolio Fidelity Advisor® Consumer Staples Fund Class M : FDTGX |

| | | |

This semi-annual shareholder report contains information about Consumer Staples Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 64 | 1.22% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,405,206,341 | |

| Number of Holdings | 39 | |

| Portfolio Turnover | 39% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Beverages | 39.6 | |

| Household Products | 18.8 | |

| Food Products | 14.3 | |

| Consumer Staples Distribution & Retail | 10.8 | |

| Personal Care Products | 9.7 | |

| Tobacco | 6.4 | |

| Oil, Gas & Consumable Fuels | 0.1 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 95.1 |

| United Kingdom | 4.8 |

| Canada | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Coca-Cola Co/The | 14.2 | |

| Procter & Gamble Co/The | 14.2 | |

| Keurig Dr Pepper Inc | 9.8 | |

| Kenvue Inc | 6.3 | |

| Walmart Inc | 5.5 | |

| Philip Morris International Inc | 4.2 | |

| Monster Beverage Corp | 3.9 | |

| Energizer Holdings Inc | 3.8 | |

| PepsiCo Inc | 3.6 | |

| Estee Lauder Cos Inc/The Class A | 3.4 | |

| | 68.9 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914492.100 1782-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Gold Portfolio Fidelity Advisor® Gold Fund Class Z : FIJDX |

| | | |

This semi-annual shareholder report contains information about Gold Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 37 | 0.60% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,501,574,716 | |

| Number of Holdings | 65 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Metals & Mining* | 98.4 | |

| Financial Services | 0.0 | |

| |

*Includes gold bullion and/or silver bullion.

| Common Stocks | 98.4 |

| Other Investments | 0.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Canada | 60.3 |

| United States | 15.8 |

| Brazil | 10.3 |

| Australia | 6.3 |

| United Kingdom | 2.3 |

| South Africa | 1.9 |

| China | 1.5 |

| Burkina Faso | 1.3 |

| Egypt | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Agnico Eagle Mines Ltd | 14.8 | |

| Newmont Corp | 11.6 | |

| Wheaton Precious Metals Corp | 10.3 | |

| Franco-Nevada Corp | 9.3 | |

| Barrick Gold Corp | 4.9 | |

| Alamos Gold Inc Class A | 4.1 | |

| Northern Star Resources Ltd | 3.8 | |

| Osisko Gold Royalties Ltd | 2.7 | |

| Anglogold Ashanti Plc | 2.3 | |

| Lundin Gold Inc | 2.3 | |

| | 66.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914522.100 3235-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Gold Portfolio Fidelity Advisor® Gold Fund Class I : FGDIX |

| | | |

This semi-annual shareholder report contains information about Gold Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 45 | 0.72% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,501,574,716 | |

| Number of Holdings | 65 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Metals & Mining* | 98.4 | |

| Financial Services | 0.0 | |

| |

*Includes gold bullion and/or silver bullion.

| Common Stocks | 98.4 |

| Other Investments | 0.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Canada | 60.3 |

| United States | 15.8 |

| Brazil | 10.3 |

| Australia | 6.3 |

| United Kingdom | 2.3 |

| South Africa | 1.9 |

| China | 1.5 |

| Burkina Faso | 1.3 |

| Egypt | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Agnico Eagle Mines Ltd | 14.8 | |

| Newmont Corp | 11.6 | |

| Wheaton Precious Metals Corp | 10.3 | |

| Franco-Nevada Corp | 9.3 | |

| Barrick Gold Corp | 4.9 | |

| Alamos Gold Inc Class A | 4.1 | |

| Northern Star Resources Ltd | 3.8 | |

| Osisko Gold Royalties Ltd | 2.7 | |

| Anglogold Ashanti Plc | 2.3 | |

| Lundin Gold Inc | 2.3 | |

| | 66.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914521.100 1788-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Consumer Staples Portfolio Fidelity Advisor® Consumer Staples Fund Class C : FDCGX |

| | | |

This semi-annual shareholder report contains information about Consumer Staples Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 91 | 1.72% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,405,206,341 | |

| Number of Holdings | 39 | |

| Portfolio Turnover | 39% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Beverages | 39.6 | |

| Household Products | 18.8 | |

| Food Products | 14.3 | |

| Consumer Staples Distribution & Retail | 10.8 | |

| Personal Care Products | 9.7 | |

| Tobacco | 6.4 | |

| Oil, Gas & Consumable Fuels | 0.1 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 95.1 |

| United Kingdom | 4.8 |

| Canada | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Coca-Cola Co/The | 14.2 | |

| Procter & Gamble Co/The | 14.2 | |

| Keurig Dr Pepper Inc | 9.8 | |

| Kenvue Inc | 6.3 | |

| Walmart Inc | 5.5 | |

| Philip Morris International Inc | 4.2 | |

| Monster Beverage Corp | 3.9 | |

| Energizer Holdings Inc | 3.8 | |

| PepsiCo Inc | 3.6 | |

| Estee Lauder Cos Inc/The Class A | 3.4 | |

| | 68.9 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914491.100 1781-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Software and IT Services Portfolio Software and IT Services Portfolio : FSCSX |

| | | |

This semi-annual shareholder report contains information about Software and IT Services Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Software and IT Services Portfolio | $ 31 | 0.62% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $10,347,141,434 | |

| Number of Holdings | 50 | |

| Portfolio Turnover | 14% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Software | 71.9 | |

| IT Services | 15.5 | |

| Financial Services | 5.2 | |

| Interactive Media & Services | 3.6 | |

| Professional Services | 1.1 | |

| |

| Common Stocks | 97.3 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 95.1 |

| Ireland | 2.7 |

| France | 1.4 |

| Canada | 0.5 |

| Netherlands | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Microsoft Corp | 25.0 | |

| Adobe Inc | 8.1 | |

| Salesforce Inc | 7.3 | |

| Autodesk Inc | 3.1 | |

| Workday Inc Class A | 2.9 | |

| Palo Alto Networks Inc | 2.8 | |

| Accenture PLC Class A | 2.7 | |

| Oracle Corp | 2.4 | |

| Alphabet Inc Class A | 2.2 | |

| Atlassian Corp Class A | 2.1 | |

| | 58.6 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914496.100 28-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Materials Portfolio Fidelity Advisor® Materials Fund Class M : FMFTX |

| | | |

This semi-annual shareholder report contains information about Materials Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 64 | 1.24% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $849,835,612 | |

| Number of Holdings | 39 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Chemicals | 61.6 | |

| Metals & Mining | 25.3 | |

| Containers & Packaging | 7.9 | |

| Construction Materials | 4.4 | |

| |

| Common Stocks | 99.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 89.9 |

| Canada | 6.0 |

| Zambia | 2.4 |

| Brazil | 1.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Linde PLC | 19.1 | |

| Ecolab Inc | 10.2 | |

| Dow Inc | 6.9 | |

| Air Products and Chemicals Inc | 5.4 | |

| Freeport-McMoRan Inc | 5.0 | |

| Corteva Inc | 3.9 | |

| Nucor Corp | 3.9 | |

| Axalta Coating Systems Ltd | 3.6 | |

| Chemours Co/The | 3.3 | |

| First Quantum Minerals Ltd | 2.4 | |

| | 63.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914549.100 1792-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Telecommunications Portfolio Telecommunications Portfolio : FSTCX |

| | | |

This semi-annual shareholder report contains information about Telecommunications Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Telecommunications Portfolio | $ 41 | 0.76% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $196,158,282 | |

| Number of Holdings | 27 | |

| Portfolio Turnover | 29% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Diversified Telecommunication Services | 75.8 | |

| Wireless Telecommunication Services | 12.7 | |

| Media | 4.1 | |

| IT Services | 0.6 | |

| Construction & Engineering | 0.2 | |

| |

| Common Stocks | 93.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 92.5 |

| Puerto Rico | 4.0 |

| Belgium | 3.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| AT&T Inc | 23.3 | |

| Verizon Communications Inc | 19.7 | |

| Lumen Technologies Inc | 6.2 | |

| Cogent Communications Holdings Inc | 4.9 | |

| T-Mobile US Inc | 4.8 | |

| Iridium Communications Inc | 4.8 | |

| Liberty Latin America Ltd Class C | 4.0 | |

| Liberty Global Ltd Class C | 3.5 | |

| Telephone and Data Systems Inc | 3.4 | |

| Gogo Inc | 2.9 | |

| | 77.5 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914517.100 96-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Communication Services Portfolio Fidelity Advisor® Communication Services Fund Class M : FGEMX |

| | | |

This semi-annual shareholder report contains information about Communication Services Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 63 | 1.21% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,564,235,226 | |

| Number of Holdings | 49 | |

| Portfolio Turnover | 39% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Interactive Media & Services | 52.6 | |

| Entertainment | 22.6 | |

| Media | 8.0 | |

| Diversified Telecommunication Services | 7.9 | |

| Broadline Retail | 5.3 | |

| Ground Transportation | 2.5 | |

| IT Services | 0.0 | |

| Consumer Staples Distribution & Retail | 0.0 | |

| Software | 0.0 | |

| |

| Common Stocks | 98.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 93.7 |

| Puerto Rico | 1.8 |

| Belgium | 1.3 |

| Singapore | 1.2 |

| China | 0.7 |

| France | 0.7 |

| Japan | 0.5 |

| Canada | 0.1 |

| United Kingdom | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Meta Platforms Inc Class A | 24.9 | |

| Alphabet Inc Class A | 22.6 | |

| AT&T Inc | 4.8 | |

| Walt Disney Co/The | 4.6 | |

| Amazon.com Inc | 4.6 | |

| Netflix Inc | 4.6 | |

| Charter Communications Inc Class A | 2.6 | |

| Uber Technologies Inc | 2.5 | |

| Liberty Media Corp-Liberty Formula One Class A | 2.3 | |

| Comcast Corp Class A | 2.3 | |

| | 75.8 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914540.100 3325-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Materials Portfolio Fidelity Advisor® Materials Fund Class Z : FIJFX |

| | | |

This semi-annual shareholder report contains information about Materials Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 30 | 0.58% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $849,835,612 | |

| Number of Holdings | 39 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Chemicals | 61.6 | |

| Metals & Mining | 25.3 | |

| Containers & Packaging | 7.9 | |

| Construction Materials | 4.4 | |

| |

| Common Stocks | 99.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 89.9 |

| Canada | 6.0 |

| Zambia | 2.4 |

| Brazil | 1.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Linde PLC | 19.1 | |

| Ecolab Inc | 10.2 | |

| Dow Inc | 6.9 | |

| Air Products and Chemicals Inc | 5.4 | |

| Freeport-McMoRan Inc | 5.0 | |

| Corteva Inc | 3.9 | |

| Nucor Corp | 3.9 | |

| Axalta Coating Systems Ltd | 3.6 | |

| Chemours Co/The | 3.3 | |

| First Quantum Minerals Ltd | 2.4 | |

| | 63.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914551.100 3236-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Communication Services Portfolio Fidelity Advisor® Communication Services Fund Class Z : FGKMX |

| | | |

This semi-annual shareholder report contains information about Communication Services Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 30 | 0.58% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,564,235,226 | |

| Number of Holdings | 49 | |

| Portfolio Turnover | 39% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Interactive Media & Services | 52.6 | |

| Entertainment | 22.6 | |

| Media | 8.0 | |

| Diversified Telecommunication Services | 7.9 | |

| Broadline Retail | 5.3 | |

| Ground Transportation | 2.5 | |

| IT Services | 0.0 | |

| Consumer Staples Distribution & Retail | 0.0 | |

| Software | 0.0 | |

| |

| Common Stocks | 98.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 93.7 |

| Puerto Rico | 1.8 |

| Belgium | 1.3 |

| Singapore | 1.2 |

| China | 0.7 |

| France | 0.7 |

| Japan | 0.5 |

| Canada | 0.1 |

| United Kingdom | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Meta Platforms Inc Class A | 24.9 | |

| Alphabet Inc Class A | 22.6 | |

| AT&T Inc | 4.8 | |

| Walt Disney Co/The | 4.6 | |

| Amazon.com Inc | 4.6 | |

| Netflix Inc | 4.6 | |

| Charter Communications Inc Class A | 2.6 | |

| Uber Technologies Inc | 2.5 | |

| Liberty Media Corp-Liberty Formula One Class A | 2.3 | |

| Comcast Corp Class A | 2.3 | |

| | 75.8 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914543.100 3328-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Industrials Portfolio Industrials Portfolio : FCYIX |

| | | |

This semi-annual shareholder report contains information about Industrials Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Industrials Portfolio | $ 36 | 0.69% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $591,125,639 | |

| Number of Holdings | 51 | |

| Portfolio Turnover | 37% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Aerospace & Defense | 22.7 | |

| Machinery | 19.6 | |

| Ground Transportation | 13.2 | |

| Electrical Equipment | 12.8 | |

| Building Products | 11.5 | |

| Trading Companies & Distributors | 5.7 | |

| Construction & Engineering | 3.8 | |

| Professional Services | 3.4 | |

| Commercial Services & Supplies | 3.2 | |

| Others | 3.7 | |

| |

| Common Stocks | 99.6 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.4 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| General Electric Co | 6.4 | |

| Union Pacific Corp | 5.1 | |

| Howmet Aerospace Inc | 4.7 | |

| Parker-Hannifin Corp | 4.3 | |

| Ingersoll Rand Inc | 4.3 | |

| Trane Technologies PLC | 4.1 | |

| TransDigm Group Inc | 3.9 | |

| Boeing Co | 3.8 | |

| GE Vernova Inc | 3.4 | |

| Eaton Corp PLC | 3.3 | |

| | 43.3 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914556.100 515-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Banking Portfolio Banking Portfolio : FSRBX |

| | | |

This semi-annual shareholder report contains information about Banking Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Banking Portfolio | $ 40 | 0.71% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $439,247,104 | |

| Number of Holdings | 37 | |

| Portfolio Turnover | 29% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Banks | 97.6 | |

| Capital Markets | 2.5 | |

| Financial Services | 0.0 | |

| Consumer Finance | 0.0 | |

| |

ASSET ALLOCATION (% of Fund's net assets) |

|

| Short-Term Investments and Net Other Assets (Liabilities) - (0.1)% |

|

| United States | 94.9 |

| Puerto Rico | 5.1 |

| Cyprus | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Wells Fargo & Co | 7.5 | |

| Bank of America Corp | 6.8 | |

| M&T Bank Corp | 6.2 | |

| Citigroup Inc | 5.6 | |

| US Bancorp | 5.4 | |

| PNC Financial Services Group Inc/The | 5.3 | |

| Popular Inc | 5.1 | |

| KeyCorp | 4.0 | |

| Heartland Financial USA Inc | 3.5 | |

| Huntington Bancshares Inc/OH | 3.4 | |

| | 52.8 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914546.100 507-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Telecommunications Portfolio Fidelity Advisor® Telecommunications Fund Class Z : FIJGX |

| | | |

This semi-annual shareholder report contains information about Telecommunications Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class Z | $ 35 | 0.65% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $196,158,282 | |

| Number of Holdings | 27 | |

| Portfolio Turnover | 29% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Diversified Telecommunication Services | 75.8 | |

| Wireless Telecommunication Services | 12.7 | |

| Media | 4.1 | |

| IT Services | 0.6 | |

| Construction & Engineering | 0.2 | |

| |

| Common Stocks | 93.4 |

| Short-Term Investments and Net Other Assets (Liabilities) | 6.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 92.5 |

| Puerto Rico | 4.0 |

| Belgium | 3.5 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| AT&T Inc | 23.3 | |

| Verizon Communications Inc | 19.7 | |

| Lumen Technologies Inc | 6.2 | |

| Cogent Communications Holdings Inc | 4.9 | |

| T-Mobile US Inc | 4.8 | |

| Iridium Communications Inc | 4.8 | |

| Liberty Latin America Ltd Class C | 4.0 | |

| Liberty Global Ltd Class C | 3.5 | |

| Telephone and Data Systems Inc | 3.4 | |

| Gogo Inc | 2.9 | |

| | 77.5 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914516.100 3237-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Gold Portfolio Fidelity Advisor® Gold Fund Class M : FGDTX |

| | | |

This semi-annual shareholder report contains information about Gold Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class M | $ 75 | 1.22% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,501,574,716 | |

| Number of Holdings | 65 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Metals & Mining* | 98.4 | |

| Financial Services | 0.0 | |

| |

*Includes gold bullion and/or silver bullion.

| Common Stocks | 98.4 |

| Other Investments | 0.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Canada | 60.3 |

| United States | 15.8 |

| Brazil | 10.3 |

| Australia | 6.3 |

| United Kingdom | 2.3 |

| South Africa | 1.9 |

| China | 1.5 |

| Burkina Faso | 1.3 |

| Egypt | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Agnico Eagle Mines Ltd | 14.8 | |

| Newmont Corp | 11.6 | |

| Wheaton Precious Metals Corp | 10.3 | |

| Franco-Nevada Corp | 9.3 | |

| Barrick Gold Corp | 4.9 | |

| Alamos Gold Inc Class A | 4.1 | |

| Northern Star Resources Ltd | 3.8 | |

| Osisko Gold Royalties Ltd | 2.7 | |

| Anglogold Ashanti Plc | 2.3 | |

| Lundin Gold Inc | 2.3 | |

| | 66.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914520.100 1787-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | FinTech Portfolio FinTech Portfolio : FSVLX |

| | | |

This semi-annual shareholder report contains information about FinTech Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| FinTech Portfolio | $ 39 | 0.76% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $98,348,487 | |

| Number of Holdings | 25 | |

| Portfolio Turnover | 31% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Financial Services | 61.9 | |

| Consumer Finance | 20.9 | |

| Software | 12.3 | |

| IT Services | 4.8 | |

| |

| Common Stocks | 99.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 89.5 |

| Netherlands | 4.8 |

| Canada | 4.8 |

| Brazil | 0.5 |

| United Kingdom | 0.4 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Mastercard Inc Class A | 12.7 | |

| American Express Co | 12.1 | |

| Visa Inc Class A | 11.7 | |

| Intuit Inc | 11.1 | |

| Discover Financial Services | 4.9 | |

| Fidelity National Information Services Inc | 4.9 | |

| Fiserv Inc | 4.9 | |

| Adyen NV | 4.8 | |

| Shopify Inc Class A (United States) | 4.8 | |

| Corpay Inc | 4.8 | |

| | 76.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914528.100 98-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Gold Portfolio Gold Portfolio : FSAGX |

| | | |

This semi-annual shareholder report contains information about Gold Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Gold Portfolio | $ 42 | 0.68% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,501,574,716 | |

| Number of Holdings | 65 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Metals & Mining* | 98.4 | |

| Financial Services | 0.0 | |

| |

*Includes gold bullion and/or silver bullion.

| Common Stocks | 98.4 |

| Other Investments | 0.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Canada | 60.3 |

| United States | 15.8 |

| Brazil | 10.3 |

| Australia | 6.3 |

| United Kingdom | 2.3 |

| South Africa | 1.9 |

| China | 1.5 |

| Burkina Faso | 1.3 |

| Egypt | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Agnico Eagle Mines Ltd | 14.8 | |

| Newmont Corp | 11.6 | |

| Wheaton Precious Metals Corp | 10.3 | |

| Franco-Nevada Corp | 9.3 | |

| Barrick Gold Corp | 4.9 | |

| Alamos Gold Inc Class A | 4.1 | |

| Northern Star Resources Ltd | 3.8 | |

| Osisko Gold Royalties Ltd | 2.7 | |

| Anglogold Ashanti Plc | 2.3 | |

| Lundin Gold Inc | 2.3 | |

| | 66.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914523.100 41-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Materials Portfolio Fidelity Advisor® Materials Fund Class I : FMFEX |

| | | |

This semi-annual shareholder report contains information about Materials Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class I | $ 37 | 0.72% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $849,835,612 | |

| Number of Holdings | 39 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Chemicals | 61.6 | |

| Metals & Mining | 25.3 | |

| Containers & Packaging | 7.9 | |

| Construction Materials | 4.4 | |

| |

| Common Stocks | 99.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 89.9 |

| Canada | 6.0 |

| Zambia | 2.4 |

| Brazil | 1.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Linde PLC | 19.1 | |

| Ecolab Inc | 10.2 | |

| Dow Inc | 6.9 | |

| Air Products and Chemicals Inc | 5.4 | |

| Freeport-McMoRan Inc | 5.0 | |

| Corteva Inc | 3.9 | |

| Nucor Corp | 3.9 | |

| Axalta Coating Systems Ltd | 3.6 | |

| Chemours Co/The | 3.3 | |

| First Quantum Minerals Ltd | 2.4 | |

| | 63.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914550.100 1793-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Communication Services Portfolio Communication Services Portfolio : FBMPX |

| | | |

This semi-annual shareholder report contains information about Communication Services Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Communication Services Portfolio | $ 35 | 0.67% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,564,235,226 | |

| Number of Holdings | 49 | |

| Portfolio Turnover | 39% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Interactive Media & Services | 52.6 | |

| Entertainment | 22.6 | |

| Media | 8.0 | |

| Diversified Telecommunication Services | 7.9 | |

| Broadline Retail | 5.3 | |

| Ground Transportation | 2.5 | |

| IT Services | 0.0 | |

| Consumer Staples Distribution & Retail | 0.0 | |

| Software | 0.0 | |

| |

| Common Stocks | 98.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 1.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 93.7 |

| Puerto Rico | 1.8 |

| Belgium | 1.3 |

| Singapore | 1.2 |

| China | 0.7 |

| France | 0.7 |

| Japan | 0.5 |

| Canada | 0.1 |

| United Kingdom | 0.0 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Meta Platforms Inc Class A | 24.9 | |

| Alphabet Inc Class A | 22.6 | |

| AT&T Inc | 4.8 | |

| Walt Disney Co/The | 4.6 | |

| Amazon.com Inc | 4.6 | |

| Netflix Inc | 4.6 | |

| Charter Communications Inc Class A | 2.6 | |

| Uber Technologies Inc | 2.5 | |

| Liberty Media Corp-Liberty Formula One Class A | 2.3 | |

| Comcast Corp Class A | 2.3 | |

| | 75.8 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914544.100 503-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Materials Portfolio Fidelity Advisor® Materials Fund Class C : FMFCX |

| | | |

This semi-annual shareholder report contains information about Materials Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class C | $ 90 | 1.74% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $849,835,612 | |

| Number of Holdings | 39 | |

| Portfolio Turnover | 59% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Chemicals | 61.6 | |

| Metals & Mining | 25.3 | |

| Containers & Packaging | 7.9 | |

| Construction Materials | 4.4 | |

| |

| Common Stocks | 99.2 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 89.9 |

| Canada | 6.0 |

| Zambia | 2.4 |

| Brazil | 1.7 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Linde PLC | 19.1 | |

| Ecolab Inc | 10.2 | |

| Dow Inc | 6.9 | |

| Air Products and Chemicals Inc | 5.4 | |

| Freeport-McMoRan Inc | 5.0 | |

| Corteva Inc | 3.9 | |

| Nucor Corp | 3.9 | |

| Axalta Coating Systems Ltd | 3.6 | |

| Chemours Co/The | 3.3 | |

| First Quantum Minerals Ltd | 2.4 | |

| | 63.7 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914548.100 1791-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Biotechnology Portfolio Biotechnology Portfolio : FBIOX |

| | | |

This semi-annual shareholder report contains information about Biotechnology Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Biotechnology Portfolio | $ 34 | 0.64% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $5,008,216,225 | |

| Number of Holdings | 200 | |

| Portfolio Turnover | 31% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Biotechnology | 92.2 | |

| Pharmaceuticals | 7.1 | |

| Health Care Providers & Services | 0.2 | |

| Health Care Technology | 0.2 | |

| Life Sciences Tools & Services | 0.1 | |

| Health Care Equipment & Supplies | 0.0 | |

| Consumer Staples Distribution & Retail | 0.0 | |

| |

| Common Stocks | 98.8 |

| Preferred Stocks | 1.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.2 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 88.7 |

| Denmark | 3.9 |

| Netherlands | 3.2 |

| Belgium | 2.0 |

| United Kingdom | 0.6 |

| Switzerland | 0.5 |

| Canada | 0.4 |

| Ireland | 0.4 |

| France | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Abbvie Inc | 11.0 | |

| Amgen Inc | 9.7 | |

| Krystal Biotech Inc | 7.4 | |

| Regeneron Pharmaceuticals Inc | 5.3 | |

| Vertex Pharmaceuticals Inc | 4.4 | |

| Alnylam Pharmaceuticals Inc | 3.4 | |

| Gilead Sciences Inc | 2.6 | |

| UCB SA | 2.0 | |

| Zealand Pharma A/S | 2.0 | |

| Ascendis Pharma A/S ADR | 1.8 | |

| | 49.6 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914524.100 42-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Fidelity® Environment and Alternative Energy Fund Fidelity® Environment and Alternative Energy Fund : FSLEX |

| | | |

This semi-annual shareholder report contains information about Fidelity® Environment and Alternative Energy Fund for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Fidelity® Environment and Alternative Energy Fund | $ 37 | 0.70% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $556,919,674 | |

| Number of Holdings | 70 | |

| Portfolio Turnover | 36% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Software | 10.8 | |

| Automobiles | 9.4 | |

| Chemicals | 9.1 | |

| Electrical Equipment | 8.0 | |

| Semiconductors & Semiconductor Equipment | 7.9 | |

| IT Services | 6.8 | |

| Building Products | 6.0 | |

| Commercial Services & Supplies | 5.1 | |

| Ground Transportation | 4.7 | |

| Others | 32.1 | |

| |

| Common Stocks | 99.9 |

| Preferred Stocks | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.1 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 94.8 |

| China | 2.5 |

| Japan | 1.1 |

| Denmark | 0.8 |

| Germany | 0.5 |

| Canada | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Microsoft Corp | 10.8 | |

| Tesla Inc | 8.8 | |

| Linde PLC | 7.2 | |

| International Business Machines Corp | 5.9 | |

| Union Pacific Corp | 4.7 | |

| Prologis Inc | 4.3 | |

| Eaton Corp PLC | 3.8 | |

| Republic Services Inc | 3.2 | |

| Trane Technologies PLC | 3.1 | |

| Arista Networks Inc | 2.8 | |

| | 54.6 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914557.100 516-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Automotive Portfolio Automotive Portfolio : FSAVX |

| | | |

This semi-annual shareholder report contains information about Automotive Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Automotive Portfolio | $ 39 | 0.81% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $75,054,295 | |

| Number of Holdings | 34 | |

| Portfolio Turnover | 64% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Automobiles | 53.6 | |

| Specialty Retail | 21.1 | |

| Automobile Components | 11.0 | |

| Commercial Services & Supplies | 6.3 | |

| Distributors | 4.5 | |

| Ground Transportation | 1.9 | |

| Trading Companies & Distributors | 0.7 | |

| Consumer Staples Distribution & Retail | 0.3 | |

| Electronic Equipment, Instruments & Components | 0.0 | |

| |

| Common Stocks | 99.4 |

| Preferred Stocks | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.6 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

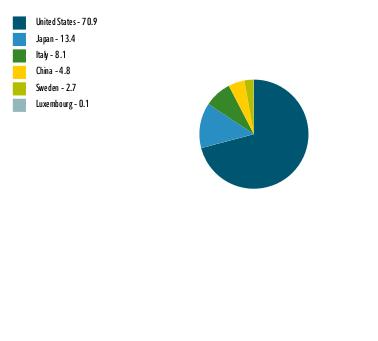

| United States | 70.9 |

| Japan | 13.4 |

| Italy | 8.1 |

| China | 4.8 |

| Sweden | 2.7 |

| Luxembourg | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Tesla Inc | 11.3 | |

| O'Reilly Automotive Inc | 9.0 | |

| Toyota Motor Corp ADR | 9.0 | |

| General Motors Co | 8.2 | |

| Ferrari NV | 8.1 | |

| Aptiv PLC | 4.8 | |

| AutoZone Inc | 4.6 | |

| Copart Inc | 4.5 | |

| Honda Motor Co Ltd ADR | 4.4 | |

| Li Auto Inc ADR | 4.2 | |

| | 68.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914538.100 502-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Consumer Discretionary Portfolio Consumer Discretionary Portfolio : FSCPX |

| | | |

This semi-annual shareholder report contains information about Consumer Discretionary Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Consumer Discretionary Portfolio | $ 35 | 0.70% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $471,659,584 | |

| Number of Holdings | 60 | |

| Portfolio Turnover | 23% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Broadline Retail | 26.0 | |

| Specialty Retail | 23.9 | |

| Hotels, Restaurants & Leisure | 19.3 | |

| Automobiles | 11.7 | |

| Textiles, Apparel & Luxury Goods | 8.3 | |

| Household Durables | 5.4 | |

| Automobile Components | 2.7 | |

| Consumer Staples Distribution & Retail | 1.0 | |

| Building Products | 0.8 | |

| Others | 0.6 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 95.8 |

| Canada | 2.1 |

| Brazil | 1.0 |

| United Kingdom | 0.4 |

| France | 0.4 |

| Switzerland | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Amazon.com Inc | 23.9 | |

| Tesla Inc | 10.0 | |

| Home Depot Inc/The | 4.8 | |

| Lowe's Cos Inc | 4.7 | |

| TJX Cos Inc/The | 3.7 | |

| Hilton Worldwide Holdings Inc | 3.1 | |

| McDonald's Corp | 2.6 | |

| Dick's Sporting Goods Inc | 2.3 | |

| NIKE Inc Class B | 2.3 | |

| Aptiv PLC | 2.2 | |

| | 59.6 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914558.100 517-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Gold Portfolio Fidelity Advisor® Gold Fund Class A : FGDAX |

| | | |

This semi-annual shareholder report contains information about Gold Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-877-208-0098 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Class A | $ 60 | 0.97% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $1,501,574,716 | |

| Number of Holdings | 65 | |

| Portfolio Turnover | 13% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Metals & Mining* | 98.4 | |

| Financial Services | 0.0 | |

| |

*Includes gold bullion and/or silver bullion.

| Common Stocks | 98.4 |

| Other Investments | 0.9 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.7 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| Canada | 60.3 |

| United States | 15.8 |

| Brazil | 10.3 |

| Australia | 6.3 |

| United Kingdom | 2.3 |

| South Africa | 1.9 |

| China | 1.5 |

| Burkina Faso | 1.3 |

| Egypt | 0.3 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Agnico Eagle Mines Ltd | 14.8 | |

| Newmont Corp | 11.6 | |

| Wheaton Precious Metals Corp | 10.3 | |

| Franco-Nevada Corp | 9.3 | |

| Barrick Gold Corp | 4.9 | |

| Alamos Gold Inc Class A | 4.1 | |

| Northern Star Resources Ltd | 3.8 | |

| Osisko Gold Royalties Ltd | 2.7 | |

| Anglogold Ashanti Plc | 2.3 | |

| Lundin Gold Inc | 2.3 | |

| | 66.1 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914518.100 1784-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Semiconductors Portfolio Semiconductors Portfolio : FSELX |

| | | |

This semi-annual shareholder report contains information about Semiconductors Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Semiconductors Portfolio | $ 34 | 0.63% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $19,711,434,026 | |

| Number of Holdings | 42 | |

| Portfolio Turnover | 42% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Semiconductors & Semiconductor Equipment | 94.3 | |

| Technology Hardware, Storage & Peripherals | 2.8 | |

| Electronic Equipment, Instruments & Components | 0.1 | |

| Financial Services | 0.0 | |

| Metals & Mining | 0.0 | |

| Software | 0.0 | |

| |

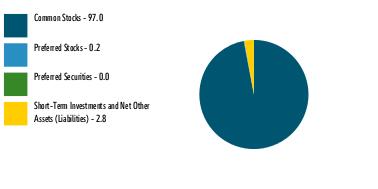

| Common Stocks | 97.0 |

| Preferred Stocks | 0.2 |

| Preferred Securities | 0.0 |

| Short-Term Investments and Net Other Assets (Liabilities) | 2.8 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 78.1 |

| Taiwan | 8.1 |

| China | 6.3 |

| Netherlands | 4.9 |

| Israel | 1.6 |

| Japan | 1.0 |

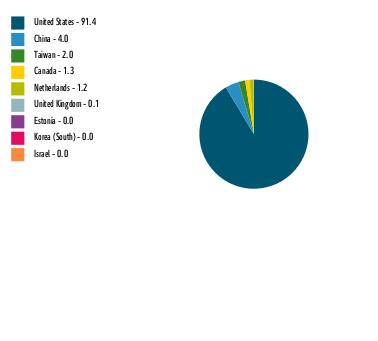

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| NVIDIA Corp | 24.8 | |

| Taiwan Semiconductor Manufacturing Co Ltd ADR | 7.7 | |

| ON Semiconductor Corp | 7.2 | |

| NXP Semiconductors NV | 6.3 | |

| Marvell Technology Inc | 5.0 | |

| Broadcom Inc | 4.9 | |

| ASML Holding NV depository receipt | 4.9 | |

| Micron Technology Inc | 4.9 | |

| GlobalFoundries Inc | 4.8 | |

| Monolithic Power Systems Inc | 4.3 | |

| | 74.8 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914489.100 8-TSRS-1024 |

| |

| | SEMI-ANNUAL SHAREHOLDER REPORT | AS OF AUGUST 31, 2024 | |

| | Brokerage and Investment Management Portfolio Brokerage and Investment Management Portfolio : FSLBX |

| | | |

This semi-annual shareholder report contains information about Brokerage and Investment Management Portfolio for the period March 1, 2024 to August 31, 2024. You can find additional information about the Fund at fundresearch.fidelity.com/prospectus/sec. You can also request this information by contacting us at 1-800-544-8544 or by sending an e-mail to fidfunddocuments@fidelity.com.

What were your Fund costs for the last six months?(based on hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment | |

| Brokerage and Investment Management Portfolio | $ 37 | 0.69% | |

Key Fund Statistics (as of August 31, 2024)

KEY FACTS | | |

| Fund Size | $917,253,584 | |

| Number of Holdings | 41 | |

| Portfolio Turnover | 21% | |

What did the Fund invest in?

(as of August 31, 2024)

TOP INDUSTRIES (% of Fund's net assets) |

| Capital Markets | 95.8 | |

| Financial Services | 3.9 | |

| |

| Common Stocks | 99.7 |

| Short-Term Investments and Net Other Assets (Liabilities) | 0.3 |

ASSET ALLOCATION (% of Fund's net assets) |

|

|

| United States | 97.0 |

| United Kingdom | 1.1 |

| Luxembourg | 0.7 |

| Grand Cayman (UK Overseas Ter) | 0.6 |

| Canada | 0.5 |

| Sweden | 0.1 |

GEOGRAPHIC DIVERSIFICATION (% of Fund's net assets) |

|

| |

|

TOP HOLDINGS (% of Fund's net assets) | | |

| Moody's Corp | 9.3 | |

| KKR & Co Inc Class A | 6.4 | |

| S&P Global Inc | 5.4 | |

| Blackstone Inc | 5.2 | |

| Ares Management Corp Class A | 5.1 | |

| Intercontinental Exchange Inc | 5.1 | |

| Blue Owl Capital Inc Class A | 5.0 | |

| BlackRock Inc | 4.6 | |

| Ameriprise Financial Inc | 4.4 | |

| Apollo Global Management Inc | 3.9 | |

| | 54.4 | |

| Fidelity, the Fidelity Investments Logo and all other Fidelity trademarks or service marks used herein are trademarks or service marks of FMR LLC. Any third-party marks that are used herein are trademarks or service marks of their respective owners. © 2024 FMR LLC. All rights reserved. |

| | For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit fundresearch.fidelity.com/prospectus/sec 1.9914504.100 68-TSRS-1024 |

| |