UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Marc Bryant, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | February 28 |

|

|

Date of reporting period: | February 28, 2015 |

This report on Form N-CSR relates solely to the Registrant's Chemicals Portfolio, Communications Equipment Portfolio, Computers Portfolio, Consumer Staples Portfolio, Electronics Portfolio, Energy Portfolio, Energy Service Portfolio, Gold Portfolio, IT Services Portfolio, Materials Portfolio, Natural Gas Portfolio, Natural Resources Portfolio, Software and Computer Services Portfolio, Technology Portfolio, Telecommunications Portfolio, Utilities Portfolio and Wireless Portfolio series (each, a "Fund" and collectively, the "Funds").

Item 1. Reports to Stockholders

Fidelity®

Select Portfolios®

Materials Sector

Chemicals Portfolio

Gold Portfolio

Materials Portfolio

Annual Report

February 28, 2015

(Fidelity Cover Art)

Contents

Chemicals | Performance | |

| Management's Discussion | |

| Shareholder Expense Example | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

Gold | Performance | |

| Management's Discussion | |

| Shareholder Expense Example | |

| Consolidated Investment Changes | |

| Consolidated Investments | |

| Consolidated Financial Statements | |

| Notes to the Consolidated Financial Statements | |

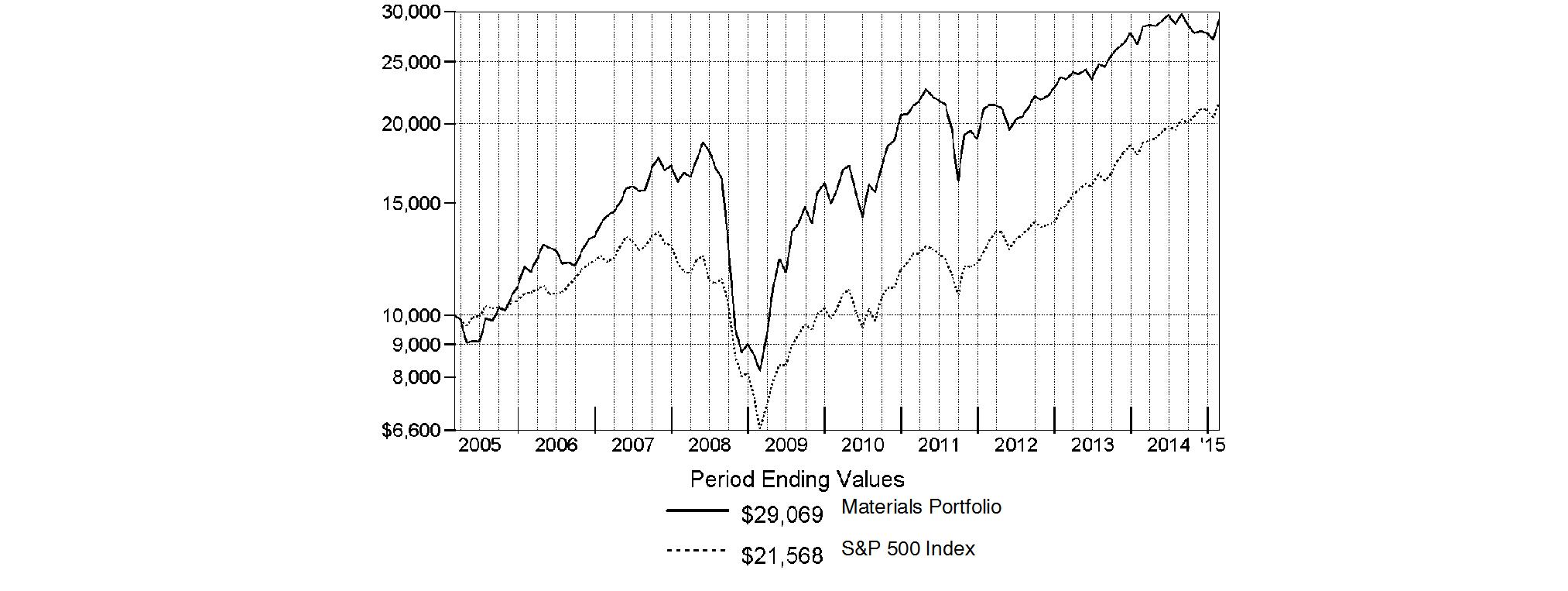

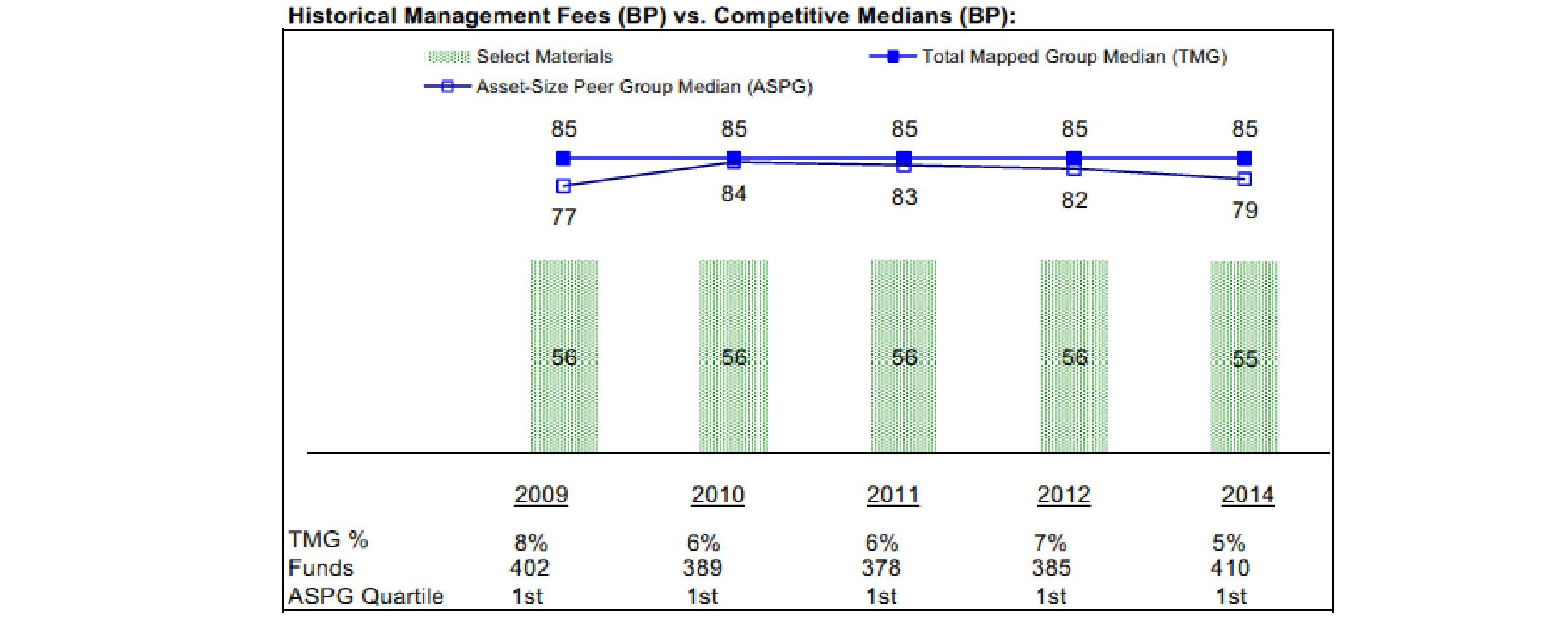

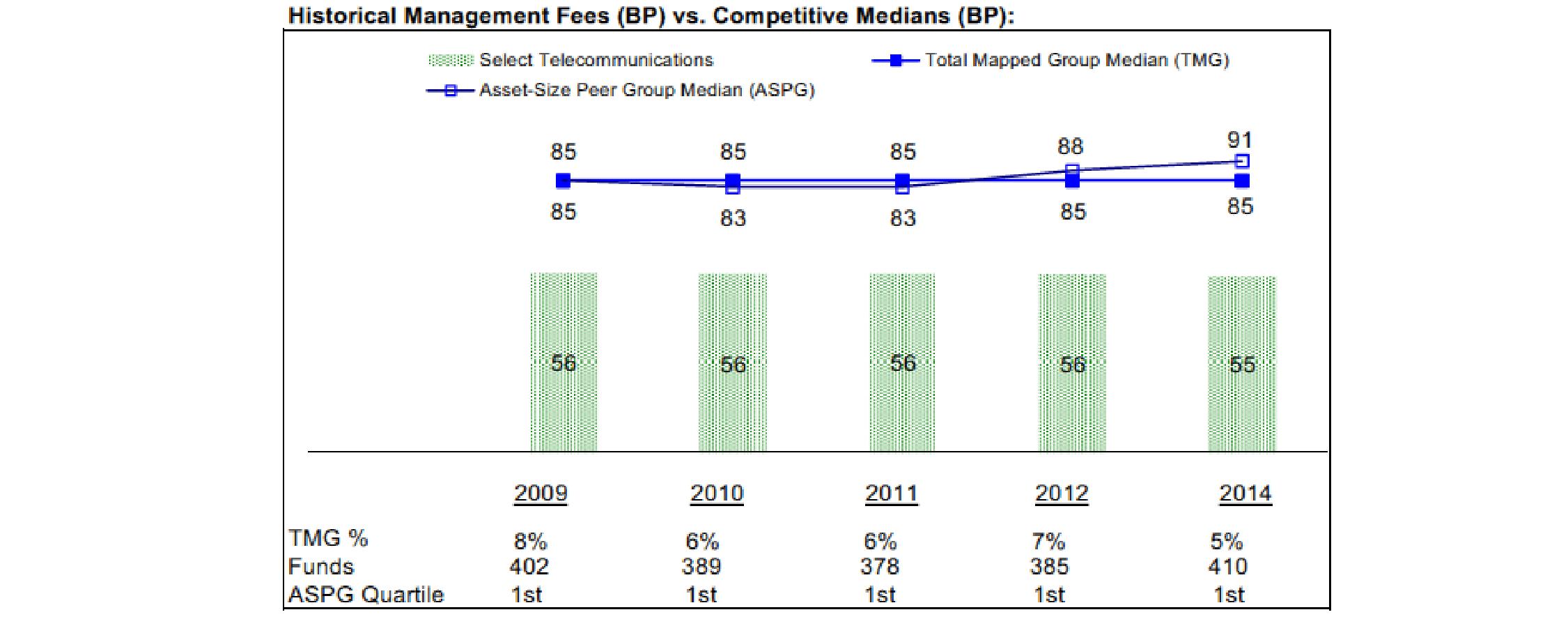

Materials | Performance | |

| Management's Discussion | |

| Shareholder Expense Example | |

| Investment Changes | |

| Investments | |

| Financial Statements | |

| Notes to the Financial Statements | |

Report of Independent Registered Public Accounting Firm |

| |

Trustees and Officers |

| |

Distributions |

| |

Board Approval of Investment Advisory Contracts and Management Fees |

|

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2015 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's web site at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330. For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.advisor.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Chemicals Portfolio

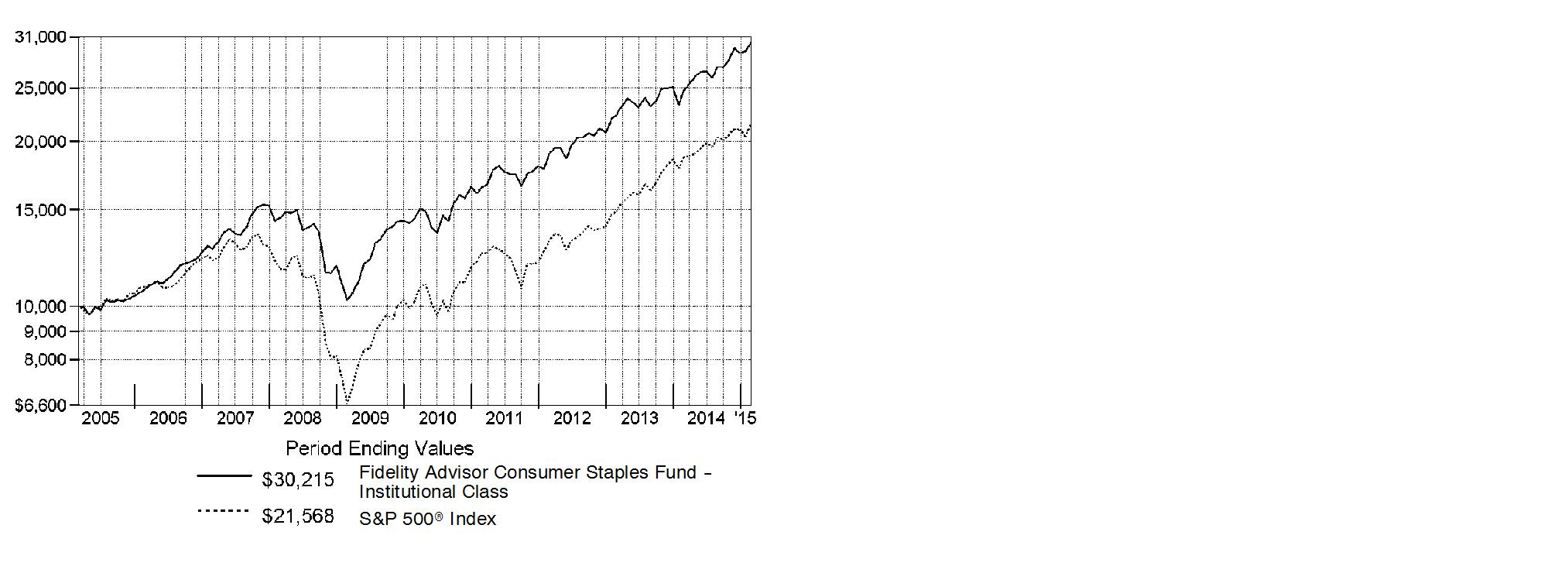

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2015 | Past 1 | Past 5 | Past 10 |

Chemicals Portfolio | 7.52% | 19.26% | 12.61% |

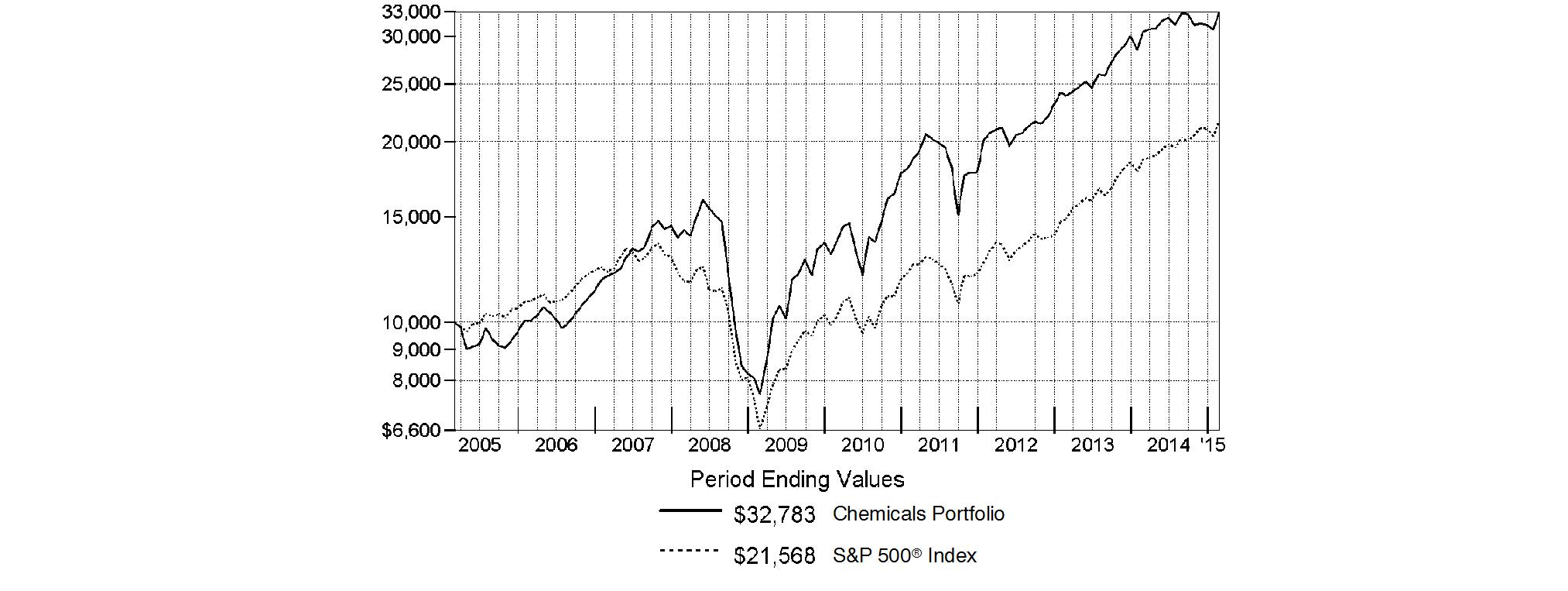

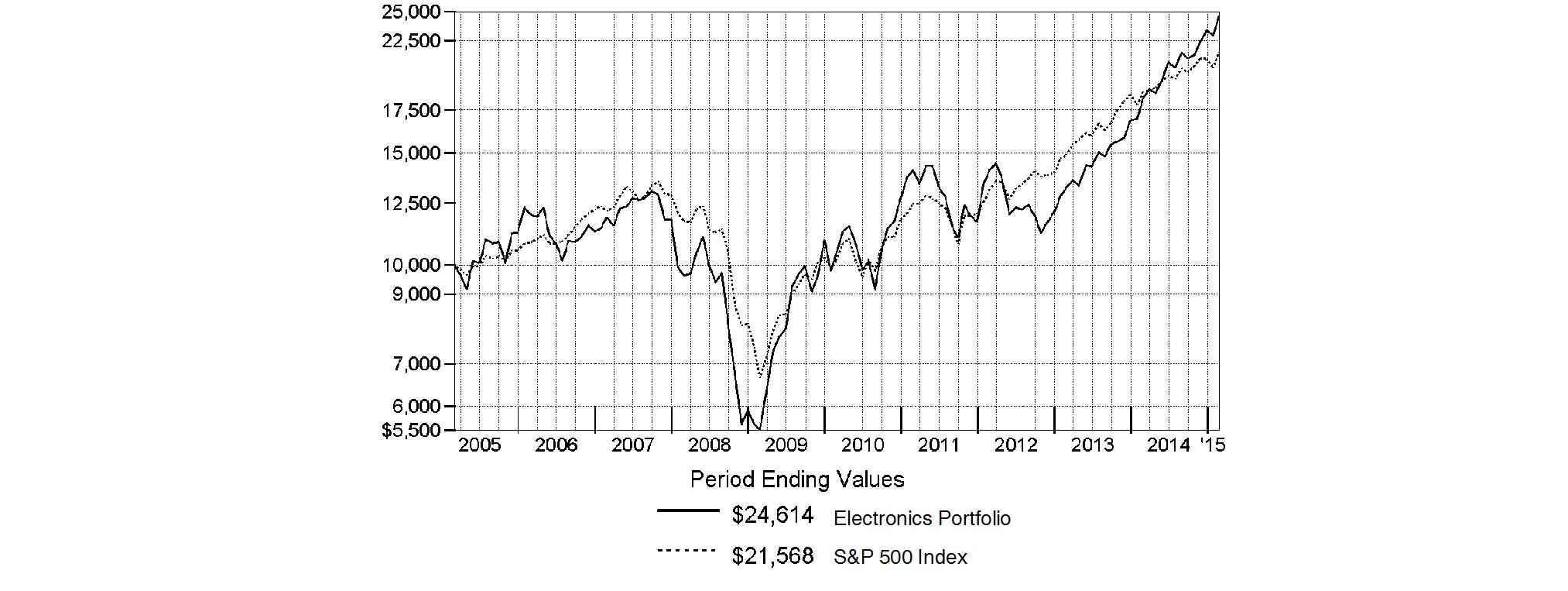

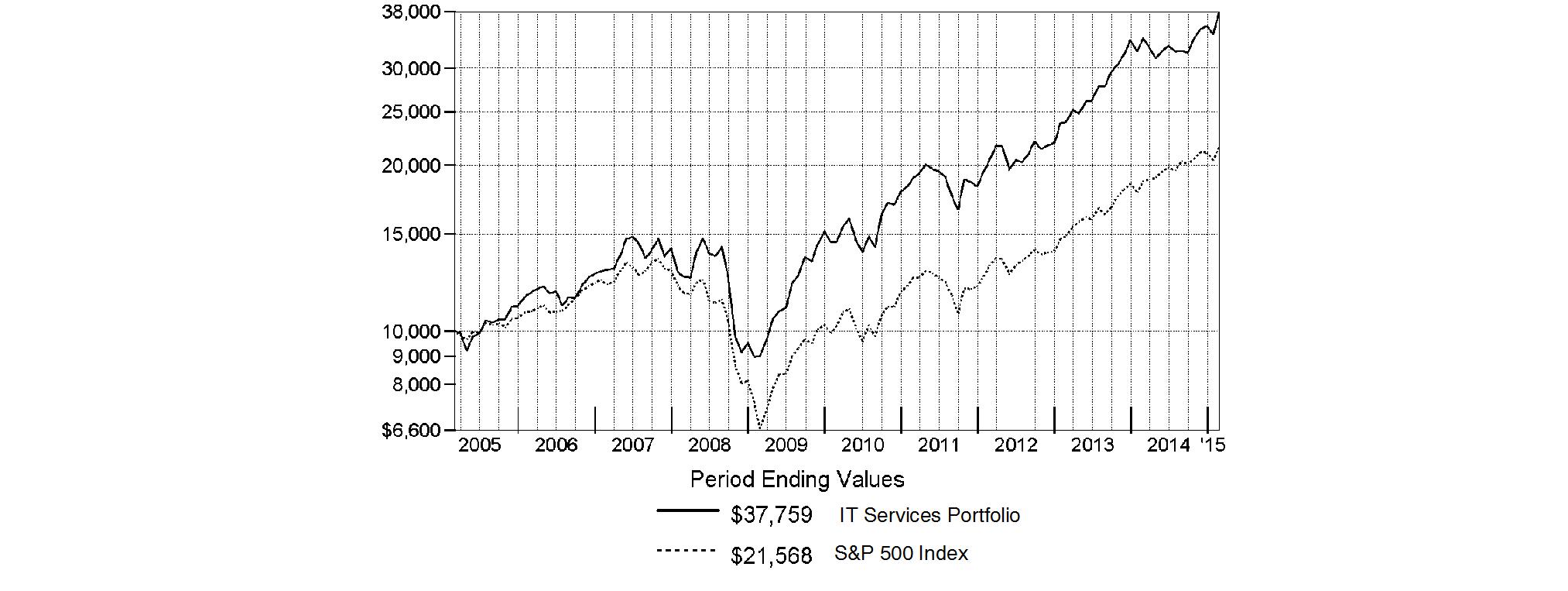

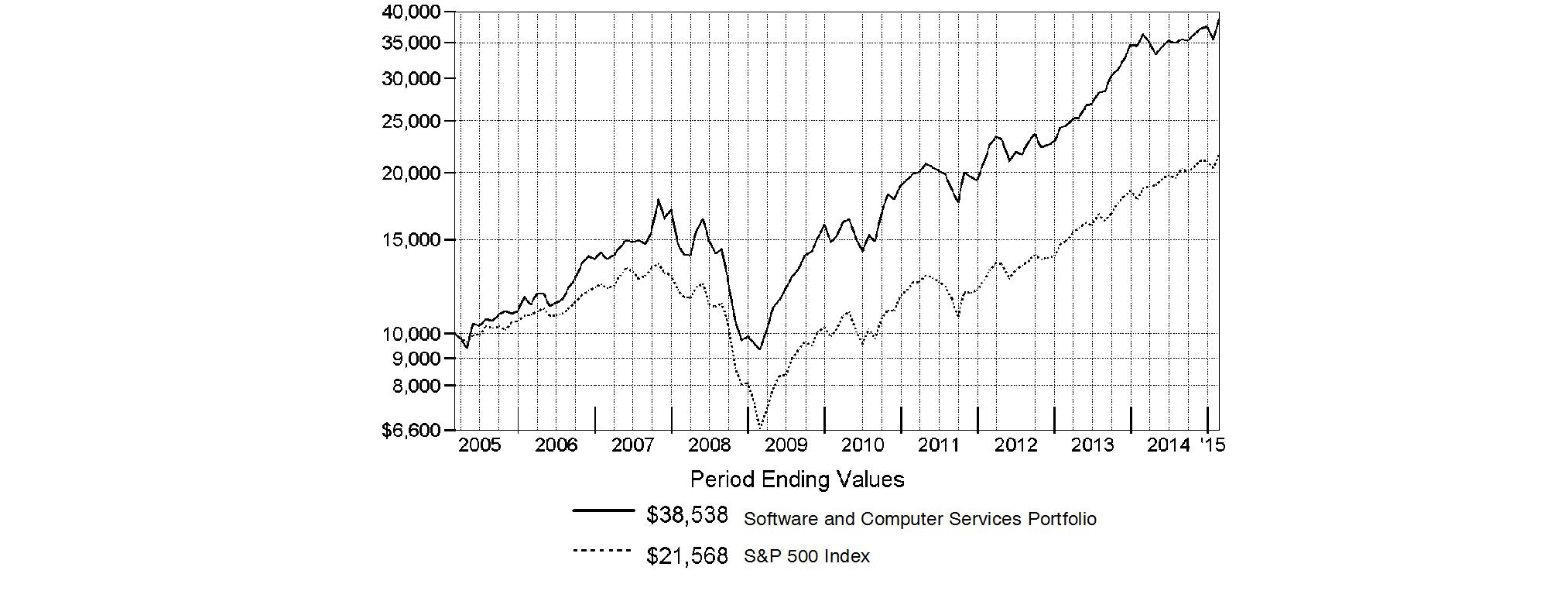

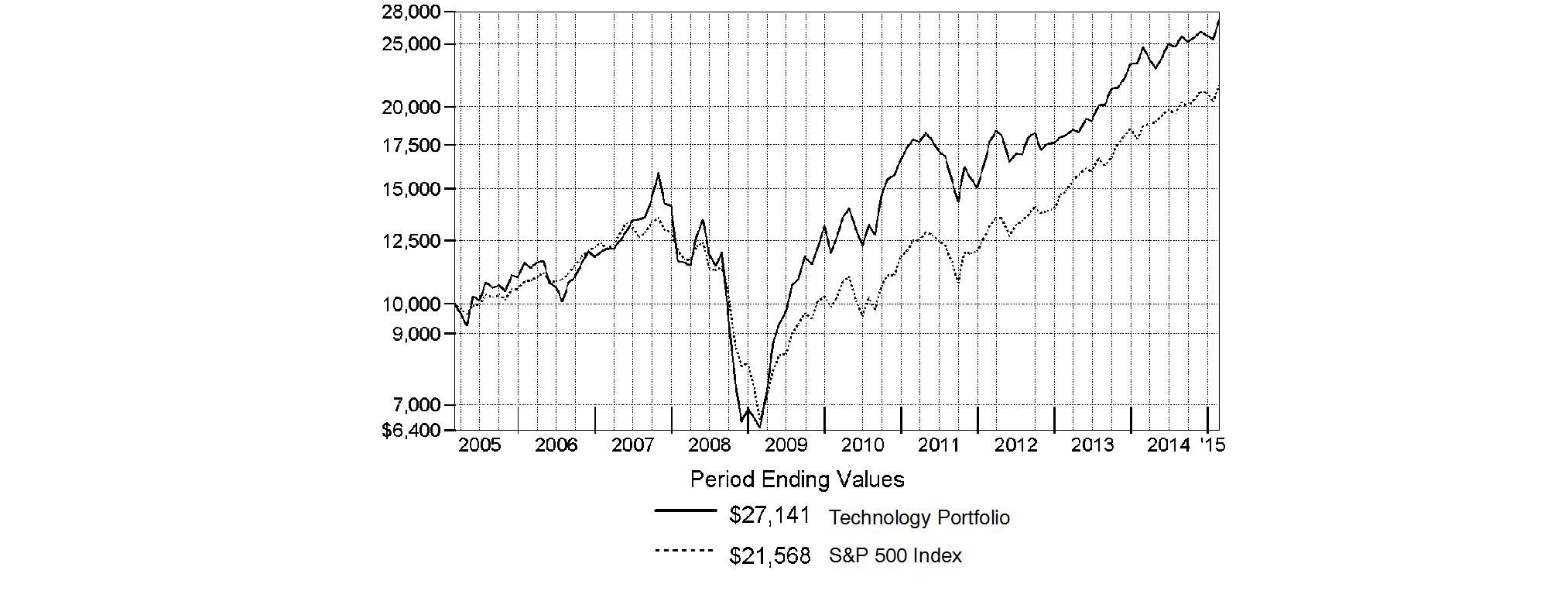

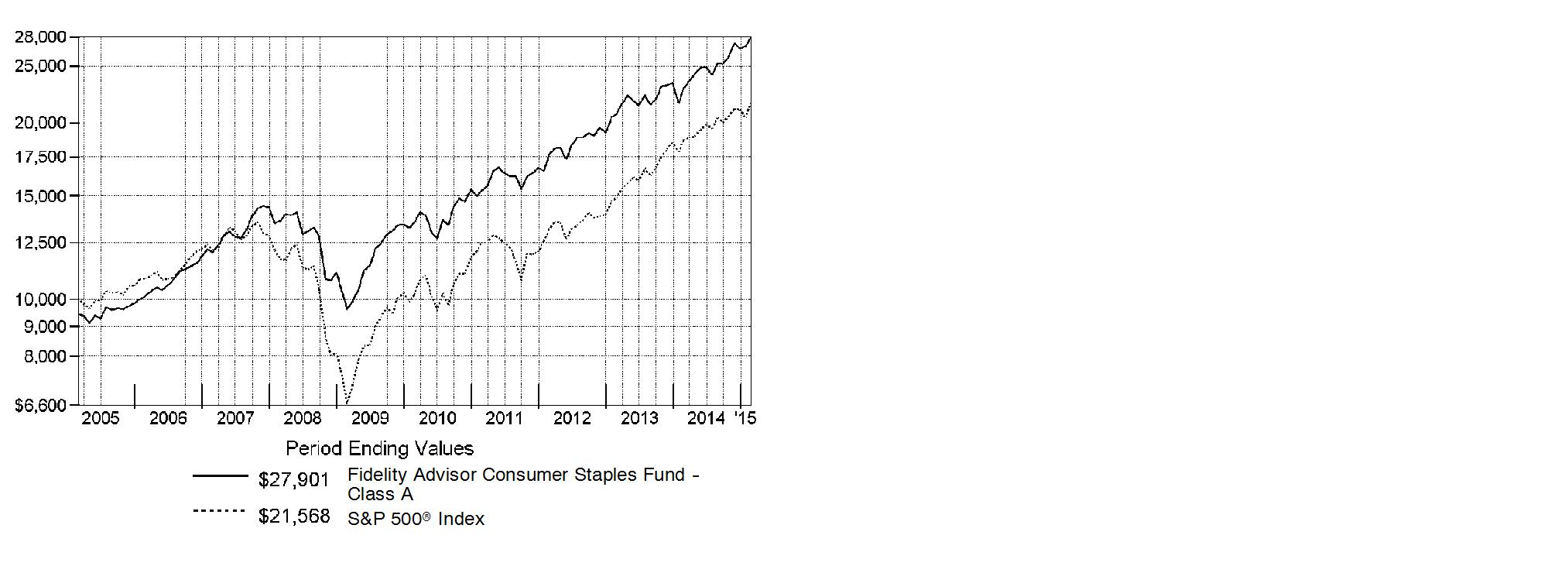

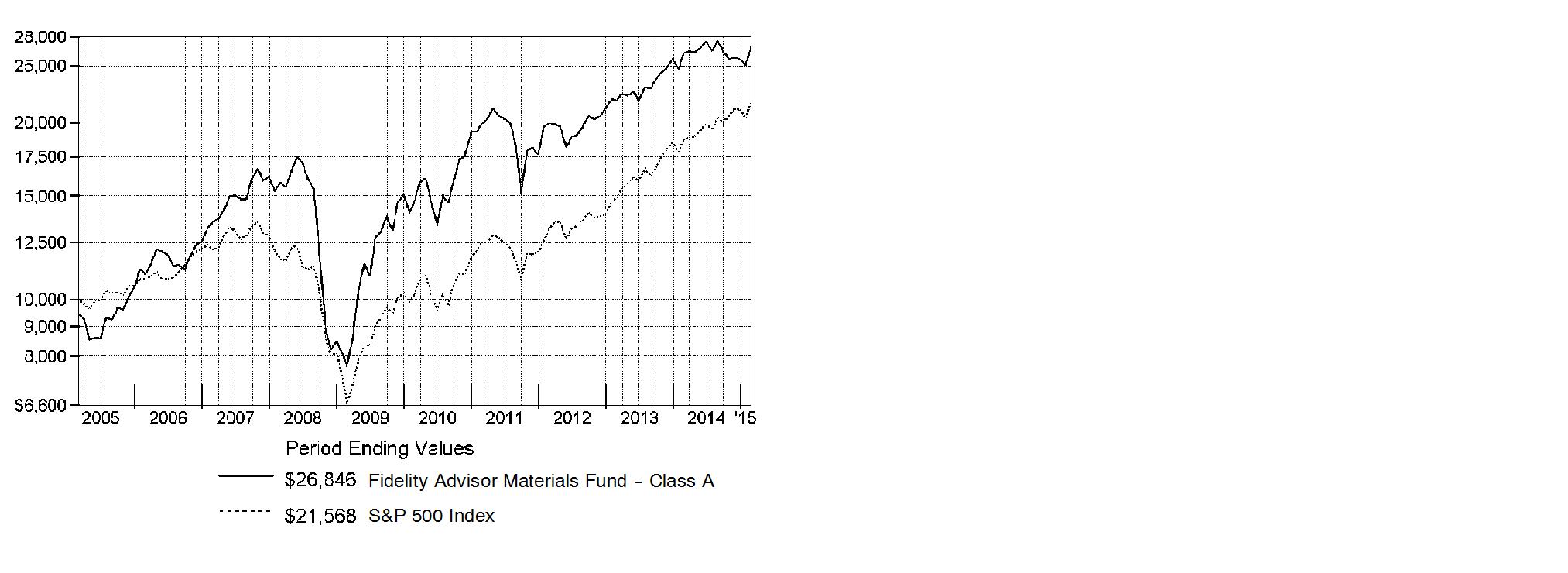

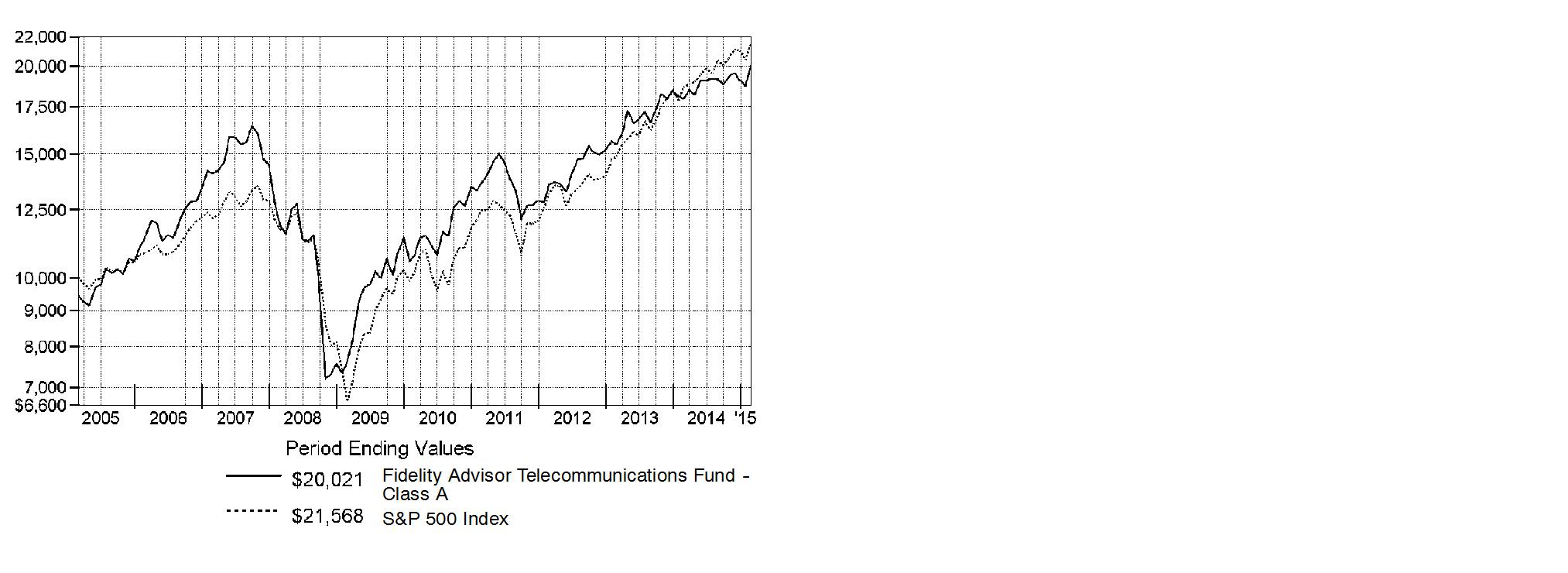

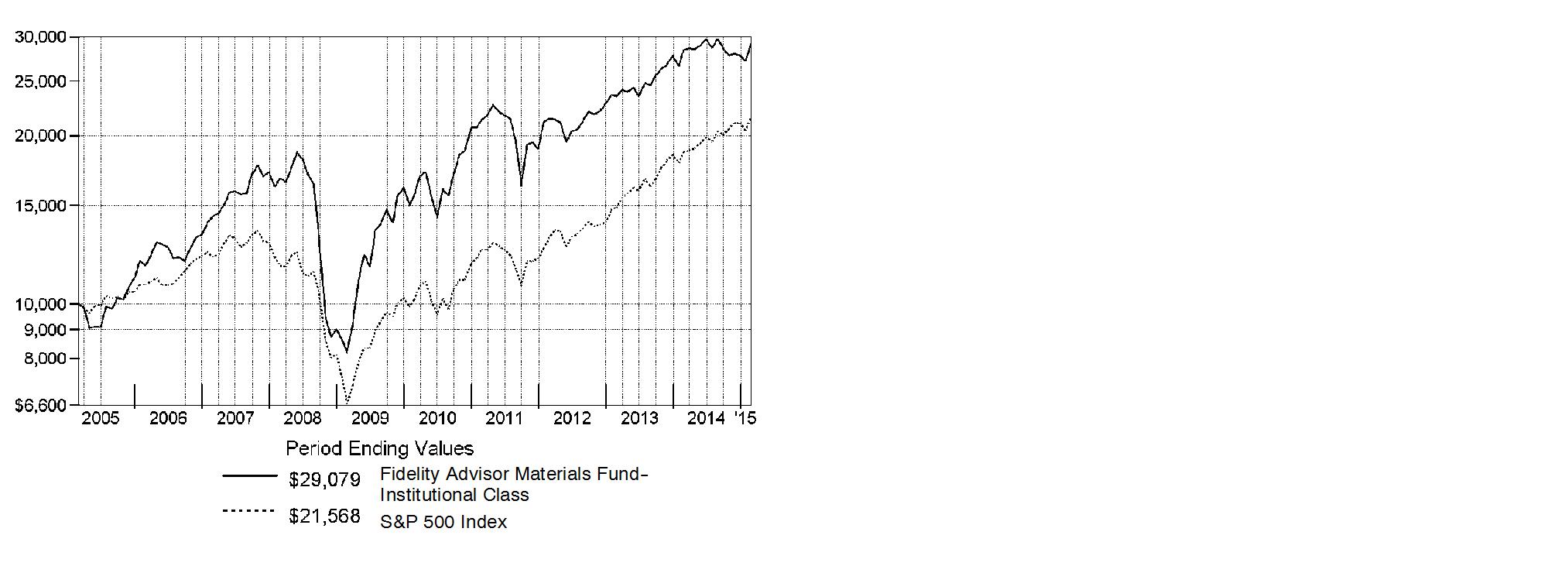

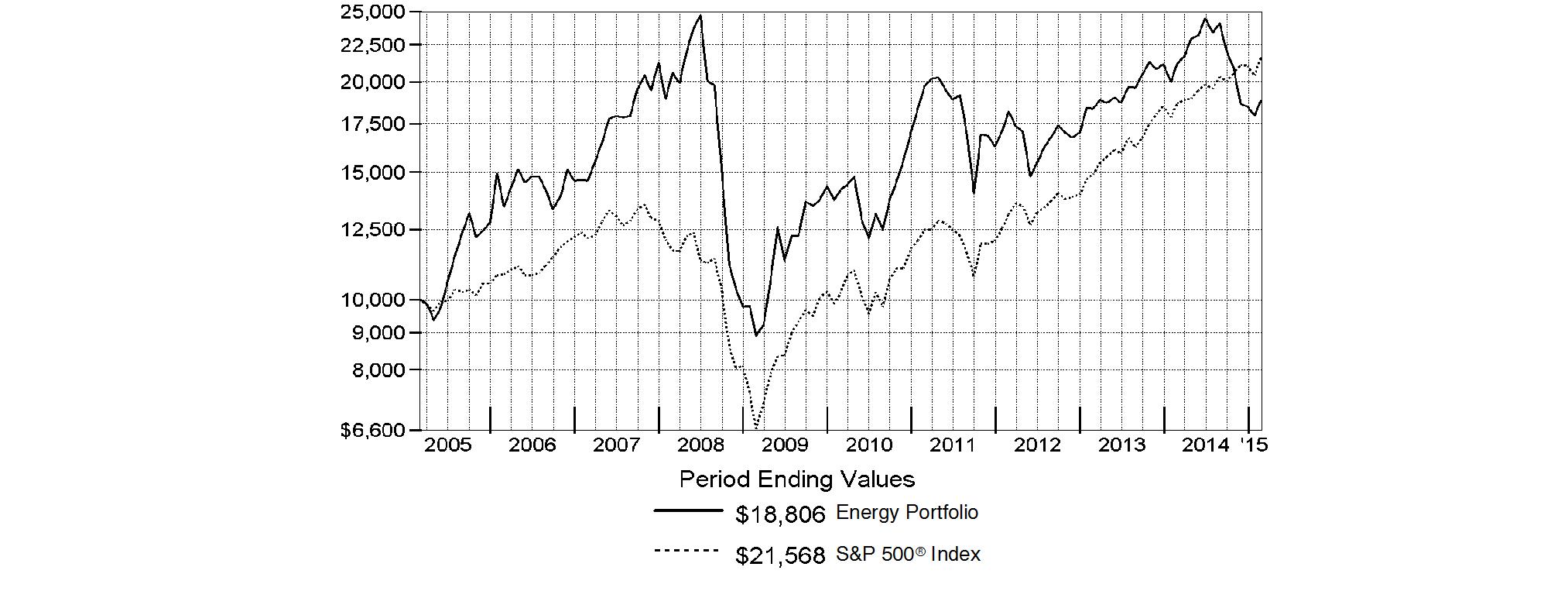

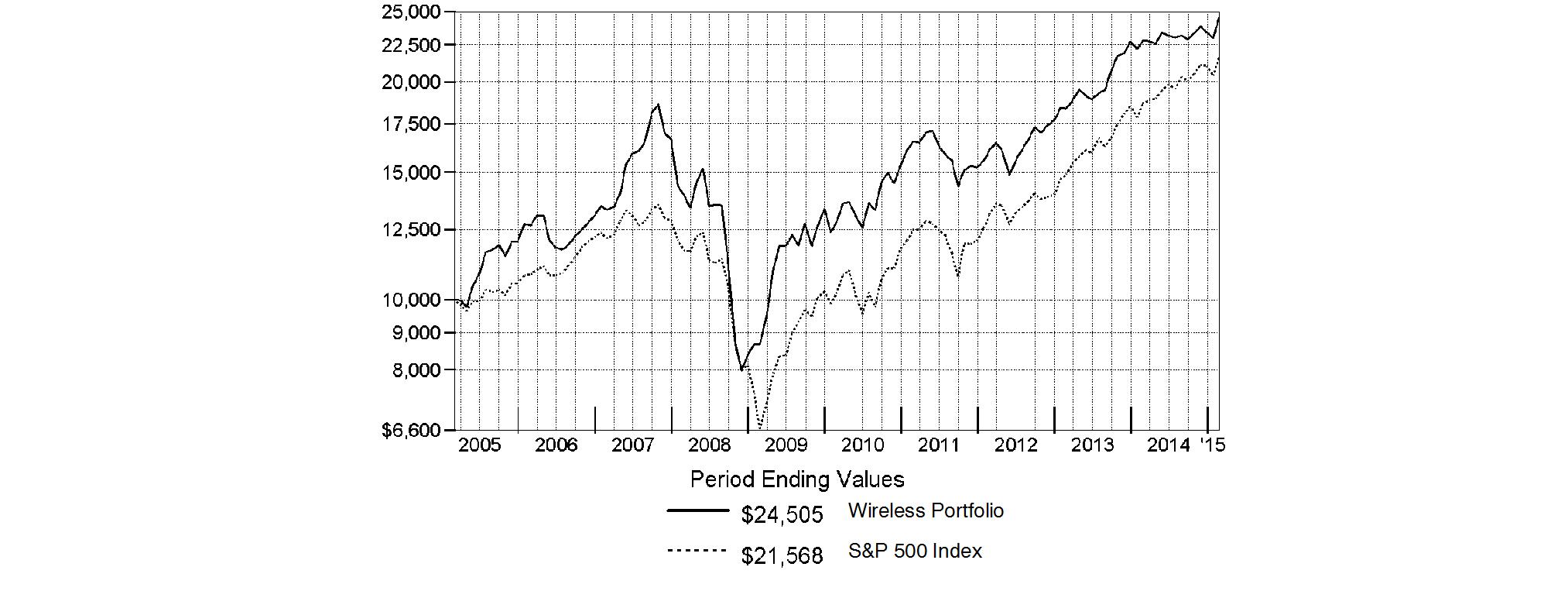

$10,000 Over 10 Years

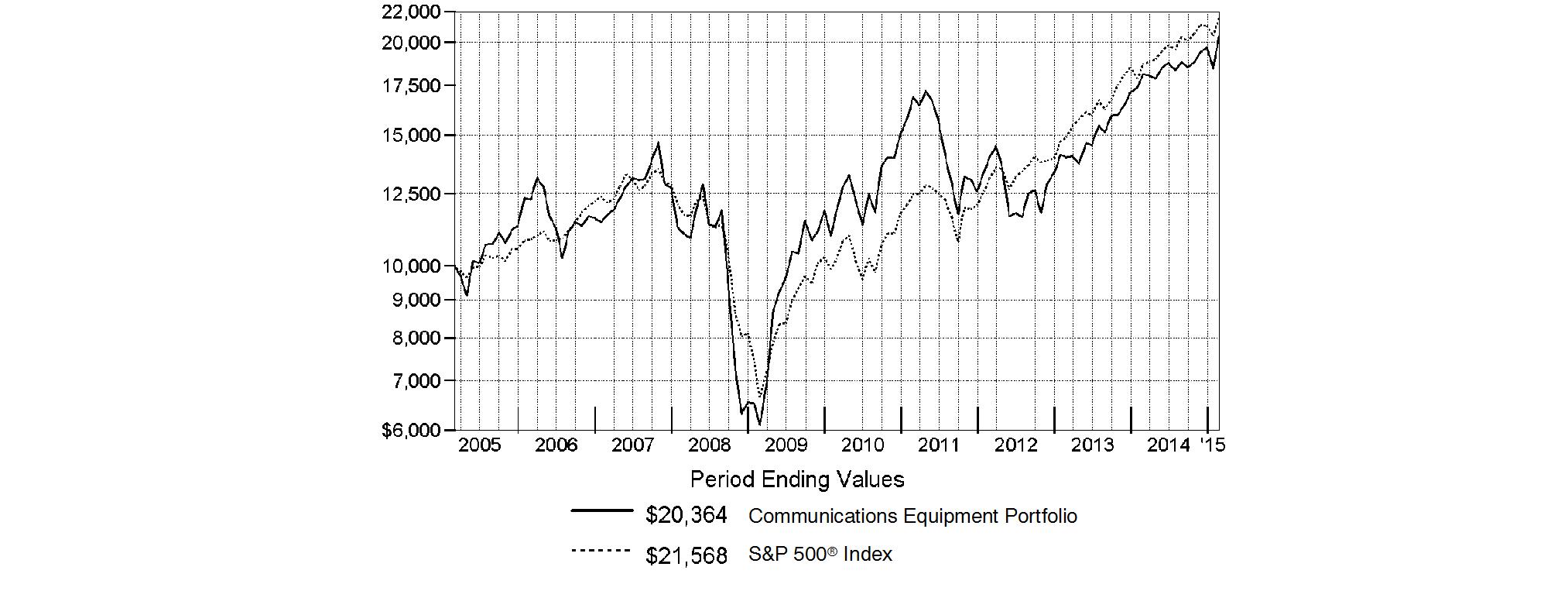

Let's say hypothetically that $10,000 was invested in Chemicals Portfolio on February 28, 2005. The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

Annual Report

Chemicals Portfolio

Management's Discussion of Fund Performance

Market Recap: The U.S. stock market closed near its all-time high for the 12 months ending February 28, 2015, supported by low interest rates and the relative strength of the U.S. economy and dollar. The large-cap S&P 500® Index returned 15.51%. Growth stocks in the index outperformed value-oriented names. The tech-heavy Nasdaq Composite Index® rose 16.58%, while the small-cap Russell 2000® Index advanced 5.63%, rallying from early-period weakness amid growth and valuation worries. Among the 10 major market sectors tracked by MSCI U.S. IMI 25-50 classifications, most notched a double-digit gain, led by health care (+24%), consumer staples (+21%), information technology (+20%) and utilities (+15%). Conversely, energy (-9%) was the only sector to lose ground, reflecting a sharp drop in crude prices beginning midyear and attributed to weaker global demand and a U.S. supply boom. Volatility spiked to a three-year high in October amid concerns about economic growth and Ebola, as well as unrest in Syria, Iraq and Ukraine. Nevertheless, the S&P 500® finished the period well above its mid-October nadir, bolstered by the relative economic strength of the U.S., which marked a six-year low in its unemployment rate, and consumer confidence that declined only slightly from its 11-year high reached in January.

Comments from Mahmoud Sharaf, Portfolio Manager of Chemicals Portfolio: For the year, the fund returned 7.52%, behind the 11.28% gain of its industry benchmark, the MSCI U.S. IMI Chemicals 25-50 Index, and the S&P 500®. The period started out relatively well, with most markets benefiting from the slow-paced global economic recovery. However, oil prices began to decline mid-summer due to an increase in global production and anemic consumption. Then, in a surprise move in November, OPEC, the Organization of the Petroleum Exporting Countries, announced it would not cut production to ease the price decline, causing oil to plummet further. Prices continued to tumble through period end, flattening the global cost curve for commodity chemicals firms, which use crude oil in their production. As a result, this subindustry - the fund's largest overweighting versus its MSCI benchmark the past year - weighed on its relative performance. This period, many of the fund's biggest detractors were from this area, including Methanex - an out-of-index holding - and Westlake Chemical. As oil continued to decline and the U.S. dollar gained strength during the back half of the period, higher-quality, more-defensive chemicals names began to outperform. This included paint and coatings makers, which also benefited from the plummeting oil prices because these firms use oil-based raw materials. Here, an underweighting in Sherwin-Williams was the fund's biggest individual detractor. Sherwin-Williams outperformed as investors were drawn to the safe-haven stock due to firm's U.S.-focused business and its tie to the improving domestic housing market. Elsewhere, a modest cash position of roughly 2%, on average, hurt amid a relatively strong market. On the flip side, an average overweighting in biochemical and organic chemical producer Sigma-Aldrich was the fund's biggest contributor the past year and one of its largest holdings. The stock of this long-time fund holding popped in September after Germany-based Merck KgaG, a multinational chemicals, pharmaceuticals and life sciences firm, agreed to buy Sigma-Aldrich to expand its business in chemicals used in research labs and drug manufacturing. The deal was completed in December. Another multiyear holding, specialty chemical producer Ashland, lifted the fund's relative result. Ashland successfully sold one of its low-margin, low-multiple divisions and used the proceeds to buy back some of its stock. I remained to be bullish on the firm's growth potential, and Ashland remained one of the fund's biggest holdings at period end.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Chemicals Portfolio

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2014 to February 28, 2015).

Actual Expenses

The first line of the accompanying table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Annualized | Beginning | Ending | Expenses Paid |

Actual | .79% | $ 1,000.00 | $ 1,001.60 | $ 3.92 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.88 | $ 3.96 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Annual Report

Chemicals Portfolio

Investment Changes (Unaudited)

Top Ten Stocks as of February 28, 2015 | ||

| % of fund's | % of fund's net assets |

E.I. du Pont de Nemours & Co. | 14.3 | 11.9 |

Monsanto Co. | 12.3 | 8.3 |

LyondellBasell Industries NV Class A | 8.1 | 10.8 |

The Dow Chemical Co. | 6.0 | 7.3 |

Ecolab, Inc. | 5.5 | 4.3 |

Praxair, Inc. | 5.0 | 6.9 |

CF Industries Holdings, Inc. | 4.6 | 4.4 |

Ashland, Inc. | 4.3 | 3.3 |

Eastman Chemical Co. | 3.6 | 4.2 |

International Flavors & Fragrances, Inc. | 3.4 | 0.0 |

| 67.1 | |

Top Industries (% of fund's net assets) | |||

As of February 28, 2015 | |||

| Chemicals | 96.1% |

|

| All Others* | 3.9% |

|

As of August 31, 2014 | |||

| Chemicals | 96.3% |

|

| Oil, Gas & | 2.3% |

|

| All Others* | 1.4% |

|

* Includes short-term investments and net other assets (liabilities). |

Annual Report

Chemicals Portfolio

Investments February 28, 2015

Showing Percentage of Net Assets

Common Stocks - 96.1% | |||

Shares | Value | ||

CHEMICALS - 96.1% | |||

Commodity Chemicals - 11.2% | |||

LyondellBasell Industries NV Class A | 1,527,322 | $ 131,212,233 | |

Methanex Corp. | 399,600 | 21,733,305 | |

Orion Engineered Carbons SA | 528,543 | 8,699,818 | |

Tronox Ltd. Class A | 423,149 | 9,156,944 | |

Westlake Chemical Corp. | 162,000 | 10,815,120 | |

Westlake Chemical Partners LP | 29,300 | 782,017 | |

| 182,399,437 | ||

Diversified Chemicals - 23.9% | |||

E.I. du Pont de Nemours & Co. | 2,977,500 | 231,798,373 | |

Eastman Chemical Co. | 784,261 | 58,396,074 | |

The Dow Chemical Co. | 1,993,606 | 98,165,159 | |

| 388,359,606 | ||

Fertilizers & Agricultural Chemicals - 17.9% | |||

CF Industries Holdings, Inc. | 242,016 | 74,112,560 | |

Monsanto Co. | 1,664,849 | 200,497,765 | |

Potash Corp. of Saskatchewan, Inc. | 438,800 | 15,742,885 | |

| 290,353,210 | ||

Industrial Gases - 10.6% | |||

Air Products & Chemicals, Inc. | 271,708 | 42,424,487 | |

Airgas, Inc. | 416,400 | 48,810,408 | |

Praxair, Inc. | 634,821 | 81,193,606 | |

| 172,428,501 | ||

Specialty Chemicals - 32.5% | |||

Albemarle Corp. U.S. | 273,792 | 15,488,413 | |

Ashland, Inc. | 551,050 | 70,325,001 | |

Axalta Coating Systems | 706,003 | 20,050,485 | |

Ecolab, Inc. | 766,531 | 88,564,992 | |

Ferro Corp. (a) | 1,564,283 | 19,944,608 | |

Innophos Holdings, Inc. | 320,406 | 17,984,389 | |

International Flavors & Fragrances, Inc. | 455,500 | 55,539,115 | |

| |||

Shares | Value | ||

NewMarket Corp. | 60,296 | $ 28,405,446 | |

PolyOne Corp. | 576,317 | 22,902,838 | |

PPG Industries, Inc. | 219,304 | 51,619,776 | |

Quaker Chemical Corp. | 25,747 | 2,090,141 | |

RPM International, Inc. | 853,879 | 43,163,583 | |

Sherwin-Williams Co. | 139,953 | 39,914,596 | |

Valspar Corp. | 491,200 | 42,562,480 | |

W.R. Grace & Co. (a) | 100,391 | 9,953,768 | |

| 528,509,631 | ||

TOTAL COMMON STOCKS (Cost $1,154,785,184) | 1,562,050,385 | ||

Money Market Funds - 3.3% | |||

|

|

|

|

Fidelity Cash Central Fund, 0.13% (b) | 52,612,341 |

| |

TOTAL INVESTMENT PORTFOLIO - 99.4% (Cost $1,207,397,525) | 1,614,662,726 |

NET OTHER ASSETS (LIABILITIES) - 0.6% | 10,404,430 | ||

NET ASSETS - 100% | $ 1,625,067,156 | ||

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 32,724 |

Fidelity Securities Lending Cash Central Fund | 251,742 |

Total | $ 284,466 |

Other Information |

All investments are categorized as Level 1 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Distribution of investments by country or territory of incorporation, as a percentage of total net assets, is as follows (Unaudited): |

United States of America | 87.3% |

Netherlands | 8.1% |

Canada | 2.3% |

Bermuda | 1.2% |

Others (Individually Less Than 1%) | 1.1% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Chemicals Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 28, 2015 | |

|

|

|

Assets | ||

Investment in securities, at value - See accompanying schedule: Unaffiliated issuers (cost $1,154,785,184) | $ 1,562,050,385 |

|

Fidelity Central Funds (cost $52,612,341) | 52,612,341 |

|

Total Investments (cost $1,207,397,525) |

| $ 1,614,662,726 |

Receivable for investments sold | 12,003,000 | |

Receivable for fund shares sold | 1,853,368 | |

Dividends receivable | 3,093,725 | |

Distributions receivable from Fidelity Central Funds | 3,051 | |

Prepaid expenses | 6,251 | |

Other receivables | 29,516 | |

Total assets | 1,631,651,637 | |

|

|

|

Liabilities | ||

Payable for fund shares redeemed | 5,474,940 | |

Accrued management fee | 736,857 | |

Other affiliated payables | 302,973 | |

Other payables and accrued expenses | 69,711 | |

Total liabilities | 6,584,481 | |

|

|

|

Net Assets | $ 1,625,067,156 | |

Net Assets consist of: |

| |

Paid in capital | $ 1,184,824,543 | |

Undistributed net investment income | 3,797,390 | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | 29,180,022 | |

Net unrealized appreciation (depreciation) on investments | 407,265,201 | |

Net Assets, for 10,597,540 shares outstanding | $ 1,625,067,156 | |

Net Asset Value, offering price and redemption price per share ($1,625,067,156 ÷ 10,597,540 shares) | $ 153.34 | |

Statement of Operations

| Year ended February 28, 2015 | |

|

|

|

Investment Income |

|

|

Dividends |

| $ 30,625,548 |

Income from Fidelity Central Funds |

| 284,466 |

Total income |

| 30,910,014 |

|

|

|

Expenses | ||

Management fee | $ 8,990,765 | |

Transfer agent fees | 3,243,996 | |

Accounting and security lending fees | 509,882 | |

Custodian fees and expenses | 26,708 | |

Independent trustees' compensation | 31,616 | |

Registration fees | 107,740 | |

Audit | 42,820 | |

Legal | 10,551 | |

Interest | 3,721 | |

Miscellaneous | 27,532 | |

Total expenses before reductions | 12,995,331 | |

Expense reductions | (3,515) | 12,991,816 |

Net investment income (loss) | 17,918,198 | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investment securities: |

|

|

Unaffiliated issuers | 49,888,942 | |

Foreign currency transactions | (6,764) | |

Redemptions in-kind with affiliated entities | 44,600,048 | |

Total net realized gain (loss) |

| 94,482,226 |

Change in net unrealized appreciation (depreciation) on: Investment securities | 120,669 | |

Assets and liabilities in foreign currencies | 10,359 | |

Total change in net unrealized appreciation (depreciation) |

| 131,028 |

Net gain (loss) | 94,613,254 | |

Net increase (decrease) in net assets resulting from operations | $ 112,531,452 | |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Changes in Net Assets

| Year ended | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ 17,918,198 | $ 11,321,031 |

Net realized gain (loss) | 94,482,226 | 106,436,765 |

Change in net unrealized appreciation (depreciation) | 131,028 | 180,559,217 |

Net increase (decrease) in net assets resulting from operations | 112,531,452 | 298,317,013 |

Distributions to shareholders from net investment income | (15,536,694) | (11,058,506) |

Distributions to shareholders from net realized gain | (47,390,610) | (65,324,116) |

Total distributions | (62,927,304) | (76,382,622) |

Share transactions | 895,876,330 | 719,398,651 |

Reinvestment of distributions | 60,869,457 | 73,918,871 |

Cost of shares redeemed | (810,770,343) | (720,642,710) |

Net increase (decrease) in net assets resulting from share transactions | 145,975,444 | 72,674,812 |

Redemption fees | 53,824 | 47,042 |

Total increase (decrease) in net assets | 195,633,416 | 294,656,245 |

|

|

|

Net Assets | ||

Beginning of period | 1,429,433,740 | 1,134,777,495 |

End of period (including undistributed net investment income of $3,797,390 and undistributed net investment income of $2,509,218, respectively) | $ 1,625,067,156 | $ 1,429,433,740 |

Other Information Shares | ||

Sold | 5,974,565 | 5,317,546 |

Issued in reinvestment of distributions | 422,535 | 540,024 |

Redeemed | (5,443,032) | (5,441,546) |

Net increase (decrease) | 954,068 | 416,024 |

Financial Highlights

Years ended February 28, | 2015 | 2014 | 2013 | 2012 H | 2011 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 148.23 | $ 122.98 | $ 110.52 | $ 100.85 | $ 75.43 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) B | 1.64 | 1.23 | 1.84E | .76 | .69 |

Net realized and unrealized gain (loss) | 9.09 | 32.11 | 15.10 | 9.52 | 27.20 |

Total from investment operations | 10.73 | 33.34 | 16.94 | 10.28 | 27.89 |

Distributions from net investment income | (1.42) | (1.18) | (1.55) | (.62) | (.57) |

Distributions from net realized gain | (4.20) | (6.92) | (2.95) | - | (1.91) |

Total distributions | (5.62) | (8.10) | (4.49) J | (.62) | (2.47) K |

Redemption fees added to paid in capital B | - I | .01 | .01 | .01 | - I |

Net asset value, end of period | $ 153.34 | $ 148.23 | $ 122.98 | $ 110.52 | $ 100.85 |

Total ReturnA | 7.52% | 27.77% | 15.61% | 10.31% | 37.74% |

Ratios to Average Net AssetsC, F |

|

|

|

|

|

Expenses before reductions | .79% | .81% | .83% | .85% | .90% |

Expenses net of fee waivers, if any | .79% | .81% | .83% | .85% | .90% |

Expenses net of all reductions | .79% | .80% | .81% | .84% | .89% |

Net investment income (loss) | 1.10% | .91% | 1.62% E | .77% | .84% |

Supplemental Data |

|

|

|

|

|

Net assets, end of period (000 omitted) | $ 1,625,067 | $ 1,429,434 | $ 1,134,777 | $ 861,539 | $ 692,332 |

Portfolio turnover rateD | 80% G | 109% | 60% | 119% | 108% |

ATotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown. BCalculated based on average shares outstanding during the period. CFees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds. DAmount does not include the portfolio activity of any underlying Fidelity Central Funds. EInvestment income per share reflects a large, non-recurring dividend which amounted to $.30 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.35%. FExpense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund. GPortfolio turnover rate excludes securities received or delivered in-kind. HFor the year ended February 29. IAmount represents less than $.01 per share. JTotal distributions of $4.49 per share is comprised of distributions from net investment income of $1.547 and distributions from net realized gain of $2.947 per share. KTotal distributions of $2.47 per share is comprised of distributions from net investment income of $.565 and distributions from net realized gain of $1.905 per share. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended February 28, 2015

1. Organization.

Chemicals Portfolio (the Fund) is a non-diversified fund of Fidelity Select Portfolios (the Trust) and is authorized to issue an unlimited number of shares. Share transactions on the Statement of Changes in Net Assets may contain exchanges between funds. The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. The Fund invests primarily in securities of companies whose principal business activities fall within specific industries.

2. Investments in Fidelity Central Funds.

The Fund invests in Fidelity Central Funds, which are open-end investment companies generally available only to other investment companies and accounts managed by the investment adviser and its affiliates. The Fund's Schedule of Investments lists each of the Fidelity Central Funds held as of period end, if any, as an investment of the Fund, but does not include the underlying holdings of each Fidelity Central Fund. As an Investing Fund, the Fund indirectly bears its proportionate share of the expenses of the underlying Fidelity Central Funds.

The Money Market Central Funds seek preservation of capital and current income and are managed by Fidelity Investments Money Management, Inc. (FIMM), an affiliate of the investment adviser. Annualized expenses of the Money Market Central Funds as of their most recent shareholder report date are less than .01%.

A complete unaudited list of holdings for each Fidelity Central Fund is available upon request or at the Securities and Exchange Commission (the SEC) website at www.sec.gov. In addition, the financial statements of the Fidelity Central Funds, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC website or upon request.

3. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. The Board of Trustees (the Board) has delegated the day to day responsibility for the valuation of the Fund's investments to the Fidelity SelectCo, LLC (SelectCo) Fair Value Committee (the Committee). In accordance with valuation policies and procedures approved by the Board, the Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Committee, in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Fund's valuation policies and procedures and reports to the Board on the Committee's activities and fair value determinations. The Board monitors the appropriateness of the procedures used in valuing the Fund's investments and ratifies the fair value determinations of the Committee.

The Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities, including restricted securities, for which market quotations are readily available, are valued at the last reported sale price or official closing price as reported by a third party pricing vendor on the primary market or exchange on which they are traded and are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the last quoted bid price or may be valued using the last available price and are generally categorized as Level 2 in the hierarchy. For foreign equity securities, when market or security specific events arise, comparisons to the valuation of American Depositary Receipts (ADRs), futures contracts, Exchange-Traded Funds (ETFs) and certain indexes as well as quoted prices for similar securities may be used and would be categorized as Level 2 in the hierarchy. Utilizing these techniques may result in transfers between Level 1 and Level 2. For equity securities, including restricted securities, where observable inputs are limited, assumptions about market activity and risk are used and these securities may be categorized as Level 3 in the hierarchy.

Investments in open-end mutual funds, including the Fidelity Central Funds, are valued at their closing net asset value (NAV) each business day and are categorized as Level 1 in the hierarchy.

Annual Report

3. Significant Accounting Policies - continued

Investment Valuation - continued

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy.

Foreign Currency. The Fund may use foreign currency contracts to facilitate transactions in foreign-denominated securities. Gains and losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts' terms.

Foreign-denominated assets, including investment securities, and liabilities are translated into U.S. dollars at the exchange rates at period end. Purchases and sales of investment securities, income and dividends received and expenses denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date.

The effects of exchange rate fluctuations on investments are included with the net realized and unrealized gain (loss) on investment securities. Other foreign currency transactions resulting in realized and unrealized gain (loss) are disclosed separately.

Investment Transactions and Income. For financial reporting purposes, the Fund's investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day. Gains and losses on securities sold are determined on the basis of identified cost. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Income and capital gain distributions from Fidelity Central Funds, if any, are recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. Subsequent to ex-dividend date the Fund determines the components of these distributions, based upon receipt of tax filings or other correspondence relating to the underlying investment. Investment income is recorded net of foreign taxes withheld where recovery of such taxes is uncertain.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. Under a Deferred Compensation Plan (the Plan), independent Trustees may elect to defer receipt of a portion of their annual compensation. Deferred amounts are invested in a cross-section of Fidelity funds, are marked-to-market and remain in the Fund until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting payable to the Trustees are included in the accompanying Statement of Assets and Liabilities.

Income Tax Information and Distributions to Shareholders. Each year, the Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of February 28, 2015, the Fund did not have any unrecognized tax benefits in the financial statements; nor is the Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The Fund files a U.S. federal tax return, in addition to state and local tax returns as required. The Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction. Foreign taxes are provided for based on the Fund's understanding of the tax rules and rates that exist in the foreign markets in which it invests.

Distributions are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to in-kind transactions, partnerships, deferred trustees compensation and losses deferred due to wash sales.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows:

Gross unrealized appreciation | $ 409,784,548 |

Gross unrealized depreciation | (9,546,355) |

Net unrealized appreciation (depreciation) on securities | $ 400,238,193 |

|

|

Tax Cost | $ 1,214,424,533 |

Annual Report

Notes to Financial Statements - continued

3. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

The tax-based components of distributable earnings as of period end were as follows:

Undistributed ordinary income | $ 3,821,941 |

Undistributed long-term capital gain | $ 36,207,029 |

Net unrealized appreciation (depreciation) on securities and other investments | $ 400,238,193 |

The tax character of distributions paid was as follows:

| February 28, 2015 | February 28, 2014 |

Ordinary Income | $ 39,145,206 | $ 23,947,481 |

Long-term Capital Gains | 23,782,098 | 52,435,141 |

Total | $ 62,927,304 | $ 76,382,622 |

Trading (Redemption) Fees. Shares held by investors in the Fund less than 30 days may be subject to a redemption fee equal to .75% of the NAV of shares redeemed. All redemption fees, which reduce the proceeds of the shareholder redemption, are retained by the Fund and accounted for as an addition to paid in capital.

New Accounting Pronouncement. In June 2014, the Financial Accounting Standards Board issued Accounting Standard Update No. 2014-11, Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures (the Update). The Update amends the accounting for certain repurchase agreements and expands disclosure requirements for reverse repurchase agreements, securities lending and other similar transactions. The disclosure requirements are effective for annual and interim reporting periods beginning after December 15, 2014. Management is currently evaluating the impact of the Update on the Fund's financial statements and related disclosures.

4. Purchases and Sales of Investments.

Purchases and sales of securities, other than short-term securities and in-kind transactions, aggregated $1,494,917,803 and $1,272,244,611, respectively.

5. Fees and Other Transactions with Affiliates.

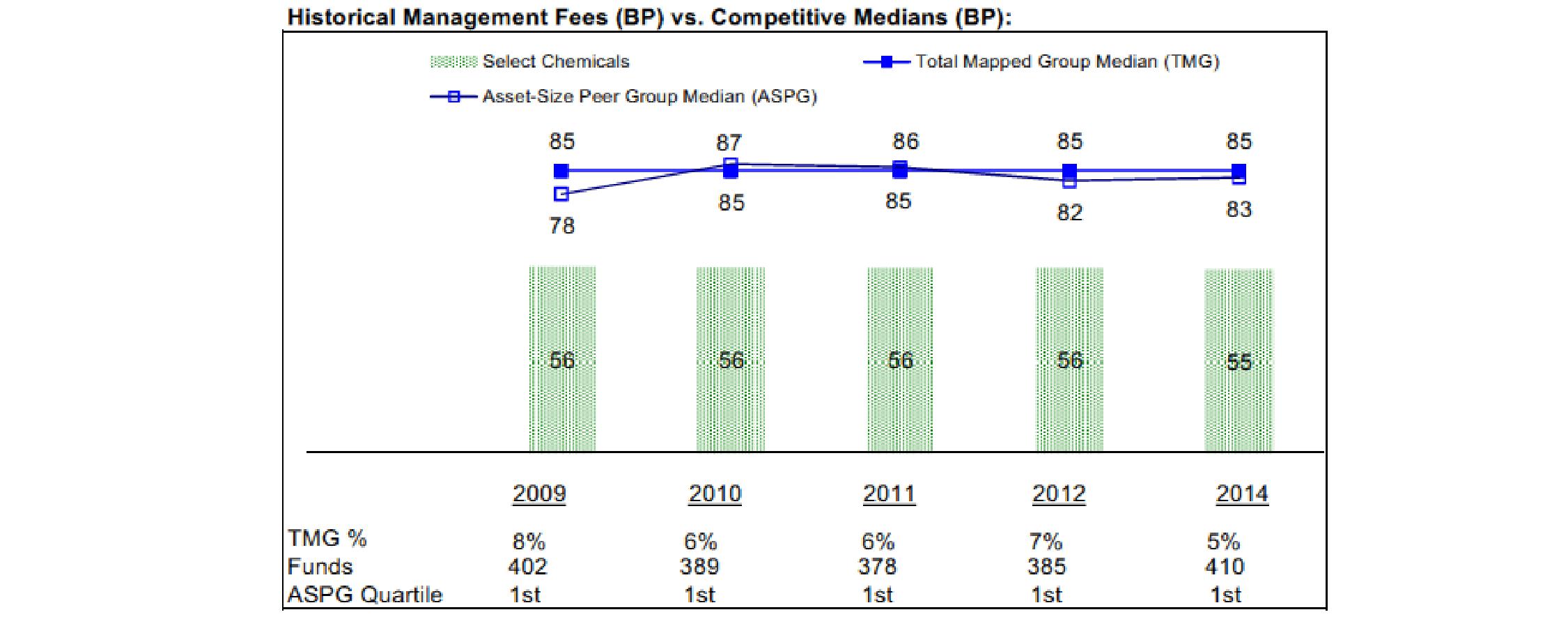

Management Fee. Fidelity SelectCo, LLC (the investment adviser) and its affiliates provide the Fund with investment management related services for which the Fund pays a monthly management fee. The management fee is the sum of an individual fund fee rate that is based on an annual rate of .30% of the Fund's average net assets and an annualized group fee rate that averaged .25% during the period. The group fee rate is based upon the average net assets of all the mutual funds advised by Fidelity Management & Research Company (FMR) and the investment adviser. The group fee rate decreases as assets under management increase and increases as assets under management decrease. For the reporting period, the total annual management fee rate was .55% of the Fund's average net assets.

Transfer Agent Fees. Fidelity Investments Institutional Operations Company, Inc. (FIIOC), an affiliate of the investment adviser, is the Fund's transfer, dividend disbursing and shareholder servicing agent. FIIOC receives account fees and asset-based fees that vary according to account size and type of account. FIIOC pays for typesetting, printing and mailing of shareholder reports, except proxy statements. For the period, the transfer agent fees were equivalent to an annual rate of .20% of average net assets.

Accounting and Security Lending Fees. Fidelity Service Company, Inc. (FSC), an affiliate of the investment adviser, maintains the Fund's accounting records. The accounting fee is based on the level of average net assets for each month. Under a separate contract, FSC administers the security lending program. The security lending fee is based on the number and duration of lending transactions.

Brokerage Commissions. The Fund placed a portion of its portfolio transactions with brokerage firms which are affiliates of the investment adviser. Brokerage commissions are included in net realized gain (loss) and change in net unrealized appreciation (depreciation) in the Statement of Operations. The commissions paid to these affiliated firms were $26,565 for the period.

Annual Report

5. Fees and Other Transactions with Affiliates - continued

Interfund Lending Program. Pursuant to an Exemptive Order issued by the SEC, the Fund, along with other registered investment companies having management contracts with FMR or other affiliated entities of FMR, may participate in an interfund lending program. This program provides an alternative credit facility allowing the funds to borrow from, or lend money to, other participating affiliated funds. At period end, there were no interfund loans outstanding. The Fund's activity in this program during the period for which loans were outstanding was as follows:

Borrower or Lender | Average Loan | Weighted Average Interest Rate | Interest Expense |

Borrower | $ 8,247,590 | .33% | $ 2,928 |

Redemptions In-Kind. During the period, 624,612 shares of the Fund held by affiliated entities were redeemed for cash and investments with a value of $94,716,088. The net realized gain of $44,600,048 on investments delivered through in-kind redemptions is included in the accompanying Statement of Operations. The amount of in-kind redemptions is included in share transactions in the accompanying Statement of Changes in Net Assets. The Fund recognized no gain or loss for federal income tax purposes.

6. Committed Line of Credit.

The Fund participates with other funds managed by the investment adviser or an affiliate in a $4.25 billion credit facility (the "line of credit") to be utilized for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity purposes. The Fund has agreed to pay commitment fees on its pro-rata portion of the line of credit, which amounted to $2,433 and is reflected in Miscellaneous expenses on the Statement of Operations. During the period, the Fund did not borrow on this line of credit.

7. Security Lending.

The Fund lends portfolio securities through a lending agent from time to time in order to earn additional income. On the settlement date of the loan, the Fund receives collateral (in the form of U.S. Treasury obligations, letters of credit and/or cash) against the loaned securities and maintains collateral in an amount not less than 100% of the market value of the loaned securities during the period of the loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. If the borrower defaults on its obligation to return the securities loaned because of insolvency or other reasons, the Fund may apply collateral received from the borrower against the obligation. The Fund may experience delays and costs in recovering the securities loaned. Any cash collateral received is invested in the Fidelity Securities Lending Cash Central Fund. At period end, there were no security loans outstanding. Security lending income represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities. Security lending income is presented in the Statement of Operations as a component of income from Fidelity Central Funds. Total security lending income during the period amounted to $251,742.

8. Bank Borrowings.

The Fund is permitted to have bank borrowings for temporary or emergency purposes to fund shareholder redemptions or for other short-term liquidity requirements. The Fund has established borrowing arrangements with certain banks. The interest rate on the borrowings is the bank's base rate, as revised from time to time. The average loan balance during the period for which loans were outstanding amounted to $8,162,833. The weighted average interest rate was .58%. The interest expense amounted to $793 under the bank borrowing program. At period end, there were no bank borrowings outstanding.

9. Expense Reductions.

The investment adviser reimbursed a portion of the Fund's operating expenses during the period in the amount of $3,515.

10. Other.

The Fund's organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Annual Report

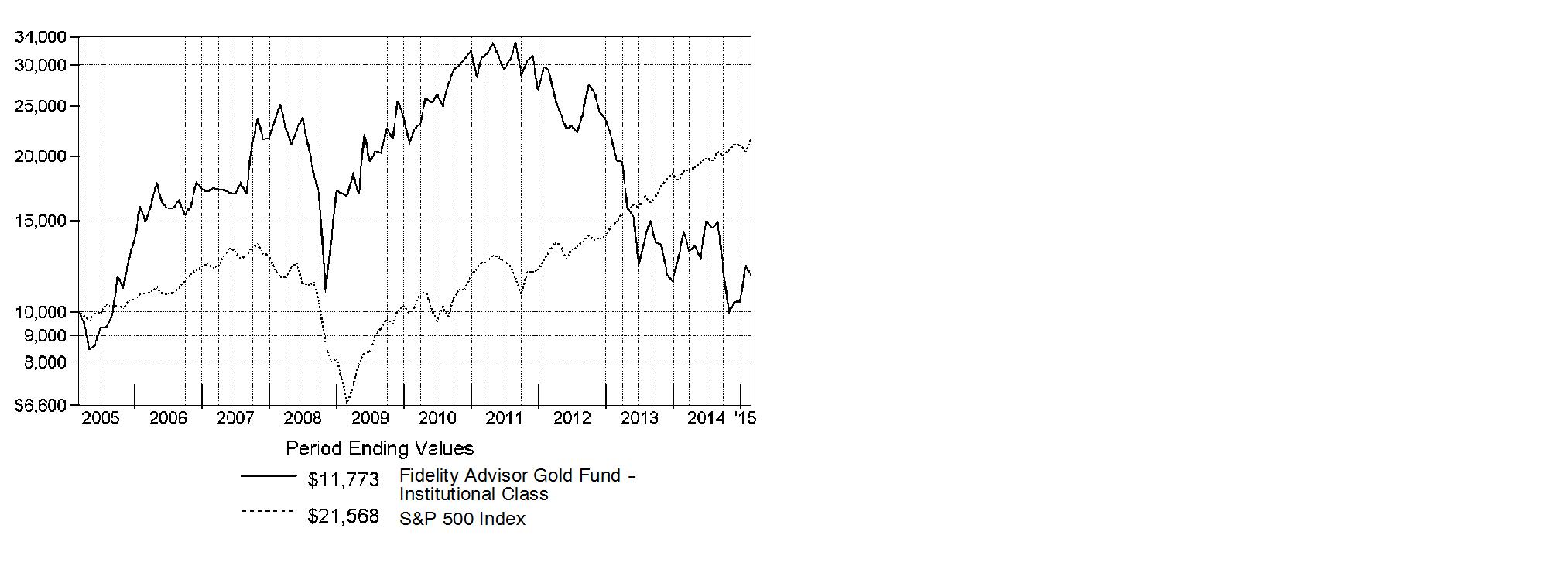

Gold Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the class' distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended February 28, 2015 | Past 1 | Past 5 | Past 10 |

Gold Portfolio | -17.45% | -12.27% | 1.61% |

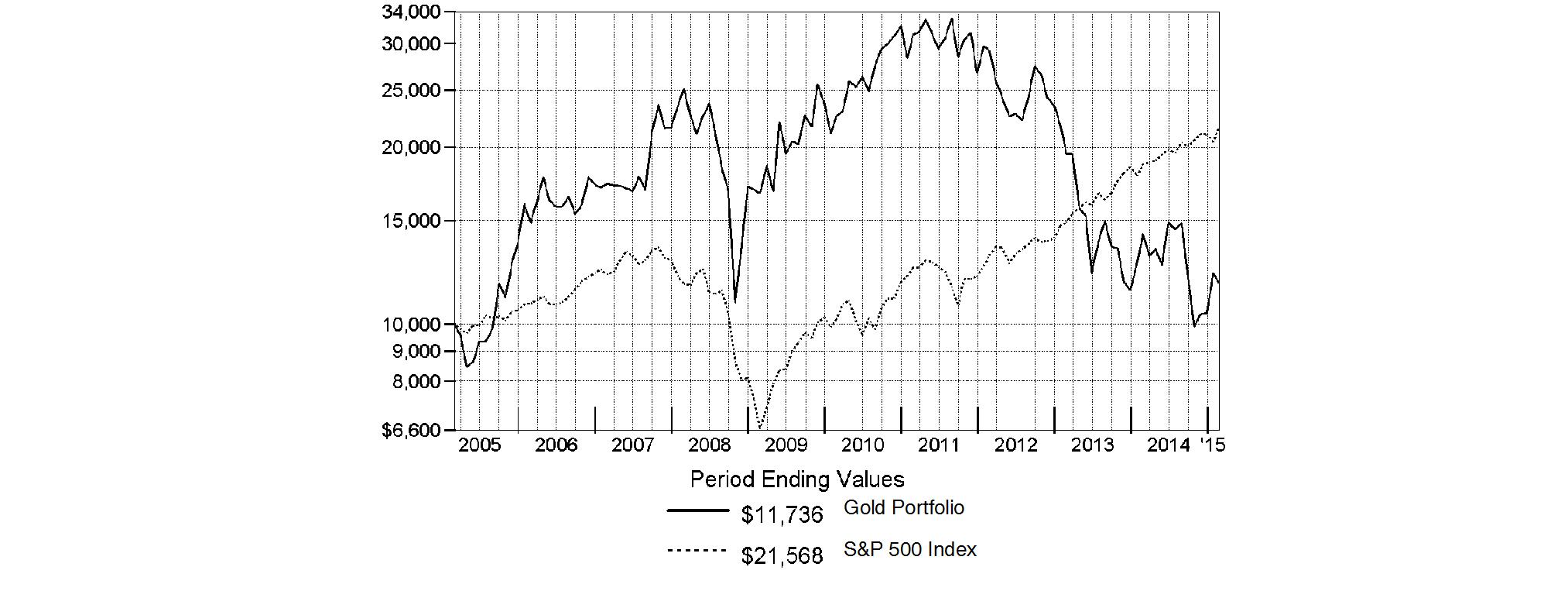

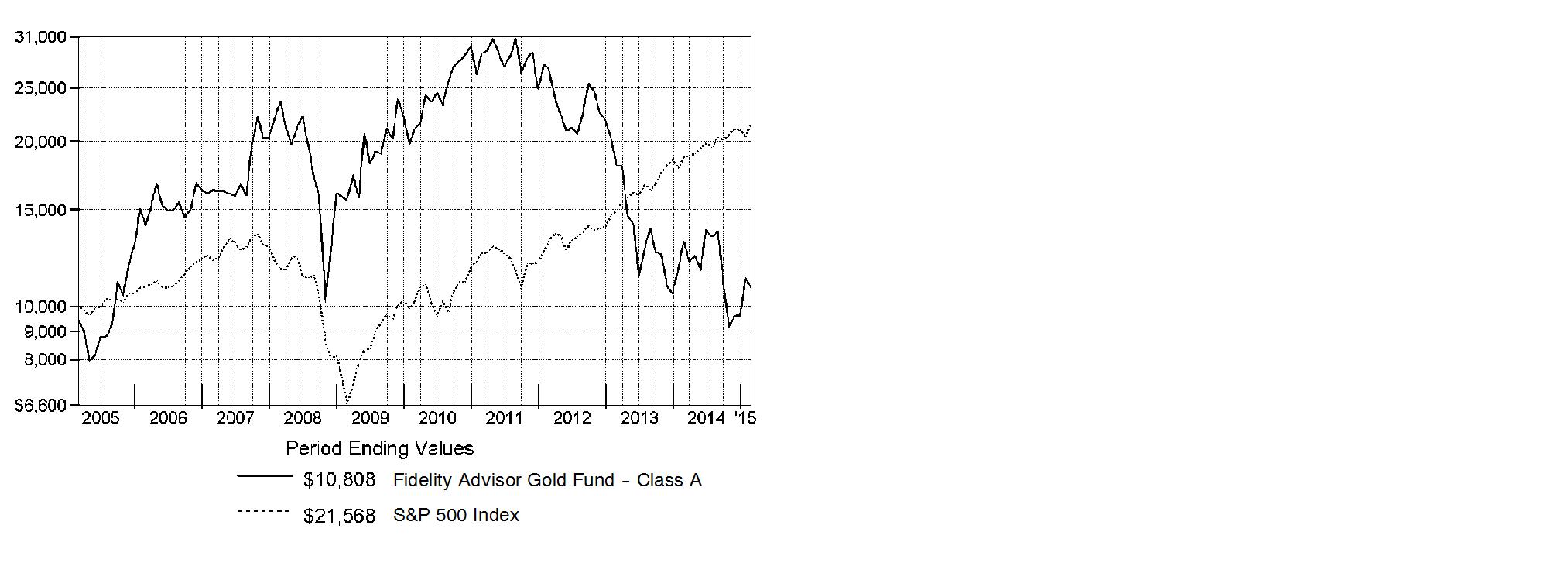

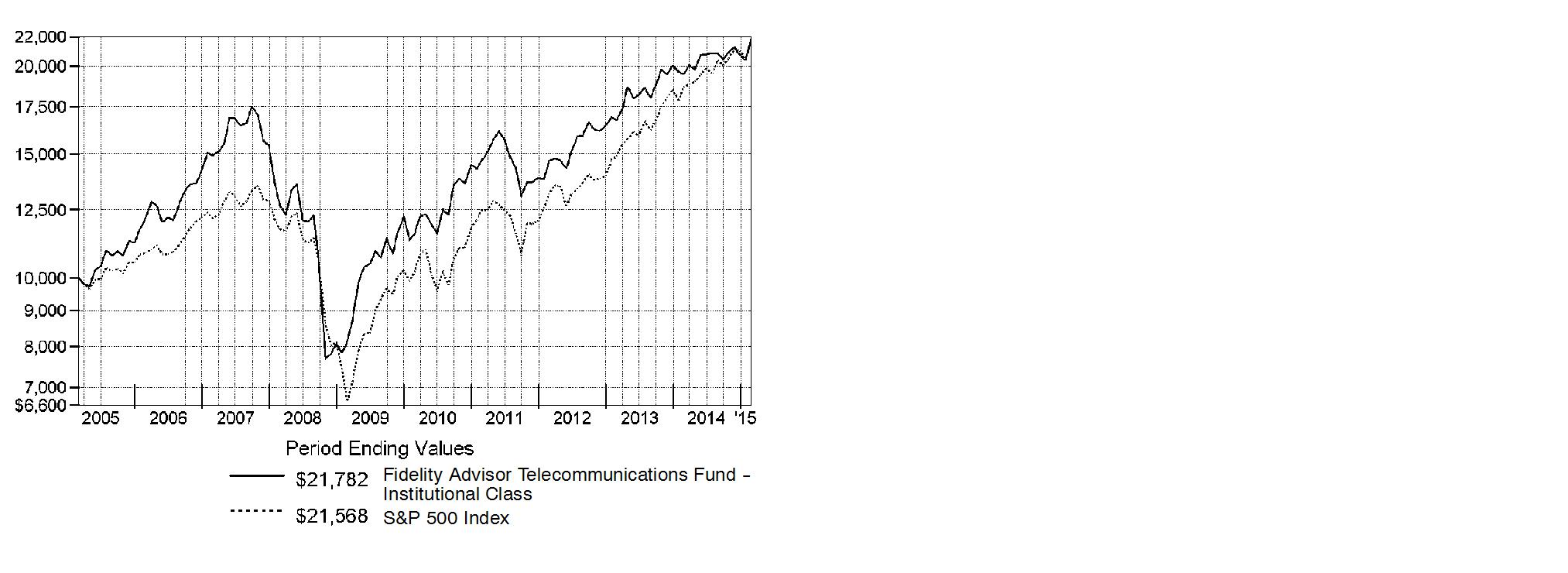

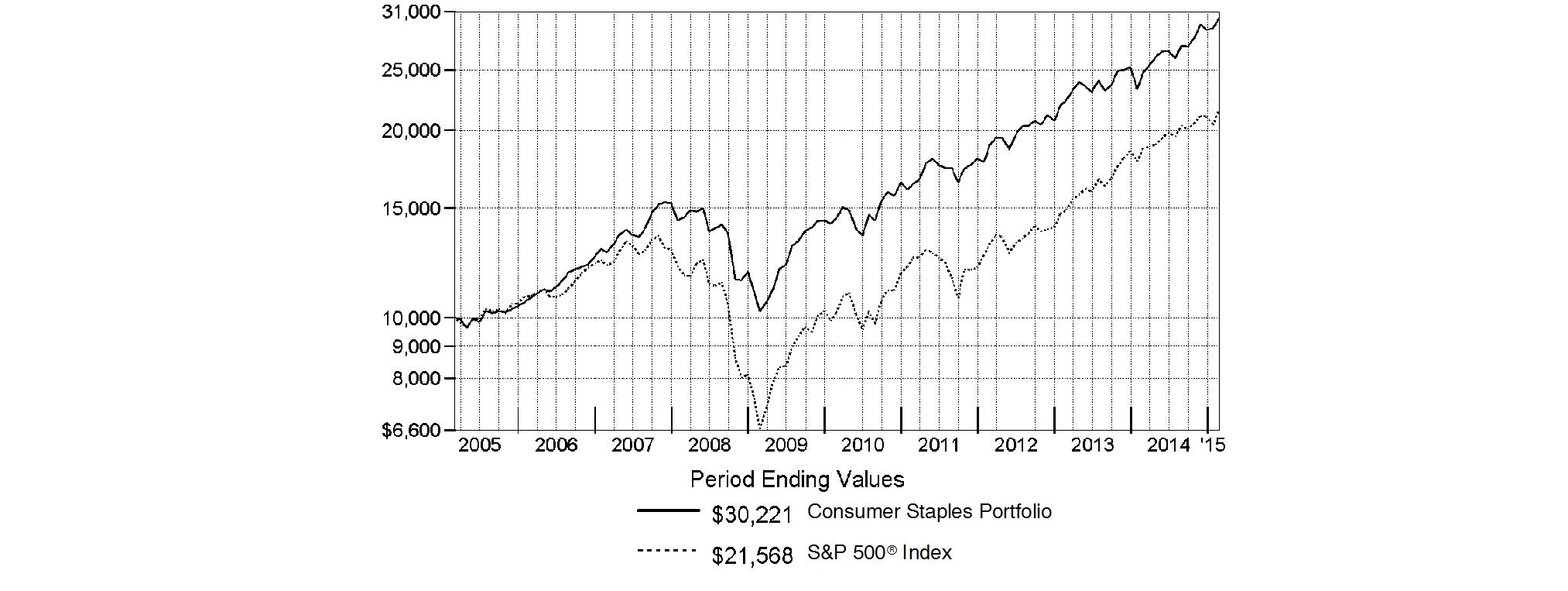

$10,000 Over 10 Years

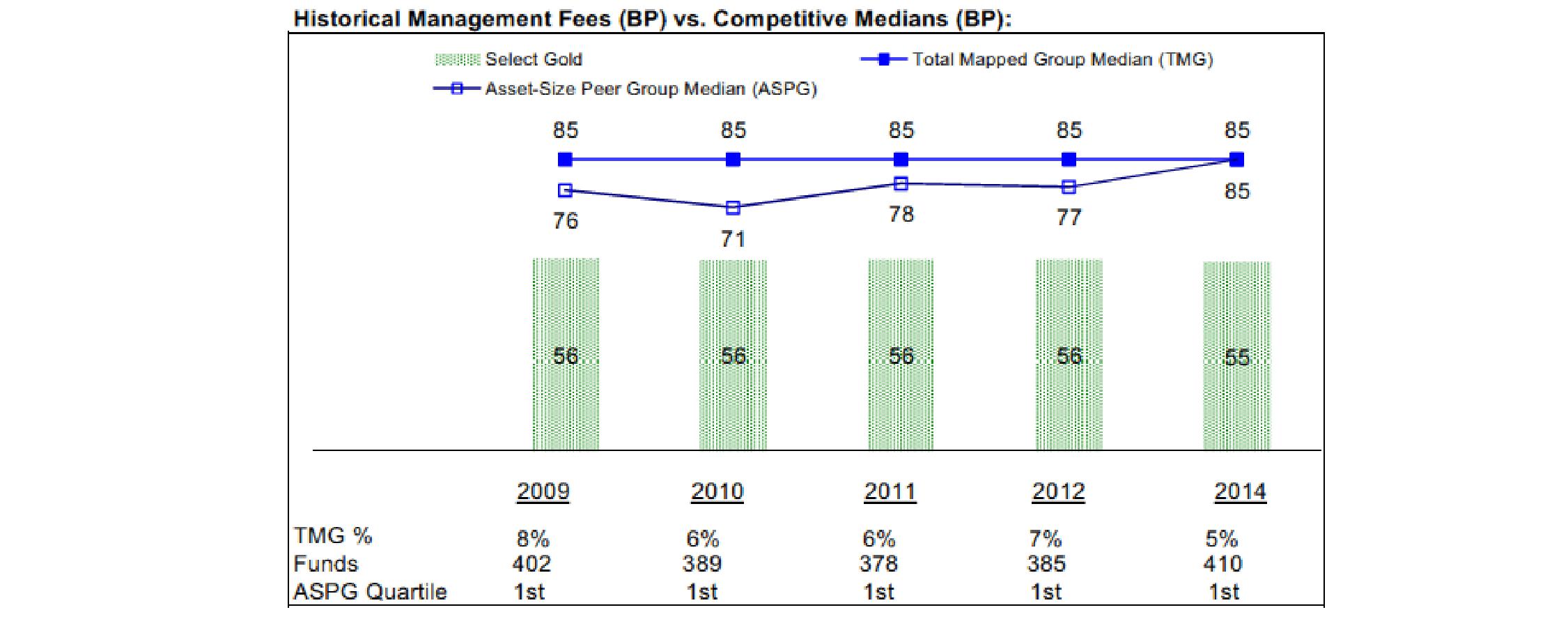

Let's say hypothetically that $10,000 was invested in Gold Portfolio, a class of the fund, on February 28, 2005. The chart shows how the value of your investment would have changed, and also shows how the S&P 500 Index performed over the same period.

Annual Report

Gold Portfolio

Management's Discussion of Fund Performance

Market Recap: The U.S. stock market closed near its all-time high for the 12 months ending February 28, 2015, supported by low interest rates and the relative strength of the U.S. economy and dollar. The large-cap S&P 500® Index returned 15.51%. Growth stocks in the index outperformed value-oriented names. The tech-heavy Nasdaq Composite Index® rose 16.58%, while the small-cap Russell 2000® Index advanced 5.63%, rallying from early-period weakness amid growth and valuation worries. Among the 10 major market sectors tracked by MSCI U.S. IMI 25-50 classifications, most notched a double-digit gain, led by health care (+24%), consumer staples (+21%), information technology (+20%) and utilities (+15%). Conversely, energy (-9%) was the only sector to lose ground, reflecting a sharp drop in crude prices beginning midyear and attributed to weaker global demand and a U.S. supply boom. Volatility spiked to a three-year high in October amid concerns about economic growth and Ebola, as well as unrest in Syria, Iraq and Ukraine. Nevertheless, the S&P 500® finished the period well above its mid-October nadir, bolstered by the relative economic strength of the U.S., which marked a six-year low in its unemployment rate, and consumer confidence that declined only slightly from its 11-year high reached in January.

Comments from S. Joseph Wickwire II, Portfolio Manager, Gold Portfolio: For the year, the fund's Retail Class shares returned -17.45%, underperforming the -16.34% return of its industry benchmark, the S&P® Global BMI Gold Capped Index and the S&P® 500. By comparison, the broadly based MSCI ACWI (All Country World Index) Index added 7.95%. It was a difficult year for gold and gold stocks as the period saw gold prices fall from a high of $1,383 to a low of $1,141 an ounce. The fund underperformed its industry benchmark by underweighting names that outperformed, including Newmont Mining and Zinjin Mining Group, the latter of which we did not own. Overweighting names that lost ground also hurt, including B2Gold and Argonaut Gold. Some non-gold equity positions also dragged on the fund's result. Conversely, underweighting stocks that underperformed contributed to results, including Barrick Gold, which lagged on concerns about its debt level and management changes, along with uncertainty about its strategy after a failed attempt to acquire Newmont. Our bullion position also contributed, as it outperformed the gold equity benchmark.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Gold Portfolio

Shareholder Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments or redemption proceeds, redemption fees and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (September 1, 2014 to February 28, 2015).

Actual Expenses

The first line of the accompanying table for each class of the Fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a class of the Fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each class of the Fund provides information about hypothetical account values and hypothetical expenses based on a Class' actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Class' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. A small balance maintenance fee of $12.00 that is charged once a year may apply for certain accounts with a value of less than $2,000. This fee is not included in the table below. If it was, the estimate of expenses you paid during the period would be higher, and your ending account value lower, by this amount. In addition, the Fund, as a shareholder in the underlying Fidelity Central Funds, will indirectly bear its pro-rata share of the fees and expenses incurred by the underlying Fidelity Central Funds. These fees and expenses are not included in the Fund's annualized expense ratio used to calculate the expense estimate in the table below.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Annualized | Beginning | Ending | Expenses Paid |

Class A | 1.19% |

|

|

|

Actual |

| $ 1,000.00 | $ 789.50 | $ 5.28 |

HypotheticalA |

| $ 1,000.00 | $ 1,018.89 | $ 5.96 |

Class T | 1.46% |

|

|

|

Actual |

| $ 1,000.00 | $ 788.20 | $ 6.47 |

HypotheticalA |

| $ 1,000.00 | $ 1,017.55 | $ 7.30 |

Class B | 1.93% |

|

|

|

Actual |

| $ 1,000.00 | $ 786.80 | $ 8.55 |

HypotheticalA |

| $ 1,000.00 | $ 1,015.22 | $ 9.64 |

Class C | 1.93% |

|

|

|

Actual |

| $ 1,000.00 | $ 786.80 | $ 8.55 |

HypotheticalA |

| $ 1,000.00 | $ 1,015.22 | $ 9.64 |

Gold | .91% |

|

|

|

Actual |

| $ 1,000.00 | $ 790.90 | $ 4.04 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.28 | $ 4.56 |

Institutional Class | .89% |

|

|

|

Actual |

| $ 1,000.00 | $ 790.90 | $ 3.95 |

HypotheticalA |

| $ 1,000.00 | $ 1,020.38 | $ 4.46 |

A 5% return per year before expenses

B Annualized expense ratio reflects consolidated expenses net of applicable fee waivers.

* Expenses are equal to each Class' annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Annual Report

Gold Portfolio

Consolidated Investment Changes (Unaudited)

Top Ten Holdings as of February 28, 2015 | ||

| % of fund's | % of fund's net assets |

Goldcorp, Inc. | 8.8 | 8.9 |

Randgold Resources Ltd. sponsored ADR | 7.1 | 5.6 |

Newcrest Mining Ltd. | 6.2 | 4.8 |

Gold Bullion | 6.2 | 6.3 |

Franco-Nevada Corp. | 6.1 | 4.9 |

Agnico Eagle Mines Ltd. (Canada) | 5.0 | 4.7 |

Silver Bullion | 4.2 | 5.1 |

Eldorado Gold Corp. | 4.1 | 5.1 |

Newmont Mining Corp. | 4.0 | 3.1 |

Barrick Gold Corp. | 3.8 | 5.1 |

| 55.5 | |

Top Industries (% of fund's net assets) | |||

As of February 28, 2015 | |||

| Gold | 87.6% |

|

| Commodities & Related Investments** | 10.4% |

|

| Precious Metals & Minerals | 0.1% |

|

| Silver | 0.7% |

|

| Diversified Metals & Mining | 0.2% |

|

| Steel | 0.0% |

|

| All Others* | 1.0% |

|

As of August 31, 2014 | |||

| Gold | 87.0% |

|

| Commodities & Related Investments** | 11.4% |

|

| Precious Metals & Minerals | 0.6% |

|

| Diversified Metals & Mining | 0.3% |

|

| Coal & Consumable Fuels | 0.2% |

|

| Silver | 0.2% |

|

| All Others* | 0.3% |

|

* Includes short-term investments and net other assets (liabilities). |

** Includes gold bullion and/or silver bullion. |

Geographic Diversification (% of fund's net assets) | |||

As of February 28, 2015 | |||

| Canada | 55.8% |

|

| United States of America* | 19.1% |

|

| Australia | 8.1% |

|

| Bailiwick of Jersey | 7.9% |

|

| South Africa | 6.9% |

|

| Peru | 0.8% |

|

| Bermuda | 0.7% |

|

| Cayman Islands | 0.4% |

|

| United Kingdom | 0.3% |

|

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

As of August 31, 2014 | |||

| Canada | 59.0% |

|

| United States of America* | 18.2% |

|

| South Africa | 7.1% |

|

| Australia | 6.9% |

|

| Bailiwick of Jersey | 6.5% |

|

| Bermuda | 0.9% |

|

| Peru | 0.7% |

|

| Cayman Islands | 0.5% |

|

| United Kingdom | 0.2% |

|

Percentages are based on country or territory of incorporation and are adjusted for the effect of futures contracts, if applicable. |

Annual Report

Gold Portfolio

Consolidated Investments February 28, 2015

Showing Percentage of Net Assets

Common Stocks - 88.6% | |||

Shares | Value | ||

Australia - 8.1% | |||

METALS & MINING - 8.1% | |||

Gold - 8.1% | |||

Beadell Resources Ltd. (d) | 7,687,418 | $ 1,922,223 | |

Evolution Mining Ltd. | 1,437,195 | 948,955 | |

Kingsgate Consolidated NL (a) | 78,274 | 48,319 | |

Medusa Mining Ltd. (a)(d) | 1,983,595 | 1,518,982 | |

Newcrest Mining Ltd. (a) | 6,223,650 | 69,980,874 | |

Northern Star Resources Ltd. | 4,604,518 | 8,491,210 | |

Perseus Mining Ltd.: | |||

(Australia) (a)(d) | 2,122,134 | 588,674 | |

(Canada) (a) | 1,300,000 | 369,170 | |

Regis Resources Ltd. (a)(d) | 2,525,393 | 3,759,217 | |

Resolute Mng Ltd. (a) | 2,390,161 | 616,332 | |

Saracen Mineral Holdings Ltd. (a) | 4,516,787 | 1,482,355 | |

Silver Lake Resources Ltd. (a)(d) | 4,346,985 | 696,330 | |

Troy Resources NL (a) | 195,000 | 84,567 | |

Troy Resources NL (a)(e) | 734,826 | 323,298 | |

| 90,830,506 | ||

Bailiwick of Jersey - 7.9% | |||

METALS & MINING - 7.9% | |||

Gold - 7.9% | |||

Centamin PLC | 1,848,700 | 1,878,008 | |

Lydian International Ltd. (a) | 2,325,200 | 930,006 | |

Polyus Gold International Ltd. (d) | 222,400 | 697,863 | |

Polyus Gold International Ltd. sponsored GDR | 1,509,831 | 4,620,083 | |

Randgold Resources Ltd. sponsored ADR (d) | 1,010,495 | 80,021,099 | |

| 88,147,059 | ||

Bermuda - 0.7% | |||

METALS & MINING - 0.7% | |||

Gold - 0.7% | |||

Continental Gold Ltd. (a) | 4,907,000 | 7,850,572 | |

Steel - 0.0% | |||

African Minerals Ltd. (a)(d) | 1,718,700 | 27 | |

TOTAL METALS & MINING | 7,850,599 | ||

Canada - 55.8% | |||

METALS & MINING - 55.8% | |||

Diversified Metals & Mining - 0.2% | |||

Ivanhoe Mines Ltd. (a) | 2,225,300 | 1,477,481 | |

Ivanhoe Mines Ltd. Class A warrants 12/10/15 (a)(e) | 837,300 | 20,094 | |

NovaCopper, Inc. (a) | 488,333 | 293,000 | |

Sabina Gold & Silver Corp. (a)(d) | 980,000 | 301,816 | |

True Gold Mining, Inc. (a) | 191,000 | 29,794 | |

| 2,122,185 | ||

Gold - 54.8% | |||

Agnico Eagle Mines Ltd. (Canada) (d) | 1,759,901 | 56,551,654 | |

| |||

Shares | Value | ||

Alacer Gold Corp. | 2,187,363 | $ 4,741,824 | |

Alamos Gold, Inc. | 1,174,000 | 7,099,784 | |

Argonaut Gold, Inc. (a) | 4,558,862 | 7,585,340 | |

ATAC Resources Ltd. (a) | 67,200 | 32,253 | |

AuRico Gold, Inc. | 112,100 | 395,457 | |

B2Gold Corp. (a) | 22,915,693 | 38,678,596 | |

Barrick Gold Corp. (d) | 3,295,369 | 42,862,731 | |

Centerra Gold, Inc. | 1,335,600 | 6,527,891 | |

Detour Gold Corp. (a) | 2,042,100 | 19,749,611 | |

Detour Gold Corp. (a)(e) | 785,900 | 7,600,617 | |

Eldorado Gold Corp. (d) | 7,903,535 | 45,583,943 | |

Franco-Nevada Corp. | 1,297,800 | 68,476,832 | |

Gabriel Resources Ltd. (a)(d) | 1,020,600 | 661,296 | |

Goldcorp, Inc. | 4,486,700 | 98,807,176 | |

GoldQuest Mining Corp. (a) | 2,318,500 | 250,378 | |

Guyana Goldfields, Inc. (a) | 3,286,900 | 8,571,549 | |

Guyana Goldfields, Inc. (a)(e) | 155,000 | 404,208 | |

IAMGOLD Corp. (a) | 2,920,000 | 7,147,588 | |

Kinross Gold Corp. (a) | 3,460,291 | 9,743,400 | |

Kirkland Lake Gold, Inc. (a)(d) | 376,000 | 1,570,050 | |

Lake Shore Gold Corp. (a)(d) | 2,806,600 | 2,559,414 | |

Midas Gold Corp. (a) | 100,500 | 40,197 | |

New Gold, Inc. (a) | 6,615,175 | 25,347,323 | |

NGEx Resources, Inc. (a) | 65,000 | 55,116 | |

Novagold Resources, Inc. (a) | 1,935,700 | 7,200,228 | |

OceanaGold Corp. | 2,842,300 | 5,434,043 | |

Orezone Gold Corp. (a) | 371,100 | 157,334 | |

Osisko Gold Royalties Ltd. | 546,193 | 7,794,643 | |

Pilot Gold, Inc. (a) | 1,418,150 | 1,225,184 | |

Premier Gold Mines Ltd. (a)(g) | 10,416,222 | 20,747,454 | |

Pretium Resources, Inc. (a) | 856,538 | 5,289,556 | |

Pretium Resources, Inc. (a)(e) | 225,000 | 1,389,489 | |

Pretium Resources, Inc. (a)(f) | 225,000 | 1,389,489 | |

Primero Mining Corp. (a)(d) | 1,506,800 | 5,351,725 | |

Richmont Mines, Inc. (a) | 239,900 | 804,080 | |

Rio Alto Mining Ltd. (a) | 2,742,235 | 8,598,961 | |

Romarco Minerals, Inc. (a) | 31,476,998 | 13,596,975 | |

Romarco Minerals, Inc. (a)(e) | 5,900,000 | 2,548,596 | |

Romarco Minerals, Inc. (f) | 4,600,000 | 1,788,337 | |

Roxgold, Inc. (a) | 100,000 | 51,996 | |

Rubicon Minerals Corp. (a) | 5,376,402 | 6,279,135 | |

Seabridge Gold, Inc. (a) | 659,166 | 5,121,721 | |

SEMAFO, Inc. (a) | 2,895,700 | 8,964,370 | |

Teranga Gold Corp. (a) | 85,000 | 46,916 | |

Teranga Gold Corp. CDI unit (a)(d) | 3,338,072 | 1,851,942 | |

Timmins Gold Corp. (a) | 122,600 | 106,899 | |

Torex Gold Resources, Inc. (a) | 20,093,200 | 18,484,265 | |

Yamana Gold, Inc. | 6,909,420 | 29,348,868 | |

| 614,616,434 | ||

Precious Metals & Minerals - 0.1% | |||

Chesapeake Gold Corp. (a) | 12,000 | 21,886 | |

Common Stocks - continued | |||

Shares | Value | ||

Canada - continued | |||

METALS & MINING - CONTINUED | |||

Precious Metals & Minerals - continued | |||

Gold Standard Ventures Corp. (a) | 2,125,400 | $ 918,099 | |

Klondex Mines Ltd. (a) | 1,000 | 2,160 | |

| 942,145 | ||

Silver - 0.7% | |||

MAG Silver Corp. (a) | 171,000 | 1,237,941 | |

Silver Wheaton Corp. | 47,700 | 1,030,238 | |

Tahoe Resources, Inc. | 426,600 | 5,968,510 | |

| 8,236,689 | ||

TOTAL METALS & MINING | 625,917,453 | ||

Cayman Islands - 0.4% | |||

METALS & MINING - 0.4% | |||

Gold - 0.4% | |||

Endeavour Mining Corp. (a) | 8,267,400 | 3,968,035 | |

Peru - 0.8% | |||

METALS & MINING - 0.8% | |||

Gold - 0.8% | |||

Compania de Minas Buenaventura SA sponsored ADR | 777,528 | 9,003,774 | |

South Africa - 6.9% | |||

METALS & MINING - 6.9% | |||

Gold - 6.9% | |||

AngloGold Ashanti Ltd. sponsored ADR (a) | 3,046,508 | 34,334,145 | |

Gold Fields Ltd. sponsored ADR | 5,219,126 | 24,268,936 | |

Harmony Gold Mining Co. Ltd. (a) | 1,484,000 | 3,625,670 | |

Harmony Gold Mining Co. Ltd. sponsored ADR (a)(d) | 1,757,900 | 4,324,434 | |

Sibanye Gold Ltd. ADR | 1,023,906 | 10,843,165 | |

| 77,396,350 | ||

United Kingdom - 0.3% | |||

METALS & MINING - 0.3% | |||

Gold - 0.3% | |||

Acacia Mining PLC | 837,800 | 3,559,540 | |

Pan African Resources PLC | 15,000 | 2,721 | |

| 3,562,261 | ||

United States of America - 7.7% | |||

METALS & MINING - 7.7% | |||

Gold - 7.7% | |||

Gold Resource Corp. (d) | 115,000 | 397,900 | |

McEwen Mining, Inc. (a)(d) | 679,110 | 767,394 | |

| |||

Shares | Value | ||

Newmont Mining Corp. | 1,718,500 | $ 45,248,105 | |

Royal Gold, Inc. | 552,113 | 39,807,347 | |

| 86,220,746 | ||

TOTAL COMMON STOCKS (Cost $1,340,424,123) |

| ||

Commodities - 10.4% | |||

Troy Ounces |

| ||

Gold Bullion (a) | 57,510 | 69,704,996 | |

Silver Bullion (a) | 2,837 | 47,051,645 | |

TOTAL COMMODITIES (Cost $130,172,232) |

| ||

Money Market Funds - 11.1% | |||

|

|

|

|

Fidelity Cash Central Fund, 0.13% (b) | 6,190,705 | 6,190,705 | |

Fidelity Securities Lending Cash Central Fund, 0.13% (b)(c) | 118,585,234 | 118,585,234 | |

TOTAL MONEY MARKET FUNDS (Cost $124,775,939) |

| ||

TOTAL INVESTMENT PORTFOLIO - 110.1% (Cost $1,595,372,294) | 1,234,429,363 |

NET OTHER ASSETS (LIABILITIES) - (10.1)% | (112,830,851) | ||

NET ASSETS - 100% | $ 1,121,598,512 | ||

Legend |

(a) Non-income producing |

(b) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

(c) Investment made with cash collateral received from securities on loan. |

(d) Security or a portion of the security is on loan at period end. |

(e) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $12,286,302 or 1.1% of net assets. |

(f) Restricted securities - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $3,177,826 or 0.3% of net assets. |

Additional information on each restricted holding is as follows: |

Security | Acquisition Date | Acquisition Cost |

Pretium Resources, Inc. | 3/31/11 | $ 2,172,293 |

Romarco Minerals, Inc. | 12/12/14 | 1,987,728 |

(g) Affiliated company |

Affiliated Central Funds |

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows: |

Fund | Income earned |

Fidelity Cash Central Fund | $ 9,364 |

Fidelity Securities Lending Cash Central Fund | 439,263 |

Total | $ 448,627 |

Consolidated Subsidiary | Value, | Purchases | Sales | Dividend | Value, |

Fidelity Select Gold Cayman Ltd. | $ 225,764,683 | $ 65,099,608 | $ 147,759,808 | $ - | $ 116,684,748 |

Other Affiliated Issuers |

An affiliated company is a company in which the Fund has ownership of at least 5% of the voting securities. Fiscal year to date transactions with companies which are or were affiliates are as follows: |

Affiliate | Value, | Purchases | Sales | Dividend | Value, |

Premier Gold Mines Ltd. | $ 20,772,705 | $ 1,654,461 | $ 668,621 | $ - | $ 20,747,454 |

Other Information |

The following is a summary of the inputs used, as of February 28, 2015, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Investment Valuation section in the accompanying Notes to Consolidated Financial Statements. |

Valuation Inputs at Reporting Date: | ||||

Description | Total | Level 1 | Level 2 | Level 3 |

Investments in Securities: | ||||

Common Stocks | $ 992,896,783 | $ 987,434,430 | $ 5,414,007 | $ 48,346 |

Commodities | 116,756,641 | 116,756,641 | - | - |

Money Market Funds | 124,775,939 | 124,775,939 | - | - |

Total Investments in Securities: | $ 1,234,429,363 | $ 1,228,967,010 | $ 5,414,007 | $ 48,346 |

See accompanying notes which are an integral part of the Consolidated financial statements.

Annual Report

Gold Portfolio

Consolidated Financial Statements

Consolidated Statement of Assets and Liabilities

| February 28, 2015 | |

|

|

|

Assets | ||

Investment in securities, at value (including securities loaned of $113,727,253) - See accompanying schedule: Unaffiliated issuers (cost $1,309,030,420) | $ 972,149,329 |

|

Fidelity Central Funds (cost $124,775,939) | 124,775,939 |

|

Commodities (cost $130,172,232) | 116,756,641 |

|

Other affiliated issuers (cost $31,393,703) | 20,747,454 |

|

Total Investments (cost $1,595,372,294) |

| $ 1,234,429,363 |

Foreign currency held at value (cost $104,547) | 104,547 | |

Receivable for investments sold | 5,509,685 | |

Receivable for fund shares sold | 2,227,907 | |

Dividends receivable | 369,487 | |

Distributions receivable from Fidelity Central Funds | 21,274 | |

Prepaid expenses | 5,477 | |

Other receivables | 25,556 | |

Total assets | 1,242,693,296 | |

|

|

|

Liabilities | ||

Payable for investments purchased | $ 106,570 | |

Payable for fund shares redeemed | 1,407,905 | |

Accrued management fee | 512,689 | |

Distribution and service plan fees payable | 50,874 | |

Other affiliated payables | 295,764 | |

Other payables and accrued expenses | 135,748 | |

Collateral on securities loaned, at value | 118,585,234 | |

Total liabilities | 121,094,784 | |

|

|

|

Net Assets | $ 1,121,598,512 | |

Net Assets consist of: |

| |

Paid in capital | $ 2,578,854,710 | |

Accumulated net investment loss | (19,281) | |

Accumulated undistributed net realized gain (loss) on investments and foreign currency transactions | (1,096,295,003) | |

Net unrealized appreciation (depreciation) on investments and assets and liabilities in foreign currencies | (360,941,914) | |

Net Assets | $ 1,121,598,512 | |

Consolidated Statement of Assets and Liabilities -

continued

| February 28, 2015 | |

|

|

|

Calculation of Maximum Offering Price Class A: | $ 18.11 | |

|

|

|

Maximum offering price per share (100/94.25 of $18.11) | $ 19.21 | |

Class T: | $ 17.83 | |

|

|

|

Maximum offering price per share (100/96.50 of $17.83) | $ 18.48 | |

Class B: | $ 17.27 | |

|

|

|

Class C: | $ 17.20 | |

|

|

|

Gold: | $ 18.50 | |

|

|

|

Institutional Class: | $ 18.50 | |

A Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the consolidated financial statements.

Annual Report

Gold Portfolio

Consolidated Financial Statements - continued

Consolidated Statement of Operations

| Year ended February 28, 2015 | |

|

|

|

Investment Income |

|

|

Dividends |

| $ 9,166,344 |

Income from Fidelity Central Funds (including $439,263 from security lending) |

| 448,627 |

Income before foreign taxes withheld |

| 9,614,971 |

Less foreign taxes withheld |

| (1,113,899) |

Total income |

| 8,501,072 |

|

|

|

Expenses | ||

Management fee | $ 7,307,511 | |

Transfer agent fees | 3,307,819 | |

Distribution and service plan fees | 625,615 | |

Accounting and security lending fees | 580,399 | |

Custodian fees and expenses | 283,527 | |

Independent trustees' compensation | 25,214 | |

Registration fees | 150,605 | |

Audit | 44,883 | |

Legal | 6,776 | |

Interest | 472 | |

Miscellaneous | 28,792 | |

Total expenses before reductions | 12,361,613 | |

Expense reductions | (454,642) | 11,906,971 |

Net investment income (loss) | (3,405,899) | |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | ||

Investments: |

|

|

Unaffiliated issuers | (218,966,450) | |

Other affiliated issuers | (897,919) |

|

Commodities | (11,867,162) |

|

Foreign currency transactions | 197,792 | |

Total net realized gain (loss) |

| (231,533,739) |

Change in net unrealized appreciation (depreciation) on: Investments | (5,621,130) | |

Assets and liabilities in foreign currencies | (1,978) | |

Commodities | (13,914,448) | |

Total change in net unrealized appreciation (depreciation) |

| (19,537,556) |

Net gain (loss) | (251,071,295) | |

Net increase (decrease) in net assets resulting from operations | $ (254,477,194) | |

Consolidated Statement of Changes in Net Assets

| Year ended | Year ended |

Increase (Decrease) in Net Assets |

|

|

Operations |

|

|

Net investment income (loss) | $ (3,405,899) | $ 3,413,053 |

Net realized gain (loss) | (231,533,739) | (556,608,289) |

Change in net unrealized appreciation (depreciation) | (19,537,556) | (88,077,933) |

Net increase (decrease) in net assets resulting from operations | (254,477,194) | (641,273,169) |

Share transactions - net increase (decrease) | (124,744,949) | (461,130,558) |

Redemption fees | 222,335 | 396,348 |

Total increase (decrease) in net assets | (378,999,808) | (1,102,007,379) |

|

|

|

Net Assets | ||

Beginning of period | 1,500,598,320 | 2,602,605,699 |

End of period (including accumulated net investment loss of $19,281 and accumulated net investment loss of $8,084, respectively) | $ 1,121,598,512 | $ 1,500,598,320 |

See accompanying notes which are an integral part of the consolidated financial statements.

Annual Report

Consolidated Financial Highlights - Class A

Years ended February 28, | 2015 | 2014 | 2013 | 2012 I | 2011 |

Selected Per-Share Data |

|

|

|

|

|

Net asset value, beginning of period | $ 22.01 | $ 30.25 | $ 45.37 | $ 50.92 | $ 40.50 |

Income from Investment Operations |

|

|

|

|

|

Net investment income (loss) D | (.10) | - A | .07 | (.13) | (.30) |

Net realized and unrealized gain (loss) | (3.80) | (8.25) | (15.19) | (2.83) | 15.28 |

Total from investment operations | (3.90) | (8.25) | (15.12) | (2.96) | 14.98 |

Distributions from net realized gain | - | - | - | (2.59) | (4.57) |

Redemption fees added to paid in capital D | - A | .01 | - A | - A | .01 |

Net asset value, end of period | $ 18.11 | $ 22.01 | $ 30.25 | $ 45.37 | $ 50.92 |

Total ReturnB, C | (17.72)% | (27.24)% | (33.33)% | (6.24)% | 36.99% |

Ratios to Average Net Assets E, H |

|

|

|

|

|

Expenses before reductions | 1.23% | 1.21% | 1.18% | 1.14% | 1.16% |

Expenses net of fee waivers, if any | 1.19% | 1.19% | 1.17% | 1.14% | 1.15% |

Expenses net of all reductions | 1.19% | 1.18% | 1.17% | 1.14% | 1.14% |

Net investment income (loss) | (.51)% | -% G | .18% | (.28)% | (.63)% |

Supplemental Data |

|

|

|

|

|