UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03114

Fidelity Select Portfolios

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | February 29 |

Date of reporting period: | February 29, 2020 |

Item 1.

Reports to Stockholders

Fidelity® Select Portfolios®

Consumer Discretionary Sector

Automotive Portfolio

Communication Services Portfolio

Construction and Housing Portfolio

Consumer Discretionary Portfolio

Leisure Portfolio

Retailing Portfolio

February 29, 2020

Includes Fidelity and Fidelity Advisor share classes

See the inside front cover for important information about access to your fund’s shareholder reports.

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a financial advisor, broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically, by contacting your financial intermediary. For Fidelity customers, visit Fidelity's web site or call Fidelity using the contact information listed below.

You may elect to receive all future reports in paper free of charge. If you wish to continue receiving paper copies of your shareholder reports, you may contact your financial intermediary or, if you are a Fidelity customer, visit Fidelity’s website, or call Fidelity at the applicable toll-free number listed below. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Account Type | Website | Phone Number |

| Brokerage, Mutual Fund, or Annuity Contracts: | fidelity.com/mailpreferences | 1-800-343-3548 |

| Employer Provided Retirement Accounts: | netbenefits.fidelity.com/preferences (choose 'no' under Required Disclosures to continue to print) | 1-800-343-0860 |

| Advisor Sold Accounts Serviced Through Your Financial Intermediary: | Contact Your Financial Intermediary | Your Financial Intermediary's phone number |

| Advisor Sold Accounts Serviced by Fidelity: | institutional.fidelity.com | 1-877-208-0098 |

Contents

Automotive Portfolio | |

Communication Services Portfolio | |

Construction and Housing Portfolio | |

Consumer Discretionary Portfolio | |

Leisure Portfolio | |

Retailing Portfolio | |

Board Approval of Investment Advisory Contracts and Management Fees | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 if you’re an individual investing directly with Fidelity, call 1-800-835-5092 if you’re a plan sponsor or participant with Fidelity as your recordkeeper or call 1-877-208-0098 on institutional accounts or if you’re an advisor or invest through one to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2020 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Note to shareholders:

(No Action is Required by You)

As part of a regular review of its organizational structure, Fidelity has decided to merge certain entities to streamline operations, increase efficiency, simplify reporting, and reduce legal, compliance, and accounting complexity and costs. In separate events, Fidelity has merged four of its investment advisers and two of its broker-dealers.

Effective on or about January 1, 2020, following any required regulatory notices and approvals:

Investment advisers Fidelity Investments Money Management, Inc., FMR Co., Inc., and Fidelity SelectCo, LLC, merged with and into Fidelity Management & Research Company. In connection with the merger transactions, the resulting, merged investment adviser was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to “Fidelity Management & Research Company LLC”.

Broker-dealer Fidelity Distributors Corporation merged with and into Fidelity Investments Institutional Services Company, Inc. (“FIISC”). FIISC was then redomiciled from Massachusetts to Delaware, changed its corporate structure from a corporation to a limited liability company, and changed its name to “Fidelity Distributors Company LLC”.

These mergers are not expected to affect fund shareholders or Fidelity clients, nor are they expected to result in any changes to the day-to-day management of Fidelity’s brokerage services, the Fidelity funds, their investment policies and practices, their portfolio management teams, or the funds’ expenses.

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following the end of this reporting period, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, the U.S. government took unprecedented action – in concert with the U.S. Federal Reserve and central banks around the world – to help support consumers, businesses, and the broader economy, and to limit disruption to the financial system.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Automotive Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended February 29, 2020 | Past 1 year | Past 5 years | Past 10 years |

| Automotive Portfolio | 9.14% | 2.98% | 9.66% |

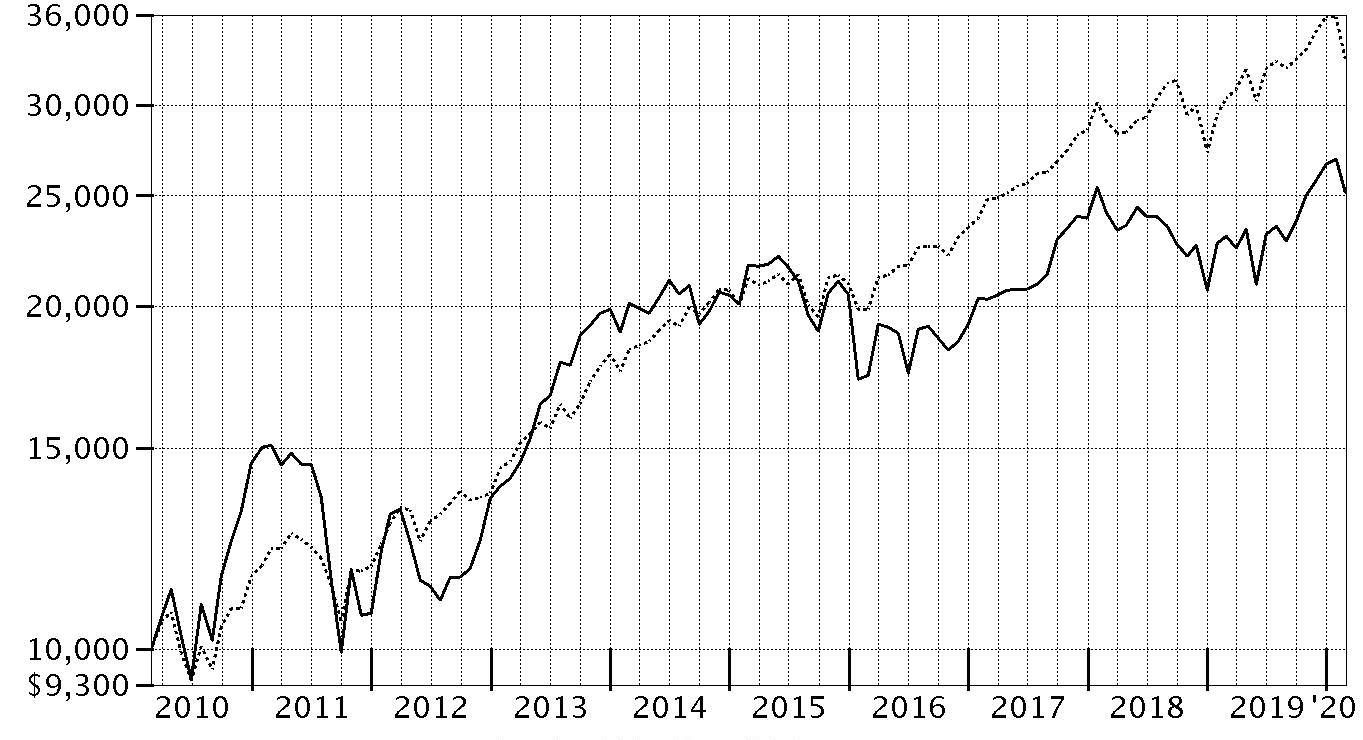

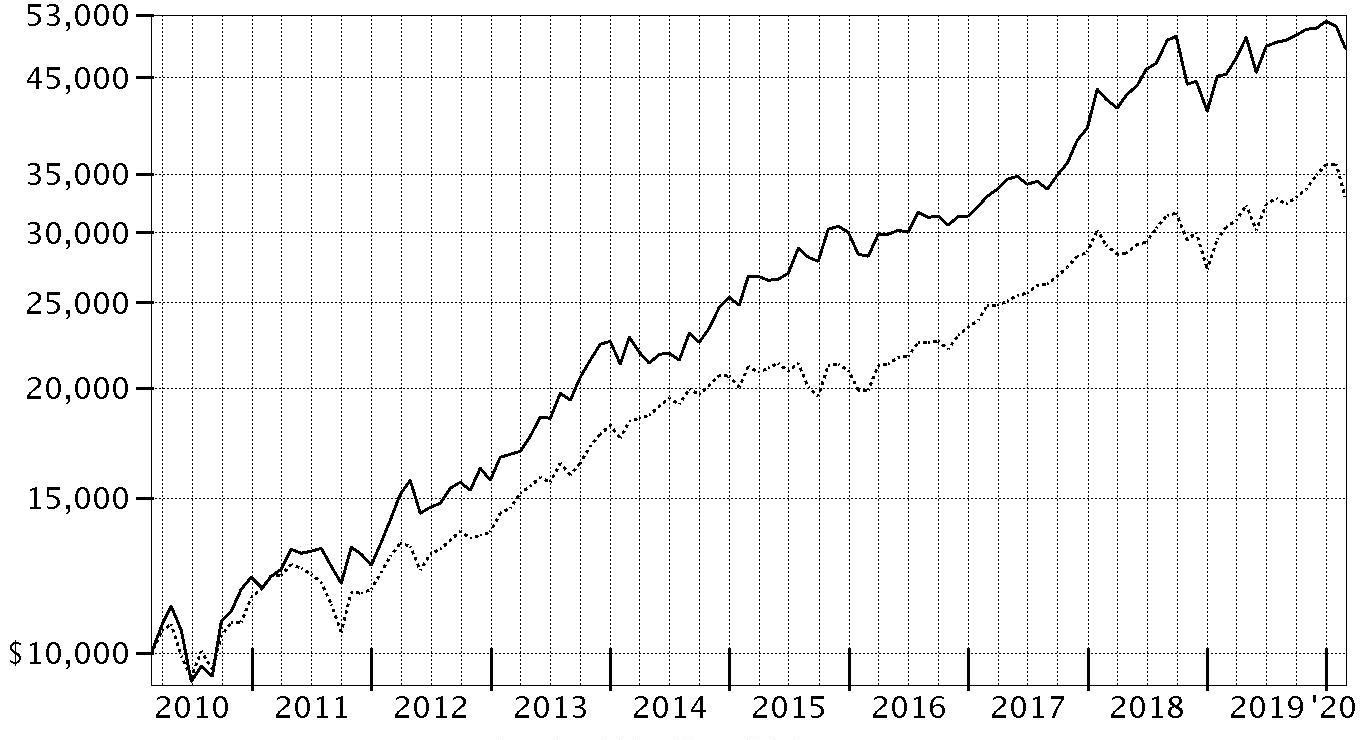

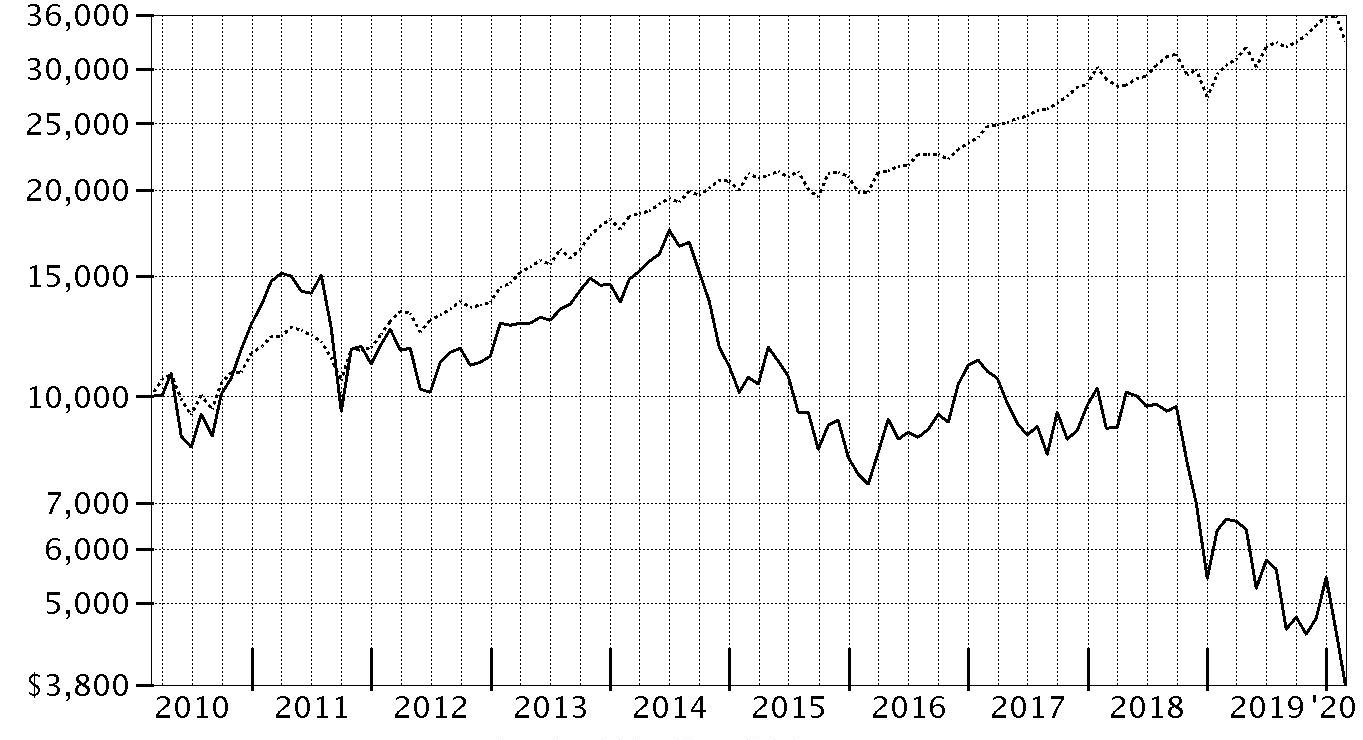

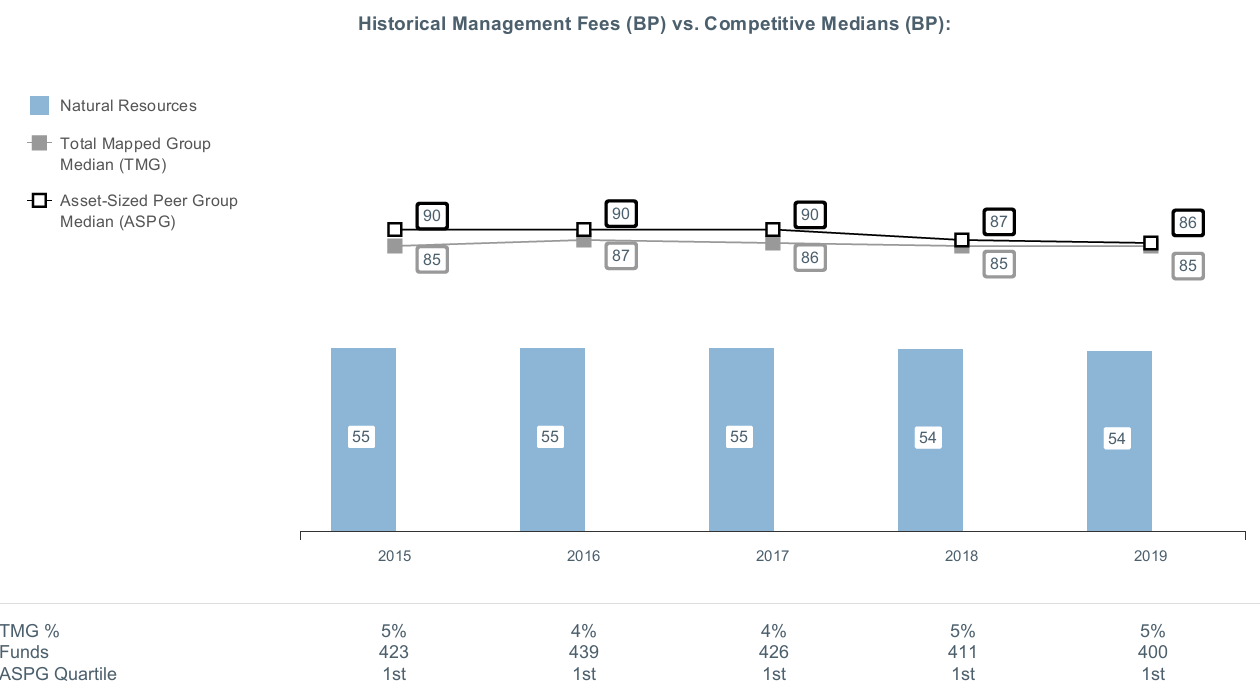

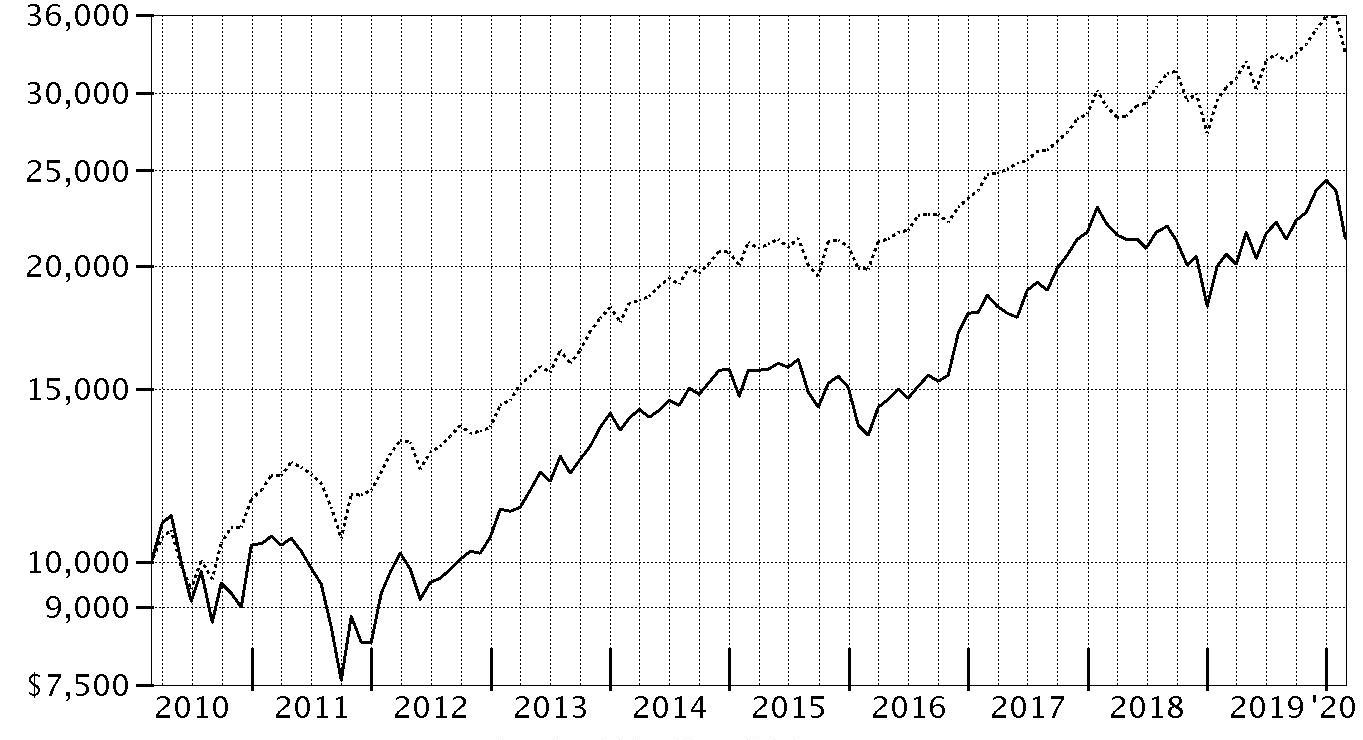

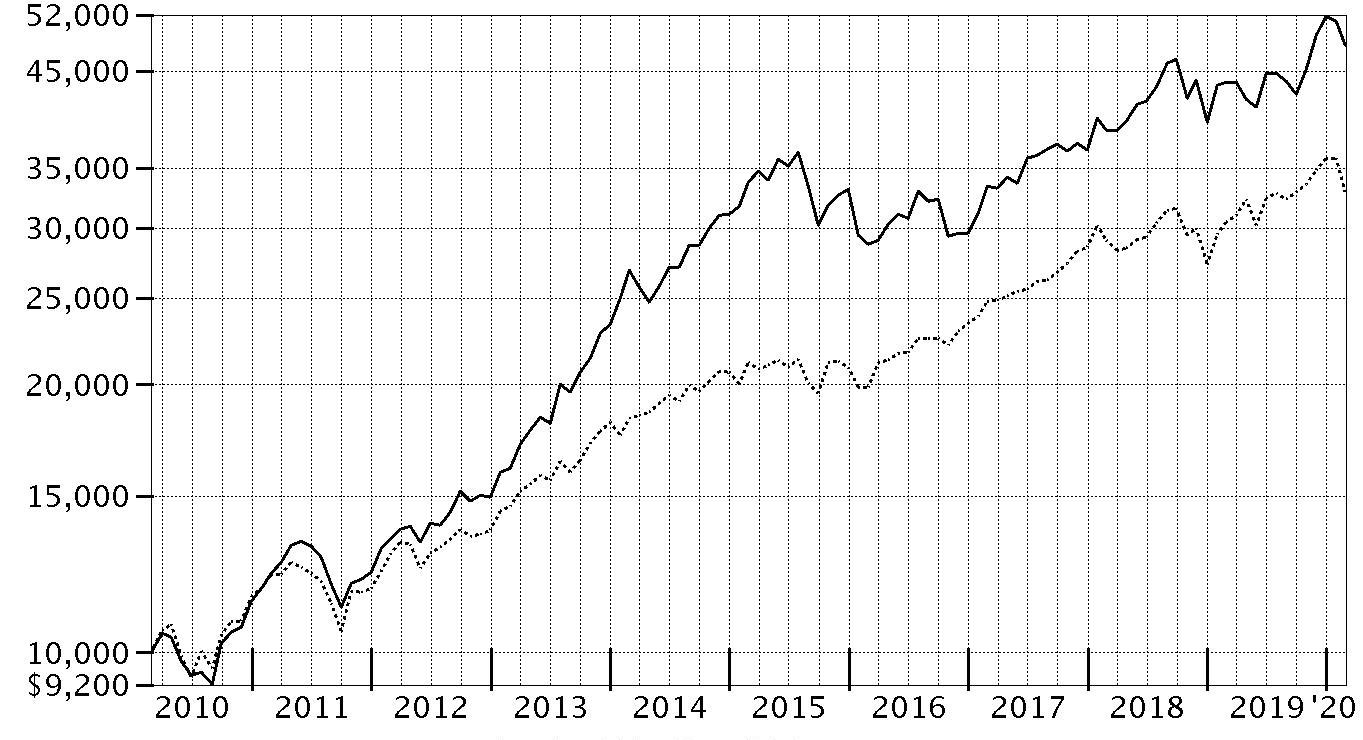

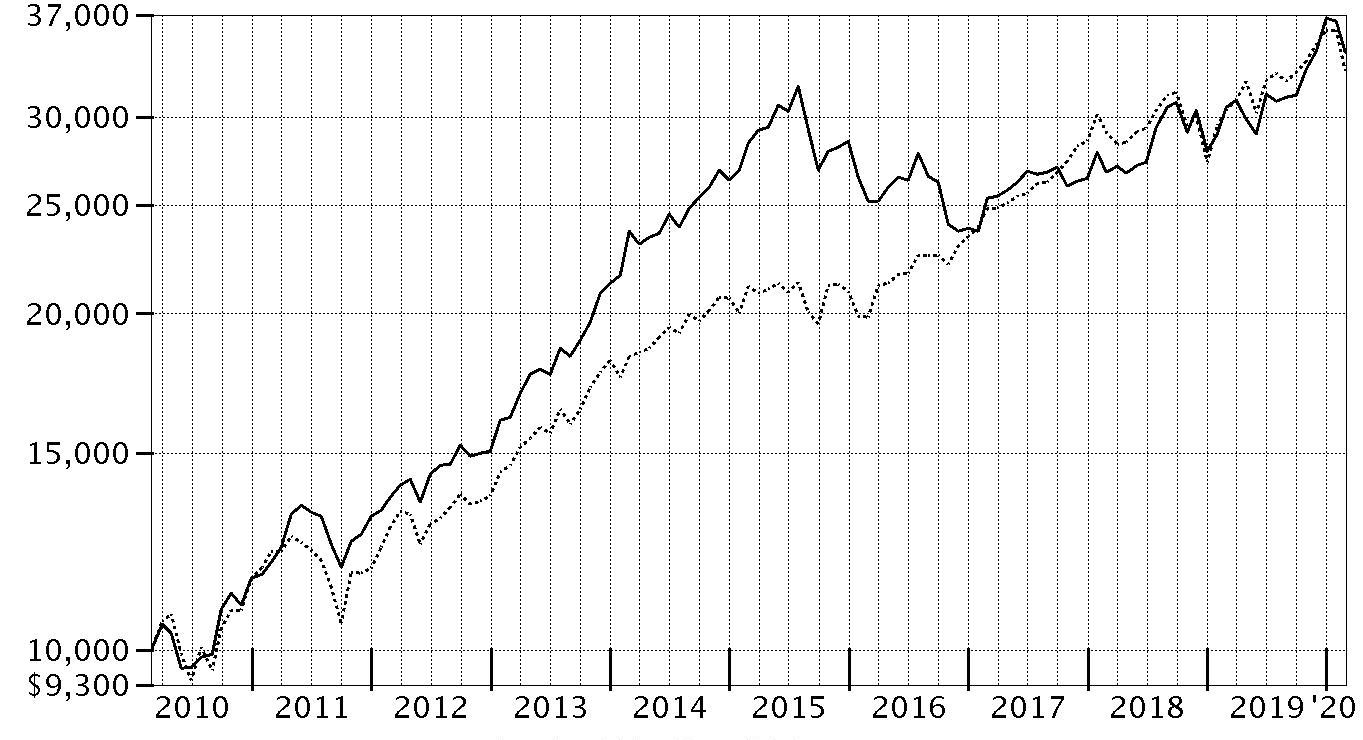

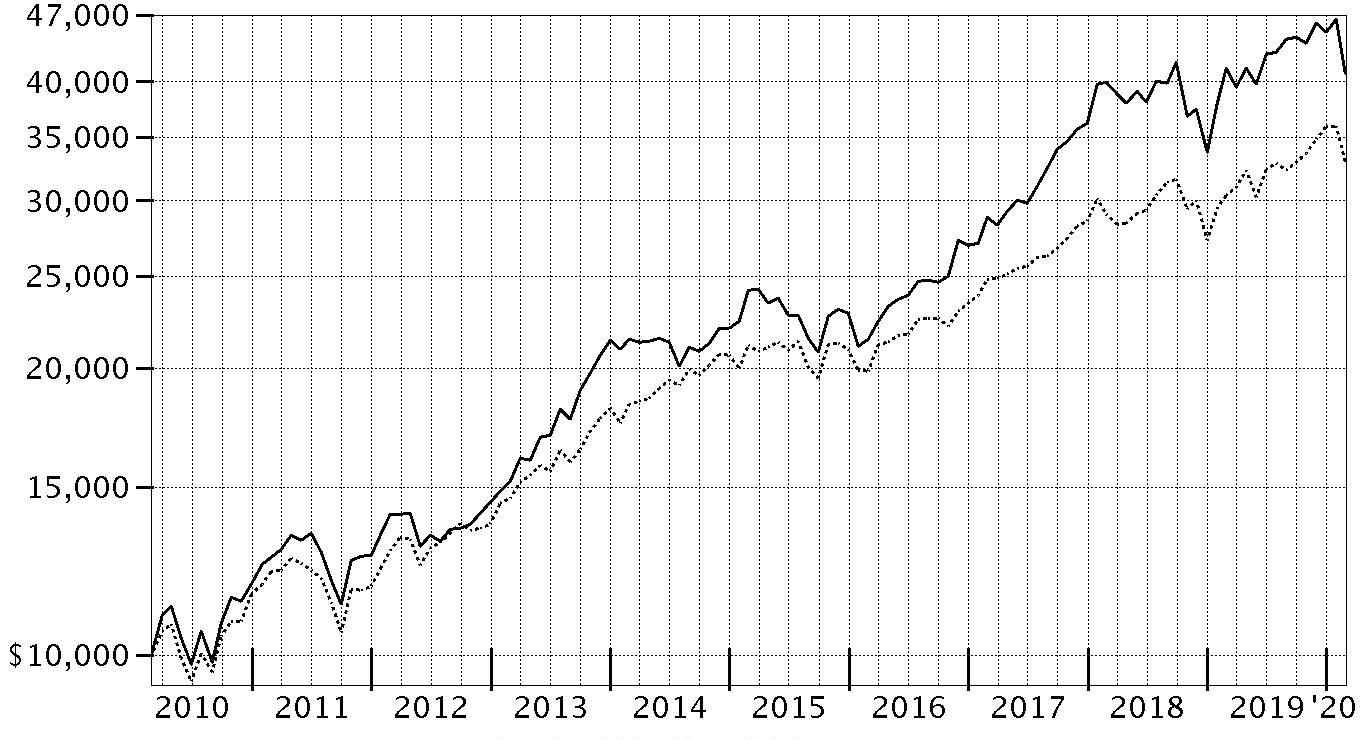

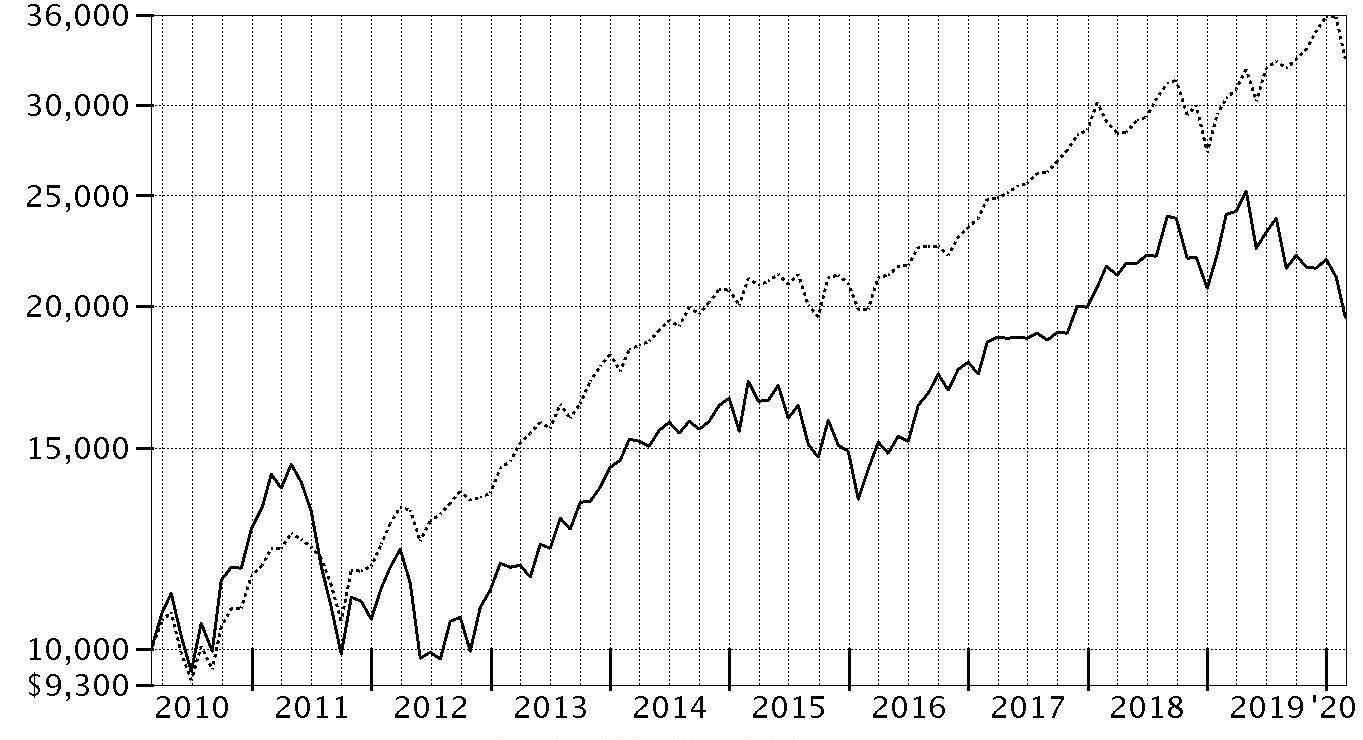

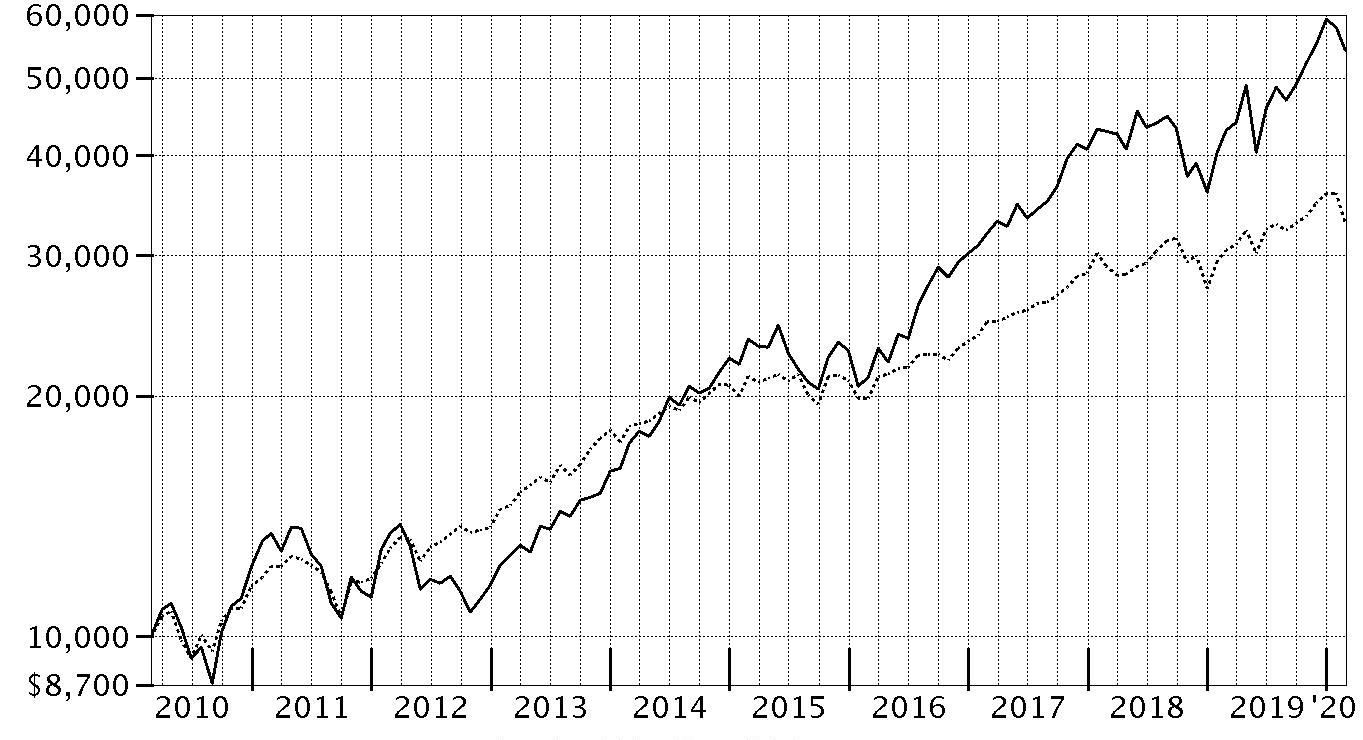

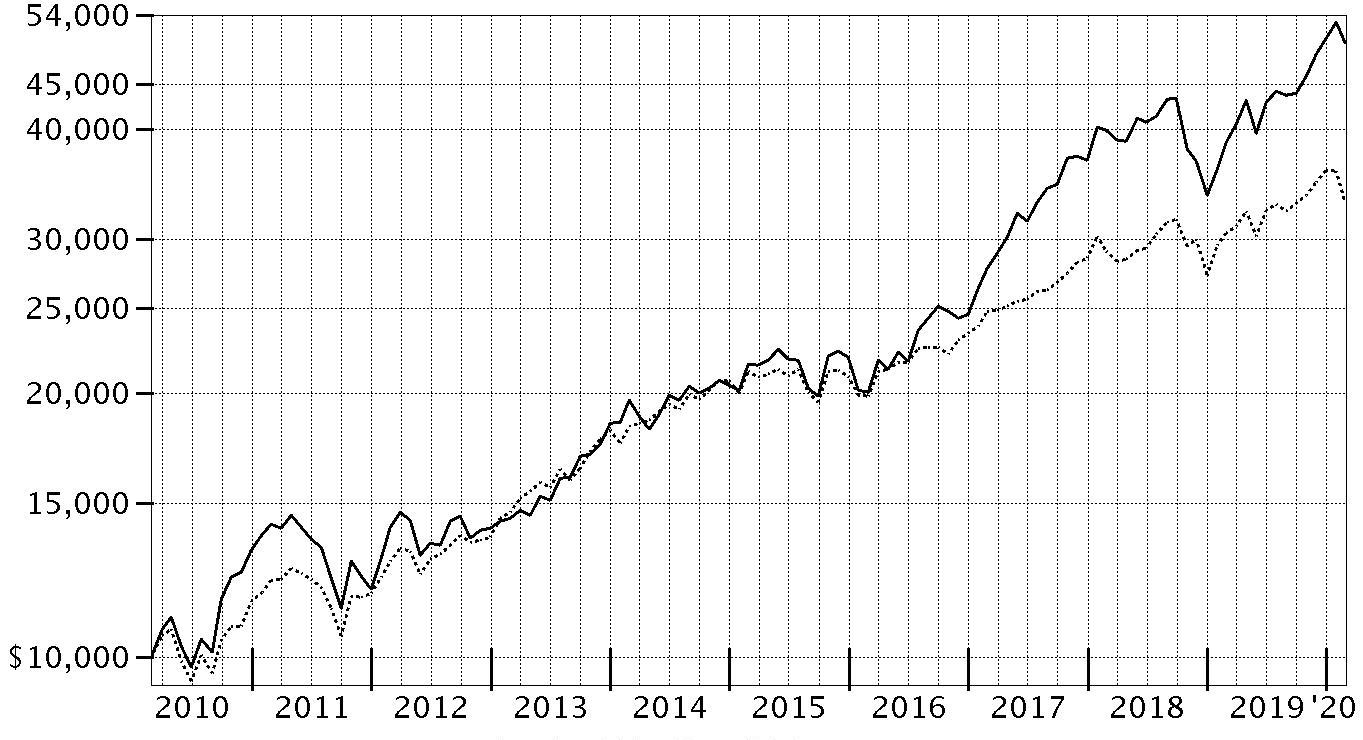

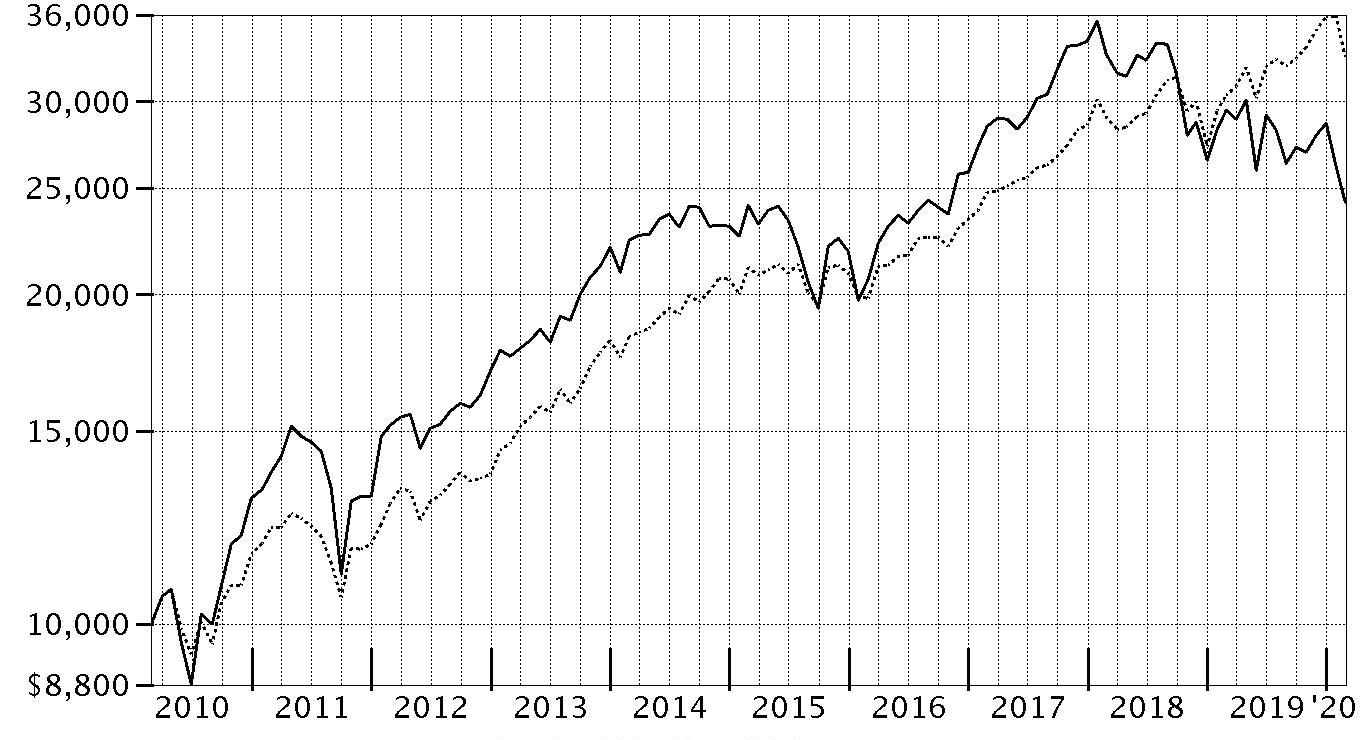

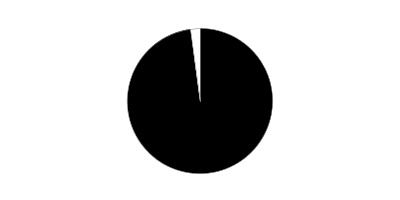

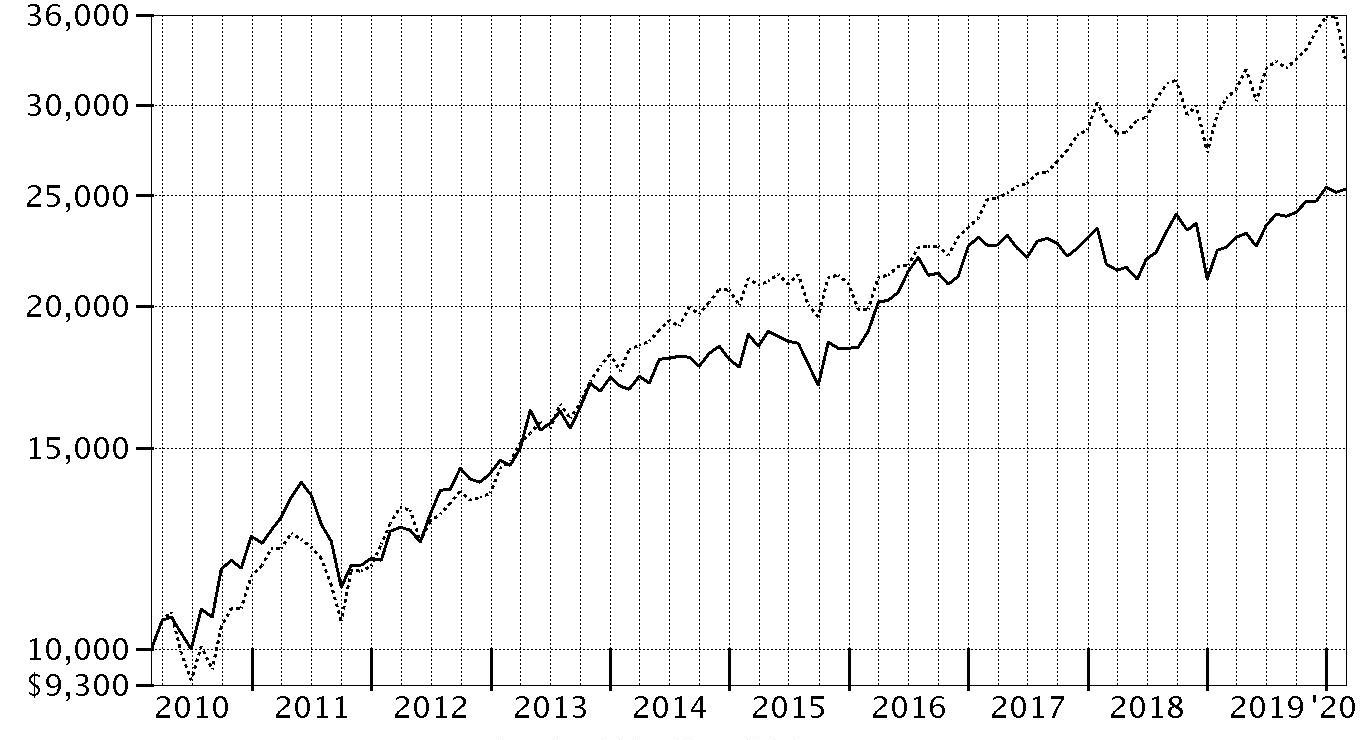

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Automotive Portfolio on February 28, 2010.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values | ||

| $25,144 | Automotive Portfolio | |

| $32,918 | S&P 500® Index | |

Automotive Portfolio

Management's Discussion of Fund Performance

Market Recap: U.S. stocks stalled to begin the new year and declined in late February, as the outbreak and spread of the new coronavirus threatened to hamper global economic growth and corporate earnings. For the 12 months ending February 29, 2020, the U.S. equity bellwether S&P 500® index gained 8.19%. The period began with equities rising amid upbeat company earnings and signs the U.S. Federal Reserve may pause on rates. The uptrend extended until May, when the index dipped as trade talks between the U.S. and China broke down. The bull market roared back to record a series of highs in July, when the Fed cut interest rates for the first time since 2008. Volatility intensified in August, as the Treasury yield curve inverted, which some investors viewed as a sign the U.S. economy could be heading for recession. But the market proved resilient, hitting a new high on October 30, when the Fed lowered rates for the third time in 2019, and moving higher through December 31. Following a roughly flat January, stocks sank in late February, after a surge in coronavirus cases outside China created considerable uncertainty and pushed investors to safer asset classes. By sector, information technology (+27%) led the way by a wide margin, followed by utilities and communication services (+13% each). In contrast, energy (-25%) was by far the weakest category, struggling due to sluggish oil prices. Other notable laggards included materials and industrials (-2% each).Comments from Portfolio Manager Elliot Mattingly: For the fiscal year, the fund gained 9.14%, outpacing the 6.04% advance of the FactSet Automotive Linked Index, as well as the broad-based S&P 500® index. The fund’s outperformance of the FactSet industry index was due to favorable positioning within the top-performing diversified support services group. Strong stock picks among automobile manufacturers, as well as auto parts & equipment companies, also helped. Specifically, the leading individual relative contributor was an overweight stake in electric vehicle maker Tesla (+108%), the portfolio’s largest holding at period end. Further bolstering relative performance was the fund’s timely positioning in KAR Auction Services (+24%). In June, the firm’s salvage auction business was spun-off, creating a new, publicly traded company formally named IAA that continued to be held in the portfolio as of February 29. What remained of Kar Auction Services was its less-attractive wholesale auction segment of the company, which was sold prior to period end. An overweighting in salvage auction company Copart (+43%) also added value the past 12 months and was a top-10 holding at the conclusion of the period. In contrast, lackluster investment choices within the construction machinery & heavy trucks industry group outweighed the impact of a beneficial overweighting in this strong-performing category. A larger-than-index position in shares of Lear (-25%), a maker of automotive seats and wiring harnesses, was the biggest stock-specific detractor. The fund’s overweighting in auto manufacturer General Motors (-20%) and an out-of-index stake in Allison Transmission Holdings (-17%) also weighed on the portfolio’s relative result. Lear, General Motors and Allison all continued to be held in portfolio fund at the end of the fiscal year.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Automotive Portfolio

Investment Summary (Unaudited)

Top Ten Stocks as of February 29, 2020

| % of fund's net assets | |

| Tesla, Inc. | 10.7 |

| General Motors Co. | 10.4 |

| Toyota Motor Corp. sponsored ADR | 9.9 |

| Honda Motor Co. Ltd. sponsored ADR | 8.3 |

| Aptiv PLC | 5.4 |

| Copart, Inc. | 5.2 |

| Ford Motor Co. | 4.9 |

| O'Reilly Automotive, Inc. | 4.7 |

| AutoZone, Inc. | 4.4 |

| Ferrari NV | 3.4 |

| 67.3 |

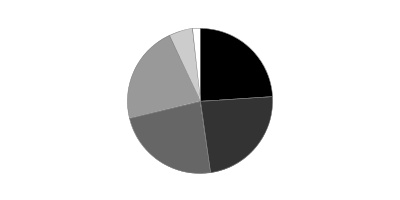

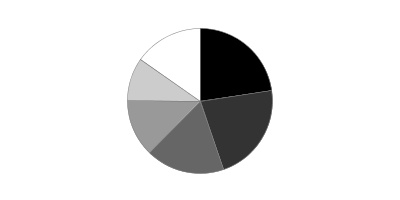

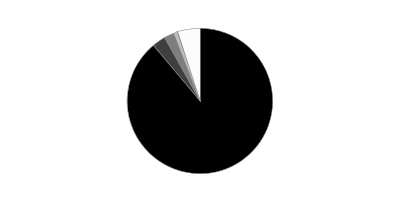

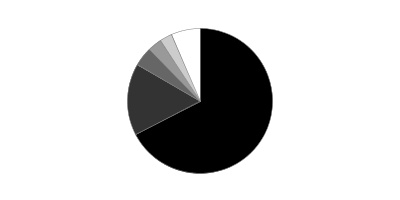

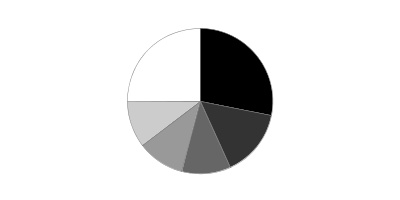

Top Industries (% of fund's net assets)

| As of February 29, 2020 | ||

| Automobiles | 51.4% | |

| Auto Components | 16.0% | |

| Specialty Retail | 15.8% | |

| Commercial Services & Supplies | 7.3% | |

| Distributors | 5.3% | |

| All Others* | 4.2% | |

* Includes short-term investments and net other assets (liabilities).

Automotive Portfolio

Schedule of Investments February 29, 2020

Showing Percentage of Net Assets

| Common Stocks - 99.4% | |||

| Shares | Value | ||

| Auto Components - 16.0% | |||

| Auto Parts & Equipment - 15.7% | |||

| Aptiv PLC | 25,059 | $1,957,358 | |

| Autoliv, Inc. | 3,815 | 254,575 | |

| BorgWarner, Inc. | 21,615 | 683,034 | |

| Gentex Corp. | 28,067 | 749,389 | |

| Lear Corp. | 8,202 | 912,062 | |

| Magna International, Inc. Class A (sub. vtg.) | 25,367 | 1,154,532 | |

| 5,710,950 | |||

| Tires & Rubber - 0.3% | |||

| The Goodyear Tire & Rubber Co. | 11,242 | 108,879 | |

| TOTAL AUTO COMPONENTS | 5,819,829 | ||

| Automobiles - 51.0% | |||

| Automobile Manufacturers - 51.0% | |||

| Ferrari NV | 7,808 | 1,231,712 | |

| Fiat Chrysler Automobiles NV | 45,726 | 568,831 | |

| Ford Motor Co. | 255,604 | 1,779,004 | |

| General Motors Co. | 124,388 | 3,793,834 | |

| Honda Motor Co. Ltd. sponsored ADR | 117,807 | 3,022,928 | |

| Subaru Corp. | 10,471 | 254,300 | |

| Tata Motors Ltd. sponsored ADR (a) | 49,000 | 448,840 | |

| Tesla, Inc. (a) | 5,848 | 3,906,403 | |

| Toyota Motor Corp. sponsored ADR | 27,626 | 3,612,100 | |

| 18,617,952 | |||

| Commercial Services & Supplies - 7.3% | |||

| Diversified Support Services - 7.3% | |||

| Copart, Inc. (a) | 22,599 | 1,909,164 | |

| IAA Spinco, Inc. (a) | 17,607 | 752,171 | |

| 2,661,335 | |||

| Distributors - 5.3% | |||

| Distributors - 5.3% | |||

| Genuine Parts Co. | 9,276 | 809,238 | |

| LKQ Corp. (a) | 38,605 | 1,141,936 | |

| 1,951,174 | |||

| Machinery - 1.3% | |||

| Construction Machinery & Heavy Trucks - 1.3% | |||

| Allison Transmission Holdings, Inc. | 11,987 | 486,672 | |

| Road & Rail - 2.7% | |||

| Trucking - 2.7% | |||

| Lyft, Inc. | 12,372 | 471,621 | |

| Uber Technologies, Inc. | 15,044 | 509,540 | |

| 981,161 | |||

| Specialty Retail - 15.8% | |||

| Automotive Retail - 15.8% | |||

| Advance Auto Parts, Inc. | 4,052 | 538,835 | |

| AutoZone, Inc. (a) | 1,560 | 1,610,716 | |

| CarMax, Inc. (a) | 10,463 | 913,525 | |

| Carvana Co. Class A (a)(b) | 6,157 | 510,477 | |

| Lithia Motors, Inc. Class A (sub. vtg.) | 3,817 | 454,834 | |

| O'Reilly Automotive, Inc. (a) | 4,662 | 1,718,973 | |

| 5,747,360 | |||

| TOTAL COMMON STOCKS | |||

| (Cost $27,261,726) | 36,265,483 | ||

| Nonconvertible Preferred Stocks - 0.4% | |||

| Automobiles - 0.4% | |||

| Automobile Manufacturers - 0.4% | |||

| Volkswagen AG | |||

| (Cost $120,359) | 875 | 145,256 | |

| Money Market Funds - 1.6% | |||

| Fidelity Cash Central Fund 1.60% (c) | 48,965 | 48,975 | |

| Fidelity Securities Lending Cash Central Fund 1.60% (c)(d) | 535,891 | 535,945 | |

| TOTAL MONEY MARKET FUNDS | |||

| (Cost $584,920) | 584,920 | ||

| TOTAL INVESTMENT IN SECURITIES - 101.4% | |||

| (Cost $27,967,005) | 36,995,659 | ||

| NET OTHER ASSETS (LIABILITIES) - (1.4)% | (515,879) | ||

| NET ASSETS - 100% | $36,479,780 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

(d) Investment made with cash collateral received from securities on loan.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $5,291 |

| Fidelity Securities Lending Cash Central Fund | 18,520 |

| Total | $23,811 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of February 29, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Common Stocks | $36,265,483 | $36,265,483 | $-- | $-- |

| Nonconvertible Preferred Stocks | 145,256 | -- | 145,256 | -- |

| Money Market Funds | 584,920 | 584,920 | -- | -- |

| Total Investments in Securities: | $36,995,659 | $36,850,403 | $145,256 | $-- |

Other Information

Distribution of investments by country or territory of incorporation, as a percentage of Total Net Assets, is as follows (Unaudited):

| United States of America | 66.0% |

| Japan | 18.9% |

| Bailiwick of Jersey | 5.4% |

| Netherlands | 4.9% |

| Canada | 3.2% |

| India | 1.2% |

| Others (Individually Less Than 1%) | 0.4% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Automotive Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 29, 2020 | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $489,169) — See accompanying schedule: Unaffiliated issuers (cost $27,382,085) | $36,410,739 | |

| Fidelity Central Funds (cost $584,920) | 584,920 | |

| Total Investment in Securities (cost $27,967,005) | $36,995,659 | |

| Receivable for investments sold | 3,015,267 | |

| Receivable for fund shares sold | 32,277 | |

| Dividends receivable | 70,564 | |

| Distributions receivable from Fidelity Central Funds | 695 | |

| Prepaid expenses | 383 | |

| Other receivables | 2,768 | |

| Total assets | 40,117,613 | |

| Liabilities | ||

| Payable for investments purchased | $2,841,100 | |

| Payable for fund shares redeemed | 199,467 | |

| Accrued management fee | 17,884 | |

| Other affiliated payables | 8,200 | |

| Other payables and accrued expenses | 35,757 | |

| Collateral on securities loaned | 535,425 | |

| Total liabilities | 3,637,833 | |

| Net Assets | $36,479,780 | |

| Net Assets consist of: | ||

| Paid in capital | $24,895,564 | |

| Total accumulated earnings (loss) | 11,584,216 | |

| Net Assets | $36,479,780 | |

| Net Asset Value, offering price and redemption price per share ($36,479,780 ÷ 1,045,014 shares) | $34.91 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Year ended February 29, 2020 | ||

| Investment Income | ||

| Dividends | $743,154 | |

| Special dividends | 95,800 | |

| Income from Fidelity Central Funds (including $18,520 from security lending) | 23,811 | |

| Total income | 862,765 | |

| Expenses | ||

| Management fee | $199,273 | |

| Transfer agent fees | 85,553 | |

| Accounting and security lending fees | 14,643 | |

| Custodian fees and expenses | 7,398 | |

| Independent trustees' fees and expenses | 202 | |

| Registration fees | 24,031 | |

| Audit | 39,143 | |

| Legal | 650 | |

| Miscellaneous | 381 | |

| Total expenses before reductions | 371,274 | |

| Expense reductions | (2,054) | |

| Total expenses after reductions | 369,220 | |

| Net investment income (loss) | 493,545 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 4,079,996 | |

| Fidelity Central Funds | 260 | |

| Foreign currency transactions | (56) | |

| Total net realized gain (loss) | 4,080,200 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | (1,479,720) | |

| Assets and liabilities in foreign currencies | (100) | |

| Total change in net unrealized appreciation (depreciation) | (1,479,820) | |

| Net gain (loss) | 2,600,380 | |

| Net increase (decrease) in net assets resulting from operations | $3,093,925 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Year ended February 29, 2020 | Year ended February 28, 2019 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $493,545 | $448,747 |

| Net realized gain (loss) | 4,080,200 | 1,271,345 |

| Change in net unrealized appreciation (depreciation) | (1,479,820) | (3,853,613) |

| Net increase (decrease) in net assets resulting from operations | 3,093,925 | (2,133,521) |

| Distributions to shareholders | (1,655,954) | (3,068,342) |

| Share transactions | ||

| Proceeds from sales of shares | 14,390,055 | 11,884,432 |

| Reinvestment of distributions | 1,571,589 | 2,935,846 |

| Cost of shares redeemed | (21,701,036) | (24,976,652) |

| Net increase (decrease) in net assets resulting from share transactions | (5,739,392) | (10,156,374) |

| Total increase (decrease) in net assets | (4,301,421) | (15,358,237) |

| Net Assets | ||

| Beginning of period | 40,781,201 | 56,139,438 |

| End of period | $36,479,780 | $40,781,201 |

| Other Information | ||

| Shares | ||

| Sold | 396,128 | 351,778 |

| Issued in reinvestment of distributions | 42,404 | 87,676 |

| Redeemed | (618,672) | (710,478) |

| Net increase (decrease) | (180,140) | (271,024) |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Automotive Portfolio

| Years ended February 28, | 2020 A | 2019 | 2018 | 2017 | 2016 A |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $33.29 | $37.52 | $36.78 | $33.72 | $48.82 |

| Income from Investment Operations | |||||

| Net investment income (loss)B | .46C | .36 | .39D | .33 | .65 |

| Net realized and unrealized gain (loss) | 2.67E | (2.15) | 6.11 | 5.22 | (9.37) |

| Total from investment operations | 3.13 | (1.79) | 6.50 | 5.55 | (8.72) |

| Distributions from net investment income | (.49)F | (.38) | (.20) | (.52) | (.45) |

| Distributions from net realized gain | (1.02)F | (2.06) | (5.56) | (1.98) | (5.93) |

| Total distributions | (1.51) | (2.44) | (5.76) | (2.49)G | (6.38) |

| Redemption fees added to paid in capitalB | – | – | –H | –H | –H |

| Net asset value, end of period | $34.91 | $33.29 | $37.52 | $36.78 | $33.72 |

| Total ReturnI | 9.14%E | (4.66)% | 19.08% | 16.80% | (20.00)% |

| Ratios to Average Net AssetsJ,K | |||||

| Expenses before reductions | 1.00% | .97% | .97% | .96% | .87% |

| Expenses net of fee waivers, if any | 1.00% | .97% | .96% | .96% | .87% |

| Expenses net of all reductions | .99% | .97% | .96% | .95% | .86% |

| Net investment income (loss) | 1.33%C | 1.04% | 1.04%D | .92% | 1.49% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $36,480 | $40,781 | $56,139 | $54,069 | $65,745 |

| Portfolio turnover rateL | 45% | 31% | 117% | 83% | 80% |

A For the year ended February 29.

B Calculated based on average shares outstanding during the period.

C Net investment income per share reflects a large, non-recurring dividend which amounted to $.09 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been 1.07%.

D Net investment income per share reflects a large, non-recurring dividend which amounted to $.08 per share. Excluding this non-recurring dividend, the ratio of net investment income (loss) to average net assets would have been .83%.

E Net realized and unrealized gain (loss) per share reflects proceeds received from litigation which amounted to $.19 per share. Excluding these litigation proceeds, the total return would have been 8.58%.

F The amounts shown reflect certain reclassifications related to book to tax differences that were made in the year shown.

G Total distributions of $2.49 per share is comprised of distributions from net investment income of $.515 and distributions from net realized gain of $1.975 per share.

H Amount represents less than $.005 per share.

I Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

J Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

K Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

L Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

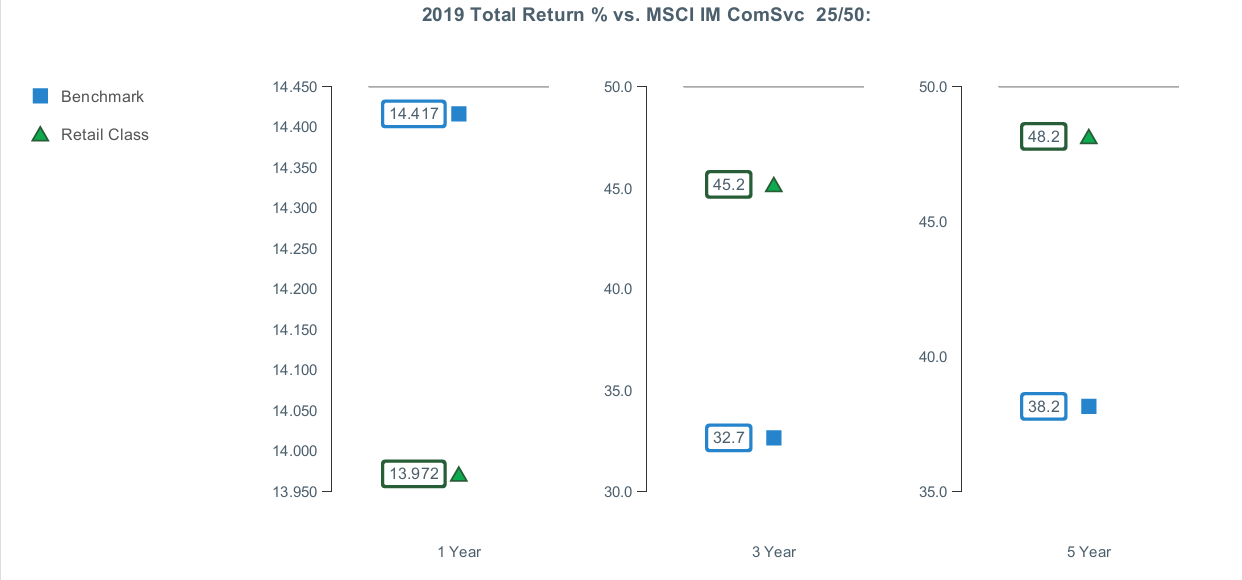

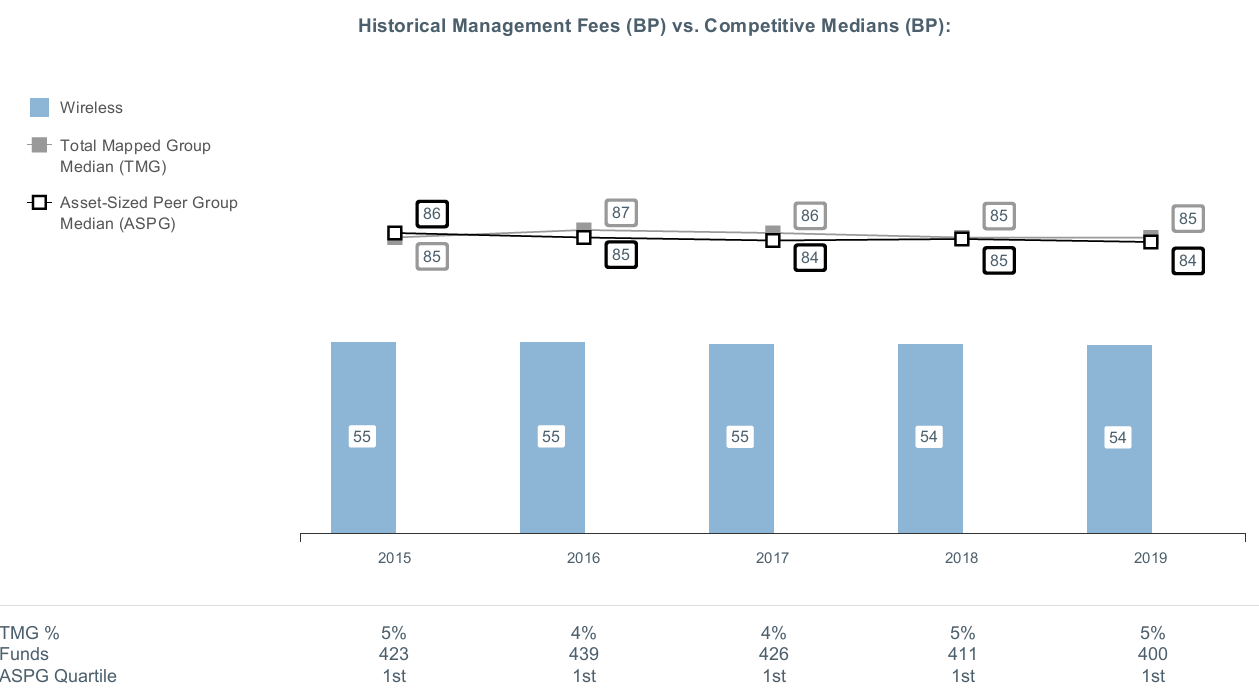

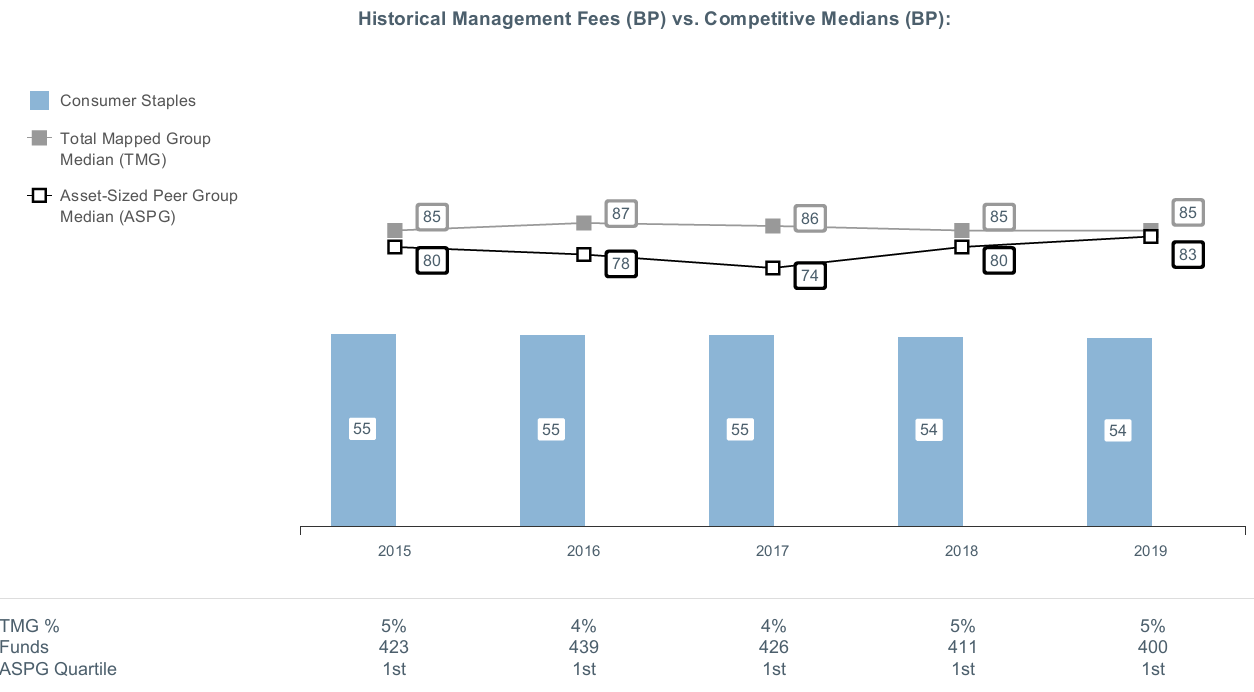

Communication Services Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

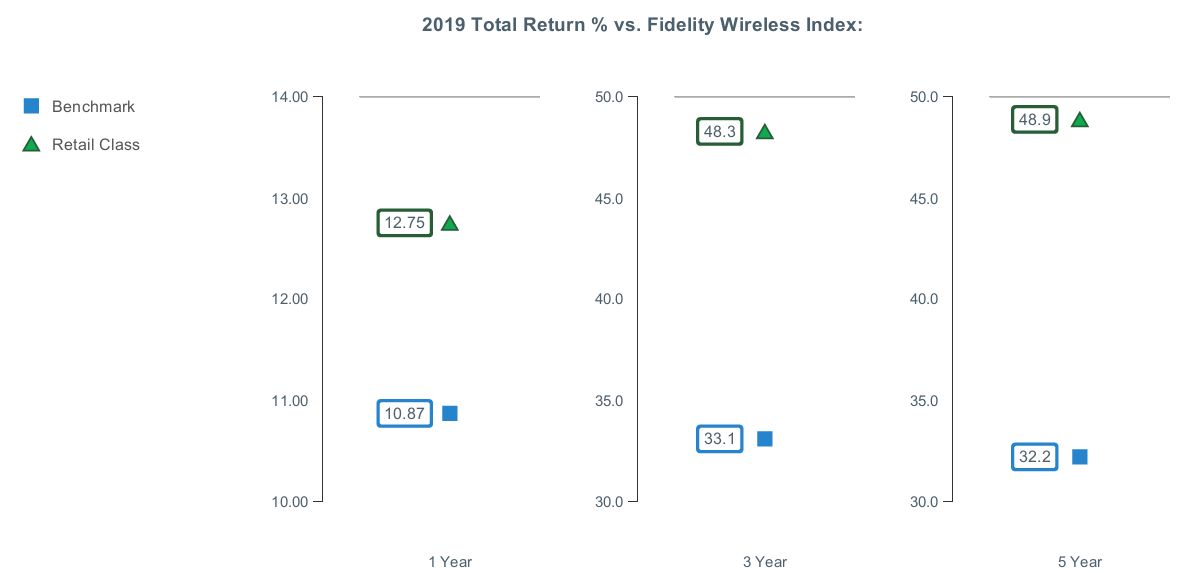

Average Annual Total Returns

| For the periods ended February 29, 2020 | Past 1 year | Past 5 years | Past 10 years |

| Class A (incl. 5.75% sales charge) | 5.47% | 6.06% | 14.01% |

| Class M (incl. 3.50% sales charge) | 7.67% | 6.48% | 14.23% |

| Class C (incl. contingent deferred sales charge) | 10.20% | 7.11% | 14.57% |

| Communication Services Portfolio | 12.22% | 7.40% | 14.72% |

| Class I | 12.22% | 7.40% | 14.72% |

| Class Z | 12.38% | 7.43% | 14.74% |

Class C shares' contingent deferred sales charges included in the past one year, past five years and past ten years total return figures are 1%, 0% and 0%, respectively.

The initial offering of Class Z shares took place on November 30, 2018. Returns prior to November 30, 2018, are those of Class I.

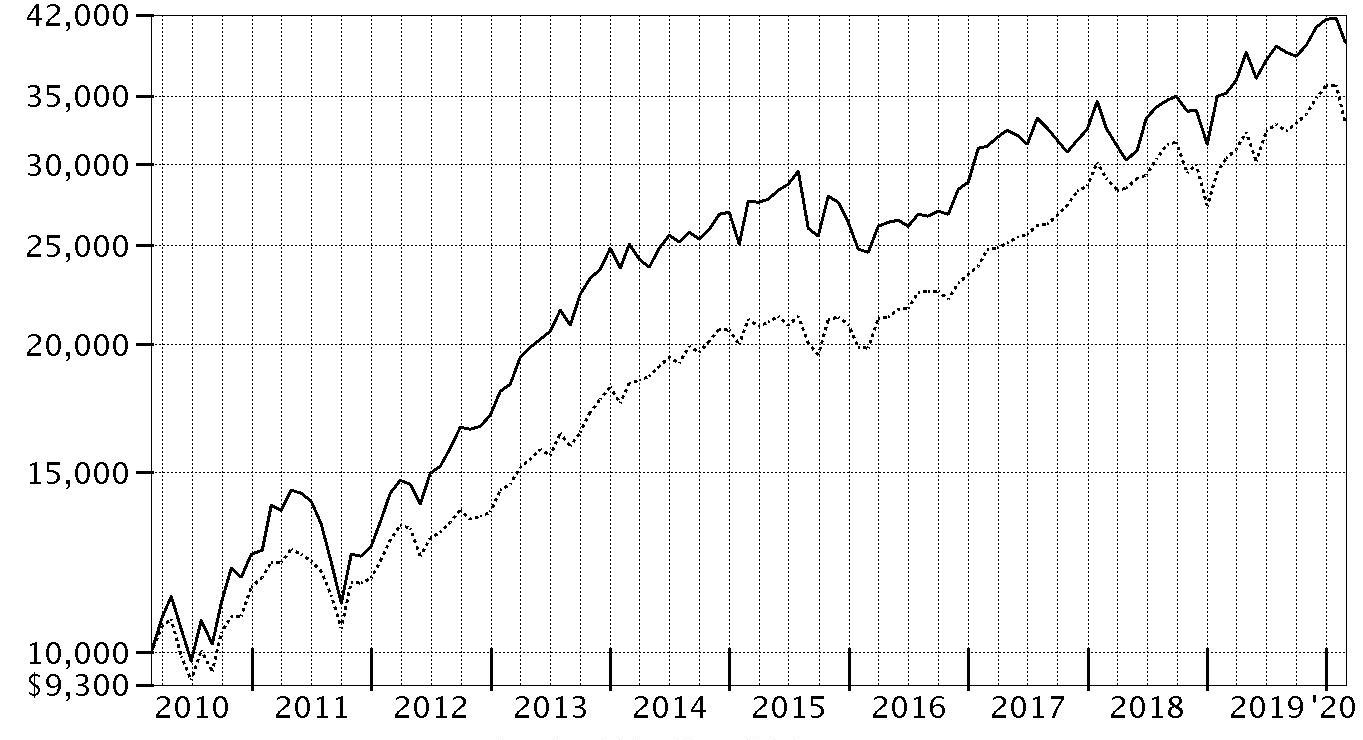

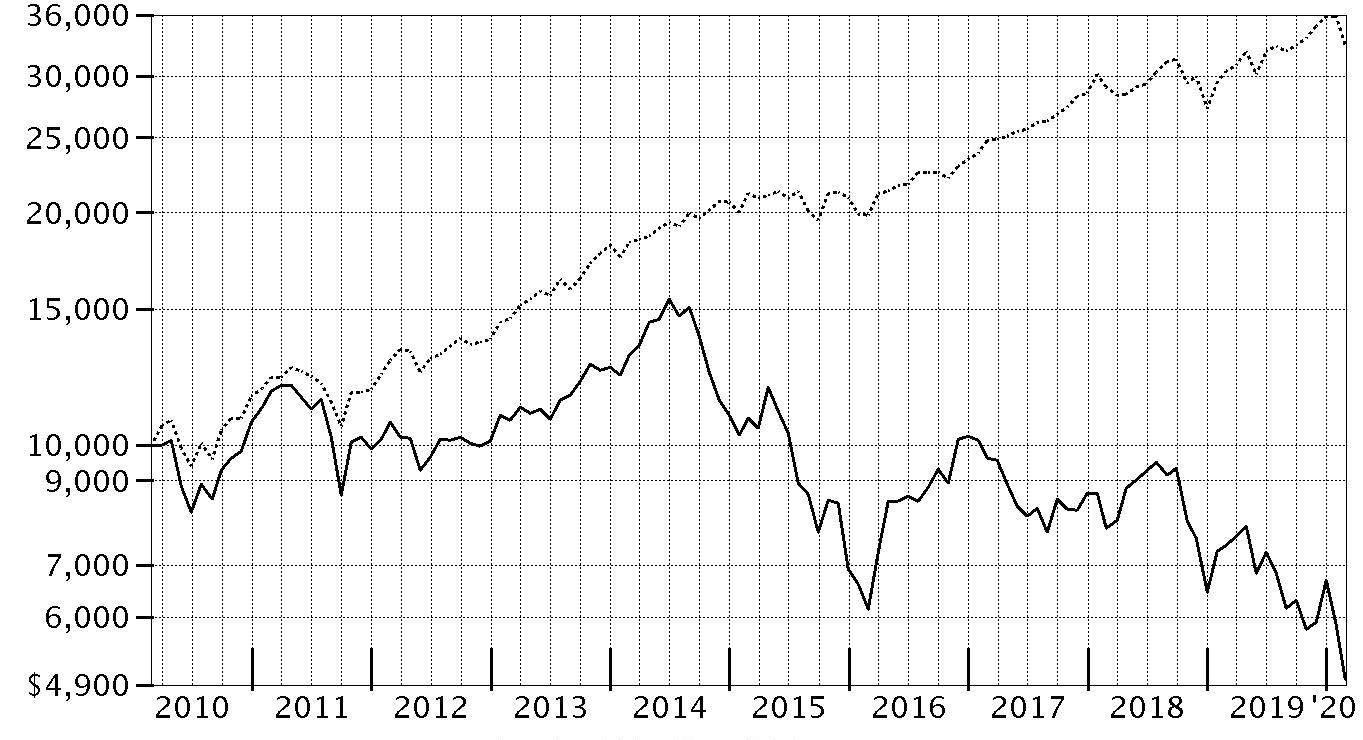

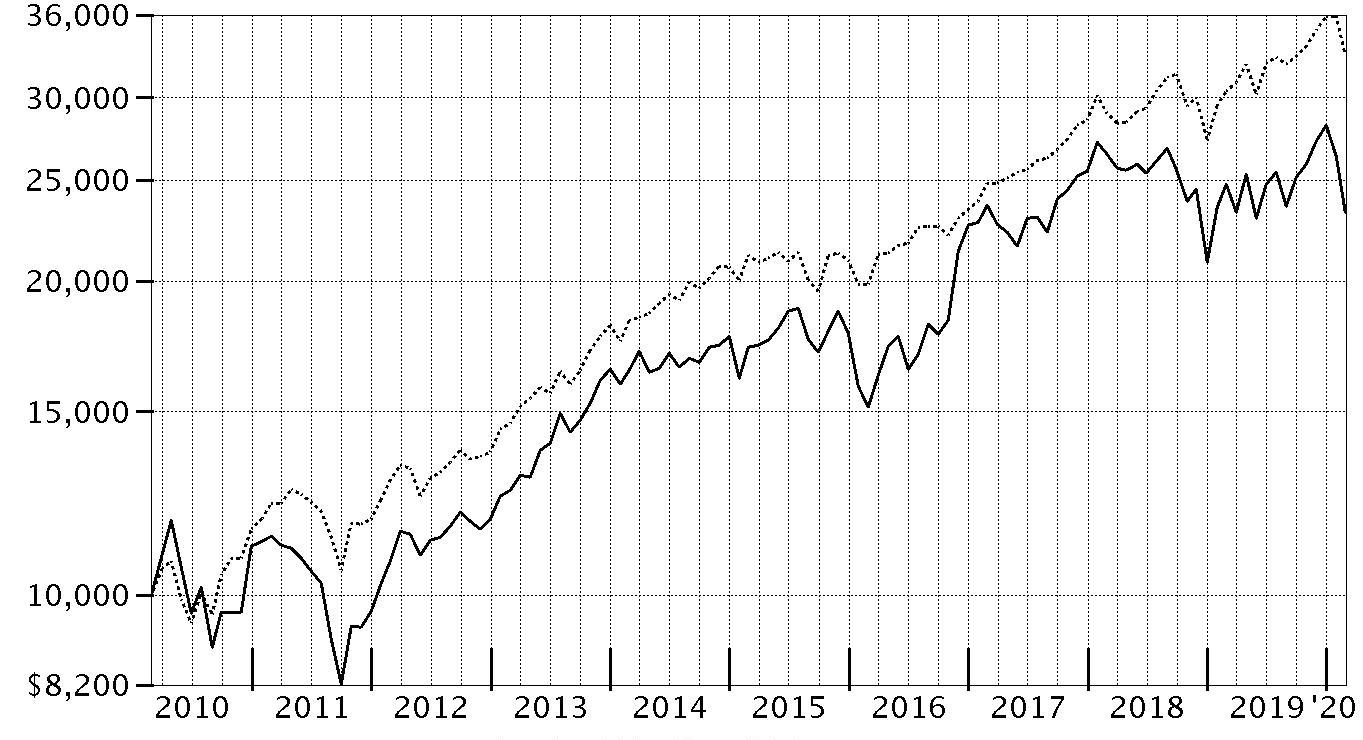

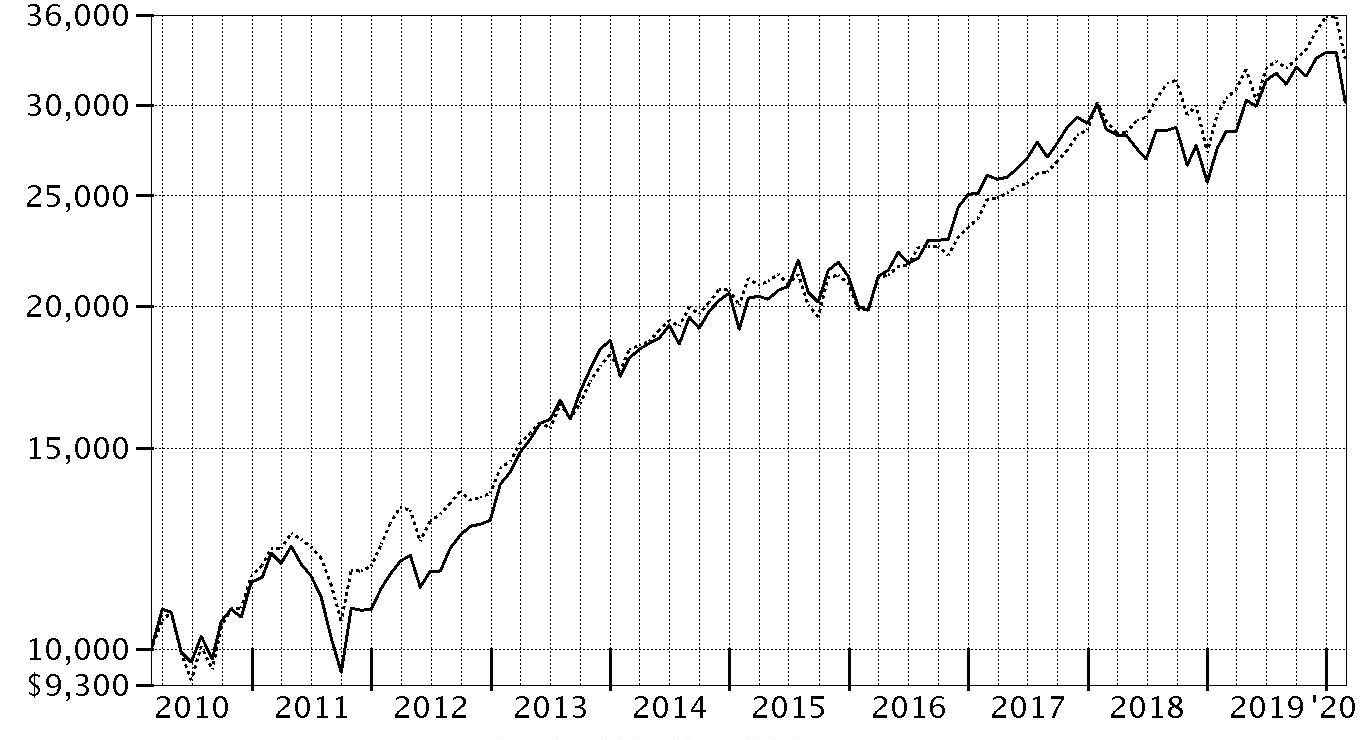

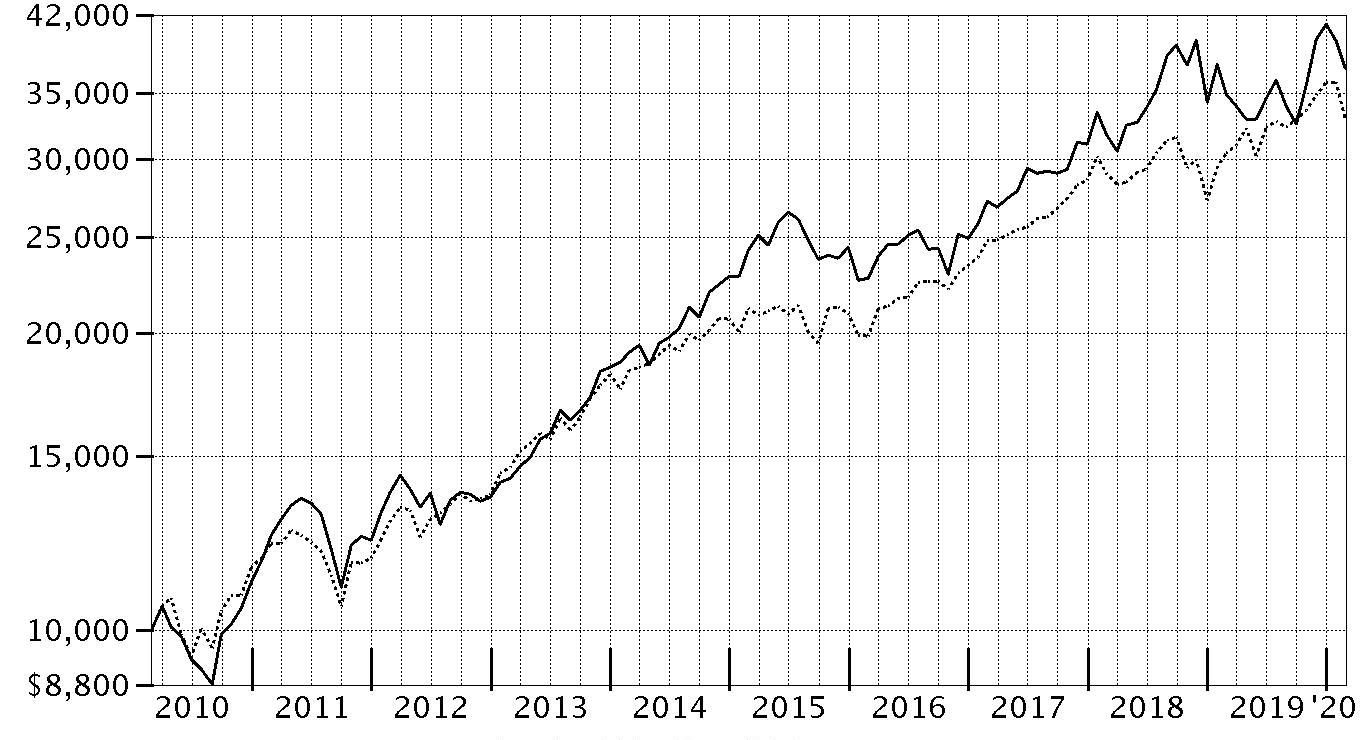

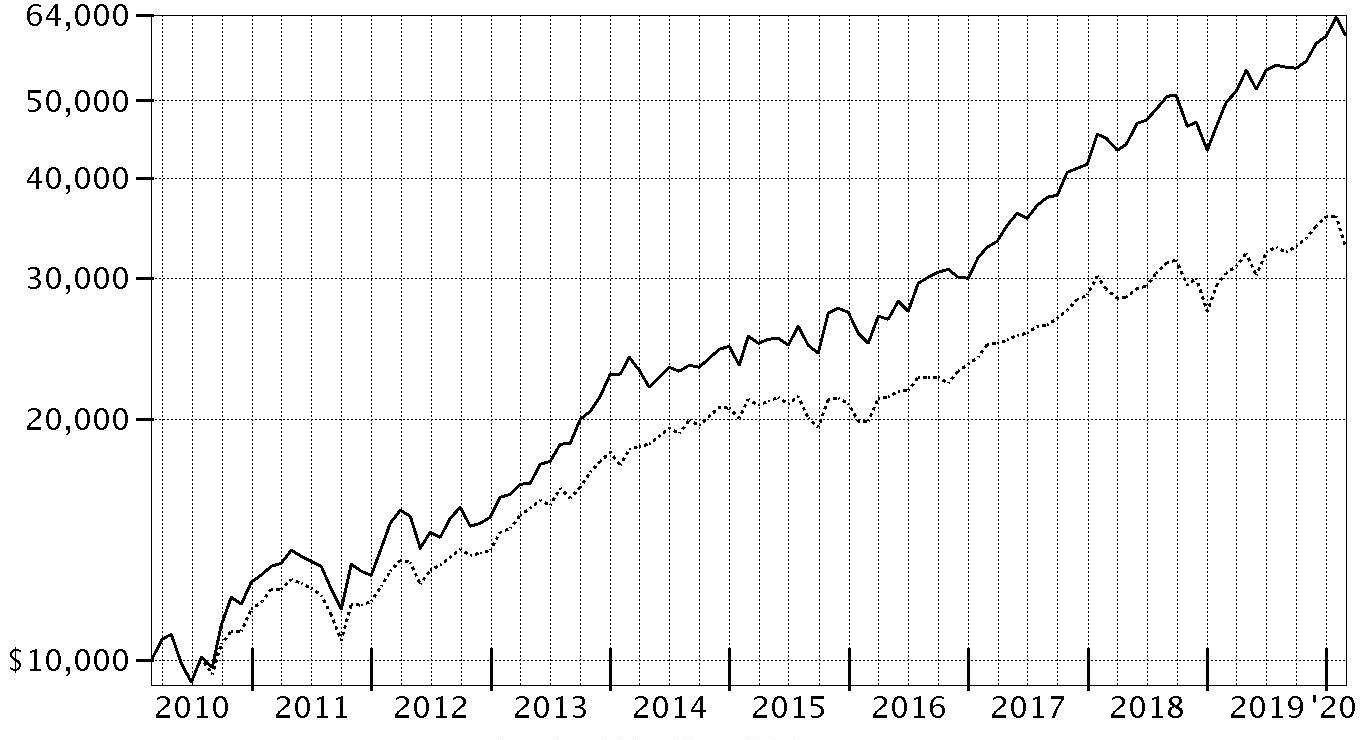

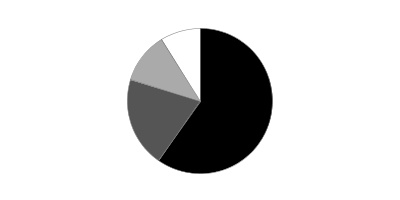

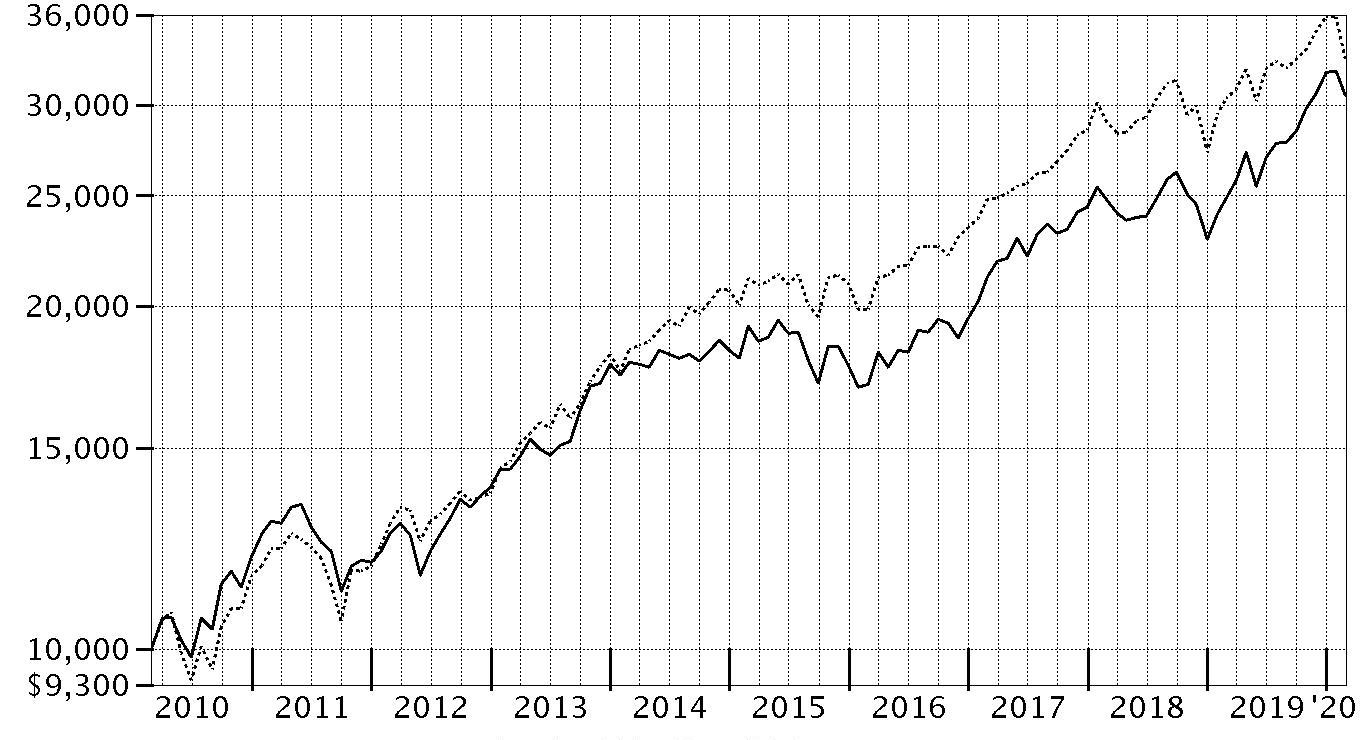

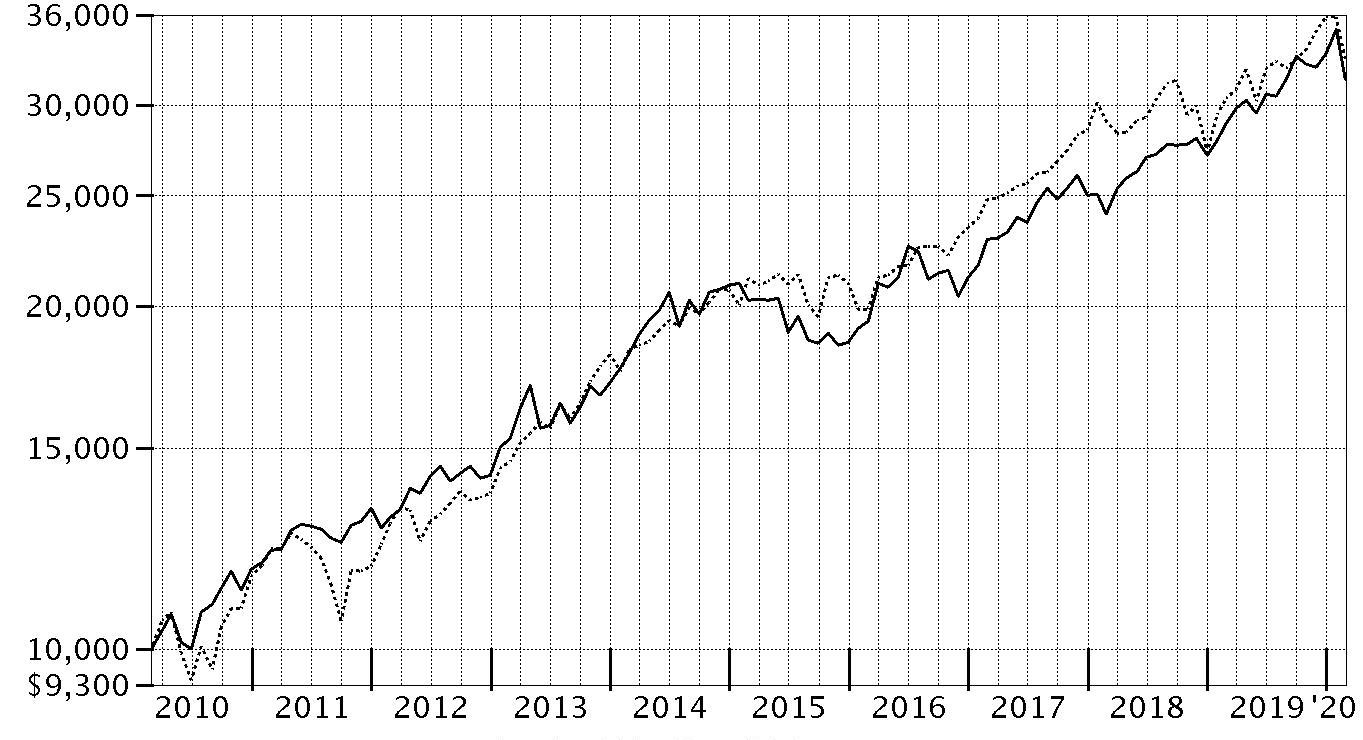

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Communication Services Portfolio, a class of the fund, on February 28, 2010.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values | ||

| $39,488 | Communication Services Portfolio | |

| $32,918 | S&P 500® Index | |

Communication Services Portfolio

Management's Discussion of Fund Performance

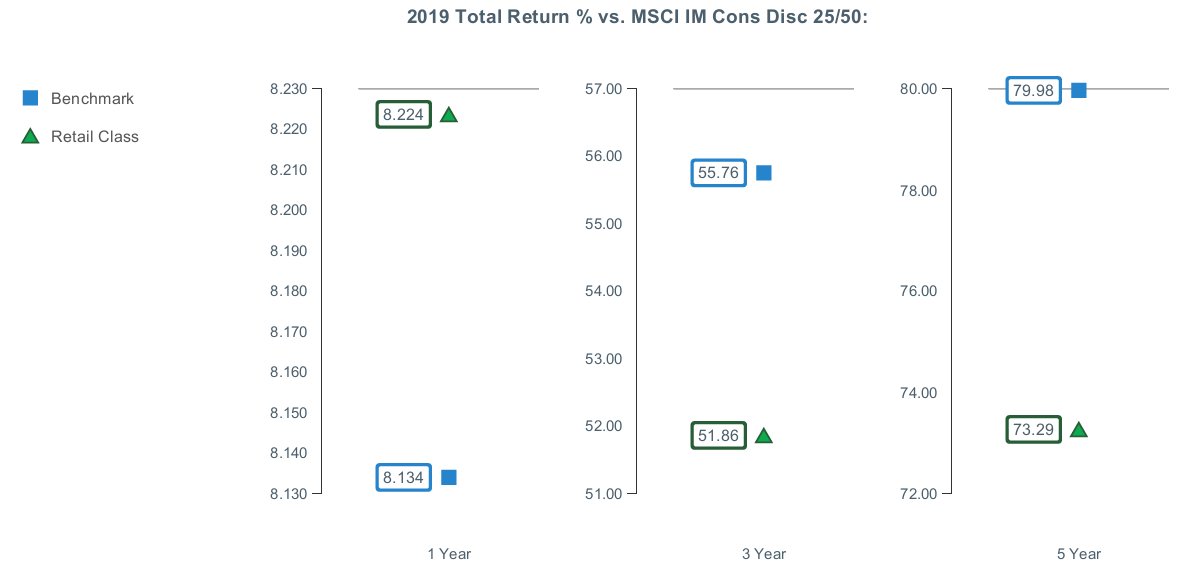

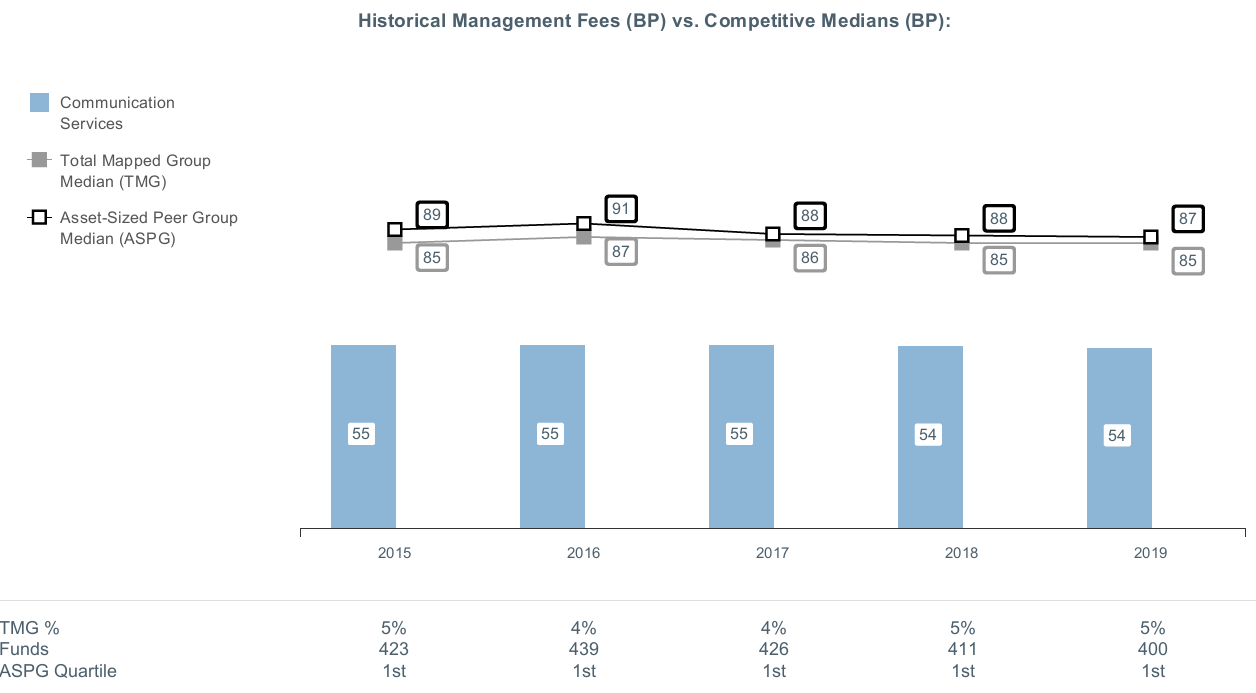

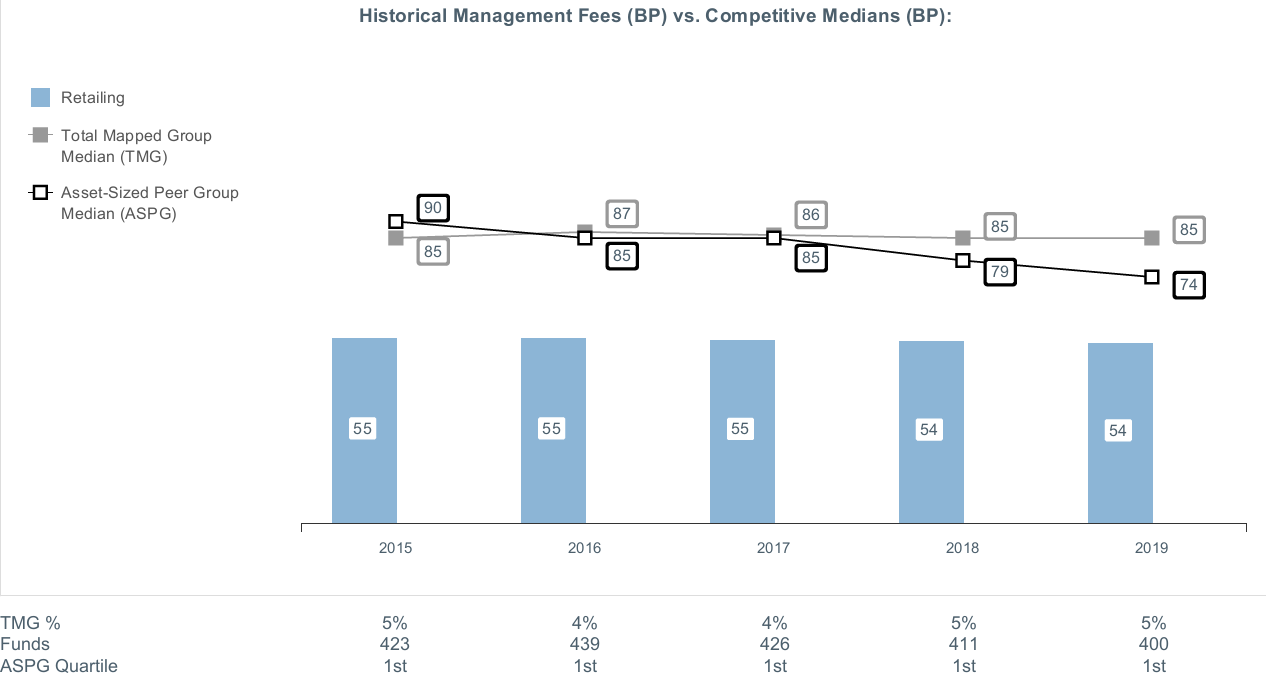

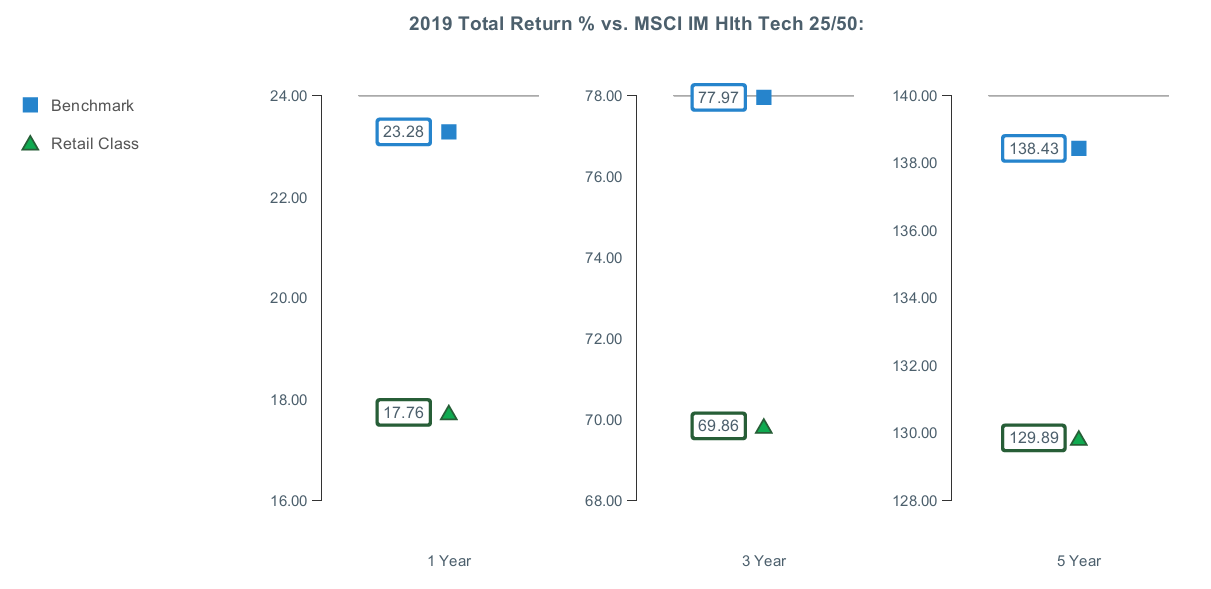

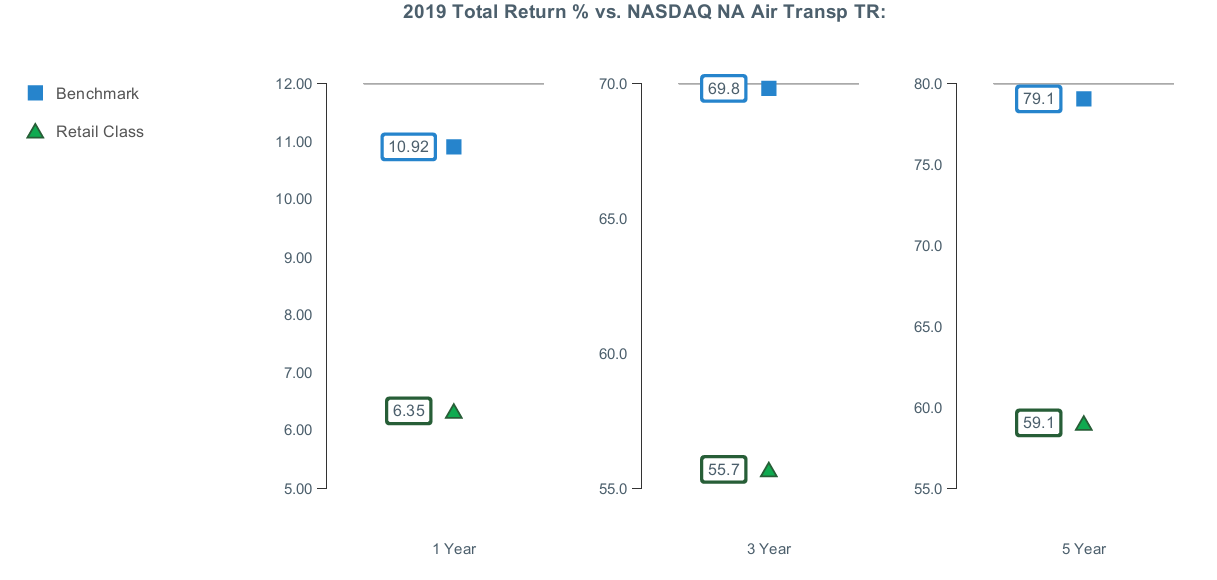

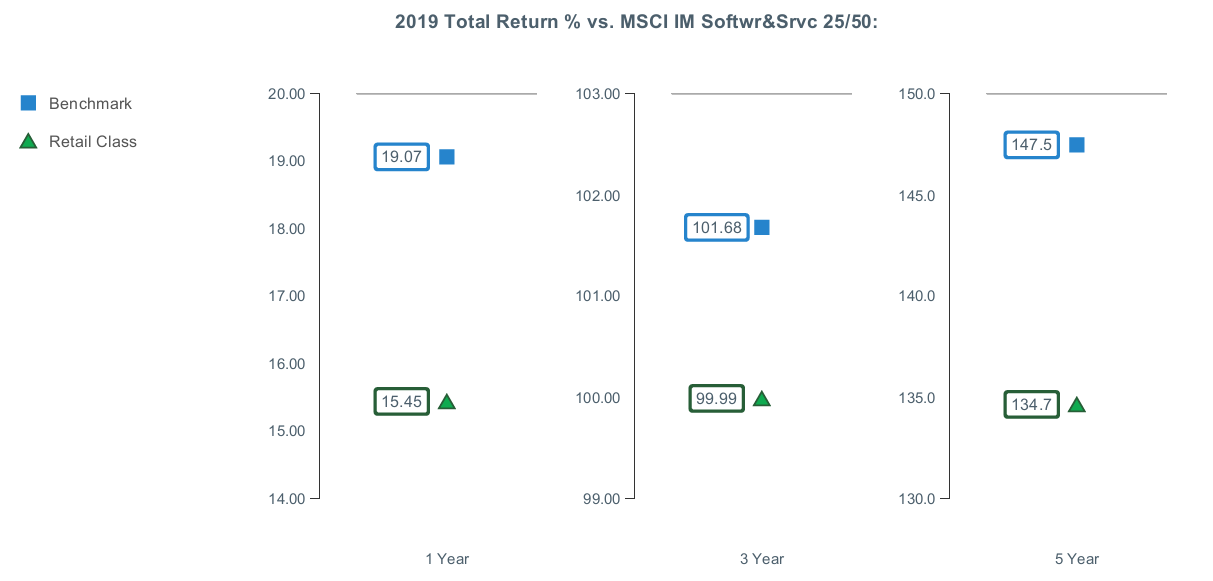

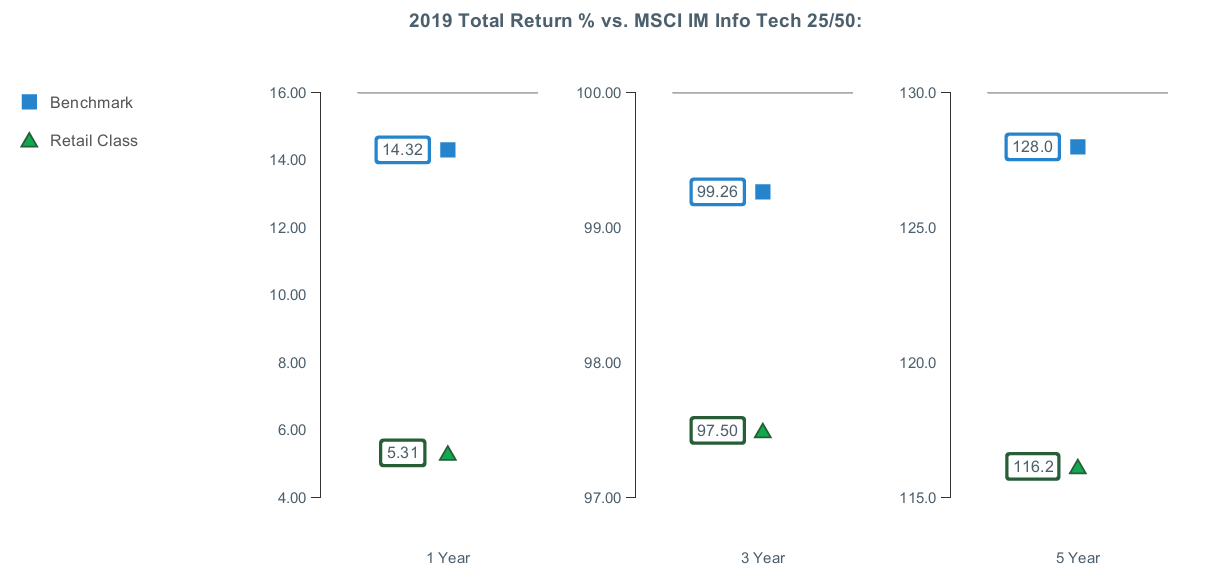

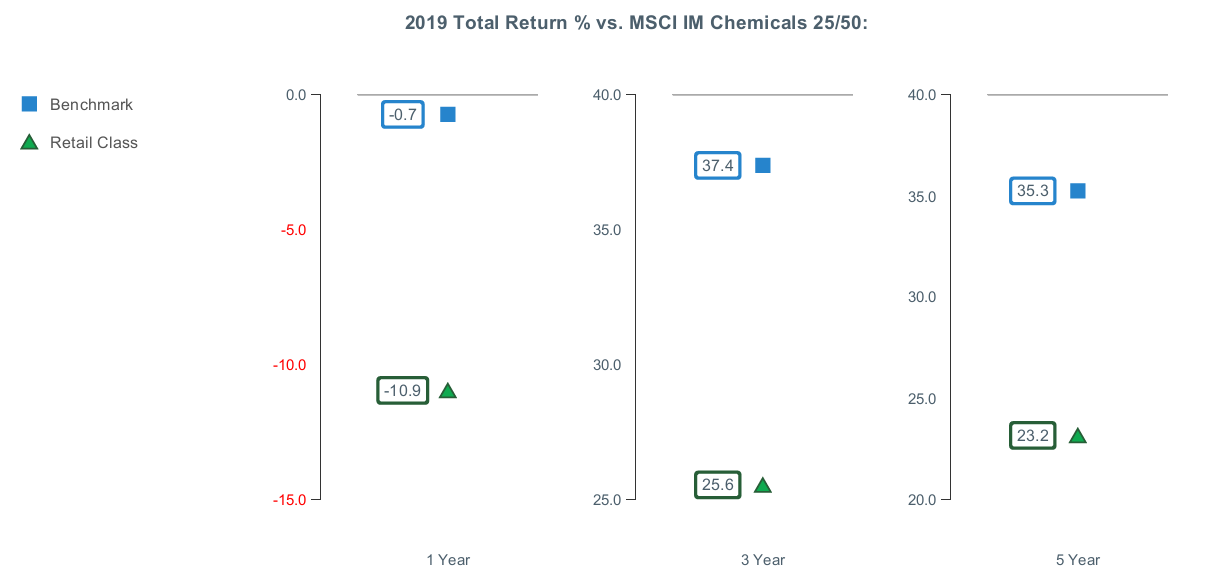

Market Recap: U.S. stocks stalled to begin the new year and declined in late February, as the outbreak and spread of the new coronavirus threatened to hamper global economic growth and corporate earnings. For the 12 months ending February 29, 2020, the U.S. equity bellwether S&P 500® index gained 8.19%. The period began with equities rising amid upbeat company earnings and signs the U.S. Federal Reserve may pause on rates. The uptrend extended until May, when the index dipped as trade talks between the U.S. and China broke down. The bull market roared back to record a series of highs in July, when the Fed cut interest rates for the first time since 2008. Volatility intensified in August, as the Treasury yield curve inverted, which some investors viewed as a sign the U.S. economy could be heading for recession. But the market proved resilient, hitting a new high on October 30, when the Fed lowered rates for the third time in 2019, and moving higher through December 31. Following a roughly flat January, stocks sank in late February, after a surge in coronavirus cases outside China created considerable uncertainty and pushed investors to safer asset classes. By sector, information technology (+27%) led the way by a wide margin, followed by utilities and communication services (+13% each). In contrast, energy (-25%) was by far the weakest category, struggling due to sluggish oil prices. Other notable laggards included materials and industrials (-2% each).Comments from Portfolio Manager Matthew Drukker: For the fiscal year, the fund's share classes gained roughly 12%, notably outpacing the 9.62% result of the sector benchmark, the MSCI U.S. IMI Communication Services 25/50 Index, and the S&P 500®. Communication services stocks benefited from their relatively limited exposure to global trade uncertainty this year. Many also capitalized on digital growth trends that drove strong business fundamentals the past 12 months. Versus the sector benchmark, both stock and market selection added value. Stock picking in the interactive home entertainment segment contributed more than any other group. Within this segment, an outsized stake in video game developer Activision Blizzard (+39%) benefited from the success of its franchise games, as well as developments in its free-to-play and mobile business lines. Additionally, non-index shares of Beijing-based Meituan Dianping (+40%), a holding company that owns mobile-centric dining services akin to those offered by U.S.-based OpenTable, GrubHub and Yelp, also gained strongly. I sold Meituan Dianping by period end to take profits. Conversely, untimely ownership of Sinclair Broadcast Group, which owns local television networks, dragged on the fund's relative return, as did a larger-than-index stake in World Wrestling Entertainment.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Communication Services Portfolio

Investment Summary (Unaudited)

Top Ten Stocks as of February 29, 2020

| % of fund's net assets | |

| Alphabet, Inc. Class A | 24.2 |

| Facebook, Inc. Class A | 17.3 |

| Activision Blizzard, Inc. | 7.8 |

| The Walt Disney Co. | 4.8 |

| Netflix, Inc. | 4.7 |

| Liberty Broadband Corp. Class A | 4.7 |

| Verizon Communications, Inc. | 4.4 |

| Liberty Global PLC Class C | 3.9 |

| Lyft, Inc. | 3.1 |

| T-Mobile U.S., Inc. | 2.6 |

| 77.5 |

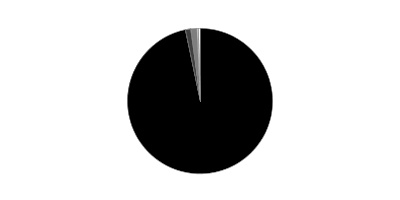

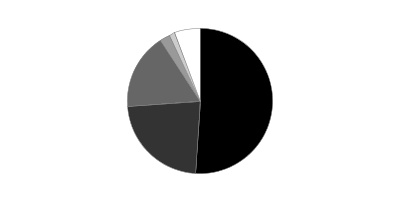

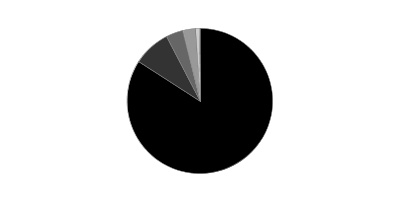

Top Industries (% of fund's net assets)

| As of February 29, 2020 | ||

| Interactive Media & Services | 44.3% | |

| Entertainment | 24.0% | |

| Media | 17.8% | |

| Diversified Telecommunication Services | 5.1% | |

| Wireless Telecommunication Services | 4.1% | |

| All Others* | 4.7% | |

* Includes short-term investments and net other assets (liabilities).

Communication Services Portfolio

Schedule of Investments February 29, 2020

Showing Percentage of Net Assets

| Common Stocks - 99.4% | |||

| Shares | Value | ||

| Communications Equipment - 1.0% | |||

| Communications Equipment - 1.0% | |||

| EchoStar Holding Corp. Class A (a) | 169,200 | $5,908,464 | |

| Diversified Telecommunication Services - 5.1% | |||

| Alternative Carriers - 0.7% | |||

| GCI Liberty, Inc. (a) | 28,132 | 1,944,203 | |

| Vonage Holdings Corp. (a) | 275,500 | 2,468,480 | |

| 4,412,683 | |||

| Integrated Telecommunication Services - 4.4% | |||

| Verizon Communications, Inc. | 482,400 | 26,126,784 | |

| TOTAL DIVERSIFIED TELECOMMUNICATION SERVICES | 30,539,467 | ||

| Entertainment - 24.0% | |||

| Interactive Home Entertainment - 12.9% | |||

| Activision Blizzard, Inc. | 799,100 | 46,451,683 | |

| DouYu International Holdings Ltd. ADR | 579,465 | 4,502,443 | |

| Electronic Arts, Inc. (a) | 132,500 | 13,431,525 | |

| Take-Two Interactive Software, Inc. (a) | 89,300 | 9,597,964 | |

| Zynga, Inc. (a) | 430,400 | 2,887,984 | |

| 76,871,599 | |||

| Movies & Entertainment - 11.1% | |||

| Lions Gate Entertainment Corp.: | |||

| Class A (a) | 34,500 | 274,275 | |

| Class B (a) | 282,834 | 2,092,972 | |

| Netflix, Inc. (a) | 75,800 | 27,972,474 | |

| Spotify Technology SA (a) | 33,800 | 4,634,656 | |

| The Walt Disney Co. | 243,871 | 28,691,423 | |

| World Wrestling Entertainment, Inc. Class A | 58,600 | 2,740,722 | |

| 66,406,522 | |||

| TOTAL ENTERTAINMENT | 143,278,121 | ||

| Interactive Media & Services - 44.3% | |||

| Interactive Media & Services - 44.3% | |||

| Alphabet, Inc. Class A (a) | 107,600 | 144,103,300 | |

| ANGI Homeservices, Inc. Class A (a)(b) | 1,091,300 | 7,780,969 | |

| Facebook, Inc. Class A (a) | 534,200 | 102,817,474 | |

| Match Group, Inc. (a)(b) | 18,200 | 1,183,000 | |

| Twitter, Inc. (a) | 151,400 | 5,026,480 | |

| Zillow Group, Inc. Class A (a) | 51,100 | 2,844,737 | |

| 263,755,960 | |||

| Media - 17.8% | |||

| Broadcasting - 4.9% | |||

| CBS Corp. Class B | 380,800 | 9,371,488 | |

| Liberty Media Corp.: | |||

| Liberty Media Class A (a) | 250,962 | 9,408,565 | |

| Liberty SiriusXM Series A (a) | 129,700 | 5,793,699 | |

| Sinclair Broadcast Group, Inc. Class A | 200,200 | 4,646,642 | |

| 29,220,394 | |||

| Cable & Satellite - 12.9% | |||

| Altice U.S.A., Inc. Class A (a) | 120,500 | 3,116,130 | |

| Comcast Corp. Class A | 367,200 | 14,845,896 | |

| DISH Network Corp. Class A (a) | 105,639 | 3,541,019 | |

| Liberty Broadband Corp. Class A (a) | 223,523 | 27,645,325 | |

| Liberty Global PLC Class C (a) | 1,253,400 | 23,300,706 | |

| Liberty Latin America Ltd. Class C (a) | 190,800 | 2,898,252 | |

| SES SA (France) (depositary receipt) | 105,700 | 1,211,995 | |

| 76,559,323 | |||

| TOTAL MEDIA | 105,779,717 | ||

| Road & Rail - 3.1% | |||

| Trucking - 3.1% | |||

| Lyft, Inc. | 483,300 | 18,423,396 | |

| Wireless Telecommunication Services - 4.1% | |||

| Wireless Telecommunication Services - 4.1% | |||

| Millicom International Cellular SA | 37,600 | 1,711,176 | |

| Sprint Corp. (a) | 771,211 | 7,087,429 | |

| T-Mobile U.S., Inc. (a) | 174,600 | 15,741,936 | |

| 24,540,541 | |||

| TOTAL COMMON STOCKS | |||

| (Cost $482,443,505) | 592,225,666 | ||

| Money Market Funds - 1.6% | |||

| Fidelity Securities Lending Cash Central Fund 1.60% (c)(d) | |||

| (Cost $9,111,739) | 9,110,828 | 9,111,739 | |

| TOTAL INVESTMENT IN SECURITIES - 101.0% | |||

| (Cost $491,555,244) | 601,337,405 | ||

| NET OTHER ASSETS (LIABILITIES) - (1.0)% | (5,662,157) | ||

| NET ASSETS - 100% | $595,675,248 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Investment made with cash collateral received from securities on loan.

(d) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $112,503 |

| Fidelity Securities Lending Cash Central Fund | 116,550 |

| Total | $229,053 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of February 29, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Common Stocks | $592,225,666 | $591,013,671 | $1,211,995 | $-- |

| Money Market Funds | 9,111,739 | 9,111,739 | -- | -- |

| Total Investments in Securities: | $601,337,405 | $600,125,410 | $1,211,995 | $-- |

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 29, 2020 | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $8,956,756) — See accompanying schedule: Unaffiliated issuers (cost $482,443,505) | $592,225,666 | |

| Fidelity Central Funds (cost $9,111,739) | 9,111,739 | |

| Total Investment in Securities (cost $491,555,244) | $601,337,405 | |

| Receivable for investments sold | 11,742,384 | |

| Receivable for fund shares sold | 1,060,106 | |

| Distributions receivable from Fidelity Central Funds | 24,584 | |

| Prepaid expenses | 3,734 | |

| Other receivables | 5,272 | |

| Total assets | 614,173,485 | |

| Liabilities | ||

| Payable to custodian bank | $1,041,427 | |

| Payable for investments purchased | 3,391,393 | |

| Payable for fund shares redeemed | 4,500,980 | |

| Accrued management fee | 292,177 | |

| Distribution and service plan fees payable | 5,118 | |

| Other affiliated payables | 113,113 | |

| Other payables and accrued expenses | 43,704 | |

| Collateral on securities loaned | 9,110,325 | |

| Total liabilities | 18,498,237 | |

| Net Assets | $595,675,248 | |

| Net Assets consist of: | ||

| Paid in capital | $475,585,897 | |

| Total accumulated earnings (loss) | 120,089,351 | |

| Net Assets | $595,675,248 | |

| Net Asset Value and Maximum Offering Price | ||

| Class A: | ||

| Net Asset Value and redemption price per share ($9,947,014 ÷ 164,073 shares)(a) | $60.63 | |

| Maximum offering price per share (100/94.25 of $60.63) | $64.33 | |

| Class M: | ||

| Net Asset Value and redemption price per share ($2,263,711 ÷ 37,402 shares)(a) | $60.52 | |

| Maximum offering price per share (100/96.50 of $60.52) | $62.72 | |

| Class C: | ||

| Net Asset Value and offering price per share ($1,982,191 ÷ 32,928 shares)(a) | $60.20 | |

| Communication Services: | ||

| Net Asset Value, offering price and redemption price per share ($577,156,767 ÷ 9,489,834 shares) | $60.82 | |

| Class I: | ||

| Net Asset Value, offering price and redemption price per share ($2,492,813 ÷ 40,998 shares) | $60.80 | |

| Class Z: | ||

| Net Asset Value, offering price and redemption price per share ($1,832,752 ÷ 30,120 shares) | $60.85 |

(a) Redemption price per share is equal to net asset value less any applicable contingent deferred sales charge.

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Year ended February 29, 2020 | ||

| Investment Income | ||

| Dividends | $3,451,624 | |

| Income from Fidelity Central Funds (including $116,550 from security lending) | 229,053 | |

| Total income | 3,680,677 | |

| Expenses | ||

| Management fee | $3,337,779 | |

| Transfer agent fees | 1,120,685 | |

| Distribution and service plan fees | 29,135 | |

| Accounting and security lending fees | 228,790 | |

| Custodian fees and expenses | 15,609 | |

| Independent trustees' fees and expenses | 3,324 | |

| Registration fees | 109,915 | |

| Audit | 45,346 | |

| Legal | 1,654 | |

| Interest | 2,721 | |

| Miscellaneous | 4,313 | |

| Total expenses before reductions | 4,899,271 | |

| Expense reductions | (60,581) | |

| Total expenses after reductions | 4,838,690 | |

| Net investment income (loss) | (1,158,013) | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 57,250,691 | |

| Fidelity Central Funds | 1,478 | |

| Foreign currency transactions | 2,429 | |

| Total net realized gain (loss) | 57,254,598 | |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 13,008,696 | |

| Fidelity Central Funds | (65) | |

| Total change in net unrealized appreciation (depreciation) | 13,008,631 | |

| Net gain (loss) | 70,263,229 | |

| Net increase (decrease) in net assets resulting from operations | $69,105,216 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Year ended February 29, 2020 | Year ended February 28, 2019 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $(1,158,013) | $844,441 |

| Net realized gain (loss) | 57,254,598 | 199,087,558 |

| Change in net unrealized appreciation (depreciation) | 13,008,631 | (164,960,880) |

| Net increase (decrease) in net assets resulting from operations | 69,105,216 | 34,971,119 |

| Distributions to shareholders | (180,128,842) | (67,435,980) |

| Share transactions - net increase (decrease) | 141,718,647 | 88,069,949 |

| Total increase (decrease) in net assets | 30,695,021 | 55,605,088 |

| Net Assets | ||

| Beginning of period | 564,980,227 | 509,375,139 |

| End of period | $595,675,248 | $564,980,227 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Communication Services Portfolio Class A

| Years ended February 28, | 2020 A | 2019 B |

| Selected Per–Share Data | ||

| Net asset value, beginning of period | $74.84 | $78.20 |

| Income from Investment Operations | ||

| Net investment income (loss)C | (.30) | (.12) |

| Net realized and unrealized gain (loss) | 8.78 | 2.68 |

| Total from investment operations | 8.48 | 2.56 |

| Distributions from net investment income | – | (.14) |

| Distributions from net realized gain | (22.69) | (5.77) |

| Total distributions | (22.69) | (5.91) |

| Net asset value, end of period | $60.63 | $74.85 |

| Total ReturnD,E,F | 11.90% | 3.83% |

| Ratios to Average Net AssetsG,H | ||

| Expenses before reductions | 1.07% | 1.13%I |

| Expenses net of fee waivers, if any | 1.07% | 1.12%I |

| Expenses net of all reductions | 1.06% | 1.11%I |

| Net investment income (loss) | (.47)% | (.68)%I |

| Supplemental Data | ||

| Net assets, end of period (000 omitted) | $9,947 | $715 |

| Portfolio turnover rateJ | 73% | 107% |

A For the year ended February 29.

B For the period November 30, 2018 (commencement of sale of shares) to February 28, 2019.

C Calculated based on average shares outstanding during the period.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio Class M

| Years ended February 28, | 2020 A | 2019 B |

| Selected Per–Share Data | ||

| Net asset value, beginning of period | $74.82 | $78.20 |

| Income from Investment Operations | ||

| Net investment income (loss)C | (.48) | (.16) |

| Net realized and unrealized gain (loss) | 8.75 | 2.67 |

| Total from investment operations | 8.27 | 2.51 |

| Distributions from net investment income | – | (.12) |

| Distributions from net realized gain | (22.57) | (5.77) |

| Total distributions | (22.57) | (5.89) |

| Net asset value, end of period | $60.52 | $74.82 |

| Total ReturnD,E,F | 11.58% | 3.76% |

| Ratios to Average Net AssetsG,H | ||

| Expenses before reductions | 1.35% | 1.36%I |

| Expenses net of fee waivers, if any | 1.35% | 1.35%I |

| Expenses net of all reductions | 1.34% | 1.34%I |

| Net investment income (loss) | (.75)% | (.90)%I |

| Supplemental Data | ||

| Net assets, end of period (000 omitted) | $2,264 | $485 |

| Portfolio turnover rateJ | 73% | 107% |

A For the year ended February 29.

B For the period November 30, 2018 (commencement of sale of shares) to February 28, 2019.

C Calculated based on average shares outstanding during the period.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the sales charges.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio Class C

| Years ended February 28, | 2020 A | 2019 B |

| Selected Per–Share Data | ||

| Net asset value, beginning of period | $74.76 | $78.20 |

| Income from Investment Operations | ||

| Net investment income (loss)C | (.81) | (.25) |

| Net realized and unrealized gain (loss) | 8.74 | 2.67 |

| Total from investment operations | 7.93 | 2.42 |

| Distributions from net investment income | – | (.09) |

| Distributions from net realized gain | (22.49) | (5.77) |

| Total distributions | (22.49) | (5.86) |

| Net asset value, end of period | $60.20 | $74.76 |

| Total ReturnD,E,F | 11.01% | 3.63% |

| Ratios to Average Net AssetsG,H | ||

| Expenses before reductions | 1.86% | 1.87%I |

| Expenses net of fee waivers, if any | 1.86% | 1.85%I |

| Expenses net of all reductions | 1.85% | 1.84%I |

| Net investment income (loss) | (1.26)% | (1.37)%I |

| Supplemental Data | ||

| Net assets, end of period (000 omitted) | $1,982 | $377 |

| Portfolio turnover rateJ | 73% | 107% |

A For the year ended February 29.

B For the period November 30, 2018 (commencement of sale of shares) to February 28, 2019.

C Calculated based on average shares outstanding during the period.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Total returns do not include the effect of the contingent deferred sales charge.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Annualized

J Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio

| Years ended February 28, | 2020 A | 2019 | 2018 | 2017 | 2016 A |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $74.88 | $79.70 | $80.75 | $68.59 | $82.48 |

| Income from Investment Operations | |||||

| Net investment income (loss)B | (.12) | .13 | .21 | .22 | .27 |

| Net realized and unrealized gain (loss) | 8.79 | 5.31 | 3.14 | 17.53 | (8.82) |

| Total from investment operations | 8.67 | 5.44 | 3.35 | 17.75 | (8.55) |

| Distributions from net investment income | – | (.20) | (.16) | (.33) | (.23) |

| Distributions from net realized gain | (22.73) | (10.06) | (4.23) | (5.26) | (5.12) |

| Total distributions | (22.73) | (10.26) | (4.40)C | (5.59) | (5.34)D |

| Redemption fees added to paid in capitalB | – | – | –E | –E | –E |

| Net asset value, end of period | $60.82 | $74.88 | $79.70 | $80.75 | $68.59 |

| Total ReturnF | 12.22% | 8.12% | 4.16% | 26.85% | (10.88)% |

| Ratios to Average Net AssetsG,H | |||||

| Expenses before reductions | .78% | .82% | .80% | .82% | .81% |

| Expenses net of fee waivers, if any | .78% | .81% | .80% | .82% | .81% |

| Expenses net of all reductions | .77% | .80% | .79% | .82% | .80% |

| Net investment income (loss) | (.18)% | .17% | .26% | .30% | .34% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $577,157 | $562,422 | $509,375 | $680,392 | $576,118 |

| Portfolio turnover rateI | 73% | 107% | 22% | 33% | 42% |

A For the year ended February 29.

B Calculated based on average shares outstanding during the period.

C Total distributions of $4.40 per share is comprised of distributions from net investment income of $.163 and distributions from net realized gain of $4.233 per share.

D Total distributions of $5.34 per share is comprised of distributions from net investment income of $.227 and distributions from net realized gain of $5.115 per share.

E Amount represents less than $.005 per share.

F Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

G Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

H Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio Class I

| Years ended February 28, | 2020 A | 2019 B |

| Selected Per–Share Data | ||

| Net asset value, beginning of period | $74.88 | $78.20 |

| Income from Investment Operations | ||

| Net investment income (loss)C | (.11) | (.06) |

| Net realized and unrealized gain (loss) | 8.79 | 2.67 |

| Total from investment operations | 8.68 | 2.61 |

| Distributions from net investment income | – | (.15) |

| Distributions from net realized gain | (22.76) | (5.77) |

| Total distributions | (22.76) | (5.92) |

| Net asset value, end of period | $60.80 | $74.89 |

| Total ReturnD,E | 12.22% | 3.91% |

| Ratios to Average Net AssetsF,G | ||

| Expenses before reductions | .77% | .70%H |

| Expenses net of fee waivers, if any | .77% | .69%H |

| Expenses net of all reductions | .76% | .68%H |

| Net investment income (loss) | (.17)% | (.30)%H |

| Supplemental Data | ||

| Net assets, end of period (000 omitted) | $2,493 | $452 |

| Portfolio turnover rateI | 73% | 107% |

A For the year ended February 29.

B For the period November 30, 2018 (commencement of sale of shares) to February 28, 2019.

C Calculated based on average shares outstanding during the period.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

Communication Services Portfolio Class Z

| Years ended February 28, | 2020 A | 2019 B |

| Selected Per–Share Data | ||

| Net asset value, beginning of period | $74.89 | $78.20 |

| Income from Investment Operations | ||

| Net investment income (loss)C | (.03) | (.03) |

| Net realized and unrealized gain (loss) | 8.80 | 2.65 |

| Total from investment operations | 8.77 | 2.62 |

| Distributions from net investment income | – | (.16) |

| Distributions from net realized gain | (22.81) | (5.77) |

| Total distributions | (22.81) | (5.93) |

| Net asset value, end of period | $60.85 | $74.89 |

| Total ReturnD,E | 12.38% | 3.92% |

| Ratios to Average Net AssetsF,G | ||

| Expenses before reductions | .65% | .64%H |

| Expenses net of fee waivers, if any | .65% | .62%H |

| Expenses net of all reductions | .64% | .61%H |

| Net investment income (loss) | (.05)% | (.16)%H |

| Supplemental Data | ||

| Net assets, end of period (000 omitted) | $1,833 | $529 |

| Portfolio turnover rateI | 73% | 107% |

A For the year ended February 29.

B For the period November 30, 2018 (commencement of sale of shares) to February 28, 2019.

C Calculated based on average shares outstanding during the period.

D Total returns for periods of less than one year are not annualized.

E Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

F Fees and expenses of any underlying Fidelity Central Funds are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of the expenses of any underlying Fidelity Central Funds.

G Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from brokerage service arrangements or reductions from other expense offset arrangements and do not represent the amount paid by the class during periods when reimbursements or reductions occur. Expense ratios before reductions for start-up periods may not be representative of longer-term operating periods. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from brokerage service arrangements or other expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the class.

H Annualized

I Amount does not include the portfolio activity of any underlying Fidelity Central Funds.

See accompanying notes which are an integral part of the financial statements.

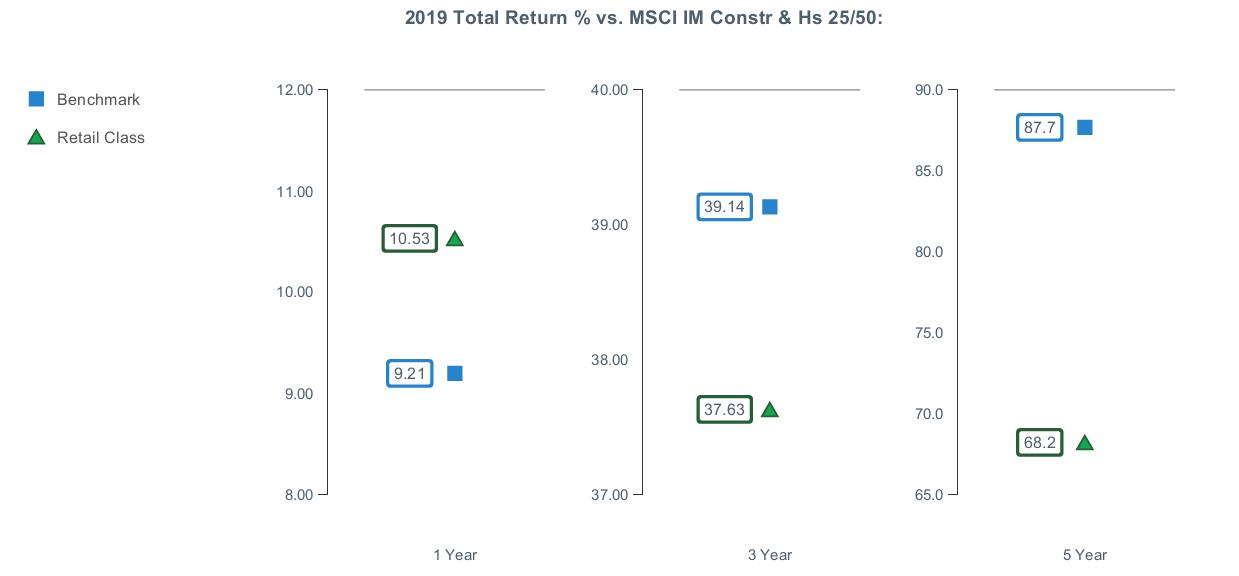

Construction and Housing Portfolio

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The hypothetical investment and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund’s total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

| For the periods ended February 29, 2020 | Past 1 year | Past 5 years | Past 10 years |

| Construction and Housing Portfolio | 17.10% | 8.37% | 14.14% |

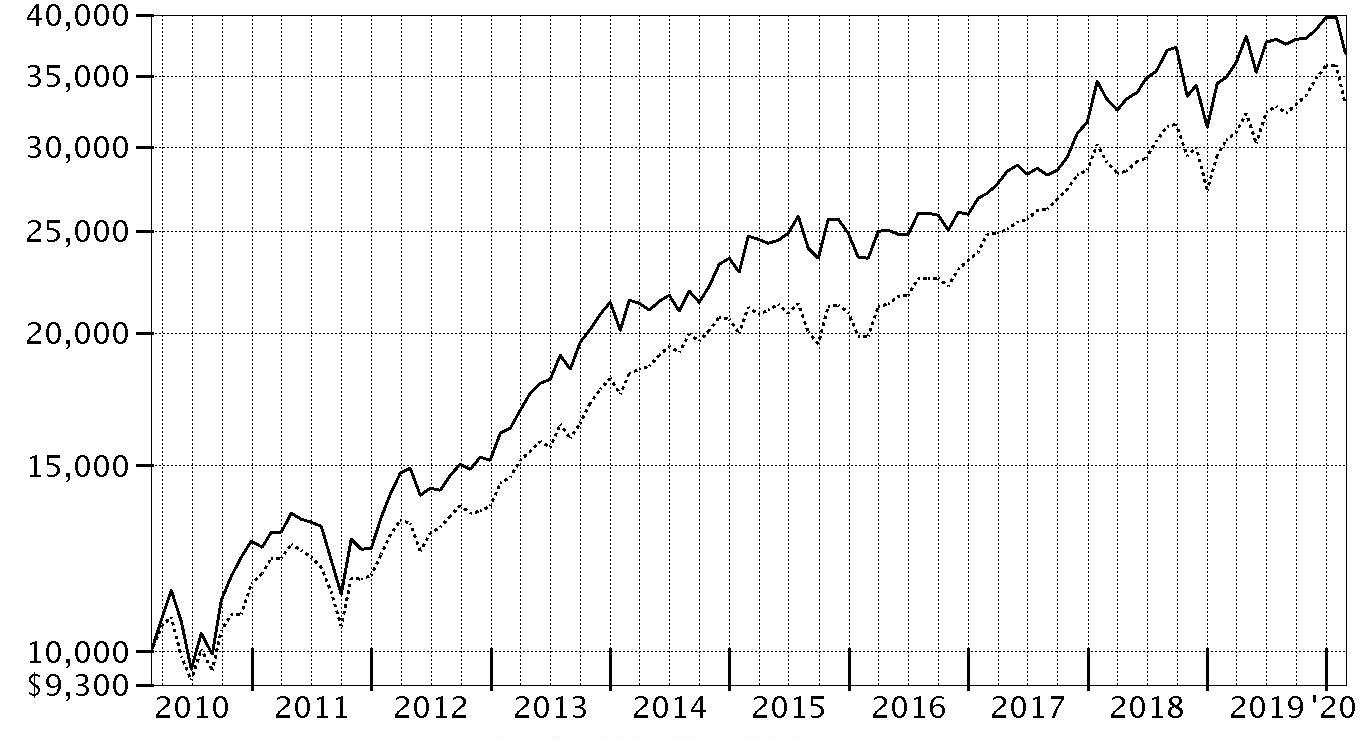

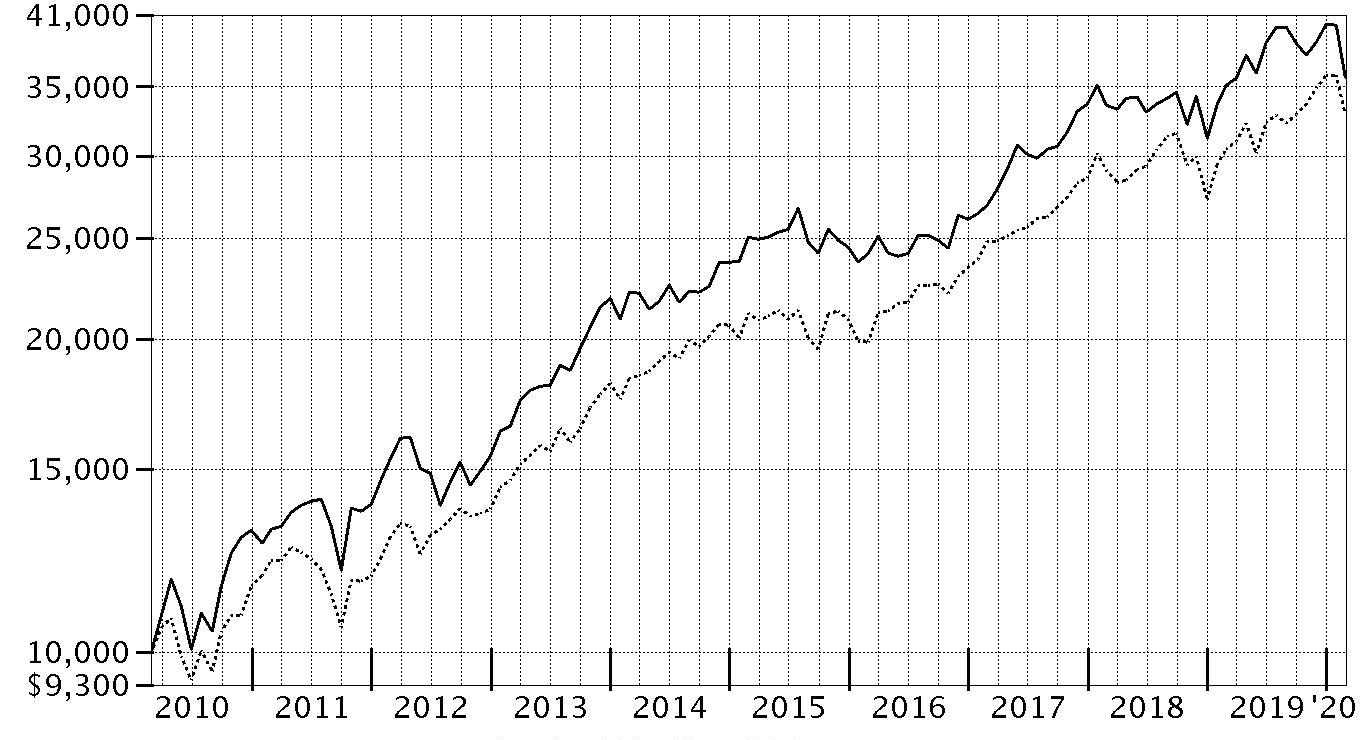

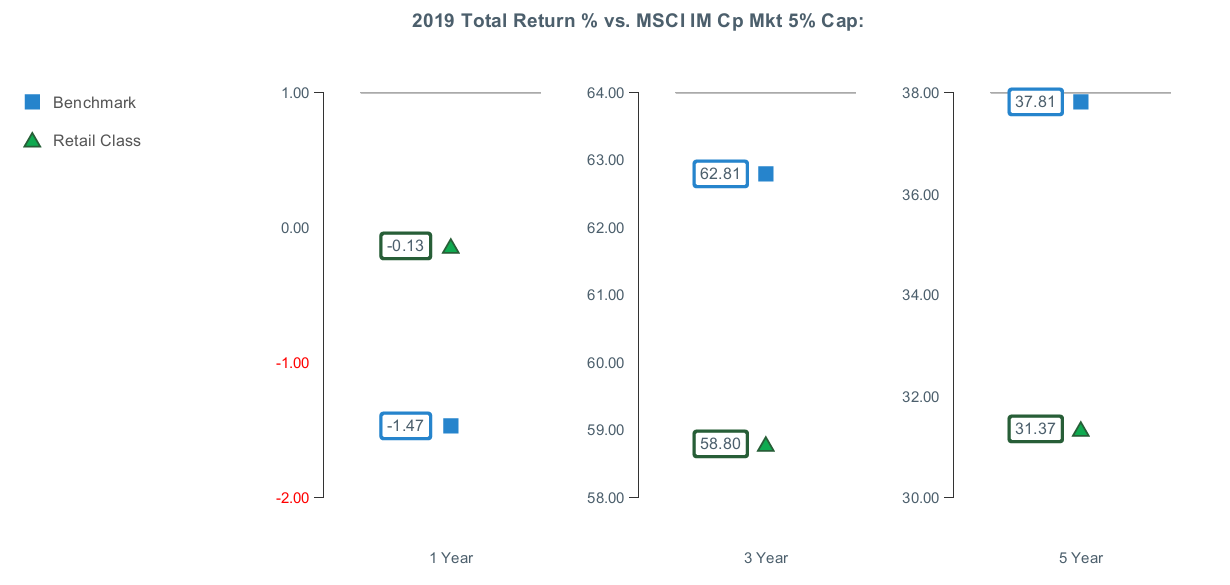

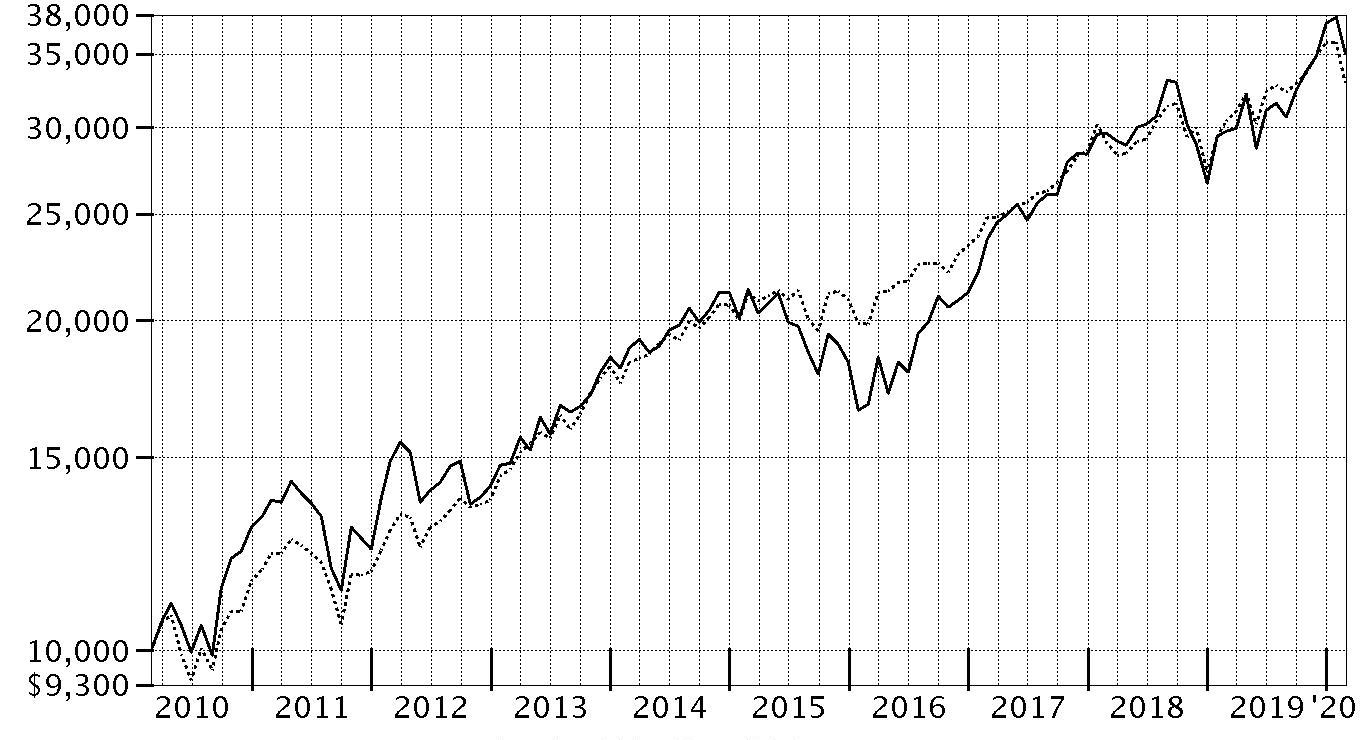

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Construction and Housing Portfolio on February 28, 2010.

The chart shows how the value of your investment would have changed, and also shows how the S&P 500® Index performed over the same period.

| Period Ending Values | ||

| $37,538 | Construction and Housing Portfolio | |

| $32,918 | S&P 500® Index | |

Construction and Housing Portfolio

Management's Discussion of Fund Performance

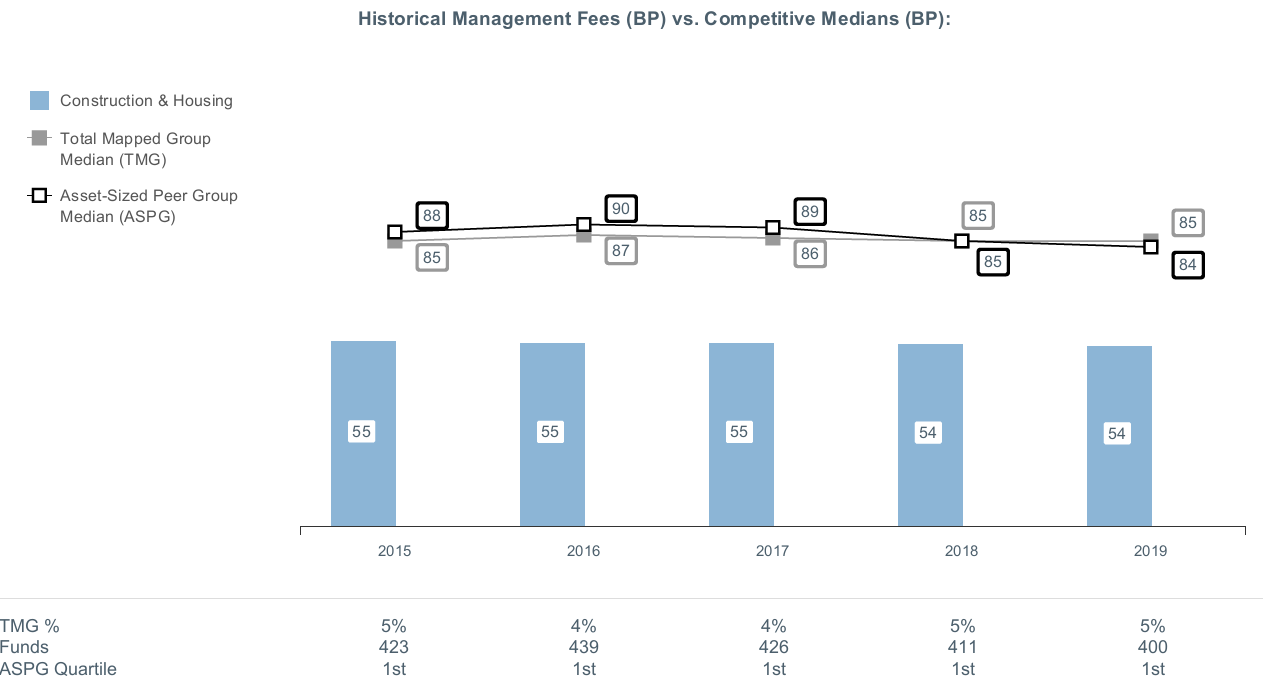

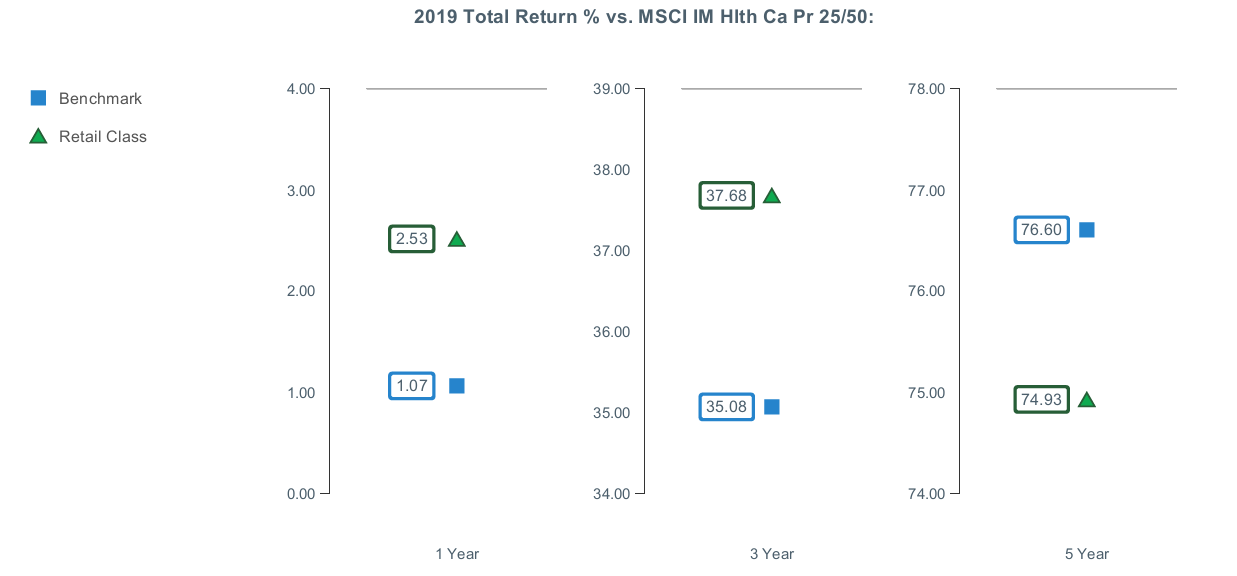

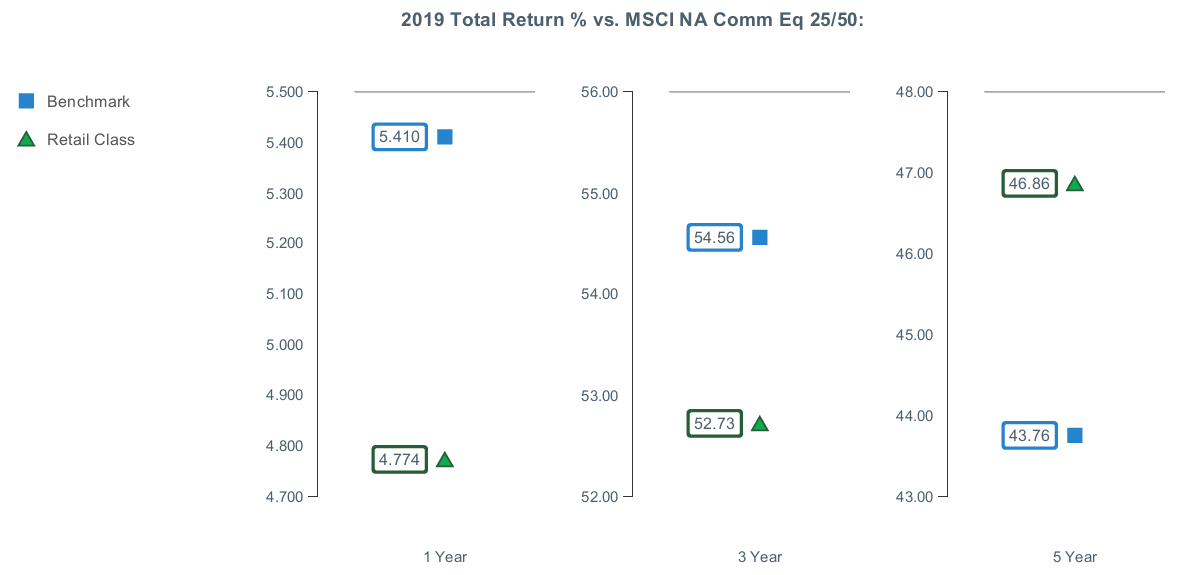

Market Recap: U.S. stocks stalled to begin the new year and declined in late February, as the outbreak and spread of the new coronavirus threatened to hamper global economic growth and corporate earnings. For the 12 months ending February 29, 2020, the U.S. equity bellwether S&P 500® index gained 8.19%. The period began with equities rising amid upbeat company earnings and signs the U.S. Federal Reserve may pause on rates. The uptrend extended until May, when the index dipped as trade talks between the U.S. and China broke down. The bull market roared back to record a series of highs in July, when the Fed cut interest rates for the first time since 2008. Volatility intensified in August, as the Treasury yield curve inverted, which some investors viewed as a sign the U.S. economy could be heading for recession. But the market proved resilient, hitting a new high on October 30, when the Fed lowered rates for the third time in 2019, and moving higher through December 31. Following a roughly flat January, stocks sank in late February, after a surge in coronavirus cases outside China created considerable uncertainty and pushed investors to safer asset classes. By sector, information technology (+27%) led the way by a wide margin, followed by utilities and communication services (+13% each). In contrast, energy (-25%) was by far the weakest category, struggling due to sluggish oil prices. Other notable laggards included materials and industrials (-2% each).Comments from Portfolio Manager Neil Nabar: For the fiscal year ending February 29, 2020, the fund gained 17.10%, besting the 14.17% advance of the MSCI U.S. IMI Construction & Housing 25/50 Index and well ahead of the S&P 500®. Construction and housing stocks performed well over the period, benefiting from declining interest rates and strong employment data. Within the MSCI industry index, the biggest subindustry winner was homebuilding (+35%), a group closely tied to interest rates. Stock picks in the homebuilding and construction & engineering segments provided the biggest boost to the fund’s relative performance, with added gains from investment choices in the residential REITS (real estate investment trusts) and building products groups. Versus the index, the fund’s top individual contributors were construction & engineering company Williams Scotsman (+72%), which benefited from price increases, and affordable, entry-level homebuilders Skyline Champion (+26%) and D.R. Horton (+38%), which target an underserved end of the market. Conversely, security selection in the home improvement retail group detracted from the fund’s relative performance, mainly due to an overweighting in Lowe’s Companies (+3%). The stock was hindered by choppy execution by management, resulting in a longer-than-expected turnaround. All the stocks mentioned here were overweightings, and Lowe’s and D.R. Horton were top-10 fund positions at period end.The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Construction and Housing Portfolio

Investment Summary (Unaudited)

Top Ten Stocks as of February 29, 2020

| % of fund's net assets | |

| The Home Depot, Inc. | 16.9 |

| Lowe's Companies, Inc. | 16.5 |

| Essex Property Trust, Inc. | 8.6 |

| Johnson Controls International PLC | 5.6 |

| Camden Property Trust (SBI) | 4.8 |

| Digital Realty Trust, Inc. | 4.2 |

| D.R. Horton, Inc. | 3.9 |

| Vulcan Materials Co. | 3.6 |

| American Homes 4 Rent Class A | 2.9 |

| Fortune Brands Home & Security, Inc. | 2.3 |

| 69.3 |

Top Industries (% of fund's net assets)

| As of February 29, 2020 | ||

| Specialty Retail | 33.4% | |

| Equity Real Estate Investment Trusts (Reits) | 22.6% | |

| Building Products | 12.4% | |

| Household Durables | 11.9% | |

| Construction & Engineering | 6.8% | |

| All Others* | 12.9% | |

* Includes short-term investments and net other assets (liabilities).

Construction and Housing Portfolio

Schedule of Investments February 29, 2020

Showing Percentage of Net Assets

| Common Stocks - 99.5% | |||

| Shares | Value | ||

| Building Products - 12.4% | |||

| Building Products - 12.4% | |||

| A.O. Smith Corp. | 97,100 | $3,840,305 | |

| Allegion PLC | 16,800 | 1,931,832 | |

| Fortune Brands Home & Security, Inc. | 122,000 | 7,533,500 | |

| Johnson Controls International PLC | 488,334 | 17,858,374 | |

| Patrick Industries, Inc. | 54,200 | 2,863,386 | |

| Simpson Manufacturing Co. Ltd. | 27,216 | 2,161,767 | |

| Universal Forest Products, Inc. | 74,895 | 3,509,580 | |

| 39,698,744 | |||

| Commercial Services & Supplies - 1.1% | |||

| Environmental & Facility Services - 1.1% | |||

| ABM Industries, Inc. | 105,432 | 3,470,821 | |

| Construction & Engineering - 6.8% | |||

| Construction & Engineering - 6.8% | |||

| AECOM (a) | 88,476 | 3,976,111 | |

| Comfort Systems U.S.A., Inc. | 56,600 | 2,389,652 | |

| Construction Partners, Inc. Class A (a)(b) | 165,500 | 2,815,155 | |

| Dycom Industries, Inc. (a)(b) | 55,800 | 1,649,448 | |

| Granite Construction, Inc. | 84,400 | 1,715,008 | |

| Jacobs Engineering Group, Inc. | 12,002 | 1,108,265 | |

| Quanta Services, Inc. | 132,700 | 5,059,851 | |

| Williams Scotsman Corp. (a)(b) | 178,067 | 3,123,295 | |

| 21,836,785 | |||

| Construction Materials - 5.1% | |||

| Construction Materials - 5.1% | |||

| Forterra, Inc. (a) | 112,500 | 1,523,250 | |

| Summit Materials, Inc. (a) | 159,000 | 3,106,860 | |

| Vulcan Materials Co. | 96,331 | 11,584,766 | |

| 16,214,876 | |||

| Electrical Equipment - 1.0% | |||

| Electrical Components & Equipment - 1.0% | |||

| Atkore International Group, Inc. (a) | 82,500 | 3,045,075 | |

| Equity Real Estate Investment Trusts (REITs) - 22.6% | |||

| Residential REITs - 18.4% | |||

| American Homes 4 Rent Class A | 362,200 | 9,377,358 | |

| Camden Property Trust (SBI) | 143,200 | 15,176,336 | |

| Equity Lifestyle Properties, Inc. | 99,974 | 6,831,223 | |

| Essex Property Trust, Inc. | 96,800 | 27,429,248 | |

| 58,814,165 | |||

| Specialized REITs - 4.2% | |||

| Digital Realty Trust, Inc. | 111,700 | 13,416,287 | |

| TOTAL EQUITY REAL ESTATE INVESTMENT TRUSTS (REITS) | 72,230,452 | ||

| Household Durables - 11.9% | |||

| Homebuilding - 11.9% | |||

| Blu Homes, Inc. (a)(c)(d) | 11,990,913 | 20,739 | |

| D.R. Horton, Inc. | 230,000 | 12,252,100 | |

| M.D.C. Holdings, Inc. | 103,400 | 4,067,756 | |

| NVR, Inc. (a) | 2,013 | 7,382,033 | |

| PulteGroup, Inc. | 166,500 | 6,693,300 | |

| Skyline Champion Corp. (a) | 129,090 | 3,289,213 | |

| TopBuild Corp. (a) | 42,300 | 4,272,300 | |

| 37,977,441 | |||

| Mortgage Real Estate Investment Trusts - 1.6% | |||

| Mortgage REITs - 1.6% | |||

| MFA Financial, Inc. | 701,800 | 5,074,014 | |

| Paper & Forest Products - 1.1% | |||

| Forest Products - 1.1% | |||

| Louisiana-Pacific Corp. | 117,800 | 3,351,410 | |

| Real Estate Management & Development - 1.7% | |||

| Diversified Real Estate Activities - 0.7% | |||

| The RMR Group, Inc. | 61,300 | 2,284,038 | |

| Real Estate Services - 1.0% | |||

| Jones Lang LaSalle, Inc. | 20,600 | 3,044,062 | |

| TOTAL REAL ESTATE MANAGEMENT & DEVELOPMENT | 5,328,100 | ||

| Specialty Retail - 33.4% | |||

| Home Improvement Retail - 33.4% | |||

| Lowe's Companies, Inc. | 492,470 | 52,482,528 | |

| The Home Depot, Inc. | 248,131 | 54,052,859 | |

| 106,535,387 | |||

| Trading Companies & Distributors - 0.8% | |||

| Trading Companies & Distributors - 0.8% | |||

| Beacon Roofing Supply, Inc. (a) | 88,300 | 2,622,510 | |

| TOTAL COMMON STOCKS | |||

| (Cost $245,870,305) | 317,385,615 | ||

| Money Market Funds - 1.2% | |||

| Fidelity Securities Lending Cash Central Fund 1.60% (e)(f) | |||

| (Cost $3,874,950) | 3,874,563 | 3,874,950 | |

| TOTAL INVESTMENT IN SECURITIES - 100.7% | |||

| (Cost $249,745,255) | 321,260,565 | ||

| NET OTHER ASSETS (LIABILITIES) - (0.7)% | (2,355,194) | ||

| NET ASSETS - 100% | $318,905,371 |

Legend

(a) Non-income producing

(b) Security or a portion of the security is on loan at period end.

(c) Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $20,739 or 0.0% of net assets.

(d) Level 3 security

(e) Investment made with cash collateral received from securities on loan.

(f) Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Acquisition Cost |

| Blu Homes, Inc. | 6/10/13 | $4,000,001 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Cash Central Fund | $55,378 |

| Fidelity Securities Lending Cash Central Fund | 469 |

| Total | $55,847 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable. Amount for Fidelity Securities Lending Cash Central Fund represents the income earned on investing cash collateral, less rebates paid to borrowers and any lending agent fees associated with the loan, plus any premium payments received for lending certain types of securities.

Investment Valuation

The following is a summary of the inputs used, as of February 29, 2020, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Common Stocks | $317,385,615 | $317,364,876 | $-- | $20,739 |

| Money Market Funds | 3,874,950 | 3,874,950 | -- | -- |

| Total Investments in Securities: | $321,260,565 | $321,239,826 | $-- | $20,739 |

See accompanying notes which are an integral part of the financial statements.

Construction and Housing Portfolio

Financial Statements

Statement of Assets and Liabilities

| February 29, 2020 | ||

| Assets | ||

| Investment in securities, at value (including securities loaned of $3,670,675) — See accompanying schedule: Unaffiliated issuers (cost $245,870,305) | $317,385,615 | |

| Fidelity Central Funds (cost $3,874,950) | 3,874,950 | |