SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

UNIFIED WESTERN GROCERS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

UNIFIED WESTERN GROCERS, INC.

5200 Sheila Street, Commerce, California 90040

Notice of Annual Meeting of Shareholders

February 17, 2004

The annual meeting of shareholders of Unified Western Grocers, Inc., a California corporation, will be held at the Sheraton Cerritos Hotel, 12725 Center Court Drive, Cerritos, California 90703 on Tuesday, February 17, 2004 at 11:00 a.m. (Pacific Standard Time), for the following purposes:

1. To elect the sixteen members of the Board of Directors for the ensuing year, thirteen by the holders of Class A Shares and three by the holders of Class B Shares.

2. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The names of the nominees intended to be presented by the Board of Directors for election as directors for the ensuing year are set forth in the accompanying proxy statement.

Only shareholders of record at the close of business on December 23, 2003 will be entitled to notice of and to vote at the meeting or any adjournment or postponement thereof.

All shareholders are cordially invited to attend the meeting in person.

WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING, IT IS REQUESTED THAT YOU COMPLETE, DATE AND SIGN THE ENCLOSED PROXY RELATING TO THE ANNUAL MEETING AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. YOU MAY REVOKE YOUR PROXY IF YOU ATTEND THE MEETING AND WISH TO VOTE YOUR SHARES IN PERSON. THE PROXY MAY BE REVOKED AT ANY TIME BEFORE ITS EXERCISE.

By Order of the Board of Directors

Robert M. Ling, Jr.,

Executive Vice President, General Counsel and

Secretary

January 13, 2004

YOUR VOTE IS IMPORTANT

PLEASE SIGN, DATE AND RETURN YOUR PROXY

UNIFIED WESTERN GROCERS, INC.

5200 Sheila Street, Commerce, California 90040

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To be Held on Tuesday, February 17, 2004

INTRODUCTION

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Unified Western Grocers, Inc. (“Unified” or the “Company”) of proxies for use at the annual meeting of shareholders (the “Annual Meeting”) to be held at the Sheraton Cerritos Hotel, 12725 Center Court Drive, Cerritos, California 90703 on Tuesday, February 17, 2004 at 11:00 a.m. (Pacific Standard Time), or at any adjournment or postponement thereof, for the purposes set forth herein and in the attached Notice of Annual Meeting of Shareholders.

A shareholder giving a proxy may revoke it at any time before it is exercised by filing with the Secretary of the Company a written revocation or a fully executed proxy bearing a later date. A proxy may also be revoked if the shareholder who has executed it is present at the meeting and elects to vote in person.

Only the holders of record of Class A Shares and Class B Shares at the close of business on December 23, 2003 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. On that date, the Company had outstanding 83,950 Class A Shares, 501,593 Class B Shares and 36,924 Class E Shares.

These proxy materials will be first mailed to shareholders on or about January 14, 2004. The cost of soliciting the proxies, consisting of the preparation, printing, handling and mailing of the proxies and the related material, will be paid by the Company. Proxies may be solicited by officers and regular employees of the Company by telephone, facsimile, e-mail or in person. These persons will receive no additional compensation for their services. The total estimated cost of the solicitation of proxies is approximately $15,000, excluding the costs of salaries and wages of regular employees and officers.

VOTING RIGHTS

Shareholders may vote in person or by proxy. Each shareholder is entitled to one vote per share held as of the Record Date, for each class of stock, on all matters on which the class is entitled to vote. However, if any shareholder gives notice of its intention to cumulate its votes in the election of directors, then all shareholders may cumulate their votes in the election of directors. To be effective, such notice (which need not be written) must be given by the shareholder at the Annual Meeting before any votes have been cast in such election. Under cumulative voting, each holder of Class A Shares may give one nominee a number of votes equal to the number of Class A Shares which the holder is entitled to vote multiplied by the number of directors to be elected by the holders of Class A Shares (thirteen at this meeting) or the holder may distribute such votes among any or all of the nominees as the holder sees fit. Similarly, the Class B Shares entitled to be voted may be voted cumulatively by the holders of such shares for the three directors to be elected by the holders of Class B Shares.

In the election of directors, the nominees receiving the highest number of affirmative votes of the class of shares entitled to be voted for them, up to the number of directors to be elected by such class, will be elected;

2

provided that no more than three nominees who are non-Shareholder-Related Directors shall be elected and any additional non-Shareholder-Related Director nominees shall not be elected. A Shareholder-Related Director is a director who is a shareholder, partner, or member of a member-patron formed as a corporation, partnership or limited liability company, respectively, or an employee of a member-patron. Under the California Corporations Code, votes against a nominee and votes withheld have no legal effect.

The proxy holders named on the enclosed form of proxy relating to the Annual Meeting will vote the proxies received in accordance with the shareholder’s instructions. With respect to the election of directors, shareholders may vote in favor of all nominees, or withhold their votes as to all nominees or specific nominees. If no instructions are given the shares will be voted FOR the election of the Board of Directors’ nominees. In the unanticipated event that any nominee should become unavailable for election as a director, the proxies will be voted for any substitute nominee named by the present Board of Directors. In their discretion, the proxy holders may cumulate the votes represented by the proxies received. If additional persons are nominated for election as directors by persons other than the Board of Directors, the proxy holders intend to vote all proxies received by them in such manner as will assure the election of as many of the Board’s nominees as possible, with the specific nominees to be voted for to be determined by the proxy holders.

ELECTION OF DIRECTORS

At the Annual Meeting sixteen directors (constituting the entire Board) are to be elected to serve until the next annual meeting and until their successors are elected and qualified. Thirteen directors are to be elected by the holders of the Company’s Class A Shares, and three directors are to be elected by the holders of the Company’s Class B Shares.

Pursuant to the Company’s Bylaws as amended, all but three of the directors of the Company are required to be Shareholder-Related Directors. Thirteen of the nominees recommended by the Board of Directors for election by the Class A Shares are Shareholder-Related Directors (defined as having an ownership interest and/or an employment relationship with a member of the Company) and the remainder of the nominees are non-Shareholder-Related Directors.

3

The following table sets forth certain information concerning the nominees for election to the Board of Directors. All nominees have consented to being named herein as nominees and to serve as directors if elected.

Name

| | Age as of

12/31/03

| | Year First

Elected

| | Principal Occupation During Last 5 Years

|

NOMINEES FOR ELECTION

BY CLASS A SHARES | | | | | | |

| | | |

Louis A. Amen | | 74 | | 1974 | | President, Super A Foods, Inc. |

David M. Bennett | | 50 | | 1999 | | Co-owner, Mollie Stone’s Markets |

John Berberian | | 52 | | 1991 | | President, Berberian Enterprises, Inc. |

Edmund Kevin Davis | | 50 | | 1998 | | President, Chairman and Chief Executive Officer, Bristol Farms Markets |

Dieter Huckestein | | 60 | | 2003 | | President, Hotel Operations, Owned and Managed, Hilton Hotels Corporation |

Darioush Khaledi | | 57 | | 1993 | | Chairman of the Board and Chief Executive Officer, K.V. Mart Co., operating Top Valu Markets and Valu Plus Food Warehouse |

John D. Lang | | 50 | | 2003 | | President & Chief Executive Officer, Epson America, Inc. |

Jay T. McCormack | | 53 | | 1993 | | President, Rio Ranch Markets |

Peter J. O’Neal | | 59 | | 1999 | | President, White Salmon Foods, Inc., Estacada Foods, Inc. and Novato Foods, Inc. |

Michael A. Provenzano, Jr. | | 61 | | 1986 | | President, Pro & Son’s, Inc., President, Provo, Inc. and President, Pro and Family, Inc. |

Thomas S. Sayles | | 53 | | 2003 | | Vice President, Governmental and Community Affairs, Sempra Energy |

Kenneth Ray Tucker | | 56 | | 1999 | | President, Evergreen Markets, Inc. |

Richard L. Wright | | 66 | | 1999 | | President, Wright’s Foodliner, Inc. |

| | | |

NOMINEES FOR ELECTION

BY CLASS B SHARES | | | | | | |

| | | |

Douglas A. Nidiffer | | 54 | | 2001 | | President and Chief Executive Officer, C&K Market, Inc. |

Mimi R. Song | | 46 | | 1998 | | President and Chief Executive Officer, Super Center Concepts, Inc. |

Robert E. Stiles | | 64 | | 1999 | | President, Gelson’s Markets |

None of the directors, nominees for director or executive officers were selected pursuant to any arrangement or understanding, other than with the directors and executive officers of the Company acting within their capacity as such. Except as set forth below, there are no family relationships among directors or executive officers of the Company and, as of the date hereof, no directorships are held by any director in a company which has a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company under the Investment Company At of 1940. Officers serve at the discretion of the Board of Directors.

The Board of Directors recommends a vote “FOR” the election of each of the nominees listed above.

4

BOARD MEETINGS AND COMMITTEES

The Board of Directors of the Company held a total of eight (8) meetings during fiscal 2003. Each incumbent director attended at least 75% of the aggregate of the total number of meetings of the full Board and of the committee on which the director served, except Dieter Huckestein and Michael A. Provenzano, Jr. The Company does not have a written policy regarding attendance at Board and committee meetings, although attendance is closely monitored and is considered by the Nominating and Corporate Governance Committee during its selection of nominees for election to the Board of Directors.

The Company has an Audit Committee that presently consists of Director Richard L. Wright, Committee Chairman, and Directors Edmund Kevin Davis, John D. Lang, Jay T. McCormack and Kenneth Ray Tucker. Louis A. Amen, Chairman of the Board of Directors, is an ex-officio member of the Audit Committee. Messrs. Wright and Lang are considered by the Board to be “Audit Committee financial experts” as defined by the rules promulgated by the Securities and Exchange Commission (the “SEC”). In the opinion of the Board, the members of the Audit Committee are “independent” as such term is defined by the listing standards applicable to companies listed on the New York Stock Exchange. The Company is not so listed. The Audit Committee, which met six (6) times during fiscal 2003, is primarily responsible for reviewing and approving audit and non-audit related services performed by the Company’s independent auditors, reviewing the annual audited financial statements and quarterly unaudited financial statements with management and with the Company’s independent auditors, reviewing information with respect to the independence of auditors and making recommendations to the Board concerning such matters. The Audit Committee performs its duties in accordance with the Charter for the Audit Committee as amended by the Board and attached hereto as Appendix A.

The Company has a Compensation Committee that presently consists of Director Edmund Kevin Davis, Committee Chairman, and Directors John Berberian, Dieter Huckestein, Jay T. McCormack, and Thomas S. Sayles. Louis A. Amen, Chairman of the Board of Directors, is an ex-officio member of the Compensation Committee. The Compensation Committee, which met six (6) times during fiscal 2003, is responsible for reviewing salaries and other compensation arrangements of all officers and for making recommendations to the Board of Directors concerning such matters.

The Company has a Nominating and Corporate Governance Committee that presently consists of Director David M. Bennett, Committee Chairman, and Directors John Berberian, John D. Lang, Jay T. McCormack, Peter J. O’Neal, Michael A. Provenzano, Jr., Thomas S. Sayles and Robert E. Stiles. Louis A. Amen, Chairman of the Board of Directors, is an ex-officio member of the Nominating and Corporate Governance Committee. In the opinion of the Board, the members of the Nominating and Corporate Governance Committee are “independent” as such term is defined by the listing standards applicable to companies listed on the New York Stock Exchange. The Company is not so listed. The Nominating and Corporate Governance Committee, which met four (4) times during fiscal 2003, is responsible for (i) selecting nominees to be submitted to the shareholders for election to the Board of Directors; and (ii) examining and making recommendations to the Board of Directors regarding various corporate governance issues.

Each year the Nominating and Corporate Governance Committee meets to consider potential nominees that have been recommended by security holders or security holders that have expressed to the committee their interest in serving as a Director either directly or in response to a solicitation of interest that is sent to representatives of all members of the Company in advance of the committee’s deliberations. Submissions by security holders must be made to the Nominating and Corporate Governance Committee in writing, and should be accompanied by a description of the proposed nominee’s qualifications, as well as a consent to serve. In addition, the committee considers security holders that the committee, based on information submitted by the members of the committee, believes are worthy of consideration. The committee considered the qualifications of three security holders that requested consideration that were ultimately not selected as nominees. Finally, when deemed appropriate and necessary, the committee has employed the services of a third party search firm to identify potential nominees. The committee did not employ the services of a third party search firm in connection

5

with selecting the nominees identified in this proxy, although it has done so in the past. The committee considers various factors in selecting nominees, including the individual’s (i) status as a member in good standing with the Company; (ii) experience with the Company and in the grocery industry; (iii) special or relevant experience, including management, financial or public service; and (iv) prior service as a Director of the Company.

PRINCIPAL STOCKHOLDERS

As of the Record Date, no person was known by the Company to own beneficially more than five percent (5%) of the outstanding Class A Shares of the Company, and the only shareholder known by the Company to own beneficially more than 5% of the outstanding Class B Shares of the Company is as set forth in the table below.

Title of Class

| | Name and Address of Beneficial Owner

| | Amount of

Ownership

| | % of Class

| |

Class B | | Mimi R. Song Super Center Concepts, Inc. 15510 Carmenita Road Santa Fe Springs, CA 90620 | | 26,260 | | 5.24 | % |

6

SECURITY OWNERSHIP OF DIRECTORS AND OFFICERS

The following table sets forth the beneficial ownership of the Company’s Class A Shares and Class B Shares, as of the Record Date, by each director and Shareholder-Related Director nominee, and their affiliated companies, and by all directors and their affiliated companies, as a group. Non-Shareholder-Related Directors and officers of the Company do not own any class of the Company’s stock.

| | | Shares Owned

| |

| | | Class A Shares

| | | Class B Shares

| | | Class E Shares

| |

Name and Affiliated Company

| | No. of

Shares

| | % of Total

Outstanding

| | | No. of

Shares

| | % of Total

Outstanding

| | | No. of

Shares

| | % of Total

Outstanding

| |

Louis A. Amen Super A Foods, Inc. | | 150 | | 0.18 | % | | 12,287 | | 2.45 | % | | 1,162 | | 3.15 | % |

David M. Bennett Mollie Stone’s Markets | | 150 | | 0.18 | % | | 2,594 | | 0.52 | % | | 473 | | 1.28 | % |

John Berberian Berberian Enterprises, Inc. | | 150 | | 0.18 | % | | 8,808 | | 1.76 | % | | 1,062 | | 2.88 | % |

Edmund Kevin Davis Bristol Farms Markets | | 150 | | 0.18 | % | | 813 | | 0.16 | % | | 103 | | 0.28 | % |

Dieter Huckestein (4) Hilton Hotels Corporation | | 0 | | 0.00 | % | | 0 | | 0.00 | % | | 0 | | 0.00 | % |

Darioush Khaledi K.V. Mart Co. | | 150 | | 0.18 | % | | 17,673 | | 3.52 | % | | 2,005 | | 5.43 | % |

John D. Lang (4) Epson America, Inc. | | 0 | | 0.00 | % | | 0 | | 0.00 | % | | 0 | | 0.00 | % |

Jay T. McCormack (2) Rio Ranch Markets | | 450 | | 0.54 | % | | 2,726 | | 0.54 | % | | 190 | | 0.51 | % |

Douglas A. Nidiffer (1) C&K Market, Inc. | | 150 | | 0.18 | % | | 19,096 | | 3.81 | % | | 3,498 | | 9.47 | % |

Peter J. O’Neal White Salmon Foods, Inc., Estacada Foods, Inc. and Novato Foods, Inc. | | 150 | | 0.18 | % | | 456 | | 0.09 | % | | 1 | | 0.00 | % |

Michael A. Provenzano, Jr. Pro & Son’s, Inc. | | 150 | | 0.18 | % | | 6,779 | | 1.35 | % | | 1 | | 0.00 | % |

Thomas S. Sayles (4) Sempra Energy | | 0 | | 0.00 | % | | 0 | | 0.00 | % | | 0 | | 0.00 | % |

Mimi R. Song (1) Super Center Concepts, Inc. | | 150 | | 0.18 | % | | 26,260 | | 5.24 | % | | 701 | | 1.90 | % |

Robert E. Stiles (1)(3) Gelson’s Markets | | 150 | | 0.18 | % | | 9,075 | | 1.81 | % | | 1,529 | | 4.14 | % |

Kenneth Ray Tucker Evergreen Markets, Inc. | | 150 | | 0.18 | % | | 114 | | 0.02 | % | | 0 | | 0.00 | % |

Richard L. Wright Wright’s Foodliner, Inc. | | 150 | | 0.18 | % | | 2,763 | | 0.55 | % | | 446 | | 1.21 | % |

|

| | | | | | |

All Directors and their affiliated companies as a group | | 2,250 | | 2.70 | % | | 109,444 | | 21.82 | % | | 11,171 | | 30.25 | % |

|

| (1) | | Elected by Class B Shareholders. |

| (2) | | Mr. McCormack is affiliated with Glen Avon Foods, Inc., which owns 150 Class A Shares (0.18% of the outstanding class of shares), 553 Class B Shares (0.11% of the outstanding class of shares) and 94 Class E Shares (0.25% of the outstanding class of shares), Yucaipa Trading Co., Inc., which owns 150 Class A Shares (0.18% of the outstanding class of shares) and 1,469 Class B Shares (0.29% of the outstanding class |

7

| | of shares) and Alamo Foods, Inc., which owns 150 Class A Shares (0.18% of the outstanding class of shares), 704 Class B Shares (0.14% of the outstanding class of shares) and 96 Class E Shares (0.26% of the outstanding class of shares). |

| (3) | | Shares owned by Arden-Mayfair, Inc., parent corporation of Gelson’s Markets. Mr. Stiles disclaims beneficial ownership of these shares. |

| (4) | | Non-Shareholder-Related Director. |

Section 16(a) Beneficial Ownership Reporting Compliance

Under Section 16(a) of the Exchange Act, the Company’s directors, executive officers and any person holding ten percent or more of the shares of any class are required to report their ownership and any changes in that ownership to the SEC and to furnish the Company with copies of such reports. Specific due dates for these reports have been established and the Company is required to report in this proxy statement any failure to file on a timely basis by such persons. No officer or director failed to file a report required by Section 16(a) of the Securities Exchange Act of 1934 on a timely basis during the most recent fiscal year except that, based solely on a review of Forms 3, 4 and 5 furnished to the Company by officers and directors of the Company, late Forms 4 or 5 were filed by Louis A. Amen, David M. Bennett, John Berberian, Edmund Kevin Davis, Darioush Khaledi, Jay T. McCormack, Douglas A. Nidiffer, Peter J. O’Neal, Michael A. Provenzano, Jr., Mimi R. Song, Robert E. Stiles, Kenneth Ray Tucker and Richard L. Wright.

CODE OF FINANCIAL ETHICS

The Company has adopted a Code of Financial Ethics that applies to its principal executive officer and senior financial officers as required by the rules promulgated by the SEC. A copy of the Code of Financial Ethics is available free of charge by writing to Unified Western Grocers, Inc., attention Corporate Secretary, 5200 Sheila Street, Commerce, CA 90040.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Compensation Committee Interlocks and Insider Participation

The Company’s Compensation Committee consists of Director Edmund Kevin Davis, Committee Chairman, and Directors John Berberian, Dieter Huckestein, Jay T. McCormack and Thomas S. Sayles, as well as ex-officio member and Chairman of the Board, Louis A. Amen. As Chairman of the Board of Directors, Mr. Amen is an officer under the Bylaws of the Company, although he is not an employee and does not receive any compensation or expense reimbursement beyond that to which he is entitled in his capacity as a director or committee member.

In the normal course of business, the Company has issued loans and entered into leases, subleases and supply agreements with members; provided guarantees for other third party loans and leases; and made investments in the businesses of its members. Refer to “Transactions With Management and Other Persons” on page 18 for a description of transactions the Company has entered into with certain member-patrons with which members of the Compensation Committee are affiliated.

Report of the Compensation Committee on Executive Compensation

The Report of the Compensation Committee of the Board of Directors shall not be deemed filed under the Securities Act of 1933 or under the Securities Exchange Act of 1934.

The principal components of the Company’s executive compensation program consist of an annual salary, an annual cash bonus contingent upon individual and Company performance in the preceding fiscal year, auto allowances, relocation expense reimbursements and certain pension, health insurance, retirement and life insurance benefits.

8

Salary. The Compensation Committee is responsible for the review of salaries of officers other than the Chief Executive Officer (“CEO”) as recommended by the CEO. Such review is conducted in closed session and, with the exception of the CEO and General Counsel (except when the salary of the General Counsel is being discussed), without management personnel present. This process centers on the Compensation Committee’s consideration of the CEO’s evaluation of each officer based on various criteria, including the CEO’s evaluation of officer performance against assigned responsibilities and goals, the relative value and importance of the officer’s contributions toward the overall success of the organization, the relative level of officer responsibilities, changes in the scope of officer responsibilities, officer accomplishments and contributions and the overall financial results for the Company for the most recent fiscal year end. In performing its reviews, the Compensation Committee engages the services of an independent consultant to render an opinion on, or provide recommendations with respect to, proposed compensation for its most senior executive officers in order to ensure the competitiveness of the Company’s compensation arrangements. Final salary recommendations by the Compensation Committee are presented to the full Board for approval. Salary earned for fiscal 2003 for the named executives are reflected in the Summary Compensation Table.

The Compensation Committee recommends to the Board of Directors the CEO’s salary based on its assessment of the CEO’s performance in accordance with the policies and considerations discussed directly above.

The Company has entered into written employment, termination and severance agreements with certain of its executive officers. See “Executive Employment, Termination and Severance Agreements” below.

Annual Bonuses. In recognition of the correlation between the Company’s performance and enhancement of shareholder value, the Company’s officers may be awarded annual cash bonuses. The Company’s officers other than the CEO are eligible for bonuses pursuant to an annual incentive plan for senior management. The plan uses a performance matrix to determine an earned incentive, expressed as a percent of base salary. The plan provides for the annual determination of a target bonus, a maximum bonus and performance levels below which no bonus is paid. The performance measures for fiscal 2003 were pre-patronage dividend income and revenue growth. The earned incentive determined by these performance measures, as may be adjusted at the discretion of the CEO, is awarded as a bonus. The CEO may adjust the bonus, plus or minus 25% percent of the earned incentive, based on individual contributions to the overall performance of the Company. Pursuant to the plan, bonuses totaling approximately $1.0 million were paid in December 2003 based on performance in fiscal 2003. The CEO may use discretion in distributing the bonuses using other factors such as effort and resolve. No bonuses were paid pursuant to the plan in fiscal 2001 or fiscal 2002. However, in January 2003, the Board authorized the payment of discretionary bonuses totaling approximately $230,000 to certain officers other than the CEO for achieving a combination of individual and Company performance goals. In addition, a discretionary bonus of approximately $50,000 was paid to the CEO in January 2003.

For fiscal 2003, the CEO’s bonus was determined by the Compensation Committee based on Company and CEO performance against established criteria and performance targets. The criteria and performance targets were established by the Board of Directors during the fiscal year. Company performance was based on the achievement of pre-patronage dividend income relative to budgeted goals. CEO performance was based on a weighted average of certain criteria (such as CEO leadership with the Board of Directors, CEO leadership with senior management, CEO impact on industry and community, and performance of senior management as a team). In recognition of the CEO’s efforts, and pursuant to the criteria of the CEO bonus plan, the Board of Directors in fiscal 2003 approved the payment of a bonus to the CEO in the amount of $402,171.

Bonuses awarded to named executives pursuant to the plan in the prior two fiscal years are disclosed in the Summary Compensation Table.

Following a study conducted by the committee with the assistance of an independent third party consultant, the committee recommended that the annual incentive plan for the CEO and other officers be modified for fiscal 2004. The amended plan uses a performance matrix to determine an earned incentive, expressed as a percent of base salary. The plan provides for the annual determination of a target bonus, a maximum bonus and performance levels below which no bonus is paid. The performance measures for fiscal 2004 include EBITDAP

9

(earnings before interest, taxes, depreciation, amortization and patronage dividends), return on capital employed, expense ratio, and revenues. In addition, the amended plan provides for adjustment based upon criteria related to the specific performance targets for each officer and individual contributions to the overall performance of the Company.

Benefits. Consistent with the Company’s objective to attract and retain qualified executives, the compensation program provides pension benefits to Company employees, including officers, pursuant to the Company’s defined benefit pension plan. The Company also provides supplemental retirement benefits to its officers pursuant to an Executive Salary Protection Plan II (“ESPP II”). Both types of retirement benefits are described in connection with the Pension Plan Table. In addition, Company employees, including officers, may defer income from their earnings through voluntary contributions to the Company’s Sheltered Savings Plan adopted pursuant to Section 401(k) of the Internal Revenue Code and the Company’s Amended and Restated Deferred Compensation Plan which is a nonqualified plan. In the case of those employees who elect to defer income under these plans, the Company makes additional contributions for their benefit. The amount of these additional contributions made during fiscal 2003 for the benefit of the CEO and other named executive officers is set forth in the footnotes to the Summary Compensation Table.

| | | Compensation Committee Members | | |

| | |

| | | Edmund Kevin Davis, Chairman | | |

| | | Louis A. Amen, Ex-Officio Member | | |

| | | John Berberian | | |

| | | Dieter Huckestein | | |

| | | Jay T. McCormack | | |

| | | Thomas S. Sayles | | |

10

Executive Officer Compensation

The following table summarizes compensation paid to the President and Chief Executive Officer and to certain executive officers of the Company for services for the Company’s last three fiscal years.

Summary Compensation Table

Name and Principal Position

| | Fiscal

Year

| | Annual Compensation

| | All Other

Compensation($)

| |

| | | Salary($)

| | Bonus

Pursuant to

Plan($)

| | Discretionary Bonus($)

| | Other Annual

Compensation($)(1)

| |

Alfred A. Plamann President and Chief Executive Officer | | 2003 2002 2001 | | 540,384 500,000 500,000 | | 402,171 0 0 | | 50,000 0 0 | | 21,141

20,159 17,615 | | 45,794 33,670 40,410 | (2) |

| | | | | | |

Robert M. Ling, Jr. Executive Vice President, General Counsel and Secretary | | 2003 2002 2001 | | 296,154 271,442 245,000 | | 150,000 0 0 | | 40,000 0 0 | | 19,517

18,642

16,084 | | 23,352 21,362 19,059 | (3) |

| | | | | | |

Richard J. Martin Executive Vice President, Finance and Administration and Chief Financial Officer | | 2003 2002 2001 | | 288,077 277,019 270,000 | | 115,000 0 0 | | 20,000 0 0 | | 60,423

18,781 16,464 | | 16,220 18,559 21,709 | (4) |

| | | | | | |

Philip S. Smith Executive Vice President, Chief Marketing / Procurement Officer | | 2003 2002 2001 | | 222,115 201,058 180,000 | | 90,000 0 0 | | 20,000 0 0 | | 17,891

17,124 14,900 | | 18,036 16,133 14,249 | (5) |

| | | | | | |

Daniel J. Murphy Senior Vice President, Retail Support Services | | 2003 2002 2001 | | 216,462 208,269 184,615 | | 75,000 0 0 | | 10,000 0 0 | | 17,891

17,216 14,137 | | 15,269 13,202 0 | (6) |

| (1) | | For 2003, consists of $21,141, $19,517, $19,517, $17,891 and $17,891 in auto allowances paid to Messrs. Plamann, Ling, Martin, Smith and Murphy, respectively, and $40,906 of relocation expenses paid to Mr. Martin. |

| (2) | | Consists of a $14,812 Company contribution to the Company’s Sheltered Savings Plan, a $26,050 Company contribution to the Company’s Amended and Restated Deferred Compensation Plan, and $4,932 representing the economic benefit associated with the Company paid premium on the Executive Life Plan. |

| (3) | | Consists of a $12,140 Company contribution to the Company’s Sheltered Savings Plan, a $10,367 Company contribution to the Company’s Amended and Restated Deferred Compensation Plan, and $845 representing the economic benefit associated with the Company paid premium on the Executive Life Plan. |

| (4) | | Consists of a $12,239 Company contribution to the Company’s Sheltered Savings Plan, a $1,936 Company contribution to the Company’s Amended and Restated Deferred Compensation Plan, and $2,045 representing the economic benefit associated with the Company paid premium on the Executive Life Plan. |

| (5) | | Consists of an $8,758 Company contribution to the Company’s Sheltered Savings Plan, an $8,248 Company contribution to the Company’s Amended and Restated Deferred Compensation Plan, and $1,030 representing the economic benefit associated with the Company paid premium on the Executive Life Plan. |

| (6) | | Consists of a $13,636 Company contribution to the Company’s Sheltered Savings Plan, a $218 Company contribution to the Company’s Amended and Restated Deferred Compensation Plan, and $1,415 representing the economic benefit associated with the Company paid premium on the Executive Life Plan. |

11

The Company has a pension plan (the “Pension Plan”) that covers both non-union and executive employees. The Pension Plan consists of two parts, a defined benefit plan based on final average compensation and a cash balance plan. The defined benefit portion of the Pension Plan provides benefits based on years of service through December 31, 2001 and final average compensation. Effective January 1, 2002, the cash balance plan was included as part of the Pension Plan for post January 1, 2002 accruals. Benefits earned under the Pension Plan are equal to the sum of the benefits accrued under both the defined benefit and average cash balance plans. There is no offset under the Pension Plan for Social Security.

As of December 31, 2001, years of service under the defined benefit plan were grandfathered and will not increase. Employees will receive benefits under the defined benefit plan based on years of service as grandfathered on December 31, 2001 and final average compensation. As of December 31, 2001, credited years of service under the defined benefit plan for named executive officers were: Mr. Plamann, 12 years; Mr. Ling, 5 years; Mr. Martin, 3 years; Mr. Smith, 7 years; and Mr. Murphy, 1 year. Benefits accrued under the defined benefit plan will be paid as an annuity.

The cash balance portion of the Pension Plan is expressed in the form of a hypothetical account balance. Commencing at the end of calendar year 2002 and annually thereafter, a participant’s hypothetical cash balance account will be increased by (i) pay credits based on a percentage of compensation for that year, from 4% to 10% based on years of service and age, and (ii) interest credits based on the participant’s hypothetical account balance at the thirty year U.S. Treasury Bond rate, with a minimum guaranty of 5%. Benefits under the cash balance portion of the plan are generally stated as a cash balance account value and will be distributed as an annuity.

The Company’s Executive Salary Protection Plan II, as amended (“ESPP II”), provides supplemental post-termination retirement income based on each participant’s final salary and years of service as an officer of the Company. The financing of this benefit is facilitated through the purchase of life insurance policies, the premiums of which are paid by the Company.

The ESPP II is intended to provide eligible officers with retirement benefits when they reach age 62. The combination of payments under the ESPP II and the Company’s Pension Plan is designed to provide pension benefits equal to approximately 65% of the participant’s final salary. Employees become eligible to participate in the ESPP II after three years of service as an officer of the Company in the position of Vice President or higher. Upon eligibility, officers receive credit for years of service with the Company at the rate of 5% of final pay for each year of service up to a maximum of 13 years. Officers first elected after December 1998 receive credit only for years of service as an officer. Payments under the ESPP II are discounted for executives who retire prior to age 62. In May 2003 the Board of Directors approved amendments to the ESPP II (the “Plan Amendments”). The Plan Amendments, which are effective for all officers elected after the effective date of the Plan Amendments, maintain the eligibility features described above. In addition, the Plan Amendments provide that eligible officers receive service credit for years of service as an officer of the Company at the rate of 4.33% of final pay (defined as the sum of the three highest base salaries received in the preceding ten years and the average of the bonuses received in the three years prior to separation or retirement) up to a maximum of 15 years. Thereafter, officers receive an additional 1% of final pay for each year of service in excess of 15 years. As of December 31, 2003, credited years of service under the ESPP II for named executive officers were: Mr. Plamann, 14 years; Mr. Ling, 7 years; Mr. Martin, 5 years; Mr. Smith, 9 years; and Mr. Murphy, 3 years. Officers employed as of the date of the amendments may elect to receive benefits pursuant to either the ESPP II as it existed prior to the Plan Amendments or as amended.

The following table summarizes the estimated combined annual benefits payable under both the defined benefit and ESPP II portion of the Pension Plan. The amounts shown represent annual compensation payable on a straight-line basis with respect to the benefits under the defined benefit portion and a 15 year annuity with respect to the benefits under the ESPP II for qualifying executives with selected years of service as if such executives had retired on September 27, 2003 at age 65.

12

PENSION PLAN TABLE

| | | Years of Service

|

Remuneration

| | 5 Years

| | 10 Years

| | 15 Years

| | 20 Years

| | 25 Years

| | 33 Years

|

$100,000 | | $ | 25,978 | | $ | 51,955 | | $ | 67,933 | | $ | 68,910 | | $ | 69,888 | | $ | 71,452 |

$130,000 | | $ | 33,819 | | $ | 67,594 | | $ | 88,391 | | $ | 89,688 | | $ | 90,985 | | $ | 93,060 |

$160,000 | | $ | 41,740 | | $ | 83,481 | | $ | 109,221 | | $ | 110,963 | | $ | 112,703 | | $ | 115,488 |

$190,000 | | $ | 49,240 | | $ | 98,481 | | $ | 128,721 | | $ | 130,463 | | $ | 132,203 | | $ | 134,988 |

$220,000 | | $ | 56,740 | | $ | 113,481 | | $ | 148,221 | | $ | 149,963 | | $ | 151,703 | | $ | 154,488 |

$250,000 | | $ | 64,240 | | $ | 128,481 | | $ | 167,721 | | $ | 169,463 | | $ | 171,203 | | $ | 173,988 |

$300,000 | | $ | 76,740 | | $ | 153,481 | | $ | 200,221 | | $ | 201,963 | | $ | 203,703 | | $ | 206,488 |

$350,000 | | $ | 89,240 | | $ | 178,481 | | $ | 232,721 | | $ | 234,463 | | $ | 236,203 | | $ | 238,988 |

$400,000 | | $ | 101,740 | | $ | 203,481 | | $ | 265,221 | | $ | 266,963 | | $ | 268,703 | | $ | 271,488 |

$450,000 | | $ | 114,240 | | $ | 228,481 | | $ | 297,721 | | $ | 299,463 | | $ | 301,203 | | $ | 303,988 |

$500,000 | | $ | 126,740 | | $ | 253,481 | | $ | 330,221 | | $ | 331,963 | | $ | 333,703 | | $ | 336,488 |

$550,000 | | $ | 139,240 | | $ | 278,481 | | $ | 362,721 | | $ | 364,463 | | $ | 366,203 | | $ | 368,988 |

Executive Employment, Termination and Severance Agreements

The Company has an employment agreement with Alfred A. Plamann, the Company’s President and Chief Executive Officer. The initial term of Mr. Plamann’s contract was three years, with automatic one-year extensions, and as amended, expired on September 29, 2003. The term has been extended for an additional one-year term, and will be automatically extended for successive one-year terms on the anniversary date of the contract unless either party provides notice of an intention to terminate the contract at least eleven months prior to such anniversary date. Under the contract, Mr. Plamann serves as the Company’s President and Chief Executive Officer and receives a base salary, set at $550,000 at fiscal year-end, subject to annual review and upward adjustment at the discretion of the Board of Directors. Mr. Plamann is also eligible for annual bonuses based on performance criteria established by the Board of Directors at the beginning of each fiscal year. Additionally, Mr. Plamann will receive employee benefits such as life insurance and Company pension and retirement contributions. The contract is terminable at any time by the Company, with or without cause, and will also terminate upon Mr. Plamann’s resignation, death or disability. Except where termination is for cause or is due to Mr. Plamann’s resignation (other than a resignation following designated actions of the Company or its successor which trigger a right by Mr. Plamann to resign and receive severance benefits), death or disability, the amended contract provides that Mr. Plamann will be entitled to receive his highest base salary during the previous three years, plus an annual bonus equal to the average of the most recent three annual bonus payments, throughout the balance of the term of the agreement. Mr. Plamann would also continue to receive employee benefits such as life insurance and Company pension and retirement contributions throughout the balance of the term of the agreement.

The Company and Messrs. Ling and Martin have executed severance agreements. Each agreement provides for severance payments in the event the executive’s employment is terminated (i) by the Company other than for cause, death or extended disability, (ii) by the executive for good reason, or (iii) by the executive without cause within 12 months following a change in control. The severance payment is equal to two times the highest annual base salary in the three years prior to termination plus two times the highest annual incentive bonus paid during that three-year period. In the event of the occurrence of the specified termination events, the executive is also entitled to Company payment of COBRA health insurance premiums until the earlier of 24 months or the cessation of COBRA eligibility and coverage. Subsequent to fiscal 2003, and upon his election to the position of Executive Vice President, Chief Marketing / Procurement Officer, the Company and Mr. Smith entered into a severance agreement on terms described above.

The Company and Mr. Murphy have also executed a severance agreement providing a severance benefit equal to one year’s salary and bonus based on the highest annual salary and the highest incentive bonus paid over

13

the prior three years in the event of the occurrence of specified termination events. These include termination (i) by the Company other than for cause, death or extended disability, and (ii) by the executive for good reason.

Officer Health Insurance Plan

The Board of Directors approved, effective January 1, 2001, a supplemental officer health insurance benefit and an officer retiree medical plan for officers and their eligible dependents. Pursuant to the Supplemental Officer Health Insurance Plan, officers will be eligible for payment by the insurance plan of the portion of covered expenses not covered under the Company’s health insurance plan. Under the Officer Retirement Medical Plan, officers who are at least 55 years of age and have seven years service with the Company as an officer will be eligible to participate in the Officer Retirement Medical Insurance Plan following termination of employment. Former officers (and surviving spouses) must enroll in Medicare Parts A and B when they reach age 65 at which time Medicare becomes the primary carrier and the Officer Retiree Medical Plan becomes secondary. Active officers will continue to be obligated to pay the regular premium for the Company health insurance plan they have selected.

Officer Disability Insurance

The Board of Directors approved, effective January 1, 2001, a supplemental disability insurance plan for officers that provides 100% of their pre-disability base salary while on a disability leave for up to two years. This disability coverage will be coordinated with existing sick leave, state disability insurance, short-term disability insurance, and long-term disability plans available to all employees so that the officer disability insurance is a supplemental benefit. During the first six months of disability, state disability insurance and short-term disability insurance pays 66 2/3% of the employee’s salary and officer disability insurance pays 33 1/3%. After six months of disability, state disability insurance and long-term disability insurance pays 50% of the employee’s salary and officer disability insurance pays the remaining 50%.

Director Compensation

The Board of Directors suspended payment of director fees for a one-year period beginning with the Company’s Annual Meeting in 2002. Beginning with the Annual Meeting in 2003, each Shareholder-Related Director received an annual payment of $7,500 as compensation for service as a director of the Company and as a member of any committees of the Board of the Company and any Board of a subsidiary of the Company, if applicable. Directors that are non-Shareholder-Related Directors received an annual payment of $35,000 as compensation for service as a director of the Company and as a member of any committees of the Board of the Company and any Board of a subsidiary of the Company, if applicable. In recognition of the additional duties and responsibilities attendant with such positions, the Chairman of the Board received annual compensation of $12,500, and each Vice Chairman received annual compensation of $10,000. In addition, directors are reimbursed for Company related expenses.

Following the Annual Meeting in 2004, each Shareholder-Related Director will receive an annual payment of $15,000 as compensation for service as a director of the Company and as a member of any committees of the Board of the Company and any Board of a subsidiary of the Company, if applicable. Directors that are non-Shareholder-Related Directors will receive an annual payment of $30,000 as compensation for service as a director of the Company and as a member of any committees of the Board of the Company and any Board of a subsidiary of the Company, if applicable. In addition, each Director will receive additional compensation of $1,000 for each Board meeting attended, and $500 for each committee or subsidiary Board meeting attended, not to exceed $1,000 if multiple meetings are attended on any given day. In recognition of the additional duties and responsibilities attendant with such positions, the Chairman of the Board will receive additional annual compensation of $5,000. In addition, directors will continue to be reimbursed for Company related expenses.

14

AUDIT COMMITTEE REPORT

The Report of the Audit Committee of the Board of Directors shall not be deemed filed under the Securities Act of 1933 or under the Securities Act of 1934.

The Audit Committee of the Board of Directors (the “Audit Committee”) operates pursuant to a written charter as amended by the Board and attached hereto as Appendix A. The Audit Committee is responsible for overseeing the Company’s financial reporting process on behalf of the Board of Directors. Company management has the primary responsibility for the Company’s financial reporting process, principles and internal controls, as well as preparation of its financial statements. The Company’s independent auditors are responsible for performing an audit of the Company’s financial statements and expressing an opinion as to the conformity of such financial statements with accounting principles generally accepted in the United States.

The Audit Committee: (1) has reviewed and discussed with management the audited financial statements contained in the Company’s Annual Report on Form 10-K for fiscal 2003; (2) has obtained from management their representation that the Company’s financial statements have been prepared in accordance with accounting principles generally accepted in the United States; (3) has discussed with Deloitte & Touche LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees) as currently in effect; (4) has received the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as currently in effect; (5) has reviewed and discussed with Deloitte & Touche LLP the independent accountant’s independence and (6) has considered whether the provision of non-audit services is compatible with maintaining Deloitte & Touche LLP’s independence.

Based on the review and discussions described above, the Audit Committee recommended to the Board of Directors that the audited financial statements described in the report of Deloitte & Touche LLP dated December 8, 2003, be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 27, 2003 for filing with the Securities and Exchange Commission.

| | | Audit Committee Members | | |

| | |

| | | Richard L. Wright, Chairman | | |

| | | Louis A. Amen, Ex-Officio Member | | |

| | | Edmund Kevin Davis | | |

| | | John D. Lang | | |

| | | Jay T. McCormack | | |

| | | Kenneth Ray Tucker | | |

15

INDEPENDENT AUDITORS

The Board of Directors has selected Deloitte & Touche LLP as the Company’s independent auditors for fiscal 2004. A representative of Deloitte & Touche LLP will be present at the Annual Meeting and will have the opportunity to make a statement if such representative desires to do so and will also be available to answer appropriate questions from shareholders.

The aggregate fees billed to the Company by Deloitte & Touche LLP with respect to services performed for fiscal 2003 and 2002 are as follows:

| | | 2003

| | 2002

|

Audit fees (1) | | $ | 1,057,024 | | $ | 1,061,608 |

Audit related fees (2) | | | 235,295 | | | 428,900 |

Tax fees (3) | | | 204,962 | | | 176,605 |

All other fees | | | — | | | — |

| | |

|

| |

|

|

Total | | $ | 1,497,281 | | $ | 1,667,113 |

| | |

|

| |

|

|

| (1) | | Audit fees consisted of fees billed by Deloitte & Touche LLP for professional services rendered for the audit of the Company’s annual financial statements and for reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q for fiscal 2003 and 2002. |

| (2) | | Audit related fees consisted of fees billed by Deloitte & Touche LLP for services rendered to the Company for SEC registration statement review, services reasonably related to the performance of the audit or review of our financial statements and that are not reported as audit fees, audits of the Company’s employee benefit plans, and technical accounting assistance for fiscal 2003 and 2002. |

| (3) | | Tax fees consisted principally of fees billed by Deloitte & Touche LLP for assistance relating to tax compliance and reporting for fiscal 2003 and 2002. |

The Audit Committee’s policy is to approve all audit, audit related and tax services performed by the Company’s independent auditors and all other services for amounts either in the aggregate or for a single occurrence equal to or exceeding $50,000. The Audit Committee pre-approved all audit services, audit related services and tax services performed for the Company by Deloitte & Touche during fiscal 2003.

CUMULATIVE TOTAL SHAREHOLDER RETURN

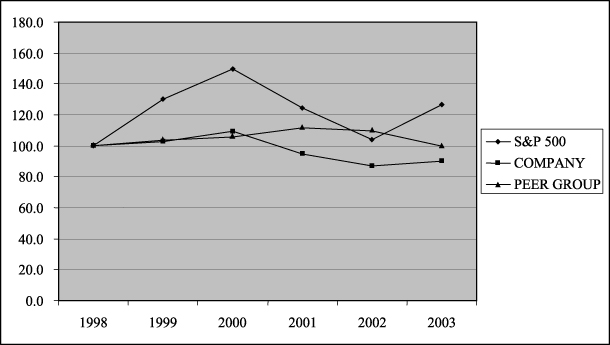

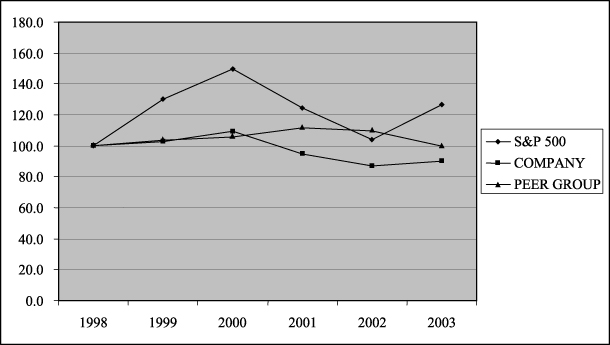

The following graph sets forth the five year cumulative total shareholder return on the Company’s shares as compared to the cumulative total shareholder return for the same period of the S&P 500 Index and the Company’s Peer Group. The Company’s Peer Group consists of Nash Finch Company, Spartan Stores, Inc. and Supervalu, Inc. These companies were selected on the basis that the companies, although unlike Unified in that they are not structured as cooperative organizations, they have certain operational characteristics that are similar to Unified. For example, each of the companies is a full-line distributor of grocery products. In contrast, while all shares of the companies included in the Peer Group are publicly traded, the Company’s shares are privately held. The Company’s Class A and Class B Shares are purchased and sold based on the book value per share of the Company at the close of the last fiscal year end prior to sale or purchase. Accordingly, a graphical presentation of the cumulative total return of the companies included in the Peer Group is not particularly meaningful since the value of the shares of the Company is based on historical cost while the value of the shares of the publicly traded companies is based on fair value.

The comparison assumes $100 was invested on August 29, 1998 in the shares of the Company and in each of the foregoing indices and the reinvestment of dividends through September 27, 2003. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

16

This graph shall not be deemed incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act or under the Exchange Act, except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under such Acts.

Comparison of Five Year* Cumulative Total Return**

Among Unified Western Grocers, Inc., S&P 500 Index and Peer Group

| * | | Fiscal years ended August 29, 1999, September 30, 2000, September 29, 2001, September 28, 2002 and September 27, 2003. |

| ** | | Total return assumes reinvestment of dividends. |

17

TRANSACTIONS WITH MANAGEMENT AND OTHER PERSONS

Members affiliated with directors of the Company make purchases of merchandise from the Company and also may receive benefits and services that are of the type generally offered by the Company to its similarly situated eligible members.

Since the programs listed below are only available to patrons of the Company, it is not possible to assess whether transactions with members of the Company, including entities affiliated with directors of the Company, are less favorable to the Company than similar transactions with unrelated third parties. However, management believes such transactions are on terms that are generally consistent with terms available to other patrons similarly situated.

A brief description of related party transactions with members affiliated with directors of the Company follows:

Loans and Loan Guarantees

Unified provides loan financing and loan guarantees to its member-patrons. The Company had the following loans outstanding at December 27, 2003 to members affiliated with directors of the Company:

(dollars in thousands)

|

| | |

| Director | | Aggregate Loan Balance at December 27, 2003 | | Maturity Date |

|

Darioush Khaledi | | $ | 6,324 | | 2004-2005 |

Michael A. Provenzano, Jr. | | | 1,617 | | 2008 |

Jay T. McCormack | | | 270 | | 2006-2007 |

On May 12, 2000, the Company loaned $7.0 million to K.V. Mart Co. (“KV”) which is payable over a period of five years. The loan is secured by leasehold deeds of trust on several parcels currently leased by KV from an affiliated entity, as well as a subordinate lien on substantially all the assets of KV. Additionally, shareholders Darioush Khaledi and Parviz Vazin and two affiliated entities have guaranteed the obligations of KV under the loan. Coincident with the transaction, KV and the Company extended the term of their existing supply agreement until May 12, 2005. In December 2002, KV and the Company agreed to modifications to the above, including amending the loan to require payment of interest only for the remaining term of the note with the principal due at maturity.

In December 2002, Grocers Capital Company (“GCC”), a wholly owned subsidiary of Unified whose primary function is to provide financing to the Company’s member-patrons, loaned approximately $2.0 million to an entity affiliated with director Michael A. Provenzano, Jr. to finance equipment and leasehold improvements for store expansion purposes. The note is due in December 2007. Interest and principal payments are payable monthly.

The Company has guaranteed 22% of the principal amount of a third party loan to C&K Market, Inc. (“C&K”), of which director Douglas A. Nidiffer is a shareholder, director and officer. At December 27, 2003, the principal amount of this guarantee was $0.3 million.

The Company provides loan guarantees to its members. GCC has guaranteed 10% of the principal amount of certain third-party loans to KV and KV Property Company of which director Darioush Khaledi is an affiliate. The maximum amount of this guarantee is $0.7 million. At December 27, 2003, the principal amount of this guarantee was $0.2 million.

18

Lease Guarantees and Subleases

The Company provides lease guarantees and subleases to its member-patrons. The Company has executed lease guarantees or subleases to members affiliated with directors of the Company at December 27, 2003 as follows:

(dollars in thousands)

|

| | | | |

| Director | | No. of Stores | | Total Current Annual Rent | | Total Guaranteed Rent | | Expiration Date(s) |

|

Darioush Khaledi | | 4 | | $ | 1,306 | | $ | 4,234 | | 2004-2012 |

Douglas A. Nidiffer | | 3 | | | 446 | | | 1,873 | | 2006-2010 |

Mimi R. Song | | 2 | | | 630 | | | 11,368 | | 2020-2023 |

Michael A. Provenzano, Jr. | | 2 | | | 351 | | | 4,576 | | 2016-2017 |

John Berberian | | 2 | | | 310 | | | 1,094 | | 2007-2008 |

David M. Bennett | | 1 | | | 328 | | | 218 | | 2004 |

Richard L. Wright | | 1 | | | 264 | | | 946 | | 2007 |

Peter J. O’Neal | | 1 | | | 144 | | | 972 | | 2010 |

Sale and Purchase of Assets

On November 1, 2001, the Company signed an agreement with Super Center Concepts, Inc. (“Super Center”), of which director Mimi R. Song is affiliated. Under the agreement, the Company leased real property to a limited liability company affiliated with principals of Super Center, which in turn subleases the property to Super Center. Super Center has guaranteed all obligations of the limited liability company under the lease. In consideration for the right to sublease the real property, the limited liability company paid $0.7 million to the Company. The lease expires in March 2023, subject to an option to extend the lease. Annual rent during the term is $0.4 million and commenced in June 2002. In addition, the Company and Super Center entered into a seven-year supply agreement and a right of first refusal agreement with respect to certain of Super Center’s operating assets and stock. The Company paid Super Center a total of $2.0 million as consideration for entering into the supply and right of first refusal agreements.

Supply Agreements

During the course of its business, the Company enters into individually negotiated supply agreements with members of the Company. These agreements require the member to purchase certain agreed amounts of its merchandise requirements from the Company and obligate the Company to supply such merchandise under agreed terms and conditions relating to such matters as pricing and delivery. The Company has executed supply agreements with members affiliated with directors of the Company at December 27, 2003 as follows:

|

| |

| Director | | Expiration

Date |

|

Douglas A. Nidiffer | | 12/29/2013 |

Mimi R. Song | | 12/20/2008 |

Michael A. Provenzano, Jr. | | 10/03/2009 |

Jay T. McCormack | | 12/31/2006 |

Darioush Khaledi | | 5/12/2005 |

Direct Investment

At August 29, 1998, GCC owned 10% of the common stock of KV. The cost of the investment was approximately $3.0 million. The stock purchase agreement contained a provision which allowed KV to

19

repurchase the shares upon certain terms and conditions. In March 1999, KV exercised its repurchase rights under the agreement and purchased the shares for $4.5 million, payable in cash and in an interest-bearing note. The stock purchase agreement also provides that for a five-year period commencing as of the date of the agreement, in the event of (i) a change of control of KV or (ii) a breach of the supply agreement by KV, KV shall pay the Company $0.9 million or an amount equal to the difference between 10% of the appraised value of KV as of the approximate date of the agreement (as prepared by an independent third party appraisal firm) and $4.5 million, whichever is greater.

On December 19, 2000, the Company initially purchased 80,000 shares of preferred stock (the “Series A-1 Preferred Shares”) of C&K Market, Inc. (“C&K”) for $8.0 million. Douglas A. Nidiffer, a director of the Company, is a shareholder, director and an officer of C&K. The preferred stock bore a 9.5% cumulative dividend rate, with cash dividend payments deferred until after November 15, 2002, and then payable quarterly only if permitted by applicable loan agreements. Unified received cash dividends of $0.7 million in fiscal 2003.

In connection with the recapitalization of C&K, on December 31, 2003, the Company exchanged its 80,000 Series A-1 Preferred Shares (including approximately $1.5 million of deferred dividends with respect to such shares) for 95,000 shares of Series A-2 Preferred Shares. The Series A-2 Preferred Shares have an 8% cumulative dividend rate, with cash dividend payments payable quarterly beginning in May 2004, subject to applicable loan agreements. The dividend rate will be adjusted in December 2008 to the greater of 8% or the then current five-year U.S. Treasury Bill rate plus 5%. Additionally, a new ten-year supply agreement was executed with C&K in connection with this transaction. The Series A-2 Preferred Shares are eligible for redemption of up to 19,000 shares per year, beginning in December 2009 and concluding in December 2013. The controlling shareholders of C&K have provided a guarantee to the Company with respect to certain of the Company’s rights with respect to the share redemption and nonpayment of certain dividends upon the occurrence of certain designated events.

Transactions with Executive Officers

In December 2000, to facilitate Senior Vice President Daniel J. Murphy’s relocation to Southern California, the Company loaned to Mr. Murphy, pursuant to a note, $0.1 million with interest of 7.0% per annum payable quarterly and principal due at the option of the holder.

VOTING ON OTHER MATTERS

Management is not aware of any other matters that will be presented for action at the Annual Meeting. If a shareholder presents a proper item of business for shareholder action, the matter would be entitled to be voted upon at the meeting. If any such shareholder proposals or other matters properly come before the Annual Meeting, it is intended that the shares represented by proxies will be voted in accordance with the judgment of the proxy holders, and authority to do so is included in the proxies.

SHAREHOLDER PROPOSALS FOR NEXT YEAR’S ANNUAL MEETING

Under certain circumstances, shareholders are entitled to present proposals at shareholder meetings. Any such proposal to be included in the proxy statement for Unified’s 2005 annual meeting of shareholders must be submitted by a shareholder prior to September 15, 2004, in a form that complies with applicable regulations. Under the rules promulgated by the SEC governing a company’s ability to use discretionary proxy authority with respect to shareholder proposals which are not submitted by the shareholders in time to be included in the proxy statement, in the event a shareholder proposal is not submitted to Unified prior to November 29, 2004, the proxies solicited by the Board of Directors for the 2005 annual meeting of shareholders will confer authority of the holders of the proxy to vote the shares in accordance with their best judgment and discretion if the proposal is presented at the 2005 annual meeting of shareholders without any discussion of the proposal in the proxy statement for such meeting.

20

ANNUAL REPORT ON FORM 10-K

The Company’s annual report to shareholders for the fiscal year ended September 27, 2003 accompanies or has preceded this proxy statement. The annual report contains financial statements of the Company and the report thereon of Deloitte & Touche LLP, the Company’s independent auditors.

A copy of the Company’s Annual Report on Form 10-K for the fiscal year ended September 27, 2003, as filed with the Securities and Exchange Commission, excluding exhibits, may be obtained without charge by writing to the Corporate Secretary of Unified at the address of Unified’s principal executive office shown on the first page of this proxy statement. The Annual Report on Form 10-K is also available on the SEC’s website at www.sec.gov.

By Order of the Board of Directors

Robert M. Ling, Jr.,

Executive Vice President, General Counsel and

Secretary

Dated: January 13, 2004

21

APPENDIX A

UNIFIED WESTERN GROCERS, INC.

AUDIT COMMITTEE CHARTER

Purpose:

The Audit Committee will represent the Board of Directors by:

| • | | Overseeing the integrity of the financial statements, including financial disclosures; |

| • | | Overseeing the independent auditor’s qualification and independence; |

| • | | Overseeing the performance of the independent auditor and the internal audit function; |

| • | | Providing an avenue of communication between the independent auditor, management, the internal audit function, and the Board of Directors; and |

| • | | Overseeing the system of disclosure controls and system of internal controls regarding finance, accounting, legal compliance, and ethics that management and the Board of Directors have established. |

The Committee will report at each Board of Directors meeting following a Committee meeting.

Duties and Responsibilities:

General Activities:

1. Provide an open avenue of communication between the independent auditor, management, the internal audit function, and the Board of Directors.

2. Meet a minimum of four times per year or more frequently, as circumstances require. The Committee may ask members of management or others to attend meetings and provide pertinent information, as necessary. Each regularly scheduled meeting shall conclude with an executive session of the audit committee absent members of management.

3. Review with the independent auditors and the internal audit function the coordination of audit efforts to assure completeness of coverage, reduction of redundant efforts, and the effective use of audit resources.

4. Consider and review with management, the independent auditors, and the internal audit function:

(a) Significant findings during the year, including the status of previous audit recommendations;

(b) Any difficulties encountered in the course of audit work, including any restrictions on the scope of activities or access to required information; and

(c) Any changes required to the planned scope of the audit plan.

5. Set clear hiring policies, compliant with governing laws or regulations, for employees or former employees of the independent auditor.

6. Establish and maintain procedures for the receipt, retention, and treatment of complaints regarding accounting, internal accounting, or auditing matters. Additionally, establish and maintain procedures for confidential, anonymous submission by Company employees regarding questionable accounting or auditing matters.

7. Review management activities to establish and monitor compliance with any Code of Ethics adopted by the Company.

8. Ensure there are no unjustified restrictions or limitations on the Internal Audit function.

9. Review periodically with the General Counsel legal and regulatory matters that may have a material impact on the Company’s financial statements, compliance policies and programs.

10. Conduct or authorize investigations into any matters within the Committee’s scope of responsibilities. The Committee shall be empowered to retain independent counsel and other professionals to assist in the conduct of any investigation or to obtain advice, as the Committee deems appropriate to perform its duties and responsibilities.

Scheduled Activities:

Independent Auditors

1. Appoint, compensate, and oversee the work performed by the independent auditor for the purpose of preparing or issuing an audit report or related work. The Committee shall review the performance of the independent auditor and remove the independent auditor, if circumstances warrant. The independent auditor shall report directly to the Committee and the Committee shall oversee the resolution of disagreements between management and the independent auditor in the event that they arise. The Committee shall consider whether the independent auditor’s performance of permissible non-audit services is compatible with the auditor’s independence.

2. At least annually, obtain and review a report by the independent auditor describing:

(a) The independent auditor’s internal quality control procedures;

(b) Any material issues raised by the most recent internal quality control review or by any inquiry or investigation by governmental or professional authorities within the preceding five years, and any steps taken to deal with any such issues; and

(c) Assess all relationships between the independent auditor and the Company.

3. Hold timely discussions with the independent auditor regarding the following:

(a) Audit scope and plan;

(b) Any problems or difficulties encountered during the audit and related management’s response;

(c) The independent auditor’s attestation and management’s internal control report;

(d) All critical accounting policies and practices, as defined by the Securities and Exchange Commission (SEC);

(e) All alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor;

(f) Other material written communications between the independent auditor and management, including, but not limited to, the management letter and schedule of unadjusted differences;

(g) The auditor’s independent qualitative judgment about the appropriateness, not just the acceptability, of the accounting principles applied and the clarity of the financial disclosure practices uses or proposed to be adopted by management;

(h) The independent auditor’s reasoning for accepting or questioning significant estimates made by management; and

(i) The independent auditor’s reasoning for appropriateness of the accounting principles and disclosure practices adopted by management for new transactions or events.

2

4. Review and pre-approve both audit and non-audit services to be provided by the independent auditor (other than with respect tode minimis exceptions permitted by the Sarbanes Oxley Act of 2002). Approval of non-audit services shall be disclosed in periodic reports required by the SEC.

5. Review with management and the independent auditors the results of quarterly reviews, annual audits, and related reporting requirements, including internal control reports or management internal control certifications, in consultation with the Finance Committee and other committees as deemed appropriate.

6. Arrange for the independent auditors to be available to the Board of Directors at least annually to help provide a basis for the Board to recommend to the Committee the appointment of the independent auditors.

Management

7. Review with management major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company’s selection or application of accounting principles, and major issues as to the adequacy of the Company’s internal controls and any other special audit steps adopted in light of material control deficiencies.

Internal Audit

8. Review and concur in the appointment, replacement, and dismissal of the Director of Internal Audit.

9. Review and approve the Internal Audit charter.

10. Review with management and the Director of Internal Audit the following:

(a) Annual business risk assessment;

(b) Annual internal audit plan; and

(c) Quarterly internal audit update on the results of internal audit reviews and resource needs.

Other

11. Review the Committee charter periodically, at least annually, and recommend to the Board of Directors any necessary amendments, as conditions dictate.

Audit Committee Membership Requirements and Reporting:

1. The Committee will be comprised of members from the Board of Directors.

2. The Committee members will include an Audit Committee Chairman, three to five committee members, and the Chairman of the Board of Directors, ex-officio.

3. Each member of the Committee shall be free from any relationship that, in the opinion of the Board of Directors, would interfere with the exercise of his or her independent judgment as a member of the Committee.

4. All members of the Committee shall have a working familiarity with basic finance and accounting practices. The Board of Directors shall determine whether at least one member of the Committee qualifies as an “audit committee financial expert” in compliance with the criteria established by the SEC and other relevant regulations. The existence of such member shall be disclosed in periodic filings, as required by the SEC.

5. The Director of Internal Audit reports functionally to the Committee and administratively to the chief financial officer.

3

PROXY

SOLICITED BY THE BOARD OF DIRECTORS OF

UNIFIED WESTERN GROCERS, INC.

FOR ANNUAL MEETING OF SHAREHOLDERS ON FEBRUARY 17, 2004

The undersigned, revoking any previous proxies respecting the subject matter hereof, hereby appoints LOUIS A. AMEN, ALFRED A. PLAMANN and ROBERT M. LING, JR. attorneys and proxies (each with power to act alone and with power of substitution) to vote all of the Class A Shares and Class B Shares which the undersigned is entitled to vote, at the annual meeting of shareholders of Unified Western Grocers, Inc., to be held on February 17, 2004, or at any adjournment thereof, as follows:

Election of Thirteen Directors by Class A Shares.

Nominees: Louis A. Amen, David M. Bennett, John Berberian, Edmund Kevin Davis, Dieter Huckestein, Darioush Khaledi, John D. Lang, Jay T. McCormack, Peter J. O’Neal, Michael A. Provenzano, Jr., Thomas S. Sayles, Kenneth Ray Tucker and Richard L. Wright

¨ FOR all nominees listed above,except any whose names are crossed out in the above list (the Board of Directors favors an instruction to vote for all nominees).

¨ WITHHOLD AUTHORITY to vote for all nominees listed above.

Election of Three Directors by Class B Shares.

Nominees: Douglas A. Nidiffer, Mimi R. Song and Robert E. Stiles

¨ FOR all nominees listed above,except any whose names are crossed out in the above list (the Board of Directors favors an instruction to vote for all nominees).

¨ WITHHOLD AUTHORITY to vote for all nominees listed above.

| 2. | In their discretion, on such other matters as may properly come before the meeting or any adjournment thereof. |

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS DIRECTED, BUT IF NO DIRECTION IS INDICATED IT WILL BE VOTED “FOR” ITEM 1 AND ACCORDING TO THE DISCRETION OF THE PROXYHOLDERS ON ANY OTHER PROPERLY PRESENTED MATTERS.

DATED: , 2004

| |

|

Signature | | Title |

| |

| |

|

Signature | | Title |

| |

| |

|

Signature | | Title |

PLEASE READ: Execution should be exactly in the name in which the shares are held; if by a fiduciary, the fiduciary’s full title should be shown; if by a corporation, execution should be in the corporate name by its chairman of the board, president or a vice president, or by other officers authorized by resolution of its board of directors or its bylaws; if by a partnership, execution should be in the partnership name by an authorized person.

PLEASE COMPLETE, DATE, SIGN AND RETURN

THIS PROXY PROMPTLY USING THE ENCLOSED ENVELOPE

2