Filed Pursuant to Rule 424(b)(3)

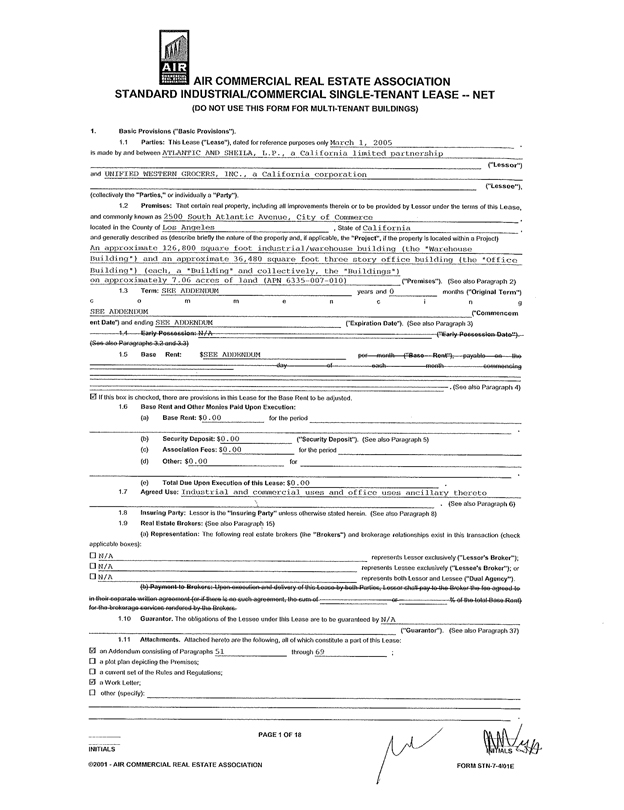

Registration Number 333-179658

PROSPECTUS SUPPLEMENT NO. 1

to Prospectus dated

April 20, 2012

(Registration No. 333-179658)

UNIFIED GROCERS, INC.

This Prospectus Supplement No. 1 supplements our Prospectus dated April 20, 2012. The securities that are the subject of the Prospectus have been registered to permit their sale by us.

This Prospectus Supplement includes the attached Quarterly Report on Form 10-Q for the period ended March 31, 2012 of Unified Grocers, Inc., as filed by us with the Securities and Exchange Commission.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus Supplement is May 18, 2012

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | FOR | | THE QUARTERLY PERIOD ENDED MARCH 31, 2012 |

OR

¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | FOR THE TRANSITION PERIOD FROM TO |

Commission file number: 0-10815

UNIFIED GROCERS, INC.

(Exact name of registrant as specified in its charter)

| | |

| California | | 95-0615250 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

5200 Sheila Street, Commerce, CA 90040

(Address of principal executive offices) (Zip Code)

(323) 264-5200

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | |

Large accelerated filer [ ] | | Accelerated filer [ ] |

Non-accelerated filer [X] | | Smaller reporting company [ ] |

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of April 28, 2012, the number of shares outstanding was:

Class A:154,350 shares; Class B:428,715 shares; Class C:15 shares; Class E:251,808 shares

Table of Contents

2

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

Unified Grocers, Inc. and Subsidiaries

Consolidated Condensed Balance Sheets – Unaudited

(dollars in thousands)

| | | | | | | | |

| | | March 31,

2012 | | | October 1,

2011 | |

Assets | | | | | | | | |

| | |

Current assets: | | | | | | | | |

Cash and cash equivalents | | $ | 8,019 | | | $ | 5,117 | |

Accounts and current portion of notes receivable, net of allowances of $3,248 and $2,302 at March 31, 2012 and October 1, 2011, respectively | | | 189,565 | | | | 191,684 | |

Inventories | | | 243,196 | | | | 267,745 | |

Prepaid expenses and other current assets | | | 9,508 | | | | 9,118 | |

Deferred income taxes | | | 8,445 | | | | 8,445 | |

| |

Total current assets | | | 458,733 | | | | 482,109 | |

Properties and equipment, net | | | 176,433 | | | | 179,811 | |

Investments | | | 92,216 | | | | 88,599 | |

Notes receivable, less current portion and net of allowances of $73 and $581 at March 31, 2012 and October 1, 2011, respectively | | | 19,639 | | | | 17,809 | |

Goodwill | | | 38,997 | | | | 38,997 | |

Other assets, net | | | 123,676 | | | | 116,353 | |

| |

Total Assets | | $ | 909,694 | | | $ | 923,678 | |

| |

Liabilities and Shareholders’ Equity | | | | | | | | |

| | |

Current liabilities: | | | | | | | | |

Accounts payable | | $ | 193,604 | | | $ | 209,886 | |

Accrued liabilities | | | 62,595 | | | | 62,047 | |

Current portion of notes payable | | | 3,820 | | | | 3,748 | |

Members’ deposits and estimated patronage dividends | | | 10,943 | | | | 13,398 | |

| |

Total current liabilities | | | 270,962 | | | | 289,079 | |

Notes payable, less current portion | | | 224,246 | | | | 226,162 | |

Long-term liabilities, other | | | 225,069 | | | | 221,773 | |

Members and Non-Members’ deposits | | | 9,160 | | | | 5,959 | |

Commitments and contingencies | | | | | | | | |

| | |

Shareholders’ equity: | | | | | | | | |

Class A Shares: 500,000 shares authorized, 154,000 and 158,550 shares outstanding at March 31, 2012 and October 1, 2011, respectively | | | 28,752 | | | | 29,531 | |

Class B Shares: 2,000,000 shares authorized, 428,715 and 440,273 shares outstanding at March 31, 2012 and October 1, 2011, respectively | | | 76,559 | | | | 78,465 | |

Class E Shares: 2,000,000 shares authorized, 251,808 shares outstanding at both March 31, 2012 and October 1, 2011 | | | 25,181 | | | | 25,181 | |

Retained earnings after elimination of accumulated deficit of $26,976 effective September 28, 2002 – allocated | | | 78,078 | | | | 78,183 | |

Retained earnings – non-allocated | | | 6,864 | | | | 6,864 | |

| |

Total retained earnings | | | 84,942 | | | | 85,047 | |

Receivable from sale of Class A Shares to Members | | | (963 | ) | | | (1,179 | ) |

Accumulated other comprehensive loss | | | (34,214 | ) | | | (36,340 | ) |

| |

Total shareholders’ equity | | | 180,257 | | | | 180,705 | |

| |

Total Liabilities and Shareholders’ Equity | | $ | 909,694 | | | $ | 923,678 | |

| |

The accompanying notes are an integral part of these statements.

3

Unified Grocers, Inc. and Subsidiaries

Consolidated Condensed Statements of Earnings (Loss) – Unaudited

(dollars in thousands)

| | | | | | | | | | | | | | | | |

| | | Thirteen Weeks Ended | | | Twenty-Six Weeks Ended | |

| | | March 31,

2012 | | | April 2,

2011 | | | March 31,

2012 | | | April 2, 2011 | |

Net sales | | $ | 923,257 | | | $ | 932,979 | | | $ | 1,914,380 | | | $ | 1,913,254 | |

Cost of sales | | | 846,907 | | | | 849,554 | | | | 1,754,066 | | | | 1,742,182 | |

Distribution, selling and administrative expenses | | | 74,994 | | | | 77,582 | | | | 148,049 | | | | 153,239 | |

| |

Operating income | | | 1,356 | | | | 5,843 | | | | 12,265 | | | | 17,833 | |

Interest expense | | | (3,081 | ) | | | (3,079 | ) | | | (6,155 | ) | | | (6,316 | ) |

| |

Earnings (loss) before estimated patronage dividends and income taxes | | | (1,725 | ) | | | 2,764 | | | | 6,110 | | | | 11,517 | |

Estimated patronage dividends | | | (1,888 | ) | | | 389 | | | | (3,565 | ) | | | (3,017 | ) |

| |

Earnings (loss) before income taxes | | | (3,613 | ) | | | 3,153 | | | | 2,545 | | | | 8,500 | |

Income taxes | | | 1,563 | | | | (891 | ) | | | (470 | ) | | | (2,590 | ) |

| |

Net earnings (loss) | | $ | (2,050 | ) | | $ | 2,262 | | | $ | 2,075 | | | $ | 5,910 | |

| |

The accompanying notes are an integral part of these statements.

4

Unified Grocers, Inc. and Subsidiaries

Consolidated Condensed Statements of Comprehensive Earnings (Loss) – Unaudited

(dollars in thousands)

| | | | | | | | | | | | | | | | |

| | | Thirteen Weeks Ended | | | Twenty-Six Weeks Ended | |

| | | March 31,

2012 | | | April 2,

2011 | | | March 31,

2012 | | | April 2,

2011 | |

Net earnings (loss) | | $ | (2,050 | ) | | $ | 2,262 | | | $ | 2,075 | | | $ | 5,910 | |

Other comprehensive earnings, net of income taxes: | | | | | | | | | | | | | | | | |

Unrealized net holding gain (loss) on investments, net of income tax expense (benefit) of $927 and $(31) for the thirteen weeks ended and $1,258 and $(402) for the twenty-six weeks ended March 31, 2012 and April 2, 2011, respectively | | | 1,514 | | | | (228 | ) | | | 2,126 | | | | (917 | ) |

| |

Comprehensive earnings (loss) | | $ | (536 | ) | | $ | 2,034 | | | $ | 4,201 | | | $ | 4,993 | |

| |

The accompanying notes are an integral part of these statements.

5

Unified Grocers, Inc. and Subsidiaries

Consolidated Condensed Statements of Cash Flows ��� Unaudited

(dollars in thousands)

| | | | | | | | |

| | | Twenty-Six Weeks Ended | |

| | | March 31,

2012 | | | April 2,

2011 | |

Cash flows from operating activities: | | | | | | | | |

Net earnings | | $ | 2,075 | | | $ | 5,910 | |

Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 12,649 | | | | 12,181 | |

Provision for doubtful accounts | | | 799 | | | | 176 | |

(Gain) loss on sale of properties and equipment | | | (239 | ) | | | 4 | |

Pension contributions | | | (5,128 | ) | | | (3,753 | ) |

(Increase) decrease in assets: | | | | | | | | |

Accounts receivable | | | 1,219 | | | | 13,547 | |

Inventories | | | 24,549 | | | | 1,192 | |

Prepaid expenses and other current assets | | | (390 | ) | | | 115 | |

Increase (decrease) in liabilities: | | | | | | | | |

Accounts payable | | | (16,422 | ) | | | (6,960 | ) |

Accrued liabilities | | | 548 | | | | (2,307 | ) |

Long-term liabilities, other | | | 7,540 | | | | 6,483 | |

| |

Net cash provided by operating activities | | | 27,200 | | | | 26,588 | |

| |

Cash flows from investing activities: | | | | | | | | |

Purchases of properties and equipment | | | (4,543 | ) | | | (5,291 | ) |

Purchases of securities and other investments | | | (13,154 | ) | | | (42,774 | ) |

Proceeds from maturities or sales of securities and other investments | | | 11,078 | | | | 51,778 | |

Origination of notes receivable | | | (3,480 | ) | | | (2,662 | ) |

Collection of notes receivable | | | 1,751 | | | | 3,147 | |

Proceeds from sales of properties and equipment | | | 279 | | | | 30 | |

Increase in other assets | | | (10,482 | ) | | | (9,244 | ) |

| |

Net cash utilized by investing activities | | | (18,551 | ) | | | (5,016 | ) |

| |

Cash flows from financing activities: | | | | | | | | |

Net repayments under secured revolving credit agreements | | | — | | | | (3,500 | ) |

Repayments of notes payable | | | (1,844 | ) | | | (937 | ) |

Payment of deferred financing fees | | | — | | | | (2,602 | ) |

Decrease in Members’ deposits and estimated patronage dividends | | | (2,455 | ) | | | (4,933 | ) |

Increase in Members and Non-Members’ deposits | | | 3,201 | | | | 366 | |

Decrease in receivable from sale of Class A Shares to Members, net | | | 216 | | | | 303 | |

Repurchase of shares from Members | | | (5,193 | ) | | | (8,211 | ) |

Issuance of shares to Members | | | 328 | | | | 123 | |

| |

Net cash utilized by financing activities | | | (5,747 | ) | | | (19,391 | ) |

| |

Net increase in cash and cash equivalents | | | 2,902 | | | | 2,181 | |

Cash and cash equivalents at beginning of period | | | 5,117 | | | | 5,901 | |

| |

Cash and cash equivalents at end of period | | $ | 8,019 | | | $ | 8,082 | |

| |

Supplemental disclosure of cash flow information: | | | | | | | | |

Cash paid during the period for: | | | | | | | | |

Interest | | $ | 5,664 | | | $ | 5,897 | |

Income taxes | | $ | 2,676 | | | $ | 3,297 | |

| |

The accompanying notes are an integral part of these statements.

6

Unified Grocers, Inc. and Subsidiaries

NOTES TO CONSOLIDATED CONDENSED FINANCIAL STATEMENTS – UNAUDITED

1. BASIS OF PRESENTATION

The consolidated condensed financial statements include the accounts of Unified Grocers, Inc. and all its subsidiaries (the “Company” or “Unified”). Inter-company transactions and accounts with subsidiaries have been eliminated. The interim financial statements included herein have been prepared by the Company without audit, pursuant to the rules and regulations promulgated by the Securities and Exchange Commission (the “SEC”). Certain information and note disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) have been omitted pursuant to SEC rules and regulations; nevertheless, management believes that the disclosures are adequate to make the information presented not misleading. These consolidated condensed financial statements should be read in conjunction with the audited financial statements and notes thereto included in the Company’s latest Annual Report on Form 10-K for the year ended October 1, 2011 filed with the SEC. The results of operations for the interim periods are not necessarily indicative of the results for the full year.

The consolidated condensed financial statements reflect all adjustments that, in the opinion of management, are both of a normal and recurring nature and necessary for the fair presentation of the results for the interim periods presented. The preparation of the consolidated condensed financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated condensed financial statements and accompanying notes. As a result, actual results could differ from those estimates.

The Company’s banking arrangements allow the Company to fund outstanding checks when presented for payment to the financial institutions utilized by the Company for disbursements. This cash management practice frequently results in total issued checks exceeding the available cash balance at a single financial institution. The Company’s policy is to record its cash disbursement accounts with a cash book overdraft in accounts payable. At March 31, 2012 and October 1, 2011, the Company had book overdrafts of $48.6 million and $48.0 million, respectively, classified in accounts payable and included in cash provided by operating activities.

Reclassifications – The Company has modified its cash flow presentation to disclose net borrowing activities under secured revolving credit agreements as a separate line item under financing activities. The Company has conformed its presentation for the twenty-six weeks ended April 2, 2011 to be consistent with the current year’s presentation.

2. FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company evaluates the fair value of its assets and liabilities in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 820, “Fair Value Measurements and Disclosures” (“ASC Topic 820”) and ASC Topic 825, “Financial Instruments.”

ASC Topic 820 establishes a hierarchy for evaluating assets and liabilities valued at fair value as follows:

| | · | | Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| | · | | Level 2 – Inputs other than quoted prices included in Level 1 that are either directly or indirectly observable. These inputs include quoted prices for similar assets or liabilities other than quoted prices in Level 1, quoted prices in markets that are not active, or other inputs that are observable or can be derived principally from or corroborated by observable market data for substantially the full term of the assets or liabilities. |

| | · | | Level 3 – Unobservable inputs in which little or no market activity exists, therefore requiring an entity to develop its own assumptions about the assumptions that market participants would use in pricing. |

7

The Company records marketable securities at fair value in accordance with ASC Topic 320, “Investments – Debt and Equity Securities.” These assets are held by the Company’s Insurance segment. The Company’s Wholesale Distribution segment holds insurance contracts and mutual funds valued at fair value in support of certain employee benefits. See Note 3 for further discussion on investments.

The following methods and assumptions were used to estimate the fair value of each class of financial instruments for which it is practicable to estimate that value:

Cash and cash equivalents. The carrying amount approximates fair value due to the short maturity of these instruments.

Accounts receivable and current portion of notes receivable. The carrying amount of accounts receivable and the current portion of notes receivable approximates the fair value of net accounts and notes receivable due to their short-term maturity.

Concentration of credit risk. The Company’s largest customer, Smart & Final, Inc., a Non-Member customer, and the ten largest Member and Non-Member customers (including Smart & Final, Inc.) constituted approximately 12% and 46%, respectively, of total net sales for the twenty-six week period ended March 31, 2012, and approximately 11% and 45%, respectively, of total net sales for the twenty-six week period ended April 2, 2011. The Company’s ten customers with the largest accounts receivable balances accounted for approximately 38% and 37% of total accounts receivable at March 31, 2012 and October 1, 2011, respectively. Management believes that receivables are well diversified, and the allowances for doubtful accounts are sufficient to absorb estimated losses.

Investments. Generally, the fair values for investments are readily determinable based on actively traded securities in the marketplace. Investments that are not actively traded are valued based upon inputs including quoted prices for identical or similar assets. Equity securities that do not have readily determinable fair values are accounted for using the cost or equity methods of accounting. The Company regularly evaluates securities carried at cost to determine whether there has been any diminution in value that is deemed to be other than temporary and adjusts the value accordingly.

The following table represents the Company’s financial instruments recorded at fair value and the hierarchy of those assets as of March 31, 2012:

| | | | | | | | | | | | | | | | |

(dollars in thousands) | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Money market funds | | $ | 2,456 | | | $ | — | | | $ | — | | | $ | 2,456 | |

Common equity securities | | | 10,988 | | | | — | | | | — | | | | 10,988 | |

Mutual funds | | | 13,451 | | | | — | | | | — | | | | 13,451 | |

Corporate securities | | | — | | | | 27,624 | | | | — | | | | 27,624 | |

Government securities | | | 9,724 | | | | 29,201 | | | | — | | | | 38,925 | |

Municipal securities | | | — | | | | 1,178 | | | | — | | | | 1,178 | |

| |

Total | | $ | 36,619 | | | $ | 58,003 | | | $ | — | | | $ | 94,622 | |

| |

The following table represents the Company’s financial instruments recorded at fair value and the hierarchy of those assets as of October 1, 2011:

| | | | | | | | | | | | | | | | |

(dollars in thousands) | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Money market funds | | $ | 1,604 | | | $ | — | | | $ | — | | | $ | 1,604 | |

Common equity securities | | | 8,657 | | | | — | | | | — | | | | 8,657 | |

Mutual funds | | | 10,683 | | | | — | | | | — | | | | 10,683 | |

Corporate securities | | | — | | | | 25,440 | | | | — | | | | 25,440 | |

Government securities | | | 10,637 | | | | 29,456 | | | | — | | | | 40,093 | |

Municipal securities | | | — | | | | 907 | | | | — | | | | 907 | |

| |

Total | | $ | 31,581 | | | $ | 55,803 | | | $ | — | | | $ | 87,384 | |

| |

8

Money market funds are valued based on quoted prices in active markets (Level 1 inputs) and are included in cash and cash equivalents in the Company’s consolidated condensed balance sheets. Common equity securities and mutual funds are valued based on information received from a third party. These assets are valued based on quoted prices in active markets (Level 1 inputs). As of March 31, 2012, $11.0 million of common equity securities are included in investments and $13.5 million of mutual funds are included in other assets in the Company’s consolidated condensed balance sheets. Corporate securities, consisting of high quality investment grade corporate bonds, and government and municipal securities, consisting of obligations of U.S. government corporations and agencies, U.S. government treasury securities and U.S. state and municipal bonds, are held by two of the Company’s insurance subsidiaries to fund loss reserves. These assets are valued based on information received from a third party pricing service. For assets traded in active markets, the assets are valued at quoted bond market prices (Level 1 inputs). For assets traded in inactive markets, the service’s pricing methodology uses observable inputs (such as bid/ask quotes) for identical or similar assets. Assets considered to be similar will have similar characteristics, such as: duration, volatility, prepayment speed, interest rates, yield curves, and/or risk profile and other market corroborated inputs (Level 2 inputs). The Company determines the classification of financial asset groups within the fair value hierarchy based on the lowest level of input into each group’s asset valuation. The financial instruments included in the preceding table, other than money market funds and mutual funds discussed above, are included in investments in the Company’s consolidated condensed balance sheets at March 31, 2012.

The Company did not have any transfers into and out of Levels 1 and 2 during the twenty-six week period ended March 31, 2012. Since the Company does not own any Level 3 financial instruments, the adoption of the requirement pursuant to Accounting Standards Update No. 2010-06,“Improving Disclosures About Fair Value Measurements,” to separate disclosures on a gross basis about purchases, sales, issuances and settlements relating to Level 3 measurements did not have an impact on the Company’s consolidated condensed financial statements.

Notes payable. The fair values of borrowings under the Company’s revolving credit facilities are estimated to approximate their carrying amounts due to the short maturities of those obligations. The fair values for other notes payable are based primarily on rates currently available to the Company for debt with similar terms and remaining maturities.

The fair value of notes payable, excluding capital leases, was $232.8 million and $237.2 million compared to their carrying value of $228.0 million and $229.7 million at March 31, 2012 and October 1, 2011, respectively.

The methods and assumptions used to estimate the fair values of the Company’s financial instruments at March 31, 2012 and October 1, 2011 were based on estimates of market conditions, estimates using present value and risks existing at that time. These values represent an approximation of possible value and may never actually be realized.

3. INVESTMENTS

The amortized cost and fair value of investments are as follows:

| | | | | | | | | | | | | | | | |

(dollars in thousands) | | | | | | | | | | | | |

March 31, 2012 | | Amortized

Cost | | | Gross

Unrealized

Gains | | | Gross

Unrealized

Losses | | | Fair

Value | |

Available for sale securities: | | | | | | | | | | | | | | | | |

Fixed maturity securities: | | | | | | | | | | | | | | | | |

U.S. Treasury securities and obligations of U.S. government corporations and agencies | | $ | 37,355 | | | $ | 1,588 | | | $ | (18 | ) | | $ | 38,925 | |

Municipal securities | | | 1,115 | | | | 63 | | | | — | | | | 1,178 | |

Corporate securities | | | 26,602 | | | | 1,054 | | | | (32 | ) | | | 27,624 | |

| |

Total fixed maturity securities | | | 65,072 | | | | 2,705 | | | | (50 | ) | | | 67,727 | |

Equity securities | | | 11,079 | | | | 298 | | | | (389 | ) | | | 10,988 | |

| |

Total available for sale securities | | $ | 76,151 | | | $ | 3,003 | | | $ | (439 | ) | | | 78,715 | |

| | | | | |

Common stock, at cost | | | | | | | | | | | | | | | 13,501 | |

| |

Total investments | | | | | | | | | | | | | | $ | 92,216 | |

| |

9

| | | | | | | | | | | | | | | | |

(dollars in thousands) | | | | | | | | | | | | |

October 1, 2011 | | Amortized

Cost | | | Gross

Unrealized

Gains | | | Gross

Unrealized

Losses | | | Fair

Value | |

Available for sale securities: | | | | | | | | | | | | | | | | |

Fixed maturity securities: | | | | | | | | | | | | | | | | |

U.S. Treasury securities and obligations of U.S. government corporations and agencies | | $ | 38,239 | | | $ | 1,883 | | | $ | (29 | ) | | $ | 40,093 | |

Municipal securities | | | 870 | | | | 37 | | | | — | | | | 907 | |

Corporate securities | | | 24,954 | | | | 652 | | | | (166 | ) | | | 25,440 | |

| |

Total fixed maturity securities | | | 64,063 | | | | 2,572 | | | | (195 | ) | | | 66,440 | |

Equity securities | | | 10,110 | | | | — | | | | (1,453 | ) | | | 8,657 | |

| |

Total available for sale securities | | $ | 74,173 | | | $ | 2,572 | | | $ | (1,648 | ) | | | 75,097 | |

| | | | | |

Common stock, at cost | | | | | | | | | | | | | | | 13,502 | |

| |

Total investments | | | $ | 88,599 | |

| |

During the interim period ended March 31, 2012 and the fiscal year ended October 1, 2011, the Company did not hold any trading or held-to-maturity securities.

The Company’s insurance subsidiaries invest a significant portion of premiums received in fixed maturity securities and equity securities to fund loss reserves. As a result, the Company’s insurance subsidiaries are subject to both credit and interest rate risk. Management has established guidelines and practices to limit the amount of credit risk through limitation of non-investment grade securities. The Company assesses whether unrealized losses are other-than-temporary. The discussion and table that follow describe the Company’s securities that have unrealized losses.

Unrealized losses on the Company’s investments in fixed maturity securities and equity securities were caused by interest rate increases rather than credit quality. Because the Company’s insurance subsidiaries do not intend to sell, nor do they have or anticipate having a regulatory requirement to sell, these investments until recovery of fair value, which may be upon maturity, the Company does not consider these investments to be other-than-temporarily impaired at March 31, 2012.

The table below illustrates the length of time available for sale fixed maturity securities and equity securities, not deemed to be other-than-temporarily impaired, have been in a continuous unrealized loss position at March 31, 2012:

| | | | | | | | | | | | | | | | | | | | | | | | |

(dollars in thousands) | | Less than 12 Months | | | 12 Months or Greater | | | Total | |

Description of Securities | | Fair

Value | | | Unrealized

Losses | | | Fair

Value | | | Unrealized

Losses | | | Fair

Value | | | Unrealized

Losses | |

U.S. Treasury securities and obligations of U.S. government corporations and agencies | | $ | 5,699 | | | $ | 18 | | | $ | — | | | $ | — | | | $ | 5,699 | | | $ | 18 | |

Corporate debt securities | | | 2,863 | | | | 24 | | | | 210 | | | | 8 | | | | 3,073 | | | | 32 | |

Equity securities | | | 3,723 | | | | 389 | | | | — | | | | — | | | | 3,723 | | | | 389 | |

| |

Total investments | | $ | 12,285 | | | $ | 431 | | | $ | 210 | | | $ | 8 | | | $ | 12,495 | | | $ | 439 | |

| |

The table below illustrates the length of time available for sale fixed maturity securities and equity securities, not deemed to be other-than-temporarily impaired, have been in a continuous unrealized loss position at October 1, 2011:

| | | | | | | | | | | | | | | | | | | | | | | | |

(dollars in thousands) | | Less than 12 Months | | | 12 Months or Greater | | | Total | |

Description of Securities | | Fair

Value | | | Unrealized

Losses | | | Fair

Value | | | Unrealized

Losses | | | Fair

Value | | | Unrealized

Losses | |

U.S. Treasury securities and obligations of U.S. government corporations and agencies | | $ | 5,957 | | | $ | 29 | | | $ | — | | | $ | — | | | $ | 5,957 | | | $ | 29 | |

Corporate debt securities | | | 10,642 | | | | 166 | | | | — | | | | — | | | | 10,642 | | | | 166 | |

Equity securities | | | 8,657 | | | | 1,453 | | | | — | | | | — | | | | 8,657 | | | | 1,453 | |

| |

Total investments | | $ | 25,256 | | | $ | 1,648 | | | $ | — | | | $ | — | | | $ | 25,256 | | | $ | 1,648 | |

| |

10

Available for sale fixed maturity securities are due as follows:

| | | | | | | | |

(dollars in thousands) | | | | | | |

March 31, 2012 | | Amortized

Cost | | | Fair

Value | |

Due in one year or less | | $ | 1,101 | | | $ | 1,102 | |

Due after one year through five years | | | 19,842 | | | | 20,635 | |

Due after five years through ten years | | | 19,217 | | | | 20,127 | |

Due after ten years | | | 24,912 | | | | 25,863 | |

| |

| | $ | 65,072 | | | $ | 67,727 | |

| |

Expected maturities will differ from contractual maturities because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties. Corporate mortgage-backed securities are shown as being due at their average expected maturity dates.

Amounts reported as “due in one year or less” are included in long-term investments, as the Company’s insurance subsidiaries are required to maintain investments in support of regulatory deposit requirements. Hence, investments with maturities less than one year maintained in support of this long-term commitment are generally sold to repurchase investments with longer maturities. As these investments continue to support a long-term commitment obligation related to insurance reserves, the Company classifies such amounts as long-term. At March 31, 2012 and October 1, 2011, the long-term portion of the related insurance reserves of $33.5 million and $33.8 million, respectively, are included in long-term liabilities, other in the Company’s consolidated condensed balance sheets.

Investments carried at fair values of $44.9 million and $42.4 million at March 31, 2012 and October 1, 2011 (which include $0.7 million and $0.5 million recorded in cash and cash equivalents), respectively, are maintained in support of regulatory deposit requirements ($40.9 million and $38.8 million in direct deposit of securities at March 31, 2012 and October 1, 2011, respectively) in compliance with statutory regulations. Investments with fair values of $7.2 million and $7.3 million at March 31, 2012 and October 1, 2011 (which include $0.9 million and $0.1 million recorded in cash and cash equivalents), respectively, are on deposit with regulatory authorities in compliance with statutory regulations. Investments with fair values of $0.9 million at both March 31, 2012 and October 1, 2011 (which include zero recorded in cash and cash equivalents) are on deposit in compliance with collateral requirements on reinsurance arrangements.

Net investment income, which is included in net sales, is summarized as follows:

| | | | | | | | | | | | | | | | |

(dollars in thousands) | | | | | | | |

| | | Thirteen Weeks Ended | | | Twenty-Six Weeks Ended | |

| | | March 31,

2012 | | | April 2,

2011 | | | March 31,

2012 | | | April 2,

2011 | |

Fixed maturity securities | | $ | 570 | | | $ | 769 | | | $ | 1,153 | | | $ | 1,857 | |

Equity securities | | | 26 | | | | 1,111 | | | | 425 | | | | 1,505 | |

Cash and cash equivalents | | | 1 | | | | 1 | | | | 1 | | | | 2 | |

| |

| | | 597 | | | | 1,881 | | | | 1,579 | | | | 3,364 | |

Less: investment expenses | | | (74 | ) | | | (75 | ) | | | (149 | ) | | | (152 | ) |

| |

| | $ | 523 | | | $ | 1,806 | | | $ | 1,430 | | | $ | 3,212 | |

| |

Equity investments held by the Company that do not have readily determinable fair values are accounted for using the cost or equity methods of accounting. The Company evaluated its equity investments for impairment as of March 31, 2012, and the Company did not consider any of these equity investments to be impaired.

The Company held investments in Western Family Holding Company (“Western Family”) common stock of $9.4 million at both March 31, 2012 and October 1, 2011. Western Family is a private cooperative located in Oregon from which the Company purchases food and general merchandise products. The investment represents approximately a 20% ownership interest at both March 31, 2012 and October 1, 2011. The Company’s ownership percentage in Western Family is based, in part, on the volume of purchases transacted with Western Family. The investment is accounted for using the equity method of accounting.

11

The Company’s wholly-owned finance subsidiary, Grocers Capital Company (“GCC”), has an investment in National Consumer Cooperative Bank (“NCB”), which operates as a cooperative and therefore its borrowers are required to own its Class B common stock. The investment in the Class B common stock of NCB aggregated $4.1 million at both March 31, 2012 and October 1, 2011. The Company did not recognize dividend income from NCB in the interim period ended March 31, 2012 or the fiscal year ended October 1, 2011.

4. SEGMENT INFORMATION

Unified is a retailer-owned, grocery wholesale cooperative serving supermarket, specialty and convenience store operators located primarily in the western United States and the Pacific Rim. The Company’s customers range in size from single store operators to regional supermarket chains. The Company sells a wide variety of products typically found in supermarkets. The Company’s customers include its owners (“Members”) and non-owners (“Non-Members”). The Company sells products through Unified or through its specialty food subsidiary (Market Centre) and international sales subsidiary (Unified International, Inc.). The Company reports all product sales in its Wholesale Distribution segment. The Company also provides support services, including insurance and financing, to its customers through the Wholesale Distribution segment and through separate subsidiaries. Insurance activities are reported in Unified’s Insurance segment while finance activities are grouped within Unified’s All Other business activities. The availability of specific products and services may vary by geographic region.

Management identifies segments based on the information monitored by the Company’s chief operating decision makers to manage the business and, accordingly, has identified the following two reportable segments:

| | · | | The Wholesale Distribution segment includes the results of operations from the sale of groceries and general merchandise products to both Members and Non-Members, including a broad range of branded and corporate brand products in nearly all the categories found in a typical supermarket, including dry grocery, frozen food, deli, meat, dairy, eggs, produce, bakery, ethnic, gourmet, specialty foods, natural and organic, general merchandise and health and beauty care products. Support services (other than insurance and financing), including promotional planning, retail technology, equipment purchasing services and real estate services, are reported in the Wholesale Distribution segment. As of, and for the twenty-six weeks ended, March 31, 2012, the Wholesale Distribution segment collectively represented approximately 85% of the Company’s total assets, and 99% of total net sales. |

Non-perishable products consist primarily of dry grocery, frozen food, deli, ethnic, gourmet, specialty foods, natural and organic, general merchandise and health and beauty care products. They also include (1) retail support services and (2) products and shipping services provided to Non-Member customers through Unified International, Inc. Perishable products consist primarily of service deli, service bakery, meat, eggs, produce, bakery and dairy products. Net sales within the Wholesale Distribution segment include $636.0 million and $666.9 million, or 69.2% and 71.8% of total Wholesale Distribution segment net sales, for the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively, attributable to sales of non-perishable products, and $282.7 million and $262.0 million, or 30.8% and 28.2% of total Wholesale Distribution segment net sales, for the thirteen weeks ended March 31, 2012 and April 2, 2011, respectively, attributable to sales of perishable products. Net sales within the Wholesale Distribution segment include $1.321 billion and $1.368 billion, or 69.3% and 71.8% of total Wholesale Distribution segment net sales, for the twenty-six weeks ended March 31, 2012 and April 2, 2011, respectively, attributable to sales of non-perishable products, and $585.2 million and $537.5 million, or 30.7% and 28.2% of total Wholesale Distribution segment net sales, for the twenty-six weeks ended March 31, 2012 and April 2, 2011, respectively, attributable to sales of perishable products. Wholesale Distribution segment net sales also include revenues attributable to the Company’s retail support services, which comprised less than 1% of total Wholesale Distribution segment net sales, for each of the foregoing respective periods.

| | · | | The Insurance segment includes the results of operations for the Company’s three insurance subsidiaries (Unified Grocers Insurance Services, Springfield Insurance Company and Springfield Insurance Company, Limited). These subsidiaries provide insurance and insurance-related products, including workers’ compensation and liability insurance policies, to both the Company and its Member and Non-Member customers. Unified Grocers Insurance Services is an insurance agency that places business with insurance carriers, both non-affiliated and Springfield Insurance Company. Springfield Insurance Company, Limited is a captive re-insurer for Springfield Insurance Company. Unified Grocers Insurance Services is a licensed insurance agency in Alaska, Arizona, California, Idaho, New Mexico, Nevada, Oregon, Texas, Washington and Utah. Springfield Insurance Company is a licensed insurance carrier in Arizona, California, Colorado, Idaho, |

12

| | Montana, New Mexico, Nevada, Oregon, Texas, Washington, Wyoming and Utah. Springfield Insurance Company, Limited is a licensed insurance carrier in the Commonwealth of Bermuda. As of, and for the twenty-six weeks ended, March 31, 2012, the Company’s Insurance segment collectively accounted for approximately 12% of the Company’s total assets, and 1% of total net sales. |

The All Other category includes the results of operations for the Company’s other support businesses, including its finance subsidiary, whose services are provided to a common customer base, none of which individually meets the quantitative thresholds of a reportable segment. As of, and for the twenty-six weeks ended, March 31, 2012, the All Other category collectively accounted for approximately 3% of the Company’s total assets, and less than 1% of total net sales.

Information about the Company’s operating segments is summarized below.

| | | | | | | | | | | | | | | | |

(dollars in thousands) | | | | | | | | | | | | |

| | | Thirteen Weeks Ended | | | Twenty-Six Weeks Ended | |

| | | March 31,

2012 | | | April 2,

2011 | | | March 31,

2012 | | | April 2,

2011 | |

Net sales | | | | | | | | | | | | | | | | |

Wholesale distribution | | $ | 918,694 | | | $ | 928,890 | | | $ | 1,905,655 | | | $ | 1,905,695 | |

Insurance | | | 6,729 | | | | 6,961 | | | | 13,783 | | | | 13,579 | |

All other | | | 329 | | | | 237 | | | | 674 | | | | 479 | |

Inter-segment eliminations | | | (2,495 | ) | | | (3,109 | ) | | | (5,732 | ) | | | (6,499 | ) |

| |

Total net sales | | $ | 923,257 | | | $ | 932,979 | | | $ | 1,914,380 | | | $ | 1,913,254 | |

| |

Operating income (loss) | | | | | | | | | | | | | | | | |

Wholesale distribution | | $ | 1,476 | | | $ | 4,404 | | | $ | 11,632 | | | $ | 15,176 | |

Insurance | | | (228 | ) | | | 1,449 | | | | 410 | | | | 2,677 | |

All other | | | 108 | | | | (10 | ) | | | 223 | | | | (20 | ) |

| |

Total operating income | | | 1,356 | | | | 5,843 | | | | 12,265 | | | | 17,833 | |

| |

Interest expense | | | (3,081 | ) | | | (3,079 | ) | | | (6,155 | ) | | | (6,316 | ) |

Estimated patronage dividends | | | (1,888 | ) | | | 389 | | | | (3,565 | ) | | | (3,017 | ) |

Income taxes | | | 1,563 | | | | (891 | ) | | | (470 | ) | | | (2,590 | ) |

| |

Net earnings (loss) | | $ | (2,050 | ) | | $ | 2,262 | | | $ | 2,075 | | | $ | 5,910 | |

| |

Depreciation and amortization | | | | | | | | | | | | | | | | |

Wholesale distribution | | $ | 6,247 | | | $ | 5,984 | | | $ | 12,452 | | | $ | 11,987 | |

Insurance | | | 85 | | | | 83 | | | | 169 | | | | 163 | |

All other | | | 14 | | | | 16 | | | | 28 | | | | 31 | |

| |

Total depreciation and amortization | | $ | 6,346 | | | $ | 6,083 | | | $ | 12,649 | | | $ | 12,181 | |

| |

Capital expenditures | | | | | | | | | | | | | | | | |

Wholesale distribution | | $ | 2,627 | | | $ | 1,441 | | | $ | 4,531 | | | $ | 5,228 | |

Insurance | | | 7 | | | | 47 | | | | 12 | | | | 63 | |

All other | | | — | | | | — | | | | — | | | | — | |

| |

Total capital expenditures | | $ | 2,634 | | | $ | 1,488 | | | $ | 4,543 | | | $ | 5,291 | |

| |

Identifiable assets at March 31, 2012 and April 2, 2011 | | | | | | | | | | | | | | | | |

Wholesale distribution | | $ | 769,007 | | | $ | 785,133 | | | $ | 769,007 | | | $ | 785,133 | |

Insurance | | | 113,700 | | | | 102,352 | | | | 113,700 | | | | 102,352 | |

All other | | | 26,987 | | | | 22,218 | | | | 26,987 | | | | 22,218 | |

| |

Total identifiable assets | | $ | 909,694 | | | $ | 909,703 | | | $ | 909,694 | | | $ | 909,703 | |

| |

5. SHAREHOLDERS’ EQUITY

During the twenty-six week period ended March 31, 2012, the Company issued 1,050 Class A Shares with an issuance value of $0.3 million and redeemed 5,600 Class A Shares with a redemption value of $1.7 million. The Company also redeemed 11,558 Class B Shares with a redemption value of $3.5 million during the twenty-six week period ended March 31, 2012.

13

6. CONTINGENCIES

The Company is a party to various litigation, claims and disputes, some of which are for substantial amounts, arising in the ordinary course of business. While the ultimate effect of such actions cannot be predicted with certainty, the Company believes the outcome of these matters will not result in a material adverse effect on its financial condition or results of operations.

7. PENSION AND OTHER POSTRETIREMENT BENEFITS

The Company sponsors a cash balance plan (“Unified Cash Balance Plan”). The Unified Cash Balance Plan is a noncontributory defined benefit pension plan covering substantially all employees of the Company who are not subject to a collective bargaining agreement. Benefits under the Unified Cash Balance Plan are provided through a trust.

The Company also sponsors an Executive Salary Protection Plan (“ESPP”) for the executive officers of the Company that provides supplemental post-termination retirement income based on each participant’s salary and years of service as an officer of the Company (see Note 11 of “Notes to Consolidated Financial Statements”in Part II, Item 8.“Financial Statements and Supplementary Data” of the Company’s Annual Report on Form 10-K for the year ended October 1, 2011 for additional discussion). Funds are held in a rabbi trust for the ESPP consisting primarily of life insurance policies reported at cash surrender value and mutual fund assets consisting of various publicly-traded mutual funds reported at estimated fair value based on quoted market prices. In accordance with ASC Topic 710,“Compensation – General,” the assets and liabilities of a rabbi trust must be accounted for as if they are assets and liabilities of the Company. In addition, all earnings and expenses of the rabbi trust are reported in the Company’s consolidated condensed statement of earnings. The cash surrender value of such life insurance policies aggregated $16.9 million and $15.1 million at March 31, 2012 and October 1, 2011, respectively, and are included in other assets in the Company’s consolidated condensed balance sheets. Mutual funds reported at their estimated fair value of $13.5 million and $10.7 million at March 31, 2012 and October 1, 2011, respectively, are included in other assets in the Company’s consolidated condensed balance sheets. The related accrued benefit cost (representing the Company’s benefit obligation to participants) of $40.4 million and $38.5 million at March 31, 2012 and October 1, 2011, respectively, is recorded in long-term liabilities, other in the Company’s consolidated condensed balance sheets. The assets held in the rabbi trust are not available for general corporate purposes. The rabbi trust is subject to creditor claims in the event of insolvency. The trust assets are excluded from ESPP plan assets as they do not qualify as plan assets under ASC Topic 715, “Compensation – Retirement Benefits.”

The Company sponsors other postretirement benefit plans that provide certain medical coverage to retired non-union employees and provide unused sick leave benefits for certain eligible non-union and union employees. Those plans are not funded.

The components of net periodic cost for pension and other postretirement benefits for the respective twenty-six weeks ended March 31, 2012 and April 2, 2011 consist of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(dollars in thousands) | | | | | | | | | | | | | | | |

| | | Pension Benefits | | | Other Postretirement Benefits | |

| | | Thirteen Weeks

Ended | | | Twenty-Six Weeks

Ended | | | Thirteen Weeks

Ended | | | Twenty-Six Weeks

Ended | |

| | | March 31,

2012 | | | April 2,

2011 | | | March 31,

2012 | | | April 2,

2011 | | | March 31,

2012 | | | April 2,

2011 | | | March 31,

2012 | | | April 2,

2011 | |

Service cost | | $ | 1,942 | | | $ | 1,925 | | | $ | 3,884 | | | $ | 3,850 | | | $ | 381 | | | $ | 470 | | | $ | 762 | | | $ | 940 | |

Interest cost | | | 3,161 | | | | 2,972 | | | | 6,322 | | | | 5,944 | | | | 630 | | | | 639 | | | | 1,260 | | | | 1,277 | |

Expected return on plan assets | | | (3,168 | ) | | | (3,100 | ) | | | (6,336 | ) | | | (6,200 | ) | | | — | | | | — | | | | — | | | | — | |

Amortization of prior service cost (credit) | | | 3 | | | | 55 | | | | 6 | | | | 111 | | | | (247 | ) | | | (118 | ) | | | (494 | ) | | | (236 | ) |

Recognized actuarial loss (gain) | | | 1,303 | | | | 996 | | | | 2,606 | | | | 1,991 | | | | (77 | ) | | | (34 | ) | | | (154 | ) | | | (67 | ) |

| |

Net periodic cost | | $ | 3,241 | | | $ | 2,848 | | | $ | 6,482 | | | $ | 5,696 | | | $ | 687 | | | $ | 957 | | | $ | 1,374 | | | $ | 1,914 | |

| |

14

The Company’s funding policy is to make contributions to the Unified Cash Balance Plan in amounts that are at least sufficient to meet the minimum funding requirements of applicable laws and regulations, but no more than amounts deductible for federal income tax purposes. The Company expects to make estimated contributions to the Unified Cash Balance Plan totaling $12.9 million during fiscal 2012, which is comprised of $5.8 million for the 2012 plan year and $7.1 million for the 2011 plan year. At its discretion, the Company may contribute in excess of these amounts. Additional contributions, if any, will be based, in part, on future actuarial funding calculations and the performance of plan investments. The Company contributed $0 million and $5.1 million to the Unified Cash Balance Plan during the twenty-six weeks ended March 31, 2012 for the 2012 and 2011 plan years, respectively. The Company is scheduled to make the initial quarterly contribution for the 2012 plan year at the beginning of the third quarter of fiscal 2012.

Additionally, the Company expects to contribute $0.7 million to the ESPP to fund projected benefit payments to participants for the 2012 plan year. The Company contributed $0.5 million to the ESPP during the twenty-six weeks ended March 31, 2012 to fund benefit payments to participants for the 2012 plan year.

During fiscal year 2010, comprehensive health care reform legislation under thePatient Protection and Affordable Care Act (HR 3590) and theHealth Care Education and Affordability Reconciliation Act (HR 4872) (collectively, the “Acts”) was passed and signed into law. The Acts contain provisions that could impact the Company’s accounting for retiree medical benefits in future periods. However, the extent of that impact, if any, cannot be determined until regulations are promulgated under the Acts and additional interpretations of the Acts become available. Elements of the Acts, the impact of which are currently not determinable, include the elimination of lifetime limits on retiree medical coverage and reduction of the existing insurance coverage gap for prescription drug benefits that are actuarially equivalent to benefits available to retirees under theMedicare Prescription Drug, Improvement and Modernization Act of 2003. The Company will continue to assess the accounting implications of the Acts as related regulations and interpretations of the Acts become available. In addition, the Company may consider plan amendments in future periods that may have accounting implications.

8. RELATED PARTY TRANSACTIONS

Members affiliated with directors of the Company make purchases of merchandise from the Company and also may receive benefits and services that are of the type generally offered by the Company to similarly situated eligible Members. Management believes such transactions are on terms that are generally consistent with terms available to other Members similarly situated.

During the course of its business, the Company enters into individually negotiated supply agreements with its Members. These agreements require the Member to purchase certain agreed amounts of its merchandise requirements from the Company and obligate the Company to supply such merchandise under agreed terms and conditions relating to such matters as pricing and delivery.

A supply agreement with Super Center, Inc., a Member affiliated with Mimi Song, a director of the Company, became effective in February 2012. The agreement will expire in the Company’s fiscal year 2016.

As of the date of this report, other than noted above, there have been no material changes to the related party transactions disclosed in Note 17 to“Notes to Consolidated Financial Statements” in Part II, Item 8.“Financial Statements and Supplementary Data”of the Company’s Annual Report on Form 10-K for the year ended October 1, 2011.

9. RECENTLY ADOPTED AND RECENTLY ISSUED AUTHORITATIVE ACCOUNTING GUIDANCE

In September 2011, the FASB issued Accounting Standards Update (“ASU”) No. 2011-09,“Compensation—Retirement Benefits – Multiemployer Plans (Subtopic 220): Disclosures about an Employer’s Participation in a Multiemployer Plan” (“ASU No. 2011-09”). ASU No. 2011-09 creates greater transparency in financial reporting by requiring additional disclosures about an employer’s participation in a multiemployer pension plan and multiemployer other postretirement benefit plans. The additional disclosures will increase awareness about the commitments that an employer has made to a multiemployer pension plan and multiemployer other postretirement benefit plans and the potential future cash flow implications of an employer’s participation in the plans. ASU No. 2011-09 is effective for annual periods for fiscal years ending after December 15, 2011; however, disclosure requirements should be applied retrospectively for all prior periods presented. Early adoption is permitted. Accordingly, the Company will adopt ASU No. 2011-09 for fiscal year end 2012. Other than enhanced disclosure, the adoption of ASU No. 2011-09 is not expected to have an impact on the Company’s consolidated condensed financial statements.

15

In June 2011, the FASB and the International Accounting Standards Board (“IASB”) issued ASU No. 2011-05,“Comprehensive Income (Topic 220): Presentation of Comprehensive Income” (“ASU No. 2011-05”). ASU No. 2011-05 addresses concerns about how other comprehensive income is reported under U.S. GAAP and International Financial Reporting Standards (“IFRSs”) and increases the prominence of other comprehensive income in the financial statements. ASU No. 2011-05 allows for the option of presenting either one continuous statement of net income and other comprehensive income or two consecutive statements. Further, an entity will be required to present on the face of the financial statements reclassification adjustments for items that are reclassified from other comprehensive income to net income in the statement(s) where the components of net income and the components of other comprehensive income are presented for both interim and annual periods. The standard does not change the items which must be reported in other comprehensive income, how such items are measured or when they must be reclassified to net income. ASU No. 2011-05 is effective for fiscal years, and interim periods within those years, beginning after December 15, 2011. Early adoption is permitted. In December 2011, the FASB issued ASU No. 2011-12,“Deferral of the Effective Date for Amendments to the Presentation of Reclassifications Out of Accumulated Other Comprehensive Income in ASU No. 2011-05” (“ASU No. 2011-12”). ASU No. 2011-12 indefinitely defers only the specific provision requiring companies to present reclassification adjustments out of accumulated other comprehensive income by component in both the statement where net income is presented and the statement where other comprehensive income is presented.

The Company will formally adopt ASU No. 2011-05 commencing in the first quarter of fiscal 2013, except for the requirement to present reclassification adjustments out of accumulated other comprehensive income by component, which has been indefinitely deferred by ASU No. 2011-12. However, since the Company currently presents the consolidated condensed statements of earnings and the consolidated condensed statements of comprehensive earnings as two consecutive statements, the Company does not expect the adoption of this portion of ASU No. 2011-05 to have an impact on the consolidated condensed financial statements.

In May 2011, the FASB and the IASB issued ASU No. 2011-04,“Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs” (“ASU No. 2011-04”). ASU No. 2011-04 does not extend the use of fair value accounting, but provides guidance on how it should be applied where its use is already required or permitted by other standards within U.S. GAAP or IFRSs. The amendments in ASU No. 2011-04 change the wording used to describe many of the requirements in U.S. GAAP for measuring fair value and for disclosing information about fair value measurements. Amendments in ASU No. 2011-04 include those that: (1) clarify the FASB’s intent about the application of existing fair value measurement and disclosure requirements; and (2) change a particular principle or requirement for measuring fair value or for disclosing information about fair value measurements. For many of the requirements, the FASB does not intend for the amendments in ASU No. 2011-04 to result in a change in the application of the requirements in Topic 820. ASU No. 2011-04 is effective during interim and annual periods beginning after December 15, 2011. Accordingly, the Company adopted ASU No. 2011-04 commencing in the second quarter of fiscal 2012. The adoption of ASU No. 2011-04 did not have an impact on the Company’s consolidated condensed financial statements.

In October 2010, the FASB issued ASU No. 2010-26,“Financial Services – Insurance (Topic 944): Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts (a consensus of the FASB Emerging Issues Task Force)” (“ASU No. 2010-26”). ASU No. 2010-26 addresses the diversity in practice regarding the interpretation of which costs relating to the acquisition of new or renewal insurance contracts qualify for deferral. ASU No. 2010-26 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2011. The amendments in ASU No. 2010-26 are to be applied prospectively upon adoption. Retrospective application to all prior periods presented upon the date of adoption also is permitted, but not required. Accordingly, the Company will adopt ASU No. 2010-26 commencing in the first quarter of fiscal 2013. The adoption of ASU No. 2010-26 is expected to have an insignificant impact on the Company’s consolidated condensed financial statements.

In January 2010, the FASB issued ASU No. 2010-06,“Improving Disclosures About Fair Value Measurements”(“ASU No. 2010-06”), an amendment to ASC Topic 820. ASU No. 2010-06 amends ASC Topic 820 to add new requirements for: (1) disclosures about transfers of assets and liabilities measured at fair value into and out of Levels 1 and 2 of the fair value measurement hierarchy; and (2) separate disclosures on a gross basis about purchases, sales, issuances and settlements relating to Level 3 measurements. It also clarifies existing fair value disclosures about the level of disaggregation and about inputs and valuation techniques used to measure fair

16

value. ASU No. 2010-06 also amends guidance on employers’ disclosures about postretirement benefit plan assets under ASC Topic 715,“Compensation – Retirement Benefits – Defined Benefits Plans – General – Disclosure,”to require that disclosures be provided by classes of assets instead of by major categories of assets. The guidance in ASU No. 2010-06 is effective for the first reporting period (including interim periods) beginning after December 15, 2009, except for the requirement to provide the Level 3 activity of purchases, sales, issuances and settlements on a gross basis, which is effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. In the period of initial adoption, entities will not be required to provide the amended disclosures for any previous periods presented for comparative purposes. However, those disclosures are required for periods ending after initial adoption.

The Company adopted ASU No. 2010-06 in its second quarter of fiscal year end 2010, except for the requirement to provide separate disclosures about purchases, sales, issuances and settlements relating to Level 3 measurements, which the Company adopted in its first quarter of fiscal year end 2012. Since the Company continues to have no transfers into and out of Levels 1 and 2, the requirements of ASU No. 2010-06 did not have an impact on the Company’s consolidated condensed financial statements. Similarly, since the Company does not own any Level 3 financial instruments, the adoption of this portion of ASU No. 2010-06 did not have an impact on the Company’s consolidated condensed financial statements.

10. SUBSEQUENT EVENTS

Subsequent events have been evaluated by the Company through the date the financial statements were issued.

17

ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

FORWARD-LOOKING INFORMATION

This report contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to expectations concerning matters that (a) are not historical facts, (b) predict or forecast future events or results, or (c) embody assumptions that may prove to have been inaccurate. These forward-looking statements involve risks, uncertainties and assumptions. When we use words such as “believe,” “expect,” “anticipate” or similar expressions, we are making forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot give readers any assurance that such expectations will prove correct. The actual results may differ materially from those anticipated in the forward-looking statements as a result of numerous factors, many of which are beyond our control. Important factors that could cause actual results to differ materially from our expectations include, but are not limited to, the factors discussed in the sections entitled “Risk Factors” and “Critical Accounting Policies and Estimates” within “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All forward-looking statements attributable to us are expressly qualified in their entirety by the factors that may cause actual results to differ materially from anticipated results. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinion only as of the date hereof. We undertake no duty or obligation to revise or publicly release the results of any revision to these forward-looking statements. Readers should carefully review the risk factors described in this document as well as in other documents we file from time to time with the Securities and Exchange Commission (the “SEC”).

COMPANY OVERVIEW

General

Unified Grocers, Inc. (referred to in this Form 10-Q, together with its consolidated subsidiaries, as “Unified,” “the Company,” “we,” “us” or “our”), a California corporation organized in 1922 and incorporated in 1925, is a retailer-owned, grocery wholesale cooperative serving supermarket, specialty and convenience store operators located primarily in the western United States and the Pacific Rim. We operate our business in two reportable business segments: (1) Wholesale Distribution; and (2) Insurance. All remaining business activities are grouped into All Other (see Note 4 of“Notes to Consolidated Condensed Financial Statements – Unaudited” in Part I, Item 1.“Financial Statements (Unaudited)”of this Quarterly Report on Form 10-Q for additional discussion).

We sell a wide variety of products typically found in supermarkets, as well as a variety of specialty products, through the Cooperative and Dairy Divisions of Unified, our specialty food subsidiary (Market Centre) and our international sales subsidiary (Unified International, Inc.). We report all product sales and results from certain of our support services to customers, including promotional planning, retail technology, equipment purchasing and real estate services, in our Wholesale Distribution segment, which represents approximately 99% of our total net sales. We also provide insurance and financing to our customers through separate subsidiaries, the results of which are reported in our Insurance segment and All Other business activities, respectively. Insurance activities account for approximately 1% of total net sales. The availability of specific products and services may vary by geographic region. We have three separate geographical and marketing regions: Southern California, Northern California and the Pacific Northwest.

Our customers include our owners (“Members”) and non-owners (“Non-Members”). We do business primarily with those customers that have been accepted as Members. Our Members operate supermarket companies that range in size from single store operators to regional supermarket chains. Members are required to meet specific requirements, which include ownership of our capital shares and may include required cash deposits. Customers who purchase less than $1 million annually from us would not generally be considered for membership, while customers who purchase over $3 million annually are typically required to become Members. See Part I, Item 1.“Business – Member Requirements,” Part I, Item 1.“Business – Capital Shares” and Part I, Item 1.“Business – Customer Deposits” of our Annual Report on Form 10-K for the year ended October 1, 2011 for additional information. Additionally, see“DESCRIPTION OF DEPOSIT ACCOUNTS” in our Amendment No. 2 to Registration Statement on Form S-1 filed on April 19, 2012, with respect to our offering of Partially Subordinated Patrons’ Deposit Accounts for further information. The membership requirements, including purchase and capitalization requirements, may be modified at any time at the discretion of our Board of Directors (the “Board”).

18

We distribute the earnings from patronage activities conducted by us, excluding our subsidiaries, with our Members (“Patronage Business”) in the form of patronage dividends. The Board approves the payment of patronage dividends and the form of such payment for our three patronage earnings divisions: the Cooperative Division, the Southern California Dairy Division and the Pacific Northwest Dairy Division. See Part I, Item 1.“Business – Company Structure and Organization – Wholesale Business – Wholesale Distribution”of our Annual Report on Form 10-K for the year ended October 1, 2011 for additional discussion. An entity that does not meet Member purchase requirements may conduct business with us as a Non-Member customer. We may also grant an entity that meets our Member purchase requirements the ability to conduct business with us as a Non-Member customer. We retain the earnings from our subsidiaries and from business conducted with Non-Members (collectively, “Non-Patronage Business”).

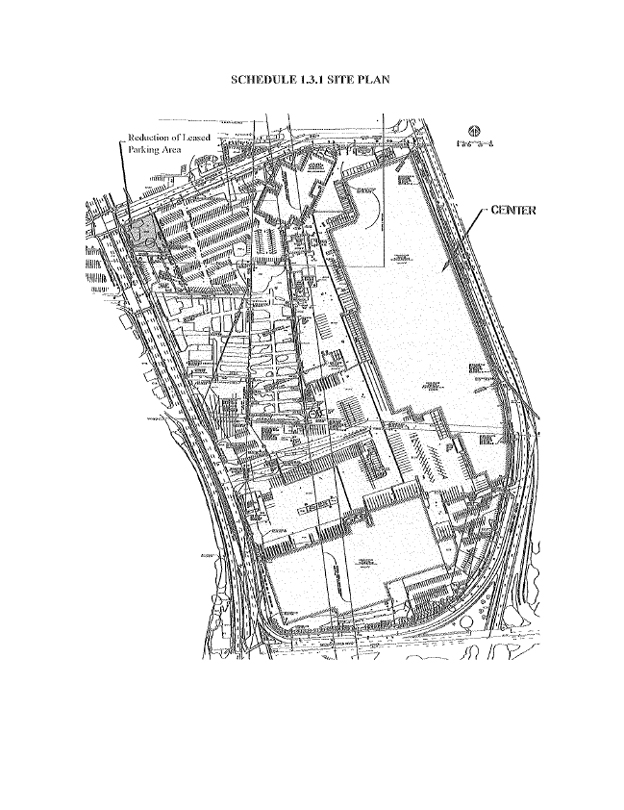

Facilities and Transportation

We operate various warehouse and office facilities that are located in Commerce, Los Angeles, Santa Fe Springs, Stockton and Fresno, California, Milwaukie, Oregon and Seattle, Washington. We also operate a bakery manufacturing facility and a milk, water and juice processing plant in Los Angeles, which primarily serve the Southern California region.

We believe our properties are generally in good condition, well maintained and suitable and adequate to carry on our business as presently conducted.

Our customers may choose either of two delivery options for the distribution of our products: have us deliver orders to their stores or warehouses or pick-up their orders from our distribution centers. For delivered orders, we primarily utilize our fleet of tractors and trailers.

INDUSTRY OVERVIEW AND THE COMPANY’S OPERATING ENVIRONMENT

Competition

We compete in the wholesale grocery industry with regional and national food wholesalers such as C&S Wholesale and Supervalu Inc., as well as other local wholesalers and distributors that provide a more limited range of products and services to their customers. We also compete with many local and regional meat, produce, grocery, specialty, general food, bakery and dairy wholesalers and distributors. Our customers compete directly with vertically integrated regional and national chains. The growth or loss in market share of our customers could also impact our sales and earnings. For more information about the competitive environment we and our customers face, please refer to “Risk Factors.”

The marketplace in which we operate continues to evolve and present challenges both to our customers and us. The continued expansion of alternative grocery and food store formats into the marketplace may present challenges for some of the retail grocery stores owned by our customers. In addition, non-traditional formats such as club stores, supercenters, discount, drug, natural and organic and convenience stores continue to expand their offering of products that are a core part of the conventional grocery store offering, thereby creating additional competition for our customers.

Our strategy to help our customers effectively compete in the marketplace includes a focus on helping our customers understand consumer trends. The ongoing challenging economic climate continues to cause consumers to place a higher emphasis on lower prices. Job losses have also caused a significant shift in consumers’ eating and living habits. To effectively adjust to these conditions, many of our customers have focused on, among other things, enhancing their corporate brand offerings to give consumers a lower-priced alternative to nationally branded products. This includes a corporate brand health and wellness offering to satisfy consumers’ desire for products that support a healthy lifestyle but at a lower price. Differentiation strategies in specialty and ethnic products and items on the perimeter of the store such as produce, service deli, service bakery and meat categories also continue to be an important part of our strategy.

One of our sales initiatives is to continue our development of programs and services designed with consumers in mind. The retail store is becoming a more important source of information for consumers about the products that are available to them. To provide this information, we are offering more in-store literature to educate consumers about the products we offer, particularly to promote value and savings through event marketing and everyday low price campaigns.

19

Economic Factors

Economic factors such as low consumer confidence and high unemployment continue to persist in certain of our operating markets. Higher food price inflation and fuel costs during calendar 2011 placed more pressure on consumer discretionary income, and these trends have continued during 2012. Consumers continue to be highly price sensitive and seek lower cost alternatives in their grocery purchases, continuing to put pressure on profit margins in an industry already characterized by low profit margins. Job losses have also caused greater demographic shifts that can change the composition of consumers and their related product focus in a given marketplace.

We are impacted by changes in the overall economic environment. An inflationary or deflationary economic period could impact our operating income in a variety of areas, including, but not limited to, sales, cost of sales, employee wages and benefits, workers’ compensation insurance and energy and fuel costs. We typically experience significant volatility in the cost of certain commodities, the cost of ingredients for our manufactured breads and processed fluid milk and the cost of packaged goods purchased from other manufacturers. Our operating programs are designed to give us the flexibility to pass on these costs to our customers; however, we may not always be able to pass on such changes to customers on a timely basis. Any delay may result in our recovering less than all of a price increase. It is also difficult to predict the effect that possible future purchased or manufactured product cost decreases might have on our profitability. The effect of deflation in purchased or manufactured product costs would depend on the extent to which we had to lower selling prices of our products to respond to sales price competition in the market. Consequently, it is difficult for us to accurately predict the impact that inflation or deflation might have on our operations.

External factors continue to drive volatility in our costs associated with fuel. Our pricing includes a fuel surcharge on product shipments to recover fuel costs over a specified index. When fuel costs differ from a specified index, pricing adjustments are passed on to our customers. The surcharge is reviewed monthly and adjusted when appropriate.

Additionally, wage increases occur as a result of negotiated labor contracts and adjustments for non-represented employees. Wage increases primarily occur in September for negotiated labor contracts. Wage increases for non-represented employees typically occur in December. We continually focus attention on initiatives aimed at improving operating efficiencies throughout the organization to offset the impact of these wage increases.

Our insurance subsidiaries invest a significant portion of premiums received in fixed maturity securities and equity securities to fund loss reserves. As a result, our operating performance may be impacted by the performance of these investments. The majority of our investments (approximately 86%) are held by two of our insurance subsidiaries, and include obligations of U.S. government corporations and agencies, high quality investment grade corporate bonds, U.S. government treasury securities, U.S. state and municipal securities and common equity securities. The investments held by our insurance subsidiaries, excluding the common equity securities, are generally not actively traded and are valued based upon inputs including quoted prices for identical or similar assets. Collectively, the estimated fair value or market value of these investments continued to exceed their cost during the twenty-six weeks ended March 31, 2012. Approximately 10% of our investments are held by our Wholesale Distribution segment, which consists primarily of Western Family Holding Company (“Western Family”) common stock. Western Family is a private cooperative located in Oregon from which we purchase food and general merchandise products. Approximately 4% of our investments are held by our other support businesses and consist of an investment by our wholly-owned finance subsidiary in National Consumer Cooperative Bank (“NCB”). NCB operates as a cooperative and therefore its borrowers are required to own its Class B common stock.

We invest in life insurance policies (reported at cash surrender value) and various publicly-traded mutual funds (reported at estimated fair value based on quoted market prices) to fund obligations pursuant to our Executive Salary Protection Plan and deferred compensation plan (see Note 7 of “Notes to Consolidated Condensed Financial Statements – Unaudited”in Part I, Item 1.“Financial Statements (Unaudited)” of this Quarterly Report on Form 10-Q for additional discussion). Life insurance and mutual fund assets with values tied to the equity markets are impacted by overall market conditions. During the twenty-six weeks ended March 31, 2012, net earnings and net comprehensive earnings experienced an increase corresponding to the increase in life insurance and mutual fund assets, respectively.

20

Technology

Technological improvements have been an important part of our strategy to improve service to our customers and lower costs. As supermarket chains increase in size and alternative format grocery stores gain market share, independent grocers are further challenged to compete. Our customers benefit from our substantial investment in supply-chain technology, including improvements in our vendor management activities through new item introductions, promotions and payment support activities.

Technological improvements in our distribution systems have been an area of concentration. Over the past several years, we have continued to upgrade our warehouse and enterprise reporting systems to improve efficiency, order fulfillment accuracy and internal management reporting capabilities. This process has been instrumental in helping drive labor efficiency. We are realizing the expected improvements from each facility’s upgrade.

We are in the process of implementing a proof of delivery application throughout our private transportation fleet. The new mobile application is expected to improve the accuracy of the delivery process. At the heart of the application is a mobile hand-held computer that tracks customer shipments. This fully electronic solution replaces the need for existing paper documents and provides real time information on service level and delivery performance.

We provide our customers with network connectivity, data exchange and a portfolio of retail automation applications. We continue to enhance these products and services to allow the retailer to easily and efficiently strengthen their business application functionality and comply with new regulations. Most of these offerings are provided under a subscription model allowing our retailers to utilize these systems without high up-front costs. We fully support these products, eliminating the need for our customers to manage these systems. In the difficult business environment and economic conditions our retailers have been facing, this approach has been helpful in promoting their success. During fiscal 2011, we continued to improve cardholder security on our ReadyPay® system, which allows the retailer to accept and process all forms of electronic payment. The improvements include moving to a web-based service model that removes cardholder data access from the retailer and makes Payment Card Industry compliance more easily achievable. We continue to invest in technology solutions that offer value to the supply chain and bring our customers closer to the consumer.

RESULTS OF OPERATIONS