Creating a leading nationwide supplier to America’s independent grocers Member Meeting Exhibit 99.1

Legal Notice Additional Important Information About the Proposed Merger and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed acquisition of Unified by SUPERVALU. In connection with the merger, Unified intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A, a preliminary version of which has been filed with the SEC on April 26, 2017. Following the filing of the definitive proxy statement with the SEC, Unified will mail the definitive proxy statement and a proxy card to each shareholder entitled to vote at the special meeting of shareholders relating to the merger. SHAREHOLDERS ARE URGED TO CAREFULLY READ THESE MATERIALS IN THEIR ENTIRETY (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT UNIFIED WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. The proxy statement and other relevant materials (when available), and any and all documents filed by Unified with the SEC, may also be obtained for free at the SEC’s website at www.sec.gov. In addition, shareholders may obtain free copies of the documents filed with the SEC by Unified via the Financial Information section of its website at www.unifiedgrocers.com, by calling Unified toll-free at 800-242-9907 or by emailing Unified at corp.sec@unifiedgrocers.com. Participants in the Solicitation Unified and its directors and officers may be deemed to be participants in the solicitation of proxies in respect of the transactions contemplated by the Merger Agreement. Information regarding Unified’s directors and executive officers is contained in Unified’s proxy statement dated January 24, 2017, previously filed with the SEC and the preliminary proxy statement filed with the SEC on April 26, 2017. To the extent holdings of securities by such directors or executive officers have changed since the amounts printed in the preliminary proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement to be filed by Unified in connection with the merger. Cautionary Statement Regarding Forward-Looking Statements This communication may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements, including, but not limited to, statements regarding the expected completion of the merger (including the timing thereof) and the ability to consummate the merger (including but not limited to the receipt of all required regulatory approvals). These forward-looking statements involve risks, uncertainties and assumptions. The actual results may differ materially from those anticipated in the forward-looking statements as a result of numerous factors, many of which are beyond Unified’s control. Important factors that could cause actual results to differ materially from Unified’s expectations include, but are not limited to, (i) the risk that Unified’s shareholders do not approve the Merger Agreement; (ii) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; (iii) the response by shareholders to the announcement of the merger; (iv) the failure to satisfy each of the conditions to the consummation of the merger, including but not limited to, the risk that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the merger on acceptable terms, or at all; (v) risks related to disruption of management’s attention from Unified’s ongoing business operations due to the merger; (vi) the effect of the announcement of the merger on Unified’s relationships with its customers or suppliers, operating results and business generally; (vii) risks related to employee retention as a result of the merger, (viii) the risk that the merger will not be consummated within the expected time period or at all and (ix) other risks that are described in Unified’s public filings with the SEC. For more information, see the risk factors described in Unified’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the SEC. Forward-looking statements speak only as of the date they are made and Unified is under no obligation to (and specifically disclaims any such obligation to) update or alter any forward looking statements, whether as a result of new information, future events or otherwise.

Agenda Process Leading To A Potential Transaction Thoughtful and deliberate process The Board believes a transaction is in the best interests of the Membership A compelling offer at the right time, with the right partner Combined excellence Highlights Of The Deal Shareholder matters Continuation of products and services Offices, distribution facilities and Associates Looking Forward Timeline What your future looks like

Process Leading To A Potential Transaction

We didn’t start with the objective of a sale or any other transaction The Strategic Plan was designed to set the course for the Company to deliver a long-term, stable source of supply Strategic Plan provided path to grow sales, become more efficient and de-lever the Company Strategic Plan included investing in facilities and de-levering the Company from the sale of real estate In evaluating the Strategic Plan, the Board considered execution risks, competition risks and the capital investment required The Board also considered changes in the grocery industry, including consolidation of wholesale competitors and changes in our Membership The Board decided to test the value of Unified before executing the Strategic Plan Process Leading Up To Decision

We undertook a confidential process with three potential buyers Details of that process will be described in the upcoming Proxy Statement The Board believes this transaction provides the best way to provide a stable, secure and competitive source of supply over the long term Three Potential Buyers Emerged

The transaction recognizes the value of Unified and the business it has built in the marketplace Details in the upcoming Proxy Statement This transaction is valued at the top end of the typical multiples of enterprise or transaction value to EBITDA for selected public companies, and transactions in the conventional wholesale and specialty distribution channel The Unified Board received a fairness opinion from its financial advisor A Compelling Offer

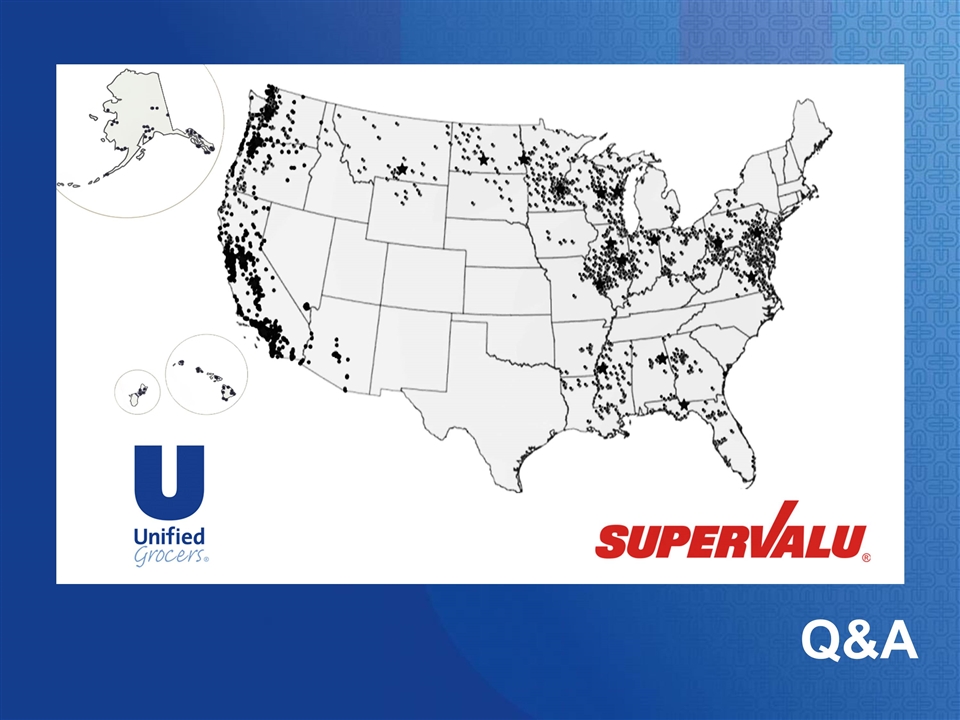

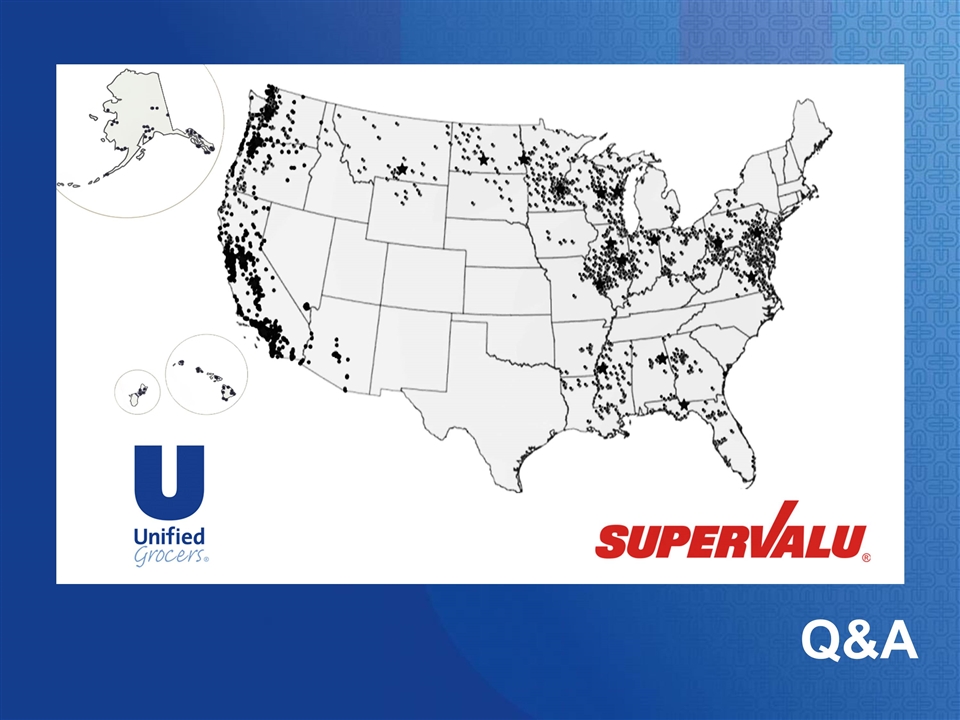

Strong alignment of culture, mission and objectives between Unified and Supervalu Combined entity expected to continue to serve you with commitment and dedication Combined organization with sales of approximately $16 billion in 2016 Will serve independents across the country Scale expected to allow for significant buying efficiencies and cost effectiveness Combined Excellence

Highlights Of The Deal - Shareholder Matters - Continuation Of Products And Services - Offices, Distribution Facilities and Associates

Shareholder Matters If the merger closes, Members will receive the full 2016 exchange value for shares in cash Under the merger agreement: Class A and B shares paid at $200.27 per share Class E shares paid at $100 per share Stated value Required deposits and excess deposits will be returned Credit deposits will carry over to Supervalu Any past-dues will be deducted Any gain on your shares will be taxable this year Supervalu will pay off or assume all Unified liabilities For now, there’s no action you need to take to receive payment More details in the Proxy Statement – coming soon

Continuation Of Products And Services Designed to avoid disruption to your business Supervalu has agreed to maintain Member pricing programs (including sell plans), product offerings and services after closing for at least one year, as will be more fully described in the Proxy Statement Payment terms will stay the same Must pay on time, in full, with no deductions, and buy at same levels It is expected that you will continue to work with the same sales and customer satisfaction teams Any contracts with Unified will continue with the surviving entity

Offices, Facilities and Associates Supervalu is expected to operate Unified’s existing warehouses and looks to execute a PNW warehouse consolidation plan Supervalu is expected to maintain offices in all of our current regions Supervalu is excited about the team that Unified has in place – the experience, the talent and dedication of our Associates Supervalu is looking forward to welcoming the Unified team to Supervalu and continuing the important work of serving independent retailers

Looking Forward - Timeline - What the Combined Company Looks Like

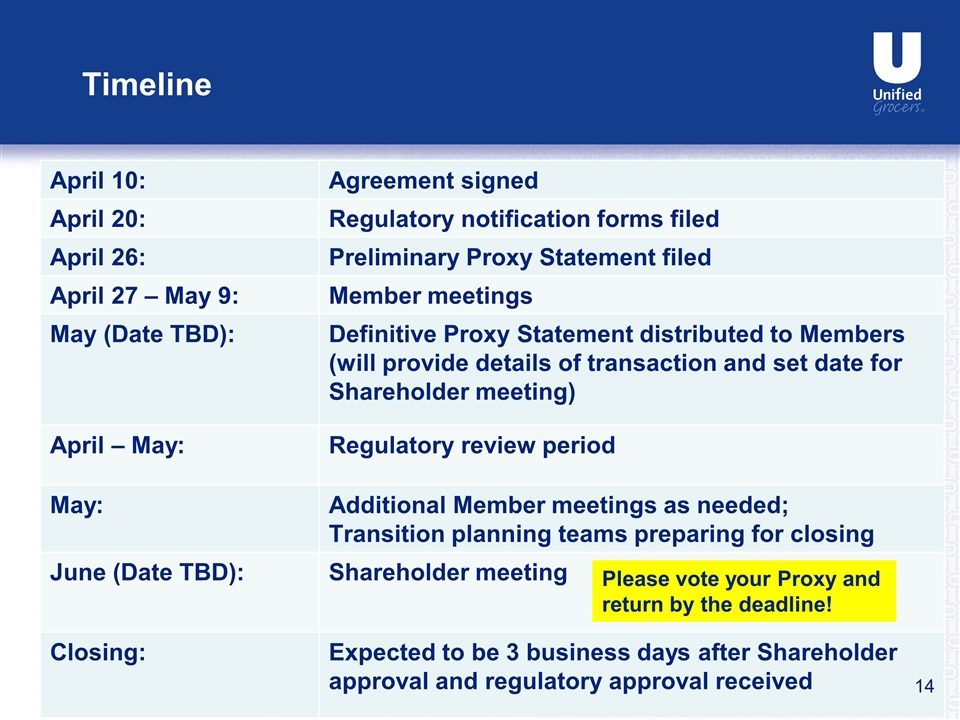

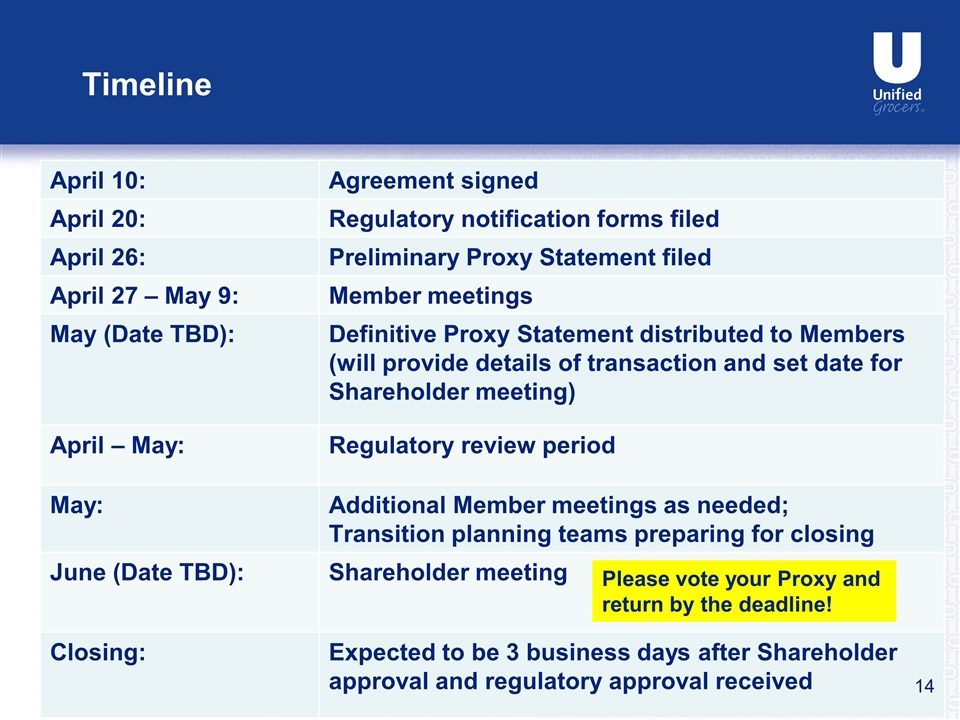

April 10: Agreement signed April 20: Regulatory notification forms filed April 26: Preliminary Proxy Statement filed April 27 – May 9: Member meetings May (Date TBD): Definitive Proxy Statement distributed to Members (will provide details of transaction and set date for Shareholder meeting) April – May: Regulatory review period May: Additional Member meetings as needed; Transition planning teams preparing for closing June (Date TBD): Shareholder meeting Closing: Expected to be 3 business days after Shareholder approval and regulatory approval received Timeline Please vote your Proxy and return by the deadline!

Leading National Provider To Independents

Q&A