UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-00483

ELFUN TRUSTS

(Exact name of registrant as specified in charter)

3001 SUMMER STREET, STAMFORD, CONNECTICUT 06905

(Address of principal executive offices) (Zip code)

GE ASSET MANAGEMENT, INC.

3001 SUMMER STREET, STAMFORD, CONNECTICUT 06905

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-242-0134

Date of fiscal year end: 12/31

Date of reporting period: 12/31/10

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Elfun Funds

Annual Report

December 31, 2010

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a current prospectus.

Information on the following performance pages relates to the Elfun Funds.

Total returns take into account changes in share price and assume reinvestment of all dividends and capital gains distributions, if any.

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Periods less than one year are not annualized. Please call toll-free 800-242-0134 or visit the Funds’ website at http://www.geam.com for the most recent month-end performance data.

A portion of the Elfun Tax-Exempt Income Fund’s income may be subject to state, federal and/or alternative minimum tax. Capital gains, if any, are subject to capital gains tax.

An investment in a Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. An investment in a Fund is subject to risk, including possible loss of principal invested.

The Standard & Poor’s (“S&P”) 500® Composite Price Index of stocks (S&P 500 Index), Morgan Stanley Capital International Europe, Australasia, Far East Index (MSCI EAFE® Index), Barclays Capital U.S. Aggregate Bond Index and the Barclays Capital U.S. Municipal Bond Index are unmanaged indices and do not reflect the actual cost of investing in the instruments that comprise each index.

S&P 500 Index is an unmanaged, market capitalization-weighted index of stocks of 500 large U.S. companies, which is widely used as a measure of large-cap stock market performance. MSCI EAFE® Index is a market capitalization-weighted index of equity securities of companies domiciled in various countries. The index is designed to represent the performance of developed stock markets outside the U.S. and Canada and excludes certain market segments unavailable to U.S. based investors. Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of taxable investment-grade debt issues, including government, corporate, asset-backed and mortgage-backed securities, with

maturities of one year or more. This index is designed to represent the performance of the U.S. investment-grade first-rate bond market. Barclays Capital U.S. Municipal Bond Index is an unmanaged index comprised of investment-grade, fixed rate securities with maturities of at least eight years and less than twelve years.

The 90 Day T-Bill is an unmanaged measure/index of the performance of U.S. Treasury bills currently available in the marketplace having a remaining maturity of 90 days.

The results shown for the foregoing indices assume the reinvestment of net dividends or interest. The above indices/measures do not reflect the actual costs of investing in the instruments that comprise each index.

The peer universe of underlying funds used in our peer ranking calculation is based on the blend of Morningstar peer categories, as shown. Morningstar is an independent mutual fund rating service. A Fund’s performance may be compared to or ranked within a universe of mutual funds with investment objectives and policies similar but not necessarily identical to the Fund.

©2010 Morningstar, Inc. All Rights Reserved. The Morningstar information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damage or losses relating from any use of this information. Past performance is no guarantee of future results.

The views, expressed in this document reflect our judgment as of the publication date and are subject to change at any time without notice.

GE Investment Distributors, Inc., member of FINRA, is the principal underwriter and distributor of the Elfun Funds and a wholly owned subsidiary of GE Asset Management Incorporated, the investment adviser of the Funds.

1

(Unaudited)

Ralph R. Layman

The Elfun International Equity Fund is managed by a team of portfolio managers that includes Brian Hopkinson, Ralph R. Layman (pictured to the left), Paul Nestro, Jonathan L. Passmore and Michael J. Solecki. As lead portfolio manager for the Fund, Mr. Layman oversees the entire team and assigns a portion of the Fund to each manager, including himself. Each portfolio manager is limited to the management of his or her portion of the Fund, the size of the portion which Mr. Layman determines on an annual basis. The portfolio managers do not operate independently of each other, rather, the team operates collaboratively, communicating purchases or sales of securities on behalf of the Fund. See portfolio managers’ biographical information beginning on page 116.

| Q. | How did the Elfun International Equity Fund perform compared to its benchmark for the twelve-month period ended December 31, 2010? |

| A. | The Elfun International Equity Fund rose 5.77% in the twelve months ending December 31, 2010. The MSCI EAFE Index, the Fund’s benchmark, returned 7.75% and the Fund’s Morningstar peer group of 851 Foreign Large Blend funds returned an average of 10.25% for the same period. |

| Q. | What market conditions impacted the Fund performance? |

| A. | Markets were volatile for much of the year as contradictory forces dampened performance early in the year but gave way to strong gains in the second half. The evolving sovereign debt crisis in Europe negatively affected markets concerned |

| | about a growing need for austerity but the persistence of low rates, anecdotal evidence of an improving global economy and strong earnings across the globe pushed stocks higher in all major markets. Similarly, doubts regarding much-needed regulatory reform in the financial sector cast a cloud over markets in the first half but increased clarity from bodies such as the Basel 3 Committee regarding bank capitalization, liquidity and leverage provided much-needed transparency to investors later in the year. |

| Q. | What were the primary drivers of Fund performance? |

| A. | Positive impact was seen from holdings in materials, energy stocks and telecom services. The steady rise of commodity prices throughout the year was highly beneficial to metals and mining stocks and fertilizer companies leveraged to rising crop prices. A somewhat different result was seen in energy where despite rising oil prices, a combination of the BP crisis and low natural gas prices saw that sector underperform. An underweight in the underperforming telecom sector was also beneficial for performance. The lion’s share of the negative performance in the portfolio came from holdings in the financial sector, mainly in European banks. Although underweight, the portfolio was hit by the assumption that all European banks would be dragged down by the sovereign debt crisis, although direct exposure to the troubled markets of Greece, Ireland and Portugal |

2

(Unaudited)

| | was insignificant. Japanese holdings, especially those in the export markets also suffered due to a strong Yen. |

| Q. | Were there any significant changes to the Fund during the period? |

| A. | Significant changes occurred during the year, most notably in the information technology and industrial sectors (additions) funded through sales in healthcare, financials, the consumer sectors and utilities. Generally, a growing conviction in a return to economic growth prompted purchases in the more cyclical sectors and disposals in the defensive segment of the portfolio. Stocks in the IT sector appealed for increasing evidence that corporate entities are beginning to spend and industrial companies in Europe gained material advantage from the weakness in the Euro caused by the sovereign debt crisis. While the outlook for the consumer is improving, especially in Emerging Asia, the outlook for consumer staples companies is less robust, as much for valuation reasons than lack of a catalyst. Financials have remained troubled all year with individual stocks in the commercial banking segment paying a steeper price than stocks in insurance for example and particular positions were reduced as a result. Healthcare companies, given the uncertainties surrounding the regulatory environment have offered little appeal and utilities have been challenged by anemic growth and a tough financing environment, despite low rates. The portfolio finished the year overweight IT, materials and industrials, and underweight consumer discretionary, utilities, healthcare, financials and telecom. |

3

(Unaudited)

Understanding Your Fund’s Expenses

As a shareholder of the Fund you incur transaction and ongoing expenses. Transaction expenses including sales charges on purchases payments, reinvested dividends (or other distributions), and redemption fees directly reduce the investment return of the Fund. Ongoing costs include portfolio management fees, distribution and services fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended December 31, 2010.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses.

You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your class under the heading “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table for both “Actual” and “Hypothetical” do not reflect any transaction costs, such as sales charges or redemption fees.

July 1, 2010 – December 31, 2010

| | | | | | | | | | | | |

| | | Account value at

the beginning

of the period ($) | | | Account value

at the end of

the period ($) | | | Expenses

paid during

the period ($)* | |

| | | |

Actual Fund Return** | | | 1,000.00 | | | | 1,247.14 | | | | 1.81 | |

| | | |

Hypothetical 5% Return

(2.5% for the period) | | | 1,000.00 | | | | 1,023.32 | | | | 1.63 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.32% (for the period July 1, 2010 - December 31, 2010), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period) |

| ** | | Actual Fund Return for the six-month period ended December 31, 2010 was: 24.71%. Past performance does not guarantee future results. |

4

(Unaudited)

Investment Profile

A mutual fund designed for investors who seek long-term growth of capital and future income by investing principally in foreign securities consistent with prudent investment management and the preservation of capital. The Fund invests at least 80% of its net assets under normal circumstances in equity securities, such as common stock and preferred stocks and invests primarily (meaning at least 65%) in companies in both developed and emerging market countries outside the United States.

Top Ten Largest Holdings

as of December 31, 2010 as a % of Fair Value(b)(c)

| | | | |

Nestle S.A. | | | 2.82% | |

Siemens AG | | | 2.53% | |

HSBC Holdings PLC | | | 2.30% | |

BHP Billiton PLC | | | 2.23% | |

Potash Corporation of Saskatchewan Inc. | | | 2.16% | |

Rio Tinto PLC | | | 2.09% | |

Linde AG | | | 1.88% | |

Suzuki Motor Corp. | | | 1.85% | |

BNP Paribas | | | 1.84% | |

Prudential PLC | | | 1.82% | |

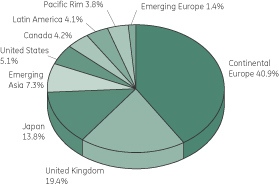

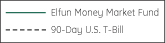

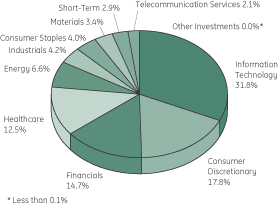

Sector Allocation

as a % of the Fair Value of $308,798 (in thousands) as of December 31, 2010.(b)(c)

Morningstar Performance Comparison

Based on average annual returns for periods ended 12/31/10

| | | | | | | | | | | | |

| | | One

Year | | | Five

Year | | | Ten

Year | |

Number of Funds in peer group | | | 851 | | | | 648 | | | | 502 | |

Peer group average annual total

return | | | 10.25 | % | | | 2.58 | % | | | 2.97 | % |

Morningstar category in peer group: Foreign Large Blend | |

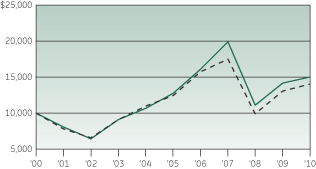

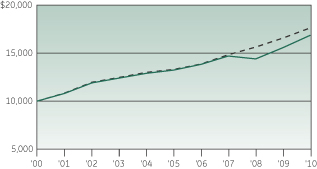

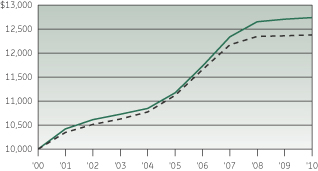

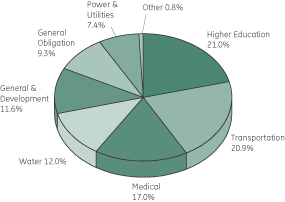

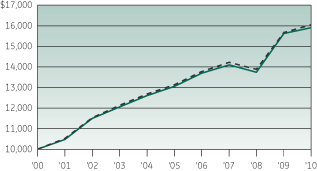

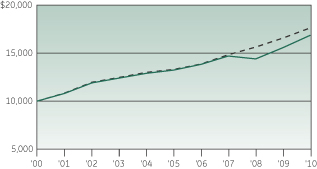

Change in Value of a $10,000 Investment(a)

Average Annual Total Return

for the periods ended December 31, 2010

| | | | | | | | | | | | | | | | |

| (Inception date: 01/01/88) | | | | | | | | | | |

| | | One

Year | | | Five

Year | | | Ten

Year | | | Ending value of a

$10,000

investment (a) | |

| | | | |

Elfun International Equity Fund | | | 5.77% | | | | 3.31% | | | | 4.16% | | | | 15,028 | |

| | | | |

MSCI EAFE Index | | | 7.75% | | | | 2.46% | | | | 3.48% | | | | 14,079 | |

| (a) | Ending value of a $10,000 investment for the ten-year period or since inception, whichever is less. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| (c) | Fair value basis is inclusive of Short Term Investment in GE Money Market Fund. |

See Notes to Performance on page 1 for further information.

Past performance does not predict future performance. The performance shown on the graph and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

5

| | |

| Elfun International Equity Fund | | (in thousands) — December 31, 2010 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | | | | | | | | |

Common Stock — 92.2%† | | | | | | | |

| |

| Australia — 2.2% | | | |

| | | |

Brambles Ltd. | | | 267,312 | | | $ | 1,951 | | | |

Lynas Corporation Ltd. | | | 1,023,773 | | | | 2,162 | | | (a) |

Paladin Energy Ltd. | | | 515,971 | | | | 2,607 | | | (a) |

| | | | | | | 6,720 | | | |

| |

| Brazil — 3.0% | | | |

| | | |

Banco Santander Brasil S.A. | | | 239,900 | | | | 3,259 | | | |

Petroleo Brasileiro S.A. ADR | | | 96,913 | | | | 3,312 | | | |

Vale S.A. ADR | | | 89,238 | | | | 2,697 | | | (a) |

| | | | | | | 9,268 | | | |

| |

| Canada — 4.2% | | | |

| | | |

Kinross Gold Corp. | | | 44,906 | | | | 855 | | | |

Potash Corporation of Saskatchewan Inc. | | | 42,936 | | | | 6,674 | | | |

Research In Motion Ltd. | | | 53,044 | | | | 3,100 | | | (a) |

Suncor Energy Inc. | | | 62,437 | | | | 2,405 | | | |

| | | | | | | 13,034 | | | |

| |

| Chile — 0.3% | | | |

| | | |

Sociedad Quimica y Minera de Chile S.A. ADR | | | 16,946 | | | | 990 | | | |

| |

| China — 1.8% | | | |

| | | |

Baidu Inc. ADR | | | 22,542 | | | | 2,176 | | | (a) |

Bank of China Ltd. | | | 2,708,976 | | | | 1,432 | | | |

CSR Corp Ltd. | | | 1,478,539 | | | | 1,944 | | | |

| | | | | | | 5,552 | | | |

| |

| Denmark — 0.6% | | | |

| | | |

AP Moller - Maersk A/S | | | 200 | | | | 1,819 | | | |

| |

| France — 10.9% | | | |

| | | |

AXA S.A. | | | 159,013 | | | | 2,656 | | | |

BNP Paribas | | | 88,790 | | | | 5,671 | | | |

Cap Gemini S.A. | | | 47,421 | | | | 2,222 | | | |

Cie Generale d’Optique Essilor International S.A. | | | 73,335 | | | | 4,740 | | | |

Credit Agricole S.A. | | | 91,683 | | | | 1,169 | | | |

European Aeronautic Defence and Space Company N.V. | | | 100,051 | | | | 2,341 | | | |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | | | | | | | | |

| | | |

Safran S.A. | | | 72,634 | | | $ | 2,582 | | | |

Schneider Electric S.A. | | | 33,411 | | | | 5,020 | | | |

Total S.A. | | | 59,580 | | | | 3,169 | | | |

Veolia Environnement S.A. | | | 73,434 | | | | 2,155 | | | |

Vinci S.A. | | | 37,313 | | | | 2,036 | | | |

| | | | | | | 33,761 | | | |

| |

| Germany — 11.2% | | | |

| | | |

Adidas AG | | | 33,524 | | | | 2,199 | | | |

Bayer AG | | | 34,808 | | | | 2,582 | | | |

Daimler AG | | | 52,972 | | | | 3,605 | | | |

Deutsche Boerse AG | | | 56,415 | | | | 3,920 | | | |

Linde AG | | | 38,182 | | | | 5,816 | | | |

Metro AG | | | 59,834 | | | | 4,325 | | | |

SAP AG | | | 42,202 | | | | 2,157 | | | |

Siemens AG | | | 62,780 | | | | 7,807 | | | |

ThyssenKrupp AG | | | 51,302 | | | | 2,132 | | | |

| | | | | | | 34,543 | | | |

| |

| Hong Kong — 1.6% | | | |

| | | |

AIA Group Ltd. | | | 457,927 | | | | 1,287 | | | (a) |

Esprit Holdings Ltd. | | | 226,067 | | | | 1,073 | | | |

Hutchison Whampoa Ltd. | | | 266,048 | | | | 2,745 | | | |

| | | | | | | 5,105 | | | |

| | | |

| India — 1.2% | | | | | | | | | | |

| | | |

Larsen & Toubro Ltd. | | | 62,728 | | | | 2,775 | | | |

Power Grid Corporation of India Ltd. | | | 404,897 | | | | 890 | | | |

| | | | | | | 3,665 | | | |

| |

| Ireland — 0.6% | | | |

| | | |

CRH PLC | | | 83,627 | | | | 1,756 | | | |

| | | |

| Italy — 1.3% | | | | | | | | | | |

| | | |

ENI S.p.A. | | | 51,043 | | | | 1,119 | | | |

UniCredit S.p.A. | | | 1,334,928 | | | | 2,772 | | | |

| | | | | | | 3,891 | | | |

| |

| Japan — 13.7% | | | |

| | | |

Daikin Industries Ltd. | | | 52,000 | | | | 1,845 | | | |

FANUC Corp. | | | 16,500 | | | | 2,537 | | | |

Mitsubishi Corp. | | | 95,000 | | | | 2,575 | | | |

Mitsubishi Estate Company Ltd. (REIT) | | | 89,946 | | | | 1,670 | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

6

| | |

| Elfun International Equity Fund | | (in thousands) — December 31, 2010 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | | | | | | | | |

| | | |

Mitsubishi UFJ Financial Group Inc. | | | 570,269 | | | $ | 3,087 | | | |

Nomura Holdings Inc. | | | 646,413 | | | | 4,105 | | | |

SMC Corp. | | | 13,800 | | | | 2,367 | | | |

Sony Financial Holdings Inc. | | | 896 | | | | 3,629 | | | |

Sumitomo Metal Industries Ltd. | | | 1,410,923 | | | | 3,479 | | | |

Sumitomo Realty & Development Company Ltd. (REIT) | | | 59,000 | | | | 1,411 | | | |

Suzuki Motor Corp. | | | 232,031 | | | | 5,722 | | | |

Taiyo Nippon Sanso Corp. | | | 162,977 | | | | 1,441 | | | |

The Bank of Yokohama Ltd. | | | 420,007 | | | | 2,180 | | | |

Toyota Motor Corp. | | | 70,482 | | | | 2,798 | | | |

Unicharm Corp. | | | 92,700 | | | | 3,692 | | | |

| | | | | | | 42,538 | | | |

| |

| Mexico — 0.8% | | | |

| | | |

America Movil SAB de C.V. ADR | | | 41,120 | | | | 2,358 | | | |

| |

| Netherlands — 2.8% | | | |

| | | |

Koninklijke Ahold N.V. | | | 126,756 | | | | 1,679 | | | |

Koninklijke Philips Electronics N.V. | | | 159,899 | | | | 4,917 | | | |

Unilever N.V., CVA | | | 66,944 | | | | 2,093 | | | |

| | | | | | | 8,689 | | | |

| |

| Russian Federation — 0.5% | | | |

| | | |

Mobile Telesystems OJSC ADR | | | 74,460 | | | | 1,554 | | | |

| |

| South Africa — 0.9% | | | |

| | | |

MTN Group Ltd. | | | 133,297 | | | | 2,708 | | | |

| |

| South Korea — 1.5% | | | |

| | | |

Samsung Electronics Company Ltd. | | | 5,480 | | | | 4,582 | | | |

| |

| Spain — 2.4% | | | |

| | | |

Banco Santander S.A. | | | 443,639 | | | | 4,718 | | | (h) |

Telefonica S.A. | | | 125,616 | | | | 2,859 | | | |

| | | | | | | 7,577 | | | |

| |

| Sweden — 0.7% | | | |

| | | |

Telefonaktiebolaget LM Ericsson | | | 198,031 | | | | 2,302 | | | |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | | | | | | | | |

| |

| Switzerland — 7.9% | | | |

| | | |

Credit Suisse Group AG | | | 83,744 | | | $ | 3,384 | | | |

Nestle S.A. | | | 148,513 | | | | 8,723 | | | |

Novartis AG | | | 56,950 | | | | 3,357 | | | |

Roche Holding AG | | | 23,066 | | | | 3,390 | | | |

Syngenta AG | | | 13,470 | | | | 3,952 | | | |

Zurich Financial Services AG | | | 5,953 | | | | 1,547 | | | |

| | | | | | | 24,353 | | | |

| |

| Taiwan — 2.8% | | | |

| | | |

Delta Electronics Inc. | | | 571,000 | | | | 2,791 | | | |

Taiwan Semiconductor Manufacturing

Company Ltd. | | | 2,157,400 | | | | 5,254 | | | |

Taiwan Semiconductor Manufacturing

Company Ltd. ADR | | | 43,822 | | | | 550 | | | |

| | | | | | | 8,595 | | | |

| |

| United Kingdom — 19.3% | | | |

| | | |

Autonomy Corporation PLC | | | 75,375 | | | | 1,776 | | | (a) |

BG Group PLC | | | 194,844 | | | | 3,954 | | | |

BHP Billiton PLC | | | 172,260 | | | | 6,880 | | | (h) |

Diageo PLC | | | 68,417 | | | | 1,269 | | | |

G4S PLC | | | 512,431 | | | | 2,055 | | | |

HSBC Holdings PLC | | | 696,782 | | | | 7,103 | | | |

Lloyds Banking Group PLC | | | 3,467,287 | | | | 3,567 | | | (a) |

National Grid PLC | | | 418,884 | | | | 3,627 | | | |

Prudential PLC | | | 537,808 | | | | 5,625 | | | |

Reckitt Benckiser Group PLC | | | 72,678 | | | | 4,011 | | | |

Rio Tinto PLC | | | 91,993 | | | | 6,462 | | | |

Royal Dutch Shell PLC | | | 160,877 | | | | 5,386 | | | |

Tesco PLC | | | 575,271 | | | | 3,828 | | | |

The Capita Group PLC | | | 160,987 | | | | 1,756 | | | |

Vodafone Group PLC | | | 997,263 | | | | 2,589 | | | |

| | | | | | | 59,888 | | | |

| | | |

Total Common Stock

(Cost $249,250) | | | | | | | 285,248 | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

7

| | |

| Elfun International Equity Fund | | (in thousands) — December 31, 2010 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | | | | | | | | |

Preferred Stock — 2.5% |

| | | |

Fresenius SE | | | 30,370 | | | $ | 2,610 | | | |

Volkswagen AG | | | 31,152 | | | | 5,074 | | | |

| | | |

Total Preferred Stock

(Cost $5,443) | | | | | | | 7,684 | | | |

Other Investments — 0.0%* | | | |

| | | |

GEI Investment Fund

(Cost $99) | | | | | | | 94 | | | (k) |

| | | |

Total Investments in Securities

(Cost $254,792) | | | | | | | 293,026 | | | |

Short-Term Investments — 5.1% | | | |

| | |

| Short-Term Investments — 4.5% | | | | | | | |

GE Money Market Fund Institutional Class | | | | | | | |

0.00% | | | | | | | 13,822 | | | (d,k) |

| | | | | | | | | | |

| | | | |

| | | | | Principal

Amount | | | | | |

|

| | | |

| Time Deposit — 0.6% | | | | | | | | |

| | |

State Street Corp. | | | | | |

| 0.01% | | 01/03/11 | | $ | 1,950 | | | 1,950 | | (e) |

Total Short-Term Investments

(Cost $15,772) | | | | | | 15,772 | | |

| | | |

Total Investments

(Cost $270,564) | | | | | | 308,798 | | |

| | | |

Other Assets and Liabilities

net — 0.2% | | | | | | 675 | | |

| | | | | | | | | | |

| | | |

NET ASSETS—100.0% | | | | | | $309,473 | | |

| | | | | | | | | | |

Other Information

The Fund had the following long futures contracts open at December 31, 2010:

| | | | | | | | | | | | | | |

| Description | | Expiration

date | | Number

of

Contracts | | | Current

Notional

Value | | | Unrealized

(Depreciation) | |

| | | | |

DJ Euro Stoxx 50 Index Futures | | March 2011 | | | 134 | | | $ | 5,023 | | | $ | (132) | |

| | | | |

FTSE 100 Index Futures | | March 2011 | | | 50 | | | | 4,613 | | | | (33) | |

| | | | |

Topix Index Futures | | March 2011 | | | 22 | | | | 2,430 | | | | (9) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | $ | (174) | |

| | | | | | | | | | | | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

8

| | |

| Elfun International Equity Fund | | December 31, 2010 |

(Unaudited)

The Fund was invested in the following categories at December 31, 2010 as a % of Fair Value:

| | | | | | |

| Industry | | | |

Diversified Financial Services | | | 10.61% | |

Integrated Oil & Gas | | | 6.26% | |

Automobile Manufacturers | | | 5.57% | |

Diversified Metals & Mining | | | 5.02% | |

Industrial Conglomerates | | | 5.01% | |

Fertilizers & Agricultural Chemicals | | | 3.76% | |

Packaged Foods & Meats | | | 3.50% | |

Life & Health Insurance | | | 3.41% | |

Semiconductors | | | 3.36% | |

Pharmaceuticals | | | 3.02% | |

Wireless Telecommunication Services | | | 2.98% | |

Steel | | | 2.69% | |

Household Products | | | 2.49% | |

Industrial Gases | | | 2.35% | |

Multi-Utilities | | | 1.87% | |

Food Retail | | | 1.78% | |

Communications Equipment | | | 1.75% | |

Electrical Components & Equipment | | | 1.63% | |

Aerospace & Defense | | | 1.59% | |

Industrial Machinery | | | 1.59% | |

Construction & Engineering | | | 1.56% | |

Healthcare Supplies | | | 1.54% | |

Hypermarkets & Super Centers | | | 1.40% | |

Multi-Line Insurance | | | 1.36% | |

Investment Banking & Brokerage | | | 1.33% | |

Application Software | | | 1.27% | |

Specialized Finance | | | 1.27% | |

Diversified Capital Markets | | | 1.10% | |

Diversified Real Estate Activities | | | 1.00% | |

| | | | | | |

Integrated Telecommunication Services | | | 0.93% | |

Electronic Components | | | 0.90% | |

Healthcare Services | | | 0.85% | |

Coal & Consumable Fuels | | | 0.84% | |

Trading Companies & Distributors | | | 0.83% | |

IT Consulting & Other Services | | | 0.72% | |

Apparel, Accessories & Luxury Goods | | | 0.71% | |

Internet Software & Services | | | 0.71% | |

Regional Banks | | | 0.71% | |

Security & Alarm Services | | | 0.67% | |

Construction & Farm Machinery & Heavy Trucks | | | 0.63% | |

Diversified Support Services | | | 0.63% | |

Building Products | | | 0.60% | |

Marine | | | 0.59% | |

Construction Materials | | | 0.57% | |

Human Resource & Employment Services | | | 0.57% | |

Distillers & Vintners | | | 0.41% | |

Apparel Retail | | | 0.35% | |

Electric Utilities | | | 0.29% | |

Gold | | | 0.28% | |

| | | | | | |

| | | 94.86% | |

| | | | | | |

| | | | | | |

| Short-Term and Other Investments | | | |

Short-Term | | | 5.11% | |

Other Investments | | | 0.03% | |

| | | | |

| | | 5.14% | |

| | | | |

| | | 100.00% | |

| | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

9

(Unaudited)

David B. Carlson

The Elfun Trusts is managed by David B. Carlson. See portfolio managers’ biographical information beginning on page 116.

| Q. | How did the Elfun Trusts Fund perform compared to its benchmark and Morningstar peer group for the twelve-month period ended December 31, 2010? |

| A. | The Elfun Trusts had a return of 13.07% for the twelve-month period ended December 31, 2010. The S&P 500 Index returned 15.06%, while the Fund’s Morningstar peer group of 1,771 US Large-Cap Growth funds returned 15.40% over the same period. |

| Q. | What market conditions impacted the Fund performance? |

| A. | While the market posted a nice gain for the year, it was a roller-coaster ride as the year unfolded. The market rose in the first quarter, then plunged in the second as European sovereign debt fears flared. The market meandered in the third quarter and then finished strong in the fourth as economic indicators improved. Aggregate earnings rose at a double-digit pace for the year, in line with stock prices, leaving the price/earnings ratio (P/E) essentially unchanged for the year. Earnings estimates by Wall Street analysts were gradually revised higher throughout the year. |

The cyclical sectors were the strongest performers with consumer-cyclical, industrial, and materials sectors all up in excess of 20%. Technology was an exception, rising only 10% for the year.

Other sectors lagging the market included healthcare, up 3% and utilities, up 6%.

| Q. | What were the primary drivers of Fund performance? |

| A. | Technology is the largest sector overweight in Elfun Trusts comprising about 31% of the portfolio. Despite improving industry conditions, tech stocks lagged the market, especially the large cap tech bellwethers such as Cisco and Microsoft. Overall, Elfun Trusts’ tech holding rose 9% for the year, underperforming the market. We had a wide range of performance in our tech holdings with Baidu (+135%) and Intuit (+60%) the best performers and Visa (-19%) and Cisco (-16%) the worst performers. Most tech companies met or exceeded their earnings expectations, but negative sentiment around long term growth rates weighed on the valuations. |

The second largest weighting in the portfolio is the consumer-discretionary sector, comprising about 17% of the portfolio. Holdings in this sector rose 32%, positively contributing to overall results. Liberty Global was the best performer in this sector with a gain of 55%. The energy and materials sectors outperformed the market, but Elfun Trusts was underweighed in these sectors.

| Q. | Were there any significant changes to the Fund during the period? |

10

(Unaudited)

| A. | We ended the year with 51 stocks in the portfolio, coincidently the same as last year, but we added 8 new names and eliminated 8 over the course of the year. Portfolio turnover remains low, coming in at 13% for the year. New positions include Apple (better late than never), Praxair, Discovery Holdings, Sirius XM Radio, and Covidien. We eliminated Transocean after the rig explosion in the gulf in April. Other sales include Berkshire-Hathaway, Medtronic, and Corning. Overall, the portfolio still consists of high quality, above-average growers with strong financial characteristics. We continue to be overweighted in the tech sector due to its global reach, above-average growth, strong balance sheets, and attractive valuation. |

| Q. | What is your outlook for the Fund for this year? |

| A. | We have a constructive view of the market at the start of the year. Stimulus remains strong, both fiscal and monetary, and estimates of economic growth have been revised up in recent months. |

But the macro fears are still significant and will result in continued market volatility. Topping our list of worries are the sovereign debt woes of Europe, the massive fiscal deficit in the US, and the fragile US consumer. Corporate America is in good shape, with strong balance sheets and free cash flow, but global macro issues will likely flare up and negatively impact the US stock market. In a market that will be buffeted by macro concerns, we will continue to focus on high quality companies that can innovate and grow at above-average rates over the long term.

11

(Unaudited)

Understanding Your Fund’s Expenses

As a shareholder of the Fund you incur transaction and ongoing expenses. Transaction expenses including sales charges on purchases payments, reinvested dividends (or other distributions), and redemption fees directly reduce the investment return of the Fund. Ongoing costs include portfolio management fees, distribution and services fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended December 31, 2010.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses.

You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your class under the heading “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table for both “Actual” and “Hypothetical” do not reflect any transaction costs, such as sales charges or redemption fees.

July 1, 2010 – December 31, 2010

| | | | | | | | | | | | |

| | | Account value at

the beginning of

the period ($) | | | Account value

at the end of

the period ($) | | | Expenses

paid during

the period ($)* | |

| | | |

Actual Fund Return** | | | 1,000.00 | | | | 1,231.75 | | | | 1.18 | |

| | | |

Hypothetical 5% Return

(2.5% for the period) | | | 1,000.00 | | | | 1,023.87 | | | | 1.07 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.21% (for the period July 1, 2010 - December 31, 2010), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period) |

| ** | | Actual Fund Return for the six-month period ended December 31, 2010 was: 23.18%. Past performance does not guarantee future results. |

12

(Unaudited)

Investment Profile

A mutual fund designed for investors who seek long-term growth of capital and future income rather than current income by investing in equity securities of U.S. companies, such as common and preferred stocks.

Top Ten Largest Holdings

as of December 31, 2010 as a % of Fair Value(b)(c)

| | | | |

| Schlumberger Ltd. | | | 4.82% | |

| QUALCOMM Inc. | | | 4.43% | |

| The Western Union Co. | | | 4.04% | |

| PepsiCo Inc. | | | 3.96% | |

| Dover Corp. | | | 3.95% | |

| DIRECTV | | | 3.64% | |

| Bed Bath & Beyond Inc. | | | 3.58% | |

| CME Group Inc. | | | 3.53% | |

| Liberty Global Inc. | | | 3.39% | |

| Amgen Inc. | | | 3.33% | |

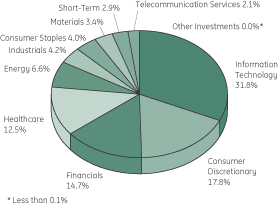

Sector Allocation

as a % of the Fair Value of $1,731,905 (in thousands) as of December 31, 2010.(b)(c)

Morningstar Performance Comparison

Based on average annual returns for periods ended 12/31/10

| | | | | | | | | | | | |

| | | One

Year | | | Five

Year | | | Ten

Year | |

Number of Funds in peer group | | | 1771 | | | | 1589 | | | | 1299 | |

Peer group average annual total return | | | 15.40 | % | | | 2.22 | % | | | -0.69 | % |

Morningstar category in peer group: Large Growth | |

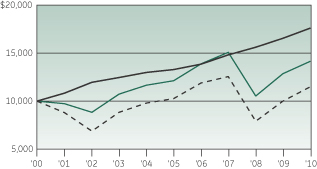

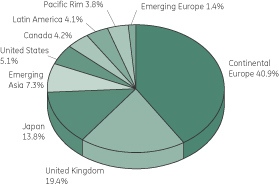

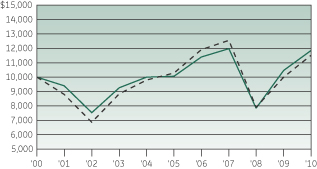

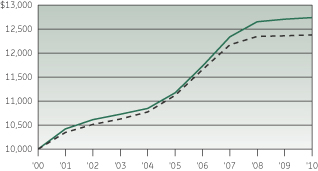

Change in Value of a $10,000 Investment(a)

Average Annual Total Return

for the periods ended December 31, 2010

| | | | | | | | | | | | | | | | |

| (Inception date: 05/27/35) | | | | | | | | | | |

| | | One

Year | | | Five

Year | | | Ten

Year | | | Ending value of a

$10,000

investment (a) | |

| | | | |

Elfun Trusts | | | 13.07% | | | | 3.28% | | | | 1.70% | | | | 11,837 | |

| | | | |

S&P 500 Index | | | 15.06% | | | | 2.29% | | | | 1.41% | | | | 11,508 | |

| (a) | Ending value of a $10,000 investment for the ten-year period or since inception, whichever is less. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| (c) | Fair value basis is inclusive of Short Term Investment in GE Money Market Fund. |

See Notes to Performance on page 1 for further information.

Past performance does not predict future performance. The performance shown on the graph and tables does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

| | |

| Elfun Trusts | | (in thousands) — December 31, 2010 |

| | | | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | | |

| | | | | | | | | | | | |

Common Stock — 97.1%† | | | | | |

| |

| Application Software — 1.4% | | | | | |

| | | |

Intuit Inc. | | | 510,000 | | | $ | 25,143 | | | | (a) | |

| |

| Asset Management & Custody Banks — 3.1% | | | | | |

| | | |

State Street Corp. | | | 1,170,000 | | | | 54,218 | | | | (e) | |

| |

| Biotechnology — 3.8% | | | | | |

| | | |

Amgen Inc. | | | 1,050,000 | | | | 57,645 | | | | (a) | |

Gilead Sciences Inc. | | | 220,000 | | | | 7,973 | | | | (a) | |

| | | | | | | 65,618 | | | | | |

| |

| Broadcasting — 0.3% | | | | | |

| | | |

Discovery Communications Inc. | | | 140,000 | | | | 5,137 | | | | (a) | |

| |

| Cable & Satellite — 9.5% | | | | | |

| | | |

Comcast Corp. | | | 1,850,000 | | | | 38,498 | | | | | |

DIRECTV | | | 1,580,000 | | | | 63,089 | | | | (a) | |

Liberty Global Inc. | | | 1,730,000 | | | | 58,630 | | | | (a) | |

Sirius XM Radio Inc. | | | 3,000,000 | | | | 4,920 | | | | (a) | |

| | | | | | | 165,137 | | | | | |

| |

| Communications Equipment — 7.7% | | | | | |

| | | |

Cisco Systems Inc. | | | 1,900,000 | | | | 38,437 | | | | (a) | |

QUALCOMM Inc. | | | 1,550,000 | | | | 76,709 | | | | | |

Research In Motion Ltd. | | | 300,000 | | | | 17,439 | | | | (a) | |

| | | | | | | 132,585 | | | | | |

| |

| Computer Hardware — 3.3% | | | | | |

| | | |

Apple Inc. | | | 175,000 | | | | 56,448 | | | | (a) | |

| |

| Data Processing & Outsourced Services — 9.7% | | | | | |

| | | |

Automatic Data Processing Inc. | | | 225,000 | | | | 10,413 | | | | | |

Paychex Inc. | | | 1,350,000 | | | | 41,729 | | | | | |

The Western Union Co. | | | 3,770,000 | | | | 70,009 | | | | | |

Visa Inc. | | | 650,000 | | | | 45,747 | | | | | |

| | | | | | | 167,898 | | | | | |

| |

| Diversified Financial Services — 1.0% | | | | | |

| | | |

JPMorgan Chase & Co. | | | 420,000 | | | | 17,816 | | | | | |

| | | | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | | |

| | | | | | | | | | | | |

| |

| Diversified Support Services — 1.2% | | | | | |

| | | |

Iron Mountain Inc. | | | 800,000 | | | $ | 20,008 | | | | | |

| |

| Electronic Manufacturing Services — 0.9% | | | | | |

| | | |

Molex Inc. | | | 870,000 | | | | 16,417 | | | | | |

| |

| Environmental & Facilities Services — 0.2% | | | | | |

| | | |

Stericycle Inc. | | | 45,000 | | | | 3,641 | | | | (a) | |

| |

| Fertilizers & Agricultural Chemicals — 2.6% | | | | | |

| | | |

Monsanto Co. | | | 650,000 | | | | 45,266 | | | | | |

| |

| Healthcare Equipment — 1.4% | | | | | |

| | | |

Becton Dickinson and Co. | | | 110,000 | | | | 9,297 | | | | | |

Covidien PLC | | | 340,000 | | | | 15,524 | | | | | |

| | | | | | | 24,821 | | | | | |

| |

| Healthcare Facilities — 0.6% | | | | | |

| | | |

VCA Antech Inc. | | | 430,000 | | | | 10,015 | | | | (a) | |

| |

| Healthcare Services — 4.1% | | | | | |

| | | |

Express Scripts Inc. | | | 800,000 | | | | 43,240 | | | | (a) | |

Lincare Holdings Inc. | | | 1,020,000 | | | | 27,367 | | | | | |

| | | | | | | 70,607 | | | | | |

| |

| Healthcare Supplies — 0.1% | | | | | |

| | | |

DENTSPLY International Inc. | | | 60,000 | | | | 2,050 | | | | | |

| |

| Home Improvement Retail — 2.3% | | | | | |

| | | |

Lowe’s Companies Inc. | | | 1,580,000 | | | | 39,626 | | | | | |

| |

| Homebuilding — 0.1% | | | | | |

| | | |

MDC Holdings Inc. | | | 60,000 | | | | 1,726 | | | | | |

| |

| Homefurnishing Retail — 3.6% | | | | | |

| | | |

Bed Bath & Beyond Inc. | | | 1,260,000 | | | | 61,929 | | | | (a) | |

| |

| Hotels, Resorts & Cruise Lines — 2.0% | | | | | |

| | | |

Carnival Corp. | | | 760,000 | | | | 35,044 | | | | | |

| |

| Industrial Gases — 0.4% | | | | | |

| | | |

Praxair Inc. | | | 70,000 | | | | 6,683 | | | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

14

| | |

| Elfun Trusts | | (in thousands) — December 31, 2010 |

| | | | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | | |

| | | | | | | | | | | | |

| |

| Industrial Machinery — 3.9% | | | | | |

| | | |

Dover Corp. | | | 1,170,000 | | | $ | 68,387 | | | | | |

| |

| Integrated Oil & Gas — 1.8% | | | | | |

| | | |

Exxon Mobil Corp. | | | 300,000 | | | | 21,936 | | | | | |

Suncor Energy Inc. | | | 220,000 | | | | 8,424 | | | | | |

| | | | | | | 30,360 | | | | | |

| |

| Internet Software & Services — 4.4% | | | | | |

| | | |

Baidu Inc. ADR | | | 400,000 | | | | 38,612 | | | | (a) | |

eBay Inc. | | | 1,350,000 | | | | 37,571 | | | | (a) | |

| | | | | | | 76,183 | | | | | |

| |

| Investment Banking & Brokerage — 2.8% | | | | | |

| | | |

The Goldman Sachs Group Inc. | | | 285,000 | | | | 47,926 | | | | | |

| |

| Life & Health Insurance — 1.5% | | | | | |

| | | |

Aflac Inc. | | | 450,000 | | | | 25,393 | | | | | |

| |

| Oil & Gas Equipment & Services — 4.8% | | | | | |

| | | |

Schlumberger Ltd. | | | 1,000,000 | | | | 83,500 | | | | | |

| |

| Pharmaceuticals — 2.6% | | | | | |

| | | |

Abbott Laboratories | | | 220,000 | | | | 10,540 | | | | | |

Hospira Inc. | | | 50,000 | | | | 2,784 | | | | (a) | |

Johnson & Johnson | | | 500,000 | | | | 30,925 | | | | | |

| | | | | | | 44,249 | | | | | |

| |

| Property & Casualty Insurance — 0.7% | | | | | |

| | | |

Alleghany Corp. | | | 38,000 | | | | 11,642 | | | | (a) | |

| |

| Real Estate Services — 2.1% | | | | | |

| | | |

CB Richard Ellis Group Inc. (REIT) | | | 1,800,000 | | | | 36,864 | | | | (a) | |

| |

| Soft Drinks — 4.0% | | | | | |

| | | |

PepsiCo Inc. | | | 1,050,000 | | | | 68,597 | | | | | |

| |

| Specialized Finance — 3.5% | | | | | |

| | | |

CME Group Inc. | | | 190,000 | | | | 61,132 | | | | | |

| | | | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | | |

| | | | | | | | | | | | |

| |

| Specialty Chemicals — 0.4% | | | | | |

| | | |

Ecolab Inc. | | | 150,000 | | | $ | 7,563 | | | | | |

| |

| Systems Software — 3.2% | | | | | |

| | | |

Microsoft Corp. | | | 2,000,000 | | | | 55,840 | | | | | |

| |

| Wireless Telecommunication Services — 2.1% | | | | | |

| | | |

American Tower Corp. | | | 700,000 | | | | 36,148 | | | | (a) | |

| | | |

Total Common Stock

(Cost $1,293,261) | | | | | | | 1,681,617 | | | | | |

Other Investments — 0.0%* | | | | | | | | | |

| | | |

GEI Investment Fund

(Cost $457) | | | | | | | 435 | | | | (k) | |

| | | |

Total Investments in Securities (Cost $1,293,718) | | | | | | | 1,682,052 | | | | | |

Short-Term Investments — 2.9% | | | | | | | | | |

GE Money Market Fund Institutional | | | | | | | | | |

Class 0.00% | | | | | | | 49,853 | | | | (d,k) | |

(Cost $49,853) | | | | | | | | | | | | |

| | | |

Total Investments

(Cost $1,343,571) | | | | | | | 1,731,905 | | | | | |

| | | |

Liabilities in Excess Of Other Assets, net — (0.0)%* | | | | | | | (189) | | | | | |

| | | | | | | | | | | | |

| | | |

NET ASSETS — 100.0% | | | | | | $ | 1,731,716 | | | | | |

| | | | | | | | | | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

15

(Unaudited)

| | |

| |

Paul M. Colonna | |

Greg Hartch |

| |

Ralph R. Layman | |

Thomas R. Lincoln |

| |

Diane M. Wehner | |

David Wiederecht |

The Elfun Diversified Fund is managed by a team of portfolio managers that includes Paul M. Colonna, Greg Hartch, Ralph R. Layman, Thomas R. Lincoln, Diane M. Wehner and David Wiederecht. Mr. Hartch and Mr. David Wiederecht are each vested with oversight authority for determining asset allocations for the Fund, while each of the other portfolio managers is responsible for managing one of four sub-portfolios: U.S. equity, U.S. mid-cap equity, international equity and fixed income. A sub-portfolio refers to the portion of the Fund’s assets that are allocated to, and managed by, a particular portfolio manager on the Fund’s portfolio management team. Mr. Lincoln manages the U.S. equity portion, Ms. Wehner manages the U.S. mid-cap equity portion, Mr. Layman manages the international equity portion and Mr. Colonna manages the fixed income portion, each with a team of portfolio managers and analysts. The sub-portfolios underlying this Fund are managed independently of each other and the portfolio managers have full discretion over their particular sub-portfolio; however, the portfolio management team is collaborative to ensure strict adherence to the Fund’s objectives. See portfolio managers’ biographical information beginning on page 116.

| Q. | How did the Elfun Diversified Fund perform compared to its benchmark and Morningstar peer group for the twelve-month period ended December 31, 2010? |

| A. | For the twelve-month period ended December 31, 2010, the Elfun Diversified Fund returned 9.98%. The Fund’s broad based benchmarks, the S&P 500 Index and the Barclays Capital U.S. Aggregate Bond Index, returned 15.06% and 6.54%, respectively. The Fund’s Morningstar peer group of 1098 U.S. Moderate Allocation funds returned an average of 11.73% for the same period. |

16

(Unaudited)

| Q. | What market conditions impacted the performance of the Fund and what were the primary drivers of Fund performance? |

| A. | The absolute performance of the Fund for the twelve-month period ended December 31, 2010 was primarily driven by the Fund’s allocation to U.S. and international equity markets and fixed income markets. The Fund’s top performing asset classes were its exposure to mid cap and small cap U.S. equity markets which posted gains of 27.0% and 26.8% in 2010. All other asset classes provided positive returns, although International equities lagged U.S. large cap equities by several hundred basis points and cash produced only a nominal return. |

The Fund has traditionally had a higher allocation to international equities than its peer group. In 2010, the underperformance of international equities relative to U.S. equities was a key driver in the performance of the Fund relative to its peer group. Other factors that contributed to the relative performance were (i) positive contributions from allocations to mid cap and small cap U.S. equity markets; (ii) negative contributions from security selection within several of the Fund’s equity strategies which underperformed their benchmarks; and (iii) positive contributions from security selection within the Fund’s fixed income and U.S. mid cap strategies which outperformed their benchmarks.

As of December 31, 2010, the Fund’s four largest allocations by asset class were: (i) fixed income core plus (30.7% of the Fund; benchmark Barclays Capital U.S. Aggregate), (ii) U.S. large cap equities (27.1% of the Fund; benchmark S&P 500), (iii) international equities (22.4% of the Fund; benchmark MSCI EAFE), and (iv) U.S. mid cap equities (11.2% of the Fund; benchmark Russell Mid

Cap). A summary of these four markets and their contribution to performance are summarized below.

Fixed Income Markets and Performance

The fixed income market benefited from both declining interest rates and spread compression over the last fiscal period, producing positive price returns which added to income generated from coupon interest. U.S. 2-year and 10-year Treasury note yields ended the year at 0.59% and 3.29% respectively, down 54 basis points each. The U.S. 30-year bond finished the year yielding 4.33%, down 31 basis points. As the U.S. economy recovered in 2010 and growth expectations for 2011 picked up, non-treasury securities outperformed treasury securities during the period due to tightening spreads. The Barclays Capital U.S. Credit Index yield spread narrowed 11 basis points, which contributed to a total return of 8.47% last year, while the broader Barclays Capital U.S. Aggregate Index returned 6.54%. Commercial mortgage-backed securities experienced the largest spread compression and led all sectors with an annual return of 20.4%. Yield spreads on high yield and emerging market debt also narrowed contributing to double digit returns for both (BC High Yield Index returned 15.12% and JPM EMBI-GD Index returned 12.24%).

The Fund’s fixed income core plus strategy allocation returned 8.01%, outperforming its benchmark by 1.47%. The largest contributor to the fixed income allocation’s performance on an absolute basis and relative to its benchmark was the overweight positions in investment grade credit and commercial mortgage-backed securities plus non-index allocations to high yield and emerging market debt. Security selection within the agency

17

(Unaudited)

and commercial MBS sectors added value as did an overweight in financial versus non-corporate issuers in investment grade credit. Duration positioning had a negative effect on performance, primarily in April and May when the fund’s duration was shorter than that of the benchmark and U.S. interest rates fell significantly in a flight to quality away from risky assets brought on by the fiscal crises among the European peripheral countries, namely Greece, Ireland, Portugal and Spain.

U.S Large Cap Equity Markets and Performance

2010’s 15% advance did not feel like an easy climb for the S&P 500, amid ongoing debate around the durability of the economic expansion. Indeed, all U.S. equity indices were in negative territory at mid-year and over much of the summer, beset by concerns about the European debt crisis, persistently high unemployment levels and skyrocketing government debt. However, reassurances that the Fed would purchase additional treasury bonds in a $600B “quantitative easing-2” program ignited a mighty second-half rally. In this environment, cyclical sectors generally outperformed, while defensive sectors lagged. For the year, the S&P 500 consumer discretionary, industrials, materials and energy each advanced over 20%, while health care, utilities and IT lagged.

2010 was a challenging investment environment for large cap, high quality investors. Small and mid cap companies led—typical in the early innings of economic recovery. Smaller companies also benefitted from increased M&A activity as larger companies looked to spend excess balance sheet cash on strategic acquisitions. Low quality also outperformed high quality, with an approximately 22% increase in S&P 500 C-rated companies, while the high-quality A-rated companies rose only 15%.

Our large cap equity portfolio managers generally prefer to invest in high quality companies, and acknowledge that relative performance may be challenged in the early stages of an economic recovery, when higher-risk (i.e., lower quality) companies get re-rated. We continue to believe that higher quality companies make the best long-term investments, and a diversified portfolio of high quality large caps has the potential to outperform over a full market cycle.

Amid the year’s uncertainties, correlations of performance among S&P 500 stocks reached levels unseen since the Great Depression. It was difficult for the active manager to differentiate as top-down factors moved the markets, with fundamentals largely ignored. For example, Microsoft achieved and raised earnings estimates throughout the year, yet suffered severe multiple contraction. This seeming disconnect between fundamentals, valuations and performance created a source of frustration for many large-cap active managers.

In 2010, the Fund had significant allocations to two U.S. large cap equity strategies, large cap growth and U.S. core, both of which underperformed the S&P 500 Index. U.S. large cap growth returned 9.68%, underperforming by 5.38% while U.S. core returned 12.54%, underperforming by 2.52%.

International Equity Markets and Performance

Markets were volatile for much of the year as contradictory forces dampened performance early in the year but gave way to strong gains in the second half. The evolving sovereign debt crisis in Europe negatively affected markets concerned about a growing need for austerity but the persistence of low rates, anecdotal evidence of an improving global economy and strong earnings

18

(Unaudited)

across the globe pushed stocks higher in all major markets. Similarly, doubts regarding much-needed regulatory reform in the financial sector cast a cloud over markets in the first half but increased clarity from bodies such as the Basel 3 Committee regarding bank capitalization, liquidity and leverage provided much-needed transparency to investors later in the year.

The Fund’s allocation to international equity returned 6.15% while the MSCI EAFE benchmark returned 7.75%. Positive impact was seen from holdings in materials, energy stocks and telecom services. The steady rise of commodity prices throughout the year was highly beneficial to metals and mining stocks and fertilizer companies leveraged to rising crop prices. A somewhat different result was seen in energy where despite rising oil prices, a combination of the BP crisis and low natural gas prices saw that sector underperform. An underweight in the underperforming telecom sector was also beneficial for performance.

Most of the negative performance in the portfolio came from holdings in the financial sector, mainly in European banks. Although underweight, the portfolio was hit by the assumption that all European banks would be dragged down by the sovereign debt crisis, although direct exposure to the troubled markets of Greece, Ireland and Portugal was insignificant. Japanese holdings, especially those in the export markets also suffered due to a strong Yen.

U.S. Mid Cap Equity Markets and Performance

In general, correlations of performance among midcap stocks reached historically high levels in 2010. It was difficult for active managers to

differentiate as top-down factors moved the markets, with fundamentals largely ignored. An offset to this lack of differentiation has increased M&A activity as larger companies looked to spend excess balance sheet cash on strategic acquisitions. The Fund benefited from consolidation with several companies being acquired in the latter part of the year. Growth stocks outperformed Value by a small margin during the year which helped performance given our skew towards companies with growth-at-a-reasonable-price. From a sector perspective, information technology, though it underperformed the overall market was the most additive to performance due to good stock selection. Meanwhile, though new investments in the industrial and basic materials sectors participated in the year-end rally, performance was dominated by lower quality, higher beta, more cyclical companies. Finally, within the financial sector our underweight in regional banks/thrifts detracted from performance along with underperformance in individual stocks within the insurance and exchanges industries.

The Fund’s allocation to mid cap stocks returned 27.0%, outperforming the Russell Mid Cap Index which returned 25.5% during the twelve-month period, due to solid stock selection within the information technology, utilities, and consumer staples sectors. Within information technology, several software names meaningfully outperformed the overall market. Specifically, Rovi Corporation (+95%) benefited as investors continue to recognize its strong technology position and view the company as a play on the future of digital entertainment and connected devices. Citrix Systems (+65%) performed well as the company benefited from the trend towards desktop virtualization. Arcsight Inc. (+65%) a developer of security software was acquired by Hewlett

19

(Unaudited)

Packard. Also, within information technology, the Fund was positively impacted by Baidu (+135%), a Chinese internet search engine company which benefited from its dominant position within the fast-growing Chinese internet industry. The Fund’s underweight in the utility sector along with good stock selection added to Fund performance with investments such as Northeast Utilities (+28%). Consumer staple stocks were also strong contributors. For example, Mead Johnson Nutrition (+45%), a global leader in the pediatric-nutrition market, outperformed in part due to its large exposure to emerging markets and its attractiveness as a takeout candidate.

Detracting from performance were some of our more defensive investments within the industrial, materials, and financial sectors. Within the industrial sector, Alliant Techsystems (-16%) detracted from performance amid ongoing concerns about its NASA contract and its exposure to defense budgets. In the financial sector, diversified insurance company HCC (+6%) lagged, as overall pricing in the property and casualty industry remains under pressure. Among banks, People’s United Financial (-12%) is considered one of the highest quality thrifts in the industry having avoided the missteps of its competition in the residential real estate debacle. With an increased appetite for risk, investors favored lower quality regional banks with more leverage to an economic recovery. Meanwhile, basic materials company Monsanto (-13%) corrected as the company restructured its chemical business in response to overcapacity and competitive pricing resulting in a near-term hit to earnings.

As of December 31, 2010, the Fund also had smaller allocations to emerging market equities,

small cap U.S. equities, REITs, and cash. None of these allocations exceeded 5% of the Fund as of December 31, 2010.

| Q. | Were there any significant changes to the Fund during the period? |

| A. | During the past year, we did make certain tactical changes to the Fund. As the year progressed and we became more confident that the economy would avoid a double dip, we gradually reduced cash in the portfolio, increasing both equity and fixed income allocations. In September, we made a tactical decision to reduce our exposure slightly to emerging market equities in favor of U.S. large cap equities on the belief that a stronger U.S. recovery would result in U.S. equities outperforming in the 4th quarter of 2010. This change also added to performance as U.S. equities outperformed emerging market equities. In November, we added a 1% real estate exposure to the Fund in the form of a REIT ETF. The allocation to REITs returned 4.1% from funding to year end. Finally, in mid December, we added a third U.S. equity large cap strategy, equity yield at a 4% allocation, on the belief that companies with higher existing dividends or with dividends that are likely to grow will outperform in 2011. As of December 31, 2010, the Fund was overweight equities with 67.5% of the Fund invested in equity strategies. |

Finally, Judy Studer, GEAM’s Chief Marktet Strategist and portfolio manager responsible for asset allocation for the Fund, retired from GE Asset Management as of December 31, 2010. She is replaced by David Wiederecht, President and CIO of Investment Strategies for GEAM and Greg Hartch, Senior Vice President, Tactical Asset Allocation and Total Return Fund Portfolio Manager, starting January 1, 2011.

20

(Unaudited)

Understanding Your Fund’s Expenses

As a shareholder of the Fund you incur transaction and ongoing expenses. Transaction expenses including sales charges on purchases payments, reinvested dividends (or other distributions), and redemption fees directly reduce the investment return of the Fund. Ongoing costs include portfolio management fees, distribution and services fees, professional fees, administrative fees and other Fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended December 31, 2010.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section,

together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your class under the heading “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table for both “Actual” and “ Hypothetical” do not reflect any transaction costs, such as sales charges or redemption fees.

July 1, 2010 – December 31, 2010

| | | | | | | | | | | | |

| | | Account value at

the beginning of

the period ($) | | | Account value

at the end of

the period ($) | | | Expenses

paid during

the period ($)* | |

| | | |

Actual Fund Return** | | | 1,000.00 | | | | 1,165.73 | | | | 2.62 | |

| | | |

Hypothetical 5% Return (2.5% for the period) | | | 1,000.00 | | | | 1,022.54 | | | | 2.45 | |

| * | | Expenses are equal to the Fund’s annualized expense ratio of 0.48% (for the period July 1, 2010 - December 31, 2010), multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period) |

| ** | | Actual Fund Return for the six-month period ended December 31, 2010 was: 16.57%. Past performance does not guarantee future results. |

21

(Unaudited)

Investment Profile

A mutual fund designed for investors who seek the highest total return consistent with prudent investment management and the preservation of capital (total return includes both income and capital appreciation) by investing primarily in a combination of U.S. and foreign equity and debt securities and cash.

Top Ten Largest Holdings

as of December 31, 2010 as a % of Fair Value(b)(c)

| | | | |

U.S. Treasury Notes 3.00%, 08/15/20 | | | 2.77% | |

FNMA, 4.50%, TBA. | | | 1.91% | |

FNMA, 4.50%, 05/01/18 - 11/01/40 | | | 1.81% | |

U.S. Treasury Bonds 3.88%, 08/15/40 | | | 1.55% | |

FNMA, 5.00%, TBA. | | | 1.03% | |

Vanguard REIT ETF | | | 0.99% | |

Microsoft Corp. | | | 0.90% | |

FNMA 5.00%, 07/01/20 - 11/01/40 | | | 0.85% | |

FNMA 4.00%, 05/01/19 - 10/01/40 | | | 0.81% | |

FNMA 4.00%, 10/01/40 | | | 0.78% | |

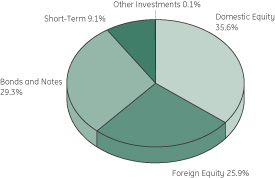

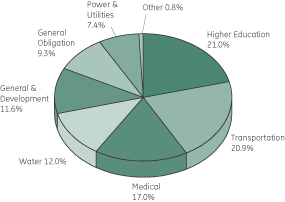

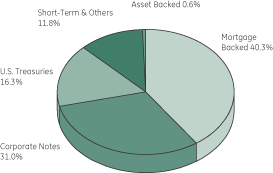

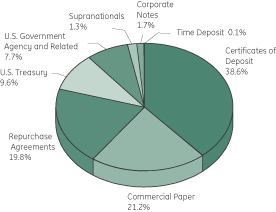

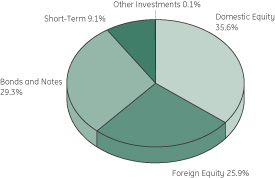

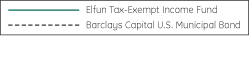

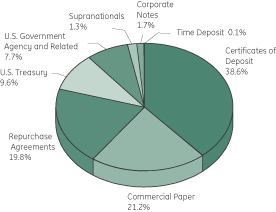

Sector Allocation

as a % of the Fair Value of $235,991 (in thousands) as of December 31, 2010.(b)(c)

Morningstar Performance Comparison

Based on average annual returns for periods ended 12/31/10

| | | | | | | | | | | | |

| | | One

Year | | | Five

Year | | | Ten

Year | |

Number of Funds in peer group | | | 1098 | | | | 858 | | | | 645 | |

Peer group average annual total

return | | | 11.73 | % | | | 3.24 | % | | | 3.03 | % |

Morningstar category in peer group: Moderate Allocation | |

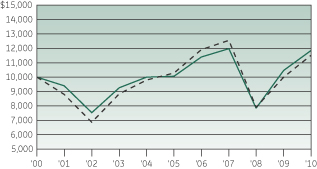

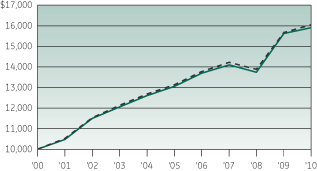

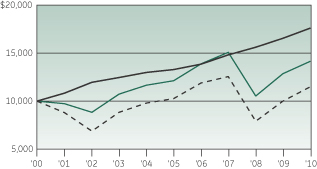

Change in Value of a $10,000 Investment(a)

Average Annual Total Return

for the periods ended December 31, 2010

| | | | | | | | | | | | | | | | |

| (Inception date: 01/01/88) | | | | | | | | | | |

| | | One

Year | | | Five

Year | | | Ten

Year | | | Ending value of a

$10,000

investment (a) | |

| | | | |

Elfun Diversified Fund | | | 9.98% | | | | 3.15% | | | | 3.53% | | | | 14,155 | |

| | | | |

S&P 500® Index | | | 15.06% | | | | 2.29% | | | | 1.41% | | | | 11,508 | |

| | | | |

Barclays Capital U.S. Aggregate Bond Index | | | 6.54% | | | | 5.80% | | | | 5.84% | | | | 17,633 | |

| (a) | Ending value of a $10,000 investment for the ten-year period or since inception, whichever is less. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| (c) | Fair value basis is inclusive of Short Term Investment in GE Money Market Fund. |

See Notes to Performance on page 1 for further information.

Past performance does not predict future performance. The performance shown on the graph and tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

22

| | |

| Elfun Diversified Fund | | (in thousands) — December 31, 2010 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | | | | | | | | |

Domestic Equity — 35.1%† |

| |

| Advertising — 0.5% | | | |

| | | |

Omnicom Group Inc. | | | 24,136 | | | $ | 1,105 | | | |

| |

| Aerospace & Defense — 0.7% | | | |

| | | |

Alliant Techsystems Inc. | | | 4,311 | | | | 321 | | | (a) |

Hexcel Corp. | | | 23,026 | | | | 417 | | | (a) |

Honeywell International Inc. | | | 15,543 | | | | 826 | | | |

Rockwell Collins Inc. | | | 1,453 | | | | 85 | | | |

| | | | | | | 1,649 | | | |

| |

| Agricultural Products — 0.1% | | | |

| | | |

Archer-Daniels-Midland Co. | | | 6,680 | | | | 201 | | | |

| |

| Air Freight & Logistics — 0.1% | | | |

| | | |

FedEx Corp. | | | 1,789 | | | | 166 | | | |

UTi Worldwide Inc. | | | 5,987 | | | | 127 | | | |

| | | | | | | 293 | | | |

| |

| Apparel Retail — 0.1% | | | |

| | | |

Urban Outfitters Inc. | | | 7,393 | | | | 265 | | | (a) |

|

| Apparel, Accessories & Luxury Goods — 0.2% |

| | | |

Coach Inc. | | | 8,736 | | | | 483 | | | |

| |

| Application Software — 0.3% | | | |

| | | |

Blackboard Inc. | | | 5,402 | | | | 223 | | | (a) |

Citrix Systems Inc. | | | 6,201 | | | | 424 | | | (a) |

| | | | | | | 647 | | | |

|

| Asset Management & Custody Banks — 1.5% |

| | | |

Affiliated Managers Group Inc. | | | 5,020 | | | | 498 | | | (a) |

Ameriprise Financial Inc. | | | 8,337 | | | | 480 | | | |

Franklin Resources Inc. | | | 374 | | | | 42 | | | |

Invesco Ltd. | | | 37,085 | | | | 893 | | | |

State Street Corp. | | | 28,029 | | | | 1,299 | | | (e) |

The Bank of New York Mellon Corp. | | | 9,722 | | | | 294 | | | |

| | | | | | | 3,506 | | | |

| |

| Automobile Manufacturers — 0.2% | | | |

| | | |

O’Reilly Automotive Inc. | | | 6,529 | | | | 394 | | | |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | | | | | | | | |

| |

| Biotechnology — 1.4% | | | |

| | | |

Alexion Pharmaceuticals Inc. | | | 3,324 | | | $ | 268 | | | (a) |

Amgen Inc. | | | 21,639 | | | | 1,188 | | | (a) |

Gilead Sciences Inc. | | | 32,970 | | | | 1,195 | | | (a) |

Human Genome Sciences Inc. | | | 6,894 | | | | 165 | | | (a) |

Incyte Corp Ltd. | | | 9,571 | | | | 159 | | | (a) |

Vertex Pharmaceuticals Inc. | | | 6,702 | | | | 235 | | | (a) |

| | | | | | | 3,210 | | | |

| |

| Brewers — 0.0%* | | | |

| | | |

Molson Coors Brewing Co. | | | 1,403 | | | | 70 | | | |

| |

| Broadcasting — 0.1% | | | |

| | | |

Discovery Communications Inc. | | | 6,571 | | | | 254 | | | (a) |

| |

| Cable & Satellite — 0.5% | | | |

| | | |

DIRECTV | | | 17,133 | | | | 684 | | | (a) |

Liberty Global Inc. | | | 16,154 | | | | 548 | | | (a) |

| | | | | | | 1,232 | | | |

| |

| Casinos & Gaming — 0.1% | | | |

| | | |

Penn National Gaming Inc. | | | 9,650 | | | | 339 | | | (a) |

| |

| Coal & Consumable Fuels — 0.1% | | | |

| | | |

Peabody Energy Corp. | | | 4,830 | | | | 309 | | | |

| |

| Communications Equipment — 1.3% | | | |

| | | |

Cisco Systems Inc. | | | 48,864 | | | | 988 | | | (a) |

Juniper Networks Inc. | | | 11,683 | | | | 431 | | | (a) |

QUALCOMM Inc. | | | 33,561 | | | | 1,661 | | | |

| | | | | | | 3,080 | | | |

| |

| Computer Hardware — 0.6% | | | |

| | | |

Apple Inc. | | | 4,064 | | | | 1,311 | | | (a) |

Hewlett-Packard Co. | | | 4,051 | | | | 171 | | | |

| | | | | | | 1,482 | | | |

| |

| Computer Storage & Peripherals — 0.2% | | | |

| | | |

Synaptics Inc. | | | 12,612 | | | | 371 | | | (a) |

| |

| Construction & Engineering — 0.1% | | | |

| | | |

Quanta Services Inc. | | | 7,898 | | | | 157 | | | (a) |

See Notes to Schedules of Investments and Notes to Financial Statements.

23

| | |

| Elfun Diversified Fund | | (in thousands) — December 31, 2010 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | | | | | | | | |

| |

| Construction & Farm Machinery & Heavy Trucks — 0.3% | | | |

| | | |

Cummins Inc. | | | 2,110 | | | $ | 232 | | | |

Deere & Co. | | | 4,543 | | | | 378 | | | |

| | | | | | | 610 | | | |

| |

| Consumer Finance — 0.1% | | | |

| | | |

American Express Co. | | | 4,749 | | | | 204 | | | |

| |

| Data Processing & Outsourced Services — 0.8% | | | |

| | | |

Automatic Data Processing Inc. | | | 1,403 | | | | 65 | | | |

The Western Union Co. | | | 47,545 | | | | 883 | | | |

Visa Inc. | | | 11,918 | | | | 839 | | | |

| | | | | | | 1,787 | | | |

| |

| Department Stores — 0.0%* | | | |

| | | |

Macy’s Inc. | | | 4,456 | | | | 113 | | | |

| |

| Distributors — 0.0%* | | | |

| | | |

Genuine Parts Co. | | | 1,518 | | | | 78 | | | |

| |

| Diversified Chemicals — 0.0%* | | | |

| | | |

EI du Pont de Nemours & Co. | | | 1,751 | | | | 87 | | | |

| |

| Diversified Financial Services — 0.9% | | | |

| | | |

Bank of America Corp. | | | 24,005 | | | | 320 | | | |

Citigroup Inc. | | | 36,684 | | | | 174 | | | (a) |

JPMorgan Chase & Co. | | | 23,334 | | | | 990 | | | |

US BanCorp | | | 5,249 | | | | 142 | | | |

Wells Fargo & Co. | | | 16,546 | | | | 513 | | | |

| | | | | | | 2,139 | | | |

| |

| Diversified Metals & Mining — 0.1% | | | |

| | | |

Freeport-McMoRan Copper & Gold Inc. | | | 1,841 | | | | 221 | | | |

| |

| Diversified Support Services — 0.1% | | | |

| | | |

Iron Mountain Inc. | | | 7,281 | | | | 182 | | | |

| |

| Drug Retail — 0.0%* | | | |

| | | |

CVS Caremark Corp. | | | 2,684 | | | | 93 | | | |

| |

| Electric Utilities — 0.7% | | | |

| | | |

Edison International | | | 3,830 | | | | 147 | | | |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | | | | | | | | |

| | | |

Entergy Corp. | | | 1,491 | | | $ | 106 | | | |

ITC Holdings Corp. | | | 10,769 | | | | 667 | | | |

NextEra Energy Inc. | | | 2,778 | | | | 144 | | | |

Northeast Utilities | | | 12,782 | | | | 407 | | | |

Southern Co. | | | 2,992 | | | | 114 | | | |

| | | | | | | 1,585 | | | |

|

| Electrical Components & Equipment — 0.3% |

| | | |

Cooper Industries PLC | | | 9,241 | | | | 539 | | | |

Emerson Electric Co. | | | 3,039 | | | | 174 | | | |

| | | | | | | 713 | | | |

| |

| Electronic Components — 0.1% | | | |

| | | |

Corning Inc. | | | 7,523 | | | | 145 | | | |

|

| Environmental & Facilities Services — 0.1% |

| | | |

Stericycle Inc. | | | 1,544 | | | | 125 | | | (a) |

|

| Fertilizers & Agricultural Chemicals — 0.5% |

| | | |

Intrepid Potash Inc. | | | 7,547 | | | | 281 | | | (a) |

Monsanto Co. | | | 12,977 | | | | 903 | | | |

| | | | | | | 1,184 | | | |

| |

| Food Distributors — 0.0%* | | | |

| | | |

Sysco Corp. | | | 2,572 | | | | 76 | | | |

| |

| General Merchandise Stores — 0.5% | | | |

| | | |

Dollar General Corp. | | | 6,970 | | | | 214 | | | (a) |

Target Corp. | | | 13,754 | | | | 827 | | | |

| | | | | | | 1,041 | | | |

| |

| Healthcare Distributors — 0.0%* | | | |

| | | |

Cardinal Health Inc. | | | 2,684 | | | | 103 | | | |

| |

| Healthcare Equipment — 1.0% | | | |

| | | |

Becton Dickinson and Co. | | | 775 | | | | 66 | | | |

Covidien PLC | | | 20,970 | | | | 958 | | | |

Gen-Probe Inc. | | | 4,148 | | | | 242 | | | (a) |

Masimo Corp. | | | 13,467 | | | | 391 | | | |

ResMed Inc. | | | 16,158 | | | | 560 | | | (a) |

| | | | | | | 2,217 | | | |

| |

| Healthcare Services — 0.8% | | | |

| | | |

Catalyst Health Solutions Inc. | | | 9,662 | | | | 449 | | | (a) |

See Notes to Schedules of Investments and Notes to Financial Statements.

24

| | |

| Elfun Diversified Fund | | (in thousands) — December 31, 2010 |

| | | | | | | | | | |

| | | Number

of Shares | | | Fair

Value | | | |

| | | | | | | | | | |

| | | |