Exhibit 99.2

EMERSON | 1 November 5, 2024 Strategic Announcement

EMERSON | 2 EMERSON | 2 Forward - Looking Statements This communication contains forward - looking statements related to Emerson, AspenTech and the proposed acquisition by Emerson of the outstanding shares of common stock of AspenTech that Emerson does not already own . These forward - looking statements are subject to risks, uncertainties and other factors . All statements other than statements of historical fact are statements that could be deemed forward - looking statements, including all statements regarding the intent, belief or current expectation of the companies and members of their senior management team . Forward - looking statements include, without limitation, statements regarding the business combination and related matters, prospective performance and opportunities, post - closing operations and the outlook for the companies’ businesses, including, without limitation, future financial results, synergies, growth potential, market profile, business plans and expanded portfolio ; the competitive ability and position of the combined company ; filings and approvals relating to the proposed transaction; the ability to complete the proposed transaction and the timing thereof; difficulties or unanticipated expenses in connection with integrating the companies; and any assumptions underlying any of the foregoing . Investors are cautioned that any such forward - looking statements are not guarantees of future performance and involve risks and uncertainties and are cautioned not to place undue reliance on these forward - looking statements . Actual results may differ materially from those currently anticipated due to a number of risks and uncertainties . Risks and uncertainties that could cause the actual results to differ from expectations contemplated by forward - looking statements include : ( 1 ) the risk that a transaction with AspenTech may not be agreed with the AspenTech special committee ; ( 2 ) the risk that the non - waivable condition that the requisite majority of the holders of AspenTech common stock which are unaffiliated with Emerson tender in or approve the proposed transaction is not met ; ( 3 ) the risk that a transaction with AspenTech may not otherwise be consummated ; ( 4 ) uncertainties as to the timing of the transaction; ( 5 ) unexpected costs, charges or expenses resulting from the proposed transaction; ( 6 ) uncertainty of the expected financial performance of AspenTech following completion of the proposed transaction ; ( 7 ) failure to realize the anticipated benefits of the proposed transaction ; ( 8 ) inability to retain and hire key personnel ; ( 9 ) potential litigation or regulatory approval requirements in connection with the proposed transaction or other settlements or investigations that may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability ; ( 10 ) evolving legal, regulatory and tax regimes ; ( 11 ) changes in economic, financial, political and regulatory conditions, in the United States and elsewhere, and other factors that contribute to uncertainty and volatility, natural and man - made disasters, civil unrest, pandemics, geopolitical uncertainty, and conditions that may result from legislative, regulatory, trade and policy changes associated with the current or subsequent U . S . administration ; ( 12 ) the ability of Emerson and AspenTech to successfully recover from a disaster or other business continuity problem due to a hurricane, flood, earthquake, terrorist attack, war, pandemic, security breach, cyber - attack, power loss, telecommunications failure or other natural or man - made event, including the ability to function remotely during long - term disruptions ; ( 13 ) the impact of public health crises, such as pandemics and epidemics and any related company or governmental policies and actions to protect the health and safety of individuals or governmental policies or actions to maintain the functioning of national or global economies and markets, including any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down or similar actions and policies ; ( 14 ) actions by third parties, including government agencies ; ( 15 ) potential adverse reactions or changes to business relationships resulting from the announcement of the proposal or completion of the transaction ; ( 16 ) the risk that disruptions from the proposed transaction will harm Emerson’s and AspenTech’s business, including current plans and operations ; and ( 17 ) other risk factors as detailed from time to time in the companies’ periodic reports filed with the U . S . Securities and Exchange Commission (the “SEC”), including current reports on Form 8 - K, quarterly reports on Form 10 - Q and annual reports on Form 10 - K . All forward - looking statements are based on information currently available to Emerson, and Emerson assumes no obligation and disclaim any intent to update any such forward - looking statements .

EMERSON | 3 EMERSON | 3 Additional Information and Where To Find It This communication relates to a proposal that Emerson has made for an acquisition by Emerson of all of the shares of issued and outstanding common stock of AspenTech not already owned by Emerson . In furtherance of this proposal and subject to future developments, Emerson may file one or more tender offer statements or other documents with the SEC . This communication is not a substitute for any tender offer statement or other document Emerson may file with the SEC in connection with the proposed transaction . Investors are urged to read the tender offer statements and/or other documents filed with the SEC carefully in their entirety if and when they become available, as they will contain important information about the proposed transaction . Investors will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Emerson through the website maintained by the SEC at http : //www . sec . gov . This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any jurisdiction . A solicitation and an offer to buy shares of AspenTech will be made only pursuant to an offer to purchase and related materials that Emerson may file with the SEC . Any information concerning AspenTech contained in this communication has been taken from, or based upon, publicly available information . Although Emerson does not have any information that would indicate that any information contained in this communication that has been taken from such documents is inaccurate or incomplete, Emerson does not take any responsibility for the accuracy or completeness of such information . Non - GAAP Measures In this presentation we will discuss some non - GAAP measures in talking about our company’s performance, and the reconciliation o f those measures to the most comparable GAAP measures is contained within this presentation or available at our website, www.Emerson.com , under Investors.

EMERSON | 4 Key Strategic Actions to Complete Portfolio Transformation Proposal to Wholly Acquire AspenTech Exploring Strategic Alternatives for Safety & Productivity Increasing Return of Capital to Shareholders • Proposal to acquire remaining shares 1 of AspenTech for $240 per share in cash • Accelerates achievement of software - defined automation strategy to provide unparalleled value to customers • Drives the realization of incremental cost synergies using Emerson’s proven integration playbook • Enhances operational performance at AspenTech leveraging the Emerson Management System • Reduces structural complexity for investors • Exploring strategic alternatives for Safety & Productivity segment, including a cash sale • Safety & Productivity segment is not core to the automation portfolio • Global manufacturer of professional plumbing and electrical tools as well as wet / dry and commercial vacuums with industry - leading margins and cash flow • Increasing return of capital to shareholders due to strong company outlook • Plans to repurchase ~$2.0 billion of common stock in fiscal year 2025 – Expecting to complete ~$1.0 billion in fiscal Q1 • Assuming successful completion of the transactions, Emerson expects total net leverage to be less than 2x by the end of fiscal year 2025 and expects to maintain its A2/A credit rating 1 Emerson currently owns ~57% of AspenTech’s outstanding shares of common stock

EMERSON | 5 AspenTech 45% ENG 10% SSE 40% Energy & Energy Transition 20% Power & Renewables 19% Other PRODUCT SUITE 3 END - MARKET 4 $0.3B Free Cash Flow 38.5% Adjusted Segment EBITA $941M ACV 2 $1 . 1B Sales 2024 FINANCIALS 1 2 Annual contract value based on AspenTech’s reported ACV. See the end notes for definition. 1 Results based on Emerson’s fiscal 2024 33% MSC 8% DGM 4% APM 17% Chemical 1% General Industries 3% Hybrid Software Portfolio Performance Engineering (ENG) Optimizing the design and operations of complex assets across the engineering lifecycle Manufacturing & Supply Chain (MSC) Maximizing margins and achieving sustainability goals by improving production performance and value chain resiliency Subsurface Science & Engineering (SSE) Solving the most complex exploration and production challenges while accelerating carbon storage solutions Asset Performance Management (APM) Increasing asset availability and reducing costs by predicting, quantifying, and mitigating risk Digital Grid Management (DGM) Operating and managing complex electric grids and gas networks Global, diversified leader specializing in industrial software for complex environments where it is critical to optimize the asset design, operation and maintenance lifecycle 4 End - market splits based on AspenTech’s revenue on Emerson’s fiscal 2024 3 Product suite by ACV as presented at AspenTech’s 9/17/24 investor day

EMERSON | 6 Combination of Emerson and AspenTech Would Accelerate Delivery of Software - Defined Automation Vision Option 1 Field Devices Control Software Optimization Software TODAY Historian Software - Defined Infrastructure Field Edge Cloud Control Hardware & Embedded Software Ethernet APL DCS Maintenance Laboratory Enterprise Operations Platform Operations Anywhere Production Safety Reliability Optimization Engineering & Design Operations Asset Performance IT Data Lake Unified Data Fabric

EMERSON | 7 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% Emerson’s Enterprise Operations Platform Would Meet Emerging Customer Needs With a Phased Deployment of Expanding Capabilities Enterprise Operations Platform A comprehensive software solution connecting the field, edge, and cloud, to manage and optimize the control, production, safety, and reliability of industrial operations, at individual sites and enterprise - wide Bundling Emerson & AspenTech software and communicating Platform vision Launching comprehensive data fabric and site - level Operations Platform Deploying Enterprise Operations Platform with full visibility and control Foundational Development Site - Level Operations Platform Enterprise Operations Platform Phased Deployment Phase 1 Phase 2 Phase 3 Evolution of Control & Optimization Market TODAY PHASE 3 ~1/3 Software % ~2/3 Hardware / Services % MSD Market Growth Rate EMR: Rule of 35 Combined TAM 1 : ~$30B ~2/3 Software % ~1/3 Hardware / Services % HSD Market Growth Rate EMR: Rule of 50 Market Needs Digital Transformation IT / OT Convergence Data Democratization Asset Optimization Remote & Autonomous Operations Software HW / Services 1 Emerson internal estimates

EMERSON | 8 Combined Portfolio Would Enable Software Offerings to Seamlessly Integrate Across Process and Hybrid Industries AspenTech Applications Emerson Applications Data Acquisition & Analysis Data Acquisition Data Integration Data Analysis Process Control Optimization Batch Management Process Simulation Process Design Process Optimization Advanced Process Control Control Performance Control Quality Control Scheduling & Execution Manufacturing Execution Recipe Management Monitoring & Diagnosis Predictive Maintenance Asset Performance Optimization Engineering / Modeling & Design Asset Performance Management Optimize Production & Operations

EMERSON | 9 Non - Traditional Players 1 Automation Peer 3 Automation Peer 2 Automation Peer 1 Emerson + AspenTech Key Capability Unified Data Fabric Integration of Industrial Software Applications Integration With Other Enterprise Systems Enterprise Scalability & Flexibility Autonomous Operations Zero Trust Security Field Device Native Connectivity Combination of Emerson and AspenTech Capabilities Would Provide Customers With an Unparalleled Enterprise Operations Platform 1 Non - traditional players include ERP and cloud providers

EMERSON | 10 Emerson Shareholders Would Benefit From Significant Synergy Opportunity Leveraging Our Integration Playbook Opportunity Transaction Expected to Meet Emerson’s Return Thresholds Expected to Be Neutral to Adjusted EPS in Fiscal 2025 With Realized Synergies • Streamline duplicative functions • Leverage regional best - cost model • Consolidate facilities • Reduce third - party spend utilizing Emerson’s scale Corporate Costs / G&A • Enhance productivity of spend • Leverage common capabilities with Control Systems & Software businesses • Supports accelerated investment in enterprise operations platform Research & Development

EMERSON | 11 Enhances operational performance at AspenTech leveraging the Emerson Management System Reduces structural complexity for investors Accelerates achievement of software - defined automation strategy to provide unparalleled value to customers Drives the realization of incremental cost synergies using Emerson’s proven integration playbook Now Is the Right Time to Proceed With a Buy - In of the Remaining Stake in AspenTech

EMERSON | 12 Safety & Productivity 76% Americas 5% Asia, Middle East & Africa 19% Europe 57% Industrial & Commercial GEOGRAPHY END - MARKET BRANDS PRODUCTS $0.2B Free Cash Flow Contribution $0.47 Adjusted EPS Contribution $1 . 4B Sales 24.5% Adjusted Segment EBITA 2024 FINANCIALS 2% Other 35% Residential 6% Utilities Global manufacturer of professional plumbing and electrical tools as well as wet/dry & commercial vacuums with 4,200 employees 42.7% Gross Profit

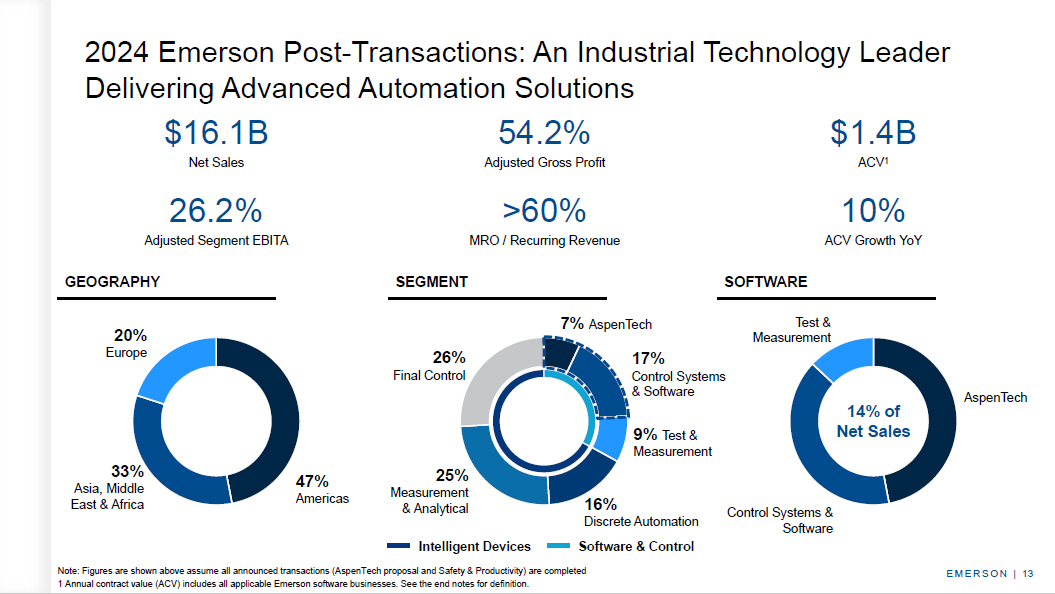

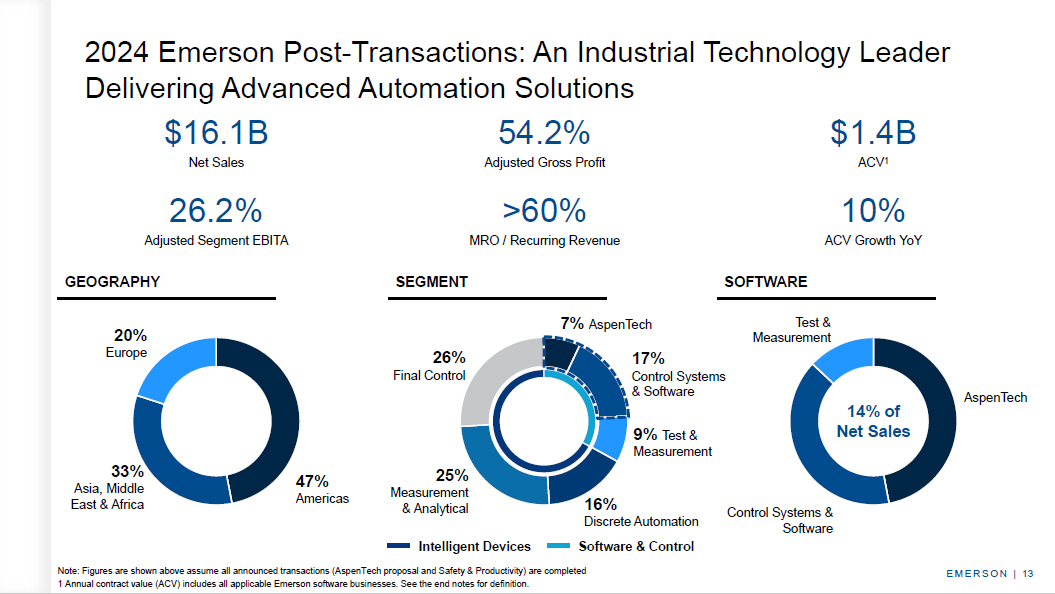

EMERSON | 13 2024 Emerson Post - Transactions: An Industrial Technology Leader Delivering Advanced Automation Solutions 47% Americas 33% Asia, Middle East & Africa 20% Europe 9% Test & Measurement 25% Measurement & Analytical 16% Discrete Automation 26% Final Control Intelligent Devices Software & Control GEOGRAPHY SEGMENT SOFTWARE Note: Figures are shown above assume all announced transactions (AspenTech proposal and Safety & Productivity) are completed 1 Annual contract value (ACV) includes all applicable Emerson software businesses. See the end notes for definition. 26.2% Adjusted Segment EBITA $16.1B Net Sales >60% MRO / Recurring Revenue 54.2% Adjusted Gross Profit 10% ACV Growth YoY $ 1.4 B ACV 1 17% Control Systems & Software 7% AspenTech Test & Measurement Control Systems & Software AspenTech 14% of Net Sales

EMERSON | 14 EMERSON | 14 Appendix

EMERSON | 15 EMERSON | 15 Endnotes Continuing Operations : All financial metrics in this presentation are on a continuing operations basis, unless otherwise noted. Annual Contract Value (ACV) : ACV is an estimate of the annual value of our portfolio of term license and software maintenance and support (SMS) contracts, th e annual value of SMS agreements purchased with perpetual licenses and the annual value of standalone SMS agreements purchased with certain legacy AspenTech term license agreements. Because software revenue recognition rules require upfront recognition of a significant portion of agreements, comparisons of revenue across periods is primarily impacted by the timing of term license renewals. ACV approximates the estimated annual billings associated with our recurring term license and SMS agreements at a point in time, and management finds this business metric useful in evaluating the growth and performance of o ur industrial software business. For agreements denominated in other currencies, a fixed historical rate is used to calculate ACV in U.S. dollars in order to eli minate the impact of currency fluctuations.

EMERSON | 16 Reconciliation of Non - GAAP Measures AspenTech and Safety & Productivity This information reconciles non - GAAP measures with the most directly comparable GAAP measure (dollars in billions, except per sh are amounts) FY24 AspenTech Adjusted Segment EBITA Margin (6.7%) AspenTech segment margin (GAAP) 45.2% Amortization of intangibles & restructuring and related costs 38.5% AspenTech adjusted segment EBITA margin (non - GAAP) FY24 AspenTech Free Cash Flow $0.3 Operating cash flow (GAAP) - Capital expenditures $0.3 Free cash flow (non - GAAP) FY24 Safety & Productivity Adjusted Segment EBITA Margin 22.2% Safety & Productivity segment margin (GAAP) 2.3% Amortization of intangibles & restructuring and related costs 24.5% Safety & Productivity adjusted segment EBITA margin (non - GAAP) FY24 Safety & Productivity Free Cash Flow $0.3 Operating cash flow (GAAP) (0.1) Capital expenditures $0.2 Free cash flow (non - GAAP) FY24 Safety & Productivity Earnings Per Share $0.43 Earnings per share (GAAP) 0.03 Amortization of intangibles 0.01 Restructuring and related costs $0.47 Adjusted earnings per share (non - GAAP)

EMERSON | 17 Reconciliation of Non - GAAP Measures Emerson (Post - Transactions 1 ) This information reconciles non - GAAP measures with the most directly comparable GAAP measure (dollars in millions, except per sh are amounts) FY24 Emerson Post - Transactions Adjusted Gross Profit Margin 50.8% Emerson gross profit margin (GAAP) 1.3% Amortization of acquisition - related inventory step - up 1.2% Amortization of intangibles and restructuring costs 0.9% Safety & Productivity impact on gross profit margin (GAAP) 54.2% Emerson post - transactions adjusted gross profit margin (GAAP) FY24 Emerson Post - Transactions Sales $17.5B FY24 Sales (GAAP) (1.4B) Safety & Productivity Sales (GAAP) $16.1B Emerson post - transactions (non - GAAP) FY24 Emerson Post - Transactions Adjusted Segment EBITA Margin $16,103 Emerson post - transactions net sales (non - GAAP) $2,020 Pretax earnings (GAAP) 11.5% Pretax earnings margin (GAAP) 1,069 Corporate items and interest expense, net 1,274 Amortization of intangibles 189 Restructuring and related costs $4,552 Adjusted segment EBITA (non - GAAP) 341 Safety & Productivity adjusted segment EBITA (non - GAAP) $4,211 Emerson post - transactions adjusted segment EBITA (non - GAAP) 26.2% Emerson post - transactions adjusted segment EBITA margin (non - GAAP) 1 Emerson assuming successful completion of the transactions announced today