- EMR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Emerson Electric (EMR) 8-KRegulation FD Disclosure

Filed: 4 Nov 08, 12:00am

Exhibit 99.1

Fiscal Year 2009 Guidance: Very Uncertain and

Challenging Global Economics in 2009

Delta

2007-08 2008 2009 Forecast (11/4/08)

Sales +12% $24.8B $23.5 to $25.5B

Operating Margin* +70 basis 16.5% 16.0 – 16.6%

points

EPS (continuing operations) +17% $3.11 $2.80 to $3.20

Operating Cash Flow 9% $3.3B $3.3B to $3.5B

Capital Expenditures 5% $714M $680 - $725M

Assumed future and completed

acquisitions +4%

Restructuring: $125 to $150M

Pension Expense: approx. neutral;

cash funding up to $200M

Currency Unfavorable: ~$1.1B (-5%)

Euro to USD$ exchange rate: ~1.28

Underlying* sales growth: -4% to +4%

(3%) to (5%)

US: Non-residential

8% to 12%

India

10% to 12%

China

(15%) to (20%)

US: Residential

2008-2009

(1%) to 1%

Japan

(1%) to 2%

Europe

5% to 7%

Latin America

Gross Fixed Investment (GFI)

Assumptions:

Emerson delivered an outstanding fiscal year 2008, and our

businesses and financial position remain very strong as we finished

this record year

Emerson is well positioned as we move into an uncertain fiscal year

2009

Strong global footprint

International sales 54% of total business

Emerging markets 30% of total business

Good mix of businesses – we have continued to actively manage the

portfolio

Financial strength to invest internally and do acquisitions where

appropriate

Summary

The Global Management Team is Prepared for an

Uncertain and Declining Global Economy

Emerson Business Summary

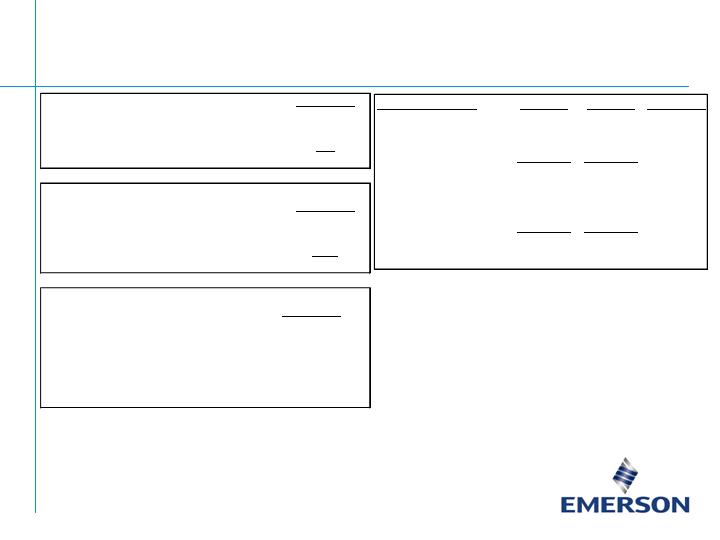

Reconciliation of Non-GAAP Financial Measures

13.5%-14.2%

% Sales

~$3,165-$3,625

Pretax Earnings

~$ 600

Other Deductions, Net

Interest Expense and

16.0%-16.6%

% Sales*

~$3,765-$4,225

Operating Profit*

Fiscal 2009

Forecasted

(5) to 3%

Net Sales

4 pts

Assumed Future and Completed Acquisitions

(5) pts

Foreign Currency Translation

(4) to 4%

Underlying Sales *

Fiscal 2009

Forecasted

12%

Net Sales

1 pt

Acquisitions/Divestitures

4 pts

Foreign Currency Translation

7%

Underlying Sales *

Fiscal 2008

This information reconciles non-GAAP measures with the most directly comparable

GAAP measure ($M)

Operating Profit

FY 2007

FY 2008

% Change

Net Sales

22,131

$

24,807

$

12%

Cost of Sales

14,066

15,668

SG&A Expense

4,569

5,057

Operating Profit *

3,496

4,082

17%

O.P. % *

15.8%

16.5%

Other Deductions, Net

175

303

Interest Expense, Net

228

188

Pretax Earnings

3,093

$

3,591

$

16%

Earnings %

14.0%

14.5%