- EMR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

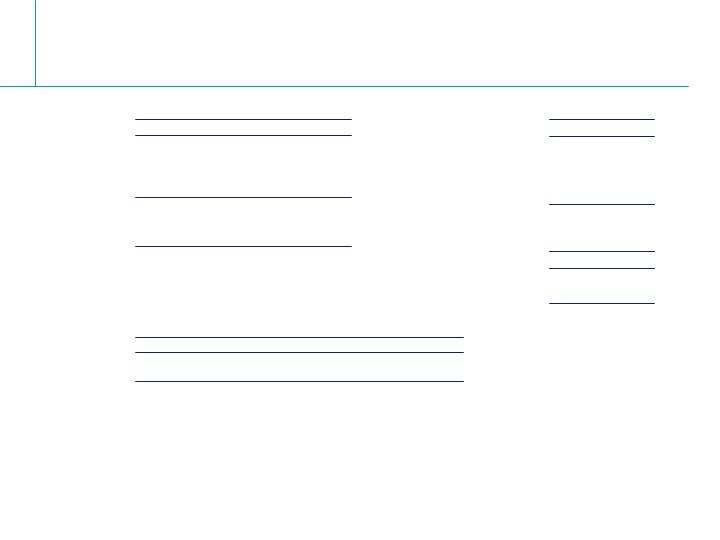

Emerson Electric (EMR) 8-KRegulation FD Disclosure

Filed: 19 May 10, 12:00am

Reconciliation of Non-GAAP Financial

Measures

The following reconciles each non-GAAP measure (denoted with an *) with the most directly comparable GAAP measure ($ M):

2007

2008

2009

Operating Profit*

$3,496

$4,082

$3,167

% of sales*

15.8%

16.5%

15.1%

Other Deductions,

net

$105

$229

$483

EBIT

$3,391

$3,853

$2,684

% of sales

15.3%

15.5%

12.8%

Interest Expense, net

$227

$187

$220

Pretax Earnings

$3,164

$3,666

$2,464

% of sales

14.3%

14.8%

11.8%

2010E

Operating Profit*

~$3,345-$3,530

% of sales*

~15.7-16.1%

Interest Expense and

Other Deductions, Net

~$685-$660

Pretax Earnings

~$2,660-$2,870

% of sales

~12.5-13.1%

2010E

Underlying Sales*

(3%)-0%

Currency & Acquisitions

+5 pts

Net Sales

+2% to +5%

2007

2008

2009

2010E

Operating Cash Flow

$3,016

$3,293

$3,086

~$2.9B-$3.1B

Capital Expenditures

$681

$714

$531

~$0.4B-$0.5B

Free Cash Flow*

$2,335

$2,579

$2,555

~$2.5B-$2.6B