Use these links to rapidly review the document

Table of Contents

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| The Empire District Electric Company |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

THE EMPIRE DISTRICT ELECTRIC COMPANY

602 S. Joplin Avenue

Joplin, Missouri 64801

March 13, 2013

Dear Stockholder:

You are cordially invited to attend our Annual Meeting of Stockholders to be held at 10:30 a.m., CDT, on Thursday, April 25, 2013, at the Holiday Inn, 3615 South Range Line, Joplin, Missouri.

At the meeting, stockholders will be asked to:

- •

- Elect three persons to our Board of Directors for three-year terms,

- •

- Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm,

- •

- Vote upon a non-binding advisory proposal to approve the compensation of our named executive officers, and

- •

- Vote upon a stockholder proposal, if properly presented, requesting the Company prepare a report on plans to reduce risk throughout its energy portfolio by pursuing cost effective energy efficiency resources.

Your participation in this meeting, either in person or by proxy, is important. Even if you plan to attend the meeting, please promptly vote the enclosed proxy through the Internet, by telephone or by mail. Please note that brokers may not vote your shares on the election of directors in the absence of your specific instructions as to how to vote. Please return your proxy card so your vote can be counted.

At the meeting, if you desire to vote in person, you may withdraw the proxy.

| | |

| | | Sincerely, |

|

|

Bradley P. Beecher

President and Chief Executive Officer |

Table of Contents

THE EMPIRE DISTRICT ELECTRIC COMPANY

602 S. Joplin Avenue

Joplin, Missouri 64801

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Holders of Common Stock:

Notice is hereby given that the Annual Meeting of Stockholders of The Empire District Electric Company will be held on Thursday, the 25th of April, 2013, at 10:30 a.m., CDT, at the Holiday Inn, 3615 South Range Line, Joplin, Missouri, for the following purposes:

- 1.

- To elect three persons named in the accompanying proxy statement as Directors for terms of three years.

- 2.

- To ratify the appointment of PricewaterhouseCoopers LLP as Empire's independent registered public accounting firm for the fiscal year ending December 31, 2013.

- 3.

- To vote upon a non-binding advisory proposal to approve the compensation of our named executive officers as disclosed in this proxy statement.

- 4.

- To vote upon a stockholder proposal, if properly presented, requesting the Company prepare a report on plans to reduce risk throughout its energy portfolio by pursuing cost effective energy efficiency resources.

- 5.

- To transact such other business as may properly come before the meeting or at any adjournment or adjournments thereof.

Any of the foregoing may be considered or acted upon at the first session of the meeting or at any adjournment or adjournments thereof.

This year, we are once again pleased to be using the U.S. Securities and Exchange Commission rule that allows companies to furnish their proxy materials over the Internet. As a result, we are mailing to many of our stockholders a notice instead of a paper copy of this proxy statement and our 2012 Annual Report. The notice contains instructions on how to access those documents over the Internet. The notice also contains instructions on how each of those stockholders can receive a paper copy of our proxy materials, including this proxy statement, our 2012 Annual Report and a form of proxy card or voting instruction card. All stockholders who do not receive a notice will receive a paper copy of the proxy materials by mail. We believe that this process will conserve natural resources and reduce the costs of printing and distributing our proxy materials.

Holders of Common Stock of record on the books of Empire at the close of business on February 25, 2013 will be entitled to vote on all matters which may come before the meeting or any adjournment or adjournments thereof. A complete list of the stockholders entitled to vote at the meeting will be open at our office located at 602 S. Joplin Avenue, Joplin, Missouri, to examination by any stockholder for any purpose germane to the meeting, for a period of ten days prior to the meeting, and also at the meeting.

Stockholders are requested, regardless of the number of shares of stock owned, to either vote the proxy through the Internet or by telephone or sign and date the proxy and mail it promptly in the envelope provided, to which no postage need be affixed if mailed in the United States. A stockholder who plans to attend the meeting in person may withdraw the proxy and vote at the meeting.

Please note that brokers may not vote your shares on the election of directors in the absence of your specific instructions as to how to vote. Please return your proxy card so your vote can be counted.

Joplin, Missouri

Dated: March 13, 2013

| | |

| | | Janet S. Watson

Secretary—Treasurer |

Table of Contents

PROXY STATEMENT

| | | | | | | |

| |

| |

| |

|---|

| | 1. | | GENERAL INFORMATION | | | 1 | |

| | 2. | | MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING | | | 2 | |

| | | | Proposal 1—Election Of Directors | | | 2 | |

| | | | Information about Nominees and Directors | | | 3 | |

| | | | Director Independence | | | 6 | |

| | | | Executive Sessions | | | 6 | |

| | | | Board Leadership Structure | | | 6 | |

| | | | Risk Oversight | | | 7 | |

| | | | Committees of the Board of Directors | | | 7 | |

| | | | Director Nomination Process | | | 8 | |

| | | | Nominating/Corporate Governance Committee Report | | | 9 | |

| | | | Attendance at Annual Meetings | | | 10 | |

| | | | Proposal 2—Ratification of Appointment of Independent Registered Public Accounting Firm | | | 10 | |

| | | | Proposal 3—Non-Binding Advisory Vote on Compensation of Named Executive Officers | | | 11 | |

| | | | Proposal 4—Stockholder Proposal | | | 12 | |

| | 3. | | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | | 15 | |

| | | | Stock Ownership of Directors and Officers | | | 15 | |

| | | | Other Stock Ownership | | | 16 | |

| | 4. | | EXECUTIVE COMPENSATION | | | 16 | |

| | | | Compensation Discussion and Analysis | | | 16 | |

| �� | | | Compensation Committee Report | | | 35 | |

| | | | Summary Compensation Table | | | 36 | |

| | | | Grants of Plan-Based Awards | | | 38 | |

| | | | Outstanding Equity Awards at Fiscal Year-End | | | 41 | |

| | | | Option Exercises and Stock Vested | | | 42 | |

| | | | Pension Benefits | | | 42 | |

| | | | Potential Payments upon Termination and Change in Control | | | 44 | |

| | | | Director Compensation | | | 47 | |

| | 5. | | TRANSACTIONS WITH RELATED PERSONS | | | 49 | |

| | | | Transactions with Related Persons | | | 49 | |

| | | | Review, Approval or Ratification of Transactions with Related Persons | | | 49 | |

| | 6. | | OTHER MATTERS | | | 49 | |

| | | | Audit Committee Report | | | 49 | |

| | | | Fees Billed by our Independent Auditors during each of the Fiscal Years Ended December 31, 2012 and December 31, 2011 | | | 50 | |

| | | | Communications with the Board Of Directors | | | 51 | |

| | | | Section 16(a) Beneficial Ownership Reporting Compliance | | | 51 | |

| | | | Other Business | | | 51 | |

| | 7. | | STOCKHOLDER PROPOSALS FOR 2014 ANNUAL MEETING | | | 51 | |

| | 8. | | HOUSEHOLDING | | | 51 | |

| | 9. | | ELECTRONIC PROXY VOTING | | | 52 | |

| | 10. | | INTERNET AVAILABILITY OF PROXY MATERIALS | | | 52 | |

| | 11. | | DIRECTIONS TO THE ANNUAL MEETING | | | 52 | |

| | | | Appendix A | | | A-1 | |

Table of Contents

THE EMPIRE DISTRICT ELECTRIC COMPANY

602 S. Joplin Avenue

Joplin, Missouri 64801

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

April 25, 2013

1. GENERAL INFORMATION

This proxy statement is furnished in connection with the solicitation on behalf of the Board of Directors of The Empire District Electric Company, hereinafter referred to as Empire (Empire), a Kansas corporation, of proxies to be voted at our Annual Meeting of Stockholders to be held on Thursday, April 25, 2013, and at any and all adjournments of the meeting.

A form of proxy is available for execution by stockholders. The proxy reflects the number of shares registered in a stockholder's name. Any stockholder giving a proxy has the right to revoke it at any time before the proxy is exercised by written notice to the Secretary—Treasurer of Empire, by duly executing a proxy bearing a later date or by voting in person at the meeting.

A copy of our Annual Report for the year ended December 31, 2012 has been mailed or made available electronically to each stockholder of record for the meeting. You are urged to read the entire Annual Report.

The entire cost of the solicitation of proxies will be borne by us. Solicitation, commencing on or about March 13, 2013, will be made by use of the mails, telephone, Internet and fax and by our regular employees without additional compensation. We will request brokers or other persons holding stock in their names, or in the names of their nominees, to forward proxy material to the beneficial owners of stock or request authority for the execution of the proxies and will reimburse those brokers or other persons for their expense in so doing.

February 25, 2013 has been fixed as the record date for the determination of stockholders entitled to vote at the meeting and at any adjournment or adjournments thereof. The stock transfer books will not be closed. As of the record date, there were 42,411,176 shares of common stock outstanding. Holders of common stock will be entitled to one vote per share on all matters presented to the meeting.

The holders of a majority of the shares entitled to vote at the Annual Meeting, represented in person or by proxy, shall constitute a quorum for the purpose of transacting business at the Annual Meeting. Each outstanding share shall be entitled to one vote on each matter submitted to a vote at the Annual Meeting. Directors will be elected by a plurality of the votes of the stockholders present in person or represented by proxy at the meeting. For the ratification of the appointment of Empire's independent registered public accounting firm, the vote of a majority of the shares voted on such matter, assuming a quorum is present, shall be the act of the stockholders on such matter.

With respect to the non-binding advisory proposal to approve the compensation of our named executive officers, the votes that stockholders cast "for" must exceed the votes that stockholders cast "against" to approve this advisory vote. However, because your votes are advisory on this proposal, they will not be binding.

1

Table of Contents

To be approved, the stockholder proposal requesting the Company prepare a report on plans to reduce risk throughout its energy portfolio by pursuing cost effective energy efficiency resources must receive a "for" vote from a majority of the shares voted on such matter, assuming a quorum is present.

A stockholder voting for the election of directors may withhold authority to vote for all or certain director nominees. A stockholder may also abstain from voting on any of the other proposals. Votes withheld from the election of any nominee for director, abstentions from any other proposal and broker non-votes will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but will not be counted in the number of votes cast on a matter. With respect to shares allocated to a participant's account under our 401(k) Plan and ESOP, such participant may direct the trustee of the plan, as indicated on the proxy card, on how to vote the shares allocated to such participant's account. If no direction is given with respect to the shares allocated to a participant's account under the plan, the trustee will vote such shares in the same proportion as the shares for which directions were received from other participants in the plan.

A "broker non-vote" occurs if a broker or other nominee who is entitled to vote shares on behalf of a record owner has not received instructions with respect to a particular item to be voted on, and the broker or nominee does not otherwise have discretionary authority to vote on that matter. Under the rules of the New York Stock Exchange ("NYSE"), brokers may vote a client's proxy in their own discretion on certain items even without instructions from the beneficial owner, but may not vote a client's proxy without voting instructions on "non-discretionary" items. The ratification of Empire's independent registered public accounting firm is considered a "discretionary" item. However, the election of directors is a "non-discretionary" item and brokers may not vote your shares on the election of directors in the absence of your specific instructions as to how to vote. The non-binding advisory proposal with respect to executive compensation and the stockholder proposal are also "non-discretionary" items. Please return your proxy card so your vote can be counted.

2. MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

A. ELECTION OF DIRECTORS

(Item 1 on Proxy Card)

The Board of Directors is divided into three classes with the Directors in each class serving for a term of three years. The term of office of one class of Directors expires each year in rotation so that one class is elected at each Annual Meeting for a full three-year term. Directors are required to retire when they reach the retirement age of 73. Empire's Articles of Incorporation permit the Board of Directors to vary in size from 9 to 11 members. The Board of Directors determines the appropriate size of the Board within this range, which may vary to accommodate the needs of Empire and its stockholders and the availability of suitable candidates. In 2011, the Board approved an increase in the size of the Board from 10 to 11 members.

During 2012, the Board of Directors held four regular meetings and two special meetings. At these meetings, the Board considered a wide variety of matters involving, among other things:

| | |

• Strategic planning

• New generation projects

• The Company's financial condition and results of operations

• Financings

• Capital and operating budgets

• Regulatory proceedings | | • Personnel matters

• Succession planning

• Risk management

• Industry issues

• Accounting practices and disclosure

• Corporate governance practices

|

2

Table of Contents

All of the members of the Board of Directors attended more than 75% of the aggregate of the Board meetings and meetings held by all committees of the Board on which the Director served during the periods that the Director served.

Unless otherwise specified, the persons named in the accompanying proxy intend to vote the shares represented by proxies for the election of Mr. Ross C. Hartley, Mr. Herbert J. Schmidt and Mr. C. James Sullivan, all who are current members of the Board of Directors, as Class II Directors. While it is not expected that any of the nominees will be unable to qualify for or accept office, if for any reason one or more shall be unable to do so, proxies will be voted for nominees selected by the Board of Directors.

Information about Nominees and Directors

The Nominating/Corporate Governance Committee selects as candidates those nominees it believes would best represent the interests of the stockholders. This assessment includes such issues as experience, integrity, competence, diversity, skills and dedication in the context of the needs of the Board. The Committee does not have a formal diversity policy; however, the Committee endeavors to select candidates with a broad mix of professional and personal backgrounds in order to best meet the needs of the Board, Empire and our stockholders. The Nominating/Corporate Governance Committee begins the director search process by identifying specific experience, qualifications, attributes or skills they believe to be the most beneficial in enabling the Board of Directors to satisfy its responsibilities effectively in light of our business and structure. These have included financial expertise, capital markets experience, environmental and regulatory experience, utility leadership experience and service-area business experience. A third-party search firm is sometimes paid a fee to assist in the process of identifying and evaluating candidates that have the experience, qualifications, attributes and skills to match the search criteria. The Director nominees must also have a reputation for integrity, honesty and adherence to high ethical standards and have demonstrated superior business acumen and an ability to exercise sound judgment.

The name, age, principal occupation for the last five years, period of service as a Director of Empire, other directorships of each Director and the qualifications of each Director are set forth below. In addition, included in the information below, is a discussion of the specific experience, qualifications, attributes or skills that led to the conclusion that the person should serve as a Director of Empire in light of our business and structure. See "—Director Nomination Process" below for more information on the selection of director nominees.

Nominees for Director

CLASS II DIRECTORS

Nominated Term Expiring at the 2016 Annual Meeting

Ross C. Hartley, age 65, joined our Board of Directors in 1988. Mr. Hartley is a private investor. He is also the Co-Founder and has been a Director of NIC Inc., an investor-owned company that is a leader in providing e-government solutions for federal, state and local governments since 1991. Mr. Hartley was a long-time leader in the independent insurance business in our tri-state area and has varied experience on both public and private boards including significant experience serving on Finance and Audit Committees. Mr. Hartley is a successful entrepreneur and is valued by the Board of Directors for his business acumen and experience gained from 25 years of service as a Director.

Herbert J. Schmidt, age 57, joined our Board of Directors in 2010. Mr. Schmidt served as the Executive Vice President of Con-way Inc. and President of Con-way Truckload (trucking services) from 2007 to 2012. Prior to the merger of Contract Freighters, Inc. ("CFI") with Conway Inc. in 2007, Mr. Schmidt held positions at CFI of President and Chief Executive Officer from 2005 to 2007 and President from 2000 to 2005. Prior to his becoming President and CEO in 2005, he was employed in a

3

Table of Contents

series of progressively more responsible positions at CFI where he gained extensive knowledge in risk management, safety, insurance, benefits, security, and compliance. Mr. Schmidt, a long-time, service-area resident and businessman, has demonstrated exceptional management ability, community involvement and leadership, and his knowledge of Empire's service area, customers and stockholders brings valuable insight to the Board of Directors.

C. James Sullivan, age 66, joined our Board of Directors in 2010. Mr. Sullivan has served as Principal of Sullivan Group LLC (utility and energy consulting) since 2008. He served as President of the Alabama Public Service Commission (the public utility regulator in Alabama) from 1983 to 2008 and has been active in the National Association of Regulatory Utility Commissioners ("NARUC") serving in various capacities including President from 1998-1999. He served as a member of the University of Chicago Board of Governors which administers the Argonne National Laboratory for the Department of Energy. He is also a member of the Alabama State Bar. Mr. Sullivan's diverse experience and vast knowledge of utility issues brings to the Board of Directors critical insight into utility regulation, the regulatory process and the challenges facing the utility industry.

The Board of Directors unanimously recommends that you vote FOR each nominee.

Members of the Board of Directors Continuing in Office

CLASS I DIRECTORS

Term Expiring at the 2015 Annual Meeting

D. Randy Laney, age 58, joined our Board of Directors in 2003 and has served as the Non-Executive Vice Chairman of the Board from 2008 to 2009 and Non-Executive Chairman of the Board since April 23, 2009. He retired as Vice-Chairman of Investlinc Group (private investment and wealth services) in 2008, a position he had held since 2003. Mr. Laney spent 23 years with Wal-Mart Stores in positions of Corporate Counsel/Corporate Secretary, Director of Finance, Vice President of Finance, Benefits and Risk Management and Vice President of Finance and Treasurer. In addition, Mr. Laney has provided strategic advisory services to both private and public companies and served on numerous profit and non-profit boards. Mr. Laney brings significant management and capital markets experience, and strategic and operational understanding to his position as Chairman of the Board.

Bonnie C. Lind, age 54, joined our Board of Directors in 2009. Ms. Lind has served as Senior Vice President, Chief Financial Officer and Treasurer, of Neenah Paper Inc. (global manufacturer of premium performance based papers) since 2004. Prior to the spin-off of Neenah Paper from Kimberly-Clark Corporation in 2004, she held various financial and strategic management positions at Kimberly-Clark from 1982 to 2003, most recently as the Assistant Treasurer from 1999 to 2003. Ms. Lind has significant financial, capital markets and banking experience in a cyclical industry which consumes large quantities of energy and is affected by energy prices. Her financial, capital markets and banking experience in a small-cap, NYSE listed company brings to the Board and the Audit Committee a wealth of knowledge in dealing with financial and accounting matters in a comparable public company. Ms. Lind has been designated an Audit Committee Financial Expert.

B. Thomas Mueller, age 65, joined our Board of Directors in 2003. Mr. Mueller is the Founder and has served as the President since 1987 of SALOV North America Corporation, a U.S. subsidiary of an Italian multi-national group that imports and markets Filippo Berio olive oil throughout the U.S. As a Certified Public Accountant and an attorney, Mr. Mueller was formerly an international tax partner with KPMG Peat Marwick. His leadership skills and accounting and finance experience, as well as his experience with complex global financial issues, make him a skilled advisor with the knowledge necessary to lead our Audit Committee. Mr. Mueller has been designated an Audit Committee Financial Expert.

4

Table of Contents

Paul R. Portney, age 67, joined our Board of Directors in 2009. Dr. Portney served as Dean of the Eller College of Management at the University of Arizona from 2005 to 2011, where he continues as a professor, teaching such courses as "Energy, Environment and Business Strategy." Dr. Portney has been at the center of public environmental policy for three decades. At Resources for the Future, where he worked from 1972-2005 and was President and Chief Executive Officer from 1995 to 2005, he conducted research on environmental protection and regulation, natural resources policy, federal energy policy, air pollution, health and safety regulation, and provision of public goods. Dr. Portney is author and co-author of ten books, includingPublic Policies for Environmental Protection. The Board of Directors values his deep knowledge of environmental policy and the environmental challenges and regulation facing our industry.

CLASS III DIRECTORS

Term Expiring at the 2014 Annual Meeting

Kenneth R. Allen, age 55, joined our Board of Directors in 2005. Mr. Allen has served as Vice President, Finance and Chief Financial Officer of Texas Industries, Inc. (cement, aggregate and concrete products firm) since 2008 and was the Vice President, Treasurer and Director of Investor Relations from 1996 to 2008. Mr. Allen also worked as an economist and an analyst for an electric industry consultant early in his career which gives him additional insight into some of the challenges facing the industry. Mr. Allen has significant financial, capital markets, and investor relations experience with a small-cap, NYSE listed company in a highly capital and energy intensive industry. He also has considerable experience developing incentive compensation plans which serves him well as a member of the Compensation Committee. Mr. Allen has been designated an Audit Committee Financial Expert.

Bradley P. Beecher, age 47, joined our Board of Directors in 2011. Mr. Beecher, a professional engineer, has served as President and Chief Executive Officer of Empire since June 1, 2011. Mr. Beecher has also held the offices of Executive Vice President of Empire, Executive Vice President and Chief Operating Officer—Electric, Vice President—Energy Supply, Director of Strategic Planning as well as other operational and management positions during his career. His engineering background combined with 24 years of broad-based electric industry experience and proven leadership skills position him well to serve as a Director and leader of the Company.

William L. Gipson, age 56, joined our Board of Directors in 2002 and served as President and Chief Executive Officer of Empire from 2002 to 2011. Mr. Gipson held various operational and management positions during his thirty year career with Empire. His deep knowledge of all aspects of our business, combined with his exceptional business acumen and drive for innovation and excellence are invaluable to the Board of Directors.

Thomas M. Ohlmacher, age 61, joined our Board of Directors in 2011. Mr. Ohlmacher served as President and Chief Operating Officer, Non-regulated Energy from Black Hills Corporation from 2002 to 2011. He began his utility career with Black Hills Corporation (diversified energy company) in 1974 as a Performance Engineer and held various operational, strategic planning, and managerial positions. Mr. Ohlmacher's experience includes the construction and operation of conventional coal and natural gas fired generation and the integration of renewable wind, solar and hydro generation. He brings to the Board of Directors a wealth of industry and technical knowledge, as well as considerable insight into the leadership and business strategy of a public utility company.

5

Table of Contents

Director Independence

The Board of Directors has adopted the following standards to assist it in making determinations of independence in accordance with the New York Stock Exchange (the "NYSE") Listed Company Manual:

- 1.

- A Director shall not fail to meet any of the independence tests set forth in Section 303A.02(b) of the NYSE Listed Company Manual or any successor provisions thereto.

- 2.

- The Board of Directors shall affirmatively determine that, after taking into account all relevant facts and circumstances, the Director has no material relationships with Empire (either directly or as a partner, stockholder or officer of an organization that has a relationship with Empire). For purposes of this determination, the following relationships are not material (unless otherwise prohibited by clause 1 above):

- a.

- If a Director (or any family member of a Director) is a current or former customer, or a current or former employee or Director of a customer (or an affiliate of a customer), of Empire.

- b.

- If a Director is a former employee of an organization which provides investment banking services to Empire or which publishes research opinions with respect to any securities of Empire.

- c.

- If a family member of a Director is an employee of, or otherwise affiliated with, a charitable organization to which Empire contributes less than $25,000 in any fiscal year.

- d.

- If a Director (or any family member of a Director) receives benefits payments under Empire's Retirement Plan or Empire's Supplemental Executive Retirement Plan.

- e.

- If a Director is an executive officer of an organization which is affiliated with an organization where an executive officer of Empire serves on the board.

The Board of Directors has determined that each of the following meet the independence standards adopted above: Kenneth R. Allen, Ross C. Hartley, D. Randy Laney, Bonnie C. Lind, B. Thomas Mueller, Thomas M. Ohlmacher, Paul R. Portney, Herbert J. Schmidt, and C. James Sullivan. The Board of Directors has determined that Bradley P. Beecher and William L. Gipson do not meet the independence standards adopted above.

Executive Sessions

The terms of our Corporate Governance Guidelines provide that Directors will meet in two separate executive sessions chaired by the Chairman of the Board, as follows: (1) all of the Directors will meet in executive session and (2) all of the independent Directors will meet in executive session. Such is the practice at each Board meeting. With the exception of Mr. Beecher and Mr. Gipson, all of the Directors of Empire are independent Directors.

Board Leadership Structure

The positions of Chairman of the Board and Chief Executive Officer have been held by separate individuals since 2002 in recognition of the differences between the two roles. The Chairman of the Board provides leadership to the Board and works with the Board to define its structure and activities in the fulfillment of its responsibilities. The Chairman works with the Chief Executive Officer and other Board members to provide strong, independent oversight of our management and affairs. The Chairman approves Board meeting agendas and presides over meetings of the full Board.

6

Table of Contents

Risk Oversight

Our Board of Directors is responsible for the oversight of management's responsibility to assess and manage our major financial and other risk exposures, including operational, legal, regulatory, business, financial, commodity, strategic, environmental, credit, liquidity, and reputation risks. The Board reviews with management the categories of risk we face, including any risk concentrations and risk interrelationships, as well as the likelihood of occurrence, the potential impact of those risks and mitigating measures. In addition, the Board reviews management's implementation of its risk practices, policies and procedures to assess whether they are being followed and are effective. As part of this oversight role, the Board participates in a bi-annual enterprise risk management assessment.

While the Board of Directors has the ultimate oversight responsibility for risk management activities, various committees of the Board also have responsibility for the oversight of risk management. In particular, the Audit Committee focuses on financial risk, including counterparty credit risk, internal controls, and receives risk assessment reports from our internal auditors. In addition, in setting compensation, the Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with our business strategy. The Strategic Projects Committee works with management to oversee utility capital projects and operational issues of strategic importance.

The Risk Oversight Committee assists the Board in fulfilling its responsibility to oversee our risk management activities. The members of the Risk Oversight Committee consist of the Chairman of the Board as well as the Chairperson of each of the Audit, Compensation, Nominating/Corporate Governance and Strategic Projects Committees.

Committees of the Board of Directors

Audit Committee

We have an Audit Committee of the Board of Directors. The Board has adopted and approved a written charter for the Audit Committee. The charter is available on our website atwww.empiredistrict.com. The Audit Committee meets the definition of an audit committee as set forth in Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the "Exchange Act").

In accordance with its written charter, the Audit Committee assists the Board in its oversight of:

- •

- The integrity of our financial statements,

- •

- Our compliance with legal and regulatory requirements,

- •

- The Independent Registered Public Accounting Firms' qualification and independence, and

- •

- The performance of our internal audit function and independent auditors.

In addition, the Audit Committee is directly responsible for the appointment, compensation, retention, termination and oversight of the work of our independent auditors. The Audit Committee held nine meetings during 2012. The members of the Audit Committee are Ms. Lind and Messrs. Allen, Hartley and Mueller, each of whom is independent (as independence is defined in the NYSE Listing Standards and the rules of the Securities and Exchange Commission (the "SEC") applicable to audit committee members) and is financially literate (as determined by the Board in its business judgment in accordance with NYSE Listing Standards). The Board has also determined that Ms. Lind and Messrs. Allen and Mueller are "audit committee financial experts" (as defined in the instructions to Item 407(d)(5)(i) of Regulation S-K). None of the members of the Audit Committee serve on the Audit Committee of another public company. The report of the Audit Committee can be found below under the heading "Other Matters—Audit Committee Report."

7

Table of Contents

Compensation Committee and Compensation Committee Interlocks and Insider Participation

We have a Compensation Committee of the Board of Directors. The Compensation Committee assists the Board in establishing and overseeing Director and executive officer compensation policies and practices of Empire on behalf of the Board. The Compensation Committee determines the compensation of each of our executive officers as more fully described under "Executive Compensation—Compensation Discussion and Analysis." Also, as more fully described under "Executive Compensation—Compensation Discussion and Analysis," our Chief Executive Officer makes recommendations to the Compensation Committee with respect to certain aspects of executive compensation. The charter for the Compensation Committee is available on our website atwww.empiredistrict.com. The Compensation Committee held five meetings during 2012. The members of our Compensation Committee are Messrs. Allen, Laney, Ohlmacher, Portney and Schmidt. The Board has determined that each member of the Compensation Committee is "independent" as defined by the NYSE Listing Standards. The report of the Compensation Committee can be found below under the heading "Executive Compensation—Compensation Committee Report."

None of the members of our Compensation Committee has ever been an officer or employee of Empire or any of its subsidiaries. None of the members of our Compensation Committee had any relationship requiring disclosure under "Transactions with Related Persons" below. None of our current executive officers has ever served as a Director or member of the Compensation Committee (or other Board committee performing equivalent functions) of another for-profit corporation.

Nominating/Corporate Governance Committee

We have a Nominating/Corporate Governance Committee of the Board of Directors. The Nominating/Corporate Governance Committee is primarily responsible for:

- •

- Identifying individuals qualified to become Board members, consistent with criteria approved by the Board, and recommending that the Board select (or re-nominate) the Director nominees for the next annual meeting of stockholders,

- •

- Developing and recommending to the Board a set of corporate governance guidelines applicable to Empire,

- •

- Developing, approving and administering policies and procedures with respect to related person transactions,

- •

- Overseeing the evaluation of the Board and its committees,

- •

- Annually reviewing and recommending Board committee membership, and

- •

- Working with the Board to evaluate and/or nominate potential successors to the CEO.

The charter for the Nominating/Corporate Governance Committee is available on our website atwww.empiredistrict.com. The Committee held three meetings in 2012. The members of the Committee are Ms. Lind and Messrs. Allen, Hartley, Laney, and Sullivan. The Board has determined that each member of the Nominating/Corporate Governance Committee is "independent" as defined by the NYSE Listing Standards. The report of the Nominating/Corporate Governance Committee can be found below under the heading "—Nominating/Corporate Governance Committee Report."

Director Nomination Process

The Nominating/Corporate Governance Committee selects as candidates those nominees it believes would best represent the interests of the stockholders. This assessment includes such issues as experience, integrity, competence, diversity, skills and dedication in the context of the needs of the Board. The Committee does not have a formal diversity policy; however, the Committee endeavors to

8

Table of Contents

select candidates with a broad mix of professional and personal backgrounds in order to best meet the needs of the Board, Empire and our stockholders. In addition, the Committee takes into account the nature of and time involved in the Director's other employment and service on other boards. The Committee reviews with the Board, as required, the requisite skills and characteristics of individual Board members, as well as the composition of the Board as a whole, in the context of the needs of Empire. The Director nominees must also have a reputation for integrity, honesty and adherence to high ethical standards and have demonstrated superior business acumen and an ability to exercise sound judgment. When seeking new candidates, the Committee has sometimes paid a fee to a third party to assist in the process of identifying and evaluating candidates.

The Nominating/Corporate Governance Committee will consider nominees recommended by stockholders for election to the Board of Directors. In order to be considered, proposals for nominees for director by stockholders must be submitted in writing to Corporate Secretary: The Empire District Electric Company, 602 S. Joplin Avenue, Joplin, Missouri 64801.

In order to nominate a director at the Annual Meeting, Empire's By-Laws require that a stockholder follow the procedures set forth in Article VI, Section 5 of Empire's Restated Articles of Incorporation. In order to recommend a nominee for a director position, a stockholder must be a stockholder of record at the time it gives notice of recommendation and must be entitled to vote for the election of directors at the meeting at which such nominee will be considered. Stockholder recommendations must be made pursuant to written notice delivered (i) in the case of a nomination for election at an annual meeting, not less than 35 days nor more than 50 days prior to the annual meeting; and (ii) in the event that less than 45 days notice or prior public disclosure of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be received not later than the close of business on the tenth day following the day on which notice of the date of the meeting was mailed or the public disclosure was made.

The stockholder notice must set forth the following:

- •

- As to each person the stockholder proposes to nominate for election or re-election as a director, all information relating to such person that is required to be disclosed in solicitations of proxies for the election of directors, or is otherwise required by applicable law (including the person's written consent to being named as a nominee and to serving as a director if elected), and

- •

- As to the nominating stockholder on whose behalf the nomination is made, (a) the name and address, as they appear on Empire's books, (b) a representation that the stockholder is a holder of record of the common stock entitled to vote at the meeting on the date of the notice and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, and (c) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder.

In addition to complying with the foregoing procedures, any stockholder nominating a director must also comply with all applicable requirements of the Exchange Act and the rules and regulations thereunder. We did not receive any recommendations for director nominees for the current Annual Meeting of Stockholders by any of our stockholders.

Nominating/Corporate Governance Committee Report

The Nominating/Corporate Governance Committee recommended that the Board of Directors nominate Mr. Ross C. Hartley, Mr. Herbert J. Schmidt and Mr. C. James Sullivan as Class II Directors. Mr. Hartley, Mr. Schmidt and Mr. Sullivan have been nominated by the Board as Class II Directors subject to stockholder approval, for three-year terms ending at the Annual Meeting of Stockholders in 2016.

9

Table of Contents

Empire's Board of Directors operates pursuant to a set of written Corporate Governance Guidelines that set forth Empire's corporate governance philosophy and the governance policies and practices that the Board has established to assist in governing Empire and its affiliates. The Guidelines describe the Board membership criteria and the internal policies and practices by which Empire is operated and controlled on behalf of its stockholders.

In 2012, the Board and its committees continued to examine their processes and strengthen them as appropriate, and the Board's evaluation of Empire's corporate governance processes is ongoing. This assures that the Board and its committees have the necessary authority and practices in place to review and evaluate Empire's business operations as needed, and to make decisions that are independent of Empire's management. As examples, the Board and its committees undertake an annual self-evaluation process, meet regularly without members of management present, have full access to officers and employees of Empire, and retain their own advisors as they deem appropriate.

The Code of Business Conduct and Ethics, which is applicable to all of our Directors, officers and employees, and the Corporate Governance Guidelines comply with the Sarbanes-Oxley Act of 2002 and the listing standards of the New York Stock Exchange. We also have a separate code of ethics that applies to our chief executive officer and our senior financial officers, including our chief financial officer and our chief accounting officer. All of our corporate governance materials, including our codes of conduct and ethics, our Corporate Governance Guidelines, and our Policy and Procedures with Respect to Related Person Transactions are available for public viewing on our website atwww.empiredistrict.com under the heading Investors, Corporate Governance. Copies of our corporate governance materials are also available without charge to interested parties who request them in writing from: Corporate Secretary, The Empire District Electric Company, 602 S. Joplin Avenue, Joplin, Missouri 64801.

Ross C. Hartley, Chairman

Kenneth R. Allen

D. Randy Laney

Bonnie C. Lind

C. James Sullivan

Attendance at Annual Meetings

Empire's Corporate Governance Guidelines provide that Directors are expected to attend the annual meeting of stockholders. All members of Empire's Board of Directors attended the Annual Meeting of Stockholders in 2012.

B. RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

(Item 2 on Proxy Card)

Empire is asking the stockholders to ratify the appointment of PricewaterhouseCoopers LLP ("PwC") as our independent registered public accounting firm for the fiscal year ending December 31, 2013. PwC was appointed by the Audit Committee of the Board of Directors on February 6, 2013, and has acted in this capacity since 1992.

Although ratification by the stockholders is not required by law, the Board of Directors has determined that it is desirable to request approval of this selection by the stockholders. In the event the stockholders fail to ratify the appointment, the Audit Committee will consider this factor when making any future determination regarding PwC. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent accounting firm at any time during the year if it determines that such a change would be in the best interests of Empire and its stockholders.

10

Table of Contents

Passage of the proposal requires the affirmative vote of a majority of the votes cast.

The Board of Directors unanimously recommends that you vote FOR the ratification of the appointment of PwC as the independent registered public accounting firm for fiscal year ending December 31, 2013.

C. NON-BINDING ADVISORY VOTE OF THE STOCKHOLDERS

ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

(Item 3 on Proxy Card)

The Company is providing its stockholders with the opportunity to cast an advisory vote on executive compensation (a "say-on-pay advisory proposal") as described below. The Company believes that it is appropriate to seek the views of stockholders on the design and effectiveness of the Company's executive compensation program.

At our annual meetings of stockholders held in April 2012 and April 2011, a substantial majority of the votes cast on the say-on-pay advisory proposal were voted in favor of the proposal. The Compensation Committee believes this affirms the stockholders' support of our approach to executive compensation.

As described in detail under the heading "Executive Compensation—Compensation Discussion and Analysis," our executive compensation program is designed to provide a competitive compensation package that will enable us to attract and retain highly talented individuals for key positions and promote the accomplishment of our performance objectives. The overarching objective is to provide a conservative, yet secure, base salary, with the opportunity to earn a significantly higher total level of compensation under programs that link executive compensation to Company and individual performance factors.

We are asking our stockholders to indicate their support for our named executive officer compensation as described in this proxy statement. This say-on-pay advisory proposal gives our stockholders the opportunity to express their views on our named executive officers' compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement pursuant to Item 402 of Regulation S-K, the compensation disclosure rule of the SEC. Accordingly, we will ask our stockholders to vote "FOR" the following resolution at the Annual Meeting of Stockholders:

"RESOLVED, that the Company's stockholders approve, on a non-binding advisory basis, the compensation of the named executive officers, as disclosed in the Company's Proxy Statement for the 2013 Annual Meeting of Stockholders pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, the compensation tables and narrative discussion."

The say-on-pay vote is advisory, and therefore not binding on the Company, the Compensation Committee or our Board of Directors. Our Board of Directors and our Compensation Committee value the opinions of our stockholders, including those expressed by their vote on this proposal, and will consider the outcome of this vote when making future decisions with respect to our executive compensation program.

The Board of Directors unanimously recommends a vote "FOR" the approval of the compensation of our named executive officers, as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K.

11

Table of Contents

D. STOCKHOLDER PROPOSAL—EXPANDING ENERGY EFFICIENCY

(Item 4 on Proxy Card)

Empire has been notified that a stockholder or his representative intends to present the following proposal for consideration at the 2013 Annual Meeting. The stockholder making this proposal has presented the proposal and supporting statement below, and we are presenting the proposal as it was submitted to us. The name, address and share ownership of the stockholder will be furnished upon oral or written request.

The Board of Directors recommends that stockholders vote AGAINST this proposal for the reasons noted in Empire's opposition statement following the stockholder's proposal.

Stockholder Proposal:

EXPANDING ENERGY EFFICIENCY

WHEREAS:

Navigant Consulting recently observed that, "the changes underway in the 21st century electric power sector create a level and complexity of risks that is perhaps unprecedented in the industry's history."

In 2008 the Brattle Group projected that the U.S. electric utility industry would need to invest capital at historic levels between 2010 and 2030 to replace aging infrastructure, deploy new technologies, and meet future consumer needs and government policy requirements. In all, Brattle predicted that total industry-wide capital expenditures from 2010 to 2030 would amount to between $1.5 trillion and $2.0 trillion.

In May 2011 a National Academy of Sciences report warned that the risk of dangerous climate change impacts is growing with every ton of greenhouse gases emitted into the atmosphere. The report also emphasized that, "the sooner that serious efforts to reduce greenhouse gas emissions proceed, the lower the risks posed by climate change, and the less pressure there will be to make larger, more rapid, and potentially more expensive reductions later."

The Tennessee Valley Authority's ("TVA") 2011 integrated resource plan, which employed a sophisticated approach to risk management determined that the lowest-cost, lowest-risk strategies were the ones that diversified TVA's resource portfolio by increasing investments in energy efficiency and renewable energy.

In October 2012 the American Council for an Energy Efficient Economy released a report ranking Missouri 43rd among all states in terms of energy efficiency performance.

A 2009 study by McKinsey & Company found that investments in energy efficiency could realistically cut U.S. energy consumption by 23% by 2020. These efficiency gains could save consumers nearly $700 billion.

In 2009 the Missouri General Assembly passed the Missouri Energy Efficiency Investment Act ("MEEIA"). In 2010 the Missouri Public Service Commission ("PSC") interpreted MEEIA and issued final rules that remove financial disincentives for regulated utilities to invest in energy efficiency. The rules allow utilities to recover costs of efficiency investments and resulting lost margins.

In 2012 both Ameren Missouri and Kansas City Power and Light Greater Missouri Operations received approval from the PSC for efficiency programs within the MEEIA framework, investing respectively $145 million and $40 million in efficiency demand side mechanisms over the next three years.

In 2012 Ceres issued a report identifying efficiency as the least cost and least risk energy resource.

12

Table of Contents

The Empire District Electric Company has not disclosed in SEC Filings or other public communications a significant accounting of investments in demand side energy efficiency.

RESOLVED:

Stockholders request a report [reviewed by a board committee of independent directors] on actions the company is taking or could take to reduce risk throughout its energy portfolio by pursuing all cost effective energy efficiency resources. The report should be provided by September 1, 2013 at a reasonable cost and omit proprietary information.

Opposing Statement

The Board of Directors recommends that stockholders vote AGAINST this proposal.

The Board has considered the proposal that Empire issue a report on actions it is taking or could take to reduce risk throughout its energy portfolio by pursuing all cost effective energy efficiency resources, and believes that the preparation of such a report would not provide additional benefit to Empire or its stockholders. As further discussed below, the Board believes that Empire's publicly available documents (including filings with the SEC, the Missouri Public Service Commission ("MPSC") and other state utility commissions), information available on Empire's website and Empire's upcoming filings with the MPSC and other state utility commissions currently provides (or will provide) stockholders with extensive information that effectively addresses the proponent's proposal.

In particular, Empire's Integrated Resource Plan, filed with the MPSC in September 2010 (the "2010 IRP"), its website and its SEC reports already provide information on Empire's existing programs designed to reduce usage through energy efficiency and demand response. Current programs applicable to our Missouri electric customers (which customers account for approximately 89% of our electric revenues), include:

- •

- Low Income Weatherization and High Efficiency Program,

- •

- Low Income New Home Program,

- •

- Home Performance with ENERGY STAR® Program,

- •

- Residential High Efficiency Central Air Conditioning Program,

- •

- ENERGY STAR® New Homes Program,

- •

- Commercial & Industrial Rebate Program,

- •

- Building Operator Certification Program,

- •

- Interruptible Service Program, and

- •

- Apogee HomeEnergy Suite and the Commercial Energy Suite energy calculators and educational libraries.

Similar programs are available to many of our other electric and gas customers.

In connection with the 2010 IRP and subsequent stipulations and agreements entered into in April 2011 and June 2012 among Empire, the staff of the MPSC, the Office of the Public Counsel, Missouri Department of Natural Resources and other interested parties (the "Energy Efficiency Agreements"), which agreements were approved by the MPSC, Empire agreed to make a filing pursuant to the Missouri Energy Efficiency Investment Act ("MEEIA") and to abide by certain provisions relating to

13

Table of Contents

Empire's existing and potential portfolio of demand-side management ("DSM") programs. The parties to the Energy Efficiency Agreements agreed, among other matters, that Empire would:

- •

- Make a filing with the MPSC requesting approval of identified DSM programs and a demand-side programs investment mechanism pursuant to the MPSC's MEEIA rules (the "MEEIA Filing") within approximately 120 days of Empire's next Integrated Resource Plan filing, which is currently expected to be filed with the MPSC in mid-2013 (the "2013 IRP"). It is anticipated that this MEEIA Filing will include information regarding Empire's new and potentially expanded energy efficiency portfolio and energy efficiency investments.

- •

- Continue its existing DSM portfolio until such time as the MEEIA Filing is approved, rejected or modified by the MPSC.

- •

- Work with a stakeholder advisory group on both new DSM programs and Empire's existing DSM portfolio.

- •

- Complete a DSM market potential study as part of the 2013 IRP (the "DSM Study"), which will assess the various categories of electrical energy efficiency and demand response potential in the residential, commercial and industrial sectors for Empire's Missouri service area.

- •

- Implement and/or consider implementing new DSM programs pending the 2013 IRP analysis and the MEEIA Filing.

The parties to the Energy Efficiency Agreements agreed that setting the timing of the MEEIA Filing as noted above will afford Empire the opportunity to complete its DSM Study and use the results of the DSM Study to provide for a comprehensive 2013 IRP filing and then a comprehensive MEEIA Filing. In connection with the preparation of its 2013 IRP filing, Empire has conducted and is continuing to conduct an integrated resource plan survey of its customers in order to understand what issues are most important to its customers. The 2013 IRP filing will include (1) information on Empire's current plans for meeting consumer needs while also balancing reliability, uncertainty, affordable cost, state and federal energy policies (e.g., energy efficiency and renewable standards) and environmental pressures, (2) a robust evaluation of Empire's various types of generation and identifiable risks, including natural gas and coal prices, environmental regulations, and construction costs, to most efficiently and cost effectively meet our customers' demand and energy requirements and (3) information on Empire's proposed DSM programs. The 2013 IRP and the MEEIA Filing will both be publicly available once they are filed. In addition, a summary of the 2013 IRP will be posted on Empire's website and all new DSM programs will be listed on Empire's website once adopted.

The Board believes that the analysis being conducted in preparation for the 2013 IRP filing and the MEEIA Filing, in conjunction with our normal planning process, provides us with a thorough and balanced approach to developing our energy portfolio and evaluating a variety of resources and programs, including DSM programs. While Empire and the Board are committed to maintaining and expanding Empire's DSM programs to the extent that it best matches the needs of its customers, the Board believes that preparing a static report, in addition to Empire's SEC reports, the DSM Study, the 2013 IRP Filing and the MEEIA Filing, would not provide additional benefit to Empire or its stockholders.

The Board of Directors recommends that stockholders vote AGAINST this proposal.

14

Table of Contents

3. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Stock Ownership of Directors and Officers

The following table shows information with respect to the number of shares of our common stock beneficially owned as of February 25, 2013 by each of our executive officers named in the Summary Compensation Table, each Director, each Director nominee and our Directors and executive officers as a group.

| | | | | | |

Name | | Position | | Shares of

Common Stock

Beneficially

Owned(1) | |

|---|

D. Randy Laney | | Director, Chairman of the Board | | | 17,912 | |

Kenneth R. Allen | | Director | | | 12,488 | |

William L. Gipson(2) | | Director | | | 77,549 | |

Ross C. Hartley(3) | | Director | | | 45,872 | |

Bonnie C. Lind | | Director | | | 500 | |

B. Thomas Mueller | | Director | | | 10,073 | |

Thomas M. Ohlmacher | | Director | | | 3,178 | |

Paul R. Portney | | Director | | | 5,366 | |

Herbert J. Schmidt | | Director | | | 2,500 | |

C. James Sullivan | | Director | | | 7,845 | |

Bradley P. Beecher(2) | | President and Chief Executive Officer and Director | | | 35,604 | |

Laurie A. Delano | | Vice President—Finance and Chief Financial Officer | | | 6,214 | |

Ronald F. Gatz(2) | | Vice President and Chief Operating Officer—Gas | | | 40,982 | |

Michael E. Palmer(2) | | Vice President—Transmission Policy and Corporate Services | | | 31,082 | |

Kelly S. Walters(2) | | Vice President and Chief Operating Officer—Electric | | | 13,929 | |

Directors and named executive officers, as a group | | | | | 311,094 | |

- (1)

- No Director or executive officer owns more than 0.5% of the outstanding shares of our common stock and all Directors and executive officers as a group own less than 1% of the outstanding shares of our common stock.

- (2)

- Includes 48,200, 15,500, 21,800, 13,500 and 5,600 shares, respectively, issuable upon the exercise of currently exercisable stock options for Mr. Gipson, Mr. Beecher, Mr. Gatz, Mr. Palmer, and Ms. Walters.

- (3)

- Includes 2,314 shares for which Mr. Hartley holds a power of attorney for a non-resident relative.

15

Table of Contents

Other Stock Ownership

The following table reflects the holdings of those known to us to own beneficially more than 5% of our common stock as of February 25, 2013.

| | | | | | | |

Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | Percent of Class | |

|---|

| BlackRock, Inc. | | | 2,355,039 | (1) | | 5.55 | % |

40 East 52nd Street | | | | | | | |

New York, NY 10022 | | | | | | | |

The Vanguard Group |

|

|

2,398,780 |

(2) |

|

5.65 |

% |

100 Vanguard Boulevard | | | | | | | |

Malvern, PA 19355 | | | | | | | |

- (1)

- Based on a Schedule 13G/A dated February 8, 2013, filed with the Securities and Exchange Commission by BlackRock, Inc. BlackRock, Inc. has sole voting and dispositive power with respect to 2,355,039 shares.

- (2)

- Based on a Schedule 13G dated February 12, 2013, filed with the Securities and Exchange Commission by The Vanguard Group. The Vanguard Group has sole voting power with respect to 77,774 shares, sole dispositive power with respect to 2,337,906 shares and shared dispositive power with respect to 60,874 shares. Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 60,874 shares or 0.14% of the Common Stock outstanding of the Company as a result of its serving as investment manager of collective trust accounts. Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 16,900 shares or 0.04% of the Common Stock outstanding of the Company as a result of its serving as investment manager of Australian investment offerings.

4. EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

The compensation program for executive officers is designed to provide a conservative yet competitive compensation package that will enable us to attract and retain highly talented individuals for key positions, promote the accomplishment of our performance objectives, and achieve Company results beneficial to our stockholders, customers and other stakeholders. The program is administered by our Compensation Committee ("Committee") which is composed entirely of non-employee, independent directors who are appointed by and serve at the sole discretion of the Board of Directors. The overarching objective of the Committee is to provide a conservative, yet secure, base salary, with the opportunity to earn a significantly higher total level of compensation under cash and equity incentive opportunities that link executive compensation to Company and individual performance factors.

In order to align the Company's executive compensation program with the interests of our stockholders, a significant portion of each executive's total compensation opportunity is presented in the form of equity compensation. In addition, equity and other at-risk elements of compensation are tied to both short-term and long-term performance measures. In essence, at-risk compensation must be "re-earned" annually.

16

Table of Contents

The Committee is assisted in accomplishing its responsibilities by an independent compensation consultant ("Consultant"). The Committee is directly responsible for the appointment, compensation and oversight of the work of the Consultant. The Consultant does not perform other services for us outside of its engagement with the Committee, but may interact directly with the President and CEO, our legal counsel and/or other Company personnel for the purpose of obtaining executive officer compensation and performance data to be used in its review and analysis. The Committee retains all decision-making and approval authority with regard to determining executive compensation levels.

The Committee structures the executive compensation program to motivate executives to achieve specified business goals and to reward the achievement of those goals. Compensation decisions made by the Committee are based on market analysis, Company performance, achievement of individual performance objectives, the level and nature of the executive's responsibilities and the level of experience in his or her position.

Our compensation program includes three basic compensation elements:

| | | | |

• Base Salary | | • Annual Cash Incentives | | • Long-Term Stock Incentives |

Base Salary combined with Annual Cash Incentives make up Total Cash Compensation. Total Cash Compensation combined with Long-Term Incentives make up Total Direct Compensation. Each of these compensation elements is discussed more fully below.

By design, Base Salary is set significantly lower than the median Base Salary of the national market (our former benchmark) and our industry-specific peer group (our current benchmark). Annual Cash Incentive and Long-Term Incentive targets are set at fixed percentages of Base Salary. These incentive compensation elements provide each executive the potential to earn higher levels of Total Direct Compensation depending on Company and individual performance.

The Committee believes the compensation approach discussed above appropriately balances stockholder, customer and other stakeholder interests and is a responsible approach to executive compensation. It includes the following features:

- •

- Short-term incentive compensation focused on tactical near-term objectives that support the Company's longer-term goals,

- •

- Limitations on potential incentive compensation awards equal to 200% of target opportunity,

- •

- Long-term performance-based stock awards linked to stockholder returns over a three-year period,

- •

- Time-vested stock awards designed to promote a proper focus on the creation of stockholder value,

- •

- Participation in the same health and welfare benefits and qualified pension plan offered to all our full-time employees, and

- •

- A traditional supplemental retirement plan that only covers compensation not included in the qualified pension plan due solely to tax limitations.

In addition, the executive compensation approach includes the following provisions:

- •

- A Change In Control Severance Pay Plan ("Severance") that includes a "double-trigger" (requiring a change in control and termination of employment) and a reasonable payment equal to 36 months of severance pay benefits (see discussion under "—Potential Payments upon Termination and Change in Control"),

- •

- A provision that non-vested equity awards do not accelerate after a change in control unless the executive is terminated, and

17

Table of Contents

- •

- No employment agreements or guaranteed compensation arrangements between the Company and the executive officers other than the severance agreement.

Analysis of Executive Officer Compensation

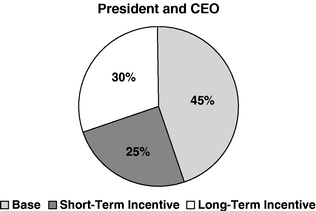

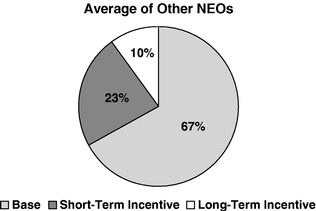

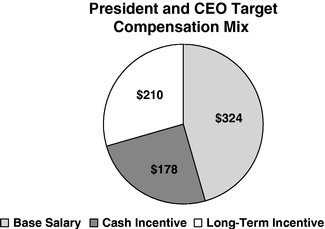

The Committee believes the 2012 mix of compensation elements (based on target-level incentive opportunities) available to our President and Chief Executive Officer ("CEO") and all other Named Executive Officers ("NEOs") as illustrated below reflects our commitment to an executive compensation program that rewards individuals for performance.

2012 Compensation Mix

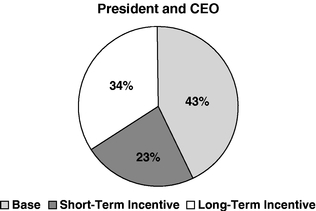

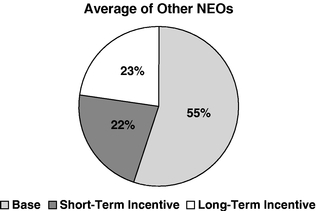

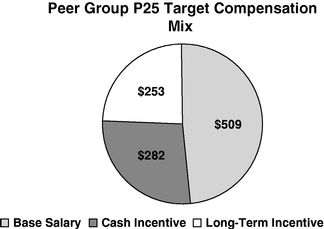

Beginning in 2013, the Committee has elected to make modifications to executive officer base salaries and the mix of compensation elements, placing more compensation in the form of incentive compensation. Each of these modifications is discussed more fully below. The 2013 mix of compensation elements (based on target-level incentive opportunities) following the implementation of these changes is illustrated below.

2013 Compensation Mix

The Committee believes this modification strengthens the relationship between pay and performance, as a larger portion of each executive officer's Total Direct Compensation has been placed in the form of at-risk short-term and long-term incentive compensation.

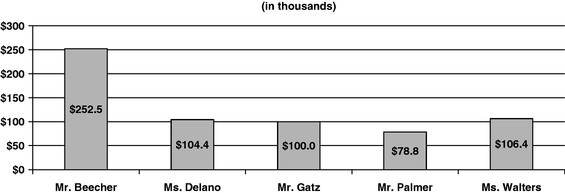

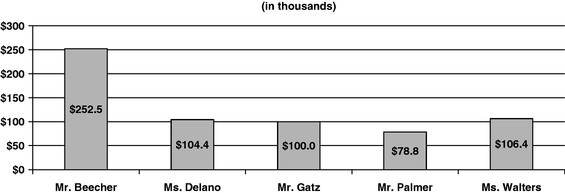

With respect to the 2012 compensation of Mr. Bradley P. Beecher, our President and Chief Executive Officer, approximately 55% of his total target direct compensation opportunity consisted of at-risk compensation in the form of short-term and long-term incentives. As illustrated below, Mr. Beecher's total 2012 target direct compensation opportunity was conservative when compared to

18

Table of Contents

the 25th percentile compensation opportunities of our industry-specific peer group of companies. Moreover, the Consultant has informed the Committee that the 2012 Total Direct Compensation opportunity of each of the CEOs included in our industry-specific peer group, at target performance levels, was greater than that of Mr. Beecher.

2012 Compensation Mix

When establishing Mr. Beecher's compensation, the Committee considers the actuarially-estimated change in pension value reported under the "—Change in Pension Value and Nonqualified Deferred Compensation Earnings" column in the Summary Compensation Table of our Proxy Statements. The Committee believes that the estimated change in pension value does not represent current compensation paid to Mr. Beecher for his service as President and CEO, as Mr. Beecher's pension benefits are not realizable until the time of his retirement. In calculating Mr. Beecher's future pension benefits, his total years of service with our Company are included in our benefit formula, rather than only those years he has served as our President and CEO. Additionally, the estimated change in Mr. Beecher's pension value is based on a life expectancy of 83 years. The table below shows Mr. Beecher's total compensation as reported in our Summary Compensation Tables since his election to the position of President and CEO in 2011, the annual amounts of estimated change in pension value included in his total compensation since and including his year of election, and the amount of his compensation that excludes the change in his estimated pension value.

| | | | | | | | | | |

Year | | Total Compensation

Reported on Summary

Compensation Table | | Change in Pension Value

Reported on Summary

Compensation Table | | Total Compensation

Excluding Change in

Pension Value | |

|---|

2012 | | $ | 927,089 | | $ | 252,290 | | $ | 674,799 | |

2011 | | $ | 683,706 | | $ | 277,308 | | $ | 406,398 | |

The Committee believes the Total Compensation Excluding Change in Pension Value is more representative of the actual compensation value Mr. Beecher received for his service as President and CEO during each year of service. This same assessment regarding actuarially-estimated change in pension value and the realization of pension benefits is applicable to each NEO.

The Role of the Compensation Committee

The Compensation Committee ("Committee"), on behalf of the Board of Directors, administers our director and executive compensation programs. The Committee meets at scheduled times during

19

Table of Contents

the year and on an as-needed basis. The duties and responsibilities of the Committee are described in its charter (which has been approved by the full Board of Directors) and include:

- •

- Assisting the Board of Directors in establishing and overseeing director and executive officer compensation policies and practices,

- •

- Hiring, terminating and directing the activities of the independent compensation consultant,

- •

- Reviewing and analyzing general industry and peer group compensation data,

- •

- Reviewing and approving executive officer goals, objectives and compensation levels,

- •

- Evaluating executive officer performance,

- •

- Making recommendations to the Board of Directors as to the form and amount of director compensation levels, and

- •

- Considering the outcome of the stockholder advisory votes on executive compensation when evaluating executive compensation policies and practices and when making future executive compensation decisions.

The Role of the President and CEO

The President and CEO attends Committee meetings, including the meeting where the Committee deliberates base salary changes and annual incentive metrics and performance measures for executive officers. His role at these meetings includes:

- •

- Reviewing the performance of each executive officer against position accountabilities and Annual Incentive Plans ("AIP") metrics and performance measures, and recommending AIP awards for the just-ended fiscal year for each executive officer,

- •

- Making base salary adjustment recommendations for the ensuing performance year for each executive officer,

- •

- Reviewing and recommending AIP metrics and performance measures for the ensuing fiscal year, and

- •

- Responding to questions Committee members may have regarding base salary levels and AIP metrics, performance measures and awards.

The President and CEO does not directly participate in the deliberations of the Committee and he is not present during nor does he take part in any way in the Committee's deliberations with respect to establishing his compensation.

The Role of the Consultant

During 2012, the Committee directly engaged Hay Group, an independent compensation consulting firm (the "Consultant"). Work performed for the Committee by the Consultant during 2012 included:

- •

- Analysis of leading practices and trends in the utility industry,

- •

- Analysis of the relative positioning of each of our executive officer positions to similar positions within its proprietary national market database,

- •

- Review and evaluation of our compensation program and compensation levels as compared to compensation practices of other companies with similar characteristics, including size and type of business (see discussion of industry-specific peer group under "—Benchmarking"),

- •

- Recommendation of appropriate industry-specific peer group of companies,

20

Table of Contents

- •

- Performing calculations necessary to determine recommendations for performance-based equity awards, and

- •

- Recommending the structure of the executive compensation program relative to the results of its analysis of national market and industry-specific peer group companies.

The Consultant's 2012 review will serve as the basis for compensation decisions beginning in 2013 and continue until such time that the Committee engages an independent consultant to perform a subsequent review. The most recent executive compensation review prior to the 2012 review was performed by the same Consultant in 2010. The work performed by the Consultant during its 2010 review was substantially similar to the work performed during its 2012 review. The 2010 review served as the basis for compensation decisions related to 2012 performance.

The Role of Stockholder Say-on-Pay Advisory Votes

We provide our stockholders with the opportunity to cast an annual advisory vote on executive compensation (a "say-on-pay advisory proposal" as described under Section 2, "—MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING"). At our annual meeting of stockholders held in April 2012, a substantial majority of the votes cast on the say-on-pay advisory proposal at that meeting were voted in favor of the proposal. The Committee believes this affirms stockholders' support of our approach to executive compensation.

Compensation Philosophy

The Committee sets target compensation levels in a manner designed to:

- •