EXHIBIT B

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

of

ENERGY CONVERSION DEVICES, INC.

1. The name of the corporation (the “Corporation”) is ENERGY CONVERSION DEVICES, INC. The date of filing of the original certificate of incorporation of the Corporation with the Secretary of State of the State of Delaware is September 3, 1964.

2. Pursuant to Sections 242 and 245 of the General Corporation Law of the State of Delaware, this Amended and Restated Certificate of Incorporation was duly adopted by the Board of Directors of the Corporation and duly approved by the Corporation’s stockholders by vote of the requisite number of shares of the Corporation at the 2007 annual meeting of stockholders.

3. The certificate of incorporation of the Corporation is hereby amended and restated to read in its entirety as set forth below, which instrument shall be entitled and hereafter referred to as the “Certificate of Incorporation of Energy Conversion Devices, Inc.”

* * *

CERTIFICATE OF INCORPORATION

OF

ENERGY CONVERSION DEVICES, INC.

ARTICLE I

NAME

The name of the corporation shall be ENERGY CONVERSION DEVICES, INC. (the “Corporation”).

ARTICLE II

OFFICE

The address of the Corporation in the State of Delaware is 2711 Centerville Road, Suite 400, in the City of Wilmington, County of New Castle, 19808. The name of its registered agent at such address is The Prentice-Hall Corporation System, Inc.

ARTICLE III

PURPOSE

The purpose of the Corporation is to engage in any lawful act or activity for which a corporation may be organized under the Delaware General Corporation Law.

B – 1

ARTICLE IV

CAPITAL STOCK

If preferred stock is not approved by the stockholders, the text of Article IV will be as follows:

The total number of shares of all classes of stock which the Corporation shall have authority to issue is 100,000,000 shares of common stock of a par value of one cent ($.01) per share.

If preferred stock is approved by the stockholders, the text of Article IV will be as follows:

The total number of shares of all classes of stock which the Corporation shall have authority to issue is [120,000,000], consisting of 100,000,000 shares of common stock, par value $.01 per share, and [20,000,000] shares of Preferred Stock, par value $.01 per share.

The Board of Directors is authorized, at any time or from time to time, to issue Preferred Stock and: (a) to provide for the issuance of shares of Preferred Stock in one or more series, and any restrictions on the issuance or reissuance of any additional Preferred Stock; (b) to determine the designation for any such series by number, letter or title that shall distinguish such series from any other series of Preferred Stock; (c) to establish from time to time the number of shares to be included in any such series, including a determination that such series shall consist of a single share, or that the number of shares shall be decreased (but not below the number of shares thereof then outstanding); and (d) to determine with respect to the shares of any series of Preferred Stock the terms, powers, preferences, qualifications, limitations, restrictions and relative, participating, optional or other special rights of the shares of such series of Preferred Stock, including but not limited to:

| (i) | whether, with respect to shares entitled to dividends, the holders thereof shall be entitled to cumulative, noncumulative or partially cumulative dividends, the dividend rate or rates (including the methods and procedures for determining such rate or rates), and any other terms and conditions relating to such dividends (including the relation which such dividends shall bear to the dividends payable on any other class or series of the Corporation’s capital stock); |

| (ii) | whether, and (if so) to what extent and upon what terms and conditions, the holders thereof shall be entitled to rights upon the voluntary or involuntary liquidation, dissolution or winding up of, or upon any distribution of the assets of, the Corporation; |

| (iii) | whether, and (if so) upon what terms and conditions, such shares shall be convertible into, or exchangeable for, other securities or property; |

| (iv) | whether, and (if so) upon what terms and conditions, such shares shall be redeemable by the Corporation; |

| (v) | whether the shares shall be subject to any sinking fund provided for the purchase or redemption of such shares and, if so, the terms and amount of such fund; |

| (vi) | whether the holders thereof shall be entitled to voting rights and, if so, the terms and conditions for the exercise thereof, provided, that the holders of shares of Preferred Stock will not be entitled (A) to more than one vote per share, when voting as a class with the holders of shares of common stock, and (B) to vote on any matter separately as a class, except with respect to any amendment or alteration of the provisions of this Certificate of Incorporation that would adversely affect the powers, preferences or special rights of the applicable series of Preferred Stock or as otherwise provided by law; and |

| (vii) | whether the holders thereof shall be entitled to other relative, participating, optional or other special powers, preferences or rights and (if so) the qualifications, limitations and restrictions of such preferences or rights. |

B – 2

ARTICLE V

DIRECTORS

The number of directors of the Corporation shall be fixed from time to time by, or in the manner provided in, the Bylaws, but in no case shall the number be less than three.

ARTICLE VI

AMENDMENT OF BYLAWS

In furtherance, and not in limitation of the powers conferred by law, and in addition to the powers which may be conferred by the Bylaws, the Board of Directors is expressly authorized to make, alter, amend or repeal the Bylaws of the Corporation subject to the power of the stockholders of the Corporation having voting power to alter, amend or repeal Bylaws made by the Board of Directors.

ARTICLE VII

INDEMNIFICATION

The Corporation shall indemnify and hold harmless, to the fullest extent permitted by applicable law as it presently exists or hereafter may be amended, any person (a “Covered Person”) who was or is made or is threatened to be made a party or is otherwise involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “proceeding”), by reason of the fact that he or she, or a person for whom he or she is the legal representative, is or was a director or officer of the Corporation or, while a director or officer of the Corporation, is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust, enterprise or nonprofit entity, including service with respect to employee benefit plans, against all expenses (including attorneys’ fees, judgments, fines, and amounts paid in settlement) actually and reasonably incurred by such Covered Person. Notwithstanding the preceding sentence, except as otherwise provided in Section 5.3 of the Corporation’s Bylaws, the Corporation shall be required to indemnify a Covered Person in connection with a proceeding (or part thereof) commenced by such Covered Person only if the commencement of such proceeding (or part thereof) by the Covered Person was authorized in the specific case by the Board of Directors.

ARTICLE VIII

LIMITATION OF LIABILITY

To the fullest extent permitted by the Delaware General Corporation Law as the same exists or hereafter may be amended, no director of the Corporation shall be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (i) for any breach of the director’s duty of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the Delaware General Corporation Law, as the same exists or hereafter may be amended, or (iv) for any transaction from which the director derived an improper personal benefit. Any repeal or modification of this paragraph by the stockholders of the Corporation shall be prospective only, and shall not adversely affect any limitation on the personal liability of a director of the Corporation existing at the time of such repeal or modification. Nothing herein shall limit or otherwise affect the obligation or right of the Corporation to indemnify its directors pursuant to the provisions of this Certificate of Incorporation, the Bylaws of the Corporation or as may be permitted by the Delaware General Corporation Law.

B – 3

ARTICLE IX

NO PREEMPTIVE RIGHTS

No holder of any of the shares of the Corporation shall be entitled as of right to purchase or subscribe for any unissued shares of any class, or any additional shares of any class to be issued by reason of any increase of the authorized shares of the Corporation, or bonds, certificates or indebtedness, debentures or other securities convertible into shares of the Corporation or carrying any right to purchase shares of any class, but any such unissued shares or such additional authorized issue of any shares or other securities convertible into shares, or carrying any right to purchase shares, may be issued and disposed of pursuant to resolution of the Board of Directors to such persons, firms, corporations or associations and upon such terms as may be deemed advisable by the Board of Directors in the exercise of its discretion.

ARTICLE X

AMENDMENT

The Corporation reserves the right at any time, and from time to time, to amend, alter, change or repeal any provision contained in this Certificate of Incorporation, and other provisions authorized by the laws of the State of Delaware at the time in force may be added or inserted, in the manner now or hereafter prescribed by law; and all rights, preferences and privileges of whatsoever nature conferred upon stockholders, directors or any other persons whomsoever by and pursuant to this Certificate of Incorporation in its present form or as hereafter amended are granted subject to the rights reserved in this article.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Incorporation to be signed by its President and Chief Executive Officer this [___] day of [_________] 2007.

| ENERGY CONVERSION DEVICES, INC. | |

| | | |

| | President and Chief Executive Officer | |

| | | |

B – 4

| ANNUAL MEETING PROXY CARD |

A. Election of Directors.

The Board of Directors recommends a vote FOR the listed nominees. | ---------------------------------------------------- |

(1) Joseph A. Avila | For o | Withhold o |

(2) Robert I. Frey | For o | Withhold o |

(3) William J. Ketelhut | For o | Withhold o |

(4) Florence I. Metz | For o | Withhold o |

(5) Mark D. Morelli | For o | Withhold o |

(6) Stephen Rabinowitz | For o | Withhold o |

(7) George A. Schreiber, Jr. | For o | Withhold o |

B. Issues.

The Board of Directors recommends a vote FOR the following proposals. | |

2. Ratification of the appointment of Grant Thornton LLP as independent registered public accounting firm for the fiscal year ending June 30, 2008. | For o | Against o | Abstain o |

3. Approval of the Annual Incentive Program. | For o | Against o | Abstain o |

4. Approval of the Amended and Restated Articles of Incorporation | For o | Against o | Abstain o |

5. Approval of Amendment to the Company's Amended and Restated Certificate of Incorporation authorizing

20,000,000 shares of preferred stock. | For o | Against o | Abstain o |

C. Authorized signatures — Sign Here — This section must be completed for your instructions to be executed.

Please sign this Proxy exactly as your name(s) appear(s) on the books of the Company. Joint owners should sign personally. Trustees and other fiduciaries should indicate the capacity in which hey sign, and where more than one name appears, a majority must sing. If a corporation, this signature should be that of an authorized officer who should state his or her title. | |

Signature: --------------------------- Date:--------------- Signature: ---------------------------- Date: --------------

| PROXY — ENERGY CONVERSION DEVICES, INC. |

| PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS |

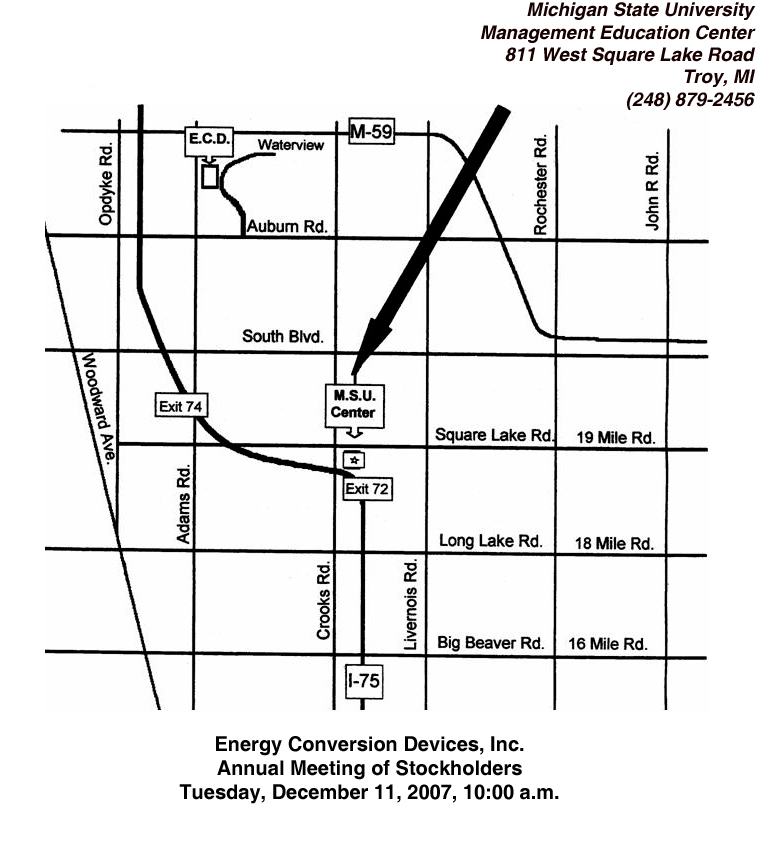

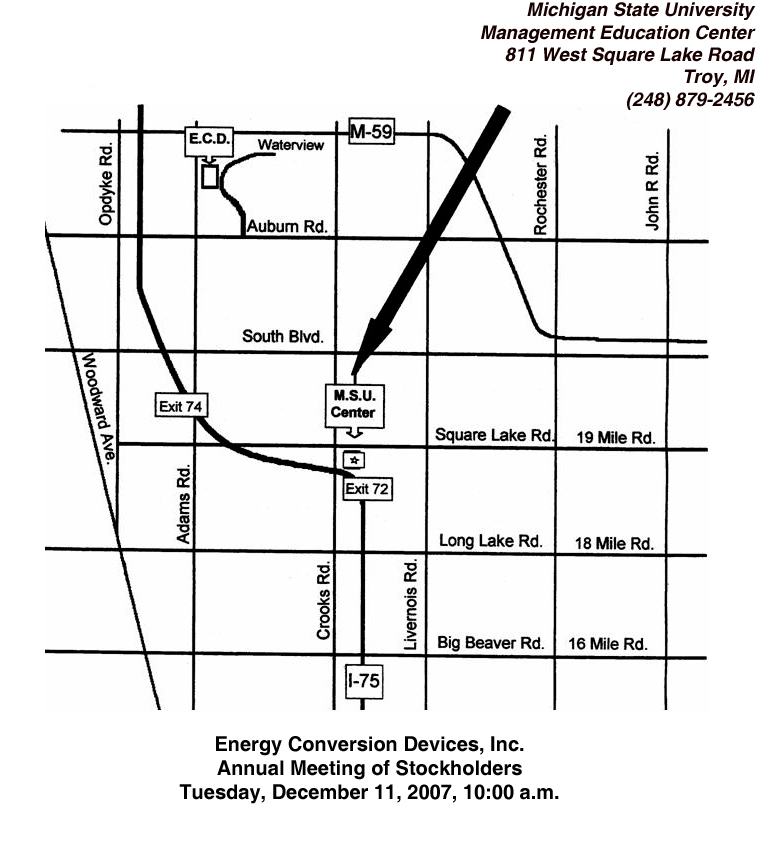

The undersigned hereby appoints JAY B. KNOLL and GHAZALEH KOEFOD and each of them, with power of substitution, and in place of each, in case of substitution, his or her substitute, the attorneys and proxies for and on behalf of the undersigned to attend the Annual Meeting of Stockholders (the "Meeting")

of ENERGY CONVERSION DEVICES, INC. (the "Company") to be held at Michigan State University Management Education Center, 811 West Square Lake Road, Troy, Michigan, on Tuesday, December 11, 2007 at 10:00 a.m. (EST) and any and all adjournments thereof, and to cast the number of votes the undersigned would be entitled to vote if then personally present. The undersigned instructs such proxies to vote as specified on this card.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED

HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL

BE VOTED FOR ALL NOMINEES FOR DIRECTORS AND FOR PROPOSALS 2,3, 4 AND 5 AS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT.

The Board of Directors of the Company recommends a vote FOR Proposals 1, 2, 3, 4 and 5.

PLEASE VOTE, DATE AND SIGN ON REVERSE AN RETURN PROMPTLY IN THE ENCLOSED

ENVELOPE.

Dear Stockholder,

Please take note of the important information enclosed with this Proxy Ballot. The matters you are asked to vote upon are discussed in detail in the enclosed proxy materials.

Your vote counts, and you are strongly encouraged to exercise your right to vote your shares.

Please mark the boxes on the proxy card to indicate how your shares will be voted. Then sign the card, detach it and return your proxy vote in the enclosed postage paid envelope.

Your vote must be received prior to the Annual Meeting of Stockholders, December 11, 2007.

Thank you in advance for your prompt consideration of these matters.

Sincerely,

Energy Conversion Devices, Inc.

Telephone and Internet Voting Instructions.

You can vote by telephone OR Internet. Available 24 hours a day 7 days a week.

| To Vote Using the Internet | To Vote Using the Telephone (within U.S. and Canada) |

Log on to the Internet and go to | OR | Call toll-free |

http://www.computershare.com/expressvote | 1-800-652-VOTE (8683) |

If you vote over the Internet or by telephone, please do not mail your card.

| ANNUAL MEETING PROXY CARD |