Capital Allocation at Esterline FY 2018 Exhibit 99.3

This presentation may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. These forward-looking statements are only predictions based on the current intent and expectations of the management of Esterline as of November 9, 2017, are not guarantees of future performance or actions, and involve risks and uncertainties that are difficult to predict and may cause Esterline’s or its industry’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Esterline's actual results, plans and the timing and outcome of events may differ materially from those expressed in or implied by the forward-looking statements due to risks detailed in Esterline's public filings with the Securities and Exchange Commission, including its most recent Annual Report on Form 10-K. This presentation also contains references to non-GAAP financial information subject to Regulation G. The reconciliations of each non-GAAP financial measure to its comparable GAAP measure as well as further information on management’s use of non-GAAP financial measures are included in Esterline’s press release dated November 9, 2017, included as Exhibit 99.1 to Form 8-K filed with the SEC on the same date, as well as in the Appendix of this presentation.

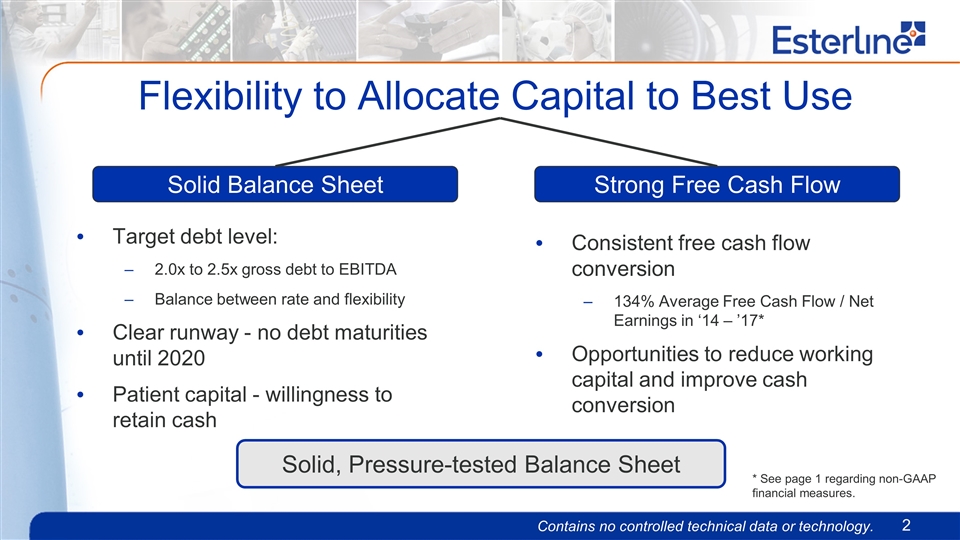

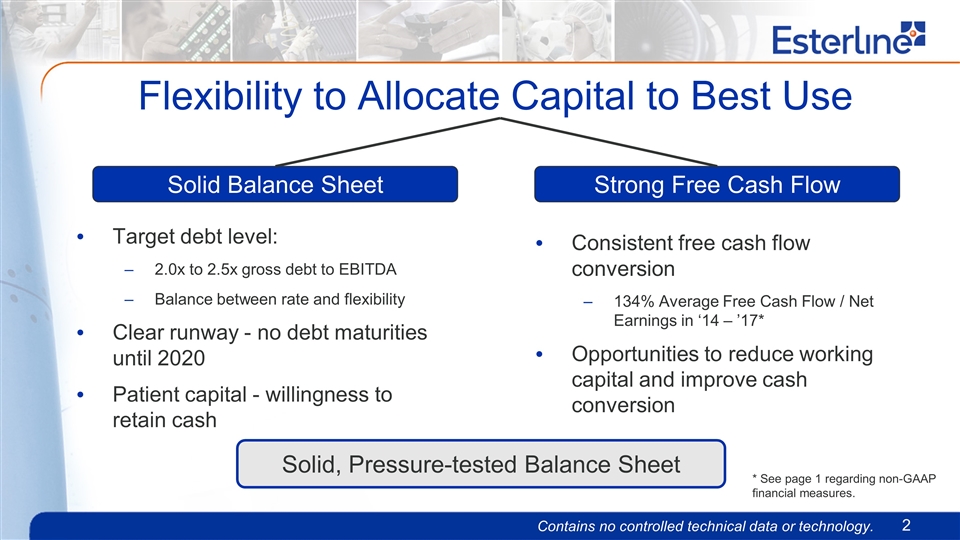

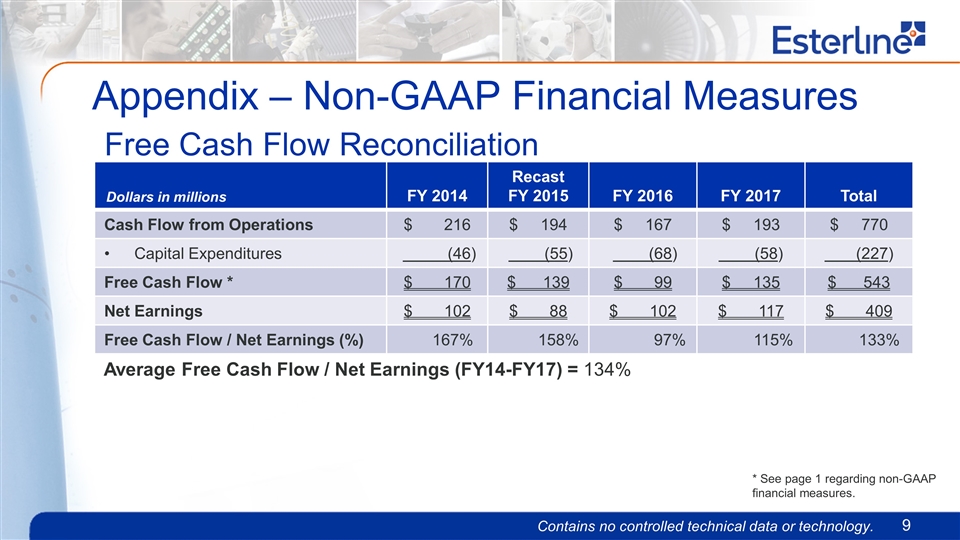

Flexibility to Allocate Capital to Best Use Solid Balance Sheet Strong Free Cash Flow Target debt level: 2.0x to 2.5x gross debt to EBITDA Balance between rate and flexibility Clear runway - no debt maturities until 2020 Patient capital - willingness to retain cash Consistent free cash flow conversion 134% Average Free Cash Flow / Net Earnings in ‘14 – ’17* Opportunities to reduce working capital and improve cash conversion 2 Solid, Pressure-tested Balance Sheet * See page 1 regarding non-GAAP financial measures.

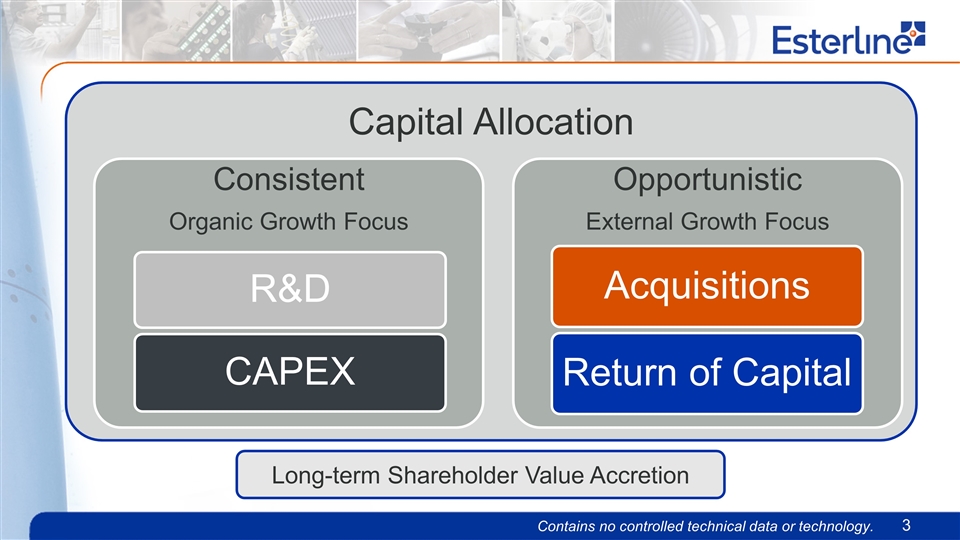

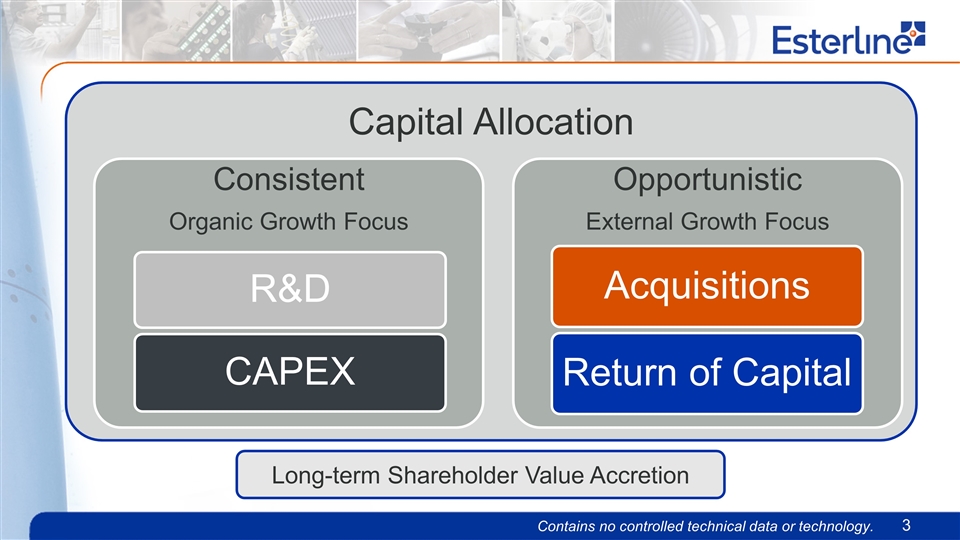

3 Capital Allocation Long-term Shareholder Value Accretion Consistent Organic Growth Focus R&D CAPEX Opportunistic External Growth Focus Acquisitions Return of Capital

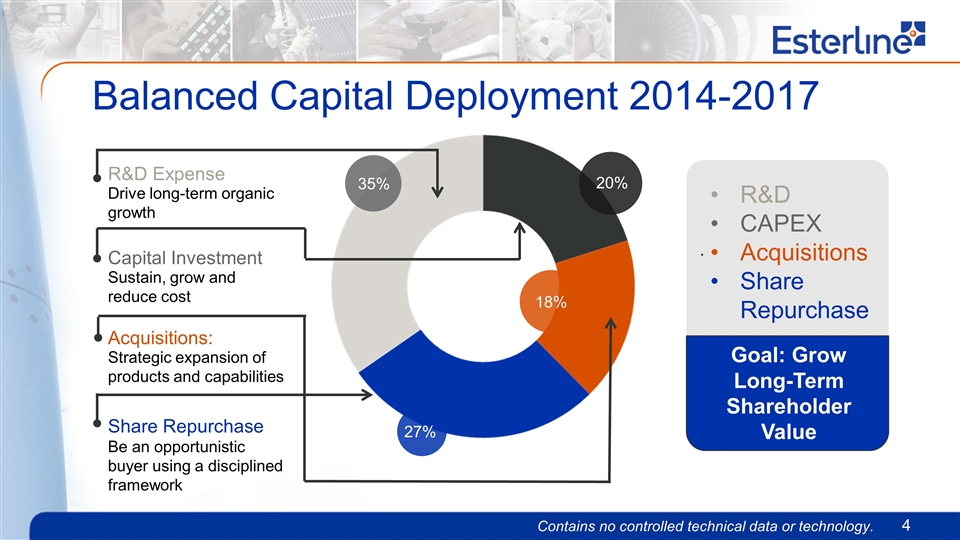

Balanced Capital Deployment 2014-2017 35% R&D Expense Drive long-term organic growth 20% Capital Investment Sustain, grow and reduce cost Acquisitions: Strategic expansion of products and capabilities 18% Share Repurchase Be an opportunistic buyer using a disciplined framework 27% R&D CAPEX Acquisitions Share Repurchase . Goal: Grow Long-Term Shareholder Value

R&D – Drive Long-term Organic Growth Customer-facing investment Specific product development for awarded programs Technology roadmaps addressing customer needs & driving long-term organic growth Internal investment with attractive risk/return profile Consistent Investment: ~5% of Sales

CAPEX– Sustain & Grow the Existing Business Maintain and enhance competitive position of existing businesses Maintain/upgrade/enhance operational capabilities Improve efficiency Enhance margins 6 Consistent Investment: $60M - $70M / year

Focused & Disciplined External Investment Economics – IRR > risk adjusted cost of capital, accretive on a cash earnings basis Strategic Fit – current core markets, meaningful scale, complementary technology/products Opportunity – leverage ESL infrastructure, hard $ synergies, enhance competitive positioning, key customer/market penetration/expansion Integration – geographic fit, cultural fit, management bandwidth, due diligence to minimize risk, dedicated team External Growth: Focused/Patient/Disciplined

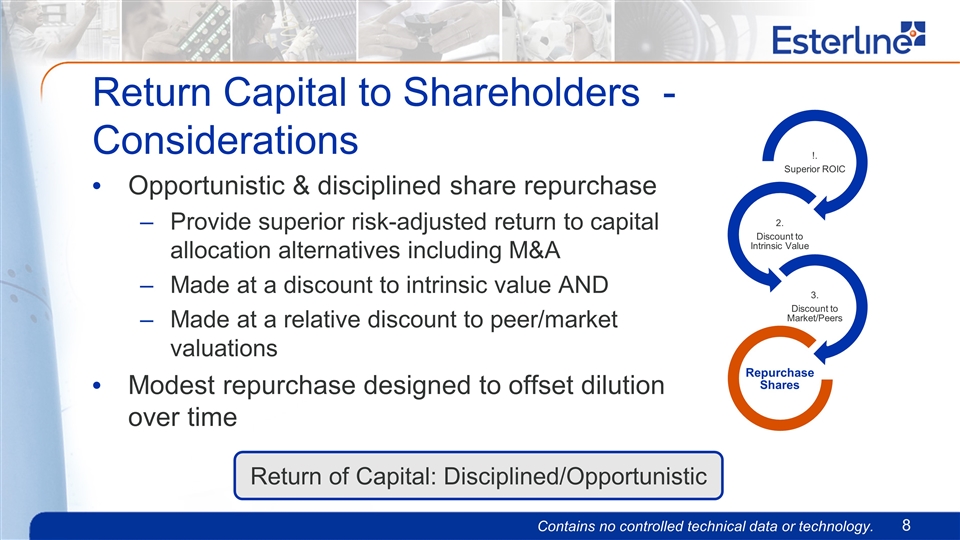

Return Capital to Shareholders - Considerations Opportunistic & disciplined share repurchase Provide superior risk-adjusted return to capital allocation alternatives including M&A Made at a discount to intrinsic value AND Made at a relative discount to peer/market valuations Modest repurchase designed to offset dilution over time Return of Capital: Disciplined/Opportunistic !. Superior ROIC 2. Discount to Intrinsic Value Repurchase Shares 3. Discount to Market/Peers

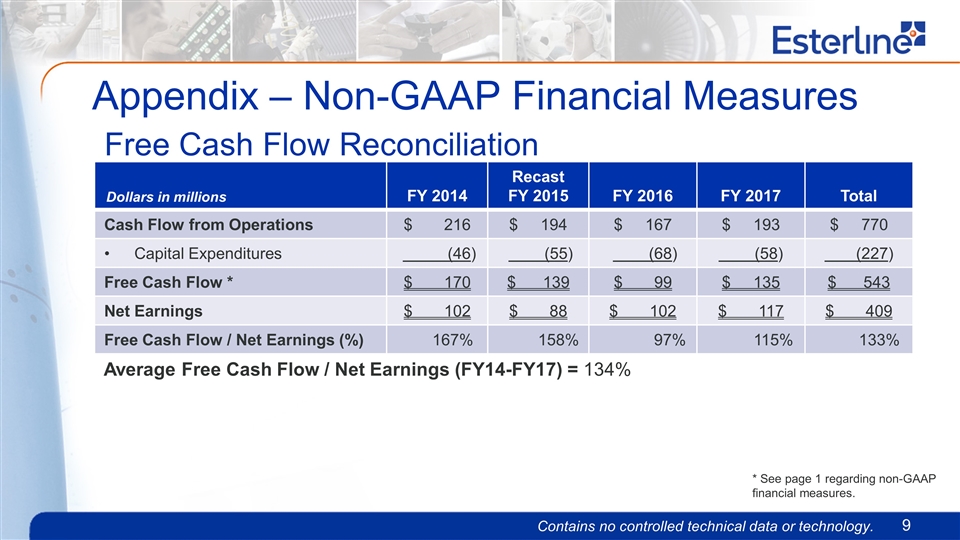

Appendix – Non-GAAP Financial Measures 9 Free Cash Flow Reconciliation FY 2014 Recast FY 2015 FY 2016 FY 2017 Total Cash Flow from Operations $ 216 $ 194 $ 167 $ 193 $ 770 Capital Expenditures (46) (55) (68) (58) (227) Free Cash Flow * $ 170 $ 139 $ 99 $ 135 $ 543 Net Earnings $ 102 $ 88 $ 102 $ 117 $ 409 Free Cash Flow / Net Earnings (%) 167% 158% 97% 115% 133% Dollars in millions Average Free Cash Flow / Net Earnings (FY14-FY17) = 134% * See page 1 regarding non-GAAP financial measures.