Q3 2018 Supplemental Financial Information August 2, 2018 Exhibit 99.2

This presentation may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “should” or “will,” or the negative of such terms, or other comparable terminology. These forward-looking statements are only predictions based on the current intent and expectations of the management of Esterline, are not guarantees of future performance or actions, and involve risks and uncertainties that are difficult to predict and may cause Esterline’s or its industry’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Esterline's actual results and the timing and outcome of events may differ materially from those expressed in or implied by the forward-looking statements due to risks detailed in Esterline's public filings with the Securities and Exchange Commission including its most recent Annual Report on Form 10-K/A. This presentation contains references to non-GAAP financial information subject to Regulation G. The reconciliations of each non-GAAP financial measure to its comparable GAAP measure as well as further information on management’s use of non-GAAP financial measures are detailed wherever non-GAAP financial measures are discussed in this presentation, included as Exhibit 99.2 to Form 8-K filed with the SEC on August 2, 2018, in the Appendix of this presentation, and in our earnings press release, included as Exhibit 99.1 to Form 8-K filed with the SEC on August 2, 2018.

Strategic Direction A high-performing aerospace and defense company whose engaged employees deliver value through world-class products, services, and technologies. Profitable & Balanced Sales Growth Enterprise Excellence Leverage the Enterprise Employee Engagement Regulatory & Customer Compliance Enhance operations, drive revenue growth, generate cash

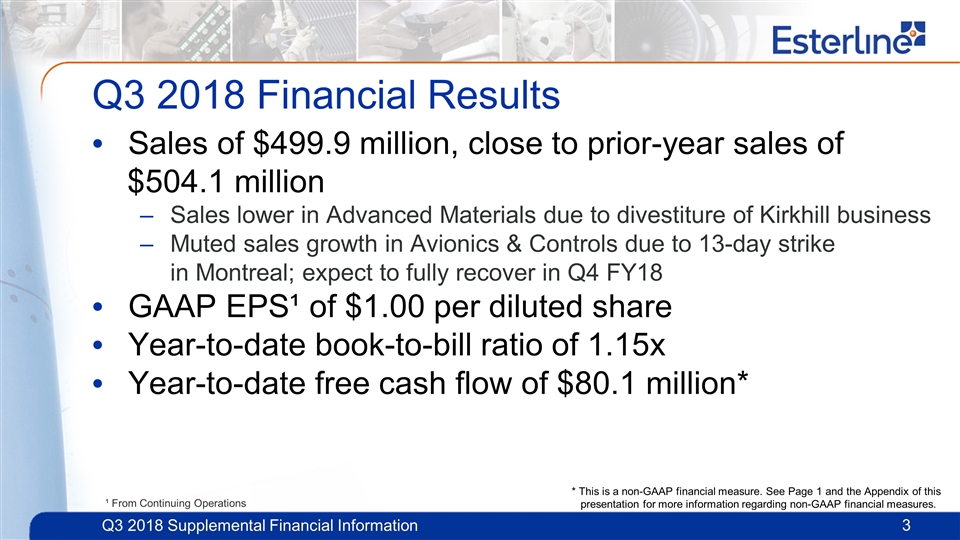

Q3 2018 Financial Results Sales of $499.9 million, close to prior-year sales of $504.1 million Sales lower in Advanced Materials due to divestiture of Kirkhill business Muted sales growth in Avionics & Controls due to 13-day strike in Montreal; expect to fully recover in Q4 FY18 GAAP EPS¹ of $1.00 per diluted share Year-to-date book-to-bill ratio of 1.15x Year-to-date free cash flow of $80.1 million* * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures. ¹ From Continuing Operations

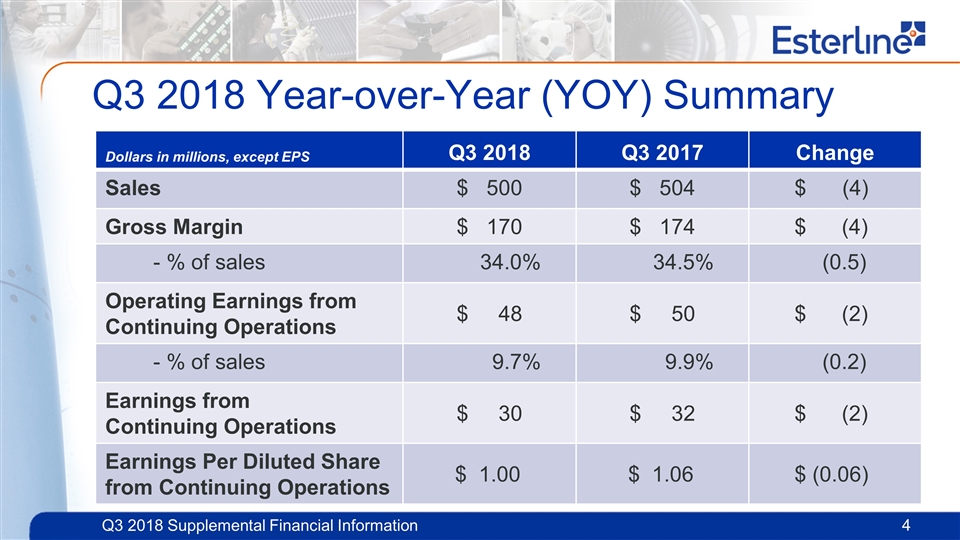

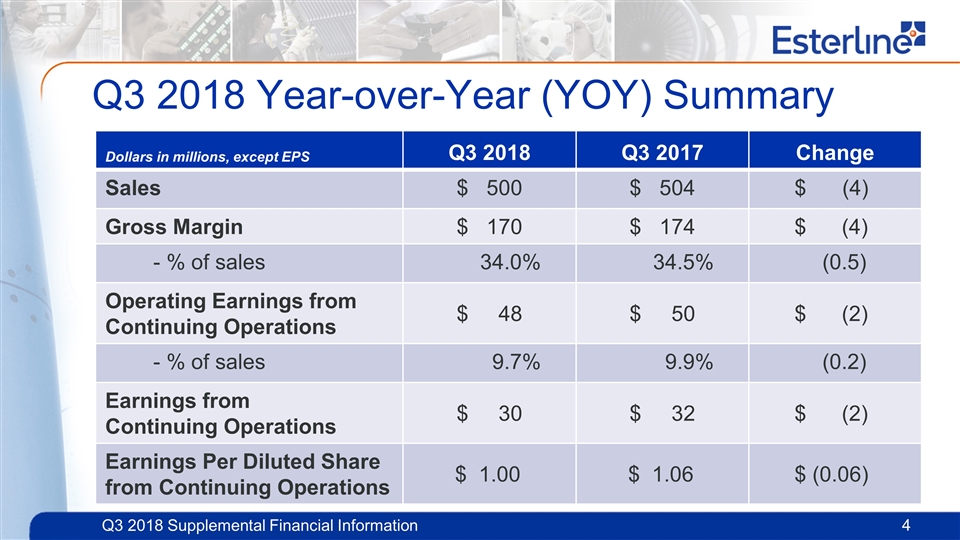

Q3 2018 Year-over-Year (YOY) Summary Dollars in millions, except EPS Q3 2018 Q3 2017 Change Sales $ 500 $ 504 $ (4) Gross Margin $ 170 $ 174 $(4) - % of sales 34.0% 34.5% (0.5) Operating Earnings from Continuing Operations $ 48 $ 50 $ (2) - % of sales 9.7% 9.9% (0.2) Earnings from Continuing Operations $ 30 $ 32 $ (2) Earnings Per Diluted Share from Continuing Operations $1.00 $ 1.06 $ (0.06)

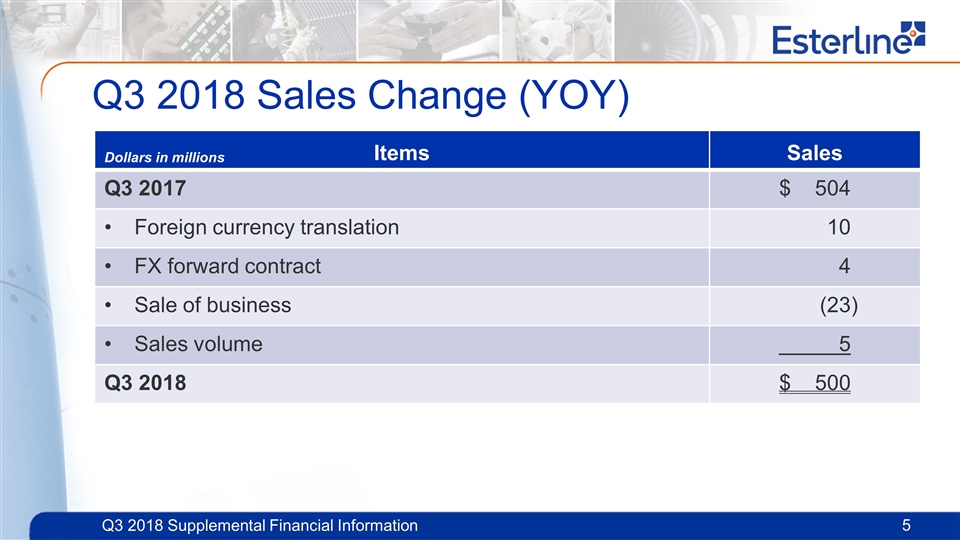

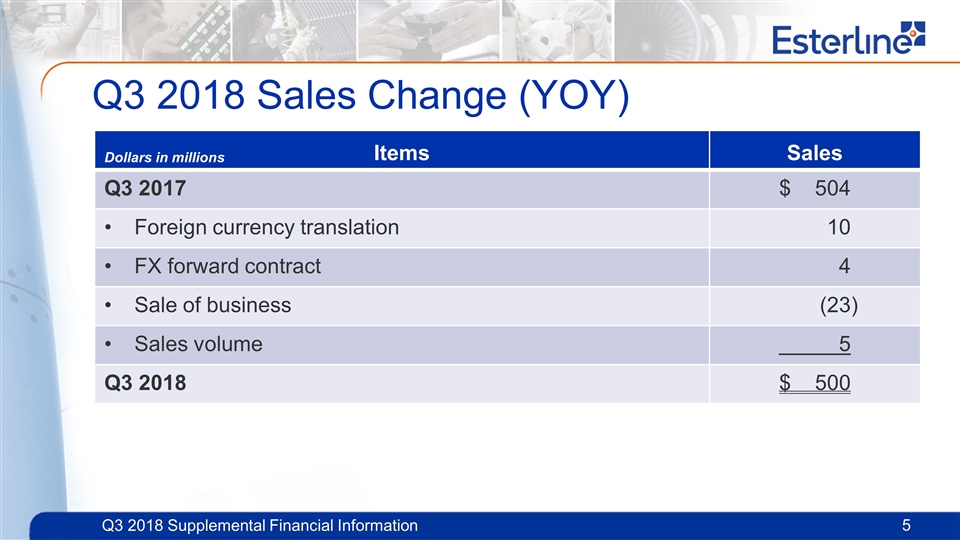

Q3 2018 Sales Change (YOY) Items Sales Q3 2017 $ 504 Foreign currency translation 10 FX forward contract 4 Sale of business (23) Sales volume 5 Q3 2018 $ 500 Dollars in millions

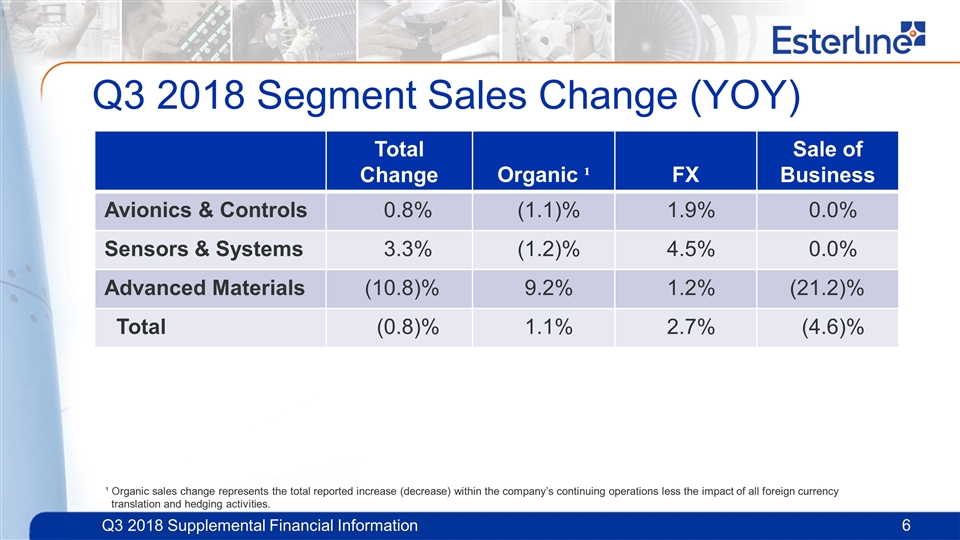

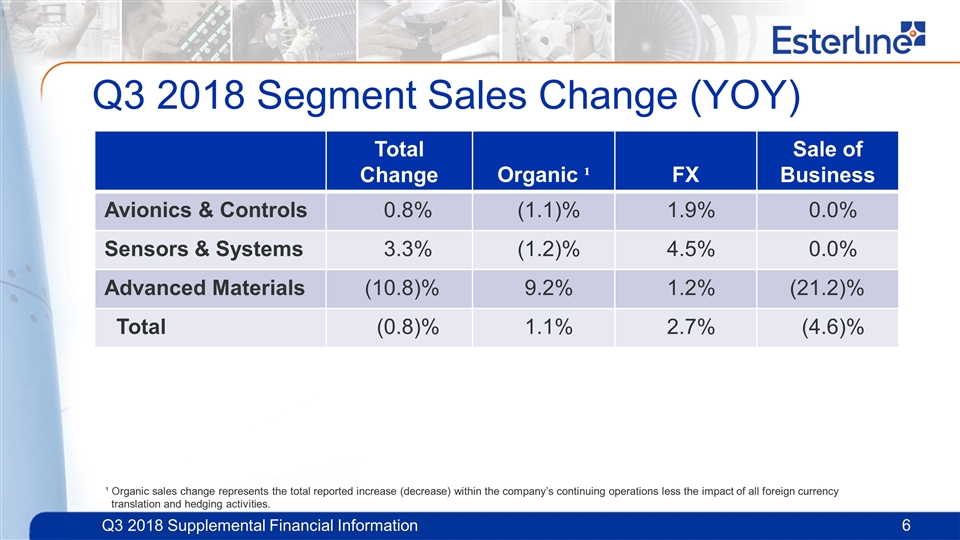

Q3 2018 Segment Sales Change (YOY) Total Change Organic ¹ FX Sale of Business Avionics & Controls 0.8% (1.1)% 1.9% 0.0% Sensors & Systems 3.3% (1.2)% 4.5% 0.0% Advanced Materials (10.8)% 9.2% 1.2% (21.2)% Total (0.8)% 1.1% 2.7% (4.6)% ¹ Organic sales change represents the total reported increase (decrease) within the company’s continuing operations less the impact of all foreign currency translation and hedging activities.

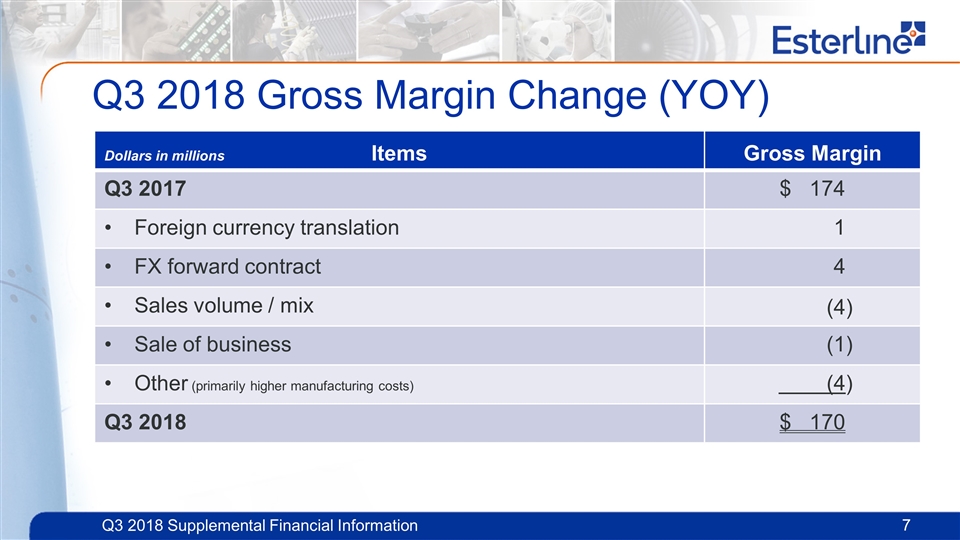

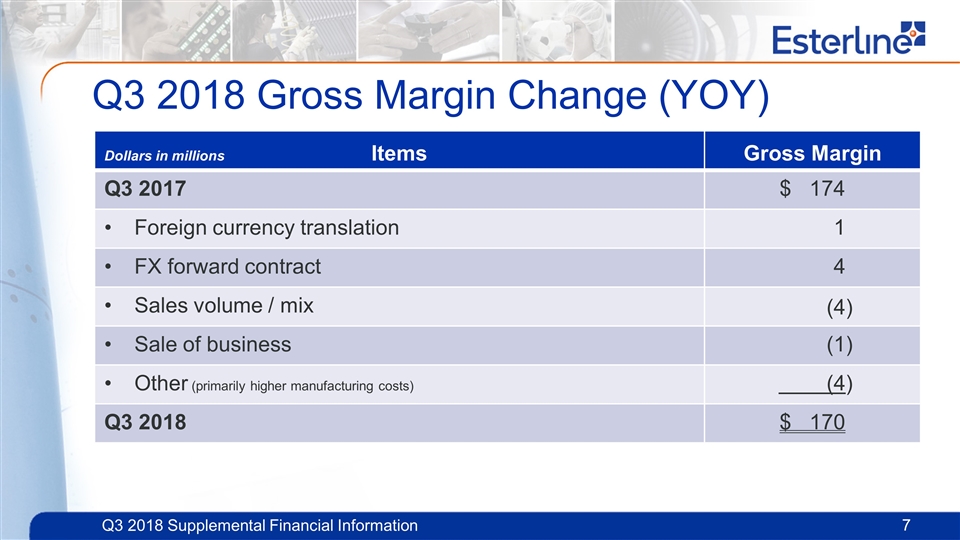

Q3 2018 Gross Margin Change (YOY) Items Gross Margin Q3 2017 $ 174 Foreign currency translation 1 FX forward contract 4 Sales volume / mix (4) Sale of business (1) Other (primarily higher manufacturing costs) (4) Q3 2018 $ 170 Dollars in millions

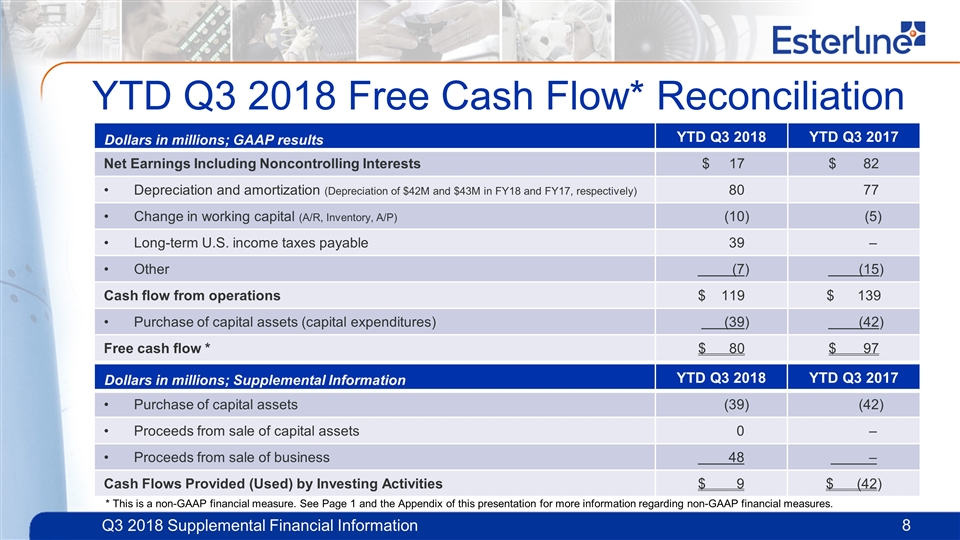

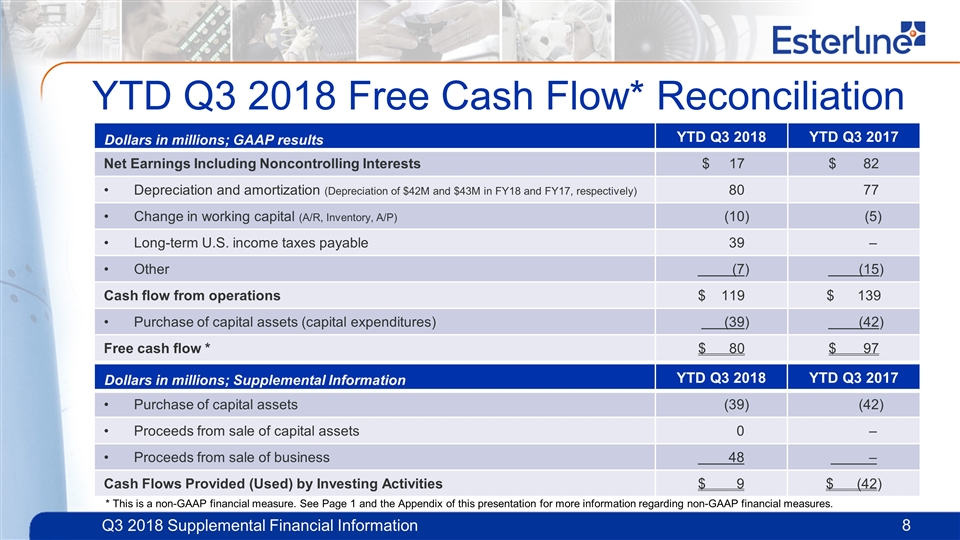

YTD Q3 2018 Free Cash Flow* Reconciliation YTD Q3 2018 YTD Q3 2017 Net Earnings Including Noncontrolling Interests $ 17 $ 82 Depreciation and amortization (Depreciation of $42M and $43M in FY18 and FY17, respectively) 80 77 Change in working capital (A/R, Inventory, A/P) (10) (5) Long-term U.S. income taxes payable 39 ‒ Other (7) (15) Cash flow from operations $ 119 $ 139 Purchase of capital assets (capital expenditures) (39) (42) Free cash flow * $ 80 $ 97 Dollars in millions; GAAP results * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures. YTD Q3 2018 YTD Q3 2017 Purchase of capital assets (39) (42) Proceeds from sale of capital assets 0 ‒ Proceeds from sale of business 48 ‒ Cash Flows Provided (Used) by Investing Activities $ 9 $ (42) Dollars in millions; Supplemental Information

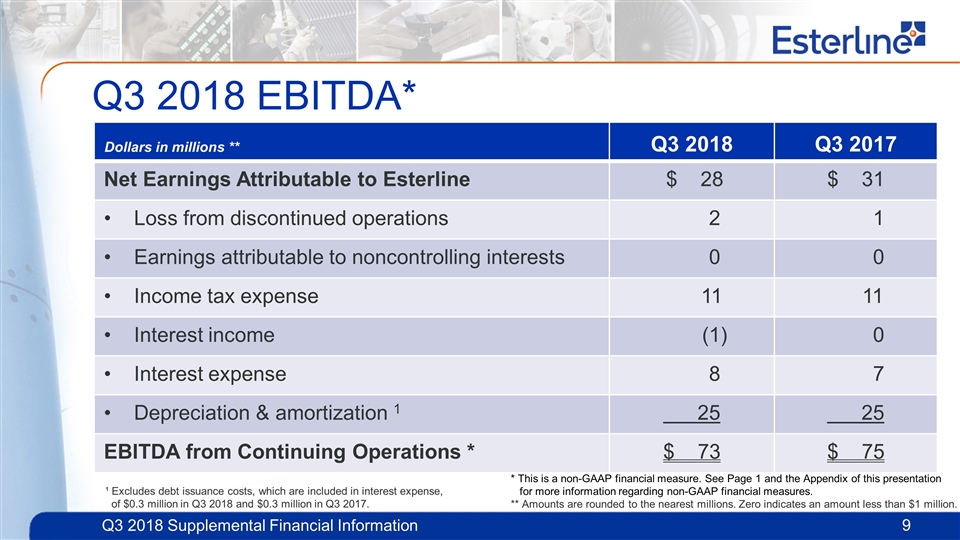

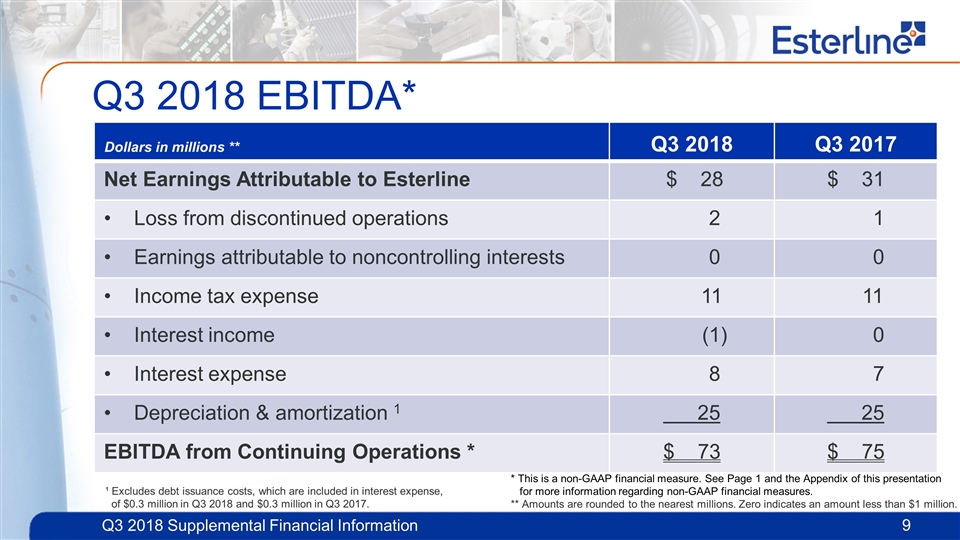

Q3 2018 EBITDA* Q3 2018 Q3 2017 Net Earnings Attributable to Esterline $ 28 $ 31 Loss from discontinued operations 2 1 Earnings attributable to noncontrolling interests 0 0 Income tax expense 11 11 Interest income (1) 0 Interest expense 8 7 Depreciation & amortization 1 25 25 EBITDA from Continuing Operations * $ 73 $ 75 Dollars in millions ** ¹ Excludes debt issuance costs, which are included in interest expense, of $0.3 million in Q3 2018 and $0.3 million in Q3 2017. * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures. ** Amounts are rounded to the nearest millions. Zero indicates an amount less than $1 million.

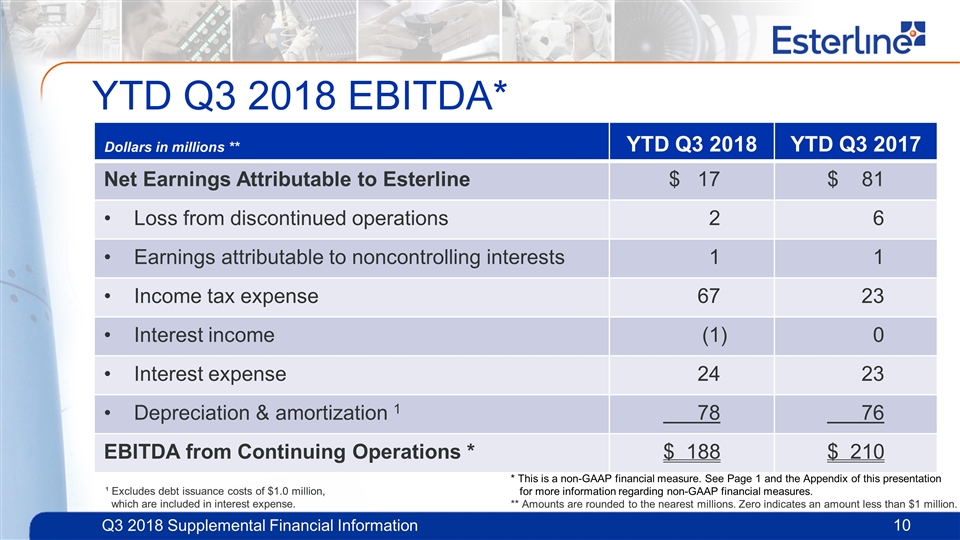

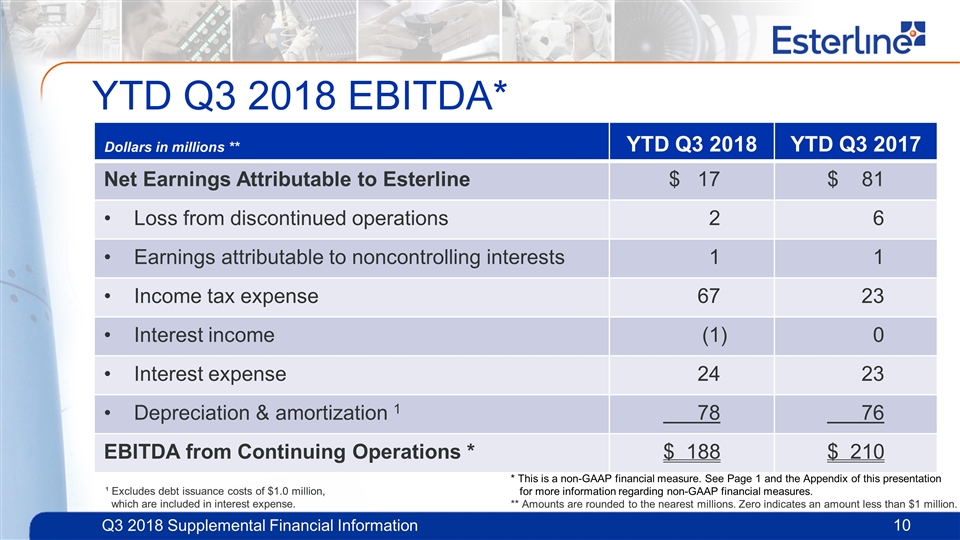

YTD Q3 2018 EBITDA* YTD Q3 2018 YTD Q3 2017 Net Earnings Attributable to Esterline $ 17 $ 81 Loss from discontinued operations 2 6 Earnings attributable to noncontrolling interests 1 1 Income tax expense 67 23 Interest income (1) 0 Interest expense 24 23 Depreciation & amortization 1 78 76 EBITDA from Continuing Operations * $ 188 $ 210 Dollars in millions ** ¹ Excludes debt issuance costs of $1.0 million, which are included in interest expense. * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures. ** Amounts are rounded to the nearest millions. Zero indicates an amount less than $1 million.

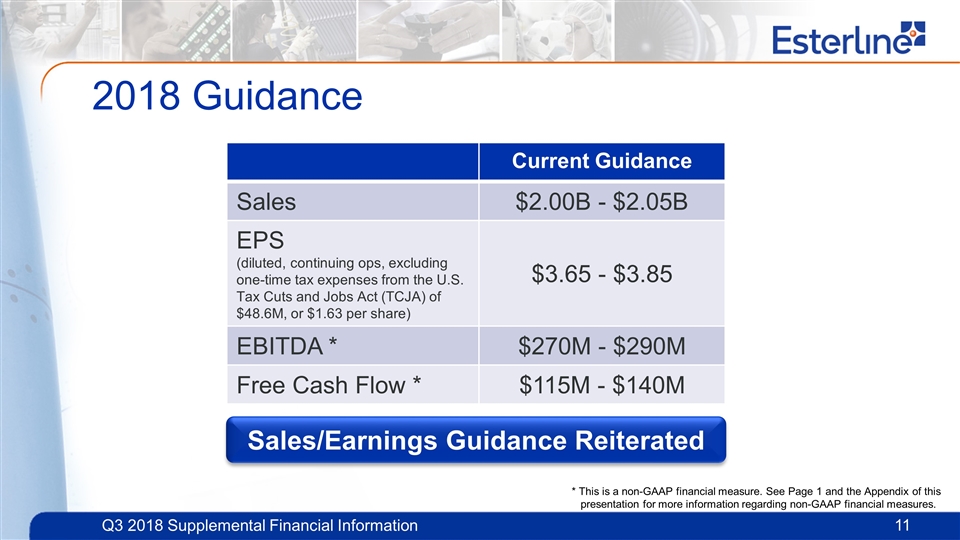

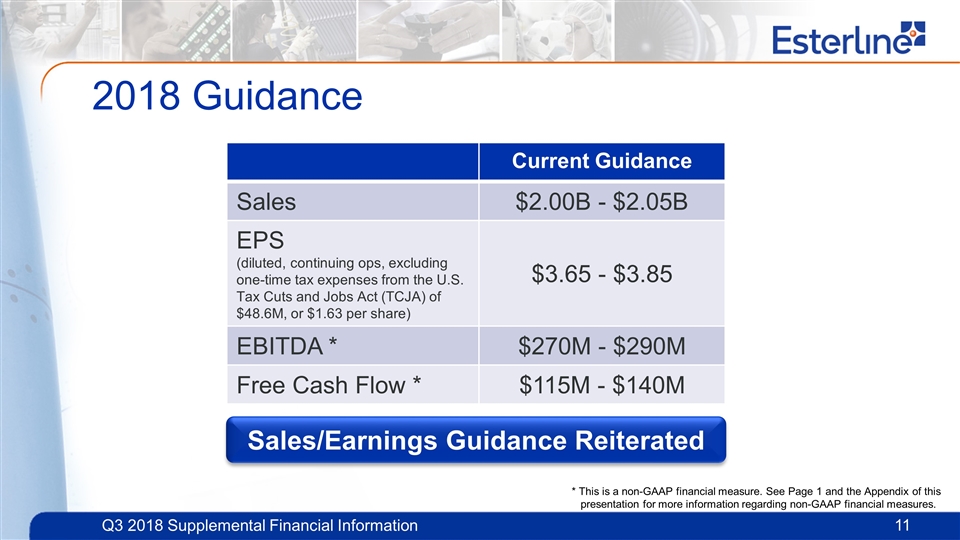

2018 Guidance Sales/Earnings Guidance Reiterated Current Guidance Sales $2.00B - $2.05B EPS (diluted, continuing ops, excluding one-time tax expenses from the U.S. Tax Cuts and Jobs Act (TCJA) of $48.6M, or $1.63 per share) $3.65 - $3.85 EBITDA * $270M - $290M Free Cash Flow * $115M - $140M * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures.

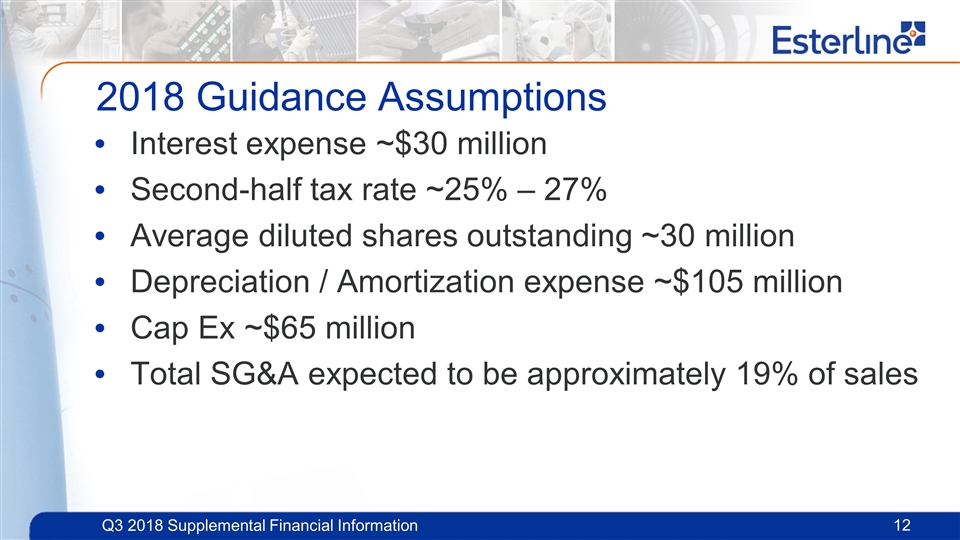

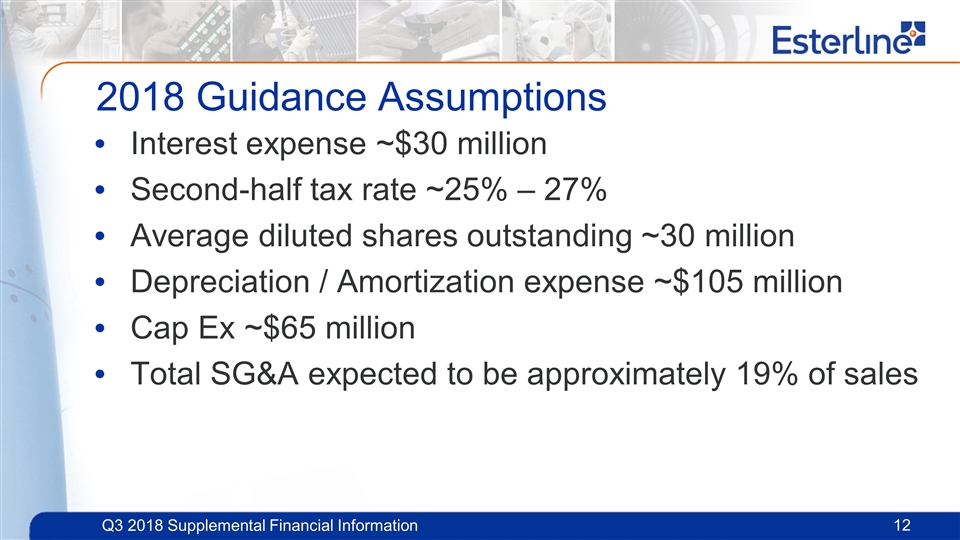

2018 Guidance Assumptions Interest expense ~$30 million Second-half tax rate ~25% – 27% Average diluted shares outstanding ~30 million Depreciation / Amortization expense ~$105 million Cap Ex ~$65 million Total SG&A expected to be approximately 19% of sales

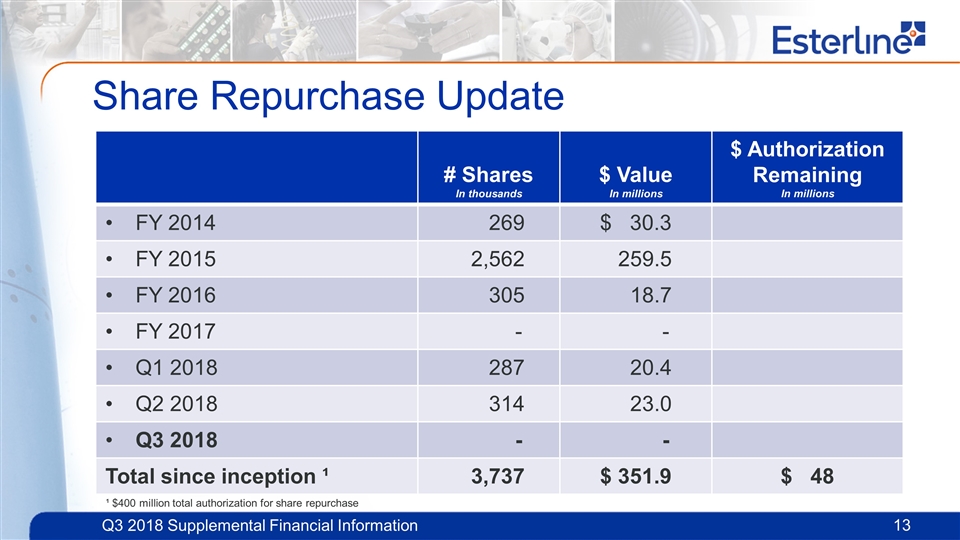

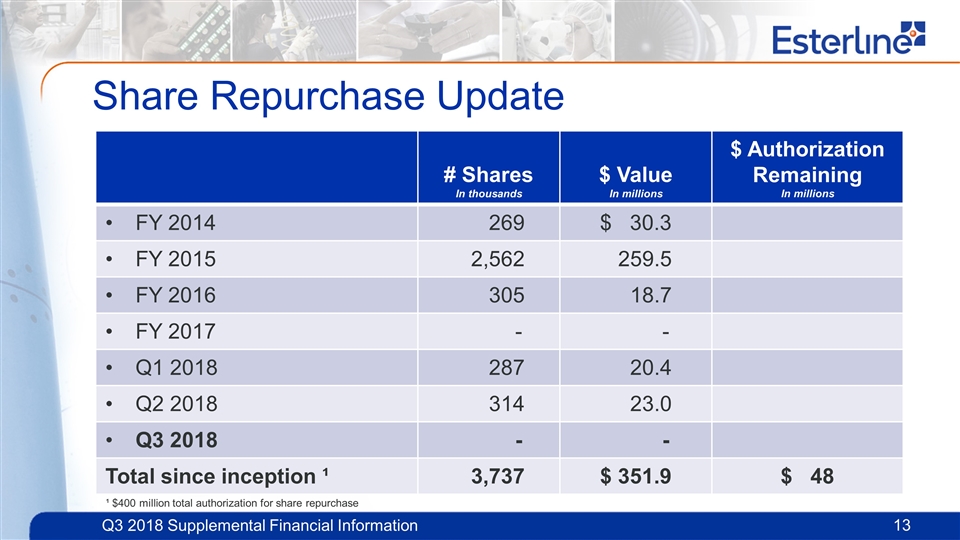

Share Repurchase Update # Shares In thousands $ Value In millions $ Authorization Remaining In millions FY 2014 269 $ 30.3 FY 2015 2,562 259.5 FY 2016 305 18.7 FY 2017 - - Q1 2018 287 20.4 Q2 2018 314 23.0 Q3 2018 - - Total since inception ¹ 3,737 $ 351.9 $ 48 ¹ $400 million total authorization for share repurchase

Appendix

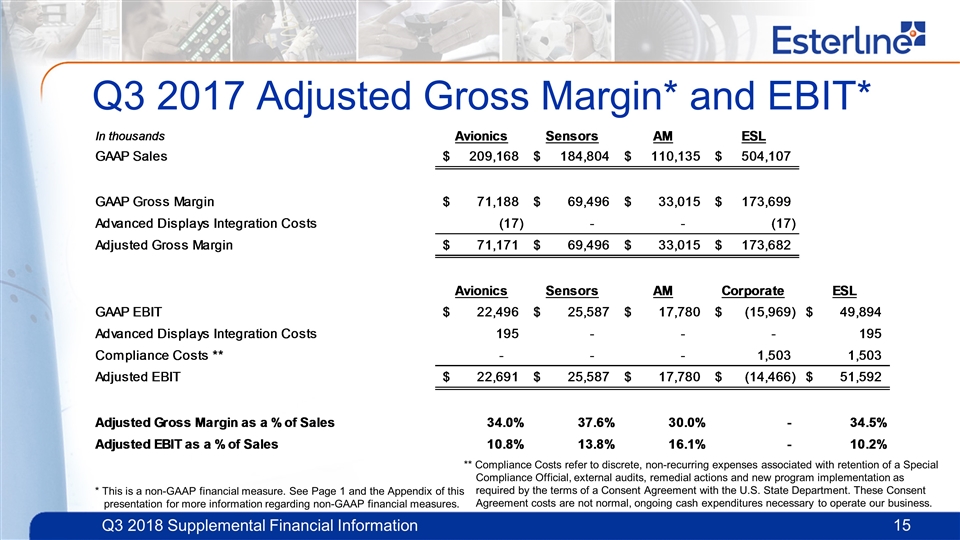

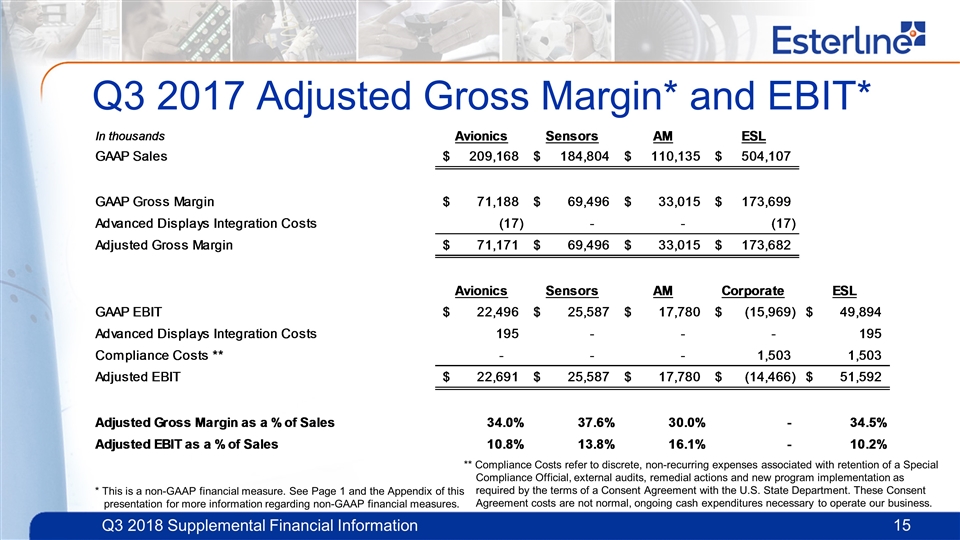

Q3 2017 Adjusted Gross Margin* and EBIT* * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures. ** Compliance Costs refer to discrete, non-recurring expenses associated with retention of a Special Compliance Official, external audits, remedial actions and new program implementation as required by the terms of a Consent Agreement with the U.S. State Department. These Consent Agreement costs are not normal, ongoing cash expenditures necessary to operate our business.

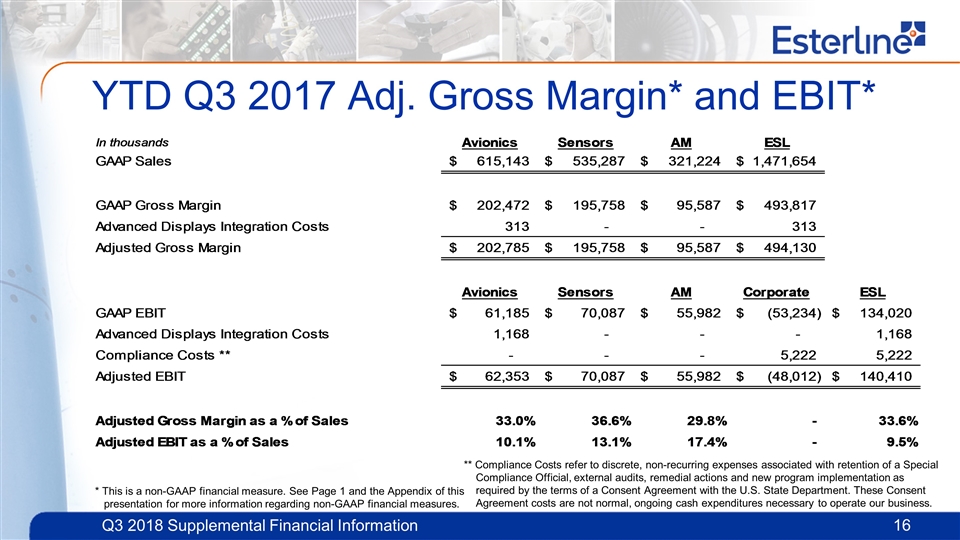

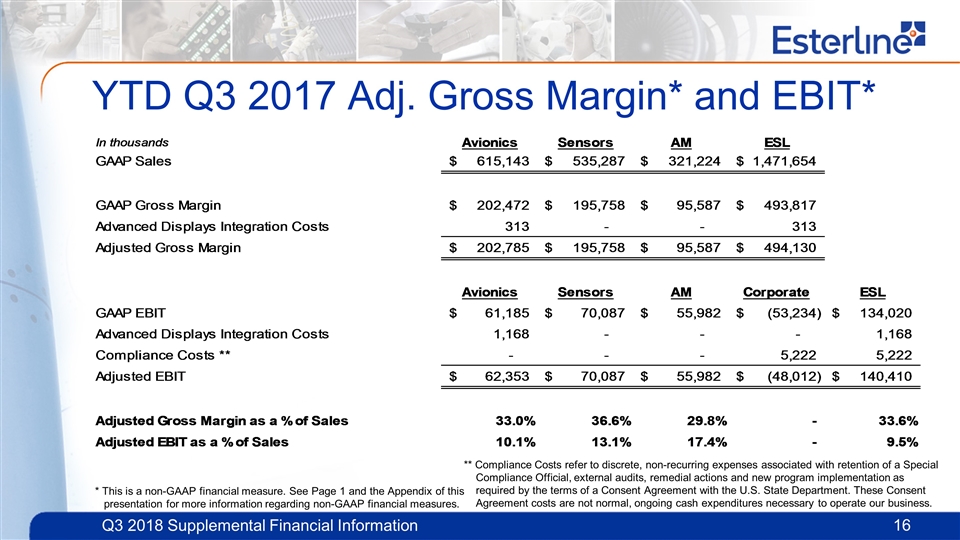

YTD Q3 2017 Adj. Gross Margin* and EBIT* ** Compliance Costs refer to discrete, non-recurring expenses associated with retention of a Special Compliance Official, external audits, remedial actions and new program implementation as required by the terms of a Consent Agreement with the U.S. State Department. These Consent Agreement costs are not normal, ongoing cash expenditures necessary to operate our business. * This is a non-GAAP financial measure. See Page 1 and the Appendix of this presentation for more information regarding non-GAAP financial measures.

This presentation contains references to non-GAAP financial information subject to Regulation G. The reconciliations of each non-GAAP financial measure to its comparable GAAP measure as well as further information on management’s use of non-GAAP financial measures are detailed wherever non-GAAP financial measures are discussed in this presentation, included as Exhibit 99.2 to Form 8-K filed with the SEC on August 2, 2018, in the Appendix of this presentation, and in our earnings press release, included as Exhibit 99.1 to Form 8-K filed with the SEC on August 2, 2018. The company provides these non-GAAP financial measures as supplemental information to the GAAP financial measures. Management uses these non-GAAP financial measures to (a) evaluate the company’s historical and prospective financial performance and its performance relative to its competitors, (b) allocate resources, and (c) measure the operational performance of the company’s business units. In addition, management believes including these non-GAAP financial measures enhances investors’ and financial analysts’ understanding of the company’s performance as well as their ability to assess and compare the company’s historical results of operations. These non-GAAP financial measures are not meant to be considered in isolation or as a substitute for the comparable GAAP measures, and free cash flow is not necessarily indicative of amounts available for discretionary use. There are limitations to these non-GAAP financial measures because they are not prepared in accordance with GAAP and may not be comparable to similarly titled measures of other companies due to potential differences in methods of calculation and items that comprise the calculation. The company compensates for these limitations by using these non-GAAP financial measures as a supplement to the GAAP measures and by providing reconciliations of the non-GAAP and comparable GAAP financial measures. The non-GAAP financial measures should be read only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP.

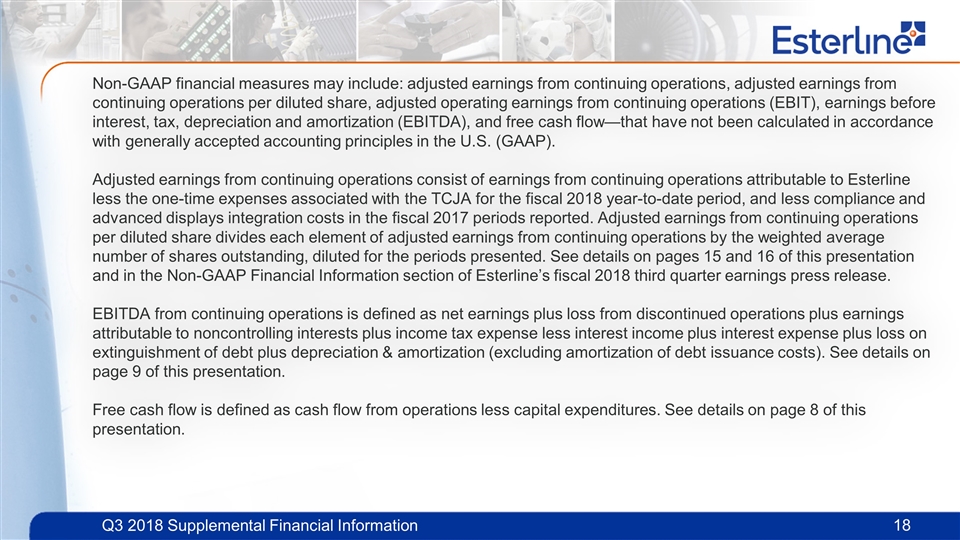

Non-GAAP financial measures may include: adjusted earnings from continuing operations, adjusted earnings from continuing operations per diluted share, adjusted operating earnings from continuing operations (EBIT), earnings before interest, tax, depreciation and amortization (EBITDA), and free cash flow—that have not been calculated in accordance with generally accepted accounting principles in the U.S. (GAAP). Adjusted earnings from continuing operations consist of earnings from continuing operations attributable to Esterline less the one-time expenses associated with the TCJA for the fiscal 2018 year-to-date period, and less compliance and advanced displays integration costs in the fiscal 2017 periods reported. Adjusted earnings from continuing operations per diluted share divides each element of adjusted earnings from continuing operations by the weighted average number of shares outstanding, diluted for the periods presented. See details on pages 15 and 16 of this presentation and in the Non-GAAP Financial Information section of Esterline’s fiscal 2018 third quarter earnings press release. EBITDA from continuing operations is defined as net earnings plus loss from discontinued operations plus earnings attributable to noncontrolling interests plus income tax expense less interest income plus interest expense plus loss on extinguishment of debt plus depreciation & amortization (excluding amortization of debt issuance costs). See details on page 9 of this presentation. Free cash flow is defined as cash flow from operations less capital expenditures. See details on page 8 of this presentation.