Exhibit 10.2

Esterline Technologies Corporation

LONG-TERM INCENTIVE PERFORMANCE SHARE PLAN

(Esterline Executive & Corporate Officers Only)

1. | Purpose. Esterline Technologies Corporation (“Esterline” or the “Company”) has established this Long-Term Incentive Performance Share Plan (“PSP” “PSP Plan”, or “the Plan”) to reward its officers and selected senior managers for effective leadership that achieves expected and superior results for shareholders over the long term. |

2. | PSP Terms. The Company established this PSP pursuant to its 2013 Equity Incentive Plan (as may be amended and/or restated from time to time) (“2013 Plan”). The terms of the PSP Appointment, the Award Table, this PSP Plan, and the 2013 Plan together constitute the “PSP Terms.” Notwithstanding any other provision of the Plan to the contrary, the Plan shall be administered and its provisions interpreted so that payments made to Participants who are “covered employees” qualify as “performance-based compensation,” in each case, within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (“Code”). |

| a. | Selection. The Company’s officers and other senior managers employed by the Company’s corporate office or by a Company subsidiary are eligible to participate in this PSP. Appointments require recommendation by an executive officer and approval by Esterline’s Board of Directors Compensation Committee (hereafter “Board” and “Committee”). In addition, Board approval is also required for appointments of the Chief Executive Officer (“CEO”) and of all other executive officers. The CEO, acting independently, also has authority to make PSP appointments, provided such appointments comply with the Company’s Equity Grant Guidelines, and do not appoint employees who report directly to the CEO. Employees who are appointed to the PSP are hereafter referred to as “Participant(s).” |

| b. | Appointment. Each Participant will receive a written appointment in the form attached (“PSP Appointment”). Participants are usually appointed to the PSP in the first fiscal quarter of a performance period. Nevertheless, Participants may be appointed at any time. Participants appointed after the first fiscal quarter will receive a pro-rata award for the portion of the performance period following their appointment, calculated as provided in Section 7 below. Appointment as a Participant in one or more PSP performance periods does not entitle employees to appointment in subsequent periods. |

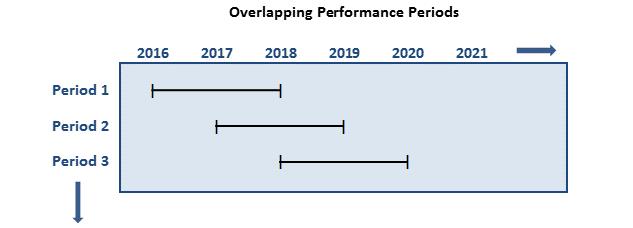

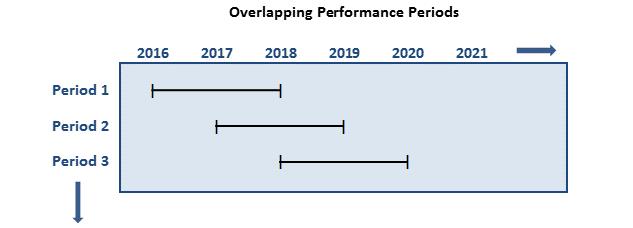

4. | Performance Periods. PSP performance periods will be three years in duration, beginning on the first day of a Company fiscal year and ending on the last day of the third consecutive fiscal year thereafter. A new three-year performance period will start with each new fiscal year, such that there will be three overlapping PSP performance periods open at any given time, as illustrated below. The Committee may establish shorter performance periods as it determines are reasonable. |

Performance Share Plan

Fiscal Years 2018 - 2020

November 2017

5.Performance Goals. The PSP has two performance goals: (a) average return on invested capital (“ROIC”); and (b) earnings per share (“EPS”) (together referred to as “PSP Goals”). At the beginning of each performance period, the Board will: (c) establish minimum threshold, target, and maximum PSP Goals; (d) determine their respective weighting; and (e) correlate performance achievement levels to potential award levels for Participants. Such decisions will be recorded and communicated to Participants in an Award Table, in the form attached.

| Notwithstanding anything to the contrary contained herein, for Participants who are “covered employees” within the meaning of Section 162(m) of the Code, payment of awards under the Plan is expressly conditioned on achievement by the Company of a specified level of net earnings from continuing operations attributable to Esterline, as reported in the Company’s consolidated financial statements, as determined by the Committee within the first ninety (90) days of the applicable performance period (“Umbrella Goal”), in which case the maximum number of shares of Company Stock available for issuance under a PSP award to each such Participant will be as determined by the Committee. |

6. | Plan Awards. The Board, Committee, or CEO will establish a target award for each Participant in the form of Performance Share Units (“Target Award”), the value of which will be based on a percentage of the Participant’s base pay at the time of appointment. The value of Participants’ actual awards will vary from their Target Award if the Company performs above or below target PSP Goals. Participants will receive no award for performance less than established minimum threshold performance as shown on the Award Table. Actual awards for superior performance are subject to a maximum of 300% of a Participant’s Target Award. |

7. | Calculations. The Company will use the following formulas to determine Company performance on PSP Goals, and to calculate actual awards: |

| |

Average Return on Invested Capital (ROIC) = | Net Income (before non-recurring and/or unusual items) + Tax-Adjusted Interest Expense Short-term Debt + Long Term Debt – Cash + Shareholders’ Equity averaged over the applicable performance period, and expressed as a percentage. The Company will use a long-term planning “most likely” tax rate of 25% in such ROIC calculations. |

Earnings Per Share (EPS) = | Fully-diluted earnings per share (net income before non-recurring and/or unusual items, divided by the monthly average of total common shares and share equivalents outstanding) (“EPS”), measured as the EPS achieved in the final fiscal year of the performance period. |

Pro-Rata Awards: | Pro-rata award calculations will be based on results for the full performance period, pro-rated for the time during which an employee participated in the PSP Plan. Participation will be measured in full-month increments, rounded up for months in which a Participant was actively employed under the Plan for 15 days or more, and rounded down for active employment under the Plan of 14 days or less. The pro-rata factor will be a fraction, the numerator of which will be the number of months of participation, and the denominator of which will be 36. |

8. | Adjustments. The Board may exercise its discretion to ensure Participants receive an equitable award, by adjusting: (a) PSP Goals; (b) Plan calculations to include or exclude non-recurring and/or unusual items (including, without limitation, material effects of changes under U.S. Generally Applicable Accounting Principles or changes in applicable tax laws or regulations), in whole or in part; or (c) the factors used to calculate Plan awards. Such adjustments may be made if unanticipated events occur, or unusual business conditions develop after the beginning of a performance period that materially alter earnings or returns. Notwithstanding the foregoing, the Board may not adjust the Umbrella Goal in such |

Performance Share Plan

Fiscal Years 2018 – 2020

Page 2

November 2017

| a manner that would increase the amount of compensation otherwise payable to a “covered employee” within the meaning of Section 162(m) of the Code. The Committee will seek and consider advice from an independent executive compensation expert and from the Company’s General Counsel before deciding whether to recommend an adjustment under this Section for Board action. |

9. | Settlement of Awards. Each Performance Share Unit earned will be settled in one share of fully-vested Company Stock, except as cash settlements are provided in Sections 11 and 15 below. Subject to other PSP Terms, the Company will settle PSP awards in January of the calendar year immediately following the conclusion of the performance period, if and only if: Company auditors have issued an opinion consistent with the calculations; and the Committee and Board have approved the awards. If these conditions delay settlement of awards beyond January, such awards must be settled on the earlier of (i) the date that is 30 days following the satisfaction of these conditions or (ii) December 31 of the calendar year immediately following the conclusion of the performance period. |

10. | Continuous Employment. To be eligible for payment, Participants must be actively employed by the Company through the end of the performance period and through the date on which the Company settles PSP awards, except as might otherwise be provided in PSP Terms. Subject to other PSP Terms, appointments will end automatically for Participants who do not satisfy these conditions and no PSP awards will be earned or due. The Company considers approved leaves of absence to be active employment, provided they do not exceed the amount of leave to which a Participant might be entitled under applicable Company policies, and under disability, family and medical leave laws. For approved leaves that exceed such limits, payment of PSP awards, if any, is subject to Committee discretion. |

11. | Employment Status Changes. Except as otherwise determined by the Board, Committee, or CEO (as appropriate), the following provisions will apply to employment status changes: |

| a. | Transfers. If during a performance period a Participant transfers within the Company to a position that is not eligible for PSP participation, his/her Plan award will be pro-rated for the time in which s/he was a Participant, as provided in Section 7 above. |

| b. | Suspension, Resignation, or Discharge. A Participant’s appointment will automatically end when s/he leaves employment with the Company for any reason, except as otherwise provided in PSP Terms. All Participant rights under this Plan will be suspended during any period of suspension from employment. The Board may immediately cancel a Participant’s appointment and recover any awards made if it discovers facts that, if known earlier, would have constituted grounds for termination of employment for cause. |

| c. | Retirement, Disability, or Death. If a Participant leaves employment with the Company due to Retirement, Disability, or death, the Company will settle the Participant’s award for the full performance period in the normal course based on actual achievement of PSP Goals, provided the Participant completed at least one year of continuous, active employment during the performance period. If a Participant does not complete this minimum employment period, his/her appointment will automatically end, and no PSP award will be earned or due. For purposes of the PSP, “Retirement” means a voluntary termination of employment with the Company when a Participant is either (i) age 65 or older or (ii) age 60 or older plus has provided at least 10 years of service to the Company, in either case, where such termination of employment is a bona fide end to the Participant’s career in the industries and markets within which the Company does business. |

| d. | Subsidiary Divestiture. In the event a Participant is terminated from employment due to a sale, transfer, assignment, or other form of transaction by which Esterline conveys a controlling interest in the shares or in substantially all the assets of a subsidiary that employs the Participant, the Company will settle PSP awards in cash, within 60 days following completion of the transaction, and on a pro rata basis, calculated as follows: |

Cash settlement value = (# of Performance Share Units at Target) (closing price of Company Stock on the day the transaction is complete)(a pro rata factor, as defined in Section 7 above).

Performance Share Plan

Fiscal Years 2018 – 2020

Page 3

November 2017

12. | Employment Terms. Participants’ terms of employment remain unchanged by appointment to this PSP, except as specifically provided in the PSP Terms. Nothing in the appointment process or in the PSP Terms guarantees continued employment. Participants remain subject to usual, applicable Company and business unit policies and practices, and to any other employment agreements, service terms, appointments, or mandates to which they are otherwise subject. |

13. | No Rights as Stockholder. Participants will not have voting or other rights as a stockholder of the Company with respect to a PSP award until the award is settled and the Participant receives shares of Company Stock. |

14. | Plan Administration & Interpretation. The Committee administers this Plan. As such, it shall consider and decide any issues arising under the Plan, and shall oversee and approve actual award calculations and settlement. The Committee’s decisions concerning PSP administration and interpretation are final and binding, except as they might relate to the CEO and other executive officers, in which case the Board has final decision-making authority. Definitions in the 2013 Plan apply to terms used in this PSP unless otherwise defined here. All references to the “Company” include a “Related Company,” as that term is defined in the 2013 Plan. |

15. | Plan Modification and Termination. The Board may modify or terminate this PSP at any time in its sole discretion. |

16. | Section 409A. The Company intends that this PSP and the payments provided hereunder comply with the requirements of Section 409A of the Code and the Treasury Regulations thereunder. Notwithstanding any provision in this PSP, the 2013 Plan or any other agreement to the contrary: (a) this PSP shall be interpreted, operated, and administered in a manner consistent with such intentions; and (b) in the event that the settlement of any PSP award is subject to acceleration upon a change in control or similar event with respect to the Company or any subsidiary, as the case may be, such acceleration shall only occur to the extent that such change in control or similar event constitutes a change in control event with respect to the Company or such subsidiary within the meaning of Section 409A of the Code and the Treasury Regulations thereunder. |

17. | Reimbursement. PSP participation and awards are subject to the Board’s Policy on Reimbursement of Incentive Awards, as it might change from time to time. |

Approved by the Committee & Board, and issued on their behalf,

/s/ Curtis C, Reusser

Curtis C. Reusser

Chairman, President & CEO

November 7, 2017

| |

Attachment: | PSP Appointment |

Performance Share Plan

Fiscal Years 2018 – 2020

Page 4

November 2017