April 24, 2018

VIA ELECTRONIC MAIL AND EDGAR

| Re: | European Investment Bank |

| | Registration Statement under Schedule B |

| | Filed March 21, 2018 |

| | File No. 333-223825 |

| | |

| | Form 18-K for Fiscal Year Ended December 31, 2016, as amended Filed April 27, 2017, as amended May 24, 2017, June 12, 2017, August 3, 2017, October 18, 2017, December 8, 2017, January 17, 2018, and February 13, 2018 |

| | File No. 001-05001 |

Dear Ms. Quarles,

On behalf of the European Investment Bank (the “EIB”), we set forth below the EIB’s responses to your comment letter, dated April 17, 2018, relating to the registration statement of the EIB under Schedule B (File No. 333-223825) (the “Registration Statement”) filed with the Securities and Exchange Commission (the “Commission”) on March 21, 2018.

The numbered paragraphs below set forth the comments made by the Staff of the Commission (the “Staff”) together with the EIB’s responses. Unless otherwise indicated, capitalized terms used below have the meanings assigned to them in the Registration Statement.

Registration Statement under Schedule B

Administration, page 8

1. Please disclose the type of decisions that each of the board of governors and the board of directors may make, and describe the voting regime associated with each type of decision.

The EIB respectfully submits that the information contained in the first and second paragraphs of the section of the Registration Statement captioned “Administration” set out the principal types of decisions that each of the EIB’s board of governors and board of directors, respectively, may make. In addition, the EIB notes that the Registration Statement incorporates by reference the EIB’s Statute (provided as Exhibit A to the EIB’s Registration Statement No. 333-198097 filed on August 13, 2014), which includes additional detail on the types of decisions that each of the EIB’s board of governors and board of directors may make. The quorum and voting requirements applicable to each type of decision by the board of governors and the board of directors are also set forth in the first and second paragraphs of the section of the Registration Statement captioned “Administration” and, in more detail, in the EIB’s Statute. Accordingly, the EIB proposes that the Registration Statement contains all the material information regarding the respective boards and, consistent with its past filings, prefers not to include any further detail.

Form 18-K for Fiscal Year Ended December 31, 2016

Exhibit I

General

2. To the extent material, please update the disclosure to address the EIB’s policy of expanding activities in areas that are contributing to the migrant crisis.

The EIB respectfully confirms that it engages in activities in areas that are contributing to the migrant crisis. The EIB does not believe that these activities rise to a level of materiality to investors that would warrant additional disclosure at this time, but will continue to monitor these activities for any necessary disclosure in the future.

3. Please expand the discussion of the EIB’s risk governance to describe any significant efforts within the past three years to improve fraud detection in connection with lending activities.

The EIB respectfully refers to the discussion contained in the second paragraph titled “Fraud Investigation” under the caption “Inspectorate General” on page 17 of Exhibit I to the EIB’s Annual Report on Form 18-K for the Fiscal Year Ended December 31, 2016 (the “Annual Report 2016”). The EIB believes that the information in this paragraph and elsewhere in the Annual Report 2016 adequately presents its procedures to detect any fraud in its lending activities. Further information on the EIB’s fraud detection activities in 2016 can be found in the EIB’s Anti-Fraud Activity Report 2016, available at http://www.eib.org/infocentre/publications/all/fraud-investigations-activity-report-2016.htm. The EIB does not believe that further disclosure regarding its ordinary course fraud detection efforts would be material to investors, considering the general level of disclosure already adopted throughout the Annual Report 2016 and historically. However, the EIB will consider on an ongoing basis whether any additional information on particular fraud detection measures would be material to investors and, if it determines that such additional information would be material to investors, will provide additional disclosure accordingly in future filings with the Commission.

Complaints Mechanism, page 18

4. Please discuss the review process of the EIB’s complaints mechanism and address concerns that critics have raised that complaints may not be adequately considered.

The EIB respectfully acknowledges the Staff’s comment. The EIB is constantly seeking ways to improve its operations, including its complaints mechanism, and monitoring criticism for helpful impulses. If during these processes the EIB becomes aware of operational issues that it considers material, it will disclose such issues. Given the general level of disclosure adopted throughout the Annual Report 2016 and historically, the EIB believes that there are no material issues relating to the complaints mechanism that warrant disclosure to investors at this time.

Exhibit II

5. Please clarify that the amounts of outstanding indebtedness are not negative amounts.

The EIB respectfully confirms that the amounts of outstanding indebtedness stated in Exhibit II are liabilities. The figures are presented from an accounting perspective and in line with internal records, where a negative sign represents liabilities. The EIB also respectfully notes that this reporting convention is consistent with the EIB’s prior filings.

* * * *

The EIB hopes that the foregoing has been responsive to the Staff’s comments. Should you have any questions relating to any of the foregoing, please feel free to contact me at +44 20 7453 1020.

| | Sincerely, | |

| | | |

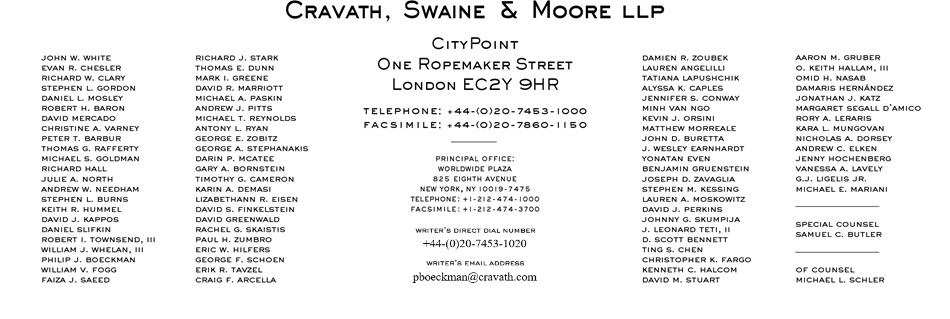

| | /s/ Philip J. Boeckman | |

| | | |

| | Philip J. Boeckman | |

| | | |

Ms. Ellie Quarles

Special Counsel

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Copy to:

Ms. Nicola Barr

Mr. Richard Schnopfhagen

Mr. Sandeep Dhawan

Ms. Alessia Proto

European Investment Bank

100, boulevard Konrad Adenauer

L-2950 Luxembourg

Grand Duchy of Luxembourg