Exhibit X

European Investment Bank The EU bank SEC report as at 30 June 2018 Financial Statements filed at the SEC Analytical report as at 30 June 2018 | 1

European Investment Bank Group Unaudited Condensed Semi-Annual Financial Statements as at June 30, 2018 - SEC Filing 2 | Analytical report as at 30 June 2018

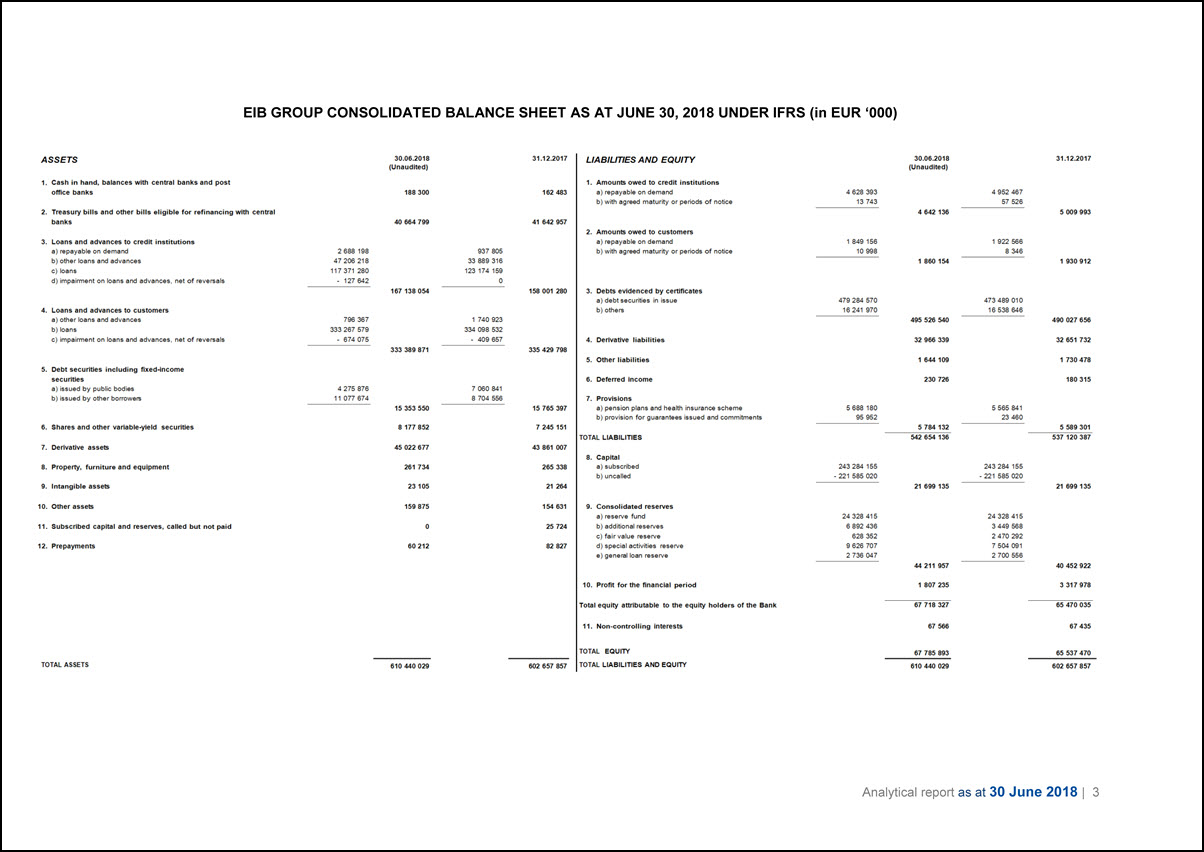

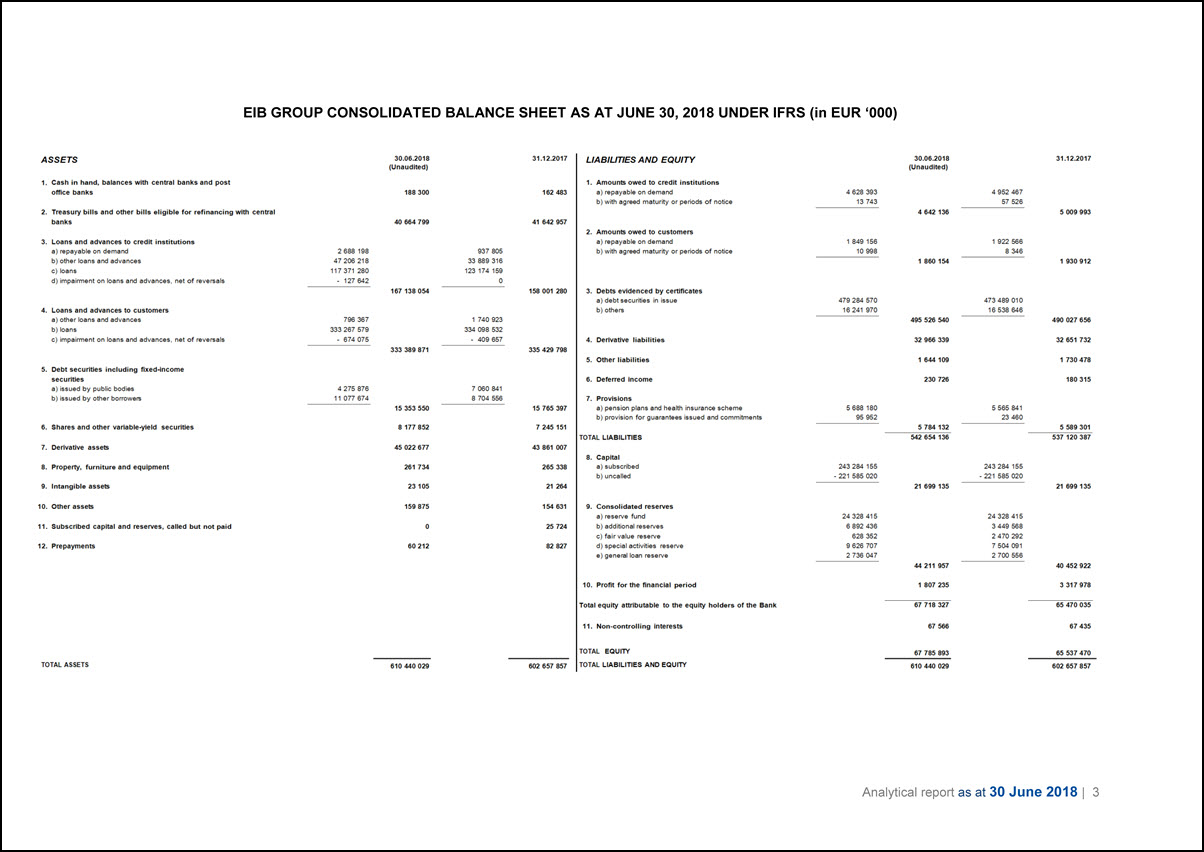

EIB GROUP CONSOLIDATED BALANCE SHEET AS AT JUNE 30, 2018 UNDER IFRS (in EUR ‘000) ASSETS 30.06.2018 (Unaudited) 31.12.2017 1. Cash in hand, balances with central banks and post office banks 188 300 162 483 2. Treasury bills and other bills eligible for refinancing with central banks 40 664 799 41 642 957 3. Loans and advances to credit institutions a) repayable on demand 2 688 198 937 805 b) other loans and advances 47 206 218 33 889 316 c) loans 117 371 280 123 174 159 d ) impairment on loans and advances, net of reversals - 127 642 0 167 138 054 158 001 280 4. Loans and advances to customers a) other loans and advances 796 367 1 740 923 b) loans 333 267 579 334 098 532 c) impairment on loans and advances, net of reversals - 674 075 - 409 657 333 389 871 335 429 798 5. Debt securities including fixed-income securities a) issued by public bodies 4 275 876 7 060 841 b) issued by other borrowers 11 077 674 8 704 556 15 353 550 15 765 397 6. Shares and other variable-yield securities 8 177 852 7 245 151 7. Derivative assets 45 022 677 43 861 007 8. Property, furniture and equipment 261 734 265 338 9. Intangible assets 23 105 21 264 10. Other assets 159 875 154 631 11. Subscribed capital and reserves, called but not paid 0 25 724 12. Prepayments 60 212 82 827 TOTAL ASSETS 610 440 029 602 657 857 LIABILITIES AND EQUITY 30.06.2018 (Unaudited) 31.12.2017 1. Amounts owed to credit institutions a ) repayable on demand 4 628 393 4 952 467 b) with agreed maturity or periods of notice 13 743 57 526 4 642 136 5 009 993 2. Amounts owed to customers a) repayable on demand 1 849 156 1 922 566 b) with agreed maturity or periods of notice 10 998 8 346 1 860 154 1 930 912 3. Debts evidenced by certificates a) debt securities in issue 479 284 570 473 489 010 b) others 16 241 970 16 538 646 495 526 540 490 027 656 4. Derivative liabilities 32 966 339 32 651 732 5. Other liabilities 1 644 109 1 730 478 6. Deferred Income 230 726 180 315 7. Provisions a) pension plans and health insurance scheme 5 688 180 5 565 841 b) provision for guarantees issued and commitments 95 952 23 460 5 784 132 5 589 301 TOTAL LIABILITIES 542 654 136 537 120 387 8. Capital a) subscribed 243 284 155 243 284 155 b) uncalled - 221 585 020 - 221 585 020 21 699 135 21 699 135 9. Consolidated reserves a) reserve fund 24 328 415 24 328 415 b) additional reserves 6 892 436 3 449 568 c) fair value reserve 628 352 2 470 292 d) special activities reserve 9 626 707 7 504 091 e) general loan reserve 2 736 047 2 700 556 44 211 957 40 452 922 10. Profit for the financial period 1 807 235 3 317 978 Total equity attributable to the equity holders of the Bank 67 718 327 65 470 035 11. Non-controlling interests 67 566 67 435 TOTAL EQUITY 67 785 893 65 537 470 TOTAL LIABILITIES AND EQUITY 610 440 029 602 657 857 Analytical report as at 30 June 2018 | 3

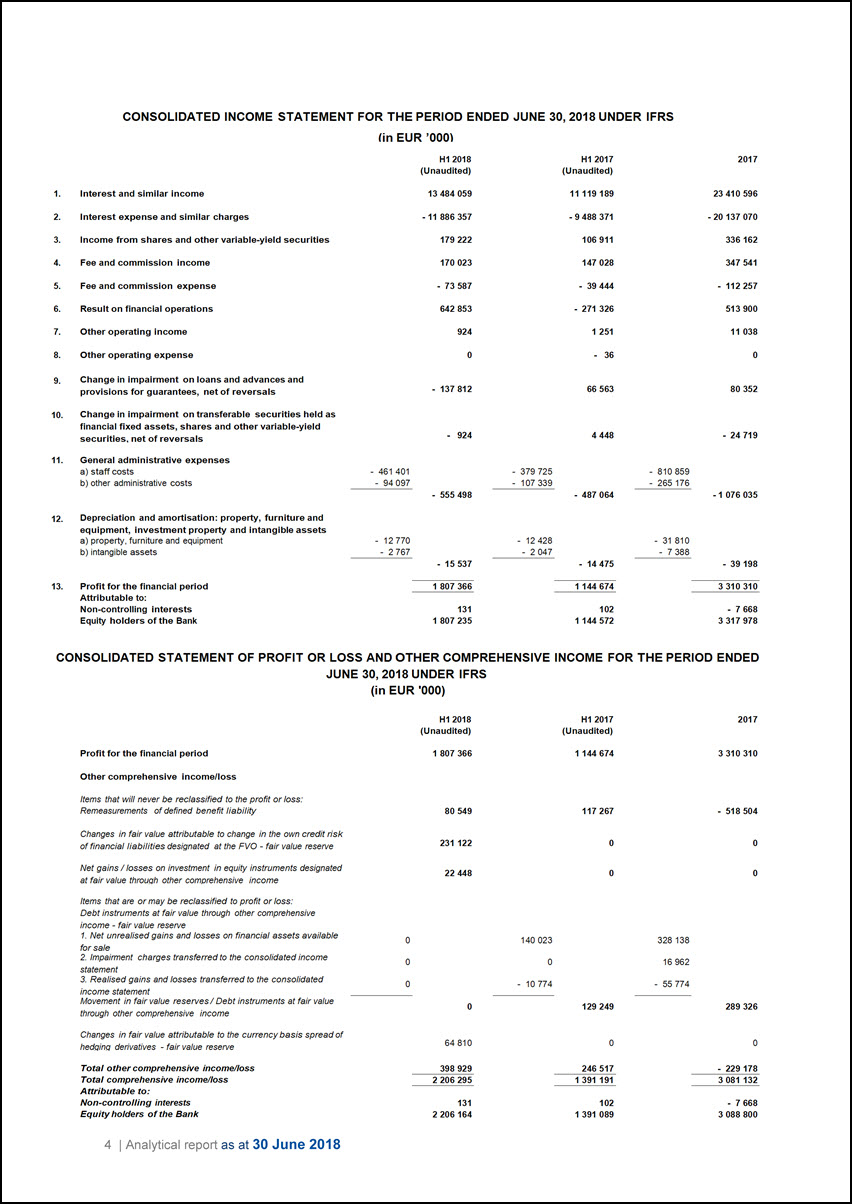

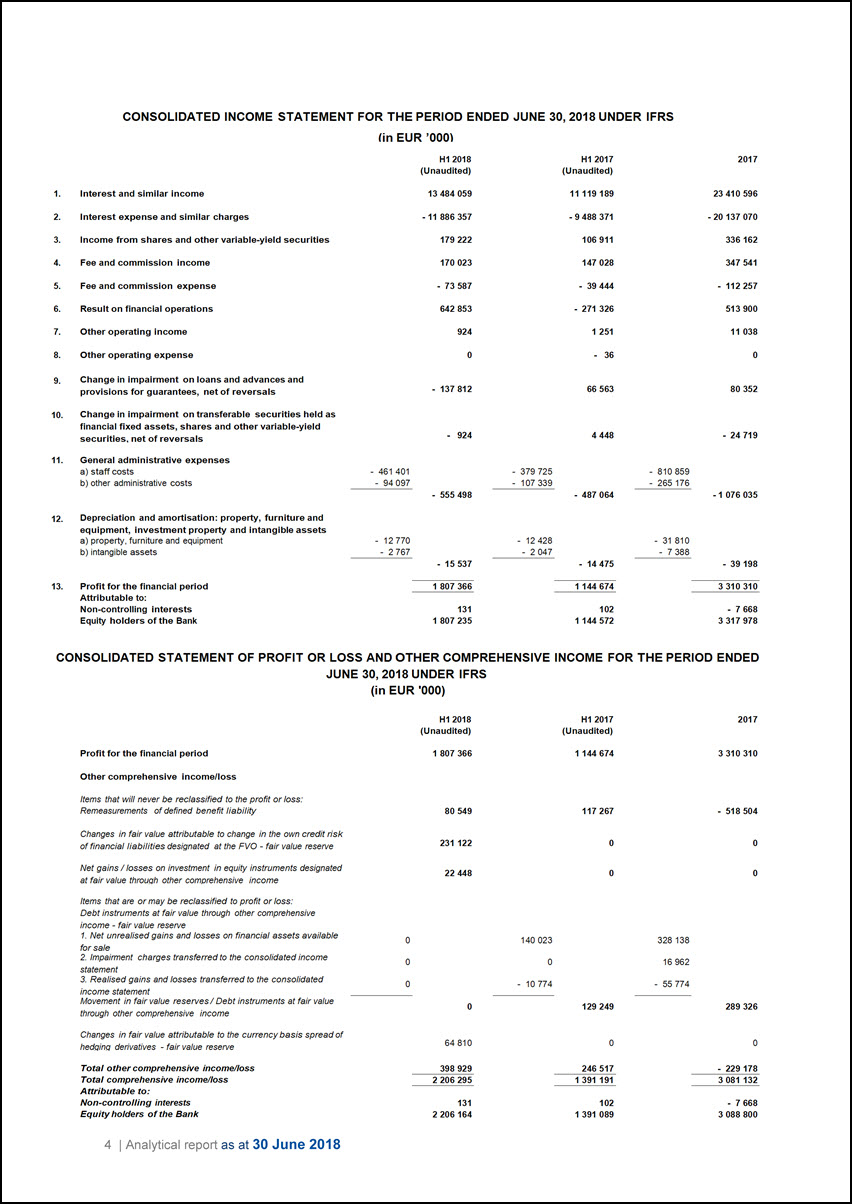

CONSOLIDATED INCOME STATEMENT FOR THE PERIOD ENDED JUNE 30, 2018 UNDER IFRS (in EUR ‘000) H1 2018 (Unaudited) H1 2017 (Unaudited) 2017 1. Interest and similar income 13 484 059 11 119 189 23 410 596 2. Interest expense and similar charges - 11 886 357 - 9 488 371 - 20 137 070 3. Income from shares and other variable-yield securities 179 222 106 911 336 162 4. Fee and commission income 170 023 147 028 347 541 5. Fee and commission expense - 73 587 - 39 444 - 112 257 6. Result on financial operations 642 853 - 271 326 513 900 7. Other operating income 924 1 251 11 038 8. Other operating expense 0 - 36 0 9. Change in impairment on loans and advances and provisions for guarantees, net of reversals - 137 812 66 563 80 352 10. Change in Impairment on transferable securities held as financial fixed assets, shares and other variable-yield securities, net of reversals - 924 4 448 - 24 719 11. General administrative expenses a) staff costs - 461 401 - 379 725 - 810 859 b) other administrative costs - 94 097 - 107 339 - 265 176 - 555 498 - 487 064 - 1 076 035 12. Depreciation and amortisation: property, furniture and equipment, investment property and intangible assets a) property, furniture and equipment - 12 770 - 12 428 - 31 810 b) intangible assets - 2 767 - 2 047 - 7 388 - 15 537 - 14 475 - 39 198 13. Profit for the financial period 1 807 366 1 144 674 3 310 310 Attributable to: Non-controlling interests 131 102 - 7 668 Equity holders of the Bank 1 807 235 1 144 572 3 317 978 CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE PERIOD ENDED JUNE 30, 2018 UNDER IFRS (in EUR ‘000) H1 2018 (Unaudited) H1 2017 (Unaudited) 2017 Profit for the financial period 1 807 366 1 144 674 3 310 310 Other comprehensive income/loss Items that will never be reclassified to the profit or loss: Remeasurements of defined benefit liability 80 549 117 267 - 518 504 Changes in fair value attributable to change in the own credit risk of financial liabilities designated at the FVO - fair value reserve 231 122 0 0 Net gains / losses on investment in equity instruments designated at fair value through other comprehensive income 22 448 0 0 Items that are or may be reclassified to profit or loss: Debt instruments at fair value through other comprehensive income - fair value reserve 1. Net unrealised gains and losses on financial assets available for sale 0 140 023 328 138 2. Impairment charges transferred to the consolidated income statement 0 0 16 962 3. Realised gains and losses transferred to the consolidated income statement 0 - 10 774 - 55 774 Movement in fair value reserves / Debt instruments at fair value through other comprehensive income 0 129 249 289 326 Changes in fair value attributable to the currency basis spread of hedging derivatives - fair value reserve 64 810 0 0 Total other comprehensive income/loss 398 929 246 517 - 229 178 Total comprehensive income/loss 2 206 295 1 391 191 3 081 132 Attributable to: Non-controlling interests 131 102 - 7 668 Equity holders of the Bank 2 206 164 1 391 089 3 088 800 4 | Analytical report as at 30 June 2018

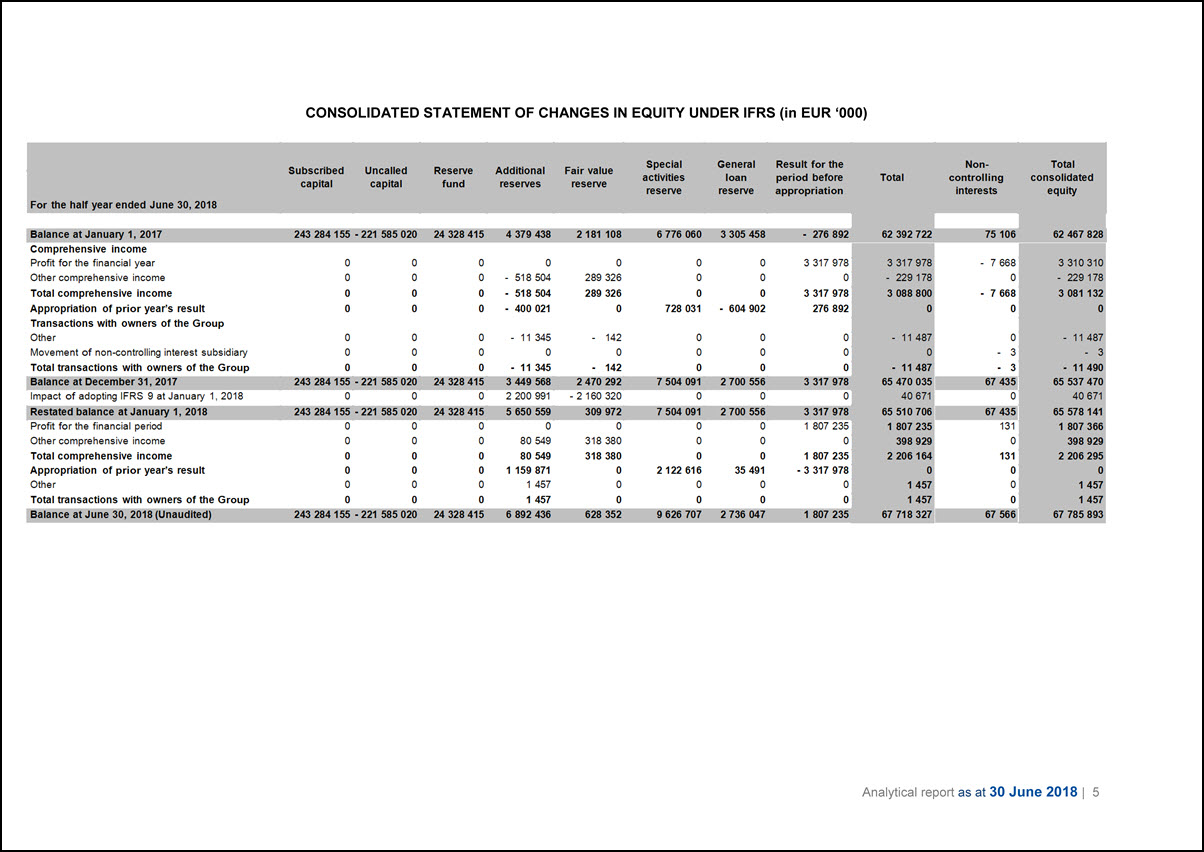

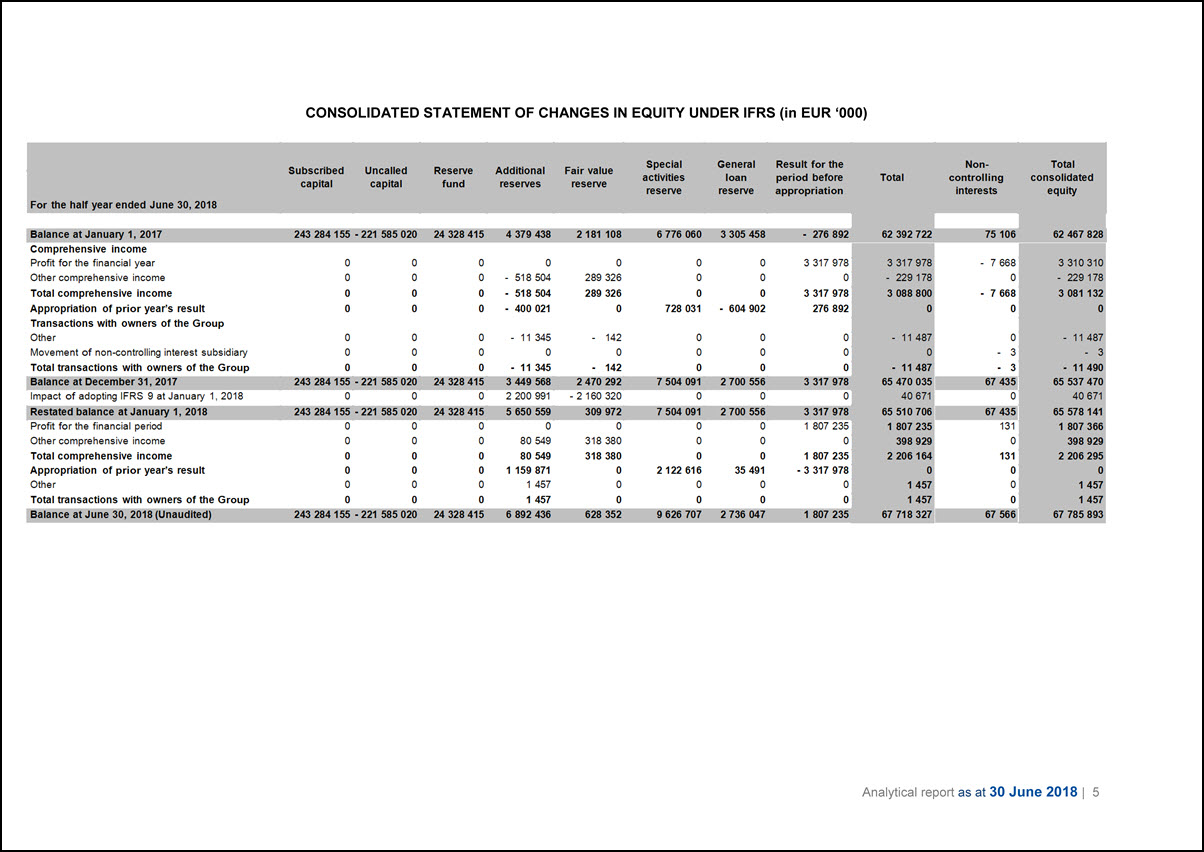

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY UNDER IFRS (in EUR ‘000) Subscribed capital Uncalled capital Reserve fund Additional reserves Fair value reserve Special activities reserve General loan reserve Result for the period before appropriation Total Non-controlling interests Total consolidated equity For the half year ended June 30, 2018 Balance at January 1, 2017 243 284 155 - 221 585 020 24 328 415 4 379 438 2 181 108 6 776 060 3 305 458 - 276 892 62 392 722 75 106 62 467 828 Comprehensive income Profit for the financial year 0 0 0 0 0 0 0 3 317 978 3 317 978 - 7 668 3 310 310 Other comprehensive income 0 0 0 - 518 504 289 326 0 0 0 - 229 178 0 - 229 178 Total comprehensive income 0 0 0 - 518 504 289 326 0 0 3 317 978 3 088 800 - 7 668 3 081 132 Appropriation of prior year’s result 0 0 0 - 400 021 0 728 031 - 604 902 276 892 0 0 0 Transactions with owners of the Group Other 0 0 0 - 11 345 - 142 0 0 0 - 11 487 0 - 11 487 Movement of non-controlling interest subsidiary 0 0 0 0 0 0 0 0 0 - 3 - 3 Total transactions with owners of the Group 0 0 0 - 11 345 - 142 0 0 0 - 11 487 - 3 - 11 490 Balance at December 31, 2017 243 284 155 - 221 585 020 24 328 415 3 449 568 2 470 292 7 504 091 2 700 556 3 317 978 65 470 035 67 435 65 537 470 Impact of adopting IFRS 9 at January 1, 2018 0 0 0 2 200 991 - 2 160 320 0 0 0 40 671 0 40 671 Restated balance at January 1, 2018 243 284 155 - 221 585 020 24 328 415 5 650 559 309 972 7 504 091 2 700 556 3 317 978 65 510 706 67 435 65 578 141 Profit for the financial period 0 0 0 0 0 0 0 1 807 235 1 807 235 131 1 807 366 Other comprehensive income 0 0 0 80 549 318 380 0 0 0 398 929 0 398 929 Total comprehensive income 0 0 0 80 549 318 380 0 0 1 807 235 2 206 164 131 2 206 295 Appropriation of prior year’s result 0 0 0 1 159 871 0 2 122 616 35 491 - 3 317 978 0 0 0 Other 0 0 0 1 457 0 0 0 0 1 457 0 1 457 Total transactions with owners of the Group 0 0 0 1 457 0 0 0 0 1 457 0 1 457 Balance at June 30, 2018 (Unaudited) 243 284 155 - 221 585 020 24 328 415 6 892 436 628 352 9 626 707 2 736 047 1 807 235 67 718 327 67 566 67 785 893 Analytical report as at 30 June 2018 | 5

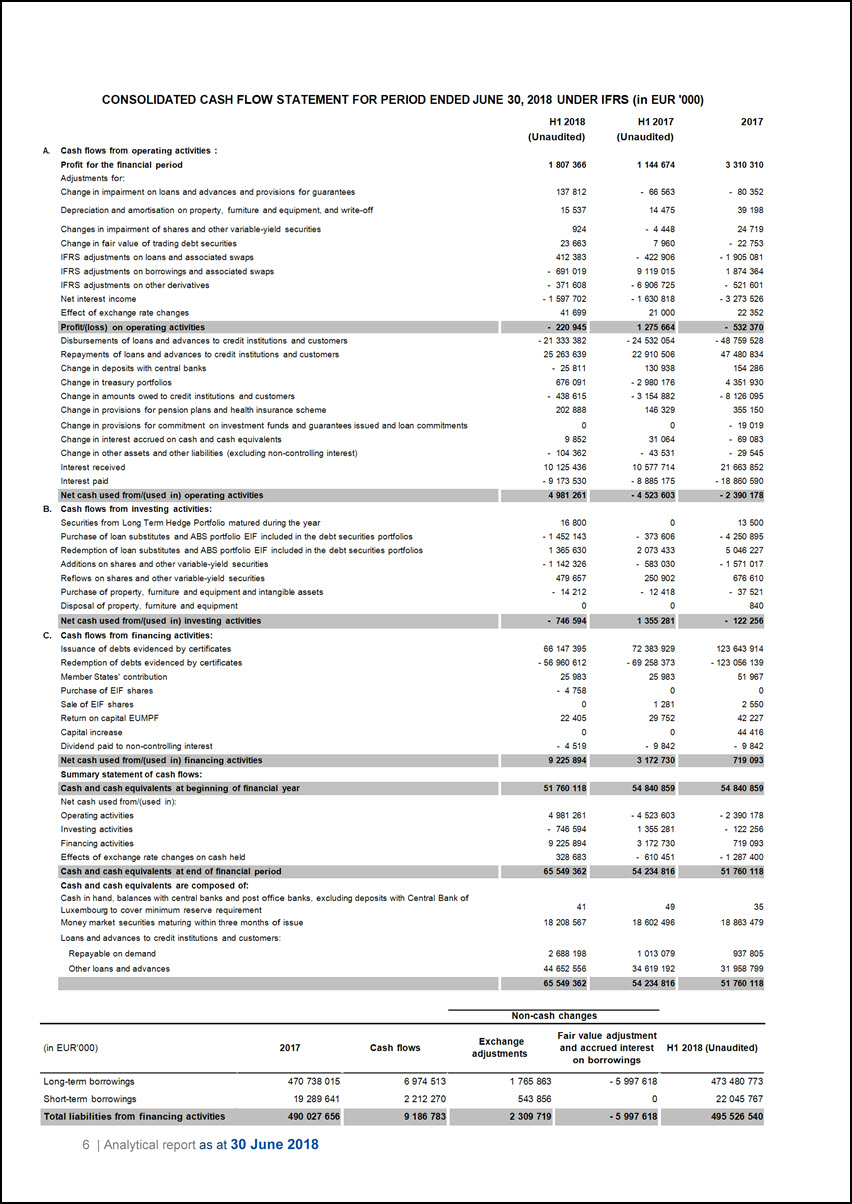

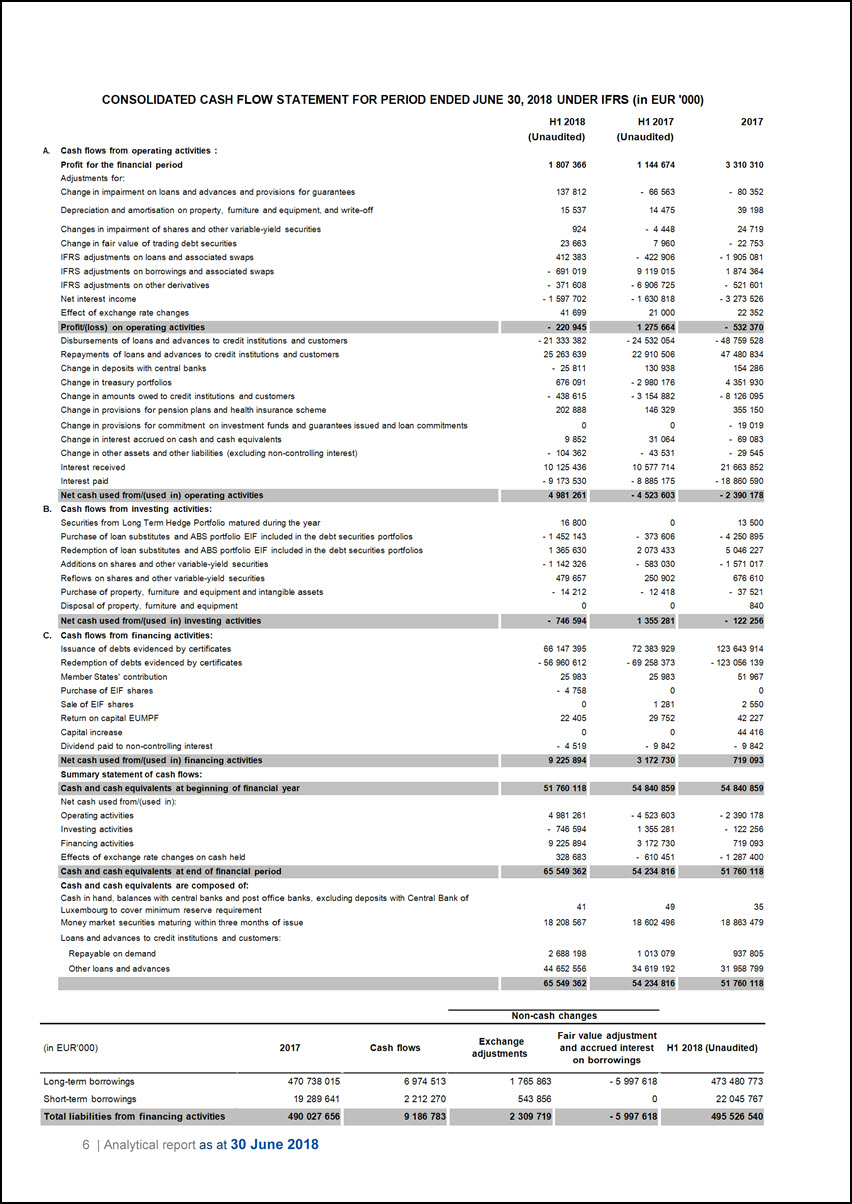

CONSOLIDATED CASH FLOW STATEMENT FOR PERIOD ENDED JUNE 30, 2018 UNDER IFRS (in EUR ‘000) H1 2018 (Unaudited) H1 2017 (Unaudited) 2017 A. Cash flows from operating activities : Profit for the financial period 1 807 366 1 144 674 3 310 310 Adjustments for: Change in impairment on loans and advances and provisions for guarantees 137 812 - 66 563 - 80 352 Depreciation and amortisation on property, furniture and equipment, and write-off 15 537 14 475 39 198 Changes in impairment of shares and other variable-yield securities 924 - 4 448 24 719 Change in fair value of trading debt securities 23 663 7 960 - 22 753 IFRS adjustments on loans and associated swaps 412 383 - 422 906 - 1 905 081 IFRS adjustments on borrowings and associated swaps - 691 019 9 119 015 1 874 364 IFRS adjustments on other derivatives - 371 608 - 6 906 725 - 521 601 Net interest income - 1 597 702 - 1 630 818 - 3 273 526 Effect of exchange rate changes 41 699 21 000 22 352 Profit/(loss) on operating activities - 220 945 1 275 664 - 532 370 Disbursements of loans and advances to credit institutions and customers - 21 333 382 - 24 532 054 - 48 759 528 Repayments of loans and advances to credit institutions and customers 25 263 639 22 910 506 47 480 834 Change in deposits with central banks - 25 811 130 938 154 286 Change in treasury portfolios 676 091 - 2 980 176 4 351 930 Change in amounts owed to credit institutions and customers - 438 615 -3 154 882 -8 126 095 Change in provisions for pension plans and health insurance scheme 202 888 146 329 355 150 Change in provisions for commitment on investment funds and guarantees issued and loan commitments 0 0 - 19 019 Change in interest accrued on cash and cash equivalents 9 852 31 064 - 69 083 Change in other assets and other liabilities (excluding non-controlling interest) - 104 362 - 43 531 - 29 545 Interest received 10 125 436 10 577 714 21 663 852 Interest paid - 9 173 530 - 8 885 175 - 18 860 590 Net cash used from/(used in) operating activities 4 981 261 - 4 523 603 - 2 390 178 B. Cash flows from investing activities: Securities from Long Term Hedge Portfolio matured during the year 16 800 0 13 500 Purchase of loan substitutes and ABS portfolio EIF included in the debt securities portfolios - 1 452 143 - 373 606 - 4 250 895 Redemption of loan substitutes and ABS portfolio EIF included in the debt securities portfolios 1 365 630 2 073 433 5 046 227 Additions on shares and other variable-yield securities - 1 142 326 - 583 030 - 1 571 017 Reflows on shares and other variable-yield securities 479 657 250 902 676 610 Purchase of property, furniture and equipment and intangible assets - 14 212 - 12 418 - 37 521 Disposal of property, furniture and equipment 0 0 840 Net cash used from/(used in) Investing activities - 746 594 1 355 281 - 122 256 C. Cash flows from financing activities: Issuance of debts evidenced by certificates 66 147 395 72 383 929 123 643 914 Redemption of debts evidenced by certificates -56 960 612 - 69 258 373 - 123 056 139 Member States’ contribution 25 983 25 983 51 967 Purchase of EIF shares - 4 758 0 0 Sale of EIF shares 0 1 281 2 550 Return on capital EUMPF 22 405 29 752 42 227 Capital increase 0 0 44 416 Dividend paid to non-controlling interest - 4 519 - 9 842 - 9 842 Net cash used from/(used in) financing activities 9 225 894 3 172 730 719 093 Summary statement of cash flows: Cash and cash equivalents at beginning of financial year 51 760 118 54 840 859 54 840 859 Net cash used from/(used in): Operating activities 4 981 261 - 4 523 603 - 2 390 178 Investing activities - 746 594 1 355 281 - 122 256 Financing activities 9 225 894 3 172 730 719 093 Effects of exchange rate changes on cash held 328 683 - 610 451 - 1 287 400 Cash and cash equivalents at end of financial period 65 549 362 54 234 816 51 760 118 Cash and cash equivalents are composed of: Cash in hand, balances with central banks and post office banks, excluding deposits with Central Bank of Luxembourg to cover minimum reserve requirement 41 49 35 Money market securities maturing within three months of issue 18 208 567 18 602 496 18 863 479 Loans and advances to credit institutions and customers: Repayable on demand 2 688 198 1 013 079 937 805 Other loans and advances 44 652 556 34 619 192 31 958 799 65 549 362 54 234 816 51 760 118 Non-cash changes (in EUR ‘000) 2017 Cash flows Exchange adjustments Fair value adjustment and accrued interest on borrowings H1 2018 (Unaudited) Long-term borrowings 470 738 015 6 974 513 1 765 863 - 5 997 618 473 480 773 Short-term borrowings 19 289 641 2 212 270 543 856 0 22 045 767 Total liabilities from financing activities 490 027 656 9 186 783 2 309 719 - 5 997 618 495 526 540 6 | Analytical report as at 30 June 2018

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS UNDER IFRS NOTE A Basis of presentation The unaudited condensed consolidated financial statements of the European Investment Bank (“the Bank”) as at June 30, 2018 do not include all of the information and footnotes required for complete financial statements, in accordance with IAS 34 Interim Financial Reporting. In the opinion of management, all adjustments, normal recurring accruals and adjustments for the impairment of financial assets considered necessary for a fair presentation have been recorded. The profit for the six-month period ended June 30, 2018 is not necessarily indicative of the results that may be expected for the year ending December 31, 2018. The audited consolidated financial statements as at and for the year ended December 31, 2017 were prepared in accordance with International Financial Reporting Standards (IFRS) as endorsed by the EU. The unaudited condensed consolidated financial statements as at and for the period ended June 30, 2018 are based on the same principles, except for IFRS 9 – Financial Instruments, which has been adopted by the Bank on January 1, 2018. Respective transitional impacts have been recorded in EIB Group’s own funds. For further information, refer to the consolidated financial statements and footnotes thereto included in the Bank’s annual report for the year ended December 31, 2017. NOTE B Summary statement of loans (in EUR ‘000) Analysis of aggregate loans granted (before specific provisions) as at June 30, 2018 To intermediary credit institutions Directly to final beneficiaries Total - Disbursed portion 117 371 280 333 267 579 450 638 859 - Undisbursed portion 28 193 284 78 711 694 106 904 978 Aggregate loans granted 145 564 564 411 979 273 557 543 837 Analysis of aggregate loans granted (before specific provisions) as at December 31, 2017 To intermediary credit institutions Directly to final beneficiaries Total - Disbursed portion 123 174 159 334 098 532 457 272 691 - Undisbursed portion 28 890 536 84 037 546 112 928 082 Aggregate loans granted 152 064 695 418 136 078 570 200 773 At the end of June 2018 and December 2017, the stake of the United Kingdom in the subscribed capital of the Bank amounted to EUR 39.2bn, out of which EUR 3.5bn have been paid-in. The disbursed exposure on borrowers located in the United Kingdom through the EIB’s lending activities, including guarantees and equity type investments, amounted to EUR 37.0bn as at June 30, 2018 (December 31, 2017: EUR 37.0bn), while the exposure on foreign borrowers with a guarantor from the United Kingdom amounted to EUR 1.5bn (December 31, 2017: EUR 1.5bn). The Bank had no direct exposure to the United Kingdom acting as borrower at the end of June 2018 whereas disbursed loans guaranteed by the United Kingdom amounted to EUR 2.1bn as at June 30, 2018 (December 31, 2017: EUR 2.0bn). The Bank will provide further updates on the subject as developments necessitate. Analytical report as at 30 June 2018 | 7

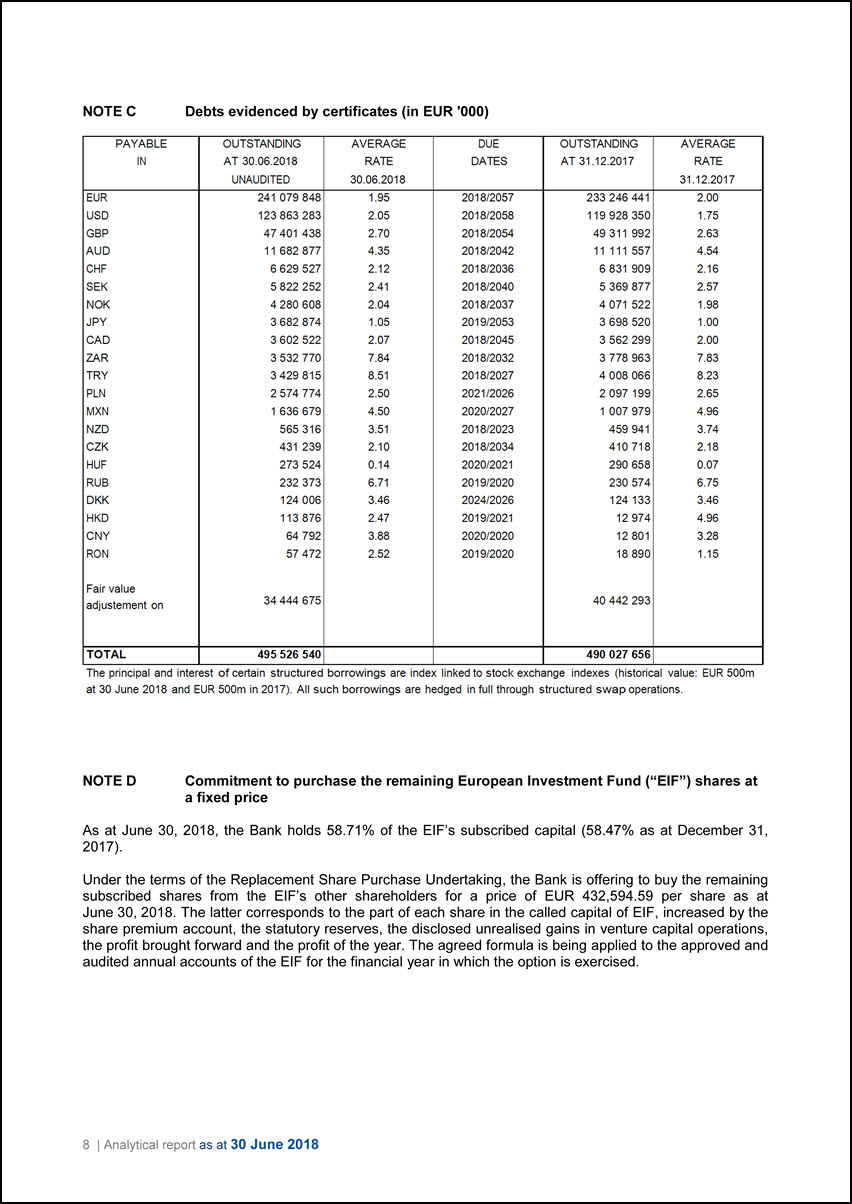

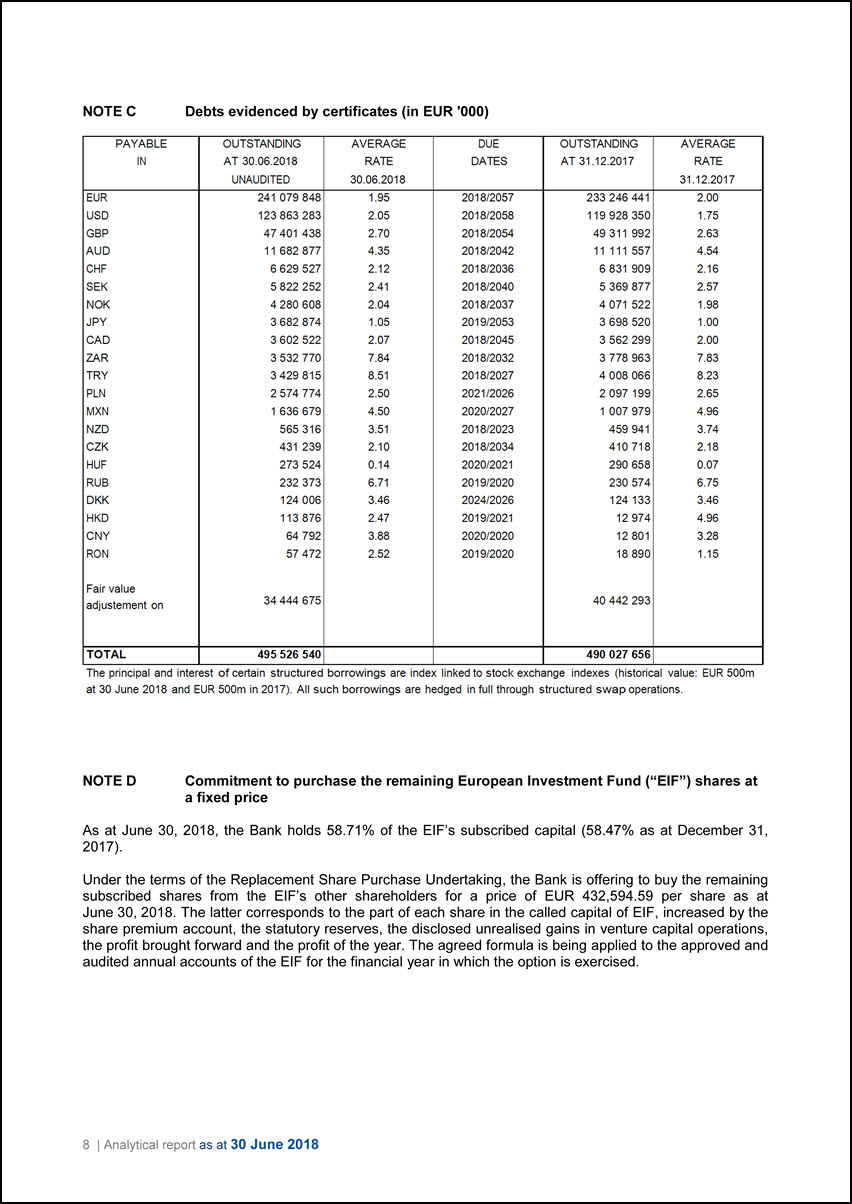

NOTE C Debts evidenced by certificates (in EUR ‘000) PAYABLE IN OUTSTANDING AT 30.06.2018 UNAUDITED AVERAGE RATE 30.06.2018 DUE DATES OUTSTANDING AT 31.12.2017 AVERAGE RATE 31.12.2017 EUR 241 079 848 1.95 2018/2057 233 246 441 2.00 USD 123 863 283 2.05 2018/2058 119 928 350 1.75 GBP 47 401 438 2.70 2018/2054 49 311 992 2.63 AUD 11 682 877 4.35 2018/2042 11 111 557 4.54 CHF 6 629 527 2.12 2018/2036 6 831 909 2.16 SEK 5 822 252 2.41 2018/2040 5 369 877 2.57 NOK 4 280 608 2.04 2018/2037 4 071 522 1.98 JPY 3 682 874 1.05 2019/2053 3 698 520 1.00 CAD 3 602 522 2.07 2018/2045 3 562 299 2.00 ZAR 3 532 770 7.84 2018/2032 3 778 963 7.83 TRY 3 429 815 8.51 2018/2027 4 008 066 8.23 PLN 2 574 774 2.50 2021/2026 2 097 199 2.65 MXN 1 636 679 4.50 2020/2027 1 007 979 4.96 NZD 565 316 3.51 2018/2023 459 941 3.74 CZK 431 239 2.10 2018/2034 410 718 2.18 HUF 273 524 0.14 2020/2021 290 658 0.07 RUB 232 373 6.71 2019/2020 230 574 6.75 DKK 124 006 3.46 2024/2026 124 133 3.46 HKD 113 876 2.47 2019/2021 12 974 4.96 CNY 64 792 3.88 2020/2020 12 801 3.28 RON 57 472 2.52 2019/2020 18 890 1.15 Fair value adjustment on 34 444 675 40 442 293 TOTAL 495 526 540 490 027 656 The principal and interest of certain structured borrowings are index linked to stock exchange indexes (historical value: EUR 500m at 30 June 2018 and EUR 500m in 2017). All such borrowings are hedged in full through structured swap operations. NOTE D Commitment to purchase the remaining European Investment Fund (“EIF”) shares at a fixed price As at June 30, 2018, the Bank holds 58.71% of the EIF’s subscribed capital (58.47% as at December 31, 2017). Under the terms of the Replacement Share Purchase Undertaking, the Bank is offering to buy the remaining subscribed shares from the EIF’s other shareholders for a price of EUR 432,594.59 per share as at June 30, 2018. The latter corresponds to the part of each share in the called capital of EIF, increased by the share premium account, the statutory reserves, the disclosed unrealised gains in venture capital operations, the profit brought forward and the profit of the year. The agreed formula is being applied to the approved and audited annual accounts of the EIF for the financial year in which the option is exercised. 8 | Analytical report as at 30 June 2018

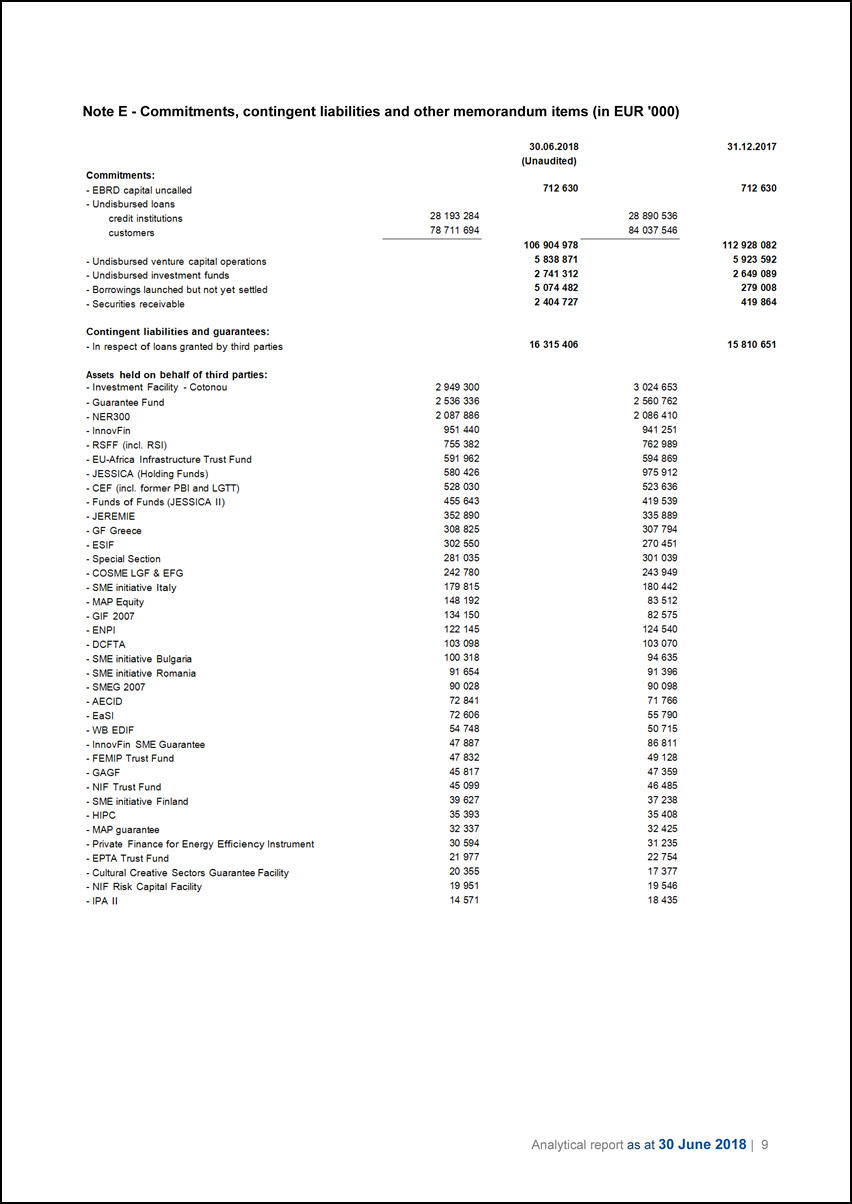

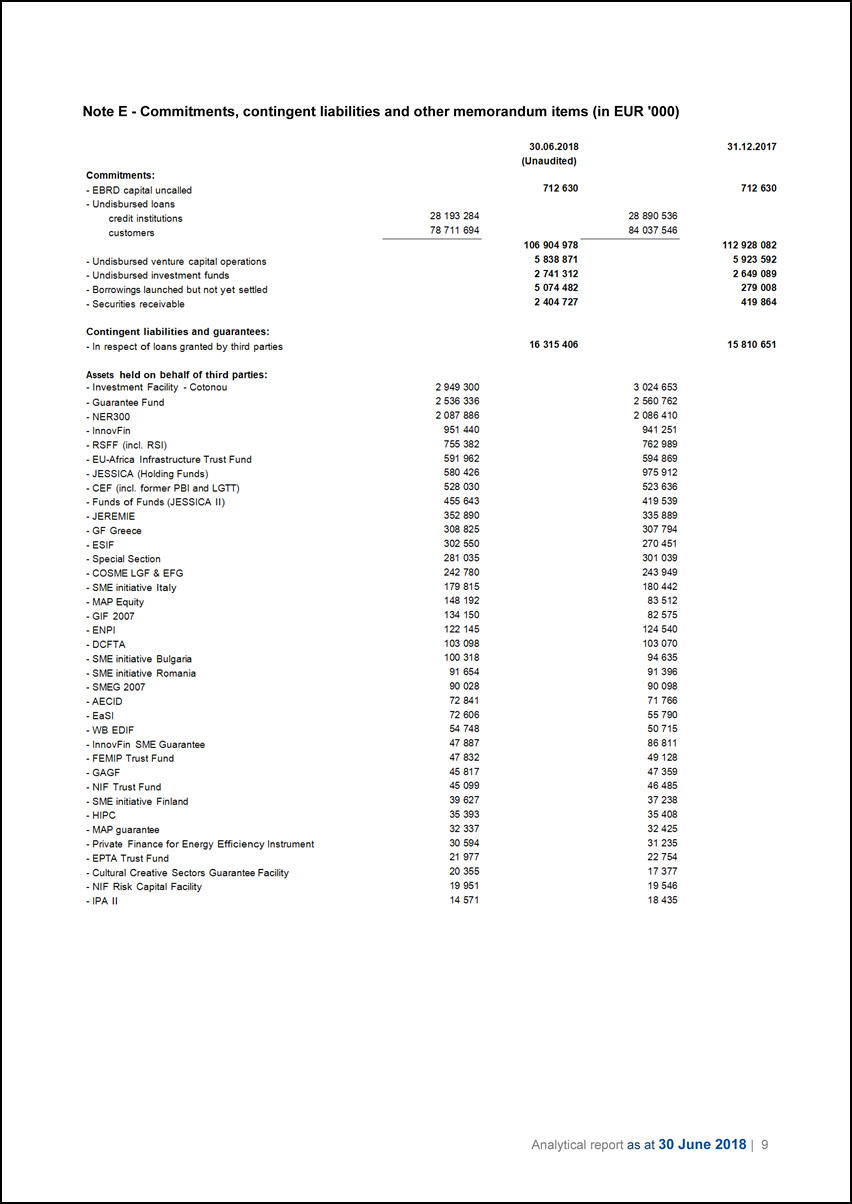

Note E - Commitments, contingent liabilities and other memorandum items (in EUR ‘000) 30.06.2018 (Unaudited) 31.12.2017 Commitments: - EBRD capital uncalled 712 630 712 630 - Undisbursed loans credit institutions 28 193 284 28 890 536 customers 78 711 694 84 037 546 106 904 978 112 928 082 - Undisbursed venture capital operations 5 838 871 5 923 592 - Undisbursed investment funds 2 741 312 2 649 089 - Borrowings launched but not yet settled 5 074 482 279 008 - Securities receivable 2 404 727 419 864 Contingent liabilities and guarantees: - In respect of loans granted by third parties 16 315 406 15 810 651 Assets held on behalf of third parties: - Investment Facility - Cotonou 2 949 300 3 024 653 - Guarantee Fund 2 536 336 2 560 762 - NER300 2 087 886 2 086 410 - lnnovFin 951 440 941 251 - RSFF (incl. RSI) 755 382 762 989 - EU-Africa Infrastructure Trust Fund 591 962 594 869 - JESSICA (Holding Funds) 580 426 975 912 - CEF (incl. former PBI and LGTT) 528 030 523 636 - Funds of Funds (JESSICA II) 455 643 419 539 - JEREMIE 352 890 335 889 - GF Greece 308 825 307 794 - ESIF 302 550 270 451 - Special Section 281 035 301 039 - COSME LGF & EFG 242 780 243 949 - SME initiative Italy 179 815 180 442 - MAP Equity 148 192 83 512 - GIF 2007 134 150 82 575 - ENPI 122 145 124 540 - DCFTA 103 098 103 070 - SME initiative Bulgaria 100 318 94 635 - SME initiative Romania 91 654 91 396 - SMEG 2007 90 028 90 098 - AECID 72 841 71 766 - EaSI 72 606 55 790 - WB EDIF 54 748 50 715 - lnnovFin SME Guarantee 47 887 86 811 - FEMIP Trust Fund 47 832 49 128 - GAGF 45 817 47 359 - NIF Trust Fund 45 099 46 485 - SME initiative Finland 39 627 37 238 - HIPC 35 393 35 408 - MAP guarantee 32 337 32 425 - Private Finance for Energy Efficiency Instrument 30 594 31 235 - EPTA Trust Fund 21 977 22 754 - Cultural Creative Sectors Guarantee Facility 20 355 17 377 - NIF Risk Capital Facility 19 951 19 546 - IPA II 14 571 18 435 Analytical report as at 30 June 2018 | 9

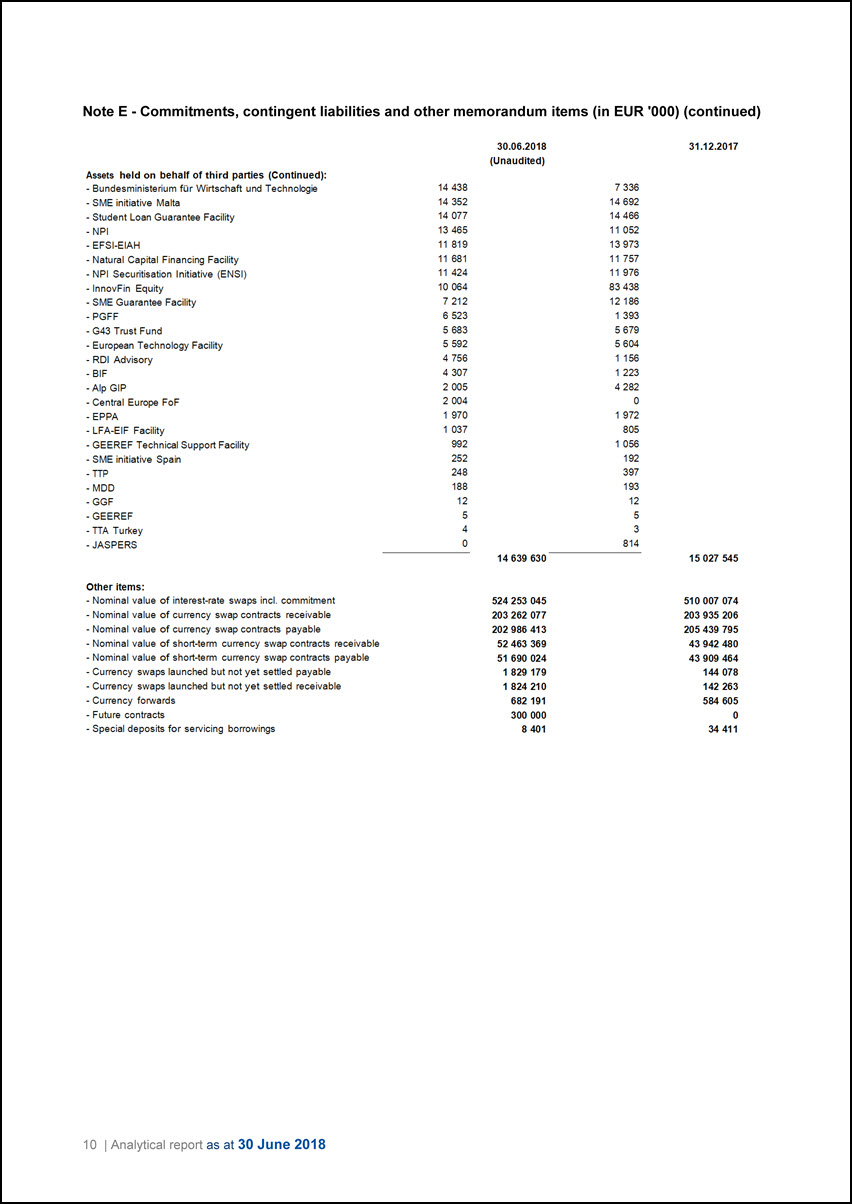

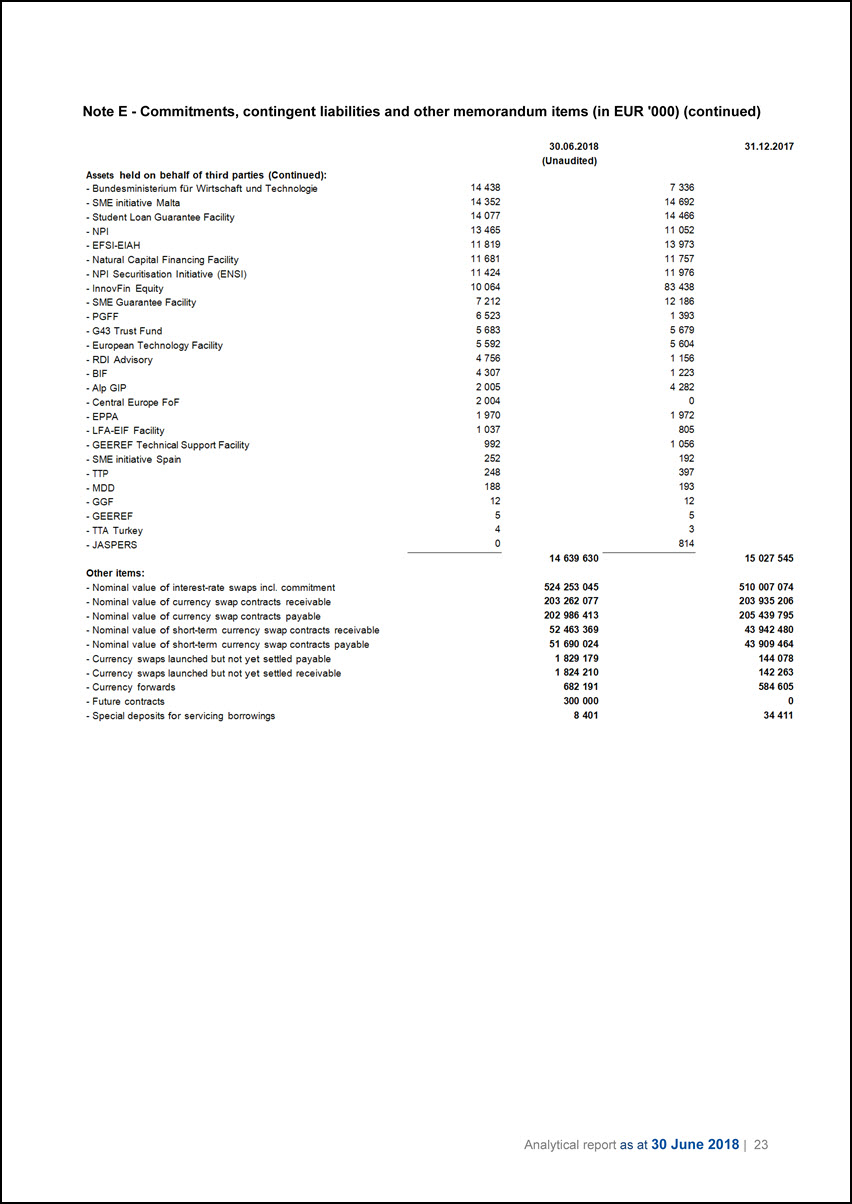

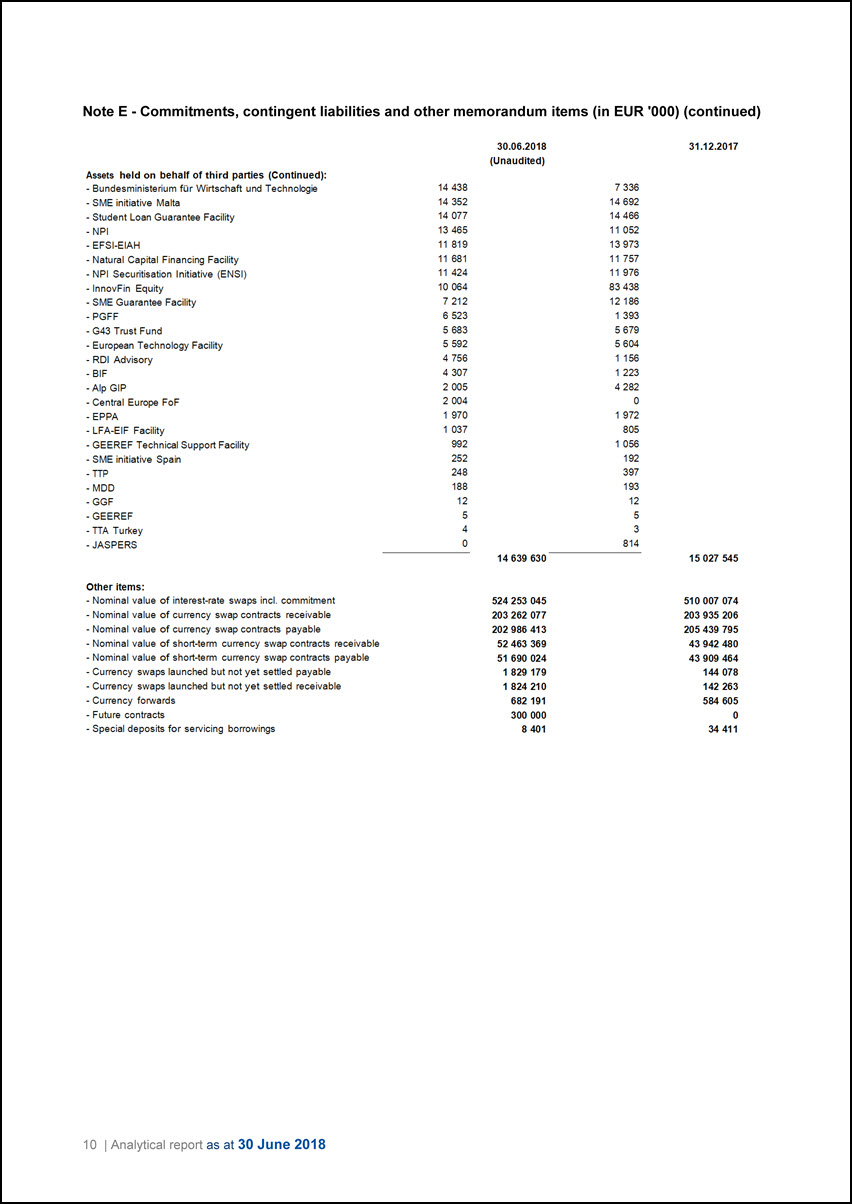

Note E - Commitments, contingent liabilities and other memorandum items (in EUR ‘000) (continued) 30.06.2018 (Unaudited) 31.12.2017 Assets held on behalf of third parties (Continued): - Bundesministerium für Wirtschaft und Technologie 14 438 7 336 - SME initiative Malta 14 352 14 692 - Student Loan Guarantee Facility 14 077 14 466 - NPI 13 465 11 052 - EFSI-EIAH 11 819 13 973 - Natural Capital Financing Facility 11 681 11 757 - NPI Securitisation Initiative (ENSI) 11 424 11 976 - InnovFin Equity 10 064 83 438 - SME Guarantee Facility 7 212 12 186 - PGFF 6 523 1 393 - G43 Trust Fund 5 683 5 679 - European Technology Facility 5 592 5 604 - RDI Advisory 4 756 1 156 - BIF 4 307 1 223 - Alp GIP 2 005 4 282 - Central Europe FoF 2 004 0 - EPPA 1 970 1 972 - LFA-EIF Facility 1 037 805 - GEEREF Technical Support Facility 992 1 056 - SME initiative Spain 252 192 - TTP 248 397 - MDD 188 193 - GGF 12 12 - GEEREF 5 5 - TTA Turkey 4 3 - JASPERS 0 814 14 639 630 15 027 545 Other items: - Nominal value of interest-rate swaps incl. commitment 524 253 045 510 007 074 - Nominal value of currency swap contracts receivable 203 262 077 203 935 206 - Nominal value of currency swap contracts payable 202 986 413 205 439 795 - Nominal value of short-term currency swap contracts receivable 52 463 369 43 942 480 - Nominal value of short-term currency swap contracts payable 51 690 024 43 909 464 - Currency swaps launched but not yet settled payable 1 829 179 144 078 - Currency swaps launched but not yet settled receivable 1 824 210 142 263 - Currency forwards 682 191 584 605 - Future contracts 300 000 0 - Special deposits for servicing borrowings 8 401 34 411 10 | Analytical report as at 30 June 2018

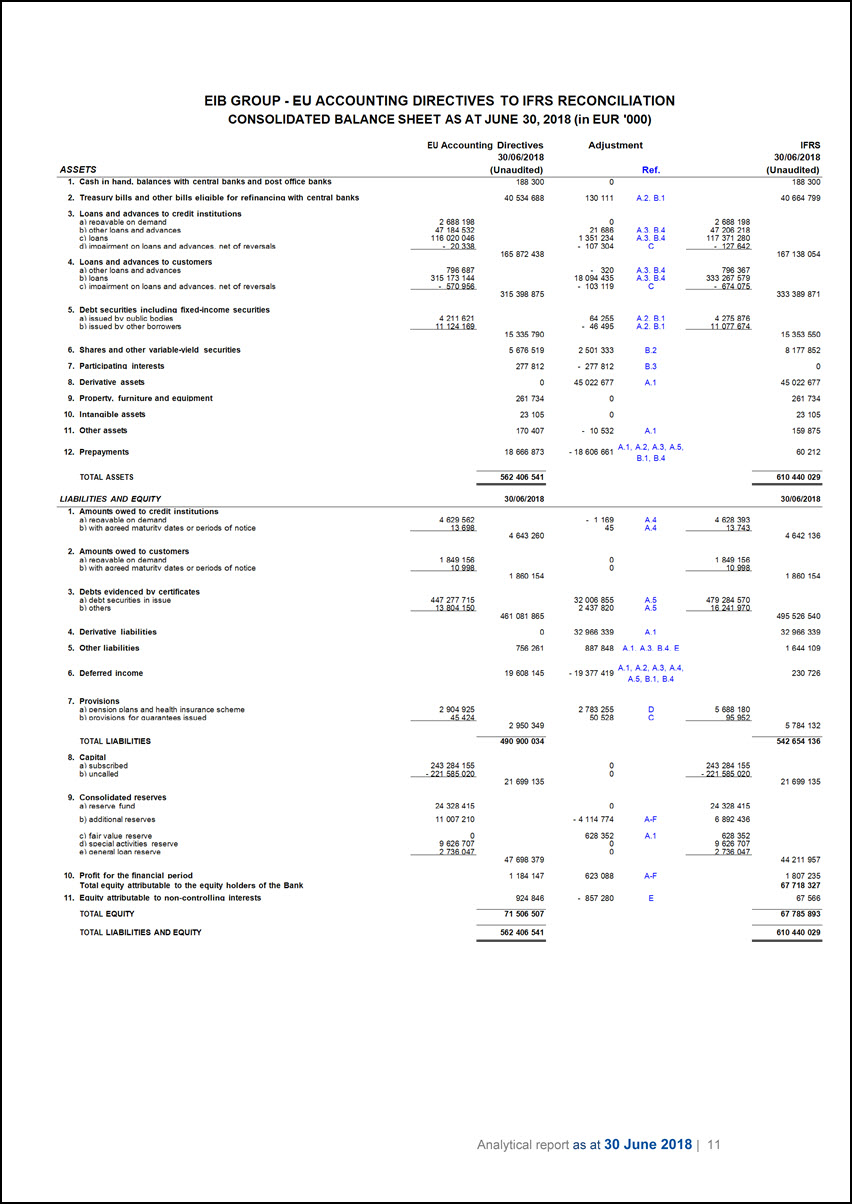

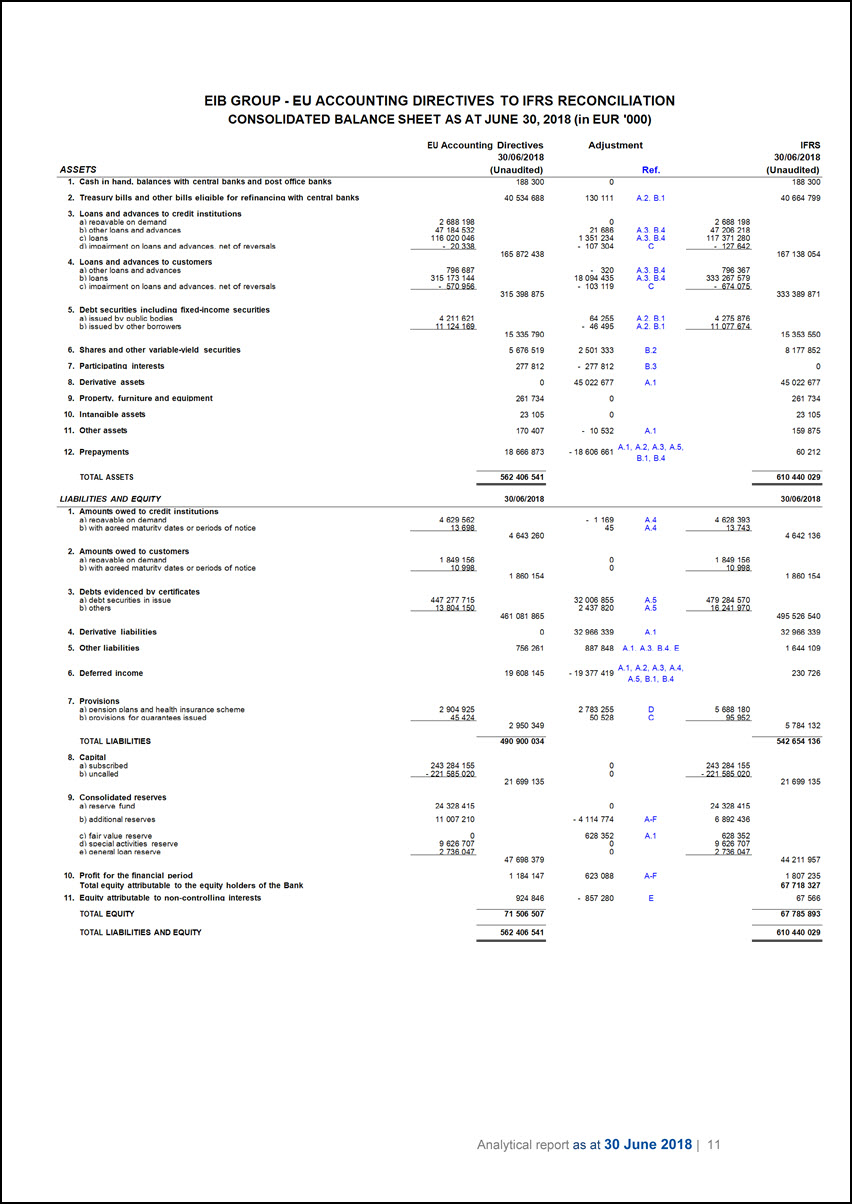

EIB GROUP - EU ACCOUNTING DIRECTIVES TO IFRS RECONCILIATION CONSOLIDATED BALANCE SHEET AS AT JUNE 30, 2018 (in EUR ‘000) ASSETS EU Accounting Directives 30/06/2018 (Unaudited) Adjustment Ref. IFRS 30/06/2018 (Unaudited) 1. Cash in hand, balances with central banks and post office banks 188 300 0 188 300 2. Treasury bills and other bills eligible for refinancing with central banks 40 534 688 130 111 A.2., B.1 40 664 799 3. Loans and advances to credit institutions a) repayable on demand 2 688 198 0 2 688 198 b) other loans and advances 47 184 532 21 686 A.3, B.4 47 206 218 c) loans 116 020 046 1 351 234 A.3. B.4 117 371 280 d) impairment on loans and advances, net of reversals - 20 338 - 107 304 C - 127 642 165 872 438 167 138 054 4. Loans and advances to customers a) other loans and advances 796 687 - 320 A.3, B.4 796 367 b) loans 315 173 144 18 094 435 A.3, B.4 333 267 579 c) impairment on loans and advances, net of reversals - 570 956 - 103 119 - 674 075 315 398 875 333 389 871 5. Debt securities including fixed-income securities a ) issued by public bodies 4 211 621 64 255 A.2, B.1 4 275 876 b) issued by other borrowers 11 124 169 - 46 495 A.2, B.1 11 077 674 15 335 790 15 353 550 6. Shares and other variable-yield securities 5 676 519 2 501 333 B.2 8 177 852 7. Participating interests 277 812 - 277 812 B.3 0 8. Derivative assets 0 45 022 677 A.1 45 022 677 9. Property, furniture and equipment 261 734 0 261 734 10. Intangible assets 23 105 0 23 105 11. Other assets 170 407 - 10 532 A.1 159 875 12. Prepayments 18 666 873 - 18 606 661 A.1, A.2, A.3, A.5, B.1, B.4 60 212 TOTAL ASSETS 562 406 541 610 440 029 LIABILITIES AND EQUITY 30/06/2018 30/06/2018 1. Amounts owed to credit institutions a) repayable on demand 4 629 562 - 1 169 A.4 4 628 393 b) with agreed maturity dates or periods of notice 13 698 45 A.4 13 743 4 643 260 4 642 136 2. Amounts owed to customers a) repayable on demand 1 849 156 0 1 849 156 b) with agreed maturity dates or periods of notice 10 998 0 10 998 1 860 154 1 860 154 3. Debts evidenced by certificates a) debt securities in issue 447 277 715 32 006 855 A.5 479 284 570 b) others 13 804 150 2 437 820 A.5 16 241 970 461 081 865 495 526 540 4. Derivative liabilities 0 32 966 339 A.1 32 966 339 5. Other liabilities 756 261 887 848 A.1., A.3., B.4., E 1 644 109 6. Deferred income 19 608 145 - 19 377 419 A.1, A.2, A.3, A.4, A.5, B.1, B.4 230 726 7. Provisions a) pension plans and health insurance scheme 2 904 925 2 783 255 D 5 688 180 b) provisions for guarantees issued 45 424 50 528 C 95 952 2 950 349 5 784 132 TOTAL LIABILITIES 490 900 034 542 654 136 8. Capital a) subscribed 243 284 155 0 243 284 155 b) uncalled - 221 585 020 0 - 221 585 020 21 699 135 21 699 135 9. Consolidated reserves a) reserve fund 24 328 415 0 24 328 415 b) additional reserves 11 007 210 - 4 114 774 A-F 6 892 436 c) fair value reserve 0 628 352 A.1 628 352 d) special activities reserve 9 626 707 0 9 626 707 e) general loan reserve 2 736 047 0 2 736 047 47 698 379 44 211 957 10. Profit for the financial period 1 184 147 623 088 A-F 1 807 235 Total equity attributable to the equity holders of the Bank 67 718 327 11. Equity attributable to non-controlling interests 924 846 - 857 280 E 67 566 TOTAL EQUITY 71 506 507 67 785 893 TOTAL LIABILITIES AND EQUITY 562 406 541 610 440 029 Analytical report as at 30 June 2018 | 11

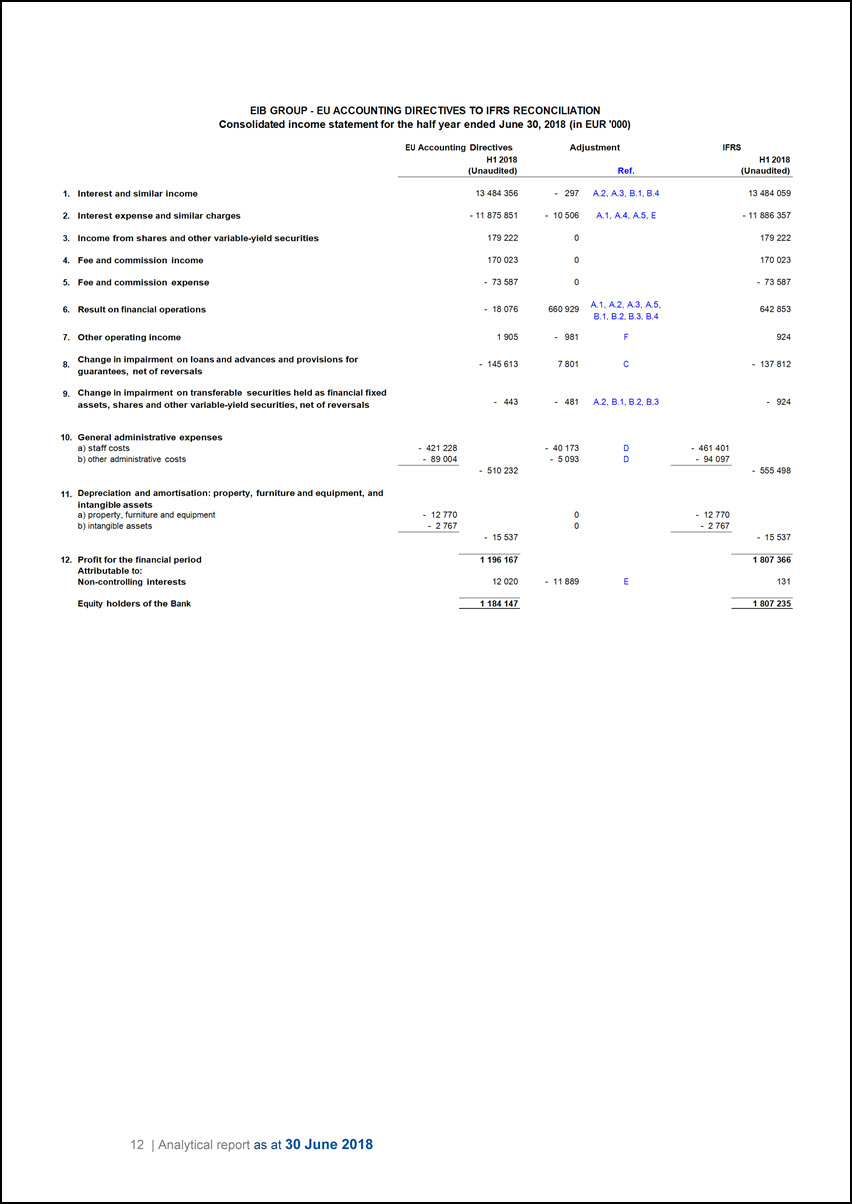

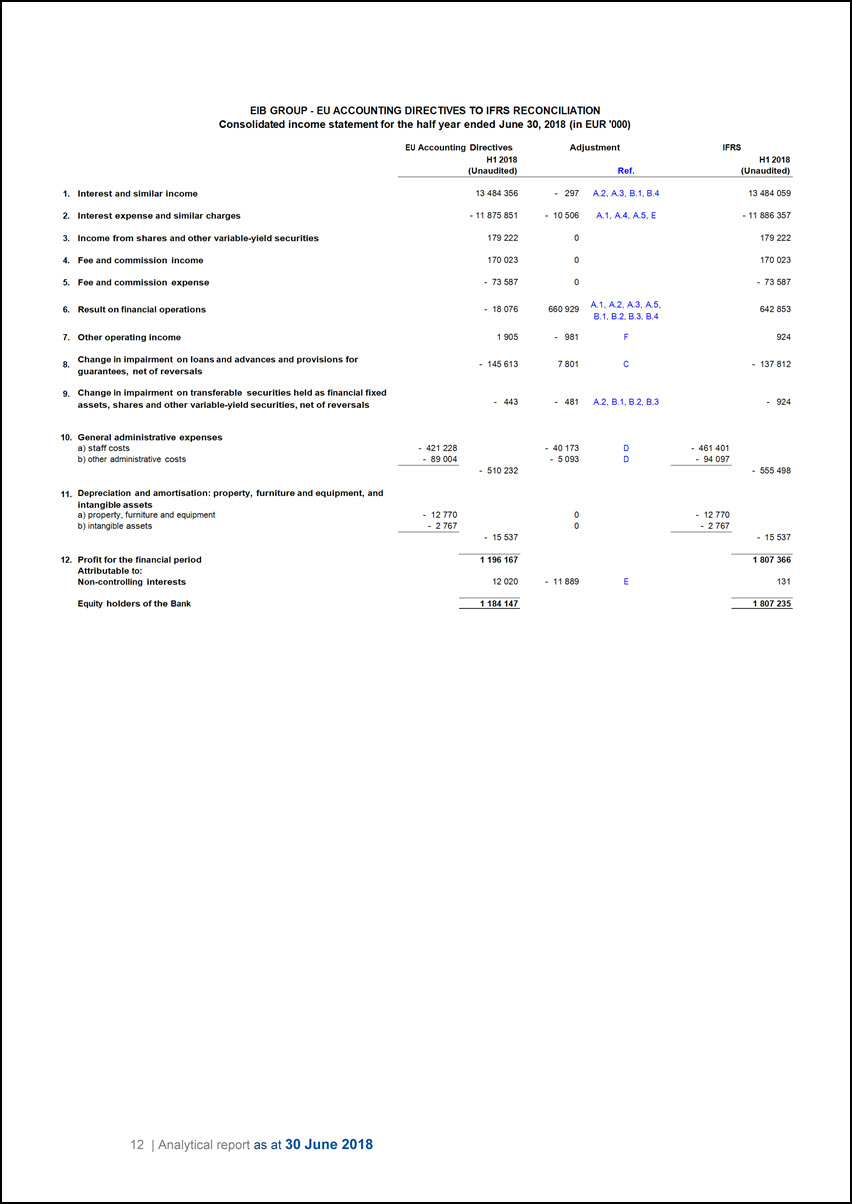

EIB GROUP - EU ACCOUNTING DIRECTIVES TO IFRS RECONCILIATION Consolidated income statement for the half year ended June 30, 2018 (in EUR ‘000) EU Accounting Directives H1 2018 (Unaudited) Adjustment Ref. IFRS H1 2018 (Unaudited) 1. Interest and similar income 13 484 356 -297 A.2, A.3, B.1, B.4 13 484 059 2. Interest expense and similar charges - 11 875 851 - 10 506 A.1, A.4, A.5, E - 11 886 357 3. Income from shares and other variable-yield securities 179 222 0 179 222 4. Fee and commission income 170 023 0 170 023 5. Fee and commission expense - 73 587 0 - 73 587 6. Result on financial operations - 18 076 660 929 A.1, A.2, A.3, A.5, B.1, B.2, B.3, B.4 642 853 7. Other operating income 1 905 -981 F 924 8. Change in Impairment on loans and advances and provisions for guarantees, net of reversals - 145 613 7 801 C - 137 812 9. Change in impairment on transferable securities held as financial fixed assets, shares and other variable-yield securities, net of reversals - 443 - 481 A.2, B.1, B.2, B.3 - 924 10. General administrative expenses a) staff costs - 421 228 - 40 173 D - 461 401 b) other administrative costs - 89 004 - 5 093 D - 94 097 - 510 232 - 555 498 11. Depreciation and amortisation: property, furniture and equipment, and intangible assets a) property, furniture and equipment - 12 770 0 - 12 770 b) intangible assets - 2 767 0 - 2 767 - 15 537 - 15 537 12. Profit for the financial period 1 196 167 1 807 366 Attributable to: Non-controlling interests 12 020 - 11 889 E 131 Equity holders of the Bank 1 184 147 1 807 235 12 | Analytical report as at 30 June 2018

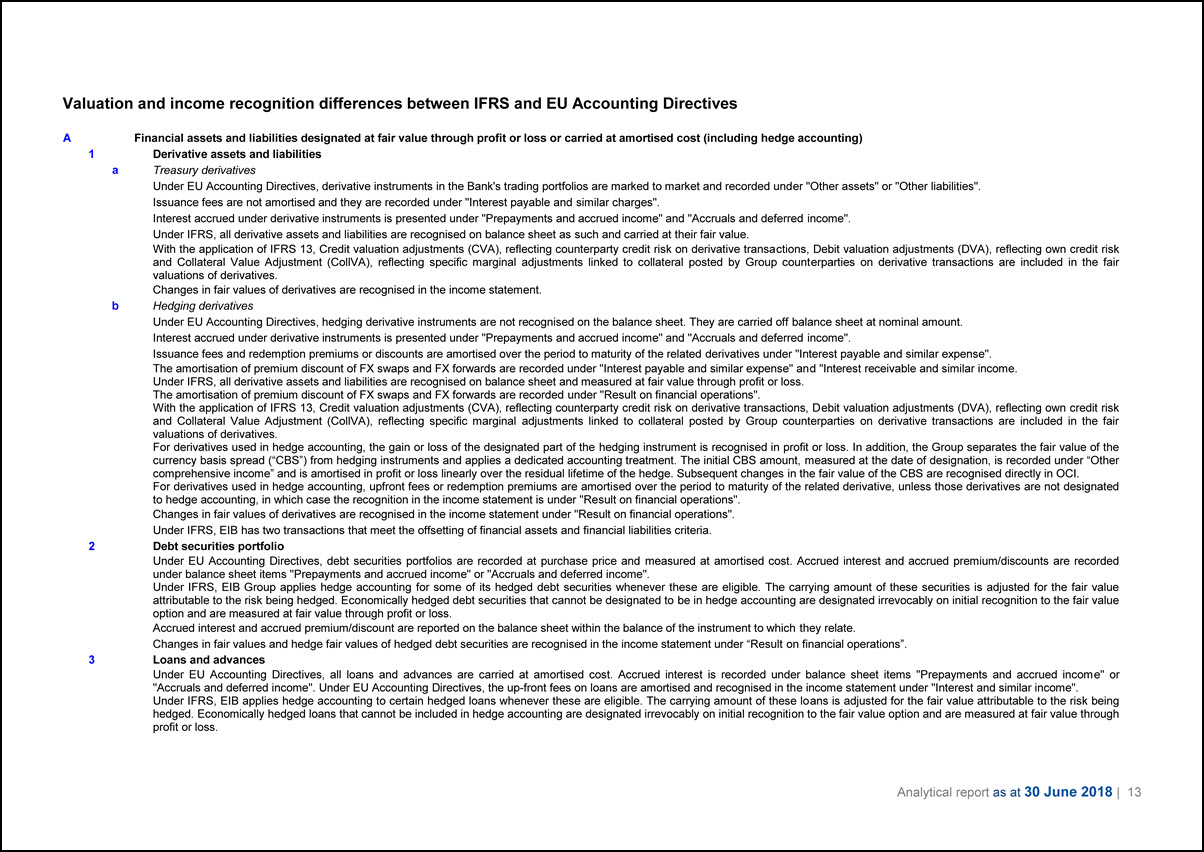

Valuation and income recognition differences between IFRS and EU Accounting Directives A Financial assets and liabilities designated at fair value through profit or loss or carried at amortised cost (including hedge accounting) 1 Derivative assets and liabilities a Treasury derivatives Under EU Accounting Directives, derivative instruments in the Bank’s trading portfolios are marked to market and recorded under “Other assets” or “Other liabilities”. Issuance fees are not amortised and they are recorded under “Interest payable and similar charges”. Interest accrued under derivative instruments is presented under “Prepayments and accrued income” and “Accruals and deferred income”. Under IFRS, all derivative assets and liabilities are recognised on balance sheet as such and carried at their fair value. With the application of IFRS 13, Credit valuation adjustments (CVA), reflecting counterparty credit risk on derivative transactions, Debit valuation adjustments (DVA), reflecting own credit risk and Collateral Value Adjustment (CollVA), reflecting specific marginal adjustments linked to collateral posted by Group counterparties on derivative transactions are included in the fair valuations of derivatives. Changes in fair values of derivatives are recognised in the income statement. b Hedging derivatives Under EU Accounting Directives, hedging derivative instruments are not recognised on the balance sheet. They are carried off balance sheet at nominal amount. Interest accrued under derivative instruments is presented under “Prepayments and accrued income” and “Accruals and deferred income”. Issuance fees and redemption premiums or discounts are amortised over the period to maturity of the related derivatives under “Interest payable and similar expense”. The amortisation of premium discount of FX swaps and FX forwards are recorded under “Interest payable and similar expense” and “Interest receivable and similar income. Under IFRS, all derivative assets and liabilities are recognised on balance sheet and measured at fair value through profit or loss. The amortisation of premium discount of FX swaps and FX forwards are recorded under “Result on financial operations”. With the application of IFRS 13, Credit valuation adjustments (CVA), reflecting counterparty credit risk on derivative transactions, Debit valuation adjustments (DVA), reflecting own credit risk and Collateral Value Adjustment (CollVA), reflecting specific marginal adjustments linked to collateral posted by Group counterparties on derivative transactions are included in the fair valuations of derivatives. For derivatives used in hedge accounting, the gain or loss of the designated part of the hedging instrument is recognised in profit or loss. In addition, the Group separates the fair value of the currency basis spread (“CBS”) from hedging instruments and applies a dedicated accounting treatment. The initial CBS amount, measured at the date of designation, is recorded under “Other comprehensive income” and is amortised in profit or loss linearly over the residual lifetime of the hedge. Subsequent changes in the fair value of the CBS are recognised directly in OCI. For derivatives used in hedge accounting, upfront fees or redemption premiums are amortised over the period to maturity of the related derivative, unless those derivatives are not designated to hedge accounting, in which case the recognition in the income statement is under “Result on financial operations”. Changes in fair values of derivatives are recognised in the income statement under “Result on financial operations”. Under IFRS, EIB has two transactions that meet the offsetting of financial assets and financial liabilities criteria. 2 Debt securities portfolio Under EU Accounting Directives, debt securities portfolios are recorded at purchase price and measured at amortised cost. Accrued interest and accrued premium/discounts are recorded under balance sheet items “Prepayments and accrued income” or “Accruals and deferred income”. Under IFRS, EIB Group applies hedge accounting for some of its hedged debt securities whenever these are eligible. The carrying amount of these securities is adjusted for the fair value attributable to the risk being hedged. Economically hedged debt securities that cannot be designated to be in hedge accounting are designated irrevocably on initial recognition to the fair value option and are measured at fair value through profit or loss. Accrued interest and accrued premium/discount are reported on the balance sheet within the balance of the instrument to which they relate. Changes in fair values and hedge fair values of hedged debt securities are recognised in the income statement under “Result on financial operations”. 3 Loans and advances Under EU Accounting Directives, all loans and advances are carried at amortised cost. Accrued interest is recorded under balance sheet items “Prepayments and accrued income” or “Accruals and deferred income”. Under EU Accounting Directives, the up-front fees on loans are amortised and recognised in the income statement under “Interest and similar income”. Under IFRS, EIB applies hedge accounting to certain hedged loans whenever these are eligible. The carrying amount of these loans is adjusted for the fair value attributable to the risk being hedged. Economically hedged loans that cannot be included in hedge accounting are designated irrevocably on initial recognition to the fair value option and are measured at fair value through profit or loss. Analytical report as at 30 June 2018 | 13

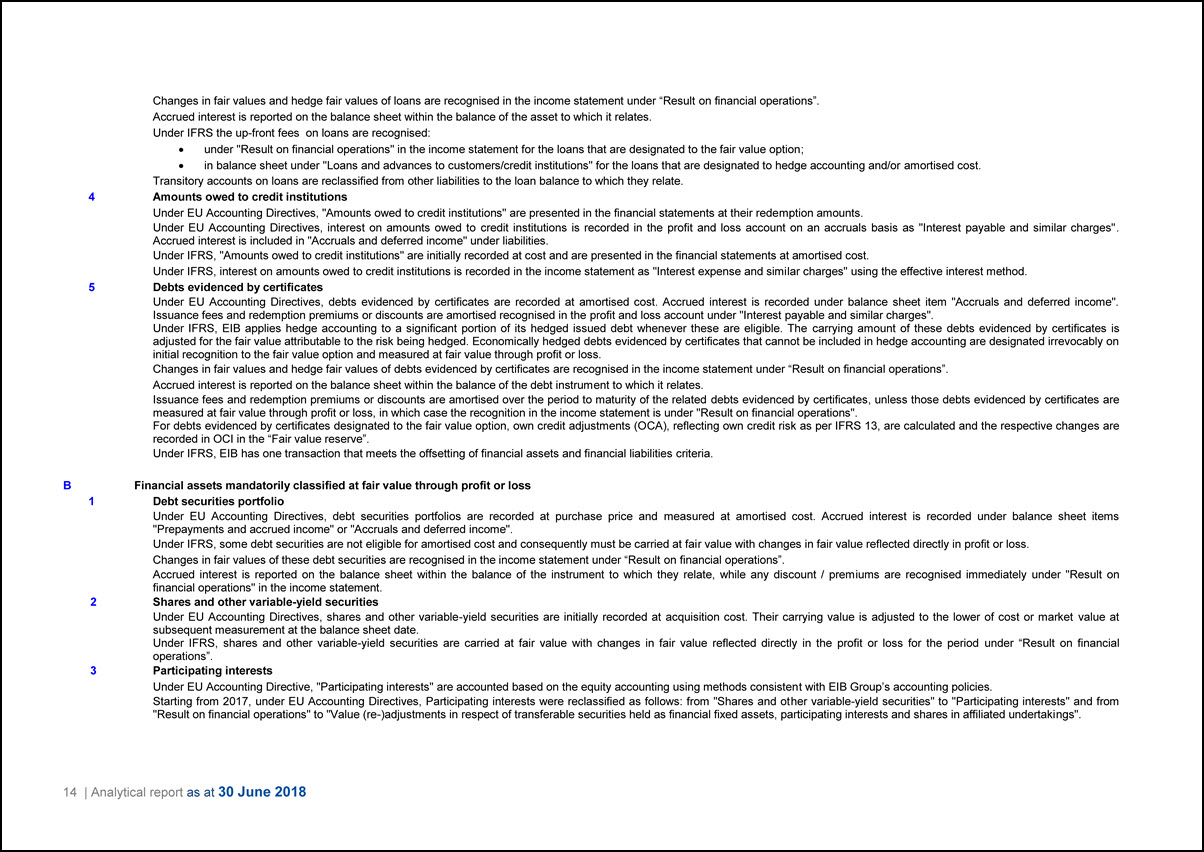

Changes in fair values and hedge fair values of loans are recognised in the income statement under “Result on financial operations”. Accrued interest is reported on the balance sheet within the balance of the asset to which it relates. Under IFRS the up-front fees on loans are recognised: · under “Result on financial operations” in the income statement for the loans that are designated to the fair value option; · in balance sheet under “Loans and advances to customers/credit institutions” for the loans that are designated to hedge accounting and/or amortised cost. Transitory accounts on loans are reclassified from other liabilities to the loan balance to which they relate. 4 Amounts owed to credit institutions Under EU Accounting Directives, “Amounts owed to credit institutions” are presented in the financial statements at their redemption amounts. Under EU Accounting Directives, interest on amounts owed to credit institutions is recorded in the profit and loss account on an accruals basis as “Interest payable and similar charges”. Accrued interest is included in “Accruals and deferred income” under liabilities. Under IFRS, “Amounts owed to credit institutions” are initially recorded at cost and are presented in the financial statements at amortised cost. Under IFRS, interest on amounts owed to credit institutions is recorded in the income statement as “Interest expense and similar charges” using the effective interest method. 5 Debts evidenced by certificates Under EU Accounting Directives, debts evidenced by certificates are recorded at amortised cost. Accrued interest is recorded under balance sheet item “Accruals and deferred income”. Issuance fees and redemption premiums or discounts are amortised recognised in the profit and loss account under “Interest payable and similar charges”. Under IFRS, EIB applies hedge accounting to a significant portion of its hedged issued debt whenever these are eligible. The carrying amount of these debts evidenced by certificates is adjusted for the fair value attributable to the risk being hedged. Economically hedged debts evidenced by certificates that cannot be included in hedge accounting are designated irrevocably on initial recognition to the fair value option and measured at fair value through profit or loss. Changes in fair values and hedge fair values of debts evidenced by certificates are recognised in the income statement under “Result on financial operations”. Accrued interest is reported on the balance sheet within the balance of the debt instrument to which it relates. Issuance fees and redemption premiums or discounts are amortised over the period to maturity of the related debts evidenced by certificates, unless those debts evidenced by certificates are measured at fair value through profit or loss, in which case the recognition in the income statement is under “Result on financial operations”. For debts evidenced by certificates designated to the fair value option, own credit adjustments (OCA), reflecting own credit risk as per IFRS 13, are calculated and the respective changes are recorded in OCI in the “Fair value reserve”. Under IFRS, EIB has one transaction that meets the offsetting of financial assets and financial liabilities criteria. B Financial assets mandatorily classified at fair value through profit or loss 1 Debt securities portfolio Under EU Accounting Directives, debt securities portfolios are recorded at purchase price and measured at amortised cost. Accrued interest is recorded under balance sheet items “Prepayments and accrued income” or “Accruals and deferred income”. Under IFRS, some debt securities are not eligible for amortised cost and consequently must be carried at fair value with changes in fair value reflected directly in profit or loss. Changes in fair values of these debt securities are recognised in the income statement under “Result on financial operations”. Accrued interest is reported on the balance sheet within the balance of the instrument to which they relate, while any discount / premiums are recognised immediately under “Result on financial operations” in the income statement. 2 Shares and other variable-yield securities Under EU Accounting Directives, shares and other variable-yield securities are initially recorded at acquisition cost. Their carrying value is adjusted to the lower of cost or market value at subsequent measurement at the balance sheet date. Under IFRS, shares and other variable-yield securities are carried at fair value with changes in fair value reflected directly in the profit or loss for the period under “Result on financial operations”. 3 Participating interests Under EU Accounting Directive, “Participating interests” are accounted based on the equity accounting using methods consistent with EIB Group’s accounting policies. Starting from 2017, under EU Accounting Directives, Participating interests were reclassified as follows: from “Shares and other variable-yield securities” to “Participating interests” and from “Result on financial operations” to “Value (re-)adjustments in respect of transferable securities held as financial fixed assets, participating interests and shares in affiliated undertakings”. 14 | Analytical report as at 30 June 2018

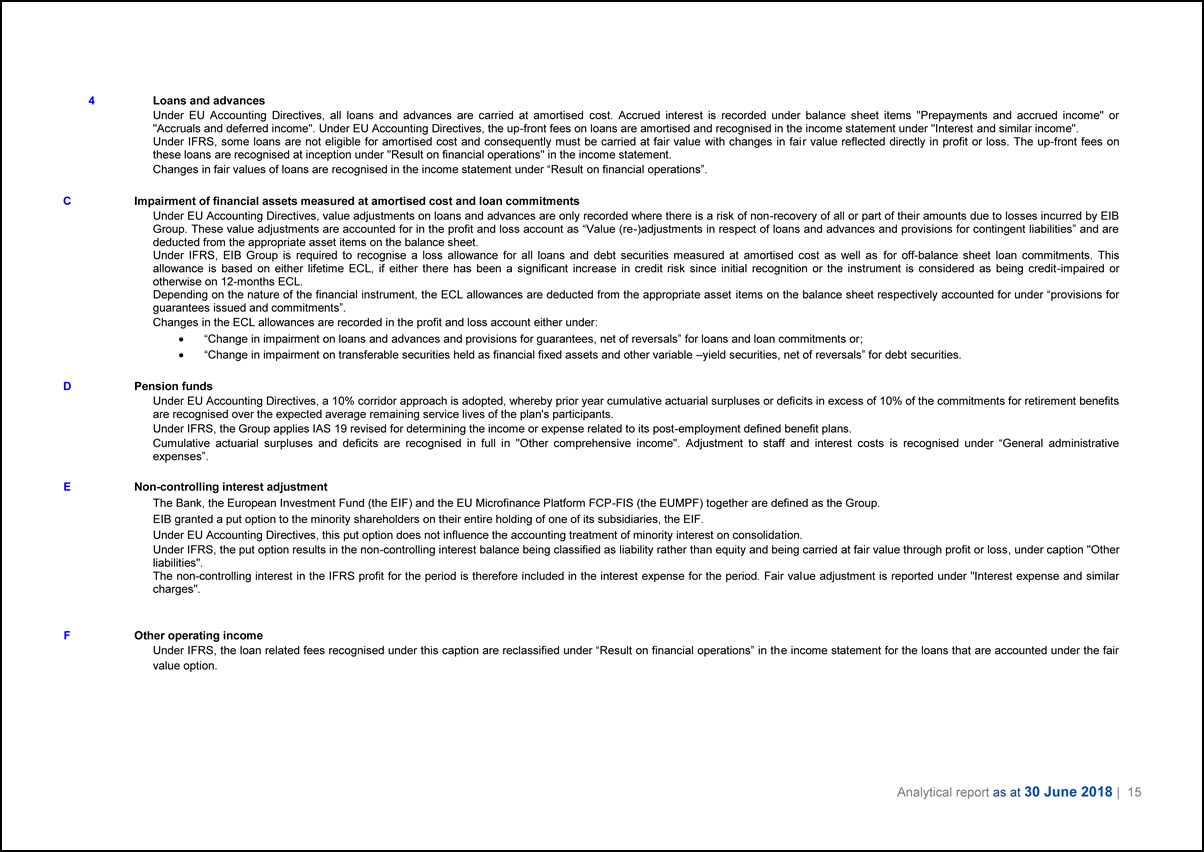

4 Loans and advances Under EU Accounting Directives, all loans and advances are carried at amortised cost. Accrued interest is recorded under balance sheet items “Prepayments and accrued income” or “Accruals and deferred income”. Under EU Accounting Directives, the up-front fees on loans are amortised and recognised in the income statement under “Interest and similar income”. Under IFRS, some loans are not eligible for amortised cost and consequently must be carried at fair value with changes in fair value reflected directly in profit or loss. The up-front fees on these loans are recognised at inception under “Result on financial operations” in the income statement. Changes in fair values of loans are recognised in the income statement under “Result on financial operations”. C Impairment of financial assets measured at amortised cost and loan commitments Under EU Accounting Directives, value adjustments on loans and advances are only recorded where there is a risk of non-recovery of all or part of their amounts due to losses incurred by EIB Group. These value adjustments are accounted for in the profit and loss account as “Value (re-) adjustments in respect of loans and advances and provisions for contingent liabilities” and are deducted from the appropriate asset items on the balance sheet. Under IFRS, EIB Group is required to recognise a loss allowance for all loans and debt securities measured at amortised cost as well as for off-balance sheet loan commitments. This allowance is based on either lifetime ECL, if either there has been a significant increase in credit risk since initial recognition or the instrument is considered as being credit-impaired or otherwise on 12-months ECL. Depending on the nature of the financial instrument, the ECL allowances are deducted from the appropriate asset items on the balance sheet respectively accounted for under “provisions for guarantees issued and commitments”. Changes in the ECL allowances are recorded in the profit and loss account either under: · “Change in impairment on loans and advances and provisions for guarantees, net of reversals” for loans and loan commitments or; · “Change in impairment on transferable securities held as financial fixed assets and other variable –yield securities, net of reversals” for debt securities. D Pension funds Under EU Accounting Directives, a 10% corridor approach is adopted, whereby prior year cumulative actuarial surpluses or deficits in excess of 10% of the commitments for retirement benefits are recognised over the expected average remaining service lives of the plan’s participants. Under IFRS, the Group applies IAS 19 revised for determining the income or expense related to its post-employment defined benefit plans. Cumulative actuarial surpluses and deficits are recognised in full in “Other comprehensive income”. Adjustment to staff and interest costs is recognised under “General administrative expenses”. E Non-controlling interest adjustment The Bank, the European Investment Fund (the EIF) and the EU Microfinance Platform FCP-FIS (the EUMPF) together are defined as the Group. EIB granted a put option to the minority shareholders on their entire holding of one of its subsidiaries, the EIF. Under EU Accounting Directives, this put option does not influence the accounting treatment of minority interest on consolidation. Under IFRS, the put option results in the non-controlling interest balance being classified as liability rather than equity and being carried at fair value through profit or loss, under caption “Other liabilities”. The non-controlling interest in the IFRS profit for the period is therefore included in the interest expense for the period. Fair value adjustment is reported under “Interest expense and similar charges”. F Other operating income Under IFRS, the loan related fees recognised under this caption are reclassified under “Result on financial operations” in the income statement for the loans that are accounted under the fair value option. Analytical report as at 30 June 2018 | 15

EIB GROUP CONSOLIDATED BALANCE SHEET AS AT JUNE 30, 2018 UNDER EU ACCOUNTING DIRECTIVES (in EUR ‘000) ASSETS 30.06.2018 (Unaudited) 31.12.2017 1. Cash in hand, balances with central banks and post office banks 188 300 162 483 2. Treasury bills and other bills eligible for refinancing with central banks 40 534 688 41 508 248 3. Loans and advances to credit institutions a) repayable on demand 2 688 198 937 805 b) other loans and advances 47 184 532 33 898 199 c) loans 116 020 046 121 560 358 d) value adjustments - 20 338 0 165 872 438 156 396 362 4. Loans and advances to customers a) other loans and advances 796 687 1 741 983 b) loans 315 173 144 313 620 389 c) value adjustments - 570 956 - 465 507 315 398 875 314 896 865 5. Debt securities including fixed-income securities a) issued by public bodies 4 211 621 7 024 316 b) issued by other borrowers 11 124 169 8 647 411 15 335 790 15 671 727 6. Shares and other variable-yield securities 5 676 519 5 035 790 7. Participating interests 277 812 263 453 8. Intangible assets 23 105 21 264 9. Tangible assets 261 734 265 338 10. Other assets 170 407 162 310 11. Subscribed capital and reserves, called but not paid 0 25 983 12. Prepayments and accrued income 18 666 873 16 596 171 TOTAL ASSETS 562 406 541 551 005 994 LIABILITIES 30.06.2018 (Unaudited) 31.12.2017 1. Amounts owed to credit institutions a) repayable on demand 4 629 562 4 953 852 b) with agreed maturity or periods of notice 13 698 57 475 4 643 260 5 011 327 2. Amounts owed to customers a) repayable on demand 1 849 156 1 922 566 b) with agreed maturity or periods of notice 10 998 8 349 3. Debts evidenced by certificates a) debt securities in issue 447 277 715 435 730 418 b) others 13 804 150 13 854 945 461 081 865 449 585 363 4. Other liabilities 756 261 854 828 5. Accruals and deferred income 19 608 145 20 531 793 6. Provisions a) pension plans and health insurance scheme 2 904 925 2 766 138 b) provision for guarantees issued 45 424 23 460 2 950 349 2 789 598 7. Subscribed capital a) subscribed 243 284 155 243 284 155 b) uncalled - 221 585 020 - 221 585 020 21 699 135 21 699 135 8. Reserves a) reserve fund 24 328 415 24 328 415 b) additional reserves 11 007 210 10 312 322 c) special activities reserve 9 626 707 7 504 091 d) general loan reserve 2 736 047 2 700 556 47 698 379 44 845 384 9. Profit for the financial period 1 184 147 2 858 647 10. Equity attributable to minority interest 924 846 899 004 TOTAL LIABILITIES 562 406 541 551 005 994 16 | Analytical report as at 30 June 2018

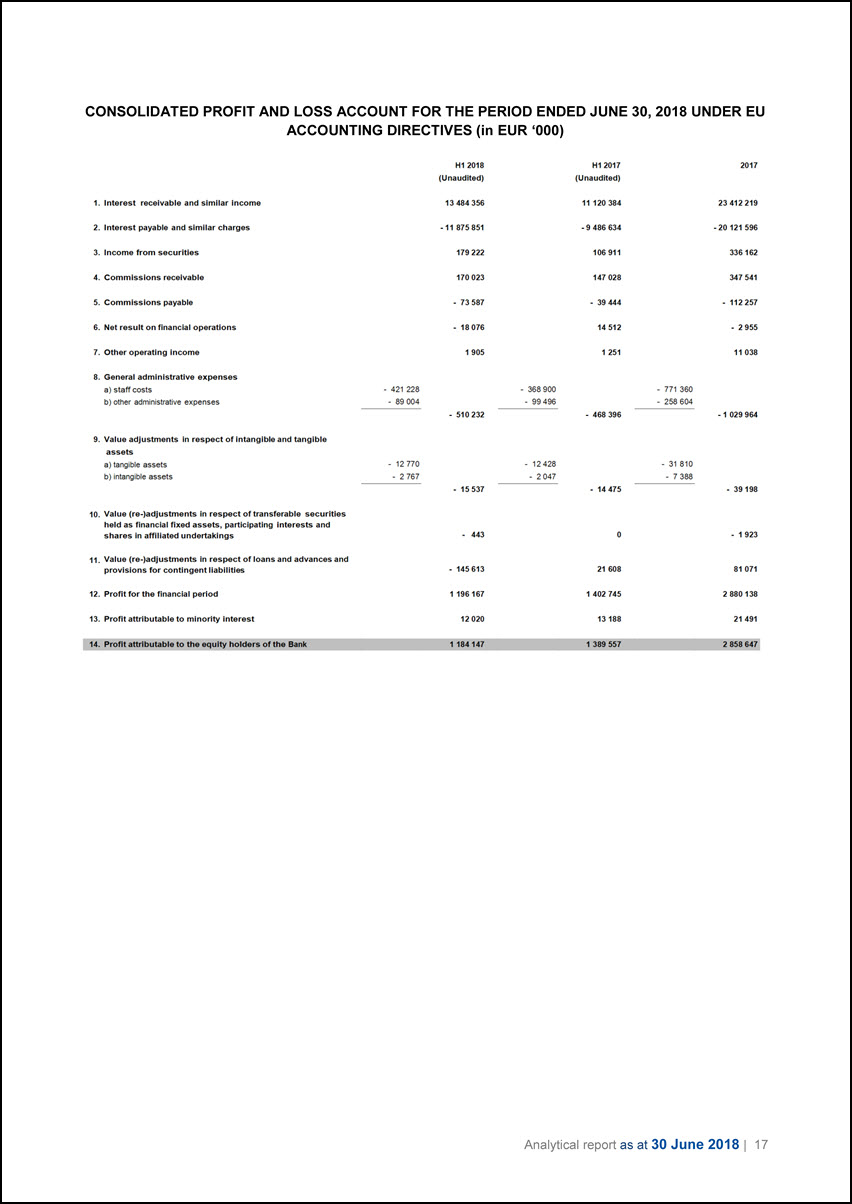

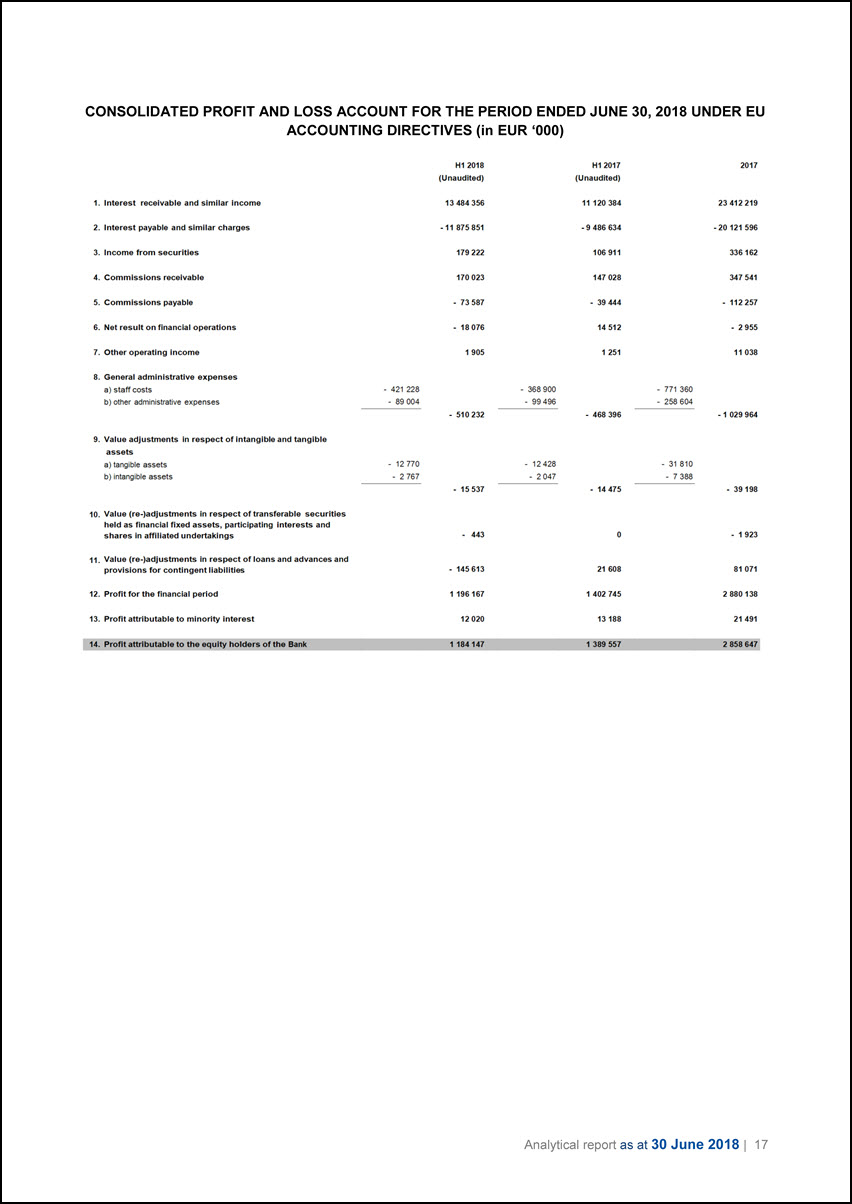

CONSOLIDATED PROFIT AND LOSS ACCOUNT FOR THE PERIOD ENDED JUNE 30, 2018 UNDER EU ACCOUNTING DIRECTIVES (in EUR ‘000) H1 2018 (Unaudited) H1 2017 (Unaudited) 2017 1. Interest receivable and similar income 13 484 356 11 120 384 23 412 219 2. Interest payable and similar charges - 11 875 851 - 9 486 634 - 20 121 596 3. Income from securities 179 222 106 911 336 162 4. Commissions receivable 170 023 147 028 347 541 5. Commissions payable - 73 587 - 39 444 - 112 257 6. Net result on financial operations - 18 076 14 512 - 2 955 7. Other operating income 1 905 1 251 11 038 8. General administrative expenses a) staff costs - 421 228 - 368 900 - 771 360 b) other administrative expenses - 89 004 -·99 496 - 258 604 - 510 232 - 468 396 - 1 029 964 9. Value adjustments in respect of intangible and tangible assets a) tangible assets - 12770 - 12 428 - 31 810 b) intangible assets - 2 767 - 2 047 - 7 388 - 15 537 - 14 475 – 39 198 10. Value (re-)adjustments in respect of transferable securities held as financial fixed assets, participating interests and shares in affiliated undertakings - 443 0 - 1 923 11. Value (re-)adjustments in respect of loans and advances and provisions for contingent liabilities - 145 613 21 608 81 071 12. Profit for the financial period 1 196 167 1 402 745 2 880 138 13. Profit attributable to minority interest 12 020 13 188 21 491 14. Profit attributable to the equity holders of the Bank 1 184 147 1 389 557 2 858 647 Analytical report as at 30 June 2018 | 17

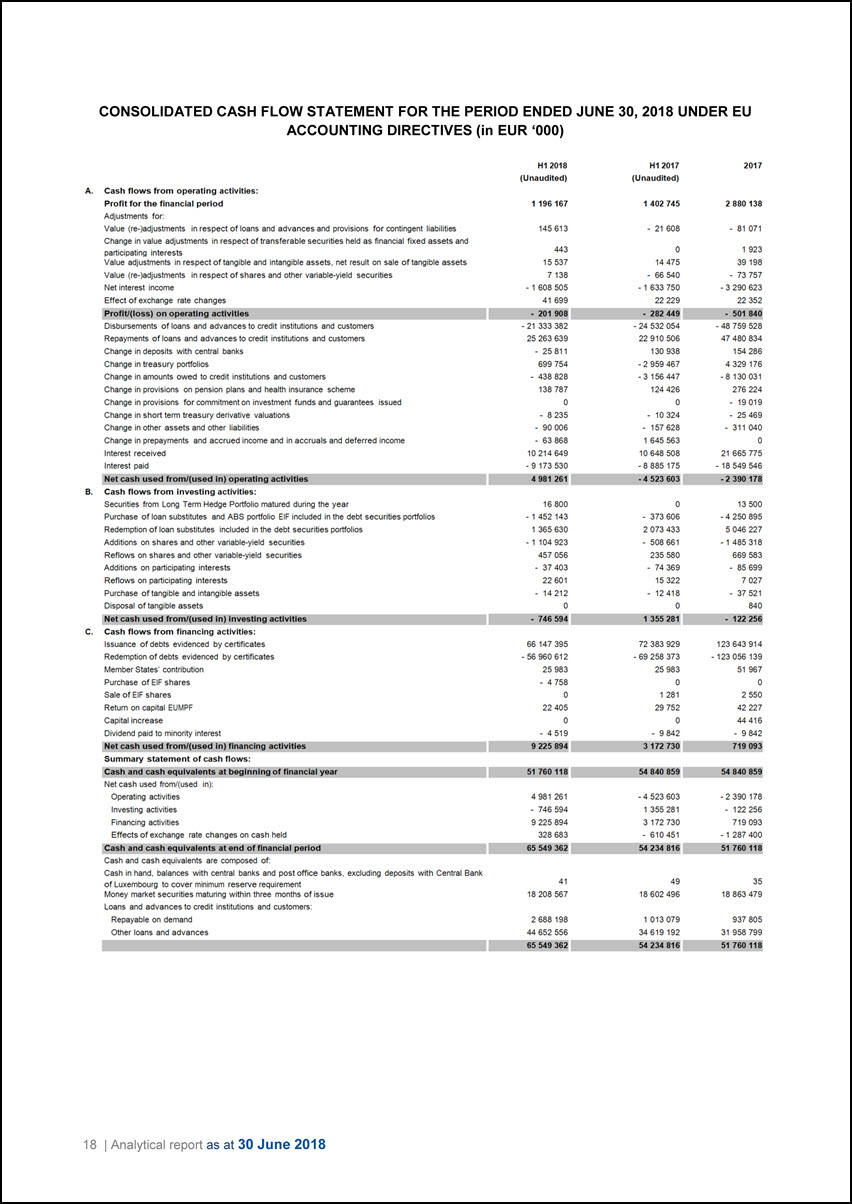

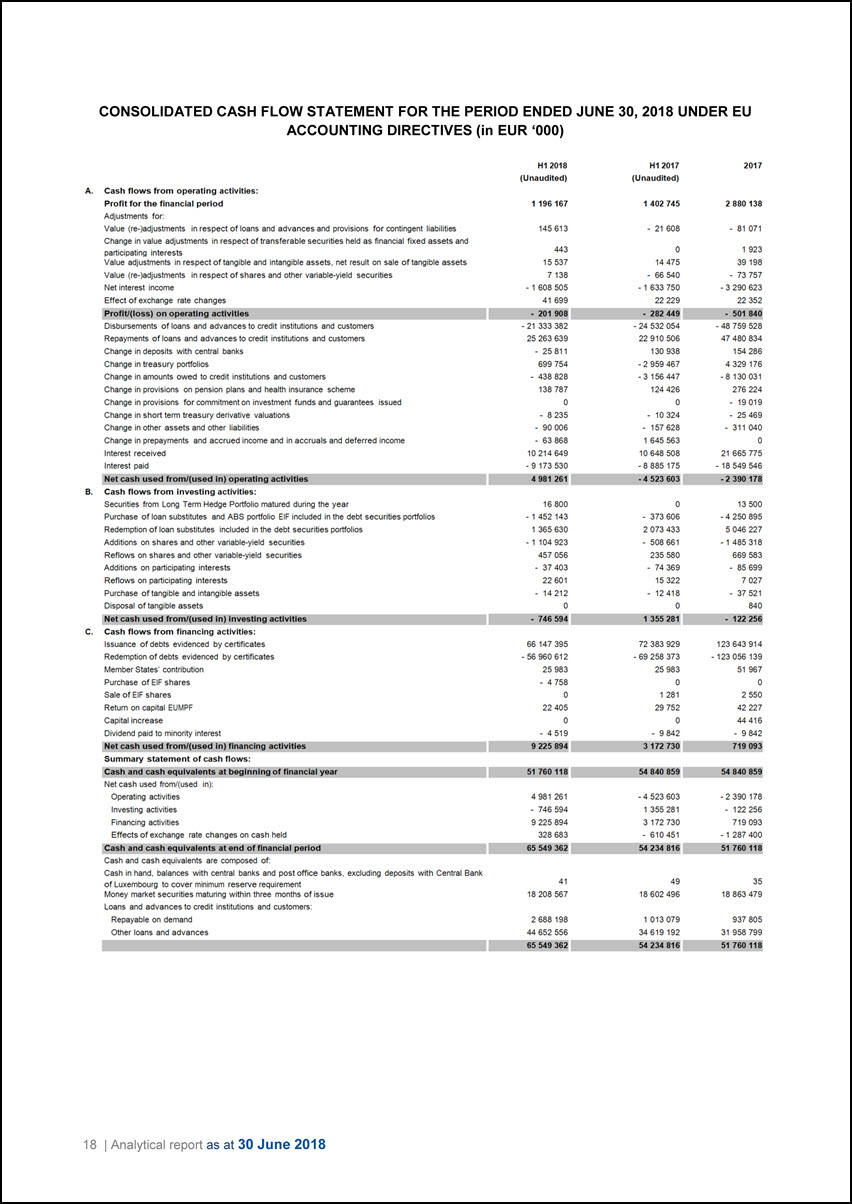

CONSOLIDATED CASH FLOW STATEMENT FOR THE PERIOD ENDED JUNE 30, 2018 UNDER EU ACCOUNTING DIRECTIVES (in EUR ‘000) H1 2018 (Unaudited) H1 2017 (Unaudited) 2017 A. Cash flows from operating activities: Profit for the financial period 1 196 167 1 402 745 2 880 138 Adjustments for: Value (re-)adjustments in respect of loans and advances and provisions for contingent liabilities 145 613 - 21 608 - 81 071 Change in value adjustments in respect of transferable securities held as financial fixed assets and participating interests 443 0 1 923 Value adjustments in respect of tangible and intangible assets, net result on sale of tangible assets 15 537 14 475 39 198 Value (re-)adjustments in respect of shares and other variable-yield securities 7 138 - 66 540 - 73 757 Net interest income - 1 608 505 - 1 633 750 - 3 290 623 Effect of exchange rate changes 41 699 22 229 22 352 Profit(loss) on operating activities - 201 908 - 282 449 - 501 840 Disbursements of loans and advances to credit institutions and customers - 21 333 382 - 24 532 054 - 48 759 528 Repayments of loans and advances to credit institutions and customers 25 263 639 22 910 506 47 480 834 Change in deposits with central banks - 25 811 130 938 154 286 Change in treasury portfolios 699 754 - 2 959 467 4 329 176 Change in amounts owed to credit institutions and customers - 438 828 -3 156 447 - 8 130 031 Change in provisions on pension plans and health insurance scheme 138 787 124 426 276 224 Change in provisions for commitment on investment funds and guarantees issued 0 0 - 19 019 Change in short term treasury derivative valuations - 8 235 - 10 324 - 25 469 Change in other assets and other liabilities - 90 006 - 157 628 - 311 040 Change in prepayments and accrued income and in accruals and deferred income - 63 868 1 645 563 0 Interest received 10 214 649 10 648 508 21 665 775 Interest paid - 9 173 530 - 8 885 175 - 18 549 546 Net cash used from/(used in) operating activities 4 981 261 - 4 523 603 - 2 390 178 B. Cash flows from Investing activities: Securities from Long Term Hedge Portfolio matured during the year 16 800 0 13 500 Purchase of loan substitutes and ABS portfolio EIF included in the debt securities portfolios - 1 452 143 - 373 606 - 4 250 895 Redemption of loan substitutes included in the debt securities portfolios 1 365 630 2 073 433 5 046 227 Additions on shares and other variable-yield securities - 1 104 923 - 508 661 - 1 485 318 Reflows on shares and other variable-yield securities 457 056 235 580 669 583 Additions on participating interests - 37 403 - 74 369 - 85 699 Reflows on participating interests 22 601 15 322 7 027 Purchase of tangible and intangible assets - 14 212 - 12 418 - 37 521 Disposal of tangible assets 0 0 840 Net cash used from/(used in) investing activities - 746 594 1 355 281 - 122 256 C. Cash flows from financing activities: Issuance of debts evidenced by certificates 66 147 395 72 383 929 123 643 914 Redemption of debts evidenced by certificates - 56 960 612 - 69 258 373 - 123 056 139 Member States, contribution 25 983 25 983 51 967 Purchase of EIF shares - 4 758 0 0 Sale of EIF shares 0 1 281 2 550 Return on capital EUMPF 22 405 29 752 42 227 Capital increase 0 0 44 416 Dividend paid to minority interest - 4 519 - 9 842 - 9 842 Net cash used from/(used in) financing activities 9 225 894 3 172 730 719 093 Summary statement of cash flows: Cash and cash equivalents at beginning of financial year 51 760 118 54 840 859 54 840 859 Net cash used from/(used in): Operating activities 4 981 261 - 4 523 603 - 2 390 178 Investing activities - 746 594 1 355 281 - 122 256 Financing activities 9 225 894 3 172 730 719 093 Effects of exchange rate changes on cash held 328 683 - 610 451 - 1 287 400 Cash and cash equivalents at end of financial period 65 549 362 54 234 816 51 760 118 Cash and cash equivalents are composed of: Cash in hand, balances with central banks and post office banks, excluding deposits with Central Bank of Luxembourg to cover minimum reserve requirement 41 49 35 Money market securities maturing within three months of issue 18 208 567 18 602 496 18 863 479 Loans and advances to credit institutions and customers: Repayable on demand 2 688 198 1 013 079 937 805 Other loans and advances 44 652 556 34 619 192 31 958 799 65 549 362 54 234 816 51 760 118 18 | Analytical report as at 30 June 2018

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS UNDER EU ACCOUNTING DIRECTIVES NOTE A Basis of presentation The unaudited condensed consolidated financial statements of the European Investment Bank (the “Bank”) as at June 30, 2018 do not include all of the information and footnotes required for complete financial statements. In the opinion of management, all adjustments, normal recurring accruals and adjustments for the impairment of financial assets considered necessary for a fair presentation have been recorded. The profit for the six-month period ended June 30, 2018 is not necessarily indicative of the results that may be expected for the year ending December 31, 2018. The audited consolidated financial statements as at and for the year ended December 31, 2017 were prepared in accordance with the general principles of the Directive 86/635/EEC of the Council of the European Communities of 8 December 1986 on the annual accounts and consolidated accounts of banks and other financial institutions, as amended by Directive 2001/65/EC of 27 September 2001, by Directive 2003/51/EC of 18 June 2003 and by Directive 2006/46/EC of 14 June 2006. The unaudited condensed consolidated financial statements as at and for the period ended June 30, 2018 are based on the same principles. For further information, refer to the consolidated financial statements and footnotes thereto included in the Bank’s annual report for the year ended December 31, 2017. NOTE B Summary statement of loans (in EUR ‘000) Analysis of aggregate loans granted (before specific provisions) as at June 30, 2018 To intermediary credit institutions Directly to final beneficiaries Total - Disbursed portion 116 020 046 315 173 144 431 193 190 - Undisbursed portion 28 193 284 78 711 694 106 904 978 Aggregate loans granted 144 213 330 393 884 838 538 098 168 Analysis of aggregate loans granted (before specific provisions) as at December 31, 2017 To intermediary credit institutions Directly to final beneficiaries Total - Disbursed portion 121 560 358 313 620 389 435 180 747 - Undisbursed portion 28 890 536 84 037 546 112 928 082 Aggregate loans granted 150 450 894 397 657 935 548 108 829 Analytical report as at 30 June 2018 | 19

At the end of June 2018 and December 2017, the stake of the United Kingdom in the subscribed capital of the Bank amounted to EUR 39.2bn, out of which EUR 3.5bn have been paid-in. The disbursed exposure on borrowers located in the United Kingdom through the EIB’s lending activities, including guarantees and equity type investments, amounted to EUR 37.0bn as at June 30, 2018 (December 31, 2017: EUR 37.0bn), while the exposure on foreign borrowers with a guarantor from the United Kingdom amounted to EUR 1.5bn (December 31, 2017: EUR 1.5bn). The Bank had no direct exposure to the United Kingdom acting as borrower at the end of June 2018 whereas disbursed loans guaranteed by the United Kingdom amounted to EUR 2.1bn as at June 30, 2018 (December 31, 2017: EUR 2.0bn). The Bank will provide further updates on the subject as developments necessitate. 20 | Analytical report as at 30 June 2018

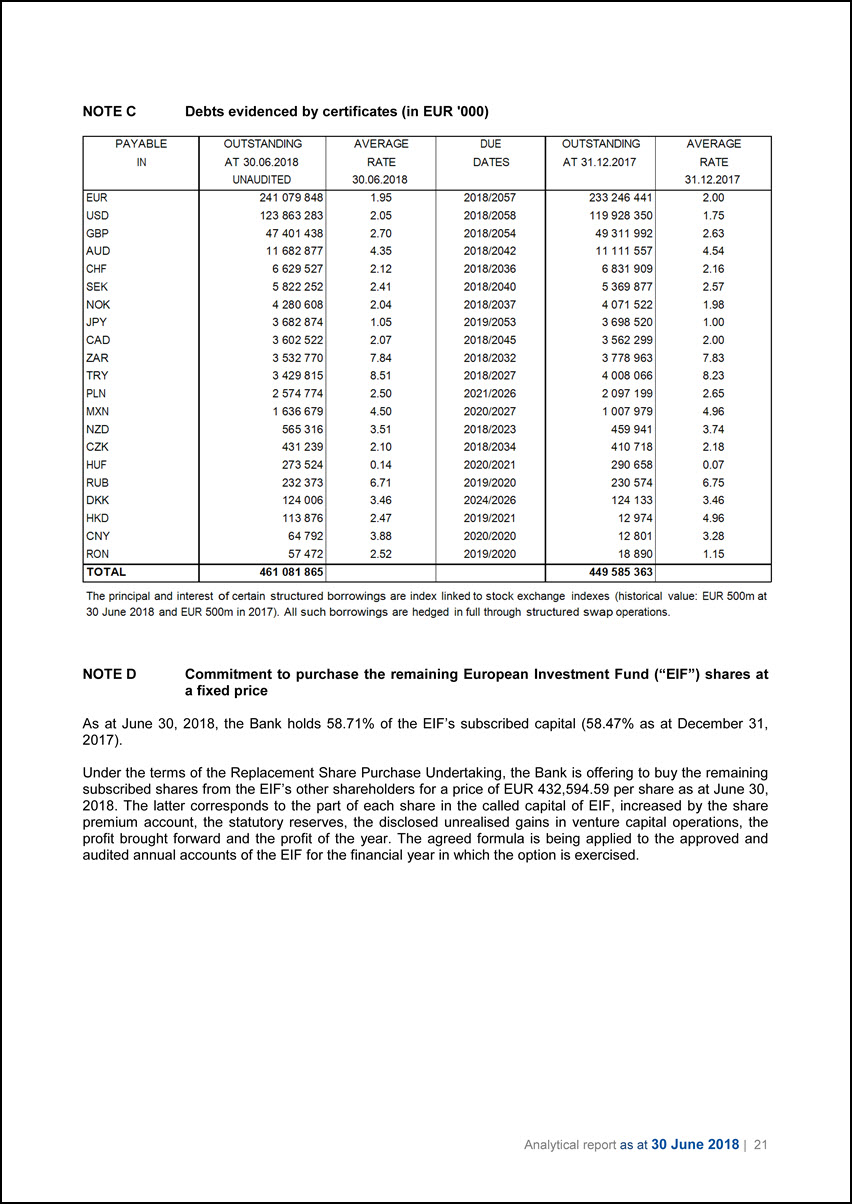

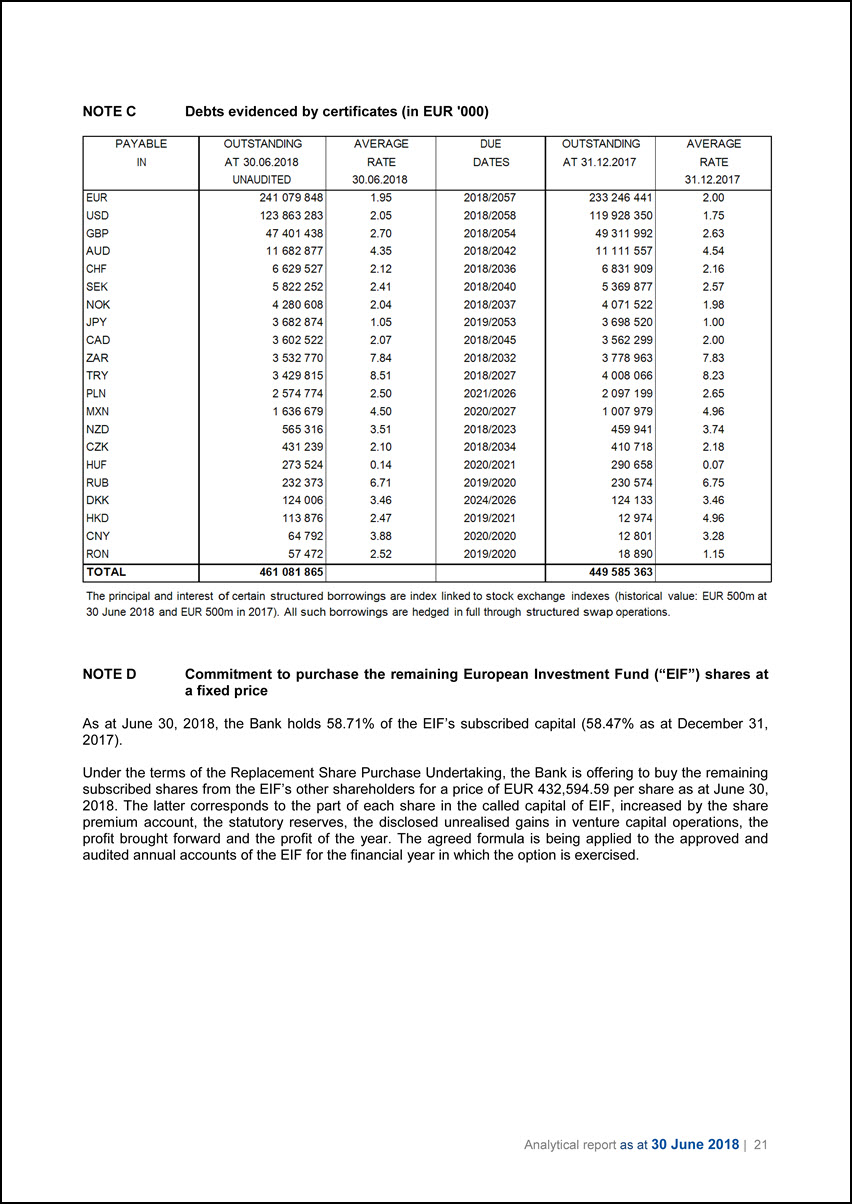

NOTE C Debts evidenced by certificates (in EUR ‘000) PAYABLE IN OUTSTANDING AT 30.06.2018 UNAUDITED AVERAGE RATE 30.06.2018 DUE DATES OUTSTANDING AT 31.12.2017 AVERAGE RATE 31.12.2017 EUR 241 079 848 1.95 2018/2057 233 246 441 2.00 USD 123 863 283 2.05 2018/2058 119 928 350 1.75 GBP 47 401 438 2.70 2018/2054 49 311 992 2.63 AUD 11 682 877 4.35 2018/2042 11 111 557 4.54 CHF 6 629 527 2.12 2018/2036 6 831 909 2.16 SEK 5 822 252 2.41 2018/2040 5 369 877 2.57 NOK 4 280 608 2.04 2018/2037 4 071 522 1.98 JPY 3 682 874 1.05 2019/2053 3 698 520 1.00 CAD 3 602 522 2.07 2018/2045 3 562 299 2.00 ZAR 3 532 770 7.84 2018/2032 3 778 963 7.83 TRY 3 429 815 8.51 2018/2027 4 008 066 8.23 PLN 2 574 774 2.50 2021/2026 2 097 199 2.65 MXN 1 636 679 4.50 2020/2027 1 007 979 4.96 NZD 565 316 3.51 2018/2023 459 941 3.74 CZK 431 239 2.10 2018/2034 410 718 2.18 HUF 273 524 0.14 2020/2021 290 658 0.07 RUB 232 373 6.71 2019/2020 230 574 6.75 DKK 124 006 3.46 2024/2026 124 133 3.46 HKD 113 876 2.47 2019/2021 12 974 4.96 CNY 64 792 3.88 2020/2020 12 801 3.28 RON 57 472 2.52 2019/2020 18 890 1.15 TOTAL 461 081 865 449 585 363 The principal and interest of certain structured borrowings are index linked to stock exchange indexes (historical value: EUR 500m at 30 June 2018 and EUR 500m in 2017). All such borrowings are hedged in full through structured swap operations. NOTE D Commitment to purchase the remaining European Investment Fund (“EIF”) shares at a fixed price As at June 30, 2018, the Bank holds 58.71% of the EIF’s subscribed capital (58.47% as at December 31, 2017). Under the terms of the Replacement Share Purchase Undertaking, the Bank is offering to buy the remaining subscribed shares from the EIF’s other shareholders for a price of EUR 432,594.59 per share as at June 30, 2018. The latter corresponds to the part of each share in the called capital of EIF, increased by the share premium account, the statutory reserves, the disclosed unrealised gains in venture capital operations, the profit brought forward and the profit of the year. The agreed formula is being applied to the approved and audited annual accounts of the EIF for the financial year in which the option is exercised. Analytical report as at 30 June 2018 | 21

Note E - Commitments, contingent liabilities and other memorandum items (in EUR ‘000) 30.06.2018 (Unaudited) 31.12.2017 Commitments: - Undisbursed loans - credit institutions 28 193 284 28 890 536 - customers 78 711 694 84 037 546 106 904 978 112 928 082 - Undisbursed shares and other variable-yield securities - Undisbursed venture capital operations 5 238 674 5 323 061 - Undisbursed investment funds 2 741 312 2 649 089 - EBRD capital uncalled 712 630 712 630 8 692 616 8 684 780 - Undisbursed participating interests - Undisbursed venture capital operations 600 197 600 531 600 197 600 531 - Borrowings launched but not yet settled 5 074 482 279 008 - Securities receivable 2 404 727 419 864 Contingent liabilities and guarantees: - In respect of loans granted by third parties 16 315 406 15 810 651 Assets held on behalf of third parties: - Investment Facility - Cotonou 2 949 300 3 024 653 - Guarantee Fund 2 536 336 2 560 762 - NER300 2 087 886 2 086 410 - InnovFin 951 440 941 251 - RSFF (incl. RSI) 755 382 762 989 - EU-Africa Infrastructure Trust Fund 591 962 594 869 - JESSICA (Holding Funds) 580 426 975 912 - CEF (incl. former PBI and LGTT) 528 030 523 636 - Funds of Funds (JESSICA II) 455 643 419 539 - JEREMIE 352 890 335 889 - GF Greece 308 825 307 794 - ESIF 302 550 270 451 - Special Section 281 035 301 039 - COSME LGF & EFG 242 780 243 949 - SME initiative Italy 179 815 180 442 - MAP Equity 148 192 83 512 - GIF 2007 134 150 82 575 - ENPI 122 145 124 540 - DCFTA 103 098 103 070 - SME initiative Bulgaria 100 318 94 635 - SME initiative Romania 91 654 91 396 - SMEG 2007 90 028 90 098 - AECID 72 841 71 766 - EaSI 72 606 55 790 - WB EDIF 54 748 50 715 - InnovFin SME Guarantee 47 887 86 811 - FEMIP Trust Fund 47 832 49 128 - GAGF 45 817 47 359 - NIF Trust Fund 45 099 46 485 - SME initiative Finland 39 627 37 238 - HIPC 35 393 35 408 - MAP guarantee 32 337 32 425 - Private Finance for Energy Efficiency Instrument 30 594 31 235 - EPTA Trust Fund 21 977 22 754 - Cultural Creative Sectors Guarantee Facility 20 355 17 377 - NIF Risk Capital Facility 19 951 19 546 - IPA II 14 571 18 435 22 | Analytical report as at 30 June 2018

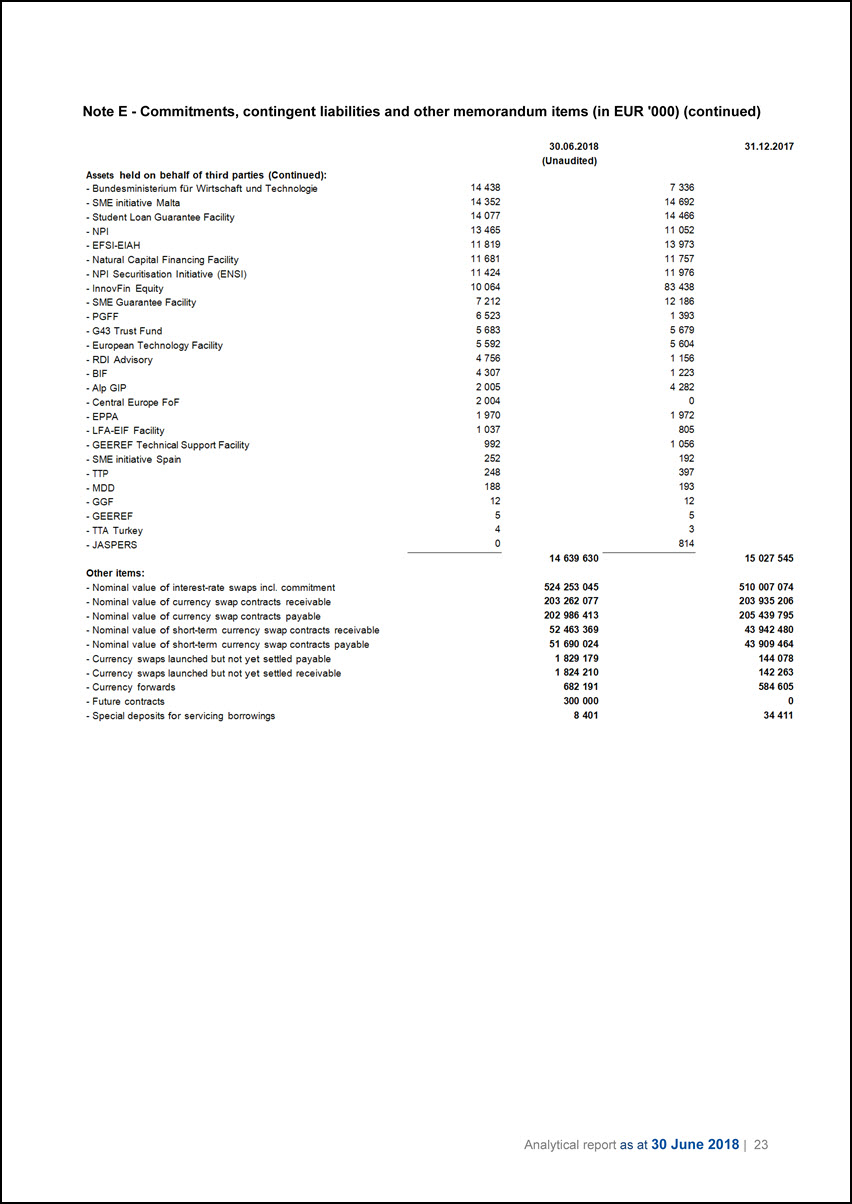

Note E - Commitments, contingent liabilities and other memorandum items (in EUR ‘000) (continued) 30.06.2018 (Unaudited) 31.12.2017 Assets held on behalf of third parties (Continued): - Bundesministerium fur Wirtschaft und Technologie 14 438 7 336 - SME initiative Malta 14 352 14 692 - Student Loan Guarantee Facility 14 077 14 466 - NPI 13 465 11 052 - EFSI-EIAH 11 819 13 973 - Natural Capital Financing Facility 11 681 11 757 - NPI Securitisation Initiative (ENSI) 11 424 11 976 - InnovFin Equity 10 064 83 438 - SME Guarantee Facility 7 212 12 186 - PGFF 6 523 1 393 - G43 Trust Fund 5 683 5 679 - European Technology Facility 5 592 5 604 - RDI Advisory 4 756 1 156 - BIF 4 307 1 223 - Alp GIP 2 005 4 282 - Central Europe FoF 2 004 0 - EPPA 1 970 1 972 - LFA-EIF Facility 1 037 805 - GEEREF Technical Support Facility 992 1 056 - SME initiative Spain 252 192 - TTP 248 397 - MDD 188 193 - GGF 12 12 - GEEREF 5 5 - TTA Turkey 4 3 - JASPERS 0 814 14 639 630 15 027 545 Other items: - Nominal value of interest-rate swaps incl. commitment 524 253 045 510 007 074 - Nominal value of currency swap contracts receivable 203 262 077 203 935 206 - Nominal value of currency swap contracts payable 202 986 413 205 439 795 - Nominal value of short-term currency swap contracts receivable 52 463 369 43 942 480 - Nominal value of short-term currency swap contracts payable 51 690 024 43 909 464 - Currency swaps launched but not yet settled payable 1 829 179 144 078 - Currency swaps launched but not yet settled receivable 1 824 210 142 263 - Currency forwards 682 191 584 605 - Future contracts 300 000 0 - Special deposits for servicing borrowings 8 401 34 411 Analytical report as at 30 June 2018 | 23

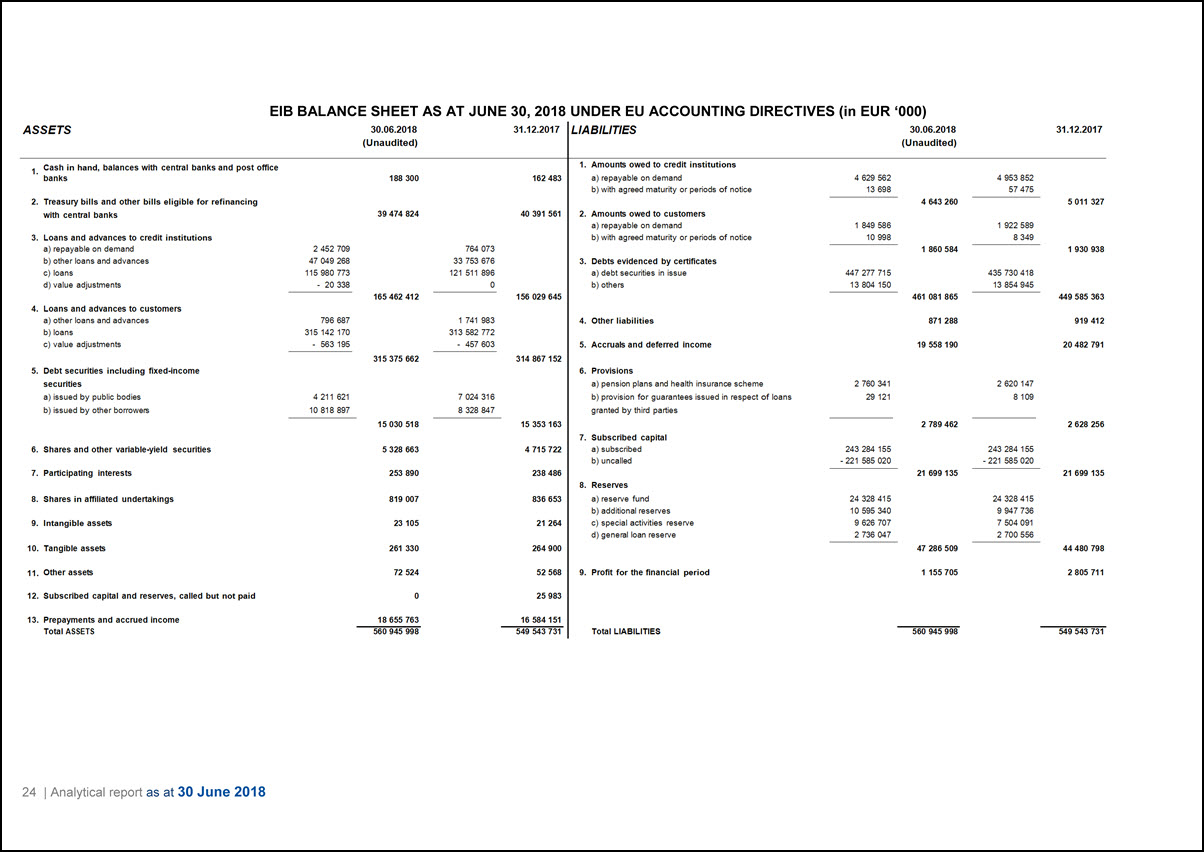

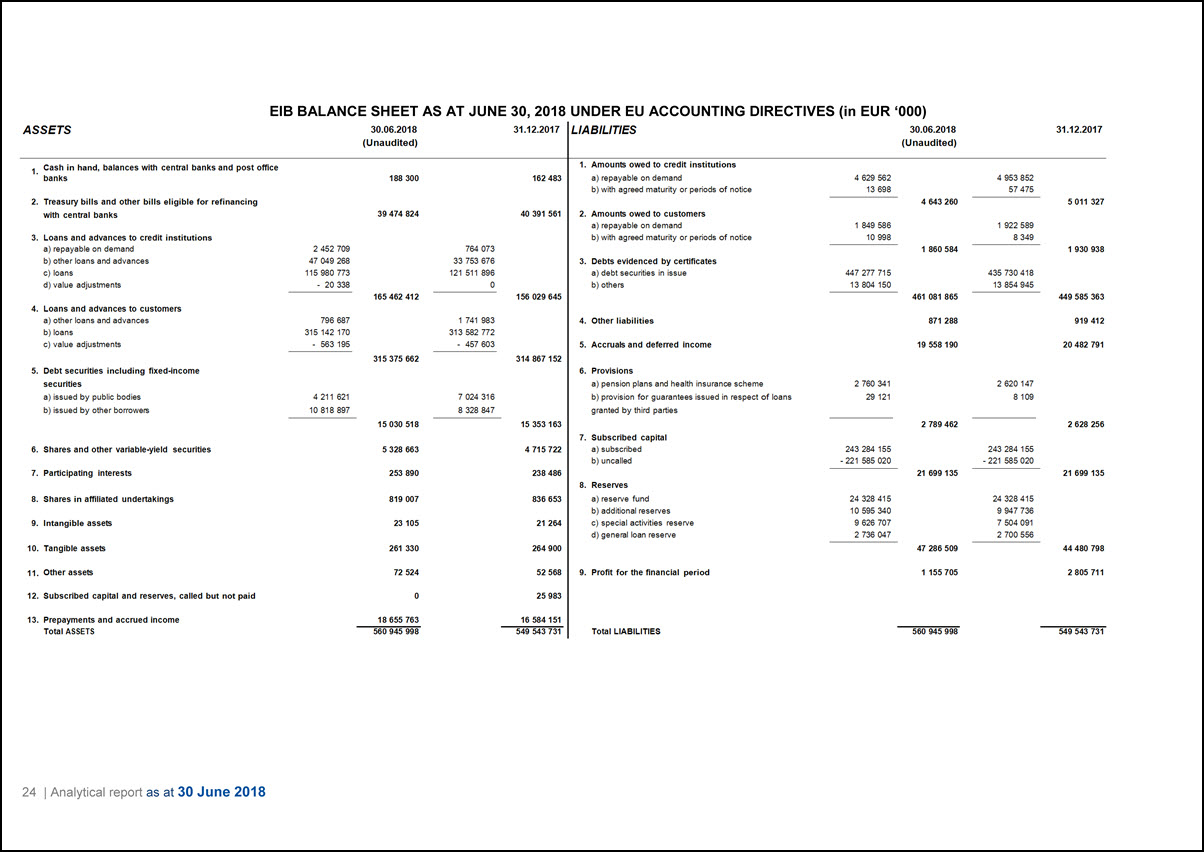

EIB BALANCE SHEET AS AT JUNE 30, 2018 UNDER EU ACCOUNTING DIRECTIVES (in EUR ‘000) ASSETS 30.06.2018 (Unaudited) 31.12.2017 1. Cash in hand, balances with central banks and post office banks 188 300 162 483 2. Treasury bills and other bills eligible for refinancing with central banks 39 474 824 40 391 561 3. Loans and advances to credit institutions a) repayable on demand 2 452 709 764 073 b) other loans and advances 47 049 268 33 753 676 c) loans 115 980 773 121 511 896 d) value adjustments - 20 338 0 165 462 412 156 029 645 4. Loans and advances to customers a) other loans and advances 796 687 1 741 983 b) loans 315 142 170 313 582 772 c) value adjustments - 563 195 - 457 603 315 375 662 314 867 152 5. Debt securities including fixed-income securities a) issued by public bodies 4 211 621 7 024 316 b) issued by other borrowers 10 818 897 8 328 847 15 030 518 15 353 163 6. Shares and other variable-yield securities 5 328 663 4 715 722 7. Participating interests 253 890 238 486 8. Shares in affiliated undertakings 819 007 836 653 9. Intangible assets 23 105 21 264 10. Tangible assets 261 330 264 900 11. Other assets 72 524 52 568 12. Subscribed capital and reserves, called but not paid 0 25 983 13. Prepayments and accrued income 18 655 763 16 584 151 Total ASSETS 560 945 998 549 543 731 LIABILITIES 30.06.2018 (Unaudited) 31.12.2017 1. Amounts owed to credit institutions a) repayable on demand 4 629 562 4 953 852 b) with agreed maturity or periods of notice 13 698 57 475 4 643 260 5 011 327 2. Amounts owed to customers a) repayable on demand 1 849 586 1 922 589 b) with agreed maturity or periods of notice 10 998 8 349 1 860 584 1 930 938 3. Debts evidenced by certificates a) debt securities in issue 447 277 715 435 730 418 b) others 13 804 150 13 854 945 461 081 865 449 585 363 4. Other liabilities 871 288 919 412 5. Accruals and deferred income 19 558 190 20 482 791 6. Provisions a) pension plans and health insurance scheme 2 760 341 2 620 147 b) provision for guarantees issued in respect of loans granted by third parties 29 121 8 109 2 789 462 2 628 256 7. Subscribed capital a) subscribed 243 284 155 243 284 155 b) uncalled - 221 585 020 - 221 585 020 21 699 135 21 699 135 8. Reserves a) reserve fund 24 328 415 24 328 415 b) additional reserves 10 595 340 9 947 736 c) special activities reserve 9 626 707 7 504 091 d) general loan reserve 2 736 047 2 700 556 47 286 509 44 480 798 9. Profit for the financial period 1 155 705 2 805 711 Total LIABILITIES 560 945 998 549 543 731 24 | Analytical report as at 30 June 2018

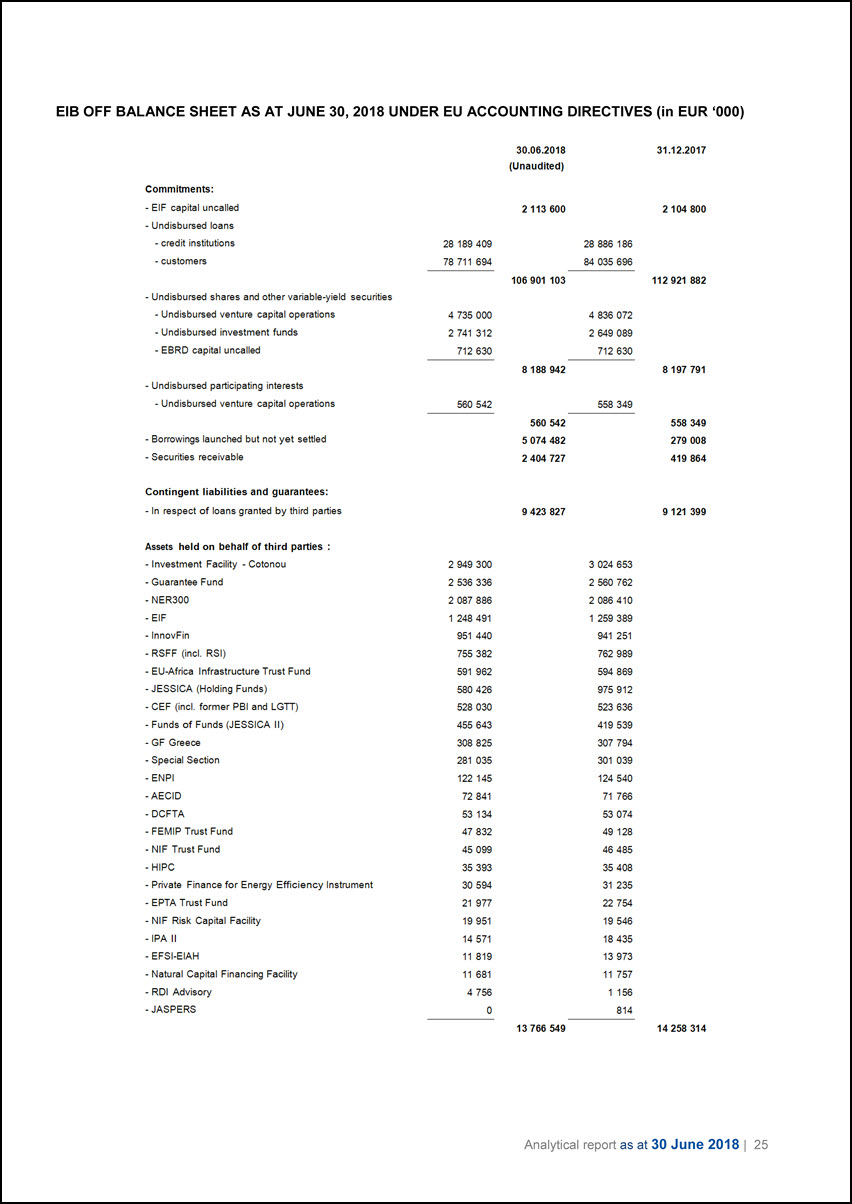

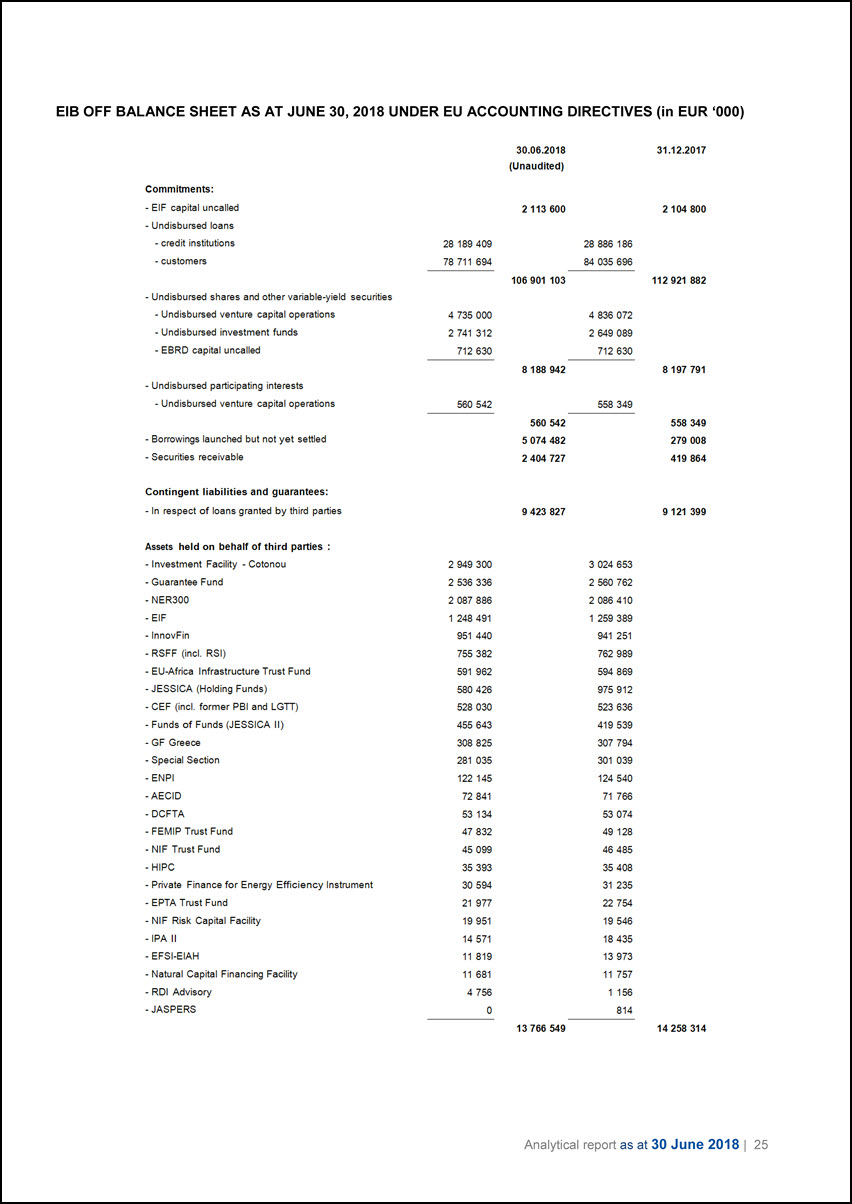

EIB OFF BALANCE SHEET AS AT JUNE 30, 2018 UNDER EU ACCOUNTING DIRECTIVES (in EUR ‘000) 30.06.2018 (Unaudited) 31.12.2017 Commitments: - EIF capital uncalled 2 113 600 2 104 800 - Undisbursed loans - credit institutions 28 189 409 28 886 186 - customers 78 711 694 84 035 696 106 901 103 112 921 882 - Undisbursed shares and other variable-yield securities - Undisbursed venture capital operations 4 735 000 4 836 072 - Undisbursed investment funds 2 741 312 2 649 089 - EBRD capital uncalled 712 630 712 630 8 188 942 8 197 791 - Undisbursed participating interests - Undisbursed venture capital operations 560 542 558 349 560 542 558 349 - Borrowings launched but not yet settled 5 074 482 279 008 - Securities receivable 2 404 727 419 864 Contingent liabilities and guarantees: - In respect of loans granted by third parties 9 423 827 9 121 399 Assets held on behalf of third parties: - Investment Facility - Cotonou 2 949 300 3 024 653 - Guarantee Fund 2 536 336 2 560 762 - NER300 2 087 886 2 086 410 - EIF 1 248 491 1 259 389 - InnovFin 951 440 941 251 - RSFF (incl. RSI) 755 382 762 989 - EU-Africa Infrastructure Trust Fund 591 962 594 869 - JESSICA (Holding Funds) 580 426 975 912 - CEF (incl. former PBI and LGTT) 528 030 523 636 - Funds of Funds (JESSICA II) 455 643 419 539 - GF Greece 308 825 307 794 - Special Section 281 035 301 039 - ENPI 122 145 124 540 - AECID 72 841 71 766 - DCFTA 53 134 53 074 - FEMIP Trust Fund 47 832 49 128 - NIF Trust Fund 45 099 46 485 - HIPC 35 393 35 408 - Private Finance for Energy Efficiency Instrument 30 594 31 235 - EPTA Trust Fund 21 977 22 754 - NIF Risk Capital Facility 19 951 19 546 - IPA II 14 571 18 435 - EFSI-EIAH 11 819 13 973 - Natural Capital Financing Facility 11 681 11 757 - RDI Advisory 4 756 1 156 - JASPERS 0 814 13 766 549 14 258 314 Analytical report as at 30 June 2018 | 25

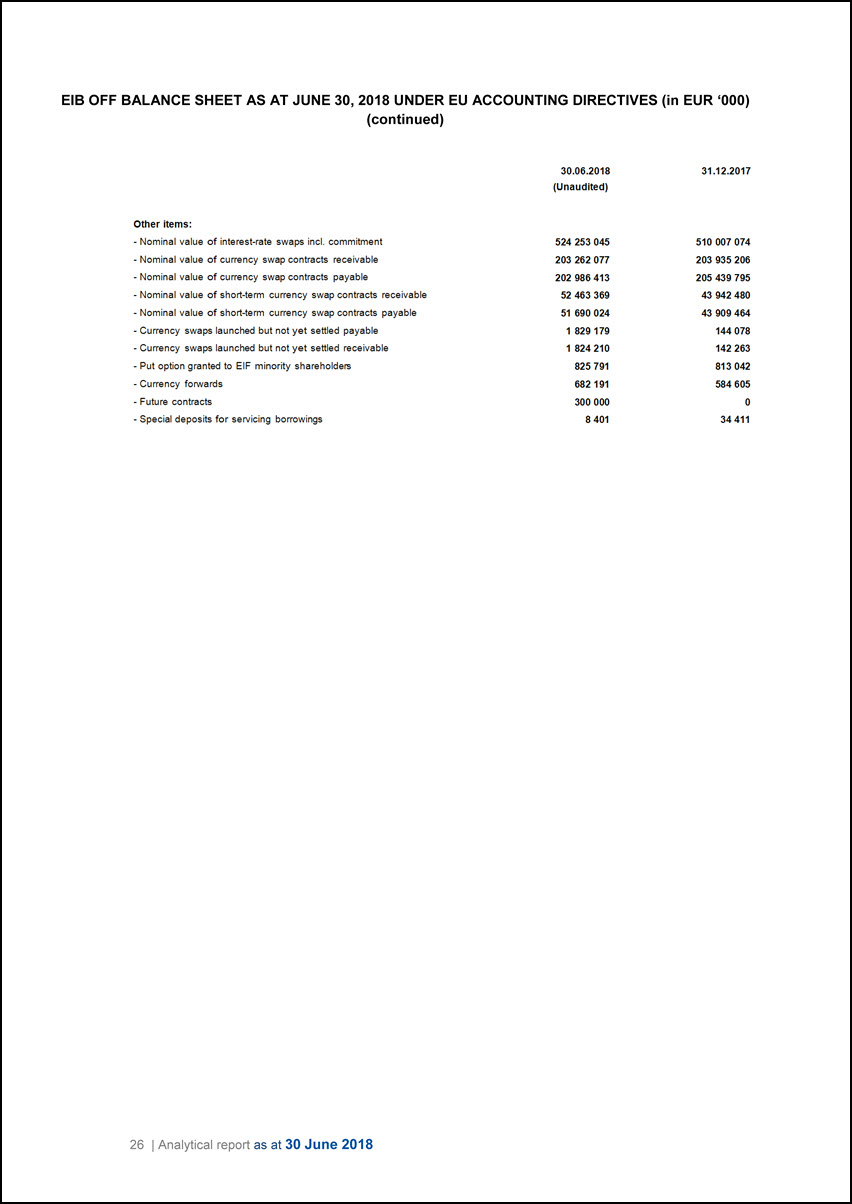

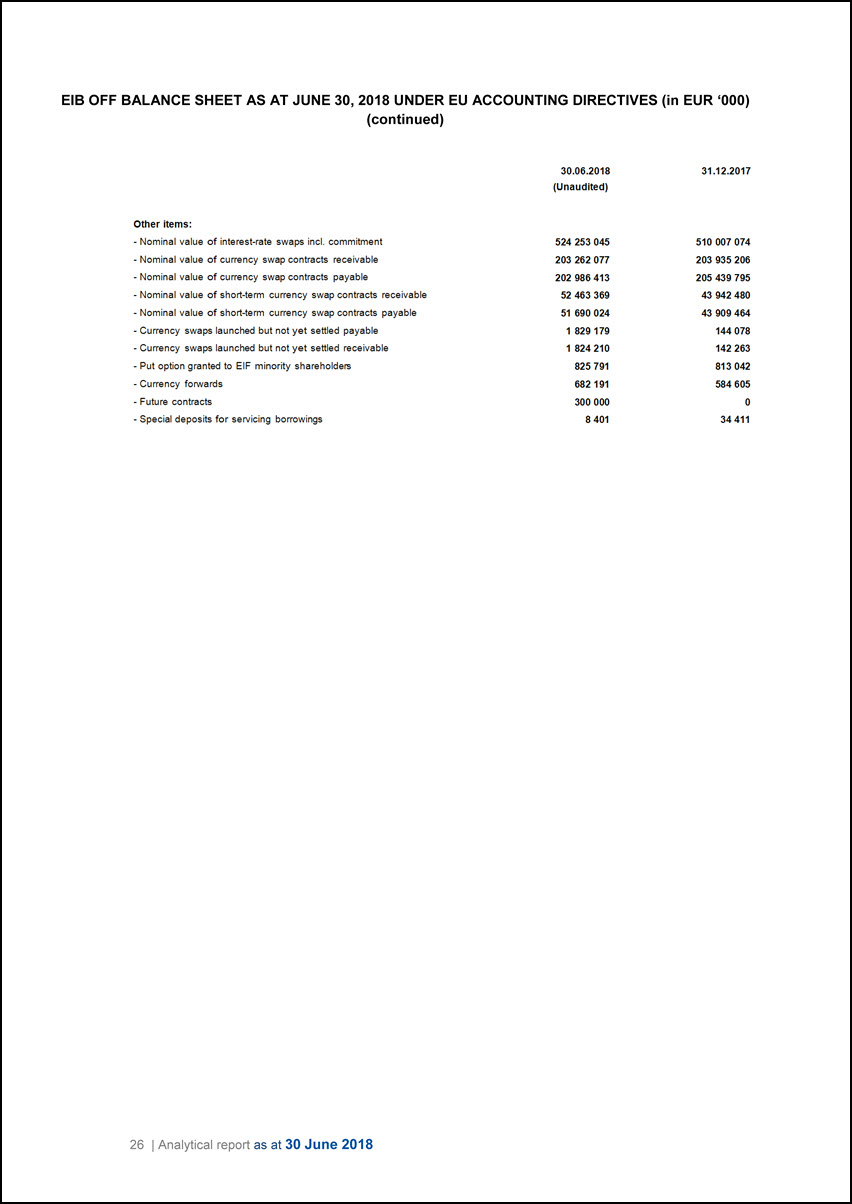

EIB OFF BALANCE SHEET AS AT JUNE 30, 2018 UNDER EU ACCOUNTING DIRECTIVES (in EUR ‘000) (continued) 30.06.2018 (Unaudited) 31.12.2017 Other Items: - Nominal value of interest-rate swaps incl. commitment 524 253 045 510 007 074 - Nominal value of currency swap contracts receivable 203 262 077 203 935 206 - Nominal value of currency swap contracts payable 202 986 413 205 439 795 - Nominal value of short-term currency swap contracts receivable 52 463 369 43 942 480 - Nominal value of short-term currency swap contracts payable 51 690 024 43 909 464 - Currency swaps launched but not yet settled payable 1 829 179 144 078 - Currency swaps launched but not yet settled receivable 1 824 210 142 263 - Put option granted to EIF minority shareholders 825 791 813 042 - Currency forwards 682 191 584 605 - Future contracts 300 000 0 - Special deposits for servicing borrowings 8 401 34 411 26 | Analytical report as at 30 June 2018

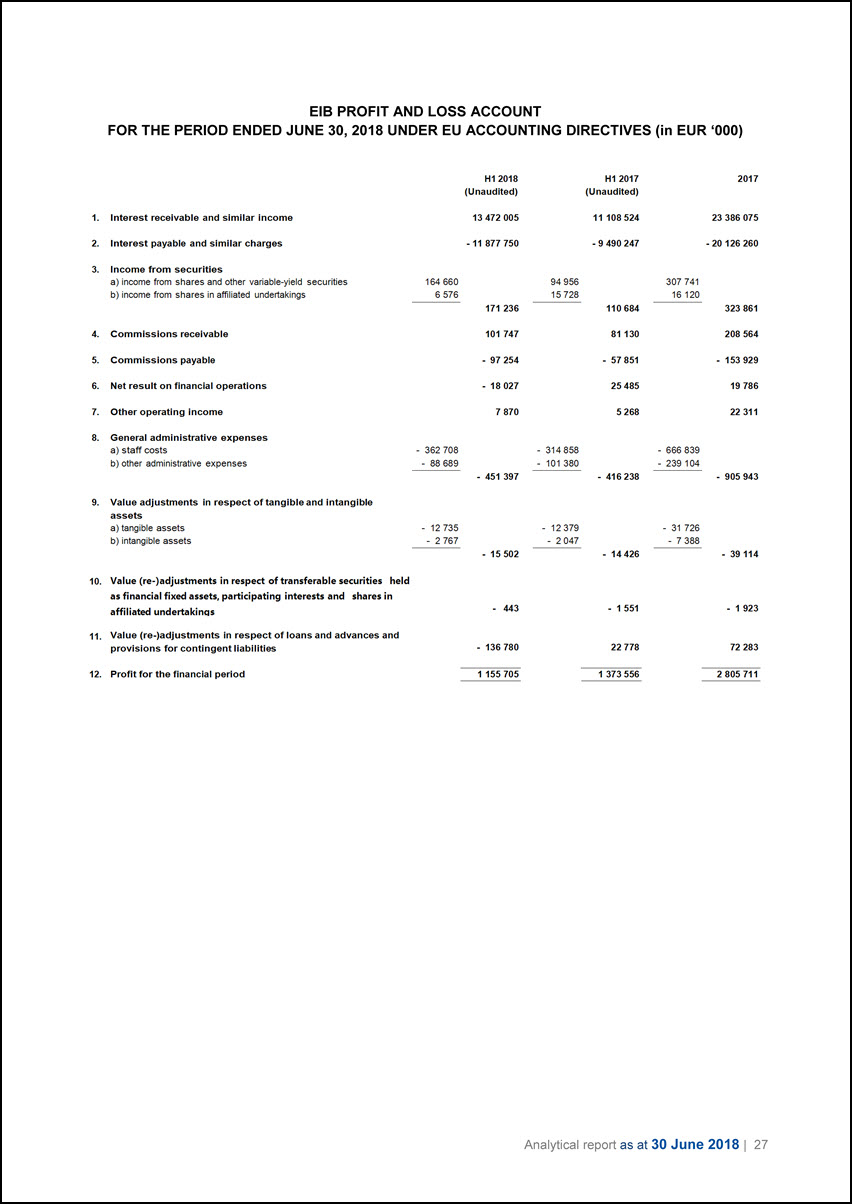

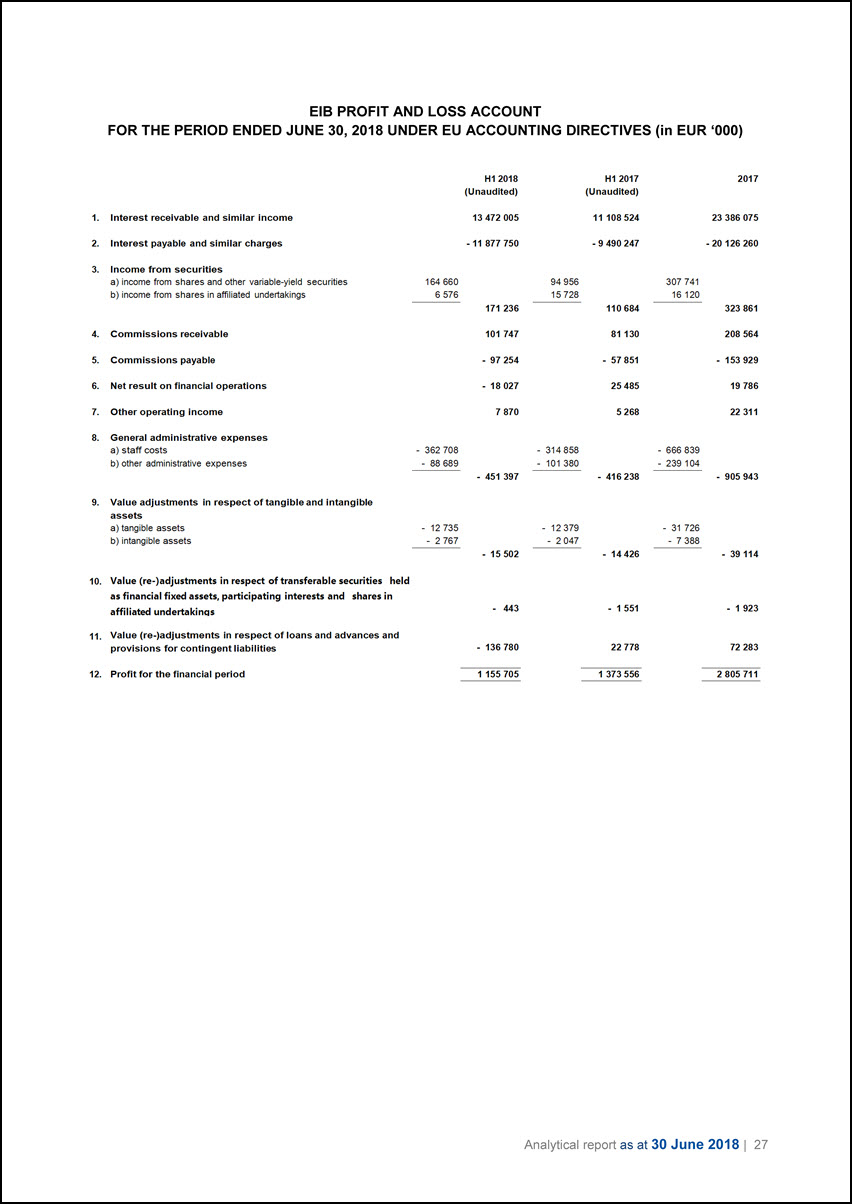

EIB PROFIT AND LOSS ACCOUNT FOR THE PERIOD ENDED JUNE 30, 2018 UNDER EU ACCOUNTING DIRECTIVES (in EUR ‘000) H1 2018 (Unaudited) H1 2017 (Unaudited) 2017 1. Interest receivable and similar income 13 472 005 11 108 524 23 386 075 2. Interest payable and similar charges - 11 877 750 - 9 490 247 - 20 126 260 3. Income from securities a) income from shares and other variable-yield securities 164 660 94 956 307 741 b) income from shares in affiliated undertakings 6 576 15 728 16 120 171 236 110 684 323 861 4. Commissions receivable 101 747 81 130 208 564 5. Commissions payable - 97 254 - 57 851 - 153 929 6. Net result on financial operations - 18 027 25 485 19 786 7. Other operating income 7 870 5 268 22 311 8. General administrative expenses a) staff costs - 362 708 - 314 858 - 666 839 b) other administrative expenses - 88 689 - 101 380 - 239 104 - 451 397 - 416 238 - 905 943 9. Value adjustments in respect of tangible and intangible assets a) tangible assets - 12 735 - 12 379 - 31 726 b) intangible assets - 2 767 - 2 047 - 7 388 - 15 502 - 14 426 - 39 114 10. Value (re-)adjustments in respect of transferable securities held as financial fixed assets, participating interests and shares in affiliated undertakings - 443 - 1 551 - 1 923 11. Value (re-)adjustments in respect of loans and advances and provisions for contingent liabilities - 136 780 22 778 72 283 12. Profit for the financial period 1 155 705 1 373 556 2 805 711 Analytical report as at 30 June 2018 | 27

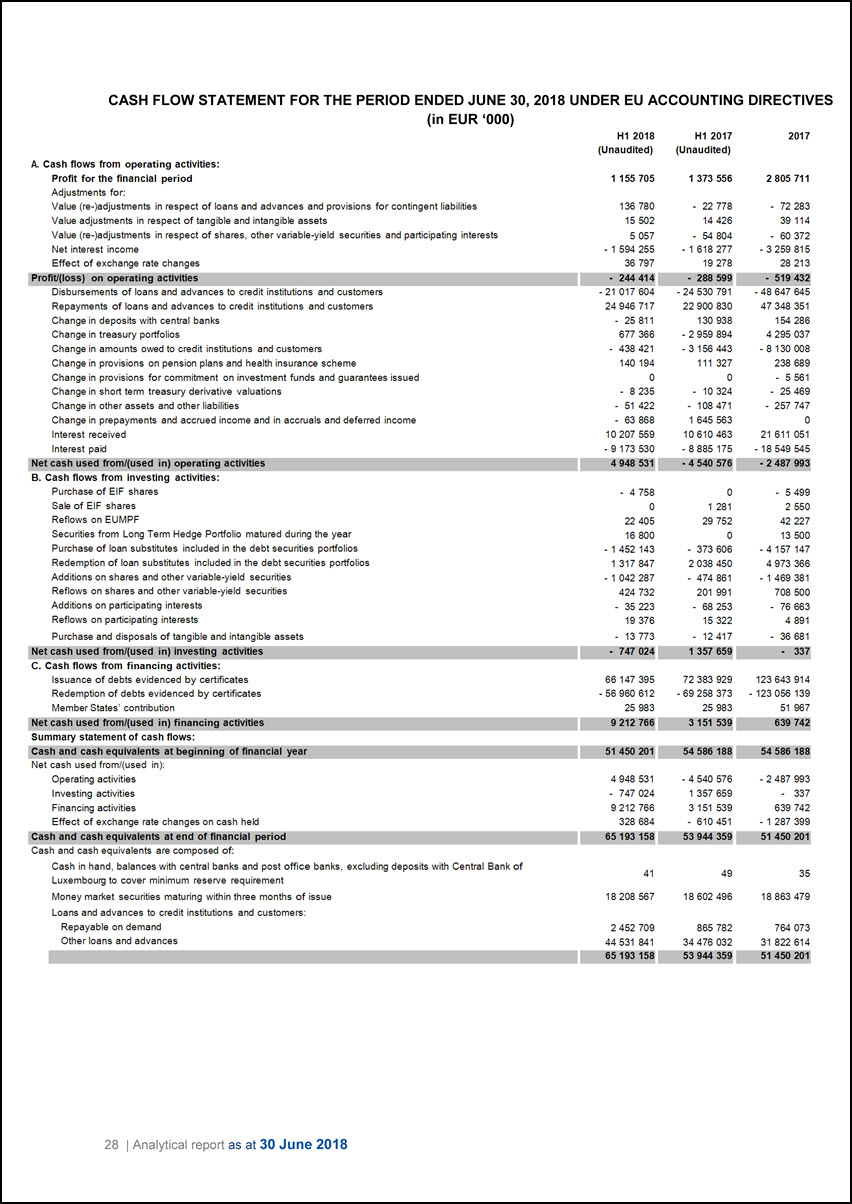

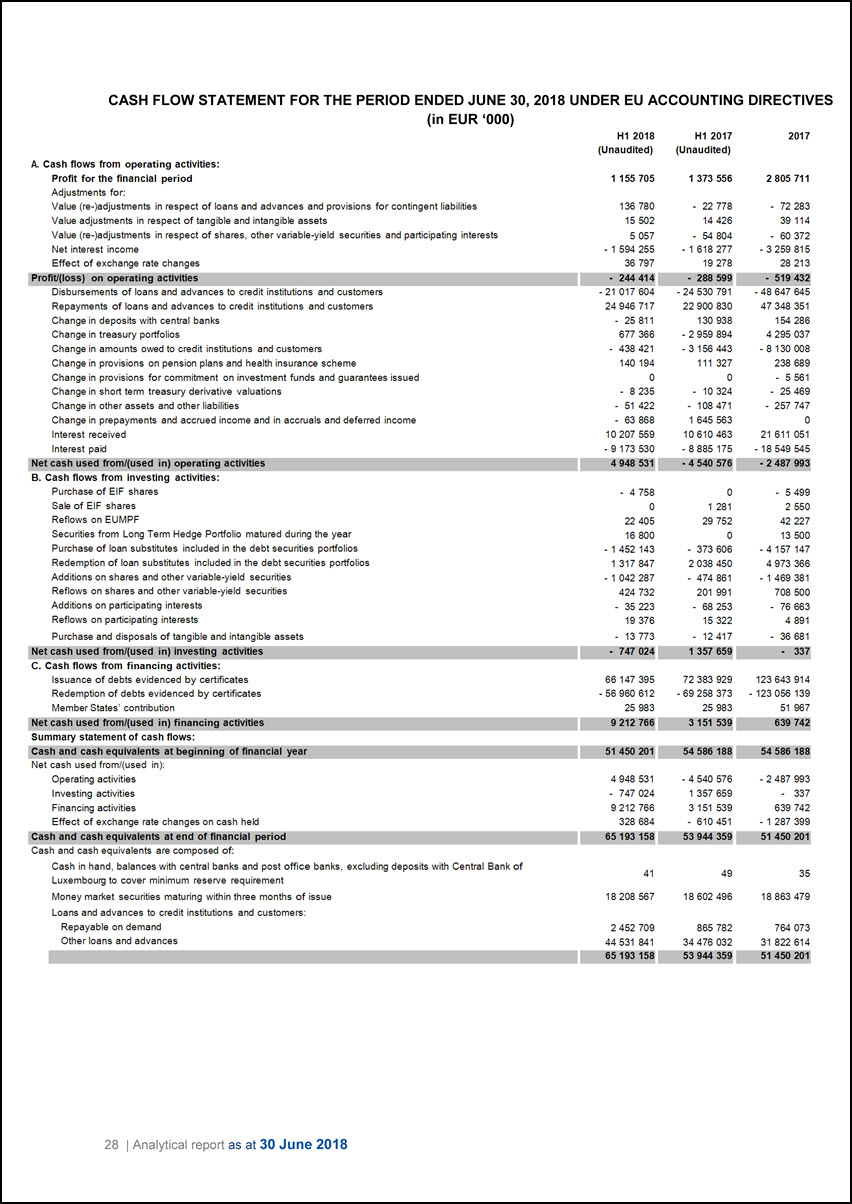

CASH FLOW STATEMENT FOR THE PERIOD ENDED JUNE 30, 2018 UNDER EU ACCOUNTING DIRECTIVES (in EUR ‘000) H1 2018 (Unaudited) H1 2017 (Unaudited) 2017 A. Cash flows from operating activities: Profit for the financial period 1 155 705 1 373 556 2 805 711 Adjustments for: Value (re-)adjustments in respect of loans and advances and provisions for contingent liabilities 136 780 - 22 778 - 72 283 Value adjustments in respect of tangible and intangible assets 15 502 14 426 39 114 Value (re-)adjustments in respect of shares, other variable-yield securities and participating interests 5 057 - 54 804 - 60 372 Net interest income - 1 594 255 - 1 618 277 - 3 259 815 Effect of exchange rate changes 36 797 19 278 28 213 Profit/(loss) on operating activities - 244 414 - 288 599 - 519 432 Disbursements of loans and advances to credit institutions and customers - 21 017 604 - 24 530 791 - 48 647 645 Repayments of loans and advances to credit institutions and customers 24 946 717 22 900 830 47 348 351 Change in deposits with central banks - 25 811 130 938 154 286 Change in treasury portfolios 677 366 - 2 959 894 4 295 037 Change in amounts owed to credit institutions and customers - 438 421 - 3 156 443 - 130 008 Change in provisions on pension plans and health insurance scheme 140 194 111 327 238 689 Change in provisions for commitment on investment funds and guarantees issued 0 0 - 5 561 Change in short term treasury derivative valuations - 8 235 - 10 324 - 25 469 Change in other assets and other liabilities - 51 422 - 108 471 - 257 747 Change in prepayments and accrued income and in accruals and deferred income - 63 868 1 645 583 0 Interest received 10 207 559 10 610 463 21 611 051 Interest paid - 9 173 530 - 8 885 175 - 18 549 545 Net cash used from/(used in) operating activities 4 948 531 - 4 540 576 - 2 487 993 B. Cash flows from investing activities: Purchase of EIF shares - 4 758 0 - 5 499 Sale of EIF shares 0 1 281 2 550 Reflows on EUMPF 22 405 29 752 42 227 Securities from Long Term Hedge Portfolio matured during the year 16 800 0 13 500 Purchase of loan substitutes included in the debt securities portfolios - 1 452 143 - 373 606 - 4 157 147 Redemption of loan substitutes included in the debt securities portfolios 1 317 847 2 038 450 4 973 366 Additions on shares and other variable-yield securities - 1 042 287 - 474 861 - 1 469 381 Reflows on shares and other variable-yield securities 424 732 201 991 708 500 Additions on participating interests - 35 223 - 68 253 - 76 663 Reflows on participating interests 19 376 15 322 4 891 Purchase and disposals of tangible and intangible assets - 13 773 - 12 417 - 36 681 Net cash used from/(used in) investing activities - 747 024 1 357 659 - 337 C. Cash flows from financing activities: Issuance of debts evidenced by certificates 66 147 395 72 383 929 123 643 914 Redemption of debts evidenced by certificates - 56 960 612 - 69 258 373 - 123 056 139 Member States’ contribution 25 983 25 983 51 967 Net cash used from/(used in) financing activities 9 212 766 3 151 539 639 742 Summary statement of cash flows: Cash and cash equivalents at beginning of financial year 51 450 201 54 586 188 54 586 188 Net cash used from/(used in): Operating activities 4 948 531 - 4 540 576 - 2 487 993 Investing activities - 747 024 1 357 659 - 337 Financing activities 9 212 766 3 151 539 639 742 Effect of exchange rate changes on cash held 328 684 - 610 451 - 1 287 399 Cash and cash equivalents at end of financial period 65 193 158 53 944 359 51 450 201 Cash and cash equivalents are composed of: Cash in hand, balances with central banks and post office banks, excluding deposits with Central Bank of Luxembourg to cover minimum reserve requirement 41 49 35 Money market securities maturing within three months of issue 18 208 567 18 602 496 18 863 479 Loans and advances to credit institutions and customers: Repayable on demand 2 452 709 865 782 764 073 Other loans and advances 44 531 841 34 476 032 31 822 614 65 193 158 53 944 359 51 450 201 28 | Analytical report as at 30 June 2018

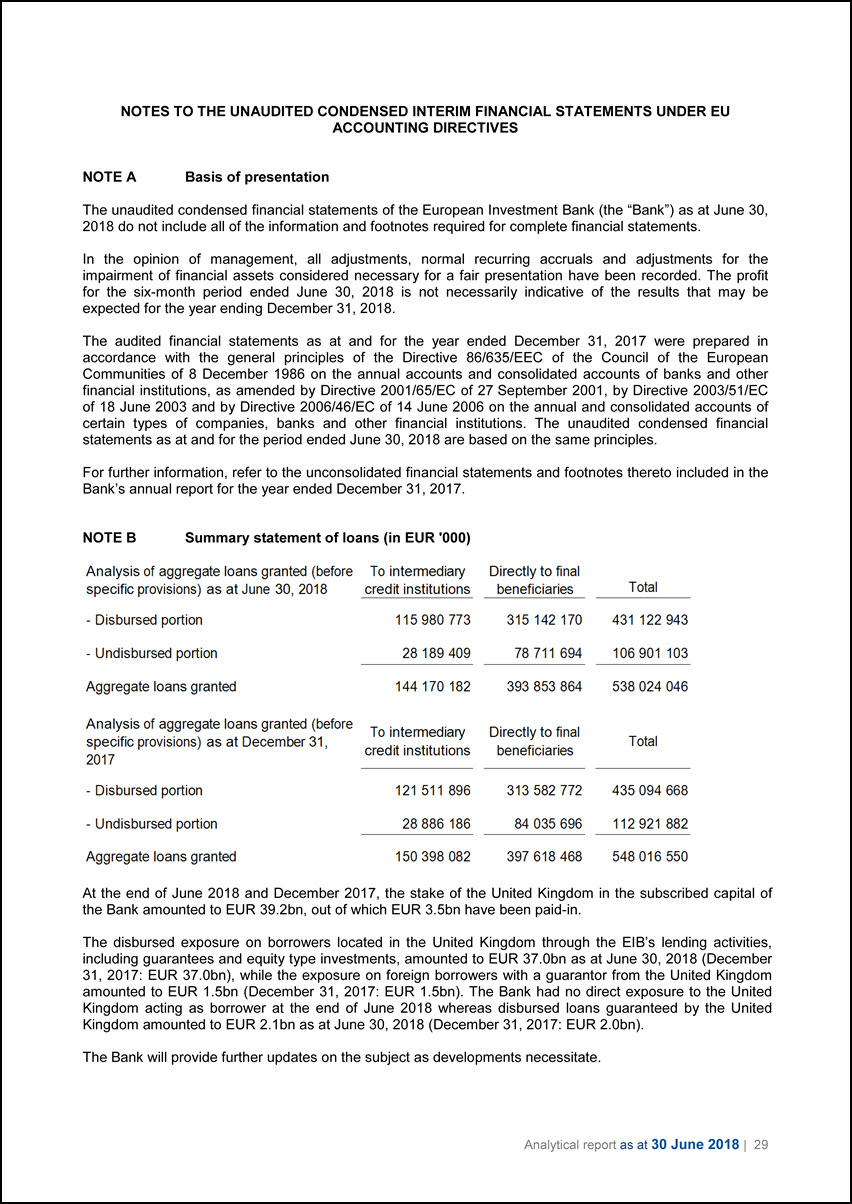

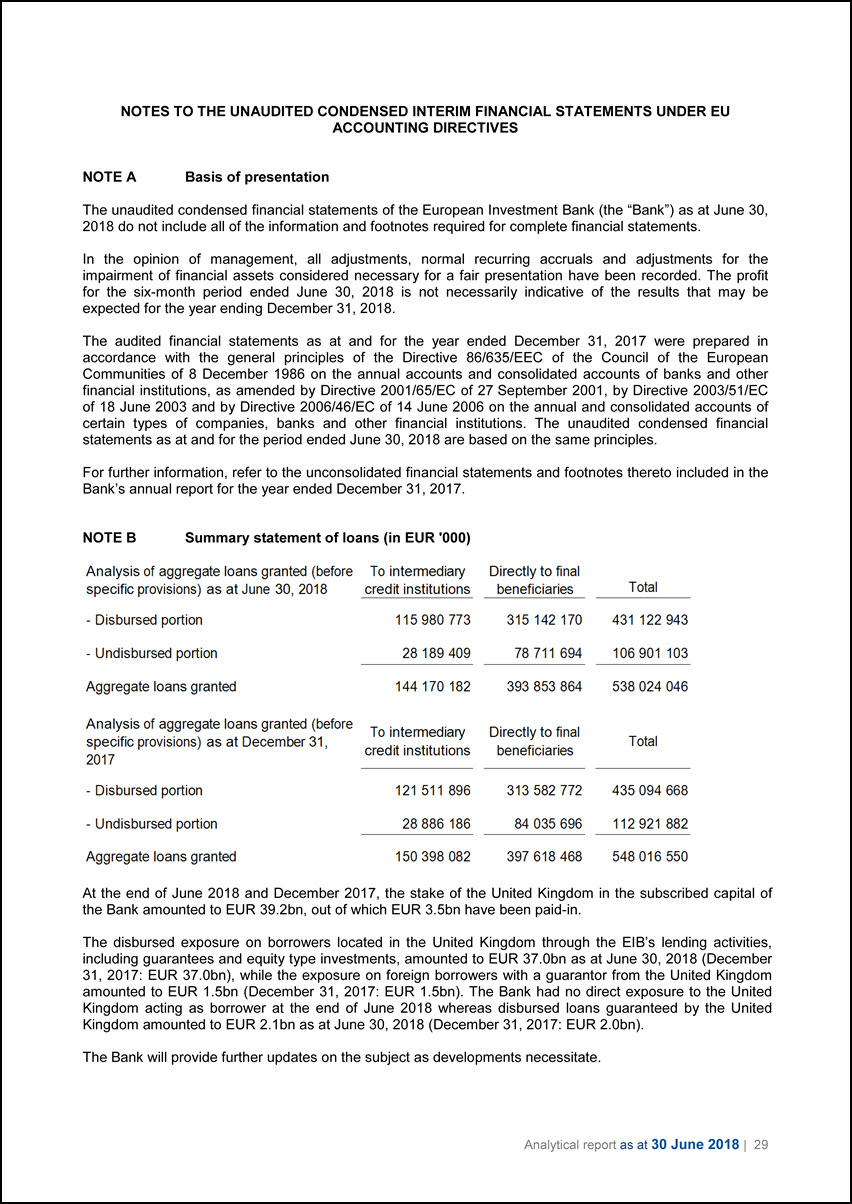

NOTES TO THE UNAUDITED CONDENSED INTERIM FINANCIAL STATEMENTS UNDER EU ACCOUNTING DIRECTIVES NOTE A Basis of presentation The unaudited condensed financial statements of the European Investment Bank (the “Bank”) as at June 30, 2018 do not include all of the information and footnotes required for complete financial statements. In the opinion of management, all adjustments, normal recurring accruals and adjustments for the impairment of financial assets considered necessary for a fair presentation have been recorded. The profit for the six-month period ended June 30, 2018 is not necessarily indicative of the results that may be expected for the year ending December 31, 2018. The audited financial statements as at and for the year ended December 31, 2017 were prepared in accordance with the general principles of the Directive 86/635/EEC of the Council of the European Communities of 8 December 1986 on the annual accounts and consolidated accounts of banks and other financial institutions, as amended by Directive 2001/65/EC of 27 September 2001, by Directive 2003/51/EC of 18 June 2003 and by Directive 2006/46/EC of 14 June 2006 on the annual and consolidated accounts of certain types of companies, banks and other financial institutions. The unaudited condensed financial statements as at and for the period ended June 30, 2018 are based on the same principles. For further information, refer to the unconsolidated financial statements and footnotes thereto included in the Bank’s annual report for the year ended December 31, 2017. NOTE B Summary statement of loans (in EUR ‘000) Analysis of aggregate loans granted (before specific provisions) as at June 30, 2018 To intermediary credit institutions Directly to final beneficiaries Total - Disbursed portion 115 980 773 315 142 170 431 122 943 - Undisbursed portion 28 189 409 78 711 694 106 901 103 Aggregate loans granted 144 170 182 393 853 864 538 024 046 Analysis of aggregate loans granted (before specific provisions) as at December 31, 2017 To intermediary credit institutions Directly to final beneficiaries Total - Disbursed portion 121 511 896 313 582 772 435 094 668 - Undisbursed portion 28 886 186 84 035 696 112 921 882 Aggregate loans granted 150 398 082 397 618 468 548 016 550 At the end of June 2018 and December 2017, the stake of the United Kingdom in the subscribed capital of the Bank amounted to EUR 39.2bn, out of which EUR 3.5bn have been paid-in. The disbursed exposure on borrowers located in the United Kingdom through the EIB’s lending activities, including guarantees and equity type investments, amounted to EUR 37.0bn as at June 30, 2018 (December 31, 2017: EUR 37.0bn), while the exposure on foreign borrowers with a guarantor from the United Kingdom amounted to EUR 1.5bn (December 31, 2017: EUR 1.5bn). The Bank had no direct exposure to the United Kingdom acting as borrower at the end of June 2018 whereas disbursed loans guaranteed by the United Kingdom amounted to EUR 2.1bn as at June 30, 2018 (December 31, 2017: EUR 2.0bn). The Bank will provide further updates on the subject as developments necessitate. Analytical report as at 30 June 2018 | 29

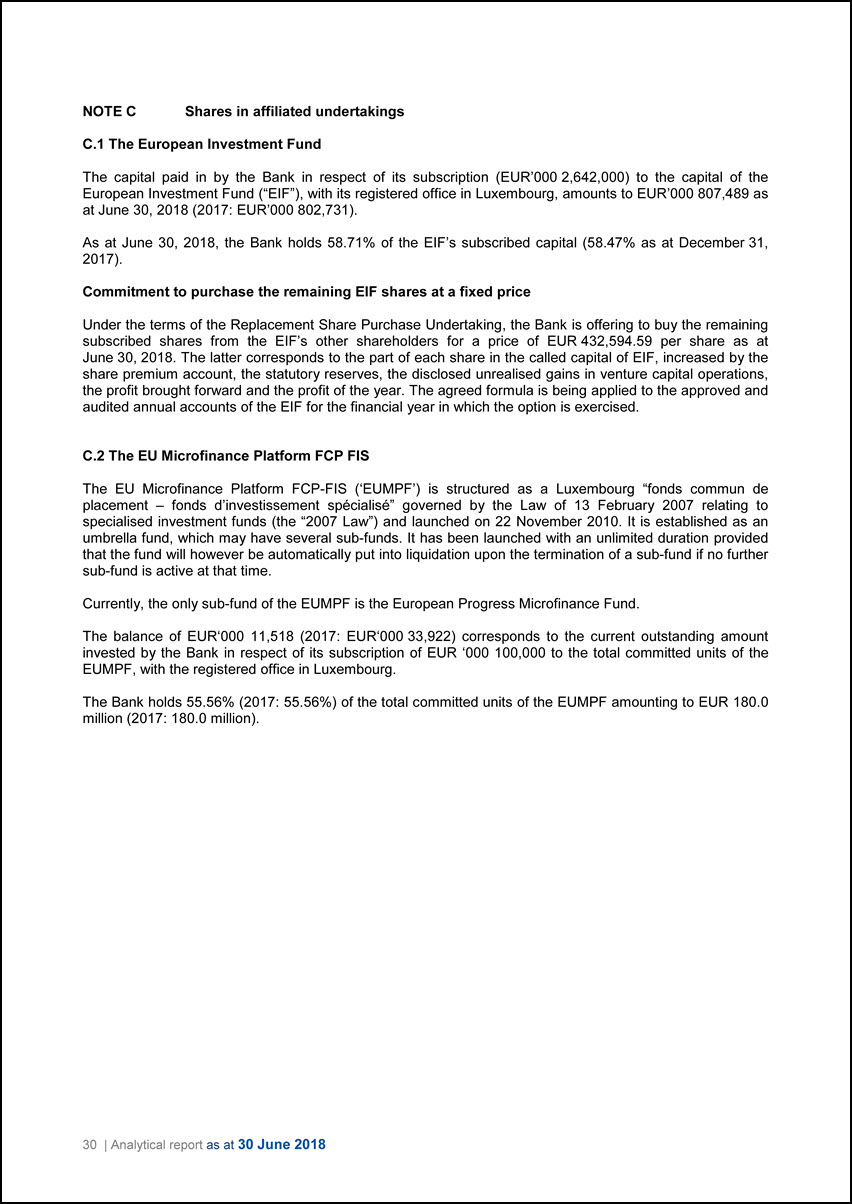

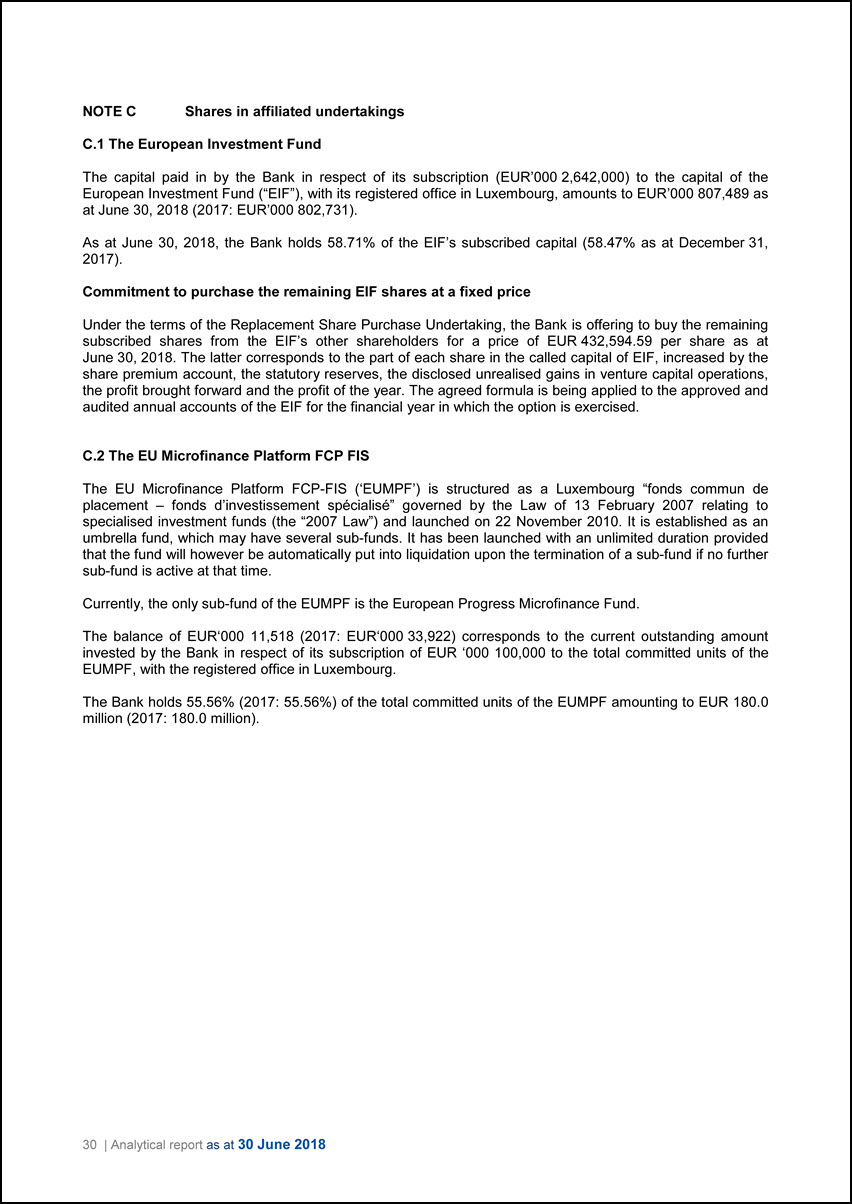

NOTE C Shares in affiliated undertakings C.1 The European Investment Fund The capital paid in by the Bank in respect of its subscription (EUR‘000 2,642,000) to the capital of the European Investment Fund (“EIF”), with its registered office in Luxembourg, amounts to EUR‘000 807,489 as at June 30, 2018 (2017: EUR‘000 802,731). As at June 30, 2018, the Bank holds 58.71% of the EIF’s subscribed capital (58.47% as at December 31, 2017). Commitment to purchase the remaining EIF shares at a fixed price Under the terms of the Replacement Share Purchase Undertaking, the Bank is offering to buy the remaining subscribed shares from the EIF’s other shareholders for a price of EUR 432,594.59 per share as at June 30, 2018. The latter corresponds to the part of each share in the called capital of EIF, increased by the share premium account, the statutory reserves, the disclosed unrealised gains in venture capital operations, the profit brought forward and the profit of the year. The agreed formula is being applied to the approved and audited annual accounts of the EIF for the financial year in which the option is exercised. C.2 The EU Microfinance Platform FCP FIS The EU Microfinance Platform FCP-FIS (‘EUMPF’) is structured as a Luxembourg “fonds commun de placement – fonds d’investissement spécialisé” governed by the Law of 13 February 2007 relating to specialised investment funds (the “2007 Law”) and launched on 22 November 2010. It is established as an umbrella fund, which may have several sub-funds. It has been launched with an unlimited duration provided that the fund will however be automatically put into liquidation upon the termination of a sub-fund if no further sub-fund is active at that time. Currently, the only sub-fund of the EUMPF is the European Progress Microfinance Fund. The balance of EUR‘000 11,518 (2017: EUR‘000 33,922) corresponds to the current outstanding amount invested by the Bank in respect of its subscription of EUR ‘000 100,000 to the total committed units of the EUMPF, with the registered office in Luxembourg. The Bank holds 55.56% (2017: 55.56%) of the total committed units of the EUMPF amounting to EUR 180.0 million (2017: 180.0 million). 30 | Analytical report as at 30 June 2018

NOTE D Debts evidenced by certificates (in EUR ‘000) PAYABLE IN OUTSTANDING AT 30.06.2018 UNAUDITED AVERAGE RATE 30.06.2018 DUE RATES OUTSTANDING AT 31.12.2017 AVERAGE RATE 31.12.2017 EUR 241 079 848 1.95 2018/2057 233 246 441 2.00 USD 123 863 283 2.05 2018/2058 119 928 350 1.75 GBP 47 401 438 2.70 2018/2054 49 311 992 2.63 AUD 11 682 877 4.35 2018/2042 11 111 557 4.54 CHF 6 629 527 2.12 2018/2036 6 831 909 2.16 SEK 5 822 252 2.41 2018/2040 5 369 877 2.57 NOK 4 280 608 2.04 2018/2037 4 071 522 1.98 JPY 3 682 874 1.05 2019/2053 3 698 520 1.00 CAD 3 602 522 2.07 2018/2045 3 562 299 2.00 ZAR 3 532 770 7.84 2018/2032 3 778 963 7.83 TRY 3 429 815 8.51 2018/2027 4 008 066 8.23 PLN 2 574 774 2.50 2021/2026 2 097 199 2.65 MXN 1 636 679 4.50 2020/2027 1 007 979 4.96 NZD 565 316 3.51 2018/2023 459 941 3.74 CZK 431 239 2.10 2018/2034 410 718 2.18 HUF 273 524 0.14 2020/2021 290 658 0.07 RUB 232 373 6.71 2019/2020 230 574 6.75 DKK 124 006 3.46 2024/2026 124 133 3.46 HKD 113 876 2.47 2019/2021 12 974 4.96 CNY 64 792 3.88 2020/2020 12 801 3.28 RON 57 472 2.52 2019/2020 18 890 1.15 TOTAL 461 081 865 449 585 363 The principal and interest of certain structured borrowings are index linked to stock exchange indexes (historical value: EUR 500m at 30 June 2018 and EUR 500m in 2017). All such borrowings are hedged in full through structured swap operations. Analytical report as at 30 June 2018 | 31