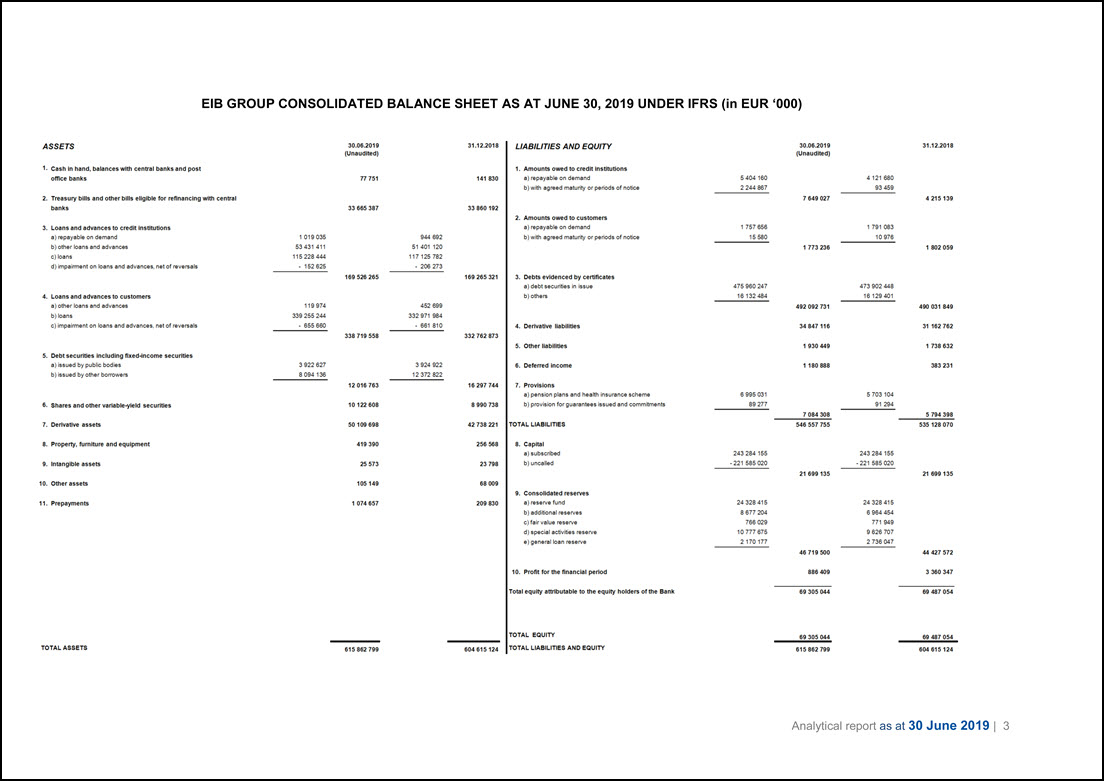

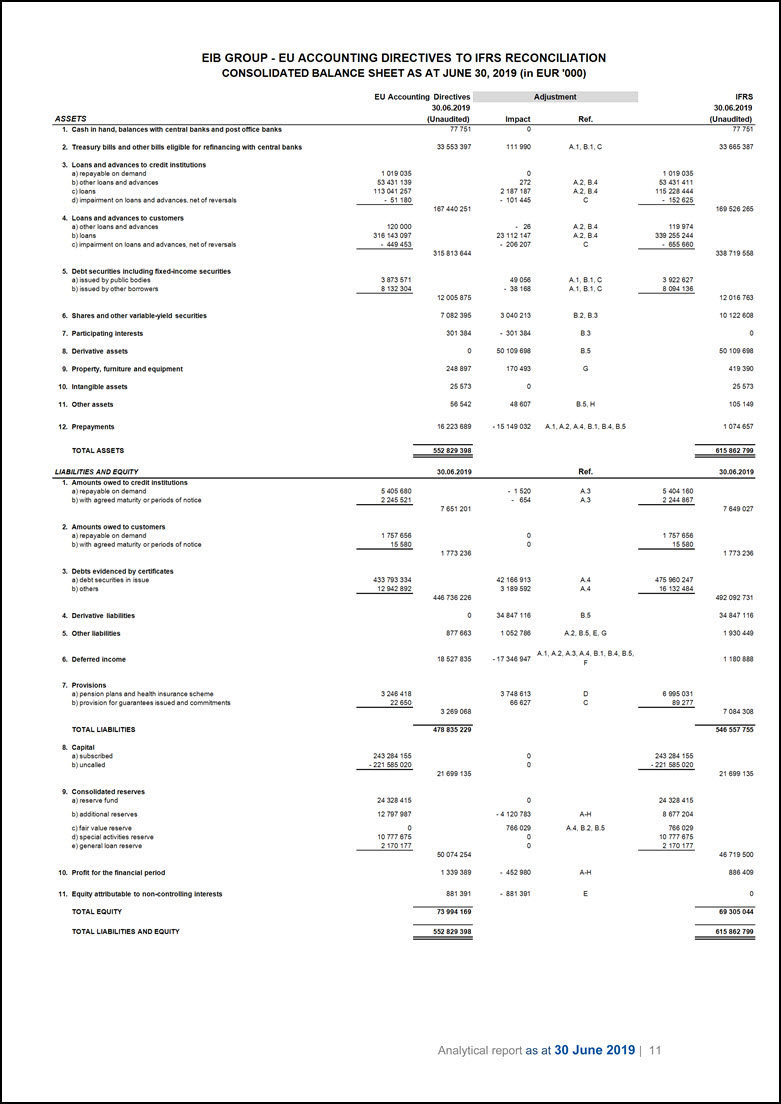

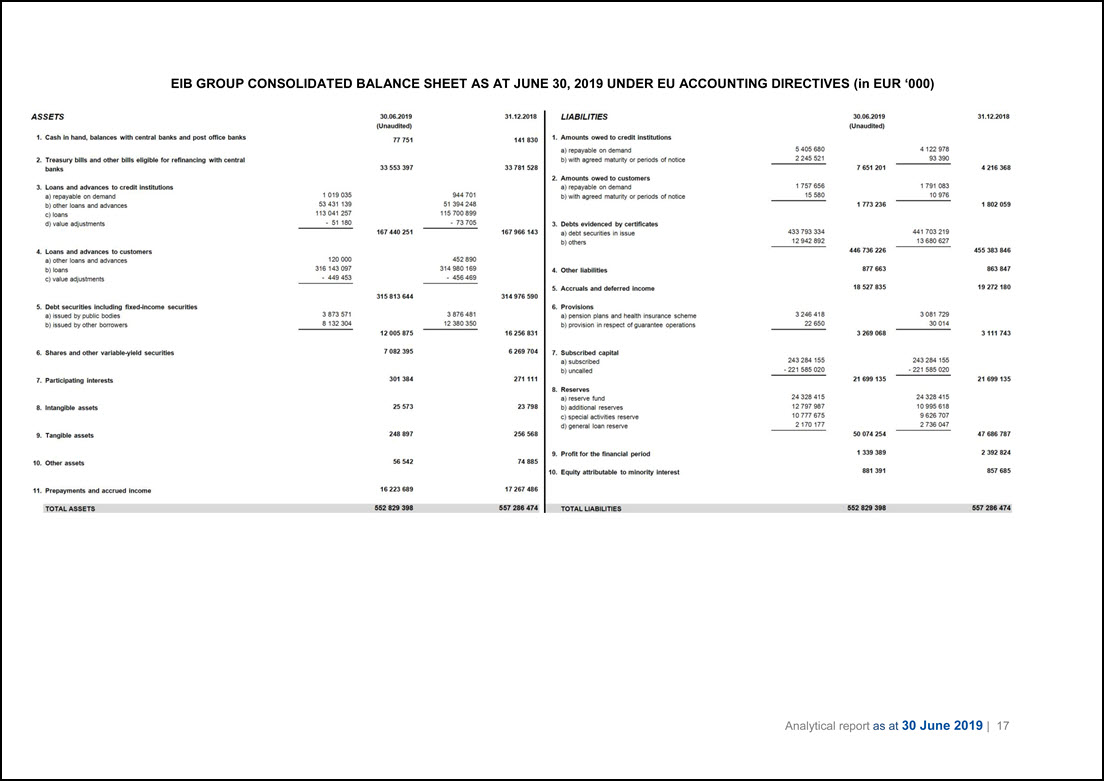

EIB GROUP - EU ACCOUNTING DIRECTIVES TO IFRS RECONCILIATION CONSOLIDATED BALANCE SHEET AS AT JUNE 30, 2019 (in EUR '000) EU Accounting Directives Adjustment IFRS 30.06.2019 30.06.2019 ASSETS (Unaudited) Impact Ref. (Unaudited ) 1. Cash in hand, balances with central banks and post office banks 77 751 0 77 751 2. Treasury bills and other bills eligible for refinancing with central banks 33 553 39 7 111 990 A 1, B.1, C 33 665 387 3. Loans and advances to credit institutions a) repayable on demand 1 019 035 0 1 019 035 b) other loans and advances 53 431 139 272 A.2, B.4 53 431 411 c) loans 113 041 257 2 187 187 A.2, B.4 115 228 444 d) impairment on loans and advances, net of reversals - 51 180 - 101 445 C - 152 625 167 440 251 169 526 265 4. Loans and advances to customers a ) other loans and advances 120 000 26 A.2, B.4 119 974 b) loans 316 143 097 23 112 147 A.2, B.4 339 255 244 c) impairment on loans and advances, net of reversals - 449 453 - 206 207 C - 655 660 315 813 644 338 719 558 5. Debt securities Including fixed-income securities a) issued by public bodies 3 873 5 71 49 056 A.1, B.1 , C 3 922 627 b) issued by other borrowers 8 132 304 - 38 168 A.1, B.1, C 8 094 136 12 005 875 12 016 763 6. Shares and other variable-yield securities 7 082 395 3 040 213 B.2, B.3 10 122 608 7. Participating interests 301 384 - 301 384 B.3 8. Derivative assets 50 109 698 B.5 50 109 698 9. Property, furniture and equipment 248 897 170 493 G 419 390 10. Intangible assets 25 573 25 573 11. Other assets 56 542 48 607 B.5, H 105 149 12. Prepayments 16 223 689 - 15 149 032 A1, A.2, A 4, B.1, B.4, B.5 1 074 657 TOTAL ASSETS 552 829 398 615 862 799 LIABILITIES AND EQUITY 30.06.2019 Ref. 30.06.2019 1. Amounts owed to credit Institutions a) repayable on demand 5 405 680 - 1 520 A.3 5 404 160 b) with agreed maturity or periods of notice 2 245 521 654 A.3 2 244 867 7 651 201 7 649 027 2. Amounts owed to customers a) repayable on demand 1 757 656 1 757 656 b) with agreed maturity or periods of notice 15 580 15 580 1 773 236 1 773 236 3. Debts evidenced by certificates a) debt securities in issue 433 793 334 42 166 913 A.4 475 960 247 b) others 12 942 892 3 189 592 A.4 16 132 484 446 736 226 492 092 731 4. Derivative liabilities 34 847 116 B.5 34 847 116 5. Other liabilities 877 663 1 052 786 A.2, B.5, E, G 1 930 449 6. Deferred income 18 527 835 - 17 346 947 A.1, A.2, A.3, A.4, B.1, B.4, B.5, 1 180 888 7. Provisions a) pension plans and health insurance scheme 3 246 418 3 748 613 D 6 995 031 b) provision for guarantees issued and commitments 22 650 66 627 C 89 277 3 269 068 7 084 308 TOTAL LIABILITIES 478 835 229 546 557 755 8. Capital a) subscribed 243 284 155 243 284 155 b) uncalled - 221 585 020 - 221 585 020 21 699 135 21 699 135 9. Consolidated reserves a) reserve fund 24 328 415 24 328 415 b) additional reserves 12 797 98 7 - 4 1 20 783 A-H 8 677 20 4 c) fair value reserve 0 766 0 29 A.4, B.2, B.5 766 029 d) special activities reserve 10 777 675 0 10 777 675 e) general loan reserve 2 170 177 0 2 170 177 50 074 254 46 719 500 10. Profit for the financial period 1 339 389 - 452 980 A-H 88 6 409 11. Equity attributable to non-controlling interests 881 391 - 881 391 E TOTAL EQUITY 73 994 169 69 305 044 TOTAL LIABILITIES AND EQUITY 552 829 398 615 862 799 11 Analytical report as at 30 June 2019