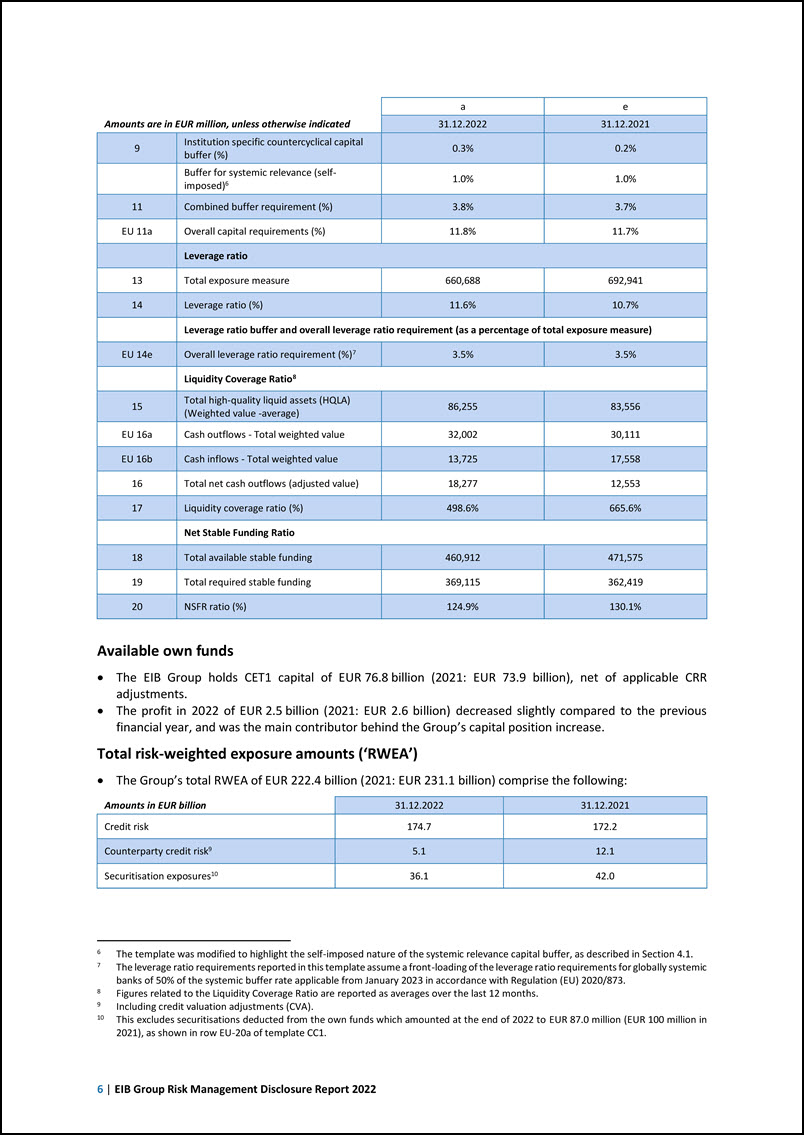

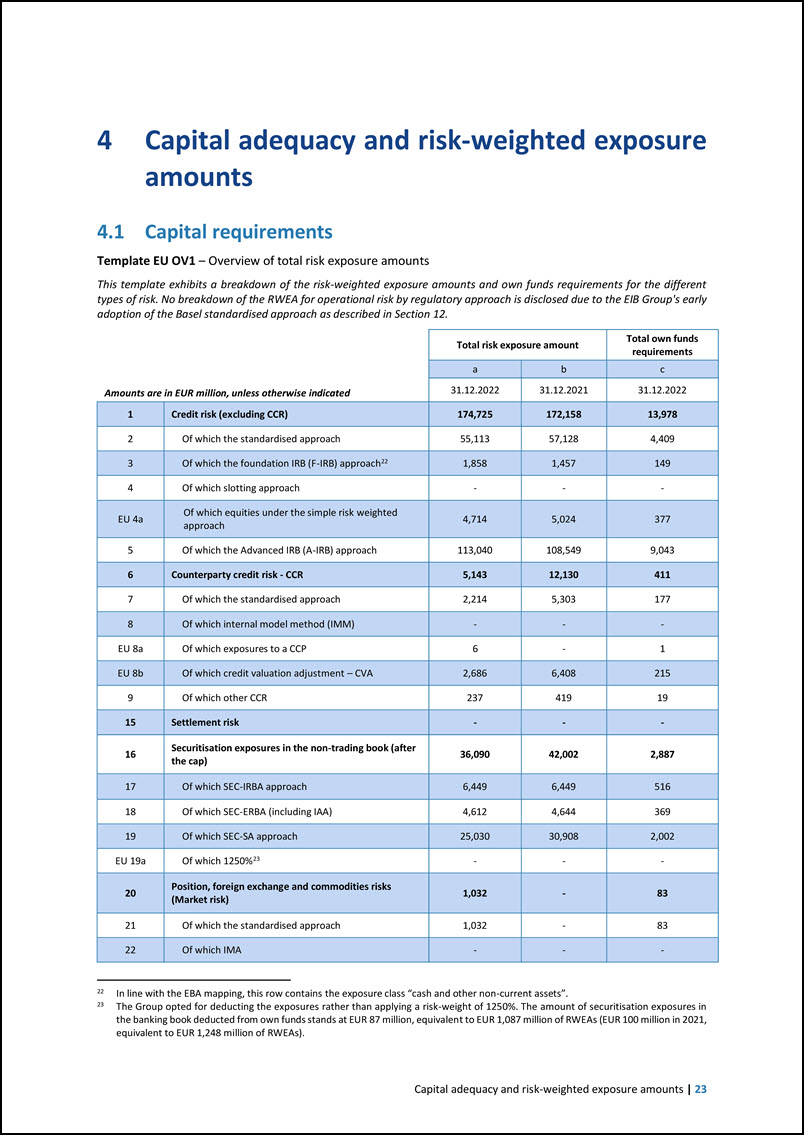

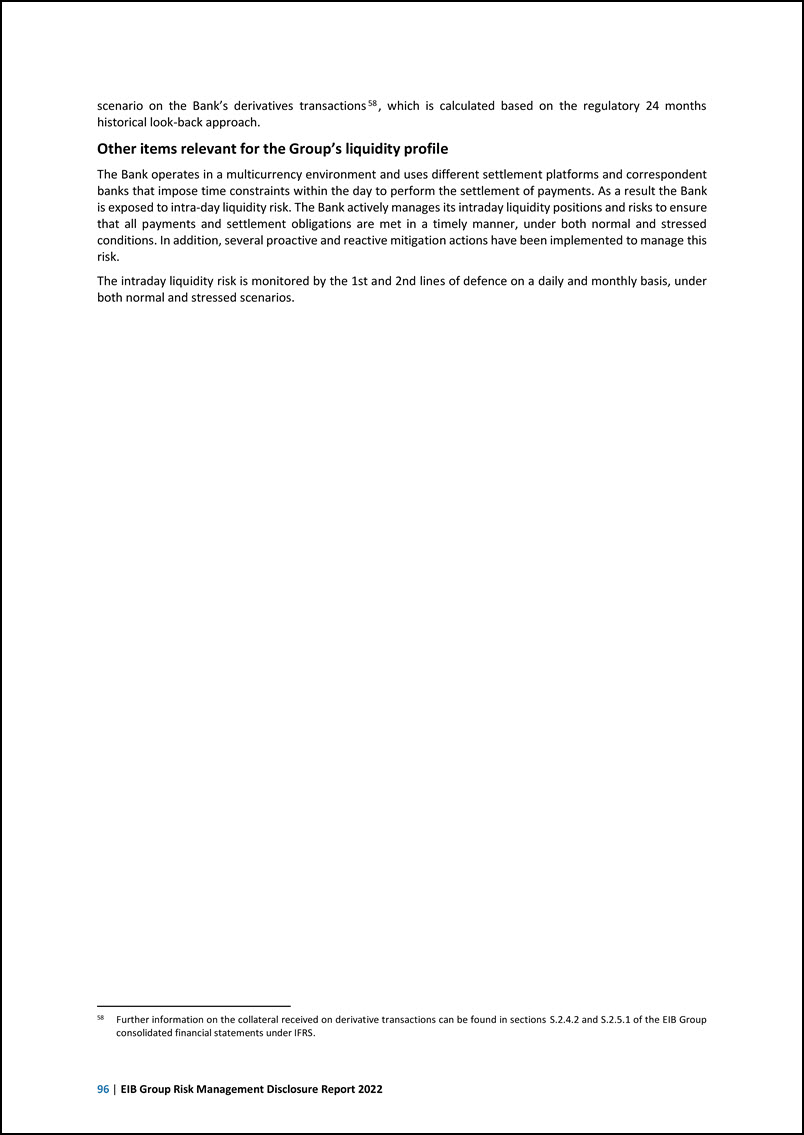

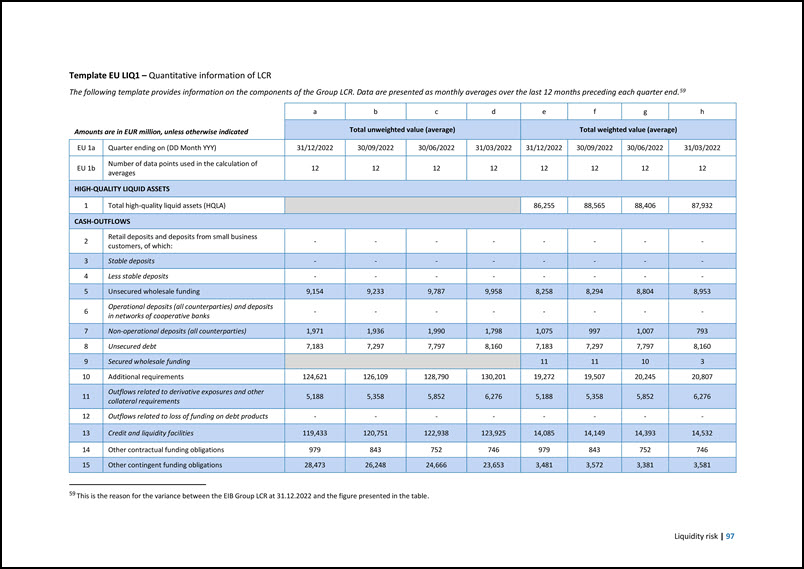

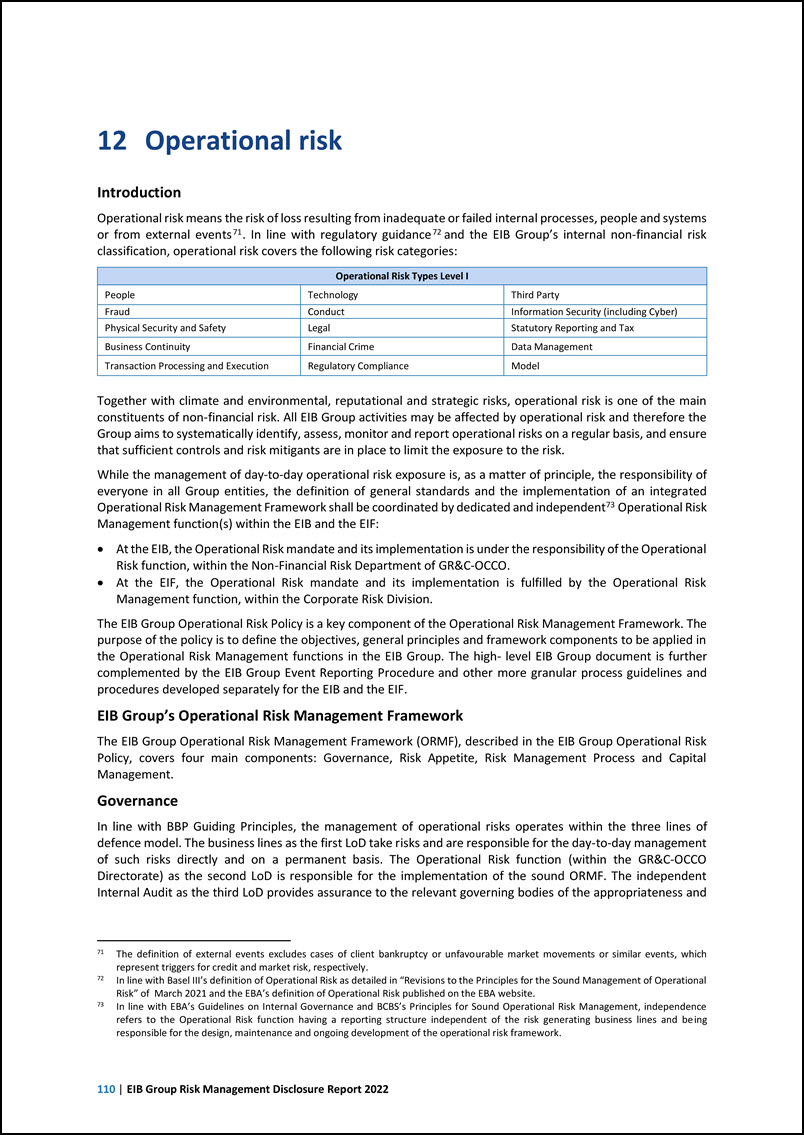

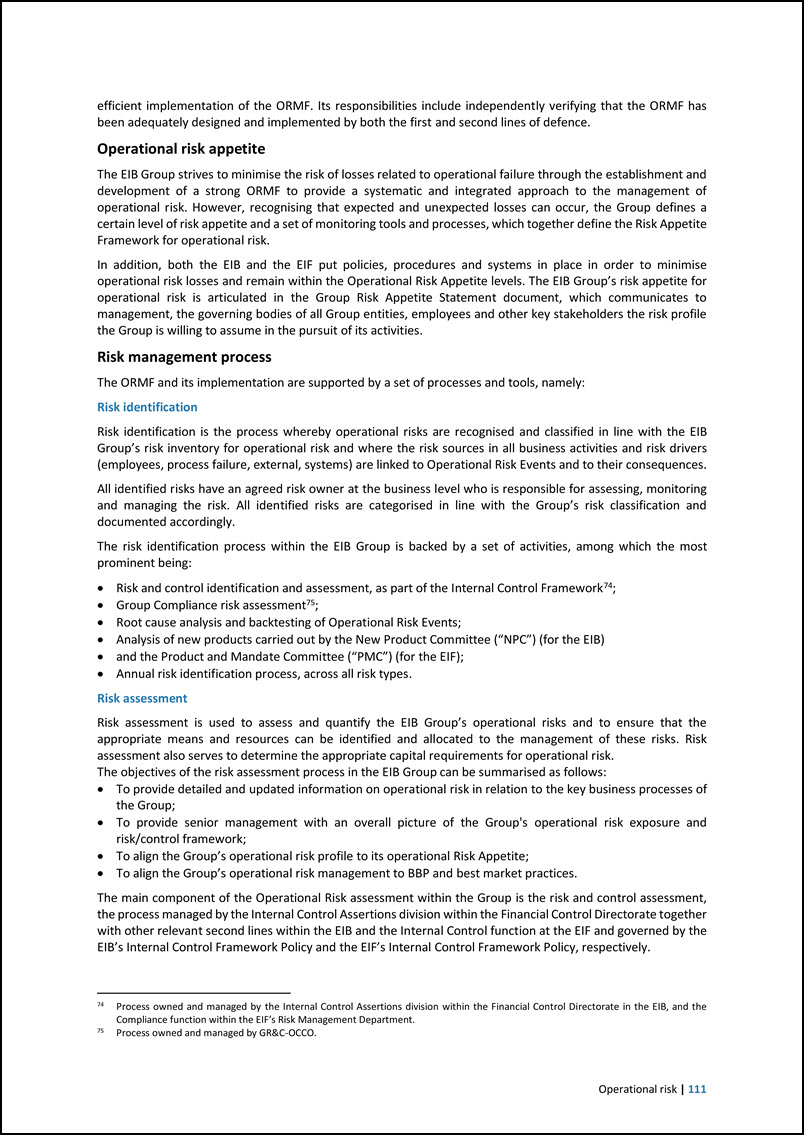

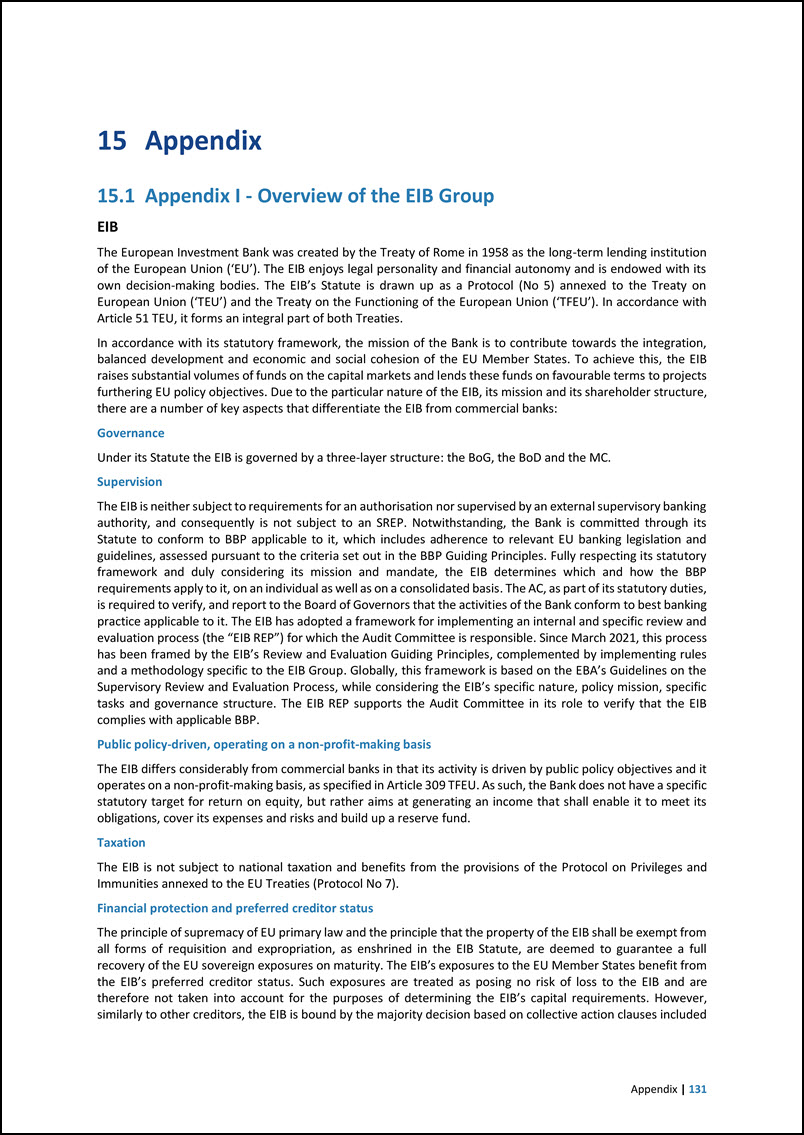

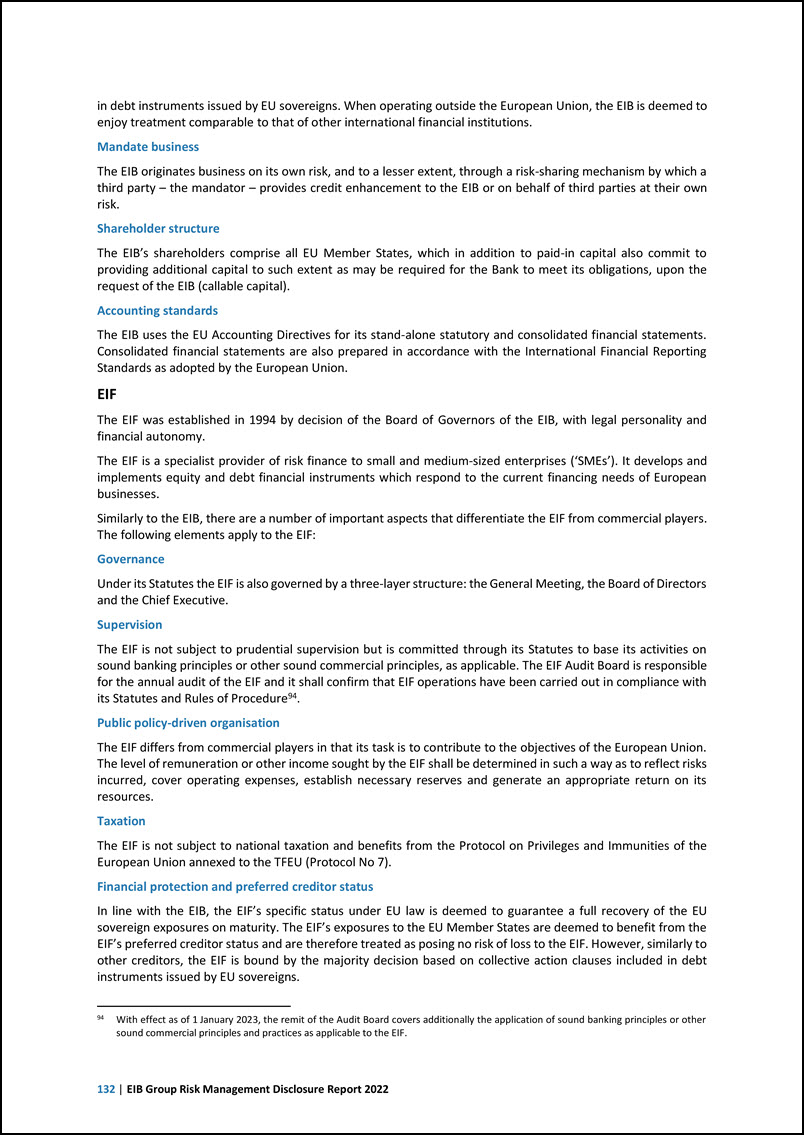

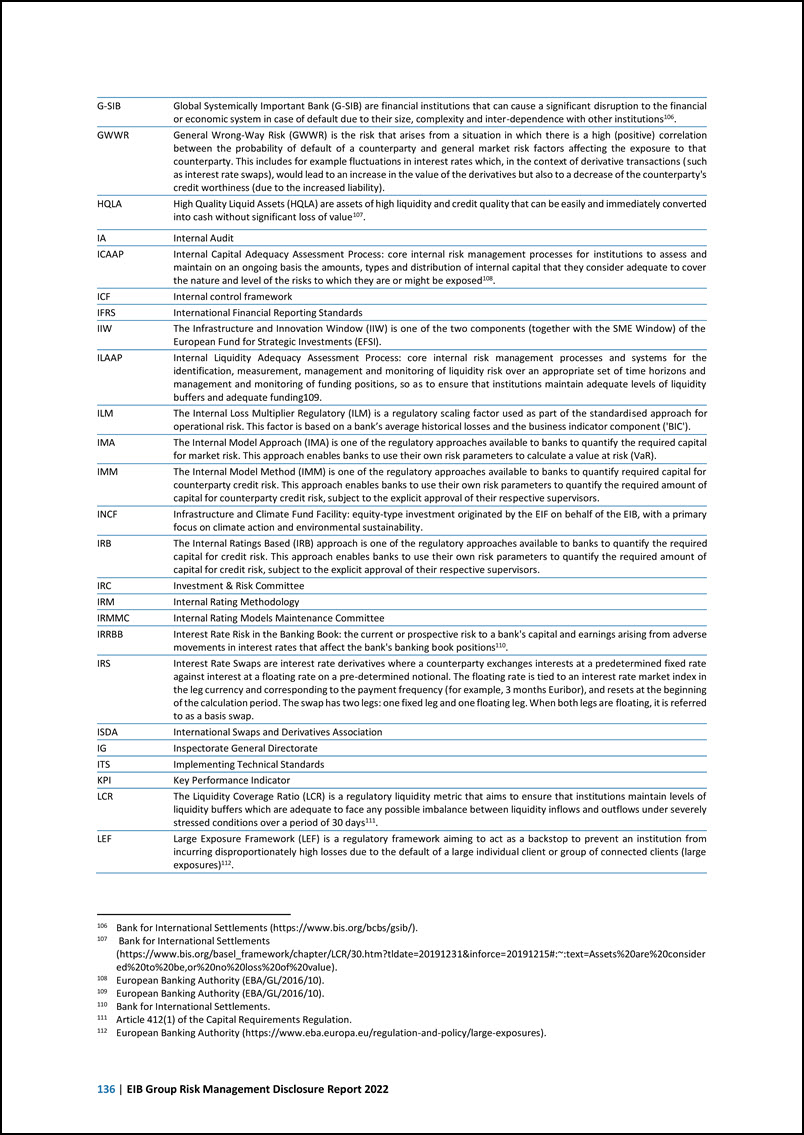

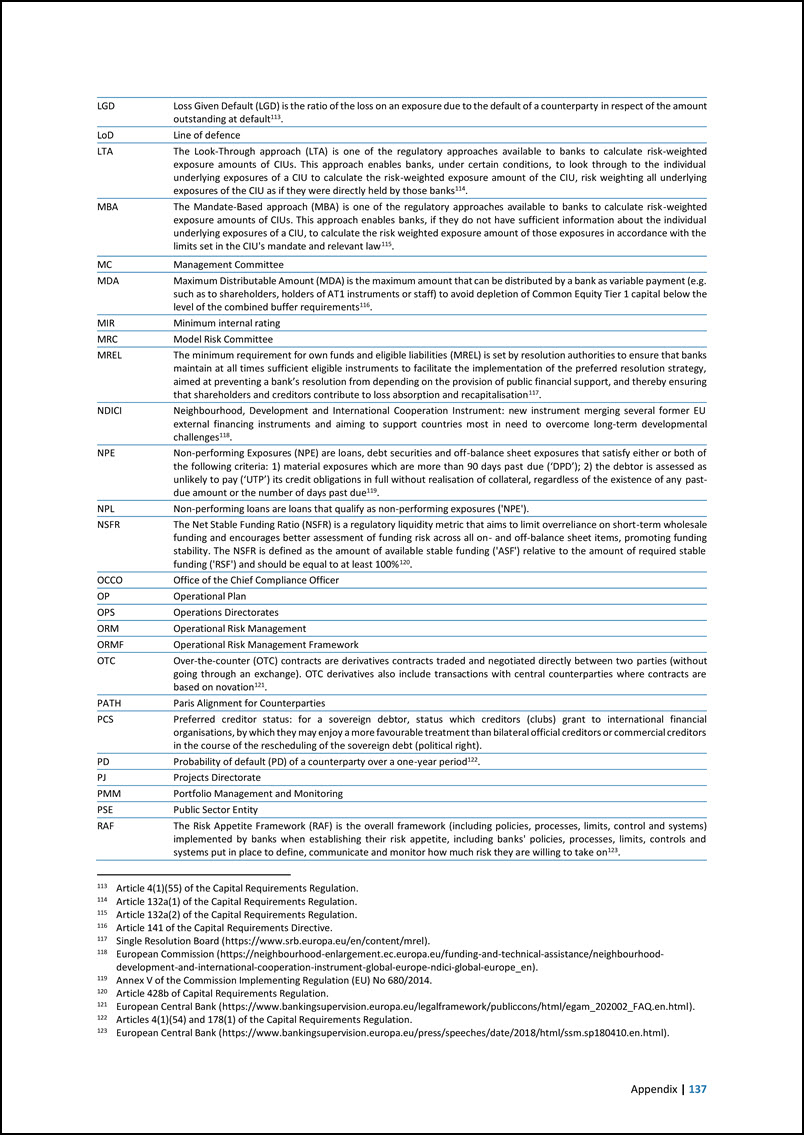

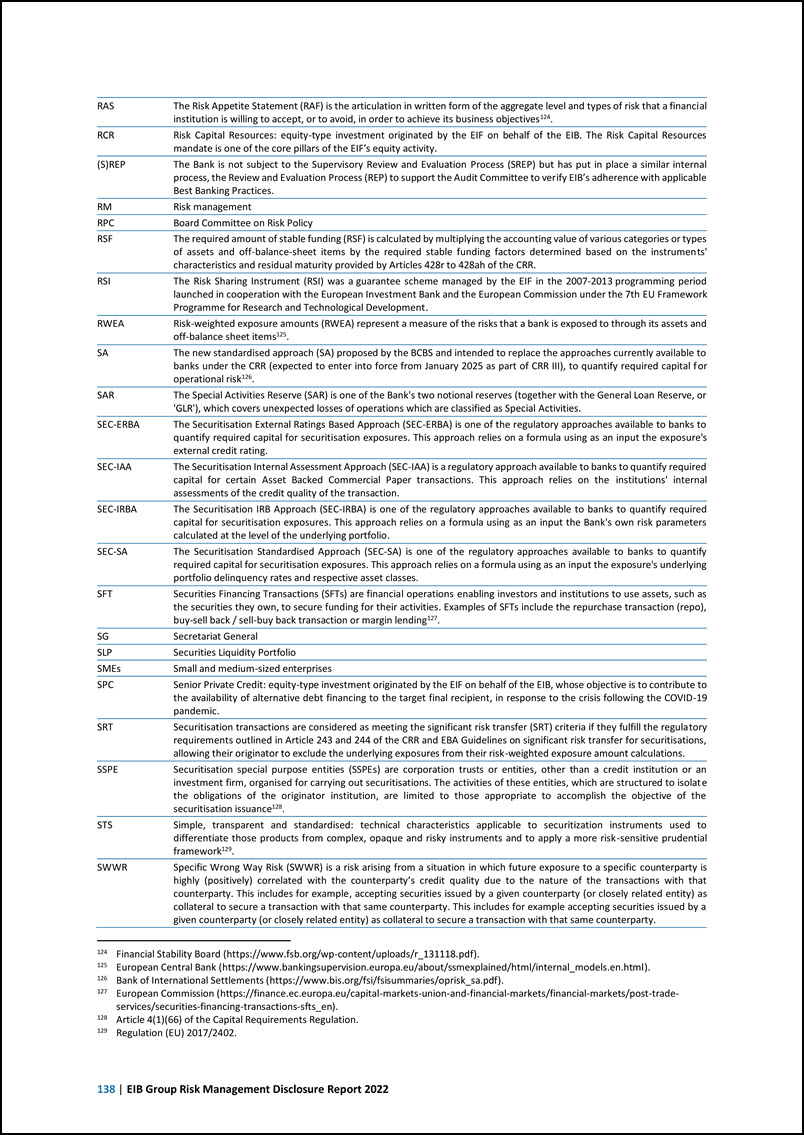

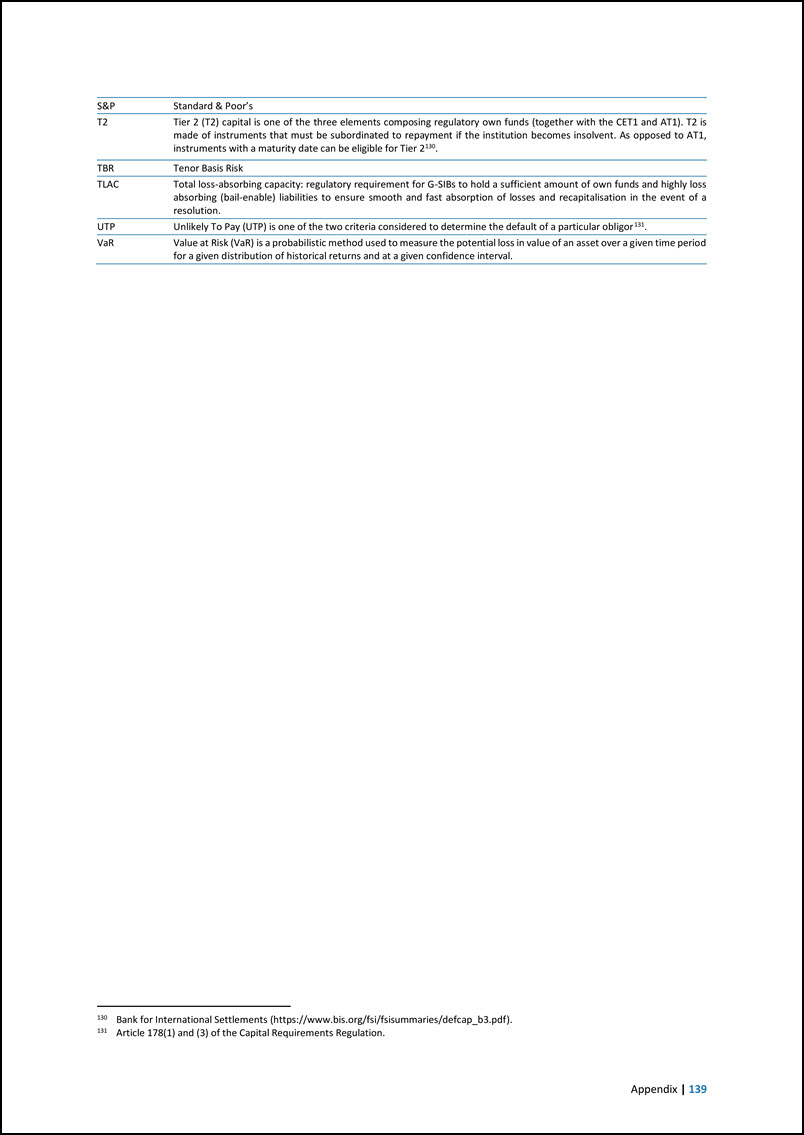

Liquidity risk | 97 Template EU LIQ1 – Quantitative information of LCR The following template provides information on the components of the Group LCR. Data are presented as monthly averages over the last 12 months preceding each quarter end.59 Amounts are in EUR million, unless otherwise indicated a b c d e f g h Total unweighted value (average) Total weighted value (average) EU 1a Quarter ending on (DD Month YYY) 31/12/2022 30/09/2022 30/06/2022 31/03/2022 31/12/2022 30/09/2022 30/06/2022 31/03/2022 EU 1b Number of data points used in the calculation of averages 12 12 12 12 12 12 12 12 HIGH-QUALITY LIQUID ASSETS 1 Total high-quality liquid assets (HQLA) 86,255 88,565 88,406 87,932 CASH-OUTFLOWS 2 Retail deposits and deposits from small business customers, of which: - - - - - - - - 3 Stable deposits - - - - - - - - 4 Less stable deposits - - - - - - - - 5 Unsecured wholesale funding 9,154 9,233 9,787 9,958 8,258 8,294 8,804 8,953 6 Operational deposits (all counterparties) and deposits in networks of cooperative banks - - - - - - - - 7 Non-operational deposits (all counterparties) 1,971 1,936 1,990 1,798 1,075 997 1,007 793 8 Unsecured debt 7,183 7,297 7,797 8,160 7,183 7,297 7,797 8,160 9 Secured wholesale funding 11 11 10 3 10 Additional requirements 124,621 126,109 128,790 130,201 19,272 19,507 20,245 20,807 11 Outflows related to derivative exposures and other collateral requirements 5,188 5,358 5,852 6,276 5,188 5,358 5,852 6,276 12 Outflows related to loss of funding on debt products - - - - - - - - 13 Credit and liquidity facilities 119,433 120,751 122,938 123,925 14,085 14,149 14,393 14,532 14 Other contractual funding obligations 979 843 752 746 979 843 752 746 15 Other contingent funding obligations 28,473 26,248 24,666 23,653 3,481 3,572 3,381 3,581 59 This is the reason for the variance between the EIB Group LCR at 31.12.2022 and the figure presented in the table.