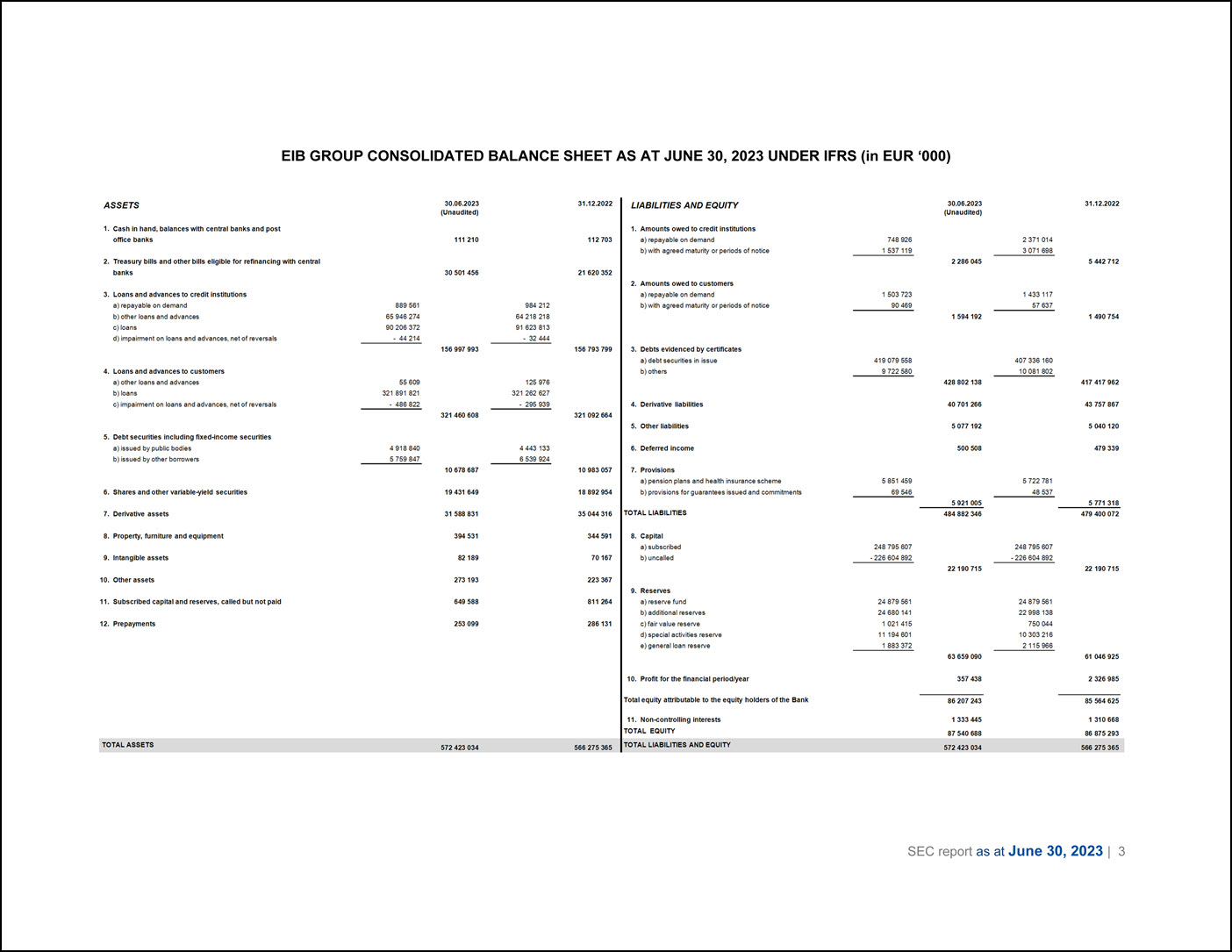

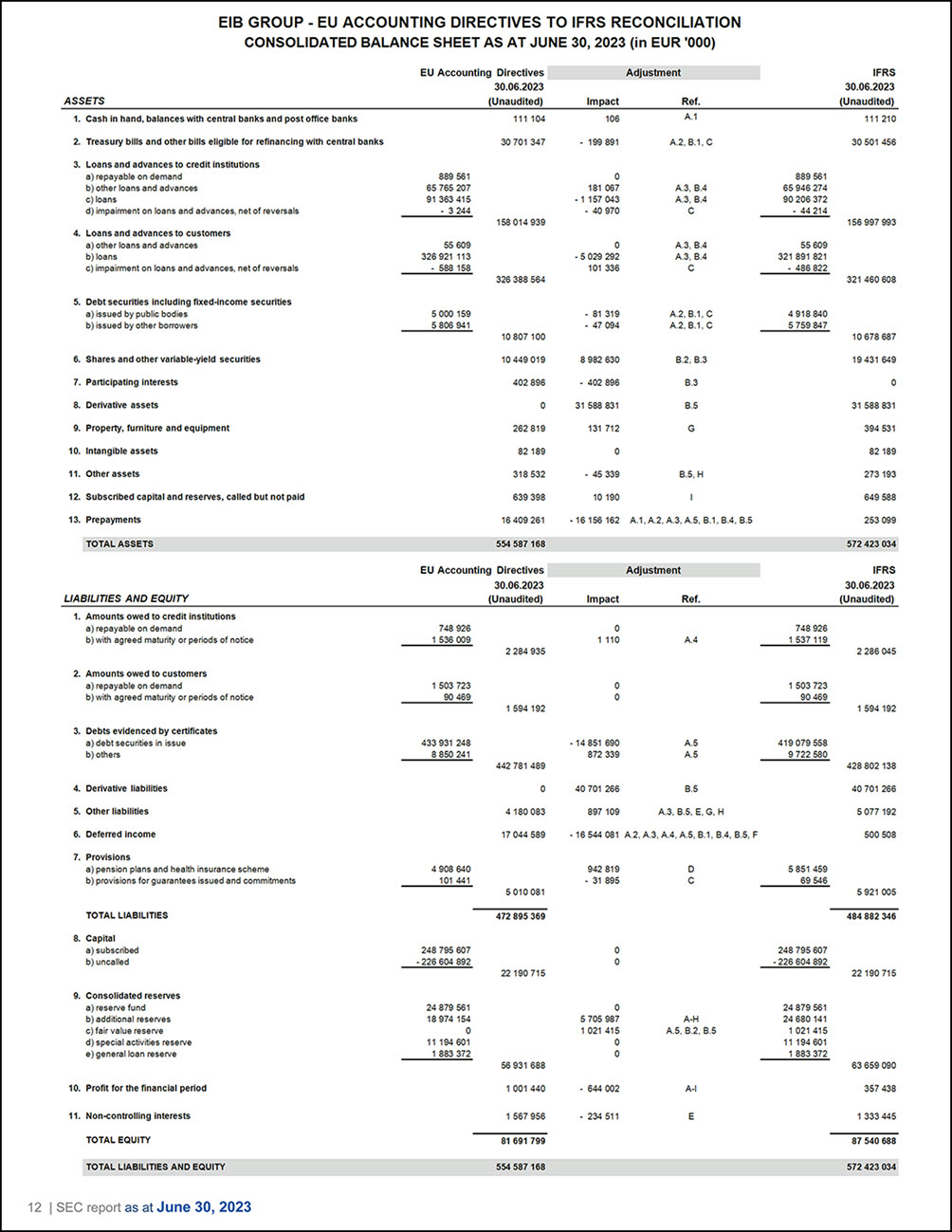

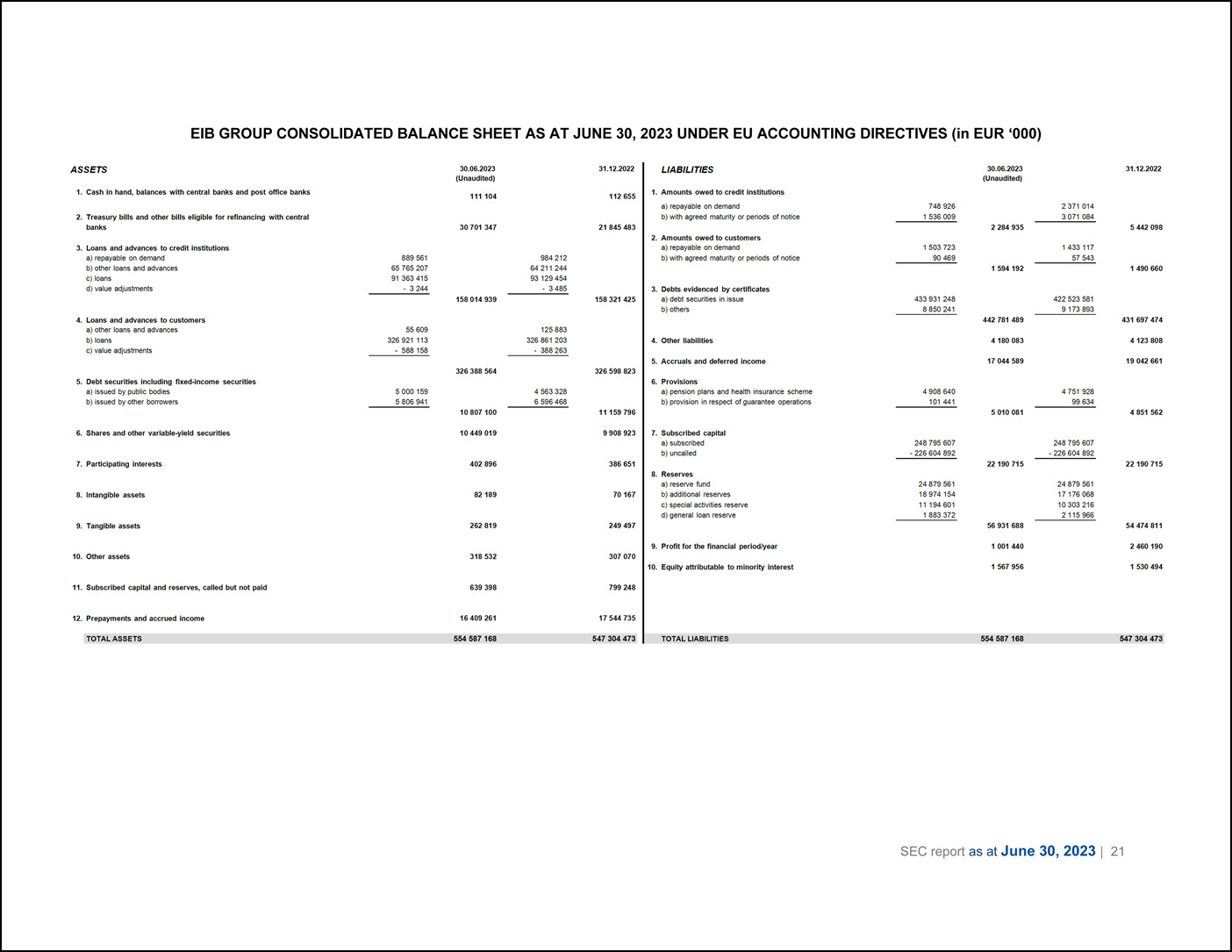

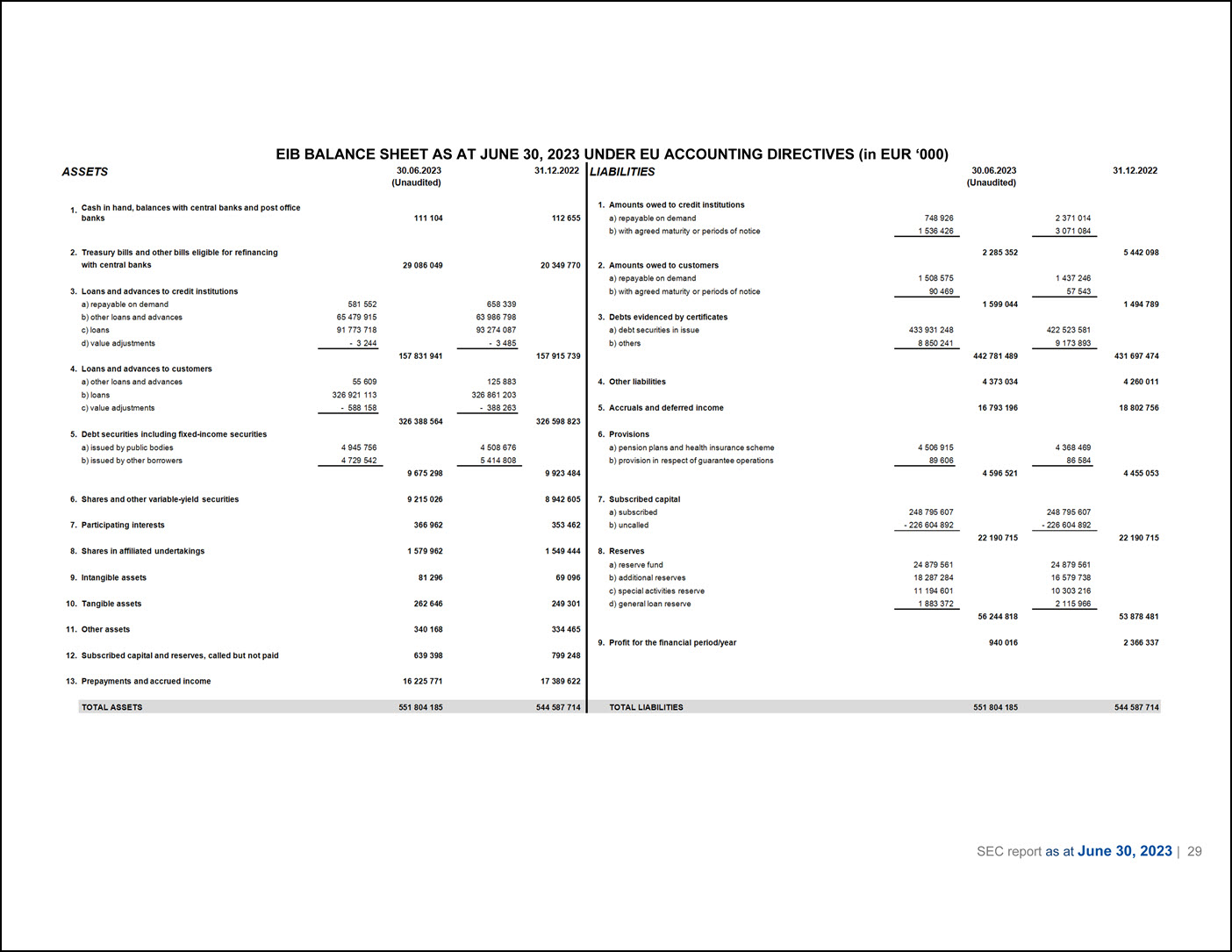

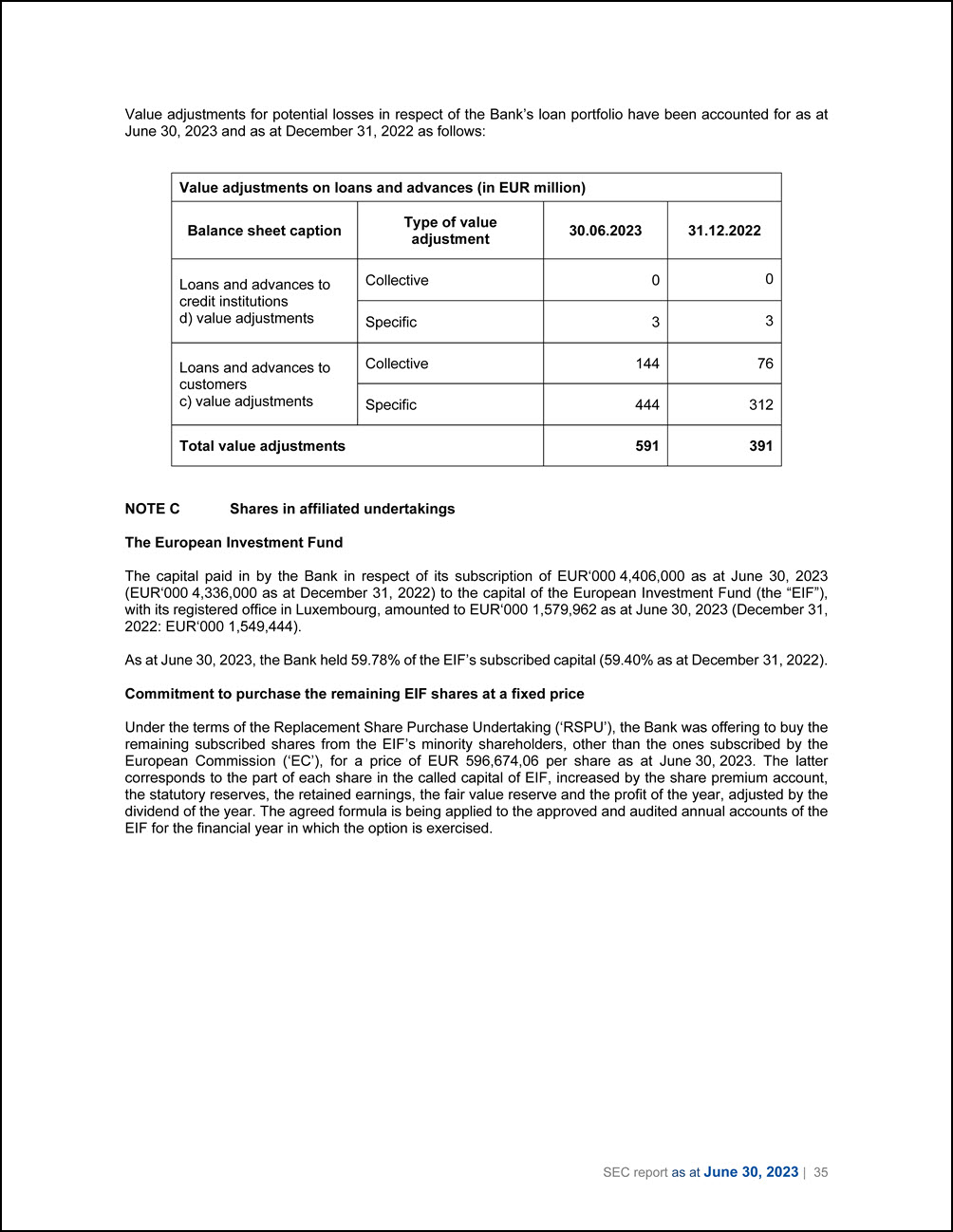

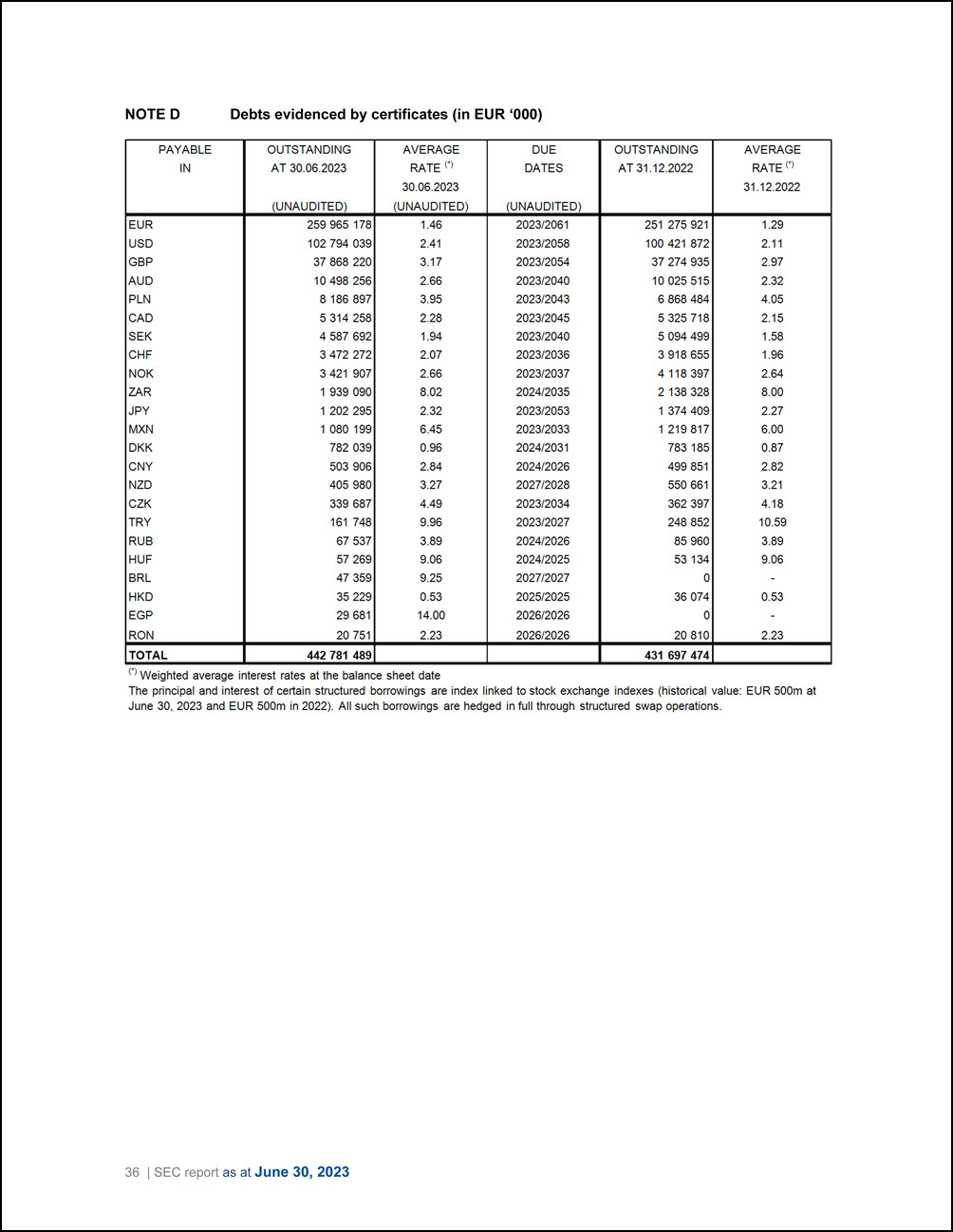

EIB GROUP - EU ACCOUNTING DIRECTIVES TO IFRS RECONCILIATION CONSOLIDATED BALANCE SHEET AS AT JUNE 30, 2023 (in EUR '000) EU Accounting Directives Adjustment 30.06.2023 ASSETS (Unaudited) Impact Ref. 1. Cash in hand, balances with central banks and post office banks 111104 106 A.1 2. Treasury bills and other bills eligible for refinancing with central ban ks 30 701 347 - 199 891 A.2, 8.1 , C 3. Loans and advances to credit institutions a) repayable on demand 889 561 b) other loans and advances 65 765 207 181 067 A.3, 8.4 c) loans 91363415 -1157043 A.3, 8.4 d) impairment on loans and advance s, net of re versals - 3 244 - 40 970 C 158 014 939 4. Loans and advances to customers a) other loans and advances 55 609 A.3, 8.4 b) loans 326 921 113 - 5 029 292 A.3, 8.4 c) impairment on loans and advances, net of reversals - 588 158 101 336 C 326 388 564 5. Debt securities including fixed-income securities a) issued by public bodies 5 000 159 - 81 319 A.2, 8 .1, C b) issued by other borrowers 5 806 941 - 47 094 A.2, 8 .1, C 10 807100 6. Shares and other variable-yield securities 10 449 019 8 982 630 8 .2, 8.3 7. Partic ipating interests 402 896 - 402 896 8 .3 8. Derivative assets 31 588 831 8 .5 9. Property, furniture and equipment 262 819 131 712 G 10. Intangible assets 82 189 11 . Other assets 318 532 - 45 339 8 .5, H 12. Subscribed capital and reserves, called but not paid 639 398 10 190 13. Prepayments 16 409 261 - 16156162 A. 1, A.2 , A.3, A.5, 8 .1, 8 .4, 8 .5 TOTAL ASSETS 554 587168 EU Accounting Directives Adjustment 30.06.2023 LIABILITIES AND EQUITY (Unaudited) Impact Ref. 1. Amounts owed to credit institutions a) repayable on demand 748 926 b) with agreed maturity or periods of notice 1 536 009 1 110 A.4 2 284 935 2. Amounts owed to customers a) repayable on demand 1 503 723 b) with agreed maturity or periods of notice 90 469 1594192 3. Debts evidenced by cenificates a) debt securities in issue 433 931 248 - 14851690 A.5 b) oth ers 8 850 241 872 339 A.5 442 781 489 4. Derivative liabilities 40 701 266 8 .5 5. Other liabilities 4 180 083 897 109 A.3, 8.5, E, G, H 6. Deferred income 17 044 589 - 16 544 081 A.2 , A.3, A.4, A.5, 8 .1, 8.4 , 8 .5, F 7. Provisions a) pension plans and health insurance scheme 4 908 640 942 819 D b) provis ions for gua rantees issued and commitments 101 441 - 31 895 C 5 010 081 TOTAL LIABILITIES 472 895 369 8. Capital a) subscribed 248 795 607 b) uncalled -226 604 892 2219071 5 9. Consolidated reserves a) reseive fund 24 879 561 b) additional reserves 18 974 154 5 705 987 A-H c} fair value reserve 0 1 021 415 A.5, 8 .2, 8 .5 d) special activities reseive 11 194 601 e) general loan reserve 1 883 372 56 931 688 10. Profit for the financial period 1 001 440 - 644 002 A-1 11. Non-controlling interests 1 567 956 - 234 511 E TOTAL EQUITY 81 691 799 TOTAL LIABILITIES AND EQUITY 554 587 168 IFRS 30.06.2023 (Unaudited) 111 210 30 501 456 889 561 65 946 274 90 206 372 - 44 214 156 997 993 55 609 321 891 821 - 486 822 321 460 608 4 918 840 5 759 847 10 678 687 19 431 649 31 588 831 394 531 82189 273 193 649 588 253 099 572 423 034 IFRS 30.06.2023 (Unaudited) 748 926 1 537119 2 286 045 1 503 723 90 469 1 594192 419 079 558 9 722 580 428 802 138 40 701 266 5 077192 500 508 5 851 459 69 546 5 921 005 484 882 346 248 795 607 -226 604 892 22190715 24 879 561 24 680 141 1 021 415 11 194 601 1 883 372 63 659 090 357 438 1 333 445 87 540 688 572 423 034 12 | SEC report as at June 30, 2023