Free Writing Prospectus | Filed Pursuant to Rule 433(d) |

Dated 22 May 2024 | Registration Statement No. 333-274695 |

European Investment Bank

USD 1,000,000,000 SOFR Floating Rate Notes due 2029

Final Term Sheet

Issuer: | European Investment Bank |

Ratings(1): | AAA (S&P)(2) / Aaa (Moody’s)(2) / AAA (Fitch)(2) |

Status: | Senior Unsecured Notes |

Format: | SEC-Registered |

Currency/Size: | USD 1,000,000,000 |

Maturity Date: | 14 August 2029 |

Coupon: | The sum of the Compounded Daily SOFR Rate for the relevant Interest Period and the Margin (each, as defined below) (together, the “Interest Rate”); provided that if any Interest Rate as so calculated would be less than 0.000% per annum, the Interest Rate for the relevant Interest Period will be deemed to be 0.000% per annum. The Interest Rate for each Interest Period shall apply with effect from, and including, the Reset Date (as defined below) for such Interest Period. The Notes will bear interest on the principal amount during (a) each successive period, from, and including, the prior Interest Payment Date (or, if there is no prior Interest Payment Date, the Interest Commencement Date) to, but excluding, the next following Interest Payment Date (or, in the case of the final Interest Period, the Maturity Date), or (b) any other period (if any) in respect of which interest is required to be calculated, being the period from, and including, the first day of such period to, but excluding, the day on which the relevant payment of interest becomes due and payable (each such period, an “Interest Period”); provided that the first Interest Period will begin on, and include, 30 May 2024 (the “Interest Commencement Date”) and will end on, but exclude, 14 August 2024 (short first coupon). |

Interest Payment Dates: | 14 February, 14 May, 14 August and 14 November of each year, subject to the Business Day Convention (as defined below), commencing on 14 August 2024 (short first coupon) |

Interest Determination Date: | With respect to an Interest Period, the date falling five (5) U.S. Government Securities Business Days (as defined below) prior to the relevant Interest Payment Date for the relevant Interest Period; provided, however, that if the Notes become due and payable prior to the scheduled Maturity Date, the final Interest Determination Date for the Notes shall, notwithstanding the Interest Determination Date specified above, be deemed to be the date on which the Notes become due and payable and the Interest Rate on the Notes shall, for so long as any such Notes remain outstanding, be the Interest Rate determined on such date (or, if such date is not a U.S. Government Securities Business Day, the U.S. Government Securities Business Day immediately preceding such date). |

Floating Rate Reference: | The Compounded Daily SOFR Rate (as defined below) |

Margin: | +0.320% per annum |

Reset Dates: | The first day of each Interest Period |

The Compounded Daily SOFR Rate (index determination): | With respect to an Interest Period and subject to the “SOFR Compounded Index Value fallback provisions (fallback to Compounded Daily SOFR with observation period shift)” as described below, the “Compounded Daily SOFR Rate” means the rate of return of a daily compound interest investment (with the secured overnight financing rate (“SOFR”) as the reference rate for the calculation of interest) and will be calculated by Citibank, N.A., London Branch (the “Calculation Agent”) on the relevant Interest Determination Date in accordance with the following formula and the resulting percentage will be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point, with 0.000005 of a percentage point being rounded upwards: where the following terms have the following meanings: “SOFR Compounded IndexStart” means, with respect to an Interest Period, the SOFR Compounded Index Value on the day which is five (5) U.S. Government Securities Business Days preceding the first day of such Interest Period (an “Index Determination Date”); “SOFR Compounded IndexEnd” means, with respect to an Interest Period and subject as provided in the definition of “Interest Determination Date”, the SOFR Compounded Index Value on the day which is five (5) U.S. Government Securities Business Days preceding the Interest Payment Date relating to such Interest Period (or, in the final Interest Period, the Maturity Date) provided, however, that if the Notes become due and payable prior to the scheduled Maturity Date, “SOFR Compounded IndexEnd” shall be deemed to be the SOFR Compounded Index Value on the day on which the Notes become due and payable (or, if such date is not a U.S. Government Securities Business Day, the SOFR Compounded Index Value on the U.S. Government Securities Business Day immediately preceding such date) (each such day, an “Index Determination Date”); “dc” means the number of calendar days from, and including, the day in relation to which SOFR Compounded IndexStart is determined to, but excluding, the day in relation to which SOFR Compounded IndexEnd is determined; “SOFR Compounded Index Value” means, in relation to an Index Determination Date, the SOFR Index value as published by the Federal Reserve Bank of New York, as the administrator of the SOFR Index and SOFR (or any designated successor administrator of the SOFR Index and SOFR) (the “SOFR Administrator”), on the website of the Federal Reserve Bank of

|

| | New York currently at https://www.newyorkfed.org, or any successor website officially designated by the SOFR Administrator (the “SOFR Administrator’s Website”) (information available on this website is not, and shall not be deemed to be, part of or incorporated by reference into this communication), on or about 3:00 p.m. (New York City time) on such Index Determination Date, as determined by the Calculation Agent in accordance with the provisions set forth in the prospectus supplement; and “U.S. Government Securities Business Day” means any day except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association (or any successor) recommends that the fixed income departments of its members be closed for the entire day for the purpose of trading in U.S. government securities. |

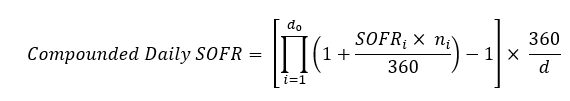

SOFR Compounded Index Value fallback provisions (fallback to Compounded Daily SOFR with observation period shift): | Subject to the “Compounded Daily SOFR fallback provisions (including permanent cessation of SOFR)” below, where applicable, if, in respect of any Index Determination Date, the Calculation Agent determines that the SOFR Compounded Index Value has not been published by the SOFR Administrator and a SOFR Cessation Effective Date (as defined below) has not occurred, the Compounded Daily SOFR Rate for such Interest Period shall be calculated by the Calculation Agent on the relevant Interest Determination Date as being equal to “Compounded Daily SOFR” for such Interest Period, determined as follows. “Compounded Daily SOFR” means, with respect to an Interest Period, the rate of return of a daily compound interest investment (with the secured overnight financing rate (“SOFR”) as the reference rate for the calculation of interest) over the Observation Period corresponding to the relevant Interest Period and will be calculated by the Calculation Agent on the relevant Interest Determination Date in accordance with the provisions set out below and the following formula and the resulting percentage will be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point, with 0.000005 of a percentage point being rounded upwards: where the following terms have the following meanings: “d” is the number of calendar days in the Observation Period corresponding to the relevant Interest Period; “do” is the number of U.S. Government Securities Business Days in the Observation Period corresponding to the relevant Interest Period; |

| | “i” is a series of whole numbers from one to ‘do’, each representing the relevant U.S. Government Securities Business Day in chronological order from, and including, the first U.S. Government Securities Business Day in the Observation Period corresponding to the relevant Interest Period to, and including, the last U.S. Government Securities Business Day in such Observation Period; “ni” for any U.S. Government Securities Business Day ‘i’ in the Observation Period corresponding to the relevant Interest Period, means the number of calendar days from, and including, such U.S. Government Securities Business Day ‘i’ to, but excluding, the following U.S. Government Securities Business Day; “Observation Period” means, with respect to an Interest Period, the period from, and including, the date falling five (5) U.S. Government Securities Business Days preceding the first calendar day of the relevant Interest Period to, but excluding, (i) the date falling five (5) U.S. Government Securities Business Days preceding (A) the Interest Payment Date for such Interest Period, or (B) in the final Interest Period, the Maturity Date, or (ii) if the Notes become due and payable prior to the scheduled Maturity Date and prior to an Interest Payment Date, the day on which the Notes become due and payable (or, if such date is not a U.S. Government Securities Business Day, the U.S. Government Securities Business Day immediately preceding such date); “SOFR” means in respect of any U.S. Government Securities Business Day, the daily Secured Overnight Financing Rate (“SOFR”) for such U.S. Government Securities Business Day, as provided by the SOFR Administrator and as published on the SOFR Administrator’s Website by 3:00 p.m. (New York City time) on the U.S. Government Securities Business Day immediately following such U.S. Government Securities Business Day, as determined by the Calculation Agent; and “SOFRi” in respect of any U.S. Government Securities Business Day ‘i’ falling in the Observation Period corresponding to the relevant Interest Period, is equal to SOFR in respect of such U.S. Government Securities Business Day ‘i’. |

Compounded Daily SOFR fallback provisions (including permanent cessation of SOFR): | (i) If SOFR is not published by 3:00 p.m. (New York City time) on a U.S. Government Securities Business Day in the relevant Observation Period, as specified under “SOFR Compounded Index Value fallback provisions (fallback to Compounded Daily SOFR with observation period shift)” above, then unless a SOFR Cessation Effective Date has occurred, the Calculation Agent will determine SOFR in respect of such U.S. Government Securities Business Day as being equal to SOFR in respect of the last U.S. Government Securities Business Day for which SOFR was published on the SOFR Administrator’s Website. |

| | (ii) If, at any time SOFR is required to be determined, a SOFR Cessation Effective Date has occurred, the Calculation Agent will determine SOFR for each U.S. Government Securities Business Day in the relevant Observation Period on or after such SOFR Cessation Effective Date as if references to SOFR were references to the rate (inclusive of any spreads or adjustments) recommended as the replacement for SOFR by the Board of Governors of the Federal Reserve System and/or by the Federal Reserve Bank of New York, or by a committee officially endorsed or convened by the Board of Governors of the Federal Reserve System and/or the Federal Reserve Bank of New York for the purpose of recommending a replacement for SOFR (which rate may be produced by the Federal Reserve Bank of New York or another administrator) and as provided by the administrator of that rate or, if that rate is not provided by the administrator thereof (or any designated successor thereof), published by an authorized distributor, in respect of that day (the “Fed Recommended Rate”). (iii) If there is a Fed Recommended Rate before the end of the first U.S. Government Securities Business Day following the SOFR Cessation Effective Date but, with respect to any U.S. Government Securities Business Day in the Observation Period in respect of which the Fed Recommended Rate is required to be determined, neither the administrator nor the authorized distributors provide or publish the Fed Recommended Rate, and provided that a Fed Recommended Rate Cessation Effective Date (as defined below) has not occurred, then in respect of any day for which the Fed Recommended Rate is required, references to the Fed Recommended Rate will be deemed to be references to the last provided or published Fed Recommended Rate. However, if there is no such last provided or published Fed Recommended Rate, then in respect of any day for which the Fed Recommended Rate is required, references to the Fed Recommended Rate will be deemed to be references to the last provided or published SOFR. In each case, as determined by the Calculation Agent. (iv) If paragraphs (ii) and (iii) above apply but (1) there is no Fed Recommended Rate before the end of the first U.S. Government Securities Business Day following the SOFR Cessation Effective Date, or (2) there is a Fed Recommended Rate and a Fed Recommended Rate Cessation Effective Date subsequently occurs, then in either case SOFR or, as the case may be, the Fed Recommended Rate, for such U.S. Government Securities Business Day occurring on or after the SOFR Cessation Effective Date or the Fed Recommended Rate Cessation Effective Date (as applicable) will be determined by the Calculation Agent by applying the above formula for Compounded Daily SOFR as described under “SOFR Compounded Index Value fallback provisions (fallback to Compounded Daily SOFR with observation period shift)” |

| | (with corresponding adjustments being deemed to be made to the formula) as if in respect of any U.S. Government Securities Business Day occurring on or after the SOFR Cessation Effective Date or the Fed Recommended Rate Cessation Date (as applicable) (including any day ‘i’) (i) references to “SOFR” were references to the daily Overnight Bank Funding Rate (the “OBFR”) as provided by the Federal Reserve Bank of New York, as the administrator of the OBFR (or any designated successor administrator of the OBFR) (the “OBFR Administrator”), on the website of the Federal Reserve Bank of New York currently at https://www.newyorkfed.org, or any successor website officially designated by the OBFR Administrator (the “OBFR Administrator’s Website”) (information available on this website is not, and shall not be deemed to be, part of or incorporated by reference into this communication), on or about 3:00 p.m. (New York City time) on each day, except for a Saturday, Sunday or a day on which the Fedwire Securities Service or the Fedwire Funds Service of the Federal Reserve Bank of New York is closed (such day, a “New York Fed Business Day”) in respect of the New York Fed Business Day immediately preceding such day and (ii) references to U.S. Government Securities Business Day were to New York Fed Business Day. (v) If neither the OBFR Administrator nor any authorized distributor provide or publish the OBFR on a New York Fed Business Day in the relevant Observation Period, as specified in paragraph (iv) above, then unless an OBFR Cessation Effective Date (as defined below) has occurred, in respect of any day for which the OBFR is required, references to the OBFR will be deemed to be references to the last provided or published OBFR, as determined by the Calculation Agent. (vi) If paragraphs (ii), (iii), (iv) and (v) apply but (1) there is no Fed Recommended Rate before the end of the first U.S. Government Securities Business Day following the SOFR Cessation Effective Date, or there is a Fed Recommended Rate and a Fed Recommended Rate Cessation Effective Date subsequently occurs, and (2) an OBFR Cessation Effective Date also occurs, then in each case, SOFR, or as the case may be, the Fed Recommended Rate, for each U.S. Government Securities Business Day occurring on or after the OBFR Cessation Effective Date (or, if the SOFR Cessation Effective Date or the Fed Recommended Rate Cessation Effective Date (as applicable) is later, each U.S. Government Securities Business Day occurring on or after the SOFR Cessation Effective Date or the Fed Recommended Rate Cessation Effective Date, as applicable) will be determined by the Calculation Agent by applying the above formula for Compounded Daily SOFR as described under “SOFR Compounded Index Value fallback provisions (fallback to Compounded Daily SOFR with observation period shift)” (with corresponding adjustments being deemed to be made to the formula) as if |

| | (i) references to “SOFR” for each U.S. Government Securities Business Day occurring on or after the OBFR Cessation Effective Date (or, if the SOFR Cessation Effective Date or the Fed Recommended Rate Cessation Effective Date (as applicable) is later, each U.S. Government Securities Business Day occurring on or after the SOFR Cessation Effective Date or the Fed Recommended Rate Cessation Effective Date, as applicable) in respect of which “SOFR” is required (including any day ‘i’) were references to the short-term interest rate target set by the Federal Open Market Committee and published on the website of the Board of Governors of the Federal Reserve System currently at https://www.federalreserve.gov, or any successor website of the Board of Governors of the Federal Reserve System (the “Federal Reserve’s Website”) (information available on this website is not, and shall not be deemed to be, part of or incorporated by reference into this communication) or, if the Federal Open Market Committee does not target a single rate, the mid-point of the short-term interest rate target range set by the Federal Open Market Committee and published on the Federal Reserve’s Website (calculated as the arithmetic average of the upper bound of the target range and the lower bound of the target range, rounded, if necessary, to the nearest second decimal place, 0.005 being rounded upwards) (the “FOMC Target Rate”), in respect of any day on which commercial banks and foreign exchange markets are open for general business (including settling payments and dealings in foreign exchange and foreign currency deposits in New York City) (such day, a “New York City Banking Day”); (ii) references to U.S. Government Securities Business Day were references to New York City Banking Day and (iii) references to the OBFR Administrator’s Website or to the SOFR Administrator’s Website, as the case may be, were references to the Federal Reserve’s Website. In respect of any day for which the FOMC Target Rate is required, references to the FOMC Target Rate will be deemed to be references to the last provided or published FOMC Target Rate as at close of business in New York City on that day. Definitions: “Fed Recommended Rate Cessation Effective Date” means, in respect of a Fed Recommended Rate Cessation Event, (a) the first date on which the Fed Recommended Rate is no longer published or provided by the Board of Governors of the Federal Reserve System and/or the Federal Reserve Bank of New York (or another designated administrator of the Fed Recommended Rate), or (b) the date as of which the Fed Recommended Rate may no longer be used; “Fed Recommended Rate Cessation Event” means the occurrence of one or more of the following events with respect to the Fed Recommended Rate, as determined by the Issuer and notified by the Issuer to the Calculation Agent: |

| | (a) a public statement or publication of information by or on behalf of the Board of Governors of the Federal Reserve System and/or the Federal Reserve Bank of New York (or any designated successor administrator or provider of the Fed Recommended Rate) announcing that it has ceased or will cease to provide the Fed Recommended Rate permanently or indefinitely; provided that, at the time of the statement or publication, there is no successor administrator or provider, as applicable, that will continue to provide the Fed Recommended Rate; or (b) a public statement or publication of information by the regulatory supervisor of the administrator or provider of the Fed Recommended Rate, the central bank for the currency of the Fed Recommended Rate, an insolvency official with jurisdiction over the administrator or provider of the Fed Recommended Rate, a resolution authority with jurisdiction over the administrator or provider of the Fed Recommended Rate or a court or an entity with similar insolvency or resolution authority over the administrator or provider of the Fed Recommended Rate, which states that the administrator or provider of the Fed Recommended Rate has ceased or will cease to provide the Fed Recommended Rate permanently or indefinitely; provided that, at the time of the statement or publication, there is no successor administrator or provider that will continue to provide the Fed Recommended Rate; or (c) a public statement or publication of information by the regulatory supervisor of the administrator of the Fed Recommended Rate announcing that (I) the regulatory supervisor has determined that the Fed Recommended Rate is no longer, or as of a specified future date will no longer be, representative of the underlying market and the economic reality that the Fed Recommended Rate is intended to measure and that representativeness will not be restored and (II) it is being made in the awareness that the statement or publication will engage certain contractual triggers for fallbacks activated by a pre-cessation announcement by such regulatory supervisor (howsoever described) in contracts; or (d) a public statement by a regulator in the European Union or in the United States or other official sector entity in the European Union or in the United States, such as the European Central Bank, the European Securities and Markets Authority, the Federal Reserve Bank of New York, the Commodity Futures Trading Commission or the Securities and Exchange Commission, prohibiting the use of the Fed Recommended Rate (whether in respect of instruments or certain types of instrument generally or in respect of the Notes or similar instruments specifically). “OBFR Cessation Effective Date” means, in respect of an OBFR Cessation Event, (a) the first date on which the OBFR is no longer published or provided by the Board of Governors of the Federal Reserve System and/or the Federal Reserve |

| | Bank of New York (or another designated administrator of the OBFR), or (b) the date as of which the OBFR may no longer be used; “OBFR Cessation Event” means the occurrence of one or more of the following events with respect to the OBFR, as determined by the Issuer and notified by the Issuer to the Calculation Agent: (a) a public statement or publication of information by or on behalf of the Federal Reserve Bank of New York (or any designated successor administrator or provider of the OBFR) announcing that it has ceased or will cease to provide the OBFR permanently or indefinitely; provided that, at the time of the statement or publication, there is no successor administrator or provider, as applicable, that will continue to provide the OBFR; or (b) a public statement or publication of information by the regulatory supervisor of the administrator or provider of the OBFR, the central bank for the currency of the OBFR, an insolvency official with jurisdiction over the administrator or provider of the OBFR, a resolution authority with jurisdiction over the administrator or provider of the OBFR or a court or an entity with similar insolvency or resolution authority over the administrator or provider of the OBFR, which states that the administrator or provider of the OBFR has ceased or will cease to provide the OBFR permanently or indefinitely; provided that, at the time of the statement or publication, there is no successor administrator or provider that will continue to provide the OBFR; or (c) a public statement or publication of information by the regulatory supervisor of the administrator of the OBFR announcing that (I) the regulatory supervisor has determined that the OBFR is no longer, or as of a specified future date, will no longer be, representative of the underlying market and the economic reality that the OBFR is intended to measure and that representativeness will not be restored and (II) it is being made in the awareness that the statement or publication will engage certain contractual triggers for fallbacks activated by a pre-cessation announcement by such regulatory supervisor (howsoever described) in contracts; or (d) a public statement by a regulator in the European Union or in the United States or other official sector entity in the European Union or in the United States, such as the European Central Bank, the European Securities and Markets Authority, the Federal Reserve Bank of New York, the Commodity Futures Trading Commission or the Securities and Exchange Commission, prohibiting the use of the OBFR (whether in respect of instruments or certain types of instrument generally or in respect of the Notes or similar instruments specifically). |

| | “SOFR Cessation Effective Date” means, in respect of a SOFR Cessation Event, (a) the first date on which SOFR is no longer published or provided by the Federal Reserve Bank of New York (or any designated successor administrator of SOFR), or (b) the date as of which SOFR may no longer be used; “SOFR Cessation Event” means the occurrence of one or more of the following events with respect to SOFR, as determined by the Issuer and notified by the Issuer to the Calculation Agent: (a) a public statement or publication of information by or on behalf of the Federal Reserve Bank of New York (or any designated successor administrator or provider of SOFR) announcing that it has ceased or will cease to provide SOFR permanently or indefinitely; provided that, at the time of the statement or publication, there is no successor administrator or provider, as applicable, that will continue to provide SOFR; or (b) a public statement or publication of information by the regulatory supervisor of the administrator of SOFR, the central bank for the currency of SOFR, an insolvency official with jurisdiction over the administrator of SOFR, a resolution authority with jurisdiction over the administrator of SOFR or a court or an entity with similar insolvency or resolution authority over the administrator of SOFR, which states that the administrator of SOFR has ceased or will cease to provide SOFR permanently or indefinitely; provided that, at the time of the statement or publication, there is no successor administrator or provider that will continue to provide SOFR; or (c) a public statement or publication of information by the regulatory supervisor of the administrator of SOFR announcing that (I) the regulatory supervisor has determined that SOFR is no longer, or as of a specified future date, will no longer be, representative of the underlying market and the economic reality that SOFR is intended to measure and that representativeness will not be restored and (II) it is being made in the awareness that the statement or publication will engage certain contractual triggers for fallbacks activated by a pre-cessation announcement by such regulatory supervisor (howsoever described) in contracts; or (d) a public statement by a regulator in the European Union or in the United States or other official sector entity in the European Union or in the United States, such as the European Central Bank, the European Securities and Markets Authority, the Federal Reserve Bank of New York, the Commodity Futures Trading Commission or the Securities and Exchange Commission, prohibiting the use of SOFR (whether in respect of instruments or certain types of instrument generally or in respect of the Notes or similar instruments specifically). |

| | Any substitution of SOFR, as specified in paragraphs (ii) to (vi) above, shall apply to the relevant Interest Period and any future Interest Periods (subject to any further operation of such paragraphs (ii) to (vi)) and notice thereof shall be given to holders of the Notes in accordance with the notice procedures described in the prospectus supplement. Notwithstanding the foregoing, in the event that the Compounded Daily SOFR Rate cannot be determined in accordance with any of the foregoing provisions, the Compounded Daily SOFR Rate shall be deemed to be: (A) that determined at the last preceding Interest Determination Date on which such Compounded Daily SOFR Rate was so determined; or (B) if there is no such preceding Interest Determination Date, the initial Interest Rate (minus the Margin) which would have been applicable to the Notes for the first scheduled Interest Period had the Notes been in issue for a period equal in duration to the scheduled first Interest Period but ending on, and excluding, the Interest Commencement Date, in each case as determined by the Calculation Agent. Notwithstanding the foregoing, if the Calculation Agent reasonably requires instructions from the Issuer to be able to perform its duties set forth in the prospectus supplement and in the calculation agency agreement between the Calculation Agent and the Issuer dated on or about the date hereof, including any amendments thereto, for the purpose of determining the Compounded Daily SOFR Rate, the SOFR Compounded Index Value, Compounded Daily SOFR, SOFR, the Fed Recommended Rate, the OBFR or the FOMC Target Rate, it shall promptly notify the Issuer thereof in writing. Upon such notification, the Issuer shall provide the Calculation Agent with instructions as to the course of action to adopt. The Calculation Agent shall not incur any liability for not performing such calculations or determinations due to the failure of the Issuer to provide such instructions. |

Interest Amount: | The Calculation Agent will, on each Interest Determination Date, determine the Interest Rate and calculate the amount of interest payable on the Notes for the relevant Interest Period (the “Interest Amount”). Each Interest Amount shall be calculated by applying the Interest Rate and the Day Count Fraction (as defined below) to the aggregate principal amount of the Notes and rounding the resultant figure to the nearest cent, with one half of one cent being rounded upwards. The Calculation Agent will cause each Interest Rate, each Interest Amount for each Interest Period, each Interest Period and the relevant Interest Payment Date to be notified to the Issuer, the Fiscal Agent, any paying agent, the relevant clearing systems and, if and for so long as any of the Notes are listed on the Official List of the Luxembourg Stock Exchange and admitted to trading on the Bourse de Luxembourg, which is the |

| | regulated market of the Luxembourg Stock Exchange, and the rules and regulations of the Luxembourg Stock Exchange so require, to the Luxembourg Stock Exchange, as set forth in the calculation agency agreement between the Calculation Agent and the Issuer dated on or about the date hereof, including any amendments thereto, in writing as soon as reasonably practicable after their determination and in no event later than the Business Day preceding the relevant Interest Payment Date. Each Interest Amount and Interest Payment Date so notified may subsequently be amended (or appropriate alternative arrangements made by way of adjustment) without notice in the event of an extension or shortening of the Interest Period. Any such amendment will be promptly notified to the Luxembourg Stock Exchange, if and for so long as any of the Notes are listed on the Official List of the Luxembourg Stock Exchange and admitted to trading on the Bourse de Luxembourg, which is the regulated market of the Luxembourg Stock Exchange, and to the holders of the Notes in accordance with the notice procedures described in the prospectus supplement. All certificates, communications, opinions, determinations, calculations, quotations and decisions given, expressed, made or obtained for these purposes by the Calculation Agent shall (in the absence of manifest error) be binding on the Issuer, the Fiscal Agent, any paying agent and the holders of the Notes. |

Business Days: | Any weekday that is a U.S. Government Securities Business Day and is not a legal holiday in New York and is not a date on which banking institutions in New York are authorized or required by law or regulation to be closed. |

Business Day Convention: | Modified Following, adjusted If any Interest Payment Date, other than the Maturity Date, is a day on which banking institutions are authorized or obligated by law to close in New York (the place that is the financial center for the currency of payment) or in any place of payment, then such payment of interest need not be made on that Interest Payment Date at such place of payment. The Issuer may make the required payment on the next succeeding day at such place of payment that is not a day on which banking institutions are authorized or obligated by law to close in New York (the place that is the financial center for the currency of payment) or in such place of payment unless that day would thereby fall in the next calendar month, in which event the payment of such amount shall be brought forward to the first preceding day at such place of payment that is not a day on which banking institutions are authorized or obligated by law to close in New York (the place that is the financial center for the currency of payment) or in such place of payment. If any such Interest Payment Date is postponed as described above, the Interest Amount for each of the corresponding and the following Interest Periods will be adjusted accordingly, and the holders of the Notes will be entitled to more or less interest. If the Maturity Date for payment of principal and interest is a day on which banking institutions are authorized or obligated |

| | by law to close in New York (the place that is the financial center for the currency of payment) or in any place of payment, then such payment will not be made until the next following day that is not a day on which banking institutions are authorized or obligated by law to close in New York (the place that is the financial center for the currency of payment) or in such place of payment, and no further interest shall be paid in respect of the delay in such payment. |

Day Count Fraction: | Actual/360 (when calculating an amount of interest on any Note for any Interest Period, the actual number of days in the relevant Interest Period divided by 360) |

Calculation Agent: | Citibank, N.A., London Branch |

Reoffer: | 100.000% |

Underwriting Discount: | None |

Trade Date: | 22 May 2024 |

Settlement(3): | 30 May 2024 (T+5) |

ISIN / CUSIP / Common Code: | US298785KD79 / 298785KD7 / 283106390 |

Denominations: | USD 1,000 |

Governing Law: | New York |

Listing: | The Notes are expected to be listed on the Luxembourg Stock Exchange. No assurance can be given that such application will be approved or that any of the Notes will be listed. |

Target Market: | Retail / Professional / Eligible Counterparties (all distribution channels)(4) |

Underwriters: | Barclays / BMO Capital Markets / Deutsche Bank |

You can access the prospectus for the registration statement at the following website:

The Issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Issuer, any Underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free at +1-888-603-5847.

____________________

| (1) | A security rating is not a recommendation to buy, sell or hold securities. Ratings are subject to revision or withdrawal at any time by the assigning rating organization. Each rating should be evaluated independently of any other rating. |

| (2) | Carrying a stable outlook. |

| (3) | It is expected that delivery of the Notes will be made against payment therefor on or about 30 May 2024, which will be the fifth business day following the date of pricing of the Notes (this settlement cycle being referred to as “T+5”). Under Rule 15c6-1 under the U.S. Securities Exchange Act of 1934, as amended, trades of securities in the secondary market generally are required to settle in (i) two business days, for such trades that occur before 28 May 2024 or (ii) one business day, for such trades that occur on or after 28 May 2024, in either case unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the second or first business day, as applicable, before the delivery of the Notes will be required, by virtue of the fact that the Notes initially will settle in T+5, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to make such trades should consult their own advisor. |

| (4) | The Issuer does not fall under the scope of application of MiFID II. Consequently, the Issuer does not qualify as an “investment firm”, “manufacturer” or “distributor” for the purposes of MiFID II. Solely for the purposes of the manufacturer’s product approval process, the target market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is eligible counterparties, professional clients and retail clients, each as defined in MiFID II; and (ii) all channels for distribution of the Notes are appropriate, subject to the distributor’s suitability and appropriateness obligations under MiFID II, as applicable. Any person subsequently offering, selling or recommending the Notes (a “distributor”) should take into consideration the manufacturer’s target market assessment; however, a distributor subject to MiFID II is responsible for undertaking its own target market assessment in respect of the Notes (by either adopting or refining the manufacturer’s target market assessment) and determining appropriate distribution channels, subject to the distributor’s suitability and appropriateness obligations under MiFID II, as applicable. For the purposes of this section, the expression “MiFID II” means Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU, as amended from time to time, and the expression “manufacturer” means any Underwriter that is a manufacturer under MiFID II. |

The Issuer does not fall under the scope of application of UK MiFIR. Consequently, the Issuer does not qualify as an “investment firm”, “manufacturer” or “distributor” for the purposes of UK MiFIR. Solely for the purposes of each manufacturer’s product approval process, the target market assessment in respect of the Notes has led to the conclusion that: (i) the target market for the Notes is eligible counterparties, as defined in COBS, professional clients, as defined in UK MiFIR and retail clients, as defined in point (8) of Article 2 of Regulation (EU) No 2017/565; and (ii) all channels for distribution of the Notes are appropriate, subject to the distributor’s suitability and appropriateness obligations under COBS, as applicable. Any person subsequently offering, selling or recommending the Notes (a “distributor”) should take into consideration the manufacturers’ target market assessment; however, a distributor subject to the UK MiFIR Product Governance Rules is responsible for undertaking its own target market assessment in respect of the Notes (by either adopting or refining the manufacturers’ target market assessment) and determining appropriate distribution channels, subject to the distributor’s suitability and appropriateness obligations under COBS, as applicable. For the purposes of this section, the expression “UK MiFIR” means Regulation (EU) No 600/2014 of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Regulation (EU) No 648/2012, as amended from time to time, as it forms part of UK domestic law by virtue of the EUWA, the expression “Regulation (EU) No 2017/565” means Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council as regards organisational requirements and operating conditions for investment firms and defined terms for the purposes of that Directive, as amended from time to time, as it forms part of UK domestic law by virtue of the EUWA, the expression “COBS” means the FCA Handbook - Conduct of Business Sourcebook, as amended from time to time, the expression “UK MiFIR Product Governance Rules” means the FCA Handbook - Product Intervention and Product Governance Sourcebook, as amended from time to time, the expression “EUWA” means the European Union (Withdrawal) Act 2018, as amended from time to time, and the expression “manufacturer” means any Underwriter that is a manufacturer under UK MiFIR.

Additional information and certain considerations related to SOFR and the SOFR Index

An investment in the Notes may entail significant risks not associated with similar investments in conventional debt securities. Any investor should ensure that it understands the nature of the terms of the Notes and the extent of its exposure to risk, and that it considers the suitability of the Notes as an investment in light of its own circumstances, financial condition and other factors. An investor should consult its own professional advisers about the risks associated with investment in the Notes and the suitability of investing in the Notes in light of its particular circumstances.

The Interest Rate in respect of the Notes will be determined on the basis of the Compounded Daily SOFR Rate, which is calculated by reference to the relevant SOFR Compounded Index Values, subject to the fallbacks set out in the prospectus supplement (the “Fallbacks”).

In June 2017, the Alternative Reference Rates Committee (“ARRC”) convened by the Board of Governors of the Federal Reserve System and the Federal Reserve Bank of New York identified SOFR as the rate that, in the consensus view of the ARRC, represented best practice for use in certain new U.S. dollar derivatives and other financial contracts. The Federal Reserve Bank of New York, as the administrator of SOFR, began publishing SOFR in April 2018. The Federal Reserve Bank of New York has also published historical indicative SOFR going back to 2014. Investors should not rely on any historical changes or trends in SOFR as an indicator of future changes in SOFR.

The Federal Reserve Bank of New York in cooperation with the Treasury Department’s Office of Financial Research (the “OFR”), began publishing the SOFR Index on March 2, 2020. The SOFR Index is intended to measure the cumulative impact of compounding SOFR on a unit of investment over time, with the initial value set to 1.00000000 on April 2, 2018, the first value date of SOFR. The Federal Reserve Bank of New York reports that the SOFR Index is compounded by the value of each SOFR thereafter, and that as a result, the SOFR Index on a given day is intended to reflect the effect of compounding SOFR across all previous U.S. Government Securities Business Days since April 2, 2018. It also reports that the SOFR Index allows for the calculation of compounded average rates over custom time periods.

The Federal Reserve Bank of New York reports that the SOFR Index is published as a number rounded to the eighth decimal place on each day that SOFR is published, on a dedicated page on its website, shortly after SOFR is published at approximately 8:00 a.m. (New York City time). The Federal Reserve Bank of New York notes that the SOFR Index will only be revised on a same-day basis at approximately 2:30 p.m. (New York City time), and only if either that day’s SOFR publication were also being revised or an error were discovered in the calculation of the SOFR Index. The Federal Reserve Bank of New York has also published an update to the indicative series of data of the SOFR Index from April 2, 2018 to March 2, 2020. However, investors should not rely on any historical changes or trends in the SOFR Index as an indicator of future changes in SOFR, the SOFR Index, the SOFR Compounded Index Value, the Compounded Daily SOFR Rate and/or the liquidity or market price of the Notes.

Further, prospective investors should be aware that the Federal Reserve Bank of New York, in cooperation with the OFR, also publishes 30-, 90-, and 180-day SOFR averages, sometimes referred to as “SOFR averages”, which are referred to as “30-day Average SOFR”, “90-day Average SOFR” and “180-day Average SOFR”. However, the Interest Rate in respect of the Notes will be determined on the basis of the Compounded Daily SOFR Rate, and not as published. Any determination based on the Compounded Daily SOFR Rate may diverge from any determination that may have been made based on any published compounded SOFR average.

SOFR is published by the Federal Reserve Bank of New York, in cooperation with the OFR, and is intended to be a broad measure of the general cost of financing Treasury securities overnight. The Federal Reserve Bank of New York reports that SOFR includes all trades used in the Broad General Collateral Rate, plus data on transactions cleared through the Fixed Income Clearing Corporation’s Delivery-versus-Payment (“DVP”) repo service. The Federal Reserve Bank of New York notes that DVP repo transactions with rates below the 25th volume-weighted percentile rate are removed from the distribution of DVP repo data each day. This has the effect of removing some (but not all) transactions in which the specific securities are said to be trading “special”. In addition, the Federal Reserve Bank of New York notes that it excludes trades between affiliated entities when relevant, and when the data to make such exclusions is available. Similarly, it excludes trades negotiated for forward settlement. To the extent possible, “open” trades, for which pricing resets daily, are included in the calculation of SOFR.

The Federal Reserve Bank of New York reports that SOFR is calculated as a volume-weighted median, which is the rate associated with transactions at the 50th percentile of transaction volume. Specifically, the volume-weighted median rate is calculated by ordering the transactions from lowest to highest rate, taking the cumulative sum of volumes of these transactions, and identifying the rate associated with the trades at the 50th percentile of dollar volume. At publication, the volume-weighted median is rounded to the nearest basis point. The Federal Reserve Bank of New York notes that SOFR is based on transaction-level data collected under the supervisory authority of the Board of Governors of the Federal Reserve System and transaction-level data obtained from DTCC Solutions LLC, an affiliate of the Depository Trust & Clearing Corporation, under a commercial agreement. The Federal Reserve Bank of New York notes on its publication page for SOFR that the use of SOFR is subject to important limitations and disclaimers, including that the Federal Reserve Bank of New York may alter the methods of calculation, publication schedule, rate revision practices or availability of SOFR at any time without notice.

Prospective investors in the Notes should be aware that the market continues to develop in relation to SOFR as a reference rate in the capital markets. The market or a significant part thereof may adopt an application of SOFR, the SOFR Index, the SOFR Compounded Index Value or the Compounded Daily SOFR Rate that differs significantly from that set out in the prospectus supplement and the Issuer may in future issue notes referencing SOFR, the SOFR Index, the SOFR Compounded Index Value or the Compounded Daily SOFR Rate that differ materially in terms of interest determination when compared with any previous SOFR, SOFR Index, SOFR Compounded Index Value or Compounded Daily SOFR Rate referenced bonds issued by it (including that applicable to the Notes). The development of SOFR as an interest reference rate for the bond markets, as well as continued development of SOFR-based rates, indices and averages for such markets and the market infrastructure for adopting such rates, could result in reduced liquidity or increased volatility or could otherwise affect the market price of the Notes. Similarly, if SOFR, the SOFR Index, the SOFR Compounded Index Value or the Compounded Daily SOFR Rate do not prove to be widely used in securities like the Notes, investors may not be able to sell the Notes at all or the trading price of the Notes may be lower than those of notes linked to indices that are more widely used, and may consequently suffer from increased pricing volatility and market risk.

In addition, the manner of adoption or application of SOFR, the SOFR Index, the SOFR Compounded Index Value or the Compounded Daily SOFR Rate in the bond markets may differ materially compared with the application and adoption of SOFR, the SOFR Index, the SOFR Compounded Index Value or the Compounded Daily SOFR Rate in other markets, such as the derivatives and loan markets. Investors should carefully consider how any mismatch between the adoption of SOFR, the SOFR Index, the SOFR Compounded Index Value or the Compounded Daily SOFR Rate across these markets may impact any hedging or other financial arrangements which they may put in place in connection with any acquisition, holding or disposal of the Notes.

Furthermore, the Interest Rate in respect of the Notes is only capable of being determined five (5) U.S. Government Securities Business Days immediately prior to the relevant Interest Payment Date (subject as set out in the prospectus supplement). It may be difficult for investors in the Notes to estimate reliably the amount of interest which will be payable on the Notes, and some investors may be unable or unwilling to trade the Notes without changes to their IT systems, both of which factors could adversely impact the liquidity of the Notes. Further, if the Notes become due and payable prior to the scheduled Maturity Date, the final Interest Rate payable in respect of the Notes shall only be determined on the date on which the Notes become due and payable and shall not be reset thereafter.

In addition, as SOFR and the SOFR Index are published by the Federal Reserve Bank of New York based on data received from other sources, the Issuer has no control over their determination, calculation or publication. There can be no guarantee that SOFR and the SOFR Index will not be discontinued or fundamentally altered in a manner that is materially adverse to the interests or rights of investors in the Notes. If the manner in which SOFR and/or the SOFR Index is calculated is changed, that change may result in a reduction of the amount of interest payable on the Notes and the trading prices of the Notes. If the definition, methodology, formula, guidelines or other means of calculating SOFR and/or the SOFR Index is modified, references to SOFR, the SOFR Index and/or the SOFR Compounded Index Value shall be to SOFR, the SOFR Index and/or the SOFR Compounded Index Value as modified, respectively. Furthermore, to the extent that the SOFR Compounded Index Value is no longer published as specified in the prospectus supplement, the applicable rate to be used to calculate the Interest Rate on the Notes will be determined using the Fallbacks. Any of these Fallbacks may result in interest payments that are lower than, or do not otherwise correlate over time with, the payments that would have been made on the Notes if SOFR, the SOFR Index and/or the SOFR Compounded Index Value had been provided by the Federal Reserve Bank of New York in its current form. In addition, the use of the Fallbacks may also effectively result in a fixed rate of interest being applied to the Notes.

17