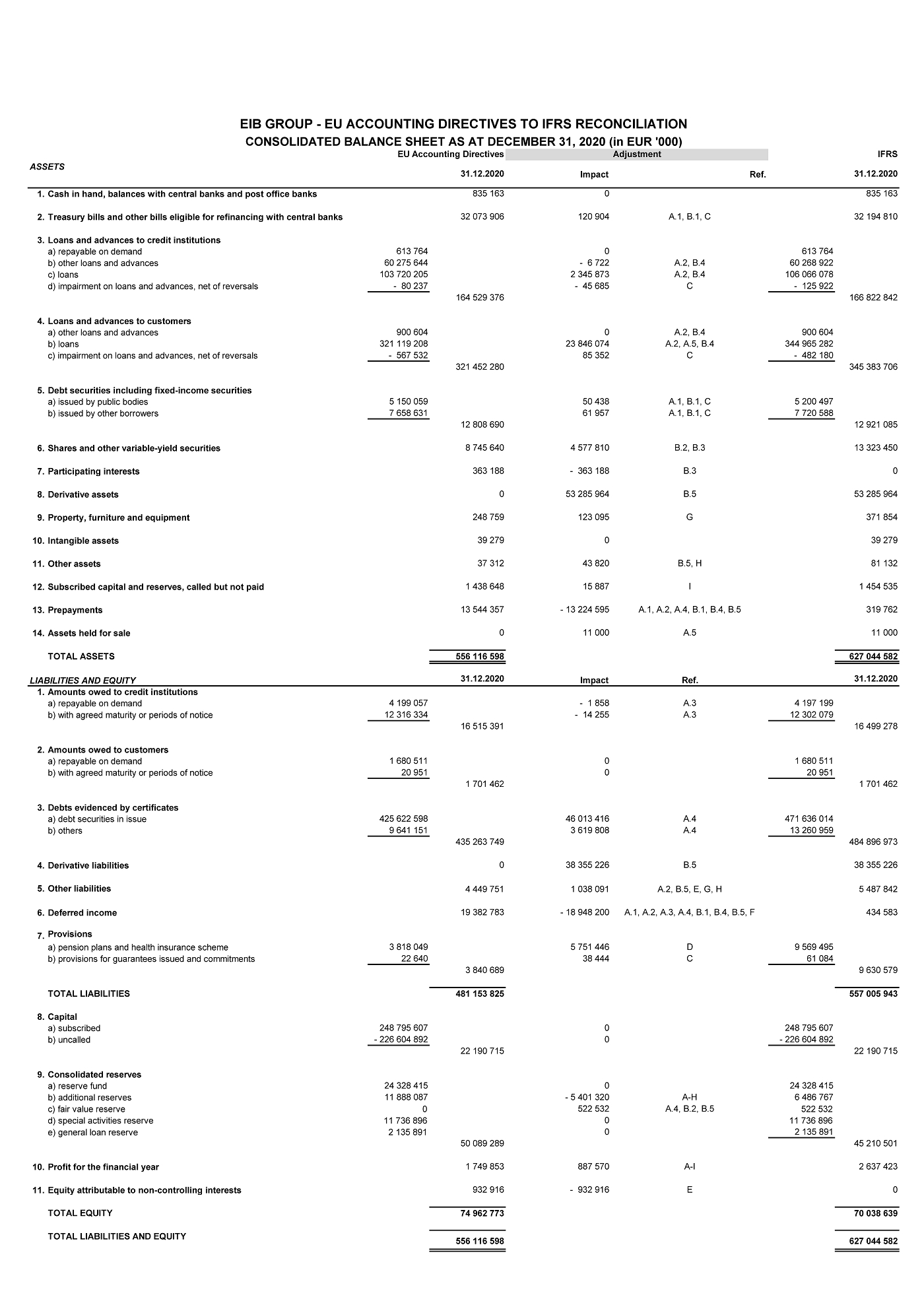

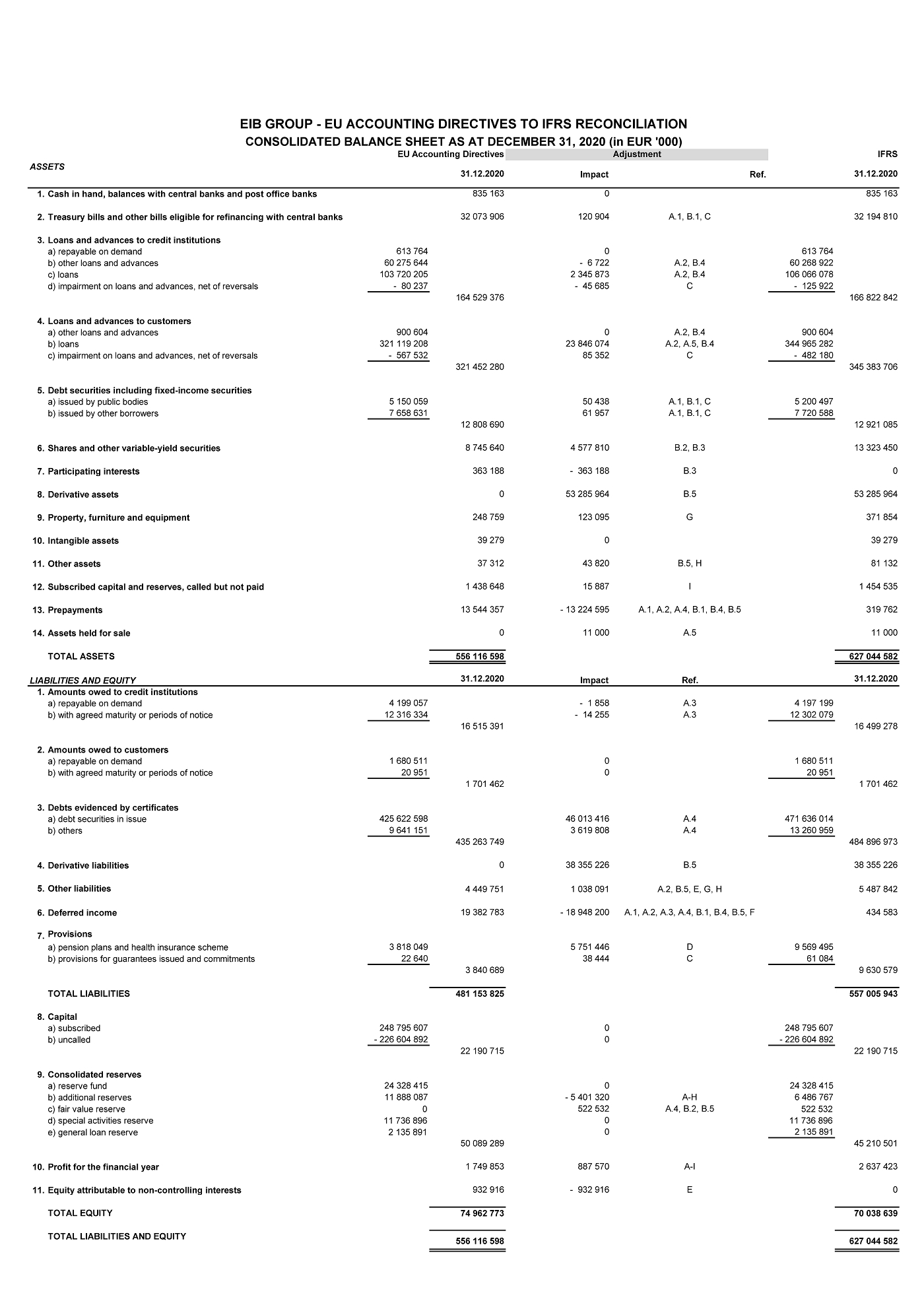

| EIB GROUP - EU ACCOUNTING DIRECTIVES TO IFRS RECONCILIATION CONSOLIDATED BALANCE SHEET AS AT DECEMBER 31, 2020 (in EUR '000) EU Accounting Directives Adjustment IFRS ASSETS Impact Ref. 1. Cash in hand, balances with central banks and post office banks 835 163 0 835 163 2. Treasury bills and other bills eligible for refinancing with central banks 32 073 906 120 904 A.1, B.1, C 32 194 810 3. Loans and advances to credit institutions a) repayable on demand 613 764 0 613 764 b) other loans and advances 60 275 644 - 6 722 A.2, B.4 60 268 922 c) loans 103 720 205 2 345 873 A.2, B.4 106 066 078 d) impairment on loans and advances, net of reversals - 80 237 - 45 685 C - 125 922 164 529 376 166 822 842 4. Loans and advances to customers a) other loans and advances 900 604 0 A.2, B.4 900 604 b) loans 321 119 208 23 846 074 A.2, A.5, B.4 344 965 282 c) impairment on loans and advances, net of reversals - 567 532 85 352 C - 482 180 321 452 280 345 383 706 5. Debt securities including fixed-income securities a) issued by public bodies 5 150 059 50 438 A.1, B.1, C 5 200 497 b) issued by other borrowers 7 658 631 61 957 A.1, B.1, C 7 720 588 12 808 690 12 921 085 6. Shares and other variable-yield securities 8 745 640 4 577 810 B.2, B.3 13 323 450 7. Participating interests 363 188 - 363 188 B.3 0 8. Derivative assets 0 53 285 964 B.5 53 285 964 9. Property, furniture and equipment 248 759 123 095 G 371 854 10. Intangible assets 39 279 0 39 279 11. Other assets 37 312 43 820 B.5, H 81 132 12. Subscribed capital and reserves, called but not paid 1 438 648 15 887 I 1 454 535 13. Prepayments 13 544 357 - 13 224 595 A.1, A.2, A.4, B.1, B.4, B.5 319 762 14. Assets held for sale 0 11 000 A.5 11 000 TOTAL ASSETS 556 116 598 627 044 582 LIABILITIES AND EQUITY 31.12.2020 Impact Ref. 31.12.2020 1. Amounts owed to credit institutions a) repayable on demand 4 199 057 - 1 858 A.3 4 197 199 b) with agreed maturity or periods of notice 12 316 334 - 14 255 A.3 12 302 079 16 515 391 16 499 278 2. Amounts owed to customers a) repayable on demand 1 680 511 0 1 680 511 b) with agreed maturity or periods of notice 20 951 0 20 951 1 701 462 1 701 462 3. Debts evidenced by certificates a) debt securities in issue 425 622 598 46 013 416 A.4 471 636 014 b) others 9 641 151 3 619 808 A.4 13 260 959 435 263 749 484 896 973 4. Derivative liabilities 0 38 355 226 B.5 38 355 226 5. Other liabilities 4 449 751 1 038 091 A.2, B.5, E, G, H 5 487 842 6. Deferred income 19 382 783 - 18 948 200 A.1, A.2, A.3, A.4, B.1, B.4, B.5, F 434 583 7. Provisions a) pension plans and health insurance scheme 3 818 049 5 751 446 D 9 569 495 b) provision for guarantees issued and commitments 22 640 38 444 C 61 084 3 840 689 9 630 579 TOTAL LIABILITIES 481 153 825 557 005 943 8. Capital a) subscribed 248 795 607 0 248 795 607 b) uncalled - 226 604 892 0 - 226 604 892 22 190 715 22 190 715 9. Consolidated reserves a) reserve fund 24 328 415 0 24 328 415 b) additional reserves 11 888 087 - 5 401 320 A-H 6 486 767 c) fair value reserve 0 522 532 A.4, B.2, B.5 522 532 d) special activities reserve 11 736 896 0 11 736 896 e) general loan reserve 2 135 891 0 2 135 891 50 089 289 45 210 501 10. Profit for the financial year 1 749 853 887 570 A-I 2 637 423 11. Equity attributable to non-controlling interests 932 916 - 932 916 E 0 TOTAL EQUITY 74 962 773 70 038 639 TOTAL LIABILITIES AND EQUITY 556 116 598 627 044 582 31.12.2020 31.12.2020 |