Exhibit I

EIB Statutory Bodies

The composition of the Bank’s statutory bodies, the curriculum vitae of their members and additional information on the remuneration arrangements are regularly updated and posted on the EIB’s website: www.eib.org.

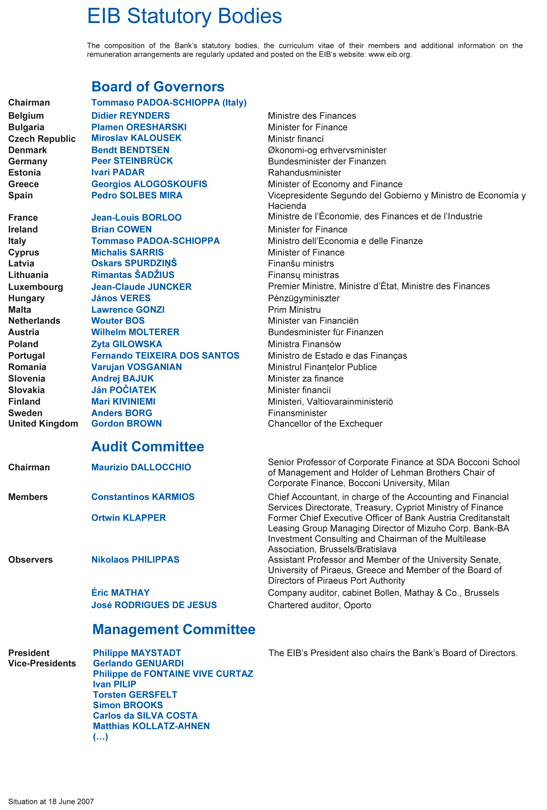

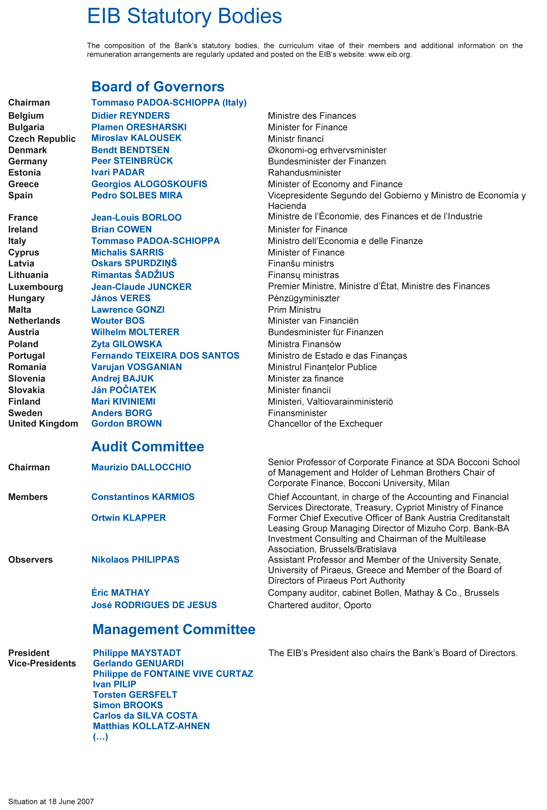

Board of Governors

Chairman Tommaso PADOA-SCHIOPPA (Italy)

Belgium Didier REYNDERS Ministre des Finances

Bulgaria Plamen ORESHARSKI Minister for Finance

Czech Republic Miroslav KALOUSEK Ministr financí

Denmark Bendt BENDTSEN Økonomi-og erhvervsminister

Germany Peer STEINBRÜCK Bundesminister der Finanzen

Estonia Ivari PADAR Rahandusminister

Greece Georgios ALOGOSKOUFIS Minister of Economy and Finance

Spain Pedro SOLBES MIRA Vicepresidente Segundo del Gobierno y Ministro de Economía y

Hacienda

France Jean-Louis BORLOO Ministre de l’Économie, des Finances et de l’Industrie

Ireland Brian COWEN Minister for Finance

Italy Tommaso PADOA-SCHIOPPA Ministro dell’Economia e delle Finanze

Cyprus Michalis SARRIS Minister of Finance

Latvia Oskars SPURDZINŠ Finanšu ministrs

Lithuania Rimantas ŠADZIUS Finansu ministras

Luxembourg Jean-Claude JUNCKER Premier Ministre, Ministre d’État, Ministre des Finances

Hungary János VERES Pénzügyminiszter

Malta Lawrence GONZI Prim Ministru

Netherlands Wouter BOS Minister van Financiën

Austria Wilhelm MOLTERER Bundesminister für Finanzen

Poland Zyta GILOWSKA Ministra Finansów

Portugal Fernando TEIXEIRA DOS SANTOS Ministro de Estado e das Finanças

Romania Varujan VOSGANIAN Ministrul Finantelor Publice

Slovenia Andrej BAJUK Minister za finance

Slovakia Ján POCIATEK Minister financií

Finland Mari KIVINIEMI Ministeri, Valtiovarainministeriö

Sweden Anders BORG Finansminister

United Kingdom Gordon BROWN Chancellor of the Exchequer

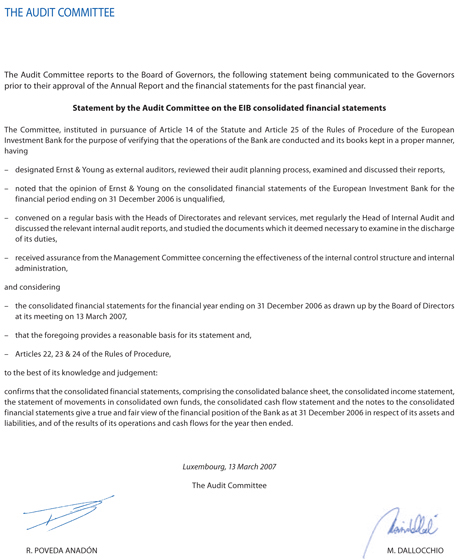

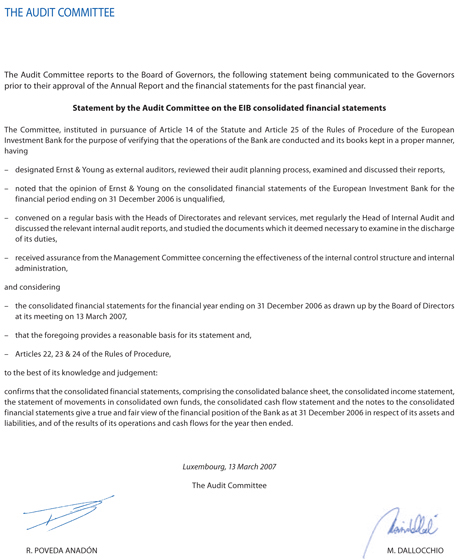

Audit Committee

Chairman Maurizio DALLOCCHIO Senior Professor of Corporate Finance at SDA Bocconi School of Management and Holder of Lehman Brothers Chair of Corporate Finance, Bocconi University, Milan

Members Constantinos KARMIOS Chief Accountant, in charge of the Accounting and Financial Services Directorate, Treasury, Cypriot Ministry of Finance

Ortwin KLAPPER Former Chief Executive Officer of Bank Austria Creditanstalt Leasing Group Managing Director of Mizuho Corp. Bank-BA Investment Consulting and Chairman of the Multilease Association, Brussels/Bratislava

Observers Nikolaos PHILIPPAS Assistant Professor and Member of the University Senate, University of Piraeus, Greece and Member of the Board of Directors of Piraeus Port Authority

Éric MATHAY Company auditor, cabinet Bollen, Mathay & Co., Brussels

José RODRIGUES DE JESUS Chartered auditor, Oporto

Management Committee

President Vice-Presidents Philippe MAYSTADT Gerlando GENUARDI Philippe de FONTAINE VIVE CURTAZ Ivan PILIP Torsten GERSFELT Simon BROOKS Carlos da SILVA COSTA Matthias KOLLATZ-AHNEN (…) The EIB’s President also chairs the Bank’s Board of Directors.

Situation at 18 June 2007

1

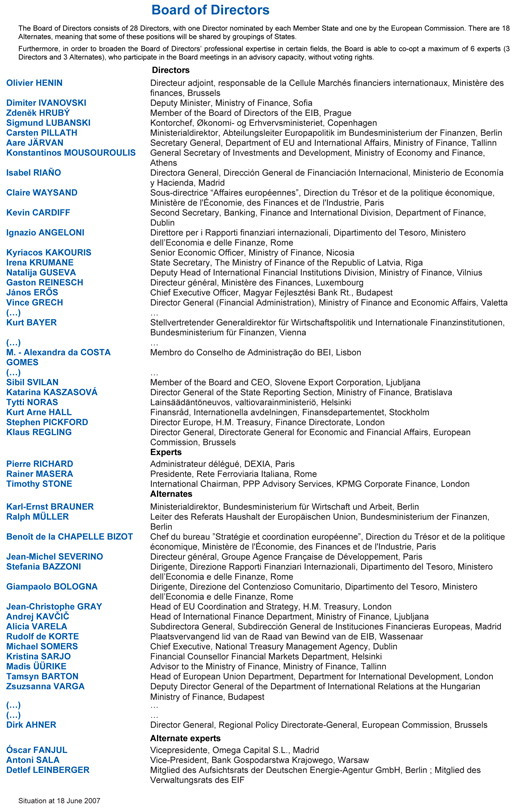

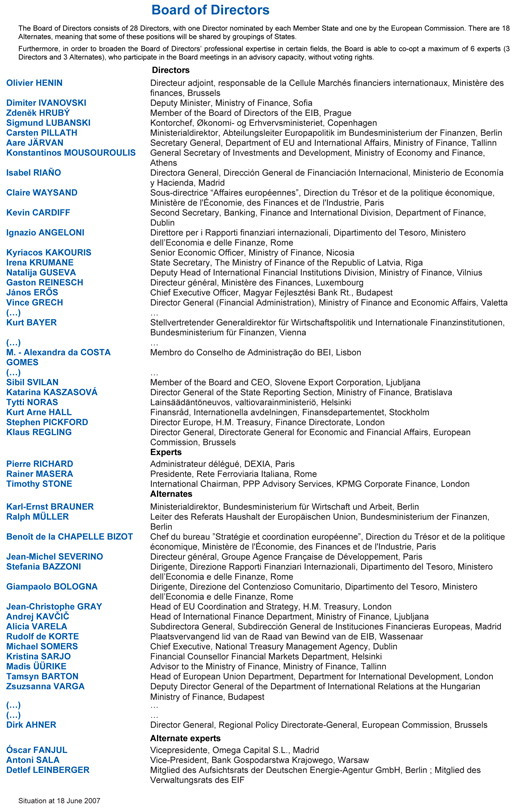

Board of Directors

The Board of Directors consists of 28 Directors, with one Director nominated by each Member State and one by the European Commission. There are 18 Alternates, meaning that some of these positions will be shared by groupings of States.

Furthermore, in order to broaden the Board of Directors’ professional expertise in certain fields, the Board is able to co-opt a maximum of 6 experts (3 Directors and 3 Alternates), who participate in the Board meetings in an advisory capacity, without voting rights.

Directors

Olivier HENIN Directeur adjoint, responsable de la Cellule Marchés financiers internationaux, Ministère des finances, Brussels

Dimiter IVANOVSKI Deputy Minister, Ministry of Finance, Sofia

Zdenek HRUBÝ Member of the Board of Directors of the EIB, Prague

Sigmund LUBANSKI Kontorchef, Økonomi- og Erhvervsministeriet, Copenhagen

Carsten PILLATH Ministerialdirektor, Abteilungsleiter Europapolitik im Bundesministerium der Finanzen, Berlin

Aare JÄRVAN Secretary General, Department of EU and International Affairs, Ministry of Finance, Tallinn

Konstantinos MOUSOUROULIS General Secretary of Investments and Development, Ministry of Economy and Finance, Athens

Isabel RIAÑO Directora General, Dirección General de Financiación Internacional, Ministerio de Economía y Hacienda, Madrid

Claire WAYSAND Sous-directrice “Affaires européennes”, Direction du Trésor et de la politique économique, Ministère de l’Économie, des Finances et de l’Industrie, Paris

Kevin CARDIFF Second Secretary, Banking, Finance and International Division, Department of Finance, Dublin

Ignazio ANGELONI Direttore per i Rapporti finanziari internazionali, Dipartimento del Tesoro, Ministero dell’Economia e delle Finanze, Rome

Kyriacos KAKOURIS Senior Economic Officer, Ministry of Finance, Nicosia

Irena KRUMANE State Secretary, The Ministry of Finance of the Republic of Latvia, Riga

Natalija GUSEVA Deputy Head of International Financial Institutions Division, Ministry of Finance, Vilnius

Gaston REINESCH Directeur général, Ministère des Finances, Luxembourg

János ERÖS Chief Executive Officer, Magyar Fejlesztési Bank Rt., Budapest

Vince GRECH Director General (Financial Administration), Ministry of Finance and Economic Affairs, Valetta

(…) …

Kurt BAYER Stellvertretender Generaldirektor für Wirtschaftspolitik und Internationale Finanzinstitutionen, Bundesministerium für Finanzen, Vienna

(…) …

M. - Alexandra da COSTA GOMES Membro do Conselho de Administração do BEI, Lisbon

(…) …

Sibil SVILAN Member of the Board and CEO, Slovene Export Corporation, Ljubljana

Katarina KASZASOVÁ Director General of the State Reporting Section, Ministry of Finance, Bratislava

Tytti NORAS Lainsäädäntöneuvos, valtiovarainministeriö, Helsinki

Kurt Arne HALL Finansråd, Internationella avdelningen, Finansdepartementet, Stockholm

Stephen PICKFORD Director Europe, H.M. Treasury, Finance Directorate, London

Klaus REGLING Director General, Directorate General for Economic and Financial Affairs, European Commission, Brussels

Experts

Pierre RICHARD Administrateur délégué, DEXIA, Paris

Rainer MASERA Presidente, Rete Ferroviaria Italiana, Rome

Timothy STONE International Chairman, PPP Advisory Services, KPMG Corporate Finance, London

Alternates

Karl-Ernst BRAUNER Ministerialdirektor, Bundesministerium für Wirtschaft und Arbeit, Berlin

Ralph MÜLLER Leiter des Referats Haushalt der Europäischen Union, Bundesministerium der Finanzen, Berlin

Benoît de la CHAPELLE BIZOT Chef du bureau ”Stratégie et coordination européenne”, Direction du Trésor et de la politique économique, Ministère de l’Économie, des Finances et de l’Industrie, Paris

Jean-Michel SEVERINO Directeur général, Groupe Agence Française de Développement, Paris

Stefania BAZZONI Dirigente, Direzione Rapporti Finanziari Internazionali, Dipartimento del Tesoro, Ministero dell’Economia e delle Finanze, Rome

Giampaolo BOLOGNA Dirigente, Direzione del Contenzioso Comunitario, Dipartimento del Tesoro, Ministero dell’Economia e delle Finanze, Rome

Jean-Christophe GRAY Head of EU Coordination and Strategy, H.M. Treasury, London

Andrej KAVČIČ Head of International Finance Department, Ministry of Finance, Ljubljana

Alicia VARELA Subdirectora General, Subdirección General de Instituciones Financieras Europeas, Madrid

Rudolf de KORTE Plaatsvervangend lid van de Raad van Bewind van de EIB, Wassenaar

Michael SOMERS Chief Executive, National Treasury Management Agency, Dublin

Kristina SARJO Financial Counsellor Financial Markets Department, Helsinki

Madis ÜÜRIKE Advisor to the Ministry of Finance, Ministry of Finance, Tallinn

Tamsyn BARTON Head of European Union Department, Department for International Development, London

Zsuzsanna VARGA Deputy Director General of the Department of International Relations at the Hungarian

Ministry of Finance, Budapest

(…) …

(…) …

Dirk AHNER Director General, Regional Policy Directorate-General, European Commission, Brussels

Alternate experts

Óscar FANJUL Vicepresidente, Omega Capital S.L., Madrid

Antoni SALA Vice-President, Bank Gospodarstwa Krajowego, Warsaw

Detlef LEINBERGER Mitglied des Aufsichtsrats der Deutschen Energie-Agentur GmbH, Berlin ; Mitglied des Verwaltungsrats des EIF

Situation at 18 June 2007

2

EIB financing in 2006

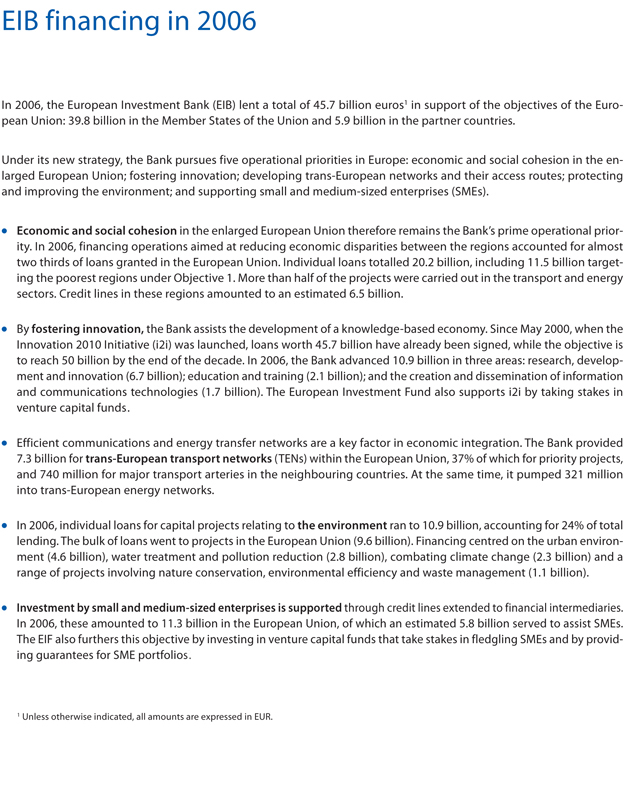

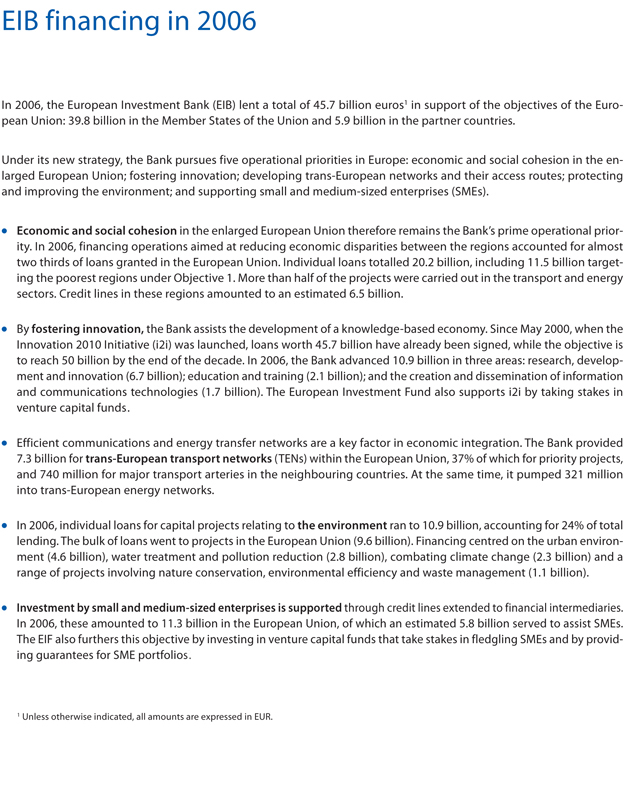

In 2006, the European Investment Bank (EIB) lent a total of 45.7 billion euros1 in support of the objectives of the Euro-pean Union: 39.8 billion in the Member States of the Union and 5.9 billion in the partner countries.

Under its new strategy, the Bank pursues five operational priorities in Europe: economic and social cohesion in the enlarged European Union; fostering innovation; developing trans-European networks and their access routes; protecting and improving the environment; and supporting small and medium-sized enterprises (SMEs).

Economic and social cohesion in the enlarged European Union therefore remains the Bank’s prime operational priority. In 2006, financing operations aimed at reducing economic disparities between the regions accounted for almost two thirds of loans granted in the European Union. Individual loans totalled 20.2 billion, including 11.5 billion targeting the poorest regions under Objective 1. More than half of the projects were carried out in the transport and energy sectors. Credit lines in these regions amounted to an estimated 6.5 billion.

By fostering innovation, the Bank assists the development of a knowledge-based economy. Since May 2000, when the Innovation 2010 Initiative (i2i) was launched, loans worth 45.7 billion have already been signed, while the objective is to reach 50 billion by the end of the decade. In 2006, the Bank advanced 10.9 billion in three areas: research, development and innovation (6.7 billion); education and training (2.1 billion); and the creation and dissemination of information and communications technologies (1.7 billion). The European Investment Fund also supports i2i by taking stakes in venture capital funds2.

Efficient communications and energy transfer networks are a key factor in economic integration. The Bank provided 7.3 billion for trans-European transport networks (TENs) within the European Union, 37% of which for priority projects, and 740 million for major transport arteries in the neighbouring countries. At the same time, it pumped 321 million into trans-European energy networks.

In 2006, individual loans for capital projects relating to the environment ran to 10.9 billion, accounting for 24% of total lending. The bulk of loans went to projects in the European Union (9.6 billion). Financing centred on the urban environment (4.6 billion), water treatment and pollution reduction (2.8 billion), combating climate change (2.3 billion) and a range of projects involving nature conservation, environmental efficiency and waste management (1.1 billion).

Investment by small and medium-sized enterprises is supported through credit lines extended to financial intermediaries. In 2006, these amounted to 11.3 billion in the European Union, of which an estimated 5.8 billion served to assist SMEs.

The EIF also furthers this objective by investing in venture capital funds that take stakes in fledgling SMEs and by providing guarantees for SME portfolios2.

1 Unless otherwise indicated, all amounts are expressed in EUR.

2 See section on EIF activity.

8 EIB Group

3

Financing 2002-2006: 218 billion

European Union Partner Countries

2006

2005

2004

2003

2002

0 25 50

In its multiannual Corporate Operational Plan, the Bank continues to accord priority to human capital. Financing for health and education in the European Union reached 5.3 billion.

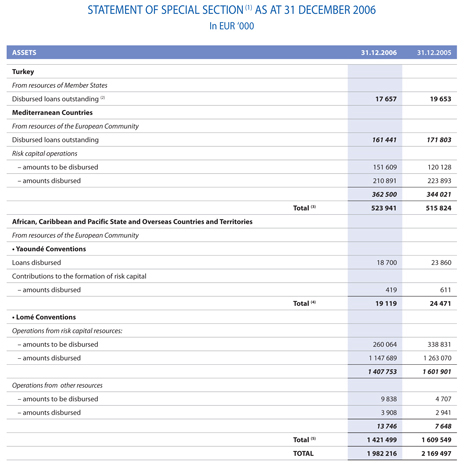

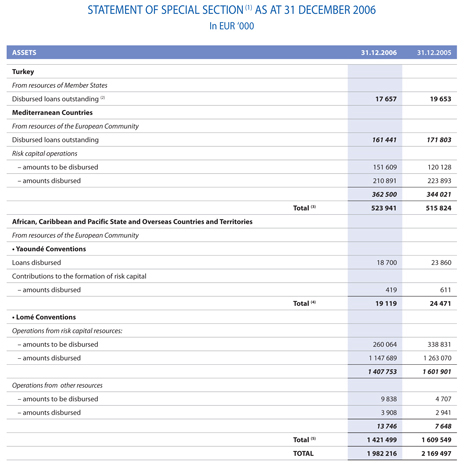

EIB backing for EU development aid and cooperation policies in the partner countries amounted to 5.9 billion in 2006.

In the Mediterranean countries, the development of the private sector is given top priority. Loans signed under the Facility for Euro-Mediterranean Investment and Partnership (FEMIP) totalled 1.4 billion. With an active portfolio of 380 million euros of risk capital operations committed to the private sector in the Mediterranean partner countries, the EIB has become, thanks to EU budgetary funds, the most active international financial institution in terms of private equity investments in the region.

Loans in South-East Europe 3 amounted to 3.2 billion, including 739 million for Bulgaria and Romania. In the Western Balkans, the EIB is pressing ahead with its financing for the rebuilding of basic infrastructure and its support for local authorities.

Lastly, the EIB continued its lending operations in Asia and Latin America (483 million), the African, Caribbean and

Pacific (ACP) countries (745 million) and South Africa (80 million).

During the year, the Bank took account of the development of EU policies and the objectives of the next COP for the period 2007-2009 were adapted accordingly:

In line with the renewed Cohesion Policy 2007-2013, the Bank will gear its activities to the objective of the convergence of the less developed regions of the European Union. These largely correspond to the areas currently classified under Objective 1. With a target of 40% to 50% of total lending in the Union, convergence will remain the Bank’s primary objective.

Energy has been made a specific priority in the COP for the period 2007-2009. Projects meeting this objective involve one of the following: renewable energies; energy efficiency; research, development and innovation; and security of internal and external supply. The Bank has set itself an annual target of 4 billion in support of projects in this sector, including 600 to 800 million for renewable energies.

3 Albania, Bosnia and Herzegovina, Bulgaria, Croatia, Montenegro, Romania, Serbia, Turkey.

Financial report 2006 9

4

EIB Borrowing Activity

A leading international debt issuer

Borrowing: strategy adds value for customers

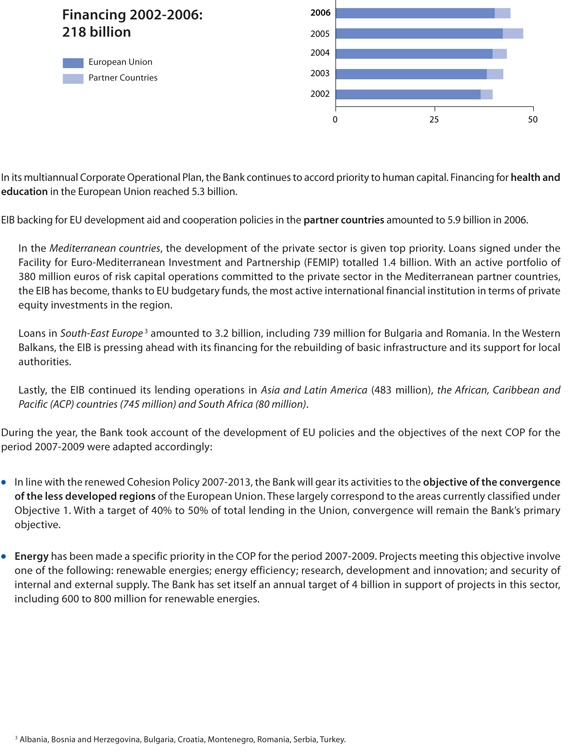

The Bank remained committed to making best use of its financial strength, founded notably on support from shareholders – the EU Member States – to secure funding at optimal cost and thus to add value for customers. In the pursuit of these objectives, the Bank maintained a consistent funding strategy, entailing both continuity and innovation in its benchmark programmes and tailor-made issuance. The resulting achievements benefited loan customers, both in the EU and local developing markets targeted by the Bank.

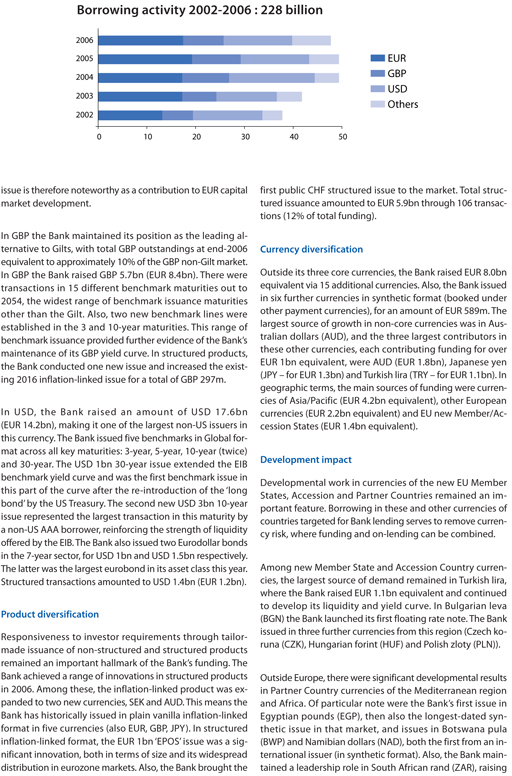

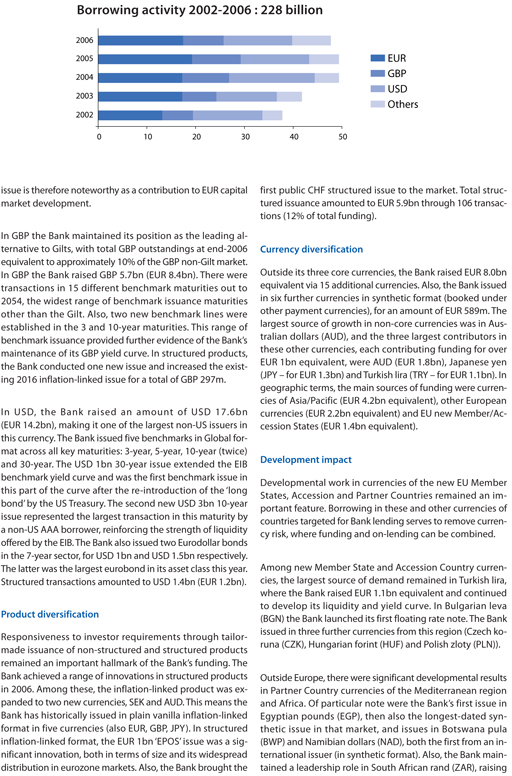

The funding volume of EUR 48bn was similar to last year. Funds were raised via 303 transactions (before swaps) in a record 24 currencies, including six currencies in synthetic format. There was increased demand in non-core currencies (notably Australian dollars), which generated funding for EUR 8bn, compared with EUR 6bn in 2005. However, core currencies (euro, sterling and US dollars) remained the main source of funding, accounting for EUR 40bn of funding (EUR 44bn in 2005).

The market’s favourable reception for the EIB’s funding activities was reflected in the EuroWeek poll, where market participants voted the Bank ‘Most Impressive Borrower’, ‘Most Innovative Borrower’ and ‘Best Supranational or Agency Borrower’ for the third consecutive year. The Bank was also voted ‘Most Exciting and Challenging Borrower for the year ahead’.

Core currencies – sovereign class and innovation

Benchmark programmes strengthened the unique positioning as a multi-currency sovereign-class benchmark issuer. The EIB is exceptional in offering highly comprehensive yield curves across EUR, GBP and USD. Benchmark issues in the Bank’s three core currencies remained a cornerstone of cost-effective funding, and raised EUR 28bn equivalent (59% of total funding). Of this, the largest amount was raised in

euro (EUR 10.6bn), followed by USD (EUR 9.7bn equivalent) and GBP (EUR 8.0bn equivalent).

In its benchmark programmes, the Bank remained responsive to investor requirements. It therefore continued to pay particular attention to market-sensitive execution, for example in terms of timing, sizing, maturity selection and fairness of pricing. Such attention to quality of execution, coupled with the Bank’s attention to the secondary market in its benchmark bonds, has supported strong aftermarket performance. Investor demand for benchmark issues in the three core currencies remained well diversified, with Europe, Asia and the US providing the largest volumes of demand.

A number of innovations and distinctive features differentiated 2006 activities in core currencies. In EUR, where the Bank raised EUR 17.4bn, there was continued proactive alignment with sovereign issuance features, including an issue size of EUR 5bn for benchmark ‘EARN’ issues – with two new EUR 5bn transactions in the 5-year and 10-year sectors. This helped deliver the funding advantage associated with the strong performance of European sovereign-class bonds in 2006. Further attention to sovereign class liquidity was visible in the EUR 580m increase of the 2008 EARN, via an auction-based liquidity allocation procedure. The Bank remains the only borrower to complement sovereigns with benchmark issues in Global format of EUR 5bn size with outstanding maturities from 3 years to 30 years. EUR benchmark outstandings reached EUR 68bn as of end-2006.

An important highlight in EUR targeted and structured issuance (raising EUR 6.9bn in total) was the first issue to be launched via a Public Offering in all 12 countries of the euro area (termed European Public Offering of Securities or ‘EPOS’). The issue was a EUR 1bn structured bond linked to eurozone inflation. It was a practical proposition thanks to the ‘passporting mechanism’ foreseen in the EU Prospectus Directive4. This was the first time that the passporting mechanism was used on this scale in the bond market. The

4 This Directive sets out an efficient mechanism for the ‘passporting’ of prospectuses in the Member States of the European Union: a prospectus approved by the competent authority in one Member State (‘home country regulator’) can be used as a valid prospectus in any other Member State (‘host Member State’) without the need for any further prospectus approval (‘mutual recognition’).

10 EIB Group

5

Borrowing activity 2002-2006 : 228 billion

2006

2005

2004

2003

2002

0 10 20 30 40 50

EUR GBP USD Others

issue is therefore noteworthy as a contribution to EUR capital market development.

In GBP the Bank maintained its position as the leading alternative to Gilts, with total GBP outstandings at end-2006 equivalent to approximately 10% of the GBP non-Gilt market. In GBP the Bank raised GBP 5.7bn (EUR 8.4bn). There were transactions in 15 different benchmark maturities out to 2054, the widest range of benchmark issuance maturities other than the Gilt. Also, two new benchmark lines were established in the 3 and 10-year maturities. This range of benchmark issuance provided further evidence of the Bank’s maintenance of its GBP yield curve. In structured products, the Bank conducted one new issue and increased the existing 2016 inflation-linked issue for a total of GBP 297m.

In USD, the Bank raised an amount of USD 17.6bn (EUR 14.2bn), making it one of the largest non-US issuers in this currency. The Bank issued five benchmarks in Global format across all key maturities: 3-year, 5-year, 10-year (twice) and 30-year. The USD 1bn 30-year issue extended the EIB benchmark yield curve and was the first benchmark issue in this part of the curve after the re-introduction of the ‘long bond’ by the US Treasury. The second new USD 3bn 10-year issue represented the largest transaction in this maturity by a non-US AAA borrower, reinforcing the strength of liquidity offered by the EIB. The Bank also issued two Eurodollar bonds in the 7-year sector, for USD 1bn and USD 1.5bn respectively. The latter was the largest eurobond in its asset class this year. Structured transactions amounted to USD 1.4bn (EUR 1.2bn).

Product diversification

Responsiveness to investor requirements through tailor-made issuance of non-structured and structured products remained an important hallmark of the Bank’s funding. The Bank achieved a range of innovations in structured products in 2006. Among these, the inflation-linked product was expanded to two new currencies, SEK and AUD. This means the Bank has historically issued in plain vanilla inflation-linked format in five

currencies (also EUR, GBP, JPY). In structured inflation-linked format, the EUR 1bn ‘EPOS’ issue was a significant innovation, both in terms of size and its widespread distribution in eurozone markets. Also, the Bank brought the

first public CHF structured issue to the market. Total structured issuance amounted to EUR 5.9bn through 106 transactions (12% of total funding).

Currency diversification

Outside its three core currencies, the Bank raised EUR 8.0bn equivalent via 15 additional currencies. Also, the Bank issued in six further currencies in synthetic format (booked under other payment currencies), for an amount of EUR 589m. The largest source of growth in non-core currencies was in Aus-tralian dollars (AUD), and the three largest contributors in these other currencies, each contributing funding for over EUR 1bn equivalent, were AUD (EUR 1.8bn), Japanese yen (JPY – for EUR 1.3bn) and Turkish lira (TRY – for EUR 1.1bn). In geographic terms, the main sources of funding were currencies of Asia/Pacific (EUR 4.2bn equivalent), other European currencies (EUR 2.2bn equivalent) and EU new Member/Accession States (EUR 1.4bn equivalent).

Development impact

Developmental work in currencies of the new EU Member States, Accession and Partner Countries remained an important feature. Borrowing in these and other currencies of countries targeted for Bank lending serves to remove currency risk, where funding and on-lending can be combined.

Among new Member State and Accession Country currencies, the largest source of demand remained in Turkish lira, where the Bank raised EUR 1.1bn equivalent and continued to develop its liquidity and yield curve. In Bulgarian leva (BGN) the Bank launched its first floating rate note. The Bank issued in three further currencies from this region (Czech koruna (CZK), Hungarian forint (HUF) and Polish zloty (PLN)).

Outside Europe, there were significant developmental results in Partner Country currencies of the Mediterranean region and Africa. Of particular note were the Bank’s first issue in Egyptian pounds (EGP), then also the longest-dated synthetic issue in that market, and issues in Botswana pula (BWP) and Namibian dollars (NAD), both the first from an international issuer (in synthetic format). Also, the Bank maintained a leadership role in South African rand (ZAR), raising

Financial report 2006 11

6

“The Way to Buy Europe” Snapshot of the EIB as an issuer

Joint EU sovereign ownership underpins top-class credit quality and means EIB bonds can be seen as “The Way to Buy Europe”.

Ownership by all EU sovereigns means EIB bonds offer a unique and diversified sovereign-class investment.? The Bank is rated Aaa/AAA/AAA by Moody’s/Standard & Poors/Fitch.

The Bank’s strategic approach to markets involves a strong focus on liquidity and transparency. It combines comprehensive benchmark programmes in the Bank’s three core currencies (EUR, GBP and USD) with tailor-made issuance across a wide range of currencies and products.

The EIB is one of the largest and most frequent borrowers in the international capital markets. In 2006 it issued a total of EUR 48bn.

The Bank has historically contributed to the development of capital markets in currencies of new EU Member States, EU-Acceding/Accession and EU-Partner Countries. Here issuance in local currencies can support the development of lending activities.

ZAR 2.8bn (EUR 312m). As part of this the 8% January 2013 ZAR issue was increased to ZAR 4.5bn, becoming the largest Eurorand bond. In other regions, there was a first synthetic issue in Indonesian rupiah (IDR), and repeat issuance in synthetic format in Brazilian real (BRL) and Russian ruble (RUB).

New ground in other European currencies

In the Swiss franc (CHF), the Bank introduced a new benchmark, a 30-year CHF 300m issue, which was the longest dated benchmark issue in the market at the time of issuance. In the Danish krone (DKK) market the Bank issued the then longest dated ‘blue-stamped’ 2% bond (2% June 2026 DKK 2.6bn), responding to investor demand for tax-efficient duration products in a segment supported by the Government. In Swedish krona (SEK), the Bank launched the first inflation-linked bond in the international market to be issued by a supranational (SEK 1.5bn issue maturing 2020). The Bank was also present in the Icelandic krona (ISK) and Norwegian krone (NOK) markets.

Asia/Pacific growth

The EIB strengthened its role as a prominent issuer in the Asia/Pacific markets. In Australian dollars (AUD), the Bank achieved the strongest growth and largest volume of issuance among non-core currencies (AUD 3.0bn/EUR 1.8bn vs. AUD 1.2bn/EUR 0.8bn in 2005) and was the largest AAA ‘Kangaroo’ (foreign) issuer. In this market, the Bank issued the first Kangaroo inflation-linked bond, an AUD 250m CPI-linked bond due 2020. The Bank also raised EUR 0.9bn equivalent in the New

Zealand dollar (NZD) market. Of particular note in Japanese yen (JPY) was the 20-year Global JPY 50bn issue, which was at launch the only current coupon 20-year benchmark from a sovereign-class issuer in the international markets. In Hong Kong dollars (HKD), the Bank issued a HKD 1bn 2-year bond, which was the first supranational transaction after relaxation of Hong Kong legislation permitting issues shorter than 3 years for supranationals.

12 EIB Group

7

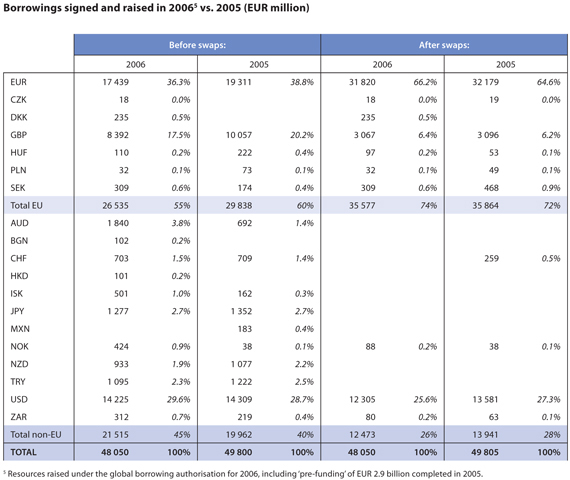

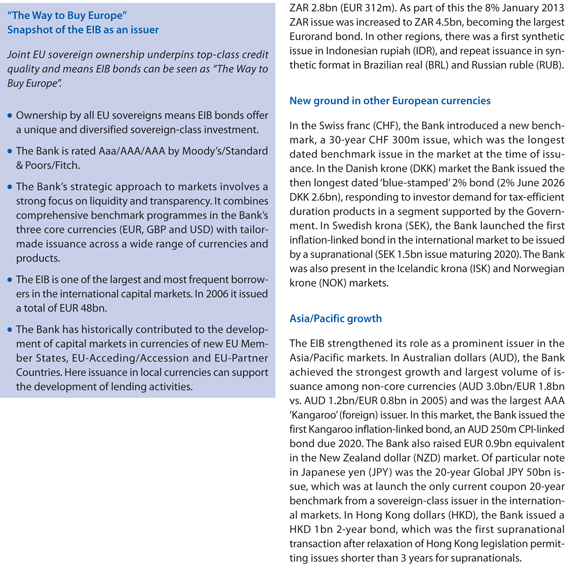

Borrowings signed and raised in 20065 vs. 2005 (EUR million)

Before swaps:

After swaps:

2006

2005

2006

2005

EUR

17 439

36.3%

19 311

38.8%

31 820

66.2%

32 179

64.6%

CZK

18

0.0%

18

0.0%

19

0.0%

DKK

235

0.5%

235

0.5%

GBP

8 392

17.5%

10 057

20.2%

3 067

6.4%

3 096

6.2%

HUF

110

0.2%

222

0.4%

97

0.2%

53

0.1%

PLN

32

0.1%

73

0.1%

32

0.1%

49

0.1%

SEK

309

0.6%

174

0.4%

309

0.6%

468

0.9%

Total EU

26 535

55%

29 838

60%

35 577

74%

35 864

72%

AUD

1 840

3.8%

692

1.4%

BGN

102

0.2%

CHF

703

1.5%

709

1.4%

259

0.5%

HKD

101

0.2%

ISK

501

1.0%

162

0.3%

JPY

1 277

2.7%

1 352

2.7%

MXN

183

0.4%

NOK

424

0.9%

38

0.1%

88

0.2%

38

0.1%

NZD

933

1.9%

1 077

2.2%

TRY

1 095

2.3%

1 222

2.5%

USD

14 225

29.6%

14 309

28.7%

12 305

25.6%

13 581

27.3%

ZAR

312

0.7%

219

0.4%

80

0.2%

63

0.1%

Total non-EU

21 515

45%

19 962

40%

12 473

26%

13 941

28%

TOTAL

48 050

100%

49 800

100%

48 050

100%

49 805

100%

5 Resources raised under the global borrowing authorisation for 2006, including ‘pre-funding’ of EUR 2.9 billion completed in 2005.

Financial report 2006 13

8

EIB Group

Financial Statements

EIB Group - Financial Statements 2006 19

9

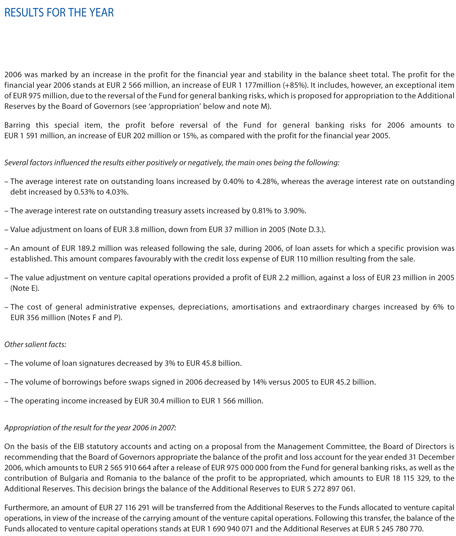

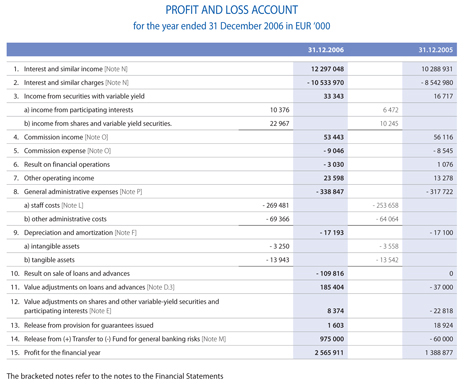

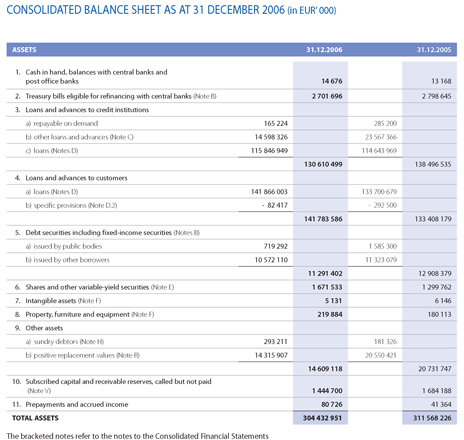

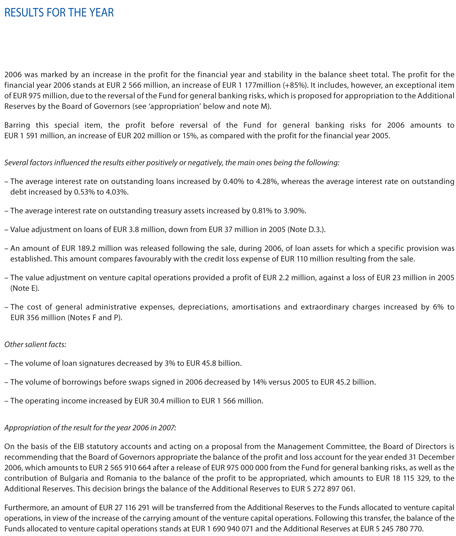

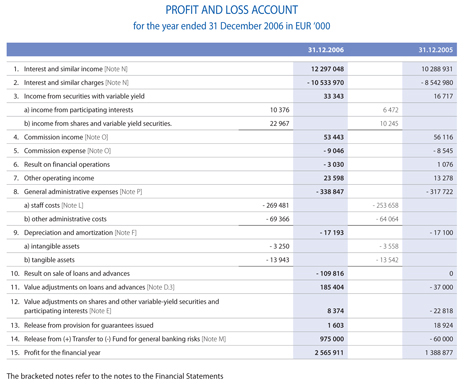

RESULTS FOR THE YEAR

For the EIB Group, the year 2006 was marked by an increase in the profit to be appropriated and a slight decrease in the balance sheet total (-2%). The profit to be appropriated for the reporting year stands at EUR 3 235 million, an increase of EUR 2 048 million (+173%). It includes, however, an exceptional item of EUR 975 million due to the reversal of the Fund for general banking risks and its proposed appropriation to the Additional Reserves by the Board of Governors (see note L).

Barring this special item, the profit before movements to/from the Fund for general banking risks for 2006 amounts to EUR 2 260 million, an increase of EUR 1 013 million or 81%. (In 2005 an amount of EUR 60 million was added to the Fund for general banking risks.)

The main contributing factors to the increase in profit are:

– The result on financial operations, which mainly comprises the net results on derivatives, loans and borrowings, with application of the fair value option under IAS 39, increased by EUR 881 million (see Note N).

– The credit loss expense, together with the movements in the specific provision for credit risk, resulted in a profit of EUR 102 million, compared with a loss of EUR 38 million in 2005, a positive impact of EUR 140 million.

– The lower impairment on venture capital operations (Note E) gave a positive impact on the result of EUR 19 million.

– General administrative expenses (Note P) increased, giving a negative impact on the result of EUR 82 million. This was mainly due to an increase in expenses relating to the Group’s defined benefit post-employment schemes (Note K) under IAS19, as compared with 2005.

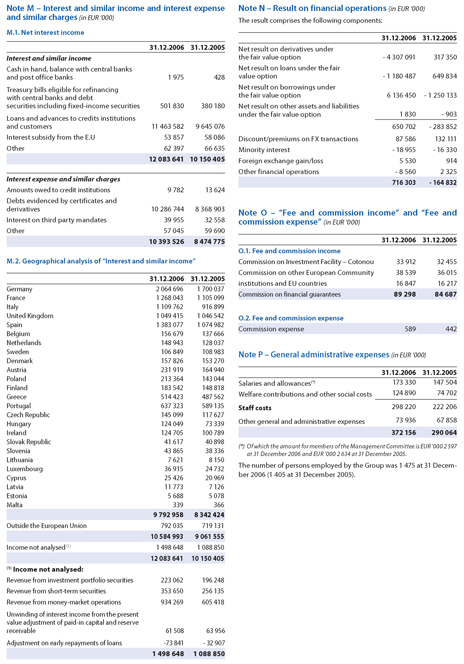

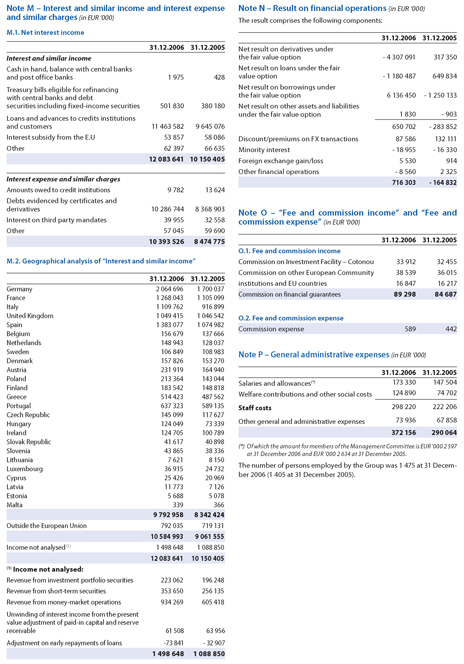

– The net result of interest and similar income and charges stands at EUR 1 690 million in 2006, i.e. a positive impact on the result of EUR 15 million (items 1 and 2 of the Income Statement).

EIB Group – Financial Statements 2006 21

10

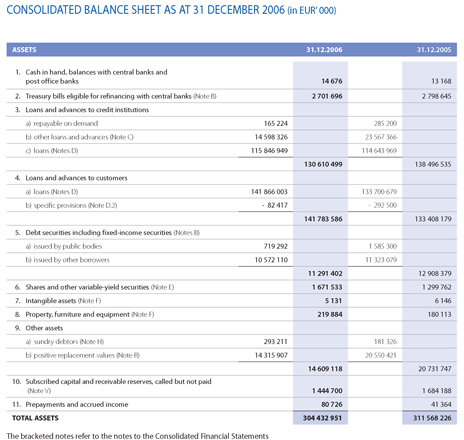

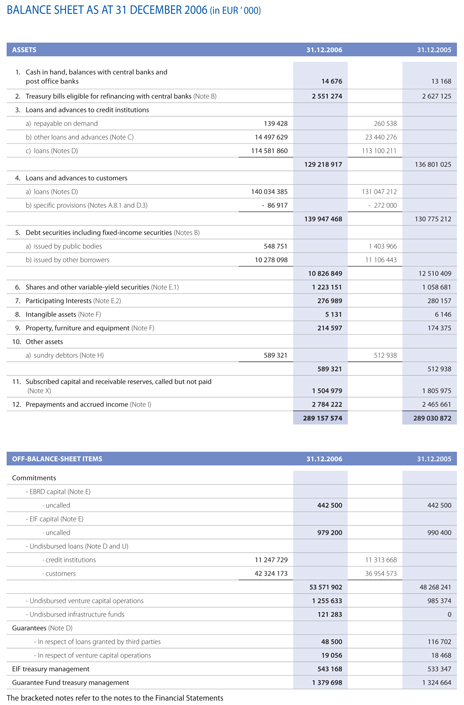

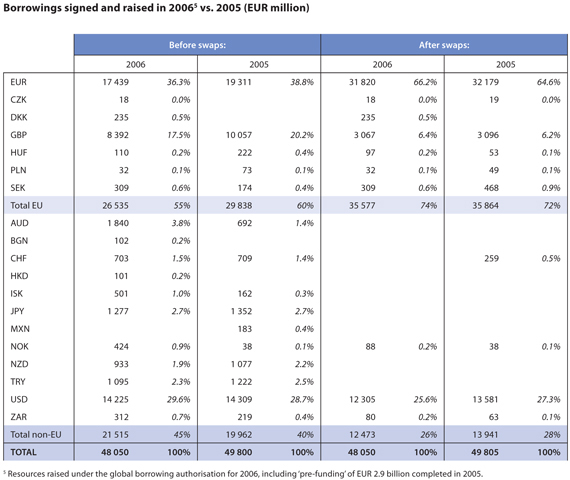

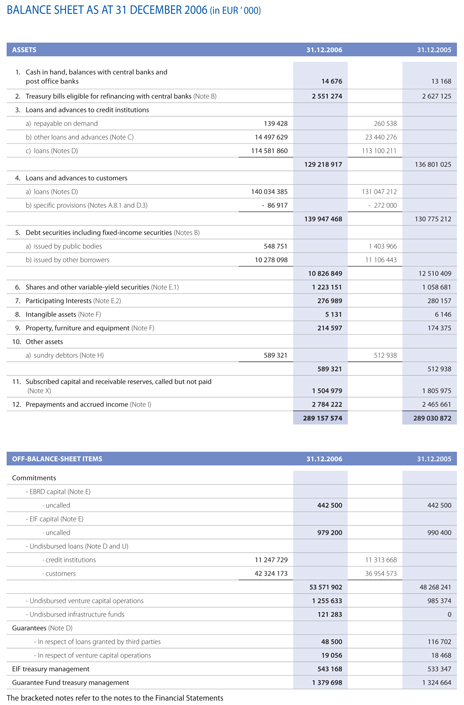

CONSOLIDATED BALANCE SHEET AS AT 31 DECEMBER 2006 (in EUR’ 000)

ASSETS 31.12.2006

31.12.2005

1.

Cash in hand, balances with central banks and

post office banks

14 676

13 168

2.

Treasury bills eligible for refinancing with central banks (Note B)

2 701 696

2 798 645

3.

Loans and advances to credit institutions

a) repayable on demand

165224

285 200

b) other loans and advances (Note C)

14598326

23 567 366

c) loans (Notes D)

115846949

114 643 969

130 610 499

138 496 535

4.

Loans and advances to customers

a) loans (Notes D)

141866003

133700679

b) specific provisions (Note D.2)

- 82 417

- 292 500

141 783 586

133 408 179

5.

Debt securities including fixed-income securities (Notes B)

a) issued by public bodies

719 292

1 585 300

b) issued by other borrowers

10 572 110

11 323 079

11 291 402

12 908 379

6.

Shares and other variable-yield securities (Note E)

1 671 533

1 299 762

7.

Intangible assets (Note F)

5 131

6 146

8.

Property, furniture and equipment (Note F)

219 884

180 113

9.

Other assets

a) sundry debtors (Note H)

293 211

181 326

b) positive replacement values (Note R)

14 315 907

20 550 421

14 609 118

20 731 747

10.

Subscribed capital and receivable reserves, called but not paid

(Note V)

1 444 700

1 684 188

11.

Prepayments and accrued income

80 726

41 364

TOTAL ASSETS

304 432 951

311 568 226

The bracketed notes refer to the notes to the Consolidated Financial Statements

22 EIB Group

11

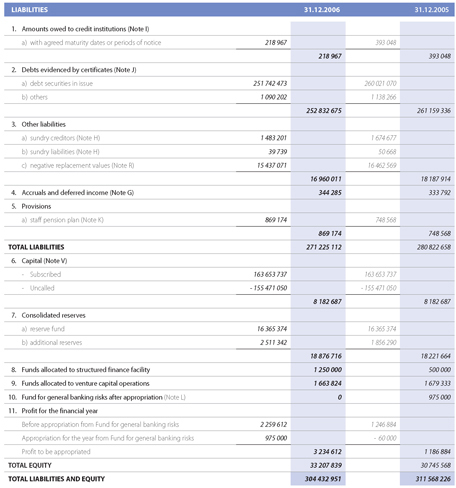

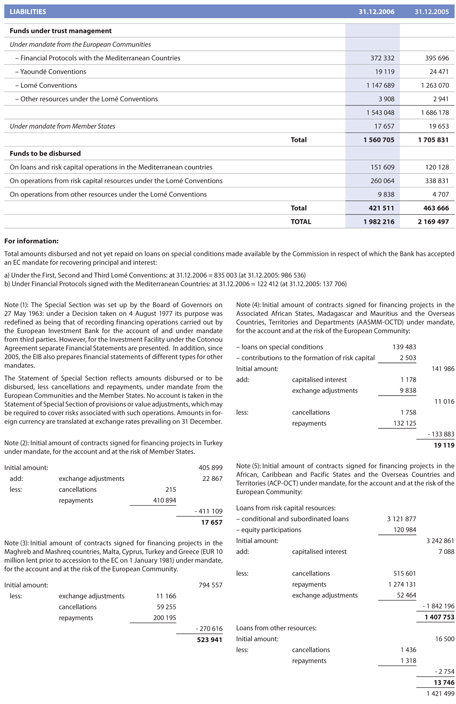

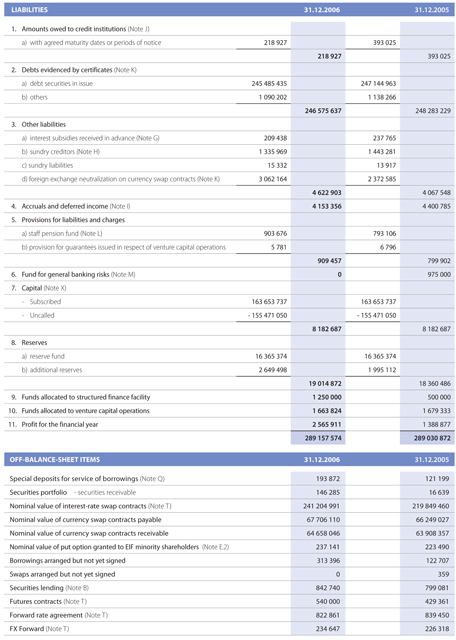

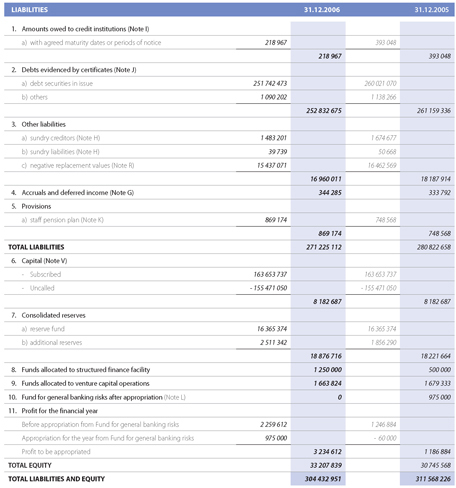

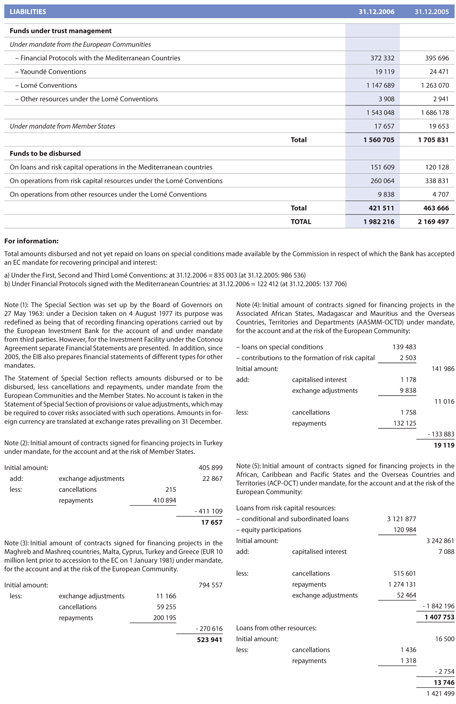

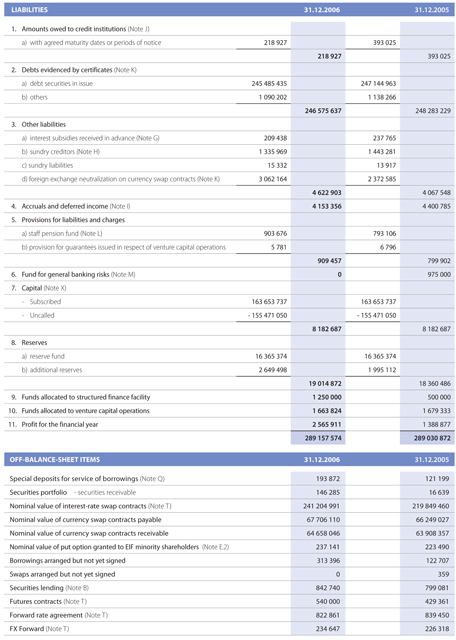

LIABILITIES

31.12.2006

31.12.2005

1.

Amounts owed to credit institutions (Note I)

a) with agreed maturity dates or periods of notice

218 967

393 048

218 967

393 048

2.

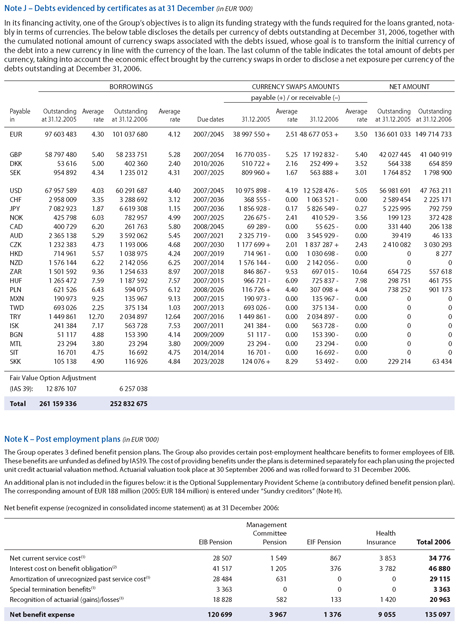

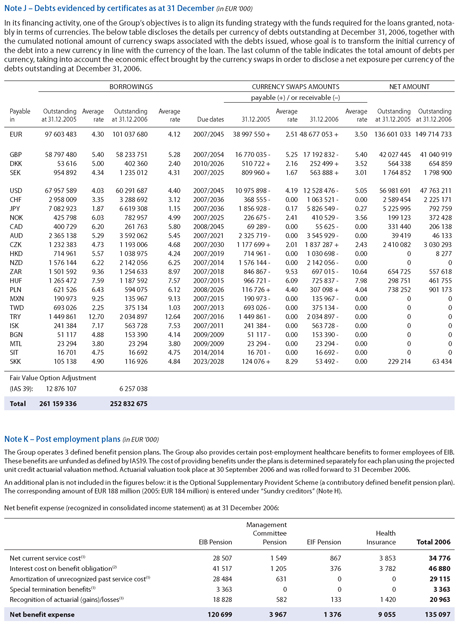

Debts evidenced by certificates (Note J)

a) debt securities in issue

251 742 473

260 021 070

b) others

1 090 202

1 138 266

252 832 675

261 159 336

3.

Other liabilities

a) sundry creditors (Note H)

1483201

1 674 677

b) sundry liabilities (Note H)

39 739

50 668

c) negative replacement values (Note R)

15437071

16462569

16 960 011

18 187 914

4.

Accruals and deferred income (Note G)

344 285

333 792

5.

Provisions

a) staff pension plan (Note K)

869 174

748 568

869 174

748 568

TOTAL LIABILITIES

271 225 112

280 822 658

6.

Capital (Note V)

- Subscribed

163 653 737

163 653 737

- Uncalled

-155471050

- 155 471 050

8 182 687

8 182 687

7.

Consolidated reserves

a) reserve fund

16 365 374

16 365 374

b) additional reserves

2 511 342

1 856 290

18 876 716

18 221 664

8.

Funds allocated to structured finance facility

1 250 000

500 000

9.

Funds allocated to venture capital operations

1 663 824

1 679 333

10.

Fund for general banking risks after appropriation (Note L)

0

975 000

11.

Profit for the financial year

Before appropriation from Fund for general banking risks

2 259 612

1 246 884

Appropriation for the year from Fund for general banking risks

975 000

- 60 000

Profit to be appropriated

3 234 612

1 186 884

TOTAL EQUITY

33 207 839

30 745 568

TOTAL LIABILITIES AND EQUITY

304 432 951

311 568 226

EIB Group – Financial Statements 2006 23

12

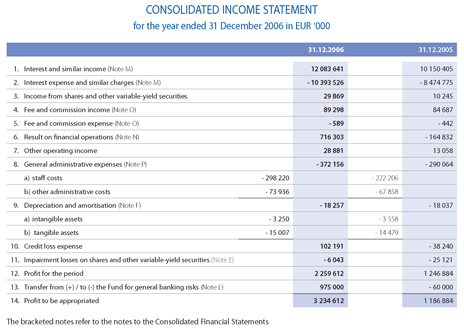

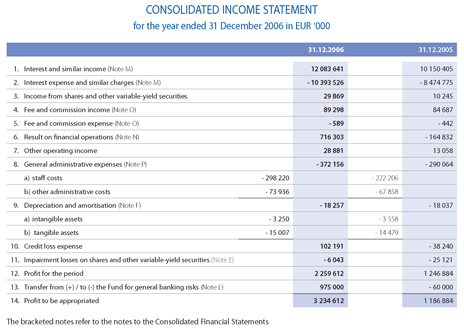

CONSOLIDATED INCOME STATEMENT

for the year ended 31 December 2006 in EUR ‘000

31.12.2006

31.12.2005

1.

Interest and similar income (Note M)

12 083 641

10 150 405

2.

Interest expense and similar charges (Note M)

- 10 393 526

- 8 474 775

3.

Income from shares and other variable-yield securities

29 869

10 245

4.

Fee and commission income (Note O)

89 298

84 687

5.

Fee and commission expense (Note O)

- 589

- 442

6.

Result on financial operations (Note N)

716 303

- 164 832

7.

Other operating income

28 881

13 058

8.

General administrative expenses (Note P)

- 372 156

- 290 064

a) staff costs

-298220

-222206

b) other administrative costs

- 73 936

- 67 858

9.

Depreciation and amortisation (Note F)

- 18 257

- 18 037

a) intangible assets

- 3 250

- 3 558

b) tangible assets

- 15 007

- 14 479

10.

Credit loss expense

102 191

- 38 240

11.

Impairment losses on shares and other variable-yield securities (Note E)

- 6 043

- 25 121

12.

Profit for the period

2 259 612

1 246 884

13.

Transfer from (+) / to (-) the Fund for general banking risks (Note L)

975 000

- 60 000

14.

Profit to be appropriated

3 234 612

1 186 884

The bracketed notes refer to the notes to the Consolidated Financial Statements

EIB Group 24

13

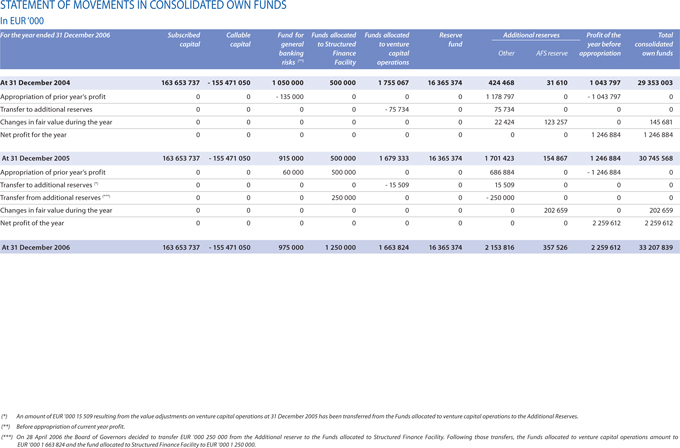

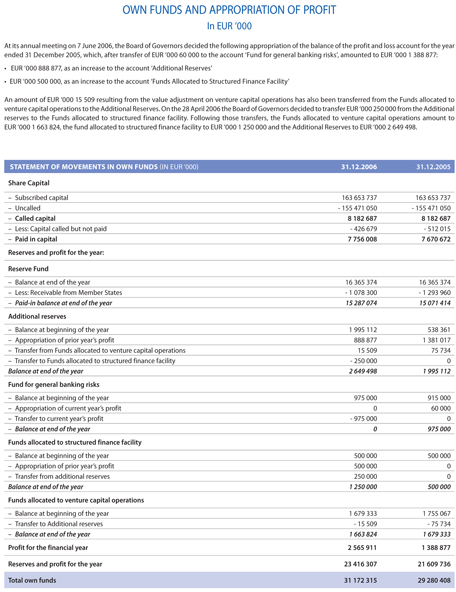

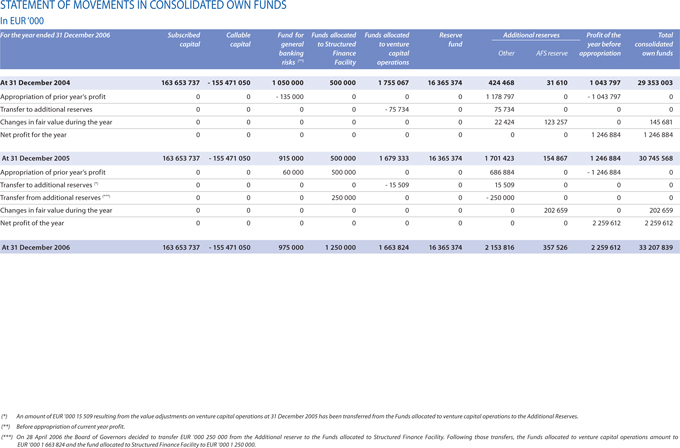

STATEMENT OF MOVEMENTS IN CONSOLIDATED OWN FUNDS

In EUR ‘000

For the year ended 31 December 2006

Subscribed

capital

Callable

capital

Fund for

general banking risks (**)

Funds allocated

to Structured Finance Facility

Funds allocated

to venture capital operations

Reserve

fund

Additional reserves

Profit of the

year before appropriation

Total

consolidated own funds

Other

AFS reserve

At 31 December 2004

163653737

-155471050

1050000

500000

1755067

16365374

424468

31610

1043797

29353003

Appropriation of prior year’s profit

0

0

-135000

0

0

0

1178797

0

-1043797

0

Transfer to additional reserves

0

0

0

0

- 75 734

0

75 734

0

0

0

Changes in fair value during the year

0

0

0

0

0

0

22 424

123 257

0

145 681

Net profit for the year

0

0

0

0

0

0

0

0

1 246884

1 246 884

At 31 December 2005

163653737

-155471050

915 000

500000

1 679333

16365374

1701423

154867

1 246884

30745568

Appropriation of prior year’s profit

0

0

60 000

500 000

0

0

686 884

0

-1246884

0

Transfer to additional reserves (*)

0

0

0

0

- 15 509

0

15 509

0

0

0

Transfer from additional reserves (***)

0

0

0

250 000

0

0

-250000

0

0

0

Changes in fair value during the year

0

0

0

0

0

0

0

202659

0

202 659

Net profit of the year

0

0

0

0

0

0

0

0

2 259612

2 259 612

At 31 December 2006

163 653 737

- 155 471 050

975 000

1 250 000

1 663 824

16 365 374

2 153 816

357 526

2 259 612

33 207 839

(*) An amount of EUR ‘000 15 509 resulting from the value adjustments on venture capital operations at 31 December 2005 has been transferred from the Funds allocated to venture capital operations to the Additional Reserves. (**) Before appropriation of current year profit.

(***) On 28 April 2006 the Board of Governors decided to transfer EUR ‘000 250 000 from the Additional reserve to the Funds allocated to Structured Finance Facility. Following those transfers, the Funds allocated to venture capital operations amount to EUR ‘000 1 663 824 and the fund allocated to Structured Finance Facility to EUR ‘000 1 250 000.

EIB Group – Financial Statements 2006 25

14

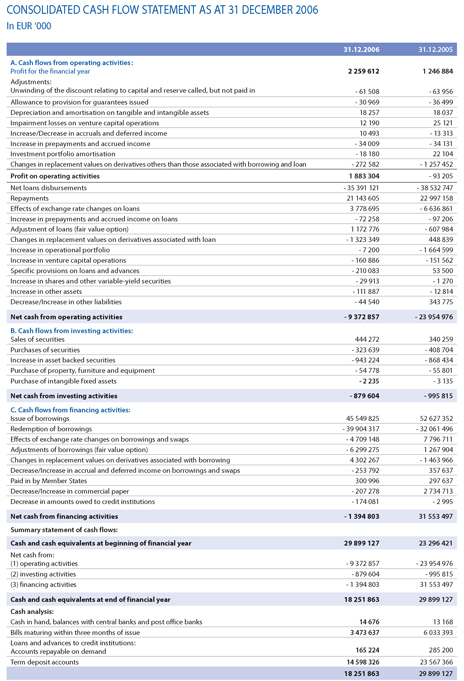

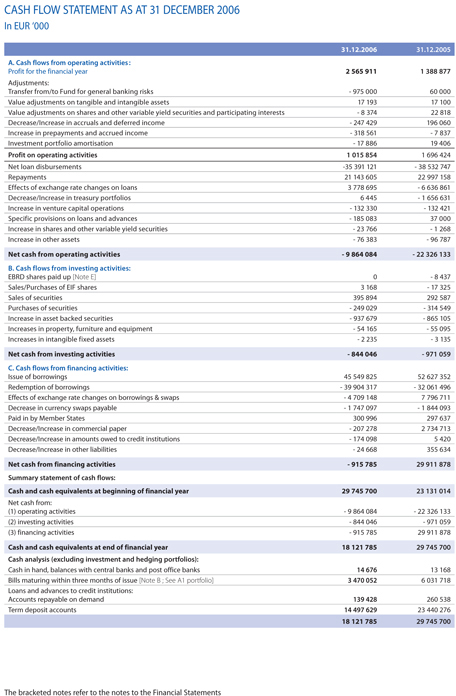

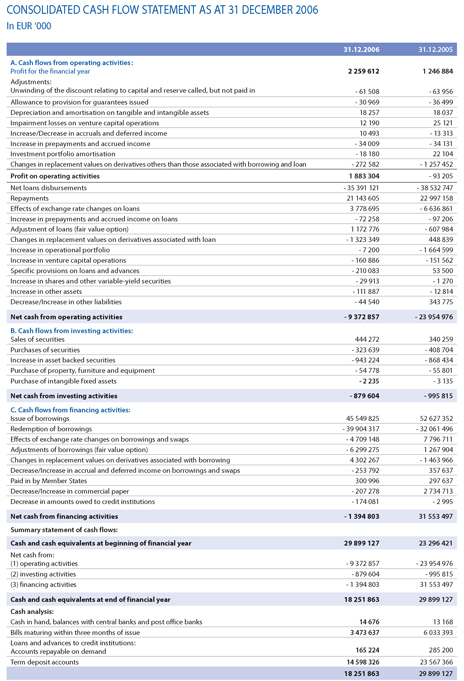

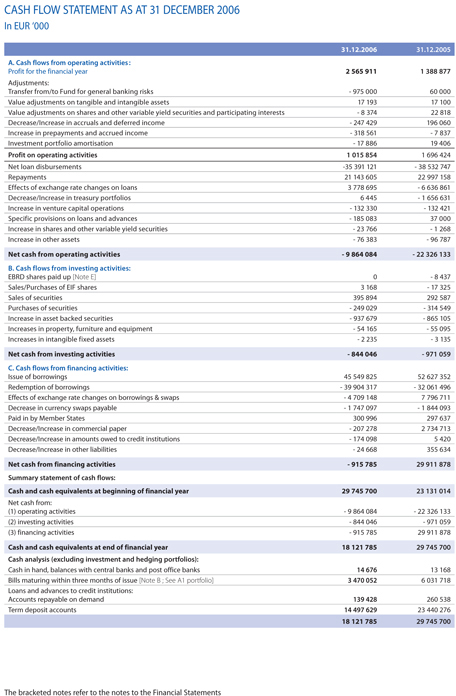

CONSOLIDATED CASH FLOW STATEMENT AS AT 31 DECEMBER 2006

In EUR ‘000

31.12.2006

31.12.2005

A. Cash flows from operating activities :

Profit for the financial year

2259612

1246884

Adjustments:

Unwinding of the discount relating to capital and reserve called, but not paid in

- 61 508

- 63 956

Allowance to provision for guarantees issued

- 30 969

- 36 499

Depreciation and amortisation on tangible and intangible assets

18 257

18 037

Impairment losses on venture capital operations

12 190

25 121

Increase/Decrease in accruals and deferred income

10 493

- 13 313

Increase in prepayments and accrued income

- 34 009

- 34 131

Investment portfolio amortisation

- 18 180

22 104

Changes in replacement values on derivatives others than those associated with borrowing and loan

- 272 582

- 1 257 452

Profit on operating activities

1883304

- 93 205

Net loans disbursements

-35391121

-38532747

Repayments

21 143605

22 997158

Effects of exchange rate changes on loans

3 778 695

- 6 636861

Increase in prepayments and accrued income on loans

- 72 258

- 97 206

Adjustment of loans (fair value option)

1 172 776

- 607 984

Changes in replacement values on derivatives associated with loan

- 1 323349

448 839

Increase in operational portfolio

- 7 200

- 1 664 599

Increase in venture capital operations

- 160 886

- 151 562

Specific provisions on loans and advances

- 210 083

53 500

Increase in shares and other variable-yield securities

- 29 913

- 1 270

Increase in other assets

- 111 887

- 12 814

Decrease/Increase in other liabilities

- 44 540

343 775

Net cash from operating activities

- 9 372857

-23954976

B. Cash flows from investing activities:

Sales of securities

444 272

340 259

Purchases of securities

- 323 639

- 408 704

Increase in asset backed securities

- 943 224

- 868 434

Purchase of property, furniture and equipment

- 54 778

- 55 801

Purchase of intangible fixed assets

- 2 235

- 3 135

Net cash from investing activities

- 879 604

- 995 815

C. Cash flows from financing activities:

Issue of borrowings

45 549825

52 627352

Redemption of borrowings

-39904317

-32061496

Effects of exchange rate changes on borrowings and swaps

- 4 709148

7 796 711

Adjustments of borrowings (fair value option)

- 6 299275

1 267 904

Changes in replacement values on derivatives associated with borrowing

4 302 267

- 1 463966

Decrease/Increase in accrual and deferred income on borrowings and swaps

- 253 792

357 637

Paid in by Member States

300 996

297 637

Decrease/Increase in commercial paper

- 207 278

2 734 713

Decrease in amounts owed to credit institutions

- 174 081

- 2 995

Net cash from financing activities

- 1 394803

31 553497

Summary statement of cash flows:

Cash and cash equivalents at beginning of financial year

29 899127

23 296421

Net cash from:

(1) operating activities

- 9 372857

-23954976

(2) investing activities

- 879 604

- 995 815

(3) financing activities

- 1 394803

31 553497

Cash and cash equivalents at end of financial year

18 251 863

29 899 127

Cash analysis:

Cash in hand, balances with central banks and post office banks

14 676

13 168

Bills maturing within three months of issue

3 473 637

6 033 393

Loans and advances to credit institutions:

Accounts repayable on demand

165 224

285 200

Term deposit accounts

14 598326

23 567366

18 251863

29 899127

26 EIB Group

15

EUROPEAN INVESTMENT BANK GROUP

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS AS AT 31 DECEMBER 2006

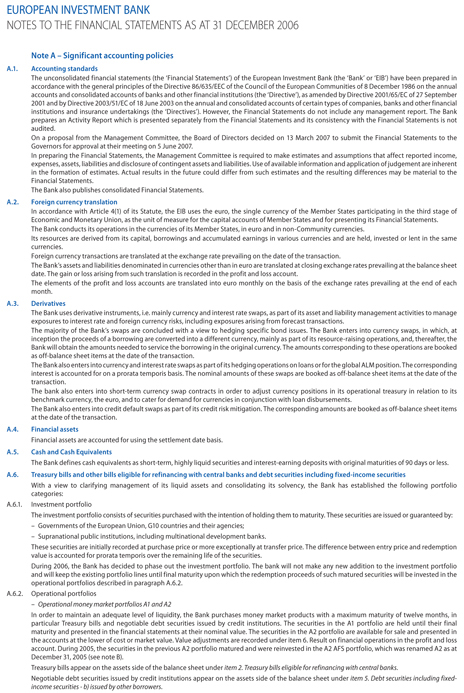

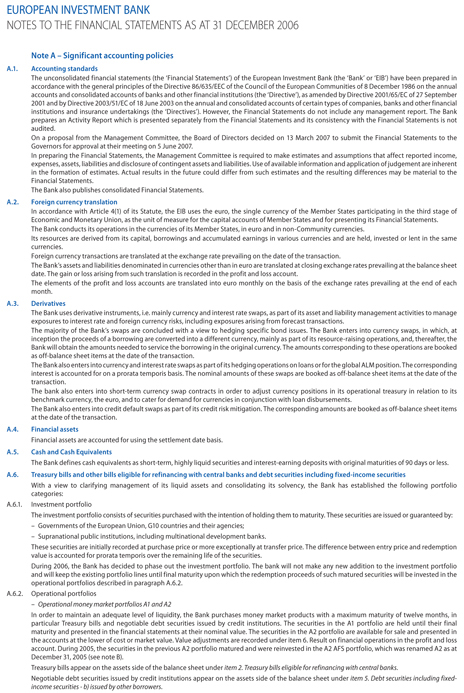

Note A – Significant accounting policies

A.1. Basis of preparation

Statement of compliance

The Group’s consolidated financial statements (the “Financial Statements”) have been prepared in accordance with international financial reporting standards (IFRS), as endorsed by the European Union.

The accounting policies applied are in conformity, in all material respects, with the general principles of the Directive 86/635/EEC of the Council of the European Communities of 8 December 1986 on the annual accounts and consolidated accounts of banks and other financial institutions, as amended by Directive 2001/65/EC of 27 September 2001 and by Directive 2003/51/EC of 18 June 2003 on the annual and consolidated accounts of certain types of companies, banks and other financial institutions and insurance undertakings (the “Directives”). However, the Financial Statements do not include any management report. The Group prepares an Activity Report which is presented separately from the Financial Statements and its consistency with the Financial Statements is not audited.

Basis of consolidation

The Financial Statements comprise those of the European Investment Bank (the “Bank” or the “EIB”) having its registered office at 100, boulevard Konrad Adenauer and those of its subsidiary, the European Investment Fund (the “Fund” or the “EIF”), having its registered office at 43, avenue J.F. Kennedy, Luxembourg. The financial statements of the Fund are prepared for the same reporting year as the Bank, using consistent accounting policies.

After aggregation of the balance sheets and income statements, all intra-group balances, transactions, income and expenses resulting from intragroup transactions are eliminated.

The Bank holds 61.20% (2005: 61.90%) of the subscribed capital of the EIF.

Minority interests represent the portion of profit or loss and net assets not owned, directly or indirectly, by the Bank and are presented under item

6. Result on financial operations in the consolidated income statement and under item 3. Other liabilities—b) sundry creditors (Note A.4.21) in the consolidated balance sheet.

Assets held in an agency or fiduciary capacity are not assets of the Group and are reported in Note U.

A.2. Significant accounting judgements and estimates

In preparing the Financial Statements, the Management Committee is required to make estimates and assumptions that affect reported income, expenses, assets, liabilities and disclosure of contingent assets and liabilities. Use of available information and application of judgement are inherent in the formation of estimates. Actual results in the future could differ from such estimates and the differences may be material to the Financial Statements.

The most significant use of judgements and estimates are as follows:

Fair value of financial instruments

Where the fair values of financial assets and financial liabilities recorded on the balance sheet cannot be derived from active markets, they are determined using a variety of valuation techniques that include the use of mathematical models. The input to these models is taken from observable markets where possible, but where this is not feasible, a degree of judgement is required in establishing fair values. The judgements include considerations of liquidity and model inputs such as correlation and volatility for longer dated derivatives.

Impairment losses on loans and advances

The Group reviews its problem loans and advances at each reporting date to assess whether an allowance for impairment should be recorded in the consolidated income statement. In particular, judgement by management is required in the estimation of the amount and timing of future cash flows when determining the level of allowance required. Such estimates are based on assumptions about a number of factors and actual results may differ, resulting in future changes to the allowance. In addition to specific allowance against individually significant loans and advances, the Bank also makes a collective impairment allowance against exposures which, although not specifically identified as requiring a specific allowance, have a greater risk of default than when originally granted. This collective allowance is based on any deterioration in the internal rating of the loan or investment since it was granted or acquired. These internal ratings take into consideration factors such as any deterioration in country risk, industry, and technological obsolescence, as well as identified structural weaknesses or deterioration in cash flows.

Valuation of unquoted equity investments

Valuation of unquoted equity investments is normally based on one of the following: – recent arms length market transactions; – current fair value of another instrument that is substantially the same;

– the expected cash flows discounted at current rates applicable for items with similar terms and risk characteristics; or – other valuation models.

The determination of the cash flows and discount factors for unquoted equity investments requires significant estimation. The Group calibrates the valuation techniques periodically and tests them for validity using either prices from observable current market transactions in the same instrument or from other available observable market data.

Impairment of equity investments

The Group treats available-for-sale equity investments as impaired when there has been a significant or prolonged decline in the fair value below its cost or where other objective evidence of impairment exists. The determination of what is “significant “ or “prolonged “ requires judgement. The Group treats “significant “ generally as 20% or more and “prolonged “ greater than 6 months. In addition, the Group evaluates other factors, including normal volatility in share price for quoted equities and the future cash flows and the discount factors for unquoted equities.

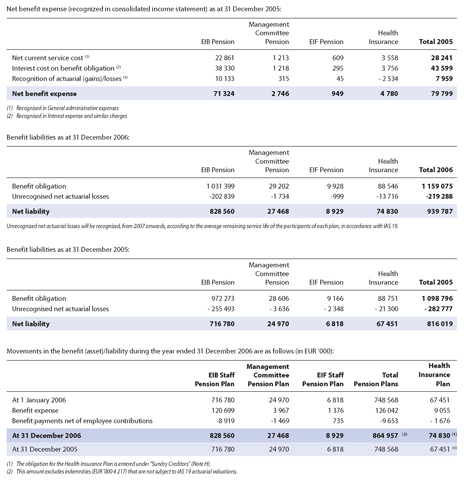

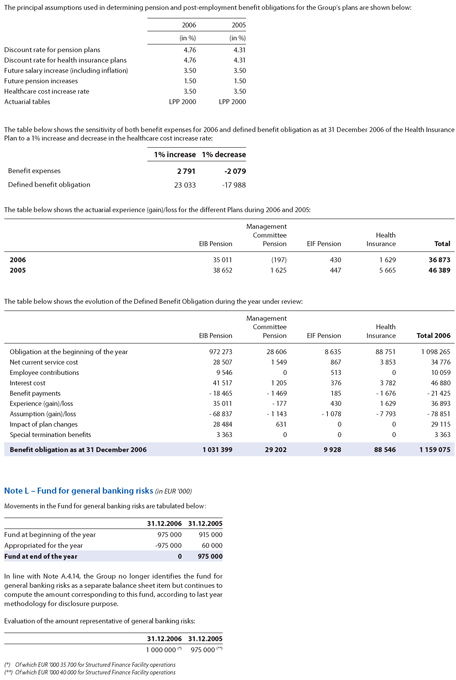

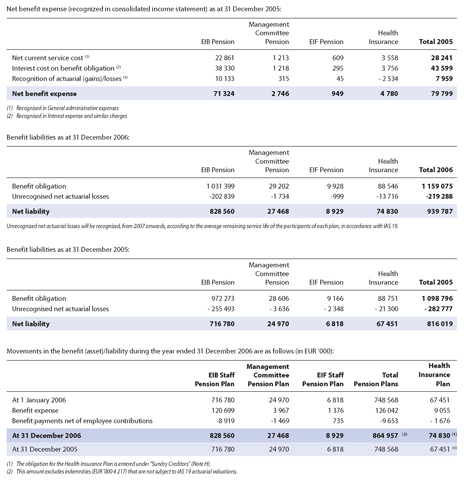

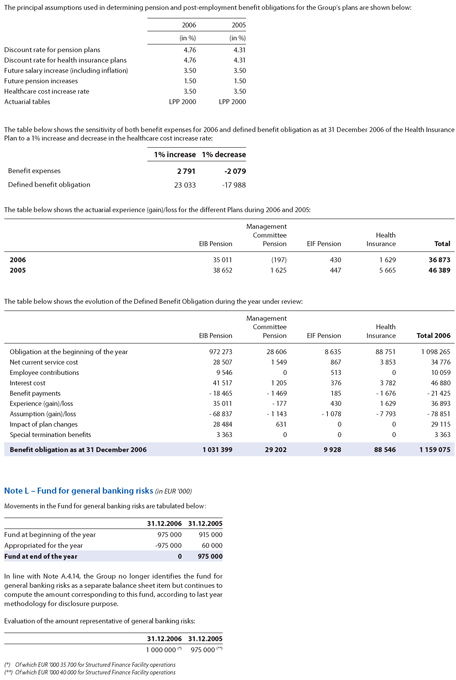

Pension and other post employment benefits

The cost of defined benefit pension plans and other post employment medical benefits is determined using actuarial valuations. The actuarial valuation involves making assumptions about discount rates, expected rates of return on assets,

future salary increases, mortality rates and future pension increases. Due to the long term nature of these plans, such estimates are subject to significant uncertainty.

A.3. Changes in accounting policies

The accounting policies adopted are consistent with those used in the previous financial year except as follows:

The Group adopted the amendment to IAS 39 Financial Instruments: Recognition and Measurement for financial guarantee contracts (issued in August 2005), which requires for financial guarantee contracts that are not considered to be insurance contracts to be recognised initially at fair value and to be remeasured at the higher of the amount determined in accordance with IAS 37 Provision, Contingent Liabilities and Contingent Assets and the amount initially recognised less, when appropriate, cumulative amortisation recognised in accordance with IAS 18 Revenue.

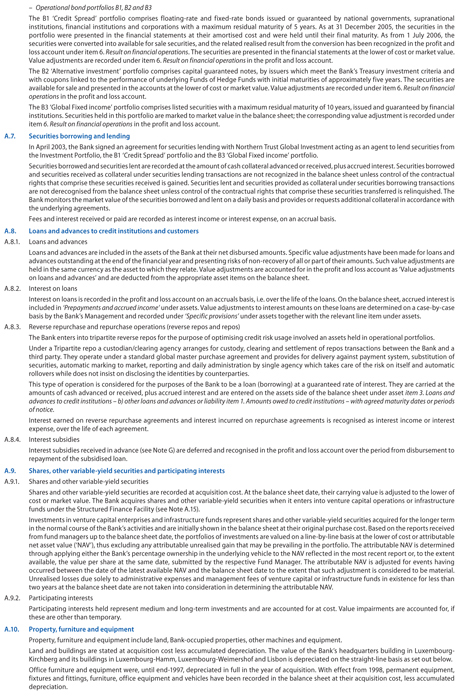

EIB Group – Financial Statements 2006 27

16

As of 1 January 2006, the Group adopted the amendments to IAS 19 Employee Benefits. As a result, additional disclosures are made providing information about trends in the assets and liabilities in the defined benefit plans and the assumptions underlying the components of the defined benefit cost. This change has resulted in additional disclosures being included for the years ending 31 December 2006 and 31 December 2005 but has not had a recognition or measurement impact, as the Group chose not to apply the new option offered to recognise actuarial gains and losses outside of the consolidated income statement.

Certain new standards, amendments and interpretations to existing standards have been published that are mandatory for the Group’s accounting periods beginning on or after 1 March 2006 or later periods but which the Group has not yet early adopted, as follows:

– IFRS 7 Financial Instruments: Disclosures (effective for annual periods beginning on or after January 1, 2007): the Standard requires the Group to make disclosures that enable users to evaluate the significance of the Group’s financial instruments and the nature and extent of risks arising from those financial instruments.

– Amendment to IAS 1 Presentation of Financial Statements (effective for annual periods beginning on or after January 1, 2007): this amendment requires the Group to make new disclosures to enable users of the financial statements to evaluate the Group’s objectives, policies and processes for managing capital.

– IFRIC 9 (effective for annual periods beginning on or after June 1, 2006): this interpretation establishes that the date to assess the existence of an embedded derivative is the date an entity first becomes a party to the contract, with reassessment only if there is a change to the contract that significantly modifies the cash flows. The Group is still evaluating the effect of this interpretation and expects that adoption of this interpretation will have no impact on the Group’s financial statements when implemented in 2007.

A.4. Summary of significant accounting policies

A.4.1. Foreign currency translation

The Financial Statements are presented in euro (EUR), the single currency of the Member States participating in the third stage of Economic and Monetary Union, as the functional currency and the unit of measure for the capital accounts and for presenting its Financial Statements.

The Group conducts its operations in euro, in the currencies of the Member States and in non-Community currencies.

Its resources are derived from its capital, borrowings and accumulated earnings in various currencies and are held, invested or lent in the same currencies.

Foreign currency transactions are translated, in accordance with IAS 21, at the exchange rate prevailing on the date of the transaction.

Monetary assets and liabilities denominated in currencies other than in euro are translated into euro at the exchange rate prevailing at the balance sheet date. The gain or loss arising from such translation is recorded in the consolidated income statement.

Non-monetary items that are measured in terms of historical cost in a foreign currency are translated using the exchange rates at the dates of the initial transactions. Non-monetary items measured at fair value in a foreign currency are translated using the exchange rates at the date when the fair value was determined.

Exchange differences arising on the settlement of transactions at rates different from those at the date of the transaction, and unrealised foreign exchange differences on unsettled foreign currency monetary assets and liabilities, are recognized in the consolidated income statement.

The elements of the consolidated income statement are translated into euro on the basis of the exchange rates prevailing at the end of each month. A.4.2. Derivatives All derivative instruments of the Group are measured at fair value through profit and loss accounts on the consolidated balance sheet and are reported as positive or negative replacement values. Fair values are obtained from quoted market prices, discounted cash flow models and option pricing models, which consider current market and contractual prices for the underlying instrument, as well as time value of money, yield curve and volatility of the underlying.

The Group uses derivative instruments mainly for hedging market exposure on borrowings and lending transactions, and also as part of its asset and liability management activities to manage exposures to interest rate and foreign currency risk, including exposures arising from forecast transactions. The Group applies the amended Fair Value Option of IAS 39 when balance sheet items, together with one or more derivative transactions meet the eligibility criteria of the amended Fair Value Option, more in particular when a significant reduction of the accounting mismatch is thus obtained.

The Group discontinued the use of hedge accounting in 2005. The existing hedge relationships at the moment of this decision have all been replaced by a choice in favour of the amended Fair Value Option, for the balance sheet items involved.

The majority of the Group’s swaps are concluded with a view to hedging specific bond issues. The Group enters into currency swaps, in which, at inception, the proceeds of a borrowing are converted into a different currency, mainly as part of its resource-raising operations and, thereafter, the Group will obtain the amounts needed to service the borrowing in the original currency.

Macro-hedging swaps used as part of asset/liability management are marked to market (fair value) using internal valuation models and are not the subject of hedge accounting. In general, derivative instruments transacted as economic hedges are treated in the same way as derivative instruments used for trading purposes, i.e. realized and unrealized gains and losses are recognized in Result on financial operations. Accrued interest on derivatives is part of the fair value recorded in the consolidated income statement and in the consolidated balance sheet.

A derivative may be embedded in a “host contract”. Such combinations are known as hybrid instruments and arise predominantly from the issuance of certain structured debt instruments. If the host contract is not carried at fair value with changes in fair value reported in the consolidated income statement, the embedded derivative is separated from the host contract and accounted for as a stand-alone derivative instrument at fair value if, and only if, the economic characteristics and risks of the embedded derivative are not closely related to the economic characteristics and risks of the host contract and the embedded derivative actually meets the definition of a derivative.

A.4.3. Financial assets

Financial assets are accounted for using the settlement date basis. A.4.4. Cash and Cash Equivalents

The Group defines cash equivalents as short-term, highly liquid securities and interest-earning deposits with original maturities of 90 days or less. A.4.5. Fee income The Group earns fee income from a diverse range of services it provides to its customers. Fee income can be divided into two broad categories: – income earned from services that are provided over a certain period of time, for which customers are generally billed on an annual or semi-annual basis, and – income earned from providing transaction-type services.

Fees earned from services that are provided over a certain period of time are recognised on an accrual basis over the service period. Fees earned from providing transaction-type services are recognized when the service has been completed. Fees or components of fees that are performance linked are recognized when the performance criteria are fulfilled. Issuance fees and redemption premiums or discounts are amortised over the period to maturity of the related borrowings, unless those borrowings are measured at fair value, in which case the recognition in the consolidated income statement is immediate.

A.4.6. Securities borrowing and lending

In April 2003, the Group signed an agreement for securities lending with Northern Trust Global Investment acting as an agent to lend securities from the Investment Portfolio, B1 ‘Credit Spread’ portfolio and B3 ‘Global Fixed income’ portfolio.

Securities borrowed and securities lent are recorded at the amount of cash collateral advanced or received, plus accrued interest. Securities borrowed and securities received as collateral under securities lending transactions are not recognized in the consolidated balance sheet unless control of the contractual rights that comprise these securities received is gained. Securities lent and securities provided as collateral under securities

28 EIB Group

17

borrowing transactions are not derecognised from the consolidated balance sheet unless control of the contractual rights that comprise these securities transferred is relinquished. The Group monitors the market value of the securities borrowed and lent on a daily basis and provides or requests additional collateral in accordance with the underlying agreements.

Fees and interest received or paid are recorded as interest income or interest expense, on an accrual basis.

A.4.7. Treasury bills and other bills eligible for refinancing with central banks and debt securities including fixed-income securities and other variable-yield securities With a view to clarifying management of its liquid assets and consolidating its solvency, the Group has established the following portfolio categories:

A.4.7.1. Held for trading portfolio

The held for trading portfolio (see Operational portfolio B3 in Note B) comprises listed debt securities issued and guaranteed by financial establishments, which are owned by the Group (“long” positions). Securities held in this portfolio are marked to market in the consolidated balance sheet, any gain or loss arising from a change in fair value being included in the consolidated income statement in the period in which it arises.

Gains and losses realized on disposal or redemption and unrealized gains and losses from changes in the fair value of trading portfolio assets are reported as Net trading income in the account “Result on financial operations”. Interest income on trading portfolio assets is included in interest income. The determination of fair values of trading portfolio assets is based on quoted market prices in active markets or dealer price quotations, pricing models (using assumptions based on market and economic conditions), or management’s estimates, as applicable.

A.4.7.2. Held-to-maturity portfolio

The held-to-maturity portfolio comprises the Group’s Investment portfolio and the operational portfolio A1 of EIB (see Note B).

The Investment portfolio consists of securities purchased with the intention of holding them to maturity. These securities are issued or guaranteed by:

– Governments of the European Union, G10 countries and their agencies;

– Supranational public institutions, including multinational development banks.

These securities are initially recorded at the purchase price, or more exceptionally the transfer price. The difference between entry price and redemption value is amortised prorata temporis over the remaining life of the securities.

The Group has decided to phase out the investment portfolio of the Bank, by ceasing to invest the redemption proceeds of matured securities in the portfolio.

The Operational portfolios A1 of the Group are held for the purpose of maintaining an adequate level of liquidity in the Group and comprise money market products with a maximum maturity of twelve months, in particular Treasury bills and negotiable debt securities issued by credit institutions. The securities are held until their final maturity and presented in the Financial Statements at their amortized cost.

A.4.7.3. Available for sale portfolio

The available for sale portfolio comprises the securities of the operational money market portfolio A2 and of the operational bond portfolios B1 and B2 (see Note B), the operational portfolio of the Fund, shares, other variable-yield securities and participating interests (see Note B). Securities are classified as available for sale where they do not appropriately belong to one of the other categories of financial instruments recognised under IAS 39, i.e. “held for trading” or “held-to-maturity”. The Management Committee determines the appropriate classification of its investments at the time of the constitution of a portfolio, financial instruments within one portfolio have always the same classification. Available-for-sale financial investments may be sold in response to or in anticipation of needs for liquidity or changes in interest rates, foreign exchange rates or equity prices. Available for sale financial investments are carried at fair value. Unrealised gains or losses are reported in consolidated reserves until such investment is sold, collected or otherwise disposed of, or until such investment is determined to be impaired. If an available for sale investment is determined to be impaired, the cumulative unrealised gain or loss previously recognised in own funds is included in consolidated income statement for the period. A financial investment is considered impaired if its carrying value exceeds the recoverable amount. Quoted financial investments are considered impaired if the decline in market price below cost is of such a magnitude that recovery of the cost value cannot be reasonably expected within the foreseeable future. For non-quoted equity investments, the recoverable amount is determined by applying recognized valuation techniques. On disposal of an available for sale investment, the accumulated unrealised gain or loss included in own funds is transferred to consolidated income statement for the period. Gains and losses on disposal are determined using the average cost method. Interest and dividend income on available-for-sale financial investments are included in “interest and similar income” and “income from securities with variable yield”.

The determination of fair values of available for sale financial investments is generally based on quoted market rates in active markets, dealer price quotations, discounted expected cash flows using market rates commensurate with the credit quality and maturity of the investment or based upon review of the investee’s financial results, condition and prospects including comparisons to similar companies for which quoted market prices are available. Venture capital operations and participating interests held represent medium and long-term investments and are measured at fair value, by using fair value measurement techniques including entity inputs, in absence of liquid market prices, commonly used by market participants. However, some are accounted for at cost when the fair value cannot be reliably measured. The nature of those investments is such that an accurate fair value can be determined only upon realization of those investments. The estimation by the Group of a fair value for venture capital investments for which the method and timing of realization have not yet been determined is therefore considered to be inappropriate in those instances. All venture capital operations are subject to review for impairment.

The Group assesses at each balance sheet date whether there is any objective evidence that a financial asset or a group of financial assets is impaired. A financial asset or a group of financial assets is deemed to be impaired if, and only if, there is objective evidence of impairment as a result of one or more events that has occurred after the initial recognition of the asset (an incurred “loss event”) and that loss event (or events) has an impact on the estimated future cash flows of the financial asset or the group of financial assets that can be reliably estimated.

In the case of equity investments classified as available-for-sale, this would include a significant or prolonged decline in the fair value of the investments below its cost. Where there is evidence of impairment, the cumulative loss measured as the difference between the acquisition cost and the current fair value, less any impairment loss on that financial asset previously recognised in the consolidated income statement is removed from equity and recognised in the income statement. Impairment losses on equity investments are not reversed through the consolidated income statement; increases in their fair value after impairment are recognised directly in equity.

A.4.8. Loans and advances to credit institutions and customers

Loans and receivable include loans where money is provided directly to the borrower. A participation in a loan from another lender is considered to be originated by the Group, provided it is funded on the date the loan is originated by the lender.

Loans and receivable are recognized in the assets of the Group when cash is advanced to borrowers. They are initially recorded at cost (their net disbursed amounts), which is the fair value of the cash given to originate the loan, including any transaction costs, and are subsequently measured at amortized cost using the effective interest rate method.

Where loans meet the eligibility criteria of the amended Fair Value Option and have been designated as at Fair Value through Profit and Loss, they are measured at their fair value. The fair value measurement technique used is a discounted cash flow technique, using current yield curves and a spread which is equal to the spread at inception of the instrument, unless credit quality of the instrument varied.

A.4.8.1. Interest on loans

Interest on loans originated by the Group is recorded in the consolidated income statement (interest and similar income) and on the consolidated balance sheet (loans and advances) on an accruals basis.

A.4.8.2. Reverse repurchase and repurchase operations (reverse repos and repos)

A reverse repurchase (repurchase) operation is one under which the Group lends (borrows) liquid funds to (from) a credit institution which provides (receives) collateral in the form of securities. The two parties enter into an irrevocable commitment to complete the operation on a date and at a price fixed at the outset.

EIB Group – Financial Statements 2006 29

18

The operation is based on the principle of delivery against payment: the borrower (lender) of the liquid funds transfers the securities to the Group’s (counterparty’s) custodian in exchange for settlement at the agreed price, which generates a return (cost) for the Group linked to the money market. This type of operation is considered for the purposes of the Group to be a loan (borrowing) at a guaranteed rate of interest. Generally treated as collateralized financing transactions, they are carried at the amounts of cash advanced or received, plus accrued interest and are entered on the assets side of the consolidated balance sheet under item 3. Loans and advances to credit institutions—b) other loans and advances (on the liabilities side of the consolidated balance sheet under item 1. Amounts owed to credit institutions—a) with agreed maturity dates or periods of notice). The securities provided as collateral are maintained in the consolidated balance sheet accounts.

Securities received under reverse repurchase agreements and securities delivered under repurchase agreements are not recognized in the consolidated balance sheet or derecognized from the consolidated balance sheet, unless control of the contractual rights that comprise these securities is relinquished. The Group monitors the market value of the securities received or delivered on a daily basis, and provides or requests additional collateral in accordance with the underlying agreements.

Interest earned on reverse repurchase agreements and interest incurred on repurchase agreements is recognized as interest income or interest expense, over the life of each agreement.

A.4.8.3. Fees on loans

Front-end fees and commitment fees are deferred in accordance with IAS 18, together with the related direct costs of originating and maintaining the commitment, and are recognised as an adjustment to the effective yield, being recorded in the consolidated income statement over the period from disbursement to repayment of the related loan. If the commitment expires without the loan being drawn down, the fee is recognised as income on expiry.

A.4.8.4. Interest subsidies

Interest subsidies received in advance (see Note G) are deferred in accordance with IAS 18, and are recognised as an adjustment to the effective yield, being recorded in the consolidated income statement over the period from disbursement to repayment of the subsidized loan.

A.4.9. Credit loss expense

An allowance for credit losses is established if there is objective evidence that the Group will be unable to collect all amounts due on a claim according to the original contractual terms or the equivalent value. A “claim” means a loan, a commitment such as a letter of credit, a guarantee, a commitment to extend credit, or other credit product.

An allowance for credit losses is reported as a reduction of the carrying value of a claim on the consolidated balance sheet, whereas for an off-balance sheet item such as a commitment a provision for credit loss is reported in Other liabilities. Additions to the allowances and provisions for credit losses are made through credit loss expense.

A.4.9.1. Credit losses related to individual loans and advances

Specific provisions have been made for individual loans and advances outstanding at the end of the financial year and presenting objective evidence of risks of non-recovery of all or part of their amounts according to the original contractual terms or the equivalent value. Changes to these provisions are entered on the consolidated income statement as “Credit loss expense”. Allowances and provisions for credit losses are evaluated on the following counterparty specific based principle.

A claim is considered impaired when the Management Committee determines that it is probable that the Group will not be able to collect all amounts due according to the original contractual terms or the equivalent value. Individual credit exposures are evaluated based upon the borrower’s character, overall financial condition, resources and payment record, the prospects for support from any financially responsible guarantors and, where applicable, the realizable value of any collateral. The estimated recoverable amount is the present value of expected future cash flows, which may result from restructuring or liquidation. Impairment is measured and allowances for credit losses are established for the difference between the carrying amount and its estimated recoverable amount of any claim considered as impaired. The amount of the loss is the difference between the asset’s carrying amount and the present value of expected future cash flows discounted at the financial instrument’s original effective interest rate.

All impaired claims are reviewed and analysed at least semi-annually. Any subsequent changes to the amounts and timing of the expected future cash flows compared to the prior estimates will result in a change in the provision for credit losses and be charged or credited to credit loss expense. An allowance for impairment is reversed only when the credit quality has improved such that there is reasonable assurance of timely collection of principal and interest in accordance with the original contractual terms of the claim agreement. A write-off is made when all or part of a claim is deemed uncollectible or forgiven. Write-offs are charged against previously established provisions for credit losses or directly to credit loss expense and reduce the principal amount of a claim. Recoveries in part or in full of amounts previously written off are credited to credit loss expense.

Upon impairment the accrual of interest income based on the original terms of the claim is discontinued, and is replaced by an accrual based upon the impaired value; in addition, the increase of the present value of impaired claims due to the passage of time is reported as interest income.

A.4.9.2. Collective impairment

In addition to specific allowances against individually significant loans and advances, the Group also makes a collective impairment allowance against exposures which, although not specifically identified as requiring a specific allowance, have a greater risk of default than when originally granted. This collective allowance is based on any deterioration in the internal rating of the loan or investment since it was granted or acquired. These internal ratings take into consideration factors such as any deterioration in counterparty risk, value of collateral or security received, and sectorial outlook, as well as identified structural weaknesses or deterioration in cash flows. As at 31 December 2006, there was no need for collective impairment provisions, following this process.

A.4.9.3. Guarantees

In the normal course of business, the Group issues various forms of guarantees to support some institutions.

Under the existing rules, these guarantees don’t meet the definition of an insurance contract (IFRS 4 Insurance Contracts) and are accounted for under IAS 39 Financial Instruments: Recognition and Measurement, either as “Derivatives” or “Financial Guarantees”, depending on their features and characteristics as defined by IAS 39.

The accounting policy for Derivatives is disclosed under Note A.4.2.

Financial Guarantees are initially recognised at fair value in the consolidated balance sheet under item 3c. Other liabilities – sundry liabilities, being the premium received.

Subsequent to initial recognition, the Group’s liabilities under each financial guarantee are measured at the higher of 1) the amount initially recognized less, when appropriate, cumulative amortization recognized in accordance with IAS 18 and 2) the best estimate of expenditure required to settle any present financial obligation arising as a result of the guarantee in accordance with IAS 37.

Any increase in the liability relating to financial guarantee is taken to the consolidated income statement in “Credit loss expense”. The premium received is recognised in the consolidated income statement in “Fee and commission income” on the basis of an amortization schedule in accordance with IAS 18 over the life of the financial guarantee.

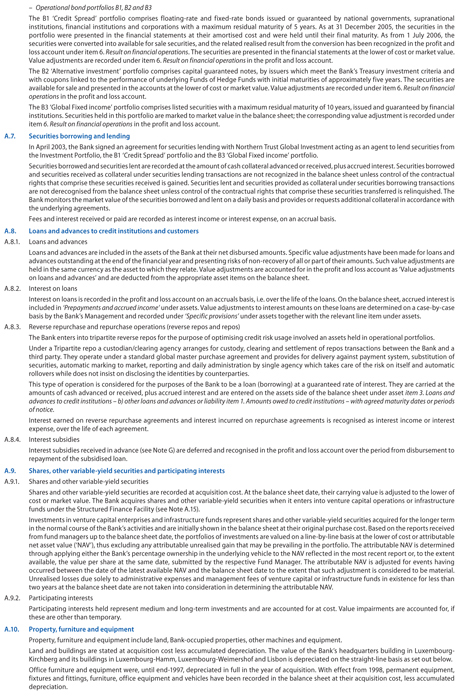

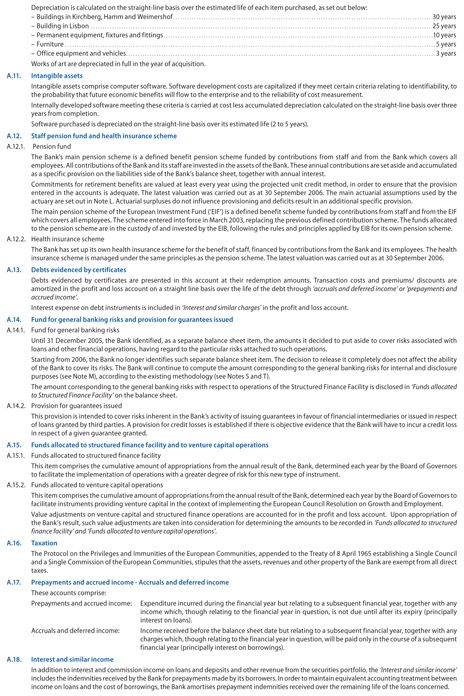

A.4.10. Property, furniture and equipment

Property, furniture and equipment include land, Group-occupied properties and other machines and equipment. Property, furniture and equipment are carried at cost less accumulated depreciation and accumulated impairment losses. Property, furniture and equipment are reviewed periodically for impairment.

Land and buildings are stated at acquisition cost less accumulated depreciation. The value of the Group’s headquarters building in Luxembourg-Kirchberg and its buildings in Luxembourg-Hamm, Luxembourg-Weimershof and Lisbon is depreciated on the straight-line basis as set out below. Office furniture and equipment were, until end-1997, depreciated in full in the year of acquisition. With effect from 1998, permanent equipment,

30 EIB Group

19

fixtures and fittings, furniture, office equipment and vehicles have been recorded in the consolidated balance sheet at their acquisition cost, less accumulated depreciation.

Depreciation is calculated on the straight-line basis over the estimated life of each item purchased, as set out below:

– Buildings in Kirchberg, Hamm and Weimershof

30years

– Building in Lisbon

25years

– Permanent equipment, fixtures and fittings .

10years

– Furniture

5years

– Office equipment and vehicles

3years

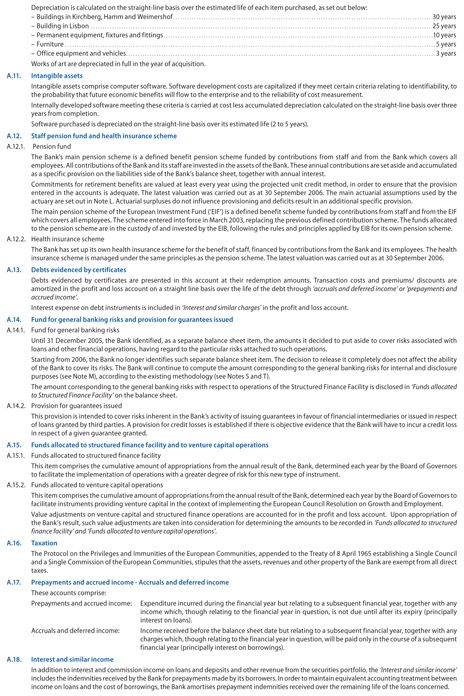

A.4.11. Intangible assets

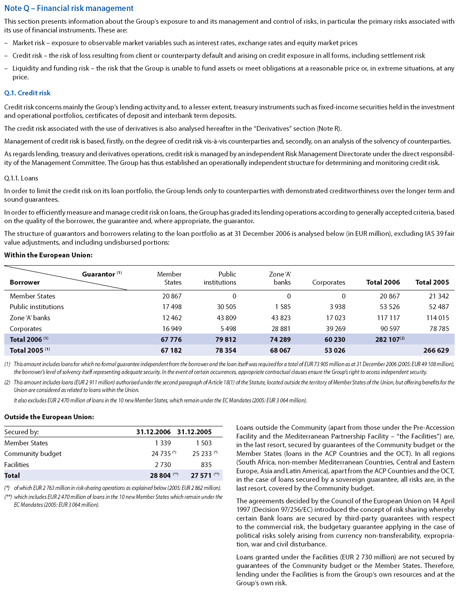

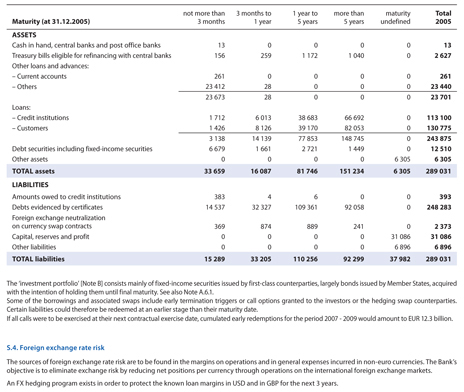

Intangible assets comprise computer software. Software development costs are capitalized if they meet certain criteria relating to identifiability, to the probability that future economic benefits will flow to the enterprise, and to the reliability of cost measurement.