SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant þ

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| þ | Soliciting Material Under Rule 14a-12 |

Bob Evans Farms, Inc.

(Name of Registrant as Specified In Its Charter)

Sandell Asset Management Corp.

Thomas E. Sandell

Castlerigg Master Investments Ltd.

Castlerigg International Limited

Castlerigg International Holdings Limited

Castlerigg Offshore Holdings, Ltd.

Castlerigg Merger Arbitrage and Equity Event Intermediate Fund, L.P.

Castlerigg Merger Arbitrage and Equity Event Fund, Ltd.

Castlerigg Merger Arbitrage and Equity Event Master Fund, Ltd.

Castlerigg Active Investment Fund, Ltd.

Castlerigg Active Investment Intermediate Fund, L.P.

Castlerigg Active Investment Master Fund, Ltd.

Pulteney Street Partners, L.P.

Douglas N. Benham

Charles M. Elson

David W. Head

C. Stephen Lynn

Annelise T. Osborne

Aron I. Schwartz

Michael Weinstein

Lee S. Wielansky

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| þ | No fee required. |

| | |

| ¨ | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | | |

| | 5) | Total fee paid: |

| | | |

| | | |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the |

| filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | | |

| | | |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | | |

| | 3) | Filing Party: |

| | | |

| | | |

| | | |

| | 4) | Date Filed: |

August 5, 2014

Dear Fellow Stockholder of Bob Evans:

We are writing you today to further explain why comprehensive change is urgently needed at Bob Evans Farms, Inc. (“Bob Evans” or the “Company”). Sandell Asset Management Corporation (“Sandell”) is one of the Company’s largest stockholders, with beneficial ownership of approximately 7.6%[1], and therefore our interests are aligned with yours – to unlock long-term value in Bob Evans that benefits all shareholders.

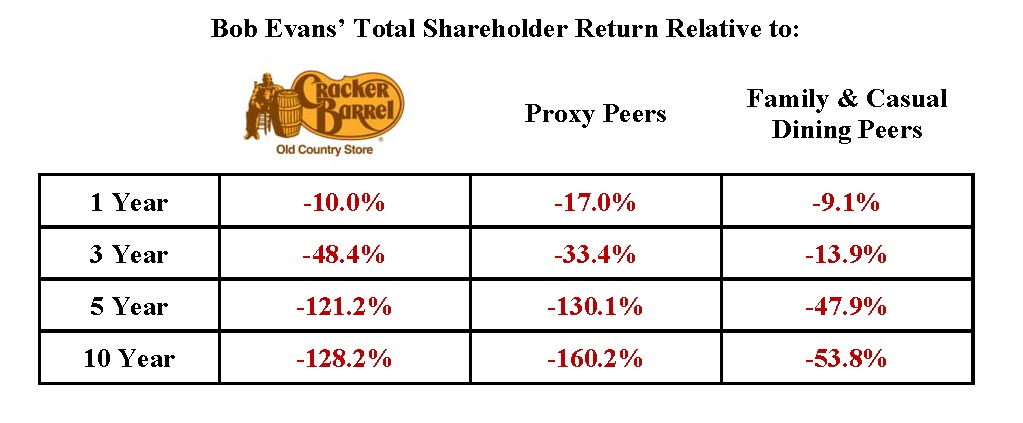

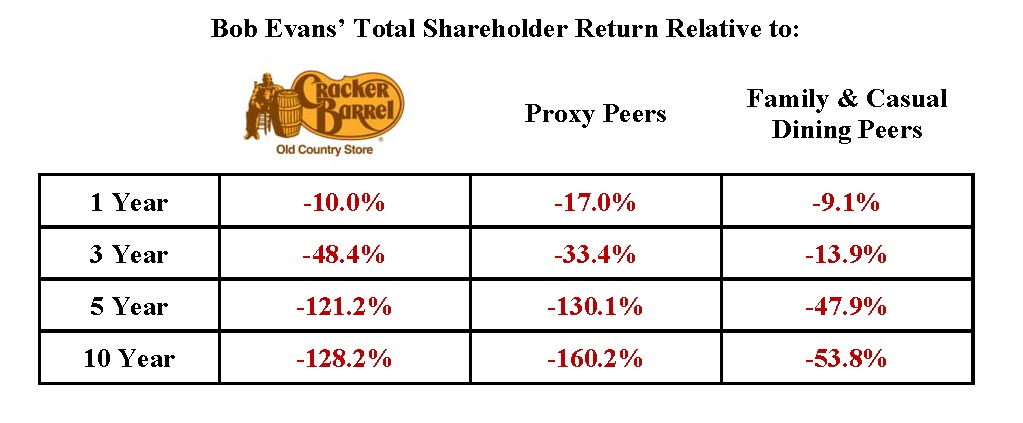

We believe there is a very real financial danger posed to shareholders of the Company if comprehensive change is not accomplished in the near-term. Bob Evans suffers from numerous problems that we believe stem from one central issue: a stale, conflicted and entrenched Board of Directors (the “Board”), that has not, in our view, exerted effective oversight over a management team led by the Company’s Chairman of the Board and CEO, Steven Davis. Mr. Davis and this Board have overseen the Company while the stock price performance has been nothing short of abysmal. As illustrated in the following chart, Bob Evans has dramaticallyunder-performed its own selected peer group, as well as many other peers, over a 1-year, 3-year, 5-year, and 10-year time period:

[1] This amount excludes certain funds managed by Thomas Sandell, CEO of Sandell, which are not participating in this solicitation.

[2] Source: Bloomberg (as of April 21, 2014, which was prior to Sandell’s nomination of its independent slate). Proxy Peers consists of: BH, BJRI, BWLD, CAKE, CBRL, DAVE, DENN, DIN, DPZ, DRI, EAT, FRS, HAIN, LNCE, MCD, MKC, PNRA, PZZA, RRGB, RT, SAFM, SJM, TAST, WEN, and YUM as per Bob Evans’ 2014 Proxy Statement. Family & Casual Dining Peers (non-majority franchised) consist of: BJRI, BLMN, CAKE, CBRL, DRI, EAT, RRGB, and TXRH. We believe that Cracker Barrel is the most comparable peer to Bob Evans due to its focus on family dining, its similar size in terms of number of restaurants and its pursuit of a non-franchised business model.

To both address and then fix the Company’s woeful track record of underperformance, Bob Evans needs fresh, highly-qualified Board members who are able to provide effective management oversight and bring new perspectives and ideas to the Company.This is why we have proposed a slate of eight director nominees (the “Nominees”) who represent forward-thinking, truly independent executives – none of whom is affiliated with Sandell – and possess a diversity of background and experience that will allow the new board to effect change that we believe would deliver significant shareholder value:

| · | Doug Benham, the former President and CEO of Arby’s Restaurant Group |

| · | Charles Elson, theDirector of the John L. Weinberg Center for Corporate Governance at the University of Delaware |

| · | David Head, theformer President and CEO of O’Charley’s Inc. |

| · | Steve Lynn, theformer Chairman and CEO of Sonic Corporation |

| · | Annelise Osborne, aSenior Credit Officer at Moody’s Investor Service |

| · | Aron Schwartz, aManaging Partner at ACON Investments, L.L.C. |

| · | Michael Weinstein, theformer CEO of Triarc Beverage Group (Snapple Beverage Group) |

| · | Lee Wielansky, the Chairman and CEO of Midland Development Group |

We note that of these eight Nominees, three are former CEOs of large restaurant companies with decades of relevant industry experience, and each of these eight Nominees possesses a skill set that we see as necessary to deliver value to the stockholders of Bob Evans. We believe that these Nominees are significantly more qualified than the entrenched legacy Directors the Company is proposing as part of their slate, as well as the three Directors more recently proposed as what we view as an attempt to placate shareholders – none of whom have any meaningful restaurant industry experience.

It is also important to again point out that the current Board of Directors, due in large part to the many long-standing personal and intertwined relationships among Mr. Davis and the other Directors, have enabled the perpetuation of a wasteful and spendthrift culture, as is evidenced by many extravagant pursuits such as the construction of a new $48.2 million corporate headquarters campus, as well as the purchase of a new corporate jet, a 2013 Bombardier Challenger 300, which according to the Aircraft Blue Book has an average retail price of $21.5 million.

Sandell recently released a new presentation detailing some of the actionable ideas advocated by our slate of Directors. The presentation, titled, “Refresh Bob Evans – The Case and Nominees for Change,” can be found at www.refreshbobevans.com. Below we have highlighted some of these ideas the nominees, should they be elected, would consider implementing starting on day one to begin toFix Bob Evans:

Top Line Improvement

Reversing the decline in same store sales would be a key priority for the Nominees – and they have the relevant experience and expertise to deliver. They also have a number of actionable ideas they believe could help Bob Evans reverse the decline in restaurant traffic, including:

| · | Revise Brand Position and Improve Customer Experience – Return the focus of the brand on what made it great:Fresh, home-style cooking from the farm. |

| · | Simplify and Enhance the Menu – Focus the menu on Bob Evans’ core competency of fresh comfort food– as opposed to trying to be something it’s not by chasing dinner customers. |

| · | Optimize Marketing Effectiveness – Modernize Bob Evans’ marketing program to attract customers and catch up to competitors by more effectively utilizing social media and selectively targeting valuable niche demographics. |

Bottom Line Improvement

There are several key actions that could be taken to improve efficiency and profitability at Bob Evans at both the restaurant and corporate levels:

- Improve Restaurant Margins –Drive out waste and inefficiency at the restaurant level and focus investment on customer facing employees.

- Reduce Corporate Overhead –Reduce redundancies at corporate HQ and tighten ratio of corporate staff to restaurants.

- Reassess Capital Spending –Eliminate spending on projects that generate a sub-optimal return on invested capital and develop procedures to ensure disciplined future capital budgeting plans

- Future Franchise Opportunities –As a longer-term strategy, focus on pursuing franchise opportunities that leverage the strength of the brand and expand the footprint in a manner that requires little in the way of cost or capital commitment.

Realizing Value of Assets

Chairman and CEO Steven Davis and his Board of Directors have been steadfast in their refusal to explore any methods that have the potential to unlock the tremendous value associated with certain of the Company’s unique assets. If elected, we expect that the Nominees, subject to the exercise of their fiduciary duties, will critically evaluate a number of strategic matters, which may include the following:

- Real Estate – Bob Evans currently owns 86% of its restaurants – substantially more than its comparable peers; the Company must perform a comprehensive analysis of these assets to determine the best means to unlock the significant value associated with these vast real estate holdings.

- We highlight that in the Company’s refusal to explore methods to unlock the value associated with its extensive real estate portfolio, Bob Evans continues to use what we believe are specious and disingenuous excuses. For example, the Company makes what we believe is the absurd claim that a sale-leaseback transaction would reduce “flexibility” to improve facilities when one considers that most lessors have a vested interest in seeing improvements to its underlying properties. Furthermore, the Company confuses its cost of debt with its much higher, true cost of capital. The Company has spent hundreds of millions of dollars of shareholders’ money on its real estate, which has an equity cost of capital associated with it; this money requires a return commensurate with the Company’s true cost of capital.

- BEF Foods– We believe that BEF Foods, the Company’s wholly owned packaged foods business, contributes little to no synergies. Furthermore, a direct competitor to BEF Foods, The Hillshire Brands Company (“Hillshire”), was recently the subject of an intense bidding war that resulted in a final offer valuing Hillshire at 16.7x EBITDA. Bob Evans should perform a full strategic review of BEF Foods in order to determine the best means for shareholders to realize its value.

Changing Corporate Culture

We believe that the current Board of Directors, due in large part to the many long-standing personal and intertwined relationships among Mr. Davis and the other directors, has enabled the perpetuation of a wasteful culture that and has failed to exert effective oversight, to the detriment of shareholders. To remedy this, the Nominees would move to:

- Improve Corporate Governance Structure –The Board has a track record of shockingly poor governance, which has resulted in multiple law suits filed by shareholders to overturn entrenching bylaw amendments. We believe comprehensive improvements are in order and that the Nominees would recommend the immediate and permanent separation of the Chairman and CEO roles and the institution of Director term limits.

- Ensure the Corporate Culture Matches Corporate Brand –Bob Evans has fallen far from its modest roots and has morphed into a HQ-centric, top-heavy organization. To be successful, the Nominees believe the Company requires a cultural-homecoming, which would mean reexamining the optics of certain leadership-perks (e.g. corporate jet) and push authority down the corporate structure to customer facing staff.

Comprehensive Change

If elected, the Nominees will work with any incumbent members of the Board that stay in office as a cohesive team, drawing upon each of their unique skills as they seek to effect positive change that we believe should encompass improvements to the Company’s operational, financial, and strategic policies.The Nominees will bring desperately needed new insight, operational expertise, and a fresh perspective to the Board and will embrace the highest standards of governance.

Vote GOLD

We look forward to the upcoming Annual Meeting where we intend to seek election of the Nominees so that they may begin to implement positive change at the Company and exert the oversight that Bob Evans so urgently needs.We urge you to sign and return the GOLD proxy card today.

Sincerely,

Thomas Sandell, Chief Executive Officer

Sandell Asset Management Corporation

SANDELL ASSET MANAGEMENT CORP., CASTLERIGG MASTER INVESTMENTS LTD., CASTLERIGG INTERNATIONAL LIMITED, CASTLERIGG INTERNATIONAL HOLDINGS LIMITED, CASTLERIGG OFFSHORE HOLDINGS, LTD., CASTLERIGG MERGER ARBITRAGE AND EQUITY EVENT FUND, LTD., CASTLERIGG MERGER ARBITRAGE AND EQUITY EVENT INTERMEDIATE FUND, L.P., CASTLERIGG MERGER ARBITRAGE AND EQUITY EVENT MASTER FUND, LTD., CASTLERIGG ACTIVE INVESTMENT FUND, LTD., CASTLERIGG ACTIVE INVESTMENT INTERMEDIATE FUND, L.P., CASTLERIGG ACTIVE INVESTMENT MASTER FUND, LTD., PULTENEY STREET PARTNERS, L.P. AND THOMAS E. SANDELL (COLLECTIVELY, "SANDELL") AND DOUGLAS N. BENHAM, CHARLES M. ELSON, DAVID W. HEAD, C. STEPHEN LYNN, ANNELISE T. OSBORNE, ARON I. SCHWARTZ, MICHAEL WEINSTEIN AND LEE S. WIELANSKY (TOGETHER WITH SANDELL, THE "PARTICIPANTS") HAVE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (THE "SEC") A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING FORM OF PROXY CARD TO BE USED IN CONNECTION WITH THE SOLICITATION OF PROXIES FROM THE STOCKHOLDERS OF BOB EVANS FARMS, INC. (THE "COMPANY") IN CONNECTION WITH THE COMPANY’S 2014 ANNUAL MEETING OF STOCKHOLDERS. ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY SANDELL, AS THEY CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS. THE DEFINITIVE PROXY STATEMENT AND AN ACCOMPANYING PROXY CARD WILL BE FURNISHED TO SOME OR ALL OF THE COMPANY'S STOCKHOLDERS AND ARE, ALONG WITH OTHER RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE ON THE SEC'S WEBSITE AT HTTP://WWW.SEC.GOV/. IN ADDITION, MACKENZIE PARTNERS, INC., SANDELL'S PROXY SOLICITOR, WILL PROVIDE COPIES OF THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARD WITHOUT CHARGE UPON REQUEST BY CALLING (800) 322-2885.

INFORMATION ABOUT THE PARTICIPANTS AND A DESCRIPTION OF THEIR DIRECT OR INDIRECT INTERESTS BY SECURITY HOLDINGS IS CONTAINED IN THE DEFINITIVE PROXY STATEMENT ON SCHEDULE 14A FILED BY SANDELL ASSET MANAGEMENT CORP. WITH THE SEC ON JULY 15, 2014. THIS DOCUMENT CAN BE OBTAINED FREE OF CHARGE FROM THE SOURCES INDICATED ABOVE.