UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Amendment No. 1

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | |

| x | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

BOB EVANS FARMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | (3) | | Filing Party: |

| | |

| | (4) | | Date Filed: |

[—], 2014

To Our Valued Stockholders:

We have enclosed with this letter the proxy statement for the 2014 Annual Meeting of Stockholders (the “Annual Meeting”) of Bob Evans Farms, Inc. (“Bob Evans” or the “Company”). This year’s Annual Meeting will be held on [—], [—] [—], 2014, at [—] Eastern Time, at [—], and you are most welcome to attend.

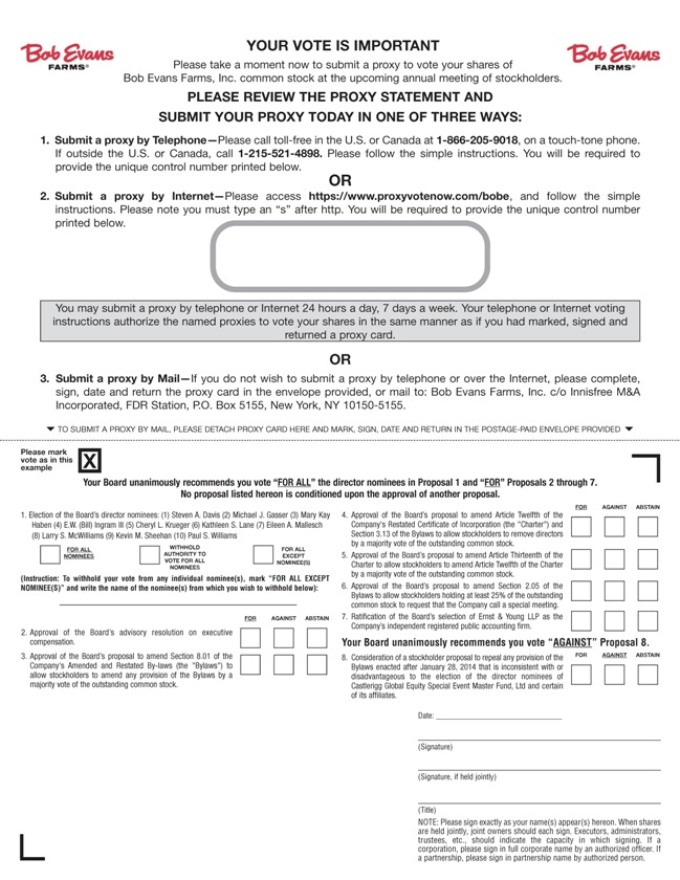

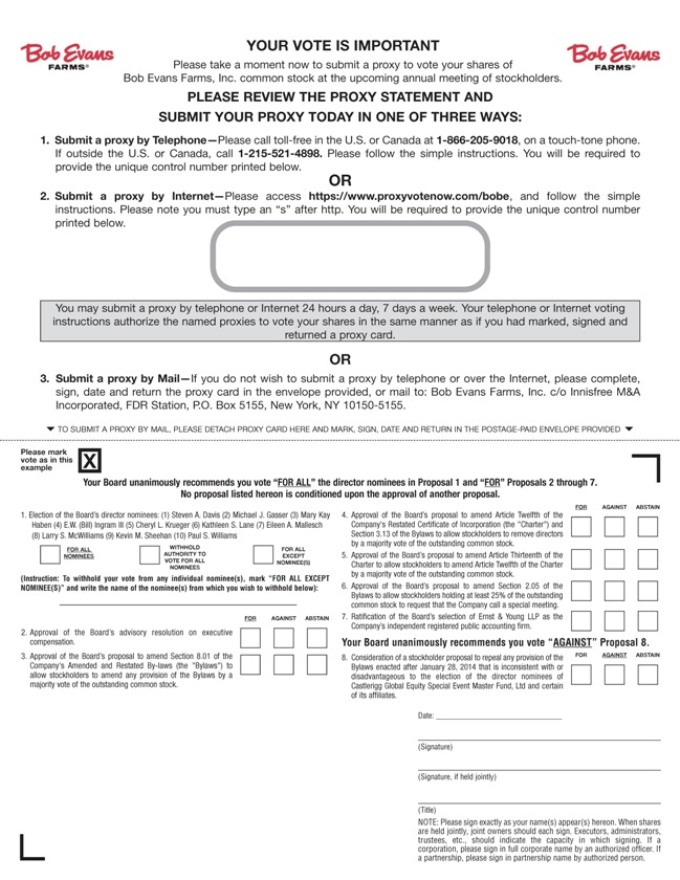

At the Annual Meeting, you will have an opportunity to vote on the following proposals:

| | (1) | the election of twelve directors; |

| | (2) | approval, on an advisory basis, of the compensation of the Company’s named executive officers; |

| | (3) | approval of an amendment of the Company’s By-laws to allow stockholders to amend all provisions of the By-laws by a majority vote of the common stock outstanding; |

| | (4) | approval of amendments of the Company’s Certificate of Incorporation and By-Laws to allow stockholders to remove directors by a majority vote of the common stock outstanding; |

| | (5) | approval of an amendment of the Company’s Certificate of Incorporation to allow stockholders to amend the provisions governing director removal by a majority vote of the common stock outstanding; |

| | (6) | approval of an amendment of the Company’s By-laws to allow holders of at least 25% of the common stock outstanding to request that the Company call a special meeting; |

| | (7) | ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm; and |

| | (8) | a stockholder proposal to repeal any provision of the Company’s By-laws that was not in the By-laws filed by the Company on January 28, 2014, and that is inconsistent with or disadvantageous to the election of the director nominees of the proposing stockholder, if such proposal is properly presented at the Annual Meeting (the “Sandell Proposal”). |

Your vote will be especially important at this year’s Annual Meeting.

Your Board of Directors has nominated a slate of ten directors for election at the Annual Meeting and is soliciting proxies for the ten Bob Evans’ nominees named herein. As you may be aware, Sandell Asset Management Corp., together with certain of its affiliates (collectively, the “Sandell Group”), has notified us of its intent to nominate eight director candidates for election to the Board in opposition to the nominees recommended by your Board and to present the Sandell Proposal. You may receive solicitation materials from the Sandell Group, including proxy statements and gold proxy cards. You should be aware that your Board of Directors has made a number of good faith attempts to arrive at a constructive settlement with the Sandell Group in order to avoid a costly and potentially divisive proxy contest. Most recently, the Board has proposed a settlement in which, among other things:

| | • | | Three individuals that had been nominated by the Sandell Group would be appointed to the Board; |

| | • | | Two of the individuals nominated by the Sandell Group and appointed to the Board would be appointed to the Board’s Finance Committee; |

| | • | | The reconstituted Finance Committee would be charged with reviewing and making recommendations to the full Board with respect to the economic proposals advanced by the Sandell Group, and other alternatives to enhance stockholder value, with the assistance of an additional independent investment bank, if it so decides; |

| | • | | The Company would retain an independent consultant to help identify cost reductions for the Company and revenue enhancement opportunities for Bob Evans Restaurants; and |

| | • | | The reconstituted Board would consider whether to separate the positions of CEO and Chairman. |

If the Sandell Group had accepted this proposal, one-half of the Board, and a majority of the Board’s independent directors, would have been comprised of directors (including the Sandell Group’s nominees) that had been added

to the Board in 2014 and that had not participated in the Board’s prior evaluation of the Sandell Group’s proposals, ensuring another fresh and independent review of all of the Company’s alternatives to enhance stockholder value. Moreover, the Sandell Group’s nominees would have constituted one-quarter of the Board and one-third of the Finance Committee.

To the contrary, the Sandell Group is insisting, as part of its settlement proposal, that two-thirds of the Board and all of the Finance Committee be composed of either new directors or directors with only recent experience with the Company’s operations, strategy and customers. In addition, the Sandell Group has demanded that any directors added to the Board be selected by the Sandell Group in its sole discretion, whereas the Board believes that the Board and the Sandell Group can and should reach mutual agreement over which of the Sandell Group’s nominees would contribute the most value to stockholders as members of the Board.

We encourage stockholders to carefully read the section of the enclosed proxy statement titled “Background to Contested Solicitation” for further information on these settlement discussions.

As your Board of Directors remains committed to an approach that delivers to stockholders a constructive resolution of this proxy contest, including an appropriate amount of fresh, independent perspectives, we have determined that, notwithstanding the previously announced retirement of two directors from the Board immediately prior to the Annual Meeting, the size of the Board will remain at twelve directors. Because your Board of Directors has nominated a slate of ten directors for the available twelve seats at the Annual Meeting, we expect that at least two nominees that were not nominated by the Board will be elected at the Annual Meeting. Since the Sandell Group is the only stockholder that notified the Company of an intention to nominate directors for election at the Annual Meeting, we expect that election of all of Bob Evans’ ten director nominees named on theWHITE proxy card would still provide for the remaining two board seats to be filled by two of the Sandell Group’s nominees.

Protect the value of your investment.

The Board of Directors unanimously recommends that you submit your voting instructions on theWHITE proxy card “FOR ALL” ten nominees recommended by the Board of Directors and “AGAINST” the Sandell Proposal. The Board of Directors strongly urges you not to sign or return any gold proxy card sent to you by the Sandell Group. If you have previously submitted a proxy using a gold proxy card, you can revoke that proxy and vote for your Board’s nominees and on the other matters to be voted on at the Annual Meeting by using the enclosedWHITE proxy card. Only the latest-dated executed proxy that you submit will be counted.

For those of you who plan to attend the Annual Meeting in person, we look forward to seeing you, and please have a safe trip. We thank you for your continued support.

Sincerely,

Steven A. Davis

Chairman of the Board of Directors and Chief Executive Officer

YOUR VOTE IS IMPORTANT!

Whether or not you plan to attend the Annual Meeting, please submit your voting instructions over the telephone or via the Internet by following the instructions on the enclosedWHITE proxy card, or by signing, dating and returning theWHITE proxy card in the postage-paid envelope provided.

If you have any questions or need assistance voting your shares,

please call the firm assisting us with the solicitation:

INNISFREE M&A INCORPORATED

Stockholders may call toll-free: +1 (877) 825-8621

Banks & Brokers may call collect: +1 (212) 750-5833

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

[—], [—] [—], 2014 ~ [—] Eastern Time

[—]

Dear Stockholder:

We invite you to attend the 2014 Annual Meeting of Stockholders (the “Annual Meeting”) of Bob Evans Farms, Inc. (the “Company”). The Annual Meeting will be held on [—], [—] [—], 2014, at [—] a.m. Eastern Time at [—].

Business for the meeting includes:

| | 1. | Electing twelve director nominees to the Company’s Board of Directors, each to hold office until our 2015 Annual Meeting of Stockholders and a successor is elected and qualified; |

| | 2. | Approving, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the accompanying proxy statement; |

| | 3. | Approving an amendment of Section 8.01 of the Company’s By-laws to allow stockholders to amend any provision of the By-laws by a majority vote of the common stock outstanding; |

| | 4. | Approving amendments of Article Twelfth of the Company’s Certificate of Incorporation and Section 3.13 of the Company’s By-laws to allow stockholders to remove directors by a majority vote of the common stock outstanding; |

| | 5. | Approving an amendment of Article Thirteenth of the Company’s Certificate of Incorporation to allow stockholders to amend Article Twelfth governing director removal by a majority vote of the common stock outstanding; |

| | 6. | Approving an amendment of Section 2.05 of the Company’s By-laws to allow stockholders with at least 25 percent of the common stock outstanding to call a special stockholder meeting; |

| | 7. | Ratifying the selection of Ernst & Young LLP as our independent registered public accounting firm; |

| | 8. | Considering and acting upon a stockholder proposal submitted by an affiliate of Sandell Asset Management Corp., Castlerigg Global Equity Special Event Master Fund, Ltd (together, with certain affiliates participating in a proxy solicitation of the Company’s stockholders, the “Sandell Group”), to repeal any provision of the Company’s By-laws as of the date of the Annual Meeting that was not in the By-laws filed by the Company on January 28, 2014, and that is inconsistent with or disadvantageous to the election of the director nominees of the Sandell Group, if such proposal is properly presented at the Annual Meeting (the “Sandell Proposal”); and |

| | 9. | Transacting other business that may properly come before the Annual Meeting, if any. |

The above matters are more fully described in the attached proxy statement, which is part of this notice. We have not received notice of any other matters that may be properly presented at the meeting.

The Board has set July 3, 2014, as the record date for the meeting. This means that only stockholders of record at the close of business on that date are entitled to vote in person or by proxy at the meeting. This proxy statement and the form of proxy are first being mailed or provided to stockholders on or about [—], 2014.

YOUR VOTE IS IMPORTANT. The Company cordially invites all stockholders to attend the meeting in person. Whether or not you personally plan to attend, please take a few minutes now to submit a proxy by telephone or by Internet by following the instructions on theWHITE proxy card, or to sign, date and return the enclosedWHITE proxy card in the enclosed postage-paid envelope provided. If you are a beneficial owner or

you hold your shares in “street name,” please follow the voting instructions provided by your bank, broker or other nominee. Regardless of the number of shares you own, your presence at the Annual Meeting in person or by proxy is helpful to establish a quorum and your vote is important.

Your Board of Directors has nominated a slate of ten directors for the available twelve seats at the Annual Meeting and is soliciting proxies for the ten Bob Evans nominees named herein. The Sandell Group has notified the Company that it intends to nominate eight director candidates for election to the Bob Evans Board of Directors in opposition to the nominees recommended by your Board and to present the Sandell Proposal at the Annual Meeting. Your Board has NOT endorsed any Sandell Group nominee or the Sandell Proposal. You may receive proxy solicitation materials from the Sandell Group, including its proxy statements and gold proxy cards. We are not responsible for the accuracy of any information provided by or relating to the Sandell Group or its nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, the Sandell Group or any other statements that the Sandell Group may otherwise make.

Because your Board of Directors has nominated a slate of ten directors for the available twelve seats at the Annual Meeting, we expect that at least two nominees that were not nominated by the Board of Directors will be elected at the Annual Meeting. The Sandell Group is the only stockholder that has notified the Company of its intention to nominate directors for election at the Annual Meeting by the applicable deadline. Therefore, your Board of Directors expects that at least two board seats will be filled by two of the Sandell Group nominees. Even if you submit your voting instructions “FOR ALL” of Bob Evans’ ten Director nominees on theWHITE proxy card, at least two nominees that are nominated by the Sandell Group will be elected as directors at the Annual Meeting. Your Board of Directors strongly urges you to vote “FOR ALL” ten of the nominees recommended by your Board of Directors.

YOUR BOARD OF DIRECTORS RECOMMENDS THAT YOU SUBMIT YOUR

VOTING INSTRUCTIONS FOR THE ELECTION OF EACH OF THE BOARD NOMINEES

USING THE ENCLOSED WHITE PROXY CARD AND

URGES YOU NOT TO SIGN OR RETURN ANY

PROXY CARD SENT TO YOU BY THE SANDELL GROUP.

If you have previously signed a gold proxy card sent by the Sandell Group, you have every right to change your voting instructions by telephone or by Internet by following the instructions on theWHITE proxy card, or by signing, dating and returning the enclosedWHITE proxy card in the postage-paid envelope provided. Only the latest dated proxy card you submit will be counted. If you are a beneficial owner or you hold your shares in “street name,” please follow the voting instructions provided by your bank, broker or other nominee to change your voting instructions. We urge you to disregard any gold proxy card sent to you by the Sandell Group.

By Order of the Board of Directors,

Colin M. Daly

Senior Vice President, General Counsel and

Corporate Secretary

New Albany, Ohio

[—], 2014

2

YOUR VOTE IS IMPORTANT

Please mark, sign and date your WHITE proxy card and return it promptly in the enclosed envelope, whether or not you plan to attend the meeting.If you own shares in a brokerage account, your broker will not be able to vote your shares on the election of directors and other important matters unless you provide voting instructions to your broker.THEREFORE, IT IS VERY IMPORTANT THAT YOU EXERCISE YOUR RIGHT AS A STOCKHOLDER AND PROVIDE VOTING INSTRUCTIONS ON ALL PROPOSALS.

If you have any questions or require any assistance with voting your shares, please contact the Company’s proxy solicitor listed below:

Innisfree M&A Incorporated

Stockholders may call toll free: (877) 825-8621

Banks and Brokers may call collect: (212) 750-5833

3

TABLE OF CONTENTS

i

ii

8111 Smith’s Mill Road

New Albany, Ohio 43054

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

When and where will the Annual Meeting be held?

The 2014 Annual Meeting of Stockholders (the “Annual Meeting”) of Bob Evans Farms, Inc. (“Bob Evans” or the “Company”) will be held on [—], [—] [—], 2014, at [—] Eastern Time, at [—].

Why did I receive these proxy materials?

You have received these proxy materials because the Bob Evans Board of Directors (the “Board”) is soliciting a proxy to vote your shares at the Annual Meeting. This proxy statement contains information that we are required to provide to you under the rules of the Securities and Exchange Commission (the “SEC”) and that is intended to assist you in making an informed vote on the proposals described in this proxy statement. This proxy statement and accompanyingWHITE proxy card and other materials are first being mailed on or about [—], 2014, in connection with the solicitation of proxies on behalf of your Board.

What proposals will be voted on at the Annual Meeting?

There are eight proposals currently scheduled to be voted on at the Annual Meeting:

Proposal 1—election of twelve directors to the Company’s Board, each to hold office until our 2015 Annual Meeting of Stockholders and a successor is elected and qualified;

Proposal 2—approval, on an advisory basis, of the compensation of the Company’s named executive officers;

Proposal 3—approval of an amendment of Section 8.01 of the Company’s Amended and Restated By-laws (the “Bylaws”) to allow stockholders to amend any provision of the Bylaws by a majority vote of the common stock outstanding;

Proposal 4—approval of amendments of Article Twelfth of the Company’s Restated Certificate of Incorporation (the “Charter”) and Section 3.13 of the Bylaws to allow stockholders to remove directors by a majority vote of the common stock outstanding;

Proposal 5—approval of an amendment of Article Thirteenth of the Company’s Charter to allow stockholders to amend Article Twelfth governing director removal by a majority vote of the common stock outstanding;

Proposal 6—approval of an amendment of Section 2.05 of the Company’s Bylaws to allow holders of at least 25% of the common stock outstanding to request that the Company call a special meeting;

Proposal 7—ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm; and

Proposal 8—consideration of a stockholder proposal submitted by an affiliate of Sandell Asset Management Corp., Castlerigg Global Equity Special Event Master Fund, Ltd (together, with certain affiliates participating in a proxy solicitation of the Company’s stockholders, the “Sandell Group”), to repeal any provision of the Company’s Bylaws that was not in the Bylaws filed by the Company on January 28, 2014, and that is inconsistent with or disadvantageous to the election of the director nominees of the Sandell Group, if such proposal is properly presented at the Annual Meeting (the “Sandell Proposal”).

1

Has the Company been notified that a stockholder intends to nominate alternative director nominees at the Annual Meeting?

Yes. The Sandell Group has notified us that it intends to nominate eight director nominees for election at the Annual Meeting in opposition to the nominees recommended by your Board. The Sandell Group’s nominees have NOT been endorsed by your Board, and your Board unanimously recommends you submit your voting instructions “FOR ALL” of your Board’s nominees for director on the enclosedWHITE proxy card accompanying this proxy statement. Your Board strongly urges you NOT to sign or return any gold proxy card sent to you by the Sandell Group. If you have previously submitted a gold proxy card sent to you by the Sandell Group, you can revoke that proxy and submit your voting instructions for your Board’s nominees and on the other matters to be voted on at the Annual Meeting by signing, dating and returning the enclosedWHITE proxy card or by submitting a proxy by telephone or by Internet by following the instructions on theWHITE proxy card.

Why is your Board of Directors nominating a slate of ten directors for the available twelve seats at the Annual Meeting?

Your Board has nominated a slate of ten directors for the available twelve seats at the Annual Meeting and is soliciting proxies for the ten Bob Evans’ nominees named herein. Your Board remains committed to an approach that delivers to stockholders a constructive resolution of this proxy contest, including an appropriate amount of fresh, independent perspectives. Consistent with its proposal to the Sandell Group that some of the Sandell Group’s third-party nominees be appointed to your Board as part of a negotiated resolution (as described further under “Background to Contested Solicitation”), your Board of Directors has determined to nominate a slate of ten directors to the twelve available seats, with the expectation that even if you submit your voting instructions FOR ALL of Bob Evans’ ten director nominees on the WHITE proxy card, at least two nominees that are nominated by the Sandell Group will be elected as directors at the Annual Meeting. Your Board strongly urges you to submit your voting instructions “FOR ALL” ten of the nominees recommended by your Board.

Who may vote at the Annual Meeting?

Your Board has set July 3, 2014, as the record date for the Annual Meeting. This means that only stockholders of record at the close of business on that date are entitled to vote at the Annual Meeting or any adjournment(s) or postponement(s) of the Annual Meeting. At the close of business on July 3, 2014, there were 23,499,911 shares of our common stock, par value $0.01 per share, outstanding.

If you were a stockholder of record at the close of business on July 3, 2014, you can vote in person at the Annual Meeting or by proxy. Each share of common stock entitles the holder to one vote on each item to be voted on at the Annual Meeting.

What is the difference between holding shares as a “stockholder of record” and in “street name”?

If your shares are registered directly in your name with the Company’s transfer agent, you are considered the “stockholder of record” of those shares. We sent these proxy materials directly to all stockholders of record. As a stockholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting. The Company has enclosed aWHITE proxy card for you to use. You may also submit voting instructions via the Internet or by telephone by following the instructions on theWHITE proxy card, as described under “How can I vote my shares without attending the Annual Meeting?”

Alternatively, if your shares are held in an account at a broker, bank or other similar organization, which is sometimes called “street name,” then you are the “beneficial owner” of those shares. That organization is the “stockholder of record” for purposes of voting the shares at the Annual Meeting. As the beneficial owner, you have the right to direct that organization on how it should vote the shares held in your account by following the voting instructions the organization provides to you.Your broker, bank or other organization holding your shares may not be able to vote your shares on the election of directors and other important matters at the

2

Annual Meeting unless you direct them how to vote. Your broker, bank or other such organization has enclosed a voting instruction form for you to use to direct the organization holding your shares regarding how to vote your shares. Please provide instructions how to vote your shares using the voting instruction form you received from them.

Who can attend the Annual Meeting?

Only stockholders who owned shares at the close of business on July 3, 2014, the record date for the Annual Meeting, or their duly appointed proxies, are permitted to attend the Annual Meeting. If you hold your shares through a broker, bank or other record owner, you may attend the Annual Meeting only if you bring a legal proxy or a copy of a statement (such as a brokerage statement) from your broker, bank or other record owner reflecting your stock ownership as of July 3, 2014. Additionally, in order to be admitted to the Annual Meeting, all stockholders must bring a driver’s license, passport or other form of government-issued identification to verify their identities.

How can I vote my shares in person at the Annual Meeting?

Shares held directly in your name as the stockholder of record may be voted in person at the Annual Meeting. If you choose to vote in person, please bring proof of identification, such as a driver’s license, passport or other form of government-issued identification. Even if you plan to attend the Annual Meeting, the Company recommends that you submit a proxy using theWHITE proxy card with respect to the voting of your shares in advance as described below so that your vote will be counted if you later decide not to attend the Annual Meeting. Shares held in street name through a brokerage account or by a broker, bank or other nominee may be voted in person by you only if you obtain a valid legal proxy from your broker, bank or other nominee giving you the right to vote the shares.

How can I vote my shares without attending the Annual Meeting?

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may submit a proxy or submit a voting instruction form without attending the Annual Meeting. If you hold your shares directly as the stockholder of record, there are three ways to submit a proxy:

| | • | | Internet—You can submit a proxy over the Internet following the instructions on the enclosedWHITEproxy card; |

| | • | | Telephone—You can submit a proxy by telephone by following the instructions on the enclosedWHITE proxy card; or |

| | • | | Mail—You can submit a proxy by mail by signing and dating the enclosedWHITE proxy card and returning it promptly in the postage-paid envelope provided. |

If you hold your shares in street name through an organization such as a broker, you should follow the voting instructions provided to you by that organization.

How many votes do I have?

Each stockholder has one vote for every share of the Company’s common stock owned of record or beneficially.

Can I cumulate my votes?

Cumulative voting is not allowed.

How will my shares be voted?

If you submit a proxy by mail, through the Internet, or by telephone, or vote in person, your shares will be voted as you direct. If you submit a valid signedWHITE proxy card prior to the Annual Meeting, but do not complete

3

the voting instructions on that card, your shares will be voted “FOR” the election of all of the Company’s director nominees, “FOR” Proposal 2 (approval, on an advisory basis, of the compensation of the Company’s named executive officers), “FOR” Proposals 3 through 6 (approval of certain amendments to the Company’s Charter and Bylaws), “FOR” Proposal 7 (ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm) and, if it is properly presented at the Annual Meeting, “AGAINST” Proposal 8 (the Sandell Proposal).

As of the date of this proxy statement, your Board knows of no business other than that set forth above to be transacted at the Annual Meeting, but if other matters requiring a vote do arise, it is the intention of the persons named on theWHITE proxy card (the Company’s management proxies), to whom you are granting your proxy, to vote in accordance with their best judgment on such matters.

What should I do if I receive a gold proxy card from the Sandell Group?

The Sandell Group has notified us that it intends to propose eight director nominees for election at the Annual Meeting in opposition to the nominees recommended by your Board, and to propose the Sandell Proposal. If the Sandell Group proceeds with its proposals, you may receive proxy solicitation materials from the Sandell Group, including an opposition proxy statement and gold proxy card. The Company is not responsible for the accuracy of any information contained in any proxy solicitation materials used by the Sandell Group or any other statements that the Sandell Group may otherwise make. Your Board has not endorsed any of the Sandell Group’s nominees and unanimously recommends that you disregard any gold proxy card or solicitation materials that may be sent to you by the Sandell Group.

Instructing to “WITHHOLD” with respect to any of the Sandell Group’s nominees on a gold proxy card sent to you by the Sandell Group is not the same as voting for your Board’s nominees because an instruction to “WITHHOLD” with respect to any of the Sandell Group’s nominees on its gold proxy card will revoke any proxy you previously submitted. If you have already submitted a proxy using the gold proxy card, you have every right to change your voting instructions by using the enclosed WHITE proxy card to submit a proxy by telephone or by Internet, or by signing, dating and returning the enclosed WHITE proxy card in the postage-paid envelope provided. Only the latest dated proxy you submit counts.

If you have any questions or need assistance voting, please call the Company’s proxy solicitor:

Innisfree M&A Incorporated

Stockholders may call toll free: (877) 825-8621

Banks and Brokers may call collect: (212) 750-5833

What does it mean if I receive more than one proxy statement or WHITE proxy card?

If you receive multiple proxy statements orWHITE proxy cards, it may mean that you have more than one account with brokers or our transfer agent. Please submit your voting instructions for all of your shares. If the Sandell Group proceeds with its nomination of alternative directors, we will likely conduct multiple mailings prior to the Annual Meeting date to ensure that stockholders have our latest proxy information and materials to vote. We will send you a newWHITE proxy card with each mailing, regardless of whether you have previously submitted a proxy. If you are not sure whether or not you have submitted theWHITE proxy card, please simply submit theWHITE proxy card again. Only the latest dated proxy you submit counts, and, IF YOU WISH TO VOTE AS RECOMMENDED BY YOUR BOARD THEN YOU SHOULD ONLY SUBMITWHITEPROXY CARDS.

How does the Bob Evans Board recommend I vote?

Your Board unanimously recommends you submit your voting instructions using theWHITE proxy card and instruct a vote “FOR ALL” the directors nominated by your Board, “FOR” Proposal 2 (approval, on an advisory

4

basis, of the compensation of the Company’s named executive officers), “FOR” Proposals 3 through 6 (approval of certain amendments to the Company’s Charter and Bylaws), “FOR” Proposal 7 (ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm) and “AGAINST” Proposal 8 (the Sandell Proposal). Your Board unanimously recommends that you NOT vote for any of the Sandell Group’s nominees.

May I revoke or change my vote?

Yes. If you are a stockholder of record, you may revoke your proxy given pursuant to this solicitation or change your voting instructions in any of the following ways:

| | • | | submitting a later-dated proxy by mail, which we receive prior to the Annual Meeting; |

| | • | | submitting a new proxy through the Internet or by telephone prior to the Annual Meeting; |

| | • | | sending written notice of revocation to our Corporate Secretary at 8111 Smith’s Mill Road, New Albany, Ohio 43054, which we receive prior to the Annual Meeting; or |

| | • | | attending the Annual Meeting and voting your shares in person if you are the stockholder of record of your shares. |

If your shares are held in street name by an organization such as a broker and you wish to revoke your proxy, you should follow the instructions provided to you by that organization.

If you have any questions or need assistance revoking your proxy or changing your vote, please call the Company’s proxy solicitor at:

Innisfree M&A Incorporated

Stockholders may call toll free: (877) 825-8621

Banks and Brokers may call collect: (212) 750-5833

Who will count the votes cast at the Annual Meeting?

The Company will appoint an independent inspector of election to serve at the Annual Meeting. The independent inspector of election for the Annual Meeting will determine the number of votes cast by holders of common stock for all matters. Preliminary voting results will be announced at the Annual Meeting, if practicable, and final results will be announced when certified by the independent inspector of election.

How can I find the voting results of the Annual Meeting?

We will include the voting results in a Current Report on Form 8-K that we will file with the SEC no later than four business days following the completion of the Annual Meeting. We will amend this filing to include final results if the independent inspector of election has not certified the results by the time the original Current Report on Form 8-K is filed.

Who pays the cost of proxy solicitation?

We will pay for the entire cost of soliciting proxies on behalf of the Company, including the costs of preparing, assembling, printing, mailing and distributing these proxy materials and accompanying proxy cards. We will also reimburse brokerage firms, banks and other agents for the costs of forwarding the Company’s proxy materials to beneficial owners. In addition, our directors and employees may solicit proxies in person, by mail, by telephone, via the Internet, press releases or advertisements. Directors and employees will not be paid any additional compensation for soliciting proxies. Innisfree M&A Incorporated (“Innisfree”), our proxy solicitor, will be paid a fee, not to exceed $600,000, for rendering solicitation services. In addition, we have agreed to reimburse Innisfree for its expenses, and to indemnify it against certain liabilities relating to or arising out of their engagement. Innisfree expects that approximately 50 of its employees will assist in the solicitation. Innisfree will solicit proxies by personal interview, mail, telephone, facsimile or email.

5

Our aggregate expenses related to our solicitation as a result of the consent solicitation threatened and the proxy contest initiated by the Sandell Group, and excluding salaries and wages of our regular employees, are expected to be approximately $8.5 million, of which the Company estimates it has incurred approximately $3.0 million to date. These expected and estimated aggregate expenses include fees paid to Innisfree and fees paid or payable to attorneys, accountants, public relations or financial advisers and solicitors, and advertising, printing, transportation, litigation and other costs incidental to the solicitation, other than salaries and wages of our regular employees. Annex A sets forth information relating to our director nominees as well as certain of our directors, officers and employees who are considered “participants” in our solicitation under the rules of the SEC by reason of their position as directors or director nominees of the Company or because they may be soliciting proxies on our behalf.

What is a “broker non-vote” and how will my shares held in street name be voted if I do not provide my proxy?

A “broker non-vote” occurs when a beneficial owner holds shares in “street name” through a broker, bank or similar organization, and the beneficial owner does not provide the broker with instructions on how to vote the shares on “non-routine” matters. Brokers cannot vote your shares on non-routine matters, such as the election of our directors, approval on an advisory basis of the compensation of the Company’s named executive officers or amendments to our Charter or Bylaws, unless they receive instructions on how to vote from the beneficial owner at least ten days before the Annual Meeting.

Since Sandell has notified us of its intent to initiate a proxy contest, to the extent your broker provides you with Sandell’s proxy materials, your broker cannot treat any of the matters to be voted on at the Annual Meeting as a routine matter, and, therefore, shares you hold in “street name” would not be voted on any proposal unless you instruct your broker, bank or similar organization holding your shares to vote in a timely manner.Your broker, bank or other organization holding your shares has enclosed a voting instruction form for you to use to direct the organization holding your shares regarding how to vote your shares. Please provide instructions how to vote your shares using the voting instruction form you received from the organization.

What if my shares are held through our 401(k) plan?

If you participate in our 401(k) plan and have money invested in the Bob Evans Farms, Inc. common stock fund, you will receive a proxy card for you to use to instruct the trustee of our 401(k) plan how to vote your shares. If you do not instruct the trustee how to vote, then the shares you hold through the 401(k) plan will not be voted.

What constitutes a quorum?

We must have a quorum at the Annual Meeting to take any action at the Annual Meeting. Under our Bylaws, a quorum is the presence at the Annual Meeting, in person or by proxy, of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting. Abstentions and “broker non-votes” are counted for purposes of determining a quorum.

What are the voting requirements for the proposals discussed in the proxy statement?

Proposal 1—Election of twelve directors to the Bob Evans Board of Directors, each to hold office until our 2015 Annual Meeting of Stockholders and a successor is elected and qualified

As a result of the Sandell Group’s intention to nominate eight alternative director nominees in opposition to the ten nominees recommended by your Board there were more than twelve nominees for election to your Board as of [—] 2014. Under our Bylaws, this means that the twelve candidates receiving the highest number of “FOR” votes cast by holders of shares represented in person or by proxy at the Annual Meeting will be elected. This number is called a plurality. A properly executed proxy card marked “WITHHOLD” with respect to the election of a director nominee will be counted for purposes of determining if there is a quorum

6

at the Annual Meeting, but will not be considered to have been voted for the director nominee. Similarly, any broker non-votes will be counted for purposes of determining if there is a quorum, but will not be considered to have been voted for the director nominee.

THE ONLY WAY TO SUPPORT ALL TEN OF YOUR BOARD OF DIRECTORS’ NOMINEES IS TO SUBMIT YOUR VOTING INSTRUCTIONS “FOR” YOUR BOARD’S NOMINEES ON THE WHITE PROXY CARD. PLEASE DO NOT SIGN OR RETURN A GOLD PROXY CARD FROM SANDELL, EVEN IF YOU INSTRUCT TO “WITHHOLD” ON THEIR DIRECTOR NOMINEES. DOING SO WILL REVOKE ANY PREVIOUS VOTING INSTRUCTIONS YOU PROVIDED ON THE COMPANY’S WHITE PROXY CARD.

Proposal 2—Approval, on an advisory basis, of the compensation of the Company’s named executive officers

Under our Bylaws, the approval of the advisory resolution on executive compensation requires the affirmative “FOR” vote of the holders of a majority of votes represented in person or by proxy at the Annual Meeting and entitled to vote thereon. Abstentions with respect to this proposal will be counted as votes “AGAINST” the proposal. Any broker non-votes will not be treated as shares represented in person or by proxy at the Annual Meeting and entitled to vote thereon with respect to this proposal, and will not be considered to have been voted “FOR” or “AGAINST” this proposal.

This advisory vote is non-binding but your Board and the Compensation Committee will give careful consideration to the results of voting on this proposal.

Proposal 3—Amendment of Section 8.01 of the Company’s Bylaws to Allow Stockholders To Amend Any Provision of the Bylaws by Majority Vote

Under our Bylaws, the adoption of this proposal requires the affirmative “FOR” vote of the holders of at least 80 percent of the shares of our common stock issued and outstanding. Abstentions and any broker non-votes with respect to this proposal will be counted as votes “AGAINST” this proposal.

Proposal 4—Amendment of Article Twelfth of the Charter and Section 3.13 of the Bylaws to Allow Stockholders to Remove Directors by a Majority Vote

Under our Charter and Delaware law, since this Proposal 4 has been unanimously recommended by our Board, the amendment of our Charter pursuant to the adoption of this resolution requires the affirmative “FOR” vote of the holders of at least a majority of the shares of our common stock issued and outstanding. Under our Bylaws, amendment of our Bylaws pursuant to the adoption of this proposal requires the affirmative “FOR” vote of the holders of at least 80 percent of the shares of our common stock issued and outstanding. However, if Proposal 3 is duly adopted by the stockholders, amendment of our Bylaws pursuant to the adoption of this proposal will require the affirmative “FOR” vote of only a majority of the shares of our common stock issued and outstanding.

In all cases, abstentions and any broker non-votes with respect to this proposal will be counted as votes “AGAINST” this proposal.

Proposal 5—Amendment of Article Thirteenth of the Charter to Allow Stockholders to Amend Article Twelfth Governing Director Removal by a Majority Vote

Under our Charter and Delaware law, since this Proposal 5 has been unanimously recommended by our Board, the amendment of our Charter pursuant to the adoption of this proposal requires the affirmative “FOR” vote of the holders of at least a majority of the shares of our common stock issued and outstanding. Abstentions and any broker non-votes with respect to this proposal will be counted as votes “AGAINST” this proposal.

7

Proposal 6—Amendment of Section 2.05 of the Company’s Bylaws to Allow Stockholders Holding at Least 25 Percent of the Common Stock Outstanding to Request that the Company Call a Special Meeting

Under our Bylaws, the adoption of this proposal requires the affirmative “FOR” vote of the holders of at least a 80 percent of the shares of our common stock issued and outstanding. However, if Proposal 3 is duly adopted by the stockholders, the adoption of this proposal will require the affirmative “FOR” vote of only a majority of the shares of our common stock issued and outstanding. Abstentions and any broker non-votes with respect to this proposal will be counted as votes “AGAINST” this proposal.

Proposal 7—Ratification of the Selection of Independent Registered Public Accounting Firm

Under our Bylaws, the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm requires the affirmative vote of the holders of a majority of votes represented in person or by proxy at the Annual Meeting and entitled to vote thereon. Abstentions with respect to this proposal will be counted as votes “AGAINST” the proposal. Broker non-votes, if any, will not be treated as shares represented in person or by proxy at the Annual Meeting and entitled to vote thereon with respect to this proposal, and will not be considered to have been voted “FOR” or “AGAINST” this proposal.

Proposal 8—Repeal any Provision of the Company’s Bylaws that Was Not in the Bylaws Filed by the Company on January 28, 2014, and that is Inconsistent with or Disadvantageous to the Election of the Director Nominees of the Sandell Group

Under our Bylaws, the adoption of this proposal would require the affirmative “FOR” vote of the holders of at least a majority of the shares of our common stock issued and outstanding, except with respect to the repeal of any provision of Sections 2.05, 2.08 and 3.13, and Article VIII, of the Bylaws, which would require the affirmative “FOR” vote of the holders of at least 80 percent of the shares of our common stock issued and outstanding. However, if Proposal 3 is duly adopted by the stockholders, the adoption of this proposal will require the affirmative “FOR” vote of a majority of the shares of our common stock currently issued and outstanding with respect to the repeal of any provision of the Company’s Bylaws. Abstentions and any broker non-votes with respect to this proposal will be counted as votes “AGAINST” this proposal.

8

BACKGROUND TO CONTESTED SOLICITATION

On April 24, 2014, the Company received a notice from the Sandell Group of its intent to nominate eight director candidates for election to the Bob Evans Board of Directors at the Annual Meeting in opposition to the nominees recommended by your Board and of its intent to present the Sandell Proposal. The discussion below outlines the key events and significant contacts between the Company, on the one hand, and the Sandell Group and its representatives, on the other hand.

On July 9, 2013, representatives of Sandell Asset Management Corp., contacted the Company to arrange a discussion with the Company’s management. On July 16, 2013, Steven A. Davis, Chairman of the Board and Chief Executive Officer of Bob Evans, and Paul F. DeSantis, former Chief Financial Officer of Bob Evans, met telephonically with representatives of the Sandell Group, including Thomas Sandell, Chief Executive Officer of the Sandell Group.

On August 5, 2013, Michael Gasser, Lead Independent Director of the Board, received a letter from the Sandell Group. On August 6, 2013, Mr. Gasser met telephonically with members of the Sandell Group, including Mr. Sandell, to discuss the topics in the Sandell Group’s letter of August 5.

Over the course of these discussions and through letters to Mr. Gasser and the Board, including a letter dated September 23, 2013, Mr. Sandell urged the Company and the Board to pursue a sale or spin-off of BEF Foods, engage in a sale-leaseback of the Company’s real estate assets, and use the proceeds of either or both transactions to expand the Company’s share repurchase program. All of these proposals were discussed by the Board over the next several months.

On September 24, 2013, the Sandell Group filed a Schedule 13D with the SEC reporting beneficial ownership by the Sandell Group of approximately 5.1% of our common stock,including call options that conferred beneficial ownership of approximately 1.4% of our common stock. In the following months, the Sandell Group continued to acquire additional shares of the Company’s common stock, accumulating beneficial ownership of approximately 8.83% of our common stock outstanding, including beneficial ownership of approximately 7.22% of our common stock and options to purchase the Company’s stock at $55.00 per share with an exercise date of September 30, 2014 that conferred beneficial ownership of approximately 1.62% of our common stock, by July 3, 2014, as shown in the section titled “Stock Ownership of Certain Beneficial Owners Table” below.

Also on September 24, 2013, the Sandell Group publicly filed various materials, including a presentation and the letter to the Bob Evans Board dated September 23, 2013 setting forth its proposals that the Company should pursue a sale or spin-off of BEF Foods, engage in a sale-leaseback of the Company’s real estate assets, and repurchase a large amount of shares.

On September 25, 2013, the Company issued a press release acknowledging that the Board had received the Sandell Group’s letter, and confirming that it takes into consideration the concerns and suggestions of stockholders.

On October 11, 2013, Mr. Davis and Mr. DeSantis again met telephonically with representatives of the Sandell Group, to discuss Sandell’s proposals.

On November 11, 2013, the Sandell Group sent another letter to the Board and issued a press release indicating that it had retained a proxy solicitation firm and was considering a possible consent solicitation of the Company’s stockholders.

On November 25, 2013, the Sandell Group sent a letter to the Bob Evans Board requesting that the Company effect certain governance changes by amending the Company’s Bylaws.

9

On December 9, 2013, the Sandell Group issued a press release and other materials criticizing the Board, stating that the Company should pursue a sale or spin-off of BEF Foods, engage in a sale-leaseback of the Company’s real estate assets, repurchase a large amount of shares and consider a leveraged buyout of the entire Company. The Sandell Group also announced its intent to commence a consent solicitation of the Company’s stockholders for unspecified purposes.

Also on December 9, 2013, the Company issued a press release stating that the Board, with the assistance of the Company’s financial advisor, Lazard Ltd. (“Lazard”), had thoroughly vetted the Sandell Group’s restructuring proposals and unanimously concluded that the proposals were not in the best interests of the Company and its stockholders.

Over the course of multiple Board meetings in 2013 and 2014, the Board discussed and evaluated the Sandell Group’s governance and economic proposals in consultation with its advisors.

On or about December 19, 2013, pursuant to a letter from Castlerigg International Limited, the Sandell Group notified Bob Evans of its intention to acquire voting securities of the Company and to file a Notification and Report Form pursuant to the Hart-Scott-Rodino Act (“HSR Act”) with the Federal Trade Commission (“FTC”) and the Antitrust Division of the Department of Justice (“Antitrust Division”). Bob Evans submitted its responsive Notification and Report Form on January 3, 2014. The FTC and Antitrust Division granted early termination of the 30-day waiting period under the HSR Act on January 9, 2014.

In mid-December 2013, the Company arranged for representatives from Lazard to meet with representatives of the Sandell Group to discuss its restructuring proposals. Representatives from Lazard met with representatives of the Sandell Group on December 19, 2013.

On January 6, 2014 representatives from Lazard met telephonically with representatives from the Sandell Group to follow up on their earlier meeting.

On January 14, 2014, Sandell Asset Management Corp. filed a complaint in the Delaware Court of Chancery naming the Company and the then-members of its Board as defendants, seeking a declaration that amendments to the Company’s Bylaws made in November 2011 were invalid. In its complaint, Sandell Asset Management Corp. also stated that it intended to commence a consent solicitation to, among other things, amend the Company’s Bylaws to increase the size of the Company’s Board and elect new directors to fill the vacancies.

On January 22, 2014, representatives of Bob Evans sought to initiate discussions with the Sandell Group to seek a settlement of the litigation and to avoid a consent solicitation, in an effort to avoid the time and expense of both. Representatives of Bob Evans proposed to representatives of the Sandell Group that, in exchange for a settlement of the litigation and customary standstill provisions, the Board would, among other things:

| | • | | amend the Bylaws to repeal the November 2011 amendments; and |

| | • | | offer Sandell the opportunity to consult with the Board in the identification and selection of new independent directors to add to the Board prior to the Annual Meeting. |

On January 24, 2014, the Sandell Group filed a motion to expedite the litigation in the Delaware Court of Chancery. The Sandell Group subsequently declined Bob Evans’ settlement offer.

At a meeting held on January 26, 2014, the Bob Evans Board voted unanimously to amend the Company’s By-laws to repeal the November 2011 amendments and to implement certain other governance changes.

On January 28, 2014, the Company issued a press release announcing the Bylaw amendments, and publicly announcing its intent to propose the Charter and Bylaw amendments described in this proxy statement and, as part of a search process that had been underway since August 2013, to appoint up to three new independent directors to the Board prior to the Annual Meeting. On January 29, 2014, the Sandell Group issued a press release announcing its intent to withdraw its complaint in the Delaware Court of Chancery.

10

On April 24, 2014, the Sandell Group sent a notice to the Company indicating its intent to nominate eight individuals to stand for election at the Annual Meeting in opposition to the nominees recommended by the Bob Evans Board. Sandell also notified the Company of its intent to present a stockholder proposal at the Annual Meeting to repeal any provision of the Company’s Bylaws that was not in the Bylaws filed by Bob Evans on January 28, 2014, and that is inconsistent with or disadvantageous to the election of the director nominees of the Sandell Group.

Also on April 24, 2014, the Sandell Group issued soliciting materials publicly announcing its intent to nominate eight director candidates for election at the Annual Meeting, criticizing the members of the Board and the Company’s management and urging the new director nominees to consider a reduction in corporate expenses, a sale or spin-off of BEF Foods and a sale-leaseback of the Company’s real estate assets.

On April 24, 2014, Bob Evans issued a press release acknowledging receipt of the Sandell Group’s notice, confirming that it would consider and evaluate the Sandell Group’s nominations and repeating its concerns with the Sandell Group’s restructuring proposals.

On April 25, 2014, the Bob Evans Board, as a result of its evaluation and succession process, on a recommendation by the Board’s Nominating and Corporate Governance Committee, unanimously voted to appoint three new independent directors, Kevin M. Sheehan, Kathleen S. Lane and Larry S. McWilliams, to the Board. For more information on the Board’s succession process and new director appointments, please see the section titled “—Background to the Board’s Recommendation in Favor of the Company’s Nominees” below. On April 28, 2014, the Company issued a press release announcing the new independent director appointments. The period for stockholder submissions of nominations for director closed on May 23, 2014.

On May 27, 2014, Mr. Gasser sent a letter to each of the Sandell Group’s nominees inviting them to meet with him and other independent members of the Board in accordance with customary governance processes for new director nominees. On May 30, the Sandell Group issued a press release publicly criticizing the Board’s good faith attempt to meet with and evaluate these directors. None of the Sandell Group’s nominees agreed to meet with Mr. Gasser or any of the other independent directors; only one of the Sandell Group’s nominees sent any response at all to Mr. Gasser’s letter, which response declined the request.

On June 3, 2014, the Bob Evans Board attempted again to address the Sandell Group’s concerns and settle the threatened proxy contest. On that date, representatives of the Bob Evans Board contacted representatives of the Sandell Group and noted that in order to avoid the time, expense and business distraction of a proxy contest, the Bob Evans Board would be willing to enter into a settlement that would:

| | • | | add two of the Sandell Group’s nominees to the Board, with the identification of those nominees to be mutually agreed between the Sandell Group and the Board; |

| | • | | have those two Sandell Group nominees added to the Board’s Finance Committee; |

| | • | | charge the reconstituted Finance Committee with reviewing and making recommendations to the full Board with respect to the economic proposals that Sandell had made previously; and |

| | • | | reimburse the Sandell Group for up to $250,000 for expenses incurred in connection with Sandell’s proxy contest. |

On June 10, 2014, representatives of the Sandell Group informed representatives of the Board that the Sandell Group would be willing to settle the proxy contest on the basis of accepting less than a “majority representation” on the Board only if the Board would publicly announce certain commitments, including a sale or spinoff of the Company’s BEF Foods business by the end of calendar year 2014 and the retention of a new financial advisor to assist in this process; monetization of 43% of the Company’s owned restaurant properties by means of a sale/leaseback transaction to be completed within 90 days; the use of the proceeds of the sale/leaseback transaction to

11

repurchase $350 million of stock, also to be completed within 90 days; the retention by the Company of Alvarez & Marsal as a consultant with respect to operational and cost improvements and growth initiatives; and the separation of the roles of Chairman and CEO. The representatives of the Sandell Group noted that if the Company were to commit to those items, the Sandell Group would then be willing to settle the proxy contest on the basis of adding four of the Sandell Group nominees — to be determined in the discretion of the Sandell Group—to the Board (with a total board size of 12) and limiting the size of the Finance Committee to four (with two of the Sandell Group’s nominees being added to the Finance Committee and the Finance Committee being charged with overseeing the economic commitments referred to above). Finally, the representatives of the Sandell Group noted that the Sandell Group would expect to be reimbursed up to $2,000,000 in respect of costs related to the proxy contest.

On June 11, 2014, representatives of the Board contacted representatives of the Sandell Group to convey that while the Board desires a resolution of the proxy contest and is willing to engage in a new review of the Sandell Group’s economic proposals, the Board was not prepared to commit to adopt these proposals as a condition of settlement. Those representatives noted that if the Sandell Group did not insist that the Board commit to these proposals as a condition of settlement, then further discussion of the other specific settlement terms would be productive and, in particular, the Board was not drawing a “line in the sand” in its June 3 proposal with respect to the numbers of nominees that it would consider, or of the size of the Finance Committee, and that productive conversation could be had within the bounds of what the Board and the Sandell Group had proposed. Representatives of the Board also noted that the Board is willing to entertain the idea of the addition of an additional independent financial advisor, and has no objection to the engagement of an independent consultant to advise the Company with respect to operational expenses and growth initiatives.

The Board’s representatives invited further feedback from the Sandell Group. Other than confirming on the June 11 call that the Sandell Group’s willingness to accept less than “majority representation” on the Board had been conditioned on the Board’s commitment to undertake the actions requested by the Sandell Group, the Sandell Group did not provide any further response.

On June 26, 2014, the Company disclosed that it had made several good faith attempts to work with the Sandell Group to arrive at a constructive settlement to avoid a costly and divisive proxy contest.

Also on June 26, 2014, the Company announced that the Board had determined that the size of the Board would remain at twelve directors, notwithstanding the retirement of Mssrs. Corbin and Lucas immediately prior to the Annual Meeting. The Board also announced that it had nominated a slate of ten directors for election for the available twelve seats at the Annual Meeting, and it expected that at least two nominees who were not nominated by the Board would be elected at the Annual Meeting. The Board further stated that, since the Sandell Group was the only stockholder that had notified the Company by the applicable deadline of an intention to nominate directors for election at the Annual Meeting, at least two of the Board seats would be filled by the Sandell Group’s nominees, even if all of Bob Evans’ ten director nominees were elected.

Beginning on July 2, 2014, the Company and the Sandell Group reengaged in settlement discussions. On July 2, 2014, representatives of the Sandell Group stated to representatives of Bob Evans that the Sandell Group no longer demanded that the Company commit to implement the Sandell Group’s full agenda in order to accept less than a “majority representation” as part of a negotiated resolution of the proxy solicitation. Representatives of the Sandell Group stated that the Sandell Group would be willing to enter into a settlement that would: add to the Board five of the Sandell Group’s nominees, to be determined in the discretion of the Sandell Group, and have three of the current members of the Board who joined the Board prior to 2014 resign from the Board (for a total Board size of twelve); separate the roles of Chairman and CEO; reconstitute the Board’s Finance Committee to be composed of two of the Sandell Group’s nominees and two of the current members of the Board who joined the Board in 2014 (for a total Committee size of four); charge the reconstituted Finance Committee with exploring all strategic alternatives, including the Sandell Group’s proposals, and oversee the implementation of whatever alternatives are chosen; and have the Finance Committee retain a new independent investment bank to

12

assist it in its review of strategic alternatives. In addition, the Sandell Group’s settlement offer required that the Company retain Alvarez & Marsal as a consultant to identify cost reductions for the Company and identify revenue enhancement opportunities for Bob Evans Restaurants, and reimburse the Sandell Group up to $2,000,000 in respect of costs related to the proxy contest. The Sandell Group’s representatives stated that the settlement offer would expire if not accepted by the Company by the date of the Company’s fiscal year 2014 earnings release.

On July 3, 2014, the representatives of the Company contacted representatives of the Sandell Group to offer a settlement counterproposal that would add to the Board three of the Sandell Group’s nominees, to be mutually agreed upon between the Board and the Sandell Group, and have one of the current members of the Board who joined the Board prior to 2014 resign from the Board (for a total Board size following the Annual Meeting of twelve); have the whole Board consider the question of whether the CEO and Chairman positions should be separated; reconstitute the Finance Committee to be composed of two of the Sandell Group’s nominees, one of the current members of the Board who joined the Board in 2014 and three of the current members of the Board who joined the Board prior to 2014 (for a total Committee size of six); charge the reconstituted Finance Committee with reviewing the Sandell Group’s proposals and other alternatives to enhance stockholder value, making recommendations to the full Board and overseeing the implementation of whatever alternatives are chosen; and have the Finance Committee decide whether it wants to retain a new independent investment bank to assist it in its review. In addition, the Board’s offer contemplated that the Finance Committee would interview and select, and the Company would retain, an independent consultant that would help identify cost reductions for the Company and revenue enhancement opportunities for Bob Evans Restaurants, and reimburse the Sandell Group’s expenses related to the proxy contest, up to a cap to be agreed between $250,000 and $2,000,000.

The Company’s representatives noted to the Sandell Group’s representatives that the Company’s settlement proposal provided that, following the Annual Meeting, one-quarter of the Board and one-third of the Finance Committee would be comprised of the Sandell Group’s nominees, and one-half of the Board and the Finance Committee, and a majority of the Board’s independent directors, would be comprised of directors that had been added to the Board in 2014 and that had not participated in the Board’s prior evaluation of the Sandell Group’s proposals.

On July 7, 2014, the Sandell Group responded to the Company’s proposal by issuing a press release stating that the Company’s response to the Sandell Group’s proposal made on July 2, 2014, was not acceptable.

Also on July 7, 2014, the Company issued a press release responding to the Sandell Group’s press release and describing the terms of both the Sandell Group’s and the Company’s most recent settlement proposals and the course of settlement discussions between the parties, which the Sandell Group had omitted from its press release.

Under the Company’s $750,000,000 Revolving Credit Facility Amended and Restated Credit Agreement, dated as of January 2, 2014 (the “Credit Agreement”), a “change of control” constitutes an event of default. Pursuant to the applicable definition in the Credit Agreement, unless the Board were to approve the nomination and election of the Sandell Group nominees, a “change of control” would occur if the Sandell Group nominees were to constitute a majority of the Board. The Board has taken action to ensure that the election of the Sandell Group nominees will not, in and of itself, result in a change of control under the Credit Agreement. This limited action is not an endorsement or recommendation for election of any of the Sandell Group’s nominees by the Board.

13

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Stock Ownership of Certain Beneficial Owners Table

The following table shows the stockholders known to us to be the beneficial owners of more than five percent of our outstanding common stock as of July 3, 2014, and shows beneficial ownership information reported by such stockholders in their most recent filings with the SEC, as indicated in the footnotes. In preparing the table, the Company has relied upon such information filed with the SEC.

| | | | | | | | |

Name and Address of Beneficial Owner | | Amount and Nature

of Beneficial Ownership(1) | | | Percent of Class(2) | |

BlackRock Inc. 40 East 52nd Street New York, New York 10022 | | | 2,387,689 | (3) | | | 10.16 | % |

| | |

Dimensional Fund Advisors LP Palisades West, Building One 6300 Bee Cave Road Austin, Texas 78746 | | | 1,530,015 | (4) | | | 6.51 | % |

| | |

River Road Asset Management, LLC 462 South Fourth Street, Suite 1600 Louisville, Kentucky 40207 | | | 2,118,559 | (5) | | | 9.02 | % |

| | |

Sandell Asset Management Corp. 40 West 57th Street, 26th Floor New York, New York 10019 | | | 2,075,950 | (6) | | | 8.83 | % |

| | |

Vanguard Group, Inc. PO Box 2600 Valley Forge, Pennsylvania 19482 | | | 1,492,456 | (7) | | | 6.35 | % |

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Unless otherwise indicated, the individuals and entities named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned. |

| (2) | The percent of class is based upon 23,499,911 shares of our common stock outstanding as of July 3, 2014. Shares of our common stock subject to options that are currently exercisable or exercisable within 60 days of July 3, 2014 are deemed to be outstanding for the purpose of computing the percentage ownership of the person holding those options, where such information is available, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

| (3) | Based on information contained in BlackRock, Inc.’s Schedule 13G/A filed with the SEC on January 28, 2014. |

| (4) | Based on information contained in Dimensional Fund Advisors LP’s Schedule 13G/A filed with the SEC on February 10, 2014. |

| (5) | Based on information contained in River Road Asset Management, LLC’s Schedule 13G/A filed with the SEC on February 12, 2014. |

| (6) | Based on information contained in Sandell Asset Management Corp.’s Schedule 13D/A filed with the SEC on July 3, 2014. Includes 380,000 shares that may be purchased at an exercise price of $55.00. |

| (7) | Based on information contained in Vanguard Group, Inc.’s Schedule 13G/A filed with the SEC on February 11, 2014. |

14

Stock Ownership of Directors and Management Table

The following table summarizes the amount of our common stock beneficially owned by each director, each individual named in the “Summary Compensation Table,” and by all of our current directors and executive officers as a group, as of June 13, 2014, the most recent practicable date for the calculation of such ownership:

| | | | | | | | | | | | | | | | | | | | | | |

| | | Amount and Nature of Beneficial Ownership(1) |

Name of Beneficial Owner or Group | | Common

Shares

Presently

Held | | | Restricted

Stock and

Restricted

Stock Units

Vested Or

That Vest

Within 60

Days(2) | | | Common Shares

Which Can Be

Acquired Upon

Exercise of

Options

Exercisable

Within 60 Days(3) | | | Common

Shares and

Restricted

Stock Units in

Deferral

Plans(4) | | | Total | | | Percent of

Class(5) |

Directors | | | | | | | | | | | | | | | | | | | | | | |

Larry C. Corbin(6) | | | 68,996 | | | | 1,908 | | | | 1,663 | | | | 0 | | | | 72,567 | | | * |

Steven A. Davis(7) | | | 250,379 | | | | 53,145 | | | | 0 | | | | 216,980 | | | | 520,504 | | | 2.22% |

Michael J. Gasser(8) | | | 46,249 | | | | 1,908 | | | | 1,663 | | | | 0 | | | | 49,820 | | | * |

Mary Kay Haben(9) | | | 2,470 | | | | 0 | | | | 0 | | | | 1,942 | | | | 4,412 | | | * |

E.W. (Bill) Ingram III(10) | | | 34,206 | | | | 0 | | | | 1,663 | | | | 7,941 | | | | 43,810 | | | * |

Cheryl L. Krueger | | | 13,233 | | | | 0 | | | | 554 | | | | 6,801 | | | | 20,588 | | | * |

Kathleen S. Lane(11) | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | * |

G. Robert Lucas(12) | | | 21,252 | | | | 1,908 | | | | 1,663 | | | | 0 | | | | 24,823 | | | * |

Eileen A. Mallesch | | | 13,080 | | | | 0 | | | | 0 | | | | 7,941 | | | | 21,021 | | | * |

Larry S. McWilliams(13) | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | * |

Kevin M. Sheehan(14) | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | * |

Paul S. Williams | | | 10,530 | | | | 0 | | | | 0 | | | | 7,941 | | | | 18,471 | | | * |

Officers | | | | | | | | | | | | | | | | | | | | | | * |

T. Alan Ashworth(15) | | | 1,418 | | | | 478 | | | | 0 | | | | 202 | | | | 2,098 | | | * |

Randall L. Hicks(16) | | | 13,123 | | | | 8,901 | | | | 0 | | | | 28,007 | | | | 50,031 | | | * |

J. Michael Townsley | | | 27,811 | | | | 7,633 | | | | 0 | | | | 11,575 | | | | 47,019 | | | * |

Joseph R. Eulberg | | | 8,941 | | | | 5,300 | | | | 2,467 | | | | 21,935 | | | | 38,643 | | | * |

All current executive officers and directors as a group (22 persons) | | | 545,895 | | | | 82,858 | | | | 31,540 | | | | 311,470 | | | | 971,763 | | | 4.14% |

| * | Represents ownership of less than one percent of our outstanding common stock. |

| (1) | Unless otherwise indicated, each individual has voting and dispositive power over the listed shares of common stock and such voting and dispositive power is exercised solely by the named individual or shared with a spouse. All fractional shares have been rounded to the nearest whole share. The Company has included for this purpose the gross number of shares of common stock deliverable, but actual shares received may be less if the participant elects to use shares for the payment of applicable withholding taxes. |

| (2) | Represents the number of shares of restricted stock and restricted stock units that are scheduled to vest within 60 days of June 13, 2014. Shares of restricted stock are shares of our common stock subject to transfer and other restrictions which lapse upon vesting of the restricted stock. Each restricted stock unit represents the contingent right to receive one share of common stock upon vesting of the unit. Shares of restricted stock have voting rights prior to vesting; restricted stock units do not. |

| (3) | Includes the number of shares of common stock that the named person can acquire upon the exercise of stock options currently exercisable or exercisable within 60-days of June 13, 2014. |

| (4) | Represents the number of phantom shares of common stock held in the Company’s nonqualified deferred compensation plans, described in further detail below under the section titled “—Nonqualified Deferred Compensation.” Phantom shares held in the deferral plans included in this table are payable solely in shares of the Company’s common stock following death, disability or termination. Phantom shares do not have voting rights. |

15

| (5) | The percent of class is based upon 23,499,911 shares of our common stock outstanding as of July 3, 2014. Shares of our common stock subject to options that are currently exercisable or exercisable within 60 days of June 13, 2014 restricted stock units that are scheduled to vest within 60 days of June 13, 2014 and phantom shares held in deferral plans payable within 60 days of a termination event are deemed to be outstanding for the purpose of computing the percentage ownership of the person holding those options, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. |

| (6) | Includes 2,439 shares of common stock held by Mr. Corbin’s spouse, as to which she has sole voting and investment power. |

| (7) | Includes 10,957 shares held in a revocable trust. |

| (8) | Includes 41,696 shares held in a revocable trust. |

| (9) | Includes 2,470 shares held in a revocable trust. |

| (10) | Includes 34,206 shares held in a revocable trust in spouse’s name. |

| (11) | Appointed to the Board effective April 25, 2014. |

| (12) | Includes 4,252 shares held in a defined benefit pension plan rollover account over which Mr. Lucas, in his capacity as trustee of the account, has sole voting and investment power. |

| (13) | Appointed to the Board effective April 25, 2014. |

| (14) | Appointed to the Board effective April 25, 2014. |

| (15) | Appointed as chief financial officer on May 16, 2014. |

| (16) | Includes seven shares of common stock held by Mr. Hicks as custodian for the benefit of his son. |

16

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires that the Company’s directors and executive officers and any person or entity holding more than 10 percent of our outstanding common stock report their initial ownership of our common stock, and any subsequent changes in their ownership, to the SEC. Specific due dates have been established by the SEC, and we are required to disclose in this proxy statement any late reports.

We believe that during the fiscal year ending April 25, 2014, our directors and executive officers timely complied with all Section 16(a) filing requirements, except Messrs. Davis, Hicks and Townsley, and Ms. Krueger. Messrs. Davis, Hicks and Townsley had deferred into the Company’s executive deferral plan, unvested stock awards in the amount of 18,790, 3,060 and 1,579, respectively. Those stock awards vested on June 14, 2013 and under the applicable Section 16 rules, the vesting of those shares required the filing of a Form 4. The Form 4’s were filed showing these shares have vested were filed on June 16, 2014. Ms. Krueger had sales of Company stock on September 5, 2012 of 3,179 shares, and on February 22, 2013 of 2,500 shares. Under the applicable Section 16 rules, a Form 4 was required to be filed for each transaction. The Form 4’s showing these sales were filed on June 17, 2014.

In making this statement, we have relied solely on a review of Section 16(a) ownership reports furnished to us during the fiscal year ending April 25, 2014 pursuant to the SEC rules and written representations from all such individuals that no annual Form 5 reports were required to be filed for them for the fiscal year ending April 25, 2014.

17

PROPOSAL 1—ELECTION OF DIRECTORS

Size and Structure of the Board

We are proud of the quality, experience, independence and diversity of your Board. In addition to independence, many of our directors possess a diverse range of experience and skills in restaurant, food products, hospitality and consumer marketing fields, and leadership experience as current and former executive officers, directors and committee members of large and complex publicly traded companies. Their combined experiences and skill sets bring to the Board and our Company strong capabilities in the areas of strategy, leadership, finance, operating performance and governance.