UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| þ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

BOB EVANS FARMS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Certain statements in this letter that are not historical facts are forward-looking statements. Forward-looking statements involve various important assumptions, risks and uncertainties. Actual results may differ materially from those predicted by the forward-looking statements because of various factors and possible events. We discuss these factors and events, along with certain other risks, uncertainties and assumptions, under the heading “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the fiscal year ended April 25, 2014, and in our other filings with the Securities and Exchange Commission. We note these factors for investors as contemplated by the Private Securities Litigation Reform Act of 1995. Predicting or identifying all such risk factors is impossible. Consequently, investors should not consider any such list to be a complete set of all potential risks and uncertainties. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update any forward-looking statement to reflect circumstances or events that occur after the date of the statement to reflect unanticipated events. All subsequent written and oral forward-looking statements attributable to us or any person acting on behalf of the Company are qualified by the cautionary statements in this section.

IMPORTANT ADDITIONAL INFORMATION

Bob Evans Farms Inc. (the “Company”), its directors and certain of its executive officers are participants in the solicitation of proxies in connection with the Company’s 2014 Annual Meeting of Stockholders. The Company has filed a definitive proxy statement and form of WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with such solicitation of proxies from the Company’s stockholders. WE URGE INVESTORS TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY CARD CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

Information regarding the names of the Company’s directors and executive officers and their respective interests in the Company by security holdings or otherwise, is set forth in the Company’s proxy statement for its 2014 Annual Meeting of Stockholders, filed with the SEC on July 11, 2014. Stockholders will be able to obtain, free of charge, copies of the definitive proxy statement (and amendments or supplements thereto) and accompanyingWHITE proxy card, and other documents filed with the SEC at the SEC’s website atwww.sec.gov. In addition, copies will also be available at no charge at the Investors section of the Company’s website athttp://investors.bobevans.com/sec.cfm.

This document contains quotes and excerpts from certain previously published material. Consent of the author and publication has not been sought or obtained to use the material as proxy soliciting material.

On August 1, 2014, Bob Evans Farms, Inc. (“Bob Evans” or “Company”) will issue a press release and include a copy of a letter to stockholders from the Company’s Board of Directors. Complete copies of the press release and the letter, first mailed to stockholders on July 31, 2014, are included on the following pages.

Bob Evans Board Describes Sandell Proposals as ‘Short-Sighted, Unsustainable and Not In the Best Interests of All Stockholders’

NEW ALBANY, Ohio – August 1, 2014 – Bob Evans Farms, Inc. (NASDAQ: BOBE) has mailed a letter to the Company’s stockholders discussing the Board of Directors’ determination that proposals made by Sandell Asset Management are “short-sighted, unsustainable and not in the best interests of all stockholders.”

In the letter, Lead Independent Director Michael Gasser and Chairman and Chief Executive Officer Steven Davis, on behalf of the Board of Directors, urged stockholders to elect the nominees recommended by the Board. They noted that after carefully evaluating the ideas presented by Sandell, the Board has concluded that: “1) BEF Foods is an important component of the Company’s long-term growth plan, and disposing of it immediately would not maximize stockholder value; 2) Based on our analysis, Sandell’s rationale for a sale-leaseback of the BER real estate assets is flawed; and 3) Sandell’s share repurchase demands are based on what we believe are unrealistic assumptions. Bob Evans, meanwhile, has consistently and responsibly returned more than $800 million of capital to its stockholders since FY 2007, including a total of $225 million of stock repurchases in FY 2014.”

The Board urged stockholders to submit their voting instructions on the WHITE proxy card to elect the Board’s slate of director nominees at the Company’s Annual Meeting on August 20, 2014.

Complete text of the letter follows:

July 31, 2014

Dear Fellow Stockholder,

At your Company’s 2014 Annual Meeting, we believe you will have a clear choice: You can elect the Board’s nominees, who support Bob Evans’ sound growth strategy, or you can turn control of your Company over to nominees proposed by Sandell Asset Management, an activist investor pushing a flawed economic agenda.Your Board has determined that the Sandell agenda would jeopardize long-term, sustainable value creation and that it is NOT in the best interests of the Company and its stockholders. We strongly urge you to protect the value of your investment and submit your voting instructions on theWHITE proxy card todayFOR ALL of your Board’s nominees.

Your Board’s proposed slate is highly qualified and open-minded, and is committed to a strategy that is sustainable, disciplined and responsible. Your Board will continue to: 1) drive the profitable growth of the existing businesses, 2) employ a balanced approach to investment and the return of meaningful capital to stockholders, and 3) regularly and proactively review strategy, while continually engaging with stockholders.

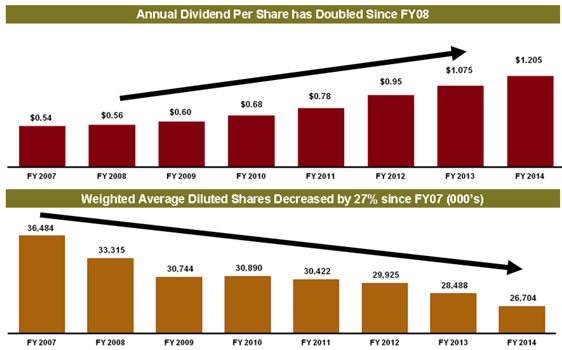

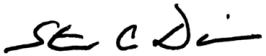

Under your Board’s leadership, Bob Evans has a strong record of investing in its businesses (including $644 million of capex invested in our current businesses since FY2007) AND returning capital to stockholders in a prudent and consistent way. Consider these facts:

Bob Evans’ Track Record of Meaningful Dividends and Share Repurchase

More than $800 million of capital returned to stockholders since fiscal 2007

By contrast, Sandell Asset Management is seeking your support for a controlling slate of nominees and, despite continual shifts in its position and demands, has repeatedly called for an unsustainable economic agenda: 1) the divestiture of BEF Foods now – before the Company can realize the benefits of its transformational investments, 2) the sale of the BER real estate, which would cause the Company to forfeit strategic control of valuable assets while burdening Bob Evans with significant annual rising rents that ratings agencies treat as debt, and 3) a rapid and large leveraged share repurchase.

While Sandell Asset Management – which reportedly managed approximately $7.5 billion in assets at its peak, but managed only about $1 billion as of 20131 – may be compelled to press this flawed agenda for Bob Evans to further its own business needs, it should not be allowed to do so at the expense of the best interests of Bob Evans’ stockholders.

YOUR BOARD BELIEVES SANDELL’S DEMANDS ARE SHORT-SIGHTED, UNSUSTAINABLE AND NOT IN THE BEST INTERESTS OF ALL STOCKHOLDERS

After carefully evaluating the ideas presented by Sandell, your Board has concluded that:

| 1. | BEF Foods is an important component of the Company’s long-term growth plan, and disposing of it immediately would not maximize stockholder value. |

In our view, your Company is poised to reap the rewards of our recently completed, multi-year investment in BEF. By optimizing the Company’s network, we have created a significant runway for growth and we continue to benefit from many valuable synergies between BEF and BER.

Meanwhile, we believe Sandell overlooks factors that would cause meaningful value erosion in a separation of the BEF business, including recurring dis-synergies, ongoing and incremental standalone costs, one-time separation costs, and significant tax expense.

As part of its commitment to drive stockholder value, the Bob Evans Board regularly evaluates the optimal strategy with respect to ALL of its assets and will continue to do so. As a result of this process, your Board has determined – with the benefit of input from its independent external advisors – that now is not the time to separate the businesses.

| 2. | Based on our analysis, Sandell’s rationale for a sale-leaseback of the BER real estate assets is flawed. |

We believe Sandell’s analysis has overlooked many important factors, including significant rent expense and future rent escalators, which would reduce EBITDA and free cash flow, and would be treated as additional debt by rating agencies and our banks. This would increase our debt costs as well as reduce our incremental debt capacity and financial flexibility.

A sale-leaseback would mean higher costs relative to other forms of available financing, and there would be strategic and financial implications. It would also require renegotiating our existing credit agreement and incurring breakage costs and significant tax expense.

Finally, selling our real estate would reduce flexibility to close underperforming restaurants and improve facilities – major factors in the historical and long-term success of our restaurant business.

Other leading family and casual dining companies have come to the same conclusion, as did the financial analyst at the sell-side firm Stephens Inc., who wrote in a recent report on Bob Evans: “With regard to a potential sale leaseback, we agree with the Company’s view that itwould present one of (if not the most) expensive forms of financing in today’s low-rate environment. Therefore, should mgmt. decide to place further leverage on the Company, we would prefer it be bank debt with a rate in the historically low range of roughly 2%.”2

| 1 | Financial Times, 12/11/13; Sandell Asset Management Corp. Form ADV, filed with the SEC for the year ending 12/31/13. |

| 2 | Stephens Inc., 7/18/14. |

| 3. | Sandell’s share repurchase demands are based on what we believe are unrealistic assumptions. Bob Evans, meanwhile, has consistently and responsibly returned more than $800 million of capital to its stockholders since FY 2007, including a total of $225 million of stock repurchases in FY 2014. |

We have a proven track record of balanced capital allocation. While continuing to invest in our businesses, we have repurchased more than $625 million worth of our stock since FY 2007, reducing the share count by 27%. The Company has paid more than $190 million in dividends since FY 2007, and the annual dividend has doubled over the last five years to $1.24 per share.

Our total leverage level and history of return of capital are in line with, or better than, other casual dining operators. And going forward, the Company’s objective is to maintain a 3.0x leverage and return excess cash to stockholders.

YOUR BOARD IS COMMITTED TO MAINTAINING AN OPEN-MINDED AND CONSTRUCTIVE APPROACH

Consistent with our fiduciary duty to you and our high governance standards, your Board of Directors has tried to work constructively with Sandell for nearly 12 months, carefully considering their ideas and proposing ways to add new independent and highly qualified individuals to the Board. We subject our financial and strategic plans to rigorous review on a regular basis – including in consultation with independent financial advisors – and we welcome fresh perspectives. As part of that process, the Board made numerous efforts to avoid the extraordinary time and costs of a proxy contest by seeking alternatives that would add some number of Sandell’s nominees to our Board. In a further demonstration of our open mindedness, we decided to keep the Board size at 12, even with the announced retirement of two incumbent directors before the 2014 Annual Meeting. Since the Board has nominated a slate of 10 directors for those 12 positions, we expect that at least two of Sandell’s nominees will be elected, even if the entire Board slate is elected.

While we are disappointed that Sandell has rejected our proposals, we are committed to continuing to work with all of our investors as we consider options for enhancing stockholder value. We will continue to review our plans and strategies carefully, and will measure their success based on performance in the markets we serve, with the overriding objective of serving your best interests.

For all of these reasons, we urge you to submit your voting instructions on the enclosedWHITE proxy card to vote “FOR ALL” of your Company’s nominees to the Board. We urge youNOT to vote using any gold proxy card sent to you by Sandell, because even a “withhold” vote with respect to Sandell’s nominees will cancel any previous WHITE proxy card that you submitted.

Thank you for your continued support.

Sincerely,

| | | | | | | | |

| | | | |

| |  | | | | | |  |

| | Michael A. Gasser Lead Independent Director | | | | | | Steven A. Davis Chairman of the Board and Chief Executive Officer |

|

YOUR VOTE IS IMPORTANT. To ensure that your voting instructions are received timely, we urge you to submit your proxy by telephone or Internet by following the easy instructions on the enclosedWHITE proxy card. Please doNOT execute any Gold proxy card you may receive from Sandell, as it could revoke any previous proxy you submitted using theWHITE proxy card. ONLY YOUR LATEST-DATED PROXY COUNTS. If you have questions or need assistance in voting your shares, please contact our proxy solicitor: INNISFREE M&A INCORPORATED Stockholders call toll-free: (877) 825-8621 Banks and Brokers call collect: (212) 750-5833 |

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Certain statements in this letter that are not historical facts are forward-looking statements. Forward-looking statements involve various important assumptions, risks and uncertainties. Actual results may differ materially from those predicted by the forward-looking statements because of various factors and possible events. We discuss these factors and events, along with certain other risks, uncertainties and assumptions, under the heading “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the fiscal year ended April 25, 2014, and in our other filings with the Securities and Exchange Commission. We note these factors for investors as contemplated by the Private Securities Litigation Reform Act of 1995. Predicting or identifying all such risk factors is impossible. Consequently, investors should not consider any such list to be a complete set of all potential risks and uncertainties. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update any forward-looking statement to reflect circumstances or events that occur after the date of the statement to reflect unanticipated events. All subsequent written and oral forward-looking statements attributable to us or any person acting on behalf of the Company are qualified by the cautionary statements in this section.

IMPORTANT ADDITIONAL INFORMATION

Bob Evans Farms Inc. (the “Company”), its directors and certain of its executive officers are participants in the solicitation of proxies in connection with the Company’s 2014 Annual Meeting of Stockholders. The Company has filed a definitive proxy statement and form of WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with such solicitation of proxies from the Company’s stockholders. WE URGE INVESTORS TO READ THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY CARD CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

Information regarding the names of the Company’s directors and executive officers and their respective interests in the Company by security holdings or otherwise, is set forth in the Company’s proxy statement for its 2014 Annual Meeting of Stockholders, filed with the SEC on July 11, 2014. Stockholders will be able to obtain, free of charge, copies of the definitive proxy statement (and amendments or supplements thereto) and accompanyingWHITE proxy card, and other documents filed with the SEC at the SEC’s website atwww.sec.gov. In addition, copies will also be available at no charge at the Investors section of the Company’s website athttp://investors.bobevans.com/sec.cfm.

This document contains quotes and excerpts from certain previously published material. Consent of the author and publication has not been sought or obtained to use the material as proxy soliciting material.

Contact Information:

Scott C. Taggart

Vice President, Investor Relations

(614) 492-4954