Investor Presentation (revised 1.19.16) Saed Mohseni, President and Chief Executive Officer Mark Hood, Chief Administrative and Chief Financial Officer Scott Taggart, VP, Investor Relations NASDAQ: BOBE Exhibit 99.1

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995 Certain statements in this presentation that are not historical facts are forward-looking statements. Forward-looking statements involve various important assumptions, risks and uncertainties. Actual results may differ materially from those predicted by the forward-looking statements because of various factors and possible events, including, without limitation: Our inability to improve our operational and marketing execution and performance, including a failure to achieve and maintain positive same-store sales; The actual results of pending, future or threatened litigation or governmental investigations and the costs and effects of negative publicity; Changing and adverse business conditions, including higher energy and commodity costs, including but not limited to protein costs for beef, pork (sows and other pork products) and chicken; Overall economic conditions that may affect consumer spending, either nationwide or in one or more of the Company’s major markets; Competition in the restaurant and food products industries, including the ability to recruit, train, and retain qualified employees; Ability to control restaurant and plant operating costs, which are impacted by the availability and cost of food, labor, workers compensation, group health care, fuel and utilities such as gas, electricity and water; The effects of our increase of indebtedness and associated restrictions on our financial and operating flexibility; The availability and cost of suitable sites for new restaurant development and our ability to identify those sites; Adverse weather conditions in locations where we operate our restaurants impacting sales and customer travel; Consumer acceptance of changes in menu offerings, atmosphere and/or service procedures, as well as the price of menu and food product offerings; Consumer acceptance of our restaurant concepts in existing and new geographic areas, and Consumer behavior based on negative publicity or concerns over nutritional or safety aspects of our food or products. We also bear the risk of incorrectly analyzing these risks or developing strategies to address them that prove to be unsuccessful. Certain risks, uncertainties and assumptions are discussed under the heading “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the fiscal year ended April 24, 2015. We note these factors for investors as contemplated by the Private Securities Litigation Reform Act of 1995. It is impossible to predict or identify all such risk factors. Consequently, you should not consider any such list to be a complete set of all potential risks and uncertainties. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which the statement is made to reflect unanticipated events. Any further disclosures in our filings with the Securities and Exchange Commission, as well as press releases and other communications, should also be consulted. All subsequent written and oral forward-looking statements attributable to us or any person acting on behalf of the company are qualified by the cautionary statements in this section.

BOB EVANS RESTAURANTS BEF FOODS

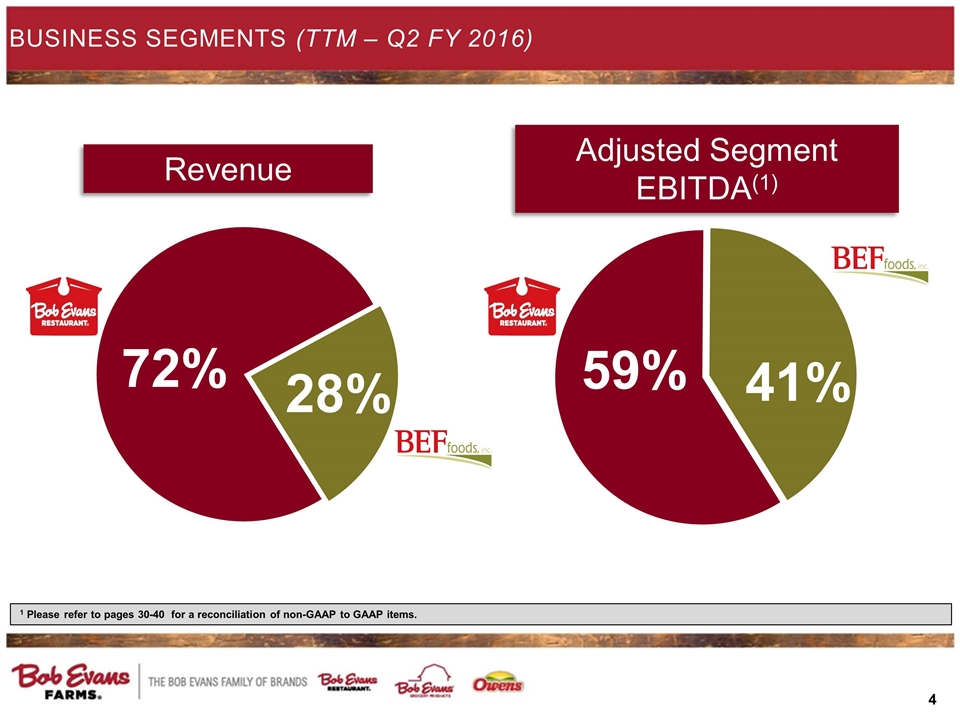

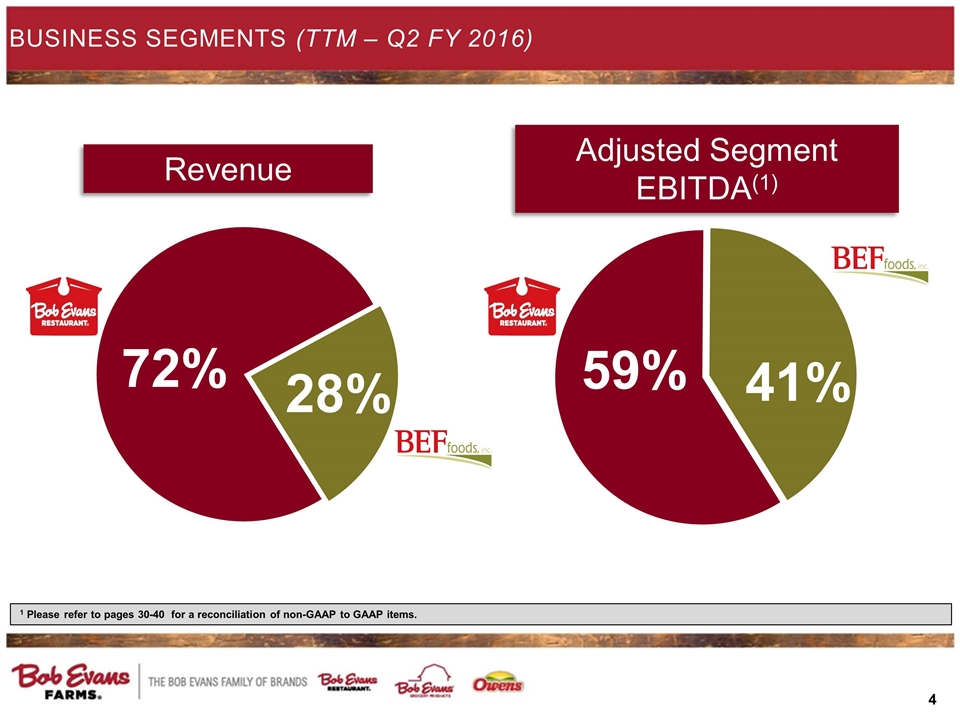

Business Segments (TTM – Q2 FY 2016) 28% 72% Revenue 41% 59% Adjusted Segment EBITDA(1) 1 Please refer to pages 30-40 for a reconciliation of non-GAAP to GAAP items.

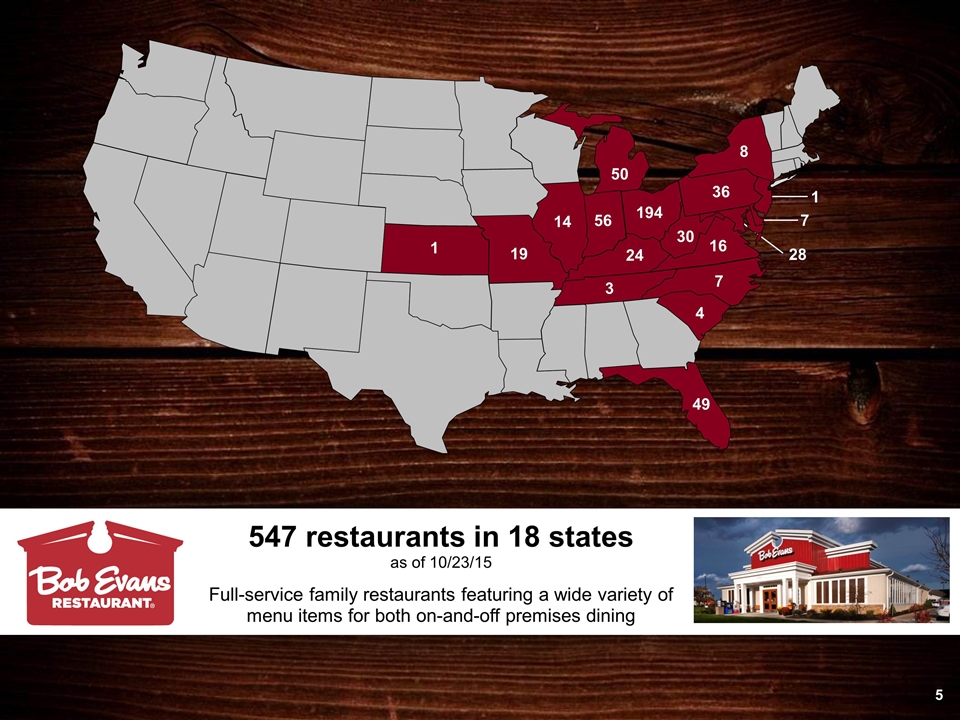

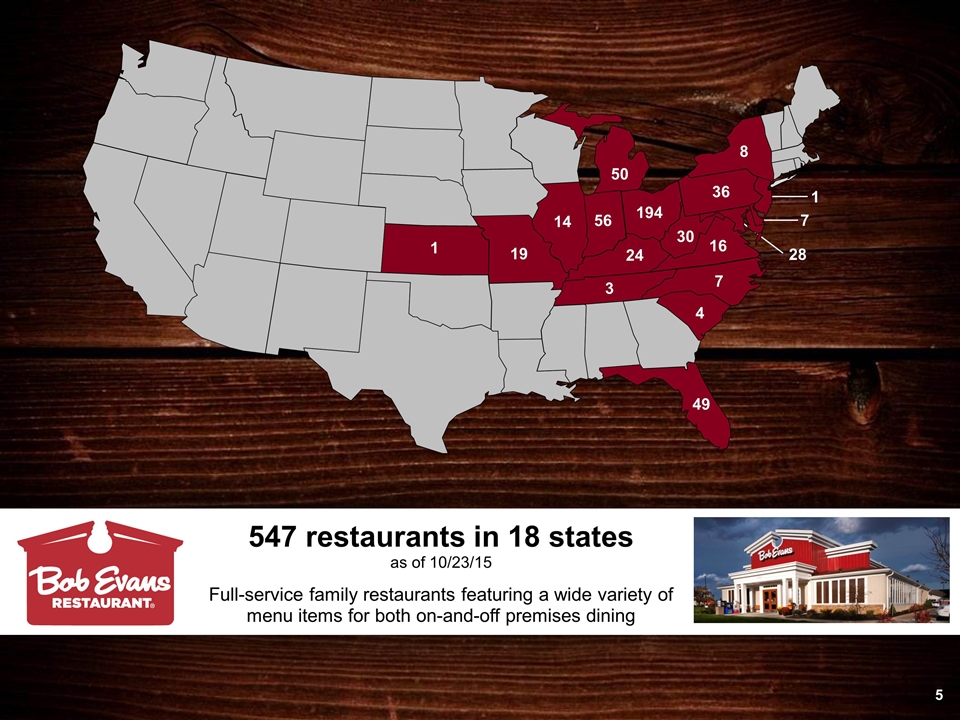

547 restaurants in 18 states as of 10/23/15 Full-service family restaurants featuring a wide variety of menu items for both on-and-off premises dining 194 56 14 19 1 50 30 36 8 1 7 28 24 3 16 7 4 49

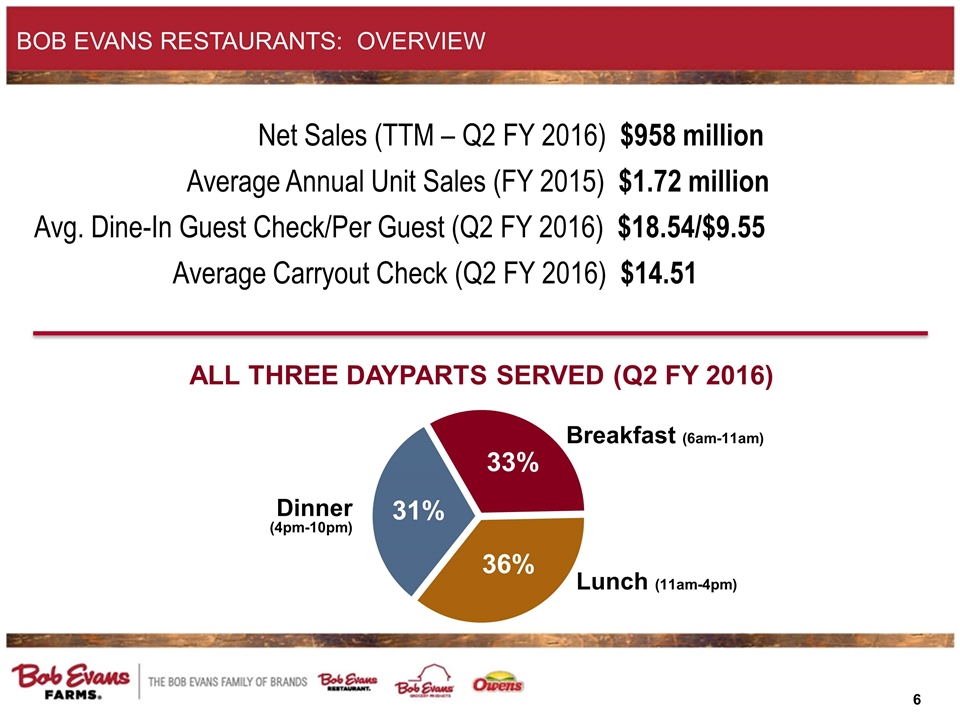

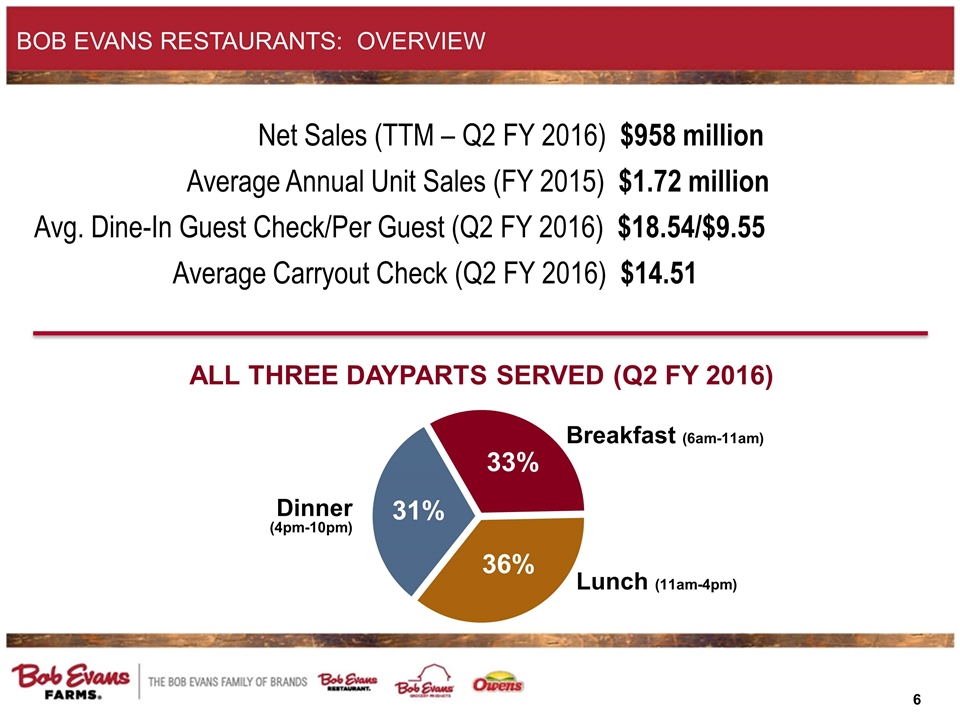

Net Sales (TTM – Q2 FY 2016) $958 million Average Annual Unit Sales (FY 2015) $1.72 million Avg. Dine-In Guest Check/Per Guest (Q2 FY 2016) $18.54/$9.55 Average Carryout Check (Q2 FY 2016) $14.51 BOB EVANS RESTAURANTS: OVERVIEW ALL THREE DAYPARTS SERVED (Q2 FY 2016) Breakfast (6am-11am) Lunch (11am-4pm) Dinner (4pm-10pm) 33% 36% 31%

bob evans restaurants’ 2016 priorities Bob Evans Restaurants’ 2016 Priorities: Improve same-store sales performance through a renewed dedication to guest hospitality Identify food and labor efficiencies Install a restaurant technology package Continue evaluating restaurant performance to drive portfolio optimization

BOB EVANS RESTAURANTS: IMMEDIATE PRIORITIES Focus on hospitality: provide great food and great service Optimize and simplify menu Flex hours with transaction trends Deliver best-in-class service and dining experience Improve ambiance through no/low-cost actions Create relevant new product news Broasted® Chicken Tenders launch Three-Course Dinner relaunch Continued development of Best in Class breakfast Daily Farmhouse Specials test Coffee flavor extension Spend marketing funds more efficiently and effectively Allocate funds between broadcast and local/digital media Broasted® is a registered trademark of The Broaster Company, LLC.

BOB EVANS RESTAURANTS: FY’16 New Product news Launch of “Best-in-Class Breakfast” Three-Course Dinner relaunch Premium Broasted Chicken and Tenders Customizable “Pick Two” meal offers “10 under $6” values $4 appetizers New beverage program

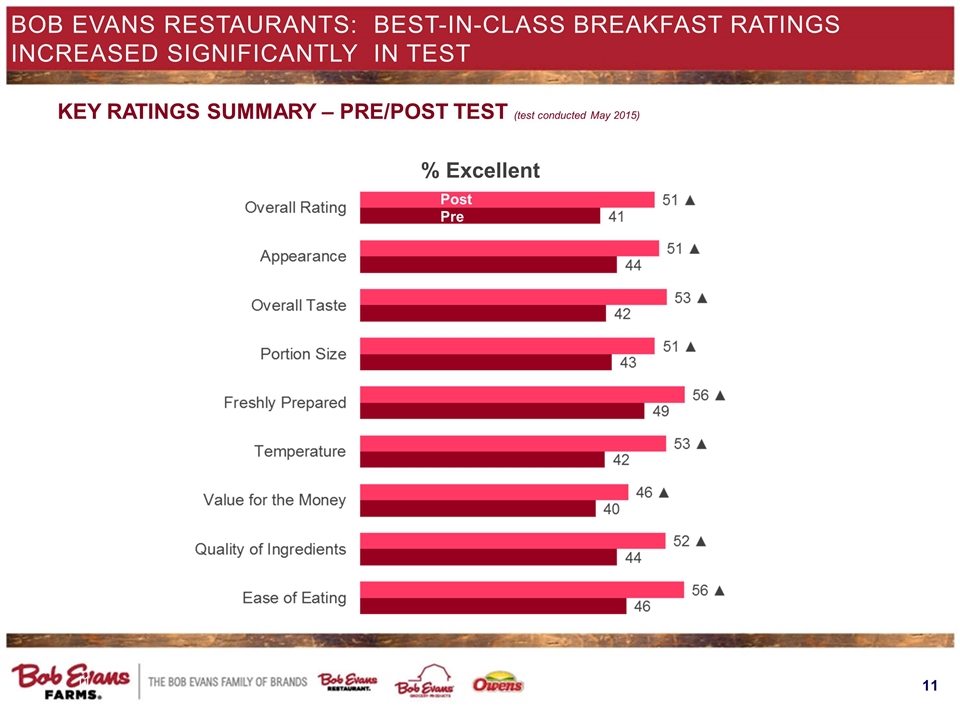

BOB EVANS RESTAURANTS: Best-In-class BreaKfast Recent breakfast actions: Improved hotcakes and omelets Seasonal toppings on Brioche, Hotcakes, Waffles and Crepes Upgraded breakfast entrée ingredients including fresh sausage, fresh cracked eggs, fresh potatoes, fresh baked biscuits, not-from-concentrate orange juice, and an improved butter blend

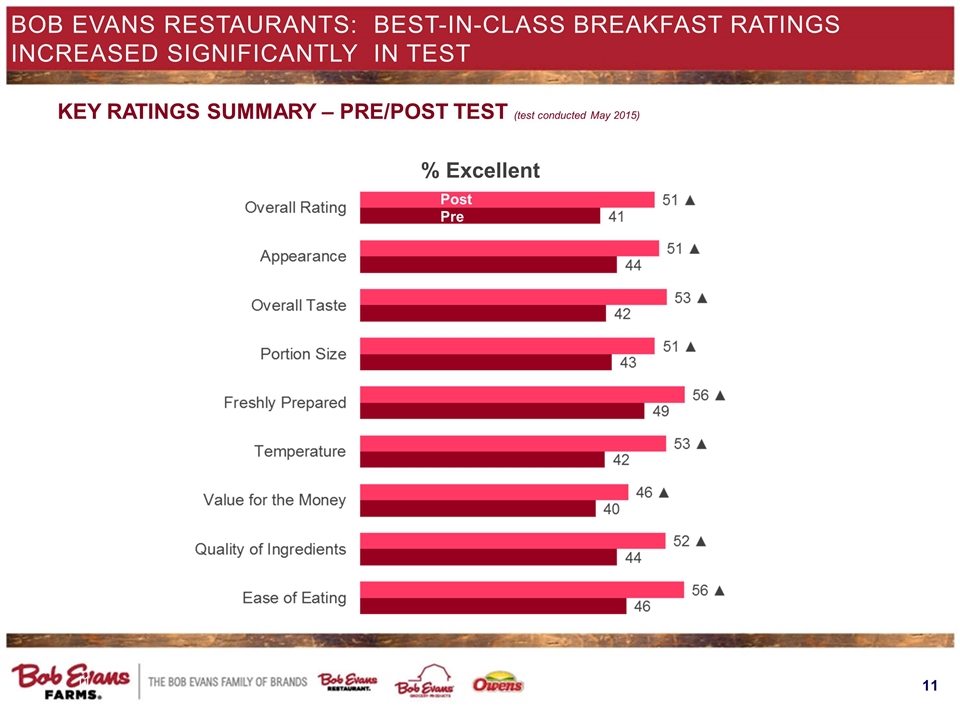

BOB EVANS RESTAURANTS: Best-in-class breakfast ratings increased significantly in test KeY Ratings Summary – pre/post TEST (test conducted May 2015) % Excellent Post Pre

BOB EVANS RESTAURANTS: new product news at lunch and dinner too 3-Course Dinners Broasted Chicken Tenders

Bob Evans/Owens Bob Evans Growth Markets Bob Evans FOUR KEY LINES OF BUSINESS Sausage, Refrigerated Sides, Frozen, and Food Service Sold at 30,000+ retail locations in 50 states and Canada

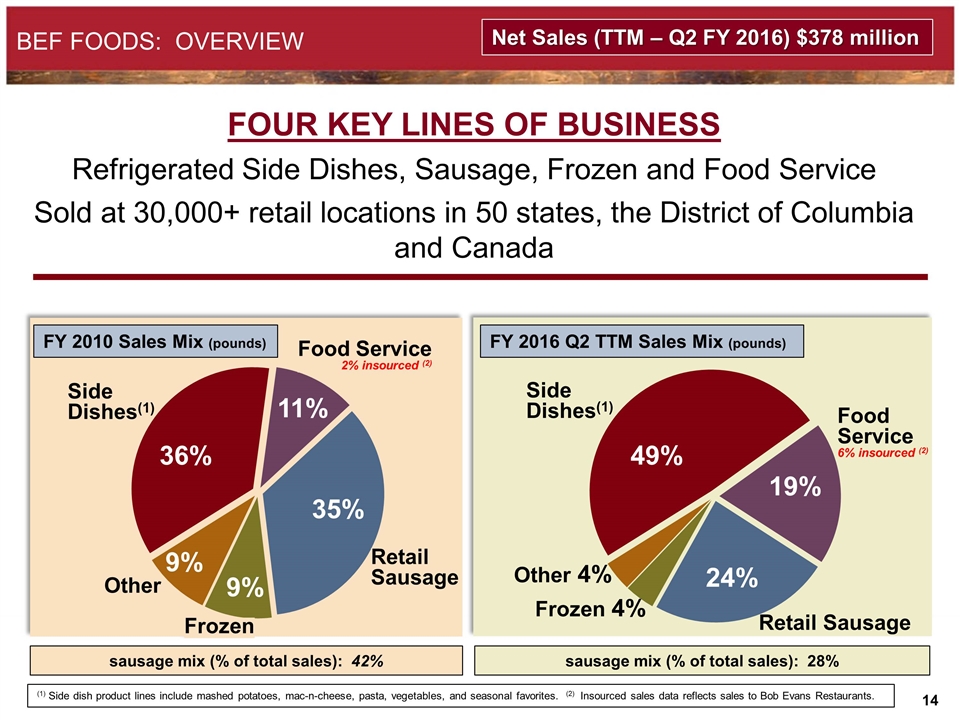

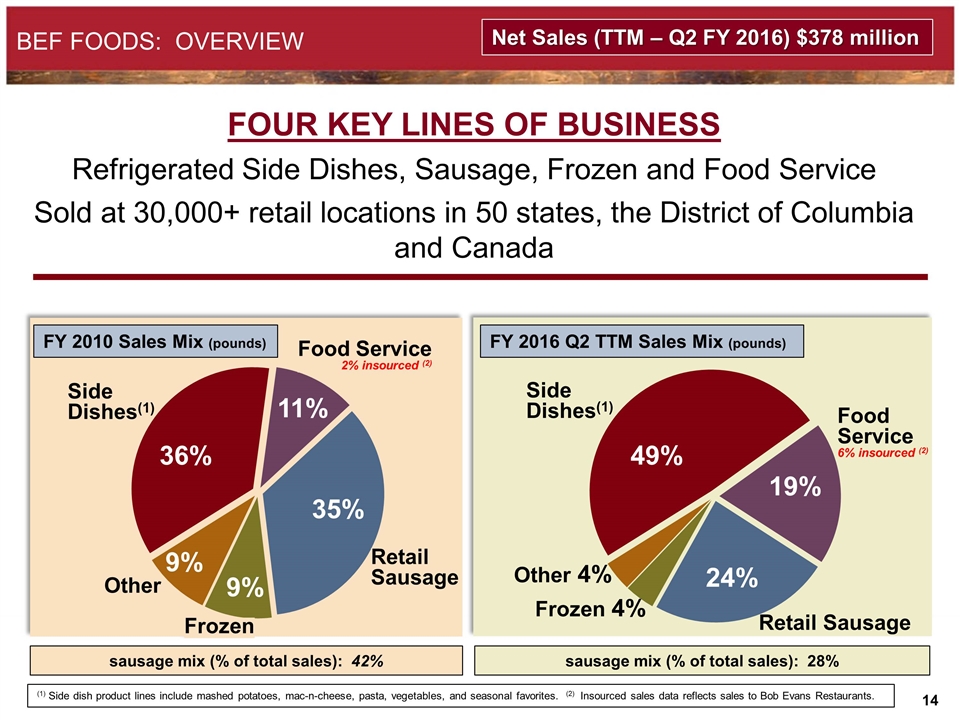

BEF FOODS: OVERVIEW FOUR KEY LINES OF BUSINESS Refrigerated Side Dishes, Sausage, Frozen and Food Service Sold at 30,000+ retail locations in 50 states, the District of Columbia and Canada sausage mix (% of total sales): 42% Net Sales (TTM – Q2 FY 2016) $378 million (1) Side dish product lines include mashed potatoes, mac-n-cheese, pasta, vegetables, and seasonal favorites. (2) Insourced sales data reflects sales to Bob Evans Restaurants. Side Dishes(1) Other Frozen Retail Sausage 11% 35% 36% FY 2010 Sales Mix (pounds) 9% 9% Food Service 2% insourced (2) Other 4% Frozen 4% Food Service 6% insourced (2) Retail Sausage 19% 24% 49% FY 2016 Q2 TTM Sales Mix (pounds) sausage mix (% of total sales): 28% Side Dishes(1)

bef foods’ 2016 priorities BEF Foods’ 2016 Priorities: Drive double-digit growth of refrigerated side-dish products Begin $20+ million expansion of Lima, Ohio, refrigerated side-dish plant Employ trade spending strategically Implement new enterprise resource planning “ERP” system Launch new products

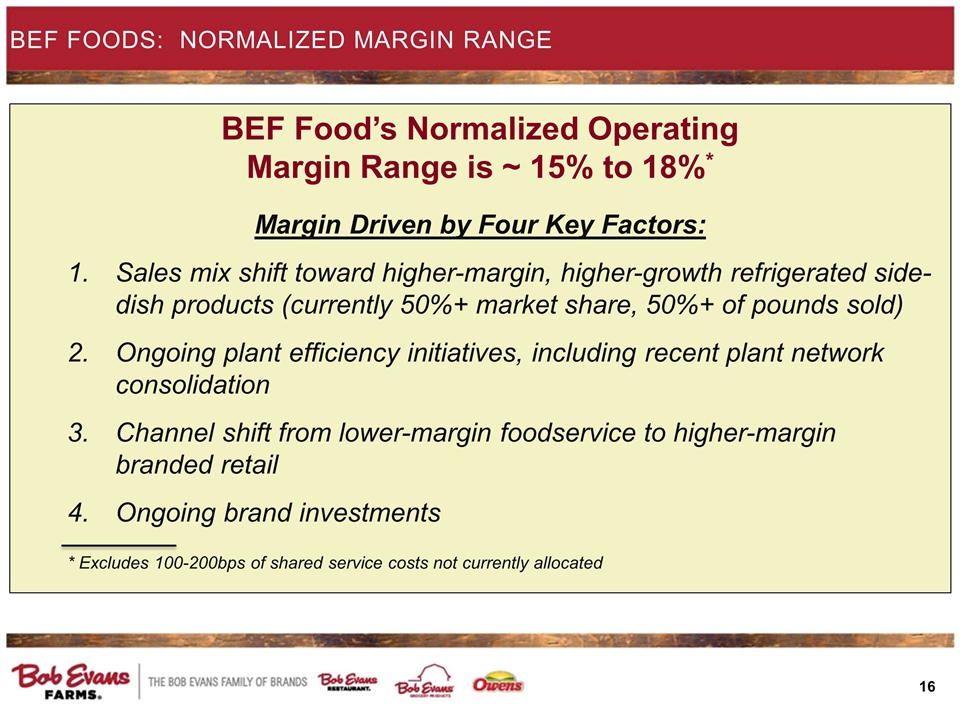

BEF Foods: Normalized Margin Range BEF Food’s Normalized Operating Margin Range is ~ 15% to 18%* Margin Driven by Four Key Factors: Sales mix shift toward higher-margin, higher-growth refrigerated side-dish products (currently 50%+ market share, 50%+ of pounds sold) Ongoing plant efficiency initiatives, including recent plant network consolidation Channel shift from lower-margin foodservice to higher-margin branded retail Ongoing brand investments * Excludes 100-200bps of shared service costs not currently allocated

BEF FOODS: BUSINESS STRATEGY Grow Bob Evans from a strong regional food brand to a national food brand leveraging our market-leading refrigerated side dish position, while protecting the #1 breakfast sausage position in the core(1) (1)Source: IRI Bob Evans Core MULO*, 52 weeks ending 11/1/15 Refrigerates Side Dishes – Grow aggressively Food Service – Be selective Breakfast Sausage - Maintain Frozen - Maintain

BEF FOODS: Retail product categories Refrigerated side dishes Breakfast sausage Frozen

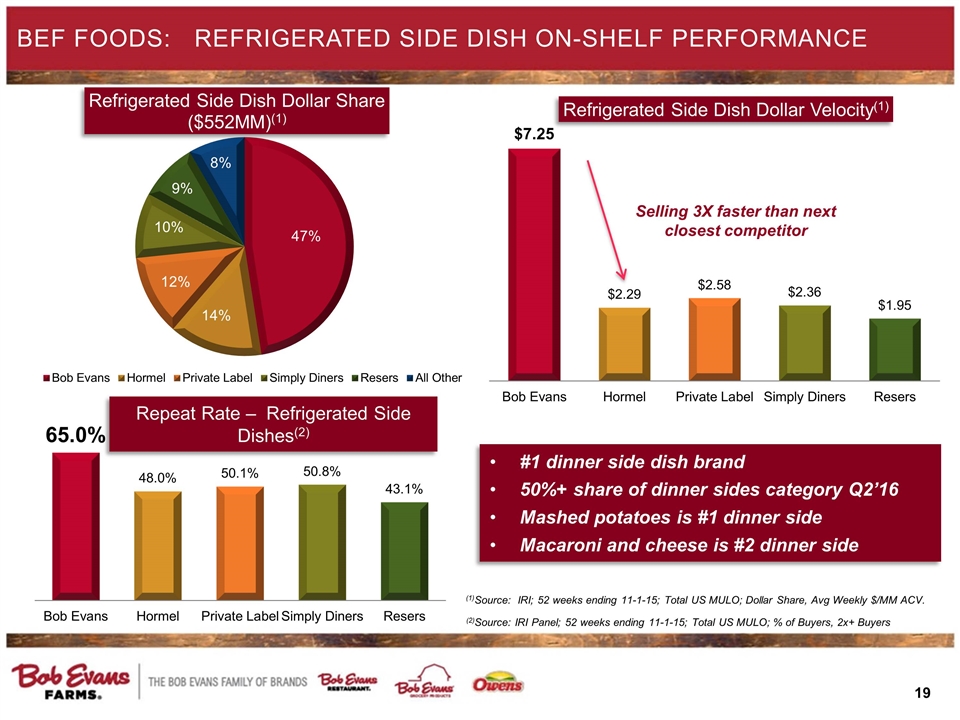

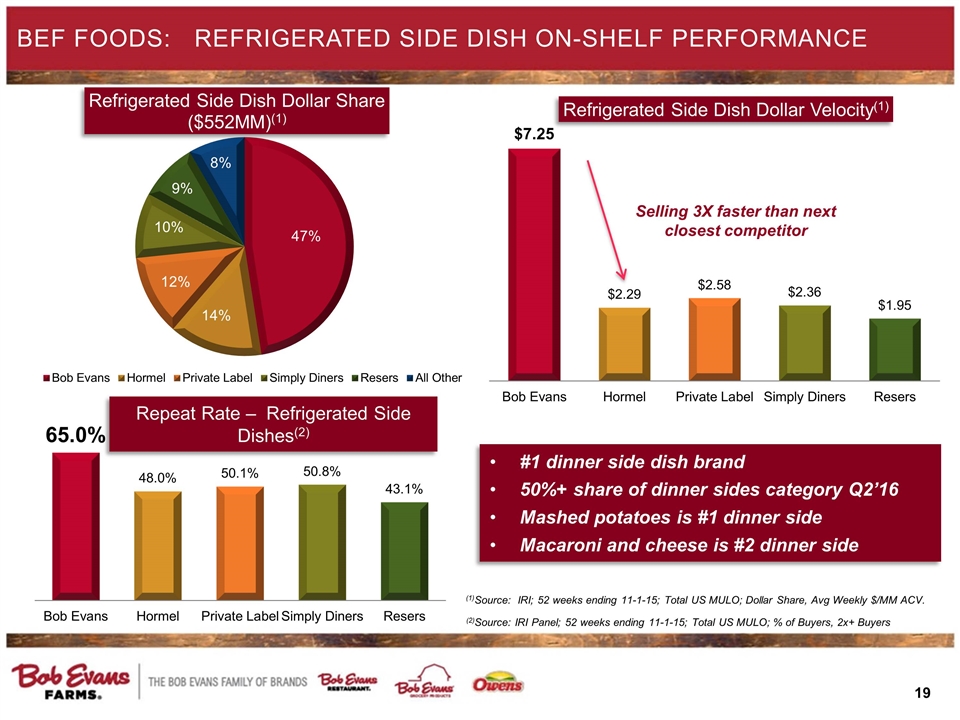

BEF FOODS: REFRIGERATED SIDE DISH ON-SHELF PERFORMANCE Selling 3X faster than next closest competitor #1 dinner side dish brand 50%+ share of dinner sides category Q2’16 Mashed potatoes is #1 dinner side Macaroni and cheese is #2 dinner side (1)Source: IRI; 52 weeks ending 11-1-15; Total US MULO; Dollar Share, Avg Weekly $/MM ACV. Repeat Rate – Refrigerated Side Dishes(2) (2)Source: IRI Panel; 52 weeks ending 11-1-15; Total US MULO; % of Buyers, 2x+ Buyers

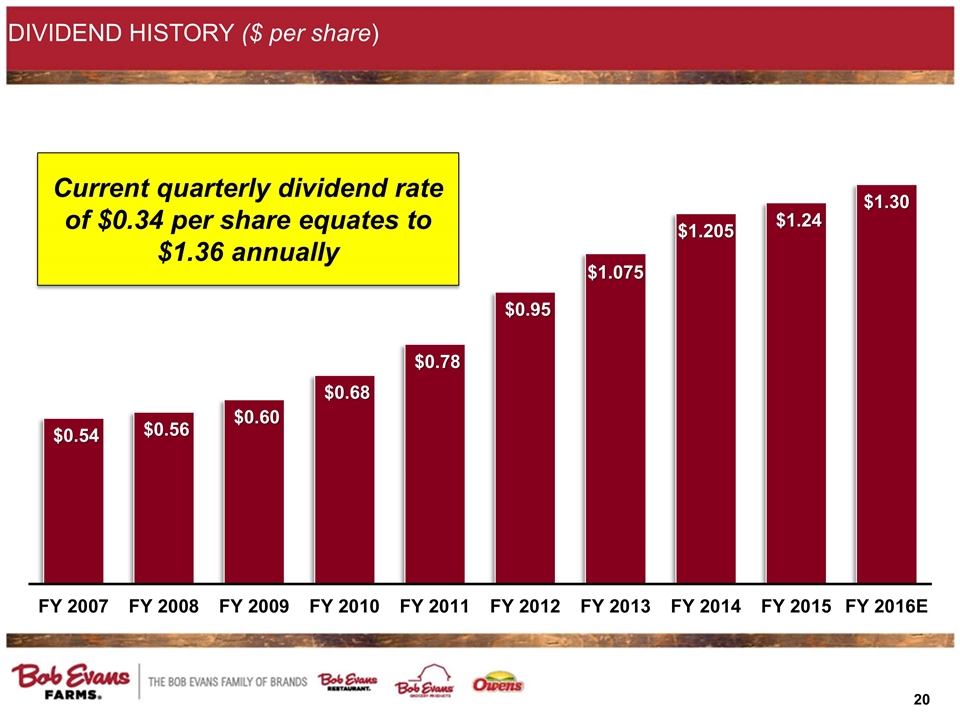

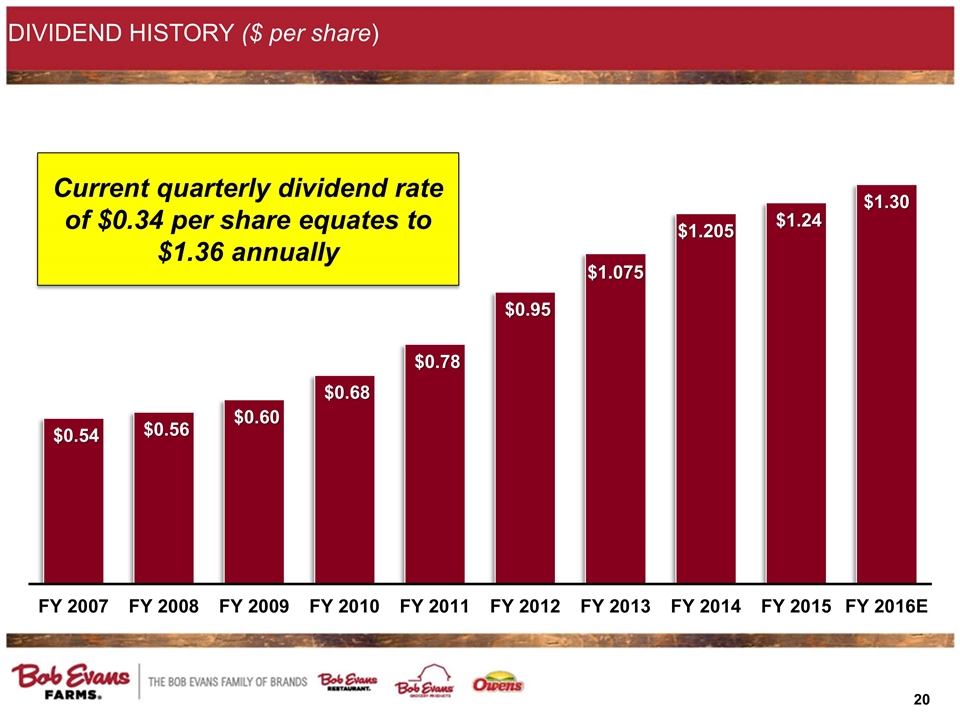

DIVIDEND HISTORY ($ per share) Current quarterly dividend rate of $0.34 per share equates to $1.36 annually

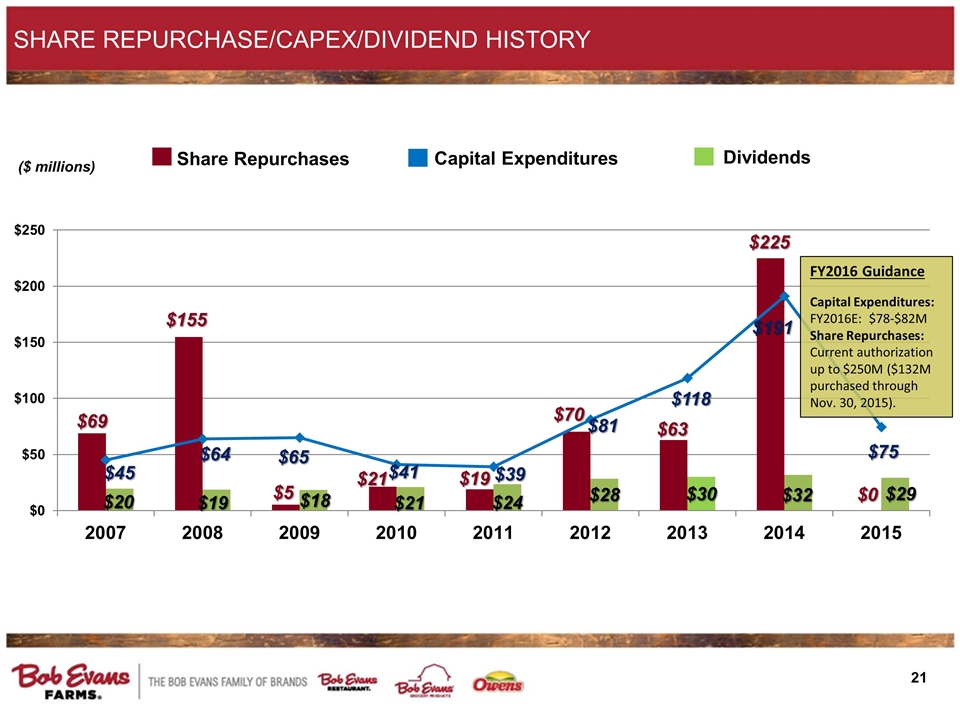

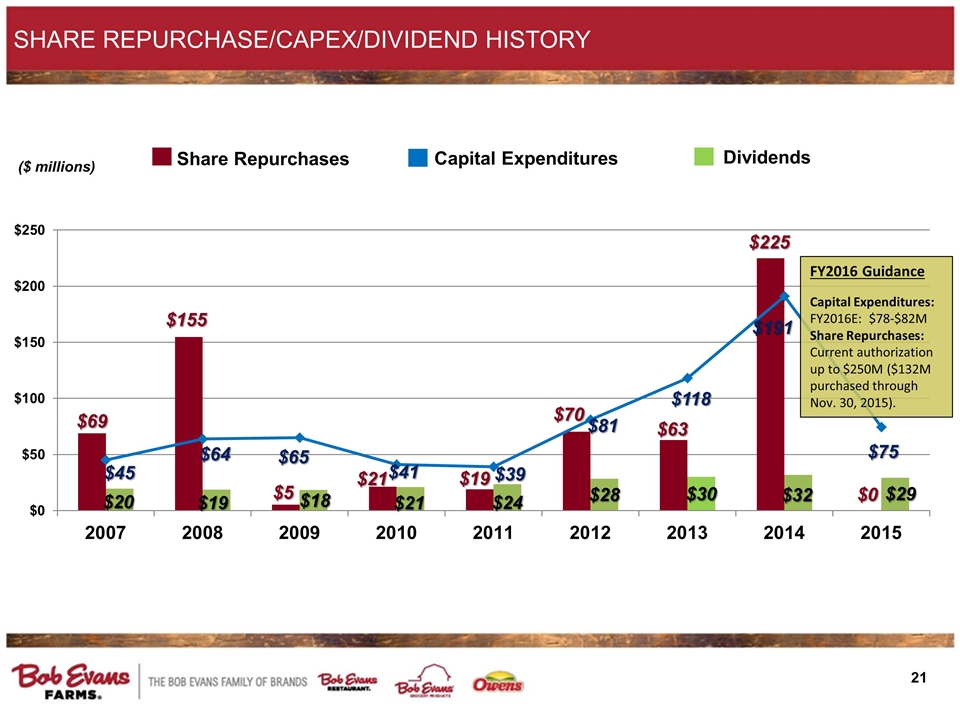

($ millions) Capital Expenditures SHARE REPURCHASE/CAPEX/DIVIDEND HISTORY Share Repurchases FY2016 Guidance Capital Expenditures: FY2016E: $78-$82M Share Repurchases: Current authorization up to $250M ($132M purchased through Nov. 30, 2015). Dividends

BOB EVANS’ TURNAROUND PLAN Corporate Priorities: Create a hospitality-based brand experience Leverage strong brand equity Increase profitability through sales growth Generate free cash flow growth Increase efficiencies Allocate capital prudently

Appendix

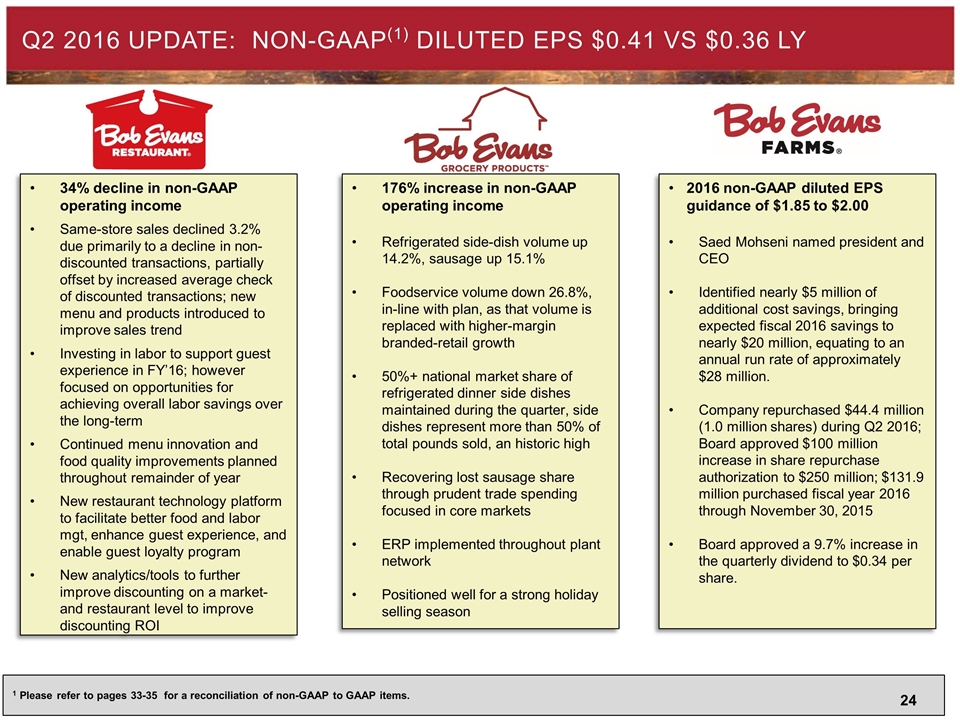

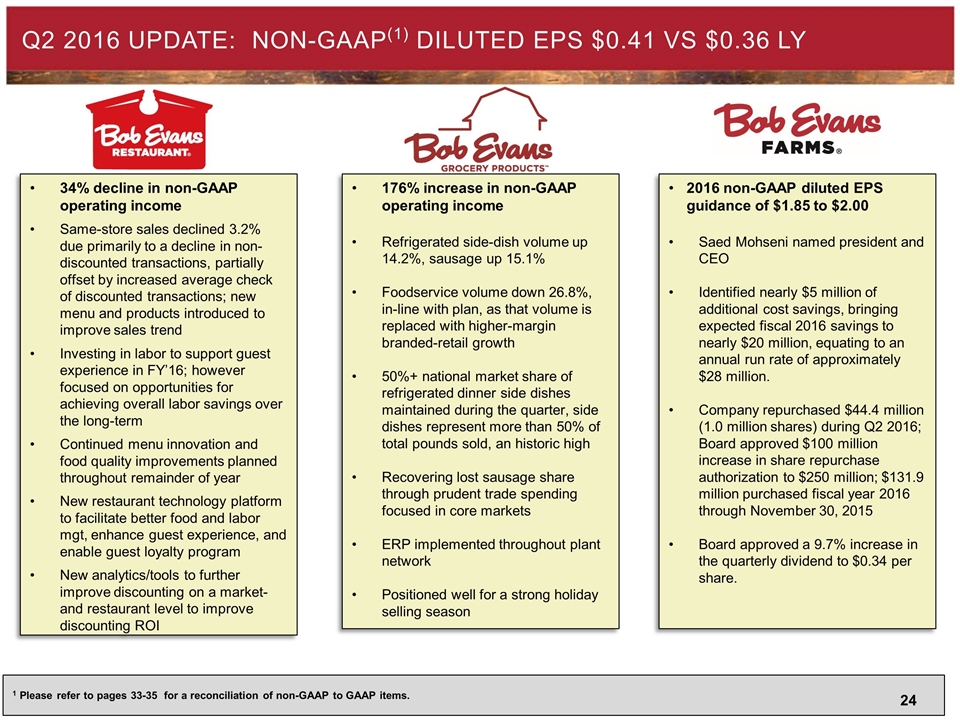

176% increase in non-GAAP operating income Refrigerated side-dish volume up 14.2%, sausage up 15.1% Foodservice volume down 26.8%, in-line with plan, as that volume is replaced with higher-margin branded-retail growth 50%+ national market share of refrigerated dinner side dishes maintained during the quarter, side dishes represent more than 50% of total pounds sold, an historic high Recovering lost sausage share through prudent trade spending focused in core markets ERP implemented throughout plant network Positioned well for a strong holiday selling season 2016 non-GAAP diluted EPS guidance of $1.85 to $2.00 Saed Mohseni named president and CEO Identified nearly $5 million of additional cost savings, bringing expected fiscal 2016 savings to nearly $20 million, equating to an annual run rate of approximately $28 million. Company repurchased $44.4 million (1.0 million shares) during Q2 2016; Board approved $100 million increase in share repurchase authorization to $250 million; $131.9 million purchased fiscal year 2016 through November 30, 2015 Board approved a 9.7% increase in the quarterly dividend to $0.34 per share. 34% decline in non-GAAP operating income Same-store sales declined 3.2% due primarily to a decline in non-discounted transactions, partially offset by increased average check of discounted transactions; new menu and products introduced to improve sales trend Investing in labor to support guest experience in FY’16; however focused on opportunities for achieving overall labor savings over the long-term Continued menu innovation and food quality improvements planned throughout remainder of year New restaurant technology platform to facilitate better food and labor mgt, enhance guest experience, and enable guest loyalty program New analytics/tools to further improve discounting on a market- and restaurant level to improve discounting ROI Q2 2016 update: Non-Gaap(1) diluted eps $0.41 vs $0.36 ly 1 Please refer to pages 33-35 for a reconciliation of non-GAAP to GAAP items.

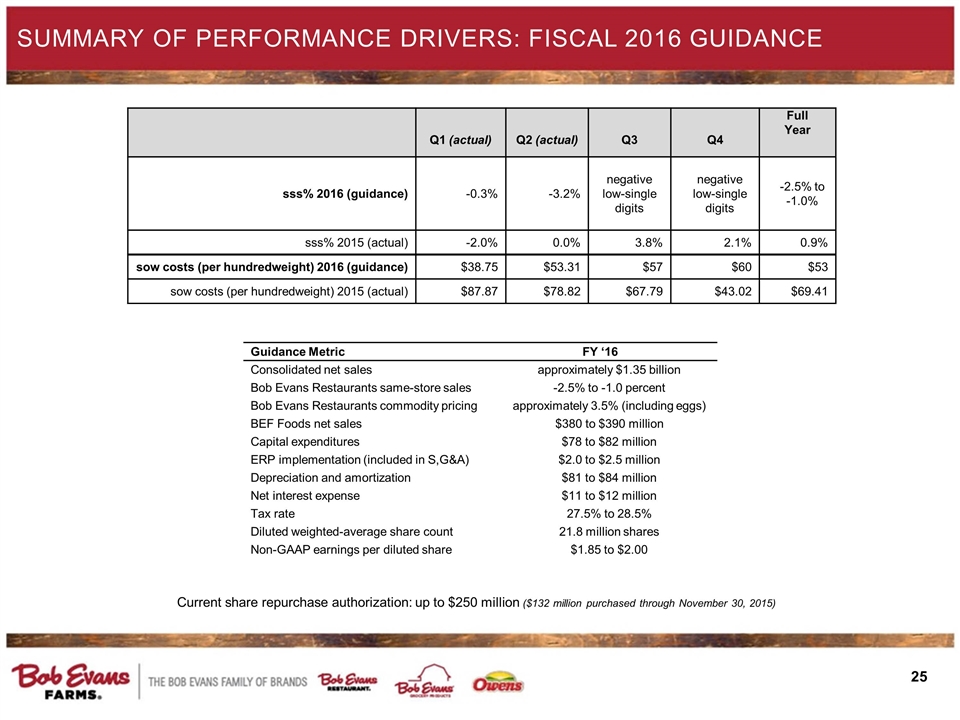

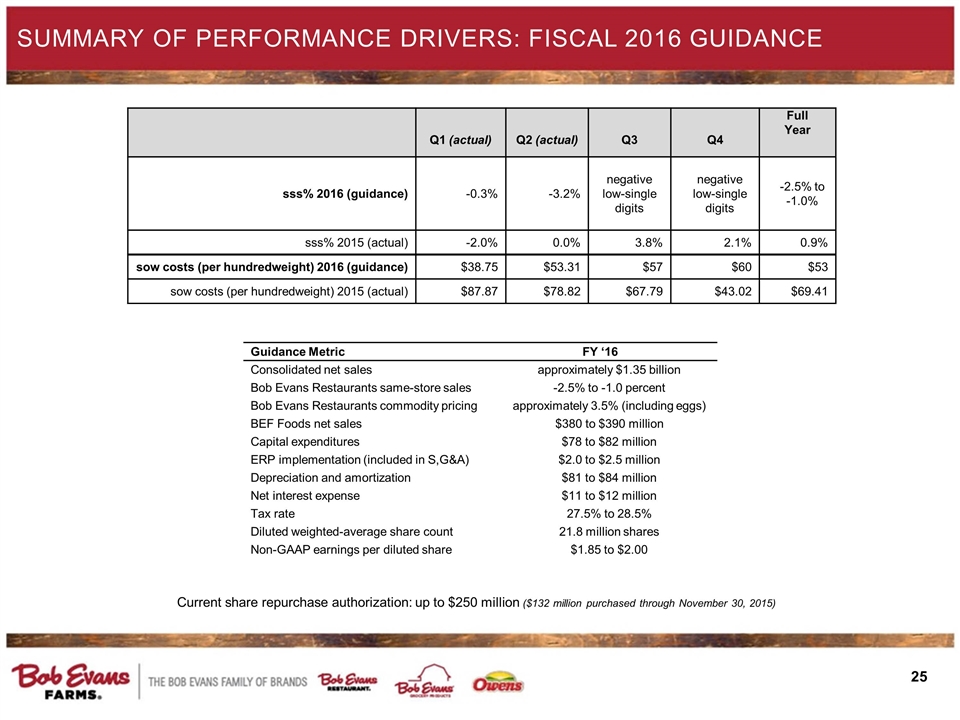

Summary of Performance Drivers: Fiscal 2016 Guidance Current share repurchase authorization: up to $250 million ($132 million purchased through November 30, 2015) Q1 (actual) Q2 (actual) Q3 Q4 Full Year sss% 2016 (guidance) -0.3% -3.2% negative low-single digits negative low-single digits -2.5% to -1.0% sss% 2015 (actual) -2.0% 0.0% 3.8% 2.1% 0.9% sow costs (per hundredweight) 2016 (guidance) $38.75 $53.31 $57 $60 $53 sow costs (per hundredweight) 2015 (actual) $87.87 $78.82 $67.79 $43.02 $69.41 Guidance Metric FY ‘16 Consolidated net sales approximately $1.35 billion Bob Evans Restaurants same-store sales -2.5% to -1.0 percent Bob Evans Restaurants commodity pricing approximately 3.5% (including eggs) BEF Foods net sales $380 to $390 million Capital expenditures $78 to $82 million ERP implementation (included in S,G&A) $2.0 to $2.5 million Depreciation and amortization $81 to $84 million Net interest expense $11 to $12 million Tax rate 27.5% to 28.5% Diluted weighted-average share count 21.8 million shares Non-GAAP earnings per diluted share $1.85 to $2.00

Second-QUARTER FISCAL 2016: Same store sales summary Second-quarter Fiscal 2016 SSS% Day Part Performance – Total Chain Day Part On-Premise Off-Premise Total Breakfast (1.2)% 7.6% (0.4)% Lunch (3.4)% (1.1)% (3.1)% Dinner (7.6)% (0.7)% (6.2)% Total (3.9)% 0.9% (3.2)% Second-quarter Fiscal 2016 SSS% Day Part Performance – Restaurants offering Broasted Chicken Day Part On-Premise Off-Premise Total Breakfast (1.9)% 6.3% (1.0)% Lunch (4.1)% (0.7)% (3.6)% Dinner (6.7)% 1.0% (4.9)% Total (4.3)% 1.5% (3.3)% Second-quarter Fiscal 2016 SSS% Day Part Performance – Restaurants without Broasted Chicken Day Part On-Premise Off-Premise Total Breakfast (0.4)% 9.9% 0.4% Lunch (2.3)% (2.1)% (2.3)% Dinner (9.0)% (5.0)% (8.4)% Total (3.4%) (0.4)% (3.1)%

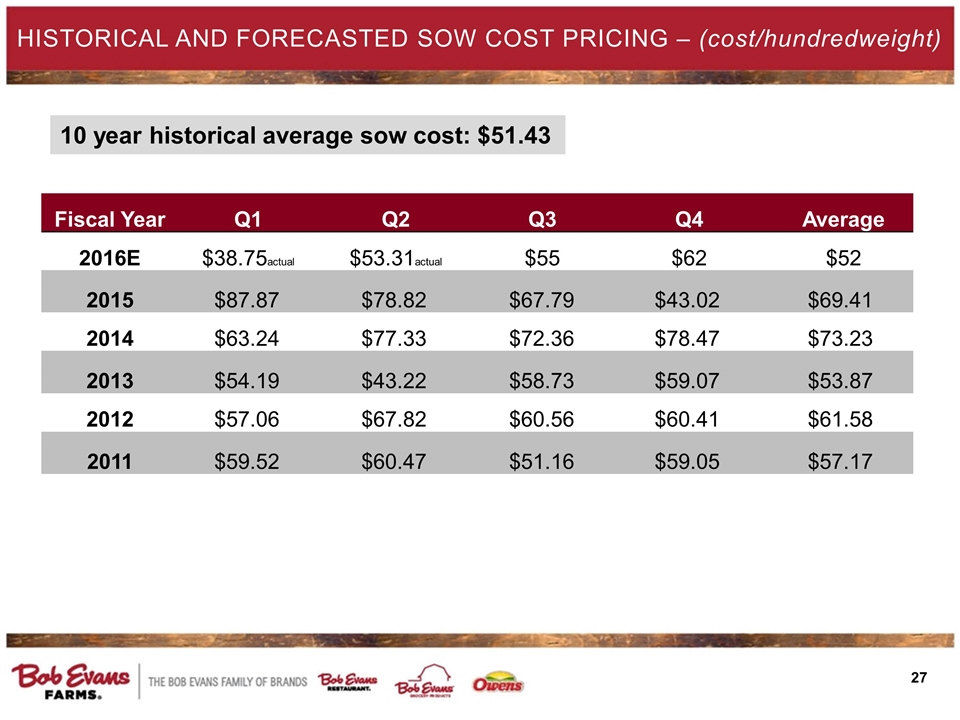

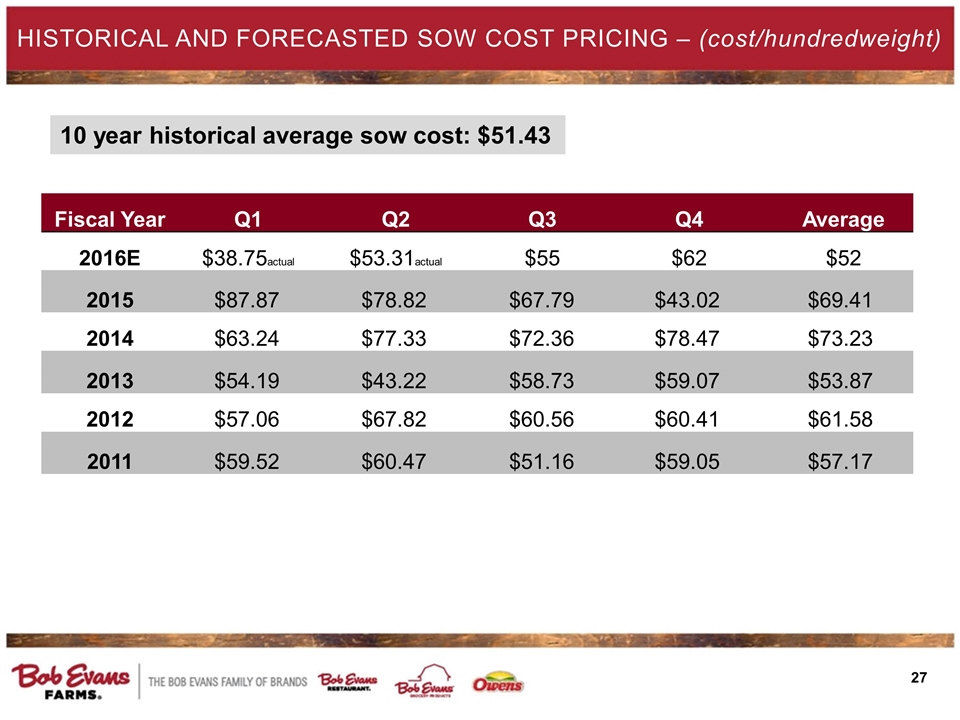

Historical and forecasted Sow Cost Pricing – (cost/hundredweight) Fiscal Year Q1 Q2 Q3 Q4 Average 2016E $38.75actual $53.31actual $55 $62 $52 2015 $87.87 $78.82 $67.79 $43.02 $69.41 2014 $63.24 $77.33 $72.36 $78.47 $73.23 2013 $54.19 $43.22 $58.73 $59.07 $53.87 2012 $57.06 $67.82 $60.56 $60.41 $61.58 2011 $59.52 $60.47 $51.16 $59.05 $57.17 10 year historical average sow cost: $51.43

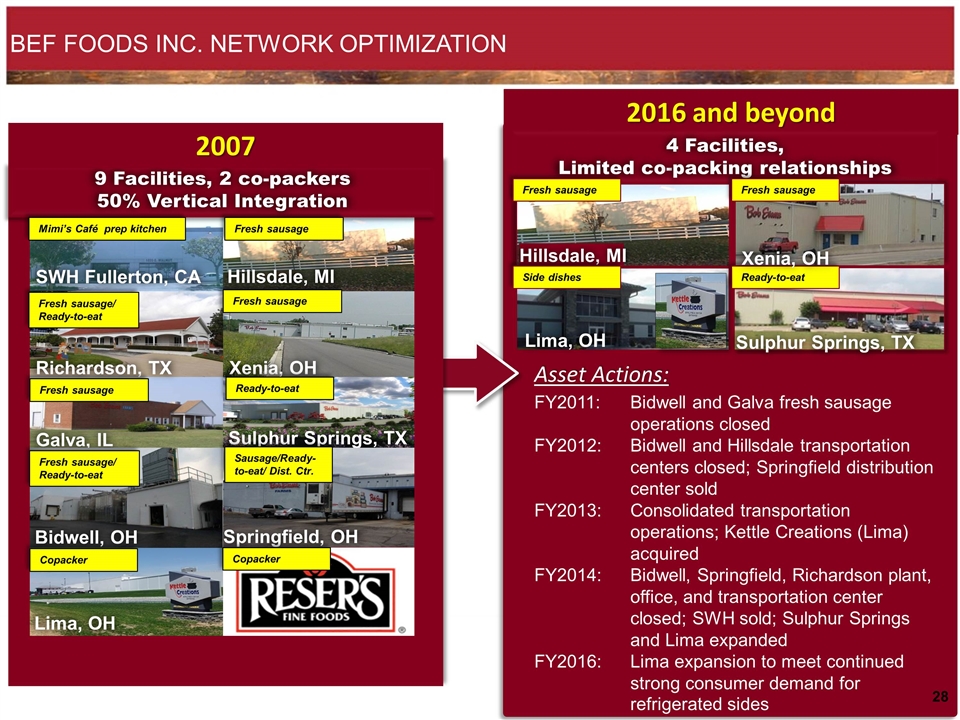

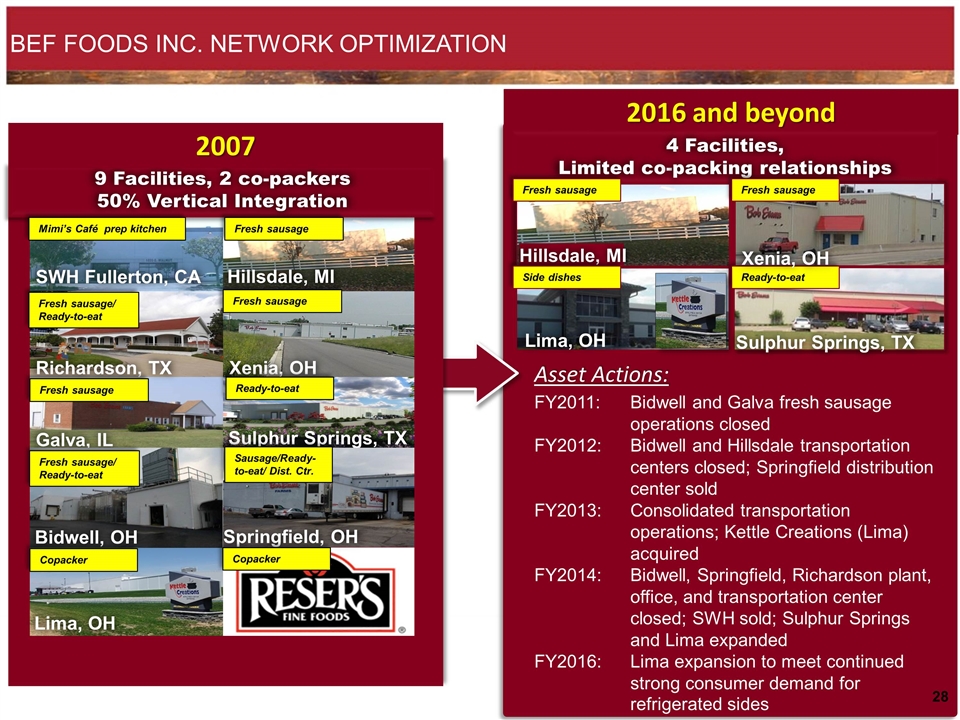

Hillsdale, MI 2016 and beyond 4 Facilities, Limited co-packing relationships Asset Actions: FY2011:Bidwell and Galva fresh sausage operations closed FY2012:Bidwell and Hillsdale transportation centers closed; Springfield distribution center sold FY2013:Consolidated transportation operations; Kettle Creations (Lima) acquired FY2014: Bidwell, Springfield, Richardson plant, office, and transportation center closed; SWH sold; Sulphur Springs and Lima expanded FY2016:Lima expansion to meet continued strong consumer demand for refrigerated sides Fresh sausage Fresh sausage Ready-to-eat Side dishes BEF FOODS INC. NETWORK OPTIMIZATION Xenia, OH Sulphur Springs, TX Lima, OH Galva, IL Bidwell, OH Richardson, TX Xenia, OH Sulphur Springs, TX SWH Fullerton, CA Hillsdale, MI Lima, OH 9 Facilities, 2 co-packers 50% Vertical Integration 2007 Springfield, OH Ready-to-eat Fresh sausage Sausage/Ready-to-eat/ Dist. Ctr. Fresh sausage Copacker Copacker Fresh sausage/ Ready-to-eat Fresh sausage Mimi’s Café prep kitchen Fresh sausage/ Ready-to-eat

Bef Foods: PARTNERSHIP WITH SANDRA LEE DRIVES NATIONAL BRAND AWARENESS National media coverage Positive consumer response Mealtime solutions for busy families Brand awareness expansion beyond core markets Partnership announcement post on Bob Evans' social media On-line recipe club at www.bobevans.com

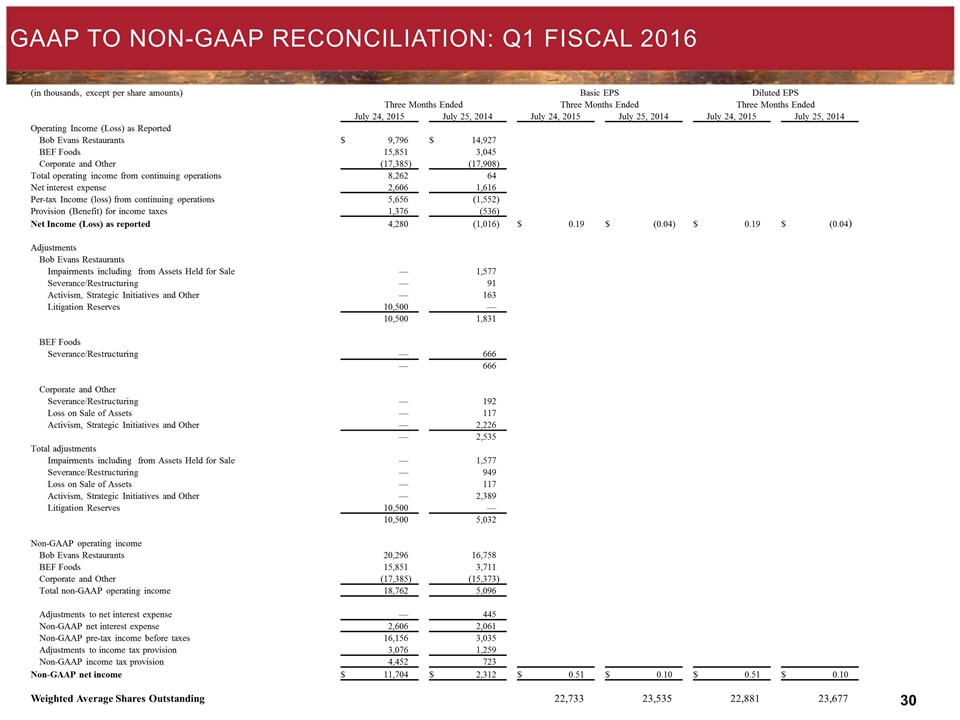

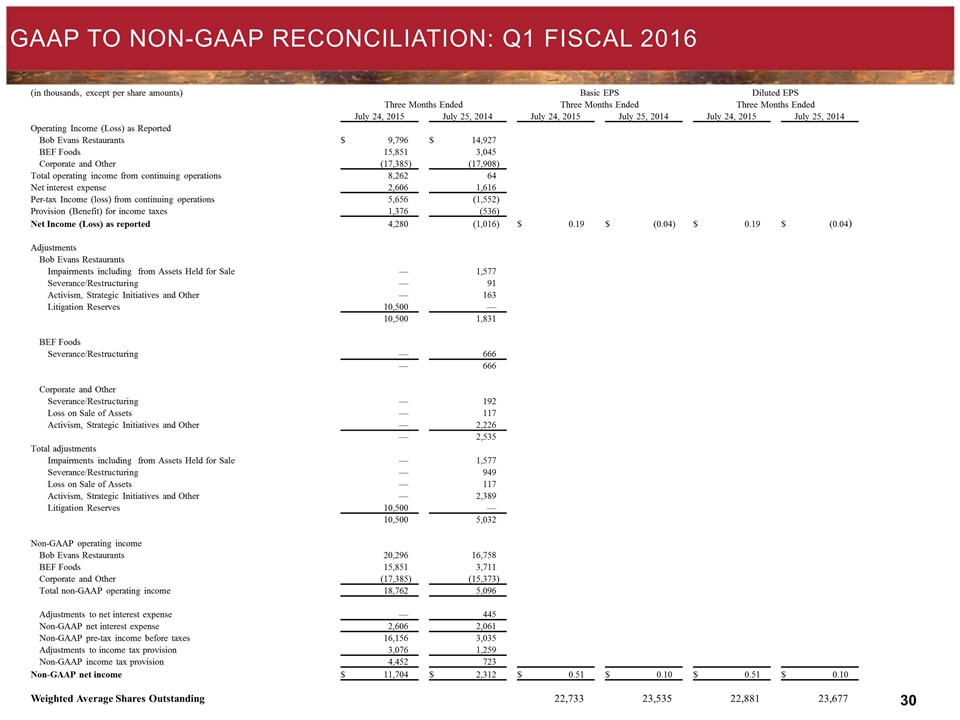

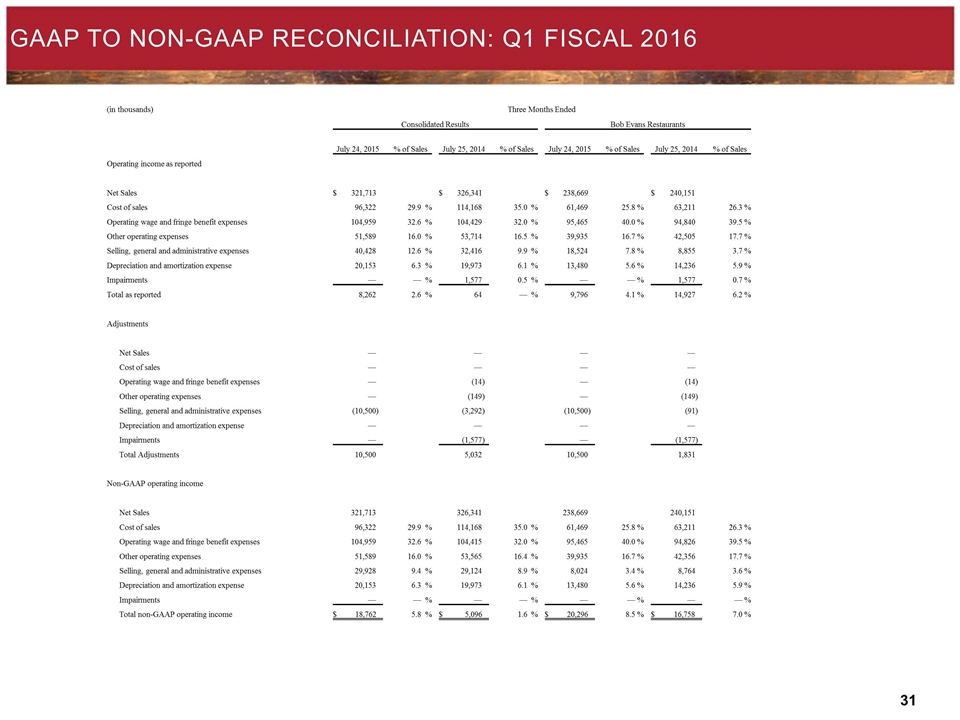

Gaap to non-gaap reconciliation: Q1 Fiscal 2016 (in thousands, except per share amounts) Basic EPS Diluted EPS Three Months Ended Three Months Ended Three Months Ended July 24, 2015 July 25, 2014 July 24, 2015 July 25, 2014 July 24, 2015 July 25, 2014 Operating Income (Loss) as Reported Bob Evans Restaurants $ 9,796 $ 14,927 BEF Foods 15,851 3,045 Corporate and Other (17,385 ) (17,908 ) Total operating income from continuing operations 8,262 64 Net interest expense 2,606 1,616 Per-tax Income (loss) from continuing operations 5,656 (1,552 ) Provision (Benefit) for income taxes 1,376 (536 ) Net Income (Loss) as reported 4,280 (1,016 ) $ 0.19 $ (0.04 ) $ 0.19 $ (0.04 ) Adjustments Bob Evans Restaurants Impairments including from Assets Held for Sale — 1,577 Severance/Restructuring — 91 Activism, Strategic Initiatives and Other — 163 Litigation Reserves 10,500 — 10,500 1,831 BEF Foods Severance/Restructuring — 666 — 666 Corporate and Other Severance/Restructuring — 192 Loss on Sale of Assets — 117 Activism, Strategic Initiatives and Other — 2,226 — 2,535 Total adjustments Impairments including from Assets Held for Sale — 1,577 Severance/Restructuring — 949 Loss on Sale of Assets — 117 Activism, Strategic Initiatives and Other — 2,389 Litigation Reserves 10,500 — 10,500 5,032 Non-GAAP operating income Bob Evans Restaurants 20,296 16,758 BEF Foods 15,851 3,711 Corporate and Other (17,385 ) (15,373 ) Total non-GAAP operating income 18,762 5,096 Adjustments to net interest expense — 445 Non-GAAP net interest expense 2,606 2,061 Non-GAAP pre-tax income before taxes 16,156 3,035 Adjustments to income tax provision 3,076 1,259 Non-GAAP income tax provision 4,452 723 Non-GAAP net income $ 11,704 $ 2,312 $ 0.51 $ 0.10 $ 0.51 $ 0.10 Weighted Average Shares Outstanding 22,733 23,535 22,881 23,677

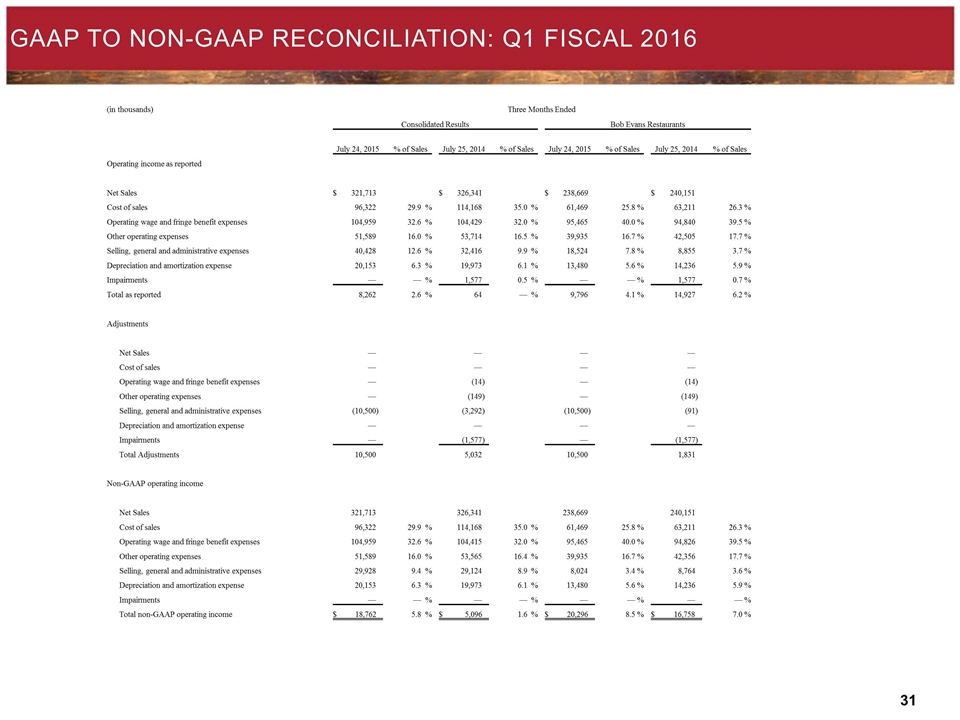

Gaap to non-gaap reconciliation: Q1 Fiscal 2016 (in thousands) Three Months Ended Consolidated Results Bob Evans Restaurants July 24, 2015 % of Sales July 25, 2014 % of Sales July 24, 2015 % of Sales July 25, 2014 % of Sales Operating income as reported Net Sales $ 321,713 $ 326,341 $ 238,669 $ 240,151 Cost of sales 96,322 29.9 % 114,168 35.0 % 61,469 25.8 % 63,211 26.3 % Operating wage and fringe benefit expenses 104,959 32.6 % 104,429 32.0 % 95,465 40.0 % 94,840 39.5 % Other operating expenses 51,589 16.0 % 53,714 16.5 % 39,935 16.7 % 42,505 17.7 % Selling, general and administrative expenses 40,428 12.6 % 32,416 9.9 % 18,524 7.8 % 8,855 3.7 % Depreciation and amortization expense 20,153 6.3 % 19,973 6.1 % 13,480 5.6 % 14,236 5.9 % Impairments — — % 1,577 0.5 % — — % 1,577 0.7 % Total as reported 8,262 2.6 % 64 — % 9,796 4.1 % 14,927 6.2 % Adjustments Net Sales — — — — Cost of sales — — — — Operating wage and fringe benefit expenses — (14 ) — (14 ) Other operating expenses — (149 ) — (149 ) Selling, general and administrative expenses (10,500 ) (3,292 ) (10,500 ) (91 ) Depreciation and amortization expense — — — — Impairments — (1,577 ) — (1,577 ) Total Adjustments 10,500 5,032 10,500 1,831 Non-GAAP operating income Net Sales 321,713 326,341 238,669 240,151 Cost of sales 96,322 29.9 % 114,168 35.0 % 61,469 25.8 % 63,211 26.3 % Operating wage and fringe benefit expenses 104,959 32.6 % 104,415 32.0 % 95,465 40.0 % 94,826 39.5 % Other operating expenses 51,589 16.0 % 53,565 16.4 % 39,935 16.7 % 42,356 17.7 % Selling, general and administrative expenses 29,928 9.4 % 29,124 8.9 % 8,024 3.4 % 8,764 3.6 % Depreciation and amortization expense 20,153 6.3 % 19,973 6.1 % 13,480 5.6 % 14,236 5.9 % Impairments — — % — — % — — % — — % Total non-GAAP operating income $ 18,762 5.8 % $ 5,096 1.6 % $ 20,296 8.5 % $ 16,758 7.0 %

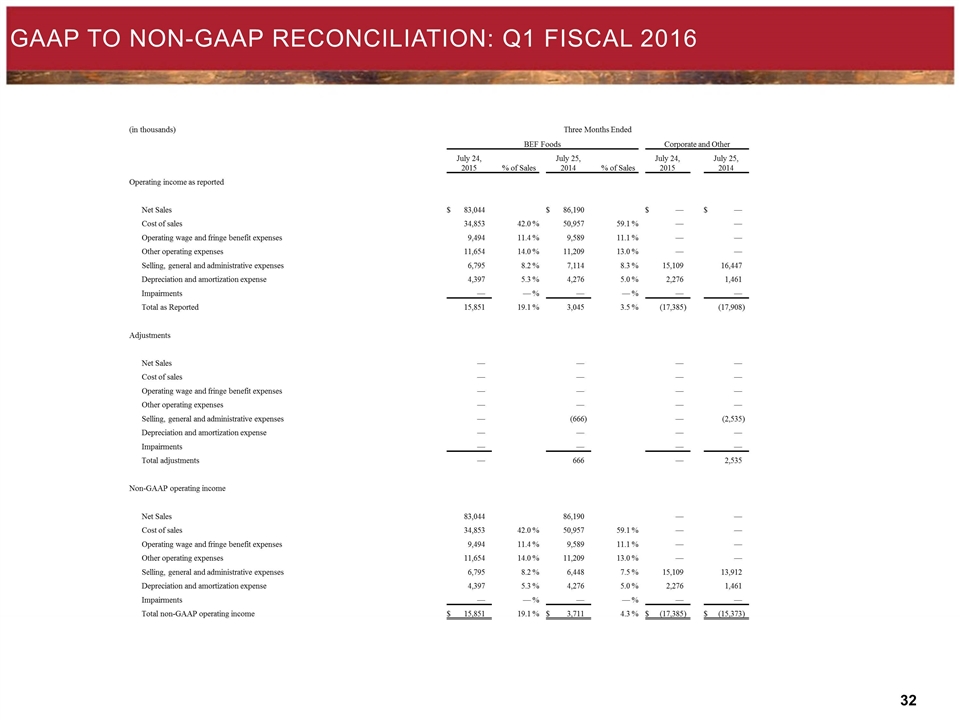

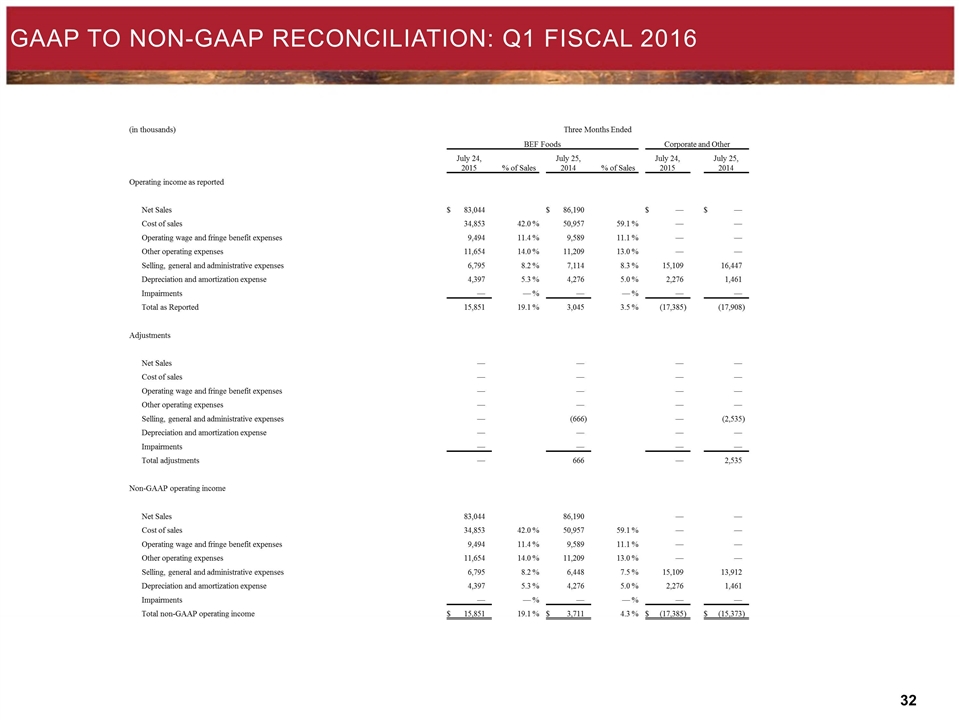

Gaap to non-gaap reconciliation: Q1 Fiscal 2016 (in thousands) Three Months Ended BEF Foods Corporate and Other July 24, 2015 % of Sales July 25, 2014 % of Sales July 24, 2015 July 25, 2014 Operating income as reported Net Sales $ 83,044 $ 86,190 $ — $ — Cost of sales 34,853 42.0 % 50,957 59.1 % — — Operating wage and fringe benefit expenses 9,494 11.4 % 9,589 11.1 % — — Other operating expenses 11,654 14.0 % 11,209 13.0 % — — Selling, general and administrative expenses 6,795 8.2 % 7,114 8.3 % 15,109 16,447 Depreciation and amortization expense 4,397 5.3 % 4,276 5.0 % 2,276 1,461 Impairments — — % — — % — — Total as Reported 15,851 19.1 % 3,045 3.5 % (17,385 ) (17,908 ) Adjustments Net Sales — — — — Cost of sales — — — — Operating wage and fringe benefit expenses — — — — Other operating expenses — — — — Selling, general and administrative expenses — (666 ) — (2,535 ) Depreciation and amortization expense — — — — Impairments — — — — Total adjustments — 666 — 2,535 Non-GAAP operating income Net Sales 83,044 86,190 — — Cost of sales 34,853 42.0 % 50,957 59.1 % — — Operating wage and fringe benefit expenses 9,494 11.4 % 9,589 11.1 % — — Other operating expenses 11,654 14.0 % 11,209 13.0 % — — Selling, general and administrative expenses 6,795 8.2 % 6,448 7.5 % 15,109 13,912 Depreciation and amortization expense 4,397 5.3 % 4,276 5.0 % 2,276 1,461 Impairments — — % — — % — — Total non-GAAP operating income $ 15,851 19.1 % $ 3,711 4.3 % $ (17,385 ) $ (15,373 )

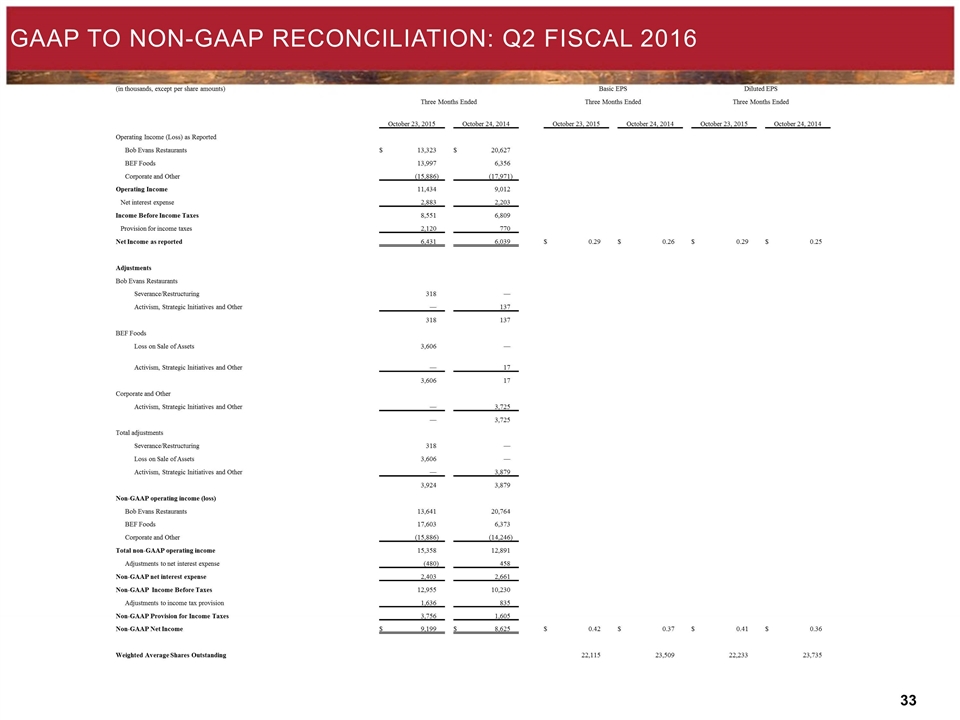

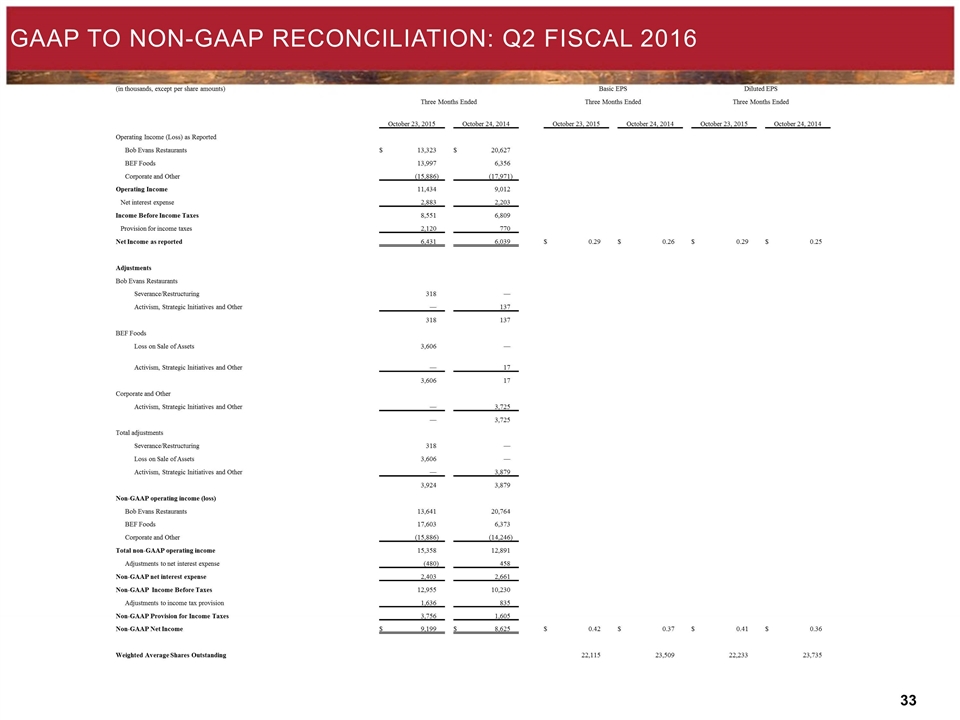

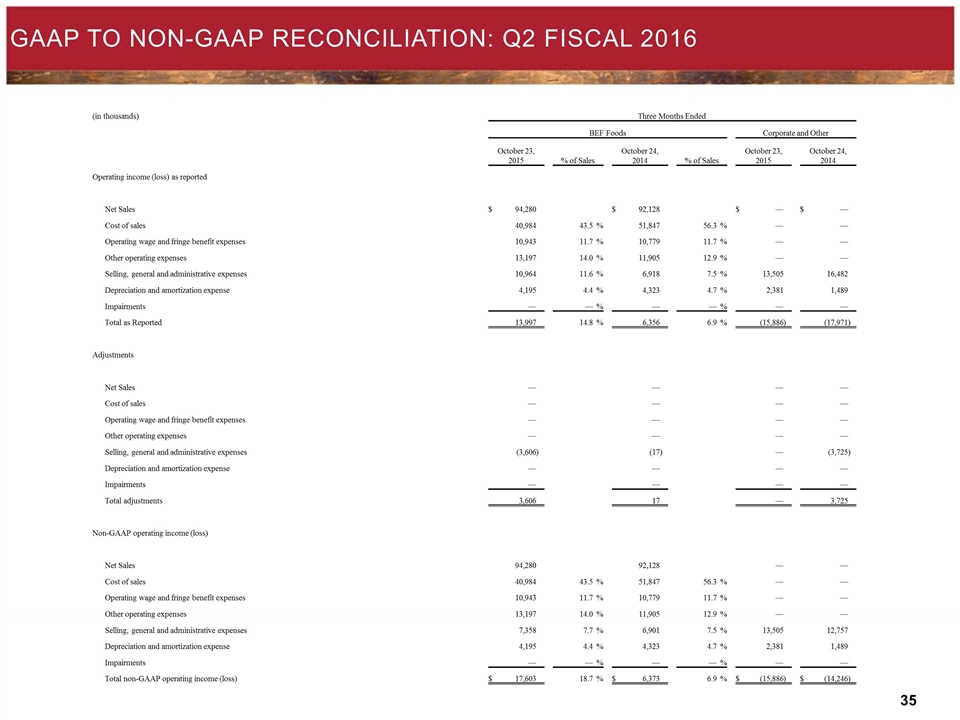

Gaap to non-gaap reconciliation: Q2 Fiscal 2016 (in thousands, except per share amounts) Basic EPS Diluted EPS Three Months Ended Three Months Ended Three Months Ended October 23, 2015 October 24, 2014 October 23, 2015 October 24, 2014 October 23, 2015 October 24, 2014 Operating Income (Loss) as Reported Bob Evans Restaurants $ 13,323 $ 20,627 BEF Foods 13,997 6,356 Corporate and Other (15,886 ) (17,971 ) Operating Income 11,434 9,012 Net interest expense 2,883 2,203 Income Before Income Taxes 8,551 6,809 Provision for income taxes 2,120 770 Net Income as reported 6,431 6,039 $ 0.29 $ 0.26 $ 0.29 $ 0.25 Adjustments Bob Evans Restaurants Severance/Restructuring 318 — Activism, Strategic Initiatives and Other — 137 318 137 BEF Foods Loss on Sale of Assets 3,606 — Activism, Strategic Initiatives and Other — 17 3,606 17 Corporate and Other Activism, Strategic Initiatives and Other — 3,725 — 3,725 Total adjustments Severance/Restructuring 318 — Loss on Sale of Assets 3,606 — Activism, Strategic Initiatives and Other — 3,879 3,924 3,879 Non-GAAP operating income (loss) Bob Evans Restaurants 13,641 20,764 BEF Foods 17,603 6,373 Corporate and Other (15,886 ) (14,246 ) Total non-GAAP operating income 15,358 12,891 Adjustments to net interest expense (480 ) 458 Non-GAAP net interest expense 2,403 2,661 Non-GAAP Income Before Taxes 12,955 10,230 Adjustments to income tax provision 1,636 835 Non-GAAP Provision for Income Taxes 3,756 1,605 Non-GAAP Net Income $ 9,199 $ 8,625 $ 0.42 $ 0.37 $ 0.41 $ 0.36 Weighted Average Shares Outstanding 22,115 23,509 22,233 23,735

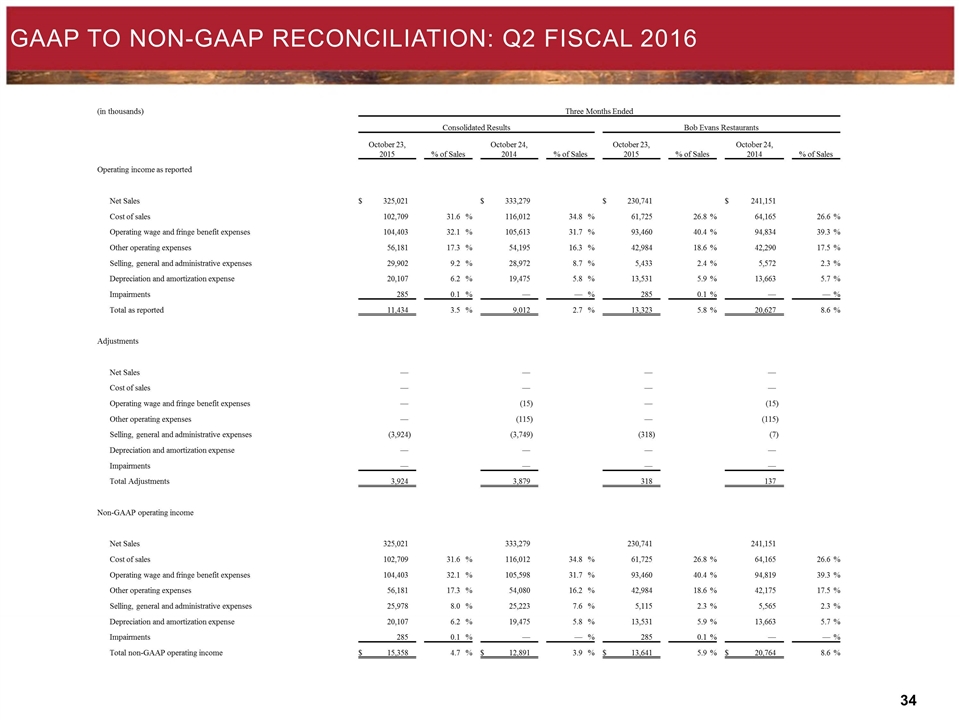

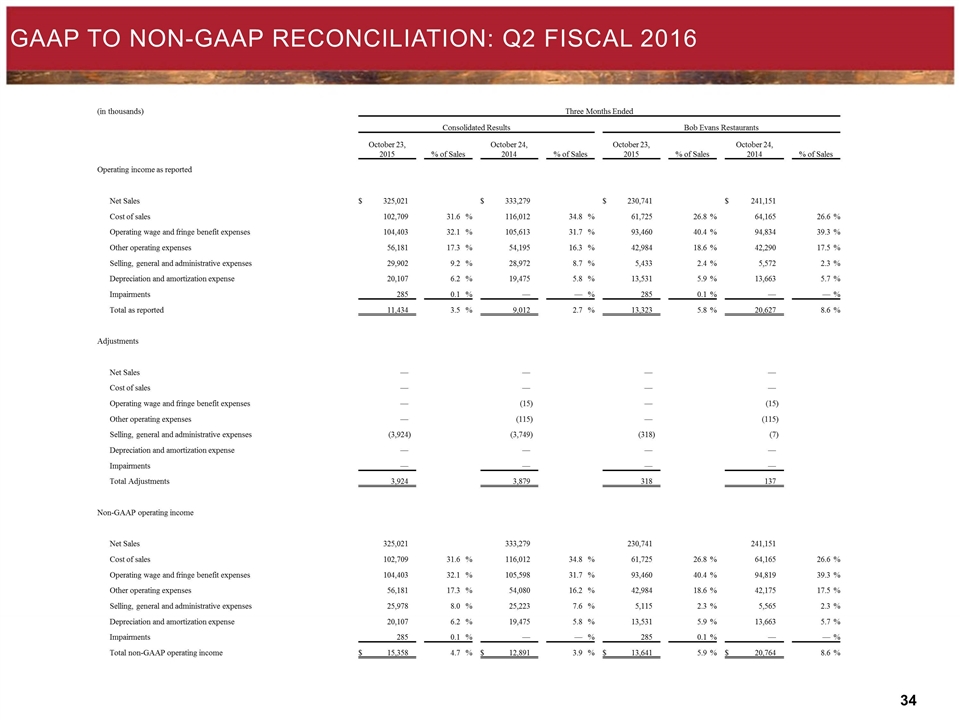

Gaap to non-gaap reconciliation: Q2 Fiscal 2016 (in thousands) Three Months Ended Consolidated Results Bob Evans Restaurants October 23, 2015 % of Sales October 24, 2014 % of Sales October 23, 2015 % of Sales October 24, 2014 % of Sales Operating income as reported Net Sales $ 325,021 $ 333,279 $ 230,741 $ 241,151 Cost of sales 102,709 31.6 % 116,012 34.8 % 61,725 26.8 % 64,165 26.6 % Operating wage and fringe benefit expenses 104,403 32.1 % 105,613 31.7 % 93,460 40.4 % 94,834 39.3 % Other operating expenses 56,181 17.3 % 54,195 16.3 % 42,984 18.6 % 42,290 17.5 % Selling, general and administrative expenses 29,902 9.2 % 28,972 8.7 % 5,433 2.4 % 5,572 2.3 % Depreciation and amortization expense 20,107 6.2 % 19,475 5.8 % 13,531 5.9 % 13,663 5.7 % Impairments 285 0.1 % — — % 285 0.1 % — — % Total as reported 11,434 3.5 % 9,012 2.7 % 13,323 5.8 % 20,627 8.6 % Adjustments Net Sales — — — — Cost of sales — — — — Operating wage and fringe benefit expenses — (15 ) — (15 ) Other operating expenses — (115 ) — (115 ) Selling, general and administrative expenses (3,924 ) (3,749 ) (318 ) (7 ) Depreciation and amortization expense — — — — Impairments — — — — Total Adjustments 3,924 3,879 318 137 Non-GAAP operating income Net Sales 325,021 333,279 230,741 241,151 Cost of sales 102,709 31.6 % 116,012 34.8 % 61,725 26.8 % 64,165 26.6 % Operating wage and fringe benefit expenses 104,403 32.1 % 105,598 31.7 % 93,460 40.4 % 94,819 39.3 % Other operating expenses 56,181 17.3 % 54,080 16.2 % 42,984 18.6 % 42,175 17.5 % Selling, general and administrative expenses 25,978 8.0 % 25,223 7.6 % 5,115 2.3 % 5,565 2.3 % Depreciation and amortization expense 20,107 6.2 % 19,475 5.8 % 13,531 5.9 % 13,663 5.7 % Impairments 285 0.1 % — — % 285 0.1 % — — % Total non-GAAP operating income $ 15,358 4.7 % $ 12,891 3.9 % $ 13,641 5.9 % $ 20,764 8.6 %

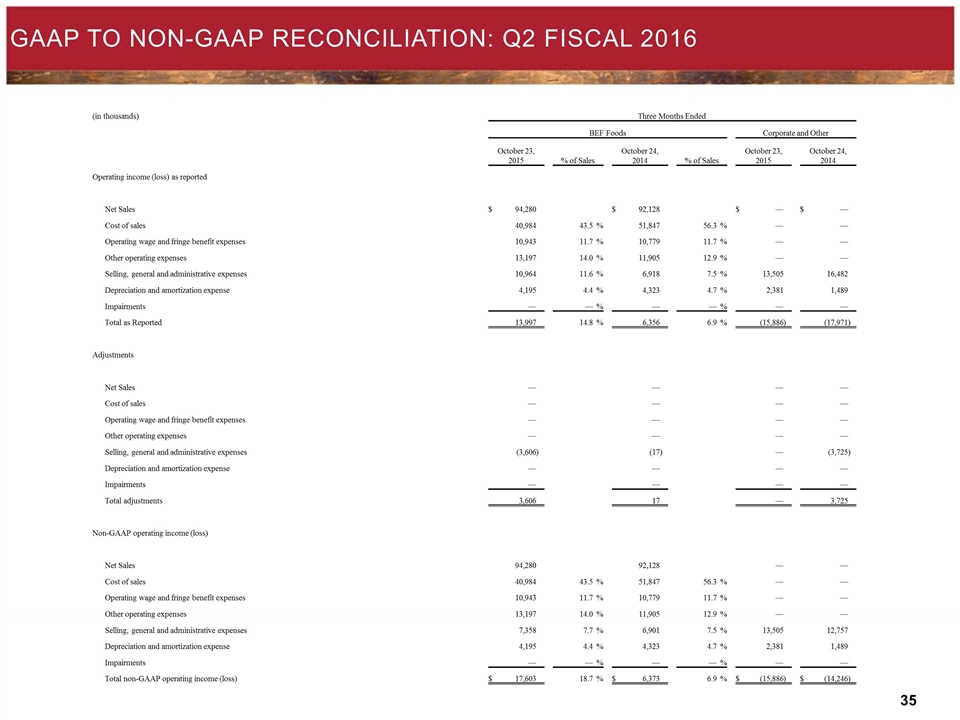

Gaap to non-gaap reconciliation: Q2 Fiscal 2016 (in thousands) Three Months Ended BEF Foods Corporate and Other October 23, 2015 % of Sales October 24, 2014 % of Sales October 23, 2015 October 24, 2014 Operating income (loss) as reported Net Sales $ 94,280 $ 92,128 $ — $ — Cost of sales 40,984 43.5 % 51,847 56.3 % — — Operating wage and fringe benefit expenses 10,943 11.7 % 10,779 11.7 % — — Other operating expenses 13,197 14.0 % 11,905 12.9 % — — Selling, general and administrative expenses 10,964 11.6 % 6,918 7.5 % 13,505 16,482 Depreciation and amortization expense 4,195 4.4 % 4,323 4.7 % 2,381 1,489 Impairments — — % — — % — — Total as Reported 13,997 14.8 % 6,356 6.9 % (15,886 ) (17,971 ) Adjustments Net Sales — — — — Cost of sales — — — — Operating wage and fringe benefit expenses — — — — Other operating expenses — — — — Selling, general and administrative expenses (3,606 ) (17 ) — (3,725 ) Depreciation and amortization expense — — — — Impairments — — — — Total adjustments 3,606 17 — 3,725 Non-GAAP operating income (loss) Net Sales 94,280 92,128 — — Cost of sales 40,984 43.5 % 51,847 56.3 % — — Operating wage and fringe benefit expenses 10,943 11.7 % 10,779 11.7 % — — Other operating expenses 13,197 14.0 % 11,905 12.9 % — — Selling, general and administrative expenses 7,358 7.7 % 6,901 7.5 % 13,505 12,757 Depreciation and amortization expense 4,195 4.4 % 4,323 4.7 % 2,381 1,489 Impairments — — % — — % — — Total non-GAAP operating income (loss) $ 17,603 18.7 % $ 6,373 6.9 % $ (15,886 ) $ (14,246 )

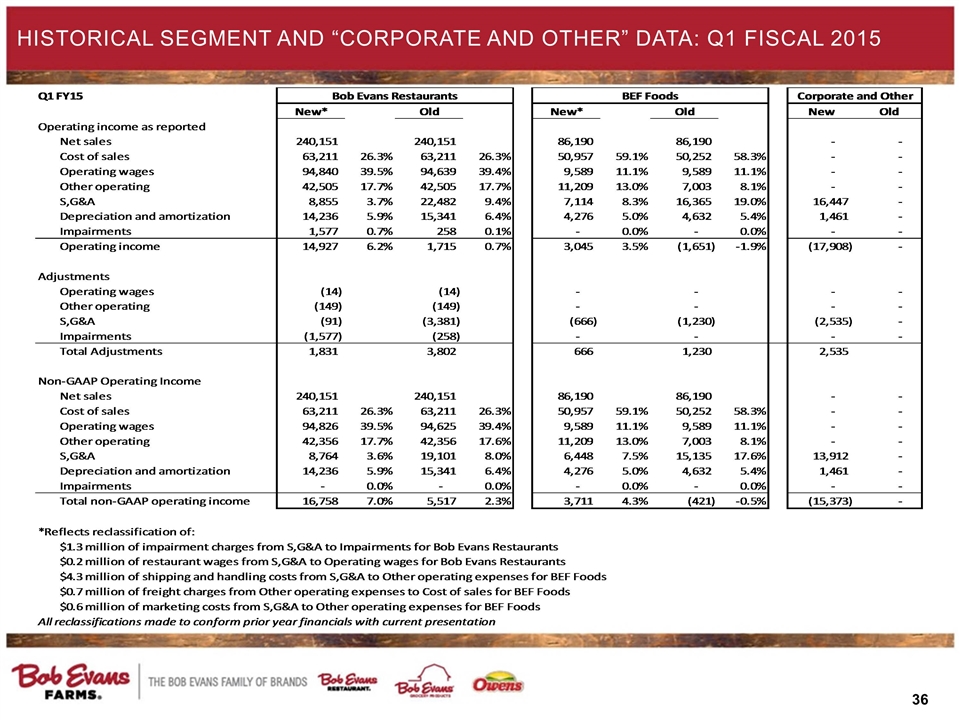

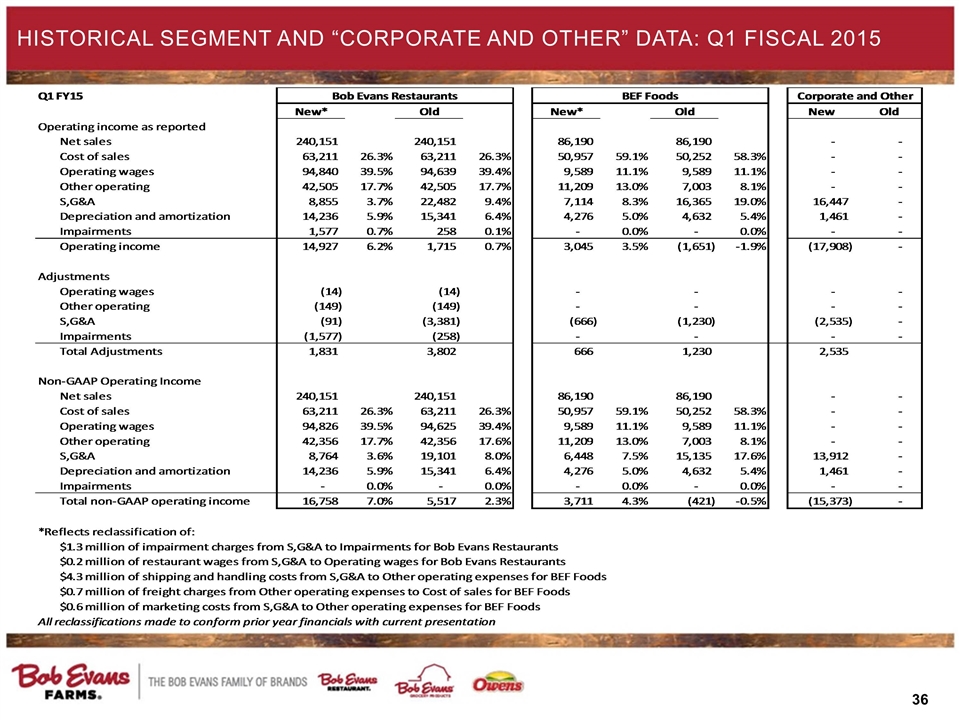

Historical segment and “Corporate and Other” data: Q1 Fiscal 2015

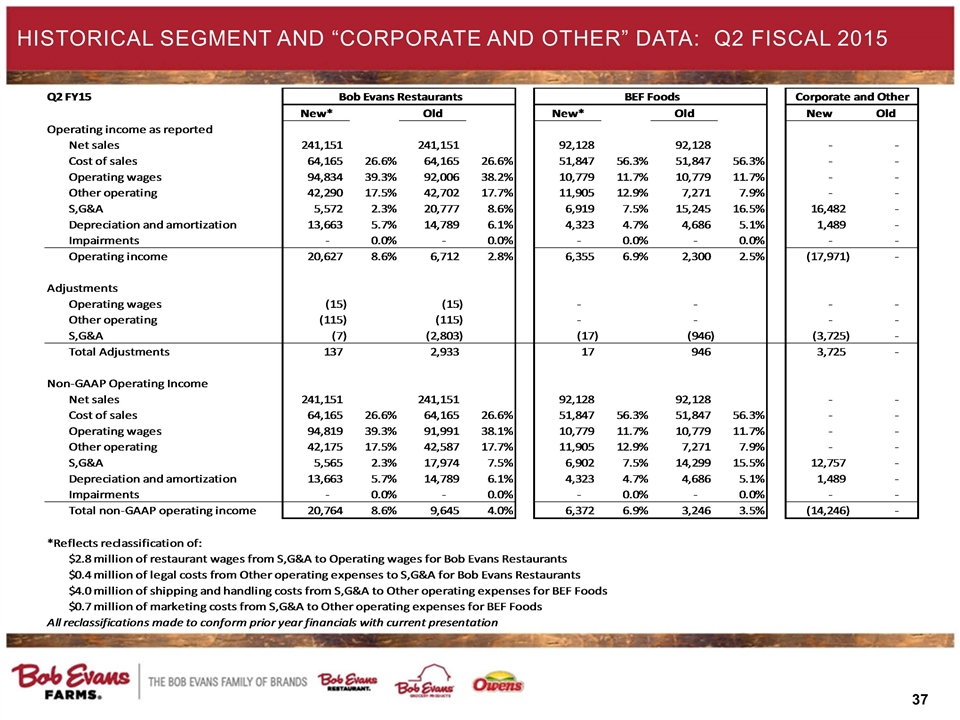

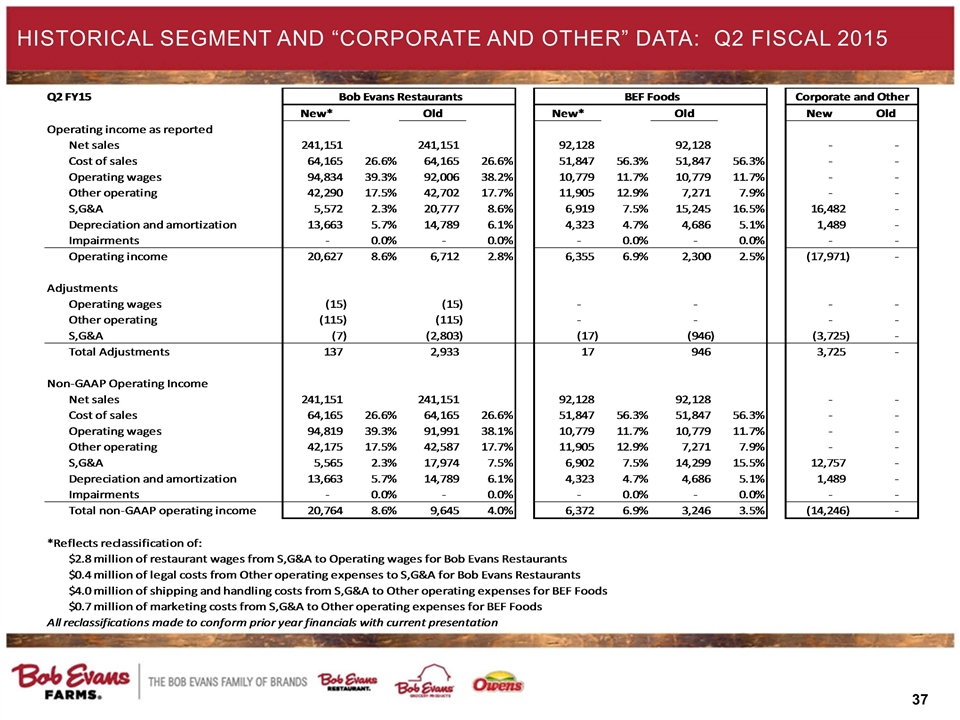

Historical segment and “Corporate and Other” data: Q2 Fiscal 2015

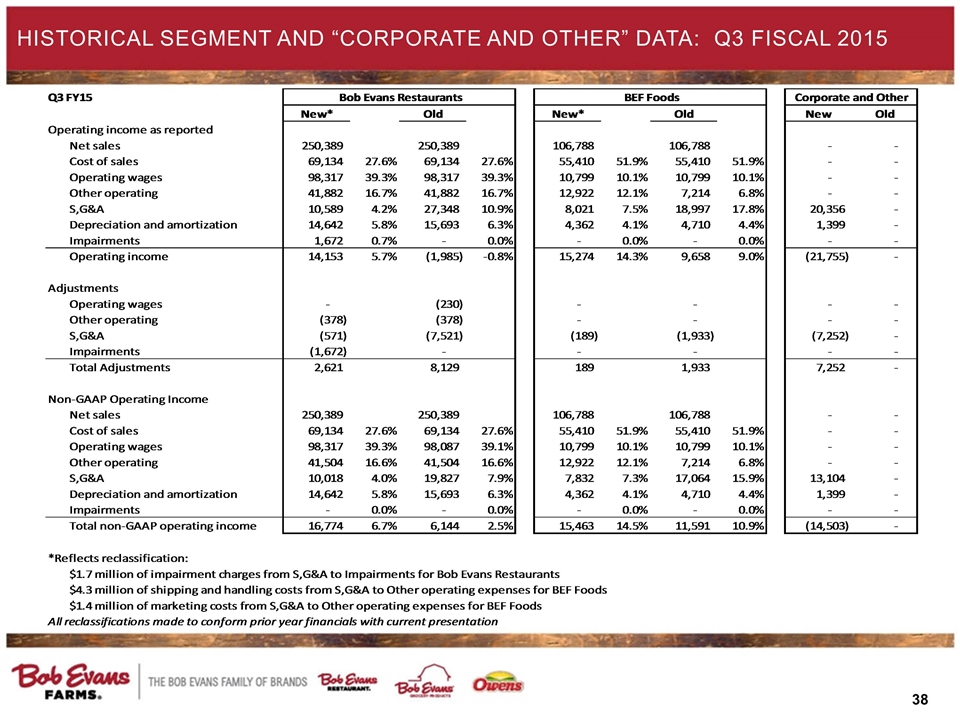

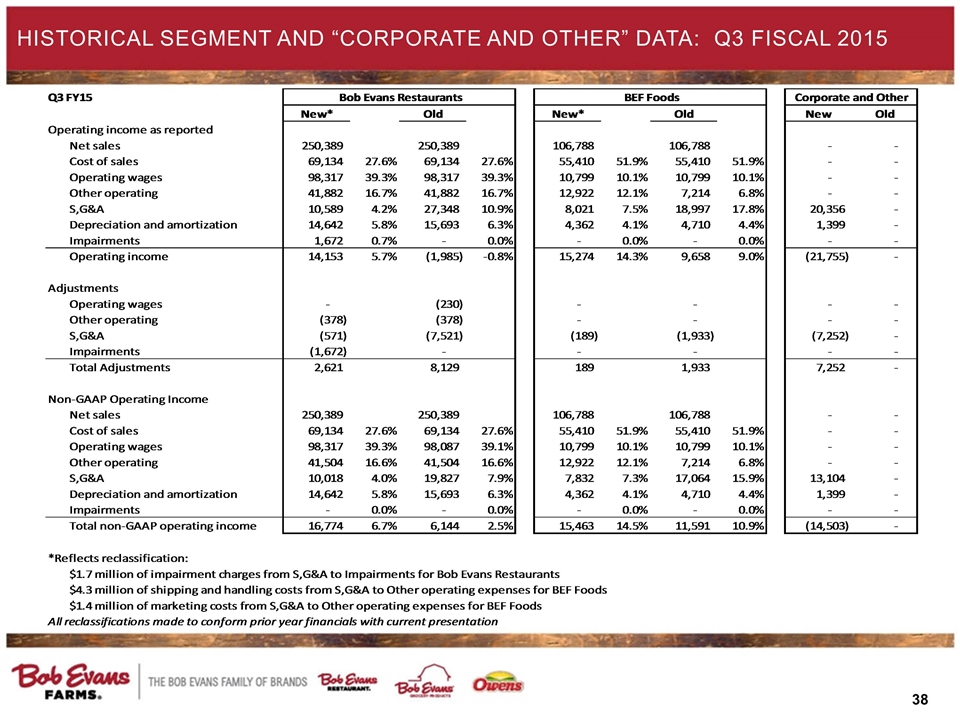

Historical segment and “Corporate and Other” data: Q3 Fiscal 2015

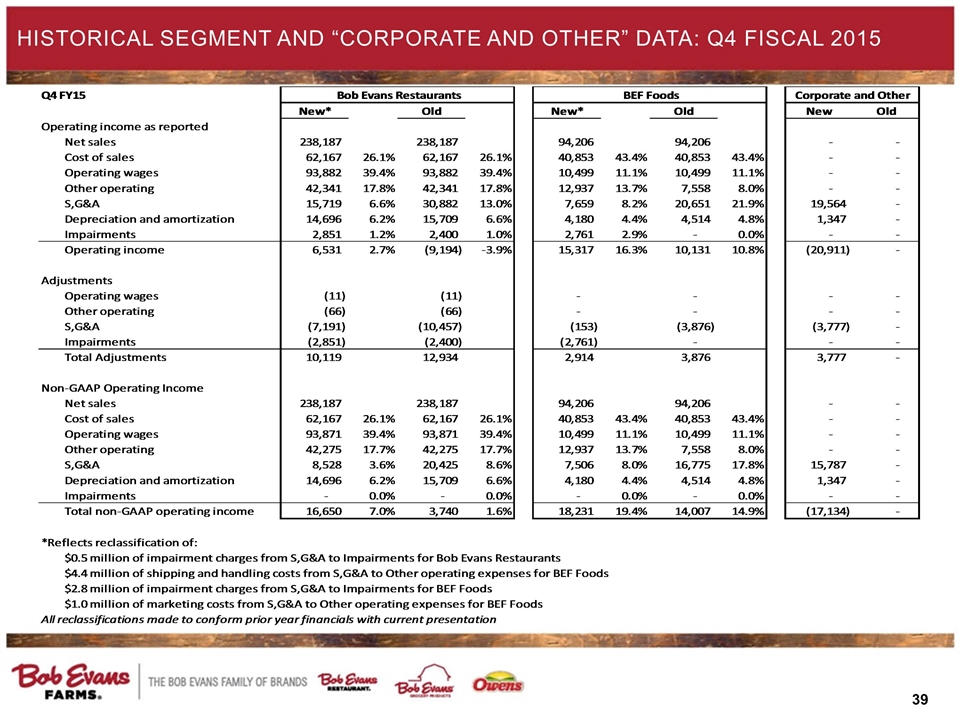

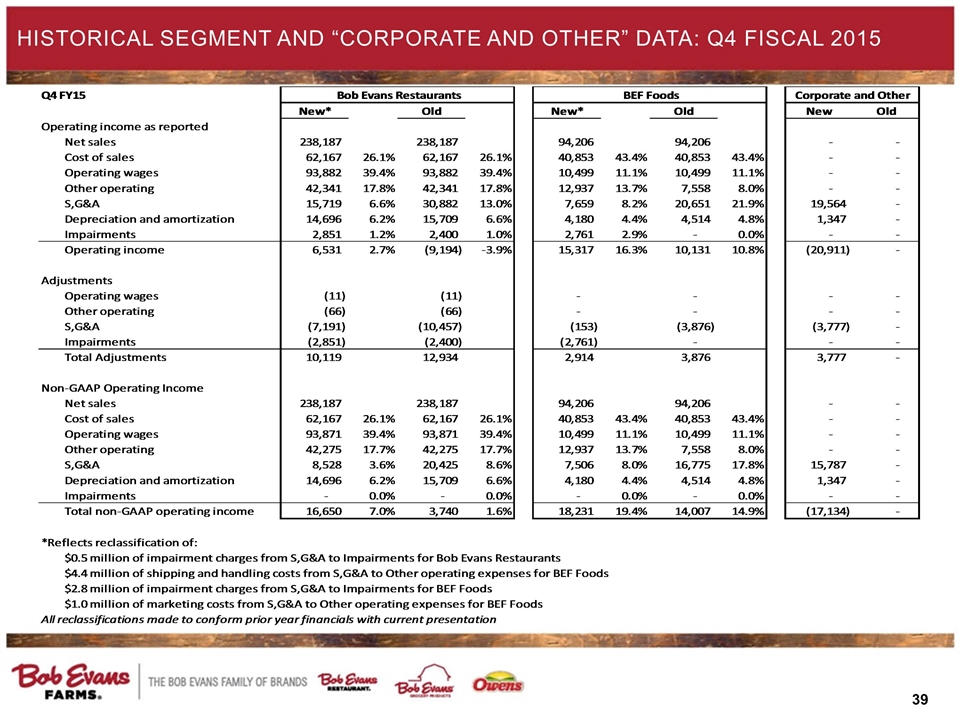

Historical segment and “Corporate and Other” data: Q4 Fiscal 2015

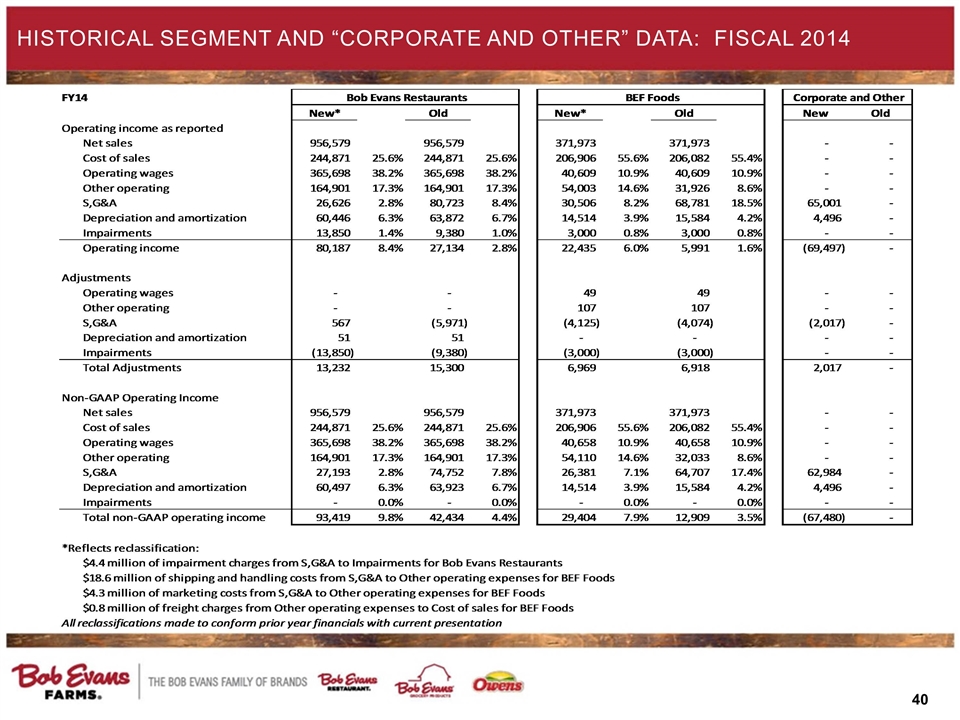

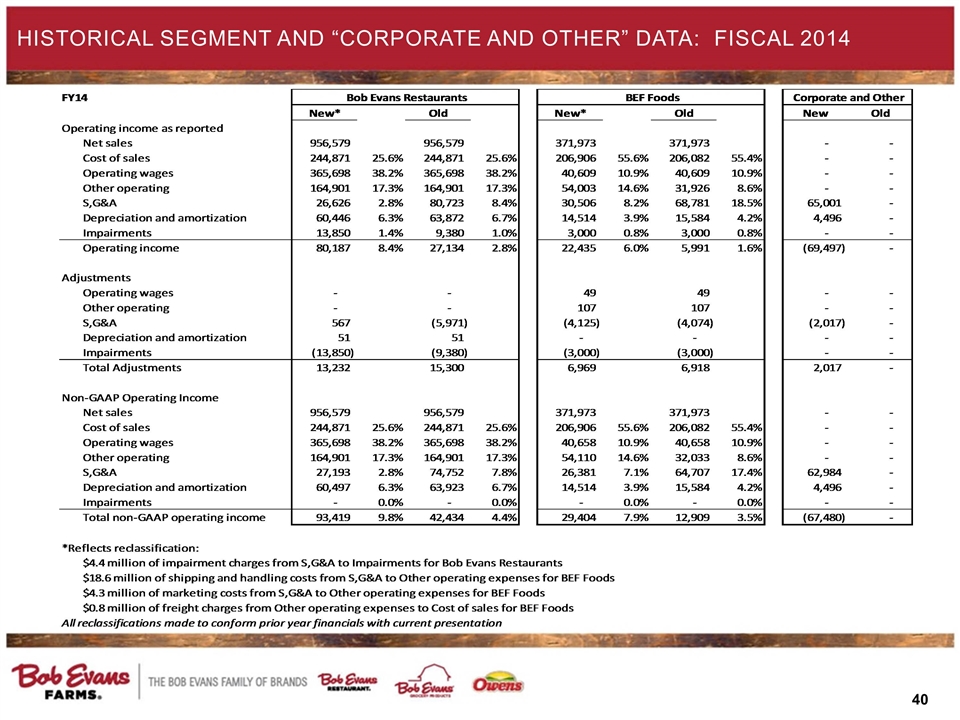

Historical segment and “Corporate and Other” data: Fiscal 2014