SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☐ Filed by a party other than the Registrant ☒

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting material pursuant to §240.14a-12 |

Bob Evans Farms, Inc.

(Name of Registrant as Specified In Its Charter)

Post Holdings, Inc.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing party: |

| | (4) | | Date Filed: |

The following is an investor presentation of Post Holdings, Inc. (“Post”) in connection with the announcement on September 19, 2017 of a definitive agreement in which Post will acquire Bob Evans Farms, Inc.

POST HOLDINGS, INC. Post Holdings to Acquire Bob Evans Farms September 19, 2017 Filed by Post Holdings, Inc. Pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Bob Evans Farms, Inc. Commission File No.: 0-1667

POST HOLDINGS Cautionary Statement Regarding Forward-Looking Statements Certain matters discussed in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are made based on known events and circumstances at the time of release, and as such, are subject to uncertainty and changes in circumstances. These forward-looking statements include, among others, statements regarding Post Holdings, Inc.’s (“Post” or the “Company”) fiscal 2017 forecasted Adjusted EBITDA (including Weetabix Limited (“Weetabix”) on an annualized basis), expected synergies and benefits of the acquisitions of Bob Evans Farms, Inc. (“Bob Evans”) and Weetabix, expected sources of financing, expectations about future business plans, prospective performance and opportunities, stockholder and regulatory approvals, the expected timing of completion of the transaction and Post’s free cash flow illustrative calculation. These statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “potential,” “continues,” “plans,” “forecasts,” “estimates,” “projects,” “predicts,” “would,” “intends,” “anticipates,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all statements regarding future performance, earnings projections, events or developments. There is no assurance that the acquisition of Bob Evans by Post will be consummated and there are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made herein. THESE RISKS AND UNCERTAINTIES INCLUDE, BUT ARE NOT LIMITED TO, THE FOLLOWING: the occurrence of any event, change or other circumstances that could delay the closing of the proposed transaction; the possibility of non-consummation of the proposed transaction and termination of the merger agreement; the ability and timing to obtain the approval of Bob Evans’ stockholders and required regulatory approvals and to satisfy other closing conditions to the merger agreement; the risk that stockholder litigation in connection with the proposed transaction may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; adverse effects on Post’s common stock or Bob Evans’ common stock because of the failure to complete the proposed transaction; Post’s or Bob Evans’ respective businesses experiencing disruptions from ongoing business operations due to transaction-related uncertainty or other factors making it more difficult than expected to maintain relationships with employees, business partners or governmental entities, both before and following consummation of the transaction; Post and Bob Evans being unable to promptly and effectively implement integration strategies and obtain expected cost savings and synergies within the expected timeframe; Post’s ability to retain certain key employees at Bob Evans; Significant transaction costs which have been and may continue to be incurred related to the proposed transaction; Post’s high leverage, Post’s ability to obtain additional financing (including both secured and unsecured debt), and Post’s ability to service its outstanding debt (including covenants that restrict the operation of its business); Post’s ability to promptly and effectively integrate the Weetabix business and obtain expected cost savings and synergies within the expected timeframe; Post’s ability to continue to compete in its product markets and its ability to retain its market position; Post’s ability to anticipate and respond to changes in consumer preferences and trends and introduce new products; Post’s ability to identify, complete and integrate acquisitions and manage its growth; changes in Post’s or Bob Evans’ management, financing and business operations; significant volatility in the costs of certain raw materials, commodities, packaging or energy used to manufacture Post’s or Bob Evans’ products; impairment in the carrying value of goodwill or other intangibles; Post’s or Bob Evans’ ability to successfully implement business strategies to reduce costs;

POST HOLDINGS Cautionary Statement Regarding Forward-Looking Statements (Cont’d) (CONTINUED FROM PRIOR PAGE): Post’s or Bob Evans’ ability to comply with increased regulatory scrutiny related to certain of their respective products and/or international sales; allegations that Post’s or Bob Evans’ products cause injury or illness, product recalls and product liability claims and other litigation; legal and regulatory factors, including advertising and labeling laws, changes in food safety and laws and regulations governing animal feeding and housing operations; the ultimate impact litigation may have on Post or Bob Evans; the loss or bankruptcy of a significant customer; consolidations in the retail grocery and foodservice industries; the ability of Post’s private label products to compete with nationally branded products; disruptions or inefficiencies in supply chain; Post’s or Bob Evans’ reliance on third party manufacturers for certain of their respective products; changes in economic conditions, disruptions in the U.S. and global capital and credit markets, and fluctuations in foreign currency exchange rates; changes in estimates in critical accounting judgments and changes to or new laws and regulations affecting Post’s or Bob Evans’ business; the impact of the United Kingdom’s exit from the European Union (commonly known as “Brexit”) on Post or Bob Evans and their respective operations; changes in weather conditions, natural disasters, disease outbreaks and other events beyond Post’s or Bob Evans’ control; loss of key employees, labor strikes, work stoppages or unionization efforts; losses or increased funding and expenses related to Post’s or Bob Evans’ qualified pension and other post-retirement plans; business disruptions caused by information technology failures and/or technology hacking; Post’s or Bob Evans’ ability to protect their respective intellectual property and other assets; Post’s ability to successfully operate its international operations in compliance with applicable laws and regulations; significant differences in Post’s or Bob Evans’ actual operating results from their respective guidance regarding their respective future performance; Post’s or Bob Evans’ ability to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, including with respect to acquired businesses; and other risks and uncertainties described in Post’s and Bob Evans’ filings with the Securities and Exchange Commission. Post and Bob Evans caution readers not to place undue reliance on any forward-looking statements. These forward-looking statements represent Post’s and Bob Evans’ judgment as of the date of this presentation, and Post and Bob Evans undertake no obligation to update or revise them unless otherwise required by law.

POST HOLDINGS Additional Information Additional Information and Where to Find It In connection with the proposed merger, Bob Evans intends to file a preliminary proxy statement on Schedule 14A with the Securities and Exchange Commission (the “SEC”). BOB EVANS STOCKHOLDERS ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS, INCLUDING ANY DEFINITIVE PROXY STATEMENT, FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The definitive proxy statement will be mailed to stockholders of Bob Evans. Investors and security holders will be able to obtain the documents (when they become available) free of charge at the SEC’s website, http://www.sec.gov. In addition, stockholders may obtain free copies of the documents (when they become available) at the Bob Evans website, www.bobevansgrocery.com, under the heading “Investors.” Participants in the Solicitation Bob Evans, Post and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Bob Evans in connection with the proposed merger. Information regarding Post’s directors and executive officers is included in Post’s Annual Report on Form 10-K for the year ended September 30, 2016, filed with the SEC on November 18, 2016 and the proxy statement for Post’s 2017 Annual Meeting of Shareholders, filed with the SEC on December 8, 2016. Information regarding Bob Evans’ directors and executive officers is included in the Bob Evans Annual Report on Form 10-K for the fiscal year ended April 28, 2017, filed with the SEC on June 15, 2017 and the proxy statement for Bob Evans’ 2017 Annual Meeting of Stockholders, filed with the SEC on July 14, 2017. Additional information regarding the interests of such participants in the solicitation of proxies in respect of the proposed merger will be included in the proxy statement and other relevant materials to be filed with the SEC when they become available.

Additional Information (Cont’d) POST HOLDINGS 5 Non-GAAP Financial Measures While the Company reports financial results in accordance with accounting principles generally accepted in the U.S., this presentation includes the non-GAAP measures Adjusted EBITDA for Post on a forecast basis and free cash flow, neither of which is in accordance with or a substitute for GAAP measures. Adjusted EBITDA is a non-GAAP measure which represents earnings before interest, income taxes, depreciation, amortization and other adjustments. Because Post discusses free cash flow in this presentation only in relation to management’s expectations of the future effect of the Bob Evans transaction on this non-GAAP measure, Post has not, for the reasons discussed below, provided a reconciliation of its forward-looking free cash flow expectations to the mostly directly comparable GAAP measures. Management uses certain non-GAAP measures, including Adjusted EBITDA and free cash flow, as key metrics in the evaluation of underlying Company and segment performance, in making financial, operating and planning decisions, and, in part, in the determination of cash bonuses for its executive officers and employees. Management believes the use of non-GAAP measures, including Adjusted EBITDA and free cash flow, provides increased transparency and assists investors in understanding the underlying operating performance of the Company and its segments and in the analysis of ongoing operating trends. Post considers Adjusted EBITDA an important supplemental measure of performance and ability to service debt. Adjusted EBITDA is often used to assess performance because it allows comparison of operating performance on a consistent basis across periods by removing the effects of various items. Adjusted EBITDA has various limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of results as reported under GAAP. Post provides its fiscal year 2017 Adjusted EBITDA guidance and discloses its expectations as to the effect of the Bob Evans and Weetabix transactions on Post’s Adjusted EBITDA, including the expected annual contribution of Bob Evans and Weetabix, and free cash flow only on a non-GAAP basis and does not provide a reconciliation of its forward-looking Adjusted EBITDA non-GAAP guidance measures to the most directly comparable GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for non-cash mark-to-market adjustments and cash settlements on interest rate and cross-currency swaps, provision for legal settlement, net foreign currency gains for purchase price of acquisition, transaction and integration costs, restructuring and plant closure costs, assets held for sale, mark-to-market adjustments on commodity hedges and other charges reflected in the Company’s reconciliation of historical numbers, the amounts of which, based on historical experience, could be significant.

Additional Information (Cont’d) POST HOLDINGS 6 Prospective Financial Information The prospective financial information provided in this presentation regarding Post’s and Bob Evans’ future performance, including Post’s expected Adjusted EBITDA for fiscal 2017 (inclusive of Weetabix), Bob Evans’ expected contribution to Post’s Adjusted EBITDA on an annual basis, and specific dollar amounts and other plans, expectations, estimates and similar statements, represents Post management’s estimates as of the date of this presentation only and are qualified by, and subject to, the assumptions and the other information set forth on the slide captioned “Forward-Looking Statements.” The estimated 2017 Adjusted EBITDA for Post (inclusive of Weetabix), Bob Evans’ expected contribution to Post’s Adjusted EBITDA on an annual basis, and the dollar amounts and other plans, expectations, estimates and similar statements contained in this presentation are based upon a number of assumptions and estimates that, while presented with numerical specificity, are inherently subject to business, economic and competitive uncertainties and contingencies, many of which are beyond Post’s and Bob Evans’ control, are based upon specific assumptions with respect to future business decisions, some of which will change, and are necessarily speculative in nature. It can be expected that some or all of the assumptions of the estimates furnished by Post or Bob Evans will not materialize or will vary significantly from actual results. Accordingly, the information set forth herein is only an estimate of what management believes is realizable as of the date hereof, and actual results will vary from the estimates set forth herein. Investors should also recognize that the reliability of any forecasted financial data diminishes the farther in the future that the data is forecast. In light of the foregoing, investors are urged to put the estimated 2017 Adjusted EBITDA for Post (inclusive of Weetabix), Bob Evans’ expected contribution to Post’s Adjusted EBITDA on an annual basis, and other prospective financial information in context and not to place undue reliance on them. The estimated fiscal 2017 Adjusted EBITDA for Post (inclusive of Weetabix) and Bob Evans’ expected contribution to Post’s Adjusted EBITDA on an annual basis are not prepared with a view toward compliance with published guidelines of the American Institute of Certified Public Accountants, and none of Post’s or Bob Evans’ independent registered public accounting firms nor any other independent expert or outside party compiles or examines these estimates and, accordingly, no such person expresses any opinion or any other form of assurance with respect thereto. The estimated 2017 Adjusted EBITDA for Post (inclusive of Weetabix) is stated as the mid-point of Post’s fiscal year 2017 guidance range, which is intended to provide a sensitivity analysis as variables are changed but it is not intended to represent that actual results could not fall outside of the estimated range. Any failure to successfully implement Post’s operating strategy or the occurrence of any of the events or circumstances set forth under “Forward-Looking Statements” could result in the actual operating results being different than the estimates set forth herein, and such differences may be adverse and material.

Additional Information (Cont’d) POST HOLDINGS Market and Industry Data This presentation includes industry and trade association data, forecasts and information that were prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys and other independent sources available to the Company. Some data also is based on Post’s good faith estimates, which are derived from management’s knowledge of the industry and from independent sources. These third-party publications and surveys generally state that the information included therein has been obtained from sources believed to be reliable, but that the publications and surveys can give no assurance as to the accuracy or completeness of such information. Post has not independently verified any of the data from third-party sources nor has it ascertained the underlying economic assumptions on which such data are based. Similarly, Post believes its internal research is reliable, even though such research has not been verified by any independent sources and Post cannot guarantee its accuracy or completeness. Post’s market share data is based on information from Nielsen Expanded All Outlets Combined (“xAOC”) or ACNielsen. Trademarks and Service Marks The logos, trademarks, trade names and service marks mentioned in this presentation, including Post®, Honey Bunches of Oats®, Pebbles™, Post Selects®, Great Grains®, Post® Shredded Wheat, Golden Crisp®, Alpha-Bits®, Spoon Size® Shredded Wheat, Post® Raisin Bran, Grape-Nuts®, Honeycomb®, Oh!s™, Shreddies™, Malt-O-Meal®, Farina®, Dyno-Bites®, MOM’s Best®, Better Oats™, CoCo Wheats™, Attune®, Uncle Sam®, Erewhon®, Golden Temple™, Peace Cereal®, Sweet Home Farm®, Willamette Valley Granola Company™, Weetabix®, Alpen®, Barbara’s®, Puffins®, Snackimals™, Weetos™, Ready Brek™, Weetabix On The Go™, Oatbix™, Premier Protein®, Joint Juice®, PowerBar®, Dymatize®, Supreme Protein®, Papetti’s®, All Whites®, Better’n Eggs®, Easy Eggs®, Emulsa™, Table Ready™, Davidson’s Safest Choice™, Abbotsford Farms®, Simply Potatoes®, Diner’s Choice™, Crystal Farms®, Crescent Valley™, Westfield Farms®, David’s Deli™ and Dreamfields® brands are currently the property of, or are under license by, Post or its subsidiaries.

Transaction Summary Post Holdings, Inc. (“Post”) to acquire Bob Evans Farms (“Bob Evans”), a leader in refrigerated side dishes, for $77.00 per share, approximately $1.5bn in equity value Bob Evans became a pure-play refrigerated sides, breakfast sausage and frozen food company following its sale of Bob Evans restaurants in May 2017 Refrigerated side dishes have delivered a 14% volume CAGR from 2012-2017 Significant white space to drive continued organic growth Substantial value creation potential Meaningful cost synergies Significant opportunity for growth as transaction increases Post’s exposure to on-trend ‘perimeter of store’ categories Purchase price represents adjusted EBITDA multiple of 15.4x1 and synergy adjusted EBITDA multiple of 12.5x1 Transaction expected to be accretive to top-line growth, Adjusted EBITDA margins, and free cash flow profile Mike Townsley, current President and CEO of Bob Evans, will continue to lead Bob Evans within Post Transaction is expected to be financed with cash on hand and through borrowings under Post’s existing revolving credit facility Pro forma adjusted leverage of ~6.0x Expected closing in the second quarter of Post’s 2018 fiscal year (first calendar quarter of 2018), subject to regulatory approvals and other conditions Based on Post management estimate of Bob Evans forecasted adjusted EBITDA of $107mm on an annual basis (which is the mid-point of Bob Evans management adjusted EBITDA guidance for FY2018) and expected run-rate cost synergies of $25mm. Please refer to “Additional Information – Prospective Financial Information” and “Additional Information – Non-GAAP Financial Measures.” POST HOLDINGS 8

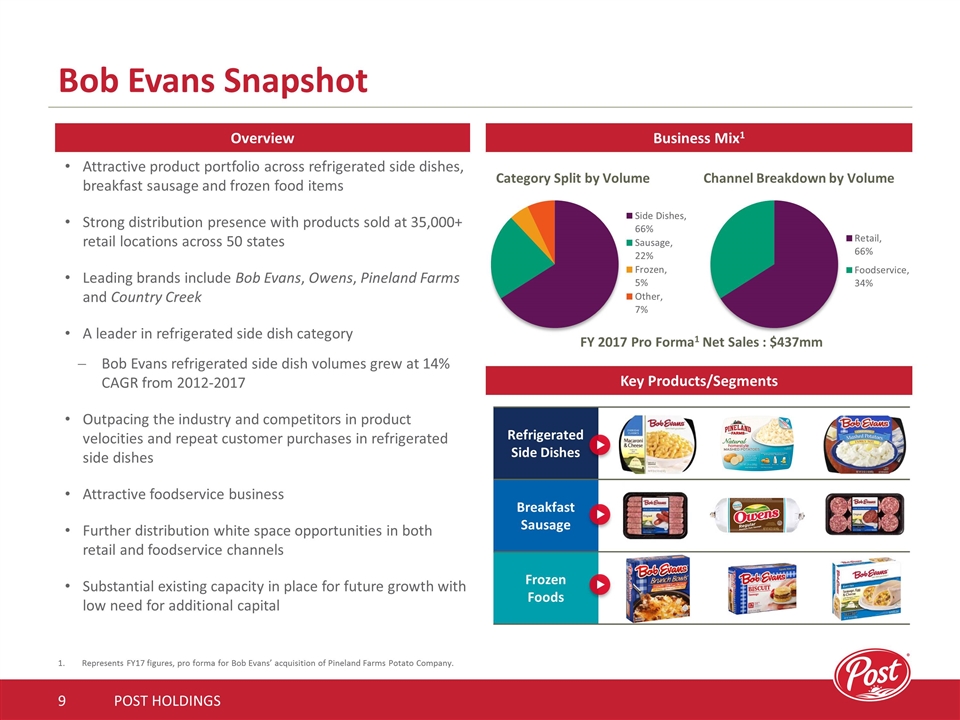

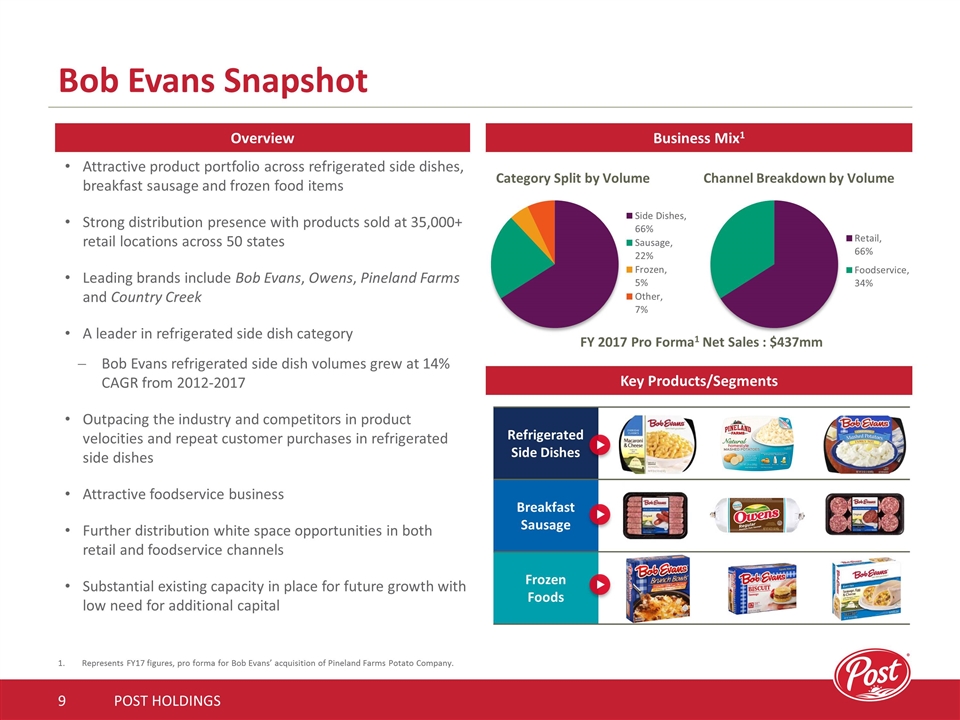

Attractive product portfolio across refrigerated side dishes, breakfast sausage and frozen food items Strong distribution presence with products sold at 35,000+ retail locations across 50 states Leading brands include Bob Evans, Owens, Pineland Farms and Country Creek A leader in refrigerated side dish category Bob Evans refrigerated side dish volumes grew at 14% CAGR from 2012-2017 Outpacing the industry and competitors in product velocities and repeat customer purchases in refrigerated side dishes Attractive foodservice business Further distribution white space opportunities in both retail and foodservice channels Substantial existing capacity in place for future growth with low need for additional capital Refrigerated Side Dishes Breakfast Sausage Frozen Foods Bob Evans Snapshot POST HOLDINGS Business Mix1 Overview Key Products/Segments Represents FY17 figures, pro forma for Bob Evans’ acquisition of Pineland Farms Potato Company. FY 2017 Pro Forma1 Net Sales : $437mm Channel Breakdown by Volume Category Split by Volume

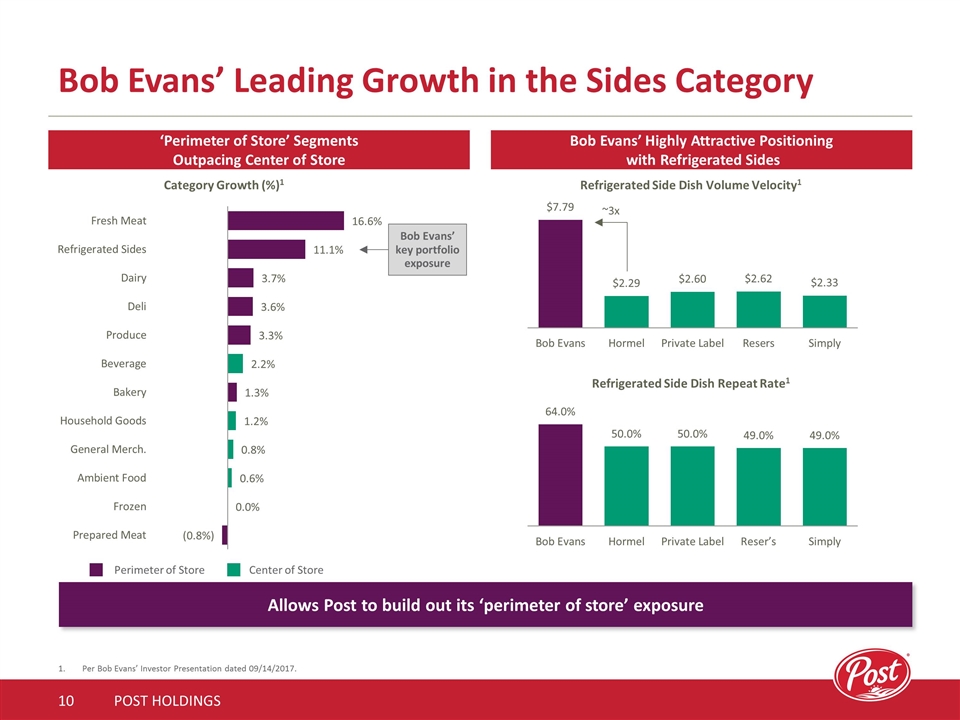

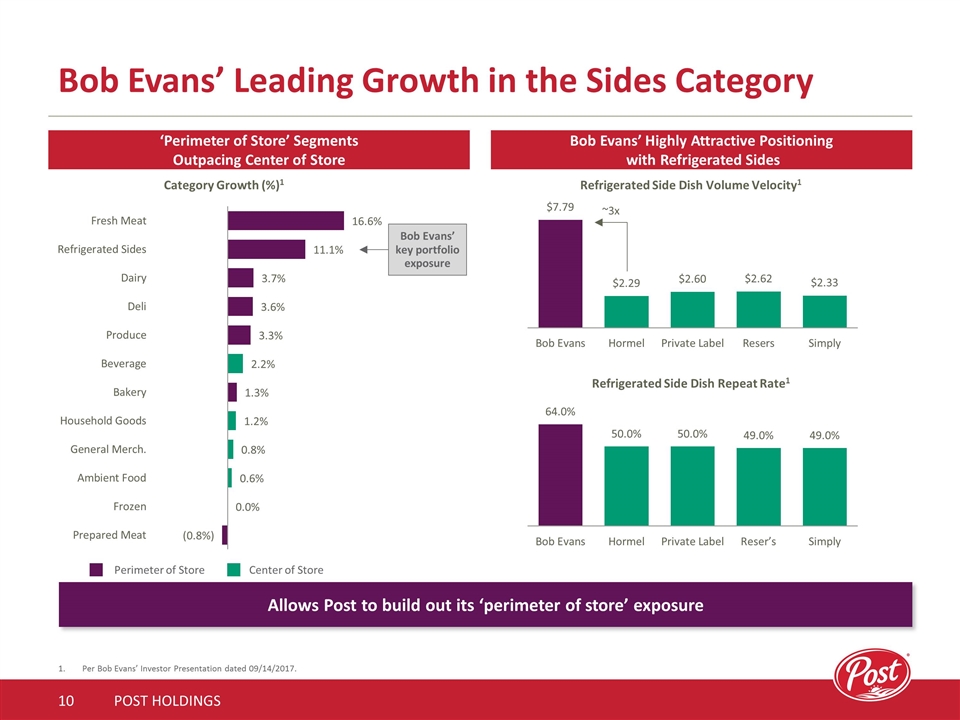

Bob Evans’ Leading Growth in the Sides Category POST HOLDINGS 10 ‘Perimeter of Store’ Segments Outpacing Center of Store Bob Evans’ Highly Attractive Positioning with Refrigerated Sides Per Bob Evans’ Investor Presentation dated 09/14/2017. Refrigerated Side Dish Volume Velocity1 Refrigerated Side Dish Repeat Rate1 Category Growth (%)1 Perimeter of Store Center of Store ~3x Allows Post to build out its ‘perimeter of store’ exposure Bob Evans’ key portfolio exposure

Bob Evans is Complementary to Post’s Existing Portfolio and Accelerates Strategic Objectives POST HOLDINGS Highly complementary to Post��s current retail and foodservice portfolios, primarily within the Michael Foods business Strengthens channel presence across both retail and foodservice Product portfolio aligned with on trend “heat and eat” and convenience themes Increased exposure to ‘perimeter of store’ Attractive growth category driven by secular consumer trends Acquisition to form the foundation of Post’s refrigerated retail platform with further expansion opportunities Expands Post’s branded portfolio mix Provides access to strong brands Bob Evans’ growth in sides faster than underlying category Category with extensive white space Well invested operational infrastructure to support future growth

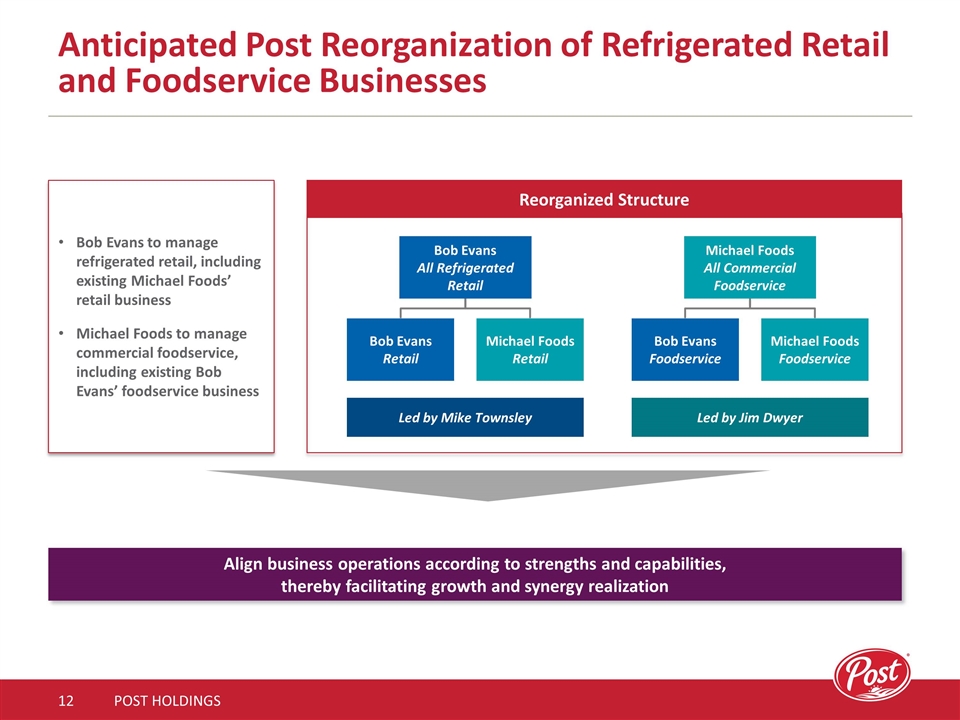

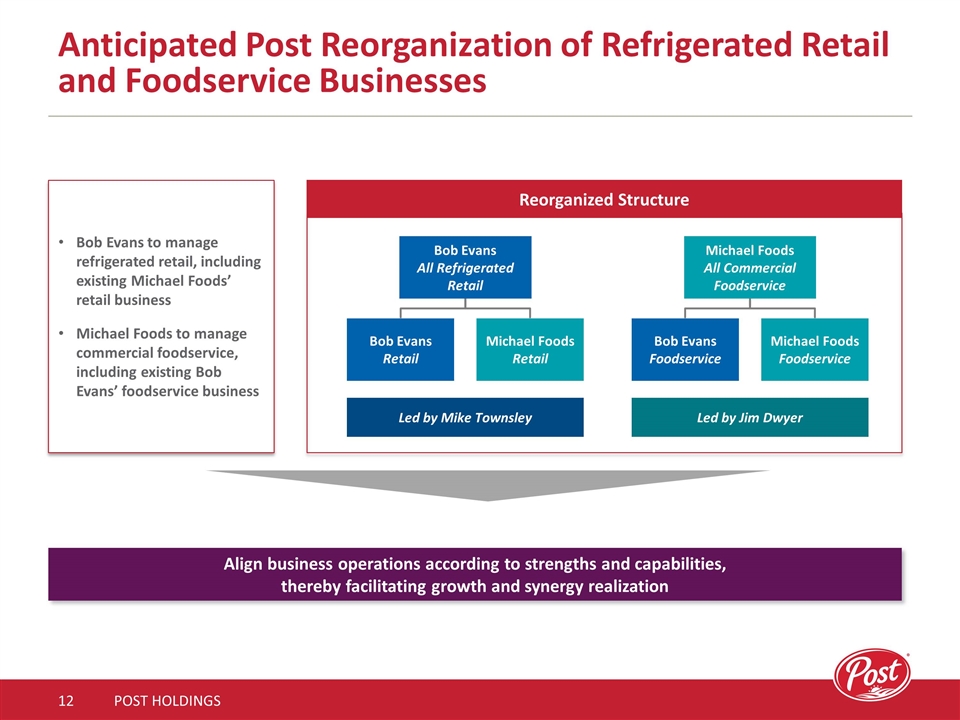

Anticipated Post Reorganization of Refrigerated Retail and Foodservice Businesses POST HOLDINGS Align business operations according to strengths and capabilities, thereby facilitating growth and synergy realization Michael Foods Bob Evans Current Current Reorganized Structure Michael Foods Retail Bob Evans Retail Michael Foods Food Service Bob Evans Food Service Bob Evans All Refrigerated Retail Bob Evans Retail Michael Foods Retail Bob Evans to manage refrigerated retail, including existing Michael Foods’ retail business Michael Foods to manage commercial foodservice, including existing Bob Evans’ foodservice business Michael Foods All Commercial Foodservice Bob Evans Foodservice Michael Foods Foodservice Led by Mike Townsley Led by Jim Dwyer

Attractive Financial Characteristics POST HOLDINGS Expected to be immediately accretive to all key financial metrics Top-line growth Adjusted EBITDA margins Free cash flow Clear line-of-sight to cost synergies $25mm expected run-rate cost synergies by third full fiscal year post-closing1 Additional upside growth opportunities Significant cross-selling opportunities across channel base Opportunity to drive further household penetration Attractive purchase price multiple given high growth, cash flow characteristics and synergy potential One-time costs to achieve synergies are estimated to be approximately $25mm.

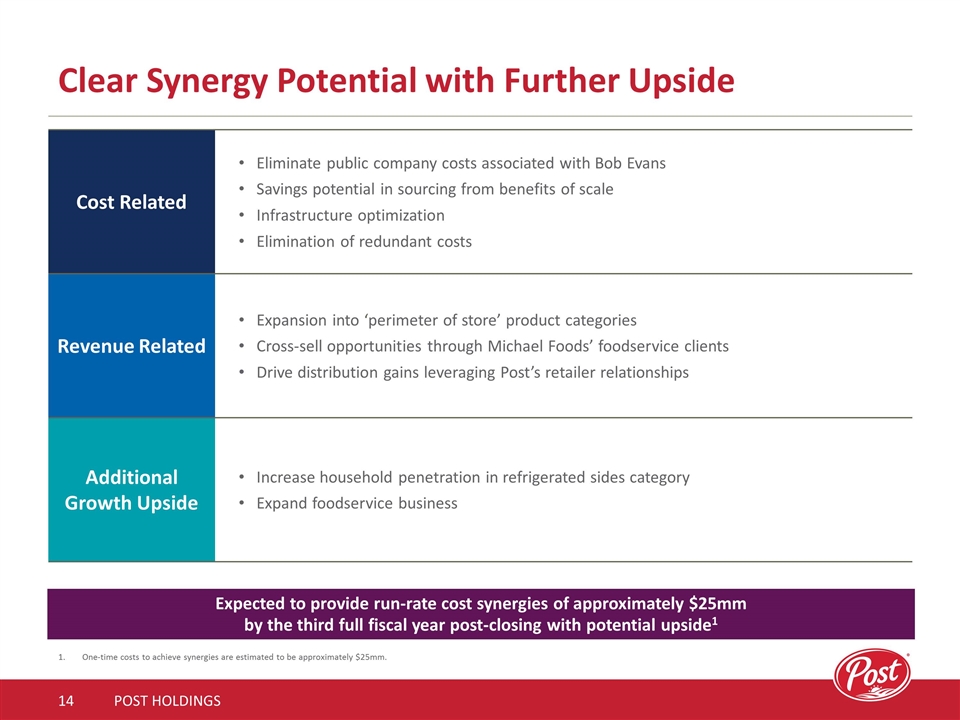

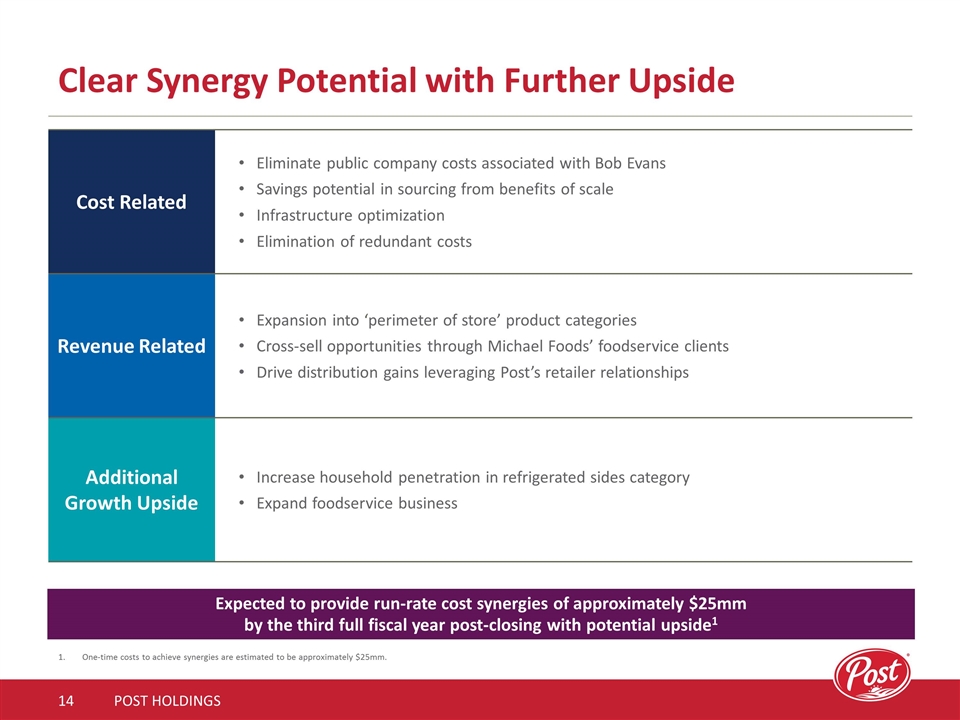

Clear Synergy Potential with Further Upside POST HOLDINGS Cost Related Eliminate public company costs associated with Bob Evans Savings potential in sourcing from benefits of scale Infrastructure optimization Elimination of redundant costs Revenue Related Expansion into ‘perimeter of store’ product categories Cross-sell opportunities through Michael Foods’ foodservice clients Drive distribution gains leveraging Post’s retailer relationships Additional Growth Upside Increase household penetration in refrigerated sides category Expand foodservice business Expected to provide run-rate cost synergies of approximately $25mm by the third full fiscal year post-closing with potential upside1 One-time costs to achieve synergies are estimated to be approximately $25mm.

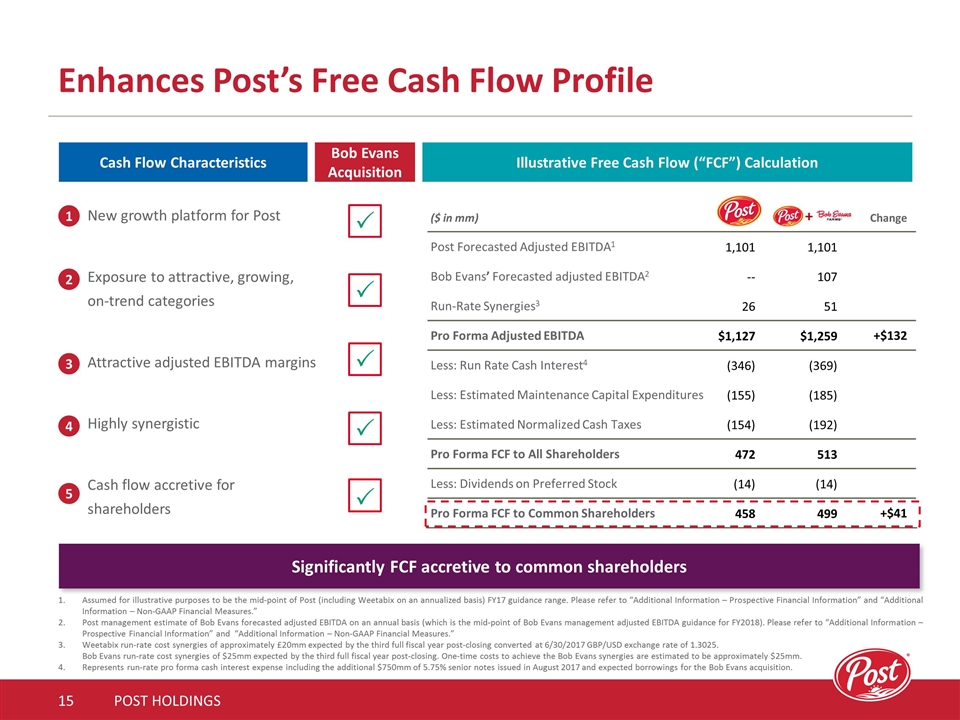

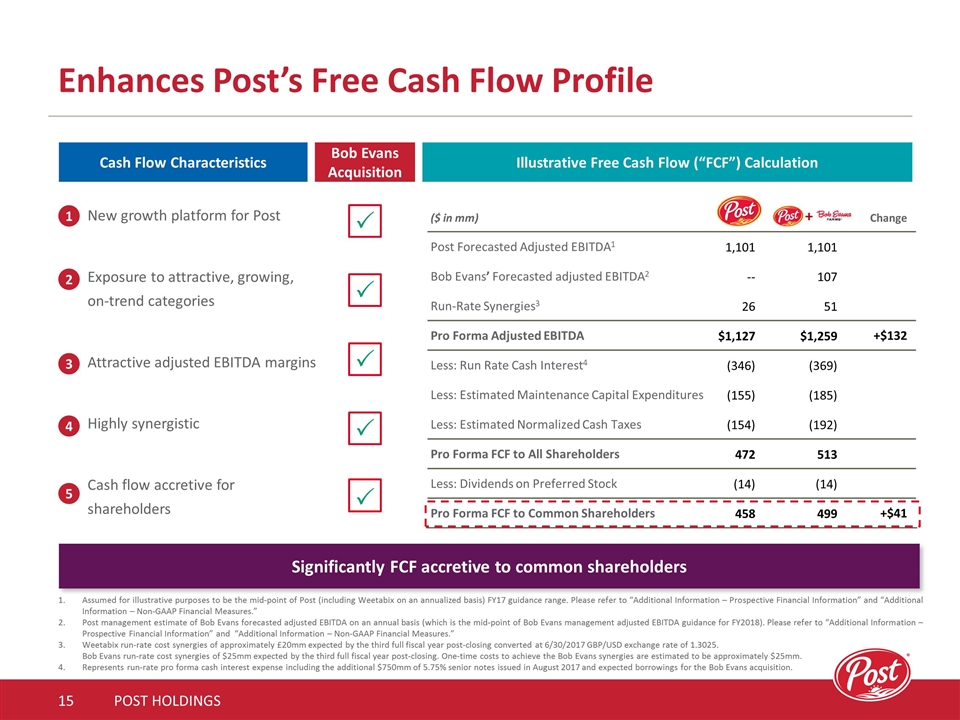

($ in mm) Change Post Forecasted Adjusted EBITDA1 1,101 1,101 Bob Evans’ Forecasted adjusted EBITDA2 -- 107 Run-Rate Synergies3 26 51 Pro Forma Adjusted EBITDA $1,127 $1,259 +$132 Less: Run Rate Cash Interest4 (346) (369) Less: Estimated Maintenance Capital Expenditures (155) (185) Less: Estimated Normalized Cash Taxes (154) (192) Pro Forma FCF to All Shareholders 472 513 Less: Dividends on Preferred Stock (14) (14) Pro Forma FCF to Common Shareholders 458 499 +$41 Enhances Post’s Free Cash Flow Profile POST HOLDINGS 15 Illustrative Free Cash Flow (“FCF”) Calculation Cash Flow Characteristics Bob Evans Acquisition New growth platform for Post Exposure to attractive, growing, on-trend categories Attractive adjusted EBITDA margins Highly synergistic Cash flow accretive for shareholders 1 2 3 4 5 P P P P P + Significantly FCF accretive to common shareholders Assumed for illustrative purposes to be the mid-point of Post (including Weetabix on an annualized basis) FY17 guidance range. Please refer to “Additional Information – Prospective Financial Information” and “Additional Information – Non-GAAP Financial Measures.” Post management estimate of Bob Evans forecasted adjusted EBITDA on an annual basis (which is the mid-point of Bob Evans management adjusted EBITDA guidance for FY2018). Please refer to “Additional Information – Prospective Financial Information” and “Additional Information – Non-GAAP Financial Measures.” Weetabix run-rate cost synergies of approximately £20mm expected by the third full fiscal year post-closing converted at 6/30/2017 GBP/USD exchange rate of 1.3025. Bob Evans run-rate cost synergies of $25mm expected by the third full fiscal year post-closing. One-time costs to achieve the Bob Evans synergies are estimated to be approximately $25mm. Represents run-rate pro forma cash interest expense including the additional $750mm of 5.75% senior notes issued in August 2017 and expected borrowings for the Bob Evans acquisition.

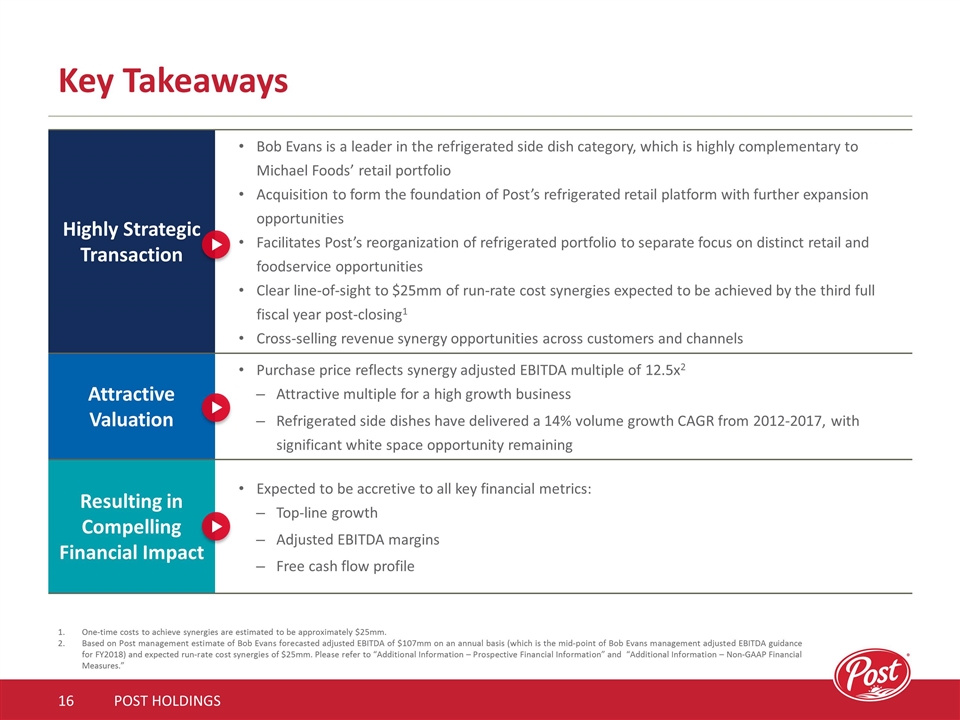

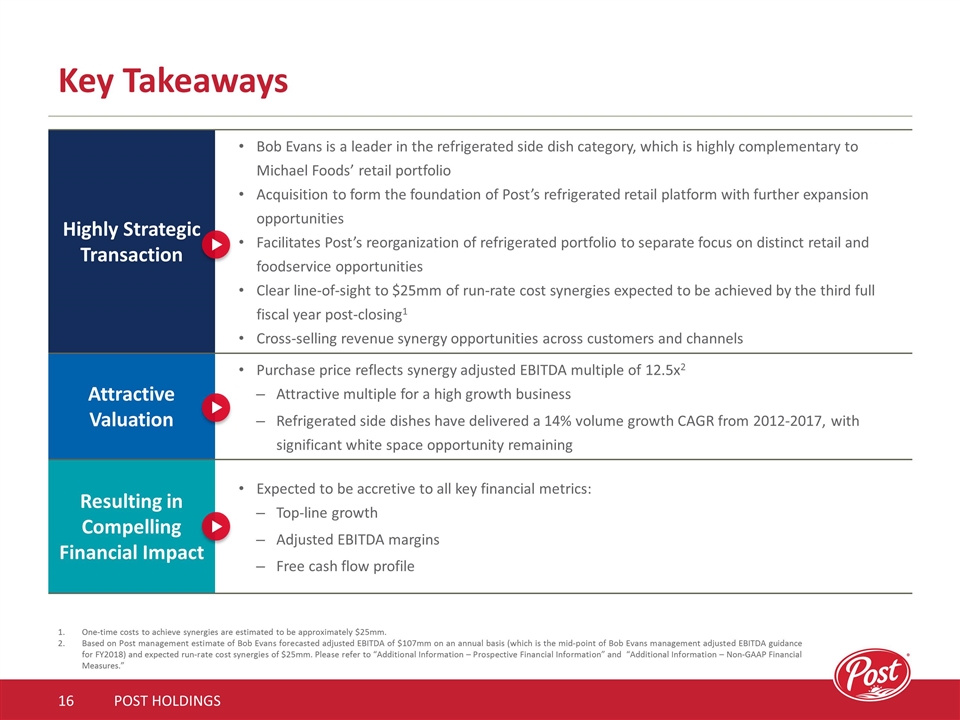

Key Takeaways POST HOLDINGS 16 Highly Strategic Transaction Bob Evans is a leader in the refrigerated side dish category, which is highly complementary to Michael Foods’ retail portfolio Acquisition to form the foundation of Post’s refrigerated retail platform with further expansion opportunities Facilitates Post’s reorganization of refrigerated portfolio to separate focus on distinct retail and foodservice opportunities Clear line-of-sight to $25mm of run-rate cost synergies expected to be achieved by the third full fiscal year post-closing1 Cross-selling revenue synergy opportunities across customers and channels Attractive Valuation Purchase price reflects synergy adjusted EBITDA multiple of 12.5x2 Attractive multiple for a high growth business Refrigerated side dishes have delivered a 14% volume growth CAGR from 2012-2017, with significant white space opportunity remaining Resulting in Compelling Financial Impact Expected to be accretive to all key financial metrics: Top-line growth Adjusted EBITDA margins Free cash flow profile One-time costs to achieve synergies are estimated to be approximately $25mm. Based on Post management estimate of Bob Evans forecasted adjusted EBITDA of $107mm on an annual basis (which is the mid-point of Bob Evans management adjusted EBITDA guidance for FY2018) and expected run-rate cost synergies of $25mm. Please refer to “Additional Information – Prospective Financial Information” and “Additional Information – Non-GAAP Financial Measures.”