SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☐ Filed by a party other than the Registrant ☒

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting material pursuant to §240.14a-12 |

Bob Evans Farms, Inc.

(Name of Registrant as Specified In Its Charter)

Post Holdings, Inc.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing party: |

| | (4) | | Date Filed: |

Filed by Post Holdings, Inc.

Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Bob Evans Farms, Inc.

Commission File No.: 0-1667

The following are (i) a letter from management of Michael Foods Group (“MFG”), a subsidiary of Post Holdings, Inc., to employees of MFG on September 19, 2017 and (ii) a presentation to MFG employees on September 19, 2017.

September 19, 2017

Dear Colleagues,

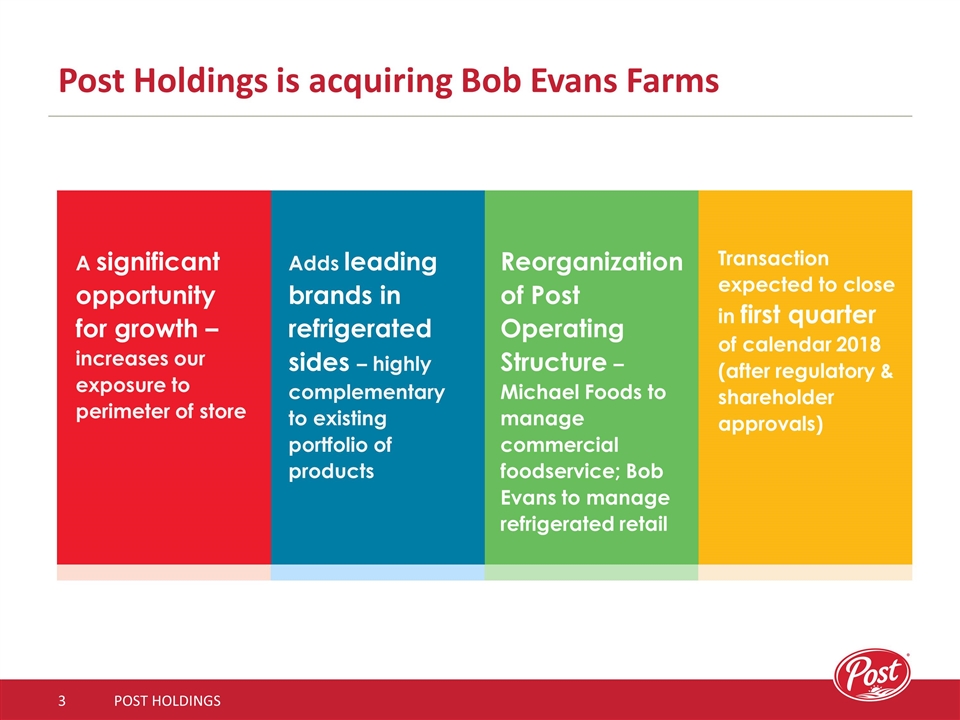

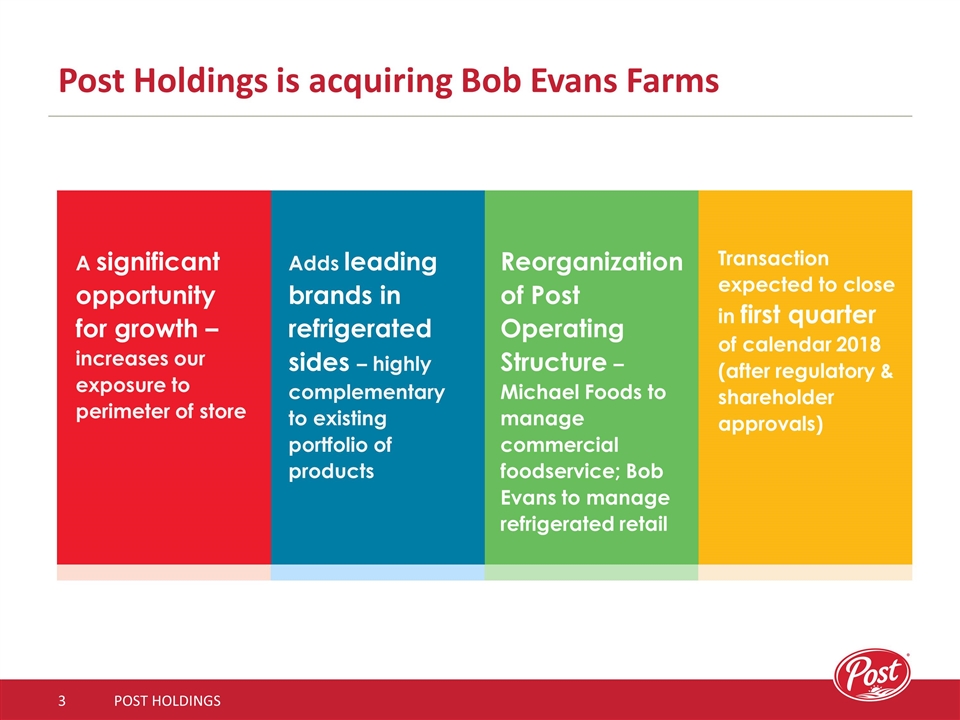

As indicated in Rob’s letter, Post Holdings today announced an agreement to acquire Bob Evans Farms. This combination presents great opportunities across Post and for Michael Foods. It will enable us to build on the distinct strengths and capabilities of our commercial foodservice and retail businesses and better position us to serve our customers and drive future growth.

WHAT’S NEXT?

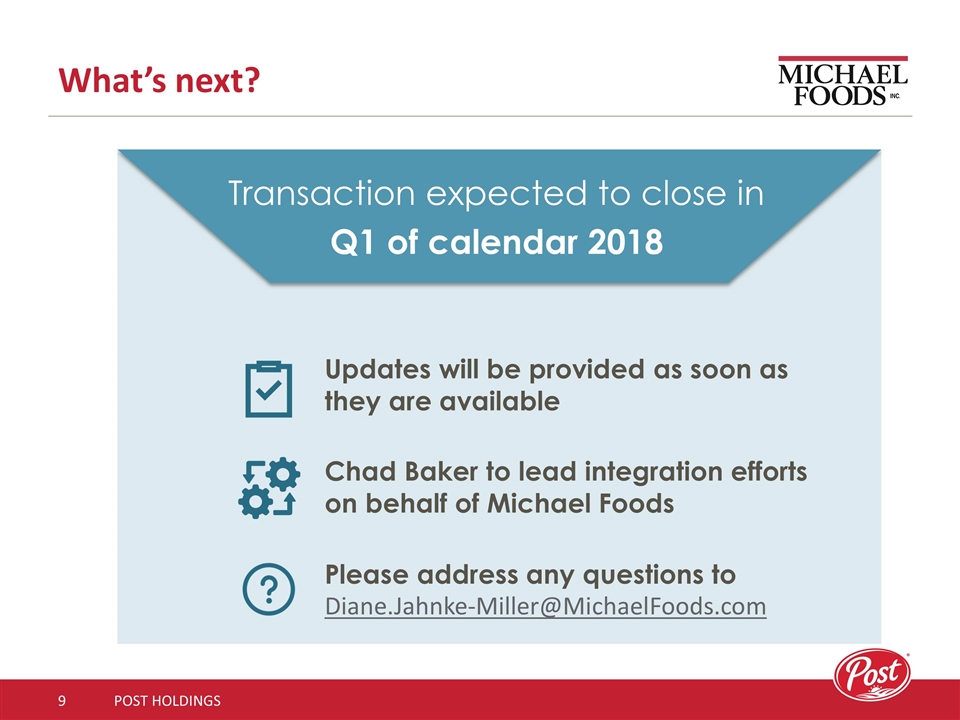

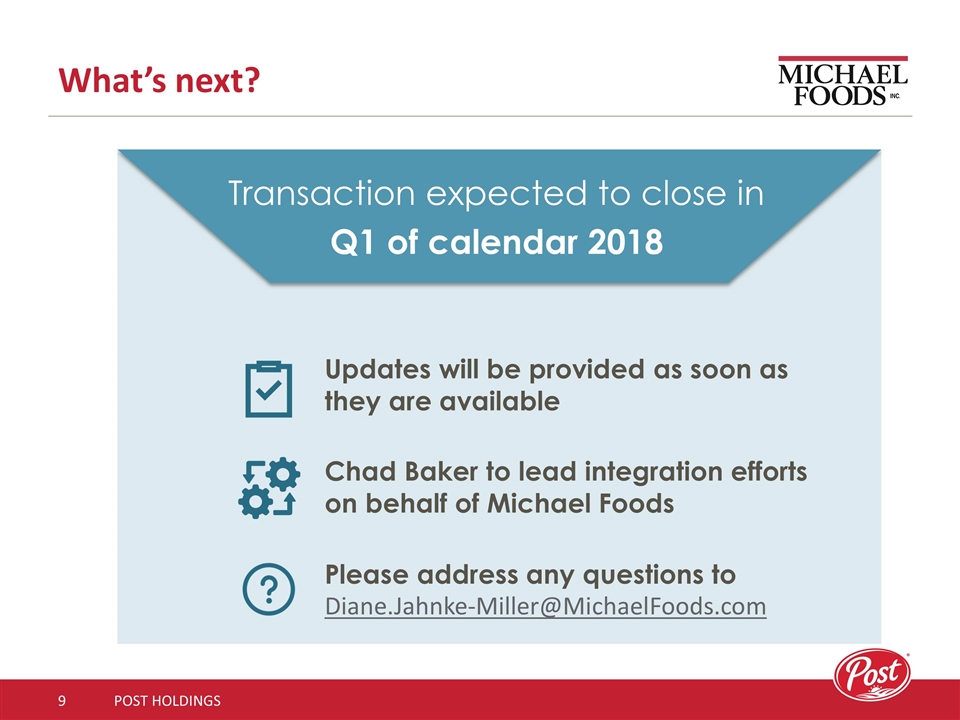

We expect the acquisition to be completed in the second quarter of our fiscal 2018 (the first calendar quarter of 2018), subject to customary regulatory review and approval by Bob Evans stockholders. Until then, nothing changes in the way we run our business. We have to focus on a strong finish to 2017 and a strong start to 2018. We will be establishing business integration teams to work through how the combination of businesses will operate and we will provide you with regular updates as the process progresses.

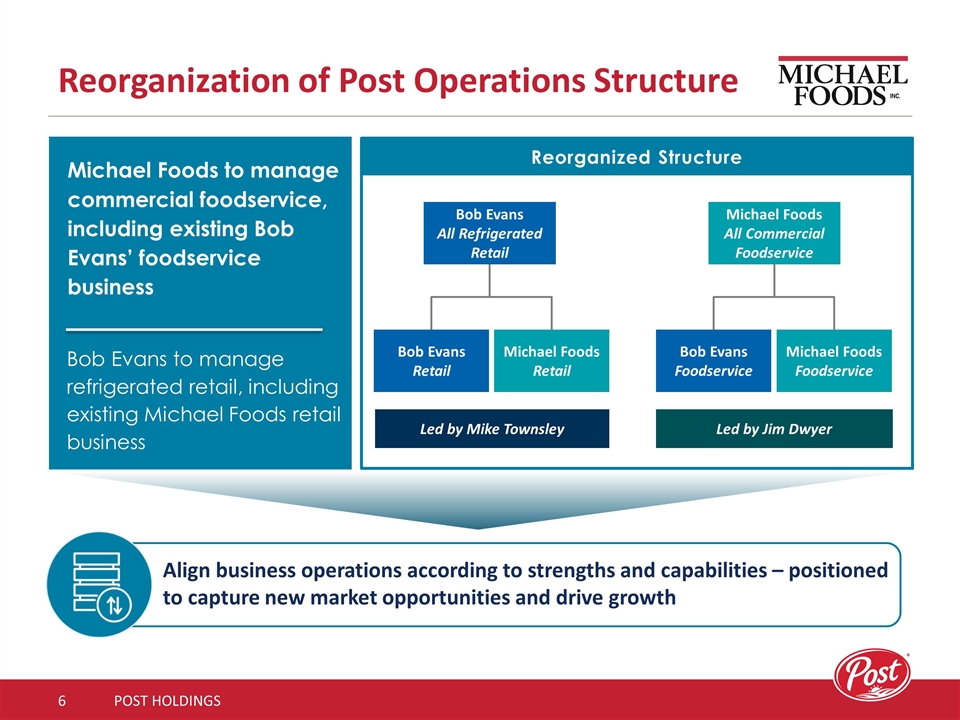

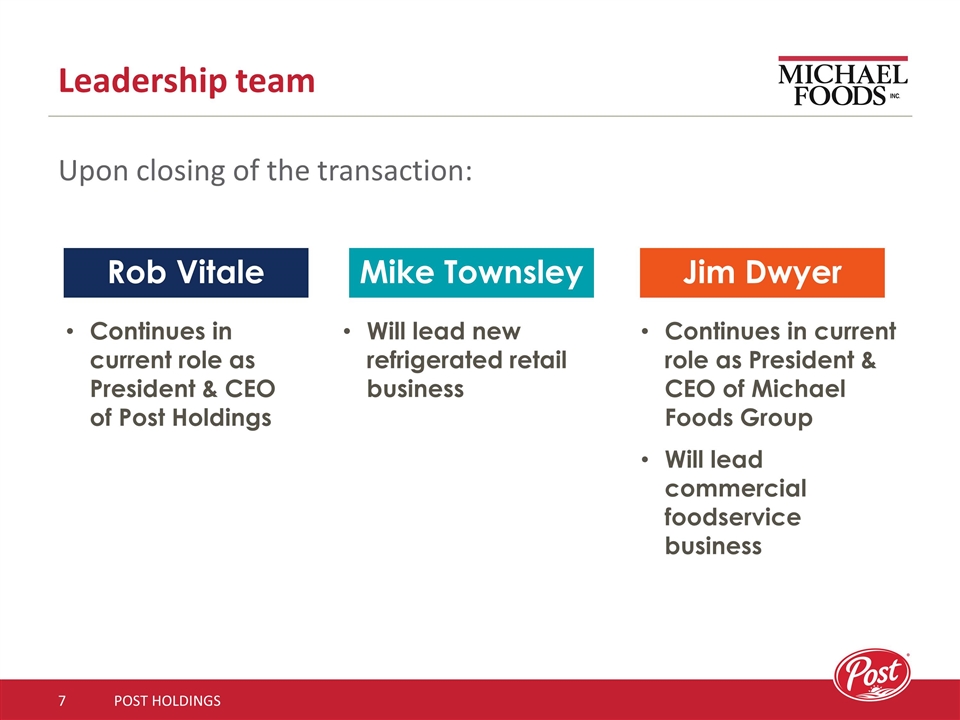

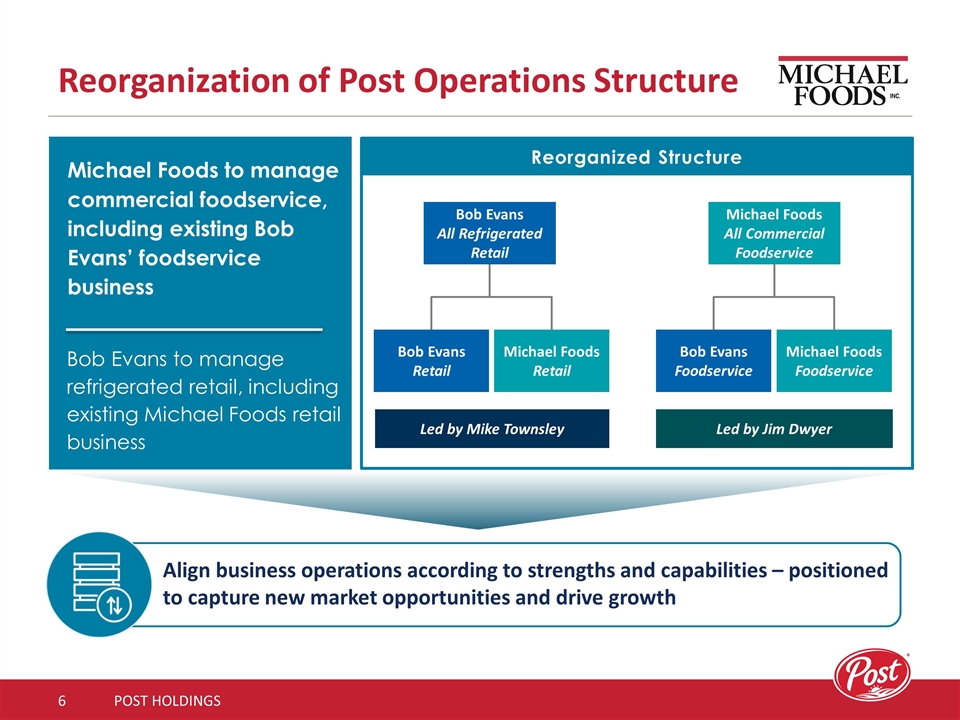

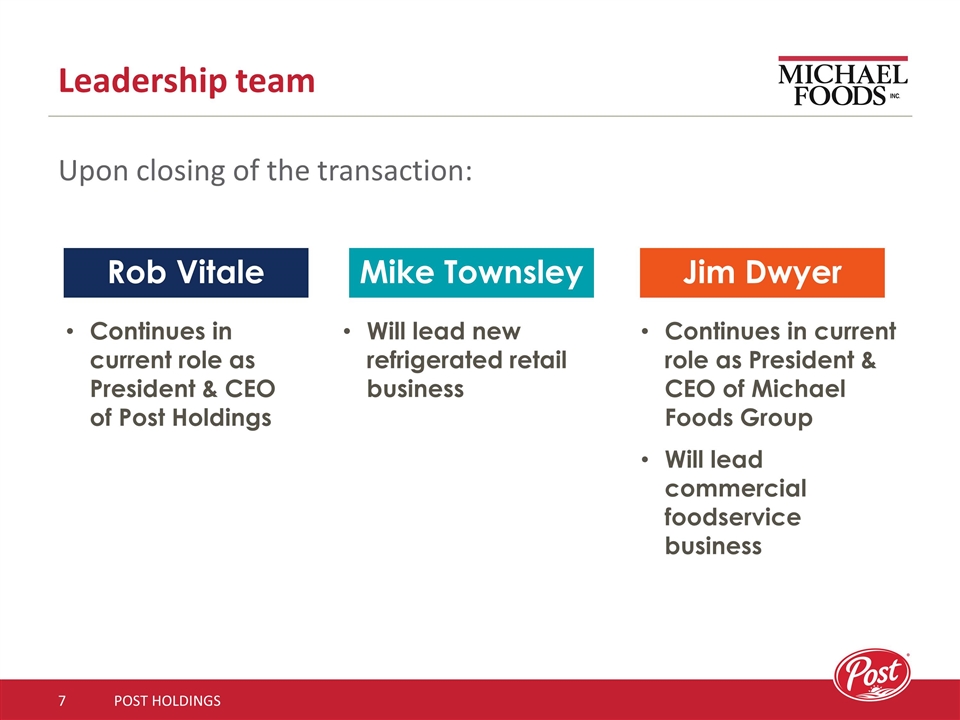

Once the acquisition is completed next year, the plan is to reorganize the Michael Foods Group and Bob Evans into two businesses – a refrigerated retail team and a commercial foodservice team. The retail business will be led by Mike Townsley, Bob Evans’ current President and CEO, and will include our existing retail refrigerated egg, potato and cheese businesses and Bob Evans’ retail business. I will lead the commercial foodservice business, which will include our existing commercial egg, potato and pasta businesses and Bob Evans’ foodservice business.

I know this announcement causes uncertainty. We will provide you with information on integration plans regularly over the coming months. Teams from Michael Foods and Bob Evans will manage the integration process and report to Mike Townsley and me. Chad Baker will lead Michael Foods’ integration team; we will begin building a cross functional team over the next several weeks.

I look forward to the town hall meeting we are having this morning where I’ll walk through today’s announcement and answer as many questions as I can. We are setting up a WebEx and dial in and there will be ways to ask questions if you are online or on the phone; watch email and/or the MFI portal for dial in info.

I look forward to sharing this exciting next stage in our growth with you.

Best regards,

Jim Dwyer

President and CEO, Michael Foods Group

Additional Information and Where to Find It

In connection with the proposed merger, Bob Evans intends to file a preliminary proxy statement on Schedule 14A with the Securities and Exchange Commission (the “SEC”). BOB EVANS STOCKHOLDERS ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS, INCLUDING ANY DEFINITIVE PROXY STATEMENT, FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The definitive proxy statement will be mailed to stockholders of Bob Evans. Investors and security holders will be able to obtain the documents (when they become available) free of charge at the SEC’s website, http://www.sec.gov. In addition, stockholders may obtain free copies of the documents (when they become available) at the Bob Evans website, www.bobevansgrocery.com, under the heading “Investors.”

Participants in the Solicitation

Bob Evans, Post and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Bob Evans in connection with the proposed merger. Information regarding Post’s directors and executive officers is included in Post’s Annual Report on Form10-K for the year ended September 30, 2016, filed with the SEC on November 18, 2016 and the proxy statement for Post’s 2017 Annual Meeting of Shareholders, filed with the SEC on December 8, 2016. Information regarding Bob Evans’ directors and executive officers is included in the Bob Evans Annual Report on Form10-K for the fiscal year ended April 28, 2017, filed with the SEC on June 15, 2017 and the proxy statement for Bob Evans’ 2017 Annual Meeting of Stockholders, filed with the SEC on July 14, 2017. Additional information regarding the interests of such participants in the solicitation of proxies in respect of the proposed merger will be included in the proxy statement and other relevant materials to be filed with the SEC when they become available.

Cautionary Statement Regarding Forward-Looking Statements

Certain matters discussed in this letter are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are made based on known events and circumstances at the time of release, and as such, are subject to uncertainty and changes in circumstances. These statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “potential,” “continues,” “plans,” “forecasts,” “estimates,” “projects,” “predicts,” “would,” “intends,” “anticipates,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all statements regarding future performance, earnings projections, events or developments. There is no assurance that the acquisition of Bob Evans by Post will be consummated and there are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made herein. The risks and uncertainties in connection with such forward-looking statements related to the proposed transaction include, but are not limited to, the occurrence of any event, change or other circumstances that could delay the closing of the proposed transaction; the possibility of non-consummation of the proposed transaction and termination of the merger agreement; the ability and timing to obtain the approval of Bob Evans’ stockholders and required regulatory approvals and to satisfy other closing conditions to the merger agreement; the risk that stockholder litigation in connection with the proposed transaction may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; adverse effects on Post’s common stock or Bob Evans’ common stock because of the failure to complete the proposed transaction; Post’s or Bob Evans’ respective businesses experiencing disruptions from ongoing business operations due to transaction-related uncertainty or other factors making it more difficult than expected to maintain relationships with employees, business partners or governmental entities, both before and following consummation of the transaction; Post and Bob Evans being unable to promptly and effectively implement integration strategies and obtain expected cost savings and synergies within the expected timeframe; Post’s ability to retain certain key employees at Bob Evans; significant transaction costs which have been and may continue to be incurred related to the proposed transaction; and other risks and uncertainties described in Post’s and Bob Evans’ filings with the Securities and Exchange Commission. Post and Bob Evans caution readers not to place undue reliance on any forward-looking statements. These forward-looking statements represent Post’s and Bob Evans’ judgment as of the date of this letter, and Post and Bob Evans undertake no obligation to update or revise them unless otherwise required by law.

Michael Foods Town Hall Acquisition of Bob Evans Farms September 19, 2017

POST HOLDINGS Additional Information Additional Information and Where to Find It In connection with the proposed merger, Bob Evans intends to file a preliminary proxy statement on Schedule 14A with the Securities and Exchange Commission (the “SEC”). BOB EVANS STOCKHOLDERS ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS, INCLUDING ANY DEFINITIVE PROXY STATEMENT, FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The definitive proxy statement will be mailed to stockholders of Bob Evans. Investors and security holders will be able to obtain the documents (when they become available) free of charge at the SEC’s website, http://www.sec.gov. In addition, stockholders may obtain free copies of the documents (when they become available) at the Bob Evans website, www.bobevansgrocery.com, under the heading “Investors.” Participants in the Solicitation Bob Evans, Post and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Bob Evans in connection with the proposed merger. Information regarding Post’s directors and executive officers is included in Post’s Annual Report on Form 10-K for the year ended September 30, 2016, filed with the SEC on November 18, 2016 and the proxy statement for Post’s 2017 Annual Meeting of Shareholders, filed with the SEC on December 8, 2016. Information regarding Bob Evans’ directors and executive officers is included in the Bob Evans Annual Report on Form 10-K for the fiscal year ended April 28, 2017, filed with the SEC on June 15, 2017 and the proxy statement for Bob Evans’ 2017 Annual Meeting of Stockholders, filed with the SEC on July 14, 2017. Additional information regarding the interests of such participants in the solicitation of proxies in respect of the proposed merger will be included in the proxy statement and other relevant materials to be filed with the SEC when they become available. Cautionary Statement Regarding Forward-Looking Statements Certain matters discussed in this presentation are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are made based on known events and circumstances at the time of release, and as such, are subject to uncertainty and changes in circumstances. These statements may be identified from the use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,” “potential,” “continues,” “plans,” “forecasts,” “estimates,” “projects,” “predicts,” “would,” “intends,” “anticipates,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and similar expressions, and include all statements regarding future performance, earnings projections, events or developments. There is no assurance that the acquisition of Bob Evans by Post will be consummated and there are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements made herein. The risks and uncertainties in connection with such forward-looking statements related to the proposed transaction include, but are not limited to, the occurrence of any event, change or other circumstances that could delay the closing of the proposed transaction; the possibility of non-consummation of the proposed transaction and termination of the merger agreement; the ability and timing to obtain the approval of Bob Evans’ stockholders and required regulatory approvals and to satisfy other closing conditions to the merger agreement; the risk that stockholder litigation in connection with the proposed transaction may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; adverse effects on Post’s common stock or Bob Evans’ common stock because of the failure to complete the proposed transaction; Post’s or Bob Evans’ respective businesses experiencing disruptions from ongoing business operations due to transaction-related uncertainty or other factors making it more difficult than expected to maintain relationships with employees, business partners or governmental entities, both before and following consummation of the transaction; Post and Bob Evans being unable to promptly and effectively implement integration strategies and obtain expected cost savings and synergies within the expected timeframe; Post’s ability to retain certain key employees at Bob Evans; significant transaction costs which have been and may continue to be incurred related to the proposed transaction; and other risks and uncertainties described in Post’s and Bob Evans’ filings with the Securities and Exchange Commission. Post and Bob Evans caution readers not to place undue reliance on any forward-looking statements. These forward-looking statements represent Post’s and Bob Evans’ judgment as of the date of this release, and Post and Bob Evans undertake no obligation to update or revise them unless otherwise required by law.

Post Holdings is acquiring Bob Evans Farms POST HOLDINGS A significant opportunity for growth – increases our exposure to perimeter of store Adds leading brands in refrigerated sides – highly complementary to existing portfolio of products Reorganization of Post Operating Structure – Michael Foods to manage commercial foodservice; Bob Evans to manage refrigerated retail Transaction expected to close in first quarter of calendar 2018 (after regulatory & shareholder approvals)

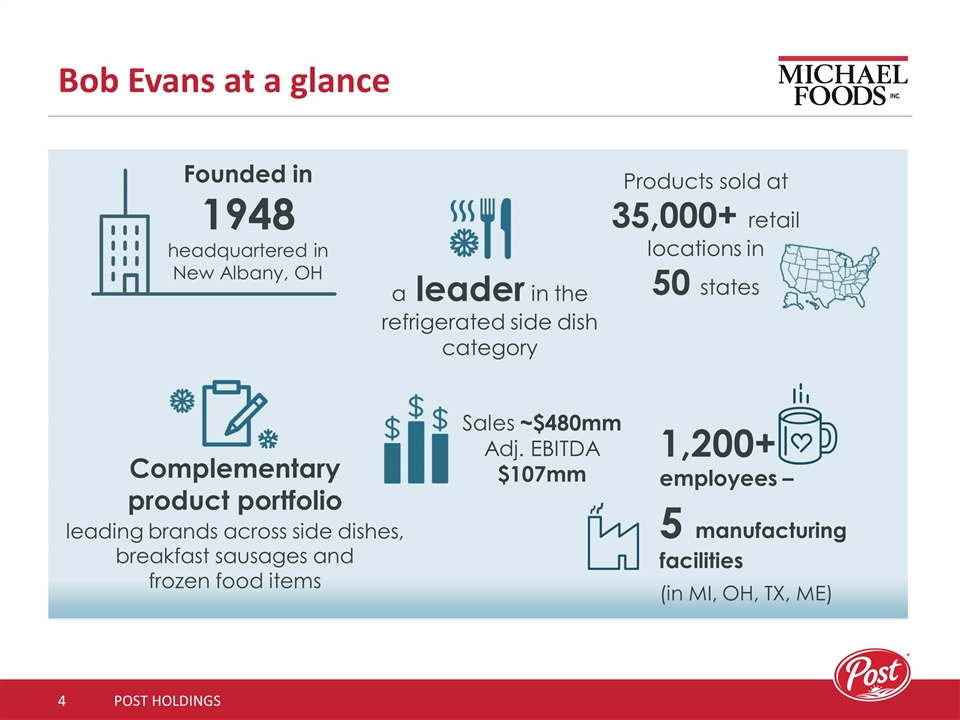

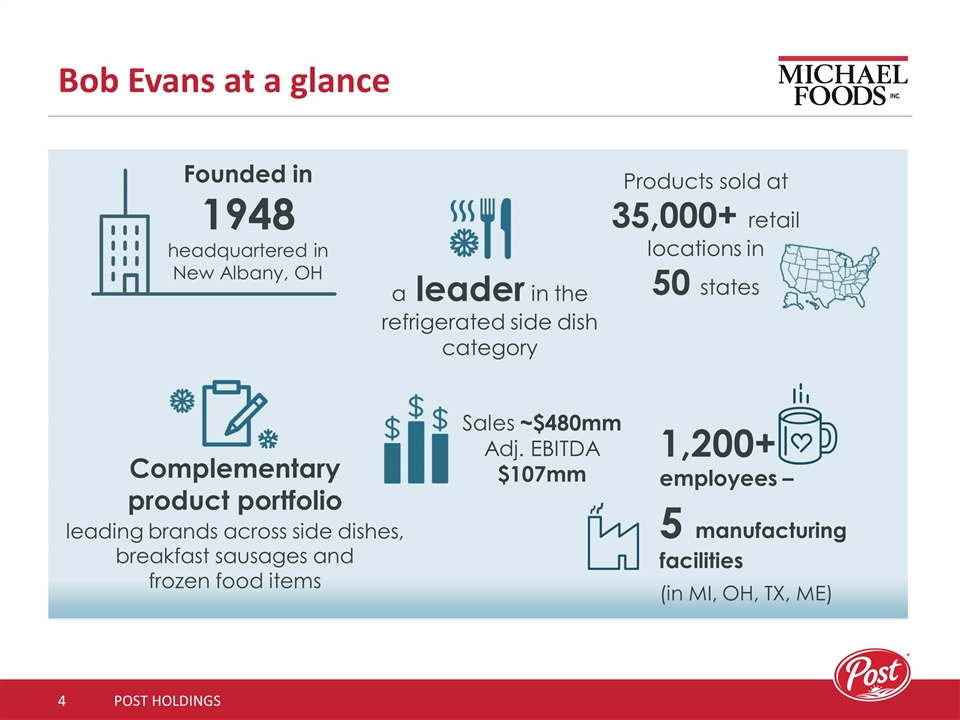

Bob Evans at a glance POST HOLDINGS Founded in 1948 headquartered in New Albany, OH a leader in the refrigerated side dish category Products sold at 35,000+ retail locations in 50 states Complementary product portfolio leading brands across side dishes, breakfast sausages and frozen food items 1,200+ employees – 5 manufacturing facilities (in MI, OH, TX, ME) Sales ~$480mm Adj. EBITDA $107mm

Products Bob Evans portfolio POST HOLDINGS Brands Highly complementary portfolio of products in attractive categories across retail and foodservice channels Refrigerated Side Dishes Breakfast Sausage Frozen Foods

Michael Foods to manage commercial foodservice, including existing Bob Evans’ foodservice business Reorganization of Post Operations Structure POST HOLDINGS Reorganized Structure Bob Evans All Refrigerated Retail Bob Evans Retail Michael Foods Retail Michael Foods All Commercial Foodservice Bob Evans Foodservice Michael Foods Foodservice Led by Mike Townsley Led by Jim Dwyer Align business operations according to strengths and capabilities – positioned to capture new market opportunities and drive growth Bob Evans to manage refrigerated retail, including existing Michael Foods retail business

Leadership team Upon closing of the transaction: POST HOLDINGS Rob Vitale Continues in current role as President & CEO of Post Holdings Mike Townsley Will lead new refrigerated retail business Jim Dwyer Continues in current role as President & CEO of Michael Foods Group Will lead commercial foodservice business

What does this mean for us? POST HOLDINGS Our job is to stay focused on doing great work, delivering on our 2017 plan and achieving our 2018 objectives For all of us – and for our customers and suppliers – it is business as usual until the transaction closes Post and Bob Evans will continue to operate as separate businesses until after the transaction closes Combined company will be stronger, more diverse and even better prepared to capitalize on future growth opportunities

What’s next? POST HOLDINGS Transaction expected to close in Q1 of calendar 2018 Chad Baker to lead integration efforts on behalf of Michael Foods Updates will be provided as soon as they are available Please address any questions to Diane.Jahnke-Miller@MichaelFoods.com

Q&A POST HOLDINGS